Dear readers,

Dear readers,

As we embrace the arrival of April, the essence of spring permeates the air, bringing with it a renewed sense of excitement and anticipation In this issue of Fall In Love with Arizona, we celebrate the vibrant real estate market and the boundless opportunities that await you in our beloved state

April is a time of rejuvenation, a season when nature comes alive with vibrant hues and the promise of new beginnings. It's a perfect time to explore the dynamic world of real estate and embark on a journey toward your dream home in Arizona.

In this edition, we delve into the intricacies of the mortgage process with our feature article, "Mortgage Fees: Understand the Cost of Your Loan." Buying a home is a significant investment, and we aim to provide you with valuable insights to help you navigate the associated costs and fees with confidence

For those eagerly awaiting the opportunity to plant roots in Arizona, our article "How Long Does It Take To Buy a House in Arizona?" offers a comprehensive look at the typical timeline, allowing you to prepare and manage your expectations throughout the home-buying journey.

If you're a first-time homebuyer setting your sights on the vibrant city of Scottsdale, our "First-Time Home Buyer Checklist in Scottsdale, AZ" is a must-read. This article serves as a valuable guide, equipping you with the knowledge and tools necessary to navigate this exciting chapter with ease.

As the real estate market continues to evolve, we also explore the potential pitfalls and costly mistakes to avoid when purchasing a new-construction home in Arizona Our article "9 Costly Mistakes Buyers Make When Purchasing a NewConstruction Home in Arizona" provides invaluable wisdom, ensuring you make informed decisions every step of the way

Throughout this issue, you'll find a wealth of expert advice, insightful articles, and practical tips to help you unlock the full potential of Arizona's thriving real estate market. Whether you're a seasoned investor or a first-time buyer, we're here to empower you and celebrate the countless opportunities that our beautiful state has to offer.

Warm regards,

YvonneMcFadden

Purchasing your first home is an exhilarating yet daunting endeavor, filled with anticipation and numerous crucial decisions. If you're a first-time homebuyer setting your sights on the vibrant city of Scottsdale, Arizona, navigating the process can seem overwhelming. From determining your budget to securing financing, and exploring neighborhoods to negotiating the purchase, there are numerous factors to consider.

Scottsdale's diverse neighborhoods, from bustling urban centers to tranquil desert oases, offer an array of options for first-time buyers By following this checklist, you'll be equipped with the knowledge and resources to find your dream home in this captivating city So, let's embark on this exciting adventure together and turn your homeownership aspirations into reality.

Establishing a realistic budget is the foundation of your home-buying journey. Begin by evaluating your current financial situation, including your monthly income, existing debts, and any other recurring expenses. It's also crucial to factor in potential future costs, such as property taxes, homeowners association fees, utilities, and maintenance expenses.

To ensure a smooth and stress-free experience, having a comprehensive checklist tailored to the Scottsdale market is invaluable. This guide will serve as your roadmap, outlining each step along the way and providing insights specific to the region. With a clear plan in place, you can approach your home-buying journey with confidence, making informed decisions that align with your lifestyle and financial goals

Consider setting a maximum price range that comfortably aligns with your finances, ensuring that your mortgage payments, along with other homeownership costs, do not exceed a predetermined percentage of your income. Many financial advisors recommend keeping housing expenses below 30% of your monthly gross income.

By defining a clear budget upfront, you'll be able to focus your home search on properties that fit within your means, avoiding the temptation to overextend yourself financially

"TheArizonahousing markethasseen fluctuations,andsupply anddemanddynamics playasignificantrole.It’s essentialtostay informedandwork closelywithprofessionals tomakeinformed decisions."

Before you start actively searching for homes, it's essential to get pre-approved for a mortgage This step involves providing a lender with your financial documentation, such as income statements, tax returns, and credit reports The lender will then evaluate your eligibility and provide you with a pre-approval letter, which outlines the maximum loan amount you qualify for and the associated interest rate

Having a pre-approval letter not only gives you a better understanding of your purchasing power but also positions you as a serious buyer in the eyes of sellers and real estate agents. When you make an offer on a property, the pre-approval letter demonstrates that you have the financial means to secure a mortgage, increasing the likelihood of your offer being accepted.

Scottsdale is renowned for its diverse array of neighborhoods, each with its distinct character and amenities. Researching these communities is crucial to finding the perfect fit for your lifestyle and preferences.

Consider factors such as proximity to your workplace, quality of schools in the area (if you have or plan to have children), access to recreational facilities like parks and hiking trails, and the overall vibe and architecture of the neighborhood Some popular areas in Scottsdale include Downtown, Old Town, McCormick Ranch, Gainey Ranch, and Grayhawk – each offering a unique blend of urban conveniences and natural beauty

Additionally, familiarize yourself with the local real estate market trends, including average home prices, appreciation rates, and the pace of sales in each neighborhood. This information will help you make an informed decision and potentially identify areas with promising long-term investment potential.

Creating a prioritized list of desired features in your first home will streamline the search process and help you focus on properties that truly meet your needs. Consider factors such as the number of bedrooms and bathrooms, the size of the living spaces, the age and condition of the home, and any specific amenities you require, such as a backyard for pets, a modern kitchen, or a home office space.

Prioritize these features based on their importance to your lifestyle, distinguishing between essential requirements and desirable extras. This will make it easier to narrow down your options and avoid compromising on your non-negotiable preferences.

While online listings and virtual tours can provide a good initial impression, there's no substitute for experiencing a property in person. Take advantage of open houses and scheduled viewings to truly immerse yourself in potential homes.

During these visits, pay close attention to details that may not be apparent in photos or listings, such as the overall condition of the home, the layout and flow of the spaces, the quality of natural light, and any potential repair or renovation needs

Additionally, take note of the surrounding neighborhood, including factors like noise levels, traffic patterns, and proximity to amenities like shops, restaurants, and parks.

These in-person evaluations will help you develop a deeper understanding of each property, enabling you to make an informed decision when the time comes to make an offer.

Partnering with a knowledgeable and experienced real estate agent can be invaluable for first-time homebuyers in Scottsdale. Agents like Yvonne Jett McFadden have extensive insider knowledge of the local market, including current trends, pricing strategies, and neighborhood insights.

A real estate agent will guide you through every step of the buying process, from identifying suitable properties and scheduling viewings to negotiating offers and navigating the legal and financial aspects of the transaction.

Additionally, agents have access to the Multiple Listing Service (MLS), which provides up-to-date information on available properties, often including listings that are not yet publicly advertised

By leveraging the expertise and resources of a dedicated real estate agent, you'll have a trusted advocate working in your best interests, ensuring a smooth and efficient home-buying experience

Once you've found a property you're interested in purchasing, it's crucial to schedule a comprehensive home inspection with a licensed and reputable professional. A thorough inspection will identify any potential issues or necessary repairs, providing you with valuable information before finalizing the purchase.

During the inspection, the professional will evaluate the home's major systems and components, including the foundation, roof, electrical and plumbing systems, HVAC, and appliances. They will also assess the overall condition of the property, looking for potential problems such as water damage, structural issues, or code violations.

While the inspection comes at an additional cost, it can save you from inheriting costly problems down the line and give you leverage to negotiate repairs or a lower purchase price if significant issues are discovered

When you're ready to make an offer on a property, your real estate agent will guide you through the process of reviewing and understanding the purchase contract This legally binding document outlines the terms and conditions of the sale, including the purchase price, closing date, contingencies, and any special provisions or addendums.

Carefully review each section of the contract with your agent, ensuring that you fully comprehend the terms and implications before signing. Don't hesitate to ask questions or seek clarification on any aspect of the contract that is unclear.

Your agent will also advise you on negotiating strategies and represent your best interests throughout the negotiation process, working to secure the most favorable terms for your home purchase.

In addition to the down payment on your new home, it's essential to budget for closing costs – the various fees and expenses associated with finalizing the mortgage and transfer of ownership. Closing costs can include items such as loan origination fees, title insurance, appraisal fees, attorney fees, prepaid property taxes, and homeowners insurance premiums. These costs can vary widely depending on the lender, location, and purchase price, but typically range from 2% to 5% of the total loan amount.

Your lender is required to provide you with a detailed estimate of closing costs shortly after you submit your mortgage application, giving you ample time to plan and save accordingly. Failing to account for these expenses upfront can lead to unpleasant surprises and potential delays in the closing process

Congratulations! After navigating the intricate journey of purchasing your first home, it's time to celebrate this significant milestone

Once the paperwork is complete and the keys are in your hands, take a moment to savor the accomplishment and the beginning of an exciting new chapter in your life

Becoming a homeowner is a remarkable achievement, and the culmination of your hard work, dedication, and perseverance. Enjoy the sense of pride and stability that comes with owning your own property, and look forward to creating cherished memories in your new home.

Remember, the process of buying a home, while challenging, is an invaluable investment in your future. With careful planning, guidance from professionals like Yvonne Jett McFadden, and a commitment to staying informed, you've successfully navigated the complexities of homeownership. Embrace this accomplishment and the countless opportunities that lie ahead in your beautiful new Scottsdale home.

Desert Mountain Sunrise Village ready to build on this acre lot, that provide stunning views of the surrounding landscape. This lot offers views of the Renegade Golf Course, as well as panoramic views of the city and nearby mountains. Desert Mountain is renowned for its committmentto preserving the natural beauty of the area, and each village is carefully designerd to build harmoniously with the desert landscape. The community is also known for its top notch security measures and a range of services and amenities that cater to the needs and preferences of its residents. Overall Desert Mountain has established itself as one of the most prestigious master planned communities in the Vally of the Sun, offering an exceptional quality of life and an unparralled living experience for the resident Come build your amazing custom home. Call for builders names

By Yvonne McFadden

By Yvonne McFadden

Buying a home is one of the biggest investments most people will make in their lifetime. While the mortgage loan itself represents the bulk of the costs, prospective homebuyers need to be aware that there are a variety of fees associated with obtaining a mortgage. From application and origination fees to closing costs and other expenses, these additional mortgage fees can add up quickly.

Borrowers must understand the full scope of costs involved in their home loan from the outset. Failing to account for mortgage-related fees could lead to unpleasant surprises and strain borrowers' budgets during the lending process. In this article, we'll take a comprehensive look at the various fees homebuyers typically encounter when securing a mortgage. Being informed allows you to plan accordingly and negotiate fees where possible to keep your overall borrowing costs in check.

The application fee is one of the first fees you'll encounter when applying for a mortgage. As the name implies, this fee covers the cost for the lender to process your loan application. Application fees generally range from $75 to $300, though some lenders may charge more or less.

The application fee amount can vary based on several factors First is the lender itself - different mortgage companies will charge different application fee amounts Additionally, the complexity of your loan scenario can impact the fee For example, if you have a more complicated financial situation with multiple income sources or investment properties, the lender may charge a higher application fee to account for the additional underwriting work required.

It's important to inquire about the lender's application fee upfront, as this is typically due when you first submit your loan application materials. Some lenders may be willing to waive or reduce the fee, especially for borrowers with excellent credit or those willing to pay discount points at closing. Shopping around can help you find the most affordable application fees.

While the application fee covers processing your initial loan file, the origination fee compensates the lender for their work in actually creating and finalizing the mortgage loan itself. Origination fees are usually calculated as a percentage of the total mortgage amount, typically ranging from 0.5% to 1.5%.

For a $300,000 mortgage, an origination fee of 1% would equal $3,000 Origination fees tend to be higher for larger loans since more work is involved However, some lenders simply charge a flat origination fee regardless of the loan size

Unlike the application fee due upfront, the origination fee is usually rolled into your closing costs and paid when you finalize the mortgage. Some lenders may quote the origination fee as separate, while others bundle it into an overall "origination charge" along with other fees.

It's important to compare origination fees between multiple lenders, as this can be one of the higher individual costs in the mortgage process. You may be able to negotiate a lower origination percentage, especially if you represent a low-risk borrower. Lenders are often willing to compete on origination charges to win your business.

Before finalizing your mortgage loan, the lender will require an appraisal to assess the fair market value of the home you want to purchase. An appraisal involves a licensed professional visiting the property to evaluate its condition, size, comparable recent home sales in the area, and other factors that determine an appropriate sale price.

The appraisal fee covers the cost of this service, which is critical for the lender to ensure the home's value justifies the mortgage amount Typical appraisal fees range from $300 to $500, though they can be higher for larger or more complex properties

While you as the buyer are responsible for paying the appraisal fee upfront, it protects your interests as well by preventing you from overpaying for the home. If the appraisal comes in lower than the contracted sale price, you may have grounds to renegotiate with the seller.

Shopping around for appraisers can help you find lower fees. However, the lender will ultimately select their preferred appraiser which meets their qualification standards.

An inspection fee pays for a certified home inspector to thoroughly examine the house before you purchase it. During the inspection, which typically takes 2-3 hours, the inspector will evaluate the condition of the home's major components like the foundation, roof, plumbing, electrical, and HVAC systems.

Their detailed report will identify any potential issues or necessary repairs, protecting you from inheriting costly problems after buying the home While inspections are optional, they provide crucial information about what you're buying that can make or break the deal

Home inspection fees generally range from $300 to $500 on average for a single-family home, though the specific rate depends on the inspector, home size, age, and location. You'll pay this fee directly to the home inspector, separate from other mortgage costs.

Don't skip an inspection to save a few hundred dollars upfront. Having an expert set of eyes assess the home first could save you exponentially more by avoiding costly repair issues or negotiating a lower price based on needed maintenance.

If your down payment is less than 20% of the home's purchase price, your lender will likely require you to p private mortgage insurance (PMI). This protects the lender should you default on the loan payments down road.

PMI rates vary based on your down payment amount credit score but typically range from 0.5% to 1.5% of t total mortgage annually. For example, if you put 5% d on a $250,000 home and pay 1% PMI, your annual PM premium would be $2,375.

While an added expense, PMI enables you to buy a ho with a smaller down payment than the traditional 20% threshold Once you reach 20% equity, either through payments or the home's appreciation, you can reques have PMI removed from your mortgage

In some higher-cost areas, lenders may require a smaller down payment to qualify for PMI removal. Be sure to ask your lender about their specific PMI cancellation policies.

In addition to the individual fees outlined above, you'll encounter closing costs when finalizing your mortgage and home purchase. Closing costs refer to a collection of charges for services like:

Title search and insurance

Deed recording fees

Lender underwriting/processing fees

Prepaid property taxes and homeowners insurance

Mortgage points (if buying down the interest rate)

Typically, closing costs range from 2% to 5% of the total mortgage amount. On a $300,000 loan, you could pay anywhere from $6,000 to $15,000 in total closing costs.

Closing cost amounts will vary based on your lender, loan program, mortgage rate, location, and other factors

However, your lender is required to provide a loan estimate detailing all the closing costs within three days of receiving your application

Be sure to go over each fee line-by-line and ask for explanations on any charges that seem excessive or unclear. Some closing costs may be negotiable, so shop around and compare the total costs across multiple lenders.

Taking out a mortgage to purchase a home involves more costs than just the loan amount itself. From application and origination fees to appraisals, inspections, mortgage insurance premiums, and closing costs, these expenses can add up quickly.

Understanding the full range of fees allows you to plan accordingly and ensure your mortgage fits comfortably within your budget. Don't let unexpected charges catch you off guard - that's a surefire way to start your home ownership journey on the wrong foot financially.

As you shop around for lenders and mortgage programs, be sure to request full cost estimates and compare the total fees you'll be paying. Reasonable fees are to be expected, but excessive charges could be a red flag about that particular lender

It's also wise to negotiate fees where possible Even shaving off fractions of a percentage point on an origination fee or haggling down some closing costs could save you hundreds or thousands of dollars

At the end of the day, buying a home is a major investment and taking the time upfront to understand all the costs will pay off in the long run. An informed mortgage borrower is an empowered one who can make smart decisions about their home loan. With preparation and due diligence, you can conquer mortgage fees and keep more money where it belongs - investing in your new home.

Experience unparalleled luxury resort living in this nearly-new, lightly-used home (built 2019) on the best lot in gated White Horse. Camelot Homes is Arizona's ''Most Awarded Luxury Homebuilder'', & White Horse won prestigious awards for innovation in indoor/outdoor living. Set back in the community on an elevated lot with mountain views, this is truly an oasis in the desert. A front courtyard with manicured desert landscaping leads to an impressive entry.

OFFERED AT

$5,250,000

The great room is masterfully built with movable glass walls on two opposing sides, creating a magical open concept where front courtyard, great room, & back courtyard converge effortlessly into one breathless vision. French Country wide plank flooring throughout brings warmth & charm. Incredible chef's kitchen offers requisite (MORE) appliances (Wolf & Sub Zero), 2 dishwashers & one of the largest most fabulous kitchen islands imaginable. In addition to the great room which offers multiple entertaining/dining areas, there is perfection in the master suite, a family room/game room/playroom, office (with ensuite), & 2 secondary bedrooms (both ensuites). No interior steps. Backyard offers stunning pool with sun shelf, mountain views, privacy, & artificial grass for easy maintenance. Perfectly located within Scottsdale's most desirable zip code of 85255, White Horse is 3 minutes to the Marketplace at DC Ranch (a lovely retail/dining/shopping experience), 3 minutes to AJs/CVS/Starbucks, 5 minutes to the 101 Freeway, 10 minutes to Scottsdale Quarter.

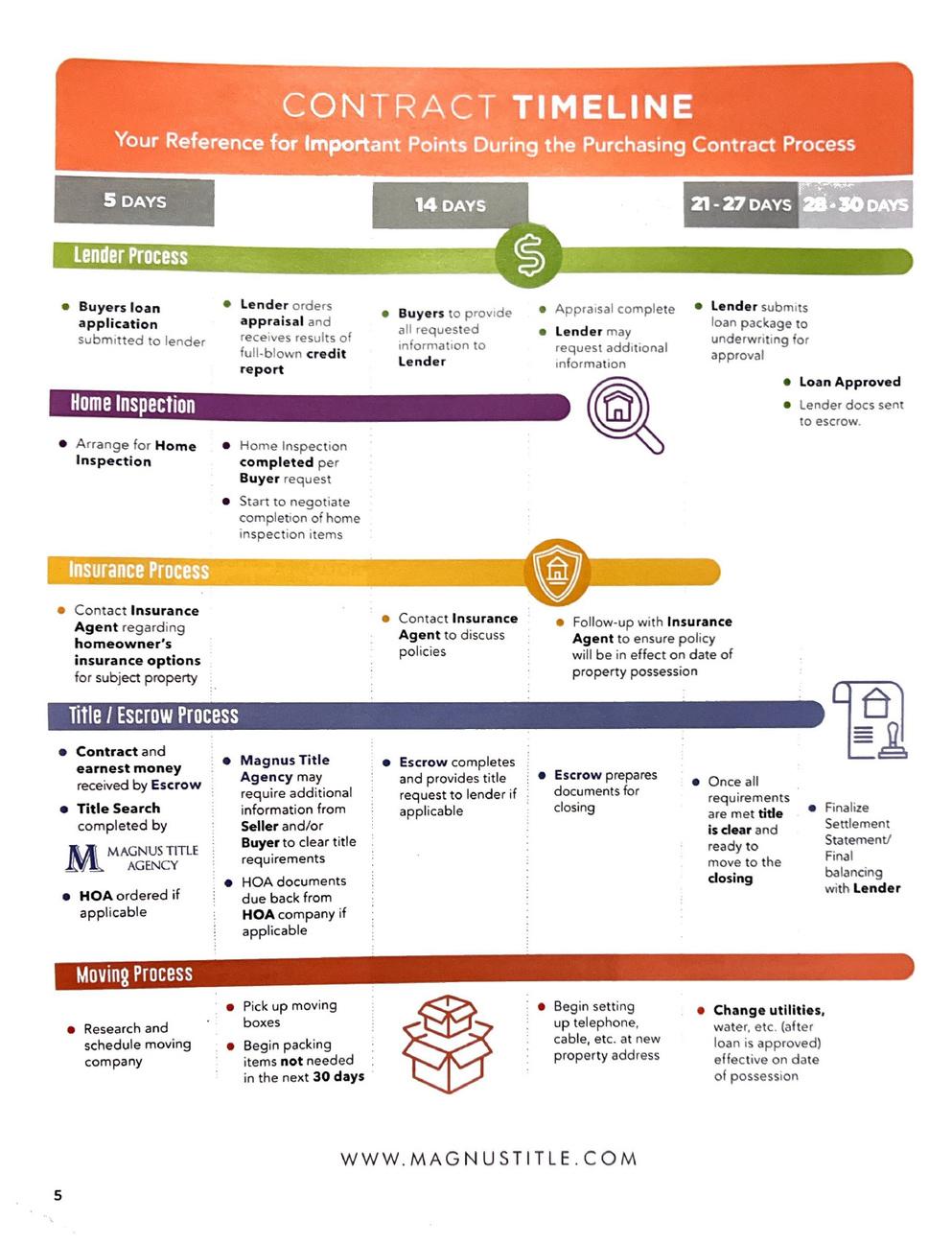

Purchasing a home is an exhilarating yet intricate process, and the timeline can vary significantly depending on various factors. If you're considering buying a house in Arizona, one of the most common questions you might have is: "How long does it take?"

Understanding the typical timeline can help you prepare and manage your expectations throughout the home-buying journey.

Before embarking on your house hunt, it's crucial to get pre-approved for a mortgage. This step involves submitting your financial documentation, such as pay stubs, tax returns, and credit reports, to a lender for evaluation. The lender will then assess your eligibility and provide you with a pre-approval letter, which outlines the maximum loan amount you qualify for and the associated interest rate.

The pre-approval process typically takes one to two weeks, depending on the lender's workload and the completeness of your documentation Having a pre-approval letter not only gives you a clear understanding of your budget but also positions you as a serious buyer in the eyes of sellers and real estate agents.

The length of the house hunting phase can vary significantly based on several factors, including your specific preferences, current market conditions, and the availability of suitable properties in your desired areas.

Some buyers may find their dream home within a few weeks, while others may need to be more patient and search for several months before finding the perfect fit. Your real estate agent, like Yvonne Jett McFadden, will play a crucial role in identifying properties that meet your criteria and scheduling viewings promptly

During this phase, it's essential to be flexible and open-minded, as your ideal home may not match your initial expectations.

Additionally, attending open houses and staying up-to-date with new listings can help you stay ahead of the competition in a hot market.

Once you've found the home you want to purchase, your real estate agent will guide you through the process of making an offer. This typically involves drafting a purchase contract that outlines the proposed purchase price, contingencies, and other terms and conditions

Your agent will also conduct a comparative market analysis to ensure your offer is competitive and aligned with recent sales in the area. The process of drafting and submitting the offer can take one to two days, depending on the complexity of the negotiations and the responsiveness of the seller.

After the seller accepts your offer, the property enters the "under contract" phase. During this period, you'll need to complete several critical tasks, including:

Home Inspection (1-2 Weeks): Scheduling a professional home inspection to identify any potential issues or necessary repairs.

Appraisal (1-2 Weeks):

Your lender will order an appraisal to confirm the home's value and ensure it meets the loan requirements

Mortgage Underwriting (2-4 Weeks): Your lender will review your mortgage application and

supporting documents to make a final decision on your loan approval.

Title Search and Insurance (1-2 Weeks): A title search will be conducted to ensure there are no outstanding claims or liens on the property, and you'll need to purchase title insurance. In Arizona, the typical timeline for the under-contract phase is 30 to 45 days, although it can vary based on the complexity of the transaction and the responsiveness of all parties involved.

Closing (1 Day): The final step in the home buying process is the closing, where you'll sign the necessary paperwork and officially take ownership of the property The closing typically takes place at a title company or attorney's office and can be completed in a single day

During the closing, you'll review and sign the closing disclosure, which outlines the final costs and fees associated with the purchase. You'll also need to provide your down payment and any remaining closing costs. Once all documents are signed and funds are distributed, you'll receive the keys to your new home.

The time it takes to buy a house in Arizona can range from a few weeks to several months, depending on various factors such as your personal preferences, market conditions, and the complexity of the transaction. While some home purchases may move quickly, others may require more patience and perseverance.

By working with an experienced real estate professional like Yvonne Jett McFadden, you'll have a knowledgeable guide who can help you navigate the process efficiently and address any challenges that arise. Remember, staying organized, communicating effectively with your agent and lender, and being prepared for potential delays can go a long way in ensuring a smooth and successful home-buying experience in Arizona

By Yvonne McFadden Photography from Canva

By Yvonne McFadden Photography from Canva

Buying a new-construction home in Arizona can be an exciting venture. With pristine designs, modern amenities, and the allure of being the first owner, it's no wonder why many buyers are drawn to this option. However, amid the excitement, it's essential to remain vigilant and avoid common pitfalls that could turn your dream home into a nightmare.

Here are nine costly mistakes buyers often make when purchasing a new-construction home in Arizona:

Skipping the Research Phase: It's easy to get swept up in the excitement of new construction, but thorough research is crucial Research the builder's reputation, past projects, and customer reviews to ensure they have a track record of delivering quality homes on time

potential delays, leading to frustration and added costs

Ignoring the Fine Print: Before signing any contracts, carefully review all documents, including warranties, HOA agreements, and construction specifications. Pay close attention to details like completion dates, upgrade options, and dispute resolution processes.

Overlooking Inspection Opportunities: Many buyers assume that new construction homes don't require inspections, but this is a costly mistake. Hire a professional inspector to evaluate the property at different construction stages to identify any issues early on.

Foregoing Negotiation: While builders may have set prices, there's often room for negotiation, especially when it comes to upgrades, closing costs, or financing incentives Don't be afraid to negotiate to get the best possible deal

Failing to Monitor Construction Progress: Stay involved in the construction process by regularly visiting the site and communicating with the builder Keep track of progress and address any concerns or discrepancies promptly

Not Planning for Future Development: Consider the long-term implications of the surrounding area, such as potential future developments, zoning changes, or infrastructure projects. Ensure that your new home will retain its value and desirability over time.

Skipping Professional Representation: Working with a knowledgeable real estate agent experienced in new construction

Purchasing a new construction home in Arizona holds the promise of a fresh start and a dream realized. Yet, amidst the excitement, it's essential to proceed with caution and avoid the costly mistakes that can derail your journey to homeownership. By conducting thorough research, understanding the process, and seeking professional guidance, you can navigate the intricacies of new construction purchases with confidence.

Remember to stay informed, vigilant, and proactive throughout the process From negotiating the best deal to monitoring construction progress and planning for the future, each step plays a crucial role in ensuring a successful outcome With the guidance of a trusted real estate advisor like Yvonne Jett McFadden, you can embark on your newconstruction home buying journey with clarity and peace of mind

Your dream home awaits in Arizona, and with the right approach, it's within reach Take the time to avoid common pitfalls, advocate for your interests, and envision the future you desire. With careful planning and expert guidance, your new-construction home in Arizona can be everything you've ever dreamed of and more.

Yvonne “JETT” McFadden is your Trusted Real Estate Advisor specializing in Scottsdale, AZ, and surrounding areas. With 16 years of experience, Yvonne is dedicated to helping homebuyers navigate the complexities of new-construction home purchases. Her website offers a wealth of up-to-date market information and a free, comprehensive real estate search tool. As a resident of Scottsdale, Yvonne is intimately familiar with the local market trends and is committed to providing personalized service to her clients. Whether you're buying, selling, or relocating, Yvonne is here to serve your real estate needs. Contact her today to embark on your real estate journey with confidence.

The Orangetree Villas is a quiet and peaceful community, perfect for those who enjoy walking their dogs or going for leisurly strolls. This single level 1882 patio home offers a spacious and open floor plan, with 2 bedroom and a den. The primary suite featuress a skylight, walk-in closet, water closet, Soaking Garden Tub

The Dining Room and Eat In Kitchen with Breakfast Bar provide for amble space for entertaining Pull pins out prior to opening slider Most rooms are adorned with sliding glass doors, allowing for plenty of natural light 2 full bathrooms, laundry room, linen closet for added convenience, The covered patio is a great spot for relaxation with slight views of local mountains Additionally, you can enjoy the community pool and jacuzzi spa for some relaxation and rejuvenation.

$615,000