Another banner year, especially for Opus Development Company

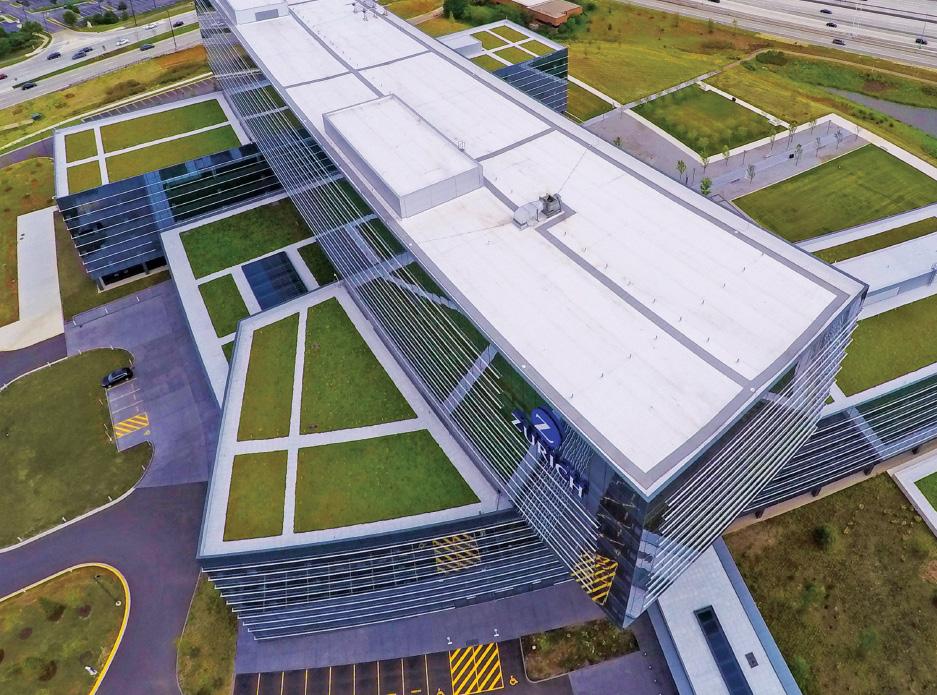

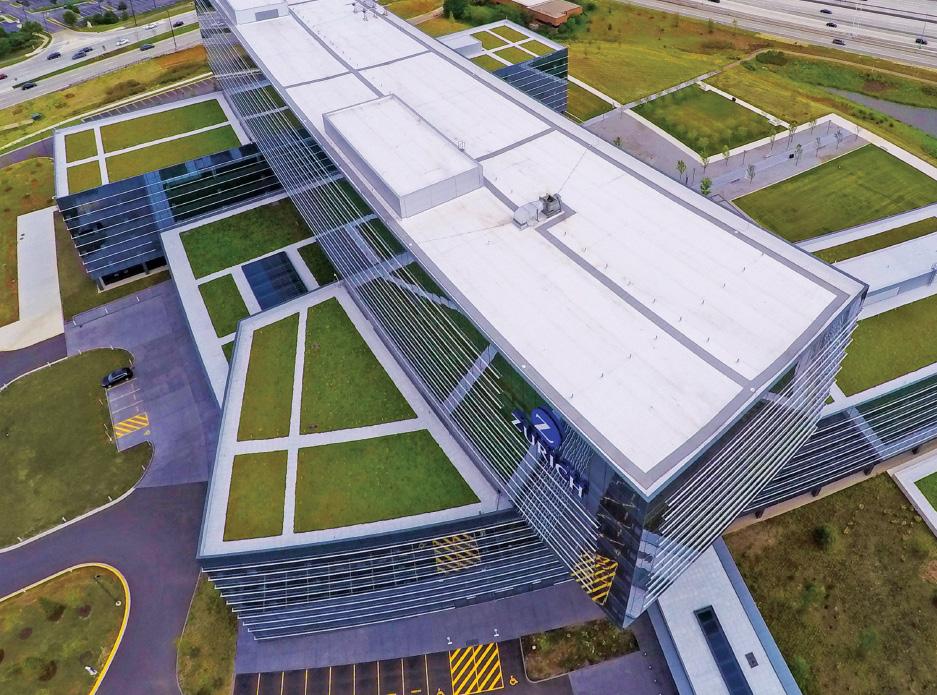

Tollway Corporate Center

By Mia Goulart, Senior Staff Writer

2022 was a record-breaking year for the sector, and all things considered, it’s looking like 2023 will be just fine.

Chicago Industrial Properties recently spoke with Mike Yungerman, Senior Vice President & General Manager of Opus Development Company, LLC, for an inside look at a few of the company’s most no table projects of this year—Chicago Logistic Service at Oakview Corporate Park and Tollway Corporate Center.

Chicago Logistic Service, a transportation company that specialized in office, computer, medical and sensitive equipment, tasked Opus to design and build an almost 50,000-square-foot building on the last remaining site in Oakview Corporate Park. The build-to-suit has 2,900 square feet of office space, with the remaining square footage designated for warehousing and the ability to expand by another 40,000 square feet. Chicago Logistic Service took occupancy in July 2022.

I-90: What’s with all the new tenants?

By Mia Goulart, Senior Staff Writer

Called the “Golden Corridor” for good reason, I-90 has experienced an ex plosion of activity this year—and it’s still growing, harboring some of the sector’s biggest projects. Huntley, Illinois, is one city getting a big slice of the action.

One of the newer spec projects that broke ground this year is Huntley Commercial Center, located at 11800 Factory Shops Blvd. Huntley Investment Partners, LLC and Newmark and Development Solutions, Inc., as general contractor, celebrated the formal groundbreaking of the first building just months ago. The Class-A, 540,960-squarefoot warehouse distribution facility, expect

YEAR

PRSRT STD U.S. Postage PAID CHICAGO, IL PERMIT NO. 3223 I-90 (continued on page 8)

IN REVIEW (continued on page 6)

VOL.32 NO.6 NOVEMBER 2022 THE LEADING NEWS SOURCE FOR INDUSTRIAL REAL ESTATE PROFESSIONALS & USERS CRE MARKETPLACE (pg.22): ASSET/PROPERTY MANAGEMENT FIRMS CONSTRUCTION COMPANIES/GENERAL CONTRACTORS ECONOMIC DEVELOPMENT CORPORATIONS FINANCE & INVESTMENT FIRMS LAW FIRMS

Reimagine What’s Possible

CenterPoint Properties is recognized as an innovator in the investment, development, and management of industrial real estate.

Let our team help reimagine what’s possible and give you the competitive edge you need to succeed.

centerpoint.com

PUBLISHER

Mark Menzies menzies@rejournals.com 708.622.0074

SENIOR STAFF WRITER

Mia Goulart mia.goulart@rejournals.com

VICE PRESIDENT OF SALES & MW CONFERENCE SERIES MANAGER

Ernie Abood eabood@rejournals.com

VICE PRESIDENT OF SALES Marianne Grierson mgrierson@rejournals.com

VICE PRESIDENT OF SALES

Frank E. Biondo Frank.biondo@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@rejournals.com

ADVERTISING SUPPORT

Hayley Myers hayley.myers@rejournals.com

DIRECTOR, NATIONAL EVENTS & MARKETING

Alyssa Gawlinski agawlinski@rejournals.com

Chicago Industrial Properties® (ISSN 1546-377X) is published bi-monthly for $59 per year by Real Estate Publishing Corporation, 1010 Lake St Suite 210, Oak Park, IL 60301. Contact the subscription department at 312.933.8559 to subscribe. © 2022 by Real Estate Publishing Corporation. All rights reserved. No part of this publication can be reproduced or transmitted in any form or by any means, electronic or mechanical including photocopying, recording or by any information storage or retrieval system.

2022 EDITORIAL BOARD

Jeanne Rogers

Arthur J. Rogers & Co.

Corey Chase Newmark

Jerry Rotunno Associated Bank

Joe Pomerenke

Arco/Murray National Construction Company, Inc

Dan Fogarty

Stotan Industrial

Steve Schnur

Duke Realty

Adam Moore

First Industrial Realty Trust Inc.

Ron Behm

Colliers International

Adam Roth

NAI Hiffman

Mike Yungerman

Opus Group

Glen Missner

The Missner Group

CONTENTS

1Another banner year, especially for Opus Development Company 2022 was a record-breaking year for the sector, and all things considered, it’s looking like 2023 will be just fine.

1I-90: What’s with all the new ten ants? Called the “Golden Corridor” for good reason, I-90 has experi enced an explosion of activity this year— and it’s still growing, harboring some of the sector’s biggest projects.

4Building boom, but high er rents and construction costs predicted for 2023 Re cord-breaking new spec construction, rising rents and continued pressure on building material pricing and availability headlined the Summit sponsored last month by REjournals.

11Development Showcase: Clarius Partners’ Lion Electric manufacturing facility: A oncein-a-lifetime project in Joliet.

Inflation, interest rates and the industrial market Pesky, lingering inflation that is higher than we’ve seen in years along with six interest rate hikes totaling 375 basis points since the beginning of the year have had varying degrees of impact on all sectors in commercial real estate.

BUILD-TO-SUIT, SPEC & BUSINESS PARKS

ASSET/PROPERTY MANAGEMENT FIRMS

CONSTRUCTION COMPANIES/ GENERAL CONTRACTORS

ECONOMIC DEVELOPMENT CORPORATIONS FINANCE & INVESTMENT FIRMS LAW FIRMS

REAL ESTATE IS A PEOPLE BUSINESS

Partnerships are built on trust. And trust is the foundation of every Conor development.

We stand by our word. We are committed to our relationships.

That’s why our partners return to us, again and again.

www.conor.com

3 NOVEMBER CHICAGO INDUSTRIAL PROPERTIES

18

21

CRE

22

MARKETPLACE

Building boom, but higher rents and construction costs predicted for 2023

By John Coleman and Mia Goulart, Senior Staff Writer

Record-breaking new spec construction, rising rents and continued pressure on building material pricing and availability head lined the Design, Construction & Leas ing panel discussion at the 19th Annual Supply Chain, Distribution & Logistics Summit sponsored last month by RE journals/Chicago Industrial Properties in Oak Brook, Illinois.

Panel experts reveled at reports of sustained tenant demand for space, predicted (without concern) that va cancy rates may rise a point or two next year, and expressed frustration over difficulty in procuring concrete, steel and power switchgear. The panel shared insight on new decarbonization mandates, the rise in “tenant ameni ties” within industrial parks (jogging paths and EV charging stations) and greater demand for office space, dock positions and trailer parking.

The good news for tenants is that they will have more options next year for new space in many submarkets than they had this year,” said MK Asset Managing Director John Coleman, who moderated the panel. “Because our market is the nexus for product move ment coast to coast, we are well-po sitioned here even if the economy is wobbly.”

According to statistics provided by JLL Research, more than 30 million square feet of new construction warehouse and distribution space will be delivered this year. JLL reports that in 2023, nearly 40 million square feet of spec space is expected to come on line—a record for the Chicago market.

“Market velocity right now is high, and we expect it to continue well into next year,” said JLL Managing Director Keith Stauber. “That means we’ll need a significant volume of leasing to keep up with supply. The market absorbed more than thirty-five million square feet in 2021, and we think it can do it again.”

Even if leasing next year falls a bit short, the market can carry more vacancy and still be considered healthy, said Josh Hearne, Principal with Cawley Chica go. “We’ve been on a very good run the past several years with vacancy rates in the four to six percent range, which at the time was considered historically low,” Hearne said. “Vacancy now is right around three percent, so even if it increased a percent or two next year, we will still be in an enviable place.”

One threat to the market is rapidly rising material costs and availability,

explained Peak Construction Vice President David Michael. “Cement is a tough commodity to come by right now,” he said. “We weathered a labor strike in the spring, but with the high volume of new construction going on right now, plus the amount of road work underway, fabricators are on short allocations. If you’re not already in the queue, it could be more than a year before you see concrete delivered to your site.”

Similarly, there is a backlog of orders for power transformers and switch gear, said Bill Hasse, President of Hasse Construction. “Certain parts made overseas for some of our most basic power components are just not available, and that’s holding everything up,” he said. “On the positive side, pric ing on roofing material and some steel items have stabilized or dropped a bit recently.” One exclusion is dock pack ages. “Put them in now, because the lead time is only getting longer.”

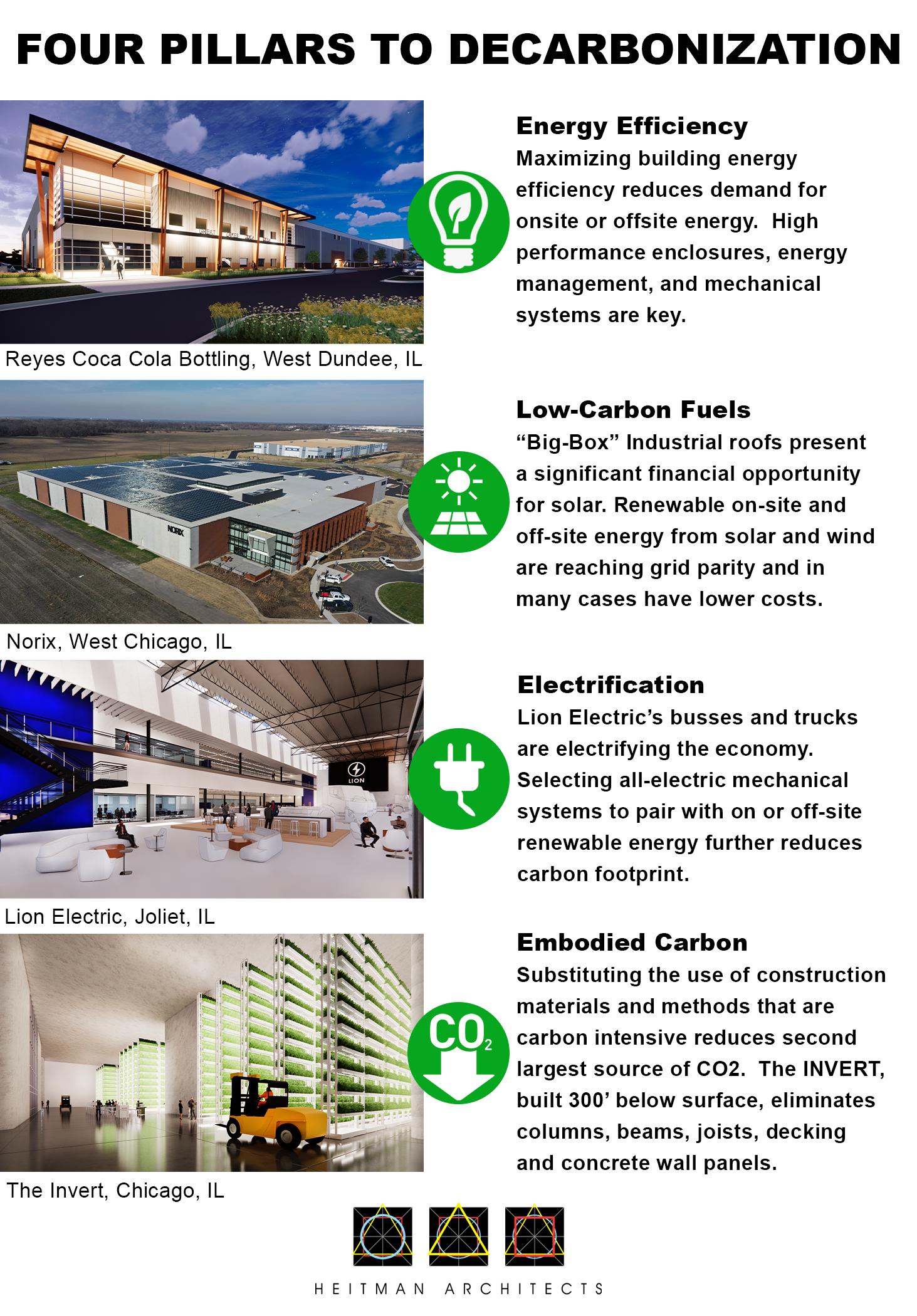

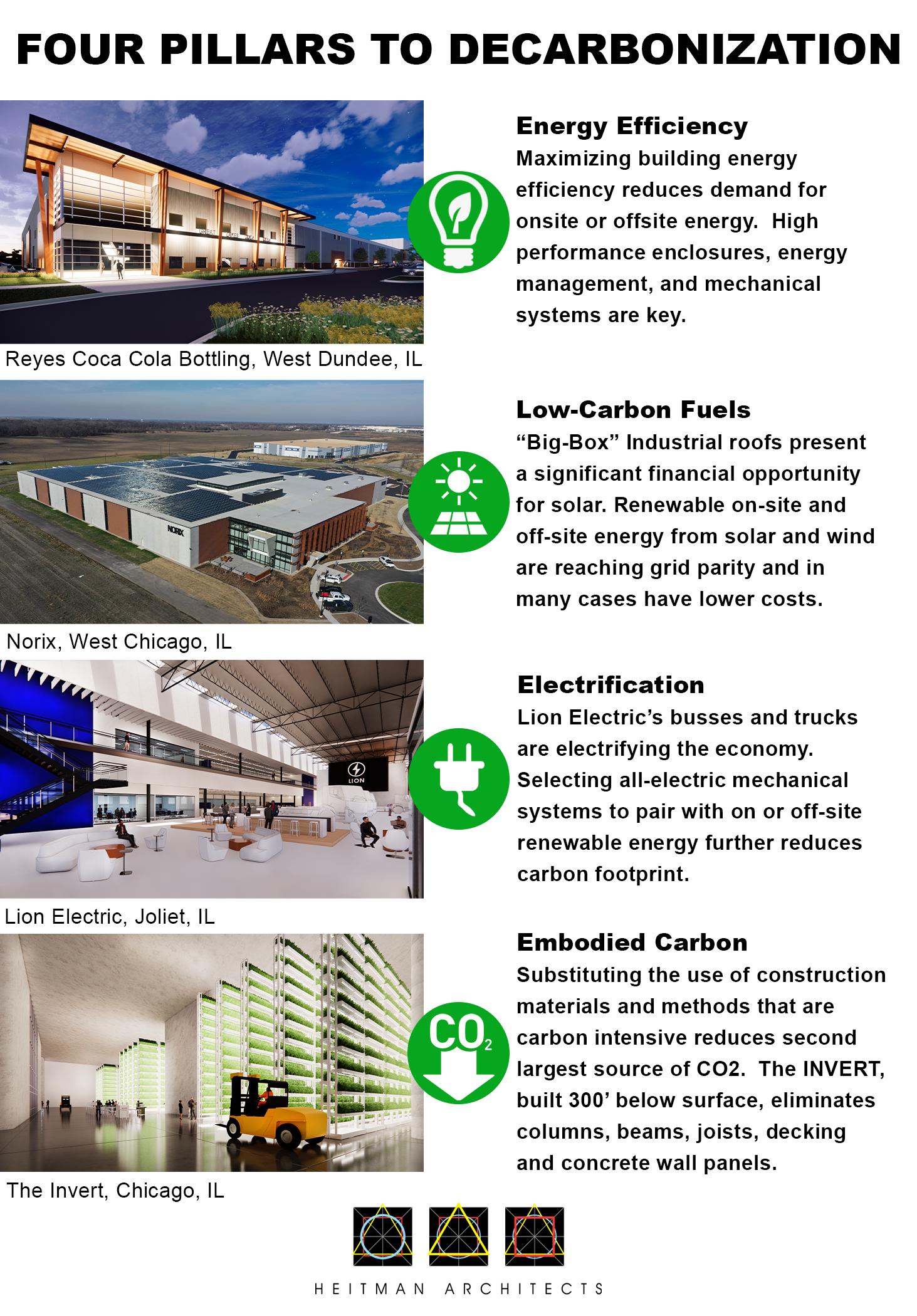

With energy prices high, a push for renewable sources has reached the industrial building sector. As part of its push for “decarbonization,” Chica go now requires all new construction warehouses to be built with reinforced steel and roofs that can hold the weight of solar panels, said Paul Heitman, Director of Heitman Architects, Inc. “Though not yet a requirement, the

trend will continue into the suburbs be cause that’s the direction our industry is heading.”

Heitman also said that employee ame nities once reserved for office tenants are finding their way into industrial developments. Walking paths, outdoor public spaces and EV charging stations are a material part of master-planned developments. Panelists referenced a new business park in Glenview being developed by Dermody Properties that includes such design elements.

“Industrial tenants want these ame nities because they are competing for employees just like office tenants,” Cawley’s Josh Hearne added. Collab orative work spaces with higher-end furniture inside the building are also part of the new amenities package for industrial. “We’re seeing tenants build a little more office space to accommo date these new amenities,” Stauber added.

Hearne and Stauber both predicted that tenants will require more dock positions and more trailer parking next year. “The standard now is one dock for every ten thousand square feet of warehouse,” Hearne said. “That could grow to seven and a half or eight in the next few years.”

In addition to the information provided by the panel, CRG Principal and Chief Development Officer Chris McKee highlighted the impact of onshoring in Chicago.

“Manufacturing operations that previ ously took place oversees are moving back or closer to the U.S.,” he said, “where users can take advantage of efficiencies afforded by newly built Class-A facilities that allow goods to be produced closer to end users, reducing transit costs while lowering the risk of furutre supply chain disruption.”

Accordingly, CRG’s focus is on infill sites and one-million-square-foot “bigbox” logistics centers, like its branded facilities collectively known as The Cubes, located about 20 miles SW of Chicago. The project is especially at tractive to users who are looking for modern logistics facilities to keep pace with the boom of e-commerce and to day’s supply chain needs, and McKee said developments of this kind will re main viable and in high demand for the forseeable future.

CRG currently has 17 active projects of this kind, which are anticipated to deliver over 12 million square feet of Class-A space.

4 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

LEFT TO RIGHT: Neal Driscoll, Partner MW Region, Dermody Properties; Kris Bjorson, Exec Managing Director, JLL; Freddy Johnson, Capital Advisor, StackSource; Moderator David Conroy, Principal, Cawley Chicago; Eric Pitcher, Reg Mgr Economic Development, BNSF Railway Co.; Tracy Davis, President, ACME Companies, Allegheny & Western LLC; Don Koliboski, VP Economic Development, LCEA

LEFT TO RIGHT: Keith Stauber, Managing Director, JLL; Moderator John Coleman, Managing Director, MK Asset Brokerage/Asset Management; Josh Hearne, Principal, Cawley Chicago; Paul Heitman, Director New Business Development, Heitman Architects Inc.; William Hasse III, President, Hasse Construction Co, Inc.; David Michael, VP Sales, Peak Construction

The Logistics Campus Chicago’s State of the Art Industrial Park in the North Suburbs Spec & Build-to-Suit Available for Lease with Immediate access to I-294 at Willow Rd Dermody.com Suzanne Serino, SIOR Executive Vice President (847) 698-8226 suzanne.serino@colliers.com Jonathan Kohn Principal (847) 698-8279 jonathan.kohn@colliers.com Christopher Volkert, SIOR Principal (847) 698-8237 chris.volkert@colliers.com 1 3 4 5 6 7 8 9 10 2 Willow Rd Sanders Rd 10 Buildings (Divisible to 50,000 SF) 3.2M SF Anticipated Delivery Summer 2023 Build to Suit up to 1.6M SF * Flexibility to construct other layouts up to 1.6 M SF Phase 2 Glenview, Illinois

Yungerman said the Northwest Corri dor, specifically Elgin, has had a high percentage of user-owners of space— hard to come by in today’s market— and because of the uptick in portfolio owners unwilling to sell their build ings, it’s been hard for user-owners to find those opportunities. Opus found this niche early and has built and sold several buildings in the park.

Simply, Elgin makes sense for Chicago Logistic Service, as well as for other companies looking to rent in proxim ity to O’Hare and Western Cook at a relatively lower cost.

The second project, Tollway Corpo rate Center in North Aurora, is the redevelopment of a small, executive golf course, and an adjacent piece of property that was owned by one of the building owners in the park. Opus combined the golf course with the smaller property, the latter serving as an access point through the property.

“We built an access road into the golf course for vehicles,” Yungerman ex plained, “as the only prior access point was through a residential neighbor hood, which wasn’t suitable for users

or the local community. The property was reassembled to bring the trucks through the former business park.”

Phase I, the 540,000-square-foot building on the eastern side of the golf course, broke ground in August 2021 and is scheduled to be delivered in a matter of weeks for occupancy by Mid west Warehouse in December. Phase II, the 100,000-square-foot building that is the former expansion land of the business owner that the land was purchased from, broke ground around the same time and will be 50% leased

to Soligent Distribution to occupy in December, with the other 50% still available for lease.

There is one more site, adjacent to the 540,000-square-foot building, that can accommodate just over 400,000 square feet, which is expected to begin construction in 2023.

Both Phase I and Phase II of Tollway Corporate Center were leased be fore completion, which, according to Opus, is a common theme in the past year and a half, seeing the uptick in distribution users in Chicagoland and throughout the U.S.

When discussing “Chicagoland”, Wis consin and Northwest Indiana must not be left out—both are included in the region from an economic (jobs, trans portation, etc.) and industrial perspec tive. Opus has a 280,000-square-foot spec building delivering now at MTC in Kenosha, Wisc., that’s available for lease, and a recently purchased site in Merrillville, Ind., where they’ll soon break ground on another building of a similar size.

Clearly there’s no slowdown in leas ing activity, especially concerning user-owners. Chicago has seen any where from 30 to 35 million square feet under construction at any time, a high percentage of project’s being spec by developers looking to build and lease it and collect the rent stream or sell it for profit. Because of this, there’s a lot of capital to invest in the market.

“Since availability of buildings and land are usually controlled by developers, it’s hard for companies that want their own building to find the opportunity,” Yungerman said. “Unless they’re put ting a lot of capital into their building, many of those users don’t want to use their own balance sheet or real estate and would rather deploy that capital into their operations. They typically do lease the buildings themselves, and as they outgrow them, they reposition themselves and move on to another location.”

But occupiers/users that need space quickly need to act fast because the market today is tighter than it was.

There’s less space to choose from, and despite the area’s hot streak of activi ty, many are wondering just how long it will continue.

According to Opus, 1H2022 was a con tinuation of trends seen in 2021. Many projects broke ground, but at the same time, the supply chain concerning the availability of construction was pent up, resulting in an unavailability of necessary items like precast, steel and concrete. Due to extended lead times on these essential building materials, 9–12-month builds were delayed to 12–18 month builds, and in some cases, even longer, causing inflation to rise in 2022, according to Opus.

“While demand continued from a user perspective, the interest rate environ ment started to climb quickly, result ing in uncertainty and freezing of the debt and capital market in the last few months that will bleed into 2023,” Yun german said. “It’s more difficult to get a construction loan and find capital or equity to go forward, so it’s hard to underwrite and determine how to ap proach projects financially, which will lead to an eventual slowdown.”

6 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

us.jll.com/industrial YEAR IN REVIEW (continued from page 1)

We shape the future of commercial real estate for a better world.

Hallmark at Liberty Heartland Logistics Center

Mike Yungerman

"While demand continued from a user perspective, the interest rate environment started to climb quickly, resulting in uncertainty ."

ed to be delivered in late 2023, and Phase II—a second, smaller building— will break ground once the first reach es a stabilized occupancy, though it’s still undetermined whether the second building will be built spec, as the first, or marketed as a build-to-suit.

The press release detailing the project noted both buildings will be construct ed of precast concrete wall panels with a structural steel frame and a 36-foot clear height. Each building will be also equipped with multiple entrance features like dock doors and drive-in doors, allowing for ultimate flexibility when leasing the buildings. But it’s less so the buildings’ features, but rather their location, that makes them stand out.

Senior Vice President Michael Reschke Jr. of The Prime Group, Inc., who’s worked closely on the project, said its location along the Rockford Foreign Trade Zone is especially valuable to users that have global operations, as they don’t have to pay taxes on product stored in warehouses within the zone.

“Whether it’s importing or exporting, users can defer excise and import taxes on goods until they’re sold,” Re schke said.

The I-90 Corridor has continued to attract a fair share of global manufac turing companies for this reason, but

they don’t make up the whole of the submarket’s user roster, according to Reschke.

“We’re also seeing an enormous e-com merce footprint as it continues to transform the market,” Reschke said. In fact, Huntley Commercial Center was

well-substantiated by a recent com mitment by a well-known e-commerce giant to occupy 1.6 million square feet across the street, and Weber-Stephen Products has maintained 800,000

8 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

OUR EXPERTISE | YOUR ADVANTAGE Krusinski Construction Company is a local, family-owned business and leader in providing unique and innovative solutions to complex building projects, nationwide. We support our clients throughout the design and construction process, delivering exceptional performance and building long-lasting partnerships along the way. 2107 Swift Drive | Oak Brook, Illinois | 630-573-7700 Let’s Start Building. Visit krusinski.com to learn more. I-90 (continued from page 1)

(continued on page 10)

Mike DeSerto

Cory Kay

"We’re also seeing an enormous e-commerce footprint as it continues to transform the market."

square feet adjacent to the site for just under a decade.

Another big facility in Huntley was recently leased by Entre Commercial Realty, LLC, which will be occupied by a single tenant and is still under construction as the first phase of a three-building portfolio.

Phase I will be 40,800 square feet once completed and equipped with eight maintenance bays and four docks. It’s scheduled to be delivered in Q1 2023, along with Phase II, which will be a 177,270-square-foot distribution facil ity. Phase III is a 45,000-square-foot maintenance facility, similar to that of Phase I, and will be delivered in the latter half of Q4 2023.

Entre’s Cory Kay and Mike DeSerto, who represented the developer and landlord in the transaction, said the portfolio received an immense amount of interest, specifically the smaller maintenance facility, given that the use is difficult to find and get approved. And it’s one of the only facilities to offer maintenance and trailer parking in the area, to boot.

“It’s been a two-year project and we’ve been working with the Village of Huntley for approval,” Kay said. “Once construction commenced, we had a lot of interest. A large trucking firm from Schiller Park leased the entire proper ty on a long-term basis.”

And this portfolio is just one of its kind. Entre has a handful of ground-up de velopments in the works, along with a number of land site zoning and entitle ment projects.

“Overall, the brokerage community is working through several spec develop ments,” DeSerto said. “What once was considered a non-core market has be come quite a focus, and a lot of that has to do with being located just outside of Cook County. In the North Kane/I-90 submarket alone, we’re seeing just under four million square feet of spec development.”

What’s behind all this growth? For one, DeSerto and Kay agreed with Michael Reschke regarding I-90’s strategic location near Rockford Internation

al Airport and O’Hare International Airport, and noted the immense labor pool, which has proven beneficial for businesses that have relocated or ex panded into the area.

But the truth is, the growth is not new, nor are the reasons for it, and the area has grown steadily for many years— depending on how you look at it. The difference between the “then” and the “now” lies in the kind of growth.

According to DeSerto and Kay, I-90 used to be a relatively inorganic sub market, with the same businesses continually expanding and contracting within its perimeter. Only recently has the submarket seen an uptick in organic growth, largely due to the tax advantag es and infrastructure improvements.

“Many companies are moving from other submarkets into North Kane/I-90 due to historically low vacancy rates across all submarkets,” DeSerto said. “This has created the need for busi nesses to move from submarkets with little inventory available that they were originally set on being in.”

For over 45 years, DarwinPW Realty/ CORFAC International has been a leader in industrial and commercial real estate. The company specializes in brokerage, property management, investment and development services primarily in the Midwest. DarwinPW Realty’s highly qualified professionals are problem solvers and utilize a breadth of tools and knowledge to serve our clients best.

10 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

630.782.9520 | darwinpw.com

“We implement strategic plans driven by client collaboration.”

Rick Daly Managing Broker

I-90 (continued from page 8)

South Loading View (Courtesy of Entre Commercial Realty)

Clarius Partners’ Lion Electric manufacturing facility: A once-in-a-lifetime project in Joliet

By Dan Rafter, Editor

By Dan Rafter, Editor

Meridian Design Build served as the general contractor on Clarius Park Joliet’s Building 2, a 906,517-square-foot industrial facility developed by Clarius Partners in partnership with Walton Street Capital in the Chicago suburb of Joliet. The fa cility will serve as a manufacturing base for Quebec-based Lion Electric, a maker of zero-emission electric vehicles.

Lion Electric will build more than 20,000 electric vehicles here each year, mostly electric school buses. The facility at 3835 Youngs Road will have a positive impact on its home of Joliet, too, employing an estimated 1,400 workers.

"This has been a unique project, and one that really doesn't happen very often to this magnitude," Schmidt said. "You have a large team that put this together, Lion Electric, the design team, the architects, the developer and our subcontrac tors. We wouldn't be where we are today without the enhanced cooperation and teamwork that this group showed on a daily and weekly basis. It's been a fantastic process."

11 DEVELOPMENT SHOWCASE

And an interesting quirk? The Clarius Park building wasn't initially planned to house assembly lines dedicated to building electric vehicles. Lion Electric select ed the building after construction started on what was originally designed as a high-end spec industrial facility.

The kind of project that doesn't come along very often. That's how Peter Schmidt, senior vice president with Rosemont, Illinois-based Meridian Design Build, described the Lion Electric project in Joliet, Illinois.

An exterior view of the Lion Electric project in Clarius Partners' Clarius Park Joliet development.

This change halfway into the construction process required everyone involved in the project -- from the architecture team of Heitman Architects Incorporated to Meridian Design Build to Clarius Partners -- to pivot quickly.

The steps these key players took to do that? Those are what made the Lion Elec tric project such a success.

No small undertaking

Lion Electric’s new manufacturing facility is no small project. There are 195-foot truck courts, 50-foot-by-54-foot bays with 75-foot speed aisles, over 200 trailer stalls and a massive parking lot with more than 1,200 car stalls.

And in addition to the manufacturing floor of assembly lines, the building in cludes nine offices. Eight of these are located in the warehouse space itself, each one watching over one of Lion Electric’s production lines.

There’s also a large corporate office space, a portion of the plant expected to come online in early 2023.

Then there is the land surrounding the facility. Lion Electric was committed to cre ating a lushly landscaped green area for their employees to enjoy. This includes plans for a large patio area and gathering space for workers, an outdoor space large enough for Lion Electric officials to hold company events and team-building exercises.

Eric Johnson, vice president with the project’s developer, Chicago’s Clarius Part ners, said that construction crews first broke ground on the building in September of 2020. During those earlier days of construction, crews focused on pouring the foundations and tackling the infrastructure and site-grading work.

Then in February of 2021, Clarius Partners received a confidential RFP asking for information about the site. The proposal indicated that a single user – which would turn out to be Lion Electric – was interested in occupying the entire build ing. That was big news. Even bigger? This this user had very specific needs for the site and needed plenty of power.

The confidential user wanted a parking lot big enough for at least 1,000 cars. The company had an aggressive timeline for the building’s construction schedule,

12 DEVELOPMENT SHOWCASE

1 2 3 4 5

1) The Lion Electric project features extensive office space. 2) Break areas were designed to provide employees the best work experience. 3) Modern facilities dot the facility. 4) Additional employee gathering space at the facility. 5) The Lion Electric facility also includes modern meeting spaces.

needing the majority of the facility up and running before the end of 2022. And it needed 10 megawatts of power to fuel its assembly lines.

“We looked at each other when we saw this and said, ‘This is a pretty crazy deal,’” Johnson said. “We didn’t even know if we could get that much power to the site. At first, we thought this would never happen. Then as construction kept progress ing, we kept hearing ‘No. It’s a real deal.’ It came down to us and a site in Texas.”

And in the winter of 2021? Texas suffered a major ice storm that resulted in widespread, and well-publicized, power outages. The disaster captured national headlines and threw doubt on the capabilities of the state’s power system. This might have played a role in Lion Electric choosing the Joliet site over one in Texas, Johnson said.

13 DEVELOPMENT SHOWCASE

Individual office spaces in the building offer views of the Lion Electric assembly areas.

A break area in the Lion Electric project building.

“I really do believe that was one of the things that was a tipping point in our direction,” Johnson said. “Lion Electric needed reliable power. They also needed speed to market. Lion didn’t have time to find a site and build something from scratch. Because we were still early in the construction process, this space fit the bill for them, hand-in-glove.”

Officials from Lion did look at existing manufacturing facilities that the company could have retrofitted to meet its deadlines. But, as Johnson says, Lion Electric had such specific needs for its site that retrofitting an existing space would have been more expensive and time-consuming than building a facility from scratch.

Construction crews had already built the walls and roof of Building 2 in Clarius Park. But the site still offered Lion Electric the potential for customization, John son said. The company could get everything it wanted in this facility.

What finally pushed Lion into selecting the Joliet site? Johnson pointed to a variety of additional factors. There was space to build a parking lot for more than 1,000 cars. The city of Joliet and state of Illinois provided important financial incentives to encourage Lion to choose the site. Clarius worked with public utility ComEd to ensure that the site could receive enough power for its manufacturing lines.

And just as importantly, Clarius committed to Lion’s construction schedule, one it has met.

“It was definitely a concerted effort by multiple parties to bring Lion here,” John son said. “It’s not often that a project comes along and brings your community 1,400 jobs. And these aren’t low-paying jobs. These are good jobs with good potential for growth and learning.”

Illinois Gov. J.B. Pritzker's office was also directly involved in helping to bring Lion to Illinois. The governor's office also orchestrated the public announcement of the lease on May 7 of 2021.

The big switch

How challenging was it for Clarius and its contractors to switch gears once they discovered that Building 2 was no longer going to be a spec space but instead would serve as a manufacturing site for Lion Electric?

Johnson said that the entire development team had to make a quick pivot to meet Lion’s needs.

“If you were looking at this from 5,000 feet up, you’d see that it was still basically the same project with a big parking space on the east side,” Johnson said. “But to me, a lot of things changed.”

Part of this change? Construction crews went underground, burying $3 million to $4 million of infrastructure under the building’s slab. This included electric, water and sewer. Fortunately, construction crews had not yet poured the slab before Lion chose the site. If they had, crews would have had two choices: Cut a new slab and install this infrastructure at a great expense or install the infrastructure overhead at an even greater cost.

Clarius also had to remove several planned dock doors from the site and install glass windows. Instead of 120 dock doors, as plans originally called for, Lion only needed 55. Clarius then ordered glass to be installed in the existing openings it

14 DEVELOPMENT SHOWCASE

Jason Rutland, in Toronto, and Luc Sicotte, in Montreal, both with Colliers Inter national managed the site selection process and also played a key role in bringing Lion to Clarius Park.

Another exterior shot highlighting the unique architectural touches of the facility.

had already carved into the building, a way to bring more natural light into the space.

Karl Bechtoldt, project executive with Rosemont, Illinois-based Meridian Design Build, said that construction crews were scheduled to pave the site at the end of May of 2021. Before that could begin, though, Lion Electric finalized its lease of the space. That required Meridian to put construction on hold briefly.

At this time, the designers of the project were working with Lion to develop a list of changes to the building's assembly plant area. What was once completely warehouse space would now need room for individual offices.

Meridian Design Build had to rework the installation of building infrastructure, too. Underground plumbing for new offices and corporate office space, for in stance, all had to be tackled before slab work could start.

Other changes? Meridian had to change course on grading and curb layout and had to reduce the number of drive-in doors.

"Trying to get all that work done and still seal the site was a big effort," Bechtoldt said. "We were moving from a warehouse facility to an assembly plant. Lion Elec tric needed space for a large number of employees. They needed new ingress and egress to the building. These were all significant changes. We had to work on the infrastructure to the building. It was all done in phases as quickly as the designers could get direction and issue orders. We all worked closely as a team to make these changes."

Creating an employee-friendly space

Erik Heitman, project manager with Itasca, Illinois-based Heitman Architects Incorporated, said that the glass features spread throughout the building are im portant to the overall success of the space. As Heitman says, Lion Electric wanted

15 DEVELOPMENT SHOWCASE

GENERAL CONTRACTING | CONSTRUCTION MANAGEMENT EXPERIENCE COMMITMENT RESULTS 847-374-9200 | www.meridiandb.com Meridian Design Build offers a full range of construction services, including all phases of construction planning and management, from conceptual design and budgeting through project completion and facility turnover New Construction Facility Renovations Tenant Improvements Additions / Expansions New Construction Facility Renovations Tenant Improvements Additions / Expansions The flags of the United States and Canada fly over the Lion Electric building.

to bring daylight into its building. The company wanted its employees to have the opportunity to look out onto green space throughout the day.

The many glass additions to the facility's exterior provided this, Heitman said.

"We looked for opportunities to maximize daylight in the facility," Heitman said. "There is an extensive number of overhead doors that allow Lion to bring vehicles into and out of the plant. Those overhead doors are large all-glass doors that bring a ton of daylight into the space."

Clarius also modified the building to make it a more enjoyable place for work ers, a trend that has been gaining momentum in industrial spaces. Construction crews converted a significant portion of the existing truck court into a large patio area for workers. The space can now serve as a home for barbecues, outdoor meetings and other employee events.

The many offices and break areas included throughout the plant are also a benefit to workers. Instead of employees having to walk 1,000 feet across the facility to a single cafeteria or locker room, several of these spaces are now spread across the building.

“Workers can now grab a cup of coffee without having to spend their entire break walking to and from one cafeteria space,” Johnson said.

Heitman, too, cites the office space as a key differentiator of this facility.

"This building has an extraordinary office component to it," he said. Overall, the building features about 100,000 square feet of office space, Heit man said, with about 75,000 square feet of this space devoted to the site's main corporate office. The individual plant offices account for the remaining 25,000 square feet or so of office space.

Heitman said that construction crews installed a significant amount of glass into these individual office areas, too, providing those inside these spaces with clear views of the facility's assembly lines.

"That helps build a strong connection between the office areas and the manu facturing areas," Heitman said. "That creates an environment that brings all the employees together and builds a strong sense of cooperation and collaboration between employees in the different environments."

Each of these individual offices also feature what Lion Electric calls oases. These areas throughout the plant give employees the chance to congregate with each other on their breaks.

"We spent a lot of time working with Lion Electric to make the oasis spaces feel like comfortable working environments," Heitman said.

The facility's main corporate office also features architectural touches that set it apart from most industrial buildings. The corridor that leads through the office is lit by wide skylights. The lobby space stretches two stories and has enough interior area to double as a showroom for Lion's electric vehicles.

16 DEVELOPMENT SHOWCASE

A second phase of construction will focus on building out this outdoor space even more, which will include an area set aside for amenities such as bocci ball courts, walking paths and landscaped seating areas.

"These enhanced amenities are something we try to incorporate into all our projects," Heitman said. "We see the value of daylight in enhancing the wellness of employees and boosting their productivity. We are always looking for oppor tunities to bring daylight into buildings and other opportunities to enhance the workplace."

Meeting the challenges

The construction business isn’t an easy one today. Developers are still dealing with supply chain disruptions. It takes longer for materials to reach job sites today. At the same time, the cost of materials and labor continues to rise, a trend that is showing few signs of slowing.

Clarius and Meridian Design Build worked around this by following a meticulous ly planned construction schedule. The companies also had one advantage: The worst of the supply chain issues hadn’t yet hit when construction on Building 2 began. That meant that major components such as concreate, asphalt and roof ing materials had already been purchased.

“When COVID hit, we were already heading down the road to building this,” Johnson said. “Our investment partners told us to continue, to press on. They saw that the market signaled that industrial vacancy rates were still tight. Because we were building so early in 2020, we didn’t experience as many significant setbacks when it came to getting materials to our site.”

On the back end of the construction process, though? Clarius has seen the im pact of supply side disruptions. It’s taken longer to get HVAC systems to the site. Ordering electrical distribution systems has been, as Johnson says, “very compli cated.”

Johnson pointed to the partnerships that Clarius has formed with local compa nies as one way that the developer overcame these hurdles. Local companies were able to get key components to the site quicker.

One such relationship? Clarius worked with Broadview, Illinois-based Nesko Electric Company. This company helped Clarius get the electrical components it needed on time.

“When talking to the standard players, the suppliers that you normally get electri cal switchgear from, we’d hear that they could give us, say, an 800-amp panel in

16 weeks,” Johnson said. “That was a non-starter if you have a client that needs power on the site in the next month. We worked with local companies to get these big breakers and larger-size panels, 300 amps and up. We had to get ex tremely creative.”

Bechtoldt said that getting PVC pipe to the site last fall proved challenging, too. Getting enough of it to the building site required careful scheduling and working with a range of suppliers.

"We had to work through the problems associated with long lead times," Bech toldt said. "Some of the equipment we had to farm out to custom builders. It required us looking at every possible solution we could find."

Schmidt said that Meridian Design Build had to juggle schedules frequently to keep the construction process moving on schedule. During one phase of con struction, crews had to install all the sanitary sewer before other crews could complete a majority of the building's slab.

This required breaking the construction schedule into phases so that all neces sary components were installed in the best possible order to keep construction crews busy throughout the building process.

"It took a lot of teamwork from our subcontractors, designers, ownership and design team to keep the project moving," Schmidt said.

Bechtoldt said that he is proud of the result and is happy to have played a part in the process of bringing Lion Electric to Chicago's suburbs.

"It has been a pleasure to work with Clarius and the Lion team," he said. "Every one has been great to deal with. As you break a project up into so many pieces, you have many different deadlines. Eric (Johnson) was a great leader on this project. That can't be overstated."

Johnson said that the Lion Electric project marks a big milestone in another way: It’s the latest success story at Clarius Park in Joliet.

“We have been developing this park since before 2012,” Johnson said. “We start ed Building 1 way back then. It’s been a great road. We’ve really enjoyed working with the city of Joliet. It’s been a great partnership.”

17 DEVELOPMENT SHOWCASE

“It has been a pleasure to work with Clarius and the Lion team. Everyone has been great to deal with. As you break a project up into so many pieces, you have many different deadlines. Eric (Johnson) was a great leader on this project. That can't be overstated.”

Inflation, interest rates and the industrial market

By Michael Millar, Open Slate Communications

Pesky, lingering inflation that is higher than we’ve seen in years along with six interest rate hikes totaling 375 basis points since the beginning of the year have had varying degrees of impact on all sectors in commercial real estate. The speculation of further hikes later this year and in early 2023 doesn’t help.

Industrial real estate remains one of the darling sectors, though it is being tested by current economic condi tions.

Four industrial real estate profes sionals, including owners, investors and brokers, three of them based in Chicago and one based in Houston, participated in a roundtable discus sion, giving their perspectives on inflation, interest rates and industrial real estate. The participants: Alfredo Gutierrez, Founder, SparrowHawk; Rick Nevarez, Director of Acquisi tions, Clear Height Properties; Kelly Disser, Executive Vice President, NAI Hiffman; and Hugh Williams, Principal and Managing Broker, MK Asset Bro kerage.

What are the implications of the five 2022 rate hikes on transaction/acqui sition activity?

Alfredo Gutierrez: It’s a challenging time as there are more investors step ping to the sideline. This means that if you are selling an asset today you might get three or four offers versus a dozen one year ago. On the buy side, if investors have cash or lines of credit tied to a low rate, they are utilizing their resources. The fundamentals on the income side of the equation, because of rent growth, are still strong—that’s factual. Some are putting down their pencils because they are concerned about the potential for a recession and

whether we’ll see the same levels of rent growth.

In reality, cap rates are a function of how much capital there is to invest into something. The question is how much dry powder remains on the side line. We’re seeing an erosion of capital on the retail side and people starting to get squeezed. However, banks, life companies and institutions still have capital to place, and I believe it will flow into industrial.

Rick Nevarez: Activity has slowed, but it hasn’t come to a grinding halt. Overall, we continue to see deal ac tivity and are expecting a big fourth quarter. It’s like airplane turbulence: some respond with white-knuckle gripping of the arm rest while others

acknowledge it’s taking place and go about their business. It’s really a mat ter of understanding the fundamentals of the real estate and how the current economic environment impacts those fundamentals.

Kelly Disser: It’s an interesting time with different groups being impacted in different ways. Owner occupants, private investors, institutional in vestors—all have acted or reacted differently. The demand for industrial space and leasing absorption today is still very strong. Inventory/vacancy is at an all-time low. As a result we’re seeing rent growth like we haven’t seen before. In certain underwriting acquisitions, we are seeing the impact of interest rates on values somewhat mitigated by rent growth and rents

trending even higher than what we see today. The equation is evolving. The development and investment sales markets have reacted and adjusted. Those with large funds have the ability to remain active and aggressive—and they are distinguishing themselves.

Investors/developers who are sourc ing capital on a deal by deal basis may be having issues in the current envi ronment.

Hugh Williams: There was a point this summer when large institutional in vestors essentially said, “pencils down on all deals,” unless it was a perfectly placed asset/tenant combination in the middle of the fairway. Investors and developers are proceeding with haunting caution because at some point the math does not work. You

18 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

Kelly Disser

Alfredo Gutierrez: Rick Nevarez

Hugh Williams

"Activity has slowed, but it hasn’t come to a grinding

halt. Overall, we continue to see deal activity and are expecting a big fourth quarter. It’s like airplane

turbulence: some respond with white-knuckle gripping of the arm rest while others acknowledge it’s taking place and go about their business."

cannot acquire an asset when you underwrite debt costs that are great er than your projected return. That is problematic.

But we need to remember we’ve been in a low-rate environment for a long time, an environment that couldn’t last forever; and there are geopolitical events taking place that are also im portant considerations. I have heard people say they are pulling back but some of them aren’t sure why. Over all, leasing activity is quite strong, and things are still moving forward particularly in select markets and mi cro-markets.

How are the rate hikes changing the flow of acquisitions and dispositions, if at all? And are they impacting dif ferent size buildings differently?

Nevarez: Interest rate hikes have pushed some buyers and sellers to the sidelines. But we are still buyers, looking at a variety of opportunities including value-add acquisitions. Sometimes you have to tweak under writing to have a deal pencil out and make sense. Now more than ever, you need to understand ALL elements of the transaction, and what is motivat ing buyers and sellers.

Gutierrez: The effect based on size is really a case by case situation. But in general, if you had two assets where essential building characteristics except for size were essentially the same, the smaller asset would feel the pinch more. While smaller build ings are more likely to have shorter term leases, it will depend on the tenant roster and the lease terms. At the same time, because the rent roll may turnover more quickly, smaller buildings may be able to adjust pricing more quickly, too.

Disser: Interest rate hikes are impact ing the flow of acquisitions and dispo sitions. The pace has slowed in the second half of 2022 from what we saw the prior 18 months. But it is all rela tive, the first 18 months coming out of covid we saw activity levels, values and rents not seen before—in Chicago and across the country. An adjustment was needed. There was simply too much money chasing too few assets: the definition of inflation. Impact var ies from case-to-case, according to lo cation, submarket, or quality of asset.

Williams: My hypothesis is that if you go to a smaller, non-institutional building, it’s generally a different type of buyer, with a different mentality. For example, an operator like Black stone is taking the long view. They are likely focused on main and main locations. When they go to build, they are focused on operating their plat form as a business, not necessarily the conditions of the moment or focused on a near to short term exit. Smaller owners may be at greater risk—real and emotional—based on being pris oners of the moment (as we all are). The short stroke is big boats are better

ballasted against storms. Small boats get tossed about.

In other asset classes—like office and multifamily—some say that activity has slowed as the market looks for a re-set. To what degree is that occur ring in the industrial sector, and are there other considerations (i.e., size, etc.)?

Nevarez: It’s really hard to say that any asset class is recession-proof, but industrial certainly is close. If the mar ket was overbuilt, the impact might be different. There may be a scaling back and slight reset of pricing, but it’s not the same as other sectors because demand has been so strong. Our port folio, for example, is 96% leased due to lack of product in the markets we own and operate in.

Gutierrez: A lot of people have put pens down, so to speak. Unless you need to place capital, you won’t. With some of the overall questions that exist, and fewer offers to consider, there isn’t necessarily a lot of pricing clarity. As 2022 wraps up our volumes will be down, particularly for the sec ond half of the year.

19 NOVEMBER CHICAGO INDUSTRIAL PROPERTIES

Please contact us for any upcoming project needs! 847.374.9200 · www.meridiandb.com Additions / Expansions New Construction Facility Renovations Tenant Improvements for Making 2022 a Success! (continued on page 20)

Disser: It is always dangerous to gen eralize. The idea of a price reset isn’t absolute in industrial, as it may be in other sectors. In the industrial sector I think value equations are evolving, given rent growth. We see absorption, leasing and rental rates continuing to increase. The user/occupier clients of mine generally are operating busi nesses that are still strong and eyeing expansion. In addition to scrutinizing interest rates, many are watching how lenders behave—as many have slowed loan origination activity. For some groups, the ability to secure the capital for a project in some cases is as much of a question as the cost of the capital. If you lose your equity partner or can’t get a loan—you’re out.

Williams: There is a group that has been waiting 5-6, 10 years for a reset! The sky is continually falling. Say it long enough and eventually you will be right. Pricing may fluctuate from its peak, but I don’t anticipate an incredi ble swing. The reality is that develop ers are much more rational today and have been that way for the last decade. What is going on in the interest rate environment forces additional auster ity measures onto industrial develop ers.

All of the various elements at play lead me to believe that the sky will not fall, maybe a little rain, but rainwater is one of the keys to life—ask California.

How are higher interest rates impact ing user sales/acquisitions? Are the higher rates making them any more or less likely to look at renting versus owning?

Nevarez: Higher Interest rates make it harder for users to come up with the capital to purchase an asset. Most users would rather place their capital in their actual business operations (machinery, employees, etc.). Current owners may also look at their overall business plan to determine where they may need additional capital and find creative ways on how to get that capital. They look at their actual real estate as an opportunity to raise cap ital—through a sale leaseback—and to Clear Height (landlords) as a way to get that capital, creating a win-win situation for both parties.

Gutierrez: One of the factors that pushes users to consider an acquisi tion is the upward trajectory of rental rates. They figure they might as well buy. But in the current interest rate environment, the cost of ownership—if there was an inventory of buildings for users to buy—is up as well.

While there are concerns across the industry about interest rates, inflation and their overall impact, Alfredo Guti errez suggests that the potential for stagflation would be worse. “If the Fed is going to push us into a recession, put us there and make it short-lived.”

Disser: Everything is getting more expensive across the board; that is why inflation is so crucial at this point in time. I don’t believe the increases in interest rates have impacted user sales whatsoever. The most limiting factor is just availability of space or available options that could be pur chased. There is virtually no invento ry. I have clients who want to sell their buildings—they need more space—but have no where to go; because there is nothing larger for them to buy. Clear ly the higher cost of funds results in

larger interest payments, but the de mand and growth seems to be greatly outweighing borrowing costs.

Williams: Not everyone needs to own a home, not everyone needs to own industrial real estate. Unless there is a specialized need, most operators should probably focus on their busi ness and not try to get into the real estate game. The other consideration is that because of the overall tight ness of the market, it’s hard to make a move—hard to buy a building. For

many owner-users real estate is as emotional as it is practical. Those that really want to buy will find a way but my supposition is that things slow on the user front because higher interest rates also affects the entire supply chain of activities within a warehouse as much as the cost of acquiring that warehouse.

20 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

630.510.4570 • siorchicago.org The Top Brokers Thank the Top Sponsors! 2022 Platinum Sponsors SIOR Chicago Chapter thanks our 2022 Platinum Sponsors for their support!

Sam Badger, SIOR President Peter Billmeyer, SIOR Vice President

Sergio Chapa, SIOR Treasurer John Cassidy, SIOR Secretary Sean Henrick, SIOR Director-At-Large

FOLLOW US: ! @siorchicago ! SIOR Chicago @siorchicagochapter INDUSTRIAL (continued from page 19)

Adam Marshall, SIOR Past President

Geneva

Region Area: Fox Valley

Total Square Feet/Acres: 1,000,000 SF

Owner: Hillwood

Address: 9550 Higgins Road, Suite 200, Rosemont, IL, 60018

Contact: Donald Schoenheider

P: 847.737.0264 Website: www.hillwood.com

Fox Valley Commerce Center is a multiphase project with Phase 1 completing 3Q2023 with two buildings (266,760 SF and 272,160 SF). Phase 2 is available for BTS projects up to 500,000 SF. Low Kane County taxes with immediate access to North Ave. and Rt. 38 make it an ideal location.

Lee & Associates

9450 W. Bryn Mawr Ave., Suite 550, Rosemont, IL, 60018

Broker Contacts: Nicholas Eboli neboli@lee-associates.com P: 630.567.7812

Mount Pleasant, Wisconsin

Region Area: Southeast Wisconsin / Racine County

Total Square Feet/Acres: 2,118,369 / 135 Acres

Owner: Ashley Capital, LLC

Address: 9810 S. Dorchester Avenue, Chicago, Illinois, 60628 Contact: Gary Rosecrans P: 847.504.6113 Website: www.ashleycapital.com

Ashley Capital is nearing completion of its 2.1 million square feet Enterprise Business Park located 15 minutes from the IL/WI border in Racine County, WI. The park can accommodate tenants from 40,000 SF to 438,000 SF and is accessible to I-94 via two 4-way interchanges.

Lee & Associates

9450 W. Bryn Mawr Ave., Suite 550, Rosemont, IL, 60018

Broker Contacts: John Sharpe, SIOR, CCIM, LEED-AP jsharpe@lee-associates.com P: 847.224.6296

McCook

Region Area: I-55 North

Total Square Feet/Acres: 245,002 SF / 14.88 Acres

Owner: Midwest Industrial Funds Address: 1211 W. 22nd Street, Suite 800, Oak Brook, IL, 60523 Contact: Justin Fierz P: 773.960.3085 Website: www.midwestindustrialfunds.com

Walls are up on Midwest Industrial Fund’s 245,002 SF spec building in McCook! Delivering in Q2 2023, 8701 W. 53rd Street will feature 36’ clear ceilings, up to 52 exterior docks, 272 car parking, potential secured truck court, and 6B real estate taxes; all at the apex of I-55 and I-294.

Lee & Associates

9450 W. Bryn Mawr Ave., Suite 550, Rosemont, IL, 60018

Broker Contacts: Brian Vanosky, bvanosky@lee-associates.com; Michael O'Leary, moleary@lee-associates.com; Dylan Maher, dmaher@lee-associates.com; P: 773.355.3023

BUILD-TO-SUIT, SPEC & BUSINESS PARKS REJOURNALS.COM

CIP MARKETPLACE

MCSHANE

ASSET/PROPERTY MANAGEMENT FIRMS

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000 Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer; bchapman@centerpoint.com; Nate Rexroth, Executive Vice President, Asset Management; nrexroth@centerpoint.com

Services Provided: CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and port-proximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems.With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

HIFFMAN NATIONAL

One Oakbrook Terrace, Suite 400 Oakbrook Terrace, IL 60181

P: 833.HIFFMAN Website: hiffman.com

Key Contacts: Dave Petersen, CEO, dpetersen@hiffman.com; Bob Assoian, Executive Managing Director of Management Services, bassoian@hiffman.com

Company Profile: Hiffman National is one of the US’s largest independent commercial real estate property management firms, providing institutional and private clients exceptional customized solutions for property management, project management, property accounting, lease administration, marketing, and research. The firm’s comprehensive property management platform and attentive approach to service contribute to successful life-long relationships and client satisfaction. As a nationally recognized Top Workplace, Hiffman National is headquartered in suburban Chicago, with more than 265 employees nationally and an additional five hub locations and 30 satellite offices across North America. For more information, visit hiffman.com

CONSTRUCTION COMPANIES/GENERAL CONTRACTORS

ALSTON CONSTRUCTION COMPANY

1901 Butterfield Road, Suite 1020 Downers Grove, IL 60515

P: 630.437.5810

Website: alstonco.com

Key Contact: Greg Kolinski, Director of Business Development, gkolinski@alstonco.com

Services Provided: Alston offers a diverse background of design-build experience, general contracting and construction management of industrial, commercial, healthcare, retail, and municipal projects.

Company Profile: Alston Construction’s success begins and ends with our approach to planning, scheduling, and choosing the right team. We have been adhering to an open and collaborative approach since our founding more than 35 years ago.

Notable/Recent Projects: Project Heartland 1.5 Million SF build to suit distribution facility for Proctor & Gamble in Morris, IL. Lakeshore Manor 210 unit senior living facility in Northwest Indiana. Dynamic Foods 3PL 500,000 SF build to suit distribution and packaging facility in Wilmington, IL. Brown Deer Distribution Center 420,000SF two building speculative distribution center in Milwaukee, WI. 106,000 SF meat packaging facility in Northwest Indiana.

LAMP INCORPORATED

460 North Grove Ave. Elgin, IL 60120

P: 847.741.7220 | F: 847.741.9677 Website: lampinc.net

Key Contact: Ian Lamp, President, ilamp@lampinc.net Services Provided: Design/Build, General Construction, and Construction Management services for additions, build outs, renovations, and new facilities for office, industrial, logistic, technology, and commercial buildings.

Company Profile: Lamp Incorporated has been providing professional construction services for over 80 years. Our commitment of exemplary service to our clients creates projects that are completed early and with exceptional value.

Notable/Recent Projects: Mitutoyo America Corporation North American Headquarters, Aurora, IL. 96,000 SF warehouse addition; 63,000 SF, three-story office addition, which includes high tech showroom, two story atrium, corporate offices/conference room, cafeteria, and locker rooms.

CONSTRUCTION COMPANY

9500 West Bryn Mawr Avenue Ste. 200 Rosemont, IL 60018

P: 847.292.4300 | F: 847.292.4310

Website: www.mcshaneconstruction.com

Key Contacts: Mat Dougherty, PE, President, mdougherty@mcshane.com Services Provided: McShane Construction Company offers more than 35 years of experience providing design-build, design-assist and general construction services on a national basis The firm’s diverse expertise includes build-to-suit and speculative warehouse, distribution and manufacturing facilities, as well as multifamily, commercial and institutional developments.

Company Profile: Headquartered in Rosemont, Illinois with regional offices in Auburn, Alabama, Irvine, California, Phoenix, Arizona, Madison, Wisconsin and Nashville, Tennessee, McShane Construction Company provides comprehensive construction services on a local, regional and national basis for a wide variety of market segments. The firm is recognized as one of the Chicago area’s most diversified and active contracting organizations with a reputation built on honesty, integrity and dependability.

Recent/Notable Project: Industry Center at Melrose Park – the construction of three speculative industrial buildings in Melrose Park, Illinois. The new development incorporates a total of 651,617 square feet.

MERIDIAN DESIGN BUILD

9550 W. Higgins Road, Suite 400 Rosemont, IL 60018

P: 847.374.9200 | F: 847.374.9222 Website: meridiandb.com

Key Contacts: Paul Chuma, President; Howard Green, Executive Vice President Services Provided: Meridian Design Build provides construction and design/ build construction services on a national basis with a primary focus on industrial, office, medical office, retail and food and beverage work.

Company Profile: With a team of in-house professional project managers, Meridian has extensive experience coordinating the design and construction of new buildings, tenant improvements, and additions/ renovations from 15,000 square feet to 1,000,000+ square feet. Meridian Design Build has been a Member of the U.S. Green Building Council since 2007.

Notable/Recent Projects: Clarius Park Joliet Building #2, Joliet, IL - 906,517 sf speculative industrial facility for Clarius Partners. Commerce Park Chicago Building B, Chicago, IL - 602,545 sf speculative multi-tenant industrial facility for NorthPoint Development. Halsted Delivery Station, Chicago, IL - 112.000 sf package delivery station on a 17-acre redevelopment site for Prologis.

PEAK CONSTRUCTION CORPORATION

9525 W. Bryn Mawr Avenue, Suite 810 Rosemont, IL 60018

P: 630.737.1500 | F: 630.737.1600 Website: peakconstruction.com Key Contacts: Michael P. Sullivan, Jr., CEO & Founder, msullivan@peakconstruction.com; John Reilly, President, jreilly@peakconstruction.com Services Provided: Peak Construction Corporation offers design/build and construction management services through a strategically developed culture, highly regarded for dynamic problem-solving abilities and a network of alliances that allow Peak to bring in experts and partners from a wide spectrum of fields and roles.

Company Profile: Peak Construction Corporation is a privately-held, well-capitalized design/build general contractor. For 25 years Peak has delivered industrial, hospitality, office, healthcare, retail, multi-family and specialty construction projects on-time and on-budget. Notable/Recent Projects: Peak’s recent Midwest projects include NorthPoint Development’s Third Coast Logistics Park in Joliet and Building 1 in Bristol, WI; Janko Group’s Bristol Business Park also in Wisconsin; Scannell Properties’ Elgin Distribution Center in Elgin and DuPage Business Center Phase II and TI in West Chicago, as well as various tenant improvements throughout Chicagoland and Wisconsin.

PRINCIPLE CONSTRUCTION CORP.

9450 West Bryn Mawr Ave., Suite 120 Rosemont, IL 60018 P: 847.615.1515 | F: 847.615.1598 Website: pccdb.com

Key Contacts: Mark E. Augustyn, COO, maugustyn@pccdb.com James A. Brucato, President, jbrucato@pccdb.com Services Provided: Principle specializes in commercial and industrial property and is committed to providing clients with the highest level of design/build construction services with an absolute dedication to each project.

Company Profile: Design/Build General Contractor established in 1999 specializing in the design and construction of Build-to-Suit, Speculative, Retail, Food Processing, Expansions/ Additions, Tenant Improvements, & Specialty Facilities. Principle also has extensive experience in interior improvements, site evaluation, due diligence, and value engineering.

Recently Completed Projects include: 100,643 SF Spec Warehouse with space built out for tenant Vital Proteins, at 3500 Wolf Road in Franklin Park, IL. 5,200 SF space at 9450 S. Bryn Mawr Ave. Suite 200 in Rosemont, IL. for 3rd time client Celerity Pharmaceuticals. 19,558 SF addition for General RV’s (another 3rd time client) location in Huntley, IL,. Principle initially constructed the building in 2011 and expanded in 2013, 2014, 2017 and 2018.

SUMMIT DESIGN + BUILD, LLC

1036 W. Fulton Market, Suite 500 Chicago, IL 60607

P: 312.229.4630 | F: 312.229.1147 Website: summitdb.com

Key Contacts: Adam Miller, President, amiller@summitdb.com; Deanna Pegoraro, Vice President, dpegoraro@summitdb.com; Jon Silvers, Business Development, jsilvers@summitdb.com

Services Provided: Summit Design + Build, LLC is a provider of full service general contracting, construction management and design/ build construction services for the commercial, industrial, multifamily residential, office/tenant interiors, hospitality and institutional markets.

Company Profile: Located in Chicago’s Fulton Market and with regional offices in Tampa, FL, Austin, TX and North Carolina, Summit Design + Build has been involved in the design and construction of over 400 buildings and spaces totaling more than 10 million square feet over the firm’s 17 year history.

Notable/Recently Completed Projects: Eli’s Cheesecake (Industrial), 2217 Loomis (Industrial), 1436 W Randolph (Adaptive Reuse Hotel), Eli’s Cheesecake (Industrial), 718 Main (Multifamily), Prenuvo (Medical TI), 5691 N Ridge Ave (Multifamily).

22 CHICAGO INDUSTRIAL PROPERTIES NOVEMBER 2022

FOR ADVERTISING OPPORTUNITIES IN THIS SECTION, PLEASE CONTACT SUSAN MICKEY AT SMICKEY@REJOURNALS.COM OR 773.575.9030

VICTOR CONSTRUCTION

2000 Center Dr., Suite East C219

Hoffman Estates, IL 60192

P: 847.392.6900

Website: victorconstruction.com

Key Contact: Zak Schuttler, President, ZakS@victorconstruction.com

Services Provided:Victor Construction Co., Inc. manages projects from ground-up site developments to interior build-outs, specializing in retail, industrial, and commercial markets.

Company Profile: Victor Construction Co., Inc. remains a family-owned and operated General Contractor.

Having been in business since 1954, our firm has extensive experience managing every aspect of interior construction for the corporate, manufacturing, industrial, and retail sectors.

Notable/Recent Projects: Owens + Minor Distribution – 600K SqFt distribution facility that involved a full LED lighting upgrade, new HVLS fans, 200K SqFt section that required new cooling for medical distribution, an office renovation of 20K SqFt, and a new exterior employee pavilion.

ECONOMIC DEVELOPMENT CORPORATIONS

LAKE COUNTY, INDIANA ECONOMIC ALLIANCE (LCEA)

440 W. 84th Drive

Merrillville, IN 46410

P: 219.756.4317

Website: LCEA.us

Key Contacts: Karen Lauerman, President & CEO, klauerman@LCEA.us; Don Koliboski, VP Economic Development, dkoliboski@LCEA.us

Services Provided:The LCEA team provides economic development and site selection assistance; business expansion services; community connections with decision makers/elected officials; workforce analysis, demographics, cost comparisons and other critical information.

Company Profile: LCEA is the Lake County Indiana Economic Development Organization representing 20+ communities just minutes away from Chicago. It is the one resource for developers, site consultants and company executives considering relocation or expansion opportunities in Lake County, Indiana.

MICHIGAN CITY ECONOMIC DEVELOPMENT CORPORATION

Two Cadence Park Plaza

Michigan City, IN 46360

P: 219.873.1211 Website: www.edcmc.com

Key Contacts: Clarence Hulse, Executive Director, chulse@edcmc.com Services/Demographic Info: Michigan City has recognized $1.5 Billion in capital investment over the last 8 years, with more deals - $300 Million Multi-family projects on the horizon. We are located on Lake Michigan with easy access to I-94, I-80 and we are 1 hour drive East of Chicago. Michigan City is home to 32,000 residents with 5.6 Million visitors annually.

Incentives: Waterfront Opportunity Zone, 3 TIF Districts, Facade Improvement Program, Tax based Incentives, Start Up Assistance, and Workforce Training Funds.

Recent CRE Activity: Double Track project ($500 Millions), Michigan City Central Station ($80 Millions), Workforce Apartments 125 units, Waterfront Condominiums 150 Units/Boutique hotel 180 units, 32 Single Family Homes, Shady Creek Winery Expansion - 9,000 SF ($3 Millions), Sullair Hitachi Expansion – 80,000 SF ($33 Millions), Shell-Criterion Expansion ($34 Millions),GAF Expansion – 200,000 SF ($30 Millions), Burn ‘Em Brewing Expansion - ($1.6 Millions), and 30 Independent Restaurants in our Downtown.

FINANCE & INVESTMENT FIRMS

ASSOCIATED BANK

525 W. Monroe Street, Ste. 2400 Chicago, IL 60661

P: 312.544.4645

Website: associatedbank.com/cre

Key Contacts: Gregory Warsek, Executive Vice President / Group Leader, greg.warsek@associatedbank.com

Services Provided:Our clients include professional developers of income producing commercial real estate, including multi-family properties, retail, office, self- storage, student housing, industrial, and for sale housing.

Company Profile: Commercial Real Estates offices are located in Chicago, Milwaukee, Madison, Green Bay, Cincinnati, Indianapolis, Minneapolis, Detroit, St. Louis, Dallas and Houston.

Associated Banc[1]Corp has total assets of $35 billion and is one of the top 50 financial services holding companies in the United States.

CENTERPOINT PROPERTIES

1808 Swift Drive

Oak Brook, IL 60523

P: 630.586.8000

Website: centerpoint.com

Key Contacts: Bob Chapman, Chief Executive Officer, bchapman@centerpoint.com; Jim Clewlow, Chief Investments Officer, jclewlow@centerpoint.com

Services Provided:CenterPoint Properties is an innovator in the investment, development and management of industrial real estate and multimodal transportation infrastructure. CenterPoint acquires, develops, redevelops, manages, leases and sells state-of-the-art warehouse, distribution and manufacturing facilities near major transportation nodes. Our experts focus on rail and portproximate distribution infrastructure assets.

Company Profile: CenterPoint Properties continuously reimagines what’s possible by creating ingenious solutions to the most complex industrial property, logistics and supply chain problems. With an agile team, substantial access to capital and industry-leading expertise, we provide our customers with a competitive edge and ensure their success — no matter how great the challenge.

MARQUETTE BANK

10000 W. 151st Street

Orland Park, IL 60462

P: 708-364-9135

Website: emarquettebank.com

Key Contact: Mark Wojack, First Vice President, mwojack@emarquettebank.com

Services Provided:Full line of Commercial, Business and Real Estate loans customized to your individual needs including: commercial and residential construction loans, commercial mortgages, equipment loans and working capital lines of credit.

Company Profile: Marquette Bank started in Chicagoland in 1945 and is still locally-owned/ operated. Expect quick decisions, competitive rates, easy application and personal service. Personal/business banking and lending, home mortgages, land trust services, estate planning, insurance services, wealth management and multifamily lending.

MAVERICK COMMERCIAL MORTGAGE 853 N. Elston Avenue Chicago, IL 60642

P: 312.268.6000 | C: 312.953.4344 Website: mavcm.com

Key Contacts: Ben Kadish, President, ben.kadish@mavcm.com; Services Provided: Maverick finances all commercial real estate properties for builders, developers, investors and owner-occupied properties. For apartment loans, Maverick has access to every multifamily program available for property owners as we are a correspondent for Fannie Mae and Freddie Mac execution along with Freddie Mac small loan program. CMBS fixed and floating rate non-recourse loans available. Bank, portfolio, and debt fund non-recourse construction and permanent financing available on a national basis.

Company Profile: Maverick Commercial Mortgage, Inc. is a boutique firm focused on middle market borrowers for properties in Chicago and surrounding areas, with a focus on Illinois, Indiana, Wisconsin, Iowa, Missouri, Michigan, and Kentucky. We are a niche lending source for Manufactured Housing Community mortgages and portfolio loans across the country with fundings in excess of $80,000,000 for MHC product on an annual basis. Significant financings for 2022 include a $63,000,000 single asset mortgage on an Illinois manufactured housing community, a $14,000,000 first mortgage on a Home Depot store in Chicago and several industrial building loans on the south and northwest side of the city of Chicago.

Service Territory: Midwest for general mortgage loans, and national for MHC financing.

LAW FIRMS

O’KEEFE LYONS & HYNES, LLC 30 N. LaSalle St., Ste. 4100 Chicago, IL 60602

P: 312.621.0400 | F: 312.621.0297 Website: okeefe-law.com

Key Contacts: Elizabeth Gracie, Partner, elizabethgracie@okeefe-law.com; Brian Forde, Partner, brianforde@okeefe-law.com

Services Provided: The firm’s partners have been on the forefront of understanding, shaping, challenging, and sometimes writing, Illinois property tax laws. Many of the partners honed theirskills overseeing taxation matters for Illinois public taxing agencies. Our firm leverages this expertise, along with a proprietary technology database, to create innovative tax and litigationstrategies that lead to successful outcomes for our clients.

Company Profile: O’Keefe Lyons & Hynes, LLC has an 85-year track record of supporting commercial real estate interests in property tax matters. We work with corporate, institutionalprivate and not-for-profit entities across the office, multifamily, industrial, retail and hospitality sectors.

SARNOFF & BACCASH

Two N. LaSalle St., Ste. 1000 Chicago, IL 60602 P: 312.782.8310 | F: 312.782.8635 Website: sarnoffbaccash.com

Key Contacts: James Sarnoff, jsarnoff@sarnoffbaccash.com; Robert Sarnoff, rsarnoff@sarnoffbaccash.com Services Provided: Sarnoff & Baccash is a leading and recognized law firm concentrating solely in the field of property taxation. We help client’s secure favorable taxes in Illinois through property tax appeals, incentives and consulting.

Company Profile: Sarnoff & Baccash’s clients include Owners, Developers, Managers, REIT’s, Fortune 500 Companies, Private Equity Firms, etc., in connection with commercial property, high-rise and low-rise apartment buildings, condominium associations and single-family home portfolios.

WORSEK & VIHON, LLP

180 North LaSalle Street, Suite 3010 Chicago, IL 60601 P1: 312.917.2307 | P2: 312.917.2312 | F: 312.596.6412 Website: wvproptax.com

Key Contacts: Francis W. O’Malley, Managing Partner fomalley@wvproptax.com; Jessica L. MacLean, Partner jmaclean@wvproptax.com

Services Provided: Worsek & Vihon, LLP represents tax payers in Illinois by limiting their tax liabilities through ad valorem appeals. We have over 35 years of experience and can handle basic to the most complex assessment issues while offering the dependable, personalized attention our clients deserve. We have experience representing owners of office buildings, shopping centers, retail stores, manufacturing plants, data centers, distribution centers, mixed-use developments, nursing homes, hospitals, condominium associations, cooperatives, apartments and single family residences. In addition to filing thousands of appeals with the Cook County Assessor, we have been involved in numerous proceedings before various Boards of Review, the Illinois Property Tax Appeal Board, and the Circuit Court of Illinois, and have appeared before the Illinois Appellate and Supreme Courts.