Matt to Be The Product of for Investors

THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE | SEPTEMBER/OCTOBER 2022

Berry Robbie Kilcrease Drew Reinking Retail Continues

Choice

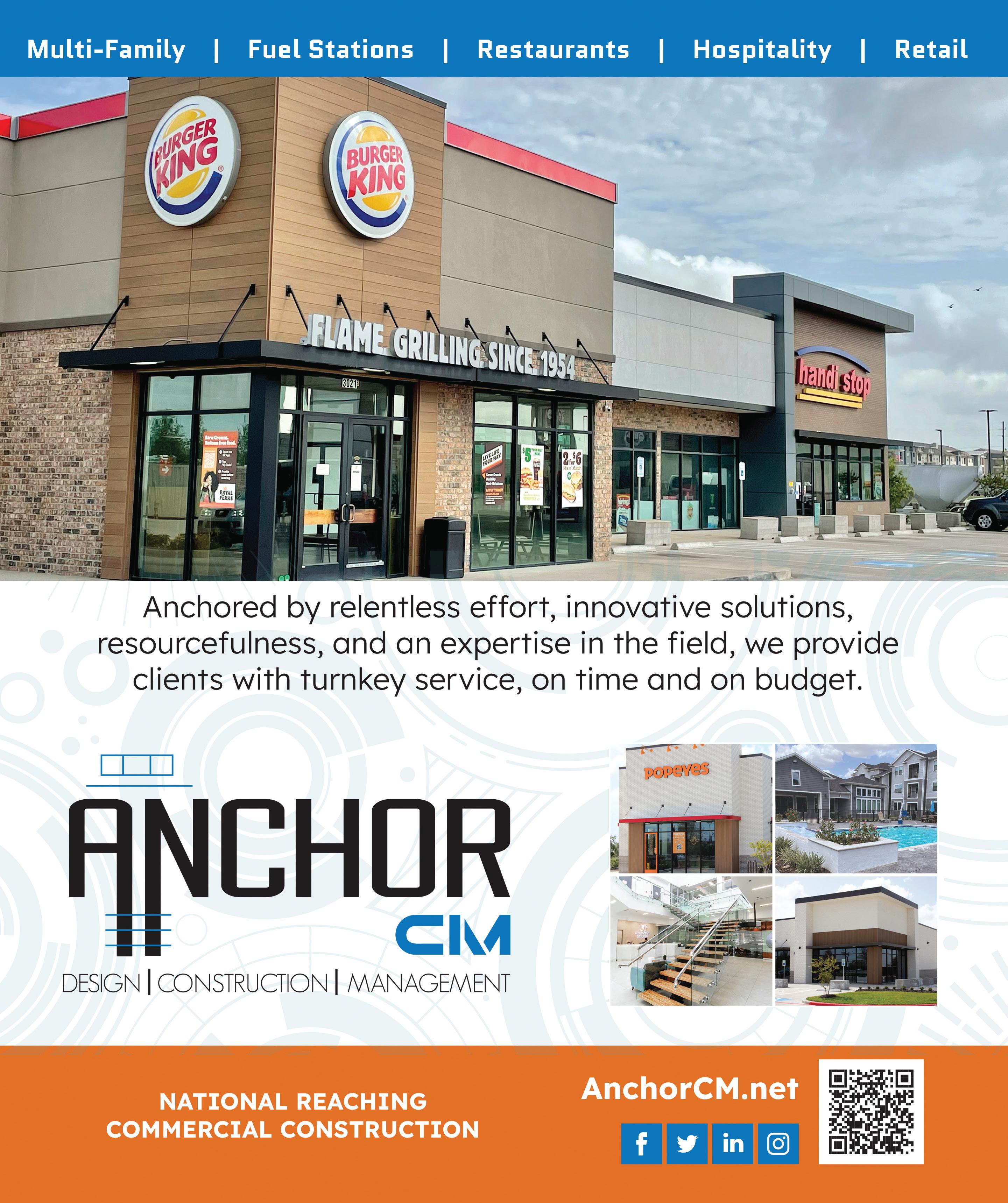

For the last two years, CBRE’s Matt Berry, Robbie Kilcrease & Drew Reinking have dominated the middle market sector for Retail Investment Sales in Houston and along the Gulf Coast.

THE

PUBLISHER

Mark Menzies menzies@rejournals.com

SENIOR

Benton Mahaffey benton@REDnews.com

STAFF

Ray Hankamer rhankamer@gmail.com

Brandi Smith info@REDnews.com

EMARKETING

Sarah Evans Carter emarketing@REDnews.com

ADVERTISING

April Daniel april.daniel@rejournals.com

Jeff Johnson jeff.johnson@rejournals.com

Jessica Johnson jessica.johnson@rejournals.com

CLASSIFIED

Susan Mickey smickey@REDnews.com

EVENT

Abby Lestin

PRINT & DIGITAL

REDnews

Texas

TOTAL

RED

REDnews

To (713) 661-6300

2537 S. Gessner, Ste. 126 Houston, TX

Putting the D in development: CRE companies focus on Dallasarea for new projects Craig International's most anticipated project is District 121, located along the 121 Corridor in McKinney

Texas office rebound is one of the strongest, but what’s going on with Houston? Texas’ office market has proven itself to be one of the strongest in the U.S.

Thanks to Office, DFW to Hit Third Consecutive Quarter of Positive Net Absorption DallasFort Worth is proving itself to be one of the hottest markets in all areas of CRE

“Workers crave flexibility”: New CBRE report looks at Great Resignation impacts on office sector The COVID-19 pandemic and shutdowns combined with the so-called “Great Resignation” that followed have generated a number of challenges for almost all CRE sectors

‘An Unmatched Opportunity’: The Real Estate Council provides one-of-a-kind membership One of the gems of the Texas commercial real estate community gems is The Real Estate Council (TREC)

REDnews events

Photos of 2 recent conferences

REDnews Houston Retail Update

A recap of the event

Scoop

A recap of local industry events

Overcoming uncertainty: Texas’ construction industry still strong Just about anywhere you look in Texas’ largest cities, there are signs of new construction

Unique commercial condo concept XSpace lands in Texas: “It’s an evolution from traditional development” Byron Smith created XSpace, which blurs the lines between commercial and creative space.

Dangerous Curves Ahead: An Update on the Energy Sector A recap of the event

REDnews 2022 Real Estate Awards Special Segment

CRE Marketplace September October Edition

6 10 12 14 16 18 20 27 28 32 36 37 46 Features

TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE

VICE PRESIDENT

WRITERS

DIRECTOR

& CONFERENCE SALES

DIRECTOR

COORDINATOR

abby.lestin@rejournals.com

DISTRIBUTION

is directly mailed each month to commercial real estate brokers, investors and developers throughout Texas and the US.

Brokers: 8,150 Texas Leasing/Tenant Rep: 6,232 Texas Investors: 4,979 Texas Developers: 4,710 Outside Texas Investors, Brokers, Developers etc: 26,387

QUALIFIED ONLINE

news DISTRIBUTION: 50,458

has gone green using recycled paper. Thank you Midway Press!

subscribe to REDnews call

or log on to REDnews.com/subscription.

77063 6 12 28 32

Retail Despite Macro-Economic

Despite the war on Ukraine, a rising interest rate environment, and multiple supply chain issues, 2022 has proven to be transactionally active. Competitive pricing has been witnessed during this time, as low leverage buyers and the 1031 market continues to drive market pricing. Furthermore, many 1031 buyers are opting to use less leverage than they previously were, taking advantage of 1031 tax benefits that create accretive returns for investors. Additionally, many institutional investors are adjusting their debt underwriting and using less leverage (0%-50%) with plans to refinance the asset when terms are more favorable. Despite recent market shifts, real estate investments provide more yield, and often, less risk, than many investment alternatives (Cash, Equities, Fixed Income). Furthermore, when comparing retail with other real estate asset types (industrial, office, multi-family, etc.), retail’s resiliency and returns are often more favorable than its counterparts.

Continues To Be a Favorable Option

Factors FIESTA Rosenburg, TX COMMONS @ HARVEST GREEN Richmond, TX Closed PINE MARKET Montgomery, TX THE SHOPS AT MEMORIAL Houston, TX Closed Closed MONTGOMERY CROSSING Houston, TX Closed Closed NINETY99 WESTHEIMER Houston, TX Closed THE SHOPS AT BELLA PIAZZA Houston, TX Closed NORTH JUNCTION PLAZA Houston, TX Closed LAKE POINTE VILLAGE EAST Sugar Land, TX Closed Source: Real Capital Analytics 0% 5% 10% 15% 20% 25% 30% 35% Axis Title CBRE Competitor 1 Competitor 2 Competitor 3 Competitor 4 Others 2022 YTD HOUSTON RETAIL TRANSACTION VOLUME 32% 15% 18% 5% 3% 10% #1 MARKET SHARE IN ACQUISITIONS AND DISPOSITIONS FOR RETAIL ASSETS UNDER $30 MILLION RECENT SALES TRANSACTIONS MATT BERRY +1 713 577 1640 matt.berry@cbre.com ROBBIE KILCREASE +1 713 577 1657 robbie.kilcrease@cbre.com DREW REINKING +1 713 577 1579 drew.reinking@cbre.com

Putting the D in development: CRE companies focus on Dallas-area for new projects

BY BRANDI SMITH

“We are blessed and fortunate to be doing business in one of the most desirable counties in the nation for relocation, development and acquisition!” says David Craig, Chairman and CEO of Craig International, which focuses its development in Collin County.

Perhaps the company’s most anticipated project is District 121, located along the 121 Corridor in McKinney.

“It was zoned for gas stations, fast food, small offices in the rear,” Craig says. “We could not let that happen to this special location and the city came

aboard and shared our vision for a more urban mixed use project that was of the highest quality.”

When it’s complete, the 18-acre project next to Craig Ranch will include upscale restaurants, such as Bob’s Steak and Chop House, Mi Cocina, 400 and Zero Gradi, Common Table and more, an 8-story Class A office building, a 102-room boutique hotel called Hotel Denizen and a .72-acre park.

6 SEPTEMBER OCTOBER 2022

Continued on Page 8 >

CARING FOR OUR ENVIRONMENT’S FUTURE CRG Texas Environmental Services, Inc. ▪ Environmental Due Diligence Services, Phase I ESA, Phase II ESA ▪ Remediation Services Phase III ESA ▪ Soil and Groundwater Sampling -Field Services ▪ Storm Water Pollution Prevention Plan -SWPPP ▪ Construction Storm Water Pollution Prevention Plan- CSWPPP ▪ Leaking Petroleum Storage Tank Program -LPST ▪ Texas Risk Reduction Program - TRRP ▪ Voluntary Cleanup Program - VCP ▪ Innocent Owner/ Operator Program -IOP ▪ Wetlands Identification and Delineation ▪ Threatened and Endangered Species ▪ NEPA permitting ▪ Facilitating Sound Decision-Making ▪ Coordinating with Regulators ENVIRONMENTAL CONSULTING TEXAS REGUL ATORY PROGRAMS - TCEQ , RRC ECOLOGICAL SERVICES When it comes to safety, efficiency, and effectiveness, CRG Texas Environmental Services delivers high quality, responsive and honest services consistently on every project. R E QUE S T A FRE E QUO T E – C A LL NO W – 713-474-1570 | 713-517-7 591 Main Ph: 713-474-1570 | 24/7 Ph: 713-517-7591 | Email: info@crgtexas.com 2504 Avenue I, Rosenberg, Texas 77471 | Visit our website @ www.crgtexas.com WE IMPR OVE WH AT OUR CL IENTS D O BY C ONTINUAL LY IMPROVING W H AT WE DO!

“That’s the heartbeat of District 121,” says Craig.

Restaurant patios will overlook a sunken park with a stage, which will feature a 9’x 16’ LED screen for live and streamed events, fireplaces and seating.

“The park will be active with entertainment and events throughout the year,” Craig shares, adding that the McKinney Community Development Corporation has provided District 121 a grant to make it a one-of-a-kind community offering in the Metroplex.

The North Texas region is still one of the hottest markets for development – no matter the sector. CenterPoint Properties, which has long focused its industrial development in the Houston area, is now working on projects around DFW.

“When we expanded out of Chicago, we went to port markets: LA, Seattle, New York, New Jersey, Charleston, Savannah, Miami and Houston,” says Rives Nolen, Senior Vice President of Investments for CenterPoint Properties.

Now Houston boasts record absorption levels and unprecedented rent growth, something CenterPoint is watching closely.

“We’re in the process of selling select assets in our Houston portfolio as we look to diversify into other submarkets and add more class A product. Houston continues to be an important piece of our national portfolio, and we anticipate increasing our acquisition and development activity in Houston in the near future,” Nolen says.

But as the Texas markets have evolved, he says CenterPoint is expanding into new markets, including the other Texas triangle markets. Population growth and tech manufacturing, he adds, are the big drivers in San Antonio and Austin. The company made its first-ever Austin investment in Q4 ’21, acquiring a low-coverage distribution facility southeast of downtown and added two class A buildings in Hutto in Q2 ‘22.

In addition to population growth, the draw in North Texas is its status as a major distribution hub.

“We are looking at opportunities throughout the entire DFW metroplex, but we have a focus on infill markets because the supply and demand fundamentals look the best there. It’s becoming increasingly difficult to develop and add new supply of warehouse space in the infill of DFW,” says Nolen.

For that reason, CenterPoint is focused on what Nolen calls “the fairway,” the area north and south of DFW airport. Nolen points to the 330,000-squarefoot Class A acquisition his team acquired between DFW and the CBD in late 2021 as the prototype for the strategic investment opportunities CenterPoint is targeting in the market.

“There, our assets are centrally located to the population and proximate to transportation infrastructure for distribution throughout the expansive DFW area and beyond,” he says.

It’s a similar approach to VanTrust Real Estate.

“We take the sites that are further out that provide better pricing and more flexibility,” says Bill Baumgardner, Executive Vice President at VanTrust.

It’s a big shift from a year ago when industrial properties were being scooped up with what seemed like little concern about price.

“Rising interest rates, rising cap rates and continually rising construction costs have forced a lot of folks to start reassessing the industrial development pipeline,” Baumgardner says.

The office development market also seems to have done an about-face in the past year, according to Baumgardner.

“We’re very, very bullish on the office side in North Texas,” he says.

VanTrust is working on plans for Tower One at Frisco Station, a 250,000 square foot Class A office building while it eyes other opportunities throughout the Metroplex.

"We believe office will rebound strongly in late '23 and early '24," adds Baumgardner. "The workforce will return in some form or another, and I believe most corporations recognize the importance of bringing people together to create a dynamic and collaborative environment."

Bill Baumgardner

David Craig

Rives Nolen

“The North Texas region is still one of the hottest markets for development – no matter the sector.”

8 SEPTEMBER OCTOBER 2022

< Development Continued from Page 6

Craig International is banking on that with its McKinney Corporate Center. The master-planned office, residential, medical and retail development offers state-of-art tech infrastructure, the latest in energy-efficient construction, WELL or Fitwel building standards, and a completely walkable community that connects employees to where they live and play. That taps into the growing demand for walkable access to residential, retail and family entertainment options.

Craig says one office trend he’s watching is existing space being converted into residential uses. He’s also noted more flexible office spaces offering availability to storage space with docks, allowing smaller companies to access shipping.

Ultimately, in Texas markets, development opportunities abound, even as shifting dynamics make a keen eye and experience more important than ever.

9SEPTEMBER OCTOBER 2022

Patrick Duffy Executive of the Year (Male) Emerging Leader of the Year (Male) Ryan Byrd Volunteer of the Year Grant Perdue Property Management Company of the Year Colliers Houston To Our 2022 REDnews Real Estate Award Winners Congratulations! colliers.com 2201 Chemsearch Blvd 3830 Promotory Point

Texas office rebound is one of the strongest, but what’s going on with Houston?

BY RED news STAFF WRITER

Texas’ office market has proven itself to be one of the strongest in the U.S. The market has continued to reflect positive trends throughout its post-pandemic recovery, though the numbers differ slightly from city to city.

Houston, for example? Vacancy and availability continue to rise, despite office brokers reporting increased activity and leased commitments.

To break it down, Partners recently analyzed the area’s activity during the first eight months of the year — August 2022 compared to August 2021.

Houston Office Vacancy at 25.5%

Overall vacancy was at 25.5% in August 2022, based on the report, up 100 basis points from last year’s 24.5%. Availability was nearly 30%, up 80 basis points from August 2021. Partners said the difference between this figure and the vacancy rate reflects expected future move-outs. Houston has recorded 9.3 million square feet of leasing activity of both new leases and renewals, which is down 13% from the 10.7 million square feet recorded at this time last year. Net absorption is at negative 100,000 square feet, up from negative 2.2 million square feet year-over-year. In addition, the amount of construction underway is at 2.5 million square feet — down almost 30% from last year.

Downtown Office Leases

Even though leasing activity is down from last year, this year’s new and renewed leases are quite large. In the largest office lease of 2022, law firm Baker Botts renewed and extended its lease in the former One Shell Plaza at 910 Louisiana Street. Baker Botts will now lease a total of 173,201 square feet where the company’s CBD headquarters has existed for over 50 years, according to the report.

Oil and Gas

Oil prices trended downward in August 2022, closing at just over $93 on August 26. The Baker Hughes rig count report for that date reflects a slight rise in active rigs compared to July — 765 active drilling rigs in the U.S, according to Partners. One month ago, the total active rig count was 758, and one year ago it was 508.

The current oil rig count is 605 rigs, compared to 599 in August 2022 and 410 in August 2021. The current gas rig count is 158 rigs, compared to 155 in August 2022 and 97 in August 2021, based on the report.

10 SEPTEMBER OCTOBER 2022

YOUR PARTNERS IN COMMERCIAL PROPERTY 7373 Broadway, Suite 201, San Antonio, TX 78209 | 210.822.5220 | WorthSA.com FEATURED PROPERTIES NOW LEASING IN SAN ANTONIO CLASS A OFFICE SPACE FLEX OFFICE SPACE UNIVERSITY HEIGHTS TECH CENTER NORTH CENTRAL SUBMARKET 5,000 – 85,000 SF of Class A Office Space 19122 N, US HWY 281, San Antonio, TX 78258 NORTH CENTRAL SUBMARKET 1,913 – 27,515 SF of Flex Office Space 1718 & 1922 Dry Creek Way, San Antonio, TX 78259 NORTHWEST SUBMARKET 10,000 – 84,890 SF of Class A Office Space 5818 Farinon Drive, San Antonio , TX 78249 NORTHWEST SUBMARKET 2,300 – 28,000 SF of Flex Office Space 5726 Hausman Road, San Antonio, TX 78249

Thanks to Office, DFW to Hit Third Consecutive Quarter of Positive Net Absorption

BY MIA GOULART

Dallas-Fort Worth is proving itself to be one of the hottest markets in all areas of CRE. And right now, the numbers are pointing toward a third consecutive quarter of positive net absorption for the first time since 2018.

That’s according to CBRE’s DFW Q2 Office Market Report. In fact, Dallas’ numbers are trending up in nearly every regard.

The Bureau of Labor Statistics, as of May 2022, reported the national unemployment rate as 3.6%, maintaining the same level in April 2022. DFW’s unemployment rate during the same period was 3.3%, and Dallas has increased its number of non-farm jobs by 7.7% — nearly 300,000 — year-over-year.

Vacancy continued to drop and stood at 24.4%, down by 70 basis points

from Q1 2022, marking yet another decline in vacancy and the longest streak since 2019, Deliveries were up 76.1% from 327,400 square feet to 576,550 square feet in Q2 2022 due to the recent completion of The Epic — Phase II and the PGA of America HQ.

Office in and around DFW continues to show signs of recovery, comparable to that of Boston, Manhattan and Houston due to evergrowing tenant requirements and competitive leasing activity, based on the report. The submarket has seen many new projects this year and quite a few are expected to break ground in the coming months.

One of the largest projects to break ground in Q2 was 2323Springs in Uptown for 622,452 square feet. Quoted face rates increased from $30.93 gross per square foot to $31.23 gross per square foot with Far North Dallas

12 SEPTEMBER OCTOBER 2022

and Richardson/Plano leading the charge. Sublease availability rose to 9.4 million square feet, representing over 4% of total inventory and 14.7% of total availability with Class-A properties, making up roughly 72% of all sublease listings.

Simply, DFW’s office rebound is one of the best in the U.S. This much is clear. Still, CBRE Econometric Advisors have expressed concern about the current effects of inflation on the real estate market and advise businesses to tread, still, with caution.

“Our baseline view expects the Fed will be able to restrain inflation to roughly seven percent by year-end,” CBRE stated. “The labor market will also soften, with the unemployment rate increasing to the mid-fourpercent range. Once inflation is tamed, both capital and real estate markets should become more predictable again.”

There will continue to be a flight to quality where newer, highly amenitized renovated buildings will have the most activity. Other projects will continue experiencing lower rent growth and shorter lease terms for new and renewing tenants. That said, CBRE said DFW should be able to sustain healthy fundamentals due to its stable local economy and unwavering demand.

“Our baseline view expects the Fed will be able to restrain inflation to roughly seven percent by year-end . Once inflation is tamed, both capital and real estate markets should become more predictable again.”

13SEPTEMBER OCTOBER 2022

“Workers crave flexibility”:

New CBRE report looks at Great Resignation impacts on office sector

BY BRANDI SMITH

It’s the one-two punch no one in commercial real estate is celebrating – and for good reason. The COVID-19 pandemic and shutdowns combined with the so-called “Great Resignation” that followed have generated a number of challenges for almost all CRE sectors.

“More U.S. workers are leaving their jobs than ever before, and job openings exceed willing workers,” CBRE points out in its recent report entitled The Great Resignation’s Impact on Office Users.

REDnews talked to Jessica Morin, one of the report’s authors and CBRE’s Head of U.S. Office Research, about her team’s findings.

REDnews: In putting the report together, did you learn anything that surprised you?

Morin: While overall levels of quits increased since the pandemic, the share of office-using positions slightly decreased from 24% on average in 20182019 to 21% of quits at the time of the report (January 2022).

REDnews: What was the biggest takeaway for you?

Morin: The great resignation was much more impactful on the retail and hospitality sectors. Still, office-using employers, particularly those with entry-level back-office and shared service positions, also felt the impact. Those office-using sectors also saw the highest wage growth over the last three years. Quits were less prevalent in higher-paying positions, like technology and financial services jobs, which are more likely to support remote working.

REDnews: Did your research change how you view working in a traditional office setting vs. working from home?

Morin: The research cemented the view that workers crave flexibility with where and when they work. Positions that could more easily work remotely were the ones that had a lower share of quits.

REDnews: It feels like the office sector got hit by a 1-2 punch of COVID + the Great Resignation. Can you predict whether it will ever rebound to prepandemic levels?

Morin: With the increasing possibility of a mild recession in 2023, we expect demand for office space will weaken, further delaying the U.S.

“Workers crave flexibility with where and when they work.

Positions that could more easily work remotely were the ones that had a lower share of quits.”

Jessica Morin

14 SEPTEMBER OCTOBER 2022

office recovery. Companies will look to further reduce expenses. We expect those reductions, coupled with the wide adoption of remote work, will translate to continued rightsizing in the near-term. However, future construction will moderate along with the decrease in demand, which will help to stabilize vacancies and support rent growth.

REDnews: Texas was well-represented in markets for labor force growth. What do you think is driving that?

Morin: Relative affordability has fueled population growth, which has attracted employers and mega office projects to Austin and Dallas over the past several years. Most recently, Meta Platforms and TikTok have expanded in Downtown Austin. Tesla established new headquarters in Southeast Austin, and Apple opened a new campus in Northwest Austin. In Dallas, Charles Schwab, Caterpillar, Keurig, and PGA of America are just some of the largest tenants to have recently committed to new office space.

Texas markets are leading the office recovery, supported by job growth. COVID restrictions were eased earlier in Texas than most of the country, contributing to a faster rebound in the office market. Austin and Dallas have led the nation in office occupancy rates throughout the pandemic, consistently among Kastle Systems’ top 10 markets for that metric.

Asking rents in both markets are more than 15% above the pre-pandemic Q1 2020 rate, and vacancies have started to contract.

Read the full report The Great Resignation’s Impact on Office Users on CBRE.com/insights.

15SEPTEMBER OCTOBER 2022

‘An Unmatched Opportunity’: The Real Estate Council provides one-of-a-kind membership

BY BRANDI SMITH

The Texas commercial real estate community is unique in myriad ways, but one of its gems is The Real Estate Council (TREC). Founded in 1990 by a group of commercial real estate heavy hitters who wanted an organization that would focus on local issues, TREC highlights leadership development, public policy and community investment. The organization has now grown to include 2,000 members and 600 member companies, which helps the organization wield strong influence across North Texas.

“Our mission is to cultivate relationships in the commercial real estate industry, to catalyze community investment, influence policy, propel careers and develop the leaders of tomorrow,” says TREC President and CEO Linda McMahon. “We believe relationships are the lifeblood of career success, community investment and civic responsibility.”

Leadership development

Members, she adds, come from every facet of the industry and are developers, builders, brokers, attorneys, architects, investment bankers, accountants, finance professionals, title professionals and more. They’re personally engaged in issues that are important to the community.

“Our programs are created for maximum engagement for our members,” McMahon says.

Those range from Young Guns, which helps young professionals connect with senior CRE pros to learn about the industry and their career, to The Deal, an industry expert-taught program in which members can learn about all aspects of a real estate transaction.

“We have a formal mentoring program, a 10-month leadership development program called the Associate Leadership Council (ALC), as well as opportunities to lead a variety of committees and projects,” adds McMahon.

Public policy

TREC also advocates for public policy issues that impact the industry and promote long-term economic growth and vitality throughout the region.

“We engage with local and political officials on issues important to the economic vitality of our region and state. We have a continually active public policy committee that provides their professional expertise to guide our positions on important policy issues,” McMahon says. “We also have a Political Action Committee which financially supports candidates for office.”

Community investment

The philanthropic arm of TREC is called, “TREC Community Investors or TREC CI.” The nonprofit joins forces with underserved communities to invest in historically disinvested neighborhoods around DFW and energize them to change lives within the community.

“Through access to flexible capital and real estate expertise, we make an unwavering commitment to build a lasting impact in the communities we serve,” says McMahon.

TREC CI seeks to build on the strong foundation of the organization’s 2,000 members and continue employing a place-based strategy that transforms neighborhoods block by block.

Linda McMahon

“Our mission is to cultivate relationships in the commercial real estate industry, to catalyze community investment, influence policy, propel careers and develop the leaders of tomorrow.”

16 SEPTEMBER OCTOBER 2022

Continued on Page 23 >

Imagine. Empower. Impact.

The Real Estate Council (TREC) would like to thank our greatest resource, our members, for a successful 2022.

As we work to serve the Dallas community and beyond, the power of the commercial real estate community is undeniable and our members’ collective expertise and dedication provides unlimited potential for creating a positive, transformative impact on our city.

Visit recouncil.com and learn how you and your company can engage with the commercial real estate community to cultivate relationships, catalyze community investments, influence policy, propel careers and develop the leaders of tomorrow.

Join TREC today and make a difference in the community where we live and work.

recouncil.com

Chris Stutzman Transwestern, Michael Bernstein, The Geyser Group, Jon Siegel, Railfield Realty,Nitin K. Chexal, Palladius Capital Management, Patton Jones, Newmark, Ting Qiao, Wan Bridge, JP Newman, Thrive FP, Cheryl Higley, NorthMarq

Abel Pacheco, 5 Talents CRE, Israel Linares, CoStar , Gus Villegas,

Infinite Capital Construction, Josh Kahn, RPM Living

Aaron Taylor, AIA, McKinney York Architects, Srinath Pai Kasturi, LEED AP, Cadence McShane Construction Company, Amber Autumn, Summit Design + Build, Cross Moceri, Presidium

Michael Gonzalez Berkadia, Spencer Roy Walker & Dunlop, Benjamin Fuller Cushman & Wakefield, Patrick Rose Corridor Title

Cheryl Higley NorthMarq

Josh Kahn RPM Living

Chris Stutzman Transwestern, Michael Bernstein, The Geyser Group, Jon Siegel, Railfield Realty,Nitin K. Chexal, Palladius Capital Management, Patton Jones, Newmark, Ting Qiao, Wan Bridge, JP Newman, Thrive FP, Cheryl Higley, NorthMarq

Abel Pacheco, 5 Talents CRE, Israel Linares, CoStar , Gus Villegas,

Infinite Capital Construction, Josh Kahn, RPM Living

Aaron Taylor, AIA, McKinney York Architects, Srinath Pai Kasturi, LEED AP, Cadence McShane Construction Company, Amber Autumn, Summit Design + Build, Cross Moceri, Presidium

Michael Gonzalez Berkadia, Spencer Roy Walker & Dunlop, Benjamin Fuller Cushman & Wakefield, Patrick Rose Corridor Title

Cheryl Higley NorthMarq

Josh Kahn RPM Living

18 SEPTEMBER OCTOBER 2022

Austin Multifamily September 16, 2022

Eric Lestin, Cushman & Wakefield, Jonathan Horowitz, MIDWAY, Haley Golden, Evergreen Commercial Realty, Erin Dyer, Read King, Crystal Allen, Transwestern, Jazz Hamilton, CBRE, Ori Batagower, The Deal Company

David Littwitz, Littwitz Investments, Gin Braverman, Gin Design Group, Jeffrey Abel, Abel Design Group, Dustin Hubbard, Texana Builders, Rick Walker, Stratiq, LLC, Saahir Ramji, JD, MS, Beacon Developments, Brian Ashby, CBRE, Jonathan W. Hicks, EDGE Realty Partners

Katy Hicks, Brian Ashby, Dr. Betsy Giutso

Benjamin Berg, Berg Hospitality Group, Sandy Nguyen, Ordinary Concepts, LLC, Cassie Ghafar, Ordinary Concepts, LLC, Melissa Stewart, Houston Restaurant Association, Kairy Tate-Barkley, French Cuff Boutique, Faysal Haddad, Island Grill

Danny Nguyen and Sami Soussan

Eric Lestin, Cushman & Wakefield, Jonathan Horowitz, MIDWAY, Haley Golden, Evergreen Commercial Realty, Erin Dyer, Read King, Crystal Allen, Transwestern, Jazz Hamilton, CBRE, Ori Batagower, The Deal Company

David Littwitz, Littwitz Investments, Gin Braverman, Gin Design Group, Jeffrey Abel, Abel Design Group, Dustin Hubbard, Texana Builders, Rick Walker, Stratiq, LLC, Saahir Ramji, JD, MS, Beacon Developments, Brian Ashby, CBRE, Jonathan W. Hicks, EDGE Realty Partners

Katy Hicks, Brian Ashby, Dr. Betsy Giutso

Benjamin Berg, Berg Hospitality Group, Sandy Nguyen, Ordinary Concepts, LLC, Cassie Ghafar, Ordinary Concepts, LLC, Melissa Stewart, Houston Restaurant Association, Kairy Tate-Barkley, French Cuff Boutique, Faysal Haddad, Island Grill

Danny Nguyen and Sami Soussan

19SEPTEMBER OCTOBER 2022 events

August 30, 2022 Houston Retail

event profile

REDnews Houston Retail Update

BY RAY HANKAMER

PANEL I — MARKET UPDATE

Moderator: Eric Westin, Cushman & Wakefield Panelists: Crystal Allen, Transwestern; Erin Dyer, Read King; Haley Golden Bresser, Evergreen Commercial Realty; Jazz Hamilton, CBRE; Jonathan Horowitz, Midway; Ori Batagower, The Deal Company

• Brands relocating to Houston should hire professionals who know how to navigate local construction challenges to assist with market entry.

• Nearly all components associated with new builds have seen soaring costs, due not only to manufacturing but to shipping and warehousing costs.

• Top-of-the-line retailers and price sensitive retailers are having the most success in this market with consumers. Middle market brands are struggling in some cases and looking to change their approach to the marketplace.

• Convenience is key now, with drive-thru service in big demand.

Ray Hankamer

Takeaway: Demand for retail space exceeds supply as supply chain woes slow down development. Tenants are opting for smaller footprints as TI costs soar with inflation. Developers are renting warehouses to preorder and to hoard materials and appliances to ensure they are available when needed. While some retailers are pairing up with larger chains to install “stores within stores”, others are learning new ways to combine brick-and-mortar outlets with e-commerce. Sales are at an all-time-high, but is a recession coming?

Bullets:

• All but the ‘tucked away’ leased spaces are occupied, and tenants are beginning to accept secondary locations just to have a presence in the market. Retail rents will inevitably rise, keeping landlords in the strong position in lease negotiations.

• Demand is growing for specialty retail experiences, or experiences e-commerce cannot deliver.

• Retail centers are moving toward a broader mix of tenants, away from soft goods and toward restaurants.

• Tenants are becoming more nimble, adapting to smaller spaces and incorporating more technology.

• Finding and retaining employees is a distinct challenge in this market. Doing this well is key to success. Many employees who were laid off during the pandemic found more desirable jobs, the lack of staff leaving businesses to operate with shortened hours.

• Hospitality and restaurant industries are the largest employers in the U.S.

• Amazon is undergoing a readjustment after the market distortions during the pandemic.

• There are uncertainties about where inflation is going, and it’s hard to price products given the uncertain future.

• It took the U.S. two years to recover from the COVID-19; Houston has not only recovered but has bounced back with 70,000 new jobs.

• Contractors for are having trouble guaranteeing pricing for longer than 30 days, making budgeting is difficult.

• Lots of retailers are ‘re-concepting’ to adjust to evolving consumer demands. Some retailers are inserting mini stores into larger retailers such as Macy’s and Target. Toys R Us is rebounding from bankruptcy with mini toy stores within 500 Macy’s locations nationwide.

• E-commerce is strengthening brick-and-mortar stores, as retailers use their stores for product try on, pick up and exchange.

• E-commerce is only about 17% of total retail sales.

• Direct-to-consumer selling is slowing down as customers want the experience of a retail store.

• Rent for restaurants is in the 5–6% range, although deals can vary.

Panel II — RETAIL & RESTAURANT DEVELOPMENT/CONSTRUCTION TRENDS

Moderator: David Littwitz, Littwitz Investments, Inc. Panelists: Brian Ashby, CBRE; Danny Nguyen, DN Commercial; Dustin Hubbard, Texana Builders; Gin Braverman, Gin Design Group; Jeffrey Abel, Abel Design Group; Jonathan W. Hicks, EDGE Realty Partners; Rick Walker, Stratiq Capital; Saahir Ramji, Beacon Developments, LLC

Takeaway: Supply chain is adjusting to higher shipping costs, with sourcing of new suppliers from countries such as Turkey and Mexico. Designers and their clients must remain flexible to changes in materials which sometimes become unavailable due to soaring prices or supply chain issues. Cooperation and communication during the design/build stage is more important than ever.

Bullets:

• Architects are having to design twice. First for the initial design, and second to adjust to the changes forced on the project by supply issues.

• Material costs are starting to stabilize and even drop slightly.

• Communication is key among all parties of a project in order to minimize delays and bottlenecks.

20 SEPTEMBER OCTOBER 2022

• Access to a warehouse for storage of construction and buildout items is important to having the items available when needed.

• Menu prices are higher compared to pre-pandemic. This reflects increased costs to the restaurateur on every level.

• Drive-thru restaurants are using AI to take and deliver customers’ orders, thus reducing reliance on salaried personnel. brick-and-mortar stores, as retailers use their stores

• When so many people are involved in a lease space buildout, trust is the currency of business. All parties need to trust each other. Investors and lenders must trust the competency and honesty of their developer/ partner/borrower.

• Houston is a great city for launching new concepts in restaurant or retail. The diverse consumer base is open to trying new entries to the market.

21SEPTEMBER OCTOBER 2022

Continued on Page 22> “E-commerce is strengthening

for product try on, pick up and exchange.” NOVEMBER 15, 2022 FORECAST 2022 DALLAS, TEXAS SUMMIT 2nd Annual PARK CITY CLUB Hybrid Event 11:30 am Networking & Registration 12:00 pm Program

<

• Tenants are turning to owning their lease space since interest rates on purchase loans can be lower than rent to the landlord.

• Retail is going vertical in some cases.

• Don’t hire a firm just because it is owned or managed by your buddy when there are more qualified firms to do the job.

• If crime is an issue to your customers, it pays to install security at your retail and restaurant locations.

Panel III — RETAIL & RESTAURANTS OWNERS & OPERATORS

Moderator: Melissa Stewart, Houston Restaurant Association

Panelists: Benjamin Berg, Berg Hospitality Group; Cassie Ghaffar, Ordinary Concepts, LLC; Faysal Haddad, Island Grill; Kairy Tate-Barkley, French Cuff Boutique; Sandy Nguyen, Ordinary Concepts, LLC

Takeaway: Minimizing operating expenses is key to profitability. The entrepreneur must follow their instinct and must not lose faith while establishing a new venture or concept. Good employees must be respected, cultivated and rewarded in order to retain them.

Bullets:

• Employees are the backbone of our business, and the good ones must be retained at all costs.

• Some restaurateurs made good deals during COVID-19 in securing second-generation sites for future development.

• Providing amenities for employees, like daycare, sweat equity ownership and ongoing professional training, is smart business.

• Your business can grow faster by empowering talented employees.

• Some employees can benefit by personal one-on-one counseling. All benefit from ongoing training.

• A successful restaurant owner creates an experience for his diners by coordinating an atmosphere with good service and well-prepared food. Often the customer is looking for an escape that they pay for in addition to the actual food and drink items.

• Many restaurateurs have a love/hate relationship with food delivery services, which are persisting even COVID-19. Owners are surprised at what people are willing to pay to have one taco delivered to their home.

• Restaurant tenants should think of their landlord not as an adversary, but as a partner in business, since the success of one depends on the success of the other.

• When opening a new restaurant location, bring your team onto the payroll while the space is still under construction. This will give your team a feeling of belonging and ownership.

• Create recognition platforms to keep employees motivated and rewarded for their hard work.

• Owners should treat employees like family so that they emotionally “take ownership” of the operation along with them.

• Hire the right employee to start with to reduce turnover later.

22 SEPTEMBER OCTOBER 2022

Houston Continued from Page 21

“For TREC members, TREC CI offers an unmatched opportunity to make a positive impact on the community and ‘Build the City You’ve Imagined,’” McMahon says.

That sign of goodwill extends into the community further with the Dallas Collaborative for Equitable Development (DCED), managed by a partnership between TREC CI, Dallas College, Lift Fund and the Texas Mezzanine Fund. A historic $6 million investment from JPMorgan Chase & Co. funded an equitable development study of three focus neighborhoods in Dallas, in order to pursue a place-based strategy of capital investment and capacity building.

Members on a mission

“We never stop thinking about the future and what we can do to improve the quality of life for everyone in our community,” says McMahon.

For now, at least, it’s a truly special membership that’s only available in North Texas.

“There is no other organization like The Real Estate Council anywhere else in the country. With an engaged membership base made up of all sectors of the commercial real estate industry, I often hear comments from commercial real estate professionals in other parts of the country that they wish they had a TREC in their community, a professional organization dedicated to engaging with the community through public policy, leadership development and community investment to improving the quality of life in their community.

Learn more about becoming a TREC member at recouncil.com or about TREC CI at treccommunityinvestors.org.

“Through access to flexible capital and real estate expertise, we make an unwavering commitment to build a lasting impact in the communities we serve. ”

23SEPTEMBER OCTOBER 2022

< TREC Continued from Page 16

St op Spinning Your W heels! L et Your TE X AS Envir onmental Consulting Firm Help You Navigate Thr ough Your Envir onmental Risks. Phase Engineering, LLC Environmental Consultants 832-485-2225 www.PhaseEngineering.com

SCOOP

Concord Announces and

San Antonio- September 13, 2022. Concord Properties, one of San Antonio’s oldest development companies, announced Taylor Dorris has been named CEO and President of the landmark San Antonio company. This comes on the heels of longtime CEO and President Jay Eddy’s decision to step down and become Chief Advisory Officer after serving the company for 45 years. Dorris, a longtime business associate, has represented Concord Properties in leasing and sales transactions for the past 18 years. “Taylor is a natural fit, he has been involved with the company for close to 20 years, and I have confidence that he will only further the success and growth of Concord Properties,” said Jay Eddy.

As CEO, Taylor Dorris is transitioning Concord Properties into a full-service commercial real estate firm offering development, leasing and property management services. Dorris saw that this transition was integral in continuing to elevate the level of services that Concord provides. Responsible for the overall financial success of the company, Dorris will also lead the efforts in marketing Concord’s properties and maintaining a high level of property management services while continuing to be at the forefront of commercial real estate trends. Dorris is perfectly poised to lead the company’s portfolio of approximately 500,000 square feet of properties owned and managed by Concord.

27SEPTEMBER OCTOBER 2022

Properties

Taylor Dorris as New CEO

President 1 BOMA Austin Members-Guests Sept 6 2022 2 CREN Houston August 26th Luncheon David Hightower Midway Cos 3 CREN Houston August 26th Luncheon Attendees 4 BACREN Sep 15 2022 Luncheon Patrick O’Connor with O’Connor and Associates and Lisa Kurrass with Real Estate Connection International 5 BOMA Houston At the August 25th Luncheon, Mark Herrera, Director of Education for the International Assoc of Venue Managers 6 CREN Houston August 26th Luncheon. 1 2 3 5 4 6

Overcoming uncertainty: Texas’ construction industry still strong

BY BRANDI SMITH

Just about anywhere you look in Texas’ largest cities, there are signs of new construction. But that doesn’t mean everything is hunky dory. In fact, builders are jumping through ever-changing hoops to bring new product to the market due to a number of factors.

“We have fought through COVID, oil prices tanking and the over-built industrial sector, which we have referred to as the ‘triple whammy’ in Houston,” says Radie Stroud, Vice President and General Manager for Alston Construction Company’s Houston office. However, we have strong tenant demand that seems to be driving growth with no end in sight.”

Jerry Yan, Project Manager for Grandview Construction, says the expansion of Greater Houston brought an increase in employment and in wages for those with experience.

“The Houston area alone has seen a spike in commercial real estate construction over the last decade,” he says.

In Dallas, Alston’s Vice President and General Manager Scott Matthews calls the construction market odd.

“Some developers are running to the sidelines, shedding land and shuttering projects while other developers are running full steam ahead, seizing the opportunity provided by competition standing by,” he adds. “There seems to be no consensus in the direction of the market other than it’s changing.”

That’s something Chad Schieber, Chief Marketing Officer at The Beck Group, is seeing too.

James Sullivan via unsplash

“Some developers are running to the sidelines, shedding land and shuttering projects while other developers are running full steam ahead, seizing the opportunity provided by competition standing by.”

28 SEPTEMBER OCTOBER 2022

“Our challenge today is deciding which deals move forward versus the ones that might pause due to the current economic headwinds,” he says.

Schieber adds that most sectors are still experiencing substantial expansion, especially healthcare.

“Significant ground-up projects and longer-term renovations have kept our design and construction teams busy,” he shares.

The Beck Group was chosen to provide construction for the expansion and modernization of the Ascension Seton Medical Center’s Women’s Pavilion in Austin. It’s also working on the TCU East Campus Student Housing & Dining in Fort Worth, as well as designing and building a new parking garage for JPS Health Network.

Alston’s Dallas team says industrial construction is still hot, but cooling a bit. Brittany Schneider, the company’s Director of Business Development in Dallas, points out her team has seen a shift from speculative pursuits to more build-tosuit opportunities.

Alston is starting a new project in Forney for a repeat customer. It will consist of three buildings, totalling 1,137,492 square feet.

Down I-45, Stroud says light industrial commercial warehouses are going up due to exceptional demand. Alston is about to break ground on a 1.2-million squarefoot spec warehouse for repeat client Lovett Industrial. It’s the company’s first project in Conroe.

Scott Matthews

Brittany Schneider

Chad Schieber

Radie Stroud

Jerry Yan

Scott Matthews

Brittany Schneider

Chad Schieber

Radie Stroud

Jerry Yan

CONGRATULATIONS ANTHONY MARRE on being named HOUSTON'S REAL ESTATE LAWYER OF THE YEAR www.wcglaw.com Follow us on LinkedIn

Continued on Page 30 >

“It seems we are seeing many new players/contractors getting into the commercial warehouse space these days making things more competitive,” he adds.

A key reason for that demand could be the sheer number of people moving to the area, which is also contributing to a strong housing sector, according to Yan.

Still, challenges loom. Which challenges depends on whom you ask.

Yan suggests the issue of labor and material shortages, as well as the increased cost of goods, is being exacerbated by technological advances in the industry.

“With new building techniques, buildings are built faster than before which has led to a shortage of skilled workers. On the other hand, the construction industry will have to increase its output as demand for housing and other buildings increases,” says Yan. “This can only be achieved if there is a drastic increase in supply of skilled workers and materials so that they can meet this demand.”

To combat labor issues, Alston is partnering with local organizations who promote workforce development and the hiring and retaining of a new generation of personnel into the workforce, according to Schneider, who adds she’s seeing a leveling out on the pricing and delivery time of steel.

“However, there are other material escalations we’re dealing with as it relates to concrete, roofing and fuel surge charges,” says Schneider.

Matthews echoes that, saying he doesn’t anticipate seeing any relief from these challenges until Q2 2023 “at best.”

“Nothing in the market is predictable,” he says. “While the market is showing signs of cooling, demand for labor and materials still remain strong due to the high volume of work currently contracted and under construction.”

That uncertainty might be the toughest thing to deal with.

“We can’t tell developers with certainty what the final cost of or the final completion of their project,” Matthews says. “Rental rates are elevated, but not keeping up with the pace of construction cost increases. As such, pro formas that were initially tight at commencement might not work at completion. That uncertainty is pushing some of the developers, specifically investors, to the sidelines.”

Schneider points out that’s having an effect on project start times too.

“Due to the market’s volatility, shortage of supplies, lack of funding etc., we’ve seen many projects push from their original start dates, which has been tricky managing field staff/projects ending and the timing of new projects to begin so field operations are back onsite,” she says.

That doesn’t even take into account what the uncertainty is doing to funding, already strained by market fluctuations.

“In my opinion,” says Yan, the economic environment is the biggest

Stroud’s taken note of that too, adding that many of Alston’s great trade partners have suffered financial hard times over the past few years.

“Some of our go-to guys are now getting questioned as to whether or not they can handle a small project given the hard times they’ve endured weakening their financial strength,” he says. “More now than ever before, we are finding ourselves having to be extra careful about who we are partnering with and relying on to perform critical trade work.”

J O I N T H E V O I C E O JF O I N T H E V O I C E O F C O M M E R C I A L R E A L E S T A T CE O M M E R C I A L R E A L E S T A T E

L E A R N M O R E A T R E C O U N C I L G F W C O M

W E E X P A N D R E L A T I O N S H I P S , D E V E L O P L E A D E R S A N D A D D R E S S D E V E L O P M E N T A N D C O M M U N I T Y C H A L L E N G E S

30 SEPTEMBER OCTOBER 2022

< Construction Continued from Page 29

Despite all those obstacles – some known, some unknown – these companies aren’t just surviving, they are thriving.

“We often talk about pivoting toward solutions when faced with challenges –one that comes to mind is moving with an increased sense of urgency on project bids as pricing continues to escalate each quarter,” says Schieber. “The good news is that owners embrace more collaboration, flexibility and creativity in their projects. Ultimately, to be successful, all parties – including our trade partners and us – need to be open to new and unique solutions. We feel like firms like us who provide integrated design and construction hold a unique advantage as we can quickly offer alternatives and solutions for pricing and materials that others cannot.”

Yan says the secret to success is adapting to individual clients and tailor projects to suit their needs.

Delivering solutions, not problems, is Stroud’s approach.

“Our goal is take a systematic approach to each and be ready to get nimble and creative when our clients’ needs call for the change. We see ourselves as an extension of our clients working harder and thinking ahead before the problems occur.”

None of that is possible without communication, Matthews’ strength.

“We present the developers with the challenges after we’ve vetted multiple options as alternative solutions from our subcontractor partners,” he says. “While delivery dates and budgets may be compromised, by presenting them early with solutions, however unpleasant they may be, there are no surprises at the tail end of the projects.”

Schneider emphasizes that: “We’ve done our best to be transparent and realistic with our clients re: material shortages, cost impacts, delays, etc. We’ve also worked with consultants to find the best possible VE options for our clients to offset and mitigate the escalation in the market.”

Ultimately, these companies aren’t just building warehouses, office towers and multi-use developments, they’re building relationships that can withstand the pressure of uncertain forces.

“It's always been true that owners, contractors and trade partners must work together to deliver successful projects,” Scheiber says. “In today's economic climate, we must collaborate, work creatively and act more urgently among all levels of the supply chain. Doing so will help the industry overcome its challenges and better position itself for new opportunities in a changing real estate market.”

“Our goal is take a systematic approach to each and be ready to get nimble and creative when our clients’ needs call for the change.”

31SEPTEMBER OCTOBER 2022

Unique commercial condo concept XSpace lands in Texas: “It’s an evolution from traditional development”

BY BRANDI SMITH

BY BRANDI SMITH

The story has reached a level of infamy at this point, but it bears repeating. The weekend after Thanksgiving, Byron Smith sat at a Houston restaurant with a margarita in his hand.

“I was in a strip mall, but looking out, I saw a church, a school next to it, an ugly office building and then a strip club,” he laughs. “I just thought, ‘Well, that’s a bit on the nose, isn’t it?’”

Smith and his business partner Tim Manson had been looking for a market to expand their Australian-based XSpace concept.

“Until now, you were either in an office building or a warehouse or selfstorage,” says Smith. “We thought there had to be an innovative way to reimagine how people can use and think about space.”

“We thought there had to be an innovative way to reimagine how people can use and think about space.”

32 SEPTEMBER OCTOBER 2022

The result is XSpace, which blurs the lines between commercial and creative space. Success in Australia helped the partners see the gap in the market in America.

“It’s an evolution from traditional commercial development,” Smith says. However, the versatile condo-style units didn’t seem to be a fit in New

York, where Smith was living, or in LA, where Manson called home.

“That was a catalyst for us to do a road trip from Houston to Austin and that’s when we decided to build XSpace in Texas,” says Smith. “We

33SEPTEMBER OCTOBER 2022

Continued on Page 34 >

said, ‘Let’s go build in Texas, lay a platform within the U.S. and grow it nationally.”

Austin ended up getting the first Xpace development, 106 customizable units ranging in size from 300 to 3,000 square feet across three levels. The

spaces, which can be used for storage, office or just about anything the owner can dream up, boast 17-foot ceilings and a bioclimatic UI-approved, needlepoint ionization air filter system.

“We are creating cool, high-caliber space that you can buy rather than lease,” Smith adds. “It resonates so much, particularly with small- and medium-sized businesses, as well as individuals.”

That’s drawing quite the roster of tenants.

“We have a lot of ex-pro athletes, comedians, podcasters,” says Smith. “The caliber of people in our buildings has blown me away.”

Roger Clemens, for example, will showcase his memorabilia and house his charitable organization in the Austin location. The Astros’ Alex Bregman and former Texans player Kasey Studdard will have units there too. Other units are owned by car enthusiasts, a tech company and small business owners.

“It really creates a great community dynamic,” says Smith.

That’s important to Smith and Manson, who added a 3,000-square foot, fourth-floor business lounge and terrace to cultivate that vibe with community events and panoramic views of Lake Travis and Texas Hill Country. The facility amenities also include 24-hour video surveillance, secure 24/7 access, janitorial services, landscaping maintenance, a kitchenette, restrooms and showers.

“XSpace is super customer-oriented,” Smith says, adding that the company is capitalizing on consumers’ flight to quality by offering upscale space and top-tier amenities.

Due to the versatility of the units, XSpace has seen owners use them professionally, personally and for investment purposes.

“Ownership is a big piece that resonates with a lot of people,” says Smith. “For the same amount it would cost you to lease a space, you can own one.”

34 SEPTEMBER OCTOBER 2022

< XSpace Continued from Page 29

The

“We information about

“Ownership is a big piece that resonates with a lot of people . For the same amount it would cost you to lease a space, you can own one.”

35SEPTEMBER OCTOBER 2022

demand is clear. The Austin XSpace almost sold out prior to completion. Houston, Smith says, is up next, then Dallas.

have more in the pipeline with a couple of high-profile partners that will be announced around the end of the year,” he adds. For more

XSpace ownership opportunities, visit XSpacegroup.com. Anchor Construction and Management 2 Beacon Developments LLC. ........................................................................ 33 CBRE Houston 1,5 City of Magnolia 34 CIVE 31 Colliers ............................................................................................................ 9 CRG Texas Environmental Services, Inc 3 Cross Continents Management 15 Gordon Partners ......................................................................................... 24,25 National Environmental Services, LLC ..................................................... 47 NewQuest 13 Phase Engineering 26 The Real Estate Council - Dallas ................................................................ 17 The Real Estate Council - Greater Ft. Worth........................................... 30 The Richland Companies 7 Texas Coastal Properties 22 Wilson Cribbs & Goren ................................................................................ 29 Worth & Associates ...................................................................................... 11 XAG Properties 23 advertiser index

Dangerous Curves Ahead: An Update on the Energy Sector

BY RAY HANKAMER

Matthew Henry for unslpash

Takeaway: As we transition from a fossil fuel-based economy to a ‘green’ economy, there will be many bumps in the road, and hard lessons to be learned. The transition involves moving from a free market energy world to an energy world created by government direction and consumer sentiment…and, the underlying truth of global warming. We are venturing into unknown territory.

Bullets:

• The ‘green movement’ is creating friction in crude oil exploration and refining markets

• One camp says ‘let the free market handle the transition’ and another camp says ‘it is too urgent to rely on markets and we must guide the process through government initiatives’

• In the meantime, coal is still the dominant fuel worldwide, and new coal burning plants are still being built in some countries

• The ‘green goal’ is to achieve an 80% energy change in a few short decades; the change is indeed underway, but it will be incremental and not brisk

• We are very slowly reducing reliance on the ‘Big 3’: coal, natural gas, & crude oil

• It takes only one year in the Permian Basin of Texas to bring a well to production status; offshore and internationally it takes much longer, hence sudden shortages in crude oil cannot be instantly be caught up

• There are a lot of government programs to accelerate battery and electricity storage development, and the solar energy to feed them, but progress is slow; solar energy cannot be created at night and wind energy cannot be created when the wind does not blow. During the Texas energy crisis during the big freeze, frozen infrastructure and no wind combined to reduce electricity generation right when we needed it the most

• In the current climate, stockholders are pushing green initiatives in corporations, although some do not make financial sense at the end of the day

• Banks are giving green energy project financing favorable loans

• Hydrogen is the newest possible green solution on the horizon

• Carbon reduction technology is still somewhat ill-defined, although many are working on it

• The next 5-8 years will be chaotic as new initiatives are explored and eventually rejected

• As the current center of the energy world, Houston is well-positioned to retain the lead as we transition to energy sources other than hydrocarbons…which is a good thing for our local economy

• One roadblock on progress is that politicians do not like to spend their immediate political capital on something that will benefit someone 30 years from now, after they themselves are gone

• Some green initiatives turn out to be more polluting than the problems they set out to solve

• Even this summer we have come close to running out of electricity and having to go into ‘slow-down mode’

• How will we have enough electricity to charge all the electric vehicles projected for coming years? How will we generate and store the needed power without fossil fuels? The transition which is in progress will encounter friction from unanticipated sources

• We do have oil and gas wells which were drilled but not completed during the era of low price per barrel, and many of those are being completed to take advantage of current high price per barrel; crude oil prices are expected to remain on the high side for the foreseeable future, not dropping below $80

• Stocks of crude oil are expected to go down in the near future as demand starts to return with falling gasoline prices-the market is at work here

• Gasoline has to go to $10 per gallon to precipitate a rush to buying electric vehiclesgasoline prices have almost reached that level in California

• With the Ukraine war and overall energy markets, electricity costs are expected to soar in Europe this coming winter

• Since LNG is considered a ‘green fuel’-for the moment-it is under high demand in Europe

• Oil companies are making lots of money but out of uncertainty about the future, they are hesitant to invest in more drilling and refineries; in anticipation of moving to green energy, refinery capacity in the US is down about 10%-the demand is there but the supply is not responding

• Supply chain/logistics problems are hampering new drilling worldwide

• Increased energy prices spread all through our economy, from agriculture production to delivery of goods across the economy

• Inflation in the US is affecting low income citizens more than any other class

• Some green initiatives are facing legal challenges by citizens and stockholders

• Long term we will have ‘demand destruction’ for carbon-based fuels

Sector Speaker: Detlef Hallerman-Director of the Reliant Energy Trade Center at Texas A & M University

36 SEPTEMBER OCTOBER 2022

THANK YOU TO OUR SPONSORS

2 2022 REDnews Commercial Real Estate Awards | REDnews.com

®

PROJECT

PROJECT AWARDS

Flex Building Project

WINNER! FUSE WORKSPACE

Greater Houston

The Clinic Plastic Surgery

HCA Kingwood Hybrid Operating Room and Cath Lab

JLL Houston Headquarters Relocation Heritage Plaza

WINNER! LAMAR STATE COLLEGE PORT ARTHUR RUBY FULLER EDUCATION ANNEX

Hotel / Hospitality

WINNER! THE GEORGE Blossom Hotel

Industrial / Manufacturing / Science Amazon Pflugerville

Buda Midway

Upper San Jacinto Bay Landing

Project Falcon

WINNER! HOU8

Interior Design - Office / Industrial / Corporate

Orchard Global Asset Management

The HUB at The Galleria

WINNER! JLL HOUSTON HEADQUARTERS RELOCATION

Southland Holdings Headquarters SWA Quorum

Interior Design - Retail / Restaurant / Hospitality

WINNER! MAHESH’S KITCHEN

Medical Property

WINNER! HCA KINGWOOD HYBRID OPERATING ROOM AND CATH LAB

The Clinic Plastic Surgery Heights Forum Mixed-Use Property

WINNER! HEIGHTS FORUM Redevelopment / Reuse / Historic - Industrial

WINNER! CONROE ECONOMIC DEVELOPMENT COUNCIL - THE HOME DEPOT

Redevelopment / Reuse / Historic - Medical WINNER! LEGACY COMMUNITY HEALTH CLINIC

Redevelopment / Reuse / Historic - Office

Gulf Coast Pavers Heritage Plaza

WINNER! LAMAR STATE COLLEGE PORT ARTHUR RUBY FULLER EDUCATION ANNEX 1500 McGowen Grand Forum Redevelopment / Reuse / Historic - Retail 3201 Allen Parkway WINNER! THE COFFEE HOUSE AT WEST END

#rednewsawards | #rejournals re_journals REDnews @REjournals

Retail / Restaurant

Minonite Retail Phase 1

Mahesh’s Kitchen

WINNER! THE HOUSTON FARMERS MARKET

Bludorn

Suburban Multifamily

WINNER! CLEARWATER AT BALMORAL

Urban Multifamily

The Parker WINNER! ST. ANDRIE

The Sterling at Regent Square

CORPORATE AWARDS

Brokerage Firm of the Year

NewQuest Properties

NAI Partners

Belvoir Real Estate Group LEE &

Stream Realty Partners of the Year

WINNER!

General Contractor of the Year

Owner / Landlord

NewQuest Properties

WINNER! HARTMAN INCOME REIT MANAGEMENT, INC.

Ben Suttles/Disrupt Equity

Professional Service Company of the Year

Montgomery Roth Architecture & Interior Design, LLC Altus Group

WINNER! KIMLEY-HORN AND ASSOCIATES

PRD Land Development Services Property Management Company of the Year

WINNER! COLLIERS

NewQuest Properties Belvoir Asset Management Disrupt Management

4 2022 REDnews Commercial Real Estate Awards | REDnews.com

Colliers

WINNER!

ASSOCIATES

Developer

NEWQUEST PROPERTIES

CIVE WINNER! ALSTON CONSTRUCTION COMPANY

CORPORATE

LIFETIME ACHIEVEMENT

EDNA MEYER-NELSON

President and Chief Executive Officer of The Richland Companies since the founding in 1993. Headquartered in Houston with offices in Dallas and San Antonio, Edna Meyer-Nelson has amassed a portfolio of 35 properties in five states representing more than 2.5 million square feet of commercially owned and managed property throughout the Southwestern United States valued in excess of $250 million. Richland garners top spots on the Houston Business Journal’s Top 50 Women Owned Businesses and Fastest Growing Businesses.

Honors include: the 2020 Texas Commercial Real Estate Icon and an Executive of the Year and Woman of the Year finalist by REDnews, awarded the Sue Trammell Whitfield Award for Resiliency from the Women’s Fund, a Houston Treasure by The Social Book, a Houston Business Journal Women Who Mean Business 2019 Honoree, a Connect Media Women in Real Estate Award winner and one of Houston’s Inaugural Power Women by BisNow. In 2018, she became one of 48 women in the country to be inducted into Real Estate Forum’s Women of Influence Hall of Fame. She was inducted into the Greater Houston Women’s Chamber of Commerce Hall of Fame. Additionally, the YWCA of Houston honored Meyer-Nelson with their Outstanding Business Woman Award. In 2017, she became the first woman to receive the Houston Business Journal’s Landmark Lifetime Achievement Award and was honored with CREW Houston’s inaugural Circle of Excellence Award.

She began her career in the banking industry where she served as Vice President, Commercial Loan Officer, and Marketing Director for several of the larger banks in Houston. During her tenure, Meyer-Nelson’s duties included initiating commercial, small business and real estate loans, as well as executive lines of credit. While managing over $50 million in assets, she also assisted in the buyouts of several independent banks, initiated and incorporated new, cost-effective programs, and actively encouraged executive women to enter new business ventures. Her dream came true last year when she had the opportunity to be a founding Director and invest in the first national women owned, women led bank in the country, Agility Bank, located in the Heights. Last month Ms. Meyer-Nelson was elected as Chairwoman of Agility Bank.

Ms. Meyer-Nelson resides in Houston, she is an avid golfer and enjoys time with Beau, her Pomeranian.

#rednewsawards | #rejournals re_journals REDnews @REjournals26 2022 REDnews Commercial Real Estate Awards | REDnews.com

PEOPLE AWARDS

Architect / Engineer of the Year

WINNER! ROBERT FARNIE, PRD LAND DEVELOPMENT SERVICE, LLC

Broker of the Year

Nick Spearman, Belvoir Real Estate Group

WINNER! TRAVIS LAND, NAI PARTNERS

Griff Bandy, NAI Partners

Andy Flack, HomeLand Properties, Inc. Eric Broussard, RESOLUT RE

Lilly Golden, Evergreen Commercial Realty Reed Vestal, SIOR, CCIM, Junction USA

Champion of Diversity

WINNER! KACI HANCOCK, CPM, ACOM, REIS ASSOCIATES, LLC

Emerging Leader of the Year - Male

Josh Brown, Newmark

Dr. Steven Kaufman, Zeus Companies

WINNER! RYAN BYRD, COLLIERS

Chris Haro, NAI Partners

Mike Pittman II, Cushman & Wakefield

Joaquin Orozco, RESOLUT RE

Will Curtis, CCIM, KW Commercial City View Matthew Bronstein, BHW Capital Aaron Morris, Oldham Goodwin

Anthony Trollope, Hartman Income REIT Thomas Erwin, Moody Rambin

Emerging Leader of the Year - Female

Lisa Roth, Montgomery Roth Architecture & Interior Design, LLC

Michelle Johnson, George E. Johnson Development

WINNER! CHRISTEN VESTAL, VIGAVI REALTY

Social Media Influencer of the Year

Dr. Steven Kaufman, Zeus Companies

WINNER! TIFFANY RYLAND, ARVO REALTY ADVISORS

Will Curtis, Keller Williams Thomas Nguyen, CBRE

Executive of the Year - Male

WINNER! PATRICK DUFFY, COLLIERS

Jon Silberman, NAI Partners

Casey Oldham, Oldham Goodwin Hachem Domloj, CIVE

Ryan McGrath, Asset Living Feras Moussa, Disrupt Equity

Executive of the Year - Female

Crystal Pye Adams, PRD Land Development Services, LLC

WINNER! BRAYLIE MANSON, PRD LAND DEVELOPMENT SERVICES, LLC

Project Manager of the Year

WINNER! JERRY YAN, GRANDVIEW HOUSTON

Philip Lepow, Zeus Companies

6 2022 REDnews Commercial Real Estate Awards | REDnews.com

PEOPLE

#rednewsawards | #rejournals re_journals REDnews @REjournals AUGUST 18, 2022

Property Manager of the Year

WINNER! CINDY K. MAGOUIRK, CPM, RPA, GRANITE PROPERTIES

Laura Harvey, Stream Realty

Real Estate Lawyer of the Year

Eleanor Curry, Curry Law

WINNER! ANTHONY L. MARRE, WILSON, CRIBBS & GOREN

Khatidja Soofi Vellani, Independence Title - Fort Bend / Vellani Law

Volunteer of the Year

WINNER! GRANT PERDUE, COLLIERS

Woman of the Year

Amy Madison, Pflugerville Community Development Corporation

Myra Vorrice, Horizon Property Group

Kelli Walter, NAI Partners Nathaliah Naipaul, XAG Group Christen Vestal, Vigavi Realty

WINNER! JILL NESLONEY, LEE & ASSOCIATES

Lilly Golden, Evergreen Commercial Realty Red Oak,

8 2022 REDnews Commercial Real Estate Awards | REDnews.com

TRANSACTION & CITY/MUNICIPALITY AWARDS Most Significant Investment Sale Transaction WINNER! 2900 AC MONTG. CO. Most Significant Lease Transaction Crayon Software Leases Full Floor at Hartman Office Building WINNER! KIRBY ICE HOUSE THE WOODLANDS Oracle-America Leases Hartman Office Space City / Municipality of the Year WINNER! CONROE ECONOMIC DEVELOPMENT COUNCIL City of

Texas EDC of the Year WINNER! THE WOODLANDS AREA ECONOMIC DEVELOPMENT PARTNERSHIP TRANSACTION /CITY

OCTOBER 7, 2022 OCTOBER 14, 2022 WOM E N I N RE A L E S TATE FO RE C A S T 202 2 DA L L A S, T E X A S 2022 COLL IN COUN T Y, T E X A S SUM M I T S U MM I T 3 r d A n n u a l 2n d A n n u a l PARK CIT Y CLUB 12:00 - 3:00 Program 11:30 Registration & Net working STONEBRIAR COUNT Y CLUB Hybrid Event 7:30 - 12:00 Program Scan code to register Scan code to register

ARCHITECTS/DESIGN-BUILD FIRMS

KDS de stijl interiors

2006 E Cesar Chavez St. Austin, TX 78702

P: 512.457.1332

Website: kdsaustin.com

Key Contacts: Jill Laverentz, Principal, jill@kdsaustin.com; Clark Kampfe, Principal, clark@kdsaustin.com

Services Provided: Programming & Client Process Analysis – Due Diligence & Building Analysis – Schematic Design – Test Fit & Pricing Notes – Project Scheduling Goals – Consultant Team Formation – Cost Analysis & Value Engineering – Design Development – Construction Documentation – Racking, Commodity, & Equipment Coordination – Permit Processing – Project Management – Construction Administration – Project Budgeting & Cost Tracking – As-Built Documents

Company Profile: KDS is a full-service commercial design firm with 30+ years of experience including 25,000,000+ SF of Industrial/Flex and 3,000,000+ SF of Office Projects. We are committed to responsiveness and to providing well designed and implemented solutions. Our extensive knowledge base and adept management of critical milestones creates consistently successful projects.

Notable/Recent Projects: American Canning – Austin, TX – 101,000 SF –Manufacturing & Distribution

FlightSafety International – TX & OK – 186,000 SF Combined – Manufacturing GT Distributors – Pflugerville, TX – 58,000 SF – Retail, Office, Fabrication, Storage & Distribution

BROKERAGE FIRMS

CMI BROKERAGE

820 Gessner, Suite 1525

Houston, TX 77024

P: 713.961.4666

Website: cmirealestate.com

Key Contacts: Trent Vacek, tvacek@cmirealestate.com; James Sinclair, jsinclair@cmirealestate.com

Services Provided: Central Management, Inc. is a full-service commercial real estate firm providing Brokerage Services; Property, Facility, Construction and Asset Management Services; Landlord and Tenant Representation; Land Sales; Receivership and Real Estate Recovery. Services are available for Industrial, Land, Multifamily, MOB, Office and Retail. Licensed in Oklahoma and Texas.

Company Profile: Central Management, Inc. (CMI) was founded by Houston real estate professional Vic Vacek in 1978. Our team understands the intricacies of the markets that offer investors an edge both from a leasing and an asset management perspective. Certified AMO® 1984, IREM, CPM, CCIM, NAR, HAR, NALP, ICSC, and TREC.

Notable Transactions/Clients: Armada Big Springs Ptnrs, Barbour Invts., Baytown ISD, Core Real Estate, Hoffpauir Estate, JLC Properties, KBR, Prudential, Rawson Blum & Leon, Subway, Texas Hearing Institute, Triple Crown Invts., US Oncology, Vigavi Realty, Walgreens.

FRANKEL DEVELOPMENT GROUP

5311 Kirby Drive, Suite 104

Houston, TX 77005

P: 713.661.0440

Website: Under Construction

Key Contact: Bruce W. Frankel, President, BFrankel@frankeldev.com

Services Provided: Frankel Development Group offers over 34 years of experience and expertise in the retail real estate business. Services include tenant representation, shopping center/project leasing, investment sales, land sales, and development services.

Company Profile: Headquartered in Houston, Frankel Development Group provides comprehensive brokerage services for its clients throughout Texas with an emphasis on the Houston MSA. The company represents over 25 "best-in-class" retailers and restaurants, 15 property owners, and possesses a skillset and depth of experience unmatched in the marketplace.

Notable Clients/Transactions: Notable retailers include Orangetheory Fitness, Burkes Outlet Stores, UBREAKIFIX, Escalante's Fine Tex-Mex & Tequila, Three Dog Bakery, BWW GO!, MyFitnessStore.com, The Joint, Modern Acupuncture, Fred Astaire Dance Studios, and WaveMax Laundry.

FRIEDMAN REAL ESTATE

10500 Northwest Fwy Suite 220 Houston, Texas 77092

P: 888.848.1671

Website: friedmanrealestate.com

Key Contacts: David B. Friedman, President/CEO; Gary Goodman, Sr. Managing Director-Brokerage Services

Services Provided: Friedman offers a full range of real estate services including commercial and multifamily property and asset management, tenant and landlord representation, investment and loan sale advisory, space planning, design and construction and a unique platform of lender focused bankruptcy, receivership and distressed asset services. All services are provided in-house, though a single point of contact, guaranteeing that clients receive the most timely and efficient service available in the marketplace.

Company Profile: Founded in 1987, Friedman Real Estate is one of the largest privately held commercial real estate organizations in the nation; currently managing over 15M SF of commercial space and more than 13,000 apartment homes throughout the U.S. The brokerage team has over 800 current listings with $20 billion in closed transactions. As owners and managers of commercial property for over 30 years, Friedman understands what it takes to achieve results that maximize objectives.

Notable Transactions/Clients: Alorica, Houston TX

One Cornerstone Plaza, Houston, TX Midway Mall, Sherman, TX

Community National Bank HQ, Midland, TX Reflection Bay Office Center, Pearland, TX Walgreens, Beverly Hills, TX

Dave’s Hot Chicken, Houston TX Stone Canyon Medical Plaza, Temple, TX

STRONGTOWER COMMERCIAL GROUP 11015 Northpointe Blvd Ste. B Tomball, TX 77375

P1: 281.733.4077 | P2: 281.229.2148

Website: strongtowercommercial.com Key Contacts: Dawn Brewer, CCIM, Principal, dawn@strongtowercommercial.com; Terrionee Garrett-Solomon, Broker Associate, terrionee@strongtowercommercial.com

Services Provided: Strongtower Commercial is a Full-Service Commercial Brokerage that provides multi-disciplinary expertise and the highest level of service that todays educated and sophisticated client’s demand. Whether representing Owners, Buyers, Tenants, Landlords, or Sellers, our services span to all facets of the Real Estate Industry – this includes Office, Industrial, Retail, Investment, Medical, Multi-Family and Land.

Company Profile: Strongtower Commercial is an ever-evolving Real Estate Brokerage operating in the Greater Houston & Dallas Area. Our goal is to maximize value for each of our clients by utilizing our expertise to guide them through any situation that may arise during a transaction. Our Professional Advisors come from all facets of the Real Estate Industry bringing with them the knowledge and experience required in today’s fast-moving market. Our decades of experience and proven dedication to success afford our clients the luxury of always knowing where to turn.

Notable Clients: Notable Clients include: State Farm, Amegy Bank, Cina Pharmaceuticals, Urban Social, Market Street, Trendy Looks, B's Girls Foundation, Gill Aviation, Mr. Shine Powerwash, R4 Specialties, 7 Bridges Capital LLC.

CONSTRUCTION COMPANES/GENERAL CONTRACTORS

ALSTON CONSTRUCTION COMPANY

1300 W Sam Houston Pkwy S, Suite 225 Houston, TX 77042

P: 713.904.2899

10440 North Central Expressway, Suite 720 Dallas, TX 75231

P: 214.363.0551

Website: alstonco.com