MEDICARE 2021 “IN A NUTSHELL”

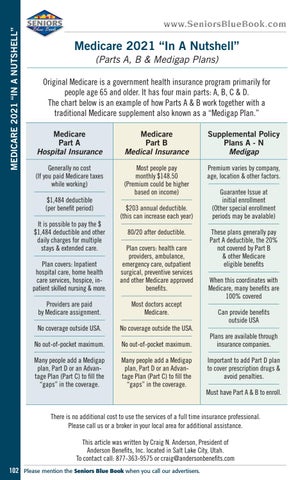

Medicare 2021 “In A Nutshell” (Parts A, B & Medigap Plans) Original Medicare is a government health insurance program primarily for people age 65 and older. It has four main parts: A, B, C & D. The chart below is an example of how Parts A & B work together with a traditional Medicare supplement also known as a “Medigap Plan.” Medicare Part A Hospital Insurance

Medicare Part B Medical Insurance

Supplemental Policy Plans A - N Medigap

Generally no cost (If you paid Medicare taxes while working)

Most people pay monthly $148.50 (Premium could be higher based on income)

Premium varies by company, age, location & other factors.

$1,484 deductible (per benefit period) It is possible to pay the $ $1,484 deductible and other daily charges for multiple stays & extended care.

$203 annual deductible. (this can increase each year) 80/20 after deductible.

Plan covers: Inpatient hospital care, home health care services, hospice, inpatient skilled nursing & more.

Plan covers: health care providers, ambulance, emergency care, outpatient surgical, preventive services and other Medicare approved benefits.

Providers are paid by Medicare assignment.

Most doctors accept Medicare.

No coverage outside USA.

No coverage outside the USA.

No out-of-pocket maximum.

No out-of-pocket maximum.

Many people add a Medigap plan, Part D or an Advantage Plan (Part C) to fill the “gaps” in the coverage.

Many people add a Medigap plan, Part D or an Advantage Plan (Part C) to fill the “gaps” in the coverage.

Guarantee Issue at initial enrollment (Other special enrollment periods may be avalable) These plans generally pay Part A deductible, the 20% not covered by Part B & other Medicare eligible benefits When this coordinates with Medicare, many benefits are 100% covered Can provide benefits outside USA Plans are available through insurance companies. Important to add Part D plan to cover prescription drugs & avoid penalties. Must have Part A & B to enroll.

There is no additional cost to use the services of a full time insurance professional. Please call us or a broker in your local area for additional assistance. This article was written by Craig N. Anderson, President of Anderson Benefits, Inc. located in Salt Lake City, Utah. To contact call: 877-363-9575 or craig@andersonbenefits.com 102

Please mention the Seniors Blue Book when you call our advertisers.