WHY IT’S IMPORTANT TO USE A BUYER’S AGENT WHEN SHOPPING FOR A HOME

PAGE 5

HOMEBUYERS KEEP HEADS IN THE GAME

PAGE 7

CLASSIFIEDS PAGE 7

JANUARY 27, 2023

INSIDE This Issue

All real estate advertised in Real Estate Weekly is subject to the Federal Fair Housing Act, which makes it illegal to advertise “any preference, limitation, or discrimination because of race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preference, limitation or discrimination.” We will not knowingly accept any advertising which is in violation of the law. All persons are hereby informed

that all dwellings advertised are available on an equal opportunity basis.

For further information call HUD Toll Free at 1-800-669-9777.

All Houses subject to prior changes without notice. Neither advertisers nor Skagit Publishing are responsible for any errors in the ad copy. Skagit Publishing reserves the right to refuse any advertising, which we deem unsuitable for our publication.

Unless otherwise noted, all photographs, artwork and ad designs printed are the sole property of Skagit Publishing and may not be duplicated or reprinted without express written permission.

Skagit Publishing is not responsible for typographical or production errors or the accuracy of information provided by advertisers.

2 Jan. 27, 2023 RE-Weekly To advertise in RE-Weekly or other Skagit Publishing publications, Call: 360.416.2180 or Email: ads@skagitads.com ©2023 by Skagit Publishing | All rights reserved.

RE-Weekly Why it’s important to use a buyer’s agent when shopping for a home P5 Q&A Ask Our Broker P6 Homebuyers keep heads in the game P7 Classifieds P7 TABLE OF CONTENTS 5 PAGE INSIDE own the local real estate market expand your reach when you combine the power of our digital audience and premium print ads in the re weekly ask your multimedia account executive for details. ContaCt: 360.424.3251 • ads@skagitads.Com M a

Real Estate Stat -1.5%

Existing-home sales fell once again in December 2022, wrapping up the year with 11 straight months of sales drops.

Source: National Association of REALTORS ®, 2022.

Creating a Home's First Impression

Curb appeal is a home’s first impressio n, and the first chance to impress potential buyers. Whether buyers are amazed by a beautiful and immaculate yard or turned off by dirty exterior walls and an overgrown lawn can meaningfully affect the speed and price at which a home sells. Improv ing a home’s curb appeal can be as simple as repainting a front door and getting rid of weeds in the front yard, or as involved as creating an outdoor lighting design and replacing all of a home’s windows.

Before placing a home on the market, it is important to make sure that the home is prepared - inside and out - so it sells quickly and for top dollar.

Source: https://www.nar.realtor

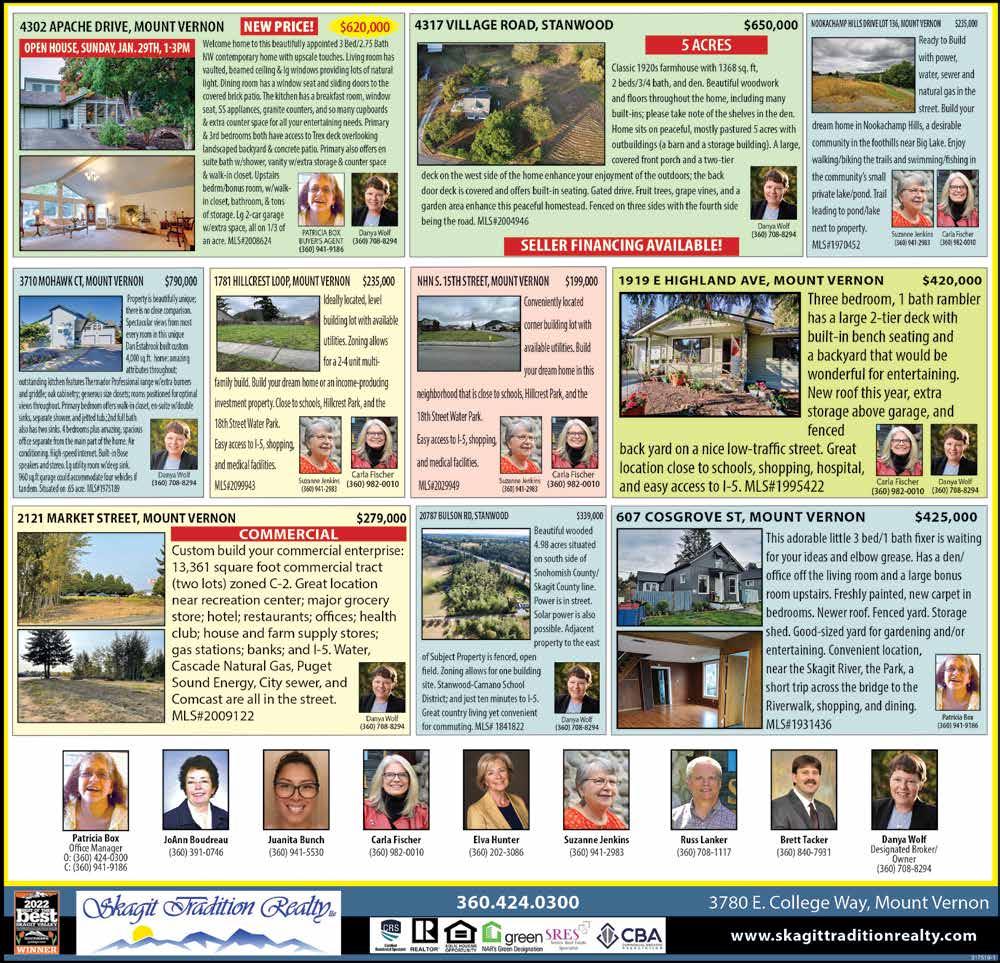

There are so many investment possibilities with this home and proper t y Classic 4 bed/2.5 bath farmhouse st yle 2560 sq.ft. home with east facing deck on 1.7 acres. Home offers kitchen w/island and ceramic tile floors, office, bonus room, mud/laundr y room, living room with propane fireplace, built-in bookshelves, and beautiful laminate over hardwood floors. Studio cottage has own kitchen and bath. Proper t y also features a 16,000+ sq.ft. pole building/barn with office space, shop, and room for RV storage. Potentially 5K in rental income each month from the cottage, barn, and RV storage.

Jan. 27, 2023 3 RE-Weekly STAT

Mission Statement: T he Nor t h P u get Sou n d Associa t ion of R ea lt or s a d voca t es for R ea lt or s a nd t h eir client s, and promotes the protection of property rights NORTH PUGET SOUND ASSOCIATIO N of REALTORS® 525 East College Way, Suite J Mount Vernon, WA 98273 Tel (360) 416 -4902 www.npsar com

517 E. Fair h aven Ave , Bur lingt on, WA 98233 Tel (360) 416 -4902 309027-1 FEATURED PR OPERT Y: 24017 T R ini T Y L A n E, S EDR O -WOOLLEY $935,000 317518-1

Skagit Tradition Realty LLC 3780 E. College Way Mount Vernon, WA 360-424-0300 www.skagittraditionrealty. com Danya Wolf (360) 708-8294

MLS#2028784

Now could be the time to sell a new home and earn a slice of the real estate pie.

Record-low interest rates is renewing interest in the housing market for many people.

“When sellers are interviewing real estate agents to market their homes, their primary focus is usually on the advertising that the agent will offer them,” says Jessica Goodbody of Weichert Realtors.

Let us help you meet your marketing goals by advertising your listings in Real Estate Weekly.

4 Jan. 27, 2023 RE-Weekly

RealEstate weekly Call 360.416.2180 Today! In print and online goskagit.com ads@skagitads.com

By Erik J. Martin CTW Features

When you are house hunting, there are a lot of moving parts to keep track of. You’ve got to research home listings and schedule home showings. A real estate contract/purchase agreement will need to be drafted carefully. Eventually, you’ll need to negotiate with the seller and close on the home.

Without expert help, these tasks can quickly become overwhelming, especially to a first-time purchaser.

That’s why it’s smart to partner with the right professional, right from the start, in the form of a real

estate agent – specifically a buyer’s agent.

“A buyer’s agent is a licensed professional who represents the interests of the home buyer. This person is different from a seller’s agent, also called a listing agent, who represents the interests of the home seller,” explains Alex Shekhtman, CEO/ founder of LBC Mortgage.

“A buyer’s agent works with the purchaser to find suitable properties, negotiate the purchase price, and coordinate the closing of the deal.”

Brandon Brown, broker/ owner of Bay Brook Realty in Laguna Beach, Califor-

nia, notes that there are several benefits to enlisting a buyer’s agent, particularly an experienced one.

“While it may seem easy to buy a home, there are so many laws, code issues, and pre-and post-negotiations to navigate that if you don’t have a knowledgeable professional on your side, you could end up with buyer’s remorse,” he cautions. “Like it or not, the seller will always be biased toward the sale of their home. That’s why buyers need protection to ensure they understand what they are purchasing and what they should know about the property during the

transaction itself.”

The biggest advantage of recruiting an agent is that you have an advocate looking out for your best interests.

“Realtors and licensed agents are trained to negotiate on your behalf and seek out potential pitfalls that often don’t get disclosed but are discovered during the inspection period. Furthermore, good agents know the market’s momentum and can help guide you toward making the right offer on a home,” continues Brown.

Among the biggest perks of collaborating with an agent is their ability to save

agent. However, the buyer may have already built this commission fee into their sales price.

The challenge for buyers is finding the right agent.

“If you ever post on social media that you are looking for an agent, you will likely get hundreds of responses rather quickly,” cautions Abbe Flynn, a broker associate with Ketchum Realty Group in Tallahassee, Florida.

To find the ideal agent, ask your friends and family for a referral to someone they’ve worked with and can vouch for. You can also meet with agents at open house events.

you time.

“Agents have extensive knowledge of the housing market and can more quickly help you find properties that meet your needs and budget,” adds Shekhtman.

Just be aware that a buyer’s agent will get a commission (percentage of the home sale). Typically, this equates to 5% to 6% of the sale price, but this amount is split 50/50 between the buyer’s agent and the seller’s agent. The good news is that the seller commonly pays the full commission, which means that the buyer doesn’t have to pay any out-of-pocket fees to their

“Look for an agent who has years of experience representing buyers. Choose an agent you feel comfortable with and whom you can trust to have your best interests at heart,” advises Shekhtman. “Partner with an agent who is familiar with the areas where you are looking to buy a property. And be sure to ask your agent plenty of questions so that you understand their process and how they work.”

If their answers don’t make sense, “ask more questions. Some agents are great at talking, but not so great at following up,” says Flynn. Additionally, be upfront about what your budget is and what your must-haves and wish-list items are for your new home.

“This will help your agent narrow down their search to properties that fit your needs best,” continues Shekhtman.

Jan. 27, 2023 5 RE-Weekly

Why it’s important to use a buyer’s agent when shopping for a home

Advantages of all-cash home transactions

Question:

My real estate broker tells me that about a quarter of her sales are for cash. If people have enough money to pay cash for a home, then surely, they can get a mortgage, so why don’t they finance and use the rest of the money for other purposes?

Answer:

All-cash transactions are surprisingly common. Figures from the National Association of Realtors (NAR) show that 26% of all existing home sales in October were all-cash transactions. The situation with new homes is a little different. The National Association of Home Builders reports that in the first three quarters of 2022 all-cash deals represented 9.5% of all sales, more than FHA-financed new home purchases for the first time since 2007.

If you have the dollars to buy a property for cash, it might well be an attractive option for several reasons.

One of the biggest headaches for home buyers is the mortgage application process, the need to meet certain standards to qualify for financing. If

you’re an all-cash buyer you can skip the whole application process, something that saves time, irritation, and sometimes lender rejections.

That’s right, it’s possible to have lots of cash as well as a mortgage application that does not pass muster. This can happen when an applicant wants financing but has woeful credit; they’re not using their cash to pay bills on time or in full, something that deeply troubles lenders.

Cash also gives buyers a marketplace advantage. Make a cash offer and sellers no longer have to worry about lender approvals. Cash buyers have a plain ability to close and that can mean discounted offers look attractive, especially in local markets where sales have slowed.

Right now, while prices have generally held up as of this writing, sales have slowed as a result of inflation, higher mortgage rates, and the possibility of recession.

In October, for example, existing sales were down 28.4% from a year earlier according to NAR, a huge drop. Prices across the country, however, were actually up 6.6% from a year earlier, though results in local markets may differ.

ASK OUR BROKER

By Peter G. Miller

The interest rates that have increased so quickly during the past year are a boon to all-cash buyers. Higher rates reduce property competition and bidding wars because there are fewer potential buyers. That means still-more market leverage for all-cash purchasers.

Why would well-healed buyers purchase with cash when they could borrow money to finance a property and use their cash to buy stocks and bonds? One answer may be a general comfort with real estate as an investment option. An October study from Coldwell Banker Real Estate found that “80% of U.S.-based high-net-worth consumers agree that real estate is a safe investment, and over one-third agree that it is the safest investment one can make when compared to stocks, bonds, cryptocurrency and pensions.”

Some of those with big savings buy with cash because it simply makes them feel comfortable, especially when times get tough. After all, there are no worries about lenders foreclosing when you don’t have a mortgage.

Email your real estate questions to Mr. Miller at peter@ctwfeatures.com.

6 Jan. 27, 2023 RE-Weekly

Q&A Q&A

Homebuyers keep heads in the game

By Marilyn Kennedy Melia CTW Features

The housing market has slowed to a crawl, but that doesn’t mean there aren’t plenty of buyers out there.

Like benched athletes who are hoping to be called into the game, buyers are looking to jump in when the right opportunity comes up.

In the market frenzy of 2021 and early 2022, buyers were dropping out because they were discouraged from losing bidding wars; today escalating mortgage rates “have weeded out many of the marginally qualified buyers,” observes Max Stokes of Fox & Stokes Team, Compass Realty in Ridgewood, NJ. Here are some tips on how these hopefuls might soon find their long-awaited buying opportunity: Check out all new listings.

Philadelphia Compass agent Brett Rosenthal sends all his sidelined clients “alerts on homes so they can see what’s going on in the market.” Buyers can also set alerts for themselves on popular home shopping sites.

“Our advice is to stay locked on the market and know what’s available,” says Chris Cook, of The Halyard Group, RE/MAX Hallmark, Toronto. “If there’s a good match, we’re recommending written offers, even if they seem too low.” Keep talking with your loan officer.

Mortgage loan officers “reputations depend on referral business and (a good one) will not miss an opportunity to communicate market turns,” says Rick Palandri with First Centennial Mortgage. Before selecting a specific home, lenders should be able to underwrite a

potential borrower, by asking for income and asset documents, and running a credit check, he explains. Then, when the right home comes up, a potential buyer can find out what the mortgage will cost at current rates.

Work to strengthen your financial position.

For down payment savings, “what is important is liquidity, meaning the funds can be converted to cash easily and quickly without a substantial drop in value,” explains John Salter, of Evensky & Katz/Foldes Wealth Management. Money market funds and savings accounts earn some interest and are liquid, he adds.

Isabel Mota, with East Greenwich, RI realty Engel & Volkers, adds that she advises “clients to keep their credit score up” and to consult with a financial advisor.

3 bedrooms, 2 full bathrooms, 1,344 Sq. Ft. Situated on a corner lot w/large, landscaped yard. Open concept w/vaulted ceilings. Large kitchen w/lots of storage. Fully fenced backyard w/two sheds. Great location, close to all amenities. Heat pump with A/C MLS # 2030476

Geri Cole, Realtor 360-391-1614

Jan. 27, 2023 7 RE-Weekly

REAL ESTATE FOR SALE Open Houses NE W TODA Y

Sedro-Woolley $179,900

600 N Reed Street #31,

OPEN HOUSE SAT, 1/28/23 12-2 PM

RENTALS

NE W TODA Y 1200 square foot

In Burlington. Vacation/Resorts Rental NE W TODA Y Whistler Condo Available February 24th-March

Windermere Real Estate/Skagit Valley

Storage/Warehouse

shop 30x40, roll up doors. Electrical and water. For storage or? $600 a month 425.750.0378.

3rd. $600. 360.770.9670

in

CLASSIFIEDS RE-Weekly RE-Weekly RE-Weekly

Find it fast

your local Classfieds!

8 Jan. 27, 2023 RE-Weekly