Aftermath of the Eviction Moratorium

GET GREAT REVIEWS A GUIDE TO BUYING & SELLING PROPERTIES

EAST BAY RENTAL HOUSING ASSOCIATION | SUMMER 2023 | $9.95 Housing SERVING ALAMEDA AND CONTRA COSTA COUNTIES

rental

The choice for premier Structural and Civil Engineering services in the Greater Bay Area. We specialize in Seismic Retrofit! E S I EARTHQUAKE AND STRUCTURES, INC. Structural and Civil Engineering + Construction Management 6355 Telegraph Avenue, Suite #101, Oakland, CA 94609 Est. 1984 | Structural Lic. No. S3093 • Soft-story screening and reports per City seismic retrofit ordinances • Cost-effective design for Seismic strengthening, foundations and retaining walls • Construction management, oversight, and inspections • More than 45 years of industry experience • Knowledgeable, reliable, and insured • More than 6,000 City approved construction projects Bishwendu K. Paul, S.E., M. Eng. UC Berkeley Alumni 510-928-1065 bk@EsiEngineers.com www.EsiEngineers.com

2 SUMMER 2023 / EBRHA.CO M SUMMER 2023 Features 32 YOUR GUIDE TO BUYING AND SELLING PROPERTIES There’s a lot to remember when buying and selling rental properties. 38 FILL ’ER UP Keep that “no vacancy” sign up for short-term rentals COVER: ANKREATIVE/ADOBESTOCK FOTOCORN / ADOBE STOCK Contents

EAST BAY RENTAL HOUSING ASSOCIATION

Volume XXXIII Number 26 | Summer 2023

EBRHA OFFICE 3664 Grand Ave., Suite B, Oakland, CA 94610

TEL 510.893.9873 | FAX 510.893.2906 ebrha.com

CHIEF EXECUTIVE OFFICER

Derek Barnes aemail@ebrha.com | 510.893.9873 ext. 407

COMMUNICATIONS AND MEDIA RELATIONS

Chris Tipton communications@ebrha.com | 510.893.9873 ext. 404 ADVERTISING AND MEMBERSHIP SALES Danielle Baxter sales@ebrha.com | 510.893.9873 ext. 403 MEMBER SERVICES AND SUPPORT membership@ebrha.com | 510.893.9873 ext. 414 FACILITIES AND EVENT SCHEDULING Shani Brown shani@ebrha.com | 510.893.9873 ext. 406

BILLING AND ACCOUNTING Ken Lam accounting@ebrha.com | 510.893.9873 ext. 405

EBRHA OFFICERS

PRESIDENT Wayne C. Rowland

FIRST VICE PRESIDENT Luke Blacklidge

TREASURER Chris Moore

SECRETARY Fred Morse

EBRHA BOARD OF DIRECTORS

Wayne C. Rowland, Luke Blacklidge, Maya Clark, Chris Cohn, Lazandra Dial, Carmen Madden, Chris Moore, Courtney Morse, Fred Morse, Deeana Owens Joshua Polston, Jack Schwartz, Aaron Young

PUBLISHED BY East Bay Rental Housing Association

PUBLISHER Derek Barnes

EDITOR Michelle Gamble

ART DIRECTOR Bree Montanarello

STAY CONNECTED WITH EBRHA

Call: 510.893.9873

Membership Questions: membership@ebrha.com

Visit: ebrha.com

Share Your Feedback: editor@ebrha.com

Advertise: sales@ebrha.com

Read: issuu.com/rentalhousing

Learn: ebrha.com/faq

Ask: ebrha.com/submit-your-questions

Participate: web.ebrha.com/events

GET SOCIAL @ebrha_rentrospect

facebook.com/EastBayRentalHousingAssociation

@EastBayRHA

Rental Housing (ISSN 1930-2002-Periodicals Postage

Paid at Oakland, California. POSTMASTER: Send address changes to RENTAL HOUSING, 3664 Grand Ave., Suite B, Oakland, CA 94610.

Rental Housing is published bimonthly for $9.95 per issue by the East Bay Rental Housing Association (EBRHA), 3664 Grand Ave., Suite B, Oakland, CA 94610.

Rental Housing is not responsible for the return or loss of submissions or artwork. The magazine does not consider unsolicited articles. The opinions expressed in any signed article in Rental Housing are those of the author and do not necessarily reflect the viewpoint of EBRHA or Rental Housing This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting or other professional services. If legal service or other expert assistance is required, the services of a competent person should be sought. Acceptance of an advertisement by this magazine does not necessarily constitute any endorsement or recommendation by EBRHA, express or implied, of the advertiser or any goods or services offered. Published bimonthly, Rental Housing is distributed to the entire membership of EBRHA. The contents of this magazine may not be reproduced without permission. Publisher disclaims any liability for published articles. Printed by Bay Central Printing Company. ©2023 by EBRHA. All rights reserved.

SUMMER 2023 / EBRHA.COM 3

4 SUMMER 2023 / EBRHA.CO M Departments 6 WELCOME Letter from the CEO, Derek Barnes 7 CALENDAR EBRHA Events and O ther H appenings 8 OUT & ABOUT A Look at Our Community Events 10 MEMBER SPOTLIGHT Gabriel Galiothe, Commercial Real Estate Agent 12 LEGISLATION An overview of the bills that affect us most 14 EDUCATE What are the best books for buying and selling properties? The Psychology of Staging Rental Properties 18 INFORM Proper Renter Screening Protects Everyone S elling your Property 24 CONNECT Putting renter screening processes under the microscope. 26 INSPIRE Tips to improve renter experiences and get great reviews. 30 ADVOCATE Eviction Moratoriums Are Ending –What’s Next? 42 INDUSTRY PARTNERS 46 LAST LOOK How lighting affects rooms 47 AD INDEX CHRIS/ADOBE STOCK. COVER: ANKREATIVE / ADOBE STOCK SUMMER 2023 Contents

EBRHA MEMBERS

EARN 2% CASH

BACK ON EVERY

PURCHASE*

EBRHA members can earn a 2% annual rebate on all in-store and homedepot.com purchases. Sign up for your free Home Depot Pro Xtra account and use program code HDNAA-EBAA to start earning today. Plus, save up to 20% OFF BEHR® Paints, Stains and Primers. Contact a BEHR PRO® Account Manager at behrpro.com/rep for details or sign up at homedepot.com/ProXtra.

*For in-store and homedepot.com purchases. Annual purchases mus t total a minimum of $25,000 to qualify for the rebate. See homedepot.com/c/ProXtra_TermsandConditions for Pro Xtra pro gram details.

Welcome

A LETTER FROM EBRHA CEO DEREK BARNES

eing an essential resource to the housing community is EBRHA’s top priority, and we constantly look for ways to help our members and the communities we serve provide safe and affordable homes to many people across Alameda and Contra Costa counties. Beyond delivering one-on-one member support services and community assistance as a non-profit trade association, EBRHA curates education, information, forms, and technologies that help our community of rental housing providers remain connected and stay ahead. Offering a wide array of services also helps members remain competitive and compliant with state and local laws.

Staying a step ahead allows rental owners and managers to seize new market opportunities, prepare for impending business threats, and begin implementing practical solutions to mitigate risks. As we’ve all seen in the last several years, threats to our industry come in many forms: a pandemic, economic and geo-political headwinds, new housing policy and legislation, and the election of candidates who are not pro-business or pro-housing. It’s a voluminous cloud that housing providers must constantly navigate around.

The association also advocates at the state and local levels, which is critical to members and the housing community. This requires EBRHA members to be engaged too – calling and writing elected officials, and showing up at rallies and legislative meetings to provide public comments. Our members were called to action multiple times this year. They fully engaged in advocacy efforts and partnered with other organizations to make significant policy changes happen. We coalesced a unified voice, political influence, and power to affect change by ending three-year eviction moratoriums (Alameda County, Berkeley, Oakland, and San Leandro), staving off bad housing policy, and creating programs to help small rental property owners stabilize after eviction moratoriums end — foreclosure prevention,

Breopening emergency rental assistance, and legal representation programs.

For many property owners who were able to weather the storm, it feels like we’re finally emerging from the haze of a tumultuous three years, but not without fallout and significant damage to housing markets. The impact of municipalities’ budget deficits and lingering high inflation have been exacerbated by the following:

• Increasing unpaid household rent debt (hundreds of millions of dollars across Alameda County)

• Surging rental property defaults and foreclosures

• Declining property values and tax revenues

• Exiting insurance companies in the California market driving up premiums and policy cancellations

• Rising crime and public safety issues

• Unresolved homeless and drug addiction crisis

Clearly, there’s much more work to be done. With some recent successes, a greater sense of hope is emerging as we prepare for the second half of 2023 – rolling into a 2024 election year with five (5) City Councilmember seats open in Oakland. We must remain vigilant, civically engaged, cautiously optimistic, and use all available tools as housing providers. This issue of RH Magazine provides many ideas and solutions to help members recover and thrive after eviction moratoriums end. What’s next is a profound question, and there are creative ways to avoid the eviction moratorium fallout.

For example, owners who have purchased their properties within the last five (5) years may consider petitioning the county for property tax reductions. The Alameda County Assessor, Phong La, has signaled support for property owners whose assets were devalued during the moratoriums due to nonpayment of rent or resident damages. Contact the County Assessor for more information.

For unpaid rent that was due during the eviction moratoriums, we continue encouraging EBRHA members to proactively work with renters to develop payment plans or pursue revenue recovery using the court system — small claims or superior. You should always seek legal counsel to determine the best options based on your circumstances. Throughout the summer, EBRHA will also hold legal and

6 SUMMER 2023 / EBRHA.CO M

Derek Barnes

financial workshops to discuss rent recovery programs and the Unlawful Detainer process.

For business reasons, you may have decided not to pursue the collection of unpaid rent due to you or to “forgive” the debt because you know you’ll never recover the lost rental income. You may also consider sending renters a notice that you are preparing to file a Federal Form 1099-C for any unpaid rent that is owed to you that has not been paid (debt forgiveness) — especially for those renters who could pay but did not. Essentially, this “Cancellation of Debt” becomes a taxable event for the renter. Discuss this alternative with your accountant or tax advisor if you are not pursuing revenue recovery options.

Remember, serving “Pay or Quit” notices or evicting a renter for unpaid rent owed during eviction moratoriums is not lawful. EBRHA encourages sending monthly notices of any balances due for past periods and using EBRHA’s notification forms. Check out our quick Eviction Moratorium FAQ guide at www.ebrha.com

The last several years have tested our fortitude and made us more resilient as rental owners/operators. We’ve learned to embrace innovative ways of doing business, new technologies and techniques for doing more with less while remaining competitive in the market. Our community of housing providers kept people in their homes since 2020. For all these things and more, you deserve acknowledgment and deep gratitude from elected officials and municipal staff for all that you’ve done and will continue doing to provide safe, accessible and affordable homes for many residents in the East Bay. EBRHA is with you, by your side, as we continue doing this work together!

JUNE 1-30

PR I D E M O NTH

JUNE 6

3-4:30PM

Rent Registry "How To"

Presentation

Presented by Shani Brown

* JUNE 7-9

Apartmentalize

Location: Atlanta, Georgia

JUNE 8

2-3:30PM

Liability Protection –Before and After

Presented by Brad Barth, Steve Williams and Paul Hitchcock

JUNE 13

2-3:30PM

The Roundtable

Presented by EBRHA

President Wayne Rowland

JUNE 15

3-5:00PM

In-Person Unlawful Detainer Instructional

Presented by Randall Whitney

JUNE 20

3-4:30PM

Monthly Member Meeting

Presentation by Scott Freedman

JUNE 22

2-3:30PM

The Forum

Presented by Dan Lieberman

JUNE 22

5:30-7:30PM

In-Person

Networking Mixer

Location: EBRHA Office

JUNE 27

3-4:30PM

How to Advocate Locally for Rental Housing

Presentation by Lazandra Dial, EBRHA

Board Member

RPM 103

* JULY 4

4th of July Celebration

JULY 11

2-3:30PM

The Roundtable

Presented by EBRHA

President Wayne Rowland

JULY 18

3-4:30PM

Member Meeting

JULY 22

6:00PM

Member Appreciation Baseball Game

JULY 25

2-3:30PM

Real Estate Information Session

Presented by Bill Pegg and Steven Wilkinson

* NON-EBRHA EVENTS

If you would like to submit an event, please send an email to editor@ebrha.com .

SUMMER 2023 / EBRHA.COM 7

THE LATEST EBRHA EVENTS & REGISTER AT WEB.EBRHA.COM/EVENTS Calendar

FIND

“

Staying a step ahead allows rental owners and managers to seize new market opportunities, prepare for impending business threats, and begin implementing practical solutions to mitigate risks.”

Out & About

8 SUMMER 2023 / EBRHA.CO M

PLANT EXCHANGE + APRIL MIXER + LEGISLATIVE DAY + PRESS CONFERENCE

Plant Exchange Event with EBRHA CEO, Derek Barnes and Plant Exchange Founder, Odette Pollar

Arena Commercial Capital Presentation with Kiera Bowden at the April Mixer

California Legislation Day at the State Capitol with Comms Mgr Chris Tipton, Board Member Aaron Young, CEO Derek Barnes, and Board Member Maya Clark

Oakland Council Member Janani Ramachandran at the April Mixer with Derek Barnes and EBRHA Board Member Fred Morse

April Networking Mixer - Mic Burns and Shani Brown

Derek Barnes speaking during the Eviction Moratorium Press Conference at the EBRHA Office

Out & About

SUMMER 2023 / EBRHA.COM 9

Oakstop Borad Event HallEBRHA NEXT

Nate Sorensen & Aaron Blatter from Banner Pest Services

Shani Brown, Derek Barnes, and Francisco Acosta (Member Since 2021)

EBRHA NEXT: INNOVATION & TECHNOLOGY CONFERENCE

Aventis Management table at the 2023 EBRHA Next: Housing Innovation & Technology Conference

Presentation by Mo Hussei from Balanced Asset Solutions

Members attending the 2023 EBRHA Next: Housing Innovation & Technology Conference

EBRHA Board Members, Luke Blacklidge and Chris Moore Bay Area Bin Support Cassandra Joachim, Intellirent

Spotlight

EBRHA MEMBER SPOTLIGHT: GABRIEL GALIOTHE

Q. What do you think about current property ownership challenges (e.g., eviction moratorium) and how to solve them?

A. The eviction moratorium, rent control in general, deferred maintenance, and the City of Oakland Permit system, just to name a few.

Q. You recently joined EBRHA, what prompted your membership?

A. I was always familiar with the group from my main job as a Commercial Real Estate Agent focused on apartments. I’ve had my clients reach out to the group when they looked for examples of applications, credit-check sites or vendors to help with their vacant units and how to handle situations with renters. I am familiar with a similar group out of San Francisco for small apartment owners so I was happy to see there is a group that does the same thing for the East Bay. Since I live in Oakland and want to invest in Oakland and surrounding areas, I knew once I started investing, I had to join to become an active member. In 2022, we purchased our first investment property to move into one unit and rent the others. My parents own rentals, my sister just purchased a duplex, and my brother is actively looking as well.

People are taking advantage of the moratorium because they can’t be evicted right now. Oakland is very careful about this issue because of the homeless issue in the Bay Area. Leaders don’t want more people to end up on the street. But, I don’t think it’s fair to make property owners take on the task to solve Oakland’s homeless problem – especially when these issues are happening more with small apartment owners and not on the same level for the new high-rise downtown corporate owners.

Plus, owners didn’t see much relief from the city with payment for non-paying renters. Then the money ran out. Once that happened, owners started to pick and choose repairs, going with a cheaper vendor just to make ends meet instead of someone they know will get the job done.

Of course, I don’t want to wait to see renters who fell on hard times end up on the street. But, it has been very obvious that some renters are taking advantage of the system. Property owners could not even apply for the rent relief, because in order to get relief you can’t have a job and renters were lying. You would hope people would have some kind of honor, but it is just not so!

With the permit system, the response and urgency from the city needs to improve. It is dangerous for contractors to do certain jobs without

permits. But when it takes six months to a year just to get response for a job, owners are deciding to do remodels and jobs unwarranted. Some feel like it’s a money-grab. For my duplex, it took seven months to get my permits in hand. I just wanted to take a wall down that split the kitchen from the living room, and I had some fire damage to one unit. I had a rep not respond to me via email or phone because they went on vacation for three weeks. Nobody covered her while she was out.

With rent control, to keep it short, it seems like everything else has suffered from inflation, but when it comes to rental units, they limit how much you can raise rents for renters, even though increases are needed to keep the upkeep of the property and taxes.

Q. You’re a fairly young man in this regional industry where most owners are more mature. What kind of fresh perspective do you bring to the business?

A. Accepting technology: On both sides of the business, using property management software to automate rent collection and maintenance requests or using smart home technology to remotely monitor and control property access and security.

Pets: A lot of renters want pets and love pets. More than half of the owners don’t accept pets. People are willing to pay more for pet deposits and pet rents. I would rather that happen than someone sneaking a dog in anyway.

Using eco-friendly materials in renovations or installing energy-efficient appliances and systems. Not only can these practices help reduce the property’s environmental footprint, but they

10 SUMMER 2023 / EBRHA.CO M

GABRIEL GALIOTHE COMMERCIAL REAL ESTATE AGENT

may also save on utility costs and appeal to environmentally conscious renters. Flexible lease terms: Shorter terms or even Airbnb are great options for management to stay on top of a new renter turning into a long-term renters. Or, if you have family that likes to visit, like my wife's family being mostly from Boston, an Airbnb unit would be great for when they come to visit or for renters when they are not in town.

Q. What is the biggest lesson you’ve learned about property ownership thus far?

A. Always plan ahead and prepare for the worst-case scenario. Have reserves for a rainy day or hurricane. Talk to people who have done it already. They will know how to navigate certain things in the business. The more you talk to different people, the more they can possibly help. People love talking about their trophies. They love giving you a referral for a contractor. Sometimes they can see themselves in me. They know how it was trying to buy their first property and what it took to pull the trigger. Also, some wish they would have started sooner. So me being 34 when I bought my first property, they see me as taking advantage of the opportunity of what property ownership can bring.

SUMMER 2023 / EBRHA.COM 11

What are you risking in providing rental housing? Be prepared and join the community of rental housing providers at EBRHA.com NEW MEMBER PROMO New members receive a $40 account credit when they join. REFERRAL PROMO Existing members refer a new member to EBRHA and receive a $50 account credit. The leader and essential resource for the rental housing community for over 80 years. www.ebrha.com | 510.893.9873

for the

“Always plan ahead

and

prepare

worst-case scenario. Have reserves for a rainy day or hurricane.”

Legislation

AN OVERVIEW OF THE BILLS THAT AFFECT US MOST

BY RON KINGSTON

January 2024.

2837

. The number of bills that have been introduced to date and unquestionably there will be more before the California Legislature is done with the year.

187. The number of bills that we are involved in this year affect property owners and renters.

Hopefully, we have got your attention, enough so, that we can feature some of the bills in this article that

show the need to stay in the game and show members of the legislature we care about the impact of the legislation on our day-to-day business.

One bill would have permitted state employees and private parties to secretly record conversations of property owners and managers to gather evidence of potentially discriminatory housing practices. Thankfully, that bill will not move forward this year, but it will be heard by the Legislature in

Another bill that was scheduled to be heard on April 11 would authorize every city and county to impose the strictest form of rent controls on single-family and condominiums and apartments and regulate the amount of rent that may be charged on new renters. The bill, SB 466 (Wahab) proposes to change the provisions of the Costa-Hawkins Rental Housing Act AB 12 (Haney) would reduce the maximum-security deposit a rental property owner/manager can collect from an applicant. Today we may collect up to two month’s rent for an unfurnished unit and up to three months’ rent for a furnished unit. This measure would reduce the amount to just one month's rent, regardless of whether the residential rental unit is furnished. Rental property owners make decisions about renting to an applicant without knowing the household as a general rule. Thus, it makes it nearly impossible to know of past rental history without credit evaluation including the applicant’s history of evictions. Limiting an owner’s ability to financially cover property damage or the non-payment of rent is unfair to owners and managers. More important, however, is that applicants that have low credit scores or eviction history will more likely than not be turned down and unable to rent units due to the severe limitation of the provisions of AB 12.

AB 1317 (Carrillo) requires all owners and managers to “unbundle” parking from rent. This would be remarkably challenging if not impossible to apply particularly at developments subject to the state’s provisions of AB 1482— the state’s Tenant Protection Act of 2019.

12 SUMMER 2023 / EBRHA.CO M

SAMIYLENKO

STOCK

/ADOBE

The bill requires owners to reduce the rent for a renewed lease or rental agreement starting January 1, 2024 by the amount of the market rate cost of parking before increasing the rent. It goes without saying that many owners have never unbundled parking costs and consider parking part of the rent such as how owners include laundry rooms, swimming pools and exercise rooms. In some cases, owners have been forced to bundle services which include parking. This is the case in the City of San Francisco. Separating parking from rent controlled properties is simply not plausible when it has been prohibited for years. And should the renter receive a housing choice voucher (Section 8) the renter cannot be separately charged for parking. In strict rent control cities the increase in rent is capped as low as 60 percent of the CPI. If parking is “unbundled” the first year and the rent is reduced accordingly, it may be years before the owner is able to gain back rent in an amount equal to the initial rent reduction. The bill also poses other uncalculatable problems. There will be thousands of situations that owners will not be able to document the market rate for an individual parking space because it will not exist. And guess what? Renters will be able to challenge the monthly rate at which a parking space may be rented. Now, there will be another element challenging an eviction for the non-payment of rent and non-payment of a parking space.

Another bill, SB 267 (Eggman) would prohibit the use of a person’s credit history as part of the application process for residential rental housing without offering the applicant the option of providing alternative (whatever that

means) evidence of financial responsibility and ability to pay in instances in which there is a government subsidy. The owner/manager would be required to consider that “alternative evidence” in lieu of the person’s credit history in the determination of whether to offer the unit to that applicant. The purpose of the bill is to allow the applicant to produce “alternative evidence” to demonstrate their ability to pay in the judgment of the applicant. It clearly sets a legal trap for owners who will face claims that the evidence was credible and that the owner should have relied on this evidence as proof that the applicant can meet their obligations under a lease. Our response: owners will have no reasonable way in which to verify the information and no realistic way to determine that the applicant can or cannot perform. At the first hearing, support for the bill claimed that housing providers were denying tenancy because they were looking at evictions and other credit histories that were 10- and 15-years old. Unfortunately, we were not given the opportunity to rebut those claims. We will continue to oppose the bill as it moves through the legislative process.

To close this article with “good news,” Assembly Member Lee introduced AB 362. The bill would require the California Department of Tax and Fee Administration to study (as a first step) the notion of replacing our current property tax system (Proposition

13) with a “land value tax.” A land value tax is a system in which the estimated current market value of land is taxed, and the buildings and other improvements are not. It would dismantle Proposition 13 protections that have for years provided tax certainty and revenue stability for local governments and property owners for four decades. Polling has consistently shown that voters and property owners support Proposition 13, the landmark California constitutional amendment that caps property tax assessments at 1 percent of the value of real property and ensures that the tax doesn’t increase more than 2 percent in one year. In a recent survey by the Public Policy Institute of California, 57 percent of Californians believe that Proposition 13 turned out to be beneficial for residents receiving support from every age group and nearly every racial demographic. Want to know why there is support? Proponents of this massive revision of our property taxation laws claim that property taxes would decrease after the adoption of the new system. This is an unlikely result as claimed by supporters, and would in our opinion result in property owners no longer being protected by the provisions pursuant to Proposition 13 assessment limitations, tax rate, and annual assessed valuation increases. We truly believe that Californians would see their costs increase and job opportunities decrease.

SUMMER 2023 / EBRHA.COM 13

“Limiting an owner’s ability to financially cover property damage or the non-payment of rent is unfair to owners and managers.”

Educate

BEST BOOKS FOR BUYING AND SELLING RENTAL PROPERTIES

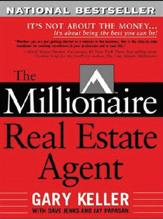

*The Millionaire Real Estate Agent

by Gary Keller

by Gary Keller

Submitted by Sanjay Gupta, president, Santa Medical

Anybody who wants to become a successful real estate agent should read this book. It offers a step-by-step plan for developing a prosperous career in the sector, including tactics for marketing, prospecting and haggling. The book offers useful insights into what it takes to become a top-performing real estate agent and is based on considerable research.

*This book got submitted by multiple experts.

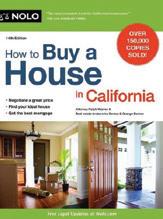

How to Purchase a Home in California

by Ralph Warner

Submitted by

Jonathan Rogers, founder of Credexel

Although this book is specifically on buying a home in California, it offers a thorough overview of the procedure. Finding the ideal property, obtaining financing, and negotiating the sale are all topics covered in the book. The author helps readers navigate California’s distinct real estate market and steer clear of common traps.

This book also comes recommended by M. Farhan, head of marketing at Lonelyaxe

Real Estate Investing in California

by Bruce Norris

This book is an excellent resource for anyone interested in real estate investing in California. It provides an in-depth look at the California real estate market, including market trends, investment strategies, and legal considerations. Bruce Norris, the author, is a seasoned real estate investor and educator whose insights are invaluable for anyone looking to make smart investments in California real estate.

The Insider’s Guide to Home Buying in San Francisco

by John Lee

This book is an excellent resource if you are looking to buy a home in San Francisco. It offers an in-depth look at the San Francisco real estate market, including market trends, neighborhoods and legal considerations. John Lee, the author, is a seasoned real estate professional with years of buying and selling homes in San Francisco, and his advice is both practical and insightful.

California Real Estate Principles

by Walt Huber

California Real Estate Principles

is another essential resource for anyone seeking to become a licensed California real estate agent or broker. It covers every aspect of the real estate industry, from licensing requirements to marketing strategies to legal considerations. Walt Huber, the author, is a seasoned real estate educator and professional, and his insights are priceless for anyone looking to succeed in the California real estate market.

Real Estate Investing in California

by David Lindahl

Submitted by Davin Joseph, CEO of MyEnamelPins

This book covers everything from finding the right property to negotiating deals to how to manage your investments. It also provides tips on calculating costs, understanding tax laws, and making wise decisions throughout the process. With over 25 years of real estate experience, this book is an invaluable resource for anyone serious about investing in the golden state.

SUMMER 2023 / EBRHA.COM 15 DROBOT DEAN/ ADOBE STOCK

We asked the experts what are their favorite books for buying and selling rental properties. The following are their answers.

Educate

THE PSYCHOLOGY OF STAGING RENTAL PROPERTIES

BY MICHELLE GAMBLE

BY MICHELLE GAMBLE

Staging keeps your properties competitive, but if you really want to leverage your staging activities, you will find adding some psychological tricks will give you the best results. Think about it like grocery sales. Depending on where and how a product is placed on a shelf will increase sales, as marketers have studied consumer buying habits. Same idea applies to staging and buying. A property staged in a certain way can either attract or repel prospective renters. So, property owners will want to apply psychological staging techniques to make the best impression on renters. These tricks should create a positive vibe about the entire property.

Staging rental properties has begun trending more and more. According to Ron Wysocarski, a real estate broker, “More than 83 percent of homebuyers prefer a staged home before deciding to buy it. This is more common in urban areas like New York, San Francisco or Los Angeles, where the rental market is highly competitive.”

The first step is to consider the front yard and exterior. What can you do to ensure that from the moment a prospective renters arrives at the property, he or she is immediately drawn into it? Start with something as basic as outdoor lighting.

“To implement this solid and effective staging idea, you need to state the time of staging from sunset time (evening/night). Lighting up your front yard with some trending fixtures at low cost is very much effective to make the property more appealing and attractive,” said Wysocarski. “Neon lighting is trending in the housing market right now. Ten to $15 is enough to get some RGB neon lighting and the total cost of

outdoor lighting could be around $100 to $150, which might increase your home’s worth by three to five percent; 90 percent of homebuyers state that this strategy is effective and appealing, and homes with outdoor lighting have the potential to get sold 19 percent more compared to the ones without.”

Next, take a look at the property’s exterior. “When it comes to making the exterior of a rental property more attractive, there are also several tricks that can be applied,” explained Alex Capozzolo, co-founder of SD House Guys. “One way is to add some curb appeal by planting flowers, shrubs and trees around the front of the property. Maintaining a well-manicured lawn and adding outdoor furniture or decor items can help create an inviting atmosphere. Additionally, updating the exterior with a fresh coat of paint or replacing any windows and doors that

may appear outdated or worn can also help to draw attention to the property.” One more detail, don’t forget to wash the windows on the outside and inside. Dirty, dingy windows don’t give off a positive message.

Here’s a fun one: add a garden to the property. Many people in our sustainable-minded culture will love the idea of having a sweet, little garden. “Who doesn’t love a pretty garden outside their home, it gets even better when they give fruits, vegetables and special flowers,” said Fant Camak, real estate expert with Coldwell Banker-Caine. “A garden section with suitable plants creates an instant effect on a buyer’s mind as they look pretty, and also how beneficial it can be for them. A vegetable garden of their own could give them amazing treats around the year, even if it’s a small chili, anyone would love it. Flowers, on the other hand, are un-

16 SUMMER 2023 / EBRHA.CO M

PHOTOCREO BEDNAREK/ ADOBE STOCK

deniable, the ornaments of a backyard. So, the more plants you have outside, increases the curb appeal for buyers.”

Now moving to the interior of the home. Two trains of thought exist. One, some experts feel that the inside should be as depersonalized as much as possible while others believe in making it as appealing as possible, but not too specific. The experts who feel it should be depersonalized want the space to be empty with neutral colors so the prospective renters can envision their own furnishings, artwork, etc., in the space. Others think each room should be maximized by the way it’s decorated and lit.

Since trends show more interest in spaces being staged, the second school of thought makes more sense to appeal to current thinking. “The most important aspect of the house-staging process is deep cleaning,” said Matt Bigach, real estate expert and founder of We Buy Houses for Cash. “This gives the impression of a brand-new home and makes it look more organized. It is also important to declutter the indoor space, as this can make it look more spacious.” In fact, most experts asked mentioned decluttering as a common trick for instant results.

Decluttering also adds to this next recommendation. “One of the most important tricks to making a space more appealing is to use psychology to manipulate the buyer or renter’s perception,” said Calvin Widmore, at CFO IBR, a real estate investing company. “For example, you can make a space feel larger by using light and bright colors or adding mirrors. You can also make a space feel more private or intimate by using softer colors and adding more personal touches.”

The psychological tricks revolve

around creating the magic around the space. “One of the most effective tricks to make a rental property more appealing is to create an illusion of space,” said Capozzolo. “This can be done by using furniture that isn’t too big or bulky and strategically placing mirrors, artwork and other decor items to help draw the eye away from any areas that may appear cramped. Additionally, adding touches such as fresh flowers, plants and scented candles can help create a pleasant atmosphere that will make the space feel inviting. Finally, decluttering surfaces and ensuring all areas of the property are clean and organized can also help create an appealing overall look.”

“My go-to tricks to enhance any room include playing with light, creating open spaces, and utilizing mirrors,” said Joy Aumann, a licensed realtor (CIPS), founder of Luxury SoCal Realty. “Light is one of the most critical elements when it comes to staging a space. Natural light from windows can create a bright, inviting atmosphere, and strategic placement of lighting fixtures can be extremely effective. Taking advantage of indirect lighting from lamps and overhead lighting can create a warm, cozy atmosphere that’s perfect for relaxing.”

Here is also an important, often overlooked detail – smell. Some people are sensitive to smell. When someone walks into a space, it should not smell musty, moldy or just off. If someone had pets in the place, use pet odor remover that contains enzymes to eat up

that urine or feces smell. An off-smelling place can immediately inundate the renter’s senses and turn him or her off.

“Smell can count for a lot here,” said Leonard Ang, CEO of iProperty Management and Leasing. “Taking the time to air out a stale apartment and supplementing that with scented candles, flowers, or fresh-baked cookies is a great way to make a space smell inviting.”

Finally, color plays a critical role in perception. “Adding pops of color to a home is my favorite because it instantly brightens and lifts the mood of the home,” said Eric Bramlett, realtor and the owner of Bramlett Residential. “It helps make the home feel vibrant and inviting while also creating visual interest, which makes potential buyers picture themselves living in the home. Color can be used to draw attention to certain areas or features in the home, like a brightly-colored accent wall that adds a unique touch to a room. Color can also be used to downplay areas, such as dull kitchen areas, by adding some vibrant kitchen accessories and textiles.”

It all boils down to renters being able to see themselves in your space. If they’re not instantly drawn to it and find elements of the property troubling, they’re not going to be inclined to choose that place to live. Home is for many people the most important place, so it’s critical that your space shouts, “Live here. You’ll be happy.”

SUMMER 2023 / EBRHA.COM 17

Michelle Gamble is the editor of Rental Housing Magazine.

“Adding pops of color to a home is my favorite because it instantly brightens and lifts the mood of the home...”

Inform

PROPER RENTER SCREENING PROTECTS EVERYONE

BY MICHELLE GAMBLE

As many property owners know, once a renter moves in and something goes wrong, it can be nearly impossible to evict him or her. Not only do evictions require lots of time and money, but also can be difficult to do. As a result, property owners need to go that extra mile to ensure they don’t get a bad deal with their renters. Thus, effective renter screening policies need to be in place to prevent long-term problems. However, property owners must also be aware and avoid any discriminatory practices or processes that could cause legal issues.

First, property owners and operators need to get their renter screening processes established. In fact, any new property owners must make renter screening a top priority. As noted, bad renters can not only cause problems with the rental property itself, but any unwelcomed noise and nuisance can drive away other renters, especially in multiunit complexes.

“Comprehensive renter screening involves running reports (credit, criminal, eviction history), collecting income documentation, speaking with the applicant’s employer, speaking with their current and former prop-

erty owners, and ideally inspecting their current home,” said Brian Davis, property owner and founder at SparkRental.com. “An applicant’s income tells you if they can pay, while their credit tells you if they will pay. That’s a distinction too few property owners appreciate. Their eviction history also speaks volumes about their history as a renter.”

“The two sources of information I tend to rely on most are references and credit scores,” said Leonard Ang, CEO of iProperty Management Leasing. “I know that credit ratings agencies can be opaque with some

18 SUMMER 2023 / EBRHA.CO M

SONG_ABOUT_SUMMER / ADOBE STOCK

of their formulas and have a history of discrimination in some cases, but I need some objective measure of financial health to consider, and this is the best one out there. References are where the real value lies. They can reveal details about a person’s exact situation and personal character that can be key in making these decisions.”

Many renter screening and background check services are available. However, experts like Ang suggest that “relying entirely on outsourced services, especially for things like background checks and credit scoring, is going to throw out a lot of good candidates with the bad ones. While some managers simply have too many applicants to give each one personal consideration, it’s far from an ideal situation.”

“One of the most critical mistakes that property owners can make when it comes to renter screening is relying solely on a credit score,” explained Zackary Smigel, real estate expert and founder of Real Estate Wizard. “A credit score doesn’t provide a complete picture of an applicant’s financial situation, and it may unfairly discriminate against individuals who have experienced financial hardship in the past, so I advise considering other factors, such as income and rental history, in addition to credit when screening potential renters.”

Joy Aumann, a licensed realtor and founder of LuxurySocalRealty.com, agreed and added, “As a real estate agent, I have witnessed several property owners commit serious oversights regarding renter screening. One of the most typical is determining a renter’s eligibility based on their credit ratings. Credit reports are an essential tool, but they only give a partial picture of

a renter’s financial history. To determine a renter’s capacity to pay rent and maintain the property, property owners must take into account criteria other than credit ratings, such as income, job history and rental history.”

AVOIDING DISCRIMINATION

Additionally, property owners and operators absolutely must prioritize and use processes that do not inadvertently discriminate against prospective renters. It’s vitally important that property owners follow all of the rules and regulations stipulated by state and local government. Education and awareness about these laws can prevent lawsuits and complaints. This is why joining organizations like East Bay Rental Housing Association (EBRHA) can be so beneficial. Trade associations like EBRHA keep property owners up to date on the latest rules, regulations and legislation that affects their industry. Discrimination isn’t always intentional but often done out of lack of awareness.

“To screen renters in a way that also protects existing renters, I suggest having a clear and transparent screening process that’s applied equally to all applicants,” said Eric Bramlett, a realtor and owner of Bramlett Residential. “This process should be documented and include specific criteria for approval or denial, and should be communicated clearly to all applicants. I’d say that the most critical mistakes are not following fair housing laws and basing screening decisions on discriminatory factors such as race, ethnicity, gender, religion, and family status. This can lead to legal issues and tarnish the reputation of the property owner or management company.”

“The best thing you can do is have a clear screening process in place that is applied consistently to all applicants, which can serve as proof that you’re treating all applicants fairly and avoiding any appearance of discrimination,” said Smigel.

Davis added, “As for avoiding discrimination, the easiest rule of thumb is to never describe the ‘ideal’ renter. Just because a tiny studio apartment is ideally suited for a young professional – and not a family of five – doesn’t mean you can say that. Have a strict screening process in writing, and follow it. Apply it equally to all applicants, and rent to the first applicant who meets your written criteria. Keep all your screening reports and interview notes on file, for both approved and rejected applicants, so that you can easily produce evidence that you applied the same screening process to all applicants.”

These suggestions are just a handful of great strategies. Transparency and proper documentation provide the most effective means to screen renters and protect your business at the same time.

Michelle Gamble is the editor of Rental Housing Magazine.

SUMMER 2023 / EBRHA.COM 19

“One of the most critical mistakes that property owners can make when it comes to renter screening is relying solely on a credit score...”

Inform

SELLING YOUR PROPERTY

BY MCCOY WORTHINGTON AND CHRISTOPHER ROGAZ

If you’re thinking about selling your property, a simple question has probably popped into your head: “Why don’t I try to save money: how hard is it to sell my house on my own?” It’s a tempting idea. After all, the average real estate agent’s commission comes out to around 5-6% on a sale. It only makes sense that you could save that money by selling alone, right?

Actually, it’s quite hard to sell your house on your own. And selling your rental property by yourself can cost you a hefty sum in the long run. According to a 2021 National Association of Realtors study, owners who used an agent to sell their property landed a price 26% high-

er than those who sold on their own. That comes out to a savings of nearly $60,000 on the median home sale. What’s more, selling your property on your own is probably much harder than you realize. In this article, we dig into exactly what it takes to sell on your own and look at the reasons why it tends to be a decision sellers regret.

Is it hard to sell a house on your own?

Chances are, you’re asking yourself, “Is it really that hard to sell my house on my own?” In most cases, the answer is “Yes!” It’s one reason why just 7% of sellers decided to go it alone in 2020.

Still, there are a few fringe cases where selling a house on your own may not be a bad idea. Attempting to sell your house alone may be doable if you fall into one of the following categories:

• You don’t care how much money you’ll make on your rental property

• You’re an experienced real estate agent yourself

• You already have a buyer lined up Unfortunately, even if you fall into the small percentage of sellers from one of the categories above, you’re still not safe from all of the for sale by owner (FSBO) risks. Knowing your

20 SUMMER 2023 / EBRHA.CO M

PEOPLEIMAGES.COM/ADOBE STOCK

buyer beforehand doesn’t protect you from taking a price cut on your sale, for example. Even worse, if you underestimate the work that goes into selling your property on your own, it can cost you hours of time and piles of money in the long run.

How hard is it to sell your own house?

Too often, sellers will start chugging toward a sale on their own, only to give up midway when they see how much work they’re spending on the whole process. By understanding what you’re signing up for beforehand, you can avoid wasting your time and money on the wrong decision. Here’s exactly what you need to know to sell your house on your own:

Selling your place on your own is a full-time job

Chances are, you already have daily responsibilities that fill up your day. Now imagine tacking on the hours upon hours of extra work that goes into preparing and selling your property. It’s not hard to understand why so many FSBO sellers become overwhelmed.

Laura McKenna, a real estate agent with nearly 40 years of home-selling experience, says one of the biggest factors owners who want to sell their place on their own overlook is how much work and expertise goes into selling.

“Sometimes I liken a real estate agent to a general contractor who assists with the tradespersons to evaluate the property, make repairs, clean, and stage the space,” explains McKenna. “There’s also the assistance with local attorney references and negotiating in their best interest.”

Wondering how hard selling your

house without an agent is? Here are a few of the jobs that you’ll need to take on if you decide to sell your property on your own:

• Conducting market research

• Identifying what your target market is looking for

• Picking out your property's most attractive features

• Spotting problems, making repairs, and polishing up your property

• Listing and marketing your property

• Reaching out to interested buyers

• Staging your space

• Negotiating prices

• Filling out and managing paperwork

Listing your rental property and walking away just doesn’t work

It’s tempting. Why not just list your property or drop a sign in your yard and go about your business? The biggest problem is that the chances of actually selling your place this way are slim. According to the 2021 National Association of REALTORS® Profile of Home Buyers and Sellers, only 4 percent of buyers found their property via a yard or open house sign.

Why?

Successful real estate agents spend a huge chunk of time marketing your property. Excellent real estate agents don’t just post your house’s listing online and walk away. Here are a few marketing tasks top real estate agents often handle:

• They conduct market research to understand why properties are selling — or not selling — in your area.

• They run marketing campaigns built

to grab and keep buyers’ attention.

• They highlight your property’s unique selling proposition and its' best qualities.

• They reach out to and connect with the best buyers for your property through social media, websites, ads, web campaigns, or whatever channels they’ve pinned down for your target market.

Prepping your property for a sale is critical and time-consuming Skimping on preparations is one of the most glaring mistakes a property eowner will make when they’re trying to sell their house on their own. And not staging your space well can scare off buyers. According to a 2021 NAR report, nearly one out of every two buyers’ agents say that staging impacts how most buyers view a property.

However, most property owners don’t have the time or the expertise to properly prepare their property for a sale alone. McKenna recalls a time when she tried to help out an owner after he had attempted to sell his place on his own:

“It was disappointing to find that items that should have been disclosed by the seller were not, property details were covered up, and the house was not as presentable as it should have been,” recalls McKenna. “There was mold in the attic and a gaping hole in the basement covered up with a towel! A Realtor® would have had these issues either repaired or disclosed.”

To squeeze the best price out of your property possible, top agents use trained eyes to spot and improve every corner of your house that could be problematic. From there, they spend

SUMMER 2023 / EBRHA.COM 21

hours staging your property in a way that will motivate buyers to sign on the bottom line.

Selling your property on your own requires constant attention

Even before you list your property, you’ll need to spend hours, if not days, preparing. For instance, most property owners overlook how much time agents spend poring over housing data and market prices.

Not only have agents spent years getting to know the trends in a specific area, they also watch housing markets like a hawk. That means they know how to price your property in that perfect sweet spot–one that’s bringing in the most profit possible but isn’t turning potential buyers off because it’s too high.

“Selling a house looks so easy,” says McKenna. “Open the door, walk around the inside, check out the basement, visit the yard and voila, a sale! But there is so much that happens before the property is put on the market, and then there’s the negotiations and preparation toward closing.”

Here are a few standard steps McKenna and other top real estate agents do — all before your property goes on the market:

• Dig into the local market

• Examine your property

• Connect with the seller

• Decide what improvements your place needs

• Pick out the upgrades that you can easily make before selling

• Identify the opportunities and potential hold ups that may affect your property’s sale

Sorting through paperwork can give you nightmares

Too many owners will grind through the FSBO process only to be pummeled by home-selling paperwork halfway through a deal. According to McKenna, there are two harsh realities sellers wake up to when they’re hit with contracts and negotiations:

1. Negotiating for thousands of dollars is hard

Simply put, effective negotiating takes time, practice, and expertise. It’s not as easy as winning an argument with pals or bartering over a few bucks at a yard sale. When it comes to navigating closing costs and negotiating your property, thousands of dollars are on the line. And that usually isn’t the amount of money you’ll want to gamble on novice or even intermediary negotiation skills.

Plus, there’s often much more riding on negotiations than just your property’s final sales cost. You may need to go back and forth on additional contingencies, closing date details, warranty terms, leaseback options, and other important items.

McKenna states it plainly: “Most sellers do not know how to negotiate their property.”

2. Sorting through paperwork is complicated and time-consuming

Even if you’re a solid negotiator,

you’ll still need to handle complicated contracts, extra paperwork, and marketing on top of nailing down a final price. That all can consume your life. In fact, the process is so time-consuming that McKenna says she outsourced many of these tasks when it came time to sell her own house.

“The proof is in the pudding,” McKenna explains. “When I put my personal house on the market, I hired an agent in my office to prepare, market, and negotiate the sale, which made for a successful transaction.”

Is there a smarter way to sell your property on your own?

In the end, there’s a good chance you’ll save time, make more money, and cut down headaches by rethinking your plan to sell your property on your own. When it comes time to sell, it’s a good idea to pick out a top real estate agent from your area who has a proven selling record.

Still, if you’re hesitating to hire an agent, and you want to sell your place fast, you do have more options. Try out our HomeLight Simple Sale tool. With Simple Sale, after answering a few questions, you can sell your house, as-is, with no prep work and receive an all-cash, no-obligation offer in as little as 48 hours.

In all cases, if you’re thinking of selling your house on your own, weigh the pros and cons of FSBO. The worst things you can do are waste hours trying to sell on your own only to revert back to an agent or to fumble through a sale on your own, losing thousands of dollars in the process. Crafting a plan now can help you sell faster, sink less time into your sale, and earn more money in the long haul.

Reprinted with permission by Homelight.

22 SPRING+ SUMMER 2023 / EBRHA.CO M

SEANLOCKEPHOTOGRAPHY/ ADOBE STOCK

“...selling your property on your own is probably much harder than you realize.”

Preferred terms

EBRHA uses and ways we help members and their renters stay informed

Preferred Language:

RENTAL HOUSING PROVIDER

Instead of "Landlord " Anyone who creates, owns, services, maintains, or governs rental housing. This includes: Investor, Rental Property Owner, Property Manager, Owner-Occupant, Industry Professional or Municipal Partner.

RENTER or RESIDENT

Use these terms instead of "Tenant". Anyone listed on the lease agreement or is an occupant of the household

HOMES

Use this term instead of "Units" Housing residences that are made available for rent.

Communication Types:

RED ALERT

E-mail & Text Alert | Ugent “Call to Action” when your participation is needed

NEWS FLASH

E-mail | Important news or updates affecting the housing industry

WEEKLY DIGEST

E-mail | Every Sunday at 5pm | Local & National news | Legislative Update | Events

WEEKLY EVENTS PREVIEW

E-mail | Every Friday at 5pm | Preview of the next week's events

MONTHLY EVENTS PREVIEW

E-mail | 1st of the Month | Upcoming Events | Early Registration

RENTROSPECT NEWSLETTER

1st of the Month | Cover Story | Trash Tips | Member Promotions | Upcoming Events

RENTAL HOUSING MAGAZINE

Bi-Monthly | Education, Legislation, Advocacy, Trends | Industry Partner Directory

EBRHA: The Essential Resource to the Housing Community www.ebrha.com | 510-893-9873

Connect

RENTER SCREENING PRACTICES ARE BEING PUT UNDER A MICROSCOPE BY

Renter screening software is no panacea. It has invited a rash of lawsuits alleging inaccurate information or discriminatory practices. For all of the marvels of technology, there is no substitute for old-fashioned personal sleuthing.

Whoever said that we live in a litigious society must have had rental housing providers in mind.

In recent memory, Bornstein Law has seen a spate of lawsuits targeting property owners. It began with renters and their attorneys claiming wrongful eviction, with six-figure payouts not uncommon when successful.

We saw enterprising attorneys attempting to “shake down” rental housing providers who summarily state that Section 8 vouchers are not accepted, a refusal that flies in the face of fair housing laws.

Renters’ attorneys became more inventive by suing real estate companies that did not have a website that accommodates disabled persons who require some additional tools to access the content.

We’ve seen massive lawsuits arise when a renter pays rent to live in an unwarranted unit, the rental relationship sours, and the disgruntled renter seeks retribution for having been placed in that unit because it is out of the good graces of the city, even if it is in pristine condition and the renter was living there for years on end.

And, of course, there are always some errant instances when the property owner effectuates an owner move-in eviction (OMI) or relative move-in eviction (RMI) without staying in the unit for a certain period of time or otherwise not being compliant with

DANIEL BORNSTEIN, ESQ.

the law. This has always been a reason for litigation, but we are starting to see much more vitriol for these types of evictions when they are done in bad faith and with an ulterior motive.

The list can go on, but we want to single out another type of lawsuit that is emerging, and that is the reliance on automated renter screening software that might provide faulty information when the property owner evaluates rental applicants, and, most importantly, the inartful communication many property owners and property managers are using to deny a tenancy.

As NBC reported, a Navy man with top-secret clearance returned home after being deployed in South Korea, but an algorithm-based screening process falsely identified him as a Mexican drug trafficker. He sued RentGrow and CoreLogic for this stain on his record.

With the decline of homeownership and a surge in apartment vacancies, renter screening has become big business. The industry has been largely unregulated up until now, but it is starting to feel some pressure. One case that has been on our radar is Connecticut Fair Housing Center et al vs. Corelogic Rental Property Solution, LLC. In a landmark civil rights decision, the Connecticut federal District Court has clamped down on renter screening practices, ruling that the standards of the Fair Housing Act apply to consumer reporting agencies.

This lawsuit arose when a property management company disallowed a disabled Latino man from moving in with his mother, who happened to be appointed the conservator. The property manager relied on data provided by CoreLogic’s “CrimSAFE” background check that revealed the blemish of a

shoplifting charge that was dropped, resulting in recommended rejection of the application.

When the mother probed into why she could not welcome her son into the home, she was unable to access the underlying background report that was used to deny the tenancy. As a result, her son had to remain in a nursing home for more than a year because of this minor infraction that was alleged long ago but was not prosecuted.

The below statement comes from legal representatives for plaintiffs Carmen Arroyo and the Connecticut Fair Housing Center, Christine E. Webber, Partner at Cohen Milstein Sellers & Toll Shamus Roller, executive director of the National Housing Law Project, and Erin Kemple, executive director at

24 SUMMER 2023 / EBRHA.CO M

WEI /ADOBE STOCK

the Connecticut Fair Housing Center: “Renter-screening technologies often lack a sufficient review process to ensure fair housing standards, yet are increasingly common as property owners look to third-party companies to evaluate and streamline their rental application process. CoreLogic RPS’s analysis and ultimate denial of Ms. Arroyo’s son’s rental application illustrates how the algorithms these technologies use are discriminatory. We look forward to proving our case in court.

“Amid the systemic racism that exists in our criminal justice system, where people of color are disproportionately burdened by the law, renter-screening algorithms that deny applicants based on past criminal records without any limitation or individualized consider-

ation are unjust in deciding a person’s right to housing. This is a significant limitation of algorithmic technologies that frequently discriminate against Black and Latino applicants.

“We hope the housing industry is paying attention to this trial, as it will set an important precedent for renter-screening technologies moving forward.”

LESSONS LEARNED

Rental housing providers already have a target on their backs. As we emerge on the other side of COVID, our community does not need another problem that is easily avoidable. Computer-generated notations that a rental application is “disqualified” with no explanation are not acceptable.

We have to take into account the individual circumstances, the severity of the offense, and other factors without painting a broad brush and having a blanket ban on all rental applicants with a checkered past. CoreLogic, which has since divested its renter screening business, argued that someone who has been arrested once is more likely than others to be arrested again.

This struck a nerve with the court, which pointed to the long-lasting impacts of stigmatizing anyone who has been arrested and that, of course, these types of exclusionary policies in turning down rental applicants with a criminal history have had a disproportionate and arbitrary effect on racial minorities.

Less communication is more. We advise that those renting residential property should not make categorical statements, and not express any preference for a certain type of renter or disfavor for another group. The reason for denying a tenancy reasonably could be explained that you found a more suitable renter. Period. Without any bias.

We’ve said many times and in many ways that technology should not be used as a crutch and that asking for references and doing your own due diligence is key when evaluating a tenancy, not solely relying on algorithms.

As a parting thought, for those of you who are property managers, we strongly recommend that you train all employees in fair housing laws and make it a core objective so that no one in your organization slips up and exposes you or your clients to liability.

Daniel Bornstein is a San Franciscobased real estate attorney practicing landlord-renter law throughout the Bay Area.

SUMMER 2023 / EBRHA.COM 25

Inspire

PROMOTING ONLINE REVIEWS TO SHOWCASE YOUR RENTALS

BY MICHELLE GAMBLE

BY MICHELLE GAMBLE

26 SUMMER 2023 / EBRHA.CO M

Positive reviews posted for short-term rentals are the lifeblood of future business.

Renters use reviews to determine whether or not they are going to rent that property – whether it’s for a vacation or temporary living space. One of the first things prospective renters do is read reviews. Positive reviews not only give that property credibility as a great place to rent, but also reassure renters that this property provides an excellent experience. These reviews also differentiate properties and make your short-term rental stand out in a competitive marketplace.

“Reviews can provide potential renters with insight into the quality of a rental before they commit to renting it out, making them more likely to choose one that is well-reviewed,” said Matt Teifke, founder and CEO of Teifke Real Estate. “Positive reviews instill confidence in potential renters, as they show that past renters have had a good experience with the property. Positive reviews also help improve visibility on rental sites, as they will often be placed at the top of search results. In addition, positive reviews can lead to more bookings by making it easier for potential renters to compare your rental to others in the area.”

“Positive reviews play a crucial role in the success of short-term rental properties, as they directly influence the decision-making process of potential renters,” said Josh Wislon, a licensed realtor and the co-founder of That Florida Life. “In the digital age, online platforms have become the primary source of information for travelers when choosing accommodations. A plethora of glowing reviews establish trust and credibility for the property

owner or operator and indicates that previous renters had an enjoyable experience, which can lead to higher occupancy rates and overall profitability. Further, platforms like Airbnb and VRBO utilize algorithms that prioritize listings with higher ratings, ensuring that well-reviewed properties receive increased visibility and bookings.”

So, it’s imperative for the success of the business that property owners devote time and resources toward ensuring that their properties shine so bright that renters will want to share and post online reviews. This requires property owners to take certain measures to maintain and offer outstanding service and amenities.

QUALITY! QUALITY! QUALITY!

Property owners should first focus on the quality of the rental experience. The first step requires owners to regularly inspect and maintain their properties. Routine maintenance and cleaning should top your priority list. Many property owners send in the cleaners right after each renter has vacated the premises. The first order of business, cleanliness, especially in the era of Covid, should take front and center.

To ensure a renter has a positive experience, you must ensure that the property is properly maintained,” said Carter Crowley, co-owner, licensed realtor and senior acquisition manager for CB Home Solutions. “This can include upgrading home appliances and furniture. It is also important to give renters exactly what is advertised to them. For example, access to amenities, early discounts, etc. This can leave a positive impression on renters and lead them to leave good user reviews.”

However, cleanliness and upkeep are

only the basics. Owners like to go a step beyond and add those little, memorable touches to their spaces. It could be adding quality soaps, shampoos, or fluffy, white towels. Classy coffee and real creamers go a long way toward impressing a renter. “Think about adding something extra to the rental experience such as providing a welcome basket with some snacks, drinks and other useful items,” said Alex Capozzolo, co-founder of SD House Guys based in San Diego. “Or provide discount codes for local attractions or restaurants to make their stay even more enjoyable.”

After ensuring your property looks its best and contains quality amenities and extras, create a rental experience that from start to finish considers the guest’s needs. “Make sure you provide a thorough description of the property, its amenities, and any other important details that renters should know before they book,” added Capozzolo. “Also include photos to give them a realistic view of what to expect.”

The entire booking experience needs to be well managed and responsive. Renters should not have to contact the property owner to find out things like how to access the property upon arrival, turn on the heating or air conditioning, figure out anything complicated about the appliances, etc. An instruction booklet or binder provided on site allows renters to effectively look up questions to find answers. Instructions should be easy-to-understand and written in a step-by-step manner. However, sometimes renters get confused and that is when responsiveness counts.

“The property owner should be welcoming and responsive to every query,” said Neil Dempsey, CEO of Four19pro-

SUMMER 2023 / EBRHA.COM 27 HAKINMHAN /ADOBE STOCK

perties. “He should take responsibility for everything that has to be taken care of by him. Well-managed services satisfy renters and encourage them to give a good review.”

Responsiveness means setting up a system that allows renters to easily communicate with property owners. Queries should not be ignored. Leaving a renter frustrated and unable to solve a problem will also leave a bad impression, and hence, negative reviews. “I communicate clearly with renters before and during their stay to answer any questions and address any concerns they may have,” said Cam Dowski, realtor and founder of WeBuyHousesChicago.co. This helps to build a rapport with them and create a positive experience.”

“Frequent communication is the key, and I make a point of keeping them informed every step of the way,” said Eric Bramlett, a realtor and owner of Bramlett Residential. “I maintain contact even after they’ve returned the

property, so they feel supported and valued rather than just forgotten. This approach helps address any issues they may have encountered during their rental, ensuring their concerns are resolved by the time they write a review.”

PROMOTING REVIEWS

Now that property owners have taken care of their renters, next they will want to encourage reviews be posted. Owners can provide a survey or questionnaire to their renters to get feedback. They can also reach out to their renters after their stay to ask them to leave a review. And finally, they can offer incentives to renters who leave good reviews. Incentives can include things like spa gift certificates, gift cards for local restaurants and activities, and discounts on future visits.

“When I aim to encourage positive reviews, my primary focus is on their overall experience during the rental process” explained Bramlett. “I am committed to delivering exceptional

customer service tailored to their unique needs and concerns. My goal is to ensure their rental experience is seamless and enjoyable, leaving them with a strong sense of satisfaction.”

Not all reviews will be positive. While some say “all publicity is good publicity” in the rental industry that doesn’t apply. A prospective renter reads negative comments about somewhere they plan to stay or visit, he/ she won’t ignore it. It’s up to property owners to mitigate as many negative reviews as possible and aim to solve the problems.

“When faced with a bad review, respond professionally and courteously, acknowledging the guest’s concerns and demonstrating a willingness to address the issue,” said Wilson. “Apologize for any inconvenience they may have experienced and detail the steps you have taken or will take to rectify the problem. This not only shows potential renters that you care about your guests’ experiences, but also helps to reestablish trust and credibility. If the review is particularly egregious or factually incorrect, you may consider contacting the platform’s support team to discuss your options.”

Ultimately some things in life cannot be helped. In those situations, remember the old adage “the customer is always right.” “Getting a bad review breaks your spirit, but don’t lose heart,” said Ben Wagner, real estate investor and house flipper at Leave the Key. “The simplest way to mitigate it is by accepting the problem and apologizing for it. Write an email or apologize publicly under the review.”

28 SUMMER 2023 / EBRHA.CO M VK STUDIO /ADOBE STOCK

Michelle Gamble is the editor of Rental Housing Magazine.

Superior Service The Owens Promise: Problem Solvers THE REAL ESTATE INDUSTRY HAS CHANGED... SO SHOULD YOUR STRATEGY Interest rates are up and prices are down. Selling a home requires more than a sign in the yard. Contact Owens Real Estate Inc. today to discuss your Real Estate needs. www.OwensRealEstate.com (510) 225-5810 Niche-Level Market Knowledge Results! Homeowners who hire Owens Real Estate Inc. achieve an average of 18% above asking price!

Advocate

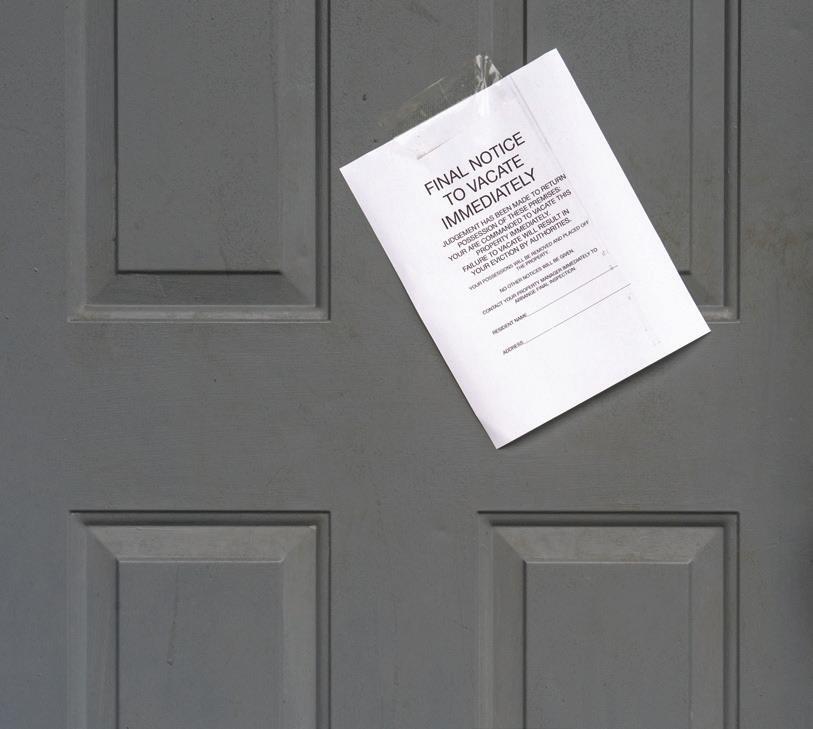

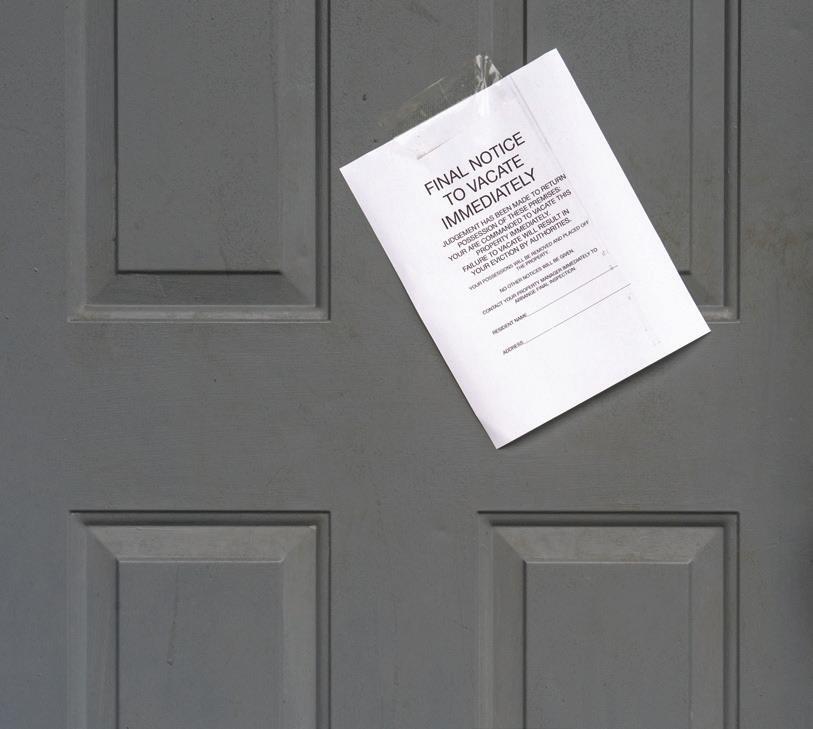

For three long years, rental property owners have suffered through the challenges of the eviction moratoriums and struggled to keep investment properties and their businesses open. The eviction moratoriums created large sums of back rent owed to owners often in the tens of thousands of dollars. The hardships have led to some owners’ properties going into foreclosure and others getting into substantial debt. Good news, though, relief is in sight.

The following cities and counties have either already lifted the moratorium or will be doing so soon. Here are some key end dates:

ALAMEDA COUNTY

April 29, 2023

OAKLAND

July 15, 2023

BERKELEY

August 31, 2023

SAN LEANDRO

July 31, 2024

Property owners are advised to follow the right procedures to collect back rent. It’s absolutely critical that property owners tread carefully in order to avoid legal problems that will only create more hardships. The winddown of the moratorium will be untidy as we reconcile state, county and local laws. We have been inundated with state and local moratorium laws such as the Berkeley/Oakland moratorium. And as a result, this patchwork has become complex to maneuver.

Specific steps and legal measures must be taken to deal with the context of the moratoriums ending. Each city or county will have different rules and regulations. These are options for most rental markets:

3-DAY NOTICE

1. Renter pays rents and cures the violation of the rental agreement

2. Renter does not pay rent and cure the violation

3. Go through the legal remedies

30/60/90-DAY NOTICE

1. Renter does not move out

2. Renter pays rent and cures problem

*The obstacles and greatest challenges are renter attorneys who will work hard to prove their case against you. Most property owners will likely go through the 90- to 120-day process. However, it may take up to 6 months, as the courts are likely to be inundated

with cases. Expect delays in this timing as the courts become deluged and there aren’t enough court personnel and courtrooms to fill demand.

RETURNING TO NORMAL

There is an expectation that we will return to how owner/renter relationships were managed before the pandemic. Housing provider/renter relationships in a pre-pandemic world will not be the same in this new era. The ending of the moratorium doesn’t mean there won’t be some residue regarding moratorium rules – it just means the moratorium on evictions is ending. In cities that don’t extend the moratorium, properties owners

30 SUMMER 2023 / EBRHA.CO M

CLSHEBLEY/ADOBE STOCK

EVICTION MORATORIUMS ARE ENDING – WHAT’S NEXT?

have a clearer path to collect rent going forward.

Do not believe when there’s tens of thousands of dollars in back rent that property owners are going to be able to collect it three days after the moratorium lifts. DO NOT demand back rent that was owed during the moratorium with a three-day notice. Rent debt going forward is something that can be reasonably demanded with a threeday notice, and rent debt in the past must be treated differently. There are a number of variables, different covered periods, and it depends upon cities as well. More restrictive environments are Berkeley, Oakland and San Leandro. In these jurisdictions, property owners should seek legal counsel to determine the best options for their specific scenario.

For rent debt owed in Alameda County (except Berkeley, Oakland and San Leandro), do not serve a three-day notice for back rent. The moratorium and the rules relating to that debt are complicated and cumbersome. Contact an attorney to discuss your options. It will depend upon where the tenancy is located. It will also depend upon when that debt arose. Unfortunately, the easy, simple solution of serving the renter a three-day notice to pay for that debt is not viable and can get property owners into trouble.

It’s likely the debt will be treated like consumer debt. Therefore, property owners cannot act on collections like a normal eviction. You'll need to get a money judgment and that can be a daunting task. Many property owners misunderstood that once moratoriums end, they could immediately serve three-day notices for that past due debt.