16 minute read

WORLD ANIMAL FOUNDATION 8

Grace Pavone is an animal lover who wanted to give a voice to those who do not have one. Grace made the kind-hearted and thoughtful decision to include a number of animal charities in her Will, as she is a strong believer in helping as many animals around the world as possible. She also wanted to make sure the charities she supports in life can continue to do the important work she is so passionate about. In many ways, Grace is your everyday Aussie doing what she can to help those less fortunate than her. But she’s also part of a small, yet growing, community of people who know the incredible difference their legacy can make. Here is her story in her own words. “My decision in 2013 to bequest World Animal Protection was an easy one. One I am proud and honoured to have made. World Animal Protection work tirelessly to defend and protect voiceless animals of all species, all sizes and every issue worldwide.

This work is carried out by teams of amazing and dedicated people (both on the field and behind the scenes) who see the horrors but have also achieved significant changes over the years for animals, including the importance of educating and raising public awareness. I am in awe of them. I’m confident, that through my gift, this work will continue to expand and that my one voice will be one of millions to make one big voice for all animals in need of attention and action by World Animal Protection.

Advertisement

Maybe the COVID-19 global pandemic highlighted that those animals have a rightful and respectful place on our planet that we all share. I hope this has inspired others to re-evaluate and consider a gift in their Will to make a better world for all animals.”

How we can help you with making your Will

There are many ways I can help you create a lasting legacy. You can call or email me direct using my details below. I’d love to hear from you, and will guide you as best I can. Or you can also visit worldanimalprotection.org.au/ support-us/bequest The World Animal Protection bequest booklet has all the information you need, and you can request one by contacting me or visiting the website. If you already have a solicitor, the bequest booklet has all the information they need to update your Will and include a gift to World Animal Protection. If you don’t have a solicitor, you may like to visit Bequest Online Wills (website). They offer a free consultation with a legal profession and can guide you in making a Will it is good to have the information in your hand to give to them when you are making your Will. You are under no obligation to leave a gift in your Will to World Animal Protection, and if you do make the generous decision to do so you can remain anonymous. I understand how personal the choice is to leave a gift in your Will, and I thank you for taking the time to read more about how your gift could make a difference to animals around the world. By leaving a bequest to World Animal Protection, you can become an animal protector forever and leave a legacy in honour of those we share the planet with. Thank you, and please reach out if you would like to chat.

For more information on how to leave a gift in your Will, please contact me on 02 9902 8057 or email JMeredith@ worldanimalprotection.org.au or scan the QR code on the right.

Which Equity Release solution is right for you?

With rising living costs and an increasing desire amongst baby boomers to take financial control of their retirement, there is a growing interest in Equity Release products to help fund financial goals.

Fortunately, there are several ways you can access the wealth accumulated in your home when you need it. The available options generally fall in to two categories – debt-based and debt-free strategies. A debt-based option is a loan product, where you borrow against the equity in your home. Repayments are not required, and instead the interest charged by the provider will be capitalised against the loan over time, adding interest to the loan amount you have borrowed. Such loans are not required to be repaid until you sell your home, or you pass away. Debt-based solutions come in different forms – you may borrow the funds via a reverse mortgage product offered by private providers or take up the loan scheme offered by the Government (previously referred to as the Pension Loan Scheme). The amounts available via a reverse mortgage and the Government loan scheme may be less than via a debt-free strategy and the interest rate charged will be higher than traditional home loan rates, given the nature of the debt. A debt-free option is not a loan, and as you don’t borrow money, there is no capitalising interest costs over time. Repayments don’t apply, and instead the entitlement of the provider is capped so you can protect a portion of the equity in your home into the future. You can also sell your home at any time, or the provider will receive their entitlement when you pass away, and your home is sold. Whichever option you may be considering, it is a big decision with lasting ramifications, and it is important that you make the right decision for your circumstances. Homesafe Wealth Release® is the popular debt free equity release solution for homeowners to access the wealth in their homes. Homesafe is not a reverse mortgage or a loan product and is specifically designed to provide protections for homeowners for the life of the arrangement. For over 16 years, Homesafe (in partnership with Bendigo & Adelaide Bank) has provided a tried and tested solution which has assisted thousands of homeowners by focusing on providing a safe and secure equity release option. As the popular alternative, the Homesafe option is a part sale property contract, where a homeowner receives a lump sum cash amount today and in return agrees to sell a capped share of the future sale proceeds of the home. Homesafe will only receive its share of the sale proceeds, usually many years down the track, when the homeowner chooses to sell or after they pass away. A special and unique feature of the Homesafe Contract ensures if the homeowner sells earlier than anticipated, due to a unique feature, Homesafe will often receive less than the agreed capped share and the balance is returned to the Homeowner at time of sale.

As an example, John and Jasmine^ from Greensborough in Victoria, approached Homesafe in 2010 as they were keen to pay out the remaining balance of their home loan and to buy a new car. Both John and Jasmine were at the end of their working lives and keen to retire completely, but their home loan was holding them back. “We were so pleased to find Homesafe 11 years ago. We had worked hard our entire lives and our home was our most valuable asset. We had raised our family in the same home, and it held special memories for us. With Homesafe, we could pay off the mortgage and become debt-free for the first time in our lives. The bonus was the purchase of a new 4WD, which made our retirement so much more interesting!” John and Jasmine approached Homesafe to access approximately $150,000, and in return sold Homesafe 40% of the future sale proceeds of their home. The amount they received was less than 40% of the value of their home in 2010, as the difference was the unique early sale rebate feature, which remained available to them if they sold their home earlier than Homesafe anticipated. “We really liked the capped share approach. From the day we received the funds, we knew that we would keep at least 60% of the sale price of our home when we eventually moved on, and that we could also receive some of the share sold to Homesafe if we needed to sell earlier. This peace of mind was priceless when making our decision”. In late 2021, due to health reasons, John and Jasmine decided to sell their beautiful home. As the Contract had not been in place for as long as initially anticipated, when they sold the home, they received approximately 70% of the sale price of their home – being the share they retained, plus some of the Homesafe share due to the early sale rebate. “The decision to sell our home last year was the biggest decision we have needed to make in many years. When everything was finalised and we knew how much we would receive at settlement, it reinforced to us, we made the right decision to go with Homesafe”.

How can I make an enquiry with Homesafe?

The team at Homesafe offer personalised service by phone initially, and a no-obligation meeting with a Homesafe Mobile Specialist in the comfort of your home is organised to ensure you can receive all the information you – and your family - need to make an informed decision For more information on how Homesafe has helped baby boomers to payout debt for over 16 years, contact Homesafe on 1300 307 059 or visit

www.homesafe.com.au.

*Terms, conditions, and eligibility criteria apply. Homesafe Wealth Release™ is available in 90% of eligible postcodes in Melbourne & Sydney. ^Actual customer story with names changed for privacy reasons.

Little Mahalia has known the four walls of a hospital for her entire life.

She spent the first five years of her life in severe pain due to a rare genetic condition.

Her severe and complex condition causes problems with her organs, and Mahalia relies on a tube to eat. She also lives with a developmental delay and anxiety, requiring regular appointments and therapy from specialists at the Queensland Children’s Hospital.

Mahalia has sadly been prevented from having a ‘normal’ childhood, and her mum, Kristie, worries what the future will hold. “When I started researching the condition, I was so unsure what her life would be like. Some kids with her condition don’t walk, talk or live independently. That’s hard to read as a mum,” Kristie said. To manage her condition, Mahalia has an extensive and diverse team of dedicated specialists, including Dr Anita Cohn, a paediatrician at Queensland Children’s Hospital. She works with Mahalia’s family to help her get the very best out of life and is determined to give her a healthy childhood and steady future. “I want her to enjoy those normal childhood things she’s missed out on because of the nature of her condition,” Dr Cohn said. During her time in hospital, Mahalia and her family were supported by Children’s Hospital Foundation, who believe that all children deserve the greatest possible care.

Children’s Hospital Foundation services help to make being in hospital as destress-free as possible, with Kristie describing the services as a ‘god-send’.

Helping just one sick child’s life is worth doing everything possible. Imagine the opportunity to help thousands of children’s lives for many years to come. A gift in your Will helps work wonders for kids like Mahalia, now and long into the future.

Donate TODAY to work wonders for sick kids

Your kindness will fund life-saving research, medical equipment, and provide support and entertainment for sick kids and their families.

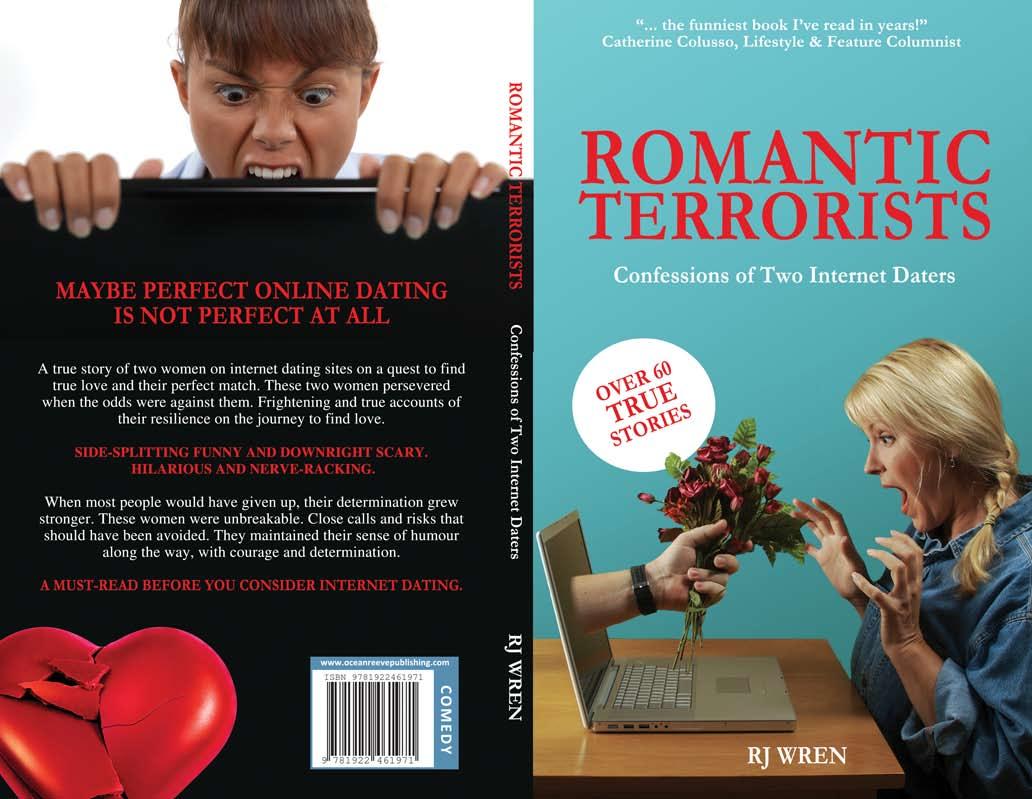

BOWLING & LIFESTYLE MAGAZINE ARE GIVING ONE LUCKY READER THE OPPORTUNITY TO WIN A COPY OF RJ WREN’S LATEST BOOK

CONFESSIONS OF 2 INTERNET DATERS

Simply email us at sales. bowlingandlifestylemagazines@outlook.com First email receives a copy

Maybe perfect online dating is not perfect at all? A true story of two women on internet dating sites on a quest to find true love and their perfect match. These women persevered when the odds were against them. Frightening and true accounts of their resilience on the journey to find love.

Side-splitting funny and downright scary. Hilarious and nerve racking.

“ROMANTIC TERRORISTS’’ is a must read for anyone who is considering Internet Dating. Or is internet dating. This book is a true story of two women on internet dating sites, on a quest to find true love and their perfect match. When most people would have given up, their determination grew stronger. These women were unbreakable. Close calls and risks that should have been avoided. However, they come across an eclectic mix of murderers, scammers, thieves and liars along the way, which adds to their determination and makes the women stronger... Book Review by Catherine Colusso Pre-order copies by emailing –Limited edition sales.bowlingandlifestylemagazines@outlook.com

COPIES AVAILABE ONLY FROM sales.bowlingandlifestylemagazines@outlook.com Cost $19.00 including postage

HISTORY MADE AS BPL14 TEAMS ARE ANNOUNCED

BY VAL FEBBO Three new franchises, a plethora of squad changes and a historic selection highlight the lead into the Bowls Premier League’s 14th edition on the Murray in February. Among the changes is the return of five-time Commonwealth Games gold medallist and seven-time World Champion, Alex Marshall, who is one of five players to claim multiple MVP honours at the BPL. Marshall will re-join the Brisbane Pirates, who have made a trio of changes to its squad from BPL13 in April. New Zealand Blackjack, English Commonwealth and World Champion Ellen Falkner makes a maiden appearance in the competition in addition to Pine Rivers’ seven-time club champion, Chris Rosanes. The Perth Suns will make history in Moama as the first team in BPL history to enter a tournament with two women in its squad, as WA stars Cody Packer and Kristina Krsticmake their long awaited return to the tournament to join Dawn Hayman, who retains her place in the team following her impressive efforts in Brisbane earlier this year. With the Gold Coast Hawks’ return to the BPL, fourtime champion and three-time tournament MVP Aron Sherriff will make the switch from the Sydney Lions to accompany former Jackaroo Nathan Rice and Kelsey Cottrell, who jumps across from the Pirates. With Sherriff departing the Lions, the Sydney franchise welcomes Aaron Wilson to join Karen Murphy and Ben Twist. BPL13 runners-up Moama Steamers have also made a solitary change, with Kevin Anderson moving from the coaching seat to the green to team up with two-time MVP Ryan Bester and Jackaroo Natasha Van Eldik. The home side will look to join the Tweed Heads Ospreys and Lions with three championships. Reigning back-to-back champions, the Ospreys, will retain the trio of Aaron Teys, Corey Wedlock and Chloe Stewart, as will the Adelaide Pioneers with Katelyn Inch, Wayne Ruediger and two-time MVP Scott Thulborn. The Melbourne Pulse will also head to the Murray with the same lineup of Barrie Lester, Gary Kelly and Ellen Ryan, while new franchise Melbourne eXtreme will field Carla Krizanic, Matthew Flapper and Ali Forsyth. Finally, the eXtreme’s fellow debutants, the Tasmania Tridents, have confirmed Rebecca Van Asch, Taelyn Male and Mark Nitz as its squad for BPL14. #BPL14 will run from February 21-25, 2022 and will be broadcast on Fox Sports, Kayo and Sky Sports NZ.

See below for the full ins and outs for each BPL franchise:

Adelaide Pioneers: Scott Thulborn, Wayne Ruediger, Katelyn Inch Coach: Les Carter

No Change

Brisbane Pirates: Alex Marshall, Ellen Falkner, Chris Rosanes Coach: Michael Breen In: Marshall, Falkner, Rosanes Out: Jeremy Henry, Kelsey Cottrell, Aaron Hewson

Gold Coast Hawks: Aron Sherriff, Kelsey Cottrell, Nathan Rice Coach: Anthony Kiepe

Returning Franchise

Melbourne eXtreme: Carla Krizanic, Matthew Flapper, Ali Forsyth Coach: Kelvin Kerkow

New Franchise

Melbourne Pulse: Barrie Lester, Gary Kelly, Ellen Ryan Coach: Jeremy Henry

No Change

Moama Steamers: Ryan Bester, Natasha Van Eldik, Kevin Anderson Coach: Ryan Burnett In: Anderson Out: Michael Walker

Perth Suns: Dawn Hayman, Kristina Krstic, Cody Packer Coach: Pieter Harris In: Krstic, Packer Out: Trystan Smallacombe, Ray Pearse

Sydney Lions: Karen Murphy, Ben Twist, Aaron Wilson Coach: Steve Glasson In: Wilson Out: Aron Sherriff

Tasmania Tridents: Rebecca Van Asch, Taelyn Male, Mark Nitz Coach: Mark Strochnetter

New Franchise

Tweed Heads Ospreys: Aaron Teys, Corey Wedlock, Chloe Stewart Coach: Wayne Turley

No Change

p: 0422 920 753. e: justbowls@hotmail.com www.justbowls.info

BOWLS AUSTRALIA NOMINATED FOR SPORTS AUSTRALIA MEDIA AWARD

BY VAL FEBBO Bowls Australia (BA) has been nominated for the accolade of Best Depiction of an Inclusive Sport as part of the 2021 Sport Australia Media Awards. With over 300 entries across all categories for the delegating committee to cast its eyes over, BA’s continuous work promoting the inclusivity and diversity of the sport proved a strong candidate for the award through channels such as The Bowls Show, ‘The Right Line’ podcast and the organisation’s website. BA has been nominated alongside four other entrants, including award winning filmmaker Peter Dickson for his documentary ‘The Ripple Effect’, exploring the ongoing mental health effects of racism. 2020 winner Amanda Shalala has been nominated again, as have journalists Megan Maurice and Mary Konstantopoulous. BA CEO Neil Dalrymple is elated with the recognition by Sports Australia, and aims to continue showcasing the inclusivity that bowls provides to the community across the nation. “I am delighted that we have been recognised for the 2021 Sport Australia Media Awards, as they are a prestigious accolade for any recipient.” Dalrymple said. “The depiction of inclusivity across our channels is something that we value dearly, as bowls is one of the most inclusive sports across the globe. “It can be played by all ages, abilities and cultures with tools that can aid any bowler to participate on the green and inclusivity is a value that we are extremely proud of.” BA Communications and Marketing Manager Aidan Davis said the organisation was humbled to be in contention for the coveted honour amongst esteemed company. “Being recognised by Sport Australia for this prestigious award is testament to the many incredible people involved within the sport of bowls from all walks of life and across the breadth of the country, with deeply rich stories and lived-experiences that are crying out to be told to help inspire the next generation of Australians to pick up a bowl, jack and mat and fall in-love with a game that is intrinsically and iconically Australian. “Simply being selected, particularly among such an esteemed company of influential journalists and media outlets, highlights the inclusive nature of bowls, as a sport that can be enjoyed equally by men and and women, young and old, able-bodied and disabled, regardless of ethnicity, and showcases the work being done to tell those stories, and will no doubt help Bowls Australia continue to shine a light on important people and initiatives, regardless of the ultimate outcome in March.”