How to repair your credit and get a better mortgage loan

by Erik J. Martin

If you want to buy a house, chances are you’re going to need to borrow funds to pay for that transaction. Problem is, you may get charged a higher interest rate and fees or get turned down completely if you pursue a mortgage loan when you have poor credit.

Your credit rating is largely determined based on two important factors: Your credit score, represented by a numerical three-digit value ranging from 350 to 800, which indicates your creditworthiness; and your credit history, as reflected in your three credit reports provided by Equifax, Experian and Trans Union.

“Poor” credit is typically any credit score below 600. e higher your credit score, the

less risky you are perceived to be by a lender. Experts recommend aiming for a credit score of 720 or higher.

“Lenders use your credit score and other factors like your income, employment history, and debt-to-income ratio to determine whether you qualify for a mortgage loan and what interest rate and terms you will be offered,” says Jason Skinrood, a certified finance expert and loan officer. “A higher credit score typically indicates that you are a responsible borrower who is likely to make on-time payments, while a low credit score suggests you may be more likely to default on a loan.”

Just as a straight-A student is more likely to get into a top-tier college, a good credit score can help you qualify for a mortgage loan with better terms and rates.”

Case in point: Let’s say you are applying for a 30-year fixed-rate mortgage loan of $200,000. Your credit score is currently 620, which qualifies you for a 5.5% fixed interest rate. But if you can up your credit score to 720, you may be eligible for a 4.0% fixed interest rate.

and you would pay a total of $343,440 over the life of your loan.”

Lenders will also look closely at your credit reports to determine if you are a worthy borrower candidate.

“Your payment history, as reflected in your credit reports, isn’t just a real-time reflection of your finances. It provides a seven-year window into your past, as most negative credit reporting items have that long to appear on your reports,” notes Michael Bovee, founder of Consumer Recovery Network in Boise, Idaho.

means taking steps to improve your credit rating and credit score, which typically involves addressing any negative items on your credit report, such as missed payments or high levels of debt, and taking steps to establish a positive credit history,” Skinrood adds.

To repair your credit before applying for a mortgage loan, take the following steps:

can negatively impact your credit score and make it more difficult to qualify for a mortgage loan,” cautions Skinrood.

• Pay your bills punctually. Late payments can severely affect your credit score and show lenders that you might be a risky borrower.

Shekhtman, CEO/ founder

Alex

of LBC Mortgage, explains that your credit score “is like a report card for your financial responsibility.

“At an interest rate of 5.5%, your monthly mortgage payment would be $1,135, and you would pay a total of $408,600 over the life of your loan, not including taxes and other fees,” continues Skinrood. “But if you qualified for a 4.0% interest rate, your monthly mortgage payment would be $954,

It’s crucial to check your credit score and three free credit reports several months before you plan to apply for a mortgage loan so that you can work to fix your credit if necessary.

“Repairing your credit

• Access and review your three free credit reports at annualcreditreport. com. Check each report for omissions, errors, and fraudulent accounts and dispute any of these with each of the three credit bureaus.

• Pay down as much of your debt as possible, particularly credit card debt. “A high debt-to-income ratio

• Don’t close old credit accounts, even if you don’t use them. is can help improve your credit utilization ratio and demonstrate to lenders that you have a long credit history.

• Don’t open new lines of credit or credit accounts, which can detrimentally impact your credit score.

• Establish positive credit. If you lack a credit history, try applying for a secured credit card or becoming an authorized user on another person’s credit account.

May 5, 2023 5 RE-Weekly

Ways to lower your insurance premiums

Question:

With all the turmoil in the banking industry this year, will it now become harder to get a mortgage?

Answer:

e turmoil created by the failure of the Silicon Valley Bank and the Signature Bank has raised questions regarding the financial system and potential harm to depositors and borrowers.

At this writing, at least, the results are mixed. We have two banks that failed. If you are a depositor, then you at least qualify for FDIC insurance coverage.

According to the FDIC, “the standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.” You can check your coverage by going to the FDIC’s Electronic Deposit Insurance Estimator (EDIE).

e URL is: https://edie.fdic.gov/

If you have deposits not covered by the FDIC, then your money at these two institutions will be fully insured under the Federal Reserve’s newly created Bank Term Funding Program (BTFP).

e government is likely to step in and fully protect depositors if other banks fail. As Treasury Secretary Janet Yellen explained in March, “similar

actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

So far, so good. Despite scary headlines, all depositor money is available. ere have been no bank runs. e big question is what happens next. Will there be other bank failures? If so, will the system continue to protect borrowers, and how does this impact mortgage borrowers?

e financial system has generally done well. FDIC-insured institutions had a net income of $68.4 billion in the fourth quarter, almost a record amount. ere are roughly 4,700 FDIC member institutions and most seem to be sensibly operated. But, yes, the mortgage marketplace will feel a backlash from the bank failures.

First, mortgage lending has not been a great business of late. e pandemic and rising interest rates have raised costs and reduced loan origination volume. In the fourth quarter, according to the Mortgage Bankers Association, the typical loan produced a $2,812 loss.

Lenders are cautious because of operating results and now with the Fed’s .25% rate increase in March they have still another reason to be careful.

As Federal Reserve Jerome Powell said, we are likely to see “tighter credit conditions for households and

ASK OUR BROKER

By Peter G. Miller

By Peter G. Miller

businesses, which would in turn affect economic outcomes.”

Translation: Getting a mortgage is likely to be tougher in the coming year – tougher, but not impossible. Borrowers with good credit, solid savings and little debt will do best.

Second, while the Federal Reserve does not control mortgage rates, its effort to slow inflation by raising interest costs has made new mortgages less affordable. Weekly rates went from 3.22 percent at the start of 2022 to 6.6 percent in mid-March 2023, according to Freddie Mac. If you borrowed $300,000 over 30 years, the monthly cost for principal and interest went from $1,301 to $1,916. Affordability issues are forcing many potential home buyers from the market.

ird, if you own real estate and financed or refinanced when rates were in the 3 percent range or even lower, your housing costs might go up with a new home and a new mortgage. e result is that many people who might have moved are staying put, a reality that keeps supply down and home prices high.

Email your real estate questions to Mr. Miller at peter@ctwfeatures.com.

6 May 5, 2023 RE-Weekly

Q&A Q&A

By Marilyn Kennedy Melia

Today’s buyers may love their home but hate their mortgage.

In the foreseeable future, rates may very well stay higher than the 3 to 4 percent loans that made home buying more affordable through much of 2020 to 2022, notes Doug Duncan, chief economist at mortgage agency Fannie Mae.

But rates may dip enough to make it advantageous for recent buyers to refinance that six-seven percent rate, say Duncan. He predicts just a one percent drop for owners’ current rate “will trigger significant refinancing.” Moreover, once the Federal Reserve inflation is under control, rates could likely settle in the 4.5 to 6 percent range.

To entice home buyers to borrow from them, some lending firms have begun advertising “no cost” refinance later on.

Right Time?

Should rates begin to fall, when should a homeowner pull the trigger – or should they wait for further declines?

No one knows exactly where rates will be next week, next month or beyond.

And, the rate a particular borrower is offered depends on his financial profile, with those with high credit scores or a large income relative to his mortgage payment and other debts earning the most competitive rates. Whether it’s worthwhile to refinance depends on your own instinct on when to jump in, informed by your monthly costs.

Cost/Savings Calculation

First, a homeowner needs a high degree of certainty that he won’t be moving soon. en, calculating the monthly savings from a lower mortgage rate to meet the costs of refinancing. For instance, if it costs $3000 to refinance, and the new loan saves $150 monthly, it will take 30 months for refinancing charges to be recouped.

However, refinancing can sometimes be counter-productive to your overall financial health, like when a borrower refinances into a bigger loan to receive “cash back,” notes Nadine Burns, CEO of A New Path Financial. And, look to see if a rate drop allows you to refinance into a shorter-term loan, swapping a thirty -year mortgage for a fifteen year, so that you can be mortgage-free earlier.

Open House Saturday 5/6 - 2-4pm

Cozy gem in Park Village, one of the most well-maintained 55+ parks in Skagit County, was completely remodeled & updated in 2022 and is calling you to come home!

Everything inside is new! The home is fresh and clean & truly move-in ready!

Local snack distribution business with 6 routes for sale!

Doing over 3 million sales per year. Contact jgsnacks@frontier.com

RENTALS

Office Rent/Lease

OFFICE SHARE in Bow-Edison

Newer building, first floor; looking for a body worker to share a space part time and share a six month to one year lease; peaceful spa like setting . Convenient to I-5 and Anacortes.

Call for more details. Florence Clean Slate Acupuncture and Physiotherapy. (503)610-0834 boylanpt@yahoo.com

Save

Jenn Eddleman REALTOR

Jenn Eddleman REALTOR

Valley

Call/text: 360-333-4048

jenneddleman@ windermere.com

May 5, 2023 7 RE-Weekly

REAL ESTATE FOR SALE Open Houses NE W TODA Y FEATURED LISTING 2725 E Fir Street

#2059676

“Homebuyers: When Can You Refinance Into A Lower Rate?”

#23 Mount Vernon $140,000 MLS

WINDERMERE

Skagit

RE/

Business for Sale NE W TODA Y

time & money selling in your local classifieds!

CLASSIFIEDS RE-Weekly

This 4 bed/ 3 bath, 3982 sq. ft. home is per fec tly situated on a shy acre offering exquisite one -level living in prime location with a spec tacular bay and mountain view Away from the hustle and bustle yet so incredibly close to ever ything! Easy access to Hw y 20 for travel West to Anacor tes, Deception Pass, and beyond; or travel East to I-5 for commuting (Nor th and South) or continue Eastward to the beautiful Nor th Cascades Recent upgrade of kitchen cabinets, decks on nor th, south, and west sides of the house, 3 car garage, expansive driveway parking, sauna, updated professional landscaping, sprinkler system, and garden space Near to beach, park, and Padilla Bay trails; great area for walking, jogging, and biking.

Ver y private 5 acres just off Mountain View Road. Come check it out, a great neighborhood.

Many investment possibilities with this home & proper ty: Classic 4 bed/2.5 bath farmhouse style 2560 sq. ft. home with east-facing deck on 1.76 acres Home offers kitchen w/island & ceramic tile floors, office, bonus room, mud/ laundr y room, living room with propane fireplace, built-in bookshelves & beautiful laminate over hardwood floors Detached building per fec t for office or studio The proper ty features a 16,000+ sq ft pole building with its own water, power & septic Pole building includes a large, insulated shop area & expansive ex ternal parking area; RV hook-up at the east end, per fec t for guests. Potentially income -producing proper ty. Special Use permits were previously approved for home -based businesses (in 1995 & 2010).

MLS#2028784

Mondo is a well- established and well-loved family-style restaurant at the foot of the Cascade Mountain Range. Locals and travelers make this par t of their Hw y 20 and Nor th Cascade National Park trip Major ar terial choice to Newhalem and continue on to Winthrop; or cross the Skagit River bridge and continue up to Cascade Pass and hiking to Stehekin. The restaurant is warm and inviting, with incredible fare Ver y spacious dining area. Some outside seating available. Small gift shop area. The kitchen is beautifully remodeled. New flooring and ex terior lighting.

MLS#2038466

Conveniently located corner building lot with available utilities. Build your dream home in this neighborhood that is close to schools Hillcrest Park, and the 18th Street Water Park. Easy access to I-5, shopping, and medical facilities.

708-8294

Custom build your commercial enterprise: 13,361 square foot commercial tract (two lots) zoned C-2. Great location near recreation center; major grocer y store; hotel; restaurants; offices; health club; house and farm supply stores; gas stations; banks; and I-5. Water, Cascade Natural Gas, Puget Sound Energy, City sewer, and Comcast are all in the street

MLS#2009122

Danya Wolf

708-8294

21136 LAfAyETTE RD, BURLiNgTON $450,000

7.5 acres of rich farmland with 200 fruit trees, ¾ acre blueberr y, 3 acres strawberries, ¾ acre blackberr y, ¾ acre raspberr y, 60x30 paver patio in place, incredible view, fully fenced with beautiful rolling gate, some farm implements and a trac tor included.

MLS#2050192

Two ver y well maintained, level lots. Bring your camper, fifth wheel, RV or tiny home

Great location

for year round residenc y or weekend / vacation getaways Well shared with seller, power at street.

MLS#1951005

Great

8 May 5, 2023 RE-Weekly w w w.sk agittr aditionr ealt y.c om 3780 E. College Way, Mount Vernon 363079-1 360.424.0300 JoAnn Boudreau (360) 391-0746 Patricia Box Office Manager O: (360) 424-0300 C: (360) 941-9186 Juanita Bunch (360) 941-5530 Russ Lanker (360) 708-1117 Brett

(360) 840-7931 Suzanne Jenkins (360) 941-2983 CRS/SRES Elva

(360) 202-3086 CRS/SRES Carla Fischer (360) 982-0010 CRS/SRES Danya Wolf Designated Broker/Owner (360) 708-8294 CRS/CBA/GREEN 0 S ANDAL RD, MOUNT VERNON $149,000

Tacker

Hunter

potential, vacant land close to Mount Vernon and Big Lake. MLS#2057092 Elva Hunter (360) 202-3086

2121 MARkET STREET, MOUNT VERNON $279,000

commer cial

(360)

14903 RUSTic LANE, cONcRETE $23,500

Patricia Box (360) 941-9186

24017 TRiNiT y LANE, SEDRO-WOOLLE y $859,000

Danya Wolf (360) 708-8294

Danya Wolf (360) 708-8294

60102 STATE ROUTE 20, MARBLEMOUNT $675,000

N e SS o N lY

oWN er F i N a N ci NG aVail a B le!

S.

STREET, MOUNT VERNON $199,000

Danya Wolf (360)

BUS i

$375,000

NHN

15TH

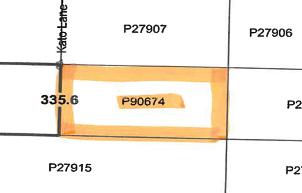

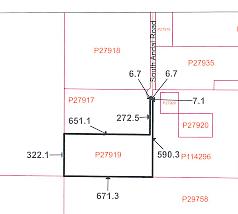

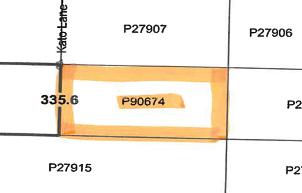

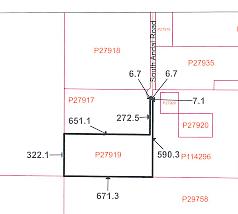

MLS#2029949 Suzanne Jenkins (360) 941-2983 Carla Fischer (360) 982-0010 kATO LANE, MOUNT VERNON $149,000

MLS#1880968 Elva Hunter (360) 202-3086 13136 BRiDgEViEW

$1,450,000 Patricia Box (360) 941-9186

WAy, MOUNT VERNON

2047824

MLS#

Jenn Eddleman REALTOR

Jenn Eddleman REALTOR