NICOLE ELLIOTT, FSTA Editor, Market Technician

Yet more tricky times for traders and investors so far this year. Braced for a slew of general elections over 12 months – in five continents no less – caution has been the watchword and, despite revisions and indecisions, market volatility has been as low as it was in the first half of 2023. It doesn’t mean this will remain the case; remember, we saw a surge in observed volatility in Q4 2023. You have been warned, and it’s a good example of the recency effect – where things that happened not that long ago begin to be seen as the norm.

What does seem to have increased is voters’ willingness to change allegiances to political parties, so that the volatility of the electorate’s choices means the outcome of polling and voting is today far more difficult to predict. Linked to this is an increased choice of political parties, with the old left/right, good/bad duopoly crumbling like other relics of the Cold War. Rowing back on green policies has added another level of economic uncertainty, so no wonder serious investment decisions have been put on the back boiler. And let’s not forget the wars, skirmishes and terrorist movements plaguing today’s world which make for a stop/go global economic trajectory.

Markets have reacted strangely to these extreme conditions, with everything moving far more slowly than used to be the case prior to the slowdown initially triggered by the great financial crash of 2008 and the subsequent zero interest rate policies. Technical analysts, especially those using cycle theory, should factor this in. David McMinn’s piece (pg.28) on the US Presidential four-year cycle might be timely. Another article in this issue that I urge you to read is on Efficient Market Theory, by Gerry Celaya (pg.56). Purists might question why we include this topic in the Market Technician magazine, but I think you’ll find it informative and well written. Gerry’s book review (pg.65) of Steven Goldstein’s new book, ‘Mastering the Mental Game of Trading’, is also slightly off piste for a true blue technical analyst. As a trading coach and mentor Steven has many years of experience helping others learn how to trade and think like a professional.

Another research paper was submitted by Alex Spiroglou (pg.34); this is a continuation of his research printed in

the previous copy of this magazine, so you might want to refresh your memory before tackling this 22-page piece. He discusses his variation on the MACD (Moving Average Advance Decline) crossover system, taking into account the different levels of volatility experienced by various markets. The article has lots of clear, colourful illustrations and tables which are most helpful.

Interest in technical analysis continues to grow and is a worldwide phenomenon as evidenced by the varied list of names who have recently passed the STA Diploma Part 2 exam. Reasons for its popularity are many, starting with a loss of faith in economic modelling, charting packages increasingly accessible and a strong visual impact. I believe it might also be linked to the rise of get-rich-quick schemes promoted by trading companies. Because many are available via Apps on a smartphone, this delivery method has encouraged a new, younger cohort who are able to trade with ever smaller wagers. Patricia Elbaz’s interview with Neofytos Christodoulou (pg.62) gives you a flavour of the thinking; alternatively read the STA June blog article on the subject.

Most STA members who can use the MSTA designation after their name have achieved this via our Diploma course and passing the exam. However, chairman Eddie Tofpik has created a new designation, the Honorary MSTA , for those who have contributed greatly to the study and the diffusion of the subject. Commodities People’s Ben Hillary is the first in this category (pg.19). Eddie also explains the grandfathering process towards an MSTA. I think you’ll find the points system used interesting, and other professional groups granting certifications might also find it useful.

Towards the end of this issue is a lovely piece penned by Karen Jones about the classic mistakes (pg.64) people make when tackling technical analysis. In a way, this might be a warning to those new to the subject where ‘a little knowledge can be dangerous’. The warnings are not only hers, but there are contributions from Gerry Celaya and David Watts, all STA Board members.

If you’re interested in getting involved with the STA, please contact Katie Abberton at info@technicalanalysts.com with your queries and ideas, CV and any other material you think might be useful. If you’d like to make a presentation at one of our monthly meetings, send an outline of your proposed subject. Also, if you’d like to contribute an article to this magazine, please contact us with a brief description of your piece.

Take control of your position size with our new fractional OTC options

Trade options with zero commission1 on our award-winning online trading platform and app2

Speculate on popular indices across daily and monthly contract expiries, backed by market-leading technology

this provider. You should consider whether you understand how

or any of our

We are a legal consultancy that offer support for those dealing with legal issues

Specialising in Employment Tribunals, Consumer Law, Landlord and Tenant Law and Family Law, Affordable Law for You was set up by Deborah Aloba, a Fellow of the Chartered Institute of Legal Executives.

We assist by

• Reviewing and commenting upon legal documentation

• Assisting you to respond appropriately to communications in legal proceedings

• Preparing legal documents in a format required and accepted by the Courts

• Researching and providing relevant statutes and case law supporting your legal arguments

For further details visit our website or contact us direct: affordablelawforyou@gmail.com 07964 805 397

11 September 2024, National Liberal Club, London

Our second conference, from Classic Charting to AI developments, took place in April 2024

Stephen Hoad , CEO of The StopHunter, kicked off the conference and delivered an exceptional talk that ranged from Brussels sprouts to building trading systems. He shared his experience of assisting the UK’s largest fruit

and vegetable farmers in turning unconventional price data into a technical analysis tool, enabling them to optimise their buying and selling decisions. Hoad outlined a comprehensive seven-step process for building a successful systematic technical analysis trading system, covering everything from conceptualisation to real-world implementation and ongoing management.

In his talk, he emphasised the importance of mindset, strategy development, coding, data analysis, and future proofing. He stressed the need for a disciplined and objective approach, leveraging technical analysis and smart thinking to create effective trading strategies. He provided examples of how diverse data sources and technical analysis can be combined to develop profitable trading systems across various market conditions.

He also highlighted the significance of seasonality in trading, using examples like the Australian dollar’s relationship with Chinese demand and touched upon game theory principles and the use of Monte Carlo simulation for strategy testing.

Our second speaker was David Linton, the Founder and CEO of Updata . David delved into the intricacies of developing trading systems based on price objectives. He and his team at Updata have done something quite ingenious and applied time to point and figure charts. They sought to answer the question of when a price target was likely to be achieved once the point and figure signal is activated.

He began by addressing the perennial challenge of back testing such objectives, noting the subjective nature of many target price predictions and the difficulty in identifying when a target objective is failing.

David delved into the complexities of back-testing technical analysis techniques, mentioning the importance of understanding how different strategies perform in various market conditions. He also touched on the significance of money management in trading systems.

He talked about point and figure charts and the development of targets based on these charts. He emphasised the importance of time frames in technical analysis and the need to consider multiple perspectives when testing trading strategies.

David discussed creating rules to fit subjective trading concepts into a grid framework. He explained the four key elements of a lower low, thrust, pullback, and move higher, each with specific criteria. He discussed using different unit sizes for different time frames and the optimisation of units for better performance.

Targets in trading were discussed, including how they relate to patterns such as triangles and head and shoulders. David emphasised the importance of considering time and price factors in targeting, as well as clustering in price and time. He also mentioned using stop losses and optimising them, as well as developing pre-written commands for testing trading strategies.

Overall, David highlighted the significance of testing and back-testing trading strategies, particularly regarding targets, and expressed optimism about the insights gained from such testing.

Price Patterns

Cloud Charts

Point & Figure

Candlesticks

Trailing Stops

Flip Charts

Correlation

Seasonality - Cycles

Market Profile

Oscillators

ALMOST NEVER

Elliot Wave

Swing Charts

Moving Averages

... and a whole lot more.

Our third speaker was David Forino, Co-Founder, Simplify Trading who discussed Maximising Alpha and unleashing the Power of Meta-labelling in Systematic Trading.

He mentioned that, in trading, sizing positions accurately is often overlooked amid a focus on market direction. He described meta labelling as a technique that uses predictions from one trading strategy as labels to increase precision and guide position sizing.

With dynamic position sizing, the system can skip trades with low probability to reduce volatility and increase profits. It works in the following way: the trading strategy gives an entry signal – either long or short. Then the machine learning model will assign a probability to suggest a position size and only then the trade is placed. He provided several case studies.

We then had stalwart Trevor Neil, Managing Director, BETA Group and Jason Ramchandani, Lead Developer Advocate, LSEG/Refinitiv who gave a talk on eXplainable AI techniques, methods that are used to study various technical analysis indicators, using Python’s scientific computing ecosystem. Jason used it to explain what is driving the markets and then started to code live!

He went on to reveal that a lot of this information is freely available on their website developers.LSEG.com (yes FREELY AVAILABLE!). Jason showcased code snippets demonstrating the creation of technical analysis features and the modelling process, including hyperparameter tuning.

Overall, the talk delved into how XAI techniques can enhance understanding in technical analysis and provide insights into market behaviour. The list below is where to find further information: -

BETA Group Academy Refinitiv Developer Community: Articles Q&A APis UC Jason's Sample Notebook · Python Quants Video Training Series w/notebooks

Books

Python for Finance, Python for Algorithmic Trading, Artificial Intelligence in Finance The Python Quants

Python for Quant Finance Meetup Group (Virtual/Live)

Adam Hartley, Director, SnapDragon Systems, who has extensive experience in both fund management and trading psychology, shared insights on systematic trading pitfalls and tips.

Adam emphasised the importance of designing robust trading systems that can adapt to changing market paradigms. He drew on his experience as a fund manager, where he and his business partner designed strategies for one of the top global funds. Their strategies needed to meet high standards of acceptance, leading them to develop a sound philosophy for system design.

He discussed the concept of a “paradigm shift” in markets, where fundamental changes in market behaviour pose challenges for systematic trading. To address this, he recommends designing systems that are robust and likely to be profitable in future unknown market conditions.

Adam highlighted several key points:

1. Avoid Over-Optimisation: Minimise the number of parameters in your trading system to reduce the risk of overfitting.

2. Respect In-Sample/Out-of-Sample Testing: Be diligent in testing your system, ensuring that outof-sample performance is a true measure of its effectiveness.

3. Understand Parameter Space: Look for explanatory curves in parameter space to understand how your system might perform under different market conditions.

4. Blend and Diversify: Diversify across parameters, markets, asset classes, and countries to create a more robust system.

5. Trading Psychology: Andrew highlighted the psychological aspects of trading, emphasising that trading involves emotions such as fear of loss and desire for profit. He discussed how traders are psychologically wired to take profits quickly and let losses run, contrary to what is ideal for successful trading.

Diversification

Across parameters

Across markets

· Across asset classes

· Across countries

Overall, Adam’s talk provided valuable insights into the intersection of systematic trading and trading psychology, emphasising the importance of designing robust systems and understanding the psychological aspects of trading.

Then it was on to the Panel discussion, on the panel were:

Eddie Tofpik Head of Technical Analysis, ADMISI

Elizabeth Miller

Lead Commodity & Macroeconomic Analyst, Mars & Wrigley UK

Rustam Lam CEO, TradeStation International

Trevor Neil Founder, BETA Group

The panel discussion delved into the future of systematic trading, focusing on the increasing consumption of data and the growing accessibility of tools like APIs. Rustam pointed out how the democratisation of these tools over the past decade has led to double-digit growth in their utilisation. Overall, the panel foresaw a trend of accelerating data consumption driven by its accessibility and affordability.

The conversation also touched upon the profound impact of technology on financial accessibility and analysis. While technologies like Python have democratised financial tools, there is also a sobering recognition of the displacement of traditional roles by automation.

Hedging techniques emerged as a focal point, with discussions centring on advancements in risk management and the pursuit of more precise hedging strategies aligned with underlying assets. However, challenges persist –notably in assessing risks accurately due to limited data availability and thin market participation.

The role of AI in trading elicited varied perspectives. While AI has revolutionised data analysis and trading strategies, there are doubts about its ability to predict price movements accurately amidst the dynamic nature of markets. Moreover, there’s a nuanced discussion about the complementary role of human expertise alongside AI-driven automation, particularly in crafting sophisticated trading strategies.

Reflecting on the current stage of AI development, opinions ranged from cautious optimism to scepticism. While AI has made significant strides, there remains a consensus that it may not yet achieve the elusive goal of general intelligence.

In conclusion, the panel underscored the intricate interplay between finance, technology, and AI. As we navigate this evolving landscape, our members agreed that it’s imperative to strike a balance between harnessing technological advancements and preserving human expertise to navigate the complexities of financial markets effectively.

Victor Kouzmanov manages a systematic trading book at FreePoint Commodities, focusing on exchange-traded energy markets. The strategies heavily rely on technical analysis, with some fundamental aspects. Victor, with a background in physics and mathematics, emphasised understanding the underlying principles of technical analysis before delving into system building. He discussed order types, market mechanics, and the role of exchanges in trading. The presentation included a detailed explanation of the limit order book and how price changes occur based on order matching. Victor explored the concept of fair price discovery in markets, illustrating how traders’ perceptions influence price movements. Ultimately, he highlighted the importance of understanding market dynamics to navigate trading successfully.

Our keynote speaker Linda Raschke, a renowned figure in the trading world, has had a multifaceted career spanning various roles in the financial industry. She has been a CTA and a principal trader for hedge funds, in fact her own hedge fund achieved impressive success, ranking 17th out of 4,500 for Best Five-Year Performance by Barclay Hedge. Her early achievements were recognised by Jack Schwager in his “Market Wizards” book series.

Raschke has also authored “Street Smarts,” a widely popular book in the mid-90s, and in 2019, she released “Trading Sardines ,” which garnered acclaim. Her insights and expertise remain sought after, as she continues to trade professionally and immerse herself as a perpetual student of the markets.

1) Modeling helps to find basic tendencies of price behaviour that repeat. These allow us to create a consistent process that builds a foundation for the development of systematic strategies.

2) Market structure dictates where bigger risk can be assumed as well as when the environment is too marginal to make trades.

3) Market structure also can be used to define risk management strategies, including hard stops as well as when to trail a stop.

In the presentation, Raschke emphasised the importance of technical analysis. Reflecting on her journey, she highlighted her transition from the options market to futures trading in the 1980s, leveraging systems and principles like standard deviation functions. She noted the need for quantifiability and repeatability in trading strategies, rooted in a deep understanding of market structure.

Raschke’s approach is founded on modelling market tendencies and behaviours, drawing from historical principles articulated by figures such as Charles Dow, Ralph Elliott, and Richard Wyckoff. She stresses the significance of

expressing market phenomena numerically, enabling a more systematic approach to trading. Utilising swing highs and lows as key data points, she advocates for a structured, data-driven methodology for analysing market movements.

Through her presentation, Raschke underscored the importance of understanding market structure and employing quantitative methods to develop robust trading strategies. Her insights serve as a guiding light for traders navigating the complexities of financial markets.

Alan Dunne, Founder of Archive Capital, has an extensive background in financial markets, including roles at hedge funds and investment banks as a CIO, macro strategist, and technical analyst. With more 25 years of experience, including managing director at Abbey Capital, he now focuses on helping traders to raise money and manage their businesses effectively through Archive Capital. His expertise spans trading, technical and macro analysis, asset allocation, and manager selection.

In his discussion, Dunne emphasised understanding market dynamics and the evolving landscape of trading strategies. He highlighted the challenges traders face

when moving into money management and what allocators consider when assessing traders. Dunne discussed changes in the industry, such as the mainstream acceptance of quant strategies, and suggests that despite market changes, opportunities exist for traders who adapt their strategies accordingly.

Key points covered include the shifting market microstructure, raising capital, investor preferences, evaluation of managers, managing a business versus a trading book, career paths in finance, and the long-term commitment required to build a successful asset management business. Overall, Dunne underscored the importance of strategy, differentiation, and long-term dedication in navigating financial markets and building successful investment management businesses.

"Across our programs we want to deliver strong absolute return, low correlation or diversification to traditional assets and a stable level of risk. Now depending on the particular program and the way it is packaged that weight we put on each of these can vary."

Kevin Cole, Campbell

"The ride with trend following is so painful. It's painful for me as a manager. I can imagine for an investor, it may be even more painful... Therefore, I think we need to try to improve the Sharpe ratio, try to make some money when trend following doesn't work."

Svante Bergstrom, Lynx

Matt Buxton, Co-founder and CEO of FTP Capital discussed the process of creating trading systems, emphasising the importance of data as the foundation. He advocated for adding a “story” to the data, highlighting the significance of understanding why the system is being created. He introduced the concept of incorporating fundamentals into trading systems, explaining that it involves quantifiable and timely data rather than subjective information. The speaker contrasted the use of fundamentals with technical analysis, suggesting that both are essential components of their trading approach. They demonstrated how combining fundamental data, such as refinery margins, with technical indicators can improve trading systems. Overall, Matt presented a comprehensive view of their trading methodology, which integrates both fundamental and technical analysis.

To wrap up, attendees expressed their admiration for the speakers, with one remarking on meeting their heroes and another noting how the conference brought technical analysis to life. Kudos to the organisers, the Society of Technical Analysts (STA), and heartfelt thanks to sponsors CMC Markets and TradeStation International for their support since the conference’s inception.

Well done team for another excellent conference and looking forward to IFTA 2026, which we will be hosting in London.

Karen Jones, FSTA BSc FSTA, Treasurer

In the ever-evolving world of trading, the quest for consistent performance and resilience is a journey that every trader undertakes. Recognising this need, we are thrilled to announce the Society of Technical Analysts' new and innovative 'High Performance Trader' Learning Programme, designed to empower traders at all levels to enhance their skills, mindset, and overall performance.

The programme is a collaboration between the STA and the AlphaMind team, which includes Mark Randall and Steven Goldstein. Together, they specialise in enhancing the risktaking capabilities within trading organisations across the broad spectrum of markets.

This inclusive programme welcomes traders from diverse markets, ranging from traditional finance to equities, commodities, and energy, as well as emerging digital markets, encompassing both retail and professional participants.

At AlphaMInd, they emphasise that successful trading requires not only strong analytical skills but also a cohesive

risk process and the ability to execute that effectively in the complex and dynamic environments traders face. While the STA has historically focused on the former, this transformative learning programme will specifically address the latter.

The High Performance Trader Learning Programme is meticulously crafted to foster a deep understanding of the risk process and how our engagement with the markets affects us. This comprehensive programme dives into the essentials of trading mindset, risk awareness, and behavioural understanding—key areas often overlooked in traditional trading education. Its aim is to equip traders with the insights necessary to navigate the complexities of the markets confidently and to recognise how their reflexive interactions with the markets impact their decision-making and overall performance.

Spanning ten engaging sessions from March 2025 to June 2025, the programme combines theory with practical insights, ensuring a robust learning environment.

Themes explored will include:

1. Foundational Concepts: Powerful frameworks developed by AlphaMind over many years to contextualise trading and examine how individuals interact with risk and uncertainty.

2. Deeper Understanding of Markets: Participants will learn more about market dynamics, inner game factors, and how these elements affect our trading decisions and behaviours.

3. Trading Approaches: We will explore various trading methods and approaches, examining how these different approaches specifically impact our personal psychology and mindsets.

4. The Trader’s Playbook: A unique component that emphasises the creation of a personal playbook, aligning trading strategies with individual values and risk tolerance.

5. Performance Process Cycle: Core to the programme will be this powerful framework which breaks down the trading process into manageable phases, from ‘Being’ to ‘Production’ and ‘Performance’.

6. Understanding Ego Impact: Exploring how ego influences decision-making, performance outcomes, and emotional resilience in trading environments.

7. Emotional Self-Awareness under pressure: Developing awareness of emotions during high-pressure situations to enhance decision-making and performance in trading.

8. Developing the key Performance skill of Letting Go: The ability to Let go is a rare gift and deeply undervalued gift that allows traders to release emotional attachments, enhance focus, develop adaptability, and drives overall performance success.

By combining interactive discussions, breakout exercises, and self-reflection activities, the High Performance Trader Learning Programme fosters an environment of shared learning. Participants will connect with like-minded traders, exchange valuable insights, and cultivate a network of support.

Success in trading isn’t just about strategies and market knowledge; it relies heavily on one's mindset and the ability to adapt to rapidly evolving market conditions and constant changes. With this programme, we aim to empower traders to not only conquer the markets but also overcome their internal challenges.

If you’re ready to elevate your trading performance and improve your chances of achieving your potential as a trader, the High Performance Trader Learning Programme is designed for you. Join us and embark on a transformative journey that could redefine your trading career.

Don’t miss this opportunity – There will be only 25 places avaialble, on a first come first serve basis.

Click

Aiden O’Donnell Principal at Bespoke Technical Analysis

On 9 May 2024 I had the honour of being a speaker at the Dublin Chapter of the STA. It was a pleasure to be asked by Alan Dunne MSTA, Head of the STA Irish Chapter, and it was great to see such a strong attendance at our first event in Dublin for many years.

Bespoke Technical Analysis is a boutique technical analysis research provider. We work with clients to supply all their technical analysis needs across a wide variety of asset classes.

The title of the presentation was ‘Technical analysis throughout the research process’ and what we delved into was the multiple uses of chart analysis at various points in the investment life cycle. We tried to push back on the comment that we often hear: “I don’t use technical analysis, but I will always look at a chart before I put on a trade”. We argue that the earlier you use it the greater the potential impact - irrespective of the asset class one is operating in.

Throughout our work we incorporate a ‘slow to fast’ approach to analysing any asset class. Starting slow and using as wide a lens as possible in our view is a far better starting point than beginning with the most recent price data. From a fundamental point of view, we see this as akin to understanding the balance sheet of a company. In the case of an equity, rarely will you see a good company with a poor long-term chart. If the goal is to find the strongest companies – a regular scan of monthly price charts is an excellent starting point.

Moving to a weekly timeframe offers the best of both worlds. This for us is the ‘cash flow statement’. You start to get more real-time information about the stock and begin to see where the clear points of support and resistance sit. This frequency also helps to identify where the prevailing trend sits and you immediately begin to understand what type of stock it is and what the volatility profile looks like. Paying attention to the really key long-term pivot points can help greatly as one looks to move towards the final phase of the analysis.

The fast stage is obviously onto a daily timeframe or shorter if you prefer. At this point, having gone through the slower phases you will have a very good understanding of the type of name you are looking at. The final stage is the income statement. Here you learn more about the day-to-day movements of the stock. You will clearly see where the short-term support and resistance is and using some basic tools like moving averages or and RSI will aid one’s analysis.

The above will seem very simplistic to most but, as we argued on the night, keeping it simple is often the best approach. We are inundated with new indicators and tools that undoubtedly have some use but in our experience this ‘slow to fast’ approach stands up very well over time and is an excellent resource for anyone who is trying to screen for new ideas.

The new Honorary Member category introduced by the STA in November 2023 is a prestigious designation reserved for individuals who may not possess the usual STA member qualifications but have achieved exceptional recognition and status both within their own professional domain and in their support of technical analysis and the STA specifically.

The criteria for being considered for this honorary title include:

• Highest standing in their field: The individual must be a distinguished figure known for their significant contributions and leadership within their professional area.

• Recognition in the Financial Community: They should be well-regarded in the financial community, demonstrating a deep understanding and influence in financial matters.

• Supporting Technical Analysis and the STA: Their approval as an Honorary Member should bring considerable benefits to the world of technical analysis and specifically enhance the reputation and objectives of the STA.

STA Chairman, Eddie Tofpik, was delighted to bestow the first honorary membership on Ben Hillary at the Commodity Trading Week event in April.

Ben is the Managing Director and Founder of Commodities People – organisers of the largest and most significant dedicated energy and commodity trading forums in the world, for front, middle, back office and technology leaders. Having spent the last 20 years in this sector, Ben is deeply passionate about commodity and energy markets.

Ben’s support of the STA has been exemplary, and we are thrilled to have him join our community.

The grandfathering process enables experienced technical analysts to become full members of the STA without undergoing our exam process.

The STA’s goal is to spread knowledge of technical analysis, and each member contributes value to our organisation. Some analysts have extensive experience but may not have joined the STA earlier due to time constraints or because they hold foreign qualifications.

The grandfathering process ensures all candidates, regardless of their background, follow the same procedure. Notably, even renowned analysts like Perry Kaufman have undergone this process, emphasising our commitment to fairness and uniformity.

The committee comprises Karen Jones, FSTA, and Anne Whitby, FSTA. Both are long-standing STA members with extensive experience in various technical analyst roles and STA board positions (Anne is a former chairperson).

The criteria were recently re-evaluated to give more weight to academic experience. IFTA members can also join the STA if they have passed the CFTe exam, thanks to our reciprocal agreement with IFTA, of which we are founding members.

• CMT Qualification

The points awarded for a CMT qualification have increased due to its rigorous assessment of technical analysis knowledge. However, it does not cover Point and Figure or Gann, leading to a different points allocation.

• Financial Degree

The points awarded for holding a financial degree have been increased.

1. Application Interested candidates should contact the STA admin office with their CV and work examples.

The grandfathering committee reviews the application. Candidates must accumulate 120 points based on specific criteria listed below.

The committee makes a recommendation to the board, which then votes on the application.

By following these steps, experienced analysts can gain STA membership through a streamlined and fair process.

1. Any candidate for grandfathering must be proposed by the grandfathering committee and be approved by the Board.

2. No candidate who has failed the diploma exam can be grandfathered.

3. Candidates must supply a CV, and this is then scored to see whether they have sufficient knowledge and experience of working in the field of technical analysis to warrant being grandfathered.

4. The framework for the criteria and points system are as follows:

a

b

e

Charlie Morris is the founder and chief investment officer at ByteTree . He is the lead portfolio manager and develops both crypto and traditional investment strategies for ByteTree. He has 25 years of experience in fund management and is best known for his expertise in alternative assets, notably Gold and Bitcoin.

I have been a member of the STA since 1999 and have the privilege to sit on the investment committee. Having spoken at various STA events over the years, this time, I will explain why I created the BOLD Index, a strategy that brings Bitcoin and Gold together.

Back in 2015, I built a simple Bitcoin valuation model based on the value of the network. It was a simple idea; Bitcoin was a digital monetary network, designed to transfer value securely and without a bank. My thesis was the more value the Bitcoin network transferred, the more valuable it would become. At the time, Bitcoin was trading at $320 and my fair value was $386 and rising. Today, it trades above $60,000, with a fair value of $64,123, having recently experienced the August flash crash. That follows a remarkable journey since its creation in 2009. New technologies thrive on adoption. In the early days, Bitcoin would rally on news that a coffee shop accepted payment in Bitcoin or on a minor celebrity endorsement. Anything that spread the word was deemed to be bullish. But things soon progressed, and today, the main driver is the billions of dollars flowing through the ecosystem. This now includes the Bitcoin ETFs, which echoes what happened to Gold in 2003.

The first Gold ETF was launched in Sydney. I remember the news coverage at the time, and it was a relatively quiet affair. Later that year, the next Gold ETF was launched in London, at which time the price was 25% higher, and investors took note. Then, a year later, GLD was launched in New York with great fanfare, paving the way for a lasting bull market. Recall that prior to the Gold ETFs, it was hard for investors to buy Gold in a liquid form. The ETF was transformational.

Source: Bloomberg Gold ETFs Created a New Source of Demand

Notice how the Syndey launch marked a low, the London launch market the tail end of a rally, and in New York, a top that lasted for a year. Fast-forward a decade to 11 January 2024, and history repeats itself. After ten years of debate, the SEC finally gave the green light, and nine Bitcoin ETFs were listed on the New York Stock Exchange by firms such as BlackRock, Fidelity and 21Shares. Bitcoin is on its way to becoming electronic Gold.

ETFs Created a New Source of Demand

Source: BOLD.Report

Although Bitcoin ETFs had existed in Europe since 2015, the great US market was untapped, and the launch saw another 250,0000 BTC scooped up by investors. Despite the Bitcoin “halving”, where the new supply halves, on 20th April, the price peaked on 13th March. The US ETFs were such a hyped event, they caused the bull to stall.

I have been studying and writing about Gold for 25 years and Bitcoin for 11 years. At heart, I’m more of a gold bug than a Bit coiner. They both interest me because they perform similar roles, which is to protect investors from monetary inflation. They are both alternative assets that sit outside the formal financial system. In addition, they have a limited supply, which protects them from the central banks, who perpetually print money.

Currently, has new supply growth of approximately 1.8% per year, but since halving, the new Bitcoin supply growth has settled at 0.9% per year. This is hardwired into the code and cannot be altered, which also means that Bitcoin will become scarcer than Gold over time.

One of the main benefits of holding alternative assets, such as Bitcoin and Gold, is to have exposure outside of the financial system, as it boosts portfolio diversification. This is the specialist subject of macro hedge fund manager Ray Dalio. A few years ago, he said, “I would take the Gold and sprinkle a little Bitcoin in the mix too.”

Dalio is a master investor, having created his “all-weather” portfolios combining bonds and equities with leverage. Personally, I’d rather leave the leverage for others, but Dalio remained successful because his company understood portfolio construction. In normal circumstances, bonds rise when the system is under pressure, while equities rise when things are going well. That all makes sense except for one thing. With government bond issuance so high and inflation still a longer-term concern, bonds are no longer the safe asset they used to be.

Over the past decade or so, Bitcoin cycles have broadly followed stockmarket cycles, especially tech stocks, while Gold has had more in common with bonds. Just as bonds and equities have traditionally been combined in portfolios to reduce risk, you can do the same with Bitcoin and Gold. The advantage is that you get the best of both worlds because Gold prefers risk-off, while Bitcoin prefers risk-on. Investors seeking protection against monetary inflation should turn to Bitcoin and Gold, which I call BOLD.

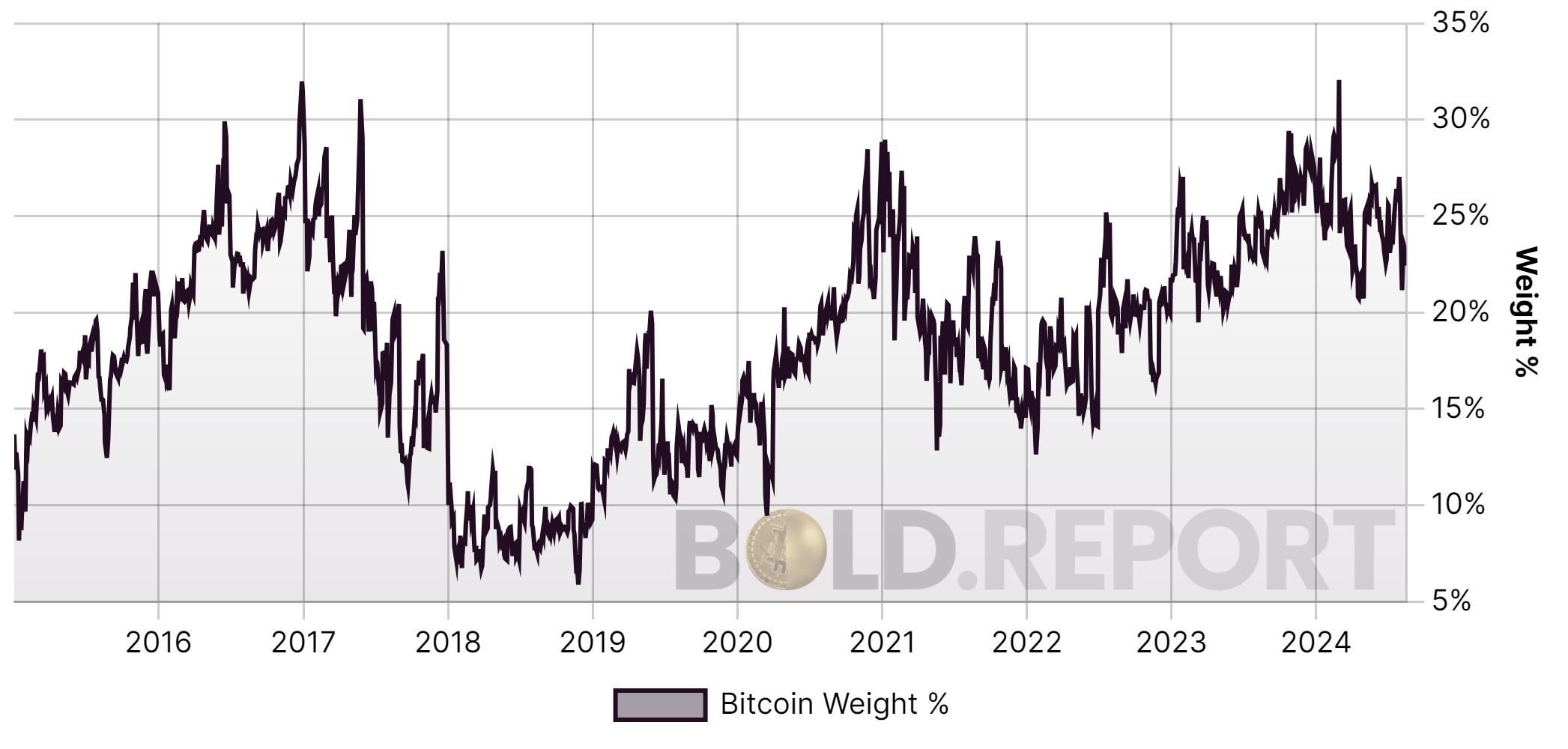

BOLD is a simple idea where you seek to hold the same amount of “risk” in each asset, as opposed to the same amount of money. The allocation is determined by past price volatility, and the least volatile asset has the higher weight.

Bitcoin Volatility Has Been Falling, Gold Is Stable

Source: Bloomberg

Obviously, that’s Gold, and it currently has approximately 75% in the BOLD Index, leaving 25% for Bitcoin. Risk-weighting means that for every $100 invested, you stand roughly the same chance of making or losing $10 in either asset. Risk-weighting is a powerful investment tool as it embraces the wisdom gathered by the signal given by medium-term volatility. BOLD is rebalanced each month, which returns it to these target weights calculated from the inverse of the 360-day volatility. This example was the rebalancing that took place at the end of July 2024.

The monthly target weight soon changes as there is normally significant dispersion between Bitcoin and Gold over the course of the month.

Rebalancing two counter-cyclical assets creates an opportunity, as the next rebalance reduces exposure to the best performer and adds to the worst. In old money, we call that buy low, sell high; something dear to technical analysts. Over time, this approach has added value to the tune of 5% to 7% per year over and above buying and holding Bitcoin and Gold without frequent rebalancing.

Consider the benefits of holding the BOLD strategy over buying and holding Bitcoin and Gold without a strategy. The benefits come in three parts:

• Risk-weighting has led to lower exposure to Bitcoin during bear markets when it has had higher volatility.

• Rebalancing transactions accumulate the weaker asset, which means the strategy is up to weight when the market turns. Failure to rebalance means too much exposure to the asset at a top, and too little to the asset at a bottom.

• Finally, BOLD has a state of calm with only slightly higher volatility than Gold itself. Contrast that with Bitcoin, which is more than twice as volatile.

BOLD’s Volatility Is Slightly Higher than Gold’s

Source: Bloomberg

Many suspect that holding BOLD means lower returns, but that might not be the case. Since the excitable Bitcoin's all-time high in 2017 ($19,041), the returns of Bitcoin and BOLD have been roughly the same. Clearly, Bitcoin wins the rallies, and Gold the slumps, but it seems to be a long-term game of the hare and the tortoise.

Bitcoin, Gold and BOLD Since the 17 December 2017 BTC High

Source: Bloomberg

Over this period (17th December 2017 BTC high to 14th August 2024 day of writing), Gold is up 96% and Bitcoin 220%. Had you held 25% in Bitcoin and 75% in Gold, you’d have made 127%, yet BOLD has made 221%, which is 94% better, and

matched Bitcoin with a fraction of the volatility.

BOLD has demonstrated consistent outperformance from Bitcoin's high points, but it goes without saying that Bitcoin wins if you know where the lows are. Yet, even if you could do that, it’s a high-risk trading strategy, whereas BOLD is a calm buy-andhold asset mix, requiring zero thought, luck, or skill.

BOLD also has a habit of beating the stock market despite the savage Bitcoin bear markets, which Gold is not exempt from either. Both assets prefer inflation to deflation, but Gold thrives when the world is going to hell, while Bitcoin thrives when the animal spirits are raging. It is a powerful and highly complementary combination.

Not only has BOLD comfortably beaten the world index total return over the last five years (black), but the alpha has also come when the VIX has spiked (green). That makes it a defensive asset mix, because it beats the stock market when it is going down, supported by a low correlation to equities and a hefty weight in Gold. I believe that both Bitcoin and Gold investors are better off by embracing BOLD.

Sign up to receive my free monthly updates to help you rebalance your Bitcoin and Gold, and please visit BOLD.report for detailed analysis and access to the full dataset. The 21Shares ByteTree BOLD ETP trades on the Swiss SIX Exchange, with listings in Germany, France, and the Netherlands under the ticker BOLD.

DAVID MCMINN

David McMinn completed a Bachelor of Science degree at the University of Melbourne in 1971 (Geology major) and subsequently became a Minerals Economist in ANZ Banking Group Ltd . Since leaving this position in 1982, he has conducted private research on cycles arising in seismic and financial trends, publishing numerous papers on cycle theory, especially in relation to the 9/56-year cycle.

According to the election cycle theory, the US stock market follows a four-year cycle, based on presidential elections. This theory was first proposed by Yale Hirsch, founder of Stock Traders Almanac. He observed US indexes performing worst in the first year of a presidential term, then recovering and peaking in the third year before declining in the fourth. The trend was repeated with the election of the next president. Under this scenario, markets perform best in the second half of a presidential term.

The four-year stock market cycle is well supported by the evidence. The problem becomes determining the causal basis of the cycle.

Verdouw (2024) assessed the four-year election cycle over the 1950-2023 era for the S&P 500 and produced the following results:

Hirsch (1999) believed the presidential election cycle worked so well because presidents want to be elected - and thus they boost the economy in pre-election and election years. After winning office, this is a less overriding concern, making them more likely to take risks:

“Wars, recessions and bear markets tend to start or occur in the first half of the term, prosperous times and bull markets in the latter half.”

Some 17 DJIA lows fell in the four-year cycle, shown in Table 1, in contrast to an expected 9.5 (significant p < .01). The lows were consistently recorded: • between 1962 and 1982 for the four-year cycle;

• between 1966 and 1998 for the eight-year cycle; and

• between 1942 and 2022 for the 20-year cycle.

All these occurred in Year 2 of a presidential term, thus accounting for the poor returns in the mid terms. This four-year cycle was only evident in the post 1930 era, possibly due to secular trends in US equity prices for which there is some evidence (McMinn, 2019).

Table 1: The Four-Year Cycle and DJIA Bear Market Lows 1886-2022.

(a) For the years 1929 to 1933, the bear market was taken as occurring between 3 September 1929 and 8 July 1932. This was to avoid distortions arising from the extreme volatility recorded in a short period of about four years.

Between 1962 and 1990, the ending of bear markets nearly always had lunar phase around the 3rd quarter Moon at between 245 and 295 Ao (see Table 2). The exception was the low of 19 October 1987 (324 Ao), which was only slightly out by 30 o. They also repeated in a well-defined four-year cycle (apart from 1987), which was widely appreciated in financial forecasting during the 1990s.

The series may be extended, as the correction low of 4 April 1994 also had lunar phase near the 3rd quarter Moon (289 Ao). The lows of 31 August 1998 (107 Ao) and 9 October 2002 (046 Ao) marked the end of the 3rd quarter Moon effect. The year 2002 also was the end of the four-year cycle of DJIA lows. NB: Ao denotes the angular degree between the Moon and Sun as viewed from Earth (lunar phase).

* Correction low.

NB: One lunar month is the time interval between two successive new moons and is equivalent to 29.53 days. Lunar month is abbreviated to Ln Mth in the table. Source: McMinn, 2022.

From the four-year cycle in Table 1, the most interesting series took place in a 28-year cycle, repeating every 4, 4, 20 years (see Table 3). A DJIA bear market low occurred in 12 of the 15 years in the cycle since 1900, compared with an expected figure of about four years.

Table 3: The 4/4/20 Year Cycle and DJIA lows.

The 9/56 year cycle consists of a grid with intervals of 56 years on the verticals (called sequences) and multiples of nine years on the horizontal (called subcycles). Various financial factors clustered with high significance in these grid patterns, such as:

• the timing of major US and Western European financial crises 1760-1940 (McMinn, 2021)

• beginning and ending of DJIA bear markets 1886-2022 (McMinn, 2022)

• DJIA annual one day falls 1886-2022 (McMinn, 2023)

The 9/56 year grid can in turn be linked intimately to Moon Sun cycles (McMinn, 2021)

Appendix 1 shows the four 4/56 year grids based on the presidential election cycle. Clearly, there is an over emphasis of DJIA lows in the mid terms. Nothing similar could be repeated for the highs at the beginning of DJIA bear markets for whatever reason, and how the 4/56 year grids integrate with the overall 9/56 year cycle is unknown.

Appendix 2 shows compilation of the 38 DJIA bear markets since 1886.)

There are two options to account for the four-year cycle in US equity prices:

• The four-year presidential election cycle impacts directly on feelings of optimism and thus trading outcomes. This is the generally accepted explanation in mainstream economics.

• Moon Sun cycles influence mass psychology, resulting in the four-year pattern in DJIA trading activity.

We prefer the latter explanation. The timing of DJIA bear market lows has been correlated with:

• the 9/56 year lunisolar grid 1886-2023 (McMinn, 2022);

• lunar phase and the associated secular trend 1885-2023 (McMinn, 2019); and

• lunar phase for the four year cycle 1962-1990 (see Table 2).

Such findings supported the Moon Sun Hypothesis that viewed markets as being mathematically structured in time and moving in tune with changing Moon Sun cycles. The presidential election cycle and the four-year cycle of DJIA lows may best be viewed as parallel trends rather than the former being the causal influence in the timing of the latter. Two cycles of the same length need not necessarily be interrelated. As noted by Cook (2024):

“the [election cycle] theory rests on an outsized estimation of presidential power. In any given year, the equity market may be influenced by any number of factors that have little or anything to do with the top executive. Presidential sway over the economy is also limited by its increasingly global nature. Political events and natural disasters, even on other continents, could affect markets in the United States.”

Bespoke Investment Group (2008) Historical Bull and Bear Markets for the Dow: 1900 - Present. Available here

Cook, J. (2024) Presidential Election Cycle Theory: Meaning, Overview, Examples. Investopedia. Available here

Durden, T. (2014) August 1914, When Global Stock Markets Closed. Available here

Hirsch, Y. (1999) The Stock Trader’s Almanac. Hirsch Organization. ISBN 9781889223-88-5

McMinn, D. (2019) DJIA Bear Market Lows & Lunar Phase. Market Technician, STA Journal 86 pp 27-33.

McMinn, D. (2021) 9/56 Year Cycle & Financial Panics. Cycles Magazine 50(4): pp 31-51.

McMinn, D. (2022) The 9/56 year cycle & DJIA bear markets. Market Technician, STA Journal 92 pp 29-35.

McMinn, D. (2023) DJIA annual one day falls, lunar phase & the 9/56 year cycle. Market Technician, STA Journal 94 pp 30-37.

Verdouw, M. (2024) Presidential Cycles. Optuma. Available here

US Presidential Cycle, DJIA Bear Market Lows and the 4/56 Year Grids 1886-2024.

The 56-year sequences are separated by an interval of four years on the horizontal.

Years highlighted in red experienced a DJIA bear market low.

NB: The 56-year sequences have been numbered in accordance with McMinn (2021), with 1817, 1873, 1929, 1985, being denoted as Sequence 01, 1818, 1874, 1930, 1986 as Sequence 02, 1819, 1875, 1931, 1987 as Sequence 03 and so forth.

Bear Markets Since 1885 (a) (b)

A bear market is usually defined as a DJIA decline of over -20% that was preceded by a rise of over +20%. However, five DJIA corrections were included as they recorded declines from -18.5% to -19.9% and thus almost qualified as bear markets. These have been denoted by a #.

* Inserted by the author.

a. Based on the closing value of the DJIA, not the intra-day low.

b. The 1886-1895 data based on the 14 Stock Average and 12 Stock Average indexes.

c. A percentage decline could not be calculated, as the 1895 high was based on the 12 Stock Average and the 1896 low on the DJIA.

d. Due to the outbreak of WWI, the NYSE was closed from 30 July to 12 December 1914, although stocks were still quoted by brokers and traded off the exchange. Global Financial Data calculated the average of the bid and ask prices from 24 August to 12 December and found that the 1914 bottom occurred on 2 November when the DJIA hit 49.07 (Durden, 2014). This was accepted as the 1914 low.

e. The early 1930s market collapse was taken as occurring from 3 September 1929 to 8 July 1932, even though it was broken down into several bear markets for the years 1929 to 1933 by Bespoke Investment Group. This was to avoid distortions arising from the extreme gyrations in US stock prices during a short period of about four years.

source: Bespoke Investment Group (2008).

This research paper won the CMT Charles H. Dow award in 2022 and the National Association of Active Investment Managers 1st Place Founders Award in the same year. The STA is pleased to be able to publish the research over two Market Technician Journals.

Alex Spiroglou is a semi-systematic, cross-asset proprietary futures trader. His involvement with capital markets began in 1998, having worked for various proprietary trading and investment management firms in the UK and Greece. He is currently trading his own book, and is active in all major liquid futures markets, across all major asset classes

This paper focuses on the study of momentum using a very popular technical analysis indicator, the Moving Average Convergence Divergence (MACD), created by one of the most respected analysts of our time – Gerald Appel (Appel, 2005). The original paper consisted of six parts; sections four to six are published here.

Average true range (ATR) is a technical analysis volatility indicator originally developed by J. Welles Wilder, Jr. for commodities.

The true range indicator is taken as the greatest of the following: Current high less the current low. The absolute value of the current high less the previous close; and the absolute value of the current low less the previous close.

The indicator does not provide an indication of price trend, simple the degree of price fluctuation.

The average true range is an N-period smoothed moving average (SMMA) of the true range values.

4.1 Construction

Since “normalisation by price” results in cross market momentum valuation discrepancies due to differences in volatility, it would be preferable to normalise by volatility itself.

As the tool for the measurement of volatility, we will be using Welles Wilder’s Average True Range (ATR).

Thus, the MACD line formula now becomes:

In order to distinguish the new indicator from the classic MACD, I have added a “V” to the original name, MACD-V, rather than creating a new name, so as to honour the original inventor.

The output of the indicator is the amount of momentum a security has, that is in excess of its average volatility, expressed as a percentage. We are measuring directional strength, “purified” from volatility fluctuations.

Let us now examine how the new MACD-V measures up against the five shortcomings of the classic MACD.

We first explore how the MACD-V behaves across time for the S&P 500.

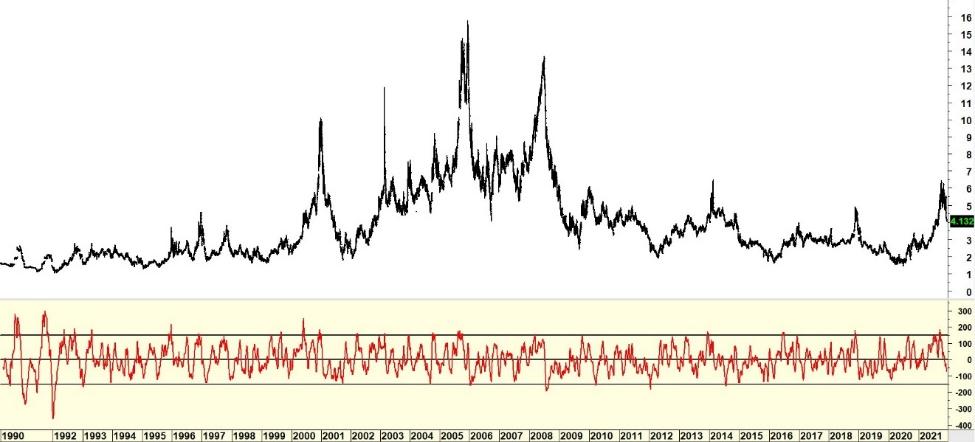

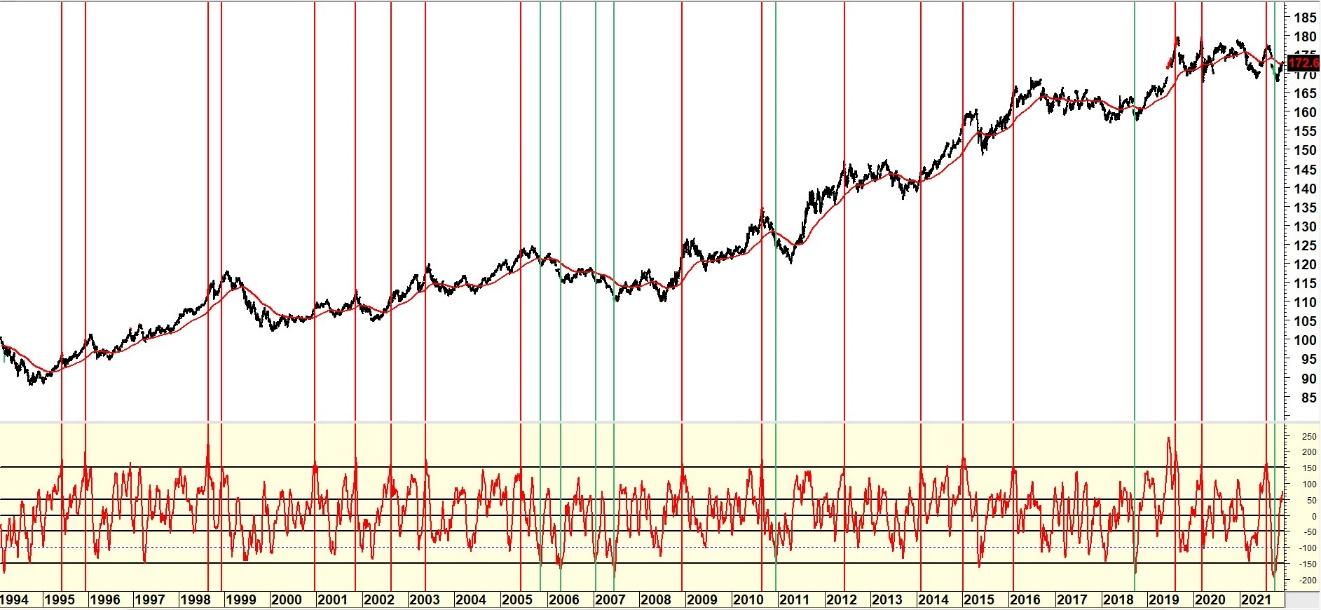

Chart 8: S&P 500 and the MACD-V (1975 - 2021)

It is easily seen that MACD-V fluctuates within a finite range of a values around its equilibrium line (similar to the PPO’s behaviour). Any indicator reading discrepancies across time have been eliminated – again – by normalisation.

MACD-V readings are time stable (comparable across time).

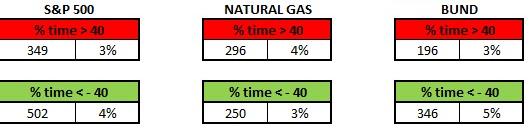

If we try to find the range where 95% of the data fluctuate, and define the rest as “extremes”, then since February 1975, for the S&P 500 the MACD-V has oscillated between 150 and -150.

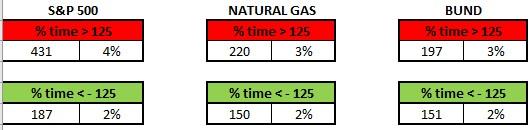

Table 5: MACD-V Ranges (S&P 500)

So, will the MACD-V succeed where the PPO failed? Does the range of 150 to -150, also hold 95% of the MACD-V values for other markets?

First, we look at charts of the German Bund and Natural Gas futures and the levels. The range of fluctuations for the two MACD-Vs is considerably more uniform than when comparing the equivalent ones for the two PPOs. They essentially oscillate the same amount around the equilibrium line, as differences in volatility have been eliminated.

Slight and sporadic extremes are strictly attributable to strong momentum (prolonged moves in a particular direction), since the MACD – at its core – is a boundless indicator.

All three markets share similar exhaustion levels (when momentum is 1.5 times its volatility), despite the fact that they have completely different absolute volatilities in general. In addition, the Min and Max values differ for each market since the MACD-V is a boundless indicator, and not constrained by a, say, 0-100 scale.

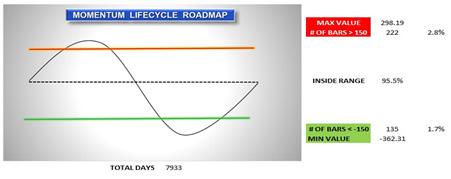

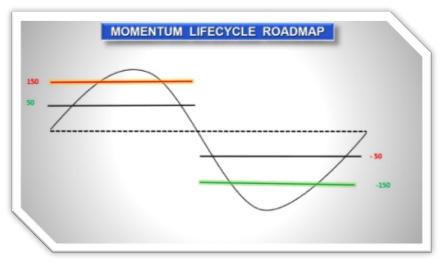

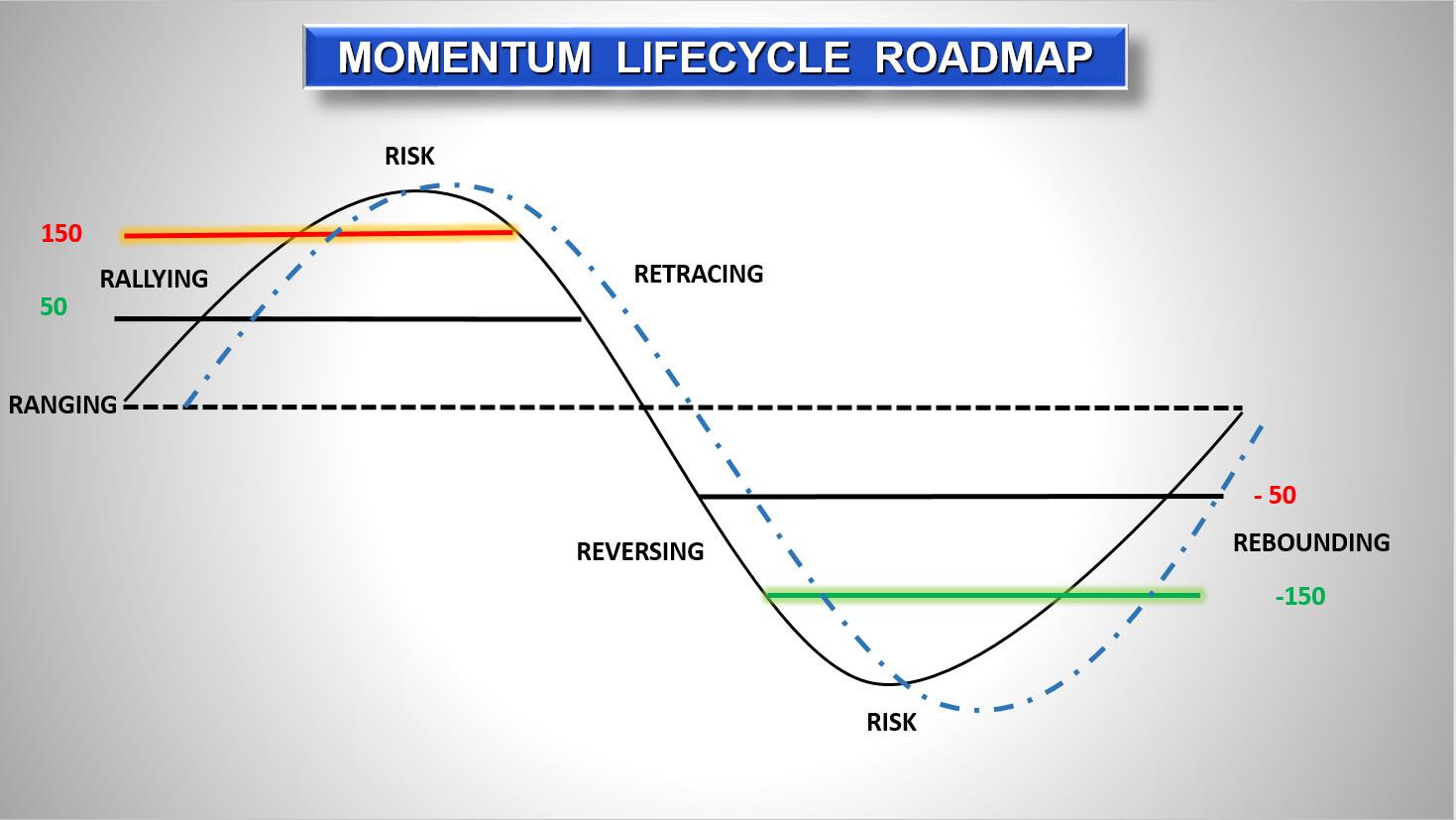

4.4.1 MACD-VRanges

Since MACD-V readings are comparable across time and markets, that means that we can create a Momentum Lifecycle RoadMap, that will rank both momentum’s direction (“bullish” or “bearish”), and strength as well (“low” vs “high” momentum, and “overbought” vs “oversold”). However, since the MACD-V is an unbounded indicator, it will have the added advantage that it will not be limited by the scaling boundaries (0-100) of conventional oscillators, and thus will avoid the problem of “pegging” at high levels.

OBOS (extreme) Momentum:

When the market has advanced too far, too fast, the EMA spread will reach a point where historically it becomes unsustainable to progress any further in the short to intermediate term. This should be around 5% of the data, and is located when momentum is 1.5 or -1.5 times its volatility.

Strong (High) Momentum:

When the market begins to gain some directional strength, then distance between the two EMA’s (12 & 26) begins to increase, as the shorter EMA is being driven away from the longer one, and thus the MACD-V would move significantly away from the equilibrium line. This should be around 35-40% of the data, and is located when momentum is over +0.5 or -0.5 times its volatility.

Weak (Low) Momentum Range:

When there is little directional conviction (low momentum), the MAs (12 & 26) should be relatively close, and thus their spread (MACD-V) should be close to zero, the equilibrium line. This should be around 45- 50% of the data, and is when momentum is between 0.5 or -0.5 times its volatility.

Based on this framework, we can test the objective momentum levels that would hold across securities, using the MACD-V.

Using data since 1975 (11,817 days) for the S&P 500, we observe that the index has been above the overbought benchmark (>150) around 4% of the time and below the oversold level (-150) around -1% of the time, reflecting the “upward drift” (bullish bias) of the market. The time spent between the “neutral zone” that is close to the equilibrium line (50 to -50) is around 45% of the time. Finally, time spent on the strong momentum zone (50<x<150 & -150<x<-50) is 36% and 14%, respectively, reflecting the bullish bias for the S&P 500.

Using data on the German Bund (a fixed income market with different volatility characteristics), we observe that the data that fall into the aforementioned brackets are roughly the same with the S&P 500.

Table 11 reflects the data for natural gas, a market with completely different trend and volatility DNA. However, the data support that again we have achieved a unified definition of “fast vs slow vs overbought/oversold” without having presented boundaries to the values that the indicators can have (eg. RSI, etc).

The extreme levels (>150 & <-150) capture roughly 5% of the data in the market again, while the “fast” range (50-150 & -50 to -150) is around 50% of the data.

Based on this framework, we can test the objective momentum levels under different Trend Regimes and across markets.

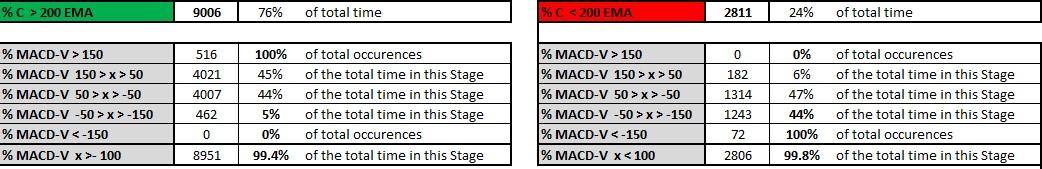

Trend

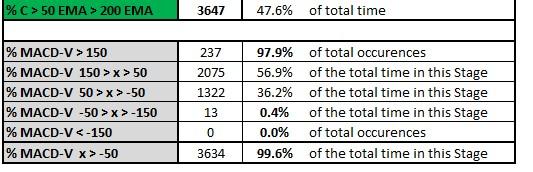

If we were to dissect the MACD-V data by a basic trend rule (above or below a 200 EMA), we would see that the S&P 500 stands above the EMA 76% of the time, (i.e having an “upward drift”, bullish bias) and 24% below. Let’s examine how the MACD-V behaves in each of these conditions. A similar concept (observation) has been suggested by Andrew Cardwell (RSI range rules). Thus we keep the same term (range rules) to study the behaviour of the MACD-V.

All of the occurrences (100%) of the MACD-V reaching the overbought range have been recorded in the Bullish Stage, and it has never reached the oversold level while over the 200 EMA. While in the Bullish Stage, 99.4% of market action is contained with readings of the MACD-V > -100. If we observe the data more closely, 5% of the data on the downside are captured within the -50 to -150 range, thus becoming the “new” oversold level while the market stands above the 200 EMA. As long as the market stays above the 200 EMA, we would not expect it to fall below the -100 range of the MACD-V.

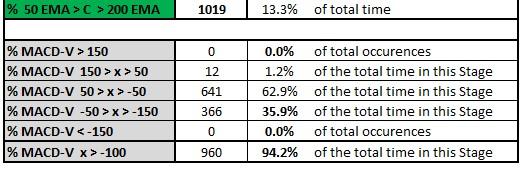

Analogous behaviour is observed on the Bearish Stage (< 200 EMA) as there are zero occurrences of the indicator reaching the overbought range (>150), and 100% readings of the oversold range. While in the Bearish Stage, 99.8% of market action is contained with readings of the MACD-V < 100, which is a quite similar number to the Bulls (99.4%).

Thus, while the market is bearish (< 200 EMA) we would expect a maximum stretch, until the MACD-V reaches the 100 level (Bear Market Rally).

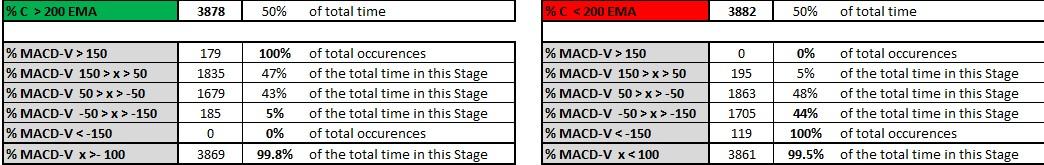

and Trend Regime Filter v.1 (Bund, 1991 – 2021)

Table 13 displays the data for the Bund. A market with different trend characteristics (i.e. > 200 EMA 67% of the time vs 76% of the time for the S&P 500) and certainly different volatility DNA. However the same observations (range rules) can be made.

While the market is in the Bullish Stage (> 200 EMA) it has 100% of the occurrences of overbought readings (>150), 0% of the oversold readings (<-150), and 98.9% of the data are captured by the >-100 level. Thus – much like the S&P 500 – any Bull Market decline can be expected to stop at the -100 MACD-V level (if the market is to stay above the 200 EMA).

Symmetrically for the Bearish Stage, it has 100% of the occurrences of oversold readings (<-150), 0% of the overbought readings (>150), and 99.8% of the data are captured by the <100 level. Thus –similarly to the S&P 500 – any Bear Market rally can be reasonably expected to stop at the 100 MACD-V level (if the market is to stay below the 200 EMA).

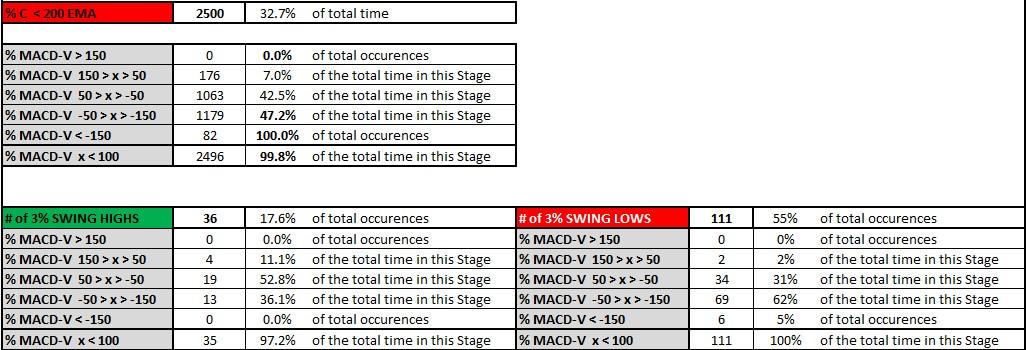

The data for NG are even more compelling, as this market has completely different trend characteristics (spends an equal amount of time in Bullish/Bearish Stages, each one is 50% of the data) and is considerably more volatile than the aforementioned ones. However, the exact same observations (range rules) can be made.

While the market is in the Bullish Stage (> 200 EMA) it has 100% of the occurrences of overbought readings (>150), 0% of the oversold readings (<-150), and 99.8% of the data are captured by the >-100 level. Thus –similarly to the S&P 500 – any Bull Market decline can be expected to stop at the -100 MACD-V level (if the market is to stay above the 200 EMA).

Symmetrically for the Bearish Stage, it has 100% of the occurrences of oversold readings (<-150), 0% of the overbought readings (>150), and 99.5% of the data are captured by the <100 level. Thus – similarly to the S&P 500 – any Bear Market Rally can be reasonably expected to stop at the 100 MACD-V level (if the market is to stay below the 200 EMA).

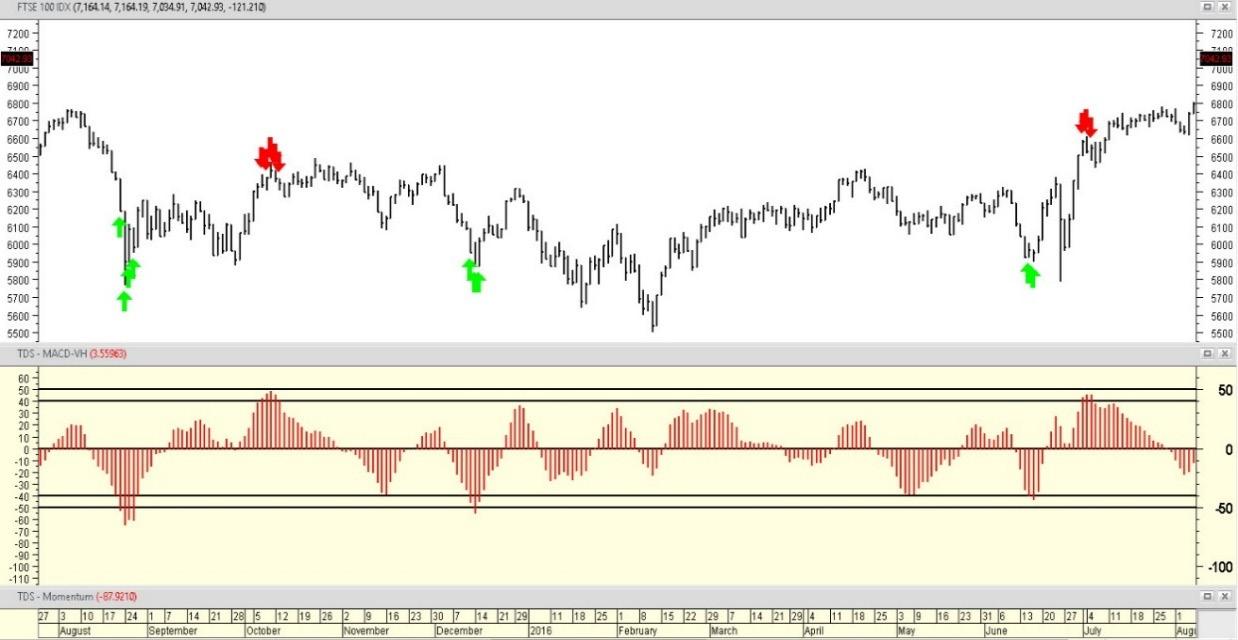

12: Natural gas and the Bear Market Rallies (2014 - 2016)

Another way to help study the data even further would be to create a swing line, as an additional price filter and then observe where market tops & bottoms occur.

For the S&P 500, we will use a 3% swing line. Our personal preference for this type of filtering work is using swing based on ATR (not percentages), but for this study, we will use percentage calculations to keep things relatively simpler.

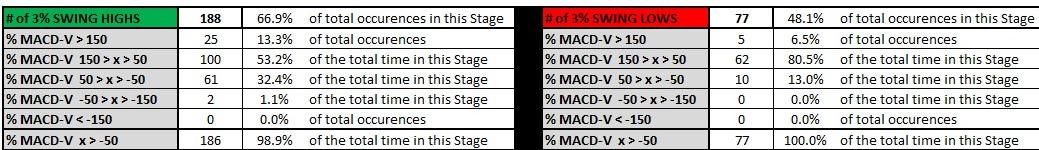

Table 15 records where these swing highs/lows are placed within the Trend Regime Filter v.1. Since 1975 the S&P 500 has made 651 swings that had a magnitude of 3% or more. 233 swing highs were recorded in the Bullish Stage and 93 in the Bearish Stage.

We provide more context to the total number of highs and lows per Stage by relating them to the MACD-V.

Table 16 sheds more light. When the market is in the Bullish Stage, almost 60% of swing highs occur in the “Strong Momentum” Range (50 to 150) and almost all (99.1%) above the -100 range of the MACD-V. Similarly, 72% of swing lows in the Bullish Stage occur in the weak momentum range (50 to -50), while almost all (99.7%) are above the -100 level for the MACD-V. This confirms the findings of Tables 11– 13 that, should the market stay above the 200 EMA, then the “maximum” decline it can have should be around -100 of the MACD-V.

Table 16 shows the data for the Bearish Stage, and they are analogous to the Bulls

In order to study the Bund, we use a 1% swing line, since the volatility for fixed income markets is considerably less than for their equity counterparts. However, the results are very similar to the ones presented for the S&P 500. The range rules for one market are applicable across other markets as well.

In order to complete our cross-market validation, we will present the same study for natural gas. The difference is with the swing line again. In this instance we employ a 5% swing filter, in order to deal with the elevated inherent volatility of this market.

The rest of the data lead to the same results, which we will leave to the reader to validate and explore further.

% MACD-V -50 > x > -150

% MACD-V < -150

% MACD-V x > -50

The numbers in Tables 11- 13, could be made more insightful by using a more detailed Trend Regime Filter.

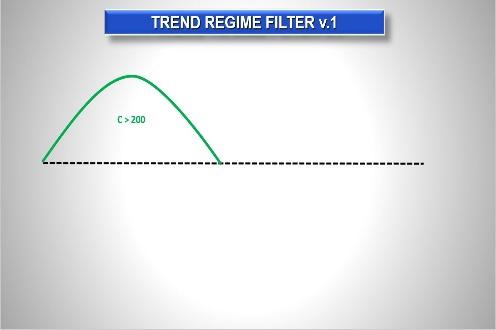

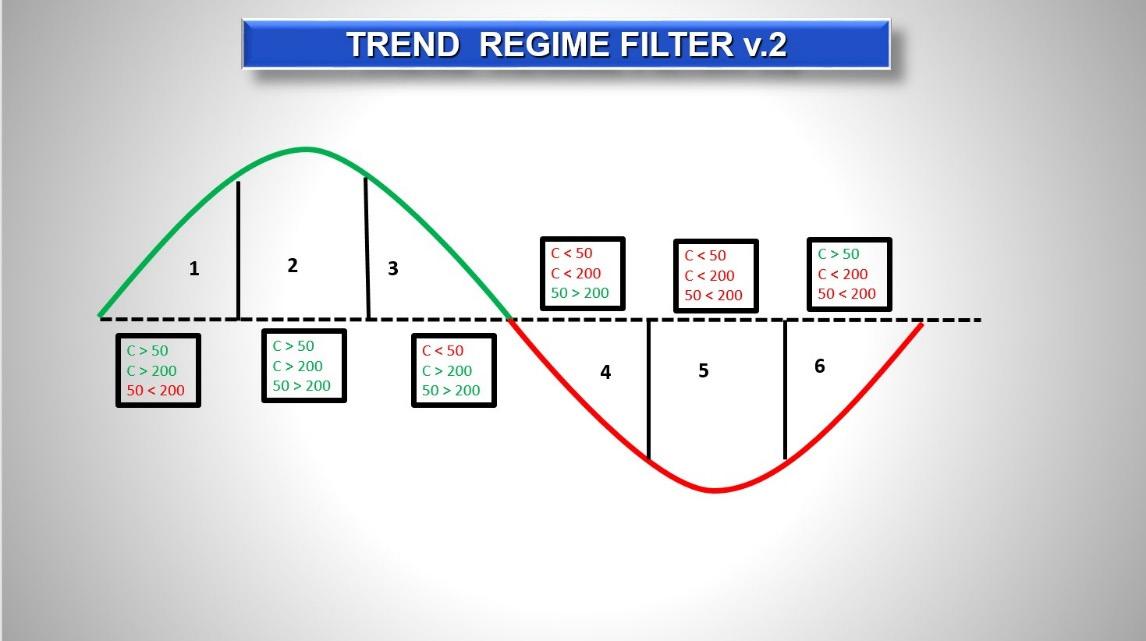

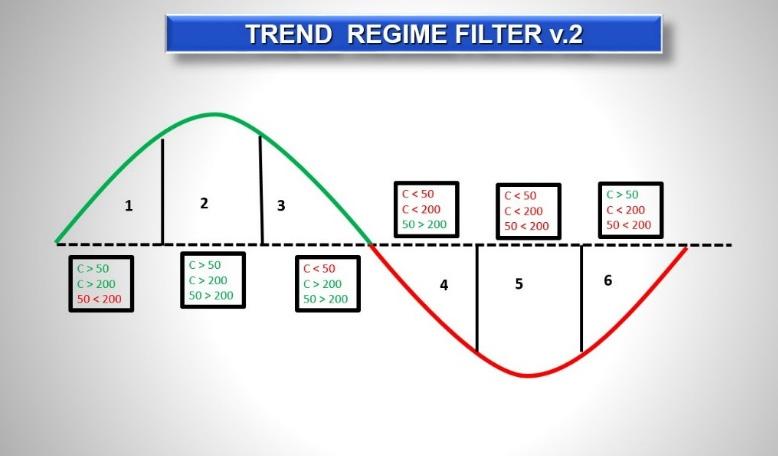

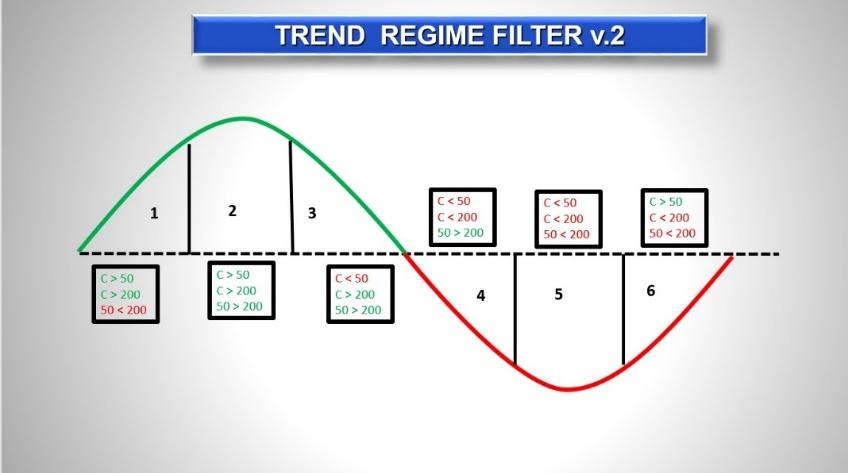

The rules for Trend Regime Filter v.2 (see Chart 13) were created – to our knowledge – by Chuck Dukas (see Dukas, 2006). We will examine the Bullish Stages (1,2,3).

The swing line percentages will remain the same for each market.

of total time in this Stage

0.2% of total time in this Stage

0.0% of total occurences

of total time in this Stage

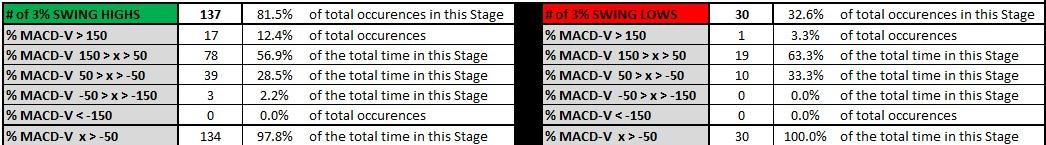

These are the relevant numbers for the S&P 500, in Stage 2 (i.e. C >50>200). This time the maximum downside stretch of the MACD-V is -50, as the range 150 to -50 contains 99.8% of the data.

Thus, if one thinks that on any pullback the market will not break the 50 EMA, then any dive that would cause the MACD-V > -50 would provide a definition of a Stage specific oversold level.

The table above shows that out of the 233 swing highs above the 200 EMA, 87.1% of these (203) have occurred in Stage 2 (C > 50 EMA > 200 EMA). The vast majority of these (59.6%) where in the 50-150 range of the MACD-V, while around 10% occurred while in the overbought range. Almost all of the highs (99.5%) where over the -50 range of the MACD-V.

Turning our attention to swing lows in Stage 2, these are extremely rare events; we have seen just 29 occurrence, in the past 46 years and 100% of them were over the -50 range of the MACD-V.

It would seem that if one expects a larger than 3% correction, one that would not extend below the 200 EMA, then the odds greatly favour that the S&P 500 would breach the 50 EMA (Stage 3) and the MACD-V to be in the -50 to -50 range (or -50 to -100 in the case of stronger corrections)

and Trend

%

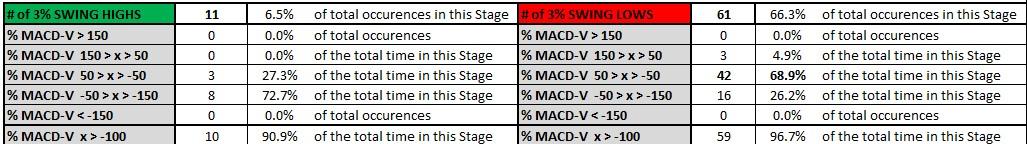

When the market has progressed into Stage 3, the vast majority of times (72.4%) the MACD-V is in the neutral range (50 to -50). In quite rare occurrences we may have a dip below the -100 level, but it would be an exception as 96.7% of the values in the Stage are above that.

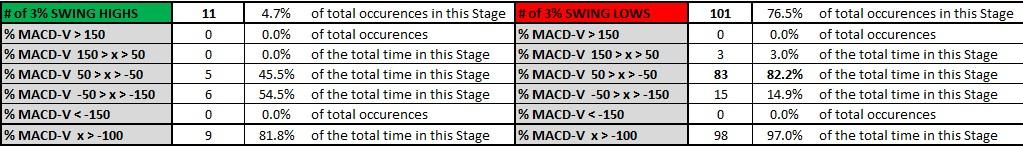

When the market has slid below the 50 EMA, in the vast majority of cases, the reversal swings associated in the Stage are lows (101) vs highs (11). A notable statistic is that 82.2% of the swing lows that occur in this Stage are in the “neutral zone” of 50 to – 50 and a few extend to the -50 to -150 range. In total 97% of swing lows in Stage 3, occur over the -100 range of the MACD-V.

Thus, pullbacks into this Stage could end in the aforementioned ranges, for a possible resumption of the trend.

and Trend

% MACD-V

%

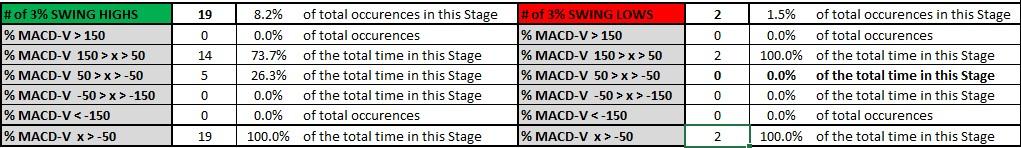

Stage 1 does not occur very often, or rather does not register for long. It is usually an explosive move to the upside coming off of a low. Hence it is the only stage (except Stage 2) that manages to drive the market into the overbought zone (>150). In the vast majority of cases, the market is in the “fast” range of the MACD-V (50 to 150), and in 100% of the cases the MACD-V stays above -50.

There aren’t many reversals (swings) occurring in this Stage and almost all are high (19) vs lows (2) in the 46 year history of the data. Notable stats are that these aforementioned highs occur in the 50 to 150 range of the MACD-V ( 73.7% of the occurrences).

Note:

The following example show the results of carrying out the same studies on the Bund and Natural Gas markets. They exhibit similar behaviour, thus we will leave it up to the readers to dive deeper into the data, without our commentary. Please note that we used a 1% swing line for the Bund and a 5% swing line for natural gas, to account for different volatility levels. Moreover, in our private work, we use ATR-based swing lines and more sophisticated Trend Regime Filters.

At this stage we can introduce the signal line (nine-period EMA of the MACD line) as it is the tool that signals changes in momentum. The signal line is guaranteed to highlight momentum shifts, but its lagging nature does so at the expense of accuracy and timing sometimes (please refer to parts 2.5 and 2.6 in the previous edition of the Market Technician). Thus, we chose to replace it with another tool, that deals (to some extent) with the aforementioned issues. However, we made a conscious choice not to present the modifications we have made on the signal line, and just focus on the MACD line, as the length of this paper would increase significantly in length. Therefore henceforth any mention of the signal line assumes that we use the nine-period EMA.

Table 28 presents the Ranges and how the MACD-V line relates to the signal line.

There are in total eight ranges that the MACD-V can take, which can of course can be easily programmed in any language of your choice (python, amibroker AFL, etc).

150 Risk

50 < x < 150 Rallying

Retracing (in price or time)

-50 < x < 50 Ranging Ranging

-150 < x < -50 Rebounding Reversing

-150 < Risk

This opens up new and unexplored opportunities to use the MACD. Up until now, the MACD could be used only two ways, either above/below the signal line, and/or above/below the 0-line. The MACD-V now presents us with eight different scenarios to explore, and of course these are multiplied in the case of cross asset comparisons!

Further to the MACD, Thomas Aspray in 1986 created the MACD Histogram, which is constructed as follows: MACD Histogram = Signal Line – MACD Line.

Since the MACD line has (now) been normalised, similar properties should also be shared by the 4th derivative of price, the MACD-V Histogram (MACD-VH). That means that it is possible to detect indicator levels which are associated with short term extreme price levels. This is a unique property of the MACD-VH, as thus far the applications of the MACD Histogram were confined to comparisons of the height of each bar of the histogram relative to the preceding ones (higher vs lower), and not relative to the absolute level that each bar has.

It appears that when the MACD-VH is above 40 (or below –40), that would imply that the market is mildly stretched to the upside (downside)

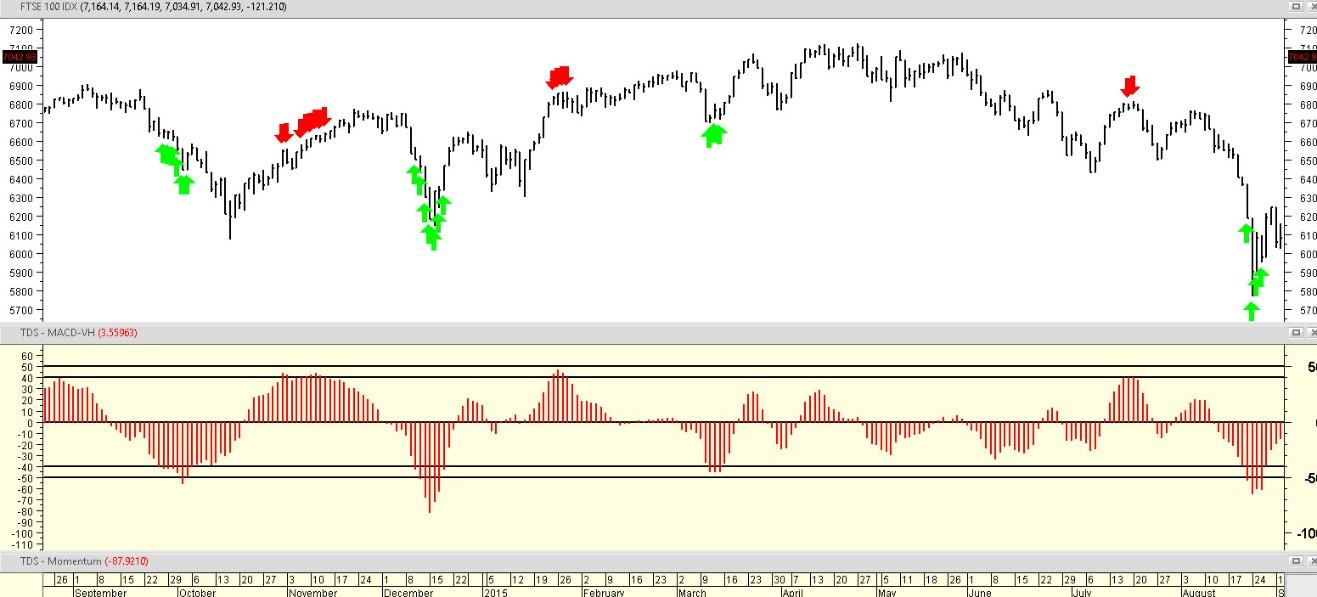

Chart 17: MACD-VH Mildly Overbought / oversold (>40, <-40) (FTSE 100, 2015 - 2016)

At this final part of the paper, I apply the concept of volatility normalisation to other well-known indicators, thus expanding their informational value.

The first tool would be the LBR 3/10 oscillator, by the esteemed trader Linda Bradford Raschke. Linda has publicly disclosed many trading setups using this tool (“Anti” setup, divergences, new momentum highs/lows). The oscillator is a MACD (3,10), thus it would be easy to create range rules for this indicator as well.

The new formula would be:

The data in Table 30 behave in a similar fashion to the MACD-V and MACD-VH.

3 Name inspired by Linda’s latest book “Trading Sardines” – see Raschke (2018). [EMA(3,C) – EMA(10,C) ] / ATR(10).

18: LBR 3/10 Oscillator & 100/125 , -100/-125 levels (S&P 500)

30:

markets

The “Elder Impulse System” was designed by Alexander Elder (see Elder, 2002) . The system according to its creator “identifies inflection points where a trend speeds up or slows down”.

The price bars are colour coded as follows

Green: EMA(13,C) > previous (EMA(13,C) and (MACD-H> previous MACD-H)

Red: EMA(13,C) < previous (EMA(13,C) and (MACD-H< previous MACD-H) Blue: in all other cases

In this particular case, additional rules could be added so as to warn the trader when a market has been overstretched in the short term. Thus, the rules could look like:

Green: EMA(13,C) > previous (EMA(13,C) and (MACD-VH> previous MACD-VH)

Red: EMA(13,C) > previous (EMA(13,C) and (MACD-VH> previous MACD-VH) and MACD-VH > 40 Blue: in all other cases

Red: EMA(13,C) < previous (EMA(13,C) and (MACD-VH< previous MACD-VH)

Green: EMA(13,C) < previous (EMA(13,C) and (MACD-VH< previous MACD-VH) and MACD-VH < - 40 Blue: in all other cases

There are certainly more possibilities to explore, but the point is to exhibit the additional value that volatility normalized momentum presents to the existing toolset.

Chart 12 presented in brief the rules for the “Chuck Dukas Diamond”, a trend classification system. Using volatility normalisation, this can be improved in a few ways.

One possible solution to “refine” the Diamond would be the following:

1. Each of the EMA’s would be expressed as a MACD-V. ie the 50 EMA would be MACD-V(1,50), the 200 EMA would be MACD-V(1,200) and the 50 EMA/200 EMA crossover rules would be MACD-V(50,200)

2. Create extreme levels for each of the MACD-V’s i.e. for the MACD-V(1,50) we would use +/- 4, for the MACD-V(1,200) we would use +/- 8 and for the MACD-V(50,200) we would use +/-5.

3. Create a weighted condition scoring system, that would serve as an warning for overbought / oversold conditions within each of the six Stages

i.e. MACD-V(1,50) > 4, 1 point

MACD-V(1,200) > 8, 2 points

MACD-V(50,200) > 5, 3 points

In addition to an OBOS warning system, another possible solution would be to then use the readings of the MACD-V(50,200) as a relative strength ranking tool for the universe of the markets classified by the system. Thus, one would not just classify securities in a Stage, but also within that Stage. The higher (lower) the reading, the stronger (weaker) the market would be.

As mentioned in Section 4.4.5, the MACD-V Momentum Lifecycle Roadmap opens up opportunities that would not exist with the simple MACD.

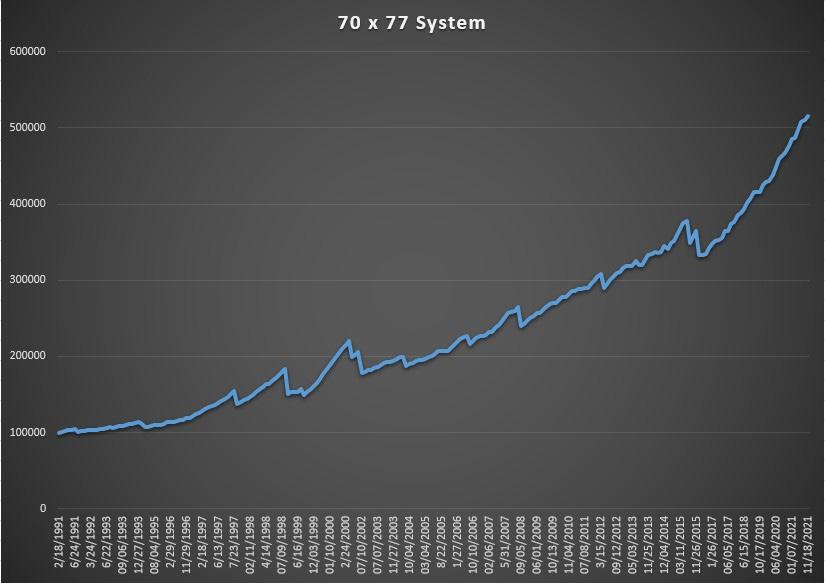

A simple example would be to filter buy signals when a market enters high in the strong momentum range. The following equity curve was created by:

• buying one DAX futures contract (long only) when the MACD-V is above 70 (market entry order).

• selling at target exit of 2.85% (next bar limit) or after 15 days if in profit (but the target exit had not been reached) or after 77 days if neither of these conditions held true.

• (€25 per roundtrip trade was deducted for slippage and commissions.)

Chart 19: 70 & 77 System Equity curve -(DAX, 1991 - 2021)

Of the 201 profitable trades 95 trades managed to reach their target exit price (77.23% of all winning trades). Of course this is not a tradeable system on its own, but serves as inspiration for further strategy idea development.

This paper is the definition of “standing on the shoulders of giants”, as it would not have been possible without the knowledge shared by esteemed technicians, past and present. I sincerely hope that we have added a small brick on the huge wall of the body of knowledge of technical analysis.

References

• Appel, Gerald (2005) Technical Analysis: Power tools for active investors”, FT Press; Reprint edition.

• Demark, Tom (2007) The New Science of Technical Analysis, Wiley; first edition.

• Dukas, Chuck (2006) The TrendAdvisor Guide to Breakthrough profits”, John Wiley & Sons, first edition.

• Elder, Alex (2002) Come Into My Trading Room, Wiley; first edition.

• Raschke, Linda (2018) Trading Sardines”, self-published.

See also Investopedia article “Average True Range” available here: https://www.investopedia.com/terms/a/atr.asp

Gerry Celaya has been professionally involved in global market research and investments since 1986. Gerry is a director at Redtower Asset Management and Tricio Investment Advisors , providing research and risk management consultancy services in the FX and investment markets to professional clients around the world. Gerry previously ran the technical trading desk whilst also managing some risk for the model trading desk at Bank of America in London and also worked at American Express Bank in London and provided global FX, fixed income, commodity and equity market research for the bank and their international FX payments company for nearly 20 years.

The Society of Technical Analysts has a huge commitment to providing education on all aspects of technical analysis (charting, technical analysis, quantitative and systematic analysis along with behavioural finance).

We have been reaching out to universities for well over 20 years and are currently speaking with more university students and academics than ever in an effort led by Simon Warren, FSTA , and the STA’s head of education, Axel Rudolph, FSTA.

One thing that we must keep in mind is that many in academia teaching market economics and finance may be fans of the efficient market hypothesis (EMH). Wikipedia provides a good summary of this theory. The 1970 article by Eugene Fama in the Journal of Finance ‘Efficient Capital Markets: A Review of Theory and Empirical Work’ followed on from his work on random walk theories. In this review, Fama laid out the idea of ‘semi-strong form’, ‘weak form’ and ‘strong form’ efficiencies. These test how new information is processed in financial markets, and if they are informationally efficient as this article by John H. Cochrane in 2014 argues, not whether the markets are functionally efficient.