Homes Design Homes Design&

Illinois Home sales, inventory and median prices increase in July

State housing report data for July released

Year-over-year home sales, homes available for sale and median prices rose in Illinois during July, according to data from Illinois Realtors.

In July 2024, statewide home sales (including single-family homes and condominiums) of 13,114 homes sold was 6.2 percent higher than 12,343 sold in July 2023.

The 20,718 homes available for sale statewide in July was 6.3 percent more than the 19,494 available homes in July 2023.

The monthly median price of $308,000 in July 2024 was 8.1 percent higher than it was in July 2023 at $285,000. The median is a typical market price where half the homes sold for more and half sold for less.

“The increased inventory offered more choices for buyers as sellers started returning to the marketplace,” says Matt Silver, Illinois Realtors 2024 President and partner and senior broker for Corcoran Urban Real Estate in Chicago.

“The upswing in both sales and median prices indicates that sellers have seen positive outcomes as well,” Silver explained.

In the nine-county Chicago Metro Area, July 2024 home sales (single-family and condominiums) totaled 8,943 homes sold, rising 5.7 percent from July 2023 sales of 8,457 homes. In July 2024, there were 14,108 homes for sale in the Chicago Metro Area, a 4.0 percent increase from 13,562 homes on the market in July 2023. The median price of a home in the Chicago Metro Area in July 2024 was $368,000, 8.3 percent greater than $339,900 in July 2023.

“Our housing market forecast highlights how sales activity and house prices are expected to decline in the coming months following typical seasonal trends,” said Geoff Smith, Executive Director, Institute for Housing Studies at DePaul University in Chicago.

“In July, inventories slightly increased statewide and in the Chicago Metro Area but declined in the City of Chicago. Inventories remained near historic lows and suggest that the market will continue to be highly competitive and challenging for homebuyers. Our forecast estimates that the coming three months will have slightly lower levels of sales activity, but higher prices compared to 2023,” Smith added.

The City of Chicago saw a 5.3 percent year-over-year home sales increase in July 2024 with 2,161 sales, up from 2,052 in July 2023. In July 2024, there were only 4,955 homes for sale in the city of Chicago, an 8.5 percent decrease from 5,415 homes on the market in July 2023. The median price of a home in the city of Chicago in July 2024 was $360,000, an increase of 5.9 percent from July 2023 when it was $340,000.

statewide home sales was 6.2 percent higher while the number of homes available was 6.3 percent higher than July of 2023. The 30-year fixed-rate mortgage also improved compared to last month.

“Closed sales and median sales price increased in July, which is indicative of the summer market,” Erika Villegas, president of the Chicago Association of Realtors and broker and owner of RE/MAX In the Village said. “Potential sellers should talk to a realtor to determine the right time to get into the market.”

Sales and price information are generated by Multiple Listing Service closed sales reported by 22 participating Illinois Realtor local boards and associations including Midwest Real Estate Data LLC data as of Aug. 7, 2024, for the period July 1 through July 31, 2024. The Chicago Metro Area, as defined by the U.S. Census Bureau, includes Cook, DeKalb, DuPage, Grundy, Kane, Kendall, Lake, McHenry and Will counties.

Based on the Freddie Mac data, the

Homes & Design

monthly average commitment rate for a 30-year, fixed-rate mortgage was 6.84 percent in July 2024, up from the previous month of 6.92 percent. The July 2023 average was 6.84 percent.

Housing market forecast

According to a report from the Institute of Housing Studies at DePaul University, the July 2024 data highlight the ways in which the ongoing limited supply of forsale housing (as indicated by continued low inventories) and increased competition (as indicated by declining time on market) are leading to a competitive housing market and continued rising prices in Illinois, the Chicago region, and the City of Chicago, in spite low levels of sales activity.

Despite mixed economic conditions

EDITOR IN CHIEF: Heather

SPECIAL

CREATIVE DIRECTOR: Heidi

ADVERTISING DIRECTOR: Vicki Vanderwerff PAGE DESIGNER: Jen DeGroot

and slow sales, house prices in Illinois and Chicago area house prices continue to grow, making homebuying increasingly unaffordable for prospective homebuyers. In the coming months, levels of singlefamily sales activity statewide, in the Chicago region, and the City of Chicago are expected to decline following seasonal trends and be lower than compared to last year’s levels.

Amid slowing sales activity, house prices statewide, in the Chicago region, and in the City of Chicago are expected be higher compared to the same time period in 2023.

Find Illinois housing stats, data and the complete August 2024 forecast from the Institute of Housing Studies at DePaul University at http://www.illinoisrealtors. org/marketstats/.

Ruenz

SECTION EDITOR: Melanie Bradley

Schulz

According to a recent report from the Illinois Realtors, in July of this year,

Dos and don’ts of bathroom renovations

Bathroom renovations are significant undertakings that cost homeowners sizable amounts of money. According to Remodeling magazine’s “2024 Cost vs. Value Report,” the average cost of a mid-range bathroom remodel across the United States in 2024 is around $25,000. Homeowners who want an upscale remodel can expect to spend around $80,000.

Such a large financial commitment underscores the significance that homeowners get their bathroom remodels right. Mistakes will only increase the already substantial financial commitment homeowners must make, so it can help to keep these dos and don’ts in mind.

What you should do

• Work with a certified, reliable contractor. YouTube tutorials can give a false impression of renovation projects in relation to their degree of difficulty.

Renovations as significant as bathroom remodeling projects require the skills and

experience of professionals.

• Pay attention to the details.

Planning a bathroom renovation can be overwhelming, as homeowners have many decisions to make before the project even begins.

For example, homeowners will have to choose a vanity, fixtures for the vanity, light fixtures, toilet, showerhead, and an assortment of additional features when planning the project.

Contractors work with clients to show them all of their options, and some will offer advice on products or materials if asked. But homeowners are ultimately the ones who will have to live with the choices they make during the planning process, so these details merit ample consideration and should not be treated as trivial.

What you should not do

• Ignore return on investment. There’s no denying certain projects provide a better

Mistakes during a bathroom renovation will only increase the already substantial financial commitment homeowners must make. It can be helpful to follow tips such as working with a reliable contractor and paying attention to the details.

return on investment than others.

The upscale bathroom remodel with a nearly $80,000 price tag noted above may prove awe-inspiring, but homeowners looking to get as much of their money back at resale should know that such a renovation recovers 45% of homeowners’ initial investment.

By contrast, the mid-range bathroom remodel yields a 74% return according to Remodeling magazine.

Though return on investment may not be the deciding factor for every homeowner, it definitely merits consideration when planning a project.

• Emphasize cost over quality.

Homeowners should do their best to establish a renovation budget and stay within that budget, but quality materials should take precedence over cost.

Many budget-friendly furnishings and accessories are durable and aesthetically appealing, so homeowners need not enter a bathroom renovation thinking high-end products are their only options. But it’s important that homeowners recognize the conventional wisdom that buyers get what they pay for when it comes to home renovations.

If homeowners try to cut costs on materials, they may need to update or redo the bathroom much sooner than they would if they invest in quality furnishings and accessories the first time around.

Bathroom renovations can be costly. Remembering some simple dos and don’ts can give homeowners the peace of mind that their renovation investment will result in an impressive, durable space. (METRO

How to make a home more cozy

Simple changes can make a space more inviting, comfortable

The meaning of the term “cozy” varies as it pertains to home decor. For some, cozy may mean intimate spaces with lots of quilts and throws. For others, cozy could indicate bright and airy spaces enhanced by plenty of fresh foliage.

Regardless of how they define cozy, homeowners typically want their homes to be inviting and comfortable. With that in mind, the following are some ways to impart a cozy vibe to any living space.

Make use of a fireplace

Flames lapping wood (or faux wood in the event of gas-powered fireplaces) can put anyone in a tranquil state of mind. Fireplaces add instant ambiance and make great places for people to congregate and engage in conversation.

During warmer months when the fire isn’t blazing, decorative candles can be lit to mimic the same feel.

Add some texture

Texture can be anything from a raised pattern on wallpaper to a knotty area rug to a mosaic piece of artwork. A home with texture tends to create cozier impressions than one with all sleek and smooth surfaces.

Enjoy a soft rug

Although many design experts say hardwood floors or laminate options are easier for allergies and keeping a home clean, a soft rug underfoot can be welcoming.

Rather than wall-to-wall carpeting, place area rugs in spots that can use some cozying up, such as beneath beds and even under the dining table.

Light candles

The warm, flickering light of candles adds cozy vibes in spades. According to The Spruce and Paula Boston, a visual merchandiser for Festive Lights, candles can be used throughout a home to create

typically want their homes to be inviting and comfortable. The good news is there are many ways to achieve that feel by making some minor changes.

instant atmosphere. Exercise caution with candles and fully extinguish them before retiring for the evening.

Try seasonal bedding

Crisp and light cotton and linen are cozy materials when the weather is warm. But when the temperature starts to dip, flannel or jersey bedding makes a bed that much more inviting, says Real Simple.

Invest in lots of pillows

Pillows can instantly make a spot cozier, whether it’s the living room sofa or an outdoor lounging nook. Look for materials that are durable for the space in which they’re being used.

Consider warm lighting

The transition from incandescent light bulbs to halogen and LED is beneficial

from an environmental standpoint. However, LEDs illuminate with a more stark, blue light that can seem clinical in home spaces.

Look for bulbs where the “temperature” can be customized. The more the color spectrum leans toward warm light, the cozier a space will feel. This can be enhanced by putting some lights on dimmer switches and toning down the brightness as needed.

Install a bookshelf

Even for those who are strict devotees of e-readers, a shelf full of actual books interspersed with some well-placed knickknacks can make a room feel more cozy. Books add texture, the feel of hallowed halls and libraries, and visual appeal.

Making a home more comfortable and inviting doesn’t have to be complicated. A few easy modifications can improve interior spaces. (METRO CREATIVE)

Regardless of how they define cozy, homeowners

Single-family construction up 19% statewide

The latest new home construction numbers released by the Wisconsin Builders Association shows new home construction is up 19 percent statewide.

The data, submitted by all municipalities across Wisconsin, shows 6,923 new home permits were pulled in the first and second quarters of this year, while 5,816 permits were pulled between Jan. 1 and June 30 of last year.

“If we compare second quarter data, we are up 4% this year compared to quarter two of last year,” said Wisconsin Builders Association President Jim Doering.

“Any increase is positive for us given the challenging interest rates we continue to see,” Doering added.

The counties that have seen the most growth quarter over quarter – Green Lake, Pepin and Pierce – are up 162%, 150% and 116%, respectively.

“Our National Association of Home Builders recently released that with mortgage rates averaging 6.92% in June, builder confidence is at its lowest reading since December 2023,” said WBA Executive Director Brad Boycks.

Schlittler Construction

“That said, with continued low existing home inventory, there is still a need for more home construction, and we are seeing that play out in these latest quarterly statistics,” Boycks added.

Pros & cons of renting vs. buying

People typically have two options regarding a place to live: rent or buy. There are pros and cons to each option, and what is best depends on the person and the situation.

Choosing to rent or buy is a decision with many moving parts, says NerdWallet. But home ownership is not right for everyone and careful consideration of owning versus renting can help people decide which option is best for them.

Home ownership

Purchasing a home is a large undertaking that requires a significant financial investment. People often buy a home because they want stability and an asset that maintains value and even appreciates in the long run. There’s also more freedom over the living situation when a person buys, as he or she is not beholden to the rules of the landlord.

People may be drawn to buying because they know precisely what they will pay each month in living expenses, provided taxes remain relatively stable. Furthermore, setting down roots can help a person feel like part of a community.

Home

ownership has some disadvantages. It’s a large financial investment that requires a potentially sizable down payment up front. Owning comes with an inherent, though not ironclad, lack of flexibility, as a person cannot simply move to a new geographic location on a whim. There’s also the responsibility of paying for all maintenance and handling any additional issues that arise.

Renting

Renting can be a more affordable short-term option than buying. Renting enables a person to get a residence at a lower monthly expense and with no down payment. Those who rent have more flexibility if they want to change homes and there’s much less responsibility.

Expenses may be less because there’s no need to pay property taxes, and some utilities may be covered by the property owner.

There’s a sentiment that renters are throwing away money each month because they are not getting any equity. Rental costs also may not be fixed, as a landlord can increase rent with each lease renewal. Renters must abide by the rules and regulations of the landlord while renting and that could mean restrictions on parties, noise after a certain time, pets, and more.

There’s no clear-cut answer as to which is better so people must identify their own priorities and needs when making the decision.

(METRO

CREATIVE)

Flipping homes: an overview of the basics

In recent years, home sellers have experienced record profits as the value of real estate has risen dramatically. Bankrate indicates the median home price across the United States is around $486,000.

According to WOWA, a personal finance resource in Canada, the national average price of a home in Canada was $657,145 CAD in December 2023.

Flipping homes gained popularity prior to the spike in real estate prices, but that increase has led some novices to consider flipping more closely.

Though it’s true the chances at turning a large profit are substantial in a market

where high prices are the norm, potential flippers may benefit from a rundown of the practice before they decide if it’s something they want to do.

What is flipping?

Flipping works when an investor purchases a property with the intention of selling the home (or business) for profit without actually using it.

The basic premise of flipping is to find a property at a low price and sell it at a much higher price, typically after renovating the home. Investopedia says it is important

to complete this transaction as quickly as possible to reap the greatest return on investment.

Time and money

Many new flippers overestimate their skills and knowledge and lose money in the process. Common mistakes include thinking that a project will cost less or the home will be turned around quickly. It can take months to find the right property, and then there will be time needed to renovate. Costs involved include the initial sale, renovations, holding costs, and capital gains tax when the sale goes through. All of these can eat into profits.

Inventory will play a role

It can be challenging to find a good deal as everyone seemingly wants to be in real estate these days. With fierce competition in a low-inventory market, flipping can be like finding a needle in a haystack.

Flippers will be paying short-term capital gains instead of long-term capital gains. According to NerdWallet, capital gains taxes are paid when one sells an asset for profit. The rate at which capital gains is taxed is based on whether you hold an asset for less than a year or longer than a year. Long-term capital gains tax rates are generally lower than short-term capital gains tax rates.

Tax benefits vs. tax risks

According to Tresa Todd, founder of the Women’s Real Estate Investors Network, flipping may be less tax-efficient in the United States than getting into investment properties.

Follow the “golden rule”

Most home flippers follow what’s referred to as the 70% rule. This says one should pay no more than 70% of what the house’s estimated ARV (after-repair value) will be, minus the cost of the repairs necessary to renovate the home, says Rocket Mortgage. The ARV is calculated by adding the current property value plus the added value of any renovations. The formula is: ARV x .70 –Estimated repair costs = Maximum buying price.

Flipping may seem like a good idea, but prospective flippers should fully understand the process, including the financial commitments it requires, prior to purchasing a home.

(METRO

Homeowners: Contract with confidence

With a median asking price of $330,000 for a home, becoming a homeowner takes dedication, patience and smart budgeting. For many first-time homebuyers, closing the deal on their purchase is a time of celebration and gratitude.

While moving furniture and solidifying paperwork might seem like the biggest obstacle to enjoying their new home, it doesn’t take long before they find their first major home improvement project.

Avoid home improvement scams

Home purchasing is one of consumers’ largest and most significant investments in their lives. It is essential to exercise caution when contracting services for home improvement projects to protect their investment.

In 2023, the BBB Scam Tracker Risk Report showed that home improvement scams were the riskiest amongst consumers 55 and older. Scammers often impersonate well-known or established companies and, after receiving initial payment, will only disappear after even beginning the project.

Desperate to establish communication, homeowners contact corporate or local offices for the company only to learn that the person who sold the job is not an employee.

Home improvement scams often begin with an unsolicited offer from a door-todoor salesperson or an ad posted on social media. While not all door-to-door solicitors are scammers, BBB recommends carefully evaluating any contractor utilizing this method to provide service, especially in the aftermath of damaging storms or other natural disasters. Some businesses may

need more insurance to cover unintentional damages to your home or yard during the project, use sub-quality materials that will not last, or lack licensing required to conduct repair or renovation work in your area. Be especially wary of contractors who claim to have been working in the area and have leftover material they can use to complete your project at a discount.

Receive at least three quotes

The bureau strongly recommends that homeowners looking to contract services for any work receive at least three quotes from separate businesses before settling on a final decision.

Receiving multiple quotes gives homeowners a solid understanding of pricing and services. It contributes to their ability to converse with their chosen contractor about the project’s price. Homeowners who take the time to interview multiple companies before deciding who to contract can be confident that they are not overpaying for services.

Never pay the total project cost upfront

Even if the contractor offers a significant discount for paying the project’s total cost upfront, BBB always recommends staggering payments throughout the length of the project.

Staggering payments allow the homeowner to inspect the work at specific milestones, ensuring that the work is completed to their satisfaction before releasing the next payment installment. Homeowners should avoid contractors

practicing aggressive tactics or insisting on receiving full payment before beginning the project, and most deposits should range between 10-30% of the total project cost.

Some contractors may require a more significant down payment due to the price of materials or other communicated issues. Still, homeowners should avoid contractors that ask for more than half of the total project cost upfront.

Understand licensing requirements

Depending on the type of work the homeowner wants, state or local regulatory agencies may require different licensing. In those industries that typically require licenses (electricians, HVAC, plumbers, pesticide applicators, etc.), spend the time to double-check that the license is valid with the applicable agency. The contractor should be forthcoming in describing how the homeowner can verify the active license.

Remember that the homeowner may be held liable for work completed by an unlicensed contractor that does not comply with building codes or results in property damage.

Be wary of ‘too good to be true’ deals

As is common in any marketplace transaction, critically evaluate any deal that seems too good to be true. Trust in your intuition and have a basic understanding of the standard cost of the project by receiving multiple quotes.

Offering goods and services at steep discounts for a ‘limited time’ is a common

tactic of scammers and con artists to encourage consumers to make immediate decisions before verifying the business’s or individual’s legitimacy.

For more information

Better Business Bureau hosts an online resource center for homeowners to understand the various aspects of home ownership and improvement or repair projects at BBB.org/HomeHQ. In addition to advice when contracting plumbers, electricians, roofers or landscapers, the resource center also provides information about mortgage lenders, home inspectors, and real estate agents. Homeowners can use BBB’s search engine to find contracting services near them, both BBB Accredited and not, to assist in their decision-making process.

If you have experienced a home improvement scam or questionable business practices, report it to BBB Scam Tracker or file an official complaint online at BBB.org. Information provided may prevent another person from falling victim and help others make informed decisions when seeking contracting services.

For more information or further inquiries, contact the Better Business Bureau at bbb. org.

Homeowners should avoid contractors that practice aggressive tactics or insist on receiving full payment before beginning a project. According to the Better Business Bureau, deposits for such projects should range between 10-30% of the total cost.

It is possible to brighten up those shady spots in your landscape. It is all about proper plant selection, planting, and care.

Plant a garden in the shade

roots and against the trunk as this can lead to tree decline and even death. Skip deep cultivation that damages the roots, the majority of which grow within the top 18 inches of soil with 50% of them in the top six inches.

Add seasonal color and vertical interest with shade-tolerant annuals like impatiens, begonias, and coleus. Avoid damaging the tree roots by planting these in containers and setting the pots on the soil surface amongst perennial shade-tolerant groundcovers or on mulched beds under the trees.

By MELINDA MYERS Contributor

Start by evaluating the sun and shade patterns in your gardens. Monitor the amount of sunlight different areas receive throughout the day and at various times of the year. You may be surprised the space gets more sunlight than you thought. Make a list of plants you have successfully grown and those that failed in the shady location you are landscaping. Use this information to help you select other plants with similar light requirements.

As always, select plants that thrive in your climate and tolerate the amount of sunlight, moisture, and soil in the proposed garden location. Look for plants that provide attractive foliage all season long and flowers at various times.

Once you’ve planted your garden, adjust the care to compensate for the limited light conditions. Plants growing under large trees or overhangs must be watered more often, especially during the first year or two until the plants become established. The dense canopy of many trees and impervious overhangs prevent rainfall from reaching the ground below. Plus, the extensive root systems of trees and shrubs absorb much of the rainfall that does make it through, so check soil moisture several times a week and water thoroughly as needed.

Spread a layer of organic mulch over the soil surface and away from the tree trunk

Avoid high nitrogen, quick-release fertilizer that promotes lush succulent growth that is more susceptible to insects

Myers has written more than 20 gardening books, including the Midwest Gardener’s Handbook, 2nd Edition and

Placing shade-tolerant container gardens below tree canopies is a way to beautify shady spots without damaging the tree roots.

MELINDA MYERS PHOTO Homes & Design

Melinda

Se Habla Español

Credit score basics for renters

What those who are interested in renting need to know

By Veronica Grecu CONTRIBUTOR

As the peak rental season is getting closer, your credit score becomes more important than ever. Whether you’re a first-time renter or a seasoned tenant, knowing how to meet credit score requirements for renting is key.

Credit scores might seem complex, but they’re pretty straightforward. Simply put, your credit score is a number that comes from analyzing your credit history and it shows how reliable you are financially.

That said, the importance of credit scores in renting is paramount these days. Your credit score acts as a first impression, especially if you’re a firsttime renter – and even more so if you’re looking at apartments for rent in hot rental markets, where this number could be the deciding factor in a landlord’s decision.

More and more landlords are using detailed credit score checks. They’re examining not just the overall score but also specifics like how much of your credit card limit you’re using, whether you pay your bills on time, and how much debt you’re carrying. As a renter, if you take the time to comb through your credit report before applying for an apartment, you can really set yourself apart.

Plus, with digital transactions becoming more common, even things like your utility bills and streaming service payments could start to influence your credit score. It’s smart to keep an eye on these regular bills because they can show whether you’re good at managing your money.

Credit score essentials for apartment leasing

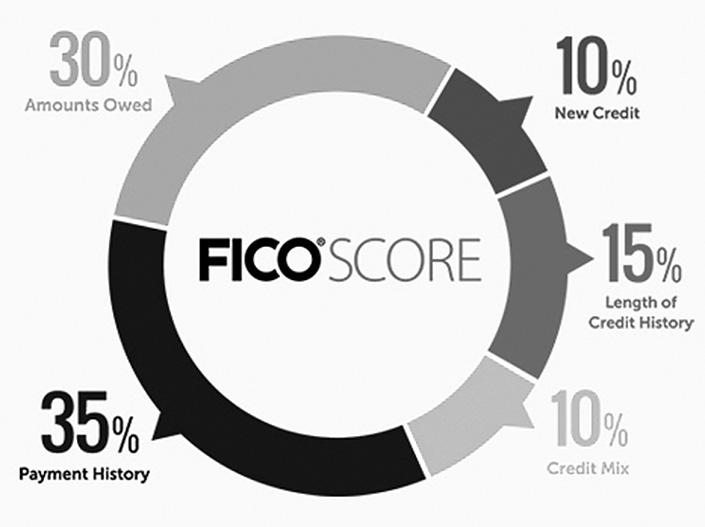

Now that we’ve covered the importance of credit scores in renting, let’s dive into what makes up a credit score, especially from a landlord’s point of view. Remember, this will be extremely useful in preparing your credit score for rental applications.

• Payment history (35%): This is the biggest part of your credit score. The payment history now also includes rent payments and utility bills, thanks to newer credit reporting technologies and expanded data sources. Making sure you pay all your bills on time is key to maintain a healthy credit score.

• Amounts owed (30%): Also known as credit utilization, this part looks at how much of your available credit you’re actually using. The lower this number, the better it is for your score. Thanks to advanced tools for managing balances and tracking your finances in real time, it’s easier to keep this ratio in good shape.

• Length of credit history (15%): The age of your oldest account and the average age of all your accounts show lenders how seasoned you are at handling credit. So, as Gen Zers start to hit the rental market, the importance of building a solid credit history early on is paramount.

• Types of credit (10%): This factor takes into account wider ranges of credit types, including digital payment solutions

above: While the credit score required by landlords will vary based on things such as market conditions and their personal preference, the higher the score, the more likely you are to be approved as a tenant. at right: This graphic shows the approximate weight of variables that figure into a person’s credit score. Most property owners will run a potential renter’s credit prior to agreeing to let them sign a lease.

STOCK PHOTOS Homes & Design

and subscription services, reflecting broader trends in how people are spending their money these days. Having a variety of credit types can really help boost your score.

•New credit (10%): Inquiries for new credit can temporarily lower your score, because it might look too risky. However, newer scoring models can tell the difference between potential financial distress and shopping for the best rates.

What credit score do landlords require?

It’s important to know that the minimum credit score required for renting apartments can vary significantly from one landlord to another. Moreover, the minimum credit score required for renting is likely influenced by local market conditions and the landlord’s own criteria. So, making sure everything is accurate and clearing up any old debts can bump up your credit score, making you look even better to potential landlords. According to myFICO, most credit scores range between 300 and 800. Here’s a general breakdown of how credit scores might influence your rental opportunities:

Excellent (800-850 or more): With a credit score in this range, you’ll likely have your pick of rental apartments. Landlords view tenants with excellent credit as highly reliable, often resulting

in favorable lease terms and minimal security deposits.

Very Good (740-799): A good credit score opens up a wide range of rental options. You’re seen as a low-risk tenant, which can help you secure leases with reasonable deposit requirements.

Good (670-739): Renters in this range may face more scrutiny. Some landlords might still approve your application, but you could be asked for a higher security deposit or additional references.

Fair (580-669): If your credit score falls in this range, renting can become challenging. This means you will likely need a cosigner, larger deposits, or prepaid rent to mitigate any potential risks.

Poor (300-579): With a score in this lowest range, your rental options are quite limited. It’s likely you’ll need to look for landlords who don’t require credit checks

or find alternative ways to prove financial stability, such as showing a history of savings or that you have a stable job.

As you can see, understanding how credit scores work and how to meet credit score requirements for renting is vital in today’s apartment market. Especially for those new to renting, managing your credit can make the process of finding an apartment much smoother. Remember, a strong credit score not only broadens your rental options but also strengthens your position when negotiating lease terms.

Veronica Grecu is a senior creative writer and researcher for RentCafe. With more than 10 years of experience in the real estate industry, she covers a variety of topics in residential and commercial real estate, including trends and industry news.

What buyers can do to get the best mortgage rate

Mortgage interest rates have been headlining financial news segments for several years running. Much of that news has been met with less than open arms, as rates have risen dramatically in recent years.

Despite being a couple of years removed from the pandemic – which was partly behind the increase, high interest rates have held steady.

Mortgage interest rates did not immediately spike after the World Health Organization declared a global pandemic more than four years ago. In fact, data from the lender Freddie Mac indicates mortgage rates were still well below 4 percent as recent as two years ago.

However, those rates hovered around 7 percent by the end of that 2022 and have remained around that level through more than half of 2024.

With such high interest rates, it’s understandable if prospective home buyers feel helpless.

However, there are several things buyers can do to help themselves as they seek to secure the lowest mortgage interest rate possible.

• Read your credit report and improve your score, if necessary. Many prospective home buyers save up for years in anticipation of the day when they will purchase their own home.

During this period, buyers can read their credit reports and address any discrepancies while taking steps to improve their credit scores.

Lenders consider a host of variables to determine an applicant’s credit worthiness, and credit history and credit scores bear significant influence.

The higher an applicant’s credit score, the more favorable mortgage rate he or she is likely to get.

• Take control of your debt-to-income ratio. Debt-to-income (DTI) ratio refers to what you owe in relation to how much you earn. The lower your DTI, the better you look to lenders.

According to Bankrate, lenders typically want to avoid issuing mortgages to individuals if the monthly payment will exceed 28 percent of their gross monthly income, and people who may be near that threshold for a given home may be denied a mortgage if their DTI is high.

Prospective home buyers currently carrying

Reasons to replace aging windows

Windows in a home are easy to take for granted. Unless windows are showing signs of wear and tear or so dirty that it’s hard to see through them, it’s easy for them to go unnoticed. However, replacement windows can add value to a home and even save homeowners a substantial amount of money.

Much of the savings that can be attributed to new windows is related to energy efficiency. The Office of Energy Efficiency and Renewable Energy estimates that as much as 30 percent of heating and cooling energy can be lost through heat gain or heat loss, and aging, inefficient windows contribute to such losses.

Replacing those windows can save homeowners substantial amounts of money, with one expert at Angi estimating that installation of energy efficient windows can help trim energy bills by as much as 12 percent.

Cost savings are often noted when firms promote replacement windows, but homeowners should know that replacement windows also provide numerous additional benefits.

In fact, the following are three great reasons for homeowners to consider upgrading their windows today.

New windows help reduce carbon footprint

significant debt, including consumer debt like credit cards and/ or student loan debts, should make a concerted effort to pay down that debt prior to applying for a mortgage. Prioritize paying off consumer debt before applying for a mortgage.

• Maintain a strong employment record. Steady employment and consistent earnings make mortgage applicants more attractive in the eyes of lenders.

If you are currently shopping for a home or about to make an offer, now might not be the best time to switch jobs. Self-employed individuals and freelancers working multiple jobs can still qualify for a good mortgage rate, but they may need to provide more extensive documentation that indicates their earnings going back several years.

Individuals who have been working full-time for the same company for years may only need to provide W-2 forms from the two most recent tax years.

• Shop around for rates. Rates may not fluctuate much between lenders, but it’s still worth shopping around for mortgage rates.

A study from Freddie Mac found that the benefits of shopping around for a mortgage rate were especially notable in 2022 compared to the decade prior, saving borrowers who took the time to shop for rates substantial sums of money.

Mortgage rates remain high compared to a half decade ago, but prospective home buyers can take steps to increase their chances of qualifying for a favorable rate.

(METRO CREATIVE)

with the new windows.

Brighten up the home’s interior

Natural light brightens a room and can make it appear larger.

Homeowners who have grown accustomed to old windows may not realize how little light such windows let into their homes.

Aging windows can become foggy over time and prevent natural light from getting into a home. That can create a gloomy feel and force homeowners to turn up the thermostat on cold days.

New windows brighten the home and the natural light that pours in on a cold day can help heat the home at the same time.

Cut down on noise

Window manufacturers are always on the lookout for ways to produce windows that make homes more comfortable. Noise reduction is one way to accomplish that goal, and Consumer Reports notes that triple-glazed windows can help to dramatically reduce outside noise.

Homeowners who currently have single-pane windows may be astonished by the difference in outside noise levels when upgrading to triple-glazed windows, which contain a third layer of glass.

The U.S. Environmental Protection Agency reports that replacing single-pane windows with ENERGY STAR certified windows can help to reduce CO2 emissions by a significant margin.

The EPA reports that such windows can save the equivalent of as much as 6,200 pounds of CO2 emissions thanks to reduced energy consumption associated

That third layer of glass significantly reduces noise levels, making triple-glaze windows ideal for homes on busy streets or those in urban areas with lots of foot traffic.

Replacement windows pay numerous dividends. Homeowners can reap these rewards and others by replacing aging windows.

(METRO CREATIVE)

There are numerous things potential home buyers can do to put themselves in a better position as they seek to secure the lowest mortgage interest rate possible.

Common questions about garage remodels

Homeowners tend to want to maximize all of the space they have in their homes. For some this may involve turning a garage from a utilitarian space into one that serves multiple purposes.

According to The Mortgage Reports, a homebuying and improvement resource, garage renovations can increase the value of a home and add living space. Garage remodels can create additional storage space, provide an area for a home gym or even create room for a home office.

Prior to beginning a garage remodel, homeowners may have some common questions about the process.

How much does the renovation cost?

Several factors will ultimately determine the final price of a garage remodel, but HomeAdvisor says the national average for a garage remodel falls between $6,000 and $26,000.

Most homeowners come in at around $15,000 for a total garage conversion.

Will I recoup the investment?

A garage conversion adds value to a home if it creates new and usable living space. The firm Cottage, which pulled together a team of builders, architects and technologists, advises the average garage conversion provides an 80 percent return on investment. That ROI varies depending on location.

How can I upgrade the flooring?

Garages traditionally feature concrete floors. Although durable, concrete floors can feel damp, hard and cold underfoot. Both vinyl plank and epoxy flooring options can elevate the design and functionality of the garage.

Can I have the best of both worlds?

Sometimes a garage needs to serve many purposes. Lofting the garage means a homeowner can still park cars or utilize the lower space as a living area, all the while items are stored overhead.

Some flip this design scenario and have the loft area as a bedroom or finished living space, while the lower portion remains a traditional garage area.

Another thought is to finish only a portion of the garage. This works well for two- or three-car garages where there will be room to park a car and the remainder will serve another purpose.

What are other ways to improve the garage?

Installing more windows or improving on the lighting in the garage can be important. The garage improvement experts at Danley’s say window installation enables people to circulate air in the garage without having to open the garage door.

Improving the lighting means the garage can still be enjoyed or utilized after dark. Spread out lighting in the garage and use a combination of overhead and task lighting just as one would in the home itself.

How do I deter bugs or other pests from entering?

Insects often want to hunker down in garages, and they may find it easy to get inside a garage. Keeping the garage clean and organized is the best way to deter pests and to spot infestations before they become problematic, indicates Mosquito Joe pest control company.

Reducing water and humidity in the space, weatherproofing at the base of the garage door and other entry spots and utilizing insect repellents to make the garage less hospitable also can decrease the risk of insect infestation.

Remodeling a garage can add value and plenty of usable space to a home. Whether a garage houses cars or hosts neighborhood game night, a garage renovation can be well worth the investment.

USDA helps people buy, repair and build homes

They have helped make home ownership a reality for 75 years

U.S. Department of Agriculture Secretary Tom Vilsack recently announced that the USDA was celebrating 75 years of helping millions of people buy, repair and build affordable homes in rural and Tribal communities.

“For decades, USDA has served as a safety net for hardworking Americans who dream of owning a home but face challenges to doing so,” Secretary Vilsack said.

“Now more than ever, people across the nation need access to safe, decent and affordable housing, especially in rural and Tribal communities. The Biden-Harris Administration remains committed to ensuring all Americans have affordable places to live. Therefore, USDA is redoubling its efforts to equip potential homebuyers with resources and information they need to be ready to take full advantage of our critical programs as funding is available,” he added.

In celebration of 75 years, the department highlighted ways USDA Rural Development homeownership programs have historically given people in rural America and on Tribal lands the opportunity to build wealth and equity, and a foundation for a brighter future for themselves and their families, including the following:

• Since 1949, USDA’s Single Family Housing Programs have helped nearly 5 million families and individuals achieve the dream of homeownership.

• Since the program’s inception, USDA’s Single Family Direct Home Loans have helped approximately 2.2 million families and individuals purchase a home.

• Through the Single Family Home Repair

Loan and Grant Program, USDA has helped nearly 455,000 individuals and families improve the quality of their homes since 1950.

• And since 1966, USDA’s Mutual SelfHelp Housing Technical Assistance Grant Program has helped more than 56,000 families build their own homes.

The Biden-Harris Administration has invested more than $43 billion to help nearly 266,000 families and individuals in rural and Tribal communities buy, repair and build homes through Rural Development’s SingleFamily Housing programs.

USDA is also highlighting the resources to help potential homebuyers prepare for buying a home and to be ready to apply for USDA programs once funding becomes available.

For instance, individuals can learn more about homeownership readiness through the Consumer Financial Protection Bureau’s Home Loan Toolkit. Individuals may also review program eligibility requirements through USDA’s Single Family Housing Self-Assessment site.

Homeownership Programs

For 75 years, USDA has made financing affordable for families who would otherwise be unable to secure a home loan. By providing low interest rates, loan guarantees, reduced down payments and construction grants, Rural Development’s Single Family Housing Programs have become a vital resource for millions of rural Americans.

These programs include:

• The Single Family Housing Direct Home Loan Program has helped qualified

lower-income applicants buy homes with no money down so they can build wealth and equity.

• The Single Family Home Repair Loan and Grant Program has helped families and individuals repair and modernize homes, and make them safer, healthier places to live.

• The Mutual Self-Help Housing Grant Program has worked with nearly 250 organizations to help families and individuals lower the cost to purchasing a home by participating in its construction.

• The Single Family Housing Guaranteed Loan Program enables USDA to partner with private lending institutions, backing their loans to help families and individuals buy homes in rural areas.

USDA Rural Development provides loans and grants to help expand economic opportunities, create jobs and improve the quality of life for millions of Americans in rural areas. This assistance supports infrastructure improvements; business development; housing; community facilities such as schools, public safety and health care; and high-speed internet access in rural, tribal and high-poverty areas.

The Rural Data Gateway online can help people learn how and where these investments are impacting rural America. To learn more, visit usda.gov.

The USDA recently celebrated 75 years of helping millions of people buy, repair and build affordable homes in rural and Tribal communities. The department has a variety of programs available.

Renovations that help sell homes

There are

several updates that can be done without high costs

The adage “there’s a lid for every pot” suggests that, even in relation to the real estate market, there’s bound to be a buyer for every home on the market.

Price is a significant variable in the minds of potential buyers, but there are additional factors that can affect the impression people get of a given home.

Certain home features can tip the scales in favor of sellers. In fact, various renovations can help sell homes more readily. And these renovations need not cost a fortune.

Putting a home on the market can be stressful, but these renovations may help it sell fast.

A fresh coat of paint

Although painting is relatively inexpensive and a job that some do-it-yourselfers can tackle, it’s not a task relished by many.

Painting is messy, it takes time, and requires moving furniture. In fact, prepping a room for painting often is the toughest component of any painting job. But fresh coats of paint can create a strong first impression.

Choose a neutral color and get painting.

Jennie Norris, chairwoman for the International Association of Home Staging Professionals, says gray is a “safe” color that has been trending in recent years.

Minor bathroom remodel

Remove dated wall coverings, replace fixtures, consider re-glazing or replacing an old tub, and swap old shower doors for fast fixes in a bathroom.

If there’s more room in the budget, replacing a tub, tile surround, floor, toilet, sink, vanity, and

fixtures can cost roughly $10,500, says HGTV. You’ll recoup an average of $10,700 at resale, making a minor bathroom remodel a potentially worthy investment.

Redone kitchen

The kitchen tends to be the hub of a home. This room gets the most usage and attention of any space, and it’s a great place to focus your remodeling attention.

The National Association of the Remodeling Industry estimates that homeowners can recover up to 52 percent of the cost of a kitchen upgrade upon selling a home. Buyers want a functional and updated kitchen.

Trending features include drawer-style microwaves and dishwashers, commercial ranges, hidden outlets, and wine refrigerators.

Updated heating & cooling system

Better Homes and Gardens reports that homeowners may be able to recoup 85 percent of the cost of new HVAC systems when they sell their homes.

Heating, cooling and ventilation components are vital to maintain. You don’t want buyers to be taken aback by an older system, and many millennial buyers are not willing to overlook old mechanical systems.

Fresh landscaping

A home’s exterior is the first thing buyers will see. If they pull up to a home with eye-catching landscaping and outdoor areas that are attractive yet functional, they’re more likely to be intrigued. Often buyers will equate a home that features an impressive exterior with upkeep inside as well.

The American Nursery Landscape Association says the average homeowner may spend $3,500 for landscaping.

Improving a home’s chances to sell quickly and at a higher price often comes down to making smart improvements that catch the eyes of buyers. (METRO CREATIVE)

Safety measures when offering vacation rentals

Vacations have changed dramatically over the last several decades. Social media has opened doors to new places, as millions of people are inspired to visit locales, they first caught sight of via platforms like Instagram.

It’s not just where people are going that has changed, but where they’re laying their heads when they arrive at their destinations.

The online marketplace for vacation rentals has no shortage of inventory, as popular websites such as Vrbo and Airbnb continue to attract property owners and renters alike. Property owners may want to consider using a home or apartment to generate some extra money.

According to Alltherooms. com, the average annual host earnings on Airbnb in North America exceeded $41,000 in 2021. That income is notable, and it’s undoubtedly one reason why Airbnb reported adding more than one million active listings in 2023.

Property owners must ponder the pros and cons to listing homes via a vacation rental service. Those that decide to go forward can take the following steps as they prepare to offer their properties as vacation rentals.

• Hire a home inspector. A certified home inspector is typically hired when individuals enter a contract to purchase a home, but these skilled professionals can be just as useful when preparing to offer a property as a rental.

Certified, experienced professionals can identify any potential problems or safety issues with a home that could cause trouble when renting a home down the road. Address any safety or structural issues with a property prior to offering it through a rental service.

• Install new safety devices. New smoke alarms, carbon monoxide detectors, locks on exterior doors, and other safety features should be upgraded prior to renting a property. In between each rental, test batteries in alarms and detectors to ensure each device is operating at peak capacity.

A new security system with external cameras also can reassure prospective renters that a property is safe. Remote locks that allow for keyless entry to a home is another upgrade that can make it more convenient for hosts and renters to access a property.

• Do your insurance homework. Existing homeowners insurance coverage likely will not apply when renting a home as a vacation property. Prior to listing a property for rent, confirm with your homeowners insurance company the coverage you need to ensure you are protected when renting a home or apartment.

Liability and accidental damage coverage are two of the many variables prospective hosts must consider.

• Keep emergency supplies on site. A fully stocked first aid kit, functioning fire extinguishers (more than one) and a listing of local emergency responder contact information (i.e., police department, fire department, nearest hospital, etc.) should be made readily available to renters. Check supplies before each new group of renters gains access to the property and restock when necessary.

Renting a property as a vacation home is a great way to generate extra revenue. But prospective hosts must take steps to protect themselves and their guests before renting a home or apartment.

(METRO CREATIVE)

Give Your Dreams A Home!

David Barnett

Senior Vice President — Mortgage Lending NMLS# 579143

Karl R. Allen

Vice President — Mortgage / Business Lending NMLS# 459341

June