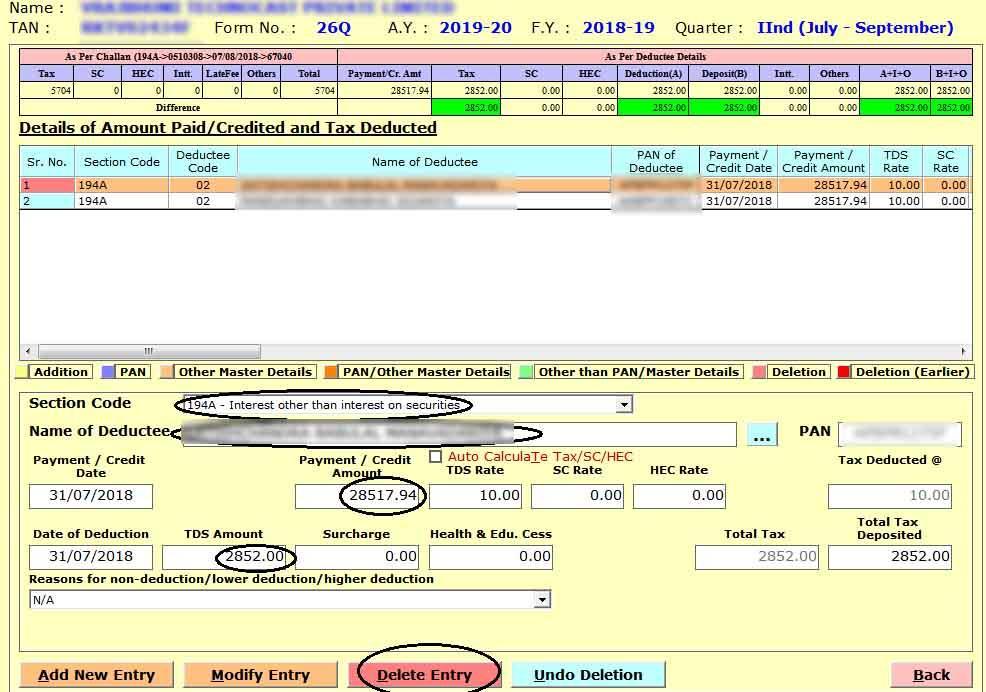

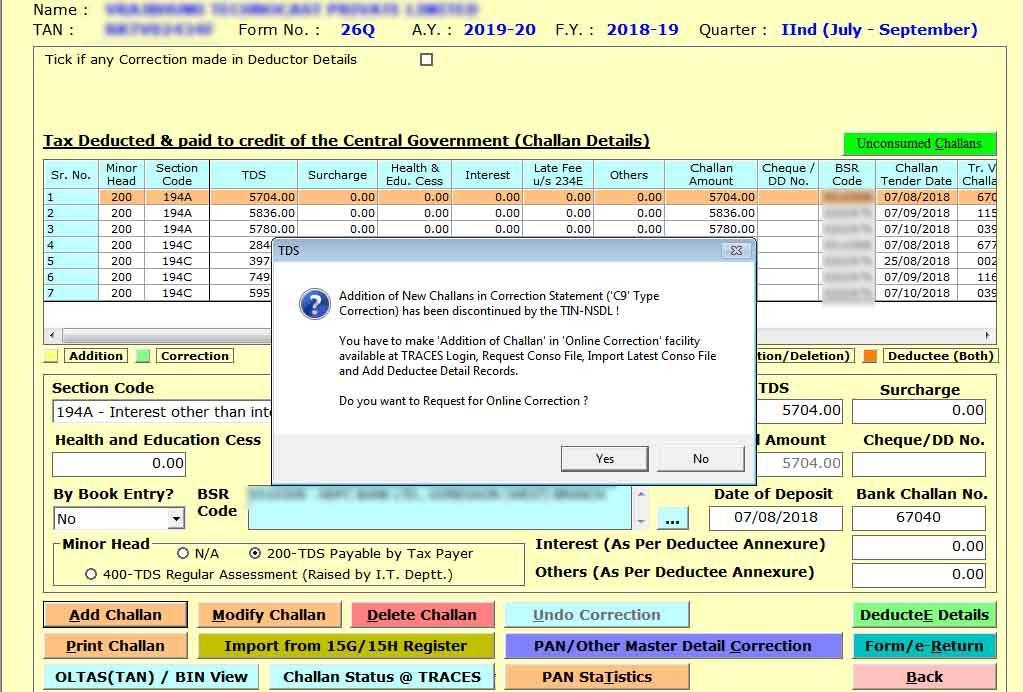

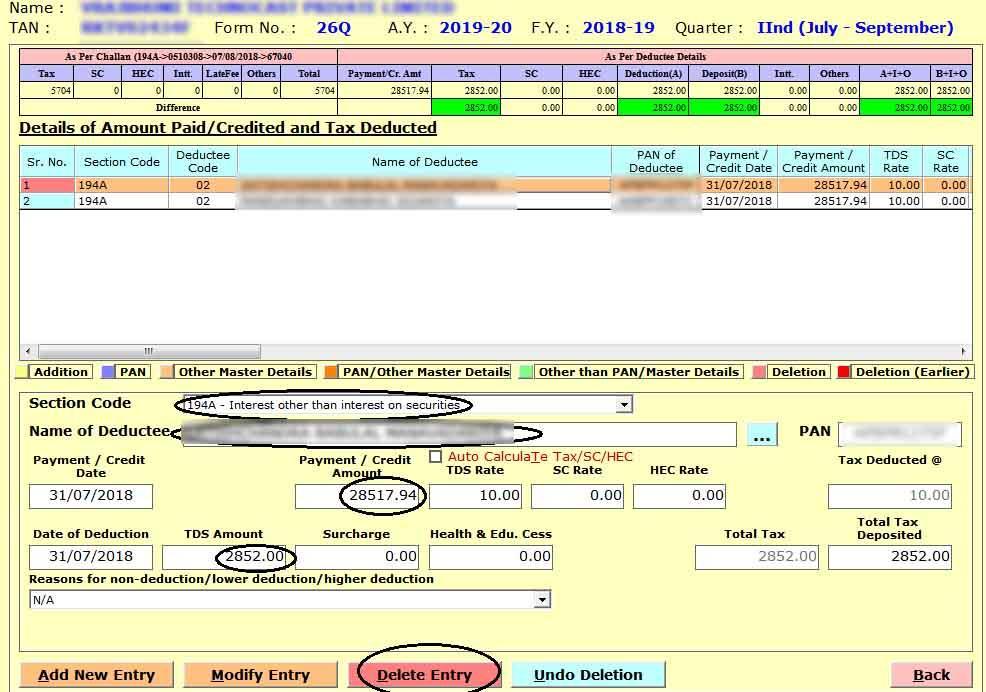

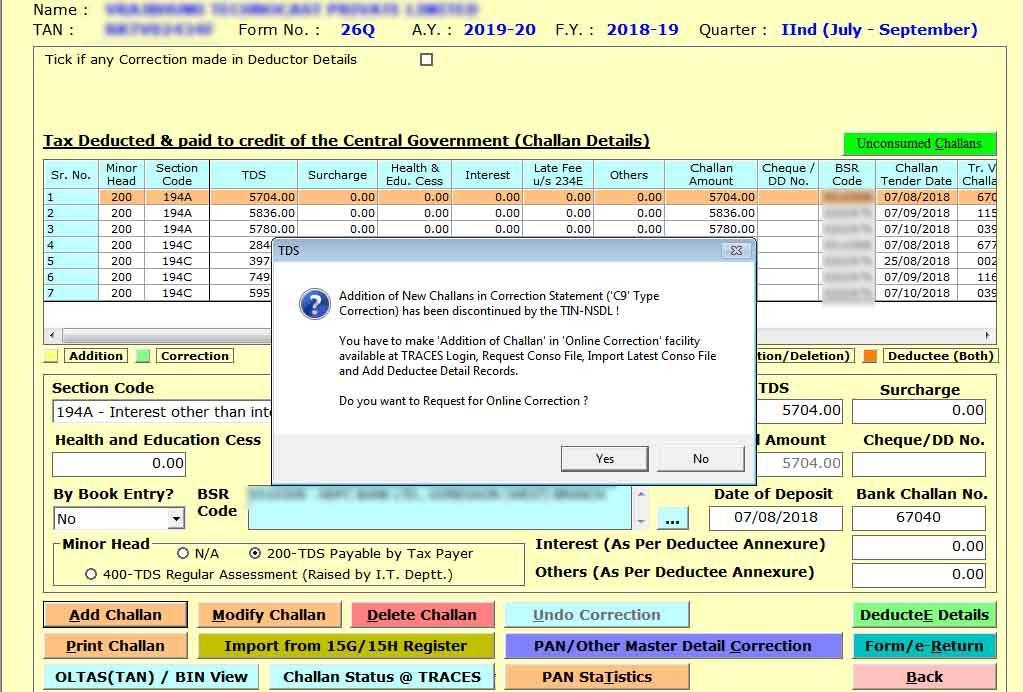

When filing TDS returns with NSDL, one may find that they seem to be incorrect. Errors could be caused by a variety of factors, such as incorrect deductions, incorrect challan information, or incorrect PAN information. It is necessary to amend the TDS/TCS return for the case in question. Here is a simple guide for correcting 4 types of mistakes with Gen TDS return software. Many corrections have been made to 24Q and 26Q reports, PANs, amounts, and many other items.