Selfbuild

Europe’s leading, award-winning window brand for over 90 years. Innovative, high-performance architectural window and door systems for self-build, renovation and Passivhaus projects. Exceptional thermal performance, outstanding noise reduction and enhanced security. For further information, please visit uk.internorm.com. *Available from 8 April – 21 June. T&Cs apply. Contemporary Triple Glazing Solutions

27-29 SEPT 2024 TEC BELFAST

As a Selfbuild+ subscriber, you’ve got full access to selfbuild.ie, including the Build Cost Hub, the House Plans Library, Selfbuild Journey, Advice Zone, the latest news, podcasts and much more. Here are a few things you may have missed on the platform and what to sign up to in the coming quarter…

Sign up to a build cost clinic for one-toone advice on your project; the sessions are limited to 10 participants and run monthly.

Extend the development levy holiday indefinitely for self-builders. It’s saving self-builders €12k on average and it’s due to expire at the end of the year.

Our online events page contains playbacks including the June 2024 build cost talk.

Missed an issue? Not to worry, you can browse through previous editions of Selfbuild magazine and themed guides here.

“In many ways it’s become easier than ever before to build a house...”

Welcome to Selfbuild magazine, one of the many benefits to your subscription to Selfbuild+.

In many ways it’s become easier than ever before to build a house. There are professionals who can help you navigate the process and the statutory requirements; there are building methods that allow you to get your house built in a matter of weeks.

But all of this comes at a cost, at a time when material and labour prices are yo-yoing more up than down. There are also the hidden costs, from connection fees to costly foundations.

Another nasty surprise comes in the form of the bill you get in the post after your local authority in ROI grants you planning permission. It’s a juicy fee to cover the costs of roads and other infrastructure that arise from the development.

This local development fee will set you back €12k on average for a 200sqm house (costs vary considerably depending where and what you build, see selfbuild. ie or the previous issue of the magazine for full details).

The good news is, this levy is waived until the end of this year.

And your Irish Water connection charges are also axed

until the end of October; this can save around €6k for water and wastewater connection fees. Who’s paying for all of this? The government is footing the bill for both self-builders and developers.

Here at Selfbuild we are campaigning to extend this holiday indefinitely for selfbuilders, who need all the help they can get (see QR code opposite page).

We know self-builders tend to be couples with young families, who get into debt to build their house. Yet the Department of Housing recently published a report that puts into question whether or not there is a need to provide financial supports to selfbuilders (see p15).

Without supports, many wouldn’t be in a position to build. The Help to Buy scheme, which has been extended for a further five years, has been a lifeline (see p16 for our Factsheet) for years.

So where does that leave you if you’re thinking of building? Now’s the time to build the dream, and avail of these supports while they

The Design stage of your Journey deals with the details you need to have finalised to secure planning permission.

If you have a question, want to share some insights, or simply let us know how you’re getting on with your project, we’d love to hear from you for our Letters page. Email us at letters@selfbuild.ie

Astrid Madsen - Editor astrid.madsen@selfbuild.ie

26 Masterclass

Architect Sinéad Thackaberry designed her new build home in Co Meath, and with the help of her quantity surveyor husband Brian, managed the build from start to finish.

36 Building love

How Chloe and Paul Barr built their family home in Co Tyrone from scratch, with their wedding day as the ultimate deadline.

46 Turning lemons into lemonade

How Tom and Miriam Higgins transformed a 1900s red brick terrace house in Co Dublin from a dark, outdated space into a warm, light filled home.

66 H is for home

How architect Declan Brennan with his wife Michelle built a contemporary H-shaped bungalow in Co Laois.

74 Screened patio

A garden design in Co Galway that makes the most of its orientation to carve out a screened patio area for the entire family to enjoy.

09 News

Get up to date with the latest in home building and home improving, in both NI and ROI.

78 Letters

All articles equally cover the 32 counties; when we refer to the Republic of Ireland the abbreviation is ROI. For Northern Ireland it’s NI.

54 From darkness to light

After the sudden loss of her husband, Oonagh Murray returned to her roots in Belfast

This issue we look at paying money upfront, mould after plastering, and more.

80 What’s a builder’s finish?

Quantity surveyor Keith Kelliher spells out what the term means and what to check for.

82 Attic conversion inspiration

We look at the many ways you can transform your roof space.

84 Reaching new heights

Explore the cost effective option of extending into your roof space for additional room.

88 Where to start with a farmhouse renovation

Architect Micah Jones shares his tips about what the first steps are, from what to prepare for to determining the budget.

90 The downsides to underfloor heating

Whether the system is electric or warm water, we look at the downsides to this near ubiquitous heat emitter.

94 Overview

An introduction to Stage 3 of your Selfbuild Journey: Design.

96 Plans at the ready

How to apply for planning permission and put together the specifications for your home building project.

99 Kitchen and bathrooms

The main elements to determine at the design stage in these rooms.

100 Is green building worth it?

Project manager Andrew Stanway’s guide to greenwashing as you select your bits of tech, from heating to ventilation.

101 Heat pumps

Passive house experts Barry McCarron and Seán McKenna weigh the pros and cons of the technology for a new build.

102 Windows and doors

A whistlestop tour of what to expect from one of the costliest components of your build.

104 Garden design

The benefits of planning ahead for your outdoor space, even if you don’t spend any money at the start.

105 Family home

Certified passive house consultant Patrick McMullan of Co Tyrone explains how he approached the design stage of his self-build.

112 Compact design

Construction industry veteran Louis Gunnigan gives us an update on the design of his home in Co Dublin.

114 Who’s Who Site assessors.

Roadstone FlowPlus is the next generation self-levelling cementitious screed developed in conjunction with the ARDEX Group.

Roadstone FlowPlus is the next generation self-levelling cementitious screed developed in conjunction with the ARDEX Group.

• Provides a quick, smooth and level surface with minimal leveling

• Ease and speed of installation

• Provides a quick, smooth and level surface with minimal leveling

• Suitable for all domestic and commercial applications

• Ease and speed of installation

• Suitable for all domestic and commercial applications

In NI, there’s been some concern self-builders are being blocked from getting planning permission on some greenbelt sites.

Arecent court ruling against ribbon development in NI indicates self-builders could be denied planning permission in some greenbelt areas.

In a potential landmark legal win, environmental activist Gordon Duff’s challenge to a planning decision by the Newry, Mourne and Down District Council could have “far-reaching” implications for rural development.

The Irish News reported that The Court of Appeal ruled in favour of Gordon Duff, who contended that the council’s approval of ‘infill’ planning permission for two houses and garages along a rural road near Ballynahinch, Co Down contravened planning policy on ribbon development (when houses or buildings are built one after the other along a road).

Duff emphasised the ruling’s broader significance, predicting: “It’s a precedent and will potentially affect thousands of similar planning applications over the next few years.” Other infill planning applications to local authorities will have to consider the court’s decision.

The case revolved around an application in April 2021 to build two detached houses and garages on Glassdrumman Road, Ballynahinch. Representing himself, Duff challenged the council’s approval of outline planning permission. He argued that the decision would contribute to ribbon development contrary to guidelines that preserve rural character and habitats.

While accepting that application constituted ribbon development, the council argued that Policy CTY8 allowed for a limited exception permitting a maximum of two houses in small gap sites.

However, after his initial judicial review challenge was dismissed, Duff mounted an appeal to rescind the planning decision. He contended that the council’s decision was unsupported by the facts and wrong in law.

The Court of Appeal judges highlighted CTY8’s “strong unambiguous language” about denying applications which will add to ribbon development. “This is an inherently restrictive policy such that, unless the exception is made out, planning permission must be refused,” Lord Justice Treacy said, reports the Irish News.

The judge found it unreasonable to consider a large open space in undeveloped land at the Glassdrumman Road site as part of the front of an existing property. “Where the infill exception is being relied upon a key question is whether there is a substantial and continuously built up frontage,” he stated.

Three social housing units in Dundalk will be the first 3D printed homes in Ireland, at a cost comparable to building a traditional cavity wall house.

The 3D printing of homes consists of piping layers of concrete, in this case 50mm, out of a giant 3D printer. It builds the walls from scratch, without using concrete blocks. HTL is the construction tech company that’s brought the technology to Ireland.

HTL says the houses are built three times faster than they would using traditional concrete blocks and that it results in reducing labour costs by a third.

The second edition of the ‘Bringing Back Homes Manual’ provides technical and grant advice to those renovating a vacant or derelict building in ROI.

The revised edition includes updates on policy, regulations, technical guidance and support schemes for renovating vacant and derelict properties for residential use. It is especially beneficial for property owners applying for the Vacant Property Refurbishment Grant.

The guide describes the process for bringing existing buildings back into residential use, and expands on how building regulations apply to three common building types.

There are also successful refurbishment examples for different building types.

Make the greener choice for your home, upgrade your existing central heating with an eco-friendly, low noise Midea Heat Pump. Air source heat pumps are the low-carbon future of home heating which integrates heating and domestic hot water into one system.

The future of heating, renewable energy is the greener, cleaner way to heat your home. Midea’s air source heat pumps are the cost-effective way to lower your energy bills and switch to a low-carbon way of heating your home.

Make yourself at home and start saving with Midea Heat Pumps.

Local Authority Home Loan extension to support purchase and renovation of eligible properties in ROI for first time buyers and

n a bid to support first-time buyers looking to renovate vacant or derelict properties, the Minister for Housing, Local Government and Heritage, Darragh O’Brien TD, announced the Government’s approval of the Local Authority Purchase and Renovation Loan (LAPR).

IThis new initiative builds on the existing Local Authority Home Loan, expanding it to cover both the purchase and renovation of properties eligible under the Vacant Property Refurbishment Grant, which offers up to €70k in subsidies towards renovating a derelict building. Grants of up to €50k are available for vacant properties that aren’t derelict, and higher amounts are available for island properties (€60k and €84k respectively).

The Vacant Property Refurbishment Grant has already seen success, with over 8,100 applications received. The new LAPR aims to further assist first-time buyers by offering a loan that covers both the purchase and necessary renovation of these vacant or derelict homes.

Applicants must be first-time buyers or fresh start applicants, meet income limits (€70,000 single, €85,000 joint), and be eligible for the Vacant Property Refurbishment Grant.

Previously, only habitable homes qualified for the Local Authority Home Loan, which was solely for property purchases. The LAPR, however, now includes renovation funding, significantly broadening the scope of eligible properties.

Minister O’Brien stated: “The extension of local authority mortgage lending to the purchase and renovation to all homes eligible for the Vacant Property Refurbishment Grant will help people who are struggling to complete the purchase and renovation of a vacant or derelict property and will give them the necessary finance to make their project viable.”

The LAPR offers a new financial pathway for potential homeowners who struggle to secure funding from commercial lenders.

A key feature is the inclusion of a bridging loan. Tied to the Vacant Property Refurbishment Grant, this will boost

applicants’ borrowing capacity and project viability. The bridging loan is repayable once the grant is paid out. This approach allows more funding for renovation works than typical bank loans.

The LAPR will take into account the cost of the project, net of the Vacant Property Refurbishment Grant, when determining whether a project is viable or not.

The LAPR is designed for two scenarios. First is a person with a project that is viable and whose income is insufficient to source the necessary financing from a bank but is sufficient to demonstrate repayment capacity for their local authority.

Or, a person whose project is not viable according to bank lending criteria but is viable according to LAPR lending criteria. They would also need sufficient income to demonstrate repayment capacity for their local authority.

Other terms and condition and more information here

The three major banks in ROI now offer the government-backed, low-interest rate loans for SEAI-backed energy upgrades. This is a major boost for consumers who are feeling the pinch but still want to upgrade the energy efficiency of their home and benefit from lower energy bills.

The interest repayment is around 3.5 per cent, depending on the lender, and supports homeowners who are availing of a Sustainable Energy Authority of Ireland (SEAI) grant, for individual energy upgrades such as adding a heat pump or solar panels, or a deep retrofit (one stop shop).

The interest rates are low thanks to the combination of an EIB Group loan guarantee and a government-funded interest rate subsidy.

There will be no requirement for the loan to be secured against the property being upgraded, as is the case with a mortgage. Once approved, the loan can be drawn down before works begin.

According to the SEAI, this gives certainty to homeowners that they have the funds for the planned energy upgrades as well as any upfront costs or milestone payments. This is often identified by homeowners as a key barrier to upgrading their homes.

Those who are thinking of buying a vacant property with a view to doing it up are now eligible for the Conservation Advice Grant Scheme for Vacant Traditional Houses.

The grant covers up to 67 per cent of the costs (up to a maximum of €5,000) of hiring a conservation expert to visit their vacant/ derelict property, conduct a survey and compile a report with tailored conservation advice.

The catch is the deadline for applications was the 31st of July 2024 though the scheme was announced less than a month earlier. The scheme should presumably reopen next year.

The grant is being rolled out thanks to the success of the pilot scheme of the same name that was launched in June 2023; the grant amount under the pilot scheme was €7,500.

To be eligible you must own a traditional house and avail of, or consider availing of, the Vacant Property Refurbishment Grant.

Your renovation project gives you one opportunity to get your insulation right, so it is important to consider it carefully.

At Unilin Insulation, our experts will help guide you to the best insulation solutions for your project – for a warmer, more energy-efficient home.

For free one-to-one advice, talk to our technical team on 046 906 6050

Water connection and local authority development contribution waivers propel one-off building starts by over 100 per cent – doubling last year’s numbers.

The Department of Housing, Local Government and Heritage released its latest data on the number of commencement notices (residential construction starts) showing that of the total buildings started in the first quarter of 2024, nearly 10 per cent (2,878) were one-off buildings, which is 1,521 more than during the same period last year, representing a 112 per cent increase.

In comparison, just 4,695 one-offs were started during the whole of 2023. Cork County is the local authority which recorded the largest number of oneoff build starts for the first quarter of 2024, with 309 commencements.

Commenting on the Housing Market Monitor Q1 2024 Brian Hayes, Chief Executive of BPFI, said: “In April 2024 alone, 18,000 housing units were commenced, partially influenced by the anticipated end of the waiver on development contributions and the rebate on water charges.”

However, government data for May 2024 indicates a slowdown in total commencements, with just 1,983 started– a 35 per cent reduction from May last year when 3,059 units were commenced.

This decrease reflects the large amount of activity

fast-tracked into April 2024, as this was when the development levy and water charge waiver were meant to end.

Given the effectiveness of these waivers in accelerating activity, they have now both been temporarily extended, to October 2024 for water charges and to the end of the year for development levies.

Self-builders can save thousands of euros on development levies alone, and €6k+ on the water charges for connecting to sewage and water.

Self-builds are leading new build mortgages across a quarter of ROI regions with 40 per cent of new build mortgages now attributed to self-builds, according to the Banking & Payments Federation Ireland’s Housing Market Monitor for the second half of 2023.

According to the report, the number of first-time buyer (FTB) mortgages taken out for self-building or

Source: CSO, data compiled by Selfbuild

purchasing new homes has increased by 4.2 per cent, totalling 8,606 loans – the highest figure since 2008. Self-build mortgages now account for more than half of new build mortgages in a quarter of Ireland’s regions. Of the new build mortgages, the share of self-builds by region is as follows:

• Dublin: 4 per cent

• Cork: 22 per cent

• Galway: 55 per cent

• Limerick: 47 per cent

• Meath: 22 per cent

• Kildare: 7 per cent

• Wicklow: 8 per cent

• Border: 38 per cent

• West: 65 per cent

• South and Mid West: 76 per cent

• Midlands: 39 per cent

• South East: 37 per cent

However, the report’s main finding is the overall number of FTB mortgage borrowers in ROI buying or building outside their own county, in part led by an increase in remote working – a trend that started during Covid. Other contributing factors are the uptick in house prices and the shortage of new homes.

Affordable Luxury of Nova Brazilian Natural Slate

Why choose Nova Graphite over Fibre Cement?

Genuine natural slate with 100+ year lifespan

Only €3.50 more per m² than fibre cement

Unmatched elegance and curb appeal

Superior weather resistance and durability

Environmentally friendly, 100% natural product

Better long-term value for your investment

LEARN MORE: www.sig.ie/nova-brazilian-natural-slate/

Belfast: +44 28 9038 0060

Omagh: +44 28 8224 6220

Dublin: +353 1 623 4541

Limerick: +353 61 531 381

Cork: +353 21 432 1868

www.sig.ie enquiries@sig.ie

TD urges protection of self-build supports amidst government report that questions €100k in subsidies, loan schemes and tax back schemes.

The Department of Public Expenditure’s

One-off Housing in Ireland: Trends and State Funding Supports report raises questions about whether self-builders, meaning those building one-off houses, need as much financial support as they are currently getting.

These supports, (see sidebar), are crucial for first-time buyers building their own homes.

The report has led to worries among TDs that the department was having doubts about continuing supports of up to €100,000 for self-builders, covering those building a new home and those renovating an existing one.

Christopher O’Sullivan, TD for Cork South-West, criticised the department’s analysis, arguing it fails to acknowledge the unique challenges faced by self-builders.

According to the Irish Examiner, O’Sullivan highlighted the significance of rural one-off housing, which accounts for a significant proportion of housing deliveries, arguing that first-time buyers opting to build their own homes deserve the same supports as those purchasing from new developments.

“I regularly meet couples who would not have been able to build their own home without the Local Authority Home Loan, Help-to-Buy scheme and the First Home Scheme,” he said.

“Building your own home can be one of the most stressful and exciting things, at the same time. Self-builders, like other buyers, are susceptible to interestrate volatility, unavoidable delays and additional costs. They are as deserving of state supports as any other first-time buyer.”

Here are the main points from the report: Self-builds are easier to complete: Oneoff housing units face less delivery risk and are more likely to be completed compared to high-density developments, so they might not need as much help from the government.

Better use of funds: The money spent on supporting one-off houses could be used more effectively to build much-needed social and affordable housing in cities where it’s harder to get projects off the ground.

Household-driven costs: Construction costs for one-off housing are driven by household preferences and funding capacity, leading to significantly larger and more expensive units compared to apartments or multi-unit housing.

Wide access to support: New policies have made it easier for wealthier households to get government help to build their own homes, letting them build bigger and more expensive houses.

Need for better targeting: The report suggests that government funds should be targeted more carefully to support building more homes where they are most needed, rather than subsidising large homes for private owners.

The supports for self-builders in ROI are for both new builds and home improvements. For new builds, there is roughly €50k in direct supports plus loan schemes. While the loan schemes and shared equity schemes help finance the build, the money has to be paid back. These include the Local Authority Home Loan and the First Home Scheme.

In terms of direct subsidies, new builds benefit of two schemes, the first being the Help to Buy scheme (see Factsheet on next page), which is a tax back scheme. This means your level of contributions over the years will determine how much you get; the maximum amount is €30k.

The second support is perhaps the biggest help, in large part because it kicks in automatically. Unlike the other schemes, there is no need to apply for it. And that is the waiver on development levies charged by your local authority when you get planning permission, which represents thousands of euros in savings. How much exactly depends on where you live. This waiver expires in December 2024.

The Irish Water waiver, which has been lumped with the development levies, requires a simple application process to avail of. Developers, including self-builders, are exempt from paying water connection fees, which on average are around €6k, until the end of October 2024.

Those building new also have the option of buying a serviced site from their local authority at a discounted rate, but due to a lack of land this scheme has been slow to roll out.

For those doing up an old house there is €100k available through the energy grants and the vacant property grants which come with an additional grant to pay for professional services. However, these schemes aren’t the most straightforward to navigate.

To extend the development levy waiver for self-builders, sign the petition

Self-builders in ROI can get €30k in tax back from the Help to Buy scheme; here’s what you need to know.

Buying or building a first home can be incredibly challenging, especially when it comes to saving up for a mortgage deposit. For many first-time buyers, the high upfront costs can be a significant barrier.

This is where the Help to Buy (HTB) scheme comes in. Designed to ease the financial burden, this government programme aims to make it more feasible to secure a new build home for first timers.

In the first half of 2024, there have been 3,500 claims under the HTB scheme – a 28 per cent increase compared to the previous year.

The latest data from the scheme, published by Mazars consultants alongside Budget 2023, states that since HTB was launched in 2016, over 8,000 self-builders have benefitted from the scheme.

Further analysis indicates that the median house price for self-builds under the scheme was €305,000, compared to €330,000 for newly purchased houses. On average, self-builds were priced at €312,114, presenting a 6 per cent saving compared to the average purchase price of €332,320 for newly built homes.

The HTB scheme is a government tax refund scheme designed to help first-time buyers fund the deposit needed to selfbuild or buy a new home. First-time buyers (FTB) can claim a tax rebate of up to €30,000 towards the price of a self-build house. This is up from €20,000 when the HTB scheme was first introduced in January 2017.

In the Budget 2024 updates, the HTB scheme was extended to December 31, 2025. Also, as of October 11, 2023, applicants using the Local Authority Affordable Purchase Scheme are now eligible for the Help to Buy Scheme.

In April 2024 Taoiseach

Simon Harris identified house building as a key priority and pledged to extend the Help to Buy scheme by a further five years.

To get the Help to Buy (HTB) scheme, you need to:

• Be a first-time buyer.

• Self-build or buy a new home between January 1, 2017 and December 31, 2025.

• Live in the home as your main residence for at least five years after building or buying it.

• Be tax compliant and have

On average, self-builds cost €312,114 to build, presenting a 6 per cent saving compared to the average purchase price of €332,320 for newly built homes.

tax clearance if needed.

You must also get a mortgage for at least 70 per cent of the home’s approved value from a qualifying lender. Normally, government shared-equity funds don’t count in this calculation, but there’s an exception if you’re using the Local Authority Affordable Purchase Scheme and signed a contract on or after October 11, 2023.

Be aware that you can’t have previously owned or built a house or apartment – alone or with others – anywhere in the world. If you’re selfbuilding with others, they

all need to be first-time buyers too. Inherited or gifted properties might not disqualify you, depending on the situation.

If you sign a contract for a new house, or draw down on a self-build mortgage, between July 23, 2020 and December 31, 2025, you can get the increased relief.

Although you don’t need a Revenue-approved contractor for self-builds, you do need a solicitor registered with Revenue as an HTB approver to confirm your claim.

You are allowed to have a guarantor on the loan. If you have a guarantor on the

loan, they do not have to be a first-time buyer.

What qualifies as a ‘new build’ in a selfbuild scenario?

Only self-builds or brandnew homes qualify. Conversions, extensions and renovations of old properties don’t count, but converting a non-domestic building into a home might be eligible.

What does the scheme consist of?

This scheme gives you a refund on income tax paid over the last four years, up to

10 per cent of the approved valuation of your self-build home or €30,000, whichever is less. It’s only for homes valued at €500,000 or less. So, if your self-build is valued at €300,000, you can get the full €30,000 rebate. If it’s valued at €400,000, you’ll still get €30,000, but you get nothing if it’s over €500,000. You must have paid enough income tax and/or DIRT in the last four years to claim the amount. Even if you were abroad, as long as you paid some income tax in that period, you could qualify.

How does Revenue determine the valuation?

For self-builds, Revenue uses the final valuation approved by your lender, not the actual building costs.

Can Revenue ask me to repay the Help to Buy payment?

You will have to repay Revenue some or all of your HTB payment in certain situations. This is called clawback. You have to pay the HTB payment back to Revenue if you:

• Don’t live in the home for at least five years.

• Don’t finish building the home within two years from the date on which the HTB payment is made.

• Weren’t entitled to the payment in the first place. If you don’t complete the build within the two-year threshold, HTB must be paid back to Revenue within three months. If you do not live in the home for five years, the amount you must repay depends on how long you lived there as per the table below:

For instance, Brendan received an HTB payment of €15,000. The house was completed by the builder in September 2021, and he moved in immediately. In November 2024, he stopped occupying the house and sold it, notifying Revenue accordingly. Since Brendan ceased to occupy the house in year 4, there is a clawback of the HTB payment as follows:

€15,000 x 40 per cent = €6,000

The application process for the Help to Buy Scheme consists of four stages:

1. Application Stage

• Apply for HTB online.

• PAYE employees apply via Revenue’s myAccount service.

• Self-assessed taxpayers apply through Revenue’s Online Service (ROS).

• Access MyEnquiries for secure correspondence with Revenue: ROS business users access it from the My Services screen under ‘Other Services’. PAYE employees access it through myAccount.

• Upon approval, you’ll receive a summary of your maximum claim amount if tax compliant.

2. Claim Stage

• Once approved, make your claim using ROS or myAccount.

• Provide mortgage documents and property details.

• Refer to Revenue’s Help to Buy – Summary Guide for Applicants for required documents and claim process details.

3. Verification Stage

The information you have provided is verified by an eligible verifier. This is the contractor if you are buying a new home, or your solicitor if you are building your home.

4. Refund process

If you’re self-building, the refund is deposited into your bank account held with your loan provider.

As the architectural awards season comes to a close, we bring you the highlights from across NI and ROI.

Royal Institute of Architects of Ireland

There’s plenty of inspiration coming from the RIAI, with highlights including 14 Clarendon Street by Shaffrey Architects getting a mention for restoration and repair, and Living in a Landscape by Arigho Larmour Wheeler Architects bagging the much coveted award for new house.

For loads more inspiration from the RIAI awards

BELFAST / 27-29 SEPT 2024

GO TO EVENT IF BUILDING, EXTENDING OR RENOVATING YOUR HOME

WHAT TO EXPECT:

l BATHROOMS & KITCHENS

l BUILDING & RENOVATING

l ENERGY & TECHNOLOGY

l INSULATION & ROOFING

l PLANNING & FINANCE

l WINDOWS & DOORS

l GARDEN & OUTDOOR LIVING

l SECURITY & MORE

150+ EXHIBITORS SHOWCASING 30+ ADVICE TALKS

THEATRES l TALKS l 1-2-1 CLINICS

EXPERTS l ADVICE l INSPIRATION AND MORE...

McGonigle McGrath Architects won two RSUA awards for rural one-off housing projects, the third year in a row that the practice scooped the accolade, thereby securing a hattrick. House on Redbrae Farm, a rural Co Down project, and Longhurst, a family home in south Belfast, both scooped

For more RSUA inspiration

Scooping an AAI award was High Street, Balbriggan designed by Robert Bourke Architects, a 6sqm alltimber micro extension that ingeniously transforms key spaces in a two storey Victorian terrace, offering a budget friendly solution for maximising space. This project also won at the RIAI awards.

The original layout featured a typical floor plan, with an entrance hall leading to separate front and back reception rooms and a kitchen return. However, the layout felt disconnected, with limited access to the garden.

Robert Bourke Architects addressed this by adding just 3sqm at ground and

top accolades.

Meanwhile architect Patrick Bradley secured his own set of awards with his shipping container home, Barney’s Ruins, which he built floating above the ruins of his family’s 200-year-old farmstead near Maghera. The original cottage was last lived in by Patrick’s great-great uncle Bernard, locally known as Barney. This project also won at the RIAI awards.

first floor levels, swapping the living and dining rooms and creating a direct link to the kitchen through the extension. A new sliding door offers easy garden access, while relocating the wood burning stove frees space for a bespoke oak booth in the dining area.

Upstairs, the cramped master bedroom was redesigned, replacing the old gas boiler and hot water cylinder – which was housed in the tiny wardrobe – with a combi boiler in the attic, allowing for a spacious wardrobe. The addition of extra square footage also enabled the installation of larger windows, enhancing garden views and increasing sunlight.

The extension and refurbishment project was built by Structure Tone Developments.

FROM ILLUSION TO REALITY

Discover the perfect fusion of form and function with MIRAGE - our new range of Wetroom Panels. Available in Fluted, Smoked and Clear Glass, this collection provides a variety of design choices to suit your taste.

Scan to download the SONAS 2024 Edition 2 Brochure for more Bathroom Inspiration.

Gaining access to the attic space can be cumbersome and let’s face it, dangerous depending on the type of ladder you have in place.

Enter QmanPro’s universal zero gravity booster spring solution that’s a dream to use. Thanks to its spring operated opening mechanism, your foldable ladder gently opens up - and folds back up again when you’re done. No need for heavy lifting.

The booster spring is compatible with wooden loft ladders which are at least 60cm in width. It can be added onto existing loft ladders or installed prior to fitting.

The zero gravity booster spring can be combined with leading loft ladders brands. Installation of this product is available all over Ireland and can be installed as a complete loft ladder or just the booster spring attachment onto an existing loft ladder.

atticaccessni.co.uk

Due to the demand for ever better insulation properties in front doors, the installation depth of the profiles and therefore also the thickness of the infill panels have increased significantly in recent years.

Depending on the design and material of the infill panel and profile, and particularly in the case of dark colours and closed panels in exposed positions, different interactions may occur, which can lead to a warping of the entire

door leaf.

Enter NorDan’s new aluminium entrance door range which produces panels with ESC composite as standard. The ESC Feature is a patented elastic sandwich composite (EP3 593 989) for exposed locations and dark colours. Thanks to the elastic sandwich compound, the forces caused by solar radiation, or the effects of cold temperatures are reduced to a minimum.

Among many other features, the doors also come with toughened safety glass (ESG) as standard for all panels above 60mm thickness, and a 19 mm glass inset meaning the edge seal is 4 mm thicker all around resulting in a lower risk of leaks (pane does not become cloudy or etched, even during long periods of use).

For NorDan’s entrance door e-brochure, email info@nordan.ie

Pipelife Ireland now offers extensive product training at its new Renewable Training Academy in White’s Cross, Little Island, Cork as well as at its new Distribution Depot in Mulhuddart, Dublin 15.

Led by members of the Pipelife Ireland Technical Team, the courses are free to attend. You’ll gain practical knowledge and get up to speed with installation practices. Plus, you’ll get a unique tour of the Pipelife manufacturing facility where visitors are given the opportunity to see first-hand where its products are designed and produced.

Designed for service engineers, plumbers, merchants, architects, local authorities and BER assessors, the courses are also open to self-builders who are planning to do some of the installation.

Pipelife specialises in renewable heating technology, primarily air-to-water heat pumps, underfloor heating and low-temperature radiator systems.

More information on pipelife.com; email ireland@pipelife.com

Set against the scenic backdrop of Ballygalley, Co. Antrim, stands a remarkable 3,000 square foot coastal self-build home featuring a Grant integrated heating system for efficient space heating and hot water.

Epitomising eco-conscious living, this beautiful single-story home was built on the site of an 18th century mill by Rob and Janice McConnell who prioritised sustainability throughout the design process.

Winner of RTE’s Home of the Year in 2023, the timber framed property was designed by 2020 Architects and features stunning high ceilings and large windows to capture scenic views.

Sharing his experience in choosing the home heating system, Rob McConnell said, “I really wanted one supplier for all our heating requirements and loved the idea of working with an Irish company to provide the heating technologies for our home. The heating design process was very straightforward, I sent my house plans through to the Grant team and they calculated the heat loss requirements for each room and provided a fully integrated heating solution including specified heating technologies for the property.”

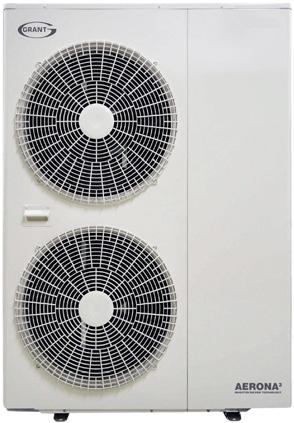

Given the property’s expansive size, a 13kW Grant Aerona³ R32 air-to-water air source heat pump was specified as the main heat source for the property. Popular with self-builders, this unit from the Aerona³ range is recognised for its quiet operation by the internationally acclaimed Quiet Mark.

Available in 6kW, 10kW, 13kW, and 17kW outputs, models within the Grant Aerona³ R32 range offer superior seasonal coefficient of performance (SCOP), delivering up to 4kW of heat energy for every 1kW of electricity used, depending on climate conditions and system demand.

To support the system, a pre-plumbed and pre-wired Grant hot water cylinder was chosen for hot water storage within the home. Additionally, Rob opted for Grant Uflex underfloor heating to be installed throughout the property to provide uniform warmth with individual room thermostats for precise zoned heating.

“Our previous home was heated by oil and having now moved to an air to water heat pump, I have noticed how the heat pump provides a level, constant heat throughout the house so it always feels warm and comfortable. Having solar PV means that I can also run the heat pump using renewable electricity during the day or take advantage of using a night-time rate so it’s a win win situation.”

Barry Gorman, National Renewables Sales Manager at Grant, commented, “We are delighted to have provided a bespoke home heating system for the McConnell’s self-build home. Designed to work together, the Grant Aerona³ heat pump combined with Grant Uflex underfloor heating provides a highly efficient, low carbon heating solution which complements the sustainability focus of this beautiful home.”

Start your journey

How to avail of Grant’s Home Heating Design Service

1. Send planning drawings, a contact number and your preference of underfloor heating, radiators or both to heatpump@grant.ie or heatpump@grantni.com

2. Grant technical specialists will be in touch to discuss your requirements

3. Full property specifications with recommended Grant products will be provided

For further information visit www.grant.ie / www.grantni.com