OCTOBER 21 , 2022 FACTORS AFFECTING HOMEOWNERS INSURANCE COSTS PAGE 5 COMING HOME TO BUY YOUR OWNHOME PAGE 7 CLASSIFIEDS PAGE 7 INSIDE This Issue

To advertise in RE-Weekly or other Skagit Publishing publications, Call: 360.416.2180 or Email: ads@skagitads.com ©2022 by Skagit Publishing | All rights reserved.

All real estate advertised in Real Estate Weekly is subject to the Federal Fair Housing Act, which makes it illegal to advertise “any preference, limitation, or discrimination because of race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preference, limitation or discrimination.” We will not knowingly accept any advertising which is in violation of the law. All persons are hereby informed

that all dwellings advertised are available on an equal op portunity basis.

For further information call HUD Toll Free at 1-800-669-9777.

All Houses subject to prior changes without notice. Neither advertisers nor Skagit Publishing are responsible for any errors in the ad copy. Skagit Publishing reserves the right to refuse any advertising, which we deem unsuitable for our publication.

Unless otherwise noted, all photographs, artwork and ad designs printed are the sole property of Skagit Publishing and may not be duplicated or reprinted without express written permission.

Skagit Publishing is not responsible for typographical or production errors or the accuracy of information provided by advertisers.

2 Oct. 21, 2022RE-Weekly

RE-Weekly Factors affecting homeowners insurance costs P5 Q&A Ask Our Broker ...................................................................... P6 Coming home to buy your own .................................. P7 Classfieds .............................................................................. P7 TABLE OF CONTENTS 5 PAGE INSIDE own the local real estate market expand your reach when you combine the power of our digital audience and premium print ads in the re weekly ask your multimedia account executive for details. ContaCt: 360.424.3251 • ads@skagitads.Com

Real Estate Stat -19.9%

2022 home

compared to

were

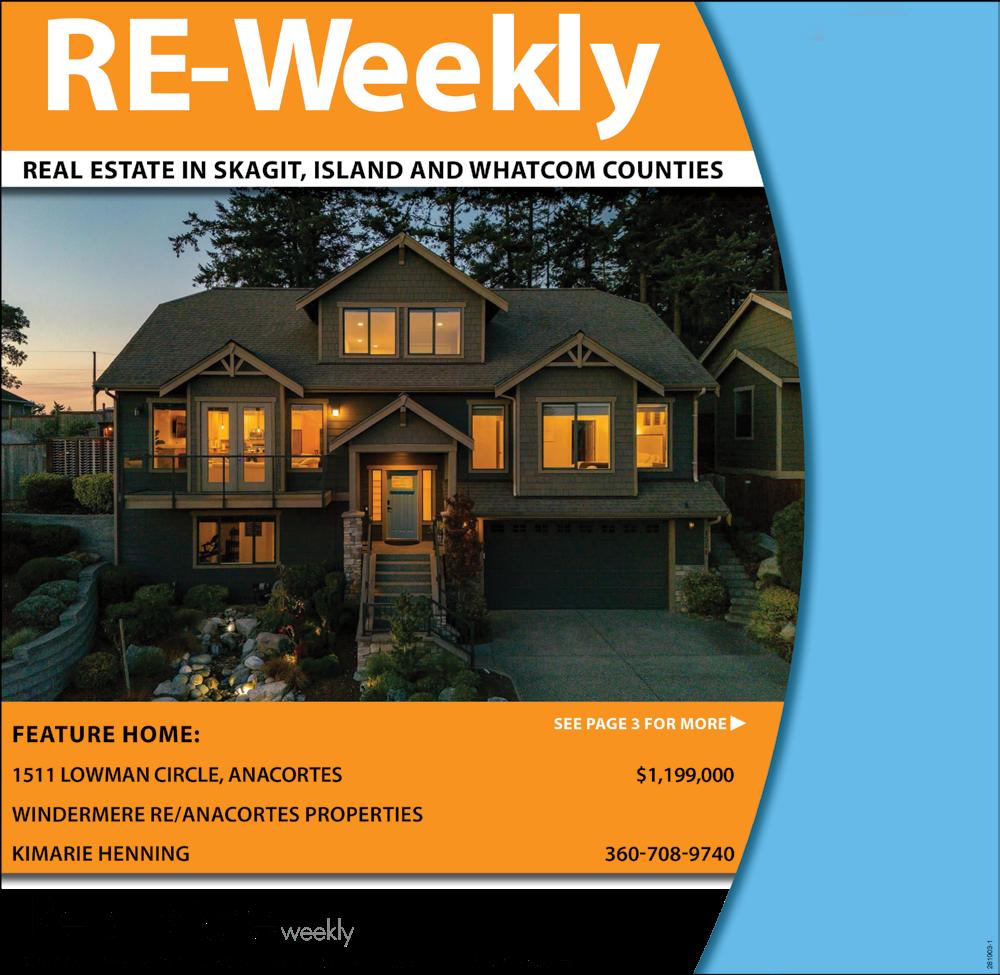

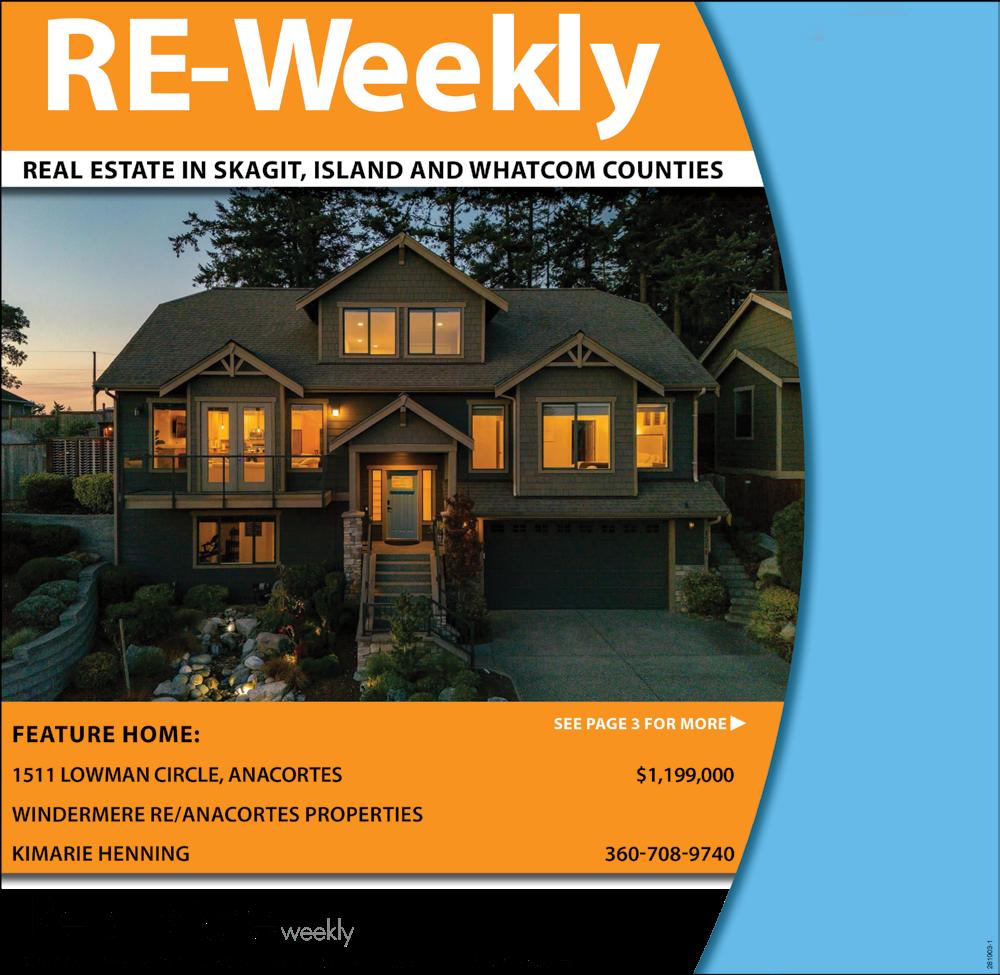

This stunning 3 stor y home is perfectly

near the Sk yline

y with

of Burrows Bay and beyond! Main-level living features large primar y suite with views, office/nurser y, dedicated laundr y room with sink and large living space open to an enter tainer ’s kitchen. French doors lead to a finished deck complete with outdoor gas fireplace for year-round enjoyment. Brand new steel railings lead upstairs to large bonus room and t wo spacious bedrooms.

Lower-level offers private guest suite with full bath and access to a 2 car garage Fully fenced in yard with low maintenance landscaping is irrigated. Recent upgrades: Brand new car pet throughout home, refinished wood floors, all new interior paint, trim, and kitchen cabinets.

Oct. 21, 2022 3RE-Weekly STAT

August

sales

down 19.9%

one year prior in 2021. Source: National Association of REALTORS ® 1511 LOWMAN CIRCLE, ANACORTES $1,199,0 0 0

situated

communit

tranquil views

MLS #2005566 WINDERMERE RE/ANACORTES PROPERTIES 3018 COMMERCIAL AVE. 360-293-80 08 www.Anacor tesRealEstate .com 281 904-1 KIMARIE HENNING 360-708-9740

Now could be the time to sell a new home and earn a slice of the real estate pie.

Record-low interest rates is renewing interest in the housing market for many people.

“When sellers are interviewing real estate agents to market their homes, their primary focus is usually on the advertising that the agent will offer them,” says Jessica Goodbody of Weichert Realtors. Let us help you meet your marketing goals by advertising your listings in Real Estate Weekly.

RealEstate

In print and online goskagit.com ads@skagitads.com

4 Oct. 21, 2022RE-Weekly

weekly Call 360.416.2180 Today!

Factors affecting homeowners insurance costs

By Erik J. Martin CTW Features

If you’re a homeowner, no doubt you felt the pain of higher prices on virtually ev erything over the past couple of years – from groceries to gas and home improvements to repairs. Another expense that hasn’t escaped the clutches of higher inflation is homeowners insurance, the premiums for which have increased substantially for many policyholders since the pandemic hit.

“Right now, we are seeing a 7% premium rate increase across the country for both new business and renewals, however, the actual impact of rate changes could vary wildly at the state level.

For example, in the North Texas market, we are seeing double-digit increases in

rates, while Central Texas may see low single digits — these large discrepancies are going to be seen across any state,” says Brian Pattillo, vice president of Strategy at Goosehead, an independent insurance agency in West lake, Texas.

What’s responsible for the hike in premiums? Plenty, say the experts.

“One reason is that the cost of rebuilding a home has gone up. So, insurers are charging more to cover that cost. Another reason is that insurers are increasingly seeing more claims for water damage, which is costly to repair,” says Zach Larsen, a personal finance expert and co-founder of Pineapple money.com.

Pattillo adds that, due to labor shortages and supply

chain constraints, it costs a lot more money to make repairs on homeowners insurance claims than it did a few years ago.

“So as claim settlements rise on average, so will the premiums charged,” he says.

Another aspect that can raise your premiums is the age of your home.

“Older homes cost more to repair or replace. They can also pose more risk and increase the likelihood of claims,” says Mark Romero, a homeowners insurance expert with Agile Rates in Miami. “A wood home, for instance, is more susceptible to damage than a brick home in a fire.”

Additionally, your home’s location also helps set the premium price. If you live in an area with a higher risk

of disasters and hazards, you will probably see increased rates.

Your property’s worth will also impact your premium bill.

“If your home rises in value, your insurance costs will likely increase as well,” Lar son explains. “The amount of coverage you have on your policy affects your premium, too. If you increase your coverage, your insurance costs will also go up. And if you have any claims on your policy, you can expect rates to climb.”

Also, if you have specific dog breeds, such as a Rottweiler or Husky, “there’s a higher bite risk – thereby increasing your premium. Adding a pool or trampo line also causes rates to go higher,” Romero continues.

There are plenty of things you can do to help keep premium costs down.

“First, look closely at your policy and your insurer’s website to learn if you are eligible for any discounts. A popular one is bundling your homeowners and auto insur ance coverages, which might yield a rate discount of 20% or more,” advises Romero.

Many carriers provide discounts for adding security amenities to your property, including Spengler systems, fire or burglar alarms, and deadbolts.

“If you insure jewelry, art work, or electronics, check on their stated values in your policy. If they depreciate, change your policy to reflect that and pay less. Some items, like fur coats, depreciate quickly,” Romero notes.

Increasing your deductible is another quick strategy that can lower your premium.

Furthermore, try to re-shop for homeowners insurance every two to three years, advises Scott Johnson, owner of Marindependent Insur ance Services LLC in Mill Valley, California.

“What may be a good deal for a policy one year might not be a good deal in three years. So, shop around and compare rates and coverages carefully,” he says.

Lastly, consider shop ping with an independent insurance agent, “who can provide multiple quotes from a variety of insurance providers all at the same time – providing an unbiased opinion and lessening your time investment,” recommends Pattillo.

Oct. 21, 2022 5RE-Weekly

Buy now, pay later financing and credit reports

Question:

We have bought a number of items with buy now, pay later financing. The stores we use tell us that such purchases will not show up on credit reports. If that’s the case, how will such financing impact our ability to refinance a mortgage?

Answer:

Buy now, pay later (BNPL) financing is simply a form of debt. Use it and you owe money. However, it’s debt that -- so far at least -- largely slips through the cracks in the mortgage underwriting process.

Lenders have debt-to-income (DTI) ratios for each mortgage program they offer. They compare required monthly debt payments with the borrower’s gross monthly income, the money earned before taxes.

The DTI includes two calculations: The “front” ratio looks at housing costs such as mortgage principal, mortgage interest, property taxes, and property insurance – PITI. The “back” ratio includes PITI plus required monthly costs for such debts as auto loans, credit card balances, and student debt.

Required DTI ratios vary by loan program.

The DTI ratio for FHA financing is 31/43, 28/36 for

conventional loans, and 29/41 for USDA mortgages. The VA has a 41% back ratio, but a different approach to the front ratio that depends on the borrower’s residual income – the money left over after various expenses. Often it is possible to have higher DTI ratios when there are compensating factors such as big cash reserves.

With a typical BNPL plan, the borrower purchases an item and then repays the debt in four equal payments. With most BNPL programs – but not all – there are no interest costs or fees as long as the payments are made in full and on time.

How does the retailer make money if buyers do not pay interest or fees? The retailer gets its money up front by paying 3% to 6% of the sale price to a BNPL lender who finances the deal in the background. In effect, the interest and fees are buried in the price of goods.

“Generally,” explains the Consumer Financial Protection Bureau (CFPB), “most buy now, pay later lenders don’t report your payment history to the major credit reporting companies, but your failure to repay may be reported by a debt collector.”

If a debt collector becomes involved, says the CFPB, then the debt “could be reported to a credit reporting company and hurt your credit scores.”

Q&A Q&A

ASK OUR BROKER

By Peter G. Miller

Why is any of this a problem for mortgage lenders?

First, lenders want to know about all borrower debt and BNPL financing is debt. Such underwriting is tough to do because short-term BNPL debt may disappear during the application process as payments are made.

Second, missed payments are common. According to DebtHammer.org, “32% of Buy Now Pay Later plan users have had to skip paying an essential bill such as rent, utilities or child support in order to make their payments.”

Third, borrowers may have multiple BNPL loans. DebtHammer says “more than 50% of respondents have been paying off multiple Buy Now Pay Later plans at one time.”

Fourth, multiple BNPL loans and missed payments increase mortgage lender risk, and that can lead to higher interest rates and maybe even declined loan applications.

It’s likely that the mortgage underwriting process will change as a result of increased BNPL activity. The next time you apply to finance or refinance a mortgage, you might find questions about BNPL debt. And, even if a lender does not ask about BNPL debt, it is debt and debt should be disclosed.

Email your real estate questions to Mr. Miller at peter@ ctwfeatures.com.

6 Oct. 21, 2022RE-Weekly

Houses for Sale

Coming home to buy your own

By Marilyn Kennedy Melia CTW Features

During the pandemic, now 28-year-old Megan Zuckerman left her New York City apartment for her parents’ home in New Jersey.

But seeing friends struggling to find af fordable rentals in the city now, she’s decided to stay with family to save for a down pay ment and avoid continually facing a lease expire.

She’s hardly alone. Although there aren’t statistics on the number of young adults living with a parent to save for a down payment, the Pew Research Center reports that in March 2021, 22.6 percent of 22 to 34 year-olds were living in the home of their parent.

“This trend is growing so popular,” says Dino Di Nenna of Southern Lifestyle Prop erties in Hilton Head Island, SC.

Still, not all family dynamics allow for easy multi-generational living, albeit temporarily.

If you’re considering the option, those cur rently taking on the challenge and making it work share their thoughts and suggestions: Contribution considerations.

“If your family is struggling to make ends meet, you should be expected to ‘pay rent,’

asserts Paola, Perez, owner of CorporateMillennil.com, who lived at home until she bought a home at age 26. If not a nominal rent, covering an expense like groceries “gives you more independence. You are an adult and you’ll want your parents to see you as one.”

Setting a worthwhile goal.

As a lender with Amplify Credit Union, Austin, TX, Alex Rodriguez is “reminded ev eryday” that homeownership offers financial security.

Earlier, his own son experienced moving and changing schools when rent hiked, and that’s why father and son have devised a plan to allow him to save post-college by coming home.

Stay motivated.

Guadalupe Sanchez came home when she left college at 22 with $43,000 in student loans. In six years, she paid it off and saved enough for a down payment. Set weekly updates on your phone to monitor savings to keep psyched on building balances, she advises.

Zuckerman says that being a short hop from the city allows her to keep up with friends and makes staying with her family longer easier. Plus, browsing real estate list ings keeps her goal top of mind.

425 East Jones Road in Sedro-Woolley, WA

600 N Reed St #3 Sedro-Woolley $185,000

OPEN HOUSE

Thurs, Oct. 20th 3:30-5:30 & Sat, Oct. 22nd 12-2

W TODA

Brand new 3 bedroom, 2 bath, 6,000 square foot lot. 2 decks, fenced and cross-fenced, 2 car concrete spaces, and birch trees. Ranch Rambler. In a nice neighborhood.

Price Reduction $410K. Call 360.630.4219 or email gwhiggins77@ gmail.com

Great location all age park! New roof, exterior paint, & decks! Open concept living area with Hunter Douglas electric blinds. Nice open kitchen with eat-in bar area & large walk-in pantry. Private Master bedroom at opposite end of home with walk-in his & her closets & En Suite with larger soaker tub & sep arate shower. Main bath also has oversized soaker tub. Heat pump with A/C. Carpets have just been professionally cleaned. Yard is already fenced on 2 sides. Great location close to schools, restau rants & shopping, only 10 minutes to I-5. No rentals in this park. MLS # 2005737

N Reed Street #28, Sedro-Woolley $189,500

OPEN HOUSE

SAT, October 22nd 12-2

1783 sq ft home situated on large lot! 3 beds, 2 full baths, 5 piece primary En suite, w/ large soaker tub.

Vaulted ceilings, double sided wood burning fireplace, walk in closets, large, updated kitchen w/ plenty of storage, Corian countertops, pantry & island.

Wood wainscoting in family room. New front door, primary toilet, blinds, exterior paint & vinyl in kitchen & laundry room. MLS # 2006288

Need more of this? Sell it in the Classifieds!

Geri Cole, 360-391-1614

Valley Windermereskagit.com

Geri Cole, 360-391-1614

Valley Windermereskagit.com

Save time & money selling!

Many buyers won’t leave a message give a best time to call

Oct. 21, 2022 7RE-Weekly

REAL ESTATE FOR SALE

Open Houses NE W TODA Y

WRE/Skagit

Open Houses NE

Y 600

WRE/Skagit

1226 ALPINE VIEW DRIVE, EAGLEMONT

$820,000

Stunning contemporar y home with an amazing t wo -stor y foyer that provides the ‘wow ’ fac tor upon entr y. This home has it all, formal dining and eat-in space in the kitchen, fabulous acacia floors; even the conveniently appointed kitchen has a view. Glass blocks in the owner ’s primar y suite bath; enhances the beaut y and enjoyment yet allows for privac y. The owner ’s suite bath also offers a jetted tub, separate shower; dual sink vanit y with plent y of counter space and storage. Moving into the suite there is also a walk-in closet, a sliding door to the covered patio, plush carpet, and a truly remarkable high ceiling. Both the living and family room feature a natural gas fireplace with an elegant mantel and large windows to take in the territorial view. MLS#2007767

Classic 1920s farmhouse with 1368 sq. ft, 2 beds/1 bath, and den. Beautiful woodwork and floors throughout the home, including many built-ins; please take note of the shelves in the den. Home sits on peaceful, mostly pastured 5 acres with outbuildings (a barn and a storage building). A large, covered front porch and a two -tier deck on the west side of the home enhance your enjoyment of the outdoors; the back door deck is covered and offers built-in seating Gated drive Fruit trees, grape vines, and a garden area enhance this peaceful homestead. Fenced on three sides with the four th side being the road. MLS#2004946

Danya Wolf (360) 708-8294

Ready to Build with power,

Gorgeous low maintenance 1 level Condo in desirable Eaglemont Community, features an open floor plan with cathedral ceilings, great room, gas fireplace. 2 bedrooms plus office/den, craftsman style millwork. Kitchen w/plenty of cabinets, stainless steel appliances, space to enter tain with large Granite eating bar & dining with sliding door leading to covered patio to enjoy nature Deluxe primar y suite with jetted tub, walk-in closet & shower. Large 2- car garage and spacious driveway. Truly a home with all the comfor

and privac y! MLS#1990564

M AR k E T S TREE T, M O u NT V ERNON $279,000

and

in Nookachamp Hills,

the

desirable community in the foothills near Big Lake. Enjoy walking/biking the trails and swimming/fishing in the community

small private lake/ pond. Trail leading to pond/lake nex t to

ty.

St, BurliNgtoN $399,000

There

a

This classic beauty has many

This coz y 2 bedroom Burlington home needs some work but has lots of personality : beautiful pergola to

Custom build your commercial enterprise: 13,361 square foot commercial tract (two lots) zoned C-2. Great location near recreation center; major grocer y store; hotel; restaurants; offices; health club; house and farm supply stores; gas stations; banks; and I-5. Water, Cascade Natural Gas, Puget Sound Energy, City sewer, and Comcast are all in the street.

MLS#2009122

Danya Wolf (360) 708-8294

Three bedroom, 1 bath rambler has a large 2-tier deck with built-in bench seating and

mid-centur y

wood beamed ceilings, slate entr y, extensive built-ins, and a lovely stone fireplace in the

basement.

home; ample cabinets and counter space in the step down kitchen, bath has a farmhouse style sink and plenty of room for a stacking washer/ dr yer off-street parking and awesome trees and shrubs. Covered concrete patio. Private yet in town and close

Maiben Park MLS#2001713

Danya Wolf (360) 708-8294

to

8 Oct. 21, 2022RE-Weekly w w w.sk agittr aditionr ealt y.c om 3780 E. College Way, Mount Vernon 284838-1 360.424.0300 JoAnn Boudreau (360) 391-0746 Patricia Box Office Manager O: (360) 424-0300 C: (360) 941-9186 Juanita Bunch (360) 941-5530 John Hunter (360) 202-3086 Carla Fischer (360) 982-0010 Elva Hunter (360) 202-3086 Suzanne Jenkins (360) 941-2983 Russ Lanker (360) 708-1117 Phil LaMay (360) 840-3086 Brett Tacker (360) 840-7931 Danya Wolf Designated Broker/ Owner (360) 708-8294 1406 EAGLE RIDGE DRIVE, MOUNT VERNON $639,000

ts

Elva Hunter (360) 202-3086 NEW PRICE!

welcome you

to

104 N Haw tHorNe

Classic 1965, 4 bedroom/3.5 bath home one block east of Skagit Valley Hospital Billiard room, bonus room and two sinks in basement. Also, near medical facilities, schools, and Hillcrest Park. The outdoor patio is next to a brick barbecue.

is also

covered patio.

favorite

modern features; vaulted

daylight

The workshop in the far corner of the large, enclosed backyard is wired for power tools. MLS#1981154 Danya Wolf (360) 708-8294 110 Cl aremo N t Pl aC e , m ou N t Ver N o N re$499,000 DuCeD PriCe! NookaCHamPS HillS DriVe lot 136, mouNt VerNoN $235 000

water, sewer

natural gas in

street Build your dream home

a

’s

proper

MLS#1970452 Suzanne Jenkins (360) 941-2983 Carla Fischer (360) 982-0010

Carla

Fischer (360) 982-0010 Danya Wolf (360) 708-8294 1919 e HigHlaND aVe, mouNt VerNoN $420,000

a backyard that would be wonder ful for enter taining. New roof this year, ex tra storage above garage, and fenced back yard on a nice low-traffic street. Great location close

schools, shopping, hospital, and easy access to 1-5. MLS#1995422 4317 V I L L AG E R OA D, S TA N WO O D $650,000 Danya Wolf (360) 708-8294

2121

COMMER

CIAL