17 minute read

Taxing Matters

President Joe Biden has proposed tax changes that could significantly impact real estate professionals. Among them are increasing the maximum income tax rate, changing how longterm capital gains are taxed, increasing the corporate income rate, and repealing Section 1031 exchanges. By William D. Elliott

The presidential election in November 2020 and the accompanying congressional elections presented diametrically opposed points of view on many issues, including taxation. How these competing visions play out in the first months of 2021 will occupy center stage as the most important current tax development.

Real estate professionals, particularly investors and developers, need to be mindful of impactful tax legislation. After all, higher taxes are a risk to be considered along with numerous other risks.

Behind the façade of the pending questions of tax reform is the eternal question of who is to be taxed. The late Senator Russell Long of Louisiana, who served as chair of the Senate finance committee from 1966 to 1981 and influenced most tax legislation of the latter half of the 20th century, made one of the wittier statements about taxation: “Don’t tax you, don’t tax me, tax that fellow behind the tree.”

Tax Rule Changes to Watch

President Joe Biden’s proposed tax plan has many parts, but those most potentially impactful to real estate professionals and investors are: • Increasing the maximum income tax rate. This would increase the top individual income tax rate for taxable incomes above $400,000 from the current maximum tax rate of 37 percent to 39.6 percent. • Removing the cap on Social Security taxes. Social Security taxes would be imposed on taxpayers earning more

than $400,000. Presently, they’re imposed only on the first $137,700 of income. • Changing how long-term capital gains are taxed. This would tax long-term capital gains and qualified dividends at the ordinary income tax rate of 39.6 percent on income above $1 million. Presently, capital gains are taxed at 20 percent. • Repealing Section 1031 like-kind exchanges. • Eliminating step-up basis for inherited property. Presently, the cost basis for inherited property is the fair market value of the property at the time of the owner’s death.

This means someone who inherits property does not pay a capital gains tax on the appreciation inherent in the property at death. This would change under Biden’s tax plan. • Limiting itemized deductions. Itemized deductions under the proposal would be limited or capped at 28 percent of their value even though the maximum tax rate is proposed to be 39.6 percent for those earning over $400,000.

Thus, the proposal creates a gap between the tax benefit of the itemized deduction and the income tax rate, at least for higher earners. This proposed limit on itemized deductions would not affect business deductions, rental properties, or real estate expenses for investors.

• Increasing corporate income tax rate from 21 to 28

percent. This would not affect those operating under a partnership or LLC not taxed as a corporation.

• Lowering estate and gift tax exemptions to $3.5 million.

The exemption is presently $11.7 million, so this represents a significant increase in the estate and gift tax.

The goal for eliminating these and other tax breaks is to raise tax revenue to pay for Biden’s domestic agenda goals, such as bolstering childcare and care for the elderly. Nevertheless, enactment of these tax reforms would have a major impact on real estate business and investing.

Some of the proposed changes have the potential to be more disruptive than others. Eliminating the lower capital gains tax rates and merging capital gains and ordinary income into one tax rate would be particularly disruptive. The estate and gift tax changes, such as eliminating the stepped-up basis at death and taxing unrealized appreciation at death, would have a long-term impact on the estate plans of real estate professionals. Like-kind exchanges have been a significant planning choice for those disposing of real estate, so repealing Section 1031 would be painful. All in all, the entire list of tax reforms, if enacted, would be acutely felt in the real estate sector.

Dodging the Bullet: Congressional Gridlock

The anticipated Democratic sweep of both houses of Congress did not unfold quite as the pundits predicted early in the election cycle. The Georgia U.S. Senate election on Jan. 5 gave the Democrats only a slight majority, so the chances of Biden succeeding in enacting his entire tax plan are problematic. Some may hope for congressional gridlock, thinking it will mean no major tax legislation changes and no tax increases. Real estate professionals should take a more nuanced view of the risk of tax legislation resulting in higher tax rates.

“Congressional gridlock” is too simplistic of a notion. While the Democrats will have a slight edge in their effort to enact their tax plan, the path is far from clear. A bipartisan tax bill is not impossible to imagine. Former President Barack Obama enacted tax legislation during his second term when Republicans controlled Congress. While Biden and the Democrats do not have a blank check to enact all of their tax legislation, they might have sufficient power to enact certain parts.

Some tax issues might lend themselves to a majority agreement. Repeal of Section 1031 like-kind exchanges is a good example of a tax issue that might not have broad popular appeal apart from the real estate community and, therefore, might be vulnerable to enactment.

Golden Moment for Wealth Transfers

Next to the political fight over who to tax and how much, the biggest current development in tax law is the rock-bottom Applicable Federal Rate (AFR), which in January 2021 was 0.52 percent and in February 2021 was 0.56 percent for midterm loans (see table). The AFR is the minimum interest rate allowed for private loans by the Internal Revenue Service (IRS). It is used to determine, among other things, the gift tax for loans to family.

From a tax-planning perspective, this is the golden moment for wealth transfers using low interest rates as the centerpiece strategy. Consider the eye-popping drop in AFR (again, midterm loans) throughout 2020, as shown in the table.

Tax planning using low-interest loans is non-controversial, non-aggressive, and plain vanilla planning, but it is hugely effective. About the only issue is whether the loan is a true loan, as opposed to a gift.

Parents or grandparents who loan money to trusts for children or grandchildren to enable their family trusts to make strategic investments should keep in mind that they can do so at a virtually zero interest rate cost. Why accumulate wealth only to incur an estate or gift tax on transferring the wealth to family when you can use low-interest loans to create the wealth at the family trust level?

However, the rates are starting to rise, so the opportunity afforded by the extraordinarily low interest rates is fading.

Applicable Federal Rate

Month Annual Compounding

Jan. 2020 1.69% Feb. 2020 1.75% March 2020 1.53% April 2020 0.99% May 2020 0.58% June 2020 0.43%

July 2020 0.45% Aug. 2020 0.41% Sept. 2020 0.35% Oct. 2020 0.38% Nov. 2020 0.39% Dec. 2020 0.48%

Jan. 2021 0.52% Feb. 2021 0.56%

Source: Internal Revenue Service

Partnership Tax Audits

Another current development that is important to the real estate community is the IRS’ increasing push to audit more partnerships and LLCs that are taxed as partnerships. The IRS is already recruiting agents for this purpose. This is important because the partnership and LLC are the single, dominant form of business entity used in the U.S., and that’s especially so in real estate.

The audit rate for partnerships has been low—less than 1 percent—largely because the rules for partnership audits are complicated. In 2015, when the Bipartisan Budget Act was enacted, the rules for audits of partnerships and entities taxed as partnerships changed along with the rules for determining who is required to pay the tax that results from any corresponding audit adjustments. Those new rules became effective after Dec. 31, 2017.

The new centralized partnership audit rules enable the IRS to audit a partnership tax return and assess the partnership with any tax owing. This change eliminated the need for the IRS to audit and collect tax from individual partners. Because of these changes, many expected the audits of partnerships to increase. This appears to be happening in 2021.

Instead of waiting for a partnership tax audit, get prepared by being proactive. For example: • Review the partnership agreement to determine how a tax audit would apply. • Update the agreement as necessary, especially being sure that the old “Tax Matters Partners” provisions have been replaced with the new rules for “Partnership Representative.” Among the provisions in the new audit regime that should be considered for an updated partnership agreement are the appointment, removal, and replacement of the Partnership Representative; the general duties and, specifically, the obligation to provide notice to partners of a tax audit; the Partnership Representative’s authority to resolve the audit; the Partnership Representative’s release from liability; and the new audit regime’s election-out rules.

Concern Over Effective Dates

Another thing to watch for is the effective date of proposed legislation. For example, the prospect of an estate tax increase retroactively taking effect Jan. 1, 2021, is a concern for many.

Rather than being driven by fear of an early effective date of seismic legislation, a better strategy might be to test any tax planning against the metric of “does it make sense?” Clients who were considering tax planning at the end of 2020 should continue planning in first quarter 2021.

Whatever the risk of sweeping tax reform in 2021—whether it results in a 2 percent, 20 percent, or even just 0.2 percent tax increase—there will be a narrow time frame in which to hedge against that risk—perhaps just the first quarter.

Unwinding the Planning

Many people began planning wealth transfers in late 2020 for fear of dramatic tax legislation, but they have doubts about parting with a substantial portion of their wealth.

Because there is a danger of moving too much wealth too soon, the question arises: Is there a way to undo a tax-planning strategy adopted in late 2020? A few fundamental questions to consider: • If you have to jump through a lot of hoops to undo the planning, then why are you planning in the first place? • Will transferring wealth keep you from being able to pay bills? If so, then the transfers should not be made. • Have you taken care of yourself before considering transferring wealth to your children?

Be Proactive, Minimize Tax Risk

Biden’s proposed tax plan, amazingly low IRS approved interest rates, and the anticipated increase in tax audits of partnerships and LLCs each serve the purpose of pointing to tax risk (and opportunities) confronting the more active real estate professionals and investors.

The tax risk is quite real and, without proactive planning, could lead to higher taxes. For those who do not dawdle, however, the opportunities are significant.

Tax laws are complicated, so be sure to consult a tax accountant or tax attorney before making financial decisions. Elliott (bill@etglawfirm.com) is a Dallas tax attorney, Board Certified, Tax Law; Board Certified, Estate Planning & Probate; Texas Board of Legal Specialization; and Fellow American College of Tax Counsel.

Should It Stay or Should It Go?

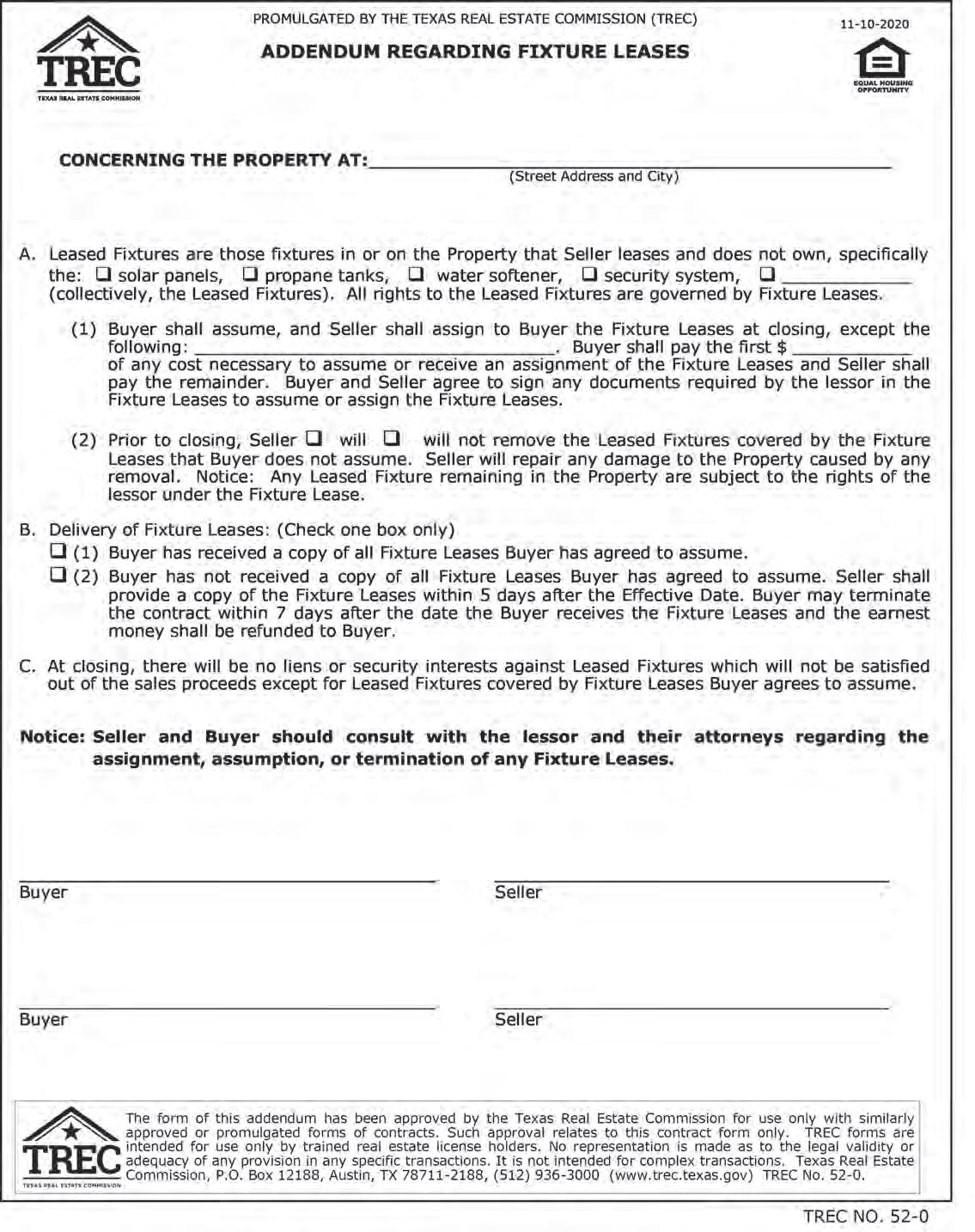

Required TREC Addendum Addresses Fixture Leases

The Texas Real Estate Commission now requires an addendum on contracts for properties that have a fixture lease. The addendum allows the parties involved in the sales transaction to address issues associated with the lease early in the transaction process rather than later. By Kerri Lewis

AAccording to a Texas Real Estate Commission (TREC) requirement that took effect April 1, if a fixture lease is on a property for sale, a new contract addendum must now be attached to the contract as part of the transaction.

No, this is not an April Fool’s Day joke. It is the result of many months of deliberation by the Broker-Lawyer Committee and TREC acknowledging a lack of direction for parties to a transaction in which a fixture lease exists on the property.

The new Addendum Regarding Fixture Leases will make parties aware of and enable them to address the many special issues that arise with fixture leases at the time of contract rather than weeks before closing. A copy of the addendum is provided at the end of this article.

What is a Fixture?

A fixture is an improvement to real property, generally some type of personal property, that is affixed or fastened in some way that makes it become a permanent part of the real property. A fixture conveys with the real property unless specifically excluded in the contract. There have been many real estate disputes about what is or is not a fixture. In Logan v. Mullis, 686 S.W.2d 605 (Tex. 1985), the Texas Supreme Court set out three factors that are relevant in determining whether personal property has become a fixture that conveys with the real property: (1) the mode and sufficiency of annexation, either real or constructive; (2) the adaptation of the article to the use or purpose of the realty; and (3) the intention of the party who annexed the personal property to the realty.

The first factor considers how the personal property is attached to the real estate and whether its removal will result in damage to the real property. A cabinet that is nailed into the wall studs would be considered a fixture, whereas a free-standing refrigerator merely plugged into an outlet would not. A flat bathroom mirror glued to the wall would be a fixture, while a framed mirror hanging on the wall with a picture hook would not.

The second factor considers whether the personal property was customized for the real property. A sub-zero refrigerator built into kitchen cabinetry is an example. An outdoor grill built into back porch masonry is another.

Courts give the third factor the most weight. What was the intention of the party who attached the item to the realty? The first two factors usually supply the evidence of this third factor.

Paragraph 2 of TREC-promulgated contracts refers to fixtures as being “permanently installed and built-in items” and lists many examples, including wall-to-wall carpet, mirrors, security equipment, light fixtures, and landscaping.

What is a Fixture Lease?

A fixture lease is an agreement with a third party who leases personal property to a homeowner that is attached to the real property in some way.

The most common types of fixture leases are solar panel leases (attached to the roof), security system leases (wired into the walls, doors, and windows), propane tank leases (attached by gas lines to the house and powers household systems), and water softener leases (attached by water lines to the house).

What Happens to a Fixture Lease When the Home is Sold?

stress the importance of getting a copy of all fixture leases ready prior to going under contract. This is important for two reasons. First, as already mentioned, the client will want to review The leased fixture property is not owned by the homeowner, the terms of the lease (preferably with an attorney) to see what so it does not automatically convey under the improvements options are available to them. Second, as set out in Paragraph B provision of Paragraph 2 B of the TREC contracts. What hap- of the addendum, if the fixture lease is not delivered before or pens to the leased fixture property on the sale of a home is at the time of the contract, the seller will have an obligation to determined as much by the terms of the fixture lease as the deliver the lease to the buyer within five days of the effective desires of the parties. This bears repeating: What happens to date, and the buyer will have a right to terminate the contract the leased fixture property is largely determined by the terms within seven days after receiving a copy of the lease and have of the fixture lease. the earnest money refunded. If the seller does not deliver the

Each fixture lease is different, and the higher the cost of lease after five days, the buyer may declare the seller in default the leased property (read: solar panels), the more complex any time before delivery up to closing and seek remedies under the terms for buyout or assignment of the lease. Most fixture default Paragraph 15. This includes termination and return of leases will have some provisions that deal with the sale of the the earnest money. underlying realty. In general, they Be sure to read and understand allow the seller to move the prop- how Paragraph A of the addendum erty under the fixture lease to their works. All subsections of Paragraph new home, assign the fixture lease A should be filled out. They are not to the buyer, or pay off the remain- an either/or proposition like the der of money owed under the lease. first two paragraphs of the Adden-

Each one of these options dum Regarding Residential Leases. raises questions and concerns. The body of Paragraph A sets out For instance, if the fixture prop- which type of fixture leases exist on erty is taken by the seller, who the property. is obligated to repair any damage Paragraph A(1) states that the to the real property caused by the buyer shall assume and the seller removal? If the fixture property shall assign all of the fixture leases and lease are to be assumed by the buyer, does the lessor have the right to approve or reject the buyer? The leased fixture property is not owned by the homeowner, so it does checked except _______________. If a buyer does not want to assume a fixture lease, the type of fixture If the buyer is approved, is there an assignment fee? If the buyer is rejected, does the seller have to pay not automatically convey under the improvements provision. lease must be written in this blank. The second blank in this subsection allows the parties to negotiate a cap off the lease in full at closing? If on how much the buyer will pay the the buyer does not assume it, can lessor for assignment of the lease or the seller be required to remove the property and repair any leases. Both parties agree to sign required lessor documents for damage? If the seller just leaves the property, does the lessor the assignment. How much is paid and what documents have to have the right to remove the leased property? If so, who is be signed will be determined by the terms of the fixture lease. responsible for repairing any damage caused by the removal? Paragraph A(2) addresses whether the seller will or will not

Fixture leases were required to be delivered to buyers in for- (one of those boxes must be checked) remove leased fixtures mer TREC contracts under the general lease provision in former covered by leases the buyer does not assume. It also states Paragraph 10 B(2), but no specific negotiated contract terms were that the seller will repair any damage caused by the removal set out in the promulgated contracts to deal with the questions of the leased fixtures. If the leased fixtures are not removed, raised above. Addressing those issues was the main purpose for the fixture lease will control what rights the lessor has to the adding the Addendum Regarding Fixture Leases. leased fixtures. Note that this paragraph does not address who Using TREC’s New Fixture Lease Addendum completes repairs if the lessor removes the leased fixtures. Again, this would be controlled by the fixture lease. The most important part of this one-page addendum is con- Finally, Paragraph C states that there will be no liens or tained at the bottom of the page in the notice. It states that security interests against leased fixtures on leases the buyer “Seller and Buyer should consult with the lessor and their does not assume. This means the seller will have to pay off attorneys regarding the assignment, assumption, or termina- any sums due for termination of the fixture lease, either before tion of any Fixture Lease.” Fixture leases, especially solar panel closing or out of sales proceeds at closing. This could be quite a leases, can be complicated, and both parties need to understand sum for solar panel leases and is another good reason the seller the terms of the lease before a decision can be made as to should review the lease and understand the options before listassumption or termination. Keep in mind license holders can- ing the property for sale. not interpret the terms of a fixture lease for their clients, nor Nothing in this publication should be construed as legal can they give advice as to whether their client should assume advice for a particular situation. For specific advice, consult an or terminate a lease. Both of these actions would constitute the attorney. unauthorized practice of law.

A listing agent should discuss the existence of any fixture Lewis (kerri@2oldchicks.com) is a member of the State Bar of Texas and leases with sellers at the listing appointment. The agent should former general counsel for TREC.