THE SLIFER REPORT

NORTHEAST

SOUTH

Our teamof market expertsupdates TheSlifer Report throughout theyear. To seethelatest numbersand diveeven deeper into thereport, scanthecodeor visit: SliferFrontRange com/Resources/Slifer-Report

NORTHEAST

SOUTH

Our teamof market expertsupdates TheSlifer Report throughout theyear. To seethelatest numbersand diveeven deeper into thereport, scanthecodeor visit: SliferFrontRange com/Resources/Slifer-Report

As we reach the midpoint of 2024, it's a good time to reflect on the current state of the Front Range real estate market. In recent months, we?ve seen some key economic developments. The Federal Reservehasmaintained interest ratesbetween 5.25%and 5.50%for almost ayear,with the June meeting marking the seventh consecutive instance of no rate changes Although the Fed acknowledges?modest progress?in inflationcontrol,significant ratecutsto stimulatedemand were expected to bemoredelayedthanoriginallyanticipated

However, recently released and revised data has started to shift expectations. Better-than-expected inflation data has significantly increased the likelihood of a rate cut by the end of summer.Asreported by Forbesand according to theCMEFedWatch Tool,theimplied odds of the Federal Reserve lowering rates by its September conclave shot up to 89%, a significant increase from prior estimates. This optimistic shift indicates increased confidence in a less aggressive monetary policy Despite the earlier lack of immediate rate cuts, there are positive aspectsto consider in both the broader economy and the local real estate market Pocketsof the economy remain resilient, particularly in the labor market The Fed?s commitment to data-driven decisions, avoiding reactionary measures, provides stability and reassurance to the overall market This approach helps prevent scenarios like the ?stagflation?of the 70s and 80s, where premature actionsled to prolongedhighinflationand interest rates

Finding this balance has also been mirrored in the real estate market on the Front Range, with an impactful shift towardshigher inventory levels This is arelief for many buyers but has resulted in longer days on market for sellers This balancing act creates a dynamic environment where patience,pricing,andstrategic planningareessential

Looking forward to the rest of 2024, we anticipate continuing to seek and find balance in the market.Stabilityinthemarket isbeneficial for long-termplanning and economic decisionsand will help unlock some of the uncertainty and volatility we?ve experienced in recent years The Front Range is projected to see a 5%increase in new housing permits, supported by ongoing migration to the state and a slight softening in interest rates While the upcoming election may bring some short-term impacts this fall, historical trends suggest that annual economic numbers remain largely unaffected Additionally, in August, we will see significant industry regulatory changes at a national level. We are well-prepared to help navigate this change and providewelcometransparencyto our clients

We encourage you to reach out and experience how we're navigating these important industry dynamics Our strength lies in our ability to adapt and remain resilient. We?ll continue to navigate these changes with confidence, leveraging our expertise and commitment to excellence. Here?s to a successful second half of 2024!

WE ARE SLIFER SMITH & FRAMPTON

world-class agents across Colorado

dedicated & local support staff

sales volume since 2020 100% Colorado owned & operated

The fundamental strength of Colorado'seconomy has shown tremendousresilience thisyear ? our educated workforceand high quality of life? remainsabedrock of stability.Aswestep into the second half of 2024 and beyond, this resilience not only continues to bolster our confidenceinthefuturebut also cementsour positionasanational leader.

- Economic Performance:

While current economic forecasts are mixed, most projections suggest Colorado will onceagain exceed stateGDPexpectationsand grow somewherebetween20%- 30% in 2024 Should these strong projections materialize, this could represent a trailing 5-year annualized growth rate over 4%, likely ranking Colorado among the Top Ten states for economic growth in the last 5 years Although the pace of growth has declined in more recent quarters, the sustained increased highlights our status as a national leader ineconomic performancesincetheGreat Financial Crisis

- Real Estate Behavioral Change:

The state's real estate sector is undergoing significant transformation, driven by evolving work habits and lifestyle shifts. A notable labor shortage remains evident, with Colorado having 52available workers for every 100 open jobs For the period of February 2020 to April 2024 Colorado standswith only Texas, Arkansas, Kentucky and South Carolinaasthe5stateswith +40%increasein job openingssincethepandemic according to the US Chamber The "Work From Home" trend, now normalized at around 26% of the workforce according to the Census Bureau, continues to significantly impact job searches and the office market This trend contributed to a 30-year high in Colorado'sofficevacancyrateswhich continuesto inch higher in 2024 and continuesto present risksinbothmacro andmicro-economic contexts

- Inf lation and Consumer Sentiment:

The Front Range has consistently experienced inflation rateshigher than the national average, outpacing it in 11of the past 13 years, primarily due to the housing market. Similar to welcomed national trends, the Front Range inflation rates are cooling with CPI fromMay2023to May2024 up26%

- Demographic Shifts:

Colorado is amid significant demographic transformations, especially noticeable in the under-18 and over-65age groups. The state is bracing for a historic demographic shift by2035,wheretheover-65population isexpected to surpasstheunder-18group for the first time. This change holds profound implications for public policy, particularlyinareasof educationandinfrastructure

Projects launched in 2023

SOURCE| FHFAHouse Price Index and FOCUS1ST

$2B+

Division historic closed + pending sales 300+ New homes delivered

With strong economic activity acrossthe state new development wasakey driver of growth in 2023, and we believe the creationof newhigh-qualityhomeswill continueto becritical asColorado settlesinto aneweconomic equilibrium. Slifer Smith & Frampton is proud to be the only brokerage in Colorado with a full division dedicated to bringing new developments to market. Our end-to-end service continued to deliver in 2023, creating more new homes in our communities.Thisyear thedivisioncelebratedover $2billioninclosed&pendingsalessinceit startedin2020.

Imagine it's the year 1964 The nation is captivated by the heated presidential race between Lyndon B Johnson and Barry Goldwater Amidst this backdrop, Slifer Smith & Frampton opens its doors, beginning a journey through six decades of political and economic shifts. We've navigated 16 presidential elections, from the contentious 1964 raceto theupcoming2024 election.

Throughout theseyears,we'vefaced major economic downturns,fromthe1970soil crisis to the Great Recession and the COVID-19 pandemic Our story is one of resilience and adaptability,emergingstronger andwiser througheachchallenge

At the heart of our success are our dedicated agents They offer expert care and personalized attention, guiding clients through fluctuating markets with deep market knowledge. Choosing Slifer Smith & Frampton means partnering with ateam that brings awealth of experienceand alegacy of trust.Weensure stability and successin your real estatejourney,offering expert guidanceand apersonal touch every step of theway Join us and become part of a story that continues to unfold with each new chapter in the ever-evolvinglandscapeof real estate

1964 - LyndonB.Johnsonvs.BarryGoldwater

1968- Richard Nixonvs.Hubert Humphrey

1972- Richard Nixonvs.GeorgeMcGovern

1976 - JimmyCarter vs.GeraldFord

1980 - RonaldReaganvs.JimmyCarter

1984 - Ronald Reaganvs.Walter Mondale

1988- GeorgeH.W.Bushvs.Michael Dukakis

1992- Bill Clintonvs.GeorgeH.W.Bush

1996 - Bill Clintonvs.BobDole

2000 - GeorgeW.Bushvs.Al Gore

2004 - GeorgeW.Bushvs.JohnKerry

2008- Barack Obamavs.JohnMcCain

2012- Barack Obamavs.Mitt Romney

2016 - DonaldTrumpvs.HillaryClinton

2020 - JoeBidenvs.Donald Trump

2024-Upcomingelection

1969-1970 Recession

1973-1975Recession

1980 Recession

1981-1982Recession

Early1990sRecession(1990-1991)

Early2000sRecession(2001)

Great Recession(2007-2009)

COVID-19 Recession(2020)

Theseeventshavehadsignificant impactson boththepoliticalandeconomiclandscapeofthe UnitedStatesoverthepastseveraldecades.

The line graph (page 9) showsthe daily level of the federal funds rate back to 1960. The federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis Thisrate isacritical factor when evaluating interest ratesfor real estate purchases, as it directly influences the cost of borrowing money The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal fundstarget rate.

Thecurrent federalfundsrateasofJuly12,2024is5.33%.

ECONOMIC DOWNTURNS (RECESSIONS)

FEDERAL FUNDS RATE

PRESIDENTIAL ELECTION

SOURCE| FEDERAL FUNDSGRAPH: WWWMACROTRENDSNET

DEMAND (ContractsSigned)

SUPPLY

AVERAGE PPSF

SALES OVER ASK

AVERAGE SALES PRICE

POPULATION | 327,468

POPULATION GROWTH | +11.16% SINCE 2010

MEDIAN AGE | 37 2

*UNEMPLOYMENT RATE | 2 9%

MEDIAN HOUSEHOLD INCOME | $99,770

AVERAGE COMMUTE TIME | 23 4 MINUTES

HOME OWNERSHIP RATE | 62 3%

*MEDIAN PROPERTY SALE PRICE | $838,000

5TIDBITSFROM THELOCALS

1. FARM TO TABLE at Black Cat Farm

2. BROWSE vintage posters and historic maps at Art Source international

3 STROLL through the Boulder Farmers Market

4. LEAF PEEP on the Peak to Peak Highway

5. CHEER on the CU Buffs at Folsom Field

POPULATION | 756,121

POPULATION GROWTH | +36.2% SINCE 2010

MEDIAN AGE | 38 4

*UNEMPLOYMENT RATE | 3 2%

MEDIAN HOUSEHOLD INCOME | $117,541

AVERAGE COMMUTE TIME | 26 8 MINUTES

HOME OWNERSHIP RATE | 65 3%

*MEDIAN PROPERTY SALE PRICE | $676,790

5TIDBITSFROM THELOCALS

1. SIP at 4 Noses Brewing Company

2. VISIT Broomfield Days

3 ENJOY over 280 miles of walking and biking trails

4 EAT at the Burns Pub & Restaurant

5. PADDLE board on Standley Lake

POPULATION | 713,252

POPULATION GROWTH | +18 84% SINCE 2010

MEDIAN AGE | 34 8

*UNEMPLOYMENT RATE | 3 4%

MEDIAN HOUSEHOLD INCOME | $85,853

AVERAGE COMMUTE TIME | 25 3 MINUTES

HOME OWNERSHIP RATE | 49.6%

*MEDIAN PROPERTY SALE PRICE | $720,700

1. CELEBRATE the West at the National Western Stock Show

2. UNWIND at Hotel Clio

3 IMMERSE in art at the Museum of Contemporary Art

4 RELAX at the Oakwell Beer Spa

5 DIVE into Michelin cuisine at The Wolf's Tailor

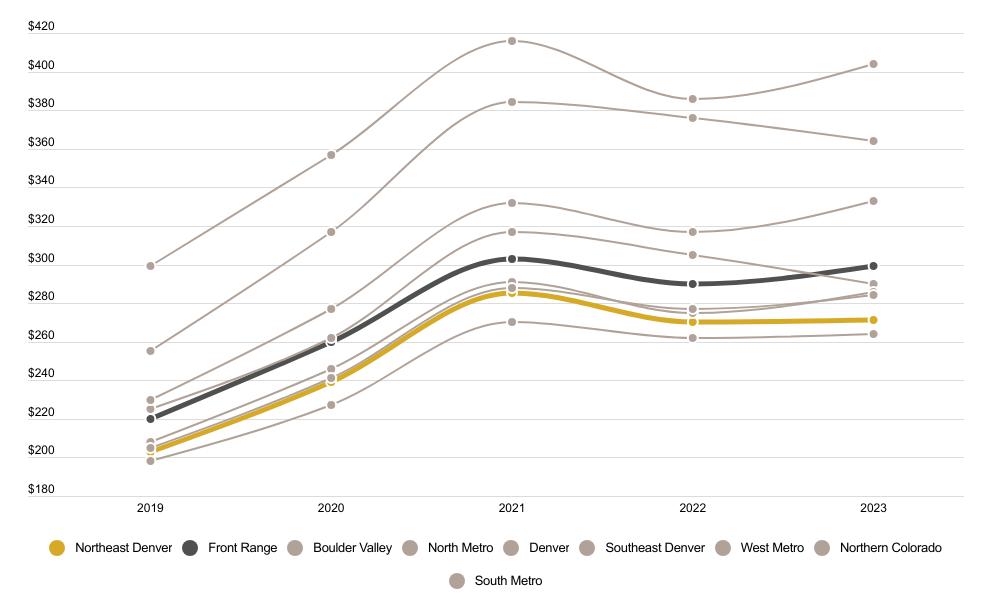

AveragePricePer SquareFoot (SFR)

| Cherry Creek State Park

POPULATION | 655,808

POPULATION GROWTH | +14 65% SINCE 2010

MEDIAN AGE | 37

*UNEMPLOYMENT RATE | 3 2%

MEDIAN HOUSEHOLD INCOME | $92,292

AVERAGE COMMUTE TIME | 27 8 MINUTES

HOME OWNERSHIP RATE | 64.9%

*MEDIAN PROPERTY SALE PRICE | $595,000

5TIDBITSFROM THELOCALS

1. TRAIN at Snöbahn Indoor Ski Facility

2. ENJOY a show at Gothic Theater

3 INDULGE the outdoor activities at Cherry Creek State Park and Reservoir

4 PERUSE through Stanley Marketplace

5. DINE at Annette

3% MedianSale -5% no of Sales

highlights 8,000 ACRES OF OPEN SPACE

AveragePricePer SquareFoot (SFR)

POPULATION | 576,143

POPULATION GROWTH | +7 78% SINCE 2010

MEDIAN AGE | 40 2

*UNEMPLOYMENT RATE | 3 0%

MEDIAN HOUSEHOLD INCOME | $103,167

AVERAGE COMMUTE TIME | 27 MINUTES

HOME OWNERSHIP RATE | 70 8%

*MEDIAN PROPERTY SALE PRICE | $700,000

5TIDBITSFROM

1. DINE at Sherpa House

2. VISIT Staunton State Park for ample hiking trails

3 FIND vintage goods at the Pine Emporium

4 FLOW at Yoga on the Rocks

5 TUBE down Clear Creek in Golden

POPULATION | 716,954

POPULATION GROWTH | +29 77% SINCE 2010

MEDIAN AGE | 35 5

*UNEMPLOYMENT RATE | 3 05%

MEDIAN HOUSEHOLD INCOME | $88,190

AVERAGE COMMUTE TIME | 25 7 MINUTES

HOME OWNERSHIP RATE | 70 15%

*MEDIAN PROPERTY SALE PRICE | $545,000

TOP5TIDBITSFROM THELOCALS

1 BOOK a tee time at TPC Colorado Golf Club

2 FLOAT down the beautiful Cache La Poudre River

3. LOUNGE at The Sunset Lounge at the Elizabeth Hotel

4. JAM out at the Mishawaka Amphitheatre

5. CAMP at Big Thompson Campground on Carter Lake Reservoir

SOURCE|

POPULATION | 527,575

POPULATION GROWTH | +19.46% SINCE 2010

MEDIAN AGE | 34 2

*UNEMPLOYMENT RATE | 3 4%

MEDIAN HOUSEHOLD INCOME | $86,297

AVERAGE COMMUTE TIME | 29 9 MINUTES

HOME OWNERSHIP RATE | 67 9%

*MEDIAN PROPERTY SALE PRICE | $535,320

5TIDBITSFROM THELOCALS

1 DISCOVER Rocky Mountain Arsenal National Wildlife Refuge

2. SHOP at the Orchard Town Center

3. EASE into your day at Sweet Bloom Coffee

4. EXPLORE Adams County Fair

5 LEARN how to line dance at the Grizzly Rose

AveragePricePer SquareFoot (SFR)

| Waterton Canyon

POPULATION | 375,988

POPULATION GROWTH | +31 71% SINCE 2010

MEDIAN AGE | 39 1

*UNEMPLOYMENT RATE | 3%

MEDIAN HOUSEHOLD INCOME | $139,010

AVERAGE COMMUTE TIME | 27 3 MINUTES

HOME OWNERSHIP RATE | 78 4%

*MEDIAN PROPERTY SALE PRICE | $740,000

5TIDBITSFROM THELOCALS

1 RELAX at The Broadmoor Hotel

2 EXPLORE over 1,200 acres at Hidden Mesa Open Space Trail

3. FIND unique and vintage furniture at Rare Finds Warehouse

4. CATCH world class trout in Cheesman Canyon

5. DINE at Cuba Cuba Castle Rock

MedianSale 1% No of Sales

AveragePricePer SquareFoot (SFR)

As a founding member Slifer Smith & Frampton is proud to fly the Forbes Global Properties flag from Aspen to the Front Range This powerful, global, network of top-tier independent brokerages gives our agents, and our clients, exclusive access to an invaluable network of the world's finest homes and the agents representing them.

In 2023 our membership with Forbes Global Properties brought some incredible Front Range homes to a global audience

Here are some of our notable sales of the year on the Front Range.

STAY UP TO DATE ALL YEAR LONG & VIEW OUR PROPERTIES ANYTIME

S L I F E R F R O N T R A N G E . C O M