26 minute read

A action

isplay and point of purchase (POP) graphics utilize every available surface to capture the consumer’s attention. This includes, but isn’t limited to, walls, partitions, windows, ceilings, countertops, and floors. Each offer “wow” factor when paired with the correct media and imagery.

Floor graphics regularly generate glances, as people are constantly looking down at their feet while walking or browsing on their phones. When the COVID-19 pandemic first started, floor graphics shined, playing an instrumental role in social distancing. While this is no longer as necessary or popular as it once was, floor graphics continue to thrive in advertising and POP scenarios.

Spike in Popularity

The buzz surrounding floor graphics during the initial stages of the pandemic has quieted down. With the over saturation of this application used for social distancing its been challenging to get back to floor graphics’ usage for promotional purposes. However, it is apparent all of the many advantages remain.

“During the pandemic there was a mad rush to get social distance guidelines out to the masses and the overkill of floor graphics was born. As people begin to come back out, they want to experience more of life pre-pandemic, so the directional floor graphics and the six-foot spacing squares on the floor are being removed,” explains Ryan Allen, regional technical specialist, Avery Dennison Graphic Solutions.

Nate Goodman, product manager, Mactac, points out that “COVID-19 graphics were more instructional signage than the normal promotional messaging that we are used to. Since these types of messages are no longer used, the design has changed but the purpose remains the same and COVID-19 has even conditioned people to look at the floor more.”

Daniel Farias, technical engineer, Drytac Canada Inc., admits that “it is possible, with the relative normalization of the pandemic situation, that floor graphics have lost some of the buzz they had during the pandemic, and some companies might have overused it. However, this doesn’t mean floor graphics are no longer a valuable tool for retailers and other businesses. Floor graphics can still play an important role in visual merchandising and in-store marketing, helping to create a more immersive shopping experience and drive customer engagement and sales.”

Roy Ritchie, president, DreamScape, does not believe there’s been an over saturation of floor graphics, but shares just how beneficial this application can be. “For example, if a brand has a temporary in-store promotion, adding graphics to the floor will enhance their space, help define it, and attract eyeballs. Plus, if the space your POP display or fixtures are located in will have unattractive floors, adding a large floor graphic is an excellent solution to transform that space into a more attractive environment for your promotion and products.”

“Imagine if just five percent of floorspace was utilized for advertising campaigns in grocery stores alone on average that would be 2,100 square feet per store. The space is there, and just like the checkout lane has suggestive selling products, the same can be said for the floor graphic with a quick response (QR) code and discount or link to recipes or product tips. It adds value to the customer to choose that product,” explains Steve Yarbrough, customer experience manager, Neschen Inc.

To overcome deterrents toward floor graphics, print providers need to think of new ways to successfully sell them, especially in display and POP. “Now is the time to reintroduce floor graphics as a revenue producer. The floor space can be sold to brands for advertising space; brands can drive revenue by innovative and inviting graphics that entice consumers to choose their products,” suggests Mike Richardson, business development manager, graphics media, Jessup Manufacturing Company.

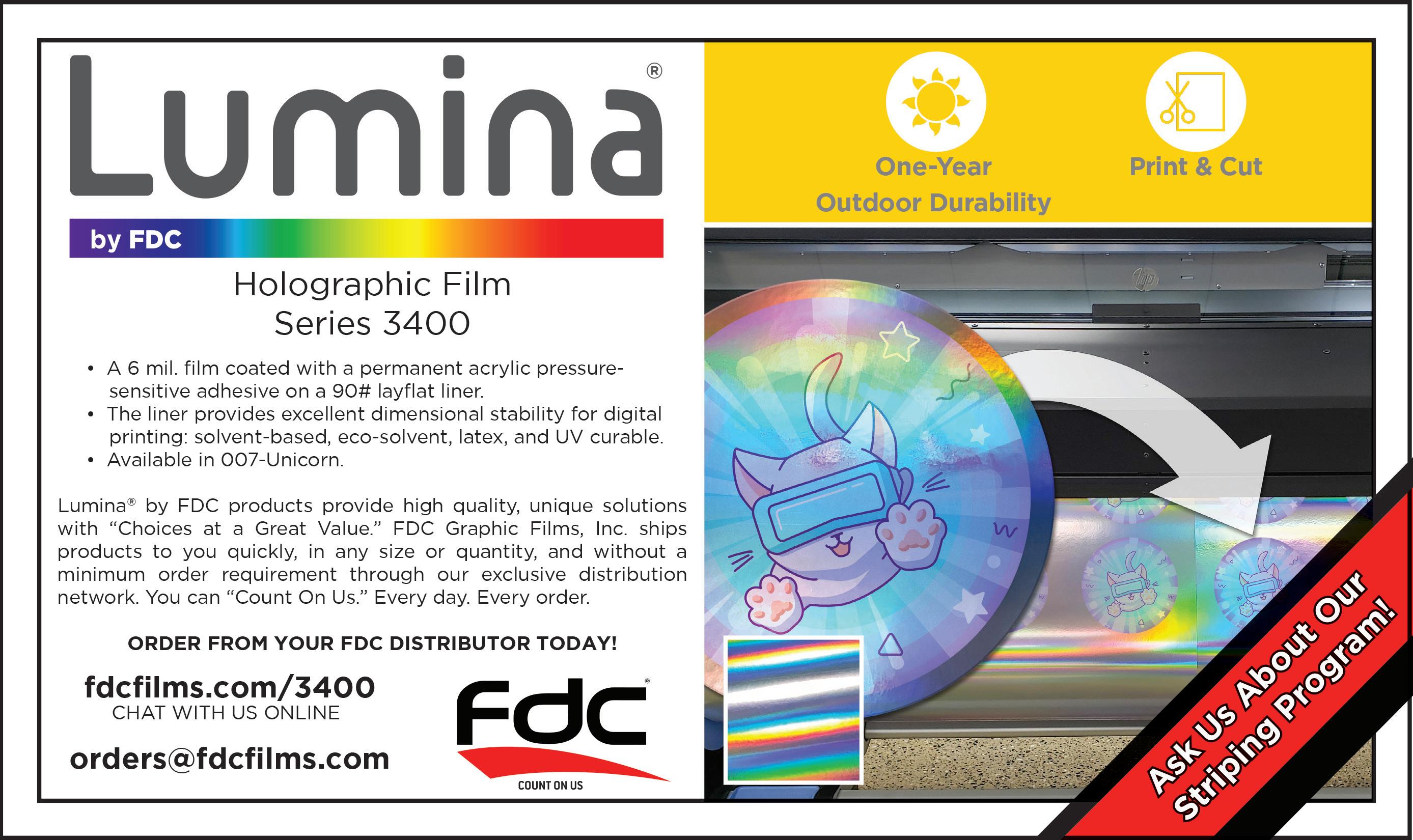

“Print providers should do their homework, be intentional with designs, and impress clients with exciting, bright colorful graphics that draw the eye and get the message across. In my opinion, there is always space for floor graphics if they are done correctly. With the right designs and messaging, they continue to be powerful,” says Michael Aldrich, product manager, FDC Graphic Films, Inc.

Angel Georgiou, senior marketing specialist, imaging supplies, Canon Solutions America, believes it’s time to get more creative in how we use floor graphics. “I think a lot of people forgot how to use the floor—even directional signage and area visibility in a point of sale environment—since there is still a lot of COVID-19 signage that hasn’t been removed. Floor graphics can be attention getters, there are so many more options than just a logo or product advertisement.”

“If you use floor graphics as part of the experience and are intentional with your branding, they provide an excellent addition to any display or POP advertising,” recommends Bill Rothe, EVP clear sales, Better Life Technology.

There will always be demand for effective advertising solutions, and this is something print service providers (PSPs) must convey to their customers. “They need to communicate the many benefits of floor graphics such as it’s an easy and cost-effective way to communicate a message, they’re versatile and can be used to promote a range of products and services, and they can be placed in locations that are highly visible and accessible to shoppers. PSPs should also focus on providing solutions that are more sustainable, made from eco-friendly materials, and provide more durability. This helps establish their products as a more responsible choice for retailers and businesses,” shares Farias.

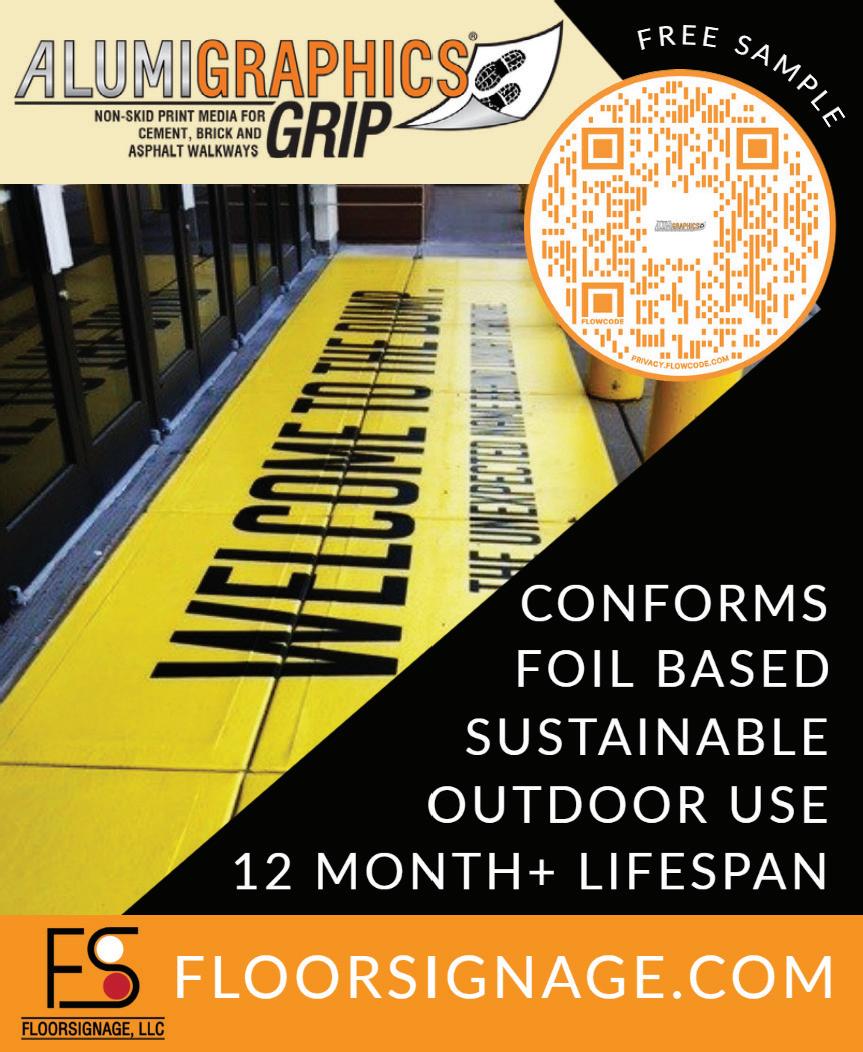

Another suggestion, educate on where floor graphics can be used, expanding into outside of stores on sidewalks and even parking lots, shares Micah Causey, VP, FloorSignage, LLC. “Graphics placed in these locations provide initial exposure to customers before they enter a store and are inundated with a plethora of signage and advertising messages inside.”

Trends in Retail

Display and POP signage is predominately seen in retail environments. For floor graphics to remain relevant, it’s important they address certain trends in imagery, dimensional size, messaging, and turnover.

“In recent years, floor graphics in retail environments have become more dynamic and engaging, with an emphasis on bold colors, high-quality imagery, and eye-catching designs. This is due to the growing importance of visual merchandising and in-store marketing, which are seen as key drivers of customer engagement and sales. Retailers and brands use floor graphics to create an immersive shopping experience and to communicate their message in an impactful way,” says Farias.

An example, points out Aldrich, is in grocery stores. “What’s trending in grocery store aisles is graphics indicating a product in that specific aisle is for sale or sponsored by a company. For example, Bud Lite may be advertising a new flavor of beer for the Super Bowl. These can also be used to promote other products in the store to get your attention.”

One way to make the advertisement more immersive—make it larger. “There is also a growing trend towards larger floor graphics, with retailers and brands looking to create impactful visuals that can be seen from a distance. This is especially effective in large, open spaces like malls and airports, where floor graphics are used to create a sense of direction and guide customers to specific areas of the store,” continues Farias.

Rothe says so far in 2023 he’s received inquiries that involve larger size floor graphics. These are included in display quotes and being used as part of the overall experience.

“There are a wide variety of shapes and sizes for graphics because of the custom nature of the application. I would say most common is wayfinding and instructional signage that is medium to small in size,” adds Goodman.

When it comes to messaging, Allen notices directional signage and signage with a call to action are trends from the pandemic that have continued. People still also use QR codes for anything from menus to in-store specials.

“There is tremendous opportunity to reimagine helpful advertising space, especially with the postpandemic increase in comfort with using QR codes. Creativity for POP campaigns focused on customer engagement and convenient product or event information can inject life and activity into this marketing space,” agrees Matt Edwards, product manager for digital print media solutions, General Formulations.

Turnover is quick in retail. As such, “we hear that many end users are demanding products that can be easily applied and removed by their staff rather than professional installers,” says Causey.

“Floor graphics in POP and advertising environments are updated or replaced on a regular basis. Retail environments change advertising campaigns and promotional deals frequently, so floor graphics supporting those campaigns need to be updated or replaced to stay relevant and effective,” notes Farias.

POP and advertising environments tend to be short term— less than three months—according to Richardson. “These floor graphics are used for a shopping season, for example back to school. In grocery we see floor graphics in the checkout areas, these may be brand promotions or invitations to join the retail store’s loyalty points program.”

“The turnover is usually focused on specialty or sale products that are marketed. A constantly turning graphic at a certain location can be very profitable for a converter if it is sold as a bi-weekly or monthly changeout,” advises Allen.

Edwin Ramos, director of sales, ACCO Brands, says “you want it to be noticed, not something that blends in all the time. Changing out graphics to match what’s popular with the season will help promotional efforts.”

Heavy Traffic

Anti-slip floor graphics are important—you can read more about the topic on page 24. But, we could argue that graphics with slip resistance are even more important in high-traffic areas. These include retail as well restaurants or hospitality locations, any place where a floor graphic is used for POP and advertising purposes. To ensure the right media is used for the job, a PSP must conduct due diligence.

“The level of traffic, floor material, and environment play a big part on selecting the right material. A one-step product may be suitable based on duration but ink durability should also be considered. Two-step systems utilizing a overlaminate to protect the graphics are much more resilient but cost more. The more you understand about the application and customer’s expectation, the better you recommend the right product to service the need in the most economical manner,” advises Dave Ofstein, quality manager, Nekoosa.

Farias notes it is also important for “print providers to work closely with their clients to

Companies Mentioned

understand their specific needs and to provide recommendations on materials, testing, and best practices for installation, maintenance, and cleaning to guarantee the safety and longevity of the floor graphics.”

Specific needs, listed by Richardson, might include how long the end customer expects the graphic to be in use. Does the end use customer expect the graphic to look just as bright and clean on day 90 as it did on day one? Will this graphic be placed indoors or outdoors? Will the graphic encounter oily liquids, water, spilled drink, or a dropped french fry? Do you expect the graphic will need to be cleaned? If so how, mop, pressure washer, or floor scrubber? What kind of traffic will it encounter, foot traffic only or could it encounter cars, forklifts, or dollies?

Traffic is more than just pedestrian-related, it could be turning wheels from shopping carts, rolling luggage, or even floor cleaning equipment, points out Causey. “It is important to note that high levels of traffic will take its toll on the product and wear down its slip-resistant property requiring the customer to monitor the graphics and have them replaced as needed.”

Avoiding an accident because of a floor graphic is paramount. “No one wants a shopper to slip and fall from the result of their floor graphic not being properly tested and certified. Whenever the conversation comes up about floor graphics, print providers need to make sure the product carries a valid certification,” stresses Ritchie.

“The print provider must know the materials and laminates. Choosing a product on preference or price is not the answer when it comes to a POP or hightraffic area floor graphic. Choosing a material because it has the proper certifications and is made for that type of application can be the difference between a lawsuit or a lasting product,” advises Allen.

You can’t use any old substrate. “It might be tempting to use available materials to create floor graphics, but it’s important to use durable floor graphic laminates and base materials to ensure the best possible performance and safety,” says Edwards.

“You might have a great slip rating on a laminate, yet you put it on a cheap or an incorrect print media and it lifts causing a trip hazard, or it simply just gets destroyed. When choosing floor graphics materials, it is essential they are suitable and safe for their intended environment,” recommends Yarbrough.

Even after installation, floor graphics should be checked repeatedly to avoid any accidents. “It is very important that where there is heavy traffic the floor graphic is inspected frequently and has the appropriate slip resistance for the location. The edges could get kicked up over time and it could cause a completely different type of hazard,” notes Goodman.

A Powerful Presence

With the rise of floor graphics during the COVID-19 pandemic this application still packs a punch in the advertising world. There are an array of opportunities available to marketers looking to utilize floor graphics for promotional purposes.

We discuss floor graphics’ powerful presence in display and POP as well as anti-slip certification requirements in our recent webinar, which is available on digitaloutput.net/webinars. D loor graphics offer great visual appeal— but behind that pretty picture, safety measures are in constant motion. Print service providers (PSPs) must be active participants when it comes to choosing the right material for the job.

Not only should they be concerned with a graphic’s visual performance but also its ability to avoid hazards. Slip resistance is paramount for graphics adhered to a floor whether it’s wood, tile, or concrete—indoors or outdoors.

Something as trivial as a spot of cleaning solution on the graphic can result in an injury. “Slip resistance is affected by factors such as floor coatings, fuel residue, grease, water, detergents, contamination, chemical treatments, cleaning, and wear,” says Micah Causey, VP, FloorSignage, LLC.

Testing standards and certifications are in place on national and international levels to ensure floor graphic media is performing with the least amount of risk. These are conducted on the first surface point of the graphic, meaning if it’s a two-step floor graphic system, then the overlaminate is tested and certified for anti-slip. For one step, only the base material is tested.

High Test Marks

Anti-slip or slip-resistant standards are executed by associations tasked with measuring the coefficient of friction (COF) of a surface. COF can be dynamic or static. Newer practices favor dynamic COF (DCOF), as it is cited to be a more real-world illustration of someone walking over the testing surface.

In general terms, “anti-slip is measured when someone is standing/walking over a floor graphic during normal conditions, on level surfaces. DCOF is the global standard used to determine slip resistance. If the DCOF score is

0.42 or greater, the surface is considered high traction, and has high slip resistance. Floor graphics with a low-traction range, below 0.30, present a higher risk of slip incidents,” explains Edwin Ramos, director of sales, ACCO Brands.

In the U.S., common slip-resistance testing standards come from associations including the American Society of Testing and Materials (ASTM), American National Standards Institute (ANSI), and Underwriters Laboratories (UL).

ASTM and ANSI

ASTM E303 is a test method that uses a pendulum tester to assess the DCOF of the surface being tested. The method was revised in 2022 to replicate even further other pendulum test methods in the rest of the world and it is now one of the most widely known and reliable ways to test for pedestrian slip resistance, according to Daniel Farias, technical engineer, Drytac Canada Inc.

“ASTM E303 relies on replicating, in a consistent and accurate way, the DCOF of a heel on floor surfaces, since it has been determined that a person’s heel is the part of the foot that starts slipping first in most floor slip situations. The device involves a swinging arm, with a rubber slider mounted on the end that sweeps over a surface and slides over it for a determined contact distance. This test can be performed in both dry and wet conditions so is valid for indoor and outdoor situations, and the results obtained are very user friendly to interpret,” continues Farias.

ASTM E303 test results are measured by a single pendulum test value and classified in three different ranges, high slip potential between 0 to 24, moderate slip potential between 25 to 35, and low slip potential for results over 36.

Ryan Allen, regional technical specialist, Avery Dennison Graphic Solutions, notes that standards such as ASTM E303 are updated annually to include new technology or more precise testing.

An example of this is ANSI A137.1/A326.3. “The newer ANSI A326.3 is practically the same as the ANSI A137.1 but it did not count with the involvement of the National Floor Safety Institute (NFSI)—although there were 61 organizations in the approval of ANSI A326.3,” shares Farias.

The ANSI A137.1/A326.3 method uses a digital tribometer to measure the DCOF of a surface, it can also be measured on dry and wet conditions and specifies a minimum of 0.42 for safety.

Farias argues that beyond the minimum DCOF, other factors need to be considered such as type of use; traffic; expected contaminants, maintenance, and wear; and manufacturers’ recommendations, but the ANSI A137.1/A326.3 standard gives no guidance on how to consider the mentioned factors.

“Nevertheless, this testing method provides useful comparisons between large areas of a surface or different surfaces as it can perform significantly more tests per hour than the pendulum, but it is recommended that a pendulum tester is used in conjunction with it to assess whether a surface’s slip resistance is suitable for the intended use,” continues Farias.

Roy Ritchie, president, DreamScape, says the two certifications that are critical to floor graphics are the AS HB198:2014 (AS/NZS 4586) pendulum test and ANSI A137.1/A326.3. “AS HB198:2014 (AS/NZS 4586) is utilized around the world and resolves the short comings of older tests.”

UL

UL is accredited in both Canada and the U.S. “It certifies products with the intent to make the world safer for consumers and workers. Along with product safety testing it sets industry standards for companies to follow during the process of innovating new products,” notes Michael Aldrich, product manager, FDC Graphic Films, Inc.

UL410 is the standard developed to test a variety of surfaces and material as slip resistant. “To be considered slip resistant, the material has to achieve a static COF (SCOF) of 0.5 or greater. SCOF is measured using a James Machine by applying weight downward through a leather foot onto the test surface and at the same time, the sample holding table begins moving laterally away from the direction of the weight. The machine records the point at which the shoe slips as the SCOF,” explains Farias.

He says the downside of this test method is that the SCOF measures how slippery a floor may be when the test subject is standing still, failing to represent accurately when someone is actually walking over the sample.

“The UL410 testing method was originally created for wax floor treatments and sealers. SCOF is not a real-world slip hazard environment, and rated product could pose an inadvertent injury risk,” advises Steve Yarbrough, customer experience manager, Neschen Inc.

Mike Richardson, business development manager, graphics media,

Jessup Manufacturing Company, notes that ASTM D2047 uses the same test method and scale as UL410. “It is a dry static test that measures the COF. The dynamic test with a swinging pendulum is a more robust method, like the B101 standard conducted and certified by the NFSI, which is both a wet and dry test.”

“NFSI has become more popular than standard ASTM ratings previously used. You will see the NFSI symbol used from media manufacturers in their sales collateral. Most of these tests are for the U.S. only,” notes Angel Georgiou, senior marketing specialist, imaging supplies, Canon Solutions America.

Other Requirements

While standards like UL410, AS HB198:2014 (AS/NZS 4586), and ANSI A137.1/A326.3 are recognized internationally, certain regions may require a specific variation or European equivalent, shares Matt Edwards, product manager for digital print media solutions, General Formulations.

Regional or European testing equivalents include the U.K.’s BS 7976-2; DIN 51130, DIN 51131, and DIN5097 from Germany; and the Australian AS/NZS 4586:2013, notes Causey.

DIN 51130 is a German ramp test. “It is rated with a value from R9 to R13. The test method uses a cleated boot and oil as a contaminate slip angle of R, which is six to ten degrees equivalent of 0.11 to 0.18 COF for hallways and aisles, R10 is 0.18 to 0.34 COF for transition areas or fast food courts, R11 is

0.34 to 0.51 COF for wet areas like bars, or bathrooms in hospitals or aged care facilities, and ranges to R13 which is 35+ degrees slip, or 0.70+ COF,” explains Yarbrough.

“Even though the mentioned organizations are recognized worldwide, it is important to note that the standards and certifications needed can vary by country or depend on the application, so it is essential to check the specific requirements of your customer especially if supplying products internationally,” advises Farias.

Specific buildings or spaces may have requirements of their own.

In general, “new construction is where the certifications are mostly needed to be approved and used. Commercial space and areas of retail would also request a certification of some type,” shares Allen.

“Certain venues—big amusement parks or municipal governments—have teams that require certain standards. Typically, these organizations will require a wet/ dry dynamic test such as the NFSI B101.1 and/or the more recent version B101.3,” notes Richardson.

Layers on Layers

Floor graphics are available as two options—one- or two-step processes. One step means the media is designed to not require a separate overlaminate on top of it. Two step includes a base material and a laminate placed over it.

When it comes to the question of whether the media is approved for anti-slip and even anti-scruff certification, the part that must be tested is the layer the traffic comes into contact with.

“Certifications for slip and scuff are for the first surface, the surface that people would come into contact with. Issues pertaining to slip and scuff resistance always qualify on the top layer.

If a material is not laminated, that material would be the one that would need to qualify for the certification,” explains Allen.

“Test methods are used to determine the slip rating of the surface that is being crossed. That could be either the overlaminate or the base media of a printed one-step product where a laminate is not required,” seconds Nate Goodman, product manager, Mactac.

If it is a two-part floor graphic system, however, that doesn’t mean the base should be ignored completely. If an overlaminate is included in the build, then both the base and overlaminate are tested together as a single unit, says Farias.

“This is because the slip resistance of the floor graphic is determined by the combination of the base media and the overlaminate. The base media, such as the adhesive vinyl or film, provides the structural support for the graphic, while the overlaminate provides a layer of protection and can enhance the slip resistance of the graphic, as the overlaminate can change the surface texture and friction of the base media,” shares Farias.

Companies Mentioned

Under Water

As media and ink advances, digitally printed graphics are seen and used everywhere. In response, “anti-slip certifications have changed to include various locations for floor graphics to better understand the elements,” says Ramos.

For example, certain floor graphic materials are compatible for use in pools or water fountains. Additionally, graphics are more apt to get wet depending on the environment, say it’s outside and it might be rained on.

“This is a very important distinction. Will your floor or ground graphic possibly get wet? If yes, a wet slip rating is required. One such rating is the NFSI B101.1 or the B101.3 test. This is a dynamic test that uses a swinging pendulum and in the case of the B101.1 test, distilled water is used. For the B101.3 test, soapy water is used. Both tests have two parts, one lab-controlled part and a second half which is a three month in situation and tested again at the end of the three month time frame,” explains Richardson.

Different tests and certifications are in place for water locations. “Separate testing would be needed to determine if a certain product would be deemed safe for a location that is subjected to standing water,” says Allen. Some of the tests aforementioned don’t include water. For example, standing water is not an application method covered by the UL410 test.

“If an area is routinely exposed to water, then a more stringent testing method is necessary. There are ANSI A137.1/A326.3 methods that may be more appropriate,” suggests Dave Ofstein, quality manager, Nekoosa.

Just because the material in question scores high on dry slip resistance, doesn’t mean the material will perform well in wet circumstances. “It is imperative to consider the expected conditions of use of the slip resistance surface at the time of determining against which standard the surface should be tested. If the floor is likely to get wet at some point, then an wet DCOF should be measured by any of the standards capable of doing so,” recommends Farias.

“The testing definitely changes when moving from dry to wet as you significantly change the amount of possible friction on the material surface. Immediately any smooth floor laminate is eliminated and even some textured films perform poorly. If you install floor graphics in a location prone to regular moisture, you either want to forego floor graphics or look for a non-skid material instead,” suggests Edwards.

Beyond slip-resistance testing, Farias points out “it is also worth noting that the materials used in floor graphics that will be subjected to water exposure should be waterproof or water resistant to prevent the graphics from dissolving or peeling off. In addition, regular cleaning and maintenance should be done to the floor graphic to help retain its slip-resistance performance over time.”

“If you know a graphic is going to be in a wet environment, you want to make sure you have a higher rating and it is approved for such location. You don’t want your graphic to be a slip and slide, and you don’t want it lifting causing a trip hazard. The surface should be clean and dry and free of any contaminants prior to installation. Products must adhere well to the floor surface for the desired duration of the project without curling at the edges and have a non-slip surface to prevent accidents,” adheres Yarbrough.

Seasons of Change

Anti-slip certifications change over time in response to new materials being introduced as well as other advancements.

“Improvements primarily focus on increasing the accuracy and consistency of slip resistance testing and incorporating new test methods to better simulate real-world conditions, also giving priority to testing slip resistance when surfaces are wet, and testing the DCOF instead of the static one, as well as covering a range of flooring types,” explains Farias.

Look at testing methods B101.1/ B101.3 from NFSI. “Both methods use a digital tribometer to measure COF, static coefficient in the case of the B101.1 standard, and dynamic coefficient based on the B101.3 standard, however in January 2020 the NFSI announced that its ANSI accreditation to develop floor safety standards had been terminated and this termination effectively outdated these two methods,” explains Farias.

Goodman provides another example with ASTM C1028, a test method that became obsolete because it produced misleading results. It is because of this and other scenarios that Goodman sees the possibility of a test method being mandated by OSHA in the future to eliminate confusion.

“Many products utilized are not properly certified—especially with respect to slip resistance. In fact, most products rely on ancient test methods that can’t determine the slipperiness of a surface,” cautions Ritchie.

Anti-slip certifications continue to evolve, with slip resistance standards changing as awareness of slip-and-fall accidents grows, according to Farias. Another area that impacts slip resistance is the popularity of sustainable materials and flooring. “Certifications and testing methods for slip resistance will probably consider the environmental impact of the materials, as well as their performance.”

“UL-certified laminates have been around for a while. With COVID-19 restrictions there were lots of new technologies in antislip films and options to choose from, some UL-approved. There is always room for improvement, and I would say we will see more and better options in the future for multiple floor surface applications,” shares Aldrich.

This is especially true in the U.S. “The testing in the U.S. has improved however it is not yet as demanding or as thorough as standards in Australia and Europe. Because of this there are many products being sold in the U.S. for floor graphics that would not pass in other countries,” shares Causey.

“In the last few years Americans have adopted the European standards for a more universal approach,” adds Bill Rothe, EVP clear sales, Better Life Technology.

That being said, Georgiou believes more materials are tested because the product choices are increasing. This is especially ideal for onestep floor graphic systems because it’s “easier for more PSPs to participate in confidently offering that application to their clients.”

In the Know

The various testing methods for anti-slip requirements on floor graphic material are vast and constantly changing, which is why print providers need to remain aware of the importance of COF when choosing floor graphic media, however this is not the only critical factor. “They need to know type of use—outdoor/ indoor, concrete/ title/carpet; traffic level; expected contaminants, maintenance, and wear; and manufacturers’ guidelines and recommendations,” suggests Ramos.

fic level; expecthow this applicachase space, visit

To learn more about anti-slip certifications and testing, new floor graphic substrates, and how this application is fairing in the display and point of purchase space, visit digitaloutput. net/webinars and tune in to our latest webinar. D ased on a report from Acumen Research and Consulting published in December 2022, in North America alone, the automotive wrap films market share was more than 35.8 percent in 2021. “This expansion is primarily the result of the presence of major automakers in the region. Color-changing advanced technologies and an increase in

by Digital Output Staff

research and development expenses by major influencers contribute to the expansion of the region’s automotive wrap films market,” states the report.

The study, Automative Wrap Films Market and Region Forecast, 2022 - 2030, also notes that the global automotive wrap films market revenue was worth USD

4,689 million in 2021. It forecasts the automotive wrap films market will be worth USD 28,344 million in 2030. That means a compound annual growth rate of 22.4 percent from 2022 to 2030.

Below) Fedrigoni Self-Adhesives Ri-Jet C50 Ultimate Slide & Tack is ideal for wrapping cars and vehicle fleets, thanks to its adaptability on irregular surfaces, such as bumpers, mirrors, and van corrugations.

To match demand, there must be material—whether that be color change films or substrates optimized for digital print. Unfortunately, the raw materials that make up the media—PVC, plasticizers, pigments, fillers, processing aids, and certain additives—are experiencing supply chain delays, which lead to pricing volatility.

Delays and cost obviously impact print service providers (PSPs) from doing their jobs. So how is it being remedied? New products that may not include certain components, older products revamped, and the use of material not specifically designed for the job at hand.

Committed Vendors

Supply chain challenges aren’t disappearing anytime soon. New product roll outs for media intended for vehicle wraps are influenced in a number of ways, however that hasn’t deterred vendors from continuing to advance the industry.

“The challenges over the last few years allow both customers and suppliers the chance to get creative in manufacturing and raw materials used but this comes with delays in the release of new products. Many manufacturers are also consolidating products. With that said, Mactac is launching new colors and print medias for wraps in 2023 as we continue to create high demand, innovative products,” notes Amanda Smith marketing communications manager, Mactac.

Matt Edwards, product manager for digital print media solutions, General Formulations, says new product roll outs are more than “responding to specific raw material delays or competition’s product shortages” and instead a “constant area of growth and improvement as part of a corporate direction to meet market demands and continue our own product and solution innovation.”

“That said, hearing of the outages and backorders puts pressure on us to fill orders faster and keep our house clean in terms of inventory and supply chain, and it puts pressure to provide new and different options. But with all of this, we need to stay focused on providing products that work consistently with the highest quality,” continues Edwards.

Fedrigoni Self-Adhesives is new to the vehicle wrap market, so it has a different spin on the current state of affairs. According to Melissa Harton, marketing manager, North America, Fedrigoni SelfAdhesives, the company began servicing the European market in December 2022 and at press time had not been impacted by supply chain disruptions.

“Currently, Fedrigoni Self-Adhesives’ cast vinyl for the vehicle wraps market are made with components that are readily available in Europe. At this time, Fedrigoni Self-Adhesives does not foresee major supply challenges for its materials and is eager to begin offering vehicle graphics to the North American market in 2023,” she continues.

Construction Focus

In response, new products are introduced that don’t require some of the raw materials that may be effected by the supply chain. Or even older products are re-introduced without the more challenging-toobtain components.

An example of an older product being revamped in response to the supply chain challenges—albeit not for vehicle wraps—is Mactac’s high-performance permanent wallNOODLE. The company announced the modification—a new, heavier liner—of the multi-print wall mural product in November 2022. According to Mactac, the new 90# stay flat polyethylenecoated kraft liner ensures customers more consistent and uninterrupted product availability.

“At Mactac we work with raw material suppliers of key components to come up with new products that meet our needs as well as bringing on other sources for the same material as a backup. This allows us to have a steady flow of materials needed to continue consistent production,” explains Smith.

Edwards cautions that “wrap films in general are precise chemistries that are not open to substitutions with ingredients, so formulations need to take into account the longterm availability of the components as well as a robust supply chain throughout. This contract negotiation process is not unlike how any ongoing business might operate to ensure consistency and quality.”

General Formulations continues to roll out new product. In August 2022 it announced GF 830 AutoMark Cast with DRIFT Technology. This premium, full-body gloss white wrap film is designed to meet the long-term demands of full or partial vehicle wraps as well as many other graphic applications. The DRIFT Technology and adhesive combination offer the right amount of adhesive tack and Micro Air Egress channels that make application quick, easy, and bubble free.

Getting By

In the face of adversity, print providers continue to prove their creativity. With supply chain issues, many are forced to rely on dated material or even material not specially designed for vehicle wraps to get the job completed.

Harton provides one example. “In the European market, we have seen printers/installers utilizing polymeric calendared films as opposed to cast vinyl for their total or partial wraps due to material cost savings. When using polymeric film in place of cast vinyl, installers often need to cut the film in complex areas such as vehicle recesses. Polymeric films are typically used for shortterm applications.”

“There is a somewhat natural tendency to make do with what we have on hand, hope for the best, and fix our mistakes if or when they become problems. If the exact solution you want is not available, you can check first for adjacent materials from other suppliers or similar materials, but always keep in mind the intended use and manufacturer’s recommendations for applications,” recommends Edwards.

Smith says in her experience, it is more about print providers stocking up on materials when they can to ensure they have the material they need when they need it. “Now the question is whether it is the right media for that specific application. That can be a risk the PSP may not want to take.”

Easing Up

It’s been difficult to forecast the ups and downs of the supply chain. Seemingly, anything that can happen has happened, but then again—should we be surprised when something else comes out of left field? The vendors interviewed for this article admit the situation is fluid.

“In most areas we’re already seeing the challenges improve; lead times have gotten shorter and materials are more readily available, but it changes every day,” explains Edwards.

“We believe the supply chain restraints will start to lighten in 2023 but nothing is certain,” adds Smith.

New Normal

Sourcing media used in vehicle wraps isn’t as easy as it was once was, and with the supply chain challenges not going away anytime soon, how PSPs navigate this odd time is up to them.

Product rollouts are influenced, either by being delayed or in the better scenario, the new product is designed without the raw materials that may cause delays. Older products are revamped to ensure consistent availability.

Also, PSPs—so many already trained to do more with less—rely on dated material or material not specifically used for vehicle wraps to get by. While this isn’t explicitly recommended for a host of reasons, it is a good stop gap to leverage inventoried media to its fullest until supply chain issues ease up.

Despite the challenges, vendors supplying vehicle graphic media continue to address demand by introducing new products as best they can. D