Exceptional Service

For those new to the Emerald City, who want to explore a different region, or are lifelong residents, Realogics Sotheby’s International Realty’s (RSIR) team of local experts makes every move seamless. From the latest market data and hottest neighborhoods in every town to exceptional opportunities to buy or rent, RSIR’s global real estate advisors handle it all.

With unique connections, resources, and strategies, and as a part of the powerful Sotheby’s International Realty® brand, the network of more than 26,000 sales associates in 81 countries and territories bring the exceptional to each homebuying journey. It’s expertise that reaches down the block and around the world.

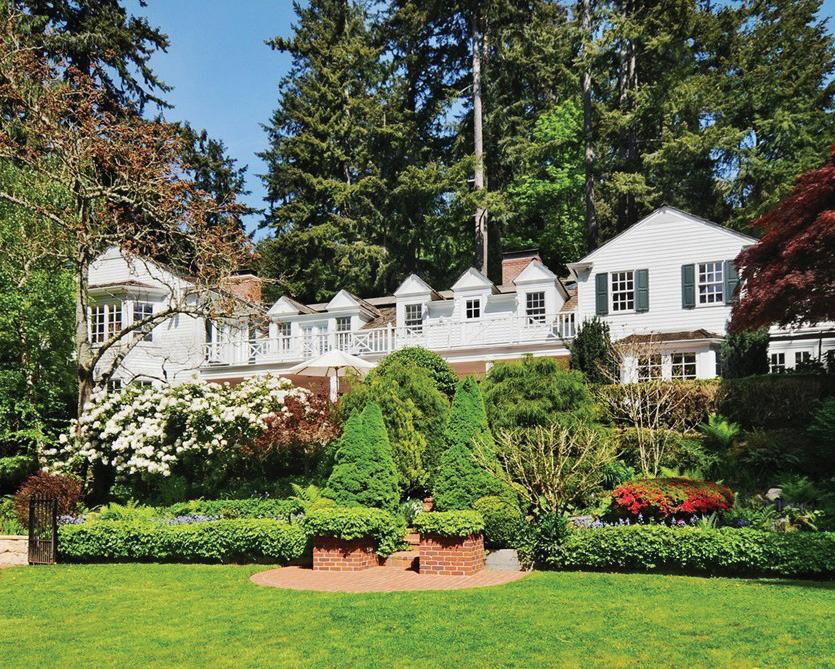

A home is more than a building or an address, it’s where connection, growth, and life happen.

Local Power, Global Reach

Realogics Sotheby’s International Realty creates new conversations within the markets it serves.

The Pacific Northwest’s largest affiliate within the global real estate network, Realogics Sotheby’s International Realty has branch offices in Downtown Seattle, Madison Park, Bainbridge Island, Kirkland, Mercer Island, and Downtown Bellevue. The brokerage’s global real estate advisors proudly serve all property types and price points throughout the Puget Sound and beyond.

With an “international” middle name, Realogics Sotheby’s International Realty represents the best of both worlds through local and global reach. Given this position, we are responsible for representing the Puget Sound region to an international audience; proudly representing global citizens choosing to make their homes here.

6 Local Offices 300 Real Estate Advisors

#1 Largest Sotheby’s International® Realty Affiliate in Washington state.

$2.6B In Sales Volume 2022

We expertly guide our clients’ real estate journey to extraordinary results.

Purchasing a home is often one of the most important financial transactions of your life. You are not only choosing a new place to live, but making a substantial investment and creating a significant asset. Our brokers will provide you with the support, market knowledge and negotiation skills honed while navigating the competitive market.

This handbook has been prepared to help familiarize you with some of the more common terms you’re likely to encounter, as well as provide you with an overview of both the process and components of a successful transaction. Before starting the home search, you and your real estate advisor can discuss your timeline, price range, needs, preferences, and other parameters for a property that will suit you, your lifestyle, and goals. You and your real estate advisor will review options in property type, architectural style, neighborhood, amenities, and financing. We’ll review the current market conditions and trends, and how they will affect your search. We’ll discuss how we can work together most effectively and the steps you can take to make the process successful.

Rest assured that you will receive the utmost care, attention, hard work, and professionalism, with a promise to provide unparalleled service and to follow the highest ethical standards.

I cannot say enough about Grant’s professionalism and loyalty in representing me in my recent purchase of a home. He toured me through multiple properties and submitted several offers before we were able to close the deal on my current home. This demanded considerable time and energy on his part. He always came through and demonstrated great insight and a positive attitude at all steps along the way. His gracious perseverance and commitment to my needs resulted in a purchase that I am very happy with. I have worked with many real estate professionals over the years but none compare to Grant. I recommend him whole heartedly to anyone looking to list or buy real estate in the Pacific Northwest.

James BakkerWe were more than pleased with the amount of time and energy Grant spent suggesting and discussing the smartest options for marketing our house. He connected us with excellent, speedy and efficient workers to help present our home in the best possible light. Grant’s listing strategies paid off with multiple, higher-than-expected offers. We are very pleased and highly recommend choosing Grant as your real estate agent to assist you in selling your home.

Kathy ParrishTestimonials

Working with Grant to find a new home was absolutely a pleasure. He was patient, thoughtful, and good at listening to me as I tried to figure out my priorities in a challenging market. Honestly you want your real estate agent to be someone you don’t mind hanging out with fairly often—and Grant was both delightful and also a consummate professional. I’d recommend him to any friend looking to buy or sell!

Grant has helped us purchase two properties. We’ve enjoyed working with him. All the guidance and information he provided during the process were really helpful. We highly recommend you to work with him to get your dream house.

Grant led me through the process of buying my first home, and I’m grateful I was connected with him. Unlike other real estate agents I’ve worked with, he never pressured me to go above my price range or settle for something I didn’t want. He knew what to ask about when it came to my biggest priorities, and he has a great connection of lenders and inspectors who are responsive and high quality. Working with him felt natural and easy. I have and will continue to recommend him to others.

I have worked with Grant for five years in my long journey to find the perfect home. Grant is an exceptional broker who goes above and beyond in several key ways. First, he is super responsive. II would have answers to my questions almost immediately. Second, he makes the extra effort to find out details about properties and sellers, and many times these hidden details caused me to look elsewhere. Third, he guides you through every step of the process, even in parts that are not his role (e.g. mortgage loans), which was a tremendous help for me as a first-time homebuyer. Finally, Grant’s suggestions for structuring offers are unique and insightful–it was one of these ‘outside-the-box’ suggestions that got me my first home! Grant’s knowledge, experience, and insight made him invaluable in my home-buying journey. I would recommend Grant in a heartbeat.

Grant was incredible to work with. My wife and I were referred to Grant by a friend of ours, whom Grant also helped to buy a home, and we were not disappointed. He personally showed us at least 10 homes before we found the one, and he was responsive, friendly, knowledgeable, and easy to work with all the way through the process. In fact,

his knowledge of the process, and of homes in general, allowed us to ask for several credits from the seller. Now, we always refer our friends and family to Grant when any of them say they are looking.

I started to work with Grant after I was not so impressed with the performance of my previous agent. The experience working with Grant was absolutely amazing, and drastically better than my previous agent. This was my first time buying a property. Grant’s deep knowledge and years of experience in this market has helped a lot in our discussions, and eventually helped me get a property I’m happy with, in one of the most competitive neighborhoods in Seattle. He was able to provide me information whenever necessary, without me asking specific questions, or even without me knowing what questions I should be asking. I believe that’s extremely important and helpful, especially for first-time buyers. In addition, he is super responsive to whatever communication channels I’m on: email, text, phone calls, anything. For a first-time buyer like me, the complicated purchase process can be intimidating. Having a responsive agent like Grant made me feel relaxed and was super helpful during

the entire process. He was also willing to negotiate on behalf of me with the seller and seller’s agent when an opportunity was present, which eventually had our offer accepted below asking price. Last but not least, he is a very professional agent and an elegant gentleman. He has never been late to any of our appointments (in fact, he would always arrive at least 10 minutes earlier). That is in fact pretty amazing, given how busy his schedule is every day. He would always dress properly and has always been respectful and courteous whenever we chatted. I would strongly recommend Grant to anyone in the housing market, especially, based on my own experience, to first-time buyers. I would definitely like to work with Grant again in the future.

I wouldn’t hesitate a second to recommend Grant. He was very knowledgeable about our market, able to move fast to get the property listed during the early pandemic, and extremely responsive to our questions and concerns throughout the listing, sale, and close process. Grant rocks, and my wife and I are looking forward to our next home purchase through Grant on the road ahead.

Grant Burton Broker

A true advocate for his clients, Grant Burton consistently garners stellar sales results with his strong work ethic, experienced negotiation skills, and his commitment of honesty and integrity. Grant prides himself on his reputation of incredible service and strong client referrals. From the first handshake, he establishes caring relationships with his clients, listening to needs, understanding motivations, and working tirelessly to help them reach—and often exceed— their real estate goals.

Grant has been a consistent top producer throughout his career, assisting over 30 buyers and sellers every year in achieving their home-purchasing dreams. In today’s challenging market conditions, Grant’s advocacy for his clients and strong negotiation skills have resulted in winning bids in even the most competitive situations. Prior to entering the industry, Grant completed his undergraduate studies in Business Administration and Marketing at Seattle University’s prestigious Albers School of Business. He went on to manage an elite members-only club in New York City, where he established his impeccable standard of client care, produced private events, managed and directed staff, and served as client liaison. The skill set acquired during his collegiate years and time in New York has served as the foundation for Grant’s success as a residential real estate agent today. Given his dedication to the extraordinary, Grant’s alignment with Realogics Sotheby’s International Realty was a natural progression in his real estate career. He values the firm’s commitment to unrivaled marketing, it’s trusted brand name, diverse industry expertise and the white glove service approach for all property types and price points—as everyone deserves the exceptional. Grant’s experience on the East Coast means he values the power of a brand that reaches, not just around the corner, but around the world. Grant specializes in Seattle’s most coveted enclaves, including Capitol Hill, Madison Park, Queen Anne, Downtown, Seward Park, and the Central District. Grant spent his formative years near Sacramento, California before moving to Bellingham, Washington to complete high school. He then moved to Seattle for a decade and after trying New York for a handful of years, he returned to the Emerald City. He’s now a Capitol Hill resident who enjoys playing live music, tennis, snowboarding, and running.

206.351.3712

Grant.Burton@rsir.com

grantburton.rsir.com

Significant Sales

Seattle | $3,900,000

Seattle | $1,950,000

Seattle | $3,525,000 Seattle | $1,425,000

Financial Preparation

Before starting your home search, it is important to evaluate your financial situation, confirm your budget, familiarize yourself with mortgage options, and secure pre-approval from a lender. This will help you conduct your search with confidence and negotiate for your desired home successfully. With a Realogics Sotheby’s International Realty broker, you’ll be prepared before you even take a look at the first house, and ready to negotiate the best offer when you find the one.

Market Intelligence

We provide the latest market data on the city, neighborhood, and street that you’re interested in living on, to prepare you for your home search. As leaders in real estate, it was important for us to analyze trends emerging from the most unparalleled year in modern history. The pandemic re-calibrated interest in larger, greener properties, secondary cities, and geographies with favorable tax and emigration policies. These preferences are likely here to stay for the foreseeable future, and it was important for us to provide a resource to those looking to navigate the time ahead.

Rent vs Buy

Making a financially sound commitment to help achieve home and investment goals.

Seattle area rents have increased on average 5% annually in the last decade and are expected to continue to rise. Despite fluctuating mortgage rates over the past year, buying a home, whether an in-city condo or single-family home, may be a considerable option and still less expensive than renting in one of the most expensive housing markets in the country.

“No other city has witnessed such population growth and increases in both household prices and rent growth,” said Dean Jones, President and CEO of Realogics Sotheby’s International Realty. “And one of the unfortunate results of so many residents opting to lease an apartment instead of owning a condominium is that they missed out on both capital appreciation and annual mortgage interest deductions when it comes time to pay taxes.”

According to the Downtown Seattle Association, more than half of the downtown population rents instead of owning their home. Renters are also missing out on home appreciation as their rent continues to go up. Appreciation rates are based on multiple factors. In 2022, the forecasted appreciation in King County sat at approximately 9%. With an appreciation gain over three years, the total forecasted appreciation on a $625,000 home would increase by 17% to $731,694 or an appreciation gain of $106,694.

BUYING $800,000 VS. RENTING

Furthermore, estimated net gain over 10 years with a projected 6% rental increase per year from a starting rent of $2,700 and ending at a rent of $3,409 to buying a condominium at a PAR rate of 3.094% means condo owners would see a net gain of $216,940. And an amortization gain of nearly $64,000.

When the time comes to sell, the initial down payment of $125,000 circles back to the seller, plus the capital appreciation experienced is likely not taxable given current IRS policies for principal residence gains (up to $250,000 for a single person and up to $500,000 for a married couple).

In a year when home prices in many parts of Western Washington have remained relatively flat year over year but rent continues to rise, there is a cost to waiting to buy as well.

Of course, owning isn’t right for everyone—but for those who plan to stay in one place for more than a few years, owning can provide significant economic benefits and wealth potential for the savvy buyer.

Why You Should Partner With A Buyer’s Agent

As an industry expert, RSIR real estate advisors have extensive experience in the field and our geographical location, fully understanding the dynamics in this fast-paced, highly competitive market. As your guide, they will help you find exactly what you are looking for, ensure you pay the right price for it, take care of all paperwork, guide you through the inspection and repair process, and successfully get you to closing.

The Home Buying Process

1

CONSIDERATIONS

Needs, Wants, and Priorities

Purchase Timeline

Financial Parameters and Costs

Buyer-Agent Relationship

2

PREPARATION

Financing Pre-Approval

Assess Market Conditions and Values

Learn Property Types

Neighborhood Pros and Cons

SEARCH 3

Listing Information Review

Home Tours and Open Houses

Exploring Options/Learning the Market Find the Home You Wish to Buy

THE OFFER 4

Review Property Documents

Comparative Market Value Analysis

Negotiation of Best Terms and Price

Offer Acceptance

ESCROW 5

Create Timeline of Events

Open Escrow Account

Buyer Good-Faith Deposit

Preliminary Title Report

6

DUE DILIGENCE

Lender Appraisal

Property Inspection & Investigation

Review of Disclosures and Reports

Removal of Contingencies of Sale

7

WEEK BEFORE CLOSING

Final Walk-Through

Review and Sign Closing Documents

Buyer Final Deposit

Funding of Loan

8

DAY OF CLOSING

Record of the Deed

Close of Escrow

Delivery of Keys

Move In

Find Your New Home

FIND YOUR STYLE

While you might love craftsman homes or the sleek look of a modern kitchen in a penthouse apartment, you’ll be happiest if you consider what type of home will work best for you. Single-family homes offer more privacy, freedom, and space. Condos often come with condo associations that handle a lot of the outside maintenance for you, but a condo might not have the green space you need and you’ll pay monthly dues to the association.

ASK THE PROS

Nobody knows more about a neighborhood than the current residents! Without being intrusive, look for an opportunity to chat with your potential neighbors. What’s their opinion of the block and the neighborhood?

IMAGINE LIVING THERE

Check out the local amenities in the neighborhood you are interested in and see if it works out with your day-today routine. Are there restaurants, stores, and other services that you enjoy close by? Is the neighborhood near a freeway so you can get on the road in a reasonable amount of time? Also, try to visit the neighborhood multiple times and at different times of the day. Lastly, walk through the streets near the home and see how it feels. You will notice more things walking than just driving by.

THE RULES

If the home is part of a Homeowners’ Association (HOA) you will want to get a copy of the bylaws and study those carefully. Many HOAs have rules you would never even think of. For example, the HOA might regulate the type of plants you can have in your yard, type of fencing you can put up, whether or not you can post signs, and specific rules regarding pets.

Next Steps: Making An Offer

THE PRICE

What you offer on a property depends on a number of factors, including its condition, length of time on the market, buyer activity, and the urgency of the seller. While some buyers want to make a low offer just to see if the seller accepts, this often isn’t a smart choice, because the seller may be insulted and decide not to negotiate at all.

THE MOVE-IN DATE

If you can be flexible on the possession date, the seller will be more apt to choose your offer over others.

OFFER DETAILS

Often, the seller plans on leaving major appliances in the home; however, which items stay or go is often a matter of negotiation.

Typically, you will not be present at the offer presentation. Your real estate advisor will present it to the listing agent and/or seller. The seller will then do one of the following:

Accept the offer

Reject the offer

Counter the offer with changes

By far, the most common action is the counteroffer. In these cases, the experience and negotiation skills of a Realogics Sotheby’s International Realty real estate advisor are powerful in representing your best interest.

When a counteroffer is presented, you and your real estate advisor will work together to review each specific area of it, making sure to move forward with your goals in mind and ensure negotiation of the best possible price and terms on your behalf.

Once you have found the property you want, you and your real estate advisor will write a purchase agreement. While much of the agreement is standard, there are a few areas that can be negotiated:

Recipe For A Winning Offer

Pre-Inspection

Inspect home prior to making an offer.

Escalation Clause

When a buyer wants to submit an offer on a property for which there may be competing offers, the buyer may want to provide an escalation of the offer price to compete against other offers.

Pre-Qualification

A mortgage letter provides an estimate of the amount you are able to borrow for your home or refinance loan.

Earnest Money

A deposit made to a seller that represents a buyer’s good faith to buy a home.

Escrow

A neutral third party oversees and confirms the financial portion of the transaction. (Required in Washington state.)

Hazard Insurance

Hazard insurance, or homeowners insurance coverage, in Washington state protects your property against damage caused by fires, storms, earthquakes or other natural events.

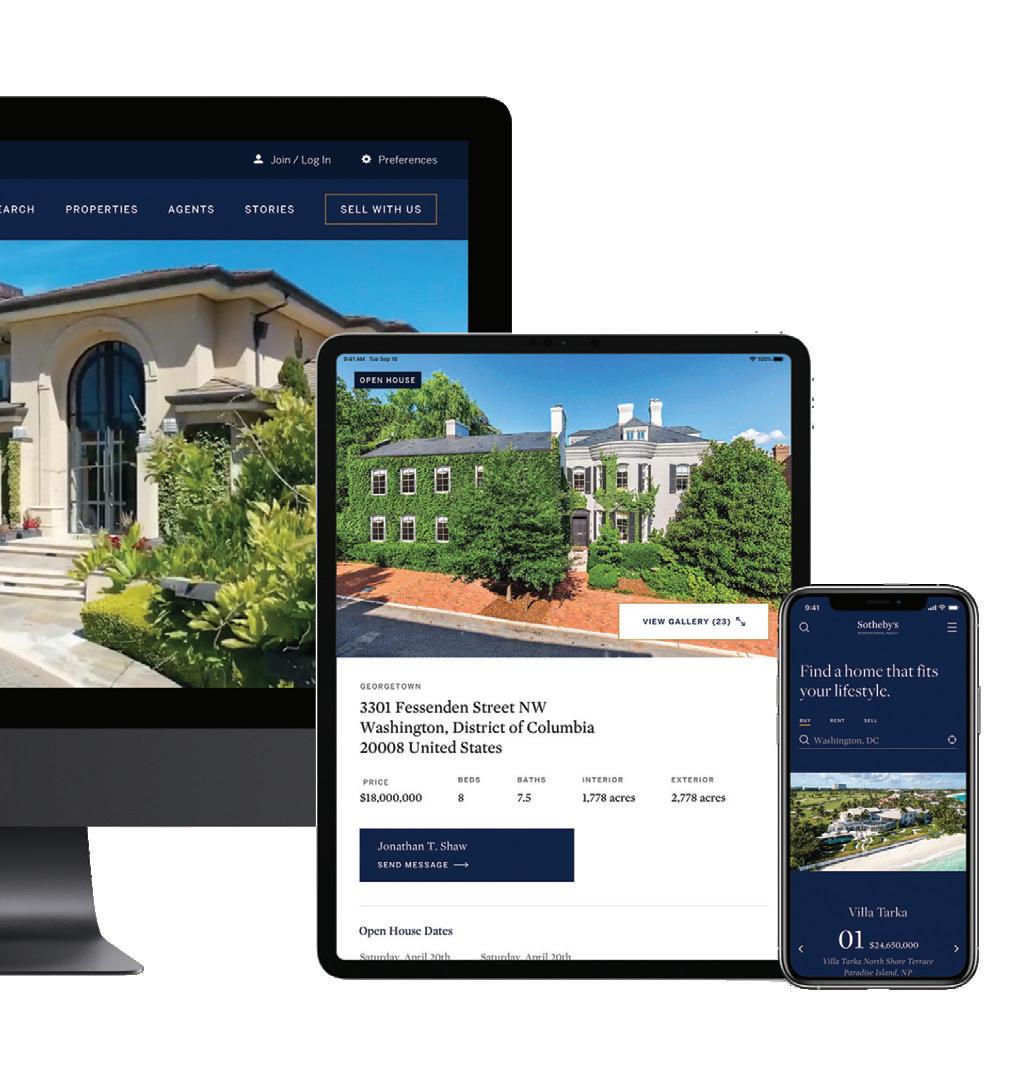

Unmatched Technology For Your Home Search

We change and evolve, just like you. And we understand that today you’re asking a lot of your home—and it needs to change and evolve, too. At Realogics Sotheby’s International Realty, we offer the intelligent solutions you seek as it’s time to head out on your real estate journey. For two years running, REAL Trends has recognized rsir.com as the “Best Overall Real Estate Website.” Featuring powerful search, customizable market data, community insights, and award-winning video, rsir.com offers a suite of online tools that make your real estate journey tangible. And we’re always working on the next thing—that next piece of the puzzle that will make it easier for me, your trusted real estate advisor, to connect you with what’s next. Your buying and selling journey is only a click away.

The Sotheby’s International Realty ® Interactive Experience

As a leader in the luxury real estate industry, Sotheby’s International Realty® is able to anticipate trends. Our priority remains to present listings in the best possible manner and to provide a superb end-user experience however buyers prefer to search for their new home. Virtual technology has been at the forefront of our marketing strategy for several years and comes as naturally to us as our commitment to high-quality service.

APPLE TV

Powered by the amazing visuals produced by our local affiliates the world over, the Sotheby’s International Realty Apple TV app allows you to share the pleasure of browsing our outstanding properties with your friends and family in the comfort of your own home. A premium real estate experience unlike any other.

SIR MOBILE VIRTUAL STAGING

More than half of home searches start on mobile devices; this makes perfect sense. Our phones and tablets travel with us everywhere we go. SIR Mobile is our user-friendly, GPS-enabled real estate listings app that puts our global collection of luxury homes and expert real estate agents in the palm of your hand.

By helping potential buyers visualize the potential of a room and make the home appeal to a targeted audience, virtual staging allows agents to add furniture, rugs, and even paint to photos of a home. Global real estate advisors will post the virtually staged photo or 3D tour online with a home’s listing.

Calling The Northwest Home

Your guide to relocating and living in the Northwest.

Explore the many opportunities the Northwest has to offer. With our collection of esteemed advertising partners who made this guide possible, we’re thrilled to not only show you the best of the Puget Sound, but also how to make that home your very own. From the Emerald City to island living or the snowcapped peaks of the Cascades and beyond, find out what it means to call the Northwest home. Request the latest edition, today.

Strategies For Winning In A Bidding Match

In a hot real estate market, a home can be listed for sale and receive multiple offers within hours.

In most cases, the offer that ultimately wins is the one that has the price, terms, and closing timeline that best match what the seller wants. Each situation can be different though, so work with your agent to identify a strategic approach and get the competitive edge that will help you win the home you want.

Assemble a strong financial package: A seller is more likely to choose your offer when it has solid financing. You can pay all cash and waive all contingencies; however, if that is not for you then consider other strategies:

• Get pre-approved for a loan to prove your finances are solid.

• Work with a local lender or one preferred by the listing agent to gain an advantage.

• Get underwriter approval for an extra sign of strength as a buyer.

• Opt for conventional financing and increase your earnest money amount.

• Ask your lender to call the listing agent and testify that your money is good.

• If the Appraisal comes in low and the lender balks, offer to borrow less to keep the deal together.

Present an irresistible offer: Matching what the seller desires in price, terms, and closing timeline will speak loudly when you make an offer. Your agent can help you find out which terms matter, including:

• Offer at list or, if the list price is low, offer at a price based on comparables.

• Shorten contingency periods or waive them altogether.

• Be flexible about the closing date, if that will win you an advantage.

• During negotiation, think carefully before renegotiating price or credits after an inspection (the seller might opt for the back-up offer).

Go the extra mile: Price and terms are one thing but you may be surprised to learn they don’t always win. When selling a foreclosure, banks sometimes choose the first offer that comes in; however, a homeowner might be swayed by a more personal touch.

• Move quickly to get the offer completed, so your agent can submit it by the offer deadline.

• Submit the offer fast so it’s on top of the stack or, if time allows, have your agent deliver it in person.

• Summarize key offer terms and highlight the ones that matter in a term sheet.

• Include a photocopy of the earnest money check to show you’re serious.

• Conclude with your agent’s deal history to show the escrow process will go off without a hitch.

Contingency In Real Estate

There are contingencies in almost every real estate contract to protect the buyer and the seller. There are several different types of real estate contract contingencies. The first of these is a mortgage contingency. This means there is a stipulation in the contract that says a buyer will obtain a mortgage loan for a specific amount within a certain time period. Once the mortgage loan is obtained, that contingency is removed from the contract. If the buyer is not able to obtain the mortgage, it is possible to withdraw the contract without being penalized. This is a contingency that protects the buyer.

Another contingency that is put into place to protect the buyer is a home inspection contingency. If there is a home inspection ordered and the house does not pass due to factors like termite damage or faulty wiring, the buyer has the right to exit the contract and receive any deposits or earnest money back. If the issues can be corrected, the buyer can request these repairs. If the seller does not agree, the contingency cannot be removed and the contract is voided.

Another popular contingency to put into the contract is one that allows for the sale of the buyer’s current home. This will allow the buyer a specified amount of time to sell their current home before buying a new one. The contract will be voided with no penalties assessed if the current home does not sell. This protects the buyer from a situation where they would have to pay two mortgage loans at once. A contingency of this type also protects the seller. If the seller receives a second offer on the home that is more attractive than the first, they will be able to accept the new contract without facing a penalty. It is important to remember that contingencies should be reasonable requests. You do not want to lose a seller or a buyer because of unreasonable contingencies. Work closely with your agent and be fair.

A contingency is a clause in the purchase contract that describes certain conditions that must be met and agreed upon by both buyer and seller before the contract is binding.

Escrow Lifecycle

The Buyer & Their Broker

Choose a real estate agent.

Gets pre-approval and provides to real estate agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with lender. Receives a Loan Estimate from lender.

Completes and returns opening package from title company.

Schedules inspections and evaluates findings. Reviews title commitment/preliminary report.

Provides all requested paperwork to lender (bank statements, tax returns, etc). All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or escrow officer) prepares CD and delivers to buyer at least 3 days prior to loan consummation.

Escrow officer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, and deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

The Seller & Their Broker

Choose a real estate agent.

Determine the value of the home with insight from the agent and a comparative market analysis.

Prepare the home for sale by cleaning, decluttering, and making any necessary repairs, before staging or virtually staging the home.

Market and show the home both online with photos, video, and 3D tours and in person.

Receive purchase offers and negotiate. Schedule an appraisal.

Prepare for a home inspection with an inspection checklist.

Completes and returns opening package from title company, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/ or repairs to be done as required by the purchase agreement.

Escrow officer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

The Escrow Officer The Lender

Upon receipt of order and earnest money deposit, orders title examinations.

Accepts buyer’s application and begins the qualification process. Provides buyer with Loan Estimate.

Requests necessary information from buyer and seller via opening packages. Orders and reviews title commitment/ preliminary report, property appraisal, credit report, employment and funds verification. Reviews title commitment/ preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Coordinates with lender on the preparation of the CD.

Reviews all documents, demands, instructions and prepares settlement statements and any other required documents.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits documents for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

Collects information such as title commitment/preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with escrow officer on the preparation of the Closing Disclosure, which is delivered to buyer at least 3 days prior to loan consummation.

Delivers loan documents to escrow.

Upon review of signed loan documents, authorizes loan funding.

Reviews all documents, demands, and instructions. Prepares settlement statements and other required documents.

Due Diligence

Typically, a home goes under contract “pending inspection.” You and your real estate advisor will hire an inspector to determine whether any repairs or monetary adjustments to the contract will be necessary.

PRE-INSPECTION

A pre-inspection is something that you would do if an offer review deadline is set by the seller. The reason you do a pre-inspection is two-fold:

Protects you from buying a home that may need repairs.

Provides you with a competitive edge from other potential buyers.

Pre-inspection ensures that your offer stands out because you are not submitting an offer with an inspection contingency.

If you find numerous issues during your preinspection, your real estate advisor will help you determine how to proceed. You may potentially negotiate the offer price based on the pre-inspection if you’re still interested in purchasing the home. If too many issues are found, the best course of action may be to simply walk away.

In a hot market favoring sellers, an offer may be more enticing if an inspection is waived. You and your advisor can discuss the pros and cons to this approach and decide if it’s right for you.

Understanding Costs

Who pays the closing costs?

Your contract and any applicable government regulations determine who pays which closing costs. Your real estate advisor can explain these costs to you.

THE BUYER GENERALLY WILL PAY THE SELLER GENERALLY WILL PAY

Lender’s title policy premium, if new loan; Owner's title insurance premium;

Escrow fee, one half; Real estate agent's commission;

Document preparation, if applicable; Escrow fee, one half;

Notary fees, if applicable;

Recording charges for all documents in buyer’s name;

Homeowner's Association transfer fee, one half;

All new loan charges (except those required by lender for seller to pay);

Any loan fees required by buyer's lender per contract;

All loans in seller's name (unless existing loan balance is being assumed by buyer);

Interest accrued on loan being paid off, statement fees, reconveyance fees and any prepayment penalties;

Termite inspection and any termite repairs per contract;

Interest on new loan from date of funding to 30 days prior to first payment date; Home warranty premium per contract;

Assumption/change of records fees for takeover of existing loan; Homeowner's Association transfer fee, one half;

Beneficiary statement fee for assumption of existing loan;

Home warranty premium per contract;

Hazard insurance premium for first year; and

All pre-paid items, such as interest, or funds for an escrow account.

Any judgments, tax liens, etc., against the seller;

Recording charges to clear all documents of record against seller;

Property taxes: pro-rated to date title is transferred plus any delinquent taxes;

Any unpaid Homeowner's Association dues; and

Any bonds or assessments per contract.

Closing The Deal

The end of your home-buying chapter, the next chapter of your life starts.

On the closing day itself, legal property ownership is transferred to your name. The mortgage amount is provided to the title company or your attorney by your lender. A title company makes sure that the title to a piece of real estate is legitimate and then issues title insurance for that property. Title insurance protects the lender and/or owner against lawsuits or claims against the property that result from disputes over the title. You will receive documentation with costs payable, including balance owing, legal fees, property transfer taxes, and other completion costs. The title company will pay the seller, complete any necessary documents, and register your home in your name.

On your closing day, your lender provides the mortgage money to the title company and you provide the down payment (minus your deposit) to your title company or attorney, as well as any remaining closing costs.

Title companies also often maintain escrow accounts―these contain the funds needed to close on the home―to ensure that this money is used only for settlement and closing costs, and may conduct the formal closing on the home. At the closing, a settlement agent from the title company will bring all the necessary documentation, explain it to the parties, collect closing costs, and distribute monies. Finally, the title company will ensure that the new titles, deeds, and other documents are filed with the appropriate entities.

Most closings will take place at the title company, an attorney’s office, or one of our office locations, where all paperwork is signed and keys are exchanged. Remote closings or fully contact-less closings can also be arranged, with the assistance of online documentation, e-signature programs, and remote notaries.