//

In-Space Services: A Major Opportunity for the UK

COPYRIGHT Copyright © Satellite Applications Catapult Ltd 2020 THE COPYRIGHT IN THIS DOCUMENT IS THE PROPERTY OF SATELLITE APPLICATIONS CATAPULT LTD.

All rights are reserved. No part of this documentation may be reproduced by any means in any material form (including photocopying or storing it in any electronic form) without the express prior consent of the Copyright Owner, except in accordance with the Copyright, Designs and Patents Act, 1988, or under the terms of a license and/or confidentiality agreement issued by the Copyright Owner, Satellite Applications Catapult. Applications for the copyright owners’ permission to reproduce any part of this documentation should be addressed to, The Chief Executive Officer, Satellite Applications Catapult, Electron Building, Fermi Avenue, Harwell Didcot, Oxfordshire, OX11 0QR, UK.

2

Background

12

What are In-Space Services?

13

Life Extension

15

Life Extension Timeline

18

Life Extension – A Case Study

19

Active Debris Removal (ADR)

21

Active Debris Removal Timeline

23

Active Debris Removal – A Case Study

24

In-Space Manufacturing & Assembly

25

In-Space Manufacturing Timeline

27

In-Space Manufacturing – A Case Study

28

In-Space Manufacturing Ecosystem and Drivers

30

Other In-Space Services

31

FOR

THE

UK

11

OPPORTUNITY

Introduction

MAJOR

7

A

What should the UK be doing?

SERVICES:

5

IN-SPACE

Executive Summary

//////////////////////

Table of Contents

4

The UK has a strong position in InSpace Services, three of the five biggest inaugural In-Space Service missions of 2020 Effective Space, Virgin Galactic, and Astroscale, have a base in the UK.

-

Building capability in on-orbit satellite servicing is a key pillar for UK growth toward major opportunities for in-space assembly and manufacturing: A clean, debris-free orbital environment is fundamental for everyone’s ambitions in space.

-

On-Orbit Servicing offers the potential of a commercially viable short-term market.

-

Ambition should not be limited to in Earth orbit activities and major programmes such as the Lunar Gateway and other more extensive missions are essential. UK involvement in these programmes is key if wider opportunities in in-space assembly and manufacturing are to be realised.

-

Future major in-space manufacturing opportunities that could support telecoms (direct to mobile), energy, or further ambitions in space are developing and will drive major benefits as our economic horizons expand from low earth orbit to the moon and beyond.

UK THE FOR

Crowding in adjacent skills and capabilities from robotics and AI toward the space sector brings knowledge, funding, and scale needed for success.

OPPORTUNITY

-

//////////////////////

-

Relevant UK capabilities include worldleading robotics, mechanical engineering, operations in hazardous and remote locations as well as advanced computing and simulation.

MAJOR

-

-

A

There are significant global drivers attracting commercial interest to the broad field of In-Space Services. These include a national security need to develop in-space capabilities; a fleet of ageing, high-value satellite assets requiring life extension; suitable technical maturity of robotics and autonomy; and a growth in New Space activities providing the potential demand for In-Space Services.

SERVICES:

-

IN-SPACE

Executive Summary

5

-

A key focus for the UK space sector engaged with In-Space Services will be to derive sustainable commercial revenue from these activities in the near-term, to position for larger future opportunities.

-

A 2019 research report from NSR predicted cumulative revenues from in-orbit satellite services to reach $4.5bn as soon as 2028 with Life Extension satellites accounting for the majority with $1.6 billion in revenues.

-

-

The accessible international market for UK companies may be limited by regulations involving docking and servicing of foreign satellites, which may put the UK in an inferior position in accessing foreign markets. Whilst the total available market for Active Debris Removal may be over $200 million, the serviceable available market is determined and constrained by deorbiting regulation. Currently, it is small due to current constellation designs, but stricter regulation regarding uncontrolled deorbit could drive demand for controlled deorbit of satellites in lower orbits.

-

Decreases in associated costs, including those of launch and components such as robotic manipulators, will increase the number of new entrants into the market and will increase customer interest.

-

GEO satellites are a primary candidate for Life Extension services in the next decade. Beyond this, the market is uncertain due to older satellite designs being outmoded by GEO satellite innovation, change in market demands, and increased satellite propulsion systems.

-

Satellite Applications Catapult believes that over the next decade, there is a nascent ÂŁ500m market opportunity in the UK for in-space assembly, servicing, and de-orbiting. By becoming a key player in this area, the UK will be well positioned for bigger growth opportunities ahead.

6

Cumulative GEO In-Orbit Servicing Revenue by Type Service

8%

5%

Deorbiting

Relocation

11%

Robotics

59 %

Life Extension

17 %

Deorbiting

Source:NSR

Source: NSR

Geo Life Extension Revenues

00

$5

00

$4

00

$3

8 202

00

$2

0

$10

3

202

$ 8 201

Commercial GEO satellites

Source: NSR

Gov/Mill GEO satellites

The UK is at the forefront of licensing for On-Orbit Servicing missions and with the advent of the sector, licensing for novel missions should be made as straightforward as possible.

2.

Fund a challenge around sustainability in space. The UK should fund a mission focussed on debris mitigation and sustainable and clean activities in future space missions.

3.

Attract constellation operators to the UK. By encouraging constellation operators to set up shop in the UK, the satellite market will grow and bring along customers for In-Space Services.

4.

Encourage development of ambitious new business propositions for In-Space manufacturing.

5.

Develop a programme of demand generation. Ultimate ‘End Users’ range from satellite operators such as Inmarsat to pharmaceutical companies.

6.

Continue to build UK venture capital and wider private finance interest in space.

7

UK THE FOR OPPORTUNITY MAJOR

-

A

Continue leadership in policy and regulation to ensure the UK attracts businesses and creates a thriving market. UK expertise in professional services such as regulatory issues, insurance, standards, legal contracts and business models make the UK an ideal centre to support the development of the international In-Space Services sector.

SERVICES:

1.

IN-SPACE

Building the Market

//////////////////////

What should the UK be doing?

Technology 7.

Encourage interest and capability from adjacent industries such as robotics to evolve expertise for In-Space services, such as de-orbiting of satellites and life extensions. This would include workshops, funding calls, challenges, skills and training, and will lead to more comprehensive In-Space manufacturing capabilities. - Having a UK capability to create technology such as advanced robotics would allow more of the supply chain to be in the UK, simplifying development of UK missions and maximising benefit from these emerging markets.

8.

The UK must build on its existing technical expertise to support an integrated ecosystem of earth-based capabilities including systems simulation; hardware, software and concept of operations development and testing; digital twin creation; robotics and automation modelling; operational safety and team training. FAIRSPACE and the Satellite Applications Catapult DISC facility are examples of key capabilities and facilities that can support this.

9.

Develop a detailed route map for the UK to exploit In-Space services; this must include pre-launch preparatory capabilities and infrastructure.

10. The UK must support development work to ensure progress in hardware and also software standardisation to facilitate upcoming servicing vehicles. 11.

Encourage UK led in-space constructions where opportunities arise e.g. developing new space telescopes. Any opportunity to build capability should be capitalised upon.

8

UK THE FOR

12. Develop a mission-oriented innovation approach that brings key stakeholders toward the same goal. The UK space sector will be successful with In-Space services when it develops a highly integrated ecosystem of all stakeholders from primes, technical supply chains and academics to financiers, government agencies and end users. 13. Continue to support start-ups to exploit novel market opportunities by providing access to finance, expertise and a favourable regulatory environment.

15. Engage with UK launch activities and develop a marketing strategy to make launch services successful. If UK launch is successful, then the UK will be well-positioned to deliver regular and responsive services in space. Stakeholder Engagement 16. Work closely with military developments. A number of shorter-term requirements will come from the military. The UK must utilise all national expertise for In-Space Services activities which include sharing knowledge between the civil and security sectors. 17. Increase engagement with international space initiatives to build capability, such as NASA’s Lunar Gateway, ESA’s ExoMars, or the European Commission’s Horizon 2020 programme. It is important that the UK is a part of these programmes to build capability for future, more challenging opportunities. 18. Undertake a comprehensive market and value chain analysis to include both supply-side stakeholders and potential end users of the complete ecosystem.

9

Satellite: ExoMars 2018 Depicts: Rover Copyright: ESA

IN-SPACE

SERVICES:

A

Satellite: Trace Gas Orbiter Copyright: ESA/ATG medialab

//////////////////////

14. Support UK initiatives that engage non-space sector players. These may be regional or technology-focused such as the ‘Oxford-Cambridge Arc’ (this programme states an ambition to “Lead the world in integrating robotics and automation into the space sector, building from in-orbit servicing to in-orbit manufacture and construction”). This initiative brings motorsport capability toward the space sector.

MAJOR

OPPORTUNITY

Ecosystem

10

11

OPPORTUNITY

FOR

THE

‘How should the UK position itself to capitalise on emerging opportunities related to in-space services and manufacturing?’

MAJOR

The purpose of this report is to generate discussion about the strategy the UK space sector could adopt to exploit commercial In-Space Services. The report uses In-Space Services as an umbrella term to describe many activities, including on-orbit and off-planet. By On-Orbit Services the report means specifically assets on orbit, such as satellites and space stations. Off-planet covers activities such as the Lunar Gateway and Mars Explorer. Technical advances in autonomous on-orbit operations are enabling the development of novel services in Earth orbit and beyond. These include extending the life of aging satellites, maintenance and repair of satellites, removing space debris and In-Space manufacturing of spacecraft, components or the production of fuel and other vital materials. In addition to items that may be developed for off-Earth use, In-Space Services will also enable the production of specialist materials that could be returned for use on Earth. This document will use a market-led approach to answer the following question:

A

-

SERVICES:

-

This briefing paper is aimed at stakeholders in the UK Space sector and highlights potential opportunities arising from In-Space Services and provides recommendations for exploitation. The briefing highlights various applications included in the In-Space Service activities, such as Life Extension, Active Debris Removal and InSpace Manufacturing. Leading In-Space Services projects and key stakeholders are reviewed identifying the global nature of this market.

IN-SPACE

-

//////////////////////

The nascent In-Space Services industry offers technical and commercial opportunities that the UK is well suited and well positioned to exploit.

UK

Introduction

Background As stated in the 2018 ‘Prosperity from Space’ report, globally, the space sector is evolving at an ever-increasing rate. Nations around the world are ramping up their space capabilities, while private operators are changing the dynamics of the industry and new technologies are lowering the barriers to entry – slashing the cost of building and launching satellites. Each of these developments represents an opportunity and a challenge for the UK. The increased activity of New Space (nongovernment funding of missions and use of cost effective ‘off-the-shelf’ technologies) and the growth of satellite services, such as remote sensing and communications, has led to over five thousand satellites in orbit in 2019. With further thousands of satellites expected to be deployed each year, the need for repair and servicing will increase considerably in the coming decades. Satellite repair and maintenance is an obvious precursor for many innovative organisations on the route to more complex in-space manufacturing. Renewed interest from major space nations to explore the solar system including returning to the Moon and further missions to Mars, the moons of Jupiter and undertaking other interplanetary missions has increased the need to develop in-space capabilities such as fuel, food, or component production. In addition, geopolitical competition on Earth supported by services derived from satellites, highlights the benefits for nations to dominate

2

space or at least have a well-developed space capability providing independent space services. The MOD emphasised the need to defend “Global Commons” such as cyberspace, the oceans and Space. “As the number of systems dependent on space-based capabilities increases, both developed and developing countries will become increasingly reliant upon them and so too will their vulnerability to disruption”2. The increased interest in space-based activities by international governments, points to increased support for In-Space services by the defence community. This is especially true for capabilities that extend satellite life and reduce costs as well as make the operational environment secure and provide technical advantage. A 2019 research report from NSR predicts cumulative revenues from on-orbit satellite services to reach $4.5bn as soon as 2028. Another earlier report from investment bank Goldman Sachs discusses In-Space manufacturing, claiming it to be an “economic game changer”. Goldman Sachs forecasts a progression from on-orbit servicing of existing space assets as the “backbone of the future”, to asteroid mining “the space-based mining of platinum worth between $25bn - $50bn”, on to In-Space manufacturing. Additionally, China is proposing to create an Earth-Moon-Mars economic zone. The On-Orbit Servicing field is attracting both large OEMs such as Northrop Grumman with their Mission Extension Vehicle (MEV) and start-ups such as Firefly and Momentus.

Source: Ministry of Defence, Global Strategic Trends, 6th Edition

12

Refuelling & Component Replacement

Active Debris Removal (ADR)

Relocation

The illustration shows many of the activities that are considered to be “In-Space Services.� However, some of these activities may not be discrete and there are technical solutions that may have multiple functions such as a service vehicle that can refuel and conduct

Inclination Correction Bringing into use of Orbital Slots

Upgrade

Source: Satellite Applications Catapult

inspection of a client satellite. In practice the development and deployment of these capabilities is expected to evolve sequentially beginning with Satellite Inspection,

13

leading to Manipulation and Manoeuvring and Ultimately to Repair, Assembly and Manufacturing On-Orbit.

MAJOR

Life Extension (LE)

In-Space Services

A

Orbit Correction

SERVICES:

In-Space Maintenance & Repair

Multi-orbitor/ Cross-orbit

IN-SPACE

Salvage and Recycling Material

De-orbiting

//////////////////////

In-Space assembly/ ReAssembly

In-Space Manufacturing

OPPORTUNITY

FOR

THE

UK

What are In-Space Services?

On-Orbit Servicing - Maturity Curve R&D

Demo

Market Intro & Growth OOS IOC DARPA: RSGS CST: InsureSat NGIS: MEV

Orbital Express Commercial OOS ISS Resupply Missions SSTL: RemoveDEBRIS

Technology Robotic Arms Vision Systems Fluid Transfer System OOS-friendly SVs Autonomy

NASA OOS Gemini/Apollo SMM, Skylab, Hubble Servicing ISS Assembly & O&M, RRM, Raven Mars Rovers

Maturity

Decline

Commodity Markets Fully Modular Systems On-Orbit SV Manufacturing Large Structure Assembly Leased Platforms

Insurance Inspection Refuel, Repair, Upgrade Modular SVs

Large Structure Assembly Human rated, Telescopes Architectures w/ Modular Systems Buy Commercial OOS

Lunar Gateway Lunar & Mars Missions Future Architectures Manned Missions

Decline Triggers - Dramatic decline Zof space activities

Maturity Triggers - Pervasive OOS capability - Auto analogy: gas stations, tow trucks, repair shops - Modular satellites assembled in space - Relaxation of design reliability, fix issues on-orbit

R&D Triggers - Human spaceflight missions - On-orbit tech upgrades needed - SVs outlive fuel - Lower SV lifecycle cost desired

Existing Universities, Non-profits & Govt. Future Universities, Non-profits & Govt.

Growth Triggers - Successful near-term demonstration missions transition to initial operating capability - Other enabling technology matured (software defined radio, interface standards, etc.) - Govt. and industry use near-term OOS capability with meaningful impact to missions - Future govt. and industry architectures baseline heavy OOS utilization - Industry uses OOS to augment insurance - Insurance companies require inspection, owners fix anomalies

Existing Commercial

Operational & Under Development Technology Maturation Path

Future Commercial

Future Technology Maturation Path

Technology Trigger Event

Source: Aerospace Corp ‘On-Orbit Servicing’ April 2019. Joshua Petal.

The chart above shows how the on-orbit servicing industry could potentially mature from stages of R&D and demo through market growth to maturity, and finally decline. Technology trigger events propel services to new stages of the maturity curve. Example projects are also split into university/non-profit/ government and commercial.

14

-

Life Extension (LE) refers to sending satellites to rendezvous with ageing satellites and extend their useful lifetimes so they can generate further revenues.

-

Additional activity may be to move the satellite to a graveyard orbit if an end of life regime has not been enacted in the original mission.

The technical solution will vary by client satellite, either using a space tug or refuelling, but the value proposition and market are very similar.

-

The value proposition is dependent on the cost of satellite replacement and to a lesser extent, the added revenue from an additional operation period.

-

The largest market for LE is geostationary telecommunications satellites, though other satellites may benefit from LE.

-

Commercial companies are early adopters. Although government satellites, especially for security related communications, offer the main potential, especially once the technology is proven in the commercial sector.

-

Control various subsystems

-

Refuel the satellite

IN-SPACE

Several technical solutions are proposed to achieve this including docking with the client satellite to

Market drivers -

-

GEO Telecommunication operators face some market uncertainty due to potential low-cost LEO constellations which may lead to delay in ordering new satellites and could make the extension of the life of older one’s satellites cost effective. Satellites in the broadcast sector use mature technologies and are less likely

15

than broadband satellites to adopt innovation. Providing an opportunity for Life Extension. -

Broadband satellite operators may be delaying ordering new satellites until new technologies are developed, such as software defined radios and beamsteerable antennas.

//////////////////////

-

-

MAJOR

GEO satellites are designed for an operational life of up to 15 years, components have high reliability, consequently, fuel becomes the main limiting factor.

A

-

SERVICES:

Overview

OPPORTUNITY

FOR

THE

UK

Life Extension

Market barriers Broadband satellite technology is advancing rapidly, with increasing demand for higher data rates. This means broadband satellite revenues decline after 5-7 years and new satellites are required. LE may be less commercially appealing for broadband satellites. The declining use of chemical propulsion systems may reduce the need for refuelling missions, though electrification is still evolving and will take up to ten years to be widely adopted. Further, even all electric craft currently use a finite chemical fuel such as Xenon which may provide an opportunity for Life Extension.

missions, the client and servicing satellites are under only one national regulator, leading to variation in regulations. The US Government may apply certain requirements to allow foreign organisations to dock with US registered satellites. NonUS corporations are in an inferior position to address the substantial budgets from NASA for the industry in the In-Space Services market In Europe both ESA and UKSA make a clear distinction between civil and National Security projects, restricting cross fertilization of funds and R&D.

Regulations regarding international missions have not been created. For current and planned

Market Scale Data on satellites currently in orbit was taken from the Union for Concerned Scientists satellite database. An average lifespan of 14 years was assumed and the number of satellites reaching the end of life plotted. The database does not differentiate between the application of the satellite.

Market (SAM) should consider the application, propulsion system and owner of each satellite. While the immediate market is for GEO satellite life extension, other use cases such as MultiOrbit and Cross-Orbit services exist. Examples include the Firefly OTV launcher adapter with propulsion (case study below).

There may be a slight overestimation due to double counting of dual use commercial/ government satellites.

In GEO, there are several services beyond life-extension including - ‘Bringing-into-use’ of orbital slots, satellite relocation, deorbiting, inclination correction and orbit correction.

Total Accessible Market of 414 GEO satellites 2020-2035 (280 commercial, 134 government). From the graph on page 17, the number of GEO satellites reaching the end of life by 2030 is expected to be 33 satellites.

The first commercial Life Extension satellite was launched on 9th October 2019, Northrop Grumman’s MEV-1 will extend the life of 18-year-old Intelsat-901 for five years and has a contract costing $13 million per year.

Any calculation of a Serviceable Available

16

Â? Â? Â? Â Â?Â? Â? Â? Â? Â Â Â?Â?

Â?Â?Â?Â? Â Â Â?

Source: Satellite Applications Catapult

17

OPPORTUNITY

FOR

THE

UK

Â?Â? Â

MAJOR

Infinite Orbits, a company looking at providing

A

The UK also registers some geostationary satellites (e.g. Inmarsat and Avanti) potentially providing the expertise to enable the licensing of LE activities in UK.

SERVICES:

life extension services, also has an office in the UK and is aiming for an In-Orbit-Rendezvous demonstration mission in 2020.

IN-SPACE

The UK is home to Effective Space Limited aiming to launch LE spacecraft in 2020. Their first contract, signed in 2017 with an international satellite operator, will see two Space Drone craft designed to extend the life of two existing satellites, and is expected to generate revenues of more than US$100 million.

//////////////////////

UK Capability

Life Extension Timeline LEO constellation uncertainty reduces

Commercial

Capability

First refuelling mission NASA Restore -L

Effective Space Space Drone Launch

NGIS Mission Extension Vechicle launch ($13million p.a)

NGIS Mission Extension Pods Launch

2020

Regulation

Market size

Governments begin adopting services

Liability frameworks discussed

Commercial satellites: 15 per year TAM

2025

Liability agreements established

Commercial and government satellites: 25 per year TAM

Electrification reduces refueling demand

Orbit Fab launches in-space refueling stations

Development of Space Stations and docking technology add refuel and repair capabilities/ hubs

2030

In Orbit Servicing Insurance coverage regulations

Commercial and government satellites pedicted to be over $1.9 billion in revenues

Source: Satellite Applications Catapult Note: Timeline reflects both likely events that have been announced, as well as predicted potential events.

18

Deep Space missions push innovation in propulsion efficiency

Regulations for use of space stations and other off-world infrastructure for refuelling and repairing

2035

2040

Regulations for use of space stations and other off-world infrastructure for refuelling and repairing

Two-way Lunar and Space Station missions would require refuelling and repair capabilities

THE

UK

Life Extension

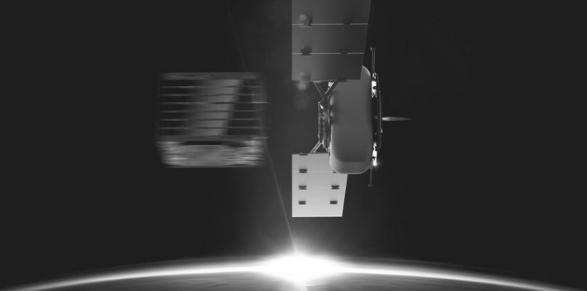

Effective Space’s Space Drone spacecraft will provide docked life extension service for GEO satellites and has secured a commercial contract to operate two of their Space Drones to extend the life of two host satellites. The Space Drone spacecraft is a small, 400kg satellite that will have a service life of 15 years and is capable of multiple rendezvous and dockings with different satellites and can fully control a host satellites, ranging from 1500kg to 4000kg, manoeuvring using four electric propulsion thrusters mounted to four deployable thruster arms.

19

The types of current missions envisioned for the Space Drone include: - - - -

Station-keeping and altitude control Relocation and deorbiting Inclination and orbit correction Bringing into use

Effective Space, headquartered in the UK, plans for their Space Drone to be adaptable and to further its capabilities with their first two life extension missions providing heritage and in-orbit validation opportunities for future cost-effective, large-scale ADR and PMD (post mission disposals) missions.

//////////////////////

Source: Effective Space

IN-SPACE

SERVICES:

A

MAJOR

OPPORTUNITY

FOR

– A Case study

Source: Astroscale

020 20

Technology still poses some challenges, for example interacting with tumbling objects to perform ADR or Life Extension. There have been trials demonstrating the capture of debris including manipulating with nets and harpoons. However, there is an issue of scaling for large constellations or a variety of debris types. Market drivers Growth in commercial LEO constellations will vastly increase satellites in orbit. Some above ~650km will fail and stay aloft for centuries if not actively deorbited. Tighter regulation of Earth orbits will need increased post-mission disposal. In some jurisdictions, companies must prove they will meet 25-year post mission disposal guidelines, either with high reliability propulsion systems or ADR agreements. Government and institutions may require oneoff satellite disposals, though there is a limited business case for funding these missions. Reduced insurance premiums for those with ADR contracts could drive demand. Market barriers The market is largely dependent on the success of mega-constellations, which is currently uncertain. The recent bankruptcy filing of OneWeb has increased uncertainty about the viability of very large constellations and Boeing is not developing

21

its proposed constellation. Amazon Kuiper constellation is only recently announced and therefore details are uncertain. In the near-term regulatory environment, ADR is only required for satellites above ~650 km as lower altitude satellites will naturally deorbit. Market size The launch campaigns of major constellations were modelled approximately, and the design life of each satellite assumed to be 5-7 years (where not otherwise known). Although the Total Available Market (TAM) is approximately 1500 satellites by 2030 this is dependent on the commercial success of the satellite operators, the graph on page 22 is for all satellites reaching the end of life. Single satellite missions and small constellations are not modelled. The only constellation where ADR would be required at the current level of regulation is Iridium. This is due to it’s constellation altitude.

UK OPPORTUNITY MAJOR

There are various technological solutions, for example, Astroscale is using magnetic plates and D-Orbit provide deorbiting devices that work independently of their host spacecraft, but robotic arms or autonomous robots may be needed for satellites without these devices and these technologies are currently expensive.

A

For satellites with propulsion systems, ADR will only be required if those systems fail.

SERVICES:

This mostly refers to LEO and MEO satellites, where a graveyard orbit is not available. There are many more satellites in LEO so this is currently the primary focus.

IN-SPACE

Active Debris Removal (ADR) refers to sending spacecraft to rendezvous with and remove spacecraft and debris from orbit.

//////////////////////

Overview

FOR

THE

Active Debris Removal (ADR)

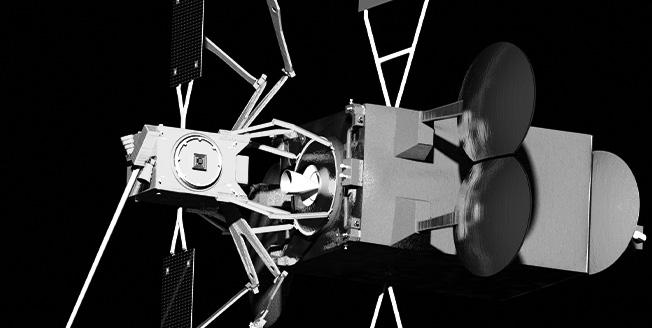

UK Capability Japan based Astroscale has a UK office and is working with the Satellite Applications Catapult for the National InOrbit Servicing Control Centre. Astroscale has proposed a multi-target end-of-life space debris removal concept which attaches a standard docking mechanism on satellites before launch that will, at end of life, allow for a more efficient capture in orbit by a ‘chaser’ spacecraft. The chaser would dock with two, or possibly more, satellites typically from a constellation, and subsequently deorbit them to mitigate space debris. The ESA Sunrise Program will develop technologies needed to enable future missions, whether it be in satellite hardware, ground infrastructure or end of life de-orbiting (scheduled before 2023). Following the bankruptcy of OneWeb it is unclear how this programme may evolve, the Sunrise programme is likely to continue to focus space debris control. Another capability including the RemoveDEBRIS harpoon has been developed by Airbus and Oxford Space Systems, while D-Orbit UK has developed the ION spacecraft as a platform for future on-orbit service missions. UK Consultants Hempsell Astronautics proposed a system ‘Necropolis’ that would collect defunct geostationary satellites and deliver them to a graveyard orbit.

Â? Â

Â?Â?

� ‡ ‡  „† … „ ‚ƒ

Â

Â?  Â?Â? Â? Â? Â? €  Â?

Source: Satellite Applications Catapult

Fair-Space is co-ordinating commericially inspired research into AI and Robotics for in-space applications.

22

Regulation

Market size

IADC guidelines codified nationally

Small market, some Iridium satellites

North Star space debris tracking constellation

First major constellations deorbit regularly with 10% failure rate

Source: Satellite Applications Catapult

‘Note: Timeline reflects both likely events that have been announced, as well as predicted potential events.

23

THE FOR

Brane Craft launch their small flexible space craft that envelops and remove debris

2030

Anti-Satellite missile regulations

OPPORTUNITY

Over 30 small satellite mega constellations

MAJOR

O. Cubed Services will be all in-one service satellite including ADR

2025

Guidelines to reduce time allowed to deorbit

Iridium third generation launches

2035

Guideline strengthened to include controlled deorbit

Market increase due to stronger guidelines and new constellations

2040

Regulations on debris removal to reduce risks of collisions due to increased amount of debris and satellites Regulations controlleddeorbiting of multiple satellite constellations

A

2020

ELSA-D mission to demonstrate debris docking and demoval

Second generations launch, first require deorbit

SERVICES:

Remove DEBRIS demonstrates ADR technology (nets, harpoons, VBN)

Telesat, Amazon in service

IN-SPACE

Capability

SpaceX, Legacy OneWeb constellation

//////////////////////

Commercial

UK

Active Debris Removal Timeline

Active Debris Removal – A Case study

Source: SSTL (Surrey Satellite Technology Ltd), RemoveDEBRIS satellite

RemoveDEBRIS RemoveDEBRIS is an Active Debris Removal technology demonstration mission to find the best way to capture orbital debris. The mission was led by Surrey Space Centre and operated by SSTL but includes a total of 10 partners and was also part funded by the European Commission. The RemoveDEBRIS satellite was released from the ISS in June 2018 and was equipped to perform four different experiments: - -

Net Experiment - Successful A CubeSat was ejected at a low velocity in order to provide a target, and at distance of 7m away, a net was ejected which

- -

- -

- -

24

successfully captured and entangled the CubeSat. VBN (Vision-Based Navigation) Experiment Successful Another CubeSat was deployed and the onboard 2D VBN camera and 3D LiDAR technology tracked the CubeSat’s movement and rotation. Harpoon Experiment – Successful A 1.5m boom was used to deploy an aluminium harpoon target, in which a harpoon, designed with deployable barbs, successfully deployed and captured the target, although snapping the boom. Dragsail Experiment – Unsuccessful The sail which intended to increase the drag of the satellite and force the satellite to deorbit within eight weeks failed to deploy.

Market size

Market drivers

-

If developers of these technologies can prove that it augments the capability of current spacecraft designs, it is more likely to be adopted.

- -

-

-

For the augmentation of smaller satellites, the market size would be all satellites that require large amounts of power or large antennas. This includes telecommunication satellites and radar satellites. For very large spacecraft missions, the market is small and dependent on these single missions. In the short term, revenue will be from earth-based R&D and the operation of testbeds as well as development of enabling technologies such as vision systems. There is a clear path for opportunities in constellation manufacture, launch and on-orbit servicing through to inspace manufacture and construction as new materials, techniques and concepts develop. The work of CASIS and others in exploiting the International Space Station (ISS) has set the baseline. The CASIS portfolio of projects has leveraged more than $100m from non-NASA and non-CASIS sources.

25

Certain future very large spacecraft missions will require in-space assembly. Other opportunities: -

- - -

-

-

Manufacture of massive antennae (enabling mobile phone users on Earth to roam seamlessly from terrestrial to satellite networks as they travel) New in-space solar power farms New in-space infrastructure (hubs with power, propulsion, service, refuelling) Developing major new activity in space, including human habitation beyond Earth orbit, and scaled-up commercial tourism in Earth orbit. Thales Alenia Space believes LEO mega constellations will drive a need for an orbital partner that is capable of performing a range of in-orbit missions, such as changing payload. Current technology on the ISS has proven

UK THE FOR OPPORTUNITY MAJOR

-

A

-

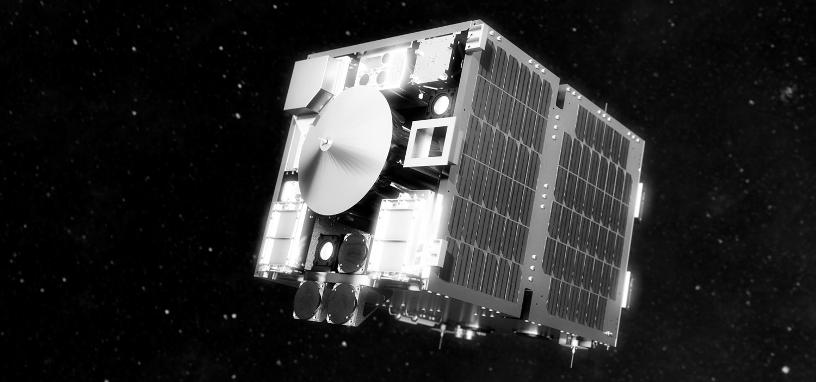

In space manufacture refers to creating spacecraft or other assets in orbit, rather than on the ground. This includes assembly of large structures, such as the International Space Station, and additive manufacturing in space. This could be used for assembling spacecraft larger than a rocket fairing will allow, or augmenting the capabilities of smaller spacecraft, by creating larger solar arrays or antennas. Drivers for such activity include lunar missions, large space antenna supporting satellite phones, remote additive manufacture or specialist products made in micro gravity.

SERVICES:

-

IN-SPACE

Overview

//////////////////////

In-Space Manufacturing and Assembly

-

the ability to have reliable, complex and transformative robotics in space; Canadarm 2 and Dextre, built by MDA, have been performing on-orbit infrastructure servicing operations together since 2008. MDA lead the way in space robotics and are providing robotic solutions for NASA’s Restore-L and Darpa’s RSGS servicing vehicles. Existing LEO infrastructure, such as the International Space Station (ISS) offers new opportunities to be capitalised upon, enabling experimentation and commercial use, particularly around the microgravity environment (more efficient therapies and better vaccines; stronger and more conductive materials; fibre optics; developing new plant varieties that are better adapted to extreme conditions).

The demand for very large spacecraft missions is low, with only a handful planned for the next decade. UK Capability -

-

- -

Market Barriers Current spacecraft manufacturers are risk averse to novel missions that require many moving parts. This risk will have to be mitigated in part through government funded missions. Ambition and commercial cases need development.

-

Image Source: SpaceNews.com, Made in Space

The UK is particularly strong at high value manufacturing and Industry 4.0, including additive manufacturing. The high value manufacturing Catapult is investigating the future of space robotics. Using AI to increase autonomy in robotics, FAIR-SPACE is developing technologies that will ultimately support in-space manufacturing requirements. However, NASA/US has currently led the way with in-space manufacturing on the ISS. ESA has not copied these missions. Expertise in deployable mechanisms (e.g. Oxford Space Systems) or large structures such as heat shields (Reaction Engines) is an advantage for UK ambitions. In-space construction, in general, is a growing area of interest and something the UK space sector is coalescing around, with the aim of driving toward a leading position for the UK as it evolves.

Image Source: NASA, Lunar Gateway

26

Capability

Namoracks launches In-Space Outpost demonstrating robotic cutting of metal

Crewed missions to the Moon with infrastructure needed to enable regular missions

Made in Space’s in-space construction, assembly and repair satellite Archinaut launches

Iridium third generation launches

THE FOR

Over 30 small satellite mega constellations

Tethers Unlimited Spider FAB enables fabrication of large-scale components

Large 15m telescope LUVOIR to be constructed in space and made upgradeable

NASA Lunar Gateway becomes the first lunar orbiting space station

Market size

ISS only

Guidelines to reduce time allowed to deorbit

Chinese Space Sation

2030

Anti-Satellite missile regulations

Comercial Satellite using on orbit assembly

Crew assisted manufacturing on Space Stations

Source: Satellite Applications Catapult Note: Timeline reflects both likely events that have been announced, as well as predicted potential events.

27

2035

Guideline strengthene d to include controlled deorbit

Large scale commercial missions requiring start-to-finish in space assembly

2040

Regulations on exporting goods from space

Increase in crewed missions and development of off world infrastructure in orbit, lunar, on mars

IN-SPACE

Regulation

IADC guidelines codified nationally

2025

//////////////////////

2020

SERVICES:

A

DARPA demonstrates in-space inspection and repair with RSGS launch

Large structures that will need be designed start to finish in orbit

OPPORTUNITY

Potential to increase capability of antennas/panels in current satellites provides new market opportunity

MAJOR

Commercial

UK

In-Space Manufacturing Timeline

In-Space Manufacturing – Case studies The Innovate UK funded SMARTER project brings together some leading UK companies to explore the steps required to develop a successful in-space manufacturing sector. The Nanoracks Space Outpost programme, as part of NASA’s NextSTEP-2 effort, has a goal of being able to repurpose spent upper stages of launch vehicles and convert them into commercial space stations and habitats whilst in orbit. This novel approach is laying the groundwork for reuse of in-space hardware, a capability Nanoracks believes could play an important role in the In-Space Services industry by providing a cost-effective method to build in-space structures. Maxar will be developing the robotic arm with friction milling capabilities. This method will use high rotations per minute melting the metal material in order to cut it yet avoiding the production of debris. The In-Space Outpost Demonstration itself is a mission to build a self-contained hosted payload platform that can demonstrate the robotic cutting of second stage tank material on-orbit. Nanoracks is targeting a Q4 2020 launch, in which they will have up to an hour to complete the cutting of three metal pieces that are representative of various vehicle upper stages.

28

Image Source: Nanoracks, Independence-1 Outpost. It will be the first mission to demonstrate metal cutting in space and the repurpose of upper stages.

OPPORTUNITY

FOR

THE

UK

In-Space Manufacturing Ecosystem and Drivers

MAJOR

Micro Gravity Medicine and Surgery

Manufacturing in Space Legislation

Autonomous Robotics

4D Printing

Asteroid Mining

Regular Servicinf of In Space Assets

DefenceContested Outer Space

Space Debris Legislation & Mitigation

Rare Elements Shortage

INSPIRE CubeSats in Earth-escape orbit

Micro Gels

L IA

Biotech (food,medicine, structures)

Microgravity Manufacture

M

M

ER

C

GU

LA

TO RY

Unique Materials (Optics; Pharma)

RY TO

C

O

RE

SERVICES:

Generative Design

A OR PL

Satellite Life Extension

EX

Jupiyer’s Moon Europa

Lunar Gateway (NASA)

Planetary (Mars)

L TECHNICA

2020

2025

2030

Source: Satellite Applications Catapult.

29

2035

2040

IN-SPACE

Space Traffic Management

Nano Technologies (solar sails, habitat structures)

Generative Design

Ownership of Space Resources

//////////////////////

UN COPUOS Resolutions (Debris)

A

Self Healing Materials

Other In-Space Services -

Technology demonstrations These will be required for all In-Space manufacturing and especially proximity or tandem services to increase confidence with stakeholders. All links in the supply and service chain will have to be tested or simulated on Earth, providing opportunities for a wide range of expert stakeholders.

-

Space Tugs or ‘In-Space Transportation Services’ Space tugs involve transportation of satellites once they are in orbit, not always for life extension purposes but for allowing for more flexibility and access to specific orbits, including orbit raising from LEO to GEO. D-Orbit provides “Space Taxi” services using their ION platform for precision deployment of spacecraft in orbit. The first two IONs will be launched in 2020 deploying multiple customer payloads to exact destinations on orbit. Airbus’s O.Cubed Service plans to offer a suite of in-orbit services operated by a Space Tug including maintenance (life extension, relocation, upgrades and inspections), logistics (second leg delivery, constellation deployment) and clean up (ADR) services.

-

Government / Defence Governments and defence agencies will continue to be a main driver in new satellite technologies, and in this case, for In-Space Services. They have already funded and created many of the largest OOS (On-

Orbit Servicing) projects such as: NASA’s $73.7 million contract to Made in Space for their Archinaut One demonstration mission, the Lunar Gateway project in which NASA is working with partners to build a space station in lunar orbit planned for 2026 (which NASA has a 2020 budget of $812.4 million) and China continuing their Tiangong programme to create their own Chinese Space Station. DARPA, a US defence agency, is also working with commercial partners to launch their RSGS Servicing Satellite to demonstrate satellite servicing for the US government. The symbiosis between government / defence agencies, and commercial companies is a force for innovation that has worked especially well for the American space industry. -

Resource Mining Resource mining is a distant future industry that plans to mine for raw materials on near earth asteroids and is an industry that will build on the current developments within the In-Space Services sector. The UK companies Asteroid Mining Corporation and Blue Asteroids have aims in identifying mining opportunities and developing technologies in prospecting asteroids with a goal of mining in the 2030s. .

-

Space tourism & off-planet habitats Space tourism encompasses a few different aspects of space including sub-orbital launches to experience microgravity, lunar flybys and space station stays (previously done by the Russian space agency Roscosmos from 2001 – 2009). Virgin

30

UK THE FOR OPPORTUNITY MAJOR //////////////////////

IN-SPACE

SERVICES:

A

Galactic has raised $1 billion in total for its sub-orbital launch service which will be available to private astronauts within the next year. The dearMoon project, in partnership with SpaceX, is a lunar tourism mission and art project that plans to fly several crew and artists on a circumlunar trajectory in 2023. Orion Span and Axiom Space are both planning commercial space stations that would be available to private customers in the next decade.

Image Source: Cosma Schema, Momentus Vigoride Extended

31

sa.catapult.org.uk T: +44 (0) 1235 567999 W: sa.catapult.org.uk

E: info@sa.catapult.org.uk @SatAppsCatapult

32