4 minute read

SUPPLY CHAIN SUCCESS

DELIVERY AREA SURCHARGES SET TO BECOME LESS RURAL IN 2020 By Keegan Leisz

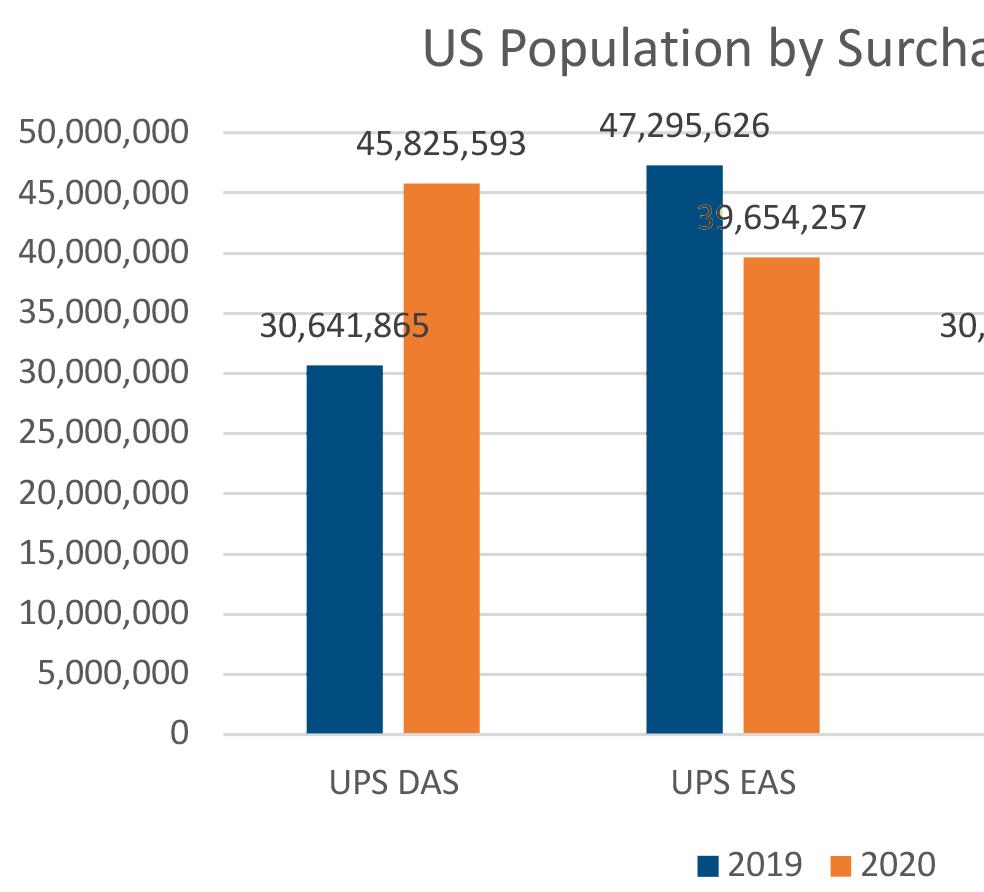

Chart 1

Advertisement

With the start of 2020 upon us, the UPS and FedEx general rate increases are impacting shippers’ transportation spend. This year, as with years past, UPS and FedEx increased the price of their transportation services as well as some key accessorial charges. However, in addition to the rate changes, both national carriers announced signifi cant changes in how they would classify two accessorials: Delivery Area Surcharge (DAS) and Delivery Area Surcharge – Extended (EAS). These accessorials are assessed based on the service level and the destination ZIP Code of a shipment. In the national carriers’ GRI announcements, each carrier announced they would be adding about 1,500 ZIP Codes, changing the classifi cation from DAS to EAS or vice versa for about 2,500 ZIP Codes, and removing about 800 ZIP

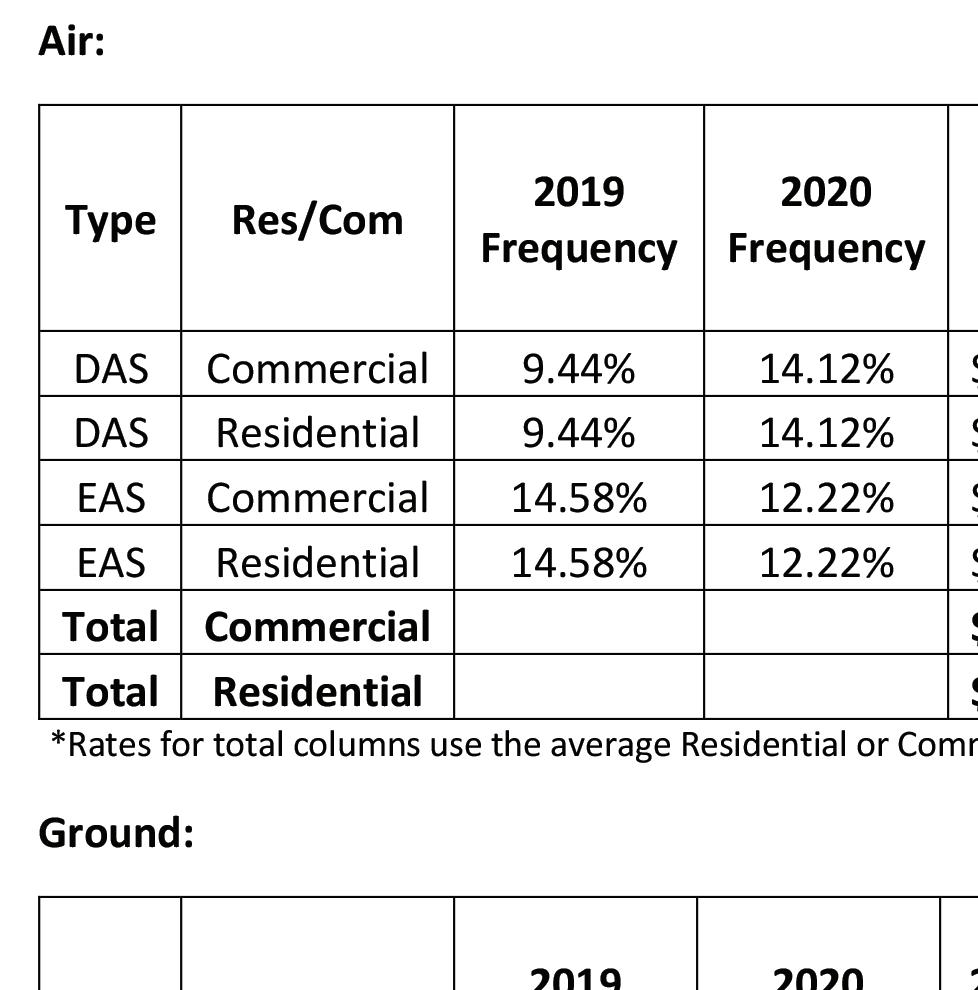

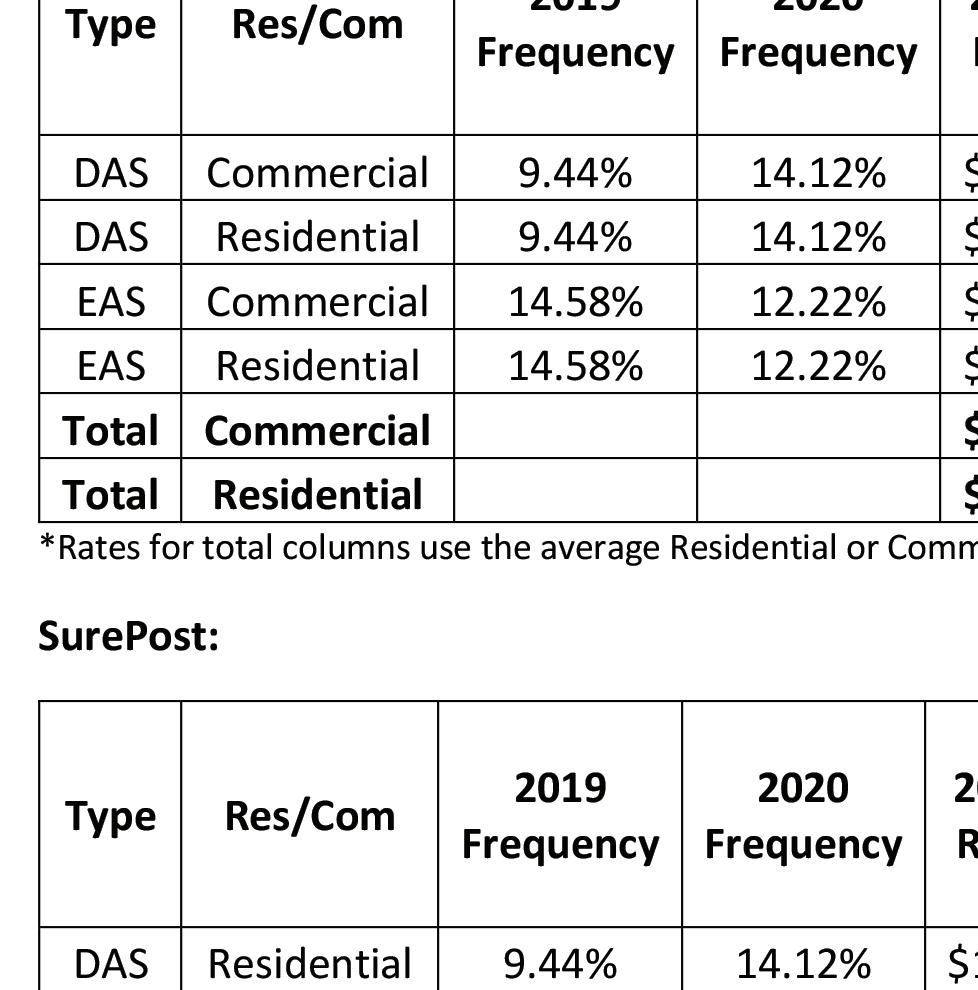

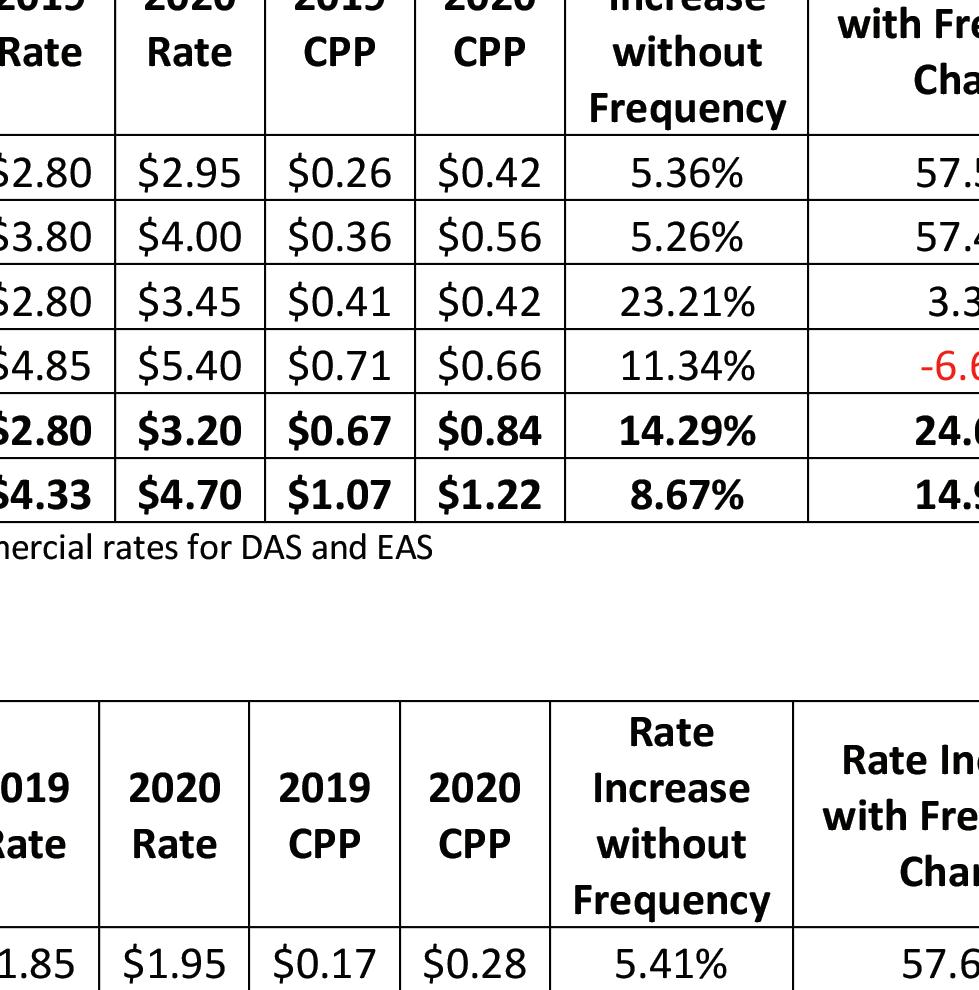

Chart 2

Codes from these lists. This is the fi rst time in several years that more than a handful of ZIP Code have changed. These changes should leave shippers with three questions: 1. Are these changes meaningful? 2. How will they impact costs? 3. What should we expect going forward?

The impact of the changes to the DAS and EAS ZIP Code list is much more diffi cult to determine than the typical rate increases, and likely will impact shippers differently based on shipping patterns. However, the US Census population data from 2017 can be used to fi gure out what portion of the US population was in a DAS or EAS ZIP Code before and after the changes. This should give a macro level view on whether these changes are meaningful. See charts 1 and 2 for this analysis.

Based on these results, the population that is in a DAS or EAS ZIP Code increased by about 9.65%. While 9.65% may seem like a meaningful increase, it does not defi nitively answer the cost question since the EAS coverage, which is the more expensive of the two charges, decreased. In order to determine the cost impact, a frequency of each charge needs to be calculated. For the purposes of this analysis, the population in a DAS/ EAS ZIP Code divided by the total US population

can be used for frequency. The frequency can then be multiplied against the national carrier’s list rates to get an estimate of the DAS and EAS cost per package. See chart 3 for the results of this analysis when using the UPS rates.

When you look at each service group, you can see that the rate increase after factoring in the frequency change

is much higher than the rate increase without using the frequency. As mentioned earlier, these results could vary for each shipper based on their shipping patterns, but at a macro level, this tells us that the DAS changes, after factoring in the ZIP Code changes, will lead to a double-digit percent increase for each service group.

In order to predict how these ZIP Code lists will change in the future, it is important to see how the profi le of the new ZIP Code changed vs the old ZIP Code. In theory, DAS and EAS charges are meant for remote locations that are not densely populated. So, looking at the changes in population density would be a good way to see if there are any trends in these changes. Chart 4 shows what those numbers look like for UPS (FedEx is almost identical).

Based on these numbers, DAS Charges are becoming signifi cantly less rural, while EAS charges are becoming slightly more rural. The DAS and EAS ZIP Code lists do not change frequently, so it is unlikely that there will be any more signifi cant changes in the short term. However, if this trend continues in the long term, there could be a signifi cant increase in DAS charges with a slight drop in EAS charges.

In order to mitigate these changes, shippers can always look to renegotiate their small parcel agreements. Using these population numbers, negotiating aggressive discounts on DAS charges could become increasingly important as the DAS ZIP Code become less rural. However, shippers should still analyze their own network to see if these changes will have the same impact to them as they do on the national level.

Keegan Leisz is a Senior Consultant at enVista, a global consulting and software solutions fi rm. In his role, Keegan is responsible for negotiating parcel carrier contracts and specializes in analytics. You can contact him at kleisz@ envistacorp.com.