Real Estate Snapshot – A look at the mid-year market numbers – where it stands compared to other years and where it is going

21 Got Montecito?! – Take a tour through the many neighborhoods and residential nooks of Montecito

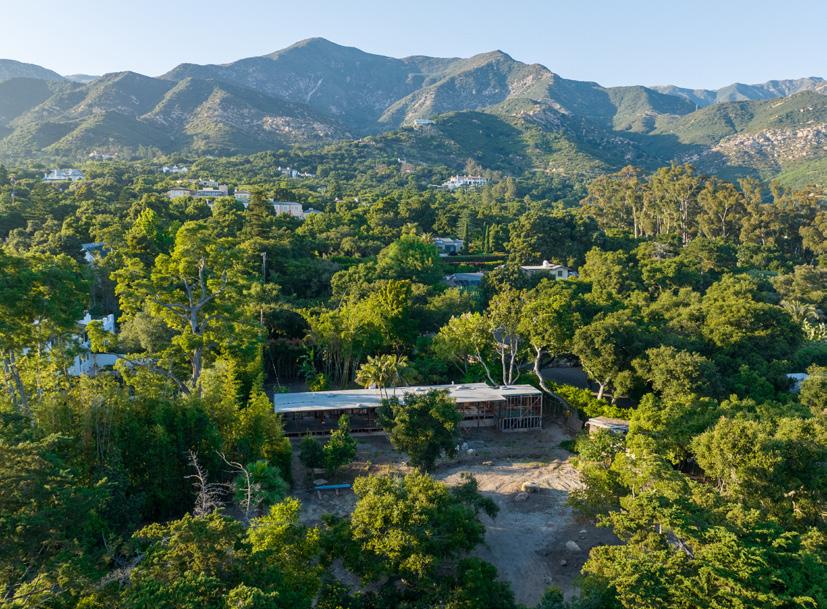

26 Renovation Situation – Whether you’re making indoor or outdoor alterations, these are the considerations for making a “House” a “Home”

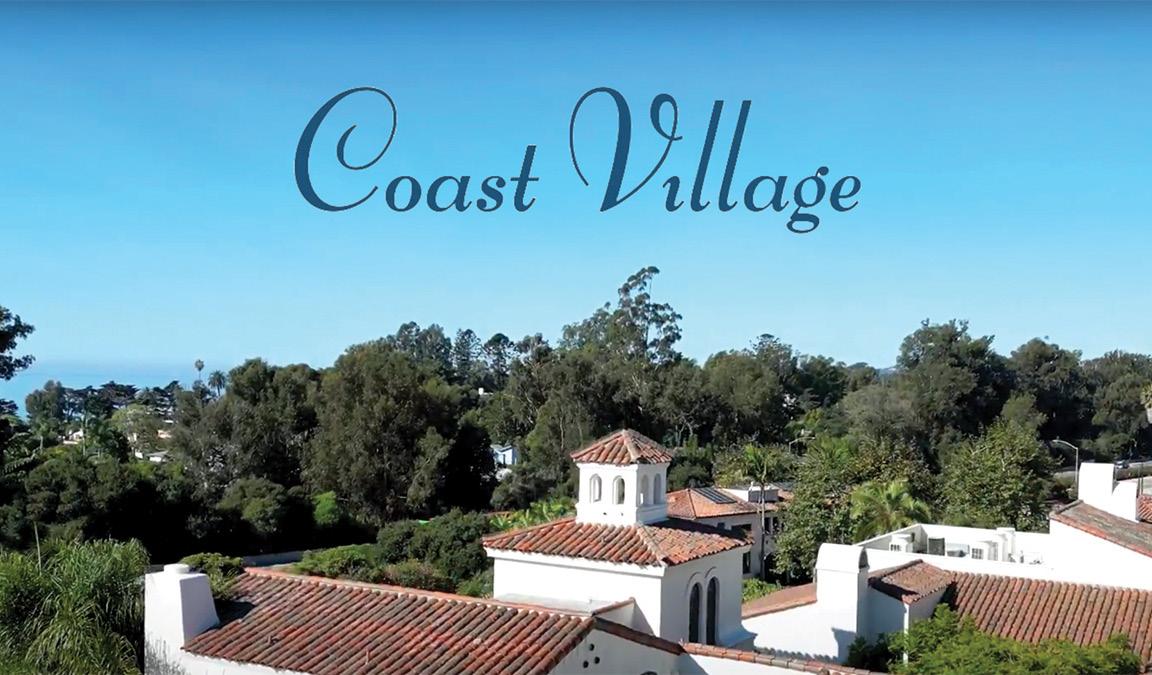

40 CVA’s Journey – Te CBID is in process along Coast Village Road – here’s what’s happened so far and what’s in store

46 Estate Afairs – From the contractor doing your kitchen remodel to your beloved (if slobbery) Pyrenean Shepherd – your Estate Manager is on the case. Put your feet up.

62 Specialty Loans – If you are buying or selling a home, loans are a key part of making it happen, and here are some options

64 Insurance Matters – Here is a look at the homeowners insurance market, along with some practical tips and considerations for one’s own plan

66 Commission Concerns – A recap of the ongoing battle between the United States Department of Justice and the National Association of REALTORS®

72 Should I Stay or Should I Go – Te Golden State comes with its price, but what if you don’t want to claim it as “home” for tax purposes

AS REPORTED IN THE

5 BEDS 5.5 BATHS 10.8 ACRES

2 CAR GARAGE POOL & SPA | | | | 5200 E CAMINO C IELO $3,495,000

Bursting with character, this mountain retreat ofers quintessential Spanish architecture, vintage themed botanic gardens blending seamlessly with the natural surroundings. Hot tub & waterfall pool create an oasis, all presiding over the most spectacular panoramic mountain views over the Santa Ynez Valley. Built by esteemed architects Grifn and Crane, this classic home is positioned for maximum privacy on over 10 picturesque acres. Tastefully updated over the years to retain the original character of both the home & gardens, this secluded oasis celebrates mountain and lake views from both levels, opening up to small patios, terraces, lawns & multiple garden areas with raised vegetable beds & fruit trees. Exceptionally versatile foorplan presents dual living opportunities with each level ofering its own living/dining rooms, outdoor entertaining areas, and bedrooms. Time slows down here and allows a peaceful tranquility to mesmerize the senses. Tis unique and very special property awaits your arrival.

Congratulations to The JJD Group for being named to the Forbes “Best-in-State Wealth Management Teams” 2024 list, published on January 9, 2024. Rankings based on data as of March 31, 2023.

The JJD Group

Merrill Lynch Wealth Management 1424 State Street Santa Barbara, CA 93101

805.963.6302 fa.ml.com/jjdgroup

2024 Forbes “Best-in-State Wealth Management Teams” list. Opinions provided by SHOOK® Research, LLC and is based on in-person, virtual and telephone due-diligence meetings and a ranking algorithm that measure best practices, client retention, industry experience, credentials, compliance records, firm nominations, assets under management and Firm-generated revenue (investment performance is not a criterion because client objectives and risk tolerance vary). SHOOK’s rankings are available for client evaluation only, are not indicative of future performance and do not represent any one client’s experience and available for investor help in evaluating the right financial advisor and not an endorsement of the advisor. Compensation was not received from anyone for the rankings study. Past performance does not guarantee future results. Details available at the SHOOK Research website. SHOOK is a registered trademark of SHOOK Research, LLC.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) is a registered broker-dealer, registered investment adviser, and Member SIPC. Bank of America, N.A., Member FDIC and MLPF&S are wholly owned subsidiaries of Bank of America Corporation.

© 2024 Bank of America Corporation. All rights reserved. MAP5911614 | AD-05-24-0482.C | 472538PM-0124 |

We are experts in staging and selling the full contents of your home — from furnishings and décor, to art and personal effects.

Knoll top California Hacienda on approx 5 acres. This Custom built gated and private retreat is just minutes to town. Dramatic great room greets you upon coming into the home from the Front courtyard. Additional features include Alder hardwood floors thru out, Vintage French tile floors in the Kitchen/Family room, Wine room, Media/library and a office/flex space. Primary suite is on the main level with direct access to the pool & spa. Several covered loggias, one with a fireplace; spill out to the terraces and gardens. Stunning pool & spa. The ultimate indoor-outdoor California lifestyle. The dramatic views include: Coastline, White Water, Islands, Harbor, Mountains, Valleys, Polo Fields. If one desires there are Approved plans for expansion/renovation including a new infinity edge pool. This coastal ranch also has a avocado orchard.

by Kelly Mahan Herrick

As we approach the middle of 2024 and the end of Q2, it’s notable that as of this writing there are currently 192 homes and PUDs (planned unit developments, i.e. single-family homes within an HOA) on the market in the South Coast of Santa Barbara, which spans from Goleta to Carpinteria. We have not seen inventory this high since October 2020, when the real estate market was extremely active due to 3% interest rates, work-culture shifts due to the pandemic, and an influx of new buyers in our area, again, driven by the pandemic. This is very welcome news for homebuyers, who have been challenged with low inventory, high prices, and high interest rates for the last few years.

Median sales price remains high: $2.25M year-to-date through May, which is up from $2.1M in 2023. The average sales price YTD is $3.5M, which is up 6.7% from 2023.

In May we saw the closing of 81 sales of single-family homes and PUDs, which is the exact same number as April. This is really encouraging, as we are seeing sales numbers pick up across all price points compared to earlier in the year. This indicates a healthier market all around: When inventory and sales both increase, it means both sellers and buyers are active in the marketplace, which is ideal.

Year-to-date, we’ve seen the closing of 518 homes, PUDs, and condos on the South Coast. In 2023 that number was 461, in 2022 that number was 584, and in 2021 it was 814. In a pre-pandemic year, we’d expect to see about 575 homes close in the first five months of the year. We are inching our way back to normalcy.

One of the key markers that indicates the heat of the market is the number of days on market, or DOM. The average number of days on market at the end of May was 34 days, which is slightly higher than what it was last year (28). This bump in DOM allows inventory to accumulate more than last year, but buyers should still be aware that well-priced, appealing homes are still selling with multiple offers.

Our median sales price – reflecting only the sales in May 2024 – was an impressive $2.6M, compared to $2.3M in May 2023 and $2.1M in May 2022. This is due in part to a handful of high-end sales, including a $21.5M sale on Padaro Lane. The continued rise in values shows that we still suffer from basic supply and demand issues in the Santa Barbara area: We have a backlog of pent-up buyers who are still searching for a home, and nearly 40% of sales in the last month were cash sales; those buyers are not affected by the current 7% interest rate. On the supply side, even though we are enjoying more inventory than in the last few years, we are still well below what would be considered a “normal” buying and selling environment. Right now we have 233 homes, PUDs, and condos actively listed and not in escrow. In pre-pandemic years, it would be expected that we’d have 500 properties on the market by the beginning of the summer.

Let’s look at condos: so far this year there have been 119 sales in the South County, compared to 112 last year. Active and new listings are up, while median list price and average sales prices are down. The median sales price for condos is now $925K, compared to $915K this time last year. The median list price ($924K) is lower than the median sales price, reflecting the multiple-offer situation on the majority of new, well-priced listings.

The number of days on market in the condo segment remains similar to last year: 29 days on average. This number was nearly half (14) in both 2022 and 2021. The luxury condo market has slumped this year, with only five luxury condos trading hands. Last year there were 8 in the same time period, and in 2022 that number was 18.

Thus far in Montecito, we’ve seen the sale of 54 homes and condos in the MUS and Cold Spring School districts, which is nearly the same number as last year. In 2022, that number was 103, and in 2021, it was 174. Sales ranged from a $1.7M 1-bed/2-bath condo on Fairway Road to a $36.8M sale of a 19,000-square-foot estate on Park Lane.

Median sold price in Montecito for the first half of the year is $5.8M, up from $5M in 2023. Average sold price is $8.7M, up significantly from $6.5M. The first half of the year there were nine sales over the $10M mark, compared to 10 sales in the same timeframe last year and a whopping 14 sales over $10M in 2022.

Notable sales include 303 Meadowbrook Drive, which closed for $9.6M after 455 days on the market; 1530 Mimosa Lane sold in March for the third time in four years; and a home on Santa Elena Lane sold in February for $8.5M, making it the highest-priced sale in Montecito Oaks, ever.

by Mark Ashton Hunt

When we say “Montecito” nowadays, that word carries a lot more weight to those outside our realm than it did five years ago. Before the Rosewood at Miramar caught the eye of L.A., and before we all knew the term “working remotely.”

More than the perception of Montecito as it has long been, a land of the “known” people residing here, I dare say the magic of Montecito is as much the land, the topography, the creeks, beaches and climate that have created a nature preserve where we all are fortunate enough to live, work and play.

Multiple mountains rise up just a mile or two from the ocean’s edge, where surf spots ignite when the swell is right. Undulating foothills provide outstanding, panoramic ocean views, while the hiking and biking trails and creeks that lace through town keep things feeling just a li’l bit country. Yet, Lucky’s, Tre Lune, and other stellar culinary experiences are just down the road.

I offer that the rural feel of the greater Montecito area comes also from the fact that many of our 93108 homes are built on half-acre or one-acre or even larger parcels, thanks to our early planners. Hopefully we can keep Montecito as she is and not “neighborhood up” by lot-splitting into oblivion. This “space” is what makes the place, if I may say.

Even with some of the most expensive homes in L.A., you are on a small lot with others homes not 20 feet away, right out your bedroom window. In many areas of Montecito, we average just one or two homes per football field.

For perspective, a football field is about 1.3 acres.

Beyond our natural advantages, I challenge you to find a town to live in that is as beautiful, well located and popular as Montecito – a village whose many basic conveniences are nevertheless surrounded by our natural wonders. Montecito is a place where, on a Monday at 2 pm, a person (me) can accomplish seven errands – from home driveway to out-and-about and home again – in a scant 47 minutes (true). Dry cleaner, juice bar, Pavilions, post office, gas station, car wash... the outing even included a relaxed coffee and greeting-card purchase at Pierre Lafond on my way home.

If you live here in Montecito or have ever looked at houses in the area, you are likely aware that there are many different neighborhoods within Montecito’s greater 93108, each offering their own charm, advantages, and distinct personality. From Fernald Point at the beach, to Eucalyptus Hill overlooking it all, to the historic estates, open spaces and creeks near Cold Springs Road, through the Golden Quadrangle and toward the ranches and multi-acre view homes along Toro Canyon Road, it’s all good in this ’hood.

While writing about these many neighborhoods, I do apologize in advance if you feel I’ve left out any area or gotten the vibe wrong. I’ve grown to know the best of each area over my 22 years living here, visiting family in Montecito and Mission Canyon since childhood, raising our daughter here, and being in and out of dozens of homes on as many streets in town.

What follows is a brief, yet hopefully thorough tour of Montecito and her greater 93108. We will start on the west side of Montecito, on the edge of Santa Barbara, then continue through central Montecito, the beach and hills, and onto the private gated communities and the more rural homes and estates in East Montecito. While Montecito is within the 93108 zip code, not all homes within the 93108 are within the Montecito school districts. Check with schools for attendance requirements. If you are currently looking for a home in Montecito, I hope this overview is helpful in defining an area that might suit you (or your pocketbook) best, and I am here to help if you need a guide through the process of buying (or finding) a home in the area. Please note that some properties featured may go into escrow or sell outright before you read this, and others may have a price reduction in time. And though the lending rates are at a 15+/- year high and first-time buyers who need a loan are often at a loss, Montecito continues to contradict the idea that higher rates affect purchase prices, as many purchases are all cash here in the 93108.

Through the first six months of 2024, the 93108 has held steady in terms of sales numbers and still strong with sales prices, from entry-level homes to estates, with multiple

Hill Road – $16,500,000 – Built in 2020, this 6,300+ sq. ft. chateau in the hills is impressive all the way from the street to the ocean view. Great close-to-town location, impressive flag lot with motor court, ocean, city lights and harbor views, a pool, 2,000-bottle wine room, and more.

homes selling each month in all price ranges. That said, we are, for the first time in years, seeing multiple price reductions on some listings before those homes find a buyer. Keep your eyes on my www.montecitobestbuys.com for 93108 listings, as I feature many homes on the market and update constantly between my articles here in the Montecito Journal. Please note that in the tour that follows, there are three homes priced at $7,495,000, so compare and decide which one you like best for the buck. Enjoy the tour.

Connecting the Cold Spring School / Westmont College area to the views along Alston Road, with the city, beaches and entertainment of Santa Barbara just around the

corner to the west, and Montecito’s Lower Village nearby, Eucalyptus Hill neighborhood homes are coveted for their location and views. Rolling foothills, commanding vistas, historic properties and new or remodeled view estates abound, mixed with more affordable ($3M’s and up) homes here and there. Homes in this neighborhood may be in the Cold Spring or Cleveland School Districts depending on street and location.

In this neighborhood, just north-ish of Eucalyptus Hill is the Cold Spring School neighborhood, which includes properties in and around Cold Spring School, Westmont College, and Lotusland. Smaller, low-traffic neighborhood streets (Chelham, Paso Robles, etc.) with smaller homes, rest at the foot of larger homes and significant historic estates along East Mountain Drive, Cold Springs Road, Ashley Road and others.

Real Estates Page 244

Just west of the Cold Spring area is the neighborhood known as Riven Rock, where homes rest on the site of a once-historic property, long since imagined into a fairy tale of a neighborhood with winding streets, larger lots, privacy, and an old-world feel (or so I opine). Signature hedged lanes and low-traffic streets with stone walls line the neighborhood. The street that runs from the Hot Springs Trail past the Riven Rock neighborhood is named Riven Rock, but many homes on the east side of that street are not within the Riven Rock hedged walls. The featured home here is one of these homes, just a few doors from the estates along East Mountain Drive.

Sycamore Canyon is a neighborhood (as well as a main road) that stretches from the intersection at Middle Road and Hot Springs near the Lower Village, connecting most of Montecito to the Cold Spring and Eucalyptus Hill areas, and the backroads into Santa Barbara. Along Sycamore Canyon and Camino Viejo (also in this area) are small lanes with homes on lower-traffic streets. This area is very convenient to everything – arguably a central taking-off point before heading north, south, east, or west. From here it’s just a few minutes to wherever you are going in the 93108.

Just below and beside Sycamore Canyon Road and above Alston Road, Pepper Hill proudly rises, offering lovely ocean views in one area and amazing mountain

Real Estates Page 304

The condo market in Montecito has been extremely slow, with only three condos trading hands so far this year. Last year that number was nine. The sales this year included a condo in Bonnymede, one in Montecito Shores, and one on Fairway Road. Average number of days on market for these sales is 18; condos in Montecito are a hot commodities these days.

Sales are healthy in Santa Barbara proper so far this year, with 255 homes, PUDs, and condos selling as of press time. This is compared to 216 in the same time frame last year. Sales ranged from a $710K 1/1 condo on State Street at Alamar to a $9.1M home on Mission Ridge.

The median sales price in Santa Barbara is $1.8M, and that does not include Hope Ranch. In Hope Ranch, sales slumped; there have been only eight sales in the semi-rural enclave so far in 2024. Normally we’d see about double that number of sales. In Real Estate Snapshot Page 424

by Jeff Wing

“Home.” It’s complicated. Home is where the heart is, and where you hang your hat. Home is where – when our best intentions go astray – the chickens come to roost. Are the words House and Home interchangeable? Only loosely. “House” is a structural term, an object subject to space, time, and mortgage amortization. “Home” speaks to something infinitely deeper and is not necessarily structure-dependent. When Home and House do indeed intersect, those four walls and a roof comprise a safe, loving harbor. This essay will assume this happy intersection and use the word “Home” to mean “House.” On the topic of Home Renovation, we are indeed entering the realm of bricks and mortar (that old couplet); as well as cabinetry, countertops, windows, doors, and the musical-sounding HVAC (Heating, Ventilation and Air Conditioning), and much more. Home Renovation is in fact a sort of catch-all that could mean anything from regrouting the shower stall to adding a room. What’s that? You’d like to know the etymology of the word itself? Oh… thanks for asking! Its derivation is Latin – renovationem – from the Latin verb novare, “to make new.” The prefix “re” – also Latin – means “again.” To renovate is to “make new again.” …you still there?

People renovate their homes for many reasons – to freshen the milieu, to address dissolving structural issues, or to pointedly prepare a home for sale. One thing that

bears mentioning is the misapprehension that an owned home is a de facto investment, and that a renovation of any kind, whatever the immediate motive, is necessarily an improvement of that investment.

A house is only an investment if you buy it with a concrete plan to sell it, along a planned timeline and having paid due diligence to forecasting the home’s projected value going forward in order to minimize risk and optimize profit. Yes, houses in the U.S., generally speaking, do tend to appreciate over time. But to actualize that gain as profit, you of course need to sell the house. That means – unless you plan to take monies from the house sale and nomadically wander the world (or become a renter)

Situation Page 284

– you will be putting the money earned from the sale into yet another home. This is called trapped equity, because you’ll necessarily need to shift that earned liquid equity into another property. You’ll realize a profit from that initial investment (your sold home) only if your next home purchase is for a house of lesser value. And unlike other “investments,” owning a home comes with what are called carrying costs. That is, apart from the brute value of the home, there are ongoing expenses related to ownership; property taxes, homeowner’s insurance (!), utilities, and, yes, renovations. Replacing flooring, doing the roof, replacing or upgrading windows and doors… each of these things could cost you (or likely tens of thousands) of dollars.

Renovations are truly realized “value-adds” only in the context of a sale, and then those accrued renovation expenses need to be factored over time and considered bites taken out of the home’s appreciation.

Three- or four-thousand dollars a year in improvements (and this is barring something major like a roof replacement or kitchen overhaul) comes to $30k (as per other articles) over a decade. But won’t those renovations be reflected in an even higher-than-market valuation of the home? Maybe, but maybe not. Home values fluctuate and are subject to a constellation of factors having to do with zip code, the condition of surrounding properties, economic vagaries, and so on.

Your house is inarguably a shelter, and if you’ve played your cards right, a lovely and gratifying Home. But its carrying costs, and the fact that improvements may or may not add value at sale, make a home a somewhat amorphous investment if your plan is, principally, just to have a place to live.

Which is all to say – when you renovate, improve, and upgrade, it should be about enhancing your human experience of the here and now. Regarding your house as pure Home – and not as an investment vehicle making vague and complex promises of future appreciation – means your renovation decisions will flow naturally from what makes you and your family feel most comfortable, protected, and nurtured. Those are the renovations that truly, lastingly matter in your life. And in the life of your home.

There are interior renovations and exterior renovations. The 2024 U.S. Houzz & Home Study annually polls and parses the renovation universe (so to speak) to provide a telling snapshot of what is happening in the space. This year’s Houzz revelations tell us that the most common interior renovations so far in 2024 (in descending order) have been to the Kitchen, Guest bathroom, Primary bathroom, Living room, Guest bedroom, Primary bedroom, Laundry room, Closet, Dining room, and Home office.

It’s worth noting that the top three on the interior renovations list – kitchen, bathroom, bathroom – speak to the symbolic and presentational importance of the

Renovation Situation Page 524

Road – $7,250,000 – This home, and the one next to it, are the only properties for sale

this remodeled home on its own, or together with the Spanish-style pool home next door at 1151 Glenview. Both are available for $15,000,000. Cold Spring School District.

views from the other. These homes all share a close-to-everything location, and the feeling that comes from being in a private enclave of homes on less travelled streets. Originally an early 1900s estate on 36.5 acres named “Pepper Hill” for the many pepper trees adorning the ocean-view property, it was later parceled into mostly one-acre lots in the 1960s, and still retains the original stone gateposts at each entrance to the enchanting Pepper Hill neighborhood.

The Lower Village would include, for the most part, the homes at Montecito Oaks off Olive Mill Road and those along Olive Mill Road in the east, and below Hot Springs Road as it runs from Casa Dorinda (high-end retirement digs) toward Montecito’s Country Mart in the west and down to the 101 Freeway. I am includ-

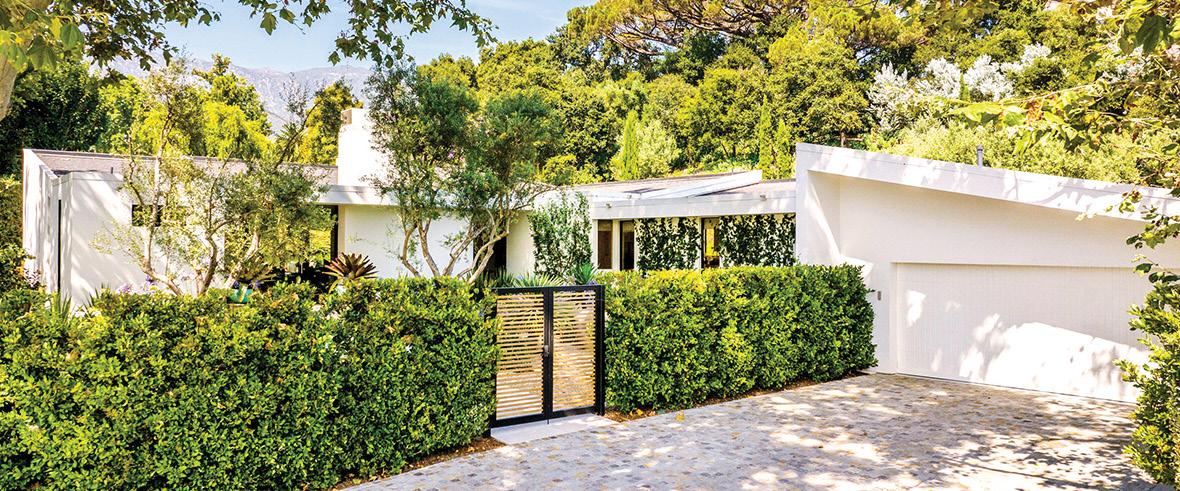

CONTEMPORARY LUXURY ON PICACHO LANE DESIGNED BY ESTEEMED ARCHITECT JOHN KELSEY

Welcome to a contemporary masterpiece designed by acclaimed architect John Kelsey situated on upper Picacho Lane in Montecito’s Golden Quadrangle. The exquisite combination of modern design and natural surroundings create a perfect balance of luxury and serenity surrounding an oasis back garden offering the ultimate private setting.

750 Picacho Lane, Montecito CA

4 BEDS / 6 BATHS / 5697± SqFt Offered at $10,500,000

ing the Montecito Oaks neighborhood based on proximity to Coast Village Road (Montecito Oaks known also as the Trick or Treat neighborhood). Homes in the Middle Road and Montecito Oaks area are just blocks from Coast Village Road and the beach and most homes in this area are in the Montecito Union School District. There are currently no homes or condos for sale in the Lower Village.

Montecito’s 93108 beach neighborhood is basically everything on the ocean side of the 101 freeway from the edge of Summerland at Sheffield Drive / Ortega Ridge in the East to Santa Barbara’s famed East Beach in the West. Within this ~ 1.5 mile stretch of Real Estates Page 324

34 Seaview Drive – Top Floor Penthouse Condo – $3,780,000 – Located in the Montecito Shores complex by the beach this 2-bedroom, 2-bathroom, 1,731 square-foot, top-floor, ocean-view condo is in the Montecito Union School District. Tennis, pool, and gorgeous oceanfront entertaining areas are yours in this oceanside community.

1586 San Leandro Lane – $8,950,000 – On a private 1.3-acre lot, this 4-bedroom, nearly 4,000 squarefoot, Spanish-style home offers a pool, mature gardens, off-street parking, and room for expanded exterior recreational and entertaining areas, all within the Montecito Union School District.

448 Court Place – $7,495,000 – Court Place is a private gated lane with only a handful of homes, located near the Upper Village and Montecito Union School. This is a rare opportunity to purchase in this enclave. An architecturally inspiring home, 2+2.5, 1.01 acres; this is a private retreat in a great location.

sand, aside from the few dozen oceanfront homes, there are multiple mini-communities existing within the stated boundaries, including condo communities with all the amenities, clusters of smaller condos and townhomes, 1+ acre oceanfront estates, etc.; not to mention the famed Miramar and Butterfly Beaches. Montecito’s Beach Area homes are in the Montecito Union School District.

Charming Homes and Mature Hedges define this neighborhood, just blocks over the freeway from the Rosewood at Miramar Beach, and near to Crane School, Laguna Real Estates Page 344

830 Picacho Lane – $39,425,000 – Through impressive gates near the top of Picacho, find this 9-bedroom, 13-bathroom home of over 14,000 square feet. Enjoy pool and tennis on 3.4 acres. This home is in the Montecito Union School district, and shares the lane with multiple other sales over $20 million –and over $30 million in recent weeks/months, and since 2020.

34 Seaview is a penthouse that boasts amazing views from all directions. The owner has moved out, has listened to the market and adjusted the price on this beauty to sell so you can enjoy the summer in Montecito. 34 Seaview has ocean, coastline, mountain and tree top views depending on which window or balcony you are experiencing them from. The penthouse location (top floor) has greater privacy and serenity than the other floors as well as soaring ceilings. 34 Seaview has a remodeled kitchen sporting new appliances, floors and cabinets that include a view through the formal dining room to the tree house setting of the magnificent Moreton Bay fig. A few more upgrades to 34 Seaview include air conditioning, new sliding glass doors leading to private patio, laundry room with new Miele washer and dryer, remodeled baths (one with shower and one with tub). 34 Seaview has just the right amount of living and storage space to sit back and enjoy the good life on the beach in Montecito.

Central Coast California lifestyle with enviable privacy and peace within a gated community. Over 1800sf of spacious living space and vaulted ceilings with a total new kitchen and breakfast area that overlooks your own private garden entrance. 2 bedrooms with 2.5 baths and new laminate plank floors downstairs. Walk to restaurants and shopping. East access to 101 and Vandenberg Space Force Base. This is truly the life you have always wanted. 30 year fixed loan is assumable at 2.25%. Amazing combination.

2125 Ten Acre Road – $11,200,000 – This 4-bedroom, 3-and-a-half bathroom French Country home is over 3,700 square feet, resting on a 1.4-acre lot in a prime location, adjacent to the golf course on a cul-desac lane. There is stonework throughout the home, a motor court, private patios and truly lovely gardens.

Blanca School’s Lower Campus, and Montecito Union School. The Hedgerows feature lovely botanic properties with mostly level lots and quaint streets with historic properties peppered here and there, some dating back to the late 1800s, that have been lovingly restored. A popular area close to schools, the beach, and both Upper and Lower Villages.

This area runs from Olive Mill Road in the west over to San Ysidro Road in the east and above the Hedgerows. An area that includes Montecito Union School, the

luxurious retirement community at Casa Dorinda, and everything below East Valley Road between Hot Springs and San Ysidro Roads. This is a very desirable area with many multiple-acre properties, very close to schools and the Upper Village.

The boundaries of the long-referenced Golden Quadrangle are commonly agreed to extend from Park Lane in the east to Hot Springs Road in the west, and from East Valley Road in the south to East Mountain Drive / Oak Creek Canyon and the San Ysidro Ranch in the north. Many larger homes on larger lots dominate these streets, where sales over $10 million are the norm. There are, however, a few small-to-medium-sized homes on the market right Real Estates Page 364

888 Lilac Drive – $29,995,000 – One of the premiere estates on the market in Montecito and one of only a few available offerings with over 13,000 square feet of living space and over two acres of land with ocean views, a theatre, exercise room, guest house and all the rest. This home is in the Montecito Union School District.

$4,750,000

For sale for only the 2nd time in 80 years, this iconic 1888 Santa Barbara residence has been elegantly enhanced and expanded for today’s living. The stately grounds feature a spectacular signature oak tree adding beauty and presence, while the house is set back from and above the street for privacy and quiet. The home’s layout combines traditional high-ceiling common rooms on the entry-level leading to a spacious newer kitchen and family room. The primary bedroom is also conveniently on the entry level, and has been expanded into a modern-sized suite. The 0.58-acre estate offers multiple outdoor areas for entertaining, dining and relaxation, including a large rear deck, roof terrace and several manicured garden spaces. A detached 3-car garage has been rebuilt with a 1-bedroom ADU above. As the 1st estate property at the gateway to the prestigious Upper East, a new owner will be only 4-6 blocks to downtown Santa Barbara’s fine dining, theaters, museums and parks. Come tour this amazing property and home in an A++ location.

now – around, and even under, $10 million in this area. Homes in the Golden Quadrangle are within the Montecito Union School District and surround the Upper Village. There are a sprinkling of condos, townhomes and cottages that come on the market from time to time.

Birnam Wood has become very popular over the past few years. Guard-gated, Birnam Wood offers golf and tennis, and lies within the Montecito Union School District. Birnam Wood is a member-only residential golf community and country club where, in purchasing a home in the neighborhood, one is also joining the country club and becoming part of the Birnam Wood community. Exit the Birnam Wood gate and you are a mere half-dozen blocks from the Upper Village.

Near Birnam Wood – above East Valley Road from Buena Vista to Stonehouse Lane in the east and up to the mountains – we find the Lilac/Romero Canyon neighborhood. Here you get that rural feeling; rolling hills, larger lots, yet still close to town. Homes in this area are for the most part within the Montecito Union School District, and the area offers a mix

Please contact

Call/Text Mark @ 805-698-2174 Mark@Villagesite.com www.MontecitoBestBuys.com DRE#01460852

of modern and historic estates as well as elevated ocean views on Lilac, Romero and Bella Vista. There are some smaller properties on smaller streets along East Valley Road, offering entry-level Montecito homes starting around $2,000,000 (rarely offered).

Home to many ocean-view estates – just a few blocks up from the sparkling Pacific, South of Birnam Wood, Valley Club and the Romero/Lilac area – is the guard-gated community of Ennisbrook. Being a homeowner here includes access to the shared amenities such as tennis, swimming and the social clubhouse. Also, there are 18 rarely available homes at The Ennisbrook Casitas and Clubhouse, which are 2,700’ish to 3,500’ish square-foot homes on smaller lots with their own shared pool and clubhouse. Homes at Ennisbrook are within the Montecito Union School District.

Closest to LA for those who commute, and the most rural area of the 93108, this neighborhood of East Montecito runs from Ortega Ridge, Freehaven and Ladera Lane in the west, to Toro Canyon in the east. Notable private lanes along the way include Cima Del Mundo, Cima Vista Lane (rarely, if ever, is a home available on either of these private estate lanes), and Hidden Valley Lane, with rolling foothills and many lovely ocean view homes on mostly larger lots. Many properties in this part of the 93108 have views, privacy and often more than one acre, and are just a quick drive down to the beach and the 101, or along East Valley Road into the Upper Village in Montecito.

I do hope this tour gave you a glimpse into the feel and advantages of each neighborhood in Montecito’s 93108. Happy summer ahead and keep

Sherry, a graduate of the University of Padova, Italy, is a 21st-century artist specializing in the time-honored craft of hand-painted tile murals inspired by the 16th and 17th century Italian masterpieces. Her work blends traditional techniques with contemporary design, creating unique, vibrant tiles that bring a touch of Mediterranean elegance to any space. Whether you are looking to add a splash of color to your home or a custom design for a special project, her tiles will infuse beauty and character to any space.

by Beth Sullivan

Writing for a publication is a new adventure for me. I appreciate the opportunity from the Montecito Journal to share our recent and future activities and goals.

In 2023, the Coast Village Association (CVA) and I reflected on a year of renewed focus on Santa Barbara’s vibrant business and residential neighborhood. A significant milestone for the organization was the establishment of the Community Benefit Improvement District (CBID) in 2022. This achievement was a result of years of diligent effort by a group of stakeholders established with the sole purpose of enhancing the district. The process was quite involved, and in the end the property owners were given ballots to vote for (or against) the assessment. By the end of 2022, the vote came in and the CBID was formed.

For those new to the concept of a CBID, it provides extra support and enhancements to a specific district, supplementing city offerings. This is funded by a modest assessment added to the annual property tax of district owners. The assessment is calculated based on property type, location, and other aspects for fairness. The funds collected are managed by entities like the CVA’s Board of Directors to promote the district’s vision and vitality.

The funds are allocated across five key categories:

1. Civil Sidewalks

2. District Identity and Placemaking

3. Capital Improvements/Traffic Management

4. Administration

5. Contingency/Reserves

My journey with the CVA began in 2022, when I consulted on the CBID proposal for property owners. This ignited a spark within me to be part of the change from the ground up. In February 2023, I became the Executive Director, working hand in hand

MATT ROWE Branch Manager

T 805.730.3350

raymondjames.com/santabarbara-branch

Hope Ranch, the median sales price is $6.3M, compared to $8.4M last year. There are currently 12 homes for sale in Hope Ranch, with two others pending sale.

In Santa Barbara, there are 99 homes and condos currently on the market. Less than a neutral market, but more than we’ve seen in over two years.

The market in Goleta remains strong, thanks in part to some sales on the higher end. The average sale price in Goleta year-to-date is $1.6M, compared to $1.4M last year at this time. There have been 143 total sales so far this year in Goleta, compared to 118 in the same time period of 2023. In 2022 there were 207 sales. Again, we are creeping up to a more “normal” year.

Goleta sales prices continue to impress; there have been a staggering 30 sales over the $2M mark, compared to 18 last year at this time. Hot spots for this kind of activity include Vista Del Rey, San Antonio Creek, Sierra Madre Heights, The Bluffs near the Ritz Carlton, and a few neighborhoods in the Mountain View and Foothill School Districts.

In the Santa Ynez Valley we saw the sale of 72 homes, condos and PUDs in the first half of the year, ranging in price from a $435K, 1/1 condo in Solvang to a 71-acre horse ranch in Santa Ynez for $14.7M. In 2023 there were 119 sales in the same time frame. Prices in the Valley are up over last year: the average sale price is $2.2M and the median sale price is $1.5M. On average, homes in the Valley sell for 95% of their list price. Buellton specifically has seen a healthy 31% bump in median home prices: the median home price at the end of May was $1,147,000.

The average number of days on market in the Santa Ynez Valley has increased to 76, compared to 56 last year. Inventory is also increasing, and there are currently 76

The Westerly Estate

is the area’s highest-priced listing at $64.5M; the 200-acre Happy Canyon property boasts a stunning Tuscan-style villa with picturesque views of the Santa Ynez Valley (listed by Riskin Partners and Carey Kendall of Village Properties)

homes and condos for sale; last year at this time there were about 20 fewer homes available. Overall in the valley we have a five-month supply of homes, which is higher than we’ve seen in years. Anything less than a six-month supply is considered a seller’s market, and we are definitely seeing the shift to a more neutral market.

The mid-year numbers accurately reflect the experience of buyers and sellers in our local market: There has been a palpable boost in inventory and it’s a refreshing change. If you talk to any active realtor in the Santa Barbara area, they’ll likely tell you that the market, which has strongly favored sellers for over two years, is loosening up for buyers, giving more opportunities to get into the market. That being said, the lower-end segments (under $2M) are still extremely active, and many properties are still garnering multiple offers and selling at or over list price. Remodeled, turnkey properties are selling for a premium, with buyers preferring to pay for upgrades rather than do the work themselves. In addition to selling property, agents and brokers will likely be spending their summer training for new real estate contracts and paperwork that will launch in August, in conjunction with some new rules regarding commission and disclosure that will go into effect August 17, 2024. The practice changes aim to increase transparency in real estate transactions, which is a positive change for sellers, buyers, and agents alike. For more information, feel free to contact me or your trusted realtor.

Kelly Mahan Herrick is a licensed realtor with the Calcagno & Hamilton Real Estate Group of Berkshire Hathaway HomeServices California Properties. She can be reached at kelly@homesinsantabarbara.com

9440 SANTA MONICA BLVD, THE PENTHOUSE | BEVERLY HILLS

1284 COAST VILLAGE RD | MONTECITO

A bespoke approach • An unrivaled pedigree

by Jeff Wing

“Estate Management.” You just know this is one of those deceptively tidy terms that contains worlds. Surely one approach to grasping the Estate Management space would be to put the question to an actual Estate Manager. “What constitutes a typical day?” Or maybe not.

“Every single day is different,” says Kelly Warner with something like joy. She is Founder and Managing Member of Warner Management, Inc., for some 28 years a premiere boutique Estate Management company here in Montecito (with several properties further afield). “You’re being pulled in 15 different directions, constantly making decisions over and over and over. There’s a very high standard that we’re being held to, so there’s always something that needs doing.”

The Estate Manager mobilizes resources in the interest of protecting, maintaining, and even enhancing the value of the property.

Blue-chip Estate Management is not only about maintaining, but foreseeing. “A lot of the mentality with these properties is about making sure a thing is taken care of before the winding down of its useful life.” Useful life is a term that describes the depreciation of an asset – or in plainer, more relevant language, the wearing out of something vital to the Estate. Warner elaborates. “In your own home, you have a water heater that might live to be 8 to 12 years old. When it finally fails, you’ll call somebody and get it fixed. In my homes, that can never happen. We make sure that we’re staying ahead of things like that. This applies to plumbing, to HVAC, to so many things. It’s always about staying 10 steps ahead.”

This combined daily ritual – being stretched like taffy while staring meaningfully into a future staggered with uncompromising deadlines – may not be for everyone, but it certainly seems to suit Kelly Warner. Throughout her description of the endlessly looping rigors of Estate Management, Warner is grinning like a lottery winner. This multi-multi-multi-tasker has long since found, and mastered, her professional purpose. The depth, variety, and dynamism of Estate Management makes every day a series of summits, and Warner wouldn’t have it any other way. The work is a cornucopia.

Blue-chip Estate Management is not only about maintaining, but foreseeing.

“It’s about keeping the household in harmony as well. So we’re talking about housekeepers, we’re talking about rosarians working with landscapers, we’re talking about working with painters. You need to have the people skills to positively engage, to really keep spirits lifted and their energy high. You want to assure, for instance, that your property stays a top priority for the subcontractors on a given project. You’re juggling different personalities all day long, and at the same time you’re trying to keep the homeowner happy.”

People may think that an Estate Manager is just a property manager whose “property” is estate-sized – but the difference between the two is much more than one of scale. A country and a village are of two different scales, but that is not their chief distinction.

The Institute of Real Estate Management describes the Estate Manager as “… responsible for overseeing the daily operations of a residential property, ensuring that

everything runs smoothly. This includes managing staff, overseeing maintenance and repairs, and ensuring that the property is secure. The Estate Manager also handles financial matters, such as budgeting and financial reporting.”

The Estate Manager is thus a sort of mega-steward with encyclopedic know-how – and the deep bench of connected experts required to leverage that know-how as the estate’s needs dictate. The Estate Manager mobilizes resources in the interest of protecting, maintaining, and even enhancing the value of the property. This necessarily involves financial astuteness, deep property management competence, and (yes) excellent people skills.

“You want to assure, for instance, that your property stays a top priority for the subcontractors on a given project.

You’re juggling different personalities all day long, and at the same time you’re trying to keep the homeowner happy.”

– Kelly Warner, Warner Management, Inc.

By way of illustration, Warner Management, Inc., self-describes as “A Boutique Management Company – Offering Detailed Personalized Services.” Detailed is a polite understatement. Dividing their service suite into the Estate Management, Personal Assistant, and Concierge categories, what Warner Management offers is…everything –from Provide project management to Event planning, organizing, coordinating, and flawless execution on day of the event, to Prepare home for arrival and secure home after departure. Even the Estate’s non-humans get the red-carpet treatment with a starkly-stated service proffer that you just know manifests as a cooing labor of love: Manage pet and equestrian care. The range of responsibilities is vast, and reliant on professionals comfortable with a degree of deeply informed autonomy.

“When it comes to project management and construction,” Warner says, “I often act as the liaison, or owner’s rep, between the homeowner and the general contractor. That entails finding the best subcontractors, collecting proposals, negotiating, reviewing invoices, overseeing the work and the craftsmanship, and keeping things running on schedule.”

“We make sure that we’re staying ahead of everything. This applies to plumbing, to HVAC, to so many things.

It’s always about staying 10 steps ahead.”

–

Kelly Warner, Warner Management, Inc.

Estate Manager Kelly Warner loves every minute of it, and has spent 28 years perfecting a granular, acutely organized regimen (and network) that gives her the 10,000-foot view necessary to, effectively, be everywhere at once. Allying with gifted in-house professionals is also absolutely key, of course. Warner greatly relies on powerhouse Administrative Associates Claire De Fabio, Katie Ortiz, and an amazing team of housekeepers and subcontractors to make all this possible.

Warner manages a business whose nonstop array of responsibilities is almost civic in scope. What tangibles can an Estate Manager offer the previously beleaguered owner of a private estate? Oh, just peace of mind.

Warner Management is all over it.

“My properties glow,” Warner says, not boastfully, but matter-of-factly. “I love seeing my client really pleased when they arrive, or after a big construction job. Something within me drives me to perfection, if you will. It’s just something that’s innate in me. I really take pride in my homes and in my clients, and I’m just happy and blessed to have this job.”

Jeff Wing is a journalist, raconteur, autodidact, and polysyllable enthusiast. He has been writing about Montecito and environs since before some people were born. He can be reached at jeff@ montecitojournal.net

home’s domestic heart, followed immediately by the reputational terror of a guest’s unsupervised, closed-door inspection of your home’s water closet (as they use to call a bathroom). It is also of note that so far in 2024 we would rather lavish attention on a delightful new closet or laundry room than an improved dining room experience. So here we have the Kitchen as our consensus #1 renovation dream, and the Dining Room nearly dead last in our list of aspirational home improvements. This curious yin and yang suggest there is some sort of nourishing ceremonial magic associated with preparing food. Once the comestibles have been lovingly and ritually presented, though, you can slouch with your paper plate to that tumbledown dining room – with its curling wallpaper and cobweb-swaddled chandelier – and chow down. Granted, this is a very loose interpretation of the Houzz findings.

Regional subject matter experts on interior renovations run the gamut. The Connie Glazer Design Group brings a surfeit of blue-chip design expertise and experiential design-centric travel to bear on your humble (or otherwise) abode, and the Santa Barbara Cabinet Company’s Tom and Colleen likewise throw their 25 years of experience into building your perfect custom cabinetry for the kitchen, bathrooms, libraries, paneled offices, wine cellars – everywhere lustrous wood is expected to inform the tone – and broaden their offerings through their Santa Barbara Interiors. And on the subject of closets and – ahem – storage; the aptly-named Santa Barbara Storage Group, with its unique and boutique storage trifecta – Self, Industrial, and Wine – almost surely has what you need for your off-site storage needs. Don’t know where to begin with your dreams of interior rehab? RD Homes has taken a remark by storied Swiss architect Le Corbusier and made it their credo: “The Home Should Be the Treasure Chest of Living.” In business since 2010, Romain Doussineau (hence the less challenging RD) and his wife Myriam are all about helping you realize your vision. And following that consultation, the Furniture Gallery by Mattress Mike has a massive display space with more beautiful interior furnishings that you can likely imagine. Oh, and mattresses. Musing over first steps in bathroom renovation? If you can imagine, there is a place called Bath Planet (no, it’s not on NASA’s exploratory probe list), and their turnkey model has made them a popular choice in dozens of locations across the country. And while we’re on the subject of water, has anyone noticed that the piped water in the American Riviera is so mineral-laden it is practically a semisolid? There is no civic wet stuff Culligan Water can’t soften, filter, or reverse-osmose (a real word). Persons of a certain age may remember the shouting “Hey, Culligan Man!” TV ad of yore. That campaign must’ve sunk into the culture, as the name Culligan is any more synonymous with home water solutions.

When interior renovations are undertaken to strategically boost the resale value of a home, it is useful to know if – and by what factor – the renovation in question may add value beyond the cost of the project. Here we have the term Return on Investment (ROI). The baseline object here is to have the renovation add value. The National

At Brighten Solar Co., we are on a mission to deliver clean energy Santa Barbara and Ventura Counties through innovative sustainable solutions. As a leader in the solar energy industry since 2015, we specialize in custom designed solar photovoltaic systems and advanced energy storage solutions that significantly reduce energy costs, increase resilience, and enhance the aesthetic appeal properties.

At a time when green building and sustainability are essential, Brighten Solar Co. takes pride in offering high-quality, ethically sourced equipment, including cobalt-free batteries. Our tailored approach ensures that every installation aligns with our customers’ unique needs and values, providing a seamless and rewarding experience. Whether involved in a home renovation or looking to optimize energy use, these solutions are designed to support sustainable living, enhance home electrification, increase safety and resilience, and boost property value.

Our dedication to environmental responsibility and customer satisfaction has earned us recognition, including being a Santa Barbara County Green Certified Business and receiving the “Best Solar Power Company” title in the Santa Barbara Independent for multiple years. Brighten Solar Co. provides cutting-edge solar and storage solutions that are as sustainable as they are sophisticated.

Association of REALTORS® Remodeling Impact Report lists 10 of the most common interior renovations and their respective ROI, and it looks like this (bearing in mind this is a nationally averaged snapshot at this moment in the present economy): Refinishing the hardwood flooring – 147% ROI; installing new hardwood flooring –118%; upgrading the home’s insulation – 100%. In the realm of flooring, Santa Barbara, Ventura, and Kern counties’ family-owned Flooring 101 works with carpets, hardwood flooring, laminate flooring, luxury vinyl tile, and ceramic tile & stone

Some projects you may assume would have a robust ROI did not in this survey. For instance, upgrading the kitchen (at a cost of $45,000 in this example) yielded a 67% ROI. The NAR Remodeling Impact Report makes one overarching point; just about half of realtors polled recommend painting the entirety of your home’s interior before selling. Santa Barbara Painting, Inc., and Chyko Painting are both long-trusted, longstanding local outfits that do both interiors and exteriors.

Renovation Situation Page 564

As for exterior renovations, the 2024 Houzz & Home Study finds this descending order of curbside rehab: roofing, windows/skylights, exterior paint, gutters/downspouts, exterior doors, deck, insulation, porch/balcony, siding/stucco, structural Renovation Situation Page 584

upgrades, and chimney. You can see at a glance that the sequence is topped by the practical – the leaky roof over your head – then becomes a mix of aesthetics and weatherproofing. If considering an energy-boosting addition to your roof renovation, both August Roofing and Solar and Brighten Solar can complement your roof with a grid-augmenting solar solution. Have you wondered if there is a way to touch up the roofline and the home’s profile generally without doing major structural work? Conejo Valley Trim Light’s weatherproof and energy-efficient solution may not be one with which you’re familiar, but is certainly worth checking out. Their unique exterior lighting design has been surprising homeowners since 2011. And if you want to bring the lovely exterior light of California into the house, Big Coast Skylights may be a good place to start. Whether inside or out, living room or garden (or why not a combination of both), The Well in Summerland – and now with an outpost in Montecito’s Upper Village – is a well (cough) of antique and vintage furniture, lighting and other décor delights that one can continue to draw from during their path to renovation.

Familiar and costly mistakes have long haunted the exterior renovation adventure. Topping most lists is the error of excitedly jumping in without a clear and followable plan. You want to forecast, to some degree, how the improvement will seem to you some years down the line. That’s just one way of assuring you are thinking seriously about what you are about to do (and pay for) and not whimsically leading with your heart, as they say. Spend your time coming up with a detailed vision and plan. Change that as many times as you want to, but only when you’re sure you have a settled plan that can be followed do you get the project started. Changing your mind mid-project is even more disastrous than it sounds.

Consider the climate, and how it may reliably be said to be changing, when choosing your materials. Consider what materials weather best in the current and predicted climatological setting. What material holds up in the full unmediated sun? What materials helpfully contract and expand with the temperature?

Lastly, stay in communication with your contractors and workers. Yes, it’s easy (and even a relief) to absent yourself from the hard hats and toolbelts and trust the work will go according to your wishes, but it is critically important you stay in touch with

your general contractor. If it becomes necessary to deviate, even a whisker, from your prescribed plan, you need to know that yesterday. If you are never in the picture, these time-and-schedule-constrained teams may barrel ahead, thinking you are not particularly engaged in the details. Don’t get strange or imperious about it, but do let your GC know you are interested and engaged.

Renovation done correctly will dramatically, and classily, improve both the body and soul of your domicile. Your Home is repository for all your dreams, the sanctified space in which your lasting memories and moments will play out over the years, and that perfectly lit corner where That Chair awaits you, your book, and a glass of vino. This is not an investment vehicle; this is Home. Make it your own.

Available to homeowners age 55 or better. For homes and condos valued over $1.2M. Loans up to $4M.

Contact Me to Learn More

Eric D. Miller NMLS #582959

Reverse Mortgage Advisor

Phone: (805) 570-8885

emiller@mutualmortgage.com

MutualReverse.com/lo/Eric-Miller 1114 State St., Ste. 320, Santa Barbara, CA 93101

Mutual of Omaha Mortgage, Inc. dba Mutual of Omaha Reverse Mortgage, NMLS ID 1025894. 3131 Camino Del Rio N 1100, San Diego, CA 92108. Licensed by the Department of Financial Protection & Innovation under the California Residential Mortgage Lending Act, License 4131356. These materials are not from HUD or FHA and the document was not approved by HUD, FHA or any Government Agency. Subject to Credit Approval. www.nmlsconsumeraccess.org #1381381459

AGuy Rivera Branch Manager NMLS # 57662 (805) 452-3804 rivera@dmfsb com

by Austin Lampson

realtor friend of mine has a card on his desk from years ago. It’s an ad for a mortgage lender, long since out of business. On it there is a reflective sticker next to the words, “If you can fog this mirror, I can get you a loan.” Banks have failed, guidelines fluctuate frequently, and Senators Dodd & Frank certainly imposed new rules to housing’s old games. For those whose lives reside outside the standardized boxes checked by underwriters everywhere, getting a mortgage these days may seem at the best invasive, and even quite possibly offensive.

Mortgages are based on four building blocks: income, assets, credit, and property.

Thankfully there are more options these days than those immediately following The Great Meltdown, when the pendulum got stuck on stupid. Mortgages are based on four building blocks: income, assets, credit, and property. Like a game of Jenga, lenders balance these together in order to create your home loan. While all four of these must be in some way measured in order to be compliant with federal and state regulations, alternative lending options allow for more flexibility than the standard Fannie Mae or Freddie Mac qualifying basis. Of course, the more creative the financing, the more expensive it can be.

Bridge loans have been around for quite a while – the idea of borrowing to buy before you sell is not a new concept. (I always picture them with my arms up, one elbow on the current house, the other on the new house, hands touching to make the bridge.) Today’s options range from those where one simply excludes the payments on the house to be sold, gets a small loan from one to give the down payment on the other, and there are even some where only the equity of the two properties concerned is the primary qualifier. Usually folks still have to make payments on both properties until one is sold, though a few options exist where the interest can be deferred until such a sale occurs (for a period of time, at least).

For those of us who live mainly off our asset portfolio, renewed programs are in the marketplace which look to those accounts to qualify. “Asset Depletion” is a lending term for just such a program. In this case, one’s qualifying income is calculated based on what liquid, accessible funds are left over once the down payment, closing costs and necessary reserves of a transaction have been taken into consideration. Each type of asset held – from checking, to savings, to stocks, bonds and retirement accounts – can be valued at different levels and for various historical lookbacks. The intent here is to create reasonable continuance of one’s ability to pay one’s obligations based on the funds accessible. Windfalls or recent liquidity events may not work for this type of program.

If you are looking for quick cash without selling openly traded accounts, you may want to check out margin loans. These are typically done with your financial advisor directly, and each trading house calls these by a different name while qualifying them by different standards. The idea is that you are lent money secured against managed funds that could be sold if necessary to repay the debt. Thus, you are not creating a capital gains event by selling the fund (or stock), nor do you have to qualify within the standardized mortgage blocks. Even though these funds are not secured by property, you may be able to still have tax advantages with this structure. Be careful though, as volatile markets could create forced sale requirements. Investor types may also want to consider a “Debt Service Coverage Ratio (DSCR)” loan. Newer to the marketplace, these are loans that qualify to the property itself only. The other, primary obligations of the debtor are not taken into account as these are for investment properties only. Title can be held by individuals, foreign nationals, or LLCs. The loan to value, amount down, and terms will vary not only according to property type, but also by credit score and the actual

amount of debt ratio that is covered by the property. Think: Does it easily cash flow or not?

The majority of options I’ve covered thus far are for folks whom may not document a lot of income on their tax returns. However, there are plenty of alternative sources of income that do show on taxes which still need particular consideration. Income from trusts, royalties, pass-through entities (LLCs, K1s, etc.), or notes receivable all have their own subsets to qualification use – even if it is taxable in a standard sense. The best thing to do in any situation is to know your own situation, since most any loan will require some established assurance of repayment.

Lending will continue to change and adjust as the market gives us demands, dips, and delineation. Options exist at a broader level than the TV ads suggest, and usually at terms different from those in that enticing pop-up you’re tempted to click. The most effective way to find your best option is to interview based on your needs and your parameters. Remember, the most creative option is typically not the least expensive – and the right professional will always ask you for more input instead of simply laying out one option. Real estate is one of the best ways to create wealth in this country, and home is one of the most important things we build together.

Austin Lampson has spent the last quarter-century helping her clients balance math and emotion to achieve their financial goals. She believes that responsible lending is one of the highest forms of community service. If you are less stressed about your mortgage payments, you are better at home, you’re better at the office, as a neighbor, and as a community member at large. Whether it is down-payment-assistance programs for first-time homebuyers, helping clients move out who have outgrown their space, folks that want to take on real estate investing, acquire a portfolio, or clients looking to downsize and simplify their lives – it’s all about taking your future goals into account in today’s multi-passive lending environment. Austin runs an epic team that focuses on your success.

At RightSize, our mission is to deliver an exceptional level of care and service to you and your family. I lead with integrity and empathy to ensure a successful, seamless, and low-stress experience for all involved.

Mobile: 805.451.4433

mike@rightsizesb.com www.rightsizesb.com

by Grace Neumann

Climate change has accelerated the frequency and intensity of natural disasters. Insurers were on the hook for $108 billion in damages from catastrophes in 2023, down from $125 billion in 2022 but above the 10-year average of $89 billion. The long-term trend of increased catastrophes from climate change will show up in rising insurance rates. The “new normal” of recurrent and severe weather events represents an unpleasant reality for both insurers and homeowners. Climate-change-driven catastrophes will continue to plague the U.S. in 2024 and beyond, and will have an outsized effect on insurance rates and availability. While there are signs of some relief in many areas of the country, those acknowledging a new reality will have an edge on controlling risk and obtaining rate relief.

The numbers are concerning: Worldwide losses from natural catastrophes amounted to $280 billion during 2023.

The numbers are concerning: Worldwide losses from natural catastrophes amounted to $280 billion during 2023. That figure doesn’t help U.S. homeowners, particularly those located in catastrophe-prone locations, who are facing sharp rate increases or struggling to find insurers willing to issue a policy. Globally, there were 143 insured natural disasters in 2023, the most ever. That included 30 disasters with losses between $1 billion and $5 billion, compared with an average of 17 such catastrophes of similar proportions in the 10 previous years. The U.S. had a record number 28 disasters totalling $1 billion or more of damage. While the wildfires in Hawaii and hurricanes generated the most headlines, convective storms, flooding and hailstorms resulted in enormous damage. Climate change has been identified as the culprit for more frequent and destructive storms and wildfires. Severe convective storms accounted for $64 billion in losses in 2023 – and 85% (approximately $54 billion) of those losses were in the United States. In fact, insured losses from severe convective storms have risen an average of 8% each year since 2008. These disasters have contributed to skyrocketing premiums for homeowners. Between the start of 2023 and 2024, average premiums for homeowners rose 23%. The number of people moving to flood-prone counties or areas with high wildfire risks nearly doubled in the wake of the pandemic. And a number of major insurers have fled the states of California, Florida, and Louisiana, making it increasingly challenging for homeowners to find property coverage.

Although catastrophes will strike North America at a higher rate and with greater intensity in the future, 2023 was less catastrophic than previous years. Property insurers had strong results, which are reflected in the property insurance market’s improvements in rates and availability. With new insurers entering the marketplace, homeowners in non-CAT zones will likely see more moderate rate increases and greater availability of coverage options. Insurance for properties with exposure to catastrophic perils, however, is likely to remain elevated. Rates will depend on factors including a property’s placement in a catastrophe zone, the type of construction involved, the year in which it was built, and myriad other factors. Underwriters will continue to pay close attention to insureds’ loss experience, valuation methodology and geographic footprint in determining premiums, and they’re more likely than ever before to request risk-mitigation measures – from water sensors and automatic shutoff valves to roof replacement and fire-resistant landscaping. Homeowners that actively try to reduce their property’s exposures will be more likely to reap rate rewards.

While finding adequate insurance for many homes will remain difficult, we expect that market instability will level off throughout the rest of 2024. To improve insurability and reduce risk in the short-term, homeowners should consider the following:

- Be open to shouldering more of the risk. With climate change leading to less insurance availability, homeowners may need to increase their deductibles, add additional policies such as flood coverage or parametric insurance or remove previously insured items from the policy, such as a home’s contents. For CAT-exposed homes in particular, homeowners may have more insurance options if they’re willing to pare down their homeowners’ policies and assume more risk.

Inflation, along with rising construction costs, have made accurate valuations an essential part of insurance renewals.

- Determine if your property valuations are current. Although many homeowners have taken steps in recent years to obtain accurate property valuations, it’s important to have the right valuation in an era of increased catastrophes. Inflation, along with rising construction costs, have made accurate valuations an essential part of insurance renewals. Know your policies’ full terms and conditions in order to understand limitations and exclusions.

- Build resiliency against disasters. Short of moving a home located in a catastrophe-prone area, it’s impossible to remove all exposure to disasters. However, investing in mitigating measures such as upgrading roofs and plumbing or installing sensors and non-combustible landscaping can reduce the risk of a claim. Underwriters may even require that some of these are implemented before they will issue a policy.

- Consult your advisor before purchasing a new property. It’s essential to understand the risks that a new home or planned construction can bring and whether the property will even be insurable in the standard market. Your broker may be able to point out ways to reduce exposures in a new build or prevent you from purchasing a potentially uninsurable property.

As a whole, throughout Santa Barbara and Montecito, we have seen a little movement with the non-admitted carriers. The non-admitted sector is serving a big role in providing options for our community. It is important to always work with an A-rated non-admitted carrier since they are not backed by the CA insurance-guarantee fund.

One tip is to strategize on non-admitted quotes. Talk with your broker about large deductibles and what coverages are truly the most important to you and which coverages you are willing to self-insure. For instance, if you have multiple homes, you may not need Loss of Use Coverage. Perhaps you have a large valuables policy, and so could decrease your contents coverage. We need to be very specific when approaching the markets.

The CA Fair Plan is also serving a bigger role than was ever anticipated. The CA Fair Plan is meant to be a last resort. Due to pricing of the non-admitted carriers, some people are turning to the Fair Plan as they feel there is no other viable financial option. It is important to always work with a broker when seeking a Fair Plan quote as these policies need to be fully explained. They write up to $3M in total insurance value, meaning there is only $3M to cover your dwelling, other structures, contents, loss of use, debris removal, fences, driveways, etc. Each item needs to be fully listed as part of the $3M or there is no coverage. The Fair Plan covers perils like fire, smoke and lightning. You then need a companion policy to go with it that covers what the Fair Plan excludes such as water, theft and liability.

Grace Neumann rejoined HUB International in 2021 and has more than 30 years of experience in designing complex insurance needs for high-net-worth clients. She provides asset-protection consultation and insurance services for affluent clientele in Santa Barbara/ Montecito, and throughout the United States.

by John J. Thyne III

Larry Wall sagely advised “Don’t wear roller skates to a tug of war.” Apparently, the United States Department of Justice and the National Association of REALTORS® did not listen. For decades, these two behemoths have played tug-of-war with the DOJ, asserting that the NAR’s commission-splitting agreements between its 1.4 million real estate agents, despite the wink and nod of “negotiable fees,” constitutes price-fixing in violation of antitrust laws. This past year the battle moved, in a big way, to the government’s side. Not to be outdone, plaintiffs’ attorneys quickly jumped into the ring with massive civil lawsuits that may or may not change the way realtors are paid.

Since the dawn of real estate sales, sellers have generally dictated the commission rate to be paid to real estate agents.

Rarely has a group of professionals so successfully obfuscated its fees for so long. When asked today, most consumers believe buyers don’t pay real estate agent fees, only sellers do. Insiders, however, note that the buyer pays for everything in the purchase of real property, even if it is the seller’s proceeds that are reduced by the agents’ fees. Since the dawn of real estate sales, sellers have generally dictated the commission rate to be paid to real estate agents. Historically, both the “listing” agent, who represents the seller and, confusingly, the “selling agent,” who represents the buyer, were sub-agents of the seller who paid them both. Years of court cases later, agents became primarily obligated to their principal, no matter who paid them, or how. In the 1980s there was a movement toward some brokers exclusively representing buyers, but consumer psychology bristled at that new paradigm and it largely faded.

Added to this mix of confusing payment structures – with sellers setting, and technically paying, agents’ fees that increase the buyer’s purchase price – is the concept

Fabulous Desserts!

Scratch made Cakes & Pastries. Breakfast, Lunch & Dinner.

Exquisite Wines, Champagne, European Beer.

High Tea daily from 2pm.

Happy Hour daily 2:30-6pm.

of “dual agency”, where one agent represents both the seller and buyer in the same transaction, much like a coach on both sides of the football in the same game, but that is beyond the pale of this article.

them, or how.

So, after decades of a cat and mouse chase, the Department of Justice caught the National Association of REALTORS® in 2020, and subpoenaed records to show that NAR’s rules mandating sellers’ agents to offer compensation to buyers’ agents are illegal. In November 2020, NAR blinked and entered a consent judgment in exchange for the DOJ agreeing to no longer investigate REALTORS®. But, in July 2021, the DOJ withdrew that consent order so NAR pushed to hold the DOJ to its agreement of no more investigations. In January 2023, a federal judge ruled the consent order should hold and the investigations should end. However, the DOJ appealed and just a few months ago, in April 2024, the Federal Court of Appeals for the D.C. Circuit ruled that the investigations can continue, and so they will, for the time being, until and unless the United States Supreme Court is asked to step in. Hence, the problem with the aforementioned roller skates.

Back now to the plaintiffs’ attorneys, who smelled blood in the water and brought a multi-gazillion-dollar lawsuit against NAR and some huge real estate agencies on behalf of buyers all around the country. RE/MAX and Keller Williams tapped out quickly and settled for $208 million combined, but NAR chose to fight, and to lose, severely. In November 2023, a Missouri jury found NAR and the remaining real estate agencies in the case liable for $1.8 billion. That case was quickly appealed. In April 2024, NAR settled its part on behalf of over one million agents (not including HomeServices of America who fight on with dozens of brands like Berkshire Hathaway California) for $418 million to be paid over four years, and adopted new rules starting in August 2024 that prohibit listing agents from advertising cooperating commissions to buyers’ agents; require buyers’ agents to sign buyer-broker agreements with their buyers to clearly explain what commission they will be paid; and, among other rules, NAR must educate agents and not allow real estate agents to “steer” buyers to listings that include payment of the agent by the seller or to create other workarounds. Sounds simple, right? Not so fast – the rope has moved again.

So, after decades of a cat and mouse chase, the Department of Justice caught the National Association of REALTORS® in 2020 and subpoenaed records to show that NAR’s rules mandating sellers’ agents to offer compensation to buyers’ agents are illegal.

Just days ago, the California Association of REALTORS® informed its more than 150,000 members that while it had drafted 67 new forms to be released on June 25, 2024, including 21 forms specific to the new rules per the civil settlement, it has now decided to delay releasing those 21 forms in light of competing feedback from the DOJ and members of NAR. Meanwhile, across the country, thousands of members of Multiple Listing Service (NAR’s virtual “book” of properties available for purchase offers) have now opted out of their local Associations of REALTORS® in order to continue to offer cooperating commissions from sellers’ agents to buyers’ agents.

Per the civil settlement, the new rules are scheduled to take effect on August 17, 2024, and the final settlement approval is scheduled for November 26, 2024, but it seems there may be plenty of tugging, followed by rolling back and forth on both sides of the rope, between now and then.

John J. Thyne III is the world’s luckiest husband; an attorney and senior partner of Thyne Taylor Fox Howard, LLP; a real estate broker and co-owner of Goodwin & Thyne Properties; and an award-winning professor of law.

by Jeffrey Harding

Ithought the Clash song would be a good title. It rather succinctly states the dilemma faced by those wishing to immigrate to California.

Here’s my premise: You are a wealthy couple from a place where you made your money, but you wish for the California lifestyle and climate in your latter years. Home is sweaty in the summer and cold and bleak in the winter. You hear about Santa Barbara and Montecito from friends who have migrated here. You start with La Jolla and work your way up the coast and when you hit Montecito you go no further. You decide this is where you want to live. Temporarily.

You plunk down millions of dollars for a stately Mediterranean-style estate. You go back and forth to your home base but the more time you spend here the longer you want to stay.

If audited, you must prove you are a nonresident. It isn’t an innocent-until-proven-guilty thing.

But then you receive a letter from the California Franchise Tax Board (FTB) saying we’re going to tax you. What!? But, you say, you are still a resident back home. You vote there, you pay taxes there, your cars have out-of-state plates, your phone has your home area code, you belong to clubs there. “We’re not California residents, dammit!”