18 minute read

2022: The Year Ahead

In Focus THE YEAR AHEAD LISTS: Hospitals, Page 19 | Urgent Care Centers, Page 20

Forecasting the Year Ahead

Former Lehman Brother economist Stephen Slifer recaps his forecast for 2022, discussing liquidity after the government oversold the recovery and the ongoing impact of tech in helping us adapt beyond a pandemic

The coming year is likely to be characterized by surprisingly robust GDP growth at 4.9%, and inflation is almost certain to remain far higher than the Fed would like to see at 4.8%. Because the Fed continues to believe that the recent run-up in inflation is caused by supply chain disruptions and not by excessive growth in the money supply, it still concludes that the flare-up in inflation is “temporary.”

As a result, it is inconceivable that it will choose to aggressively fight inflation any time soon. It may well raise rates three times in 2022, which would boost the funds rate from near 0% today to 0.75% by the end of 2022, but it would still be far below its “neutral” level of 2.5%. Fed policy will remain stimulative for years to come. The combination of robust GDP growth next year, a substantial increase in inflation, and still low rates will keep corporate earnings on a roll and the stock market soaring.

Economy continues to roll

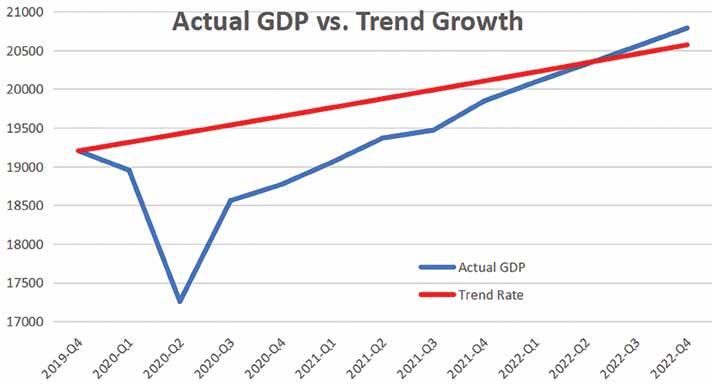

The recession in March and April of 2020 was caused by federal government action. It chose to fight COVID by shutting down the U.S. economy. As a result, GDP growth in the second quarter plunged by 31% and fell $2.2 trillion below its potential growth path. Twenty-two million Americans lost their jobs.

Given that government action was the cause of the recession, our leaders in Washington felt an obligation to make people whole. But they overdid it. The combination of $5.3 trillion of stimulus checks and $4.2 trillion of Fed purchases of securities have provided $9.5 trillion of stimulus to counter a $2.2 trillion shortfall. No wonder the economy has been on a roll, and because much of that excess liquidity remains, we are bullish on the 2022 outlook and anticipate GDP growth of 4.9%.

Tech helps us adapt

In addition to excessive stimulus, the tech sector played a pivotal role in lifting the economy out of recession, and we believe that economists have underestimated its importance. Think of the bio-tech sector and the development of the COVID vaccine. Vaccine development is typically a 10-year process but the COVID vaccine was developed in a single year thanks to technology.

When the economy was shut down a firm could not meet face-to-face with its employees. Sales people could not meet face-to-face with their clients. But along comes Zoom and Microsoft Teams to allow them to approximate face-to-face meetings when they could not otherwise do so. During the pandemic, consumers could not go to local stores to shop. They had to buy things online. Amazon was well positioned to do that but, with the help of technology, brick-and-mortar stores like Walmart and Target did a wonderful job of educating their customers to order online and pick up their merchandise at the store. Slifer Many people were sick. No one wanted to sit in a doctor’s office among a bunch of

other sick people waiting to see a doctor. Along came tele-health.

In-restaurant dining was eliminated. In order to survive, restaurants had to develop delivery or take-out services. Along came UberEats, DoorDash and Grubhub to fill the need.

Tech played a critical role in helping the economy emerge from recession, and will continue to help it adapt to this significantly revamped and ever-changing economic environment. We are confident that technology will help the U.S. economy’s speed limit climb from 1.8% currently to 2.5% or more in the years ahead.

Easing pandemic panic

Our relatively optimistic view of the economy next year could become unraveled if COVID resurfaces. We do not expect that to happen despite the recent appearance of the Omicron variant. When COVID arrived in early 2020 it had a pool of 330 million unvaccinated Americans as prime candidates to infect.

But today 233 million Americans have received at least one dose of the vaccine and another 48 million have already contracted COVID and have developed natural immunity. Thus, 281 million people now have some sort of immunity, which means the pool of potential candidates for COVID to attack has shrunk to 49 million, and COVID spreads almost exclusively amongst the unvaccinated population.

Our sense is that Americans will become progressively less fearful of COVID as the year progresses, and it will cease to be a significant factor in determining the economic outlook.

If one can eliminate COVID from the confluence of factors likely affecting GDP growth in 2022, the rest of the economy appears poised for growth.

Need a fresh start for the new year?

CAROLINA PARK

We are a global commercial real estate partner, powered by people, that puts you first.

Get in touch

+1 843 725 7200 avisonyoung.com

Daniel Island economist Stephen Slifer delivered his economic forecast in December to a group of regional professionals and business leaders online. (Photo/Mary Wessner)

Out of balance demand

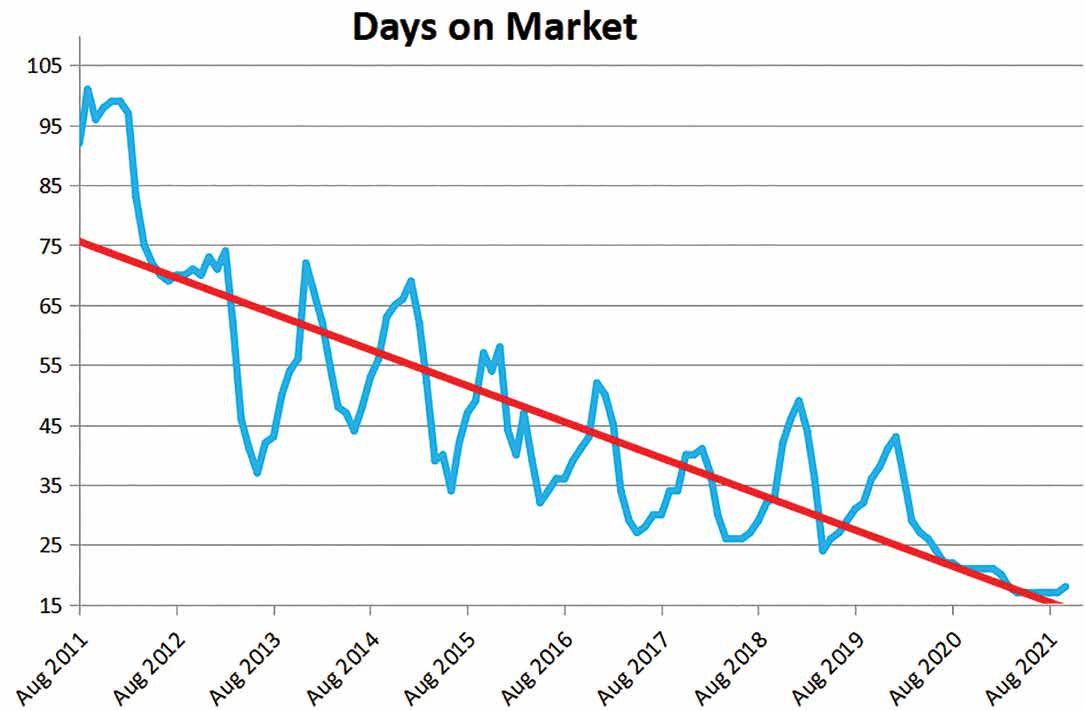

The demand for goods and services far exceeds supply in virtually every sector of the economy. For example, in the housing market, properties fly out the door once they are listed. The typical property sells in 17 days which is the shortest length of time between listing and sale on record.

Because properties have been selling so quickly, Realtors have only a 2.5month supply of homes available to show potential buyers. They need roughly a sixmonth supply for demand and supply to be in balance. There is a similar shortage of rental properties on the market. The vacancy rate for rental units is the lowest it has been since the 1980s. Thus, there a significant shortage of both single-family homes and apartment units.

The solution is for builders to step up the pace of construction. But they are hampered by both a shortage of skilled workers and materials constraints. While the pace of construction will accelerate, it will be impossible for builders to eliminate the substantial backlog of demand during this coming year.

Expect issues in manufacturing

Manufacturers are facing similar difficulties. The Institute for Supply Management’s index for the manufacturing sector is near a record high level. Orders keep flowing in. Firms step up the pace of production as best they can, but they suffer from supply side constraints – delays in getting required materials, the high cost of raw materials, a shortage of critical inputs such a semiconductors, delays at ports, a shortage of truck drivers, a shortage of warehouse space, and an inadequate supply of skilled labor.

As a result, manufacturing firms have been forced to dig dip into inventories to satisfy as much of the demand for orders as they can. In the first three quarters of this year, inventories subtracted 1.6% from GDP growth. But eventually these supply issues will be resolved and the economy will receive a tailwind of roughly that same 1.6% in 2022.

The Institute for Supply Management’s index for the service sector was at a record high level in October. It blew through that previous high by almost five points in November to establish an even more impressive record at 74.6.

Don't just

GO online, GROW online

Do you have the skills you need for the job you want? At Charleston Southern University, we’ve been helping students design their pathway to success with rewarding and a ordable online degrees for decades. Invest in your own economic recovery so you can secure the career you deserve.

ONLINE DEGREES

UNDERGRAD

Computer and Information Sciences Computer Science Psychology Criminal Justice Management Healthcare Administration Human Resources Hospitality & Tourism Management Project Management Supply Chain Management Professional Studies

GRADUATE

Criminal Justice Public Safety Management General Management Healthcare Management Supply Chain Management Organizational Leadership Human Resource Management Physical Education and Sport Coaching Nursing Education Nursing Leadership and Healthcare Administration Computer Science Management Supply Chain Management Project Management Analytics

#21 IN THE NATION

for Online Bachelor’s Programs

INTEGRATING FAITH IN LEARNING, LEADING, AND SERVING

Learn more at charlestonsouthern.edu/apply or call 800-947-7474

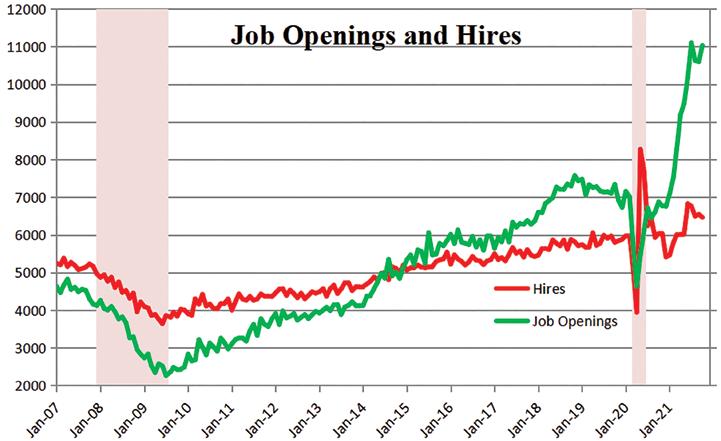

Help wanted everywhere

Throughout this past year firms have complained about an inability to get the number of workers they need. Help wanted signs are posted everywhere. Job openings have soared to a record high level and, indeed, there are more job openings in the U.S. at 11 million than there are unemployed workers at 6.9 million.

Part of the problem firms are having is that roughly 1.5 million of their former employees appear to have retired. Given massive gains in the stock market and rapidly rising home prices older Americans might be seizing the opportunity to downsize and use their newfound wealth to fund retirement.

Others appear to have rejected the idea of working for someone else and are, instead, choosing to venture out on their own by becoming gig workers or starting their own business.

Since the recession ended in April 2020 “payroll employment” has increased by 18.5 million workers. “Civilian employment,” which is derived from a separate survey and is used in calculating the unemployment rate, has climbed by 21.8 million.

Civilian employment includes not only workers on payrolls, but also self-employed workers. Typically these two series move in tandem. But that is not the case currently. The impressive gains in civilian employment have caused the unemployment rate to fall far more rapidly than anybody expected. It now stands at 4.2%, which is a shade above the Fed’s estimate of the full-employment threshold of 4%. That level should be reached by January 2022. GDP and inflation concerns

As a result of all of the above, we anticipate GDP growth of 8% to report from the fourth quarter of 2021, followed by a 4.9% pace in 2022. If those growth rates are accurate, any remaining slack in the economy will be eliminated by the second quarter of 2022.

With no remaining slack and the economy continuing to expand at a 4.9% rate, far in excess of its potential growth rate of 1.8%, inflation is not going to retreat to the 2% pace the Fed would like to see any time in the foreseeable future.

Ever since the recession ended in April of last year, the Fed has been hawking the notion that the recent run-up in inflation was caused by the supply constraints, and once they ran their course, inflation would quickly retreat to the targeted 2% mark in 2022. We reject that idea because money supply growth is soaring.

In the 1970s, Milton Friedman won a Nobel Prize for concluding that “inflation is always and everywhere a

Is Your Company a GREAT Place to Work? You want to find out for absolutely sure?

Then join companies from across the state and let’s all find out together.

All you have to do to take part in the fun is register to participate in the annual Best Places to Work in South Carolina Event. If you truly are a great place to work, you’ll join other companies from across the Palmetto State designated as such to celebrate your accomplishment together. You’ll find out how you stack up against friends, colleagues and competitors. PLUS, it will all happen at a party unlike any other. There will be a red carpet welcome, surprise speakers, cocktails, dinner, music, TV cameras, media coverage, and LOTS of glitz and glam.

Registration Now Open!

Use the QR Code below for participation and registration information

Presented by Powered by

www.scbiznews.com www.bestcompaniesgroup.com

www.BestPlacesToWorkSC.com

monetary phenomenon.”

For years, money growth was steady at about 6%. But when the Fed bought $2.5 trillion of securities in March and April of last year, money growth soared and the Fed has continued to purchase securities since then.

As a result, the gap between the current level of the money supply and its 6% trend rate has widened to $3.8 trillion. That represents surplus liquidity just waiting to get spent. When the economy was mired in recession, surplus liquidity was a good thing and helped get the economy back on track. But today with the economy at full employment that surplus liquidity will only serve to boost the inflation rate.

We expect the personal consumption expenditures measure of inflation to rise 4.9% next year. It will not return to the Fed’s targeted 2% pace until such time as the Fed gets serious about fighting inflation. That time is not on the foreseeable horizon.

For more than a year, the Fed has concluded that the flare-up in inflation would be temporary. But in early December it concluded that the supply chain issues were not being resolved as quickly as anticipated and, as a result, inflation might remain elevated for some time to come. But it still believes that the inflation jump is caused by supply chain difficulties. It makes no mention of growth in the money supply as a possible catalyst. For a central bank to be unconcerned about growth in the money supply is unconscionable.

Given its misplaced view about the cause of inflation, it is inconceivable that the Fed might begin to act aggressively to fight inflation in 2022.

Early in the year, it will have met its two goals of full employment and inflation. That sets the stage for perhaps three rate hikes in 2022 which would put the funds rate at 0.75% by the end of that year. Another four rate hikes in 2023 would boost it to 1.75%.

The Fed will not achieve a “neutral” funds rate of 2.5% until late 2024. Thus, the Fed has no intention of becoming serious about its desire to tame inflation for years to come.

Expect earnings to soar

With robust GDP growth next year, an increase in the inflation rate, which will give firms pricing power, and still low interest rates, corporate earnings should soar. In the past year, firms have experienced an increase in the cost of raw materials, sharply higher transportation costs, and higher wages. Despite those challenges corporate earnings have risen dramatically. In the decade prior to the recession corporate earnings grew 7% annually. In the six quarters since then they have climbed at an impressive 23.7% pace.

As we see it, 2022 should be characterized by 4.9% GDP growth, 4.9% inflation, and a modest increase in the funds rate to 0.75%. Thus, the outlook for 2022 appears particularly bright.

If the Fed raises rates as slowly as we envision, it may ultimately have to raise the funds quickly to a point far above the 2.5% neutral level to corral the steady increase in the inflation rate. At that point the danger of recession will increase.

But that is a worry for some year beyond 2024. CRBJ

From 1980 until his retirement in 2003, Daniel Island economist Stephen Slifer was the chief U.S. economist for Lehman Brothers in New York City, directing the firm’s U.S. economics group and responsible for the firm’s forecasts and analysis of the U.S. economy. Reach Slifer at www.numbernomics.com.

Celebrating 20 Years of Team and Service

photos: @leighhaywardphotography

CELE B R ATING

TWEN T Y Y EARS

Through bear markets, natural disasters, and pandemics, our team has stood strong.

Commonwealth began with a vision of team. Thanks to your trust in us, we’ve fulfilled our vision and continue to deepen our bench. With backgrounds in accounting, investments, banking, insurance and law, our highly experienced CFPs, advisors and support staff look forward to providing unbiased and holistic advice for another 20 years and beyond.

(843) 884-4545 info@commonwealthfg.com

commonwealthfg.com

S.C. economic forecast sunny with patchy clouds

By C. Grant Jackson

Contributing Writer

Amid concerns that new COVID-19 variants could derail the national economy again, South Carolina’s economy is booming and has recovered almost all of its losses from the pandemic, according to state experts at the University of South Carolina’s annual economic conference.

South Carolina is doing well, said Doug Woodward, director of the Division of Research at USC’s Darla Moore School of Business, “because we make things” that people want.

Much of the state’s recovery has been fueled “by the fact that South Carolina has really been at the center of our national recovery on both the supply and the demand side,” said University of South Carolina research economist Joey Von Nessen.

Consumer spending on goods is currently about 25% higher than it was before the pandemic began, according to data presented at the 2021 conference. This has generated a significant consumer goods bubble and is part of the reason for the supply chain issues that are currently impeding parts of the national recovery.

“The general high level of demand has been great news for South Carolina manufacturers over the past year, spurring growth and demand for the products they are supplying,” Von Nessen said. “That sizeable increase in demand and consumer spending is benefitting manufacturers and explains why the Upstate — which has the largest concentration of manufacturing jobs in South Carolina — has been among the state’s leaders recently in terms of the rate of recovery of lost jobs.”

In addition to the Upstate’s manufacturing might, coastal South Carolina has also had a strong recovery fueled by growing logistics and construction industries as well as a growth in population.

The economy’s comeback was the message at the Moore School’s 41st Annual Economic Outlook Conference, held in-person this year after moving to an entirely online version in 2020. About 120 people attended the conference at the USC Alumni Center, with another 60-70 attending online.

In addition to Von Nessen and Woodward, attendees also heard a keynote address on inflation concerns from Mick Mulvaney, former White House chief of staff, S.C. congressman and acting director of the Consumer Financial Protection Bureau.

“South Carolina’s economy really is in good shape going into 2022,” said Von Nessen. Metrics show the state can anticipate being fully recovered from the COVID recession in 2022, barring any new setbacks from additional variants, he said.

“One reason for that is that this was a very unique recession,” Von Nessen said. “This was a recession not because of any economic failing, but because of a government-imposed shutdown.”

As a result, when South Carolina’s economy reopened, it was able to recover far faster than expected, he said. For example, it took the state about six years to recover all the employment losses from the Great Recession in 2008.

“Contrast that with what is going on now, and we anticipate full employment recovery in South Carolina sometime in 2002,” Von Nessen said. The state’s unemployment rate already has fallen to 3.9% as of October, down from 12% during the darkest days of the pandemic, “well below the traditional measure of full employment of 5%,” he said.

But the rapid recovery has led to concerns as South Carolina enters 2022: a tightening labor market and higher inflation.

The tight state labor market is largely the result of strong demand, Von Nessen said. “Consumer spending on goods is currently about 25% higher than it was before the pandemic began,” he said.

In South Carolina, much of that demand has come from population growth.

“South Carolina had the second-largest in-migration rate in the country last year in 2020, and that has persisted into 2021,” Von Nessen said.

By some projections, the Southeastern states are expected to see the nation’s highest population growth during the next 20 years, at least into 2040, Von Nessen said. “That spurs housing demand and is why both construction and the logistics industries in South Carolina are fully recovered now,” he said. CRBJ

The right care. The right place. The right time.

Changing What’s Possible in

South Carolina

MUSC’s vision is to lead health innovation for the lives we touch. As the state’s only comprehensive academic health system, changing what’s possible is not just a tagline, it’s an imperative. With collaboration at our core, we’re leading health innovation and working to elevate, support, and enable best local care through partnership and presence. And when more is required, we seek to provide seamless access to MUSC Health’s strength - high quality, complex care.