INSIGHT

The Perth retail strip market has enjoyed improvement in overall occupancy of the five strips we survey. It has been an interesting time for the WA economy, trending well during the pandemic with strong GSP results propping up the national economy, stringent border controls resulting in limited disruption to trade compared to the East Coast. Improvements in employment and low interest rates all fuelling strong increases in the residential market after a prolonged period of treading water for some Perth markets. Growth in residential sales volumes, increased confidence all driving retail trade particularly in the food and homeware sectors given the growth in the housing market.

These indicators did not go unnoticed by investors, 2021 being the most active investment period for commercial property on record. WA was no exception as more interstate buyers speculated into commercial investments during a time of robust economic conditions. With interest rate rises this saw some

moderation this year, local private investors and owner occupiers now dominating the investment landscape albeit the volume of transactions is now considerably down. Despite the rising cost of funding, savvy buyers are still capitalising on opportunities across retail, particularly in these strips which have a proven track record of high occupancy. While there has been some change in yield expectation over the last 6-12 months sales to average in the 4% to 6% range.

Its still an interesting time for retail in this environment, while online sales have grown in recent times notably in response to COVID-19 many of our strips buck the trend and still perform well in the digital environment. Rising inflation continues to be a concern for consumers which has filtered into the retail market, the longevity of interest rate movements and inflationary pressures being key indicators of continued success of our retail strips over the next 12 months.

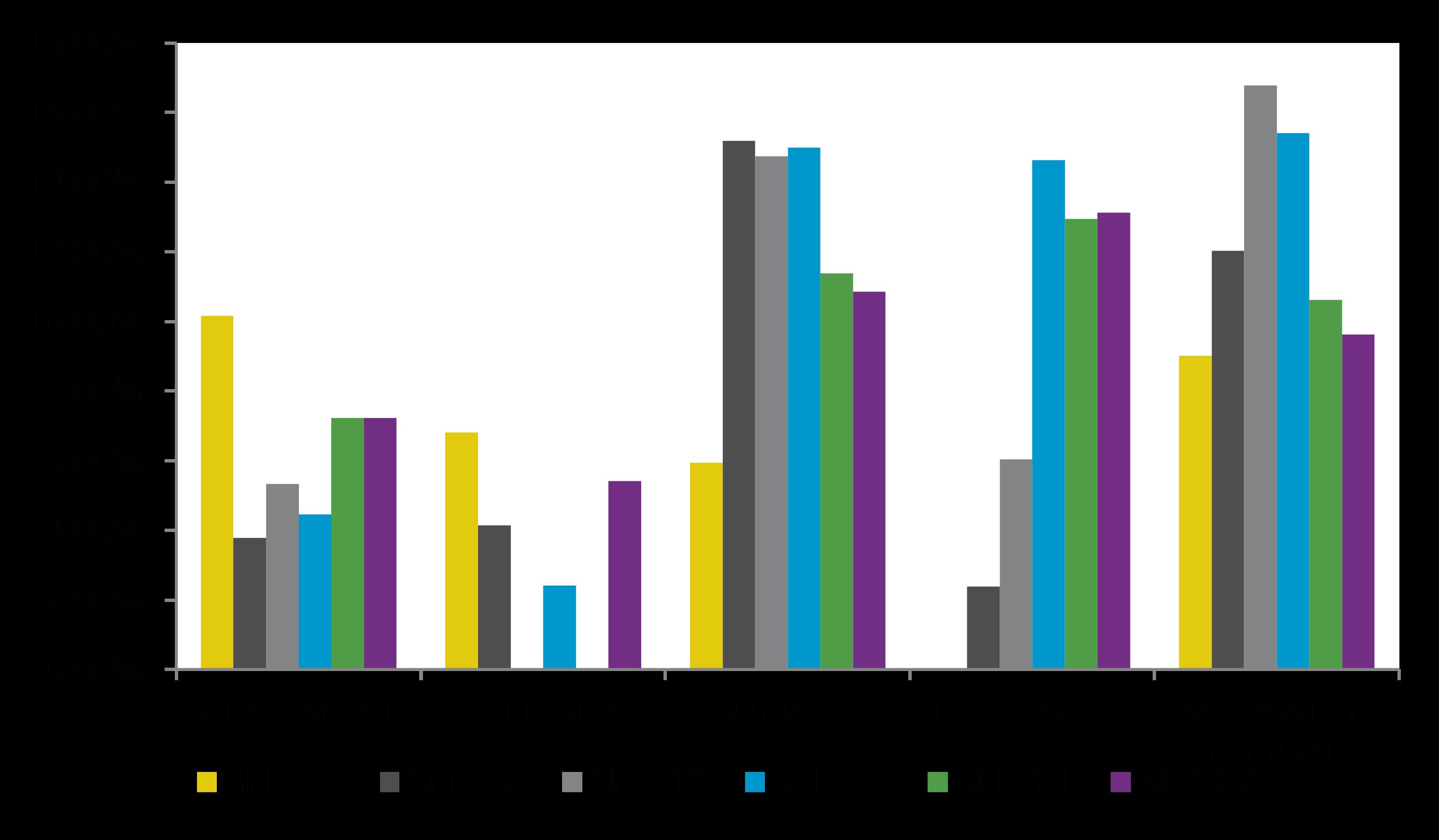

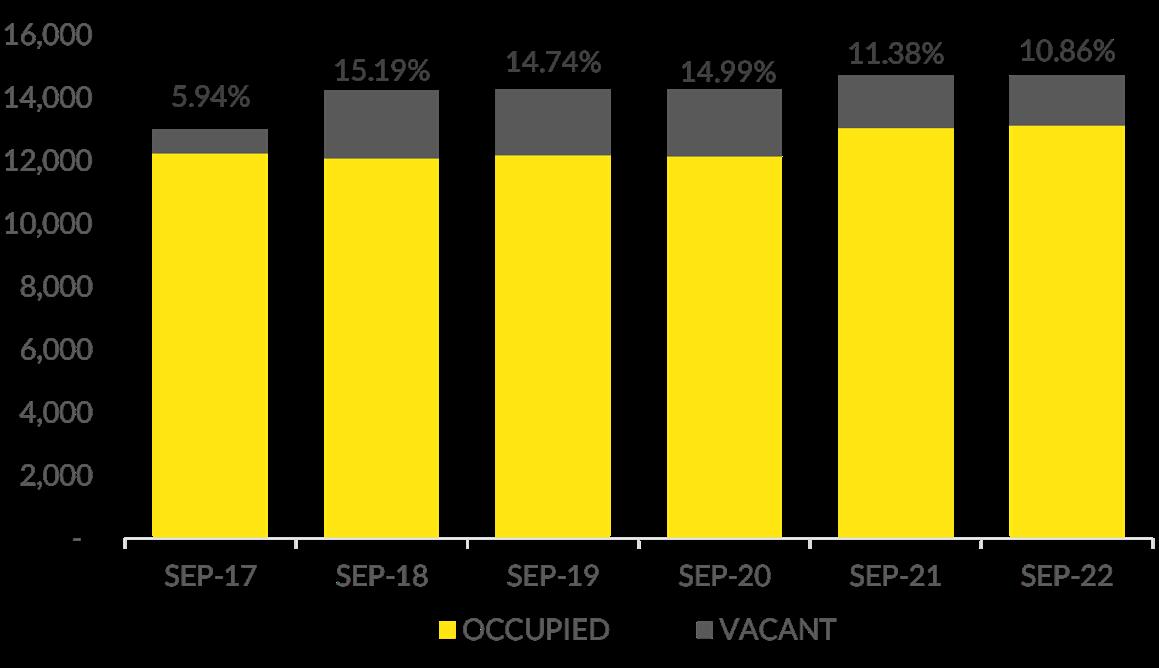

There has been some volatility in our recent retail survey results with individual markets recording mixed results. However, it is encouraging to see that the overall total average vacancy rate has continued to decline for the second year. Across all five locations we have surveyed 365 shop fronts which represents over 54,000sqm, vacancy was found at 9.63%. This is an improvement from last year’s survey results of 10.82% which is down from the difficult 2020 and 2019 period which included lockdowns resulting in a sharp increase in vacancies to 12.09% and 11.24% respectively.

Overall, we have seen some movement in the make up of our retail strips in response to changing behaviours in which the population interact with retail, notably after the pandemic period. Some markets however buck the national trends with both Bay View Terrace and Napoleon Street indicative of “fashion strips” which are limited across the country. Our other markets also have various levels take up of food and services which have been growth segments of retail trade in recent years. For those markets with higher vacancies, we expect to see an increase in these categories, while these are growth areas for retail, they improve local vibrancy as they require in person custom.

Bay View Terrace has seen no change in occupancy levels compared to last year. Still recording vacancy of 7.23% this market is home to four vacant shops. This market managed throughout the pandemic with a high occupancy rate given the changing dynamics of the neighbourhood retail market. With staff working from home, we saw a return to patronage of the local high street and there was an increase in tenancies which required an in-person experience such as services during a time where online trade increased. Over the last three years, this market has enjoyed record levels of house price appreciation, recording an increase of 29.6% over a 36-month period has done much to bolster confidence and encourage increased retail expenditure notably on discretionary goods during a time of low interest rates despite uncertainties across the globe. Demand for investment assets too were ramped up during the low interest rate environment during the pandemic resulting in compression in yields, currently assets in this location are achieving yields in the 4-6% range.

The Bay View Terrace strip has a retail mix not seen often in Australian retail strip markets. Most markets have seen a move away from the clothing & soft goods sector in a retail strip environment with these retailers moving to high online sales models with physical stores in larger centres which form part of a broader shopping experience. This region has 28.50% of all retail space devoted to this tenant type with a strong weighting to women’s footwear and fashion, in recent times we have also seen the uptick in services now represented by 18.06% of all space following the theme of beauty, optical as well as more traditional services such as Australia Post and real estate’s etc. The limited food retailing in this location an area to watch, with a growing appetite for customers for either dine-in/take away options and specialised food venues.

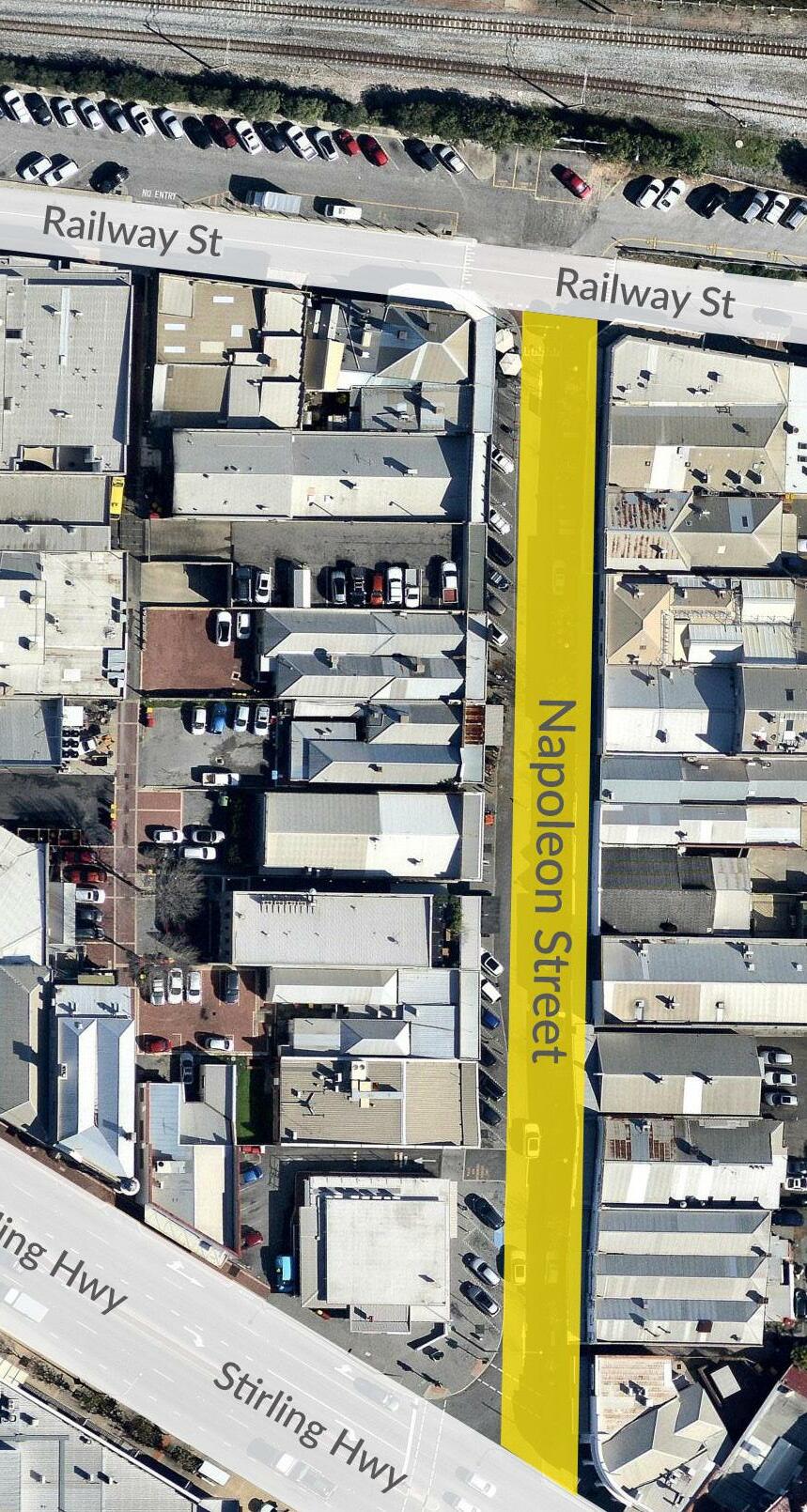

After robust few years despite the COVID-19 pandemic, Napoleon Street has recorded its highest vacancy since 2017. With vacancy at just 5.42%, this only represents two vacant shops, and this tightly held tenanted market is expected to rebound in the short term. Again, the affluent local catchment testament to the long-term lows in vacancies in this market. Demand to occupy space in this strip has always been at a high rate due to the higher than state average disposable income which has been further fuelled by rapid growth in the local housing market. With median house prices now eclipsing $3million and over 40% growth recorded over the past three years, this retail catchment has not recorded a slowdown in retail expenditure. Despite some softening in the residential market and rising interest rates, we do not expect this to significantly hinder local demand for Cottesloe retail. There have been two sales across the strip over the last year, the affordable price point of sub $5million making it attractive to the private investor market.

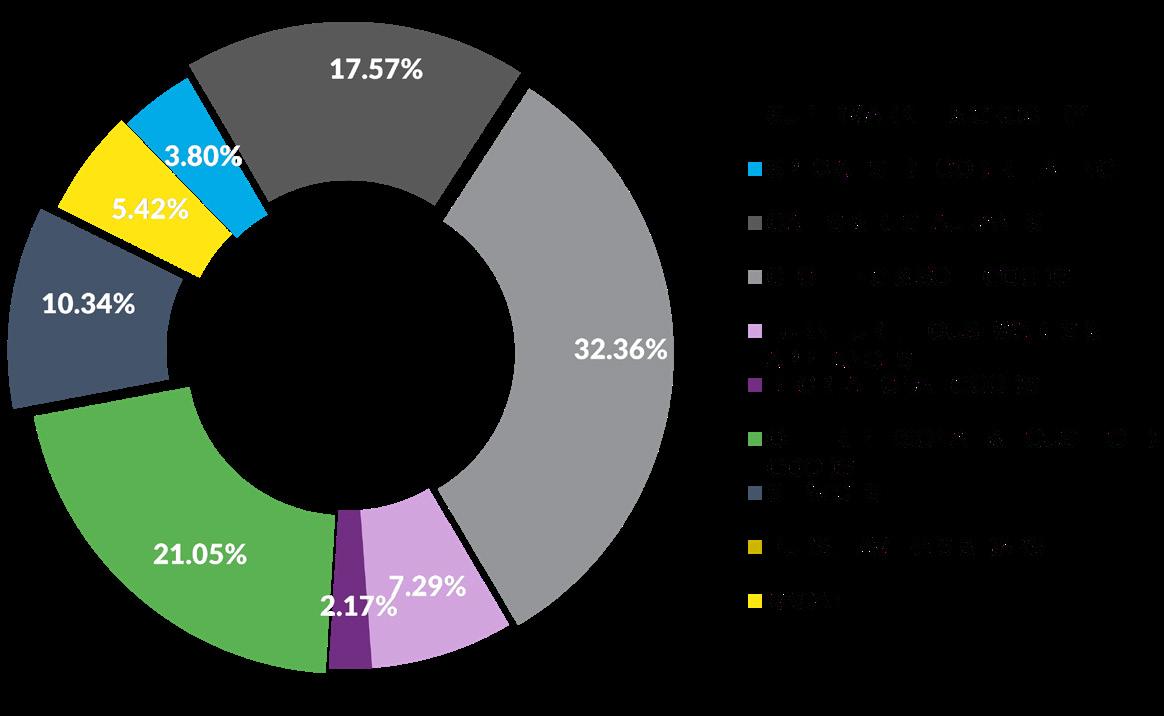

Again, bucking the broader retail strip trends across the country, this market has close to a third of all retail space devoted to the clothing & soft goods sector. The local market responding well to its reputation as a high street fashion strip, attracting visitors from outside the area who are looking for options and service different to shopping centre clothing stores. For this market Café’s do make up a larger segment again capitalising on both local and visiting customers to the area, this representing 17.57%. Another large segment of the market being Other personal & household goods driven by jewellery as an extension to the clothing segment. Services in this market only represent just over 10% accounting for beauty and real estate services.

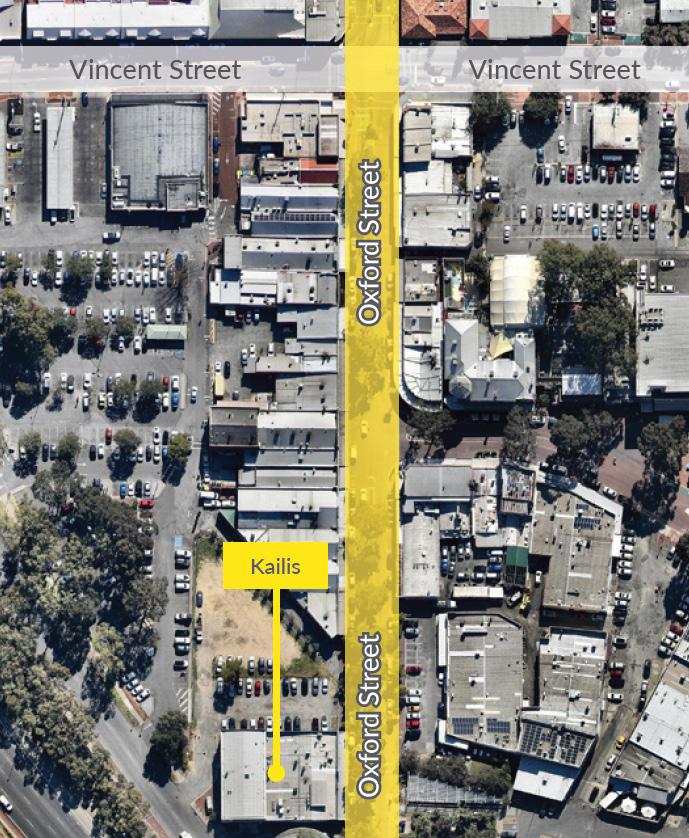

The Subiaco market has had a lot of movement over the last few years, developments in the area and changes in sentiment towards the region has seen volatility in the retail strip landscape. Encouragingly, there has been some take up of space over the last twelve months, with vacancy now recorded at 10.86% the lowest rate recorded since 2017. This market has been hindered by a variety of impacts with COVID-19 also doing much to hamper recovery. Despite this, demand to invest in this location has not dampened, a number of small commercial spaces have transacted over the last year indicative of the growing business count across the country. Owner occupiers have sought out quality, local accommodation for new, small businesses as well as an alternative working from home solution. Capital values have ranged from $3,800/sqm up to $8,000/sqm depending on size, quality, and location. Strong gains in both house and unit values in the area over the past few years also bolstering confidence across this local property market.

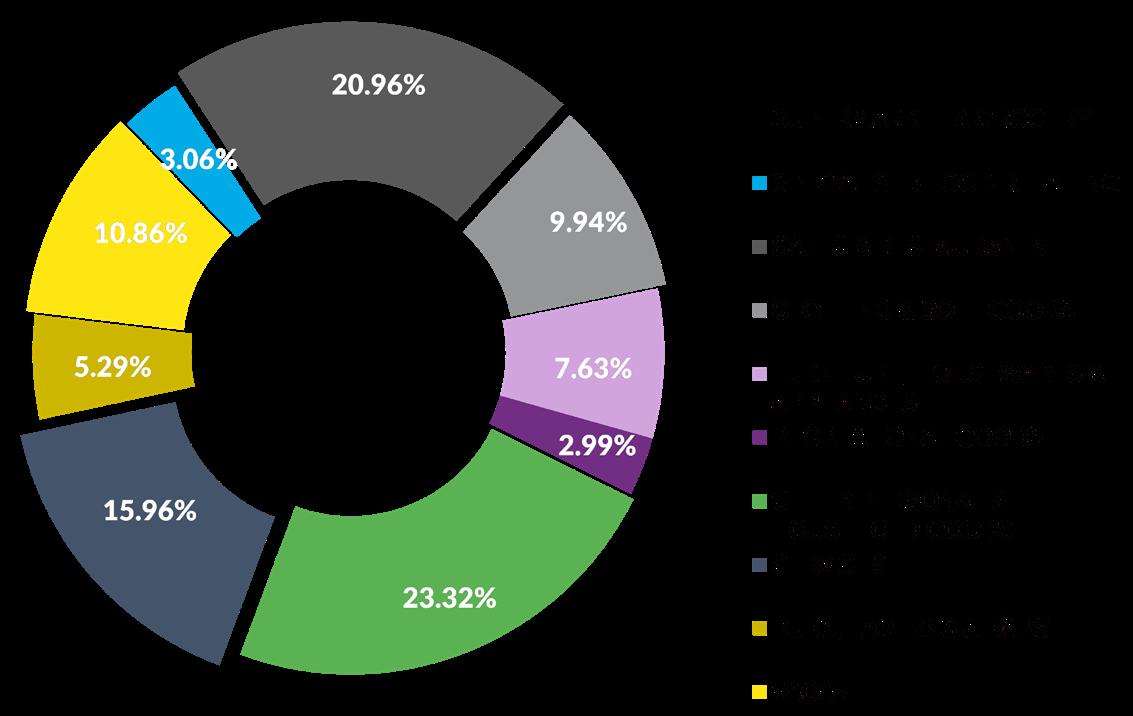

We continue to see the evolution of Rokeby Road; clothing now represents shy of 10% which is a vast change to a few years ago where this was far more prevalent. Despite this the other personal & household goods sector continues to represent close to quarter of all space, highlighting the continued discretionary spend levels in this location. The growth in the residential market also aiding this segment as well as the furniture, housewares & appliances which is higher than most other locations. Food continues to be a growing segment for this location which aligns with the local demographic with both specialised food and cafes representing close to a quarter of all stock. Services have remained steady; banks continue to be a major tenant along the strip along with medical and beauty services.

It was with great disappointment that the Leederville strip has continued to grow its vacancy. After our early survey results highlighting a vibrant retail strip with zero vacancy, this has continued to increase to its current 13.12% level. While this does only represent 5 shopfronts including the large mid strip vacancy, there continues to be buzz in this location given the night-time activity relating to food tenancies and importantly the completion of the ABN building and hundreds of workers moving into the precinct. Over the last year there has been limited investment activity in the strip, a small commercial tenancy and mid last year we saw a $6million retail transaction, however during this time, low interest rates and high demand from interstate buyers into Perth resulted in strong downward pressure on yields. With rising interest rates, many of these buyers are more cautious in the market, however yields do remain competitive up to 6.00%.

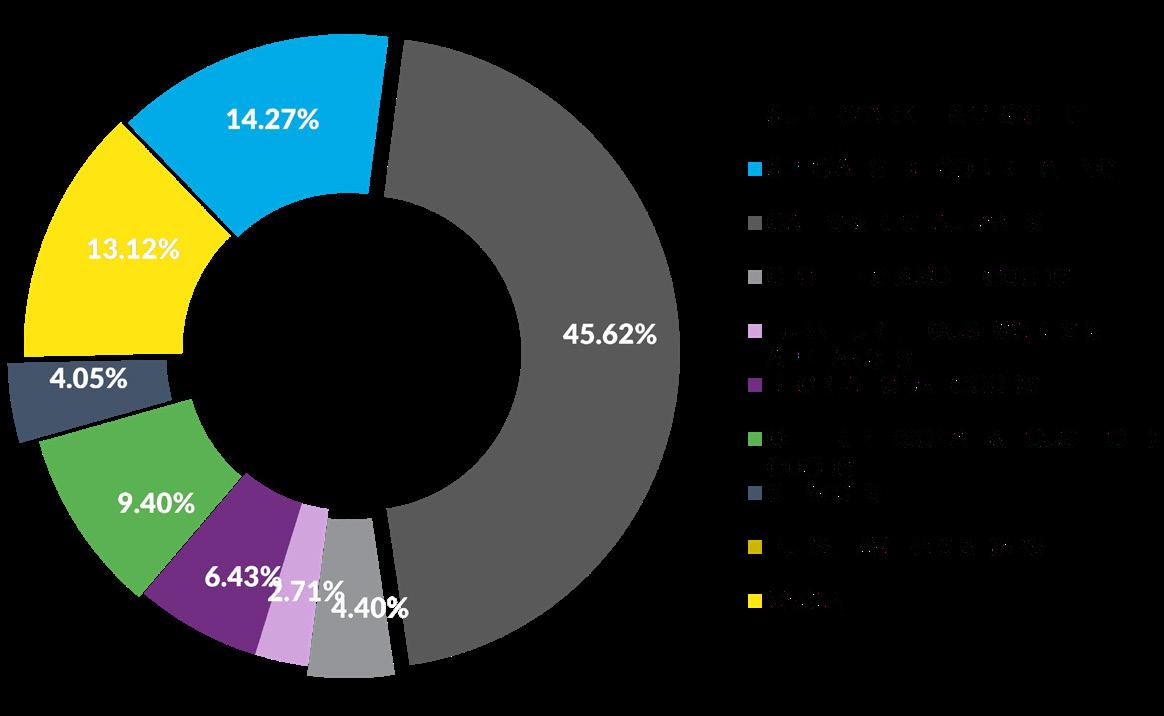

We continue to see the decline in clothing & soft goods, reducing its space use across the strip in each of our vacancy counts. Growing each year has been the café & restaurant segment now over 45% taking advantage of the local workforce and after work crowd. The confidence in this retail strip is echoed in the national chains which now have a tenancy in the strip, looking to capitalise on discretionary food retailing. Similarly, we see the specialised food segment also increase which is a mix of take away offerings as well as specific cooking products or grocery items which are on offer for the high day time population. Surprisingly, services remain a limited portion of the strip at just over 4% highlighting this location as being a “foodie” driven strip.

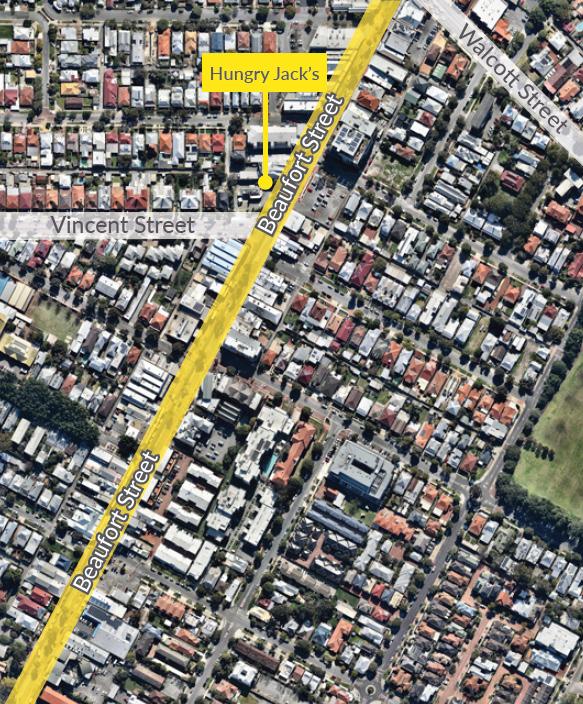

Beaufort Street is our largest strip in our retail count, and it has continued to improve. This year only 12 vacancies have been recorded down from over 20 just two years ago representing vacancy of 9.63%. This market felt the effects of COVID-19 with shutdowns and restricted trade resulting in a number of local businesses closing their doors. Some improvement in local office activity has been a feature for this market bringing more custom along the strip during the day, however the vast mix in this location is unlike many others making it a location not necessarily associated with any one use like the other strips in our retail count. Services started to see some increase which is what we have seen in most strips across the country, instrumental in getting customers into store, given the threat of online retail to most other retail segments. No transactions have been recorded this year across the strip, however demand for quality, tenanted assets in this location continue to be in good demand.

The mixed strip of Beaufort Street continues to see a decline in cafes & restaurant space, bucking the trend seen across many other regions capitalising on the continued increase in food retailing. Clothing & soft goods has again reduced its footprint, the threat of online sales seeing this trend across other locations. Services continues to be prevalent particularly in the beauty/hairdressing space which is instrumental in bringing customers to the strip. The uptick in the housing sector has seen this region grow its median house price by 26.7% over the last three years which has resulted in confidence when it comes to retail expenditure. Furniture, housewares, appliances, recreational goods as well as personal and household goods all growing their share along the strip as people look to continue to invest in their prized home asset.