Buyer’s Guide

For those new to the Emerald City, who want to explore a different region, or are lifelong residents, Realogics Sotheby’s International Realty’s (RSIR) team of local experts makes every move seamless. From the latest market data and hottest neighborhoods in every town to exceptional opportunities to buy or rent, RSIR’s global real estate advisors handle it all.

With unique connections, resources, and strategies, and as a part of the powerful Sotheby’s International Realty® brand, the network of more than 26,000 sales associates in 81 countries and territories bring the exceptional to each homebuying journey. It’s expertise that reaches down the block and around the world.

A home is more than a building or an address, it’s where connection, growth, and life happen.

The Pacific Northwest’s largest affiliate within the global real estate network, Realogics Sotheby’s International Realty has branch offices in Downtown Seattle, Madison Park, Bainbridge Island, Kirkland, Mercer Island, and Downtown Bellevue. The brokerage’s global real estate advisors proudly serve all property types and price points throughout the Puget Sound and beyond.

With an “international” middle name, Realogics Sotheby’s International Realty represents the best of both worlds through local and global reach. Given this position, we are responsible for representing the Puget Sound region to an international audience; proudly representing global citizens choosing to make their homes here.

6 Local Offices 300 Real Estate Advisors $2.6B In Sales Volume 2022

#1 Largest Sotheby’s International® Realty Affiliate in Washington state

Purchasing a home is often one of the most important financial transactions of your life. You are not only choosing a new place to live, but making a substantial investment and creating a significant asset. My role is to provide you with the support, market knowledge and negotiation skills I’ve honed throughout my business career navigating the competitive market.

I have prepared this handbook to help familiarize you with some of the more common terms you’re likely to encounter, as well as provide you with an overview of both the process and components of a successful transaction. Before starting the home search, we can discuss your timeline, price range, needs, preferences, and other parameters for a property that will suit you, your lifestyle, and goals. We’ll review options in property type, architectural style, neighborhood, amenities, and financing. We’ll review the current market conditions and trends, and how they will affect your search. We’ll discuss how we can work together most effectively and the steps you can take to make the process successful.

You can rest assured that you will receive the utmost care, attention, hard work, and professionalism. I promise to provide unparalleled service and to follow the highest ethical standards.

As a first-time homebuyer, having Cherrie as my real estate agent has been such a blessing. She is organized, methodical, and has so many years of experience under her belt which is shown through her confidence, in her communication with homesellers, and through the respect that others give her. I really cannot recommend a better real estate agent.

Ellie Kow

Cherrie Lee

Cherrie Lee

Broker | Certified Residential Specialist | Certified International Property Specialist

Since becoming a licensed real estate agent over two decades ago, Cherrie Lee has earned a sterling reputation for her acute market knowledge, keen negotiation tactics, and tremendous client care. A go-getter in every sense of the word, she truly thrives on the energy of helping her clients. Cherrie is an amazing listener, and effortlessly demonstrates her conscientious work ethic whether she’s representing the sale of a luxury property or assisting discerning clientele in finding their next residence. She always comes prepared and is unwaveringly dedicated to delivering excellent results.

Cherrie’s alignment with Realogics Sotheby’s International Realty stems from a shared appreciation for innovative marketing, thoughtful design, and the power of a globally trusted brand heritage. She leverages the firm’s awardwinning marketing to create unique opportunities for her clients’ luxury properties and is pleased to offer international connections to over 1,000 SIR® offices. Trust is integral to real estate and Cherrie is proud to be consistently ranked among Seattle Magazine’s “Five-Star” agent award winners.

She also holds several key designations, including Certified New Home Sales Professional, Certified Residential Specialist, and Certified International Property Specialist. Cherrie grew up in Hong Kong, relocating to the Seattle area to study business administration and accounting at the University of Washington. As such, she is multi-lingual, being fluent in English, Mandarin, and Cantonese Chinese.

+1 206.353.8899

Cherrie@CherrieLeeGroup.com

CherrieLeeGroup.com

Proudly representing all property types and price points throughout Puget Sound and beyond.

Hunts Point | $4,708,100

Issaquah | $2,299,298

Bellevue | $2,800,000

Mercer Island | $2,820,000

Hunts Point | $4,708,100

Issaquah | $2,299,298

Bellevue | $2,800,000

Mercer Island | $2,820,000

Cherrie was attentive, understood my needs, and was quick to answer questions I had. It was such an enjoyable experience working with her!

Vicki Chiang

Even after closing and during our renovation, Cherrie went above and beyond our expectations by being by our side and providing valuable feedback. She truly loves what she does!

Grace Pang

We have used Cherrie for our buying and selling and we can always count on her for a smooth transaction. Her 20+ years of real estate experience really helps her to understand her customers’ needs.

Rachel Ching

Cherrie is one of the most professional and avid advocates for her clients.

Michelle Sells

Her strong salesmanship skills have often given me more than what I expected when negotiating for a more favorable price. Highly recommend.

Peter Trinidad

Her knowledge of the real estate market is unparalleled. She uses her experience and resources to make a home sell fast.

Karen Cervarich

Before starting your home search, it is important to evaluate your financial situation, confirm your budget, familiarize yourself with mortgage options, and secure pre-approval from a lender. This will help you conduct your search with confidence and negotiate for your desired home successfully. With a Realogics Sotheby’s International Realty broker, you’ll be prepared before you even take a look at the first house, and ready to negotiate the best offer when you find the one.

We provide the latest market data on the city, neighborhood, and street that you’re interested in living on, to prepare you for your home search. As leaders in real estate, it was important for us to analyze trends emerging from the most unparalleled year in modern history. The pandemic re-calibrated interest in larger, greener properties, secondary cities, and geographies with favorable tax and emigration policies. These preferences are likely here to stay for the foreseeable future, and it was important for us to provide a resource to those looking to navigate the time ahead.

The rent versus buy notion has long been contemplated by consumers considering purchasing their first homes or move up buyers considering selling their existing home and purchasing a new one. According to the Department of Housing and Urban Development, the number of U.S. households that own homes declined by 106,000 compared to the previous year. The number of households renting increased by 1.05 million during the same time period.

Consumers are much more financially conscious than they were prior to the economic recession and require more data and education in making buy decisions. To illustrate just how much money new apartment renters have parted with over the last decade, the collective’s report provides some telling statistics. The average sales price for a condominium back in 2010 was $524,842, but that skyrocketed to $849,481 in 2019. To put it another way, during this time period, typical condominiums appreciated 62 percent, or an average of 6.2 percent per year. Tenants of new construction apartment buildings, on the other hand, have also seen drastic increases in monthly rents for smaller and smaller apartments, without getting similar value back in return. Typical rents in 2010 averaged $1,241, but that number rose by an astonishing 84 percent to $2,230 in 2019.

What do all these numbers mean for Seattle renters? Essentially, renters of new apartment units have typically paid out about $218,983 over this 10-year period, while condo owners of similarly sized units have gained about $324,839 in capital appreciation. Add to that these homeowners’ annual income tax savings—approximately $9,228 (2019 tax year estimates) for those with a median household income of $114,000—and it’s clear just how much more costly it is to rent new apartment units in downtown Seattle.

Many would-be buyers seem to recognize that waiting on the sidelines may cost them big in the long-term, and that now is the time to purchase. With today’s historically low interest rates, there’s never been a better time to buy and start benefiting from price appreciation.

As an industry expert, I have extensive experience in the field and our geographical location, fully understanding the dynamics in this fast-paced, highly competitive market. As your guide, I will help you find exactly what you are looking for, ensure you pay the right price for it, take care of all paperwork, guide you through the inspection and repair process, and successfully get you to closing.

1

CONSIDERATIONS

Needs, Wants, and Priorities

Purchase Timeline

Financial Parameters and Costs

Buyer-Agent Relationship

2

PREPARATION

Financing Pre-Approval

Assess Market Conditions and Values

Learn Property Types

Neighborhood Pros and Cons

SEARCH 3

Listing Information Review

Home Tours and Open Houses

Exploring Options/Learning the Market

Find the Home You Wish to Buy

THE OFFER 4

Review Property Documents

Comparative Market Value Analysis

Negotiation of Best Terms and Price

Offer Acceptance

ESCROW 5

Create Timeline of Events

Open Escrow Account

Buyer Good-Faith Deposit

Preliminary Title Report

6

Lender Appraisal

Property Inspection & Investigation

Review of Disclosures and Reports

Removal of Contingencies of Sale

7

WEEK BEFORE CLOSING

Final Walk-Through

Review and Sign Closing Documents

Buyer Final Deposit

Funding of Loan

8

DAY OF CLOSING

Record of the Deed

Close of Escrow

Delivery of Keys

Move In

While you might love craftsman homes or the sleek look of a modern kitchen in a penthouse apartment, you’ll be happiest if you consider what type of home will work best for you. Single-family homes offer more privacy, freedom, and space. Condos often come with condo associations that handle a lot of the outside maintenance for you, but a condo might not have the green space you need and you’ll pay monthly dues to the association.

Nobody knows more about a neighborhood than the current residents! Without being intrusive, look for an opportunity to chat with your potential neighbors. What’s their opinion of the block and the neighborhood?

Check out the local amenities in the neighborhood you are interested in and see if it works out with your dayto-day routine. Are there restaurants, stores, and other services that you enjoy close by? Is the neighborhood near a freeway so you can get on the road in a reasonable amount of time? Also, try to visit the neighborhood multiple times and at different times of the day. Lastly, walk through the streets near the home and see how it feels. You will notice more things walking than just driving by.

If the home is part of a Homeowners’ Association (HOA) you will want to get a copy of the bylaws and study those carefully. Many HOAs have rules you would never even think of. For example, the HOA might regulate the type of plants you can have in your yard, type of fencing you can put up, whether or not you can post signs, and specific rules regarding pets.

My real estate business has been built around one guiding principle: It’s all about you.

What you offer on a property depends on a number of factors, including its condition, length of time on the market, buyer activity, and the urgency of the seller. While some buyers want to make a low offer just to see if the seller accepts, this often isn’t a smart choice, because the seller may be insulted and decide not to negotiate at all.

If you can be flexible on the possession date, the seller will be more apt to choose your offer over others.

Often, the seller plans on leaving major appliances in the home; however, which items stay or go is often a matter of negotiation.

Typically, you will not be present at the offer presentation. We will present it to the listing agent and/or seller. The seller will then do one of the following:

Accept the offer

Reject the offer

Counter the offer with changes

By far, the most common action is the counteroffer. In these cases, my experience and negotiation skills are powerful in representing your best interest.

When a counteroffer is presented, you and I will work together to review each specific area of it, making sure that we move forward with your goals in mind and ensuring that we negotiate the best possible price and terms on your behalf.

Once you have found the property you want, we will write a purchase agreement. While much of the agreement is standard, there are a few areas that we can negotiate:

Inspect home prior to making an offer.

When a buyer wants to submit an offer on a property for which there may be competing offers, the buyer may want to provide an escalation of the offer price to compete against other offers.

A mortgage letter provides an estimate of the amount you are able to borrow for your home or refinance loan.

Is a deposit made to a seller that represents a buyer’s good faith to buy a home.

A neutral third party oversees and confirms the financial portion of the transaction. (Required in Washington state.)

Hazard insurance, or homeowners insurance coverage, in Washington state, protects your property against damage caused by fires, storms, earthquakes or other natural events.

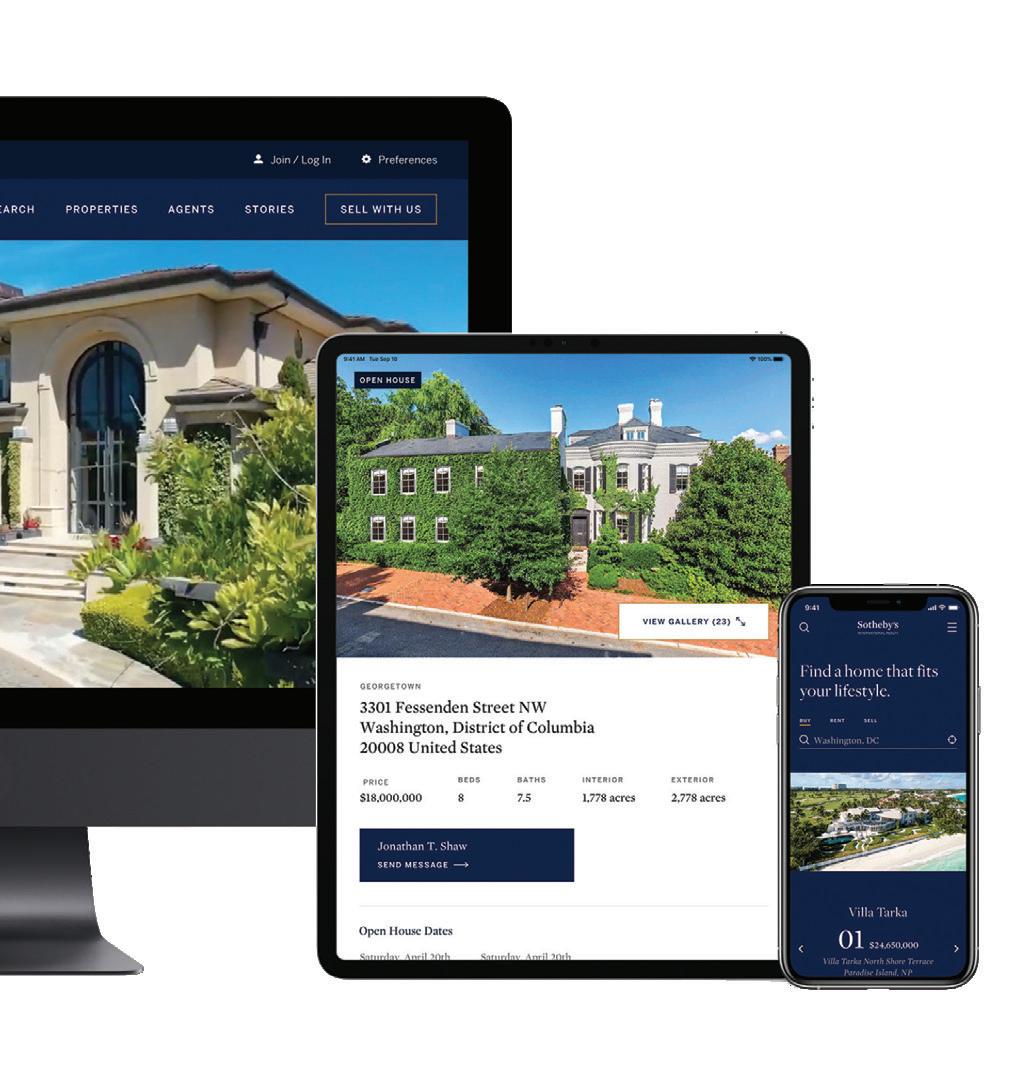

We change and evolve, just like you. And we understand that today you’re asking a lot of your home—and it needs to change and evolve, too. At Realogics Sotheby’s International Realty, we offer the intelligent solutions you seek as it’s time to head out on your real estate journey. For two years running, REAL Trends has recognized rsir.com as the “Best Overall Real Estate Website.” Featuring powerful search, customizable market data, community insights, and award-winning video, rsir.com offers a suite of online tools that make your real estate journey tangible. And we’re always working on the next thing—that next piece of the puzzle that will make it easier for me, your trusted real estate advisor, to connect you with what’s next. Your buying and selling journey is only a click away.

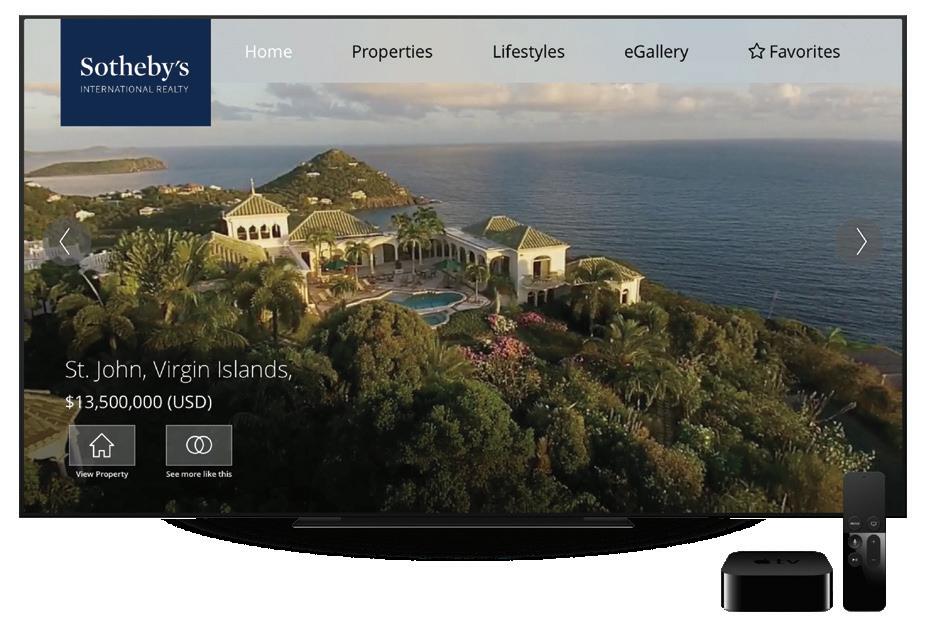

As a leader in the luxury real estate industry, Sotheby’s International Realty® is able to anticipate trends. Our priority remains to present listings in the best possible manner and to provide a superb end-user experience however buyers prefer to search for their new home. Virtual technology has been at the forefront of our marketing strategy for several years and comes as naturally to us as our commitment to high-quality service.

More than half of home searches start on mobile devices; this makes perfect sense. Our phones and tablets travel with us everywhere we go. SIR Mobile is our user-friendly, GPS-enabled real estate listings app that puts our global collection of luxury homes and expert real estate agents in the palm of your hand.

Powered

produced

Sotheby’s International Realty Apple TV app allows you to share the pleasure of browsing our outstanding properties with your friends and family in the comfort of your own home. A premium real estate experience unlike any other.

By helping potential buyers visualize the potential of a room and make the home appeal to a targeted audience, virtual staging allows agents to add furniture, rugs, and even paint to photos of a home. Global real estate advisors will post the virtually staged photo or 3D tour online with a home’s listing.

by the amazing visuals

by our local affiliates the world over, the

by the amazing visuals

by our local affiliates the world over, the

Your guide to relocating and living in the Northwest.

Explore the many opportunities the Northwest has to offer. With our collection of esteemed advertising partners who made this guide possible, we’re thrilled to not only show you the best of the Puget Sound, but also how to make that home your very own. From the Emerald City to island living or the snowcapped peaks of the Cascades and beyond, find out what it means to call the Northwest home.

In a hot real estate market, a home can be listed for sale and receive multiple offers within hours.

In most cases, the offer that ultimately wins is the one that has the price, terms, and closing timeline that best match what the seller wants. Each situation can be different though, so work with your agent to identify the strategic approach and get the competitive edge that will help you win the home you want.

Assemble a strong financial package: A seller is more likely to choose your offer when it has solid financing. You can pay all cash and waive all contingencies; however, if that is not for you then consider other strategies:

• Get pre-approved for a loan to prove your finances are solid.

• Work with a local lender or one preferred by the listing agent to gain an advantage.

• Get underwriter approval for an extra sign of strength as a buyer.

• Opt for conventional financing and increase your earnest money amount.

• Ask your lender to call the listing agent and testify that your money is good.

• If the Appraisal comes in low and the lender balks, offer to borrow less to keep the deal together.

Present an irresistible offer: Matching what the seller desires in price, terms, and closing timeline will speak loudly when you make an offer. Your agent can help you find out which terms matter, including:

• Offer at list or, if the list price is low, offer at a price based on comparables.

• Shorten contingency periods or waive them altogether.

• Be flexible about the closing date, if that will win you an advantage.

• During negotiation, think carefully before renegotiating price or credits after an inspection (the seller might opt for the back-up offer).

Go the extra mile: Price and terms are one thing but you may be surprised to learn they don’t always win. When selling a foreclosure, banks sometimes choose the first offer that comes in; however, a homeowner might be swayed by a more personal touch.

• Move quickly to get the offer completed, so your agent can submit it by the offer deadline.

• Submit the offer fast so it’s on top of the stack or, if time allows, have your agent deliver it in person.

• Summarize key offer terms and highlight the ones that matter in a term sheet.

• Write a cover letter about yourself (with photos) and what you love about the home.

• Include a photocopy of the earnest money check to show you’re serious.

• Conclude with your agent’s deal history to show the escrow process will go off without a hitch.

There are contingencies in almost every real estate contract to protect the buyer and the seller. There are several different types of real estate contract contingencies. The first of these is a mortgage contingency. This means there is a stipulation in the contract that says a buyer will obtain a mortgage loan for a specific amount within a certain time period. Once the mortgage loan is obtained, that contingency is removed from the contract. If the buyer is not able to obtain the mortgage, it is possible to withdraw the contract without being penalized. This is a contingency that protects the buyer. Another contingency that is put into place to protect the buyer is a home inspection contingency. If there is a home inspection ordered and the house does not pass due to factors like termite damage or faulty wiring, the buyer has the right to exit the contract and receive any deposits or earnest money back. If the issues can be corrected, the buyer can request these repairs. If the seller does not agree to the repair request, the buyer has the option to accept and continue, offer an alternative, or terminate the contract. Another popular contingency to put into the contract is one that allows for the sale of the buyer’s current home. This will allow the buyer a specified amount of time to sell his or her current home before buying a new one. The contract will be voided with no penalties assessed if the current home does not sell. This protects the buyer from a situation where he or she would have to pay two mortgage loans at once. A contingency of this type also protects the seller. If the seller receives a second offer on the home that is more attractive than the first, he or she will be able to accept the new contract without facing a penalty. It is important to remember that contingencies should be reasonable requests. You do not want to lose a seller or a buyer because of unreasonable contingencies. Work closely with your agent and be fair.

A contingency is a clause in the purchase contract that describes certain conditions that must be met and agreed upon by both buyer and seller before the contract is binding.

Choose a real estate agent.

Gets pre-approval and provides to real estate agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with lender. Receives a Loan Estimate from lender.

Completes and returns opening package from title company.

Schedules inspections and evaluates findings. Reviews title commitment/preliminary report.

Provides all requested paperwork to lender (bank statements, tax returns, etc). All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or escrow officer) prepares CD and delivers to buyer at least 3 days prior to loan consummation.

Escrow officer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, and deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

Choose a real estate agent.

Determine the value of the home with insight from the agent and a comparative market analysis.

Prepare the home for sale by cleaning, decluttering, and making any necessary repairs, before staging or virtually staging the home.

Market and show the home both online with photos, video, and 3D tours and in person.

Receive purchase offers and negotiate. Schedule an appraisal.

Prepare for a home inspection with an inspection checklist.

Completes and returns opening package from title company, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/ or repairs to be done as required by the purchase agreement.

Escrow officer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

Upon receipt of order and earnest money deposit, orders title examinations.

Requests necessary information from buyer and seller via opening packages.

Accepts buyer’s application and begins the qualification process. Provides buyer with Loan Estimate.

Orders and reviews title commitment/ preliminary report, property appraisal, credit report, employment and funds verification. Reviews title commitment/ preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Collects information such as title commitment/preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with lender on the preparation of the CD.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits documents for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

Delivers loan documents to escrow.

Coordinates with escrow officer on the preparation of the Closing Disclosure, which is delivered to buyer at least 3 days prior to loan consummation. Reviews all documents, demands, instructions and prepares settlement statements and any other required documents.

Upon review of signed loan documents, authorizes loan funding.

Reviews all documents, demands, and instructions. Prepares settlement statements and other required documents.

A pre-inspection is something that you would do if an offer review deadline is set by the seller. The reason you do a pre-inspection is two-fold:

Protects you from buying a home that may need repairs.

Provides you with a competitive edge from other potential buyers.

Pre-inspection ensures that your offer stands out because you are not submitting an offer with an inspection contingency.

If you find numerous issues during your preinspection, as your real estate advisor, I’ll help you determine how to proceed. We may potentially negotiate the offer price based on the pre-inspection if you’re still interested in purchasing the home. If too many issues are found, the best course of action may be to simply walk away.

In a hot market favoring sellers, an offer may be more enticing if an inspection is waived. We can discuss the pros and cons to this approach and decide if it’s right for you.

Typically, a home goes under contract “pending inspection.” I will hire an inspector to determine whether any repairs or monetary adjustments to the contract will be necessary.

Who pays the closing costs?

Your contract and any applicable government regulations determine who pays which closing costs. I can explain these costs to you.

Lender’s title policy premium, if new loan; Owner's title insurance premium;

Escrow fee, one half;

Document preparation, if applicable;

Notary fees, if applicable;

Recording charges for all documents in buyer’s name;

Homeowner's Association transfer fee, one half;

All new loan charges (except those required by lender for seller to pay);

Interest on new loan from date of funding to 30 days prior to first payment date;

Assumption/change of records fees for takeover of existing loan;

Beneficiary statement fee for assumption of existing loan;

Home warranty premium per contract;

Hazard insurance premium for first year; and

All pre-paid items, such as interest, or funds for an escrow account.

Real estate agent's commission;

Escrow fee, one half;

Any loan fees required by buyer's lender per contract;

All loans in seller's name (unless existing loan balance is being assumed by buyer);

Interest accrued on loan being paid off, statement fees, reconveyance fees and any prepayment penalties;

Termite inspection and any termite repairs per contract;

Home warranty premium per contract;

Homeowner's Association transfer fee, one half;

Any judgments, tax liens, etc., against the seller;

Recording charges to clear all documents of record against seller;

Property taxes: pro-rated to date title is transferred plus any delinquent taxes;

Any unpaid Homeowner's Association dues; and

Any bonds or assessments per contract.

On the closing day itself, legal property ownership is transferred to your name. The mortgage amount is provided to the title company or your attorney by your lender. A title company makes sure that the title to a piece of real estate is legitimate and then issues title insurance for that property. Title insurance protects the lender and/or owner against lawsuits or claims against the property that result from disputes over the title. You will receive documentation with costs payable, including balance owing, legal fees, property transfer taxes, and other completion costs. The title company will pay the seller, complete any necessary documents, and register your home in your name.

On your closing day, your lender provides the mortgage money to the title company and you provide the down payment (minus your deposit) to your title company or attorney, as well as any remaining closing costs.

Title companies also often maintain escrow accounts―these contain the funds needed to close on the home―to ensure that this money is used only for settlement and closing costs, and may conduct the formal closing on the home. At the closing, a settlement agent from the title company will bring all the necessary documentation, explain it to the parties, collect closing costs, and distribute monies. Finally, the title company will ensure that the new titles, deeds, and other documents are filed with the appropriate entities.

Most closings will take place at the title company, an attorney’s office, or one of our office locations, where all paperwork is signed and keys are exchanged. Remote closings or fully contact-less closings can also be arranged, with the assistance of online documentation, e-signature programs, and remote notaries.