- Quarterly Market Review -

A Review Of Key Market Differences Year over Year

Homes are selling on average at 98% asking price, which is a little more than this time last year.

There were 2,326 SFD sales during Q4 2023: 477 were all Cash and 441 were closed with an FHA loan.

The average home size, for properties sold during this quarter, has increased by almost 3.5%.

12 of the sales from this quarter were categorized as distressed sales (Bank Owned, Short Sale, HUD owned, pre-foreclosure etc.) compared to 0, this time last year.

1st Quarter 2023 | 1st Quarter 2024

HOMES Median List Price $425,000 $497,000 Median Sale Price $423,000 $478,000 Median SP/LP Ratio 99% 96% Average SP/LP Ratio 97% 98% Median PP/SqFt $219 $243 Total Inventory 2,079 2,222 New Listings 3,133 3,633 Total Sold 2,609 2,326 Median DOM 173 124 Average Home Size 1,889 1,955 Q1: 2023 Q1: 2024 Q1: 2023 Q1: 2024 SINGLE-FAMILY HOMES MARKET SUMMARY | 1st Quarter 2024 New Listings Med. Sale Price $55,000 Official Market Type: Seller’s New Inventory is up

are

the market conditions are

for

SINGLE-FAMILY

by almost 16% but historically inventory levels

still low and that’s why

still considered more favorable

sellers.

Total Sold 283 DOM 19 500

- Quarterly Market Review

A Review Of Key Market Differences Year over Year

-

1st Quarter 2023 | 1st Quarter 2024 SOLD BY PRICE Q1: 2023 Q1: 2024 under $400K 1,155 745 $400K - $499,999 541 494 $500K - $599,999 304 321 $600K - $699,999 178 206 $700K - $799,999 117 147 $800K - $899,999 82 127 $900K - $999,999 47 66 $1M - $1,099,999 17 25 $1.1M - $1,299,999 70 60 $1.3M - $1,499,999 25 35 $1.5M - $1,799,999 28 36 $1.8M - $1,999,999 11 10 $2M - $2,499,999 14 19 $2.5M - $2,999,999 8 13 $3M - $3,999,999 4 13 $4M - $4,999,999 4 4 $5M - $5,999,999 2 3 $6M - $6,999,999 0 2 Some of the data used to create this brochure is from the Cromford® Report. The data used to create the Cromford® Report is obtained from public records and obtained under license from the Arizona Regional Multiple Listing Service, Inc (ARMLS). Cromford Associates LLC and ARMLS expressly disclaim and make no representations or warranties of any kind, whether express, implied or statutory, as to the accuracy of the data used or the merchantability or fitness for any particular purpose.

A Note from the Team Leader...

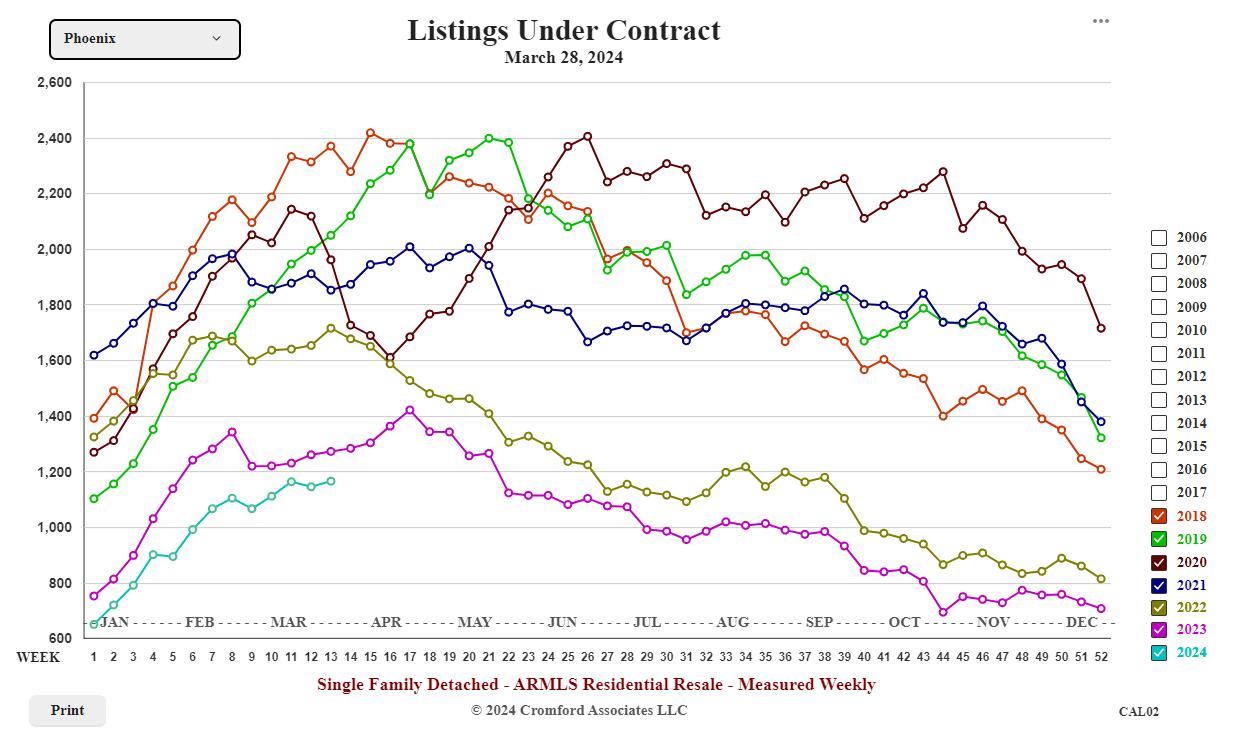

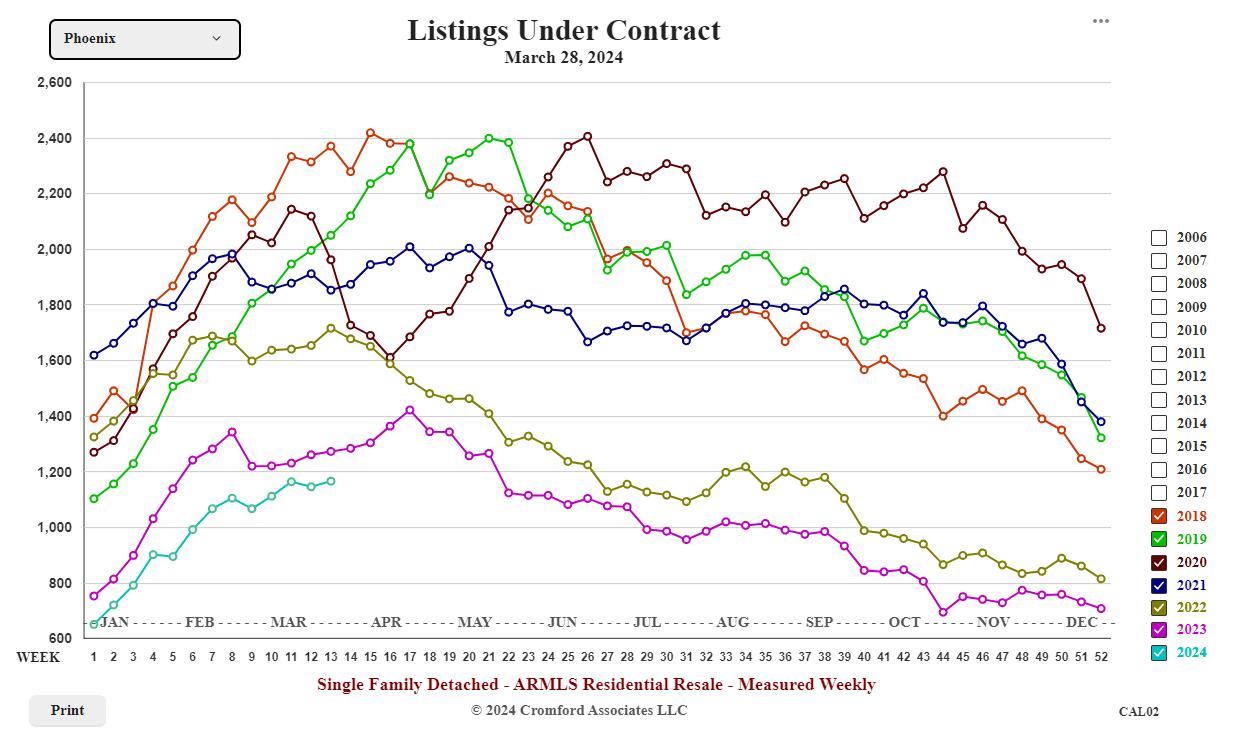

Heading into Q2 2024, Phoenix’s residential real estate landscape is proving to be both dynamic and resilient in the face of rising interest rates. This past quarter, we’ve witnessed an uptick in the listing area, yet when we draw a parallel with Q1 of the previous year, the total properties sold have seen a modest decline. And interestingly, the market is moving at a brisker pace. Despite these mixed signals, the market’s vitality is underscored by an important metric: the median sales price has risen, indicating healthy demand and a robust market environment.

For sellers, the evolving market dynamics highlight the need for strategic insight and professional guidance. Smart pricing and effective marketing are key to attracting discerning buyers. I am dedicated to providing exceptional service and insights, ensuring we navigate Phoenix’s real estate market successfully in 2024. If you would like to talk about this in further detail, feel free to give me a call.

Warmest Regards,

Erica Anderson

©2024 All rights reserved. This representation is based on sales & data reported by multiple brokers/agents to the ARMLS for January, February and March 2023 & 2024. Listings & sales may not be those of Erica Anderson or Real Premier Team of RE/MAX Fine Properties. The National Association of Realtors®, ARMLS and/or the Cromford Report do not guarantee the accuracy of this data, which may not reflect all the real estate activity in the area. E&OE. This market report is not intended to solicit properties already listed for sale nor intended to cause a breach of any existing agency relationship. Our real estate market report derives data primarily from the local Multiple Listing Service (ARMLS), public records & the Cromford Report. We employ statistical analysis, expert review, & qualitative insights to ensure the report’s accuracy. While we strive for reliability, market fluctuations & regional variations may impact the data’s precision. To find out how this data directly relates to your property’s value, contact us. Real Premier Team powered by:

RE/MAX Fine Properties Your Source for Housing Market Insights.

www.RealPremierTeam.com

- real estate -