REALTOR®, Broker/Owner CRS, GREEN, SRES, CIPS, CLHMS, ABR

Connect with me on: 919.697.5014 jodi@realestateexperts.net realestateexperts.net

I am a Realtor and Broker/Owner of Real Estate Experts — a residential real estate company that has been serving Chapel Hill, Durham, and the greater Triangle area for over 25 years.

I focus on providing seamless customer service to my buyer and seller and clients. I also have expertise in listing and positioning homes for sale and in green, high-performance homes. I have also developed North Carolina’s first 100% net-zero energy neighborhood in Orange County — visit: www.ArraySustainableLiving.com.

I will set your expectations by:

• Getting to know you

• Explaining the home buying process in North Carolina in detail

• Reviewing the North Carolina Offer to Purchase and Contract and discuss the intricacies of how the home buying process works in North Carolina. It is actually significantly different from all other states.

• Explain in detail how Realtors are compensated and your options.

The real estate process is complex. To ensure you make the right decisions for yourself, we educate you on every detail in the contract and associated paperwork as well as the entire process. As your real estate consultant, we advise you — you make decisions, and we do the work.

This Buyer’s Guide is intended to give you a resource that will help you define your goals, research your options, and direct you through the process so that you can make informed decisions.

When you buy a home, it should be about YOU:

• Your dreams

• Your requirements

• Your financial situation

• Your time

• Your lifestyle choices

• Your concerns

At Real Estate Experts, we are known for setting our client’s expectations from closing on your home and beyond. You can count on us to always tell you like it is and make sure you understand the ins and outs of the home buying process. Not only is it important for you to understand the process, we want you to know your options at every decision point. Whether you are a first time home buyer or a seasoned buyer, it helps to know the steps in the home buying process.

It is important to work with a Realtor who is committed to working with you to find the RIGHT home. When choosing an agent, consider their knowledge, experience, and expertise. Check their track record of working with buyers — from finding a home, to negotiating the offer, to helping with financial solutions.

Our job goes way beyond just opening doors for people. We have to be knowledgeable about every detail of the real estate process, the market itself, and various areas and neighborhoods.

To give you an idea, I made a list of every task we take care of from the beginning of the home sale process to the end. Between meeting a new client and handing them the keys to their new home, there are 60 items on this list (some of which we do repeatedly).

Visit my YouTube channel to watch the full video: www.youtube.com/@JodiBakstOnline/videos

Let’s determine why you are buying a home. Is it a permanent place for you and your family, an investment, a second home? Whatever the reason, it is important that you buy with an eye on the resale investment potential.

After answering the following questions you will be in a great position to research your housing and mortgage options as well as create the appropriate action plan and timeline for moving forward.

• What do you want from a home?

• What does your family want from a home?

• Do you want a turnkey home or would you prefer to renovate?

• Choose the top five ‘must-haves’

• Choose the top five ‘would-likes’

• Are you pre-approved for a mortgage?

• What can you afford on a monthly basis?

• When is the ideal time to move?

Please use this form to introduce yourself to Real Estate Experts. All information will be considered propriety and will be maintained in the strictest confidence.

Are you working with a Realtor now?

If yes, have you signed a Buyer Agency Agreement?

What is your idea of a good Realtor?

Have you bought or sold a home before?

If yes, was it with a Realtor?

Please take a moment to tell me how you felt about your experience with your agent. I want to make sure your experience with me and Real Estate Experts is exceptional.

Why are you buying now?

How soon do you want to be settled in your new home?

How long do you think you’ll be staying in your next home?

What is your target price range?

Are you going to obtain a mortgage or pay with cash?

Have you spoken with a lender? If yes, who?

Have you been pre-qualified, and if yes, will you provide me with a copy?

If not to the two questions above, do you need a recommendation to a local lender?

We work with a number of lenders who we trust implicitly. Today, it is important to take care of this because sellers require credit checked pre-approval letters or proof of funds with all offers. This is why we ask that you initiate this process prior to looking at properties. If you are not purchasing with cash, we will need a letter from your bank or financial institution or a redacted bank or financial statement showing that you have proof of funds. Our home search will take however long it takes; but, if we are lucky enough to find the right home right away, is there anything that would prevent you from buying right now?

We will work hard to find a home that meets all of your criteria. Sometimes, however, this is not possible. Please list what is negotiable and non-negotiable for your new home:

Negotiable

Do you need to sell your current home?

(If you live out of the area) If you do need to sell your current home, may I refer you to an excellent lender in your area?

(If you live in the area) If you do need to sell your current home, would you like a Comparative Market Analysis of your home and discuss listing your property?

If you are leasing, when does your lease expire?

Non- Negotiable

Please describe what you’re looking for in your next home:

What is your preferred location of school district? How far are you willing to drive to work?

Do you have any special needs?

If I do a great job for you, may I send you a request for a review after you close on your home?

Please list what activities you enjoy, what kind of neighborhoods appeal to you, what do you like to do inside/outside of your home in your spare time, etc. In other words, anything that will help me better understand your wants and needs:

1. Set your expectations throughout the entire process

2. Buyer needs assessment

3. Explain Agency – how Realtors work with buyers and sellers

4. Explain the compensation rules and Real Estate Experts office policy

5. Explain the Offer to Purchase and Contract and how to construct a competitive offer

6. Explain North Carolina’s Due Diligence process, and due diligence and earnest money

7. Set up auto search in MLS

8. Give buyer access to the best search Apps

9. Monitor MLS

10. Recommend three lenders for buyer pre-approval

11. Get pre-approval letter or proof of funds from buyer

12. Help with loan process

13. Preview properties

14. Show properties

15. Promptly return phone calls, email, and text messages

16. Send MLS documents on every property of interest or provide a link to a continually updated google drive folder, whichever is preferred

17. Research tax information and history of all properties of interest

18. Prepare a Competitive Market Analysis on every home of interest

19. Explain the good, bad and ugly of every home visited

20. Be a repair expert – know what you are looking at

21. Be a local expert

22. Know the market

23. Explain details of how real estate transactions work

24. Advise buyer on the most competitive offer based on the situation

25. Write offers

26. Review offer with buyer before sending

27. Send offers for electronic signatures

28. Negotiate offers

29. Deliver Due Diligence money to the listing agent (or have the client wire the money)

30. Deliver Earnest Money to the closing attorney (or have the client wire the money)

31. Get ALL necessary legal paperwork in appropriate office tracking system

32. Get Restrictive Covenants

33. Schedule inspections:

– Home Inspection – Termite Inspection – Radon Inspection

– Well Inspection (if applicable)

– Septic Inspection (if applicable)

34. Attend all Inspections

35. Schedule Follow Up Inspections when necessary:

– Structural Engineer

– HVAC

– Plumbing

36. Get Repair Estimates

37. Negotiate Repairs

38. Set up Closing with Closing Attorney

39. Make sure the lender orders the appraisal

40. Order Survey

41. Order Home Warranty (when necessary/appropriate)

42. Make sure buyer gets home owners insurance

43. Make sure buyer transfers utilities

44. Schedule re-inspection to check repairs

45. Attend re-inspection

46. If repairs are not done, get repair list in writing to listing agent

47. Make sure buyer is attending closing

48. Get power of attorney if buyer is not attending closing

49. Check buyers marital status; if divorced or separated, make sure buyer has a Free Trader Agreement

50. Make sure buyer has received the Closing Disclosure on time

51. Coordinate with Lawyer & get closing numbers

52. Review closing numbers with buyer

53. Correct closing numbers with attorney and lender

54. Schedule final walk-through before closing

55. Attend final walk-through

56. Negotiate anything necessary at the end to protect buyer 100%

57. Get client closing gift

58. Attend closing

59. Initiate all post-closing client follow-up

60. Follow up five days after closing to ensure everything is going well at the house

The North Carolina Offer to Purchase and Contract is also often called a Due Diligence Contract. We have a due diligence period, and within this time frame, a buyer can terminate a contract for any reason. It doesn’t have to be because of a bad inspection, loan, or other obvious problems.

When an offer in North Carolina is made, there are two important checks that accompany all the terms and conditions of the offer. These checks are the due diligence check which is made out to the seller, and the earnest money which is held in a trust account.

Buyers are allowed to terminate for any reason or no reason on or before the due diligence date. The only money at risk is the due diligence money. The earnest money will be refunded.

For a more detailed explanation on the important facts of due diligence and earnest money, scan the QR codes below:

In our market, the earnest money deposit is usually about 1% of the purchase price. However, the due diligence money can range anywhere from $500 to $2,000 or more, depending on the price of the house and whether you’re in competition with other buyers for the same house. If a buyer terminates a contract before the due diligence date, the only money that is at risk is the due diligence money; your earnest money will come back to you unequivocally. So when you’re making your offer, you need to think through the process and consider how much money you’re willing to lose if you end up terminating the contract.

If you go all the way to closing, the due diligence and the earnest money deposit both come back to you at closing as part of your down payment.

The only way a buyer can lose everything — both the due diligence AND earnest money — is if you agree to buying the home but then cancel the contract AFTER the due diligence date. That’s considered a breach of contract, and you’ll receive neither of those deposits back.

Buying and financing a home are closely related, so it is very important to review your current financial situation to understand how much you can afford.

There are three key components that determine the start of all searches:

1. LOCATION – where do you want to live?

2. TYPE – what type of home do you want?

3. PRICE – what can you afford?

Only you can determine the importance of each. Once you start to research your options, you will soon know if your expectations are realistic.

LOCATION, LOCATION, LOCATION

Why does location matter so much? For starters, you can’t move a home — at least not easily or inexpensively. When you buy a home in a good location, it is usually a solid long-term investment.

Perhaps more than ever, location is the key factor to driving price increases. In a strong housing market, homes in particularly desirable areas are more likely to see above average price increases. In weak housing markets, these homes tend to retain their value better.

No matter your prior experience, circumstance, or reason for buying, it is always in your best interest to be pre-qualified for a loan before starting to search for a home. The current rates, approval, and unexpected challenges should be addressed before you have a serious intention of buying.

The pre-approval process involves meeting with a lender and authorizing them to examine your current financial situation and credit history, which results in the amount and rate that you will be able to borrow.

• Knowing what you can afford enables you to plan accordingly — it allows you to understand how much you will be lent and how much you can actually afford to pay each month.

• As a qualified buyer, you will be taken more seriously when you make an offer on a home.

• You are able to take the time to understand the short and long-term implications, allowing you to make informed decisions and research your options.

As your buyer agent, we interface with the lender to make sure you are getting the best deal and the loan process moves according to the schedule. A huge part of the home buying process is ensuring you are making a good financial investment.

1. APPLICATION AND INTERVIEW

• Types of mortgages are reviewed in line with your requirements

• Interest rates and terms are discussed

• Credit report is requested

• Personal information is verified

2. UNDERWRITING

• The mortgage package is submitted to an underwriter for approval

3. TITLE COMPANY

• Title is examined

• Title insurance and survey are conducted

• Borrowers sign documentation

4. LOAN APPROVAL

• Parties are notified of the approval

• Loan documents are completed and sent to the Title Company

5. FUNDING

• Lender reviews the loan package

• Funds are transferred

Over 97% of buyers use the internet to start their search for homes, typically taking an average of 12 weeks to research the possibilities they believe their budget can match. However, not all homes are found online.

We will assist you with narrowing your search by reviewing your ‘must-haves’ and ‘would-likes’ — making recommendations based on our experience and local knowledge.

As real estate professionals, we also has access to:

• Previewing new properties at open houses.

• Technology that automatically sends you new home matches — so you never miss a new listing.

• Working within their network to find new properties not even listed yet.

• Every home in your preferred community, including “for sale by owner,” discounted brokerages, expired listings, or homes not actually on the market but that are known suit your requirements.

• Emailing specific home requirements to agents in the area so they know that you are a qualified purchaser.

Newspapers and real estate magazines still provide a great platform to feature homes. Not every property is listed on the internet, and sometimes your search can miss that hidden gem because it is not online.

Visit open houses and new home developments; you can learn a lot by seeing what is on the market.

At Real Estate Experts, we want to make sure your home search is as stress-free as possible. In addition to the traditional ways of house hunting, we offer a few specific tools and resources to make your search that much easier:

Visit our website for buyer information, featured properties, home search, and more.

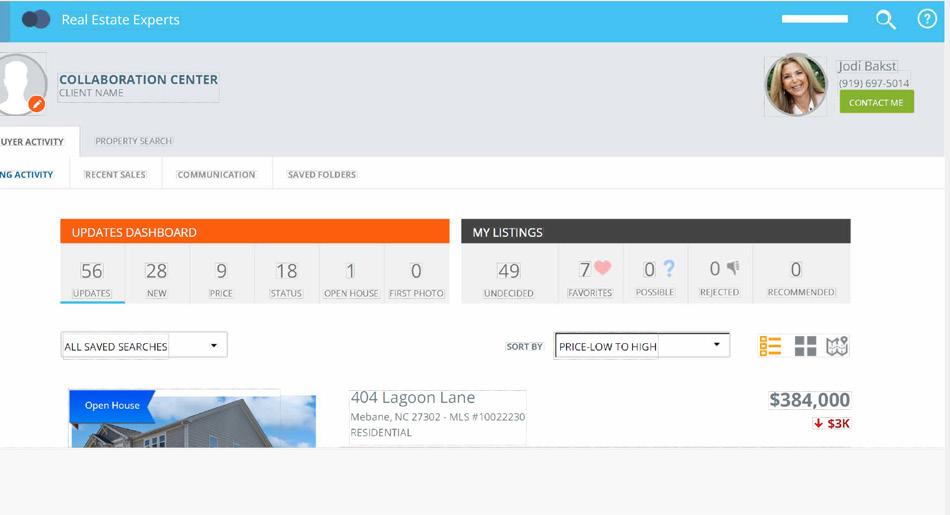

Our personal home search site keeps track of your searches, favorite homes, updates, and all communication with your Realtor.

HOMESPOTTER

Use this app on your mobile device to search and save homes on-the-go. It also sets driving distances.

As your buyer’s agent, I will help you with your home search by previewing homes, keeping you up-to-date with new homes as they come on the market, what is selling and for how much, and knowing what is for sale both inside and outside my Realtor network. Buying is all about having the right knowledge and access at your fingertips.

Here is a list of what I will do to help you during this process:

• Schedule showings and provide access to all listed properties as soon as they become available on the local MLS

• Educate you on the immediacy of new listings appearing in the local MLS and the lag time for them to appear on some websites

• Collaborate with you on properties you may have learned about through your sphere contacts

• Research and assist on all unlisted properties you wish to see

• Preview properties prior to showing, if needed

• Network with other agents to source properties not yet on the local MLS

• Contact homeowners in focus areas to see if they are considering selling

• Set up an automated email alert system through the MLS that immediately notifies you of properties that fit discussed requirements

• Arrange a tour of areas, schools, and key points of interest

• Provide resources containing neighborhood information on municipal services, schools, etc.

• Inform you of any negative aspects like nearby venues or operations that may result in issues that could impact value

• Collect and share any other vital information on available homes, remembering to follow all fair housing laws at all times

• Check applicable zoning and building restrictions

• Help you decipher public property and tax information

• Collect and share pertinent data on values, taxes, utility costs, etc.

• Compare each property shown to your wants and needs list and remind you of what you’re looking for

• Help you narrow the search until you identify your top choices

When you have found the right home, it is time to prepare and draft an offer of purchase. This offer protects and represents your interests while remaining legally binding on final acceptance. There are many components to an offer, and we will explain the entire process so that you are comfortable with all the steps involved.

An offer can be drafted with or without conditions. An offer without conditions is known as a firm or subject-free offer. An offer with conditions is known as a conditional offer and, in effect, protects one party with the placement of certain conditions on the purchase.

POINTS TO CONSIDER IN YOUR NEGOTIATIONS:

• The condition of the home

• Length of time it’s been on the market

• Buyer activity

• Location

• Urgency of the seller

The seller may accept your initial offer, reject your offer, or present a counter offer. The counter offer may differ from your original offer in respect to price, conditions, closing date, or any other items. Offers can be countered back and forth until one of you accepts or rejects, ending the negotiations altogether.

We will negotiate to get the best terms and conditions for you. Negotiating the contract is just the beginning. We negotiate repairs, we negotiate every twist and turn and bump in the road up to and including the date of closing and beyond. After closing, things do come up and we are there for you and become your trusted resource.

Closing day marks the end of your home buying process. At closing, you will sign all your legal documents, including paperwork related to your mortgage and the transfer of ownership of the property. There are usually representatives from the Escrow Company or a lawyer to facilitate the exchange.

When closing is finished, you should not only have the keys to the property, but a copy of the documentation that relates to the property, including a statement of costs, a statement outlining your mortgage terms, your mortgage note, and a copy of your deed of trust. At the end of closing, the deed will be taken and recorded at the county clerk’s office. It will be sent to you after processing.

TIP: Make arrangements to see the new home the day of or the day before you close to ensure the home is in the condition per the contract agreement.

• Encourage you to fully investigate your options in terms of a home inspector, title company, appraiser, mortgage lender, and other services

• Present a list of the types of required and optional inspections such as environmental, roofing, and mold

• Review and discuss home inspection concerns

• Negotiate repair requests from home inspection

• Guide you on meeting all contract deadlines

• Assist in coordinating communications

• Advise you to review the settlement statement

• Inform you that you need to transfer utilities to the new residence

• Schedule final walk-through

• Accompany you on the walk-through

• Assist you in questioning the appraisal report if it affects the financing

• Confirm clear-to-close with the lender

• Ensure all parties have all forms and information needed to close the sale

• Confirm the closing date and time, and notify parties if there are changes

• Gather all required forms and documents for closing

• Explain flood insurance

• Explain title insurance and refer to qualified insurance broker

• Order any surveys needed

• Order the appraisal

• Order the title search

• Confirm the status of the loan funding

• Check addendums and alterations for agreed terms

• Review your closing statement to ensure accuracy

• Explain wire fraud risks and remind you to verify all wiring instructions before transferring funds

• Double-check all tax, homeowners’ association dues, utility, and applicable prorations, if relevant

• Request final closing figures from the closing agent (often an attorney or title company)

• Receive and carefully review closing figures to ensure accuracy

• Receive and carefully review title insurance commitment with you

• Advise you to re-key the locks and consider a one-time cleaning service or landscaping before moving day

• Review documents with the closing agent (attorney)

• Support you in any final closing activities

• Going over budget. Even the wealthiest of us need to understand the associated living costs.

• Not pre-qualifying for a mortgage. After all, why pay more for a last minute mortgage?

• Not shopping for the most suitable mortgage to match your requirements.

• Not understanding all the terms and conditions: interest rates, length of contracts, mortgage types and rates, etc. before selecting your mortgage.

• Buying a new home before you sold your old home.

• Not understanding the true costs associated with buying your home.

• Not using professionals to assist in all aspects of your home purchase, including a mortgage advisor, home inspector, lawyer, notary, or a moving company.

When you have found the right home. Don’t wait for perfect conditions to buy — they don’t exist.

Getting pre-qualified before you start searching — this will help immensely and prevent disappointment.

Think of the process as equivalent to giving a job interview. Do they know your local market? Price points? Types of homes? Ask for references!

Prioritizing and compromising are necessary elements. Compile a list of ‘must haves’ and then a list of ‘would-likes’ — you will never find the right home otherwise.

Don’t be afraid to write an offer — there is no commitment until you remove all the contingencies. However, don’t write an unrealistic offer. Offer instead what the property is worth to you, otherwise you may be helping someone else’s offer look good!

Trust personal instinct and trusted advisors. Do what feels right — too much stress indicates it’s time to walk away.

Most buyers do — it’s normal and will pass if the situation is right.

New rules went into effect on August 17, 2024 that require:

• Offers of compensation can no longer be communicated through the Multiple Listing System.

• Realtors are required to have a written agreement in place with a buyer prior to showing any house in person or virtually. Real Estate Experts will use the Exclusive Buyer Agency Agreement.

Real Estate Experts agents will use the Exclusive Buyer Agency Agreement with their buyer clients. It is important that we get to know one another and that we both agree to work together. Buying a home is a significant purchase and buyers need to know their expectations will be set throughout the home buying process and that they will be well represented.

• Real Estate Experts Agents will show up to 5 houses during the get to know you period and will write a buyer agency agreement for the agreed upon period of time, e.g., one house, one week or longer.

• After the get to know you period, if the agreement is to work together, there will be a $500 fee that will be applied to the purchase at closing. The $500 fee is negotiable.

• If your home search extends beyond one-year, there will be a $1,000 fee due one year after the initial signing of the buyer agency agreement. The fee will be applied to the purchase at closing.

• Real Estate Experts agents will write their Buyer Agency Agreements for 2.5%. If a seller is offering more compensation than that, we agree to credit the difference to the buyer at closing. If the buyer would

like the agent to keep this, we will prepare form 770 for signature which allows buyer agents to take more compensation than agreed to in the buyer agency agreement as long as the buyer authorizes this on Form 770.

• Buyer agents will first seek to get compensation from the seller.

• Real Estate Experts advises buyers to check early in the process with their lender what their loan options are, should you choose to finance any shortfall in their agent’s commission.

• Buyer agents are required to have it written into their buyer agency agreements how the agent will be compensated by the buyer, if after every measure is taken to seek the compensation from the seller.

I would like to thank you for giving me the opportunity to represent you. My goal and commitment is to make the home buying process as seamless as possible.

Regardless of your real estate needs, know that I am always here to assist you because I am not just providing a service, I am building a relationship.

Jodi Bakst