FRONT RANGE

Our teamof market expertsupdates TheSlifer Report throughout theyear. To seethelatest numbersand diveeven deeper into thereport, scanthecodeor visit: SliferFrontRange.com/Resources/Slifer-Report

FRONT RANGE

Our teamof market expertsupdates TheSlifer Report throughout theyear. To seethelatest numbersand diveeven deeper into thereport, scanthecodeor visit: SliferFrontRange.com/Resources/Slifer-Report

Aswemoveinto 2025,it?sanopportunemoment to reflect onthestateof theFront Rangereal estatemarket and look ahead with aclear perspective.Over thepast year,we?veseen several important developmentsthat haveshaped thelocal economy and the housing market. The Federal Reserve's interest rate policy has played a significant role, with the central bank maintaining ratesbetween 525%and 550%for most of 2024 However,with recent shiftsin economic data,expectationsfor a rate cut have begun to rise As of early 2025, many analysts are forecasting that the Fed could reduce rates by mid-year, based on improving inflation trends and a slowing labor market According to the CMEFedWatch Tool, there is now a 70% probabilityof aratecut byJune,upfrompreviousprojectionsof amoredelayedresponse

This shift in the Fed?s stance, combined with stronger-than-expected inflation data, has led to an increasingly positive outlook for the economy in the second half of 2025. The lower rates, when they do come, are expected to help reduce borrowingcostsandinject somemuch-needed momentuminto thehousingmarket

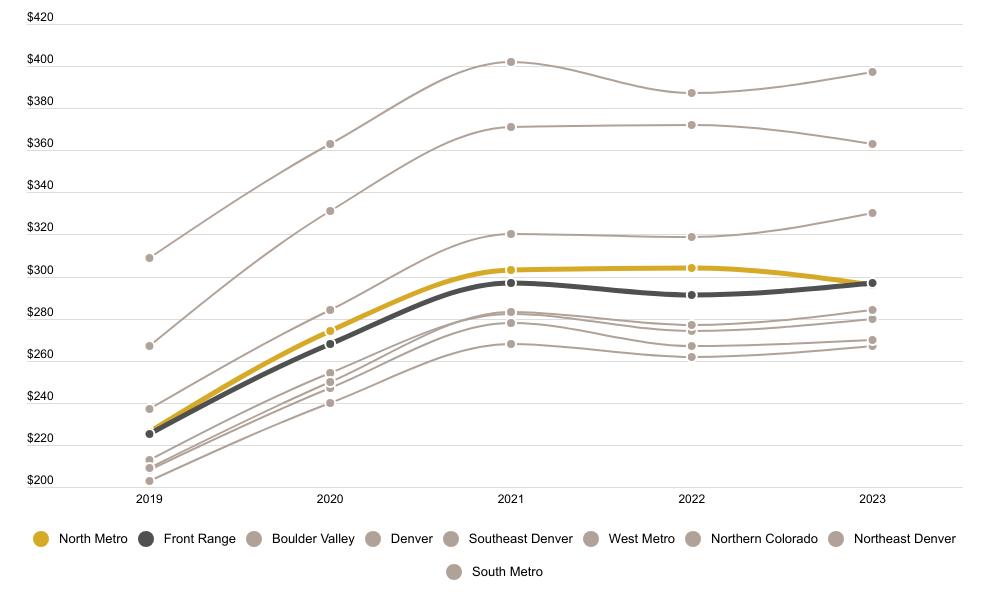

Locally,theFront Rangecontinuesto seeadynamic real estatemarket Over thepast year,we?veexperienced abalancing of supply and demand. Inventory levels have risen, giving buyers more options than in the previous few years. However, sellers have faced longer days on market asbuyers take more time to evaluate their options and adjust to the higher interest rates that have prevailed. It?s been a period of adaptation for both sides, and while price appreciation has slowed, values remain resilient,especiallyinhighlysought-after areaslikeBoulder,Denver,andColorado Springs.

Looking ahead, we anticipate that the Front Range real estate market will continue itstrend of steady, sustainable growth in 2025. Housing permits are projected to increase by 4-6%, driven by continued demand from new residents and strong migration trends. According to the Colorado Division of Housing, more people are moving to Colorado, with the state?s populationexpectedto growby1.2%annuallyover thenext fewyears,addingfuel to thehousingmarket.

While interest rates are likely to remain higher than historical lows for some time, the anticipated reduction in rates should improveaffordabilityfor manybuyers,particularlythoseenteringthemarket for thefirst time Thisshift could lead to amore balanced market where both buyers and sellers find opportunities, though it will require strategic planning and patience. Additionally, with the national political landscape undergoing change, we expect only minor short-term impacts on the local market. Historical trends show that election years tend to have minimal long-term effect on real estate activity, and we expect thesamefor 2025.

One notable change we are preparing for is a new round of regulatory updates that will take effect later in the year These changes at both the state and federal level will affect everything from property taxes to environmental policies, and we?re readyto helpour clientsnavigatethisevolvinglandscape.

At our company, we remain committed to providing clarity and guidance during thisperiod of transition We pride ourselves on our ability to stay ahead of market trends, adapting our strategies to deliver the best outcomes for our clients Whether you are buying, selling, or investing, we have the expertise and resourcesto help you make informed decisionsand succeedin2025

Weencourageyou to reach out and experiencehow wearenavigating theseexciting times Together,we?ll continueto thrivein thisevolving market Here?sto asuccessful 2025for the Front Rangereal estatemarket!

AsColorado'sindependent,locallyowned and operated real estatecompany,wearedeeply invested inour communitiesand fullycommitted to buildingup thisincredibleplace.Whenyou work withusyounot onlyget best-in-class service,youcanknowthat your businessand support stayslocal creating abright future for thebenefit of all.

100%

Colorado owned & operated

$12B+

Sales volume since 2020

#1

Colorado's leading, independent real estate company

Across t he Front Range for t he best in local insight s, real estate and ot herwise.

2350 Broadway Street | Boulder 136 2nd Avenue Ste C | Niwot 1002 Griffith Street | Louisville

136 2nd Avenue Ste E | Niwot

DENVER

150 Clayton Lane | Cherry Creek

1750 Wewatta Street Ste 100 | Denver

The US economy in 2025 is expected to grow at a moderate pace, with GDP growth forecasted at around 2% While inflation is projected to continue its decline towards the Federal Reserve's 2% target, economic conditions remain mixed The labor market is expected to stay relatively strong, with unemployment rates hovering around 3.9%, thanks to resilience in key sectorslike technology, healthcare, and clean energy. However, ongoing global uncertainties, such as trade dynamics and geopolitical tensions, could create occasional volatility in financial markets The Federal Reserve, having completed its aggressive interest rate hikes in 2023 and 2024, is anticipated to maintain a federal funds rate of 4.75%?5.0% in 2025, providing a more balanced monetary policy that supports growthwithout reignitinginflation.

For the residential real estate market, the effects of higher interest rates will continue to impact affordability and housing demand in early 2025. With 30-year mortgage rates averaging6.5%to 7%throughtheyear,manybuyers,particularlyfirst-timehomebuyers,will face challenges in securing affordable financing While this is an improvement over the peak of 8%rates in 2023, affordability remains a concern in many markets As mortgage rates stabilize, the housing market is expected to regain some momentum, with national home prices projected to rise by 3%year-over-year, reflecting a return to more balanced conditions compared to the pandemic-era price surges. Although price increases will slow, demand remains strong in high-growth regions like the Sun Belt and suburban areas, as buyersseek morespaceandaffordabilityoutsideof urbancores

Homebuilding activity is expected to remain steady in 2025, with around 1.4 million new housing starts projected nationally While this number is below the peak of 16 million in 2021 , it reflects a steady pace aimed at addressing the persistent housing shortage, especially for entry-level homes The shortage of affordable homes continues to fuel strong demand in both the rental market and for first-time homebuyers Demographic factors, such as the continued rise of millennials entering the housing market, will also support demand, particularly for suburban and exurban properties. Additionally, supply chain improvements and the potential for some easing in building material costs may help buildersmaintainmomentuminconstruction

Overall,while the US economy in 2025isexpected to facechallengesfrom higher interest rates and global uncertainties, the residential real estate market is poised to stabilize Economic growth, coupled with a return to more sustainable housing price increases, will foster a more balanced environment, with strong demand in key housing sectors despite affordabilitypressures.

>>> INTEREST RATES

The Federal Reserve's rate hikes in 2024, bringing the federal funds rate to 525%?55%, have cooled the real estate market, leading to a 275%decrease in new building permits and longer home sale times in the Front Range. Looking ahead to 2025, the Fed is expected to ease rates to around 4.75%?5.0%, driven by moderating inflation and slower economic growth Historically, the spread between the 30-year mortgage rate and the 10-year Treasury yield is about 1875%, and as the Fed slows its tightening cycle, this spread is expected to return to normal, potentially lowering 30-year mortgage rates to 5.75%?6.25%.Thiscouldcreateamorefavorablehousingmarket environment in2025.

Colorado?s economy remains resilient and poised for steady growth in 2025, underpinned by its skilled workforce,highqualityof life,and diverseindustries Thestate?sGDPisprojected to grow between 22%and 28%in 2025, continuing astrong pace of economic expansion Over the past five years,Colorado hasconsistently outpaced national growth,ranking among the top 10 states for economic performance. Key industries? tech, healthcare, outdoor recreation, and renewable energy? are driving this success, and Colorado?s innovation and skilled labor force will maintain itseconomic leadership

Real Estate Trends: The Colorado real estate market isadapting to changing work and lifestyle preferences Remote work, now comprising about 30%of the workforce, has increased demand for suburban and rural properties As a result, single-family home demand remains strong, especially for those with home offices or larger yards Meanwhile, Colorado?s office vacancy rates have surged to around 25%, the highest in decades, as hybrid work models persist. This trend is expected to continue, with re-purposing of office spaces becoming more common, especiallyinurbancenterslikeDenver.

Inf lation and Consumer Sentiment: Inflation in Colorado isexpected to stabilizein 2025, with the Consumer Price Index (CPI) rising by about 2.4%, easing pressure on housing affordability. While inflation has been above the national average, the anticipated reduction in interest rates and more stable prices will improve consumer sentiment, making housing more accessible for manybuyers,particularlyintheDenver metro area

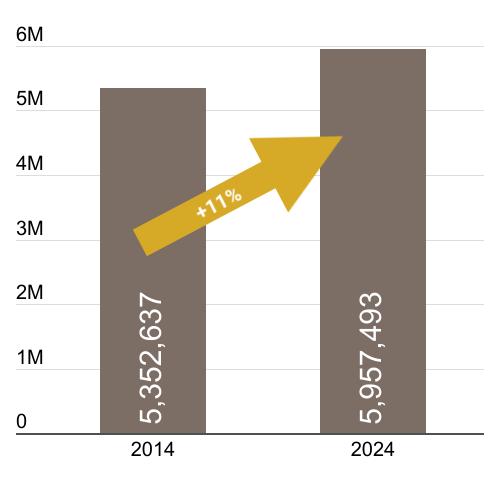

Demographic Shifts: Colorado is experiencing significant demographic changes, particularly the aging population By 2035, Coloradans over 65 are expected to outnumber those under 18, influencing healthcare, senior housing, and public policy At the same time, strong in-migration from states like California, Texas, and the Midwest continues to fuel housing demand, especially in Denver, Colorado Springs, and Fort Collins. Developers are responding with new residential projectsto accommodatethisgrowingpopulation.

Looking Ahead: In 2025,Colorado?seconomyisexpected to continueitsgrowthtrajectory,with strong demand for housing across both urban and suburban areas. While housing affordability remains a concern, stabilized inflation and lower interest rates should offer relief. The commercial real estatesector,however,will facechallengesasofficevacancyratesremainhigh Colorado?s strong economic foundations, coupled with demographic shifts and evolving consumer preferences, will shape its future. The real estate market will continue to evolve to meet the needs of a changing population, and the state is well-positioned to remain a national leader ineconomic performance

+185.5%

Since 2004

SOURCE| FHFAHouse Price Index and FOCUS1ST

SOURCE| National

POPULATION | 328,658

POPULATION GROWTH | +11 16% SINCE 2010

MEDIAN AGE | 37

*UNEMPLOYMENT RATE | 4 1%

MEDIAN HOUSEHOLD INCOME | $99,770

AVERAGE COMMUTE TIME | 23.4 MINUTES

HOME OWNERSHIP RATE | 62.3%

*MEDIAN PROPERTY SALE PRICE | $825,000

THELOCALS

SAVOR decadent foods at OAK on Fourteenth

EXPLORE the flavors of Celestial Seasonings Tea Factory

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023 *Unemployment Rate:Q4 2024

$363 averagesold price per squarefoot (sfr), a2%decreasefrom 2023

$1.06M averagesaleprice (sfr),a2%decrease from2023

4,547 number of sales,a 6%increasefrom 2023

TOP 10 places to live in the U S

POPULATION | 73,946

POPULATION GROWTH | +35 4% SINCE 2010

MEDIAN AGE | 38 6

*UNEMPLOYMENT RATE | 4 4%

MEDIAN HOUSEHOLD INCOME | $117,541

AVERAGE COMMUTE TIME | 26.8 MINUTES

HOME OWNERSHIP RATE | 63 9%

*MEDIAN PROPERTY SALE PRICE | $695,000

IN THE KNOW...

5TIDBITSFROM THELOCALS

1 PLAY round at Eagle Trace Golf Club

2 VISIT Stearns Lake

3. BROWSE at local Farmer's Markets

4 EAT and drink at Wonderland Brewing

5 RELAX on the water of Standley Lake

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023 *Unemployment Rate:Q4 2024

1,079 number of sales,a 10%increasefrom 2023

21,000 ACRES 5th smallest county in the U S $296 averagesold price per squarefoot (sfr), a3%decreasefrom 2023 $806K averagesaleprice (sfr),a1%increase from2023

POPULATION | 710,800

POPULATION GROWTH | +18 3% SINCE 2010

MEDIAN AGE | 34 9

*UNEMPLOYMENT RATE | 4 1%

MEDIAN HOUSEHOLD INCOME | $85,853

AVERAGE COMMUTE TIME | 25.3 MINUTES

HOME OWNERSHIP RATE | 49 4%

*MEDIAN PROPERTY SALE PRICE | $663,618

5TIDBITSFROM THELOCALS

1 RAISE a glass at the Great American Beer Festival

2 UNWIND at Larimer Lounge

3. STROLL around City Park

4 DISCOVER at the Meow Wolf experience

5. DIVE into nature at the Botanic Gardens

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

*Unemployment Rate:Q4 2024

$886K averagesaleprice (sfr),a2%increase from2023

9,576 number of sales,a .2%decreasefrom 2023

best city for young professionals $397 averagesold price per squarefoot (sfr), a3%increasefrom 2023

| Cherry Hills Golf Course

POPULATION | 654,453

POPULATION GROWTH | +14 65% SINCE 2010

MEDIAN AGE | 37 1

*UNEMPLOYMENT RATE | 4 3%

MEDIAN HOUSEHOLD INCOME | $92,292

AVERAGE COMMUTE TIME | 27.8 MINUTES

HOME OWNERSHIP RATE | 64 9%

*MEDIAN PROPERTY SALE PRICE | $585,000

5TIDBITSFROM THELOCALS

1 GLIDE around at South Suburban Ice Arena

2 ENJOY a show at The Venue

3. EXPLORE at Triple Creek Trailhead

4 SHOP & SAVOR at the SouthlandsShoppingCenter

5. DINE at Common Good

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

*Unemployment Rate:Q4 2024

$280 averagesold price per squarefoot (sfr), a2%increasefrom 2023

$746K averagesaleprice (sfr),a.1%decrease from2023

8,580 number of sales,a 2.5%decreasefrom 2023

8,000 acres of open space

| BIg Horn Sheep

POPULATION | 580,519

POPULATION GROWTH | +7 6% SINCE 2010

MEDIAN AGE | 40 2

*UNEMPLOYMENT RATE | 4 3%

MEDIAN HOUSEHOLD INCOME | $103,167

AVERAGE COMMUTE TIME | 27 MINUTES

HOME OWNERSHIP RATE | 70 6%

*MEDIAN PROPERTY SALE PRICE | $675,000

5TIDBITSFROM THELOCALS

1. DINE at Bridgewater Grill

2. VISIT Lookout Mountain for ample hiking trails

3 DISCOVER hidden treasures at The Little Bear

4. SNAP pictures at Golden Gate Canyon State Park

5. UNWIND at Evergreen Lake

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

*Unemployment Rate:Q4 2024

8,135 number of sales,a2% increasefrom2023

70.6% homeownship rate $330 averagesold price per squarefoot (sfr), a3%increasefrom 2023 $815K averagesaleprice (sfr),a4%increase from2023

POPULATION | 331,466

POPULATION GROWTH | +37 7% SINCE 2010

MEDIAN AGE | 35

*UNEMPLOYMENT RATE | 4.7%

MEDIAN HOUSEHOLD INCOME | $89,182

AVERAGE COMMUTE TIME | 28 2 MINUTES

HOME OWNERSHIP RATE | 75 2%

*MEDIAN PROPERTY SALE PRICE | $530,998

TOP5TIDBITSFROM THELOCALS 1 TOUR the New Belgium Brewery Company 2. HIKE at Rabbit Mountain Open Space 3 RELAX at Longmont Reservoir 4 CATCH a concert at the Mishawaka Amphitheatre 5. CAMP at Boyd Lake State Park

*Unemployment Rate:Q4 2024 IN

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

$267 averagesold price per squarefoot (sfr), a2%increasefrom 2023

$624K averagesaleprice (sfr),a2%increase from2023

11,804 number of sales,a.1% decreasefrom2023

POPULATION | 520,149

POPULATION GROWTH | +18.9% SINCE 2010

MEDIAN AGE | 34 4

*UNEMPLOYMENT RATE | 4 8%

MEDIAN HOUSEHOLD INCOME | $86,297

AVERAGE COMMUTE TIME | 29 9 MINUTES

HOME OWNERSHIP RATE | 68 3%

*MEDIAN PROPERTY SALE PRICE | $530,000

5TIDBITSFROM THELOCALS

1 VIEW the landscapes at Barr Lake State Park

2. SHOP at the Prairie Center

3 CATCH a Colorado Rapids game on the pitch

4 EXPLORE Adams County Fair

5. ENJOY family time at Boondocks Food & Fun Pictured | Westminster Castle

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

*Unemployment Rate:Q4 2024

$270 averagesold price per squarefoot (sfr), a1%increasefrom 2023

$567K averagesaleprice (sfr),a.4%increase from2023

7,218 number of sales,a1% increasefrom2023

15,988 acre wildlife refuge

POPULATION | 360,206

POPULATION GROWTH | +31 71% SINCE 2010

MEDIAN AGE | 39 3

*UNEMPLOYMENT RATE | 4 3%

MEDIAN HOUSEHOLD INCOME | $139,010

AVERAGE COMMUTE TIME | 27.3 MINUTES

HOME OWNERSHIP RATE | 78 4%

*MEDIAN PROPERTY SALE PRICE | $722,490

5TIDBITSFROM THELOCALS

1. EXPERIENCE the outdoors at Ridgeline Open Space

2 SWING at the Colorado Journey Miniature Golf

3 STROLL through historic Highlands Ranch Mansion

4. RELAX at O'Brien Park

5 DINE at Castle Cafe

SOURCE| 2022datafromDataUSA&US Bureauof Labor Statistics

*MedianSalefor SingleFamily&Duplex for 2023

*Unemployment Rate:Q4 2024

$284 averagesold price per squarefoot (sfr), a3%increasefrom 2023

$875K averagesaleprice (sfr),a3%increase from2023

6,402 number of sales,a3% increasefrom2023

healthiest counties in U S

Weareproudto betheonlybrokerageinColorado withafull divisiondedicatedto bringingnewdevelopmentsto market.Our dedicatednewdevelopment teamhasbeeninstrumental inbringingseveral keyprojectsto market, leveragingdeeplocal knowledgeand long-standingrelationshipsto navigateanever-shiftingmarket Our recent development projectsfocusoncreatingmorediversehousingoptionsthat balanceenvironmental sensitivitywith contemporarylivingneeds Byprioritizingthoughtful design,communityintegration,andmarket responsiveness, thesedevelopmentsarenot just creatinghousing? they'reshapingthefutureof mountainlivingacrossColorado

As a founding member Slifer Smith & Frampton is proud to fly the Forbes Global Properties flag from Aspen to the Front Range This powerful, global, network of top-tier independent brokerages gives our agents, and our clients, exclusive access to an invaluable network of the world's finest homes and the agents representing them. In 2024 our membership with Forbes Global Properties brought some incredible Front Range homes to a global audience

Here are some of our notable sales of the year on the Front Range.