3 minute read

Regulation: The Italian job

The job

Silvia Dell’Acqua, head of actuarial reserving at Eurovita SpA and lecturer in actuarial mathematics at Politecnico di Milano, talks to Dan Georgescu about the profession in Italy

How does one become an actuary in Italy? In Italy, insurance professionals can only call themselves actuaries if their names appear in the National Register (Albo Nazionale), meaning that they have passed a state examination. Until that point, actuarial education is university-based and restricted to a few specifi c degrees. A public institution supports actuarial professionals, maintaining quality standards, a code of ethics, and a professional development programme. There are just under a thousand registered Italian actuaries, and there are reciprocal agreements and mutual recognition with other associations.

The role of the actuary in Italy seems more limited than in the UK. Are actuaries in Italy fi nding their way into management positions? It can be hard to fi nd an Italian actuary who is a CRO, CFO or CEO, though this may become more widespread in the future. Historically, the actuary has been seen as a specialist who calculates reserves or performs some other well-defi ned, specifi c task. However, Solvency II is changing this. I see the CRO as a natural possible step in the career of a risk actuary, but the CFO position may require a deeper knowledge of assets, fi nance and accounting, and the CEO role additionally requires experience in marketing and relationship management. If an actuary spends too many years carrying out the same traditional routine tasks, it can be hard to get the breadth required for these roles. That said, the Italian Institute for the Regulation of Insurance is asking for technical competence on companies’ boards of directors, which will be good news for actuaries.

How has Solvency II changed actuarial work in Italy? Solvency II has highlighted the need to measure risk in a forward-looking manner, moving the focus away from the immediate profi t and loss position and on to how this position will emerge over time. The new regulation has raised the importance of the risk functions and created opportunities, particularly in consultancy roles. It has also opened the insurance market to many non-actuaries, who bring other skills to the industry. This is not necessarily a bad thing, speaking as someone with a background in mathematical engineering. Actuaries are more prepared than mathematicians and engineers when it comes to looking at the balance sheet and understanding insurance regulation, but dedicated mathematicians may feel more at home specifying a fi nancial model that the engineers can build into a process.

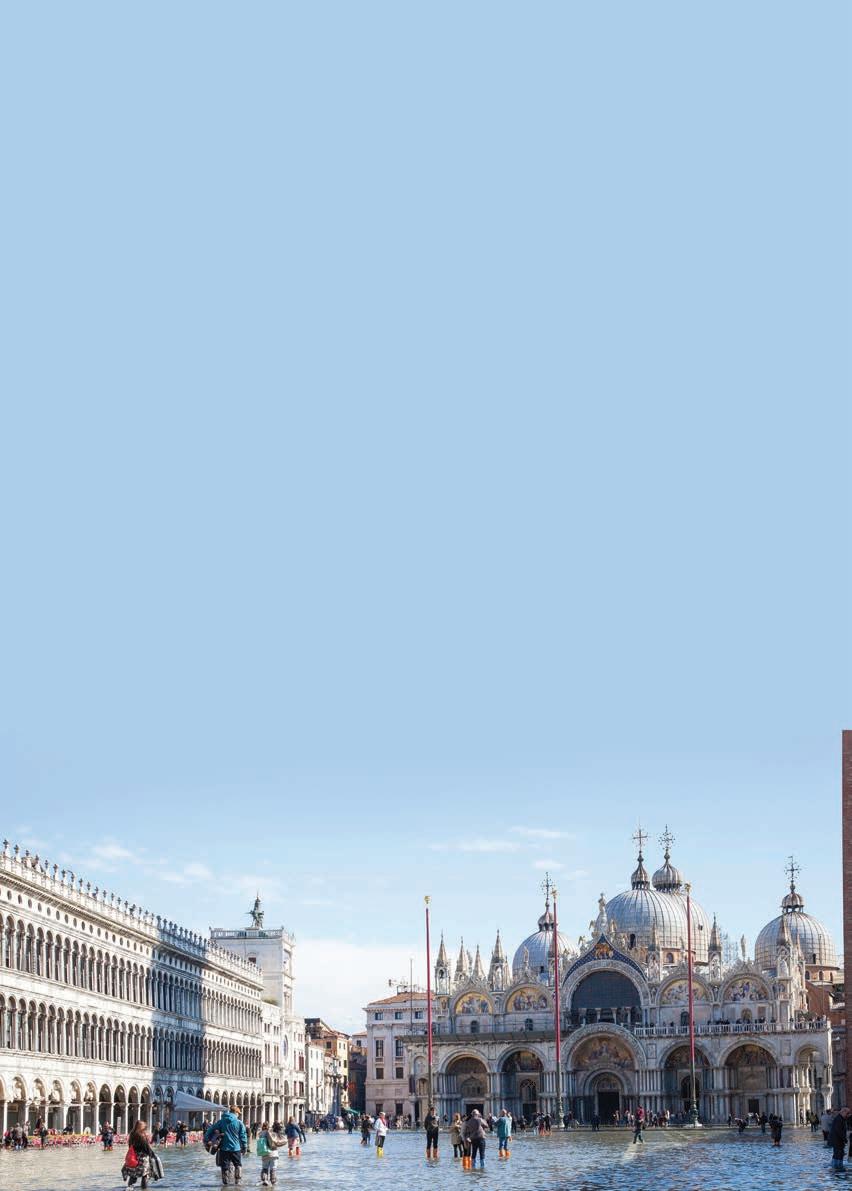

Venice, Trieste and other coastal towns have recently been fl ooded by the highest tides seen in more than 50 years. Should actuaries be doing more about climate change? The fl ooding has brought attention to the increased frequency of extreme weather events. Part of the public anger concerns the fact that the defence system of movable underwater barriers, MOSE, is running a decade behind schedule, having been beset by corruption, cost overruns and delays. Actuaries may be helpful in assessing the risks of fl oods and earthquakes, but there is still a lack of political will directing their skills. The Italian parliament has discussed, but failed to pass, legislation to improve insurance cover for major risks and the availability of insurance for disaster damages, such as compulsory contribution to a seismic fund by individuals living in areas prone to earthquakes. Retail seismic insurance remains uncommon; this needs to improve. At the moment, the driver in this area is the European Insurance and Occupational Pensions Authority, with its agenda of sensitivity-testing the climate risks embedded in insurance companies’ portfolios.