S

T e day a. . p. . Wed e day a. . 8p. . Th day a. . p. .

S

T e day a. . p. . Wed e day a. . 8p. . Th day a. . p. .

FORT WAYN , Ind.— The Fort Wayne Farm Show is back in full force for its 36th year.

Tradex pos wi ll present the annual farm show Jan. 14 -16 at the Al len County Wa r Memorial Coliseum, located at 40 00 Parnell Ave. in Fort Wayne.

Fort Wayne Farm Show exhibitors present the latest farm technology the industry has to offer along with the area’s largest variety of farm machinery equipment, all in one location

“T he Tr adex po s te am works diligently every year to meet the evolving needs of America’s livestock producers, row crop fa rmers and other agricultural pro-

fessionals,” said Dan Slowinski, show director.

“ The Fort Wayne Fa rm Show ha s be en di st inctively cu rated to prov ide real-time value and opportu nity to the indu st r y,”

Slowinski said “W hether it ’s your first ti me at tend in g the Fort Wayne Farm Show or your 30th, you’re certain to love the fantastic variety of exhibitors and educ at iona l semi na rs th at the Fort Wayne Fa rm Show pr ovides as Indiana’s la rgest i ndoor ag ricu lt ural expo. Toget her, we achieve the extraordinary.”

Attendees can expect to enjoy the innovations and wares of over1,000 booths, as

well as ample opportunities to attend seminars to learn more about current topics in agriculture from partners and trusted experts, Purdue xtension and Northeastern Indiana Soil and Water Conservation Districts.

Ther e ar e two gr and pri es inthis year’s drawing, scheduled for 3 30 p.m. Jan. 16 —a Toro ero-turn lawn mower or wa lk-behi nd snowblower, sp onsored by Plevna Implement Co., wh ich ha s location s in Aubu rn, okomo, Nappanee and Rensselaer.

Find the business at Booth 335 during the farm show, as well as online at www.plevnaimplement.com.

Show hours are9 a.m.to

5 p.m. Tuesday, Jan. 14 9 a.m.to 8 p.m. Wednesday, Jan. 15 and9 a.m.to 4 p.m. Thursday, Jan. 16.

“T he Fort Wayne Fa rm Show is back and better th an ever before,” Slowinski said

Ad mi ssion to the fa rm show is free, but there is a fee to park. The cost is 8 for the main lot, 12 for the prefer red lot and 16 for buses or RVs. Cash, credit ca rds and debit ca rds are accepted, and th is fe e is valid for one entry.

herearetwogrand ri esinthis ear sdrawing,sched ed or 3 30 .m. an. a oro ero t rn awnmowerorwa ehind snow ower,s onsored P e na m ement o.

In addition to the Fort Wayne Farm Show, Tradexpos produces the Topeka Farm Show in Topeka, ansas, and the North American Farm and Power Show in Owatonna, Minnesota. Visit the Tradexpos website at www.t ra dex po s. com.

John Bech man Ot terbein, IN 765.40 4.0396 jbe chman@halderman.com

Gary Bohl an der Darlington, IN 765.794.0221 garyb@halderman.com

D ave Bonn ell Columbus, IN 812.343.4313 daveb@halderman.com

Mich ael Bonn ell Hope, IN 812.343.4313 michaelb @halderman.com

Jim Cl ar k Frankfor t, IN 765.659.48 41 jimc@halderman.com

Sam Cl ar k Noblesville, IN 317.442.025 samc@halderman.com

Ja sonJ ohnloz Bluf fton, IN 260.273.9177 j asonj @halderman.com

Rick John loz Bluf fton, IN 260.827.8181 rick j @halderman.com

AJ Jord an Peru, IN 317.697.3086 ajj @halderman.com

Larr y Jord an Peru, IN 765.473.58 49 lj @halderman.com

Todd Li tten Ellett sville, IN 812.327.2466 to dd l@halderman.com

Robert Mc Namara Wilmington, OH 614.309.6551 robertm@halderman.com

Em ma Barr Marion, IN 260.494.0992 eb arr@halderman.com

C hris Pe acoc k Winchester, IN 765.546.0592 chrisp @halderman.com

Lauren Pe acoc k Winchester, IN 765.546.7359 laurenp@halderman.com

Jon Rosen North Manchester, IN 260.740.18 46 j onr@halderman.com

Br et t Salyer s Bowling Green, OH 419.806.56 43 bret ts@halderman.com

Larr y Smit h La Porte, IN 219.716.40 41 larr ys@halderman.com

Cr aig Springmier Eaton, OH 937.533.7126 craigs@halderman.com

Br an don St roble Dunkirk, IN 765.499.1170 brandons@halderman.com

J os h Wagenb ac h Wolcot t, IN 219.863.0870 joshw @halderman.com

Rust y Harm eyer Rushville, IN 765.570.8118 rust yh@halderman.com

Ch arle s Mc Cart y Bloomington, IN 812.480.9560 charle sm @halderman.com

Ty ler Reiger Greensburg, IN 812.614.8034 tylerr @halderman.com

Ne al Wolh eter Kendallville, IN 260.336.2219 ne alw@halderman.com

Joe Halder man Wabash, IN 260.330.1222 j oeh@halderman.com

Nolan Samp son Union Mills, IN 219.575.1486 nolans@halderman.com

Pat Kars t Huntington, IN 260.274.1606 p atk @halderman.com

FORT WAYN , Ind. The Fort Wayne Fa rm Show, to be presented Jan. 14 -16 by Tradexpos at the Allen County War Memorial Coliseumin Fort Wayne, wi ll fe at ure da ily educ at iona l seminars provided by Northeastern Indiana Soil and Water Conservation Dist ricts and Pu rdue xtension.

Al l events wi ll ta ke place in Appleseed Room A, except for the luncheon prog ram at 11 3 0 a.m. Wednesday in Appleseed Room B. Only 15 0 meals wi ll be avai lable for the luncheon, and they will be provided on a first-come, first-served basis.

TUESDAY ANUARY

10 a.m. “Midwest Ag Market Outlook” by Jon Cavanaugh, WOWO market analyst David ohli, WOWO market analyst Ryan Martin, farm origination specialist, Louis Dreyfus Co. and Rob Winters, farm director,

News Talk 1190, WOWO. Noon “Climate Impacts on Ag” by Austin Pearson, climatologist, Midwestern Regional Climate Center

2 p.m. “PesticideApplicator Program” by FredW hitford, clinical engagement professor and director, Purdue Pesticide Programs, Purdue niversity PA RP, CCH credits available.

WEDNESDAY ANUARY

10 a.m. “Farm mergency Care” by lysia Rodgers, De alb County xtension director and agriculture and natural resourceseducator, Purdue xtension.

11 30 a.m. “Hot Topics in Land se” luncheon program in

Appleseed Room B by Brianna Schroeder, partner, Jan en Schroeder Ag Law. Sponsored by Indiana Farm Bureau and Adams, Allen, De alb, Huntington, LaGrange, Noble, Steuben, Wells and Whitley County Farm Bureaus.

1 30 p.m. “Water Resources” by Jane Frankenberger, professor, agricultural and biological engineering, Purdue niversity.

3 30 p.m. “W ho, What, Where, When and Why on Drainage Regulations” by Jarrod Hahn, surveyor, Wells County

5 30 p.m. “Making Senseof Programs” by .S. Department of Agriculture Farm Service Agency staff.

THURSDAY ANUARY

10 a.m. “Tips for the Ag Job Search” by Bill Horan, Wells County xtension director, agriculture and natural resources

ns orto ndiana s Scho arshi o ndation,a ndraisinga ctionwi ehe dat .m. an. and .

educator and community development educator, Purdue xtension.

Noon “Core Pest icide Test Prep” by Purdue xtension educators.

ACRESLANDTRUST

ADVANCEDDRAINAGE SYSTEM

ADVANCEDFARMSU LY

ADVANCEDGRAIN SYSTEMSLLC 3

ADVANCEDREHABILITATION TECHNOLOGY 3

AGBAG GOLDENHILLS SALES

AGCREDIT

AGE RESS ELECTRONICSINC.

AGFOCUS

AGINFOTECH 3

AGLEADERTECHNOLOGY

AGRESOURCE MANAGEMENT 0

AGS RAYE UI MENT

AGRAG S 03

AGRIBUSINESSFINANCEINC.

AGRIEYES

AGRI KINGINC. 0

AGRI SCFOURSTAR SERVICESINC. AGRO CHEMINC. 3 AGROECO OWERLLC 3

AGRONOMICSOLUTIONSLLC AG LORE 0

ALCOOVERHEAD DOORSIILLC ALL LANTLI UID LANT FOOD 3

LLENCOUNTYSOIL WATER CONSERVATIONDISTRICT URDUEUNIVERSITY

ALMONDGARTEN 0

AMERICANNATIONAL INSURANCE 3 A UABLASTCOR . 3

AUTOVALUE B HBUILDINGINC. COVER ALLSYSTEMS 3

BAMBAUERE UI MENTLLC 3

BATHFITTER 3

BAUGHMANTILECO. DEALEYCHEMICALS

BEACHYWEALTH MANAGEMENT 0

BEACONAGGROU

BECK SSU ERIORHYBRIDS 30 BELLMANOILCO.

BESTFORAGELLC

BESTONEOFMONROEINC. 3

BIGIRONAUCTIONCO.

BOBCATOFFORTWAYNE 0

BOHLE UI MENT CRANE MACHINE 00

BORKHOLDERBUILDINGS SU LYLLC 0

BRECHBUHLERSCALES

BROOKSIDE LABORATORIESINC. 0

BROWN SONSFUELCO.

BUNGENORTHAMERICA 3

BW FUSION C AGRISERVICESLLC 3

CALMERCORNHEADS

he en o nt ar emoria o ise m,thesiteo the ort a ne armShow,is ocatedat 000 Parne e.in ort a ne, ndiana. dmissiontothe armshowis ree, tthereisa eeto ar . hecostis orthemain ot, orthe re erred otand or sesor s. ash,creditcards andde itcardsareacce ted.

CONSOLIDATEDGRAIN

CORNADOGRAIN S READERS

COUNTRYCUSTOM METALSLLC

COUNTRYMARK

COUNTRYSIDEIBALLC

COUNTRYVIEW OWERED ARACHUTES

COYOTEMACHININGLLC

CROWNLIFTTRUCKS

CROWNROYALSTOVES

CULTIVATEFOODRESCUE

ELGINSERVICECENTER

ELITEAGSOLUTIONS

GORDON ASSOCIATES C

GOSHERTINSURANCELLC

GRABERLUMBER

GRACEMANUFACTURING

GRAINSYSTEMS DISTRIBUTION 3

GRASSHO ERCOM ANY

GREATLAKESSCALE COM ANY

GREENLEAF TECHNOLOGIESINC. 3 GROWERSMINERALCOR .

GROWER SSOURCE 33

HALDERMANFARM MANAGEMENT REAL ESTATESERVICES

HARVESTSOLAR 0 HAT ENBICHLER

HAVILANDDRAINAGE RODUCTSCO.

HEADSU

HILL SSU LYINC. 3

HOCHSTETLERGRAIN E UI MENTINC. 0

HOMANINC. 0

HONEYVILLEMETALINC. 0

HOOSIERSFEEDING THEHUNGRY 3

HULLLIFTTRUCK

HUNTINGTONUNIVERSITY 3 HWY2 TAR S

HYTECHMARKETING

INDIANAAGRABILITY BREAKINGNEWGROUND

INDIANAAGRINEWS

INDIANAAUTOAUCTION

INDIANACONSERVATION OFFICERS

INDIANADEER ELK FARMERSASSOCIATION

INDIANAFARMBUREAUINC.

INDIANAFFA

INDIANAIRRIGATIONCO.

INDIANASTATECHEMIST

INDIANASTATE OLICE

INDIANAWARMFLOORS INC. 3

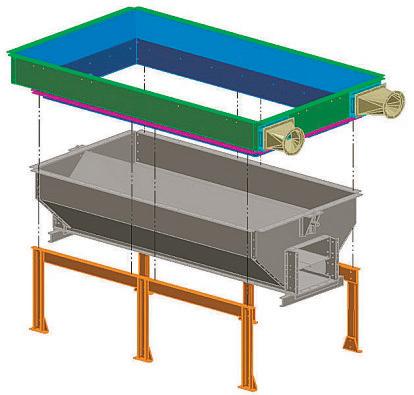

BucketElevators, upto32,000 BPH

BucketElevatorSupportT owers

CatwalkandSupportTowers

Distributors,Fl atBack &Round

U-TroughScrewConveyors

Horizontal DragConveyors (upto26,000BPH)

InclineDragConveyors (upto20,000BPH)

BinUnloadingDragConvey ors (upto6,350 BPH)

DustCollectionSystems Baghouse Filters, Cyclones,Fans, Airlocksand GrainDumpPits

youin5convenientlocations:

Bobcatisthename youknowandtrustwhenitcomestocompact equipment.

Boostefficiency aroundthe farmwithaBobcatSkidSteerloader!

Takeadvantageof0%*financing,orreceiveacashdiscountifpayingcash.

VisitBobcatof Fort WayneattheentrancetotheConferenceCenterduringthe FarmShow! *Financing availablewithapprovedcredit.Restrictionsapply,seedealer fordetails.

Boxsize 44”x 12”x 4”

• Storagestep box fitsS/STSseries JohnDeere

• No modifications required

• Fullyassembled box.

• Hardwareand mounting brackets included

Fitsthe following

• CaseIH

• Capello

• Drago

• Geringhoff

• Gleaner

• Harvestec

• John Deere

• Lexion

• Massey

• New Holland

Bonfield, IL (815) 426-2330 www.ndymfg.com

Globe Locksfit John Deere3000, 6000,and 7000 series StarFire

Fitsthe following

• Massey

Option to add 36”x 20”x 12” storagebox to fityour needs

INTEGRITYAUTOGLASS 3

IRRIGATIONSOLUTIONSLLC ISCHSEEDS 2

IVANBUCKMASTER SONSINC.

AGE UI MENTLLC

K COMMUNICATIONSINC.

MMANUFACTURING

ANITORSSU LYCO.

ONESFISH LAKE MANAGEMENT 0

K.B.HAYSU LIESLLC 0

KAEBSALES 0

KALEMARKETING

KASCOMANUFACTURING CO.

• New Holland

• John Deere

• CaseIH

• Challenger

• Versatile

• Works in 3positions

• Easy fold andunfold

• Stores out of way for transport

• No modifications required

• Fits John Deere 1790/95and 1770/75

SCAN ME

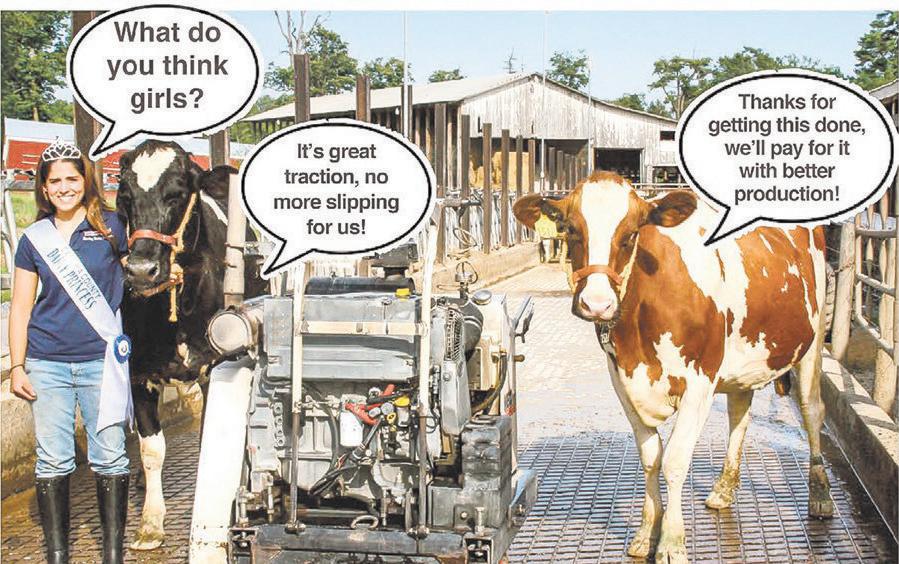

MudScrapers, Tow Hitches, and More.

LOADER ARTSSOURCE

LOUISDREYFUS COMMODITIES 30

M AGRASOLUTIONSLLC 0 M WSEEDS

MACALLISTERMACHINERY 3 3

MACALLISTER TRANS ORTATION

MAISCOLLC

MANCHESTERFARMCENTER 3 MANDAKO

MARIONTILECO.

MARTININSURANCE 333 MARTINTILL 3 MATSENMINIATUREFARMS

KEYSTONECOO ERATIVE 3

KUHNS OWERE UI MENT

LANDALERT

LANDLUVR

LANDMASTER LANKOTA

LEAFFILTERGUTTER ROTECTION

LEAFGUARD 3

LEDWISCONSIN

LEGACYE UI MENT

LGSEEDS

LIEBRECHT MANUFACTURINGLLC

LIMBBUSTERLLC 3

UALITYLIFTE UI MENT

RABER ATIOENCLOSURES FURNITURELLC

RENEWALBYANDERSEN

RINGSTEDWELDING

RMHSELF RO ELLED FEEDMI ERS

SEECO. 3

ROVENSANE T 00

RYKERTOOLS 0

SIDISTRIBUTINGINC. 0

SALTCREEKAG RODUCTS

SCHAEFFEROIL GREASE 0 3

SCHRADERREALESTATE AUCTIONCO.

SCHWABBUILDERSLLC

SCILEASINGGROU

SCOULARCOM ANY 3

SEAGRICULTURAL COMMERCIALSOLUTIONS

SEEDGENETICSDIRECT 0

SHELBYCRO INSURANCEINC.

SHI SHEWANAHARDWOODS A ALLETONECOM ANY 3

SHIVVERS MANUFACTURINGINC. 0

SHOU MANUFACTURINGCO. 00

SHUR CO 3

SHURWRA

SILVEUSINSURANCEGROU INC. 0

SISCO SU ERIOR IM LEMENT 3 SL RECISIONAGLLC

SLOANE RESS 3

SNIRTSTO ER 00

SOLARENERGY SYSTEMSLLC

SOLIDROCKAGSOLUTIONS

S NCCOR . 00 S RAYTEC

ToLe

ARTSINC.

WAGLER ASSOCIATES 3 WAITTSYSTEMLLC

WAKARUSANUTRITIONAL SERVICESLLC WAKARUSA AGLLC 3

WALINGAUSAINC.

WAYNE VAUGHNE UI MENT

WECOVERSTRUCTURESINC.

WEN INGERFARMS THE ORTABLESEEDAUGER

WESTSIDETRACTORSALES

WESTLAKEROYALROOFS 3 WICKENKAM LIVETRA MANUFACTURING 30 WILLIAMSE ERT IVOT 3

WILLIAMSONCRO INSURANCE 0

WINDOWDOCTOR

WINGFIELD MANUFACTURINGLLC

WOODCHUCKBEDDING S READER

WOODLANDINNOVATIONS 3

WOWONEWS TALK

WYCKOFFSEEDS

YODEROILLLC IMMERMAN MANUFACTURING 3 DIESEL

By TOMC.DORAN tdoran@shawmedia.com

R BA NA,I ll.—I ll inoisa nd Indiana hadthe highestamount of agricultural land lost to development intheMidwest over a20year period.

singNationalLandCover Database imagerybetween 20 01 and 2021,Illinoislost155,653 acresof agricultural land to development, themostamong Midweststates, andIndiana lost 133,243acres.

Thefindings wererecently featuredinthe niversity of Illinois Department of Ag ricultural and Consu mer conomics fa rmdoc, authored by Oh io State niversity’s Mujahidu lIslam,A ni atchova andCarl ulauf.

TheN LCD, produced by the Mu lt i-Resolution La nd Characterist icsconsort iu m, uses two satelliteimagesand othersupplementarycartographicdatasetsto analy eland-usechanges in Illinois,I nd ia na,Iowa, Mich igan,

Mi nnesota, Missou ri,Ohioand Wisconsin. Theana lysisper iod is theearliesttothe latest years inthe dataset.

“Accordi ng to NL CD images from 20 01 and2 021, ag ricultural la nd intheeig ht Midwestern states decreasedfrom150,312,467 acres in 20 01 to 148,716,812acres in 2021,a total declineof1,595,655

acres,”the studyfound.

“Ofthe ag ricultural land lost, 877,38 6acres —5 5% of 1,59 5,65 5 were convertedintodeveloped land,likelydue to urbani ation, in fr as tr uc tu re ex pa ns ion, or ot herdevelopment ac tivities Ot heragr icultu ra ll andlosses included conver sion to forest , ba rr en la nd ,openwat er and grassland.”

Conversion to developmentwas most importantinIowa. Development accountedfor 90%oft he loss of ag ricultural land in Iowa between2001and 2021

Conversion to developmentaccountedfor thesmallestofagricultural land loss in Wisconsin, Oh io andM is sour i. Development’s shareoftotal agricultural land lost was56%,48% and26%, respectively,according to theauthors.

“Tohelpu nderst andt he dynamics of theagriculturallandusechangeand aidinreg iona l pl an ni ng anddevelopment,a n analysis wascar ried outatthe Metr op olit an St at istica lA re a level. TheO ceofManagement andBudget defines aMSA as a geographical region consisting of acorecitywith apopulationof atleast 50,0 00’and maintaining strong economic and social interactionsbetween thecorecityand thesur roundingcommunit ies,” thereportnoted.

“Ofthe agricultural land inthe Midwestern states lost to development over thelasttwo decades, 81%has occurred within MSAs

“The sharewas highestinIllinois (at89%). Indiana, Michigan, Mi nnesot aa nd Wisconsin al so lost over 80%oft heir ag ricu lturallandtodevelopment within MSAs.The MSAshare waslowestinIowaat6 9%.T he share forbothMissouriand Ohio was 77%.”

Am on gt he 24 MS As ,t he hi ghestnumberofacr es conve rt ed fr om ag ri cu lt ur al to develope dl andwas theChicago -Naper vi lle- l gi nMSA ,w it h 92 ,6 73 ac re sc onve r te d. Th is MSAspa ns thenor ther npar t of Il li nois,par ts of Indianaa nd sout he as te rn Wi sc on si n. The St.L ou is MSAinM issour ia nd Il linois lost 15,740 acresovertwo decades.

See ACRES,Page

There’sareasongrowerstrustBW Fusion. Ourcropnutritionprogra msarebased onfacts,notassumptions. Weoffer comprehensivedataandsoilandtissue sampling.Plus,yougetaccess to ourteam ofexpert agronomists.Byunlockingthe naturalabilitiesofplantsandsoil, you’ll maximizeprofitability.

The MSA withthe second highest loss of agricultural la nd to development was the Minnesota MSA of Minne ap ol is- St Paul-Blo omin gt on at 65 ,7 54 ac re s, followed by the Indi an a MSA of Indianapol is-Carme l-An de rs on at 61 ,9 19 acres.

According to NLCD, agricu ltural la nd is defined as any area designated as cultivated cropland or pastu re and hay. Cu lt ivated cropla nd includes perennial woody crops such as orchards and vineyards Pa st ur e and hay ar e areas of grasses, legumes, or grass-legume mi xtures planted for livestock graing or the produc tion of seed or hay crops, typically on a perennial cycle.

By ERICA UINLAN e in an@shawmedia.com

WASH INGTON As farmers face tight profit marg ins, organi ations like the nitedSoybean Board are working hard to maximi e market opportunities for S. soy.

Du ri ng a we bi na r ho st ed by Ag ri Pu ls e, soyb ea n fa rmer s and leaders shared the latest when it come s to driving demand for S. soybeans

The U ed S a e is currently expanding its crushing plants to supply oil for renewable fuel market. This will increase the available supply of soybean meal

Our crush capacity is going to increase about 6% in 2024 and 2025 On the latest World Agricultural Supply and Demand stimates report they showed soybean meal export demand up 8.5% so there is a true demand there.

“Now that soybean oil is the primary driver of crush to meet biofueldemand (historically meal was always value driver) we’re looking at unique investments to find uses for soybean meal for example, new export markets Port of Grays Harbor expansion and soy our in firefighting foam, eliminating PFAS or per-and polyuoroalkyl substances commonly called forever chemicals.’

“W hen we feed livestock domestically, then export it that supports .S. agriculture and the economy overall.”

D la d a a S

O is to partner to deliver sustainable soy solutions to every life, every day. We do that through our meal markets, oil markets and so forth.

“One of the things we’re really keen on doing is maximi ing that profit opportunity for .S. soybean farmers. We do that by looking beyond the bushel.” S e e Re ha d Oh S

W h y export markets, China is No 1. China imports 60% of al the soy inthe world. They’rea huge customer The S. Soybean xport Council is very well-respected in China and works very well there.Mexico and the uropean nion are also inthe big three

“Butwe don’t want to forget al the other smaller countries because part of SS C’s mission— to diversify our markets all around the world. There’sa lot of upcomingmarkets like Libya, Algeria, Pakistan, India and Nigeria.

“ SS C is devoted to di fferentiating our soy, elevating preference and attaining market access for our soy.”

La e Re a Ka a S. S P S

“W hole soybean and soybean meal exports across the globe to support global hog production and egg-laying production, while increasing inclusion in those diets, is a big part of moving that pile. But that works alongside exporting value-added poultry products and red meat

We know your soil, your farm and that shor tcut past the crookedoak tree that isn’t on GPS. Our local Seed Advisors are there, working side by side with you, to find top-performing products that can maximize your yieldpotential. You cancount on us tobe there in your hometown — where it counts

ByTOMC.DORAN tdoran@shawmedia.com

CHICAGO— For the first time since the end of 2019, farmland values inthe 7th Fe dera l Reserve Di st rict did not seea year-over-year increase

Th e Fe de ra l Re se rve Ba nk of Ch icago released su rvey deta il s in it s November issue of Ag Letter Insights

“It’s been quitea run-up in farmland va lues inthe past five years, and now it has petered out, it seems like,” said David Oppedahl, a Ch ic ago Fed policy adviser, lead ag analyst and AgLetter co-author.

Va lues for “good” farmla nd inthe 7t h Di st rict overal l were 2% lower in the th ird quar ter of 20 24 than inthe second quarter, accord ing to the respondents from119 banks who completed the Oct. 1 su rvey.

Wisconsi n had anot her ye ar -ove r-ye ar ga inin farmland va lues, but on ly 4%. Il li nois, Indiana and Iowa had ye ar -over-ye ar decreases in farmland values of 1%, 2% and 1%, respectively

“You look at Wisconsin, and there you still see solid nu mbers–a 4% increase in values from a year ago. That’s also smaller than it had been, but it’s still showing some st reng ththere,” Oppedahl said “Partof the reason is that the dairy sector has been doing well this year. It’s been doing much better than it had been, and that’s given some incentive for those operations to expand.”

An Indiana respondent sa id “i nventory of fa rmland for sale in the area is still low.”

“The increaseshave got-

ten smaller and smaller unti l they vanished.I thinka huge factor in thisis the de cr ea se s in farm incomes over the past few years,” Oppedahl said “T here were double -d ig it increases in farmland values back when there was a big jump up in farm incomes in 2020 and 20 21 And now we’ve se en net fa rm income s de cl inin g, espe ci al ly cr op income s from corn and soybea ns

So that ’s lowered the dema nd for ex pa nsion and just made it tighter for operations.

“B ut you do st il l se e ex amples of some fa rmers bidd ing up pa rcels to ne ar -r ec or d level s. So , there are st il l some very hi gh auct ions out there, even with district farmland va lues genera lly grow ing less than before or decl ining.”

Ag ricu ltural credit conditions for the 7th District softened in the third quarter of 20 24 . Ag ricu lt ural interest rates, in both nomin al and re al terms, fell sl ig ht ly du ri ng the th ird quarterof this year

In the third quar ter, the district’s average nominal interest rates on new operating loans, at 8.12%, feeder catt le loans, at 8.09%, and fa rm real estate loans, at 7.19%, had all fallen to their lowest levels since the first quarterof 2023

“Mea nw hi le , in re al te rm s (a ft er be in g adju sted for in fl ation with the personal consumption ex pend it ure pr ice index),

the average interest rates on fa rm operat ing, feeder cattle and farm real estate loans exhibited thei r first de cl ine si nc e be gi nn in g thei r ru n-ups back inthe first quar ter of 20 22 ,” according to the report

For the Ju ly th roug h September period, repayment rates for non-real estate farm loans were lower than a year earlier.

The indexof loan repayment rates was 76 inthe third quarter of 2024 – and was last lower inthesecond quarter of 2020 – as 3% of responding bankers observed higher rates of loan repayment than a year ago and 27% observed lower rates.

Renewals and extensions of non-real estate ag ricu ltural loans were higher in the th ird quar ter of 20 24 than a year ago, with 32% of the responding bankers reporting more of them and 4% reporting fewer.

An Illinois banker noted that “low grain prices are definitely affecting borrowers’ ability to pay off operating loans.”

An ot he r re sp ond en t from Illinois remarked that “lower net fa rm income and cash-f low di ff iculties will affect land values.”

In the th ird quar ter of 2024, 55%of survey respondents considered farmland to be over va lued and 45% considered farmland to be appropriately valued None viewed farmland as undervalued.

A decl ine was expected for 7t h Dist rict fa rm la nd values inthe final quarter of 20 24 by 34% of su rvey respondents, wh ile 2% expected them to rise and 64% expected them to be stable

See VALUES,Page30

2

In li ne withthese su rvey resu lt s, soft er dema nd for ag ricu lt ural la nd li kely wi ll extend into 2025 45% and 35%of survey re sp ondents ex pe ct ed fa rmer s and non-fa rm investors, respectively, to have weaker demand to acqu ire fa rm la nd th is fa ll and wi nt er comp ar ed with a ye ar ea rl ier. Less than 20% expected t he se groups to have st ronger demand.

Overal l, respondents expect a drop inthe volume of farmland transfers du ri ng th is fa ll and winter relative to a year ago.

Net cash ea rn ings, wh ich include government payments, for crop and livestock farmers were expected to be lower during the fall and winter from their levels ofa year earlier, according to the responding bankers.

For crop farmers, 3% of survey respondents forecasted net cash ea rn ings to rise over the next three to six months relative to a year ago, wh ile 91% forecasted

these earnings to fall.

For dairy farmers, 14% of survey re sp ondent s ex pe cted net cash ea rn ings to increase over the next three to six months relative to a year ago, wh ile 22% expected these ea rn ings to decrease.

The dist rict ’s catt le and hog operat ions were expected to do about the same, with 22% of resp ondi ng ba nker s fore ca st in g higher net cash earnings for cattle and hog farmers over the next three to six months relative to a year earlier and31% forecasting lower such earnings.

The livestock sector faced dim prospects for income growth, but nothing like the slump facing the crop sector.

Overal l, 42% of the responding ba nkers pred icteda lower volume of farm loan repayments over the next three to six months compared with a year ea rl ier, while only 1% predicteda higher volume.

“ ns ur pr is in gly, give n income expect ations, forcedsa les or liqu id ations of fa rm assets owned by financial ly distressed farmers were anticipated to rise

inthe next three to si xmonths relative to a year ago, as 38% of the respond ing ba n kers anticipated them to increase and 2% anticipated them to decrease,” Oppedahl said Non-real estate loan volumes–specifica lly for operat ing loans, fe eder catt le lo an s and lo an s gu ar ante ed th roug h the . S. De pa rt me nt of Ag ricu lt ur e’s Fa rm Serv ic e Agency – were forecasted to be larger in the last th ree mont hs of 20 24 compared withthe sa me th ree mont hs of 2023

Farm real estate loan volumes were forecasted to be smal ler inthe last three months of 2024 compared withthe sa me three months ofa year earlier.

Although dipping fa rm interest rates could help some, ag ricu ltural cred it cond it ions were expected to keep weaken ing as farm incomes, for the most part, keep shrinking.

The7th District of Chicago includes the northern two-thirds of Illinois and Indiana, all of Iowa, the southern two-thirds of Wisconsin and Mich igan’s Lower Peninsula arm and a eshadrisenin consec ti e arters,accordingtothe edera eser e an o hicago, tthe atest arterwas attodowns ight .

GrainCarts

• Trackgraincart(anysize):$6,000

•1,300+Bushelsgraincartontires:$4,000

•1,100+Bushelsgraincartontires:$3,000

•1,000Bushelsorsmallergraincart:$1,500

Seed Tenders

•LC535SpeedTender™:$3,000

•LC290,LC390orc4·50SpeedTender™:$2,000

•SpeedTenderPro™251or451,EC270:$1,000

By RANDYKRON

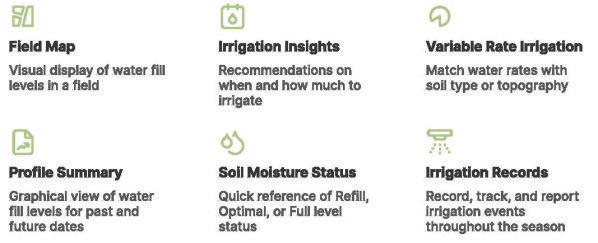

When we talk about water issues in Indiana, you might think we’re concerned with water quality rather than quantity.

Indiana is surrounded by an abundanceof waterways, including rivers, lakes and reservoirs, anda good portionof the state has strong underground aquifers

Historically, we have not faced many of the challenges thatplague other areasof the country where the water supply can be sparse, at best

However, the past couple

of years have opened our eyes to the work that needs to be done to protect our abundant water supply for the foreseeable future before it becomesa problem.

To know where we stand, we need to begin by gathering reliable data on how and where water is being used so we can make informed decisions in drafting futureregulations and legislation.

Indiana Farm Bureau formeda water task force last year with two key goals to gain a clear understandingof Indiana’s water supply and demand needs and to create thoughtful policy through conversations among subject matter experts, local elected o cials and state policymakers

As a result of those conversations, INFB

acres than ever before

Although the numbers have been widely misinterpreted, ag irrigation across Indiana only accounts for 3% of withdrawal use annually Irrigation is limited seasonally, and highly dependent on weather conditions.

We know economic development is critical to the growth of our state, but we urge our elected o cials to protect current users both agricultural and residential— first

will advocate to expand groundwater protection rights to proactively protect agriculture operations and farmers’ investments in producing food.

We look forward to the legislation authored by state Sen. Sue Glick, R-LaGrange, that will be introduced at the startof the 2025 legislative session to address this critical issue.

INFB will also advocate for implementing a statewide, dedicated groundwater well monitoring network to inventory cur-

rent groundwater supply.

This will help us be mindfulof our increasing growth residentially and industrially— and understand that water isn’t an infinite resource

As a farmer, my understanding and relationship with water is a pretty straightforward one no water, no food. And we believe food security is national security

The good news is that ag technology is ever evolving, and we’re being more ecient and effective on fewer

Farmers run their irrigation equipment only about 30 to 45 days of the year, at the times when their crops need it most.

Farmers are good stewards of the land, and deeply committed to protecting the longevityof their farms and natural resources.

So, it’s imperative that Indiana enacts policies that protect the investments made by farmers and agriculture and food manufacturers to continue fueling our state’s future

This will be a multiyear conversation, and solutions will not be reached overnight. Our commitment to advocacy today is focused on ensuring Indiana agriculture is protected for generations to come

Will you help us advocate for agriculture and protect access to the precious resource of water for Indiana farmers and residents alike

Randy Kron ha s be en presid ent of In di an a Farm Bure au sinc e 2016 . He an d hi s wife , Joyc e, farm withth eir son, Ben, ne ar Evan sville.

January14-16,2025

W ST LA FAY TT , In d.

An outbre ak ofof ten-fata l epi oot ic hemorrhagic di se ase af fl icted more than 50 0 wh iteta iled deer in Indiana’s Al len, Porter and Wabash counties last summer.

The Indi an a Depa rt ment of Natu ra l Resources, wh ich adjusts hunting deer limits in counties affected by such outbreaks, needs accu rate but ha rd-to- obta in popu lation esti mates and ot her related data to ma ke its management decisions.

“Successfu l wi ld li fe management requires us to know how many animals we have,” said Purdue niversity’s Patrick ollner, professor of quantitative ecology in theDepartment of Forestry and Natural Resources.

“W hite-tailed deer, coyote and

tu rkeys are th ree very prom inent, charismatic species inthe st ate, and we don’t have good numbers for their populations at all.”

oll ner leadsa five-year, 1.6 mi ll ion project fu nded by Indiana DN R to develop better methods for monitoring the population si esof these animals.

The project team will com-pare the effectiveness of data- gathering methods from drones, crewed aircraft and trail cameras.

The projec t al ig ns withthe comm it ment of Pu rdue’s One Healthin it iative to expand knowled ge of the interdependent nature of animal, human and environmental well-being

“T here’s a lot of uncert ai nt y associated with your abilityto detect wild animals in natural hab-

P rd e ni ersit s ose h e t , ro essoro a iationandtrans ortationtechno og ,andPat o ner right , ro essoro orestr andnat ra reso rces,s er isest dents,inc ding ina ac son center ,grad atest dentin orestr andnat ra reso rces,to sedroneswiththerma camerastodoc mentwi d i e o ations.

itats. And absenceof proof is not proofof absence,” ollner said.

The st udy wi ll help Indiana DN R understand the accuracy of various methods and how much they will cost.

Last summer’s HD outbreaks will reduce the white-tailed deer populations inthe affected coun-

ties

“We want to understand not just howmany deer we have, but also how long it takes fora deer population to recover from a disease outbreak like that,” ollner said.

The work will encompass factors th at dr ive di se ase emergence andbu ilds on prev iously

published research ack ar y Deli sle cont ribute d additional foundational insights as a Purdue doctoral student and later as a deer research biologist inthe Indiana DN R Division of Fish and Wildlife P SP S

STUDY,Page 3

Nowa National Pa rk Serv ice ecolog ist in Alaska, Delisle has an ongoing collaborative role in the project.

Additional data would enable Indiana DN R o cials to operate a more flex ible and fi ne -sca le system for regulating harvest in disease outbreak locations.

“R ig ht now, we don’t even know what the population was in the first place, and we don’t know how long it takes it to recover,” ollner said

The new study also will examine transmission patterns of bovine tubercu losis, which affects livestock producers.

Interactions between deer and catt le ca n spre ad the di se ase. Smal l species such as raccoons may serve as disease carriers, as well

“Raccoons aren’t going to be ki lled by the disease, but they may help maintain a disease reservoir inthe background,” ollner said.

ina ac son,grad atest dentin orestr andnat ra reso rcesatP rd e ni ersit , oo satdataco ected romadronee i edwithatherma camera. roneswiththerma cameraswi eoneo thetoo s sedd ringa e earst d todeterminethemoste ecti emethod ormonitoringwi d i e o ationsi es.

“T here’s a lot that we don’t know How much is this full cast of characters and their interactions in uenci ng the abil it y of bovine tubercu losis to stay in a system versus being eradicated ”

The research team wi ll sa mple selected locations across the state, including Franklin County, which borders Ohio in southern

Indiana.

“F ranklin County has had incidents inthe last decade of both H D and bovi ne tuberculosis,” ollner said

The team wi ll use the data to develop st at istica l models that can estimate species populations statewide.

The researchers wi ll collec t

aerial data from early December until mid-March, when there are no le aves to obscure imager y. They also did some sampling earlier this year

Oncold days with snow on the grou nd, the Pu rdue crews ca n operate both color video and infrared cameras.

Project collaborators include Joe Caudellof Indiana DN R’s Division of Fish and Wildlife Sonja Christensen, assistantprofessor of fisheries and wildlife at Michigan State niversity and Wendy Beauvais, assistant professor of epidemiology and publ ic health in Purdue’s College of Veterinary Medicine.

Additional coll aborators are Br ia n Di ll ma n and Joe Hupy, both as so ci at e pr ofes sors in Purdue’s School of Aviation and Transportation Technology. Dillman oversees the crewed ights, wh ile Hupy manages the drone sampling operations

Purdue and MS students play key roles in the project. MS doctora l student Mike Shaw works with Ch ristensen on fieldwork across the state, tracking the impact of HD on white-tailed deer

in recently affected areas.

Postdoctoral researcher Jonathan Brooks, who recently completed his doctorate working in oll ner’s lab, models transm ission of bovi ne tuberculosis between wh ite-ta iled deer, catt le and raccoons with Beauvais.

Hupy works with Purdue wildli fedoctora l student Tina Jackson in sampling animal populations from drones

And Pu rdue senior wi ld li fe major m ma Johnson le ad s a team of underg raduates who operate an in frared ca mera from a Pu rdue Av iation Sky Ar row aircraft to collect data on whiteta iled deer densit ies across the state.

Johnson’s presentation of related research ea rned her the Best Flash Ta lk Award at last ye ar ’s confer ence of Indi an a Chapterof The Wildlife Society.

“We are doing better research by collaborating inthis way, but we’re al so givi ng both wi ld li fe unde rg ra duat es and av iation underg raduat es un iqueex periences to open up more opportunities for them inthe future,” ollner said

W ST LA FAY TT ,

Ind. —A newly formed institute at Pu rdue n iversity is of feri ng tr aini ng and development suppor t to ag ricu lt ure produc er s with novel food and beverage product ideas.

The new In st it ut e for Food Produc t In novation and Commercial i ation is fu nded by a 1.5 mi ll ion grant from the .S. Department of Ag riculture Rural Development.

“This grant is focused on farmers who want to add value to their product,” said Dharmendra Mishra, institute director and associate professor of food science.

n tr epr en eu rs fa ce many steps and challenges in conver ti ngcommod it y crops into new products for retail sales.

“We want to remove those hurdles for farmer-entrepre-

neurs,” Mishra said.

A joint ef fort of Pu rdue’s departments of Food Science and Ag ricu lt ural c onom ic s, the in st it ute is part of the SDA Ag ricu lture Innovation Center Program.

“It’s br in gi ng together t he te ch nica l ex pe rt is e on fo odma nu fact ur in g and foodsa fety from food scienc e and the ma rketing, entrepreneurship and bu si ne ss ma na ge me nt streng ths of agecon,” said ennet h Foster, the inst itute’s as si st ant di re ct or and professor of ag ricu ltural economics.

Da ir y fa rm er s mi ght want to produce ice cream or high-protein beverages.

Growers of tomatoes and jalape os might want to marketa salsa. Or,a beekeeper who sells honey may wish to developa syrup, as well

Foster said. “W hat can we do to support value-adding at the local level so more of that stays inthe local community where the product is produced ”

A key elementof the new program is the Food ntrepreneurship and Manufacturing Institute established in 2021 while Foster served as interim head of the food science department

Li ke the new inst it ute, F MI is a collaboration of Purdue’s food science and agricultural economics departments.

global supply ch ai n th at caused so ma ny problems du ri ng the COVI D pa ndemic.

Pu rdue’s recent histor y in product development includes introducing Boiler Chips ice cream and Boiler ma ker Hot Sauce Black and Gold ditions

Whatever the value-added product, the new institute can help train rural entrepreneurs in developing a recipe, making their product, educating them about the safety factors they need to cont rol and assessing their potential market “T here’s on ly so much

ag ricu lt ur al commod it y you can produce,” said Foster, who runs a beekeeping and honey business.

An d th at co mm od it y likewise has value limits.

“We put it on a tr uck, ba rge, trai n or plane and we ship it somewhere else and people add value to it,”

Wh en Pu rd ue es ta blished F MI, “theidea was to dr ive economic grow th in Indiana andhelp entrepreneu rs st rugg li ng with commerciali ing their food products,” Foster said

Anot her idea was to reduce the re gion’s dependence on the national and

The students and faculty members involved in these projects benefited from access to the food science department’s Skidmore Food Product Development Laboratory, as will the farmers who participate in thenew SDA program at Purdue

Also providing resources to the new institute is the food science depa rt ment ’s Pilot Plant. After entrepreneurs develop their recipe, they need a pilot test before they begin fu ll-sca le commercial production.

“T hat’s where ou r Pi lot Plant is important,” Mishra said “We cancreate or simulatea commercial process in our Pilot Plant to know how thisis going to behave in a larger-scale manu facturing environment.”

Ag ricultural economists at the Purdue Institute for Fa mi ly Busi ness and the Center for Food Dema nd Analysis and Sustainabi lity will lend further expertise to the endeavor

They wi ll help develop ma rket in g and bu si ness plans, along withinsights about consumer demand for food and related products.

The prog ra m has th ree phases.Phase1 consists of six online training courses that introduce participants to the basics of food product design, foodsafety and business planning.

Once pa rt icipants pa ss the on li ne trai ni ng, they ca n pr oc ee d to Ph as e 2 fora one- day, on-c ampus workshop on the food product li fe cycle. In Phase 3, prog ra m pa rt icipants receive intensive on-campus, personali ed feedback and assessmentsof their ideas.

By E a la e in an@shawmedia.com

IN DIANAPOLIS AgriNovus Indiana iscelebratinga year of accomplishments inthe states ag bioscience sector.

“I n ag bioscience, we have much to celebrate from 20 24 ,” said Mitch Fra ier, president and C O of Ag riNovus Indiana, in a newsletter.

“F rom head lines tout ing new commercial ventures to the scienti fic adva ncements, the year was oneof continued momentum and innovation.”

The or ga ni ation sh ar ed 10 highlights from 2024.

. A N elea e e ea h e l . AgriNovus released research that found Indiana’s ag bioscience sector contributes 69.6 billion to the state’s economy and employs more than 147,000 people. “Accelerate 2050 AVision for Indiana Agbioscience” identified forces

expected to shape its global competitiveness bioinnovation, farmer-focused innovation and food is health.

2. I e e I d a a . Indiana continued to grow as a destination of choice for companies seekingrelocation or growth in 2024, including Vital Farms, BioBond and AgroRenew. Significant investments in Indiana were also made by lanco, Sustainea and Nexus W2V.

. Ne pa e h p a ed Ag bioscience companies announced new partnerships in 2024 to address some of theindustry’s greatest headwinds— fromonfarm profitability to food access. Witha focus on uniting strengths to driveinnovation,theindustry saw partnershipannouncements from Corteva Agriscience, lanco,

Purdue niversity, Primient, Biodyne SA and John Deere.

. I a D . lanco and Purdue announced the addition of the OneHealth Innovation District —a research hub dedicated to optimi ing the health of people, animals, plants and the planet. Theshared-used facility will sit near lanco’s new global headquarters in Indianapolis and is designed to deliver and scale innovation where industry and academia can collaborate.

. B MADE a e e

h I d a a. BioM AD , a manufacturing innovation institute sponsored by the .S. Department of Defense, announced Indiana on ashortlist of six states considered fora networkof bioindustrial manufacturing pilot facilities The network will allow .S. companies to transition bioproducts from lab to commercial productiondomestically

. RALLY el e h a d

e RALLY, a global cross-sec-

tor innovation conference focused on creative collisions and new innovations, welcomed 5,000-plus attendees. Food and ag innovators pitched their startups as part of the 1 million in-pri e pitch competition, which was won by Insignum AgTech

. I a a ele a e . ntrepreneurship continued to accelerate in 2024 with Anu winning the HungerTech Innovation Challenge focused on food security, and technology startup Gripp won the Producer-Led Innovation Challenge focused on administrativeburden for the farmer The challenges will transition into a year-round accelerator program called Velocity starting in 2025 Learn more at https agrinovusindiana.com velocity .

8. UADRANT ea e y. AgriNovus continued to explore forward-thinking discussions and groundbreaking technologies at ADRANT,a gathering of innovative minds from all

cornersof ag bioscience ADRANT will return in 2025 and sponsorships are available to those who are interested mail lfrit agrinovusindiana.com to get more information.

. d a la he de . The Agbioscience podcast launched video in 2024, hosting 65-plus episodes with leaders and innovators across food, animal health, plant science and agtech. Agbioscience was named inthe top 5% of all podcasts worldwide by ListenNotes. Subscribe at www.youtube.com AgriNovusIndiana.

. F eld A la a e . Field Atlas continued to foster connection between young people and careers in ag bioscience through its website, on-campus ambassador program and company tours. A new mentorship program, AMP, will launch in 2025 to connect late college and early professionals to industry leaders. Learn more and apply at https myfieldatlas.com amp .

Withfirst-handfarmingexperience,weknowthestakesarehigh.That’sbecause farmingisn’tjustabusiness;it’salifestylefamilieswanttopassdowntothenext generation—andgenerationstocome.Wehelpfamiliesintheagriculturalbusinessto grow,preserve,andtransitionlandandwealthtofuturegenerations.Andwedoitby cultivatingaholistic,needs-basedfinancialplanthatalignsgoalswithactionsfortoday andtomorrow.

MatthewHenry PrivateWealthAdvisor

AshleyStockwell DirectorofNewBusiness &Communications

By TOMC.DORAN tdoran@shawmedia.com

WA SH IN GT ON Fa mi ly farms accounted for 96% of total .S. farms and 83% of the tota l valueof production, according to the Ag ricultural Resource Management Survey.

The survey, released in December, is conducted annually by the .S. Department of Agriculture’s National Ag ricu ltural Statistics Service and conomic Research Service.

Statistics are for 2023 based on i nfor mation collec ted th roug h 2024. Farms are divided by farm si e Smal l family farms are defined as having a gross cash farm income less than 350,0 00, GCFI for midsi e fa rm s is between 350,0 00 and 999,999, and largescale farms’ GCFI is 1 million or more

Here’s what the surveyfound

Approximately 86% were small family farms, operated

41%of .S. agricultural lands and account for 17%of the total valueof production. The number ofsmall family farms fell by 1% from the previous year

Large-scale family farms accounted for 48% of the total value of production and 31% of agricultural land in 2023. Midsi e family farms accounted for 18% of agricultural land and 18% of the total value of production.

Nonfamily farms accounted for the remaining 4% of farms. Among nonfamily farms, 16% hada GCFI of 1 million or more Nonfamily farms vary widely in si e, income and ownership structure and include partnerships of unrelated persons, nonfamily corporations and farms with a hired manager unrelated to the owners

Nonfamily farms’ share of value of production increased from 11% of the total value of production in 2022 to 17% in 2023 Production was concentrated

in large-scale nonfamily farms, which accounted for 16% of nonfamily farms and 93% of all nonfamily farms’ production

Theshare of farms with a low-risk operating profit margin of at least 25% varied by farm si e in 2023, with midsi e and large-scale family farms being most likely to have low-risk OPM. Less than 30% ofsmall family farms of each type operated in the low-risk one compared with 42% of large-scale family farms. Between 52% and 85% ofsmall family farms had an OPM inthe high-risk one OPM less than 10%— depending on the farm type, compared with 34% of large and 29% of very large family farms, respectively.

Conservation Reserve Program payments continued to be more concentrated amongsmall farms than other government payments

44

CR P payments target environmentally sensitive cropland and increasingly enroll grasslands in supportof gra ing operations, with most payments going to retirement farms, off-farm occupation farms and low-sales farms. In contrast, most countercyclical-type and Natural Resources Conservation Service payments went to family farms with a GCFI of 350,0 00 or more.

Overall, 16%of farms participated in federal crop insurance in 2023, up from 14% in 2022. Participation varied by production, with 66%of farms producing row crops purchasing insurance compared with 12%of farms producing livestock.

Indemnities from federal crop insurance were roughly proportional to the acresof harvested cropland Midsi e and large-scale family farms together accounted for 67%of all harvested cropland acres and received67%of indemnities from

federal crop insurance in 2023.

Farm households, in general, were not considered low incomeor low wealth compared with .S. households In 2023, median farm household income including both farm and off-far m income sources exceeded that for al l .S. households, but was lower than the median income of al l .S. households with self-employment income About 42% of farm households had income below the median for al l .S. households, and 5% had wealth below the .S. median in 2023.

Most farm households, 85%, received over half of their income from off-farm sources, and 51% had negative income from farming. Reliance on off-farm income sources ranges from 99% of households associated with off-farm occupation farms to 11% of households that were the principal operator ofa very large family farm.

The percentof farms that held on-farm unpriced corn, soybean, or wheat commodity— as of December 2023 increased in line with farm si e, with

very large farms being the most likely to have on-farm unpriced commodity, at 60%. However, no similar trend was observed with off-farm storage, with 12% of low sales farms and 12% of very large farms reporting unpriced offfarm commodity.

The su rvey also included the data of precision agriculture uses by farm type.

Technologies that mainly provide information to support operators’ decision-making, such as yield monitors, yield maps and soil maps, were used on 13%ofsmall crop-producing farms, but 68%of large-scale crop-producing farms. Similar to other PA technologies, low usage ratesof these technologies by small farms were driven by retirement farms, of which 5% adopted, and low sales farms— GCFI less than 150,0 00 that hada 9% adoption rate

Guidance auto-steering systems on tractors, harvesters and other equipment were used on 9% ofsmall farms, 52%of midsi e farms and 70%of large-scale

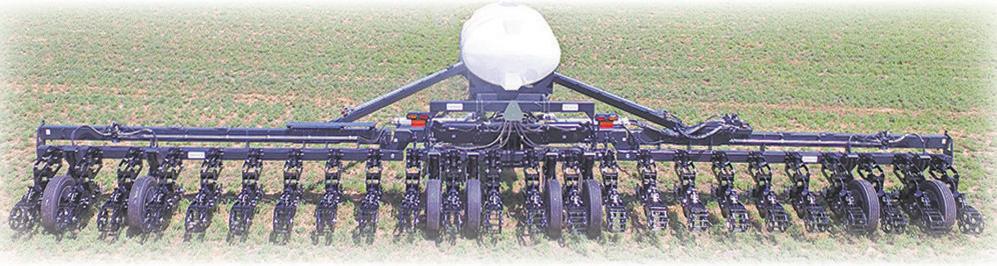

ZoneMasterisaspringstrip-tilltooldesignedtocreateoptimalspringstriporrefreshfallstrip. It’sperfectforno-tillersstrugglingwithvariableplantingconditions,conventionaltillerslookingto reducetillageorstrip-tillerslookingtorefreshfallsstriporbuildshanklessstripinthespring.

ReduceCosts. PromoteSoilHealth. ImproveYields.

•Usesverticaltillageto clearresidue,lightlyconditionthesoil andgetfasterwarm-up,dry-downforquicker,moreeven germination

•Optional applicatorsallowforprecisestarterorliquidfertilizer placementintherootzone

•Canbepulled at 6-13mphwithlowhorsepowerrequirements

•Availableinvertical-foldandpull-typetoolbars,aswellas individualunmountedrowunits.

crop-producing farms. The adoption of these systems, as with several other PA technologies, increases with farm si e primarily because larger farms can benefit more from employing these tools than smaller farms.

Variable ratetechnology was used moderately across the crop farm si e distribution, with adoption rates of 5% for small farms, 32% for midsi ed farms and 45% for large-scale farms. The scale, structure and soil variability of farms play a large role in explaining these usage patterns

The adoption of drones was quite limited, plateauing at 12% of large-scale, crop-producing family farms and 13%of nonfamily farms.

Precision livestock farming use was low, but mixed across farm si es. Robotic milking was adopted on 19%of large-scale farms that produced milk The adoption rates for wearable technologies on farms with livestock commodity sales ranged from 1% ofsmall farms to 12%of large-scale farms.

The motivations underlying farmers’ PA adoption were

diverse and broadly consistent withthe stated benefitsof the technologies For instance,of the farms that adopted yield monitors, yield maps, or soil maps, many did so to increase yields, at 55%, reduce purchased input costs, at 41%, and improve soils or reduce environmental impacts, at 40%.

These same three factors were among the most common for variable ratetechnology, although a greater share of VRT adopters were motivated by reducing purchased input costs, at 62%.

On the other hand, reduced labor time and operator fatigue spurred farmers to adopt precision agriculture technologies having substantial labor-saving potential. Half of all farms on which guidance auto-steering systems were used indicated that saving labor time wasa reason for adoption, while theshare of farms with robotic milking indicating this as a reason was 77%. Likewise, reduced operator fatigue wasa decision factor for 64%of farms using guidance auto-steering and 41%of those using robotic milking.