PORTFOLIO

As we round out 2024, we’re proud to present the December edition of Portfolio magazine.

It’s been a big year for RWC, full of challenges and triumphs, but as we head towards 2025 the commercial property market seems to be taking a turn for the better. We’d like to thank all of our clients for their support throughout 2024, and we hope to continue working with you for all your commercial property needs in the new year.

In the last edition of Portfolio for 2024, Ray White head of research Vanessa Rader discusses the prospect of a strategic buyers’ market, and whether now is the perfect time to purchase commercial property.

RWC property management performance specialist Leteicha Wilson provides some tips for preparing your commercial assets for the summer months and the inevitable storm season.

We also recap on November’s Between the Lines webinar. Hosted by Vanessa, she was joined by RWC Western Sydney director Victor Sheu and Coolamon Consulting director Bennett Wulff to discuss the future of the build-to-rent market in Australia.

James Linacre Head of Commercial RWC Australia and New Zealand

Hundreds of people tuned in to RWC’s November Between the Lines webinar, where a panel of experts discussed the build-to-rent market, an emerging market in Australia.

Ray White head of research Vanessa Rader was joined by RWC Western Sydney director Victor Sheu, and Coolamon Consulting director Bennett Wulff.

The build-to-rent (BTR) has been a hot topic in Australia in recent times as the market begins to grow.

“BTR is a very mature asset class in some overseas markets, but it’s very much still emerging here in Australia,” Mr Wulff said.

“Traditionally if you’re renting in Australia you’re renting from a mumand-dad investor, there hasn’t really been the opportunity to have an institutional landlord.

“BTR in Australia was defined in 2021 in the State Environmental Planning Policy for housing diversity, and that was the first definition that BTR had in the NSW

context which has gone some way with assisting with the emergence of BTR, particularly from a planning point of view.

“What it essentially is is large-scale, purpose-built, rental accommodation with a minimum of 50 dwellings, held for a minimum of 15 years.

“It’s a separate asset class to affordable accommodation, student housing, and co-living. They’re all from the same family, but BTR is private market rental.”

Ms Rader asked what the difference was between BTR and co-living and purpose built student accommodation (PBSA).

“BTR is a little bit less commercialised than co-living or PBSA,” Mr Sheu said.

“PBSA and co-living have a very specific mandate and a very specific target audience, and they both require operations management which BTR also requires, but your target audience is so specific.

“The size and scale of the projects are vastly different as well. When we talk

about co-living, or what used to be referred to as boarding houses, and PBSA, you’re usually talking about rooms to be held under one title and the goal is to keep them under one title.

“With BTR, while it is initially held under one title, there is potential, whether it be in 15 years or 20 years, to subdivide.”

With the current housing crisis being experienced across the country, Ms Rader said Australia was starting to see some desire from the government to have BTR as an option, with some subsidies and taxation breaks for offshore investment. She asked Mr Sheu if BTR was an asset class of interest for his clients.

“When we’re selling land, BTR has been in the discussion over the last couple of years, and it’s being assessed as one of the angles when people are looking at land and its highest and best use,”

Mr Sheu said.

“But when it comes to developers or delivery partners for these major institutions, they have a very specific mandate that they’re looking for to fulfil their pipeline.

“In essence, as Bennett mentioned earlier, we are in the infancy stage of BTR. BTR takes up less than one per cent of our total housing supply.

“If we’re talking about a goal of delivering 1.2 million dwellings by 2029, we’re talking less than 30,000 - it’s not a very large piece.

“So whenever they’re getting into assessing BTR as a final outcome, my clients are investor driven, so they are after a very secure project to own and a very secure investment to own at the end of the process, and there are a lot of blockages for BTR.

“Despite what we already know about interest rates and rising construction costs, BTR projects are usually quite large, and the amount of people looking at doing 50-150 dwellings is very minimal.

“At that scale point, if the project is well positioned enough, which is one of the requirements for BTR, people will just run build-to-sell (BTS) because that’s what people are used to, that’s what funders are used to, and that’s what banks are used to. And that’s one of the blockaids people are seeing in the BTR assessment.”

Ms Rader then asked Mr Wulff how his clients felt about the BTR market.

“There are barriers to any development, and planning certainly was one, but in 2021 we sort of had a watershed moment when BTR became its own thing and got its own definition,” Mr Wulff said.

“So what that’s enabled is some runway for BTR, and the NSW Government has been quite accommodating, for example there are some zonings where BTR can be delivered that BTS can’t.

“There are certainly efforts being made to unlock BTR.”

VANESSA RADER Ray White Head of Research

After a period of significant market correction and uncertainty, commercial real estate investors are faced with a compelling question: is now the time to step back into the market? Several key indicators suggest we may be approaching an opportune moment for strategic acquisitions across multiple asset classes.

The property clock shows many commercial sectors sitting in the trough phase of their respective cycles. This positioning traditionally signals a prime entry point for investors with longer-term horizons. While some may view current market conditions with apprehension, history shows that fortune often favours those who can recognize opportunity amid uncertainty.

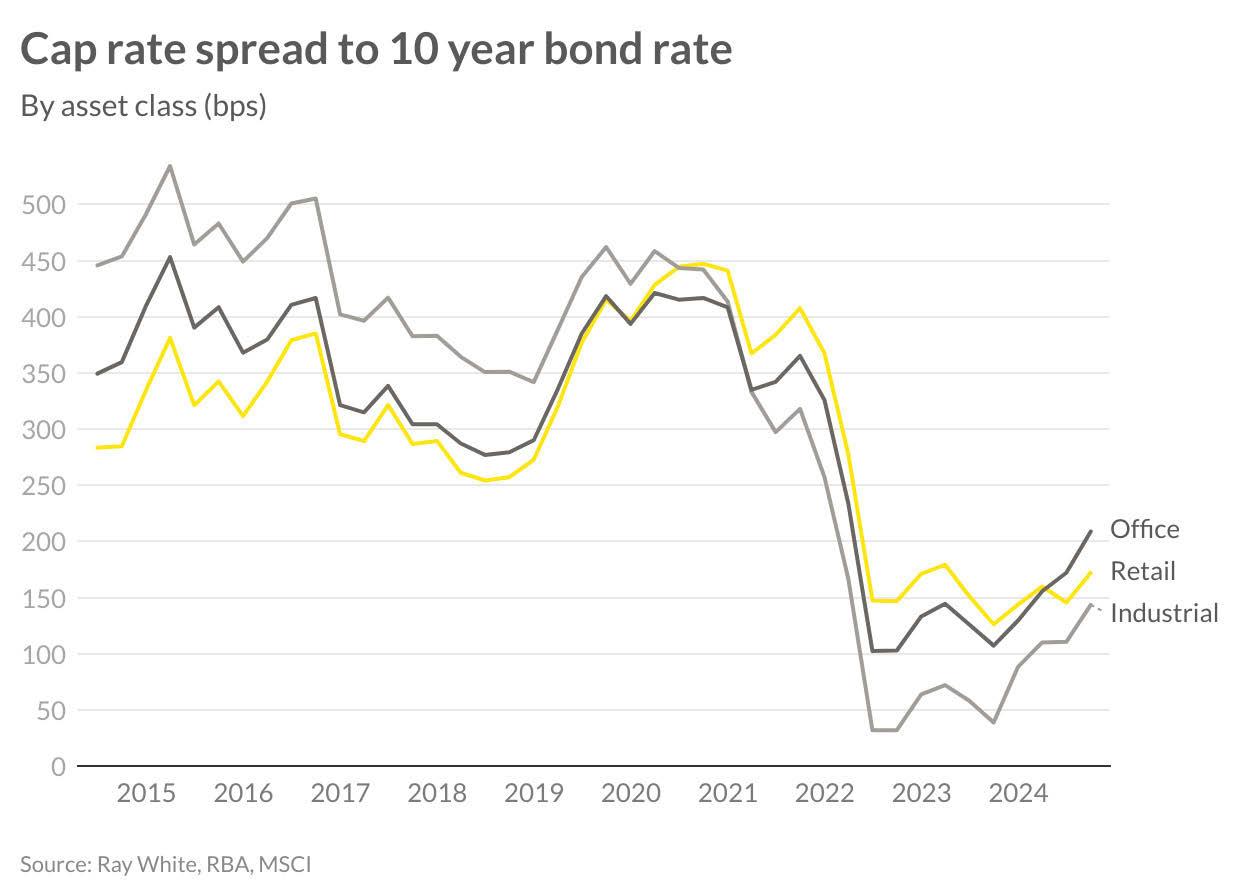

A particularly compelling indicator is the widening spread between capitalisation rates and government bond yields across all asset classes. This expanding spread suggests improved relative value compared to risk-free rates, providing investors with an attractive risk premium that has been expanding since late 2023. This trend stands in stark contrast to the compressed spreads seen during the peak of the market.

Each sector presents its own unique dynamics. Industrial property, despite moderating from its pandemic-driven highs, continues to demonstrate resilient fundamentals driven by e-commerce and owner occupier demand. The office sector, while facing structural challenges from hybrid work patterns, offers selective opportunities in premium, well-located assets that meet evolving tenant demands for quality space and amenities. Retail is experiencing a revival in certain submarkets, particularly in neighbourhood centres that have successfully adapted to changing consumer behaviours.

Alternative assets are emerging as increasingly attractive opportunities. Data centres and healthcare facilities, are benefiting from secular growth trends, while block of units, student accommodation and self-storage facilities are demonstrating strong defensive characteristics in the current market.

Capitalisation rates have expanded significantly across most asset classes, reaching levels not seen in recent years. These higher cap rates are creating attractive entry points, particularly when compared to the compressed yields of 2021-2022. While current returns may appear subdued, they’re showing signs of stabilisation – a crucial indicator that we may be approaching the bottom of the market cycle.

The risk-reward equation is increasingly tilting in favour of investors. Current pricing reflects many of the market’s concerns: higher interest rates, banking sector challenges, and economic uncertainty. This market correction has

effectively priced in much of the downside risk, creating a cushion for new investments. While further modest adjustments are possible, the dramatic repricing we’ve witnessed over the past 18-24 months appears to be largely behind us.

Looking ahead to 2025, the interest rate environment is expected to improve as central banks pivot towards more accommodative monetary policy. This anticipated shift could provide a significant tailwind for commercial property values, particularly for investors who secure assets at today’s prices with the ability to refinance at potentially lower rates in the future.

Furthermore, the current market presents opportunities for selective buyers to secure quality assets at attractive prices. Many properties that would have been out of reach during the market peak are now available at more reasonable valuations. Those who can identify assets with strong underlying fundamentals and clear value-add potential may find themselves well-positioned as the market cycles back into its recovery phase.

For investors with patient capital and a long-term perspective, current market conditions may present an opportunity that we’ll look back on as an optimal entry point. While uncertainty remains, the fundamentals increasingly suggest that now may indeed be the time to selectively re-enter the commercial property market.

LETEICHA WILSON RWC Property Management Specialist

As we lead into Summer, commercial property investors should be taking proactive steps to safeguard their assets against the risks of extreme weather, such as wild storms and dry conditions. A few preventative measures can make a big difference in minimising potential damage and costly repairs. Here are four key steps to consider:

Maintaining clean and clear gutters is essential for effective water drainage during heavy rain. Clogged gutters can cause water to overflow, potentially leading to leaks, flooding, and even structural damage to the building. By regularly clearing gutters and down pipes, you can prevent water build up and avoid major repair costs associated with water damage.

A thorough roof inspection can identify any vulnerable areas—such as cracks, loose shingles, or worn flashing—that could lead to leaks or structural issues during severe storms. Ensuring that the roof is in top condition before summer reduces the likelihood of costly emergency repairs and extends the overall lifespan of the property.

Dry summer conditions can make surrounding vegetation a fire hazard. Clearing away dry branches and trimming back trees near your building reduces both fire risk and the potential for storm damage caused by falling branches. Regular maintenance of the property’s landscaping can help

mitigate these risks, enhancing safety and reducing potential liability issues.

Checking your property insurance coverage is another critical step to prepare for extreme weather. Ensure your policy covers storm damage, flooding, and other natural disasters that could impact your property over the summer months. Reviewing the fine print now allows you to make adjustments if necessary, giving you confidence that your investment is fully protected against unforeseen events.

A proactive approach to summer maintenance is crucial, but keeping up with these tasks can be challenging.

A professional property manager can streamline this process, handling maintenance coordination, overseeing inspections, and advising on insurance reviews to help safeguard your property. By partnering with experienced property managers, you not only ensure that your asset is well prepared but also free up time to focus on your core investment goals, knowing that your property is in capable hands.

RWC manages properties across all asset classes right across Australia. Take a look at some of our top managements from across the nation. RWC will have a management specialist located right near your property, so enquire with us today.

MAREEBA, FAR NORTH QLD

Post Office Centre” in Far North Queensland with a NLA of 2133sqm*, anchored by Australia Post and Bendigo Bank.

SURRY HILLS, QLD

Located 250 metres from Central Station, this light-filled corner suite 101sqm* offers open-plan space, two private offices, and excellent transport connectivity in a prime, refurbished building. Perfect for businesses seeking visibility and accessibility.

CLEVELAND, QLD

This brand new property boasts an 80sqm* frontage with between 26,706 – 30,348 cars passing daily. Conveniently located opposite McDonald’s, BCF, and Pet Barn, the property adjoins a 7/11 Service Station, Supercheap Auto, and Bob Jane T-Mart, along with multiple leading national brands and is home to My Car, Lifeline and The Salvation Army.

COOPERS PLAINS, QLD

This centre is a fast food convenience centre located on a corner, high profile site totalling 3,054sqm* in the Brisbane suburb of Coopers Plains. The centre comprises a single-level building with 5 tenancies, including a drive-thru Hungry Jack’s.

Auction Wednesday 11 December 2024 at 10:00am (AEDT) Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Total approved GFA of 642sqm*

Prime corner setting in the heart of Cronulla

Zoning: R4 High Density Residential

DA approved plans designed by Avenue Studios

Offering a seaside lifestyle with quality amenities

DA approved for 5 x residential units across five levels RWC SC

400m* to Elouera Beach; 350m* to Cronulla Golf Club

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Henry Robertson 0420 414 580 henry.robertson@raywhite.com

raywhitecommercial.com

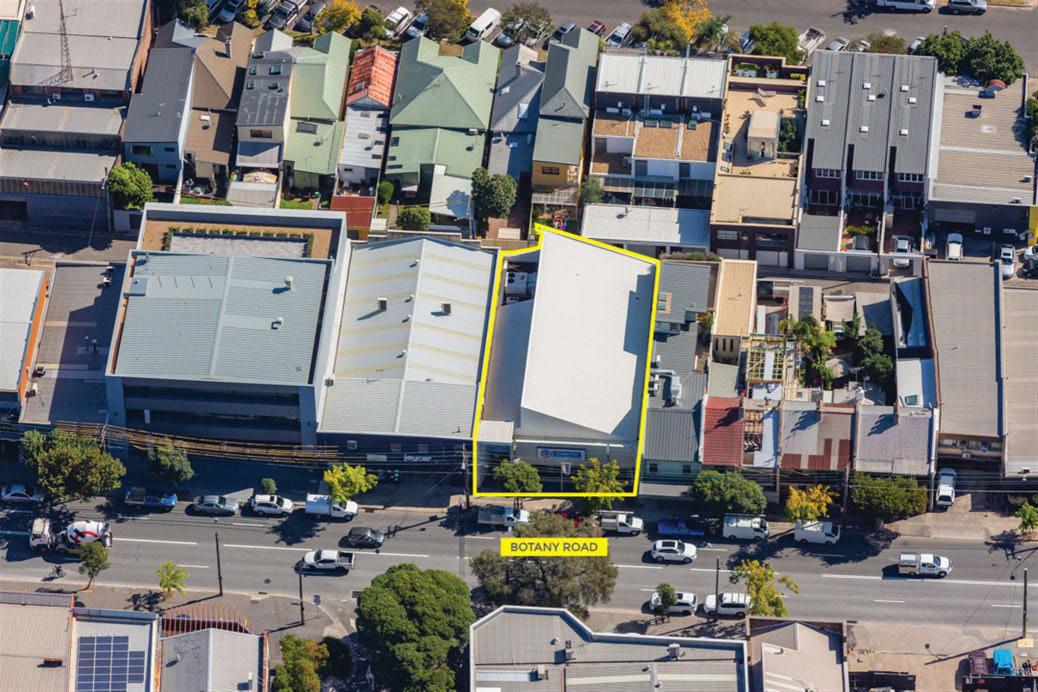

Building Area - 329sqm* | Land Area - 183sqm*

4 x lettable areas across three levels

Currently tenanted by two long-term tenants

Strong holding income with rental upside

Zoning: E1 Local Centre

Rear lane access via Little Oxford Street

Opposite the 'Oxford and Foley' development by TOGA

Wednesday, 11 December 2024 at 10:00am (AEDT)

White Corporate Office, Level 7, 44 Martin Place, Sydney

215-217, 221 & 223 Imlay Street, Eden, 2551

Auction Wednesday, 11 December 2024 at 10:00am (AEDT) Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

Zoning: MU1 Mixed Use

Existing DA approval for hotel and residential towers

Outstanding ocean views on completion

Approved GFA of 14,226 sqm*

Over 100m* of street frontage to Imlay Street

Site area - 9,975sqm* RWC SC

20km* to Merimbula Airport

Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

Nick Ward 0433 702 903 nick.ward@raywhite.com

raywhitecommercial.com

2 O'Reilly Street,

Auction Wednesday, 11 December 2024 at 10:00 (AEDT)

Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

CC ready boarding house site with at-grade parking

Site area - 809sqm*

Zoning - R4 High Density Residential

FSR - 0.8 : 1 | Height Limit - 11m

DA approved for 39 rooms over five storeys

CC documents ready

At-grade parking with minimal excavation required

Estimated fully leased rental income - $889,200 p.a.*

Leslie (Yifu) Li 0403 261 752

Samuel Hadgelias 0480 010 341

Troy Wang 0433 051 020

RWC SC

raywhitecommercial.com

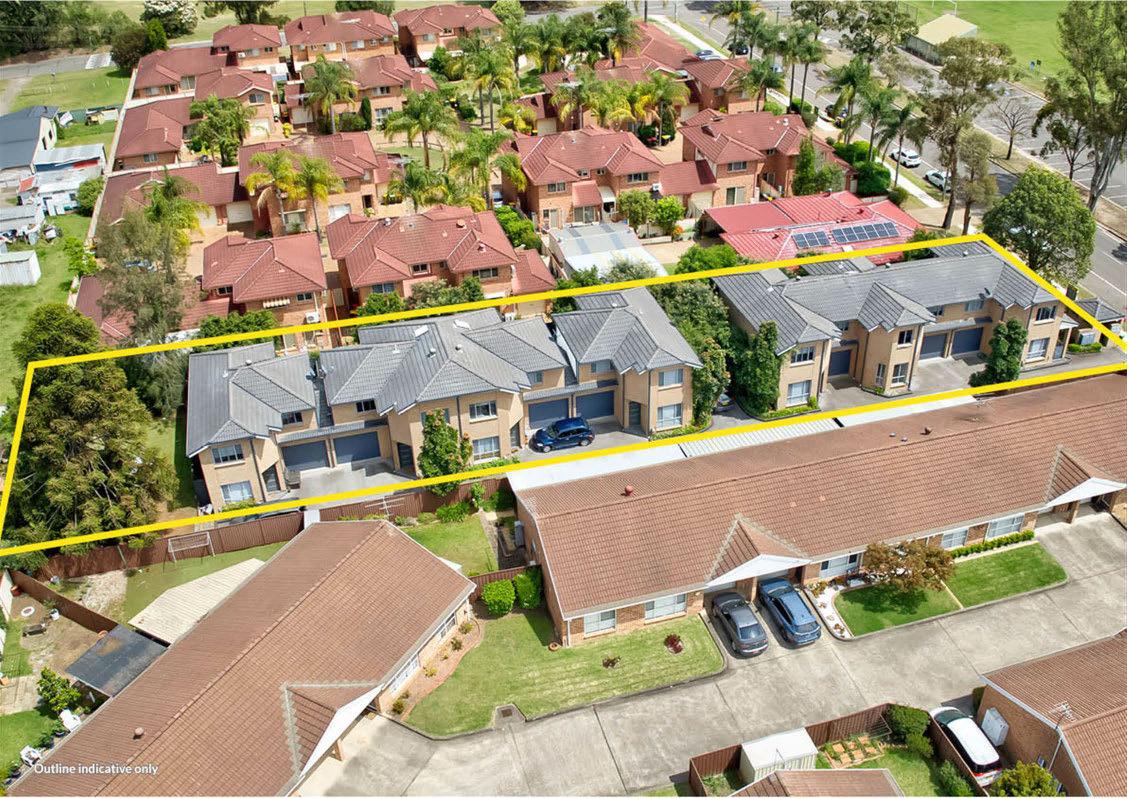

Land size: 1,475sqm*

Strata titled

Zoning: R3 Medium Density Residential Current rental income - $171,600 p.a.* Auction Wednesday, 11 December 2024 at 10:00am (AEDT) Ray White Corporate Office, Level 7, 44 Martin Place, Sydney

7 x 3-bedroom townhouses offered in one-line raywhitecommercial.com

Low outgoings

Significant rental reversion potential

Zoning: E2 Commercial Core

350m* to Sutherland Station Prime corner location on Eton Street with high visibility

7293-7295 & Lot 1, 7385 Federal Highway, Yarra, 2580

Expressions Of Interest Closing on Wednesday 11 December 2024 at 4:00pm (AEDT)

DA approved for 11 lots

RU1 Primary Production Zoning

Existing improvements: residential home, sheds/dams

1,250m* frontage to Federal Hwy with high exposure

20 min* drive to Goulburn town centre

Large 286 hectare* landholding RWC SC Samuel Hadgelias 0480 010 341 shadgelias@raywhite.com

High growth area with significant infrastructure projects

Henry Robertson 0420 414 580 henry.robertson@raywhite.com

raywhitecommercial.com

High

Designated parking to for each unit

Full

110 Audley Street, Petersham, 2049

•Zoned E1 - Local Centre

•Gross annual income - $164,310*

•Iconic corner with character-building

•Four tenants, all on current leases

•Rear and side access, off-street parking for two cars

Suite 1002/50 Margaret Street, Sydney, 2000

50 Margaret Street overlooks Wynyard Park positioned on top of Wynyard train station. Excellent natural light and expansive views, end of trip showers and lockers in basement. On site parking and loading dock. 4.5 star NABERS water rating. 5 star NABERS Energy Base Building rating. Vision Personal Training in the rear of ground floor lobby. Naked Duck Cafe now open in the main lobby.

•Brilliant natural light from this north facing suite

•Brand new spec fit out now completed

•Ready to occupy featuring reception

•10 pax boardroom, 6 pax client meeting room

•2 x 4 pax internal meeting rooms

•30 workstations, 2 focus rooms, large kitchen

•Breakout area with collaboration areas

2-14 Elsie Street, Burwood, 2134

Discover a versatile selection of strata office suites, available for sale, ranging from 60 to 860 sqm to suit businesses of all sizes.

Ideal for businesses seeking a lively community and modern amenities, Elsie Suites is perfect for hosting clients, events, or establishing your second home. Experience the convenience and vitality of working in one of the most sought after locations in the Inner West.

Elsie Suites, with DA approval and a builder appointed, is on track for completion by July 2025.

40 Gymea Bay Road, Gymea, 2227

RWC Greater Sydney South is proud to present an exceptional opportunity to purchase this solid freehold property in the tightly held Gymea high street. This asset will be available to purchase via Auction on Tuesday, 10th December 2024.

Key features to highlight include:

•Prominent street frontage in Gymea's bustling shopping precinct

•Extremely attractive position surrounded by Gymea's best food offerings

•Ability to lease retail & residential areas separately

•Rear access with two car spaces and large storage at the rear

Auction Auction Tuesday 10th Dec 6pm at Cronulla RSL

Brad Lord 0439 594 121 blord@raywhite.com

Rodney Clarke 0452 273 384 rodney.clarke@raywhite.com

RWC Greater Sydney South

raywhitecommercial.com *Approx

7 Kiama Street, Miranda, 2228

RWC Greater Sydney South is proud to present a rare opportunity to acquire a unique, freehold property located at 7 Kiama Street, Miranda. Offered for the first time in almost 40 years, this asset will be available to purchase via Auction on Tuesday, 10th December 2024.

Key features to highlight include:

•Secure freehold factory on significant land holding (1,347m2*)

•Solid 950m2* building with ground & first floor amenities

•10* car spaces with additional hardstand for loading/unloading

•Electric sliding gate entry with fully fenced hardstand

•Significant secure income with lease expiry Jan 2026

Auction 10th December, 6pm at Cronulla RSL

RWC Greater Sydney South

Brad Lord 0439 594 121 blord@raywhite.com

Rodney Clarke 0452 273 384 rodney.clarke@raywhite.com

Calling all night club and food and beverage operators to seize the opportunity to establish your brand of entertainment in this ready to go venue in the heart of city. With a loyal customer base and tourist hotspot of Cairns, the venue has been successfully operating as an R&B night club for many years but lends itself to various entertainment sectors.

Current set up includes extensive indoor bar, dance floor, seating booths plus outdoor covered verandah bar overlooking Lake Street.

Entrepreneurs already operating in this scene should enquire about our attractive leasing terms available and then get ready to turn the music on.

•Mostly open plan 495sqm* holds up to 320* patrons

•Large covered verandah bar overlooking Lake Street

588 Bruce Highway, Woree, Cairns, 4868

RWC Cairns is excited to present a compelling investment opportunity for the first time: a fully leased, two-level office building at 588 Bruce Highway, Woree, Cairns. This property represents a strong acquisition choice, making it an attractive addition for investors seeking a reliable and straightforward investment for their property portfolio.

Property highlights:

Land area: 809 sqm

Building area: 492 sqm

Onsite car parks: 15

The building features a well-designed layout and has undergone recent extensive modernisation.

208/67

$76,875 p/a

5

Second

Samuel Hoy 0423 795 273 samuel.hoy@raywhite.com

Charlee Livesey 0431 135 900 charlee.livesey@raywhite.com

Troy Sturgess 0432701600 troy.sturgess@raywhite.com

Michael Nides 0468 517 956 michael.nides@raywhite.com

Troy Sturgess 0432 701 600 troy.sturgess@raywhite.com

Chris Massie 0412 490 840 chris.massie@raywhite.com

RWC Northern Corridor Group raywhitecommercial.com

•664 m2* floor area

•Combination retail, office and workshop tenancies

•1,434m2* site area

•16 onsite car parks

•Fully tenanted with vacant possession available

Ideal for:

•Owner occupier

•Fast food / drive-thru

•Medical / allied health

•High profile office or showroom

33 Adler Circuit, Yarrabilba, 4207

Sizes ranging between 37m2* up to 276m2*

Warehouse access via remote control high roller door

CCTV security with 24/7 BTB monitoring

Secure gated complex with remote access

Ability to drop up to 40 foot containers on-site

Leasing opportunities available by negotiation

Titled and ready to occupy

79-81 Mica Street, Carole Park, 4300

Mica Place is superbly located at Carole Park in Queensland, comprising 5 freestanding industrial facilities.

•5 freestanders, 1,214 to 1,606 sqm*

•Secure tilt panel construction

•Column-free warehouse space

•Motorised container height roller shutters

•Air-conditioned offices with quality finishes

•3-phase power

•Generous parking and marshalling

•Brand new with depreciation benefits

•Expected completion Q4 2025

65 Bunya Avenue, Bunya Mountains, 4405

RWC Toowoomba is proud to offer to the market this 'one of a kind' investment opportunity.

•The Bunyas Tavern - Bistro, Restaurant, Coffee Shop & Australia's Highest Whiskey Bar

•The General Store & Bottle Shop

•Motel - 2 x studio apartments & 4 x 2-bedroom units

•3-bedroom managers' residence and adjoining 2bedroom unit (first floor)

•The building located at the south-west corner of the property is not included in the sale

•Land size 5,764sqm*

•Located in the heart of the Bunya Mountains, with spectacular rainforests and walking tracks

•Lease price: $122,423.16p.a + Outs + GST (leased until 15th April 2026, with 5-Year Option)

Paul Schmidt-Lee 0499 781 455

paul.schmidt-lee@raywhite.com

Logan Sattolo 0497 497 722

logan.sattolo@raywhite.com

RWC Toowoomba

raywhitecommercial.com

322sqm* concrete tilt unit

31sqm* air conditioned front office

5/21 Duntroon Street, Brendale, 4500 Container height electric roller door access

259sqm* warehouse Auction 10:00am Fri 13 Dec 2024 Short term lease

3 phase power & 3 exclusive parking spaces

Ben Sands 0432 547 164 ben.sands@raywhite.com

AJ Calvet 0488 113 270 aj.calvet@raywhite.com

Ben Sands 0432 547 164 ben.sands@raywhite.com Peter Laoudikos 0422 118 288 peter.l@raywhite.com Large 3,143sqm* rectangular site with 30m* frontage 1,400sqm* total combined lettable area Fully fenced and secured with 29 car spaces available 27 Counihan Road, Seventeen Mile Rocks, 4073

Only 3 tenancies remaining, 150m2*, 250m2* & 500m2* 1045

Due for completion Q2 2025*

Anchored by Viva Leisure (Club Lime)

Great opportunity for allied health providers

Main road exposure with 47,000* cars passing daily Sale/Lease

Franz Stapelberg 0430 655 676 franz.stapelberg@raywhite.com

Nicolas Milner 0416 433 217 nicolas.milner@raywhite.com

and

65sqm* first floor office including board room

2

136sqm* near new office/ warehouse Gated complex with CCTV surveillance, intercom, remote access

Maclay Kenman 0490 196 600 maclay.kenman@raywhite.com

Stephen Ferguson 0412 803 244 stephen.ferguson@raywhite.com

4-5/10 Miltiadis Street, Acacia Ridge, 4110

Total GFA of 392m2

Leased for approx $61,926.01 PA ( as at 16th December 2024)

Long term tenant in place - Austates Pest Equipment Pty Ltd

Excellent location - just off Beaudesert Road in Acacia Ridge

Popular and tightly held Unit Complex

Sale Price on Application

Luke Wray 0402 042 171 luke.wray@raywhite.com

RWC Southwest

raywhitecommercial.com

3/32 Success Street, Acacia Ridge, 4110

Unlock the potential of your business with this exceptional industrial/warehouse property located in the heart of Acacia Ridge.

Spanning an impressive 540sqm, this versatile space is perfect for a variety of industrial applications, offering both functionality and convenience.

Key Features:

•540m2 of office/warehouse area

•Excellent access to major arterial roads

•One of only three in the complex

•Being sold Vacant Possession

•All items approximate

Sale Price on Application

Luke Wray 0402 042 171 luke.wray@raywhite.com

Retail A/1056 Dandenong Road, Carnegie, 3163

•Leased to world renowned operator "Panda Hot Pot"

•Long term lease until 2041 (commenced 15th Feb 2021)

•Income of $182,334* p.a. plus GST plus Outgoings (From Feb 2025)

•Total building area | 481m2*

•High-visibility main road location with 60,000* cars passing by daily

•Coveted Commercial 1 Zone (C1Z)

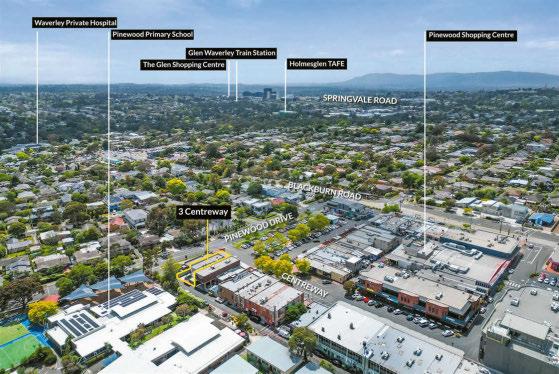

3 Centreway, Mount Waverley, 3149

80m2 Net Lettable Area (NLA) for your business needs

High visibility with foot traffic and plenty of parking

Versatile space, ideal for a variety of business types

Renovated, ready to move in and start trading

Strategic location within the busy Pinewood precinct

Lease Contact Agent

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Vincent Daniele 0428 272 887 vincent.daniele@raywhite.com

RWC Glen Waverley

raywhitecommercial.com

228-230 Station Street, Thomastown, 3074

Prime Corner Location with Endless Possibilities

High-visibility location ideal for showcasing your brand

Flexible, adaptable layout to suit a wide range of business needs

Generous 520sqm with showroom and growth potential

Zoned Industrial 3 with 3-phase power

Lease

$90,000 PA + GST and Outgoings

RWC Glen Waverley

raywhitecommercial.com

Ryan Trickey 0400 380 438 ryan.trickey@raywhite.com

Will Jonas 0422 883 011 will.jonas@raywhite.com

10-40

A truly once in a generation opportunity

9 adjacent properties on Bay View Terrace

3,250m2 site area with 60m of street frontage

Joint venture opportunity with owner or outright acquisition

Brett Wilkins 0478 611 168 brett.wilkins@raywhite.com

Andrew Woodley-Page 0438 939 869 andrew.woodley-page@raywhite.com

9BirminghamDrive, Middleton,Christchurch,8024

Sale DeadlineSaleClosing4pm Wednesday11thDecember 2024(unlesssoldprior)

Standoutfromthecrowdwiththisappealingstandalone warehouse/office/showroom buildingonahigh profile cornersiteinthepopularbusinessprecinctof Middleton. Modern,lightandbrightpremises consisting ofindividual offices,meeting rooms,storage,kitchenand full amenities. Thisversatile buildingisadvantagedby havingdualstreetfrontage,10onsitecarparks,rear containerrollerdooraccess,3phasepower,heatpumps andsecurity system. The buildingconsistsofa showroomof54.75m2*, offices (over2levels)of 108.80m2*,warehouseof305m2*plusundermezzanine storageof16.1m2*andmezzanineof 34.5m2*. Total buildingarea519.15m2*. Allowneroccupiersand investorsmakesureyouputthisdesirablestandalone buildingatthetopofyourlist.

PaulaRaine +64272214997

paula.raine@raywhite.com

RWCChristchurch

rwcchristchurch.co.nz

3aMichelleRoad, Sockburn,Christchurch,8042

Tidy,modern,industrialbuildingpreviouslyusedfor engineeringsohasgood3phasepowersupply(200 amps)andgantryrails.PopularSockburn location close toWigramandmajorarterialroutes,makingitagreat location toservicethecity from. Versatile, clearspan warehousewithcontainerheightrollerdoor.Strong seismic rating 99%NBSand150mmthick floor. Warehouseareaof565m2*, office/amenities of 175m2*.Totalbuilding740m2*.Sunny,northeasterly aspect.Secureexternalcompressorshed.Securitygated yardarea,previouslyapprovedbyMPIasa transitional facility.14carparks.Averypresentablebuildinghaving beenrefurbishedandrepainted.Anexcellent opportunitynowforanowneroccupieroraninvestorto leaseout.

rwcchristchurch.co.nz