c o n t e n t s

3

E X E C U T I V E S U M M A R Y

A U T H O R ' S O U T L I N E M A R K E T A N A L Y S I S U K M A R K E T P R O B L E M C O M P E T I T O R A N A L Y S I S B U S I N E S S O U T L I N E F I N A N C I A L P L A N

t a b l e o f O P E R A T I O N S

B U S I N E S S O B J E C T I V E S O R G A N I S A T I O N A L S T R U C T U R E R I S K M A N A G E M E N T A N D C O N T I N G E N C Y P L A N R E F E R E N C E S

about the founder

“As a 5 0” woman, I struggle to find clothes that fit me Bottoms and coats are unflattering and too long I hated the extra step of tailoring my clothes, it’s time consuming and expensive I also noticed that there are not enough offerings for petite clothing Petite clothes that are available are low quality and most likely unethically produced High quality clothes were not my style After listening to the common frustrations shared by other petite women, I decided to take matters into my own hands to create Dainty, a fashionable, yet responsible brand exclusivity tailored for the diverse shapes and sizes of petite women The official definition of the word dainty’ also defines the vision of the business pretty clothes, delicately made for short ladies

My degree in Fashion Business and Management alongside my customer facing retail experiences makes me confident in my ability to succeed as an entrepreneur My passion to fulfil the needs of petite women fuels my determination to ensure Dainty succeeds “

Rocelle Castillo

founder and CEO of Dainty, 2022

summary executive

Market Analysis:

The global average height of women is 5’2¾”. Most of the women in the world are in fact petite sized. This includes the UK where the average British woman is 5’3”. However, standard women’s clothing is designed for a height of 5’5” and over meaning that petite women are massively underserved.

UK Market Problems

Problems petite consumers addressed in the primary research questionnaire:

1. limited options – high street retailers with petite offerings only stock 1%. - 30% of petite clothing compared to their regular offerings.

2. poor fit – the petite options that are available can be too long for petite women on the shorter end of the spectrum

Curvier petite women also struggle with petite clothes fitting too tight.

3. inconsistent sizing-many participants experience size variations across different brands which adds to their frustrating shopping experience. This is due to the industry not having a regulated sizing standard.

A size chart for Dainty was developed following ASOS’ petite size chart.

4.poor quality – as high-street brands dominate the petite market, many participants are dissatisfied with the poor quality of their clothing.

Competitor Analysis

Direct competitors of Dainty are petite focused brands. Many of these brands practise sustainable ethical principles, providing timeless pieces to an older demographic of petite consumers.

High street brands with petite offerings are indirect competitors of Dainty. They hold competitiveness over greater bargaining power and market exposure; however, they fall behind in quality, fit and sustainability.

Dainty fills a gap in the market for fashion-forward yet high-quality fashion aimed at a younger generation. Dainty’s high-value propositions allow the brand set higher prices compared to its high-street retailers. Participants confirmed they are willing to pay more for the brand’s added benefits.

Business Outline

Dainty’s purposeful mission is to empower petite women of all shapes and sizes with well-fitted, fashion-forward, quality pieces.

Its estimated market size is 1,580,945 with 213,428 being early adopters.

It will target the younger millennial/older gen z generation classified as a Rising Prosperity, lower-middle/working class socioeconomic status.

Dainty will launch a 4-piece jeans collection in response to participants in the questionnaire stating that bottoms were the most frustrating piece of clothing to purchase.

The initial product launch is a 6-month process starting in October 2023 and launching in April 2024.

Financial plan

Engagement & Predicted demand -

When Dainty launches in April 2024, it has been predicted that 1500 visitors will browse the website, of that, 225 visitors will become registered customers meaning that Dainty will attract 0.1% of its early adopters market upon launching.

Dainty is expected to attract its 213,428 early adopters market to the website by 2026 and 8% of early adopters will be acquired as registered customers by 2028. 32,480 transactions over 5 years are expected to be performed. This staggering 800% increase from the first year is expected as the brand releases more collections and demand increases.

5-year revenue forecast -

Gross revenue for the first year is projected to be £90,076, this is based on 1,321 units of all the jeans being sold.

Dainty’s 5-year financial projections look positive with a 260% overall growth across the 5 years. The year-on-year increase in gross sales is a result of increasing Dainty’s market penetration and product development.

Business Objectives

1.maintain a positive net profit

2.increase brand awareness

3.improve sustainability strategy

4.expand product assortment

Operations

Dainty will set up as a Private Limited Company trading on Shopfy’s ecommerce platform. The founder is responsible for setting up multiple legal registrations to trade as an online LTD in the UK.

Organisational Structure

Democratic and transformational leadership style will be adopted by the founder.

The founder will hire freelancers in its first 5-years of operating to save costs

Risk Management and Contingency Plan

Various human, strategic and technical risk has been identified by the founder.

1 market analysis

petitedefinition

petite

[pe teet]

noun

The term used in the fashion industry to describe a woman of any shape and size whose height falls below 5’3”/160cm.*

*In the U.S., petite women are classified as 5’4”/163cm and under

Figure 1: Definition of petite

Petite can be defined as the term used in the fashion industry to describe a woman of any shape and size whose height falls below 5 3”/160cm In the U S , petite women are classified as 5 4”/163cm and under This business p an will follow the general 5 3” standard that is accepted by many countries, including the UK

3D body scans were conducted as primary research to assess the proportion of the petite frame aga nst the standard (5 4” 5 9”) frame. Due to the l mited timeframe of this assignment, on y four (two petite and two standard sized) women were wi ling to perform the body scan and since no two body proportions are the same, t is recognised that a larger samp e size would have provided a more reliable analysis

The genera findings of the body scan found that pet te women generally have these proportions in common:

Narrower shoulders

Shorter torso Shorter limbs

Shorter arms Shorter legs Shorter hemline

As such, petite clothes are typically created with the following details:

Shorter inseam

Shorter sleeves

Higher waistl ne

Higher rise jeans

Higher neck holes

Shorter neck to waist measurement

Higher kneecap placement

Women of average heights may also benef t from the specia ised cuts and silhouettes of petite sizes It is possib e for women taller than 5 3” to have pet te measurements on the top or bottom half of their bodies For example, women with long torsos and short legs may benefit better from petite bottoms, and women with short torsos and long legs may opt for petite tops As such, petite clothing is not just l mited to women who are under 5’3”

Dainty is focused on specifically targeting women under 5’3”, however the evidence presented suggests that the business can potentially attract indirect beneficiaries

petite marketglobal

According to the World Health Organisat on s (WHO) growth reference standards, the expected average height of a woman should be 5 4⅛” However, it s evident in f gure 2, that this standard s not met as the global average height of women is 5’2¾”. Most of the women in the world are in fact petite s zed This includes the UK where the average British woman is 5 3” (Teather, 2021) Furthermore, data from Appel et al (2019) ident fies that over the last few decades, human height in some countries has generally been stagnating

Despite these statistics confirming that globally petite women are the ma or ty, standard women s clothing is designed for a height of 5’5” and over. This presents the main prob em of petite women being massively underserved despite being the majority

Figure 3 exh bits that there is a strong interest in petite clothing in westernised countries, with the UK market showing the most interest Dainty’s eCommerce business model includes worldwide shipping thus allowing for global reach; however the UK is Dainty’s home market and ma n priority

The UK s apparel market is projected to recover from the economic contractions caused by COVID 19 with womenswear expecting a 22% revenue growth in the next five years reaching £66,902 billion by 2026 (Stat sta 2022) Womenswear holds the greatest market share n the UK as its predicted trajectory continues to outpace men s and children’s apparel (Statista, 2022) Th s s reinforcement that the UK womenswear market is a profitable market to penetrate

Average female height by continent (rounded to the nearest 8th of an inch) (Source: WorldData, 2022).

Figure 3: Interest in the term Petite Clothing’ from March 2021 March 2022 (Source: Google Trends, 2022)

Expanding worldwide is a future opportunity for Dainty as there is a huge global market to tap into. Asia is a particular area of interest. Besides the founder of Dainty being from the Philippines, Asia has a population of nearly 5 million people (Worldometer, 2022), with women averaging around 5’2¼” (WorldData, 2022), and a growing interest in petite clothing within developing Asian countries (Google Trends, 2022).

UK market problems

options

The petite market currently consists of several highstreet brands offering petite versions of their bestselling styles

a small selection

High street brands dominate the market, but petite clothing choices within these brands are still relatively small compared to regular size clothing Th s is displayed in figure 4 where the percentage of petite offerings are as little as 1% It is therefore evident that high street brands are not nvesting enough in petite fash on Some brands exclude petite sizing altogether failing to offer wel f tting clothes for petite women.

Pr mary research conducted by the founder confirmed that 60% of 103 respondents aged 17 30 years old disagreed/strongly disagreed with the statement there are enough petite clothing options for me’ (refer to appendix 1) Quotations displayed in figure 5 provide nsight into the market s dissatisfaction with the lack of avai abil ty and lim ted options in the industry It is simply not fair that when it comes to shopping, petite women can fee ike a minority when they actually make up the majority of the population

Figure 4: Percentage of petite offerings of high-street brands as of March 2022 (Source: ASOS,2022; Missguided, 2022; Boohoo,2022; Nasty Gal, 2022; River Island, 2022; New Look, 2022; Marks and Spencer’s, 2022; Next, 2022; Boden, 2022).

fitpoor

Due to the ack of options availab e, many petite women often settle for ill fitting clothing from the regular section and some may go to the extra lengths of getting their c othes tailored 89% of respondents confirmed they have got their clothes tailored (refer to appendix 2) with bottoms such as eans and trousers being the most common piece of clothing that requires a terations (refer to appendix 3) It is showcased in figure 6 that respondents fee d ssatisfied with the process of having to get their clothes tailored w th many claiming that the experience is extra effort, time and money (refer to appendix 4 to read a sample of responses)

Unfortunately, even the fit of some petite clothing can be inappropriate for several consumers Petite clothing can st ll be too long for women on the shorter end of the spectrum (4 11” and below) Participant 10 in the questionnaire stated that she shops in the petite section “For a better fit especial y in jeans or trousers however the length is still too long n some petite ranges,” and part cipant 23 reported that “Measurements are sti l off sometimes (sti l too long / aren’t curve friendly) ”

As previously discussed petite bodies have different proportions requ ring a separate sampling process and making adjustments to different des gn elements The poor fit from ma or high street retailers could be attributed to the fact that these compan es disregard the process of tailoring the r petite clothes accordingly as they prioritise producing clothes for their core collection

Figure 7: Comparative Size Analysis. Source: Missguided, 2022; Pretty Little Thing, 2022; River Island, 2022; Marks and Spencer, 2022; Boden, 2022; Levi, 2022; Gap, 2022; Next, 2022; ASOS, 2022; New Look, 2022; Nasty Gal, 2022.

In addit on to poor tailoring, it was d scovered in a comparative size analysis (refer to f gure 7) that petite bottoms are commonly based on a 28” inseam As primary research indicates that this standard is unsuitable for shorter petite women, Da nty should consider going beyond traditional industry standards by offering more ength sizes It was found in the comparative shop analysis that Gap and Levi s are already practising this approach Just like the one size fits all misconception, one standard length does not fit all either, especially with petite women

Figurecurvier petite womenpoor fit for

In addition to shorter petite women, quotat ons in figure 8 reveal that curvier petite women also face issues with petite clothing with the f t being “too tight” as the most common frustration among part cipants There is a common stereotype that pet te women are all slim and slender but as defined at the beg nning of this business p an petite simply refers to the height of an individual and not their weight

“sometimes i do however a lot of the time the petite clothes don’t fit over my thighs/bum which isn’t ideal, i do tend to find that petite means small AND skinny for many companies”

“My thighs are often to big for clothes that are considered to be petite and the materials depending on the style are often in flattering to my stature ”

“Petite is good but it's usually for skinny girls, my body is very much average so some of the things don't fit that well or go on the tight side”

“I m a size 12 so I feel the regular section covers my sizes abit more but I always have to cuff my jeans”

“Sometimes too tight”

“Clothes are too close fitting”

Figure 9: Comparative size analysis of retailer’s regular vs petite range. Source: Missguided, 2022; Pretty Little Thing, 2022; River Island, 2022; Marks and Spencer, 2022; Boden, 2022; Next, 2022, ASOS, 2022, New Look, 2022; Nasty Gal, 2022.

It seems ike retailers are adhering to this stigma as not only are they shrinking their petite ranges but figure 9 demonstrates a pattern n which retailers only stock smaller sizes (sizes 2 and 4) in their pet te range and their standard collection inc udes larger s zes that are not available n petite Marks and Spencer s was found to be the anomaly amongst the analysed retailers as they offer the same sizes across their petite and regular range This practice of inclus ve siz ng enables a l women, regardless of s ze or height to have equal access to clothing collections

Women come in al shapes and s zes meaning that there is no thresho d n petite sizing. Petite certainly does not equate to be ng of smaller s ze and there s such a th ng as pet te plus size women, another segment of the market that is alienated

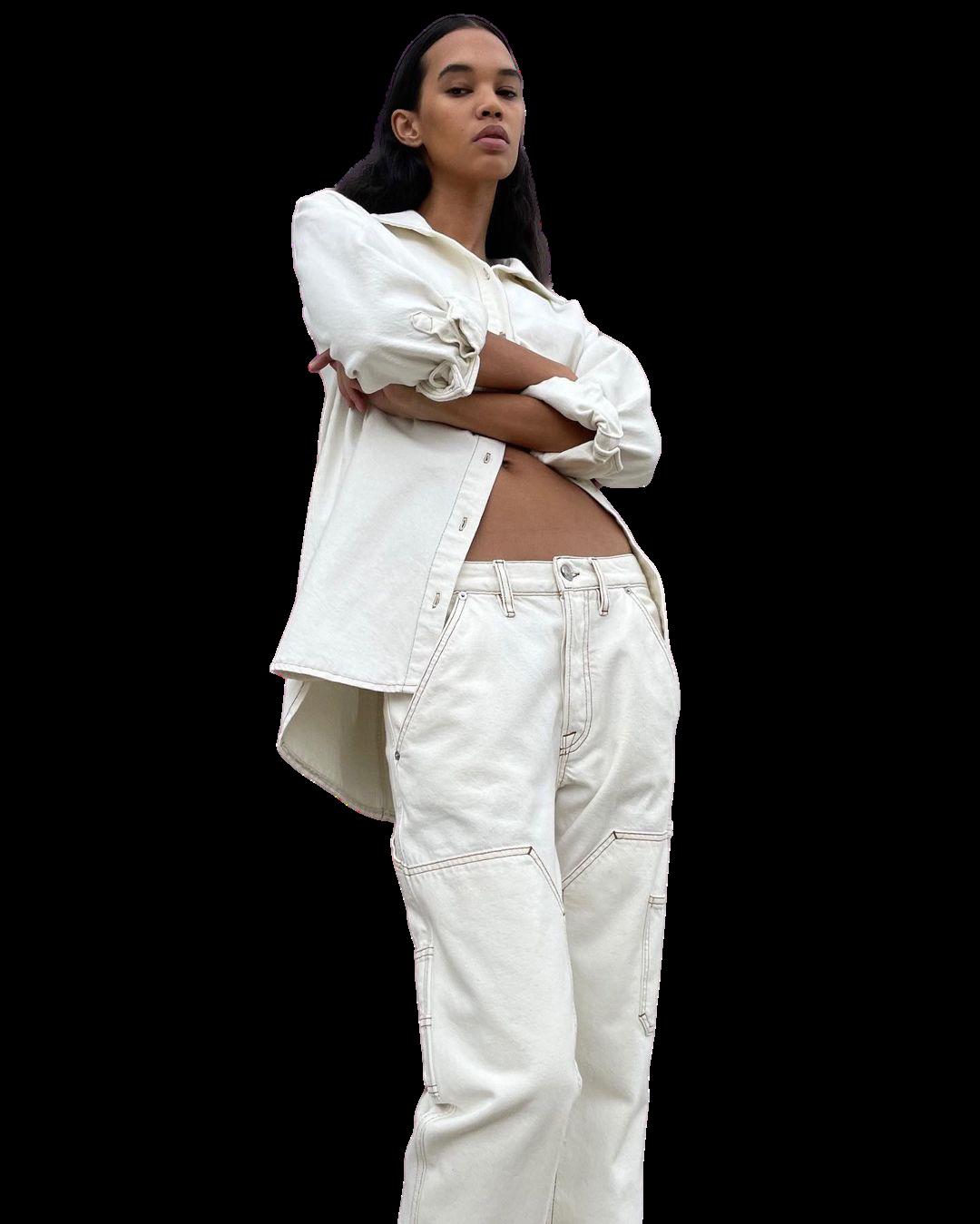

body positivity approach

Whilst t is in Da nty s best interest to be s ze inclusive and cater to a l petite women, the rigorous sampling process and higher production costs for plus s ze appare present imitat ons to this idealistic strategy As a start up, Dainty wil focus on prov ding well fitting clothes for the existing standard petite market women between 4’10” 5 3”, UK size 4 16 Instead of size inc usivity, Dainty hopes to eliminate the stereotype associated with the term ‘petite through body positivity marketing efforts This is a step in the right direction especial y due to the rise of body posit vity movements fuelled by Gen Z consumers (Ashley 2020) combined w th 63% of part cipants in the questionnaire disagreeing/strongly disagreeing with the statement I feel that there is enough representat on of petite women in the med a (refer to appendix 5) Dainty s approach to body positivity will further be discussed in the marketing and communications plan.

Expanding into petite plus size is a future cons deration for Dainty While the definition of plus size varies from different retailers Huber (2022) defines plus s ze as any s ze above UK 18 and states that 67% of British women fall into this category Despite the plus size market only accounting for 22% of the UK clothing market, it is forecasted to continue to grow s gnificantly faster than the rest of the fashion market (Fashion United, 2020) result ng in further adoption or expansion of plus size c othing amongst brands.

A size inclusive approach has proven to be successful with Binkley (2019) confirming that the payoff of a diverse range cou d be assured and mmediate Good American the first ful y inclusive fashion brand stocking all its garments from US 00 24 (UK 6 28) (Good American, 2022) has also found plus sizes to be commercia ly viable (Binkley, 2019) In the UK, Yours Cloth ng a specialised plus size retai er, offers a limited petite collection in sizes UK 16 36 (Yours Clothing, 2022) The neglection of plus s ze petite women presents a gap in the market Once financial stabi ity has been established, further market research wou d be conducted, then the recruitment of multiple plus sized petite fit models, specialised garment technologists and manufacturers to successfully extend the size range and become fu ly inclusive to all pet te women

plus-size petitepotential expansion

sizing inconsistent

Size incons stency was another problem reported by participants 2, 74 and 86 in the questionnaire (refer to appendix 6) This s an industry wide prob em with 70% of online apparel orders be ng returned due to poor fit (Fit Ana ytics 2022) Discrepanc es between sizes are brought about because the industry does not have a regulated universa standard and as such, retailers are free to adjust their sizing measurements to suit their demographics Some reta lers may engage in vanity sizing in which they adjust their sizes to psycho ogically make their customers believe they are s immer (Santamaria 2019).

Figure 10 showcases how the measurements for a UK s ze 6 petite varies between both h gh street and petite retailers When looking at Jennifer Anne and Reve the Label, a customer could have the measurements for Jennifer Anne s size 6 but could find the size 6 to be too sma l at Reve the Label meaning she would have to size up. The variation of sizes between brands creates a frustrating shopping exper ence and according to fashion psychologist Dion Terrelonge, it could impact people’s self worth (Benson 2021)

Figure 10: UK size 6 comparison (rounded to the nearest number) SOURCE: ASOS, 2022; MARKS AND SPENCER (2022); NEW LOOK, 2022; JENNIFER ANNE, 2022; THE SHORTLIST, 2022; ALYDA, 2022; REVE THE LABEL, 2019

size chart

Dainty can alleviate this frustrat on by providing an accurate and understandable size chart on the website The UK Fashion & Textile Association (UKFT) has created a sizing standard for women’s c othing; however, it does not include pet te fash on As a resu t, Dainty has fol owed ASOS petite sizing chart due to the target consumer of ASOS being a s milar demographic as Dainty’s and as such, customers would already be fam liar with the sizing system. The size chart created for Dainty is displayed in Figure 11

Ashdown et al (2016) recommend apparel companies revise the r petite sizing through trial and error, customer feedback and an analys s of sales and returned merchandise reports In addition to following the stated strategies, Dainty wil conduct f t samples using UK size 4, 8, 10 12, 16 petite fit models in the product development process to better understand petite bodies and improve the fit of its clothing It can also confirm the effectiveness of its size chart and allow adjustments to be made accordingly Da nty will ensure its size chart s kept up to date and inform customers of changes v a social media and email communication

Add tionally, Dainty w ll include photos of the clothes on different sized models a simple but effect ve approach reported by Benson (2021) that a lows shoppers to understand how the clothes would fit their body type. The statist cs of the models alongside deta ls of the dimensions and f t of the clothing will be included on each product page This encourages customers to make confident decisions when purchasing online and it benefits the business as it reduces returns related to fit, thus min mising profit loss and unsatisfied customers

Figure 11 Size chart for Dainty (Source: ASOS, 2022)qualitypoor

Primary research found that purchas ng from fast fashion companies remains popu ar for petite consumers (refer to appendix 7) However, figure 12 shows that many are disappointed with the quality of their clothing The corre at on between fast fashion and quality derives from the mass production of cheap disposable clothing using low quality fabrics (Hayes, 2021) Poor quality cloth ng is often too cheap to resell, too poor y made to keep and too useless to donate so customers resort to throwing away their clothes contributing to the 92 million tonnes of texti e waste ending up in landfills each year (Bea l, 2020) Not only is fast fashion harmful to the environment but customers are stuck n a vicious consumption cycle where they purchase new pieces to replace the damaged ones

Despite sustainabil ty rece ving a low rank ng amongst participants as an mportant factor of considerat on when shopp ng for clothing (refer to figure 13 on page 15), the founder has a strong moral obligation to implement sustainable practices At ts core, fashion thrives off newness and consumption which is a major contradiction to the conception of sustainability However, Dainty s approach to reducing environmental and social impact is to make responsible choices in its value chain Longevity will be considered when choosing fabrics to solve the frustration endured with low quality clothing and consequently reduce the amount of waste ending up in landfills. Ethical sourc ng wil also be another priority to generate a positive social impact It might not be the main concern for consumers now, but going forward, susta nabi ity will become a necessity especially because fast fashion brands are increasingly being scrutinised and more brands are starting to implement changes in response to consumer demand Establishing as a responsible brand from the get go is therefore a valuable investment for Da nty that encourages long term growth and profitability (Bonini and Swartz 2014)

“I think I’ve tried different retailers enough such that I now know where to buy from to expect an acceptable level of quality. I’ve bought from shops such as BooHoo and PLT before but the quality was noticeably bad (you can feel how thin the clothes are) that I avoid buying from them any more (explains why they’re so cheap), but I’ve found that retailers that are a bit more expensive such as the ones I listed before tend to produce better quality clothes that I can keep for years. (or for ASOS they sell brands that have high quality, I’m not a huge fan of ASOS’s own brand stuff (ASOS DESIGN))”

Participant

“I always pay much attention to fabrics (e.g. I don't ever buy clotes made out of "plastic" fabrics and try to choose 100% natural fabrics e.g. wool), I also try to check if clothes were made in a proper way by e.g. checking stitching)”

“My disappointment occurs when my clothes quality wears out within a few weeks or month after wash. Durability as a return of investment is important to me unless it is for work attire.”

“Fast fashion means that petite clothing is not always good quality but its the only option and known big brands don't always cater for petites”

“Some items I am satisfied with but some items I would prefer if they were higher quality that would last longer”

Participant 60 Participant 7 Participant 10 Participant

shopping

Fit/Size

3 competitor analysis

directcompetitors

Petite focused brands have been dentified as Dainty s direct competitors These independent brands were all founded by petite women taking matters into their own hands to solve their frustrations as a petite customer Dainty and its d rect compet tors share the advantage of a stronger brand image over high street retailers This is because petite customers are likely to va ue brands w th a clear and genuine purpose

Despite hav ng limited product offerings compared to high street retailers, petite brands focus on building personal, long term re ationships with their customers instead of just a transactional re ationship Dainty will follow th s approach where it w ll build an online community that un tes and empowers petite women to encourage strong customer relat onships Implementation of this strategy will be discussed in the marketing and communications plan

Sustainability is a common practice amongst these brands w th many adopting a slow fash on business model; offering sustainable packaging alternatives, and having ethical values in place This re nforces the idea of incorporating susta nabi ity within Dainty s ethos As well as ethical sourcing of fabr cs and manufacturers, Dainty w ll also consider sustainable packaging as another way to tackle the fashion industry s waste prob em When competing against these petite focused brands sustainabil ty won t necessarily be a unique selling point for Dainty because it is evident that this is standard practice w thin the market Instead, sustainable investments are needed to remain competitive

When analysing the style of the product offerings of petite focused brands, it appears that these brands target mature demographics (older Millennials and Gen X) as t features minimalistic, timeless des gns and styles su ted for customers des ring to bu ld a capsule wardrobe Offbeat Petite and Fierce Pet te are the exceptions as their second hand bus ness model resells vintage clothing that targets a younger demographic (Gen Z) What sets Da nty apart from its direct competitors is that it s a direct to consumer business that offers fash onab e des gns su ted to a younger demographic

High street brands have been identified as indirect competitors of Dainty as even though they have a petite offering, petite clothes are not the main focus for these brands This was d scussed earlier when high street retailers were found to be offer ng as litt e as 1% of petite clothing. Warren (2021) further reports the limitation of pet te offer ngs by h gh street brands as the pet te category saw a 7% decline n new arrivals across the U S and UK in 2021 Despite high street retai ers holding competitiveness in terms of greater bargain ng power and exposure than petite focused brands, it can be argued that the competitive threat from these rivals is reduced because these reta lers do not delegate enough investment in their petite collection

The prev ously presented hierarchy (figure 13) shows that brand reputation was ranked last as a factor of consideration when shopping for participants This means that petite consumers are likely to embrace new brands and become early adopters of Da nty (Rogers, 2003), one that prioritises them and adds value to the r needs. Be ng a specialised petite brand that provides better tailored and higher quality tems are value propositions that set Da nty apart from high street retai ers When applied to Porter s 5 forces of rivalry among exist ng competitors (1979) Dainty has a low barrier to entry as it is establishing itself in a niche marketplace that has low competition but high demand

indirectcompetitors

positionmarket

dainty

The perceptual map presented in figure 14 shows the market position of Dainty s competitors based on quality and style The map visually implies that there is a correlation between classical/timeless styles be ng of better qual ty than fad/trend driven styles A corre at on between quality and quantity has also been identified High street retailers offer more quant ty of clothing as they can afford mass production w th lead times as short as 2 weeks However these clothes are generally of lower qual ty, particular y trend driven clothes offered by fast fashion retailers. On the other hand, the slow fashion approach adopted by petite focused brands means they are offering limited but higher qua ity clothes for customers Most of them do not follow high street trends their classical designs are released through limited ed tion capsule collect ons generally each season

Dainty fills the gap in the market for fash onab e yet high quality petite clothing It competes against high street retailers in terms of quality and its fashion forward offerings distinguish Dainty apart from petite focused brands

styles

valuepropositions functional

Dainty solves petite women s problems by offering customers fashionable, high quality clothes tailored to their proportions.

emotional

Customers feel connected to the brand and feel a positive feeling when they make a purchase. In relation to Maslow’s (1943) hierarchy of needs, the customer s love and belonging needs are fulfilled having felt insecure and under-represented due to their height, they are now part of a community that unites and empowers petite women.

Dainty has a high value proposition due to the many benefits the brand offers. Da nty, therefore, has the advantage of setting higher price po nts than its competitors Primary research has conf rmed that customers are wi ling to pay more for these added benefits (refer to append x 8) It is essentia for Dainty to communicate these values to its customers effect vely This will further be d scussed n the marketing and communications plan

economical

symbolic

Similarly to the emotional value, Dainty provides its customers with pride and fulfils their self actualisation needs (Maslow, 1943). Dainty will become a fashionable yet ethical brand that many petite women will hear about and would want to support. The brand will become iconic amongst petite women because the clothes are designed exclusively for them. Responsible practices will resonate well with consumers meaning Dainty can increase its image.

As Dainty clothes are tailored to fit petite frames, time and money spent on alternations are eliminated. Additionally, the high quality nature of the clothes means customers are getting better value for their money. Dainty clothes are made to last longer than fast fashion competitors meaning customers do not have to repeatedly replace their low quality clothing.

end value

Customers feel confident after purchasing knowing they have made an investment in high quality, well fitting clothing that does not compromise their style. The feeling of guilt is also alleviated as customers know their clothes have been ethically made and that they are not contributing/supporting fast fashion practices.

business outline

mission

To empower petite women of all shapes and sizes with well-fitted, fashionforward, quality pieces.

valuesbrand

empowerment inclusion

We re here to build a commun ty where our petite girls fina ly feel confident about themselves and no longer feel excluded Empowerment s at the heart of the brand and underpins every endeavour

exciting

Dainty does not conform to any stereotypes We want to represent d versity amongst petite women We embrace imperfections and do not digitally alter our mode s

Here at Dainty, there are no ru es when t comes to petite fashion You shouldn t have to compromise your style just because you’re petite We make fash on forward clothes that petite women are finally excited to wear quality

We invest in trusted suppliers and source high quality fabrics to create durab e des gns that will last wear after wear, wash after wash, season after season

conscious

Dainty acknowledges the mportance of sustainabil ty As a new brand, it is difficult to be fully sustainable, but we’re making every effort to m nim se our impact on the environment where possib e

ethical

Dainty works with integr ty and transparency at a l stages of the business We a m to bu ld long term partnerships with our stakeholders and carry out our business in a fa r and ethical manner

authentic

We want to be real, not perfect We want to take you along our ourney and build a relationship based on trust We re genuine, honest, and not afraid to admit our mistakes

The market size for Dainty has been calculated using statistical data of the UK population.

1. 68,507,383 total UK population a. According to live data from Worldometer (2022), the UK’s population as of 1st April 2022 is 68,507,383.

2. 33,637,125 UK women 20-30 years old a. The office for national statistics (ONS) has reported that in 2018, 49.1% of British females are 20 – 30 years old (Office for National Statistics, 2022). b. 68,507,387 x 0.491 = 33,637,125

3. 16,818,563 Petite UK women 20-30 years old a. According to research conducted by Alyda, Dainty s competitor, 50% of the female population within the UK are classified as petite (Wright, 2021) b. 33,637,125 x 0.5 = 16,818,563

1. 1,580,945 Rising Prosperity Petite UK women 20-30 years old a. As stated in the customer analysis, Dainty’s core customers are categorised under the Rising Prosperity’ classification (Acorn, 2022) which makes up 9.4% of the total UK population (Acorn, 2014). b. 0.094 x 16,818,563 = 1,580,945

market size

Rogers (2003) Diffusion of Innovation theory states that 13.5% of the target market will be early adopters of an innovation. Calculating 13.5% of Dainty’s total addressable market of 1,580,945 accounts to 213,428.

In its initial phase of launching, Dainty will seek the approval of its early adopters, using their feedback to improve its products which will eventually prepare the business to successfully scale up and attract a broader customer base.

customer analysis demographic

Women aged 18 30 who are 4 10” 5 3” wearing UK s ze 4 16 clothing. They are highly educated young professionals entering a transitional era of their life, moving from higher educat on into white col ar professional occupations Most customers fal nto Acorn s ‘2: Rising Prosperity’ classification (Acorn, 2022) w th a C2: Ski led Work ng Class soc oeconomic status (IPOS 2009) Few customers are categorised under C1: Lower Middle Class as well as ‘D: Working C ass (IPOS, 2009) Customers have an average salary between £20,00 £26,000 (Indeed, 2021) with a monthly disposable ncome of £300

geographic

Urban dwe lers living in major towns and cities ideal y in the UK but Dainty anticipates worldwide expansion across urbanised countries.

Customers have a cosmopolitan outlook and en oy the r urban lifesty e They like to eat out in restaurants, go to the theatre and cinema and make the most of the culture and nightlife of the big city Most are singles or couples renting city flats or terraced townhouses

psychographic

They support equality, diversity and inc usion. They stand in so itude with social and pol tical movements and they will use socia media to call out injustice behaviour from businesses and public figures Customers additionally celebrate acceptance and indiv dual ty signa ling demand for more size nclusive apparel They are becoming more aware of environmental concerns and are becoming more conscious of the r own ind vidual impact on the environment Being in a transitiona period means they are also taking small gradual steps in their consumption as they are becoming more educated on the impacts of their purchases.

Customers place a huge emphasis on their menta and phys cal health, they like to unw nd from their busy professional lifestyles through experiences such as travelling and exercising indiv dual y or with friends/family members These young customers spend a significant time online, using social media to keep up w th others or to stay informed w th media news

The COVID 19 pandemic has shaped these consumers to be res lient, proact ve, and creative using nnovative ways of think ng to overcome challenges. They are expect ng brands to a ign with their values and attitudes.

Clothes are purchased to fulfil both their functional and symbo ic needs, more so on symbolic as the clothes they wear reflect her aspiration, personality and status symbol

behavioural

These customers are the internet generation They are the early adopters of new technology Despite stores reopening again after the COVID 19 restrictions were eased, customers still prefer shopping online to in store. They particularly value reading on ine reviews of a product or business to assist in making informed purchases If they are satisfied with a product or service, they will not hesitate to share and recommend the brand through word of mouth or by wr ting online reviews The pandemic has resulted in consumers valu ng their older garments more and they use second hand marketplaces to buy and or sell clothing Customers stretch their income to finance their social life as wel as a whole range of var ous household incomes Incentives such as a Buy Now Pay Later scheme or a referral discount work well with these consumers They part cularly value brands with a free and simp e returns pol cy Desp te a ming to practise conscious consumption, impulse purchases are still made for events and holidays They are still purchasing from fast fash on brands due to next day del very convenience.

Customers are starting to feel embarrassed shopp ng from fast fashion brands, especially in light of the negative press associated with the ndustry They are becoming increasingly frustrated with the poor quality and short ifecycle of the c othes that are purchased from fast fashion brands They are beginning to see the value of invest ng in high qual ty cloth ng, but they would describe the style of sustainab e cloth ng as boring As petite women, customers hate having to tailor the r clothes due to the extra time and money required Customers shop at the petite section of the brand f it is offered, but they are often disappointed with the lack of fashionable, high quality and we l fitting options n the market. They are yet to find a brand that addresses their issues, but they will happily pay more for a brand who meets their needs.

S/S 23 moodboard

The founder has decided the first launch of clothes will be a jeans collection as the participants in the survey commonly agreed that jeans was the most frustrating piece of clothing to purchase as a petite customer The founder has decided to launch the first range in April 2024 A moodboard has been created using WGSN (2022) to represent the first step of the design process Six months before launching, Oct 2023 the founder will update this moodboard to represent S/S24

a n g e p l a n f i r s t c o l l e c t i o n

dainty

tech pack outline

Waist belt Coin Pocket

Front side pocket

Side seam

Inside label Back yoke

Button Belt loop

zipper fly

Belt loop Back pocket

patch with logo

Rivets

Double needle top stitch

Top stitch

Chain stitch hem

project timeline to launch

1 Research undertaking and co lat on of relevant fashion research review of past ranges, competitors, future product and cultural trends

2 Concept creation of product range concept and design direction Articulation of research into a product concept, mood boards and product range ideas

3 Product development f nalisat on of concept as a product range creation of option range plans, product specifications and pricing strategies

4 Sourcing sourcing of supp iers and manufacturers for the range negotiation and agreement with suppliers to produce products within cost and quality requirements

5. Manufacture the oversight of the creation of samples and bulk production

6 Shipping liaison with suppliers to finalise product production and approve final production samples to a low shipment

7 Warehousing final review of received product and authority to either release to allocation or return to the supplier

8 Plan for next season’s launch review current ranges competitors and trends as wel as PESTLE factors to make necessary changes to future products for the season

financial plan

engagement & predicted demand forecast

Month by month increase in customer website engagement and sales disp ayed in figure 18 has been based on the increase in marketing and business expansion When Dainty launches n Apri 2024 t has been predicted that 1500 visitors will browse the webs te, of that, 225 visitors wil become registered customers meaning that Da nty will attract 0 1% of its early adopters market upon launching Throughout the first year, Da nty is projected to experience a 10% growth in the first two months; then from July October 2024, a 30% growth s expected due to an increase in marketing activit es; November 2024 December 2024 will see a 50% spike due to the holiday demands alongside the launch of Dainty s trousers collection; January 2025 will see a fall in visits and sales due to f nanc al restr ctions customers are l kely to face after Christmas; this is expected to recover s owly 10% n February 2025 and then 20% in March 2025 By the end of the f rst year of trad ng, 35% of early adopters are expected to engage in the website with 5% becoming registered customers and a total of 3609 sales are expected to be performed When looking at figure 19 Dainty is expected to attract its 213 428 early adopters market to the website by 2026 and 8% of early adopters w ll be acquired as reg stered customers by 2028 32,480 transactions over 5 years are expected to be performed Th s staggering 800% increase from the first year is expected as the brand releases more collections and demand increases

F

F

5-year total revenue forecast

A competitive pricing strategy was used to set pr ces for products The founder conducted a competitive shop analysis (refer to appendix 9 appendix 13) of jeans from Topshop/ASOS, Urban Outfitters, Good American and Levi's as the jeans from these brands are popular amongst target consumers especially due to the design and quality Good American is the exception but they are renowned for size inclusive quality jeans. As previously discussed, participants in the questionna re agreed to pay more for the added benefits of better quality, better f tting and high qual ty cloth ng As Dainty s products wil feature these benefits the prices of the eans were set to be higher than fast fashion offerings but lower than mid end high street retailers Ethically produc ng products n the UK also justifies the h gher price points of Dainty products In reference to appendix 14, when asked how much particpants are wi ling to pay the most common response was £50. This is ower than what the founder had antic pated, but it can be argued that the partipicants stated this price as they are accousted to the prices set by fast fashion companies It is therefore cruical for the brand to communicate the va ue of the products to consumers This will further be discussed in the marketing plan

Da nty s gross revenue was calculated based on total units of items projected to be sold against estimated revenue When analysing figure 21 gross revenue for the f rst year is projected to be £90,076, this is based on 1,321 units of all the jeans being sold F gure 23 visualises that Dainty s 5 year financial projections look pos tive with a 260% overall growth across the 5 years The year on year increase in gross sales is a result of increasing Dainty’s market penetration and product development

F I G U R E 2 0 : P R O D U C T P R I C I N G

F I G U R E 2 2 : 5 Y E A R F O R E C A S T T A B L E

F I G U R E 2 0 : P R O D U C T P R I C I N G

F I G U R E 2 2 : 5 Y E A R F O R E C A S T T A B L E

F I G U R E 2 3 5 Y E A R R E V E N U E F O R E C A S T G R A P H

F I G U R E 2 1 : T O T A L U N I T S A L E S A N D T O T A L G R O S S S A L E S Y E A R 1 T A B L E

A tota of £40,00 wil be required to set up the business initially and cover start up expenses prior to product launch. It w ll come from two sources, with one being reputable loan, and the other be ng personal saved finance

financeraising

F I G U R E 2 3 : S O U R C E O F F U N D I N G T A B L Ebusiness objectives

objectives Business

Maintain a positive net profit

S Ensure gross revenue increases by at least 10% year on year over a 5 year period

M Net Prof t is measured by ca culating the difference between total revenue and total expenses Revenue and expenses will be mon tored throughout the year to ensure financial forecasts are achieved

A Dainty s va ue propositions ca l for high production costs so to maintain a posit ve net profit the focus will be on ncreasing revenues /selling more goods as a result of effective marketing communication

Addit ona ly, Dainty will consider reducing costs ensuring not to comprom se on quality

R a positive net balance allows for investments nto other areas of the business so Dainty can expand

T Revenues and expenses will be recorded monthly to calcu ate the annua net profit

Improve sustainability strategy

S Reduce environmental impact espec ally w th its jeans as denim is known as one of the most environmentally damaging materials in the industry

M Measure using KPIs such as carbon footprint, energy consumption suppl er environmenta sustainab lity index, water footprint

A Achieved through partnering with sustainable initiatives such as the Better Cotton Initiat ve, sourc ng other sustainable supp iers and integrating innovation and technical advancements into operations and processes

R This object ve builds on Dainty s ‘minimal impact and ‘ethical va ues

Enhancing sustainable practices meets the growing demand from consumers as the ethical fashion market is expecting a 25 1% compound annua growth rate (Research and Markets, 2021)

T Sustainable performances w ll be measured quarterly, annually and over 5 year periods.

Increase Brand Awareness

S Increase awareness of Dainty amongst its target market and acquire new customers through organic and paid marketing

M Measured by looking at the growth rate of social med a followers as well as website visits and registrations

A Achieved through strategic marketing strateg es Marketing goals will be planned annua ly being assessed monthly and ad usted accordingly

R Dainty is here to disrupt the petite industry and so with positive brand awareness, Dainty can benefit from many high value loya customers

T Social media followings w ll be measured weekly Website visits and registration w ll be measured monthly, quarter y, annual y and over 5 year per ods

Expand Product Assortment

S Expand product ines beyond jeans over a 5 year period

M Measure the number of offerings based on product type colour, product category and style

A Develop ng seasonal col ections, dropping two collections a year: one for Spring/Summer, and the other for Autumn/Winter,

R This goal helps Dainty cont nue to fulfil its purpose of providing petite women with fashionable, qua ity and well fitting clothes

T The Gantt chart identified that the range development process beg ns in 6 months process so seasonal collections will have to be planned 6 months prior to aunch ng

operations

registrationslegal

Dainty will be an online direct to consumer business operating as a Private Limited Company Registrat on to set up a limited company with Company House costs £12 and will usually take 24 hours (Gov UK, 2022)

Establishing as a Private Limited Company works in favour for both the business and the founder as the two are separate legal entities w th the owner hav ng limited liability A limited company can therefore allow the founder to take more calculated business risks without the prospect of los ng everyth ng Additionally, the title of an LTD company can build a credible and prestige image to suppliers, investors and customers meaning Dainty can secure valuable short and long term investments Financially Dainty can benefit from tax efficiencies due to the f exible structure of a limited company.

The founder wi l trademark the brand name to prevent others from trad ng under the name Gov UK s trademark application is a four month process costing £170 (GOV, 2022) for 10 years worth of protection

As Dainty has intent ons of expanding internationa ly in the ong term future, the owner will have to register for an international trademark through the Madrid Protocol for protection in up to 126 countries. The estimated cost of register ng a trademark in Austra ia, Canada, the European Union and the U S A is 1 865 Swiss Francs (CHF) / £1,536 19 (Wor d Intellectual Property Organization 2022)

The founder has decided to voluntar ly register for VAT despite annual turnover in the f rst year unlikely to exceed the £85,000 threshold (Gov UK, 2022) This means the Recommended Retail Price (RRP) of Dainty products are calculated with the 20% VAT rate (Gov, UK) Being a VAT reg stered business from the beginning means customers wont have to ncur the increased costs once the bus ness meets/exceeds the threshold. Just like with registering as an LTD, VAT registration adds authority and permanence to the business It can be assumed by customers and competitors that the business s annual turnover exceeds £85,000 Addit onal y, the business can recover VAT ncurred start up costs sooner than having to wait to exceed the threshold (Loggie 2020) The founder will have to submit VAT returns to HMRC four times a year however this extra administration does not cause nconvenience as it allows for the founder to have updated bookkeeping records.

Dainty wi l use Shopify to run ts eCommerce platform Shopify was chosen due to the ease of setting up and Shopify being reputable amongst start ups and established businesses (W lliams 2022) The founder wil register with Shopify’s Basic Plan of £24 a month In th s plan Shopify charges a 2 2% + £0 20 credit card transaction fee and a 2% fee for currency convers on (Shopify, 2022).

Dainty wi l also register a domain name and professional email address After comparing the prices from domain name registrars, the founder has decided GoDaddy offers the greatest benefits The cost for a five year registration of the domain name shop dainty com and the domain email support@dainty com, with GoDaddy accounts to £89.64 (GoDaddy, 2022).

Dainty wi l comp y with the UK ru es of selling online This includes giving customers the right to return their orders after 14 days of delivery (Gov UK, 2022) Although customers are lega ly ent tled to returns, customers will be responsible for paying the courier fee As a start up business, not offering free customer returns means the business can reduce profit loss

Be ng an online business allows the founder to run the business from home In this case, Dainty’s headquarter is located in Nottingham As a small business with low inventory, inventory will be stored at home to maxim se control and prof ts Th s significantly reduces fixed costs as opposed to renting a warehouse or office space As a limited company, the founder can claim utility b lls like phone and broadband b lls as business expenses (Gov UK, 2022)

In terms of business insurance, Hiscox has been identified as a suitable provider to provide product liability cover This s especia ly important for the bus ness because it covers the cost of compensat ng anyone who is injured by a faulty product Hiscox s plan includes up to £10 mi lion of cover and £100 000 in legal defence (Hiscox, 2022) As a start up business, having insurance policies set in place prov des reassurance for the founder and its customers

onlineoperations

8 organisational structure

Hiring employees brings diverse voices and perspectives to the business Due to the high costs of employ ng permanent staff, Dainty’s organisational structure wi l be kept as smal as possible in the first five years of establishment The founder wi l take on a large variety of roles and responsibi ities n the business, but she will seek external expertise through freelance staff when required The founder strives to emp oy indiv duals in a fair and honest manner

Freelancers wi l be pa d through nvoices, and they are respons ble for managing their own tax and National Insurance contributions (Gov UK, 2022) Th s means Dainty w ll not need to set up a payroll and workplace pension scheme As Dainty is lega ly respons ble for the health and safety of its employees, it w ll set up an employers l abil ty insurance to cover compensation costs of emp oyees who sustain injuries or become ill through work (Gov UK 2022). Despite freelancers being less costly they are highly experienced in the r field and the f exible working schedule allows for increased product vity and employee engagement, thus increasing innovation and creativity within the business (Beattie 2019)

The management of Da nty leans strongly towards a democrat c and transformational leadership style Lewin s 1939 study (Lewin et al 1939) confirmed that democratic leadership is the most effect ve style of eadership This leadership style encourages employees to contribute their ideas to the decision making of the business, but it is the founder’s authority to make the f nal decision Emp oyees will be recognised and rewarded for their creativity and valuable contribution. Adopt ng th s recognition r ch culture has been found to reduce turnover rates as employees feel valued and more engaged with tasks (Bersin, 2012) The addition of a transformat ona eadership style means the founder wil nspire employees to feel passionate about their purpose within the business This will encourage them to reach their full potentia and become high performing yet passionate emp oyees (Cherry, 2021).

F I G U R E 2 4 S T A F F I N G C O N S I D E R A T I O N S F O R D A I N T Y

management style

F I G U R E 2 4 S T A F F I N G C O N S I D E R A T I O N S F O R D A I N T Y

management style

8 risk management and contingency plan

human

Execution delays

Probabi ity: 7/10

Impact: 8/10

strategic

Illness or death of CEO

Probab lity: 5/10

Impact: 10/10

Death is inevitable, but it is important to plan for the worst well in advance, so the business and all the hard work does not die with the founder The manager will identify a new managing director who will be trusted to run the business and then write a lega wi l that ident fies the chosen successor as well as the beneficiaries who will inher t business shares The successor w ll be informed of the location of the will as well as their responsibilit es This succession plan ensures that business disruption is kept to a minimum (Akram, 2016).

Staff illness, absence, or resignation

Probab lity: 6/10

Impact: 5/10

As previously mentioned, Dainty wi l hire freelancers and interns in its first 5 years of operation The founder wil face the challenge of reduced assistance and operations delays if key employees are absent, especially for prolonged periods These employees are not entitled to Statutory Sick Pay (GOV UK 2022) but the health and wellbeing of employees are always in Da nty s best interest A solution would be to hire alternative or temporary staff to assist in managing the workload Daily, weekly and monthly check ins with employees will be conducted by the manager to improve employee morale and productivity

The business is like y to experience problems in the supply cha n whether it is issues caused by suppl ers or the founder herself where plans are not executed accordingly.

Da nty could face issues such as resources becoming unavailable or suppliers not delivering stock on time In such scenarios, it is the founder s responsib lity to make quick, strategic decisions in order to further reduce delays The founder wil schedule timelines careful y that allow for extra time to address issues Dainty will diversify its supplier base as wel as identify backup suppliers as it expands its product offerings to spread the risk and reduce mpact

Financial risk

Prrobability: 7/10

Impact: 9/10

Da nty could experience poor financial performance from inaccurate cash flow budgeting or setting over amb tious goals and ob ectives Financia management is key to Dainty’s surviva Insolvency can be min mised through frequent review of the financial plan, analys ng current performance with historical performance and industry benchmarks Realistic business objectives can then be set followed by practical and effective strateg es that enable the bus ness to remain operational

Market rejection

Probabi ity: 3/10

Impact: 10/10

Desp te the founder conducting extensive market research presented in this business plan, targeted customers could still reject the business due to lower brand and value perception A marketing plan will proceed after this business plan which has details on how Dainty wil communicate its brand identity and value propos tions to target customers thus mit gating the risk of market rejection

External factors could also result in changes to consumer demand and expose the business to new threats The founder will keep up to date with Pol tical, Economical, Social, Technological Legal and Environmental (PESTLE) factors and wil reassess Da nty s posit oning n the environment adjusting business strateg es according y

Poor WIFI and or data connectivity

Probab lity: Medium 5/10

Impact: Medium 8/10

An internet connection is vita for Da nty s day to day business operations. A network fau t can interrupt operations stressing the mportance of investing in a high speed, re iable broadband provider to mit gate this risk. In the event of an nternet failure the customer service of the broadband provider will be contacted by the founder to seek support The founder can use mobile hotspot to provide an internet connection to the laptop meaning that investments in a h gh speed mob le network provider (preferably one that provides 5G coverage) with an unl mited data plan will be required If mobile data connectively also fails, an immediate solution is to obtain a secure internet connection within the founder s local radius Dainty wi l keep customers informed of any internet disruptions and communicate its appreciation for the customer s pat ence through social media announcements

Security Breach of data, website and or social media accounts

Probab lity: Low 4/10

Impact: High 10/10

A cyber attack has the potential to cause financial and reputationa damage to Dainty Hiscox (2022) reports that the average cost of a cyber security breach for a small business in 2019 was £11 000 Putting appropriate precautions in place can reduce this risk These include locking the laptop when it is not in use changing passwords regu arly and not opening suspicious files or links Antivirus software will be instal ed, and the founder wi l ensure to only use secure private Wi Fi networks. If employees have access to the business data, the founder will provide them with their own password protected user account that limits access to download software and access sensitive data (Hiscox 2022) If Dainty falls victim, the cyber breach will be reported to relevant authorities (Action Fraud the bank, and the ICO) (Hiscox, 2022)

Website crash reduce this impact by having IT services ready for when systems crash to fix as soon as possible.

Probab lity: 4/10

Impact: 7/10

Dainty relies on Shopify as its POS platform and if the webserver crashes, transactions are hindered The r sk cannot be prevented nternally as it is the responsibi ity of Shopify s developer team to prevent and resolve technica glitches However, the financial loss caused by this risk can be mitigated by managing f nances with consideration of unexpected emergencies so the manager can sti l pay off expenses even if orders fal short In the event of this scenar o, the manager will contact customer services at Shopify whilst keeping updated with any announcements made by Shopify The manager can use th s time to bra nstorm business development deas, tackle tasks that don t requ re access to Shopify

Damaged laptop and or phone

Probab lity: 5

Impact: 5

The manager’s aptop and mobile phone store important files such as contact details, emails and messages Damages to these assets caused by acc dents or natura disasters would result in fi es be ng corrupted and the manager having to spend extra time and money for replacement and recovery The manager has already insured persona assets, and in the event of damage, loss or theft, the manager can simp y make a claim To prevent the oss of data, the manager will backup fi es using the C oud. As well as saving files to the laptop files will be backed up us ng Microsoft OneDrive. The manager wil obta n a Microsoft 365 Business Plan at £9 40 a month (Microsoft, 2022), which includes 1 TB of storage space and access to all Microsoft Office applications inc uding Word, Outlook Excel and Teams (Microsoft, 2022) Storing files to the cloud a lows for automated backups as we l as quick recovery from accidental deletes or malicious attacks

references

appendices

T o p s h o p P e t i t e b a g g y j e a n s i n w a s h e d b l a c k

o p s h o p P e t i t e r e c y c l e d c o t t o n b l e n d J a m i e j e a n s i n b l e a c h

o p s h o p P e t i t e m i d b l u e M o m

e a n s

o p s h o p P e t i t e i n d i g o c u r v e f l a r e d J a m i e j e a n s

GOOD PETITE STRAIGHT GOOD GIRLFRIEND PETITE GOOD PETITE SKINNY

GOOD GIRLFRIEND PETITE CURTAIN £94 £140 £168

£122 64 (18% OFF) ORIGINAL PRICE: £150.00

US 00 W24.5" US 22 W45.5"

Inseam: 25 5"

US 00 / UK 2 W22 5" US22 UK 26 W45.5"

Inseam: 25 5"

Indigo025 Indigo026

72% Cotton, 25% Pre Consumer (recycled) cotton, 2% Elasterel P, 1% Elastane Trims have recycled zinc coating that is anti rust 99% cotton, 1% Elastane

US 00 / UK 2 W22.5" US22 UK 26 W45 5"

Inseam: 25 5"

US 00 / UK 2 W22 5" US22 UK 26 W45.5"

Inseam: 25 5"

Blue384, Blue869 Blue862

91% cotton, 6% elasterell p, 3% elastane 99% cotton, 1% Elastane

bibliography

imagereferences

COVER PAGE

PINTEREST (2022) COVER PAGE [On ine image] [Accessed on 31st March 2022] https //i pinimg com/564x/2e/54/7b/2e547b0a6aa3b44a0090ce3c14e4a9e1 pg

PERCEPTUAL MAP LOGOS PAGE 18

BOOHOO (2022) Boohoo Logo [Online image] [Accessed on 31st March 2022] https //media boohoo com/ /boohooamplience/boohoo ogo black

GLASSDOOR (2022) Missguided Logo [Online image] [Accessed on 31st March 2022] https //media.g assdoor.com/sqll/1027187/missguided squarelogo 1564147912496.png

PRETTY LITTLE THING (2022) Pretty Little Thing Logo [Online image] [Accessed on 31st March 2022] https //cdn sk n prettylittlething com/frontend/pretty ittlething/plt theme/images/organization logo jpg?ts=1513166000

NEW LOOK (2022) New Look logo [Online image] [Accessed on 31st March 2022] https //seeklogo com/images/N/new look ogo ABF4143CFD seeklogo com png

NEXT PLC (2022) Next Logo [Online image] [Accessed on 31st March 2022] https //www nextplc co uk/~/media/Images/N/Next PLC V2/content mages/image gallery/thumbnails/logos/next black jpg?h=320&la=en&w=767

THE QUAYS SHOPPING CENTRE (2022) River Is and logo [Online image] [Accessed on 31st March 2022] https://www thequays co uk/med a/uploads/r ver island logo png

RETAIL WEEK (2022) Boden logo [Online image] [Accessed on 31st March 2022] https //d53bpfpeyyyn7 cloudfront net/Pictures/2000xAny/8/4/1/3077841 boden ogo002 198138 crop jpg

WIKIPEDIA (2022) Marks and Spencer's logo [Onl ne image] [Accessed on 31st March 2022] https //upload wikimedia org/wikipedia/commons/thumb/2/23/MarksAndSpencer1884 logo svg/1 200px MarksAndSpencer1884 logo svg png

LOGOS DOWNLOAD (2022) Nasty Gal Logo [Online mage] [Accessed on 31st March 2022] https //logos download com/wp content/up oads/2016/06/Nasty Gal logo png

FACEBOOK (2022) Fierce Petite logo [Onl ne image] [Accessed on 31st March 2022] https://scontent lhr8 1 xx fbcdn net/v/t39 30808 6/255535454 1026838451446471 1140967860433971284 n jpg? nc cat=103&ccb=1 5& nc s d=09cbfe& nc ohc=Leckm9QGY2UAX9RHZ 0& nc ht=scontent lhr8 1 xx&oh=00 AT8tJXwmULSxO3KXlMeZb6c1 Xi2P6P q kyeiW44zxPYA&oe=624AF540

1000 LOGOS (2022) ASOS Logo [Onl ne image] [Accessed on 31st March 2022] https://1000logos.net/wp content/uploads/2021/04/Asos logo.png

OFFBEAT PETITE (2022) Offbeat Petite logo [Online image] [Accessed on 31st March 2022] https://cdn shopify com/s/files/1/0510/5513/2870/f les/OFFBEAT PETITE 22 300x300 png? v=1620492246

FACEBOOK (2022) Avo Activewear logo [Online image] [Accessed on 31st March 2022] https://scontent lhr8 2 xx fbcdn net/v/t39 30808 6/258723040 863483431007420 297906257815333937 n png? nc cat=105&ccb=1 5& nc s d=09cbfe& nc ohc=2OAenDc6V5oAX9qG29d& nc ht=scontent lhr8 2 xx&oh=00 AT83p6VQxIbzLlapcnEFnVEq9dKA2wJMDiSE2hho 0TCbA&oe=6249BBBF

ALYDA (2022) Alyda Logo [Online mage] [Accessed on 31st March 2022] https://cdn.shopify.com/s/files/1/0580/7980/5619/f les/A yda Dark.png? height=628&pad color=fcf7f2&v=1624925294&width=1200

JENNIFER ANNE (2022) Jennifer Anne Logo [Online image] [Accessed on 31st March 2022] http://cdn shopify com/s/files/1/1444/4012/t/6/assets/logo png?v=10674280674561876472

FACEBOOK (2022) Reve The Label Logo [On ine image] [Accessed on 31st March 2022] https://m facebook com/revethelabel/photos/a 2330962066954212/2330962080287544/?type=3

THE SHORTLIST (2022) The Shortlist logo [Online image] [Accessed on 31st March 2022] https://shoptheshortlist co uk/wp content/uploads/2021/04/TheShortlist Logo DarkCoral e1621692717362 png

MOODBOARD IMAGES PAGE 24

WGSN (2022) S/S23 Women's Denim Trend Forecast 1 [Online mage] [Accessed on 31st March 2022] https://media wgsn com/fo image store/boards/92631/carousel jpg

WGSN (2022) S/S23 Women s Denim Trend Forecast 2 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/artic e/92631?show= mage 35098762#page1

WGSN (2022) S/S23 Women s Denim Trend Forecast 3 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/artic e/92631?show= mage 35098772#page1

WGSN (2022) S/S23 Women s Denim Trend Forecast 4 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/artic e/92631?show= mage 35098753#page2

WGSN (2022) S/S23 Women s Denim Trend Forecast 5 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/artic e/92631?show= mage 35098764

WGSN (2022) S/S23 Women s Den m Trend Forecast 6 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/art cle/91463?show=image 34568271

WGSN (2022) S/S23 Women s Den m Trend Forecast 7 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/art cle/91463?show=image 34573671

WGSN (2022) S/S23 Women s Den m Trend Forecast 9 [Online image] [Accessed on 31st March 2022] https://www wgsn com/fashion/art cle/91463?show=image 34568117#page6

WGSN (2022) S/S23 Women s Den m Trend Forecast 10 [Onl ne image] [Accessed on 31st March 2022] https://www.wgsn.com/fashion/art cle/91525?show=image.34175178#page8

RANGE PLAN PAGE 25

WGSN (2022) Jeans CAD 1 [Online image] [Accessed on 31st March 2022] https //www wgsn com/fashion/article/92631?show= mage 35095575#page1

WGSN (2022) Jeans CAD 2 [Online image] [Accessed on 31st March 2022] https //media wgsn com/ss mage store/16/11/24/43/thumb Paneled Jean with released hems j pg

WGSN (2022) Jeans CAD 3 [Online image] [Accessed on 31st March 2022] https //media wgsn com/ss mage store/40/96/72/81/thumb HIP HUGGER BOOTCUT jpg

WGSN (2022) Jeans CAD 4 [Online image] [Accessed on 31st March 2022] https //www wgsn com/fashion/article/92631?show= mage 35095576#page2

COMPETITIVE SHOP REPORT GOOD AMERICAN PAGE 47

COCARANTI (2022) Good American logo [Online image] [Accessed on 31st March 2022] https://www cocaranti com/wp content/uploads/2020/11/Good American logo png

GOOD AMERICAN (2022) GOOD GIRLFRIEND PETITE [Online image] [Accessed on 31st March 2022] https://cdn shopify com/s/fi es/1/1381/0415/products/GGPNF062T I026 SP22 B 1 2832 768x progressive jpg?v=1646156875

GOOD AMERICAN (2022) GOOD PETITE STRAIGHT [Onl ne image] [Accessed on 31st March 2022] https://cdn shopify com/s/files/1/1381/0415/products/GPSTRH731T I025 SP22 B 1 2124 768x progressive jpg?v=1646637281

GOOD AMERICAN (2022) GOOD PETITE SKINNY [Online image] [Accessed on 31st March 2022] https://cdn shopify com/s/files/1/1381/0415/products/GPSK873T B384 B 1 768x progress ve jpg? v=1580790535

GOOD AMERICAN (2022) GOOD GIRLFRIEND PETITE[Online image] [Accessed on 31st March 2022] https://www.goodamer can.com/products/good girlfriend petite curtain b ue862

COMPETITIVE SHOP REPORT LEVIS PAGE 47

LEVIS (2022) 501® CROP JEANS [Online image] [Accessed on 31st March 2022] https://www levi com/GB/en GB/c othing/women/jeans/501 crop jeans/p/362000221

LEVIS (2022) MILE HIGH SUPER SKINNY JEANS [Online mage] [Accessed on 31st March 2022] https://lsco scene7 com/ s/image/ sco/227910052 front pdp lse? fmt=jpeg&qlt=70,1&op sharpen=0&resMode=sharp2&op usm=0.8,1,10 0&fit=crop,0&wid=900&h ei=1200

LEVIS (2022) 724™ HIGH RISE STRAIGHT JEANS [Online image] [Accessed on 31st March 2022] https://lsco scene7 com/ s/image/ sco/188830140 front pdp lse? fmt=jpeg&qlt=70,1&op sharpen=0&resMode=sharp2&op usm=0 8,1,10 0&fit=crop,0&wid=900&h ei=1200

LEVIS (2022) HIGH LOOSE TAPER JEANS [Online image] [Accessed on 31st March 2022] https://lsco scene7 com/ s/image/ sco/178470010 front pdp lse? fmt=jpeg&qlt=70,1&op sharpen=0&resMode=sharp2&op usm=0 8,1,10 0&fit=crop,0&wid=900&h ei=1200

COMPETITIVE SHOP REPORT TOPSHOP/ASOS 45

1000 LOGOS (2022) Topshop logo [Online image] [Accessed on 31st March 2022] https://1000logos net/wp content/uploads/2020/03/Topshop Logo 1900s2 png

ASOS (2022) Topshop Petite baggy jeans in washed black [Online image] [Accessed on 31st March 2022] https://images asos media com/products/topshop petite baggy jeans in washed black/201697687 1 washedblack?$n 640w$&w d=634&fit=constrain

ASOS (2022) Topshop Petite recycled cotton blend Jamie jeans in bleach [Onl ne image] [Accessed on 31stMarch 2022] https://images asos media com/products/topshop petite recycled cotton blend jamie jeans in bleach/200839485 1 blue?$n 640w$&wid=634&fit=constrain

ASOS (2022) Topshop Petite mid blue Mom jeans [Online image] [Accessed on 31st March 2022] https://images asos media com/products/topshop petite mid blue mom jeans/200505324 1 midb ue?$n 640w$&wid=634&f t=constrain

ASOS (2022) Topshop Petite indigo curve flared Jamie jeans [Online image] [Accessed on 31st March 2022] https://images.asos media.com/products/topshop pet te indigo curve f ared jamie jeans/24516464 1 purple?$n 640w$&wid=634&fit=constrain

COMPETITIVE SHOP REPORT URBAN OUTFITTERS PAGE 46

URBAN OUTFITTERS (2022) Urban Outfitters logo [Online image] [Accessed on 31st March 2022] https://download.logo.wine/logo/Urban Outfitters/Urban Outfitters Logo.wine.png

URBAN OUTFITTERS (2022) BDG SLOUCHY LOW RISE CARGO JEANS [Online image] [Accessed on 31st March 2022]

https://imageseu urbndata com/is/image/UrbanOutf ttersEU/0122593370633 107 b? $xlarge$&fit=constrain&fmt=webp&q t=80&wid=1314

URBAN OUTFITTERS (2022) BDG Two Tone Authentic Straight Leg Jeans [Online image] [Accessed on 31st March 2022]

https://imageseu urbndata com/is/image/UrbanOutf ttersEU/0122593370244 091 b? $xlarge$&fit=constrain&fmt=webp&q t=80&wid=1314

URBAN OUTFITTERS (2022) BDG Wh te Logan Cinch Back Boyfriend Jeans [On ine image] [Accessed on 31st March 2022]

https://imageseu urbndata com/is/image/UrbanOutf ttersEU/0122593370584 010 b? $xlarge$&fit=constrain&fmt=webp&q t=80&wid=1314

URBAN OUTFITTERS (2022) BDG Vintage Wash La ne S im Straight Jeans [Onl ne image] [Accessed on 31st March 2022] https://imageseu urbndata com/is/image/UrbanOutf ttersEU/0122902480006 107 b? $xlarge$&fit=constrain&fmt=webp&q t=80&wid=1314