May 2023 Proudly Serving Benton, Coos, Curry, Deschutes, Douglas, Jackson, Josephine, Klamath, Lane, Lincoln & Linn Counties Since 2015 The Journal for Business in Southern Oregon The Southern Oregon Business Journal is Sponsored by “LOST AND FOUNDER“ BOOK REVIEW- PAGE 5 OREGON SHAKESPEARE FESTIVAL’S NATAKI GARRETT RESIGNS- PAGE 6 DUTCH BROS QUARTERLY REVENUE INCREASED NEARLY 30% TO $197.3 MILLION - PAGE 8 SouthernOregonBusiness.com Nathan Miller has grown Grants Pass based RENTEC DIRECT to 16 employees and $10,000,000 in annual revenue and he thinks anyone can do it.

I strongly encourage you to read “Anyone can be successful, Just ask Nathan Miller” on page 16 of this months journal.

Nathan built a $10,000,000 a year business with only 16 employees in Grants Pass, Oregon with only $140 and a lot of sweat equity and he believes any of us can do the same. It was fun to interview him and learn some secrets to his success.

I’m really excited to see if the article impacts you as much as it does me.

My partners in 1000Museums and Art Authority and I bought another company. Read about that on Page 26. Buying companies is an interesting process and I’ll spend time in the future documenting the process and tricks and tips I have learned over the years as I have acquired several small businesses.

The Oregon Shakespeare Festival is in trouble and so is Ashland. After losing its executive director earlier in the year, they have lost their creative director. (Page 6) You may not care, but you should. I’m working on a story called “OSF by the numbers” which I hope to publish soon. I’m going to leave all the politics, all the drama, all the COVID blaming out and focus on the numbers. OSF matters to more communities than just Ashland. They have been operating the last couple of years as a $40,000,000 theatre company. They employed over 600 people with living wage jobs. They were nationally recognized as one of the top 10 theaters in the country. I live in Ashland and I had no idea. I don’t go to plays. It’s not why I live here. But my quality of life is better because of it. There are interesting people that chose to live here even if only for a couple of years and there are world class restaurants here. Ashland is one of the Crown Jewels of Oregon. I’m assuming the festival’s trouble isn’t related to one thing, but it suffers from many straws that broke it’s back or 1,000 cuts. I’m reading everything I can including old 990s. It’s about the numbers.

A non-profit is a business. Yes, even the ART non-profit with high highfalutin ideals is a business. It just has special privileges. It doesn’t pay taxes and the people and corporations that donate to it can write off the donation. The government can gift it money. This privilege comes with an expectation. The board is responsible for making fiduciary decisions that keep the organization on mission. There is a way to get OSF back on track. The board needs to roll up its sleeves and work with local business owners, the city, the state, the chamber of commerce and do what a world class theatre does. Put on Plays that entertain, excite and provoke us. Attract Customers to come to our small town to spend a weekend or week here being entertained. Attract actors and directors that want to work hard, fine tune their craft and deliver the best damn play possible. Attract donors and sponsors to help fill the gaps. Surprise and Delight. Be a partner in the community. You know, just like any other non-profit or small business in Oregon.

And for gods sake, get back to an equal partnership between the person running the business and the creative genius. They are not the same person or skills. They are equal partners. Fix that and the rest should follow.

PLEASE SUPPORT OUR ADVERTISERS

AMERITITLE- PAGE 4

PEOPLE’S BANK - PAGE 30

MANAGED HOME NET - PAGE 35

SOU - LEADERSHIP BEGINS HERE

SOUTHERN OREGON UNIVERSITYPAGE 24

PROJECT A - PAGE 40

Jim Jim@SouthernOregonBusiness.com

| Southern Oregon Business Journal May 2023 2 A Few Words from Jim May 2023

The Southern Oregon Business Journal extends sincere thanks to the following companies for sponsoring the journal. Without their support we could not produce a FREE resource for Southern Oregon businesses.

Founder Greg Henderson ghenderson703@gmail.com

Greg started the Southern Oregon Business Journal in 2015 and retired in 2020.

Nathan Miller has grown Grants Pass based RENTEC DIRECT to 16 employees and $10,000,000 in annual revenue and he thinks anyone can do it. Check out the story “Anyone can be successful, Just ask Nathan Miller” on page 16

Southern Oregon Business Journal

Book Review - Lost and Founder (A Painfully Honest Field Guide to the Startup World) by Rand Fishkin - 5

Oregon Shakespeare Festival Artistic Director, Nataki Garrett, Announces Resignation - 6

Dutch Bros Inc. Reports First Quarter 2023 Financial Results - 8

Oregon’s Part-Time Workers: One-Fifth of Employment in 2022 - 10

Business Oregon Supports Roseburg Forest Products' Oregon Expansion - 13

Business Oregon Announces Economic Equity Investment Program Grant Awards - 14

Anyone can be successful, Just ask Nathan Miller - 16

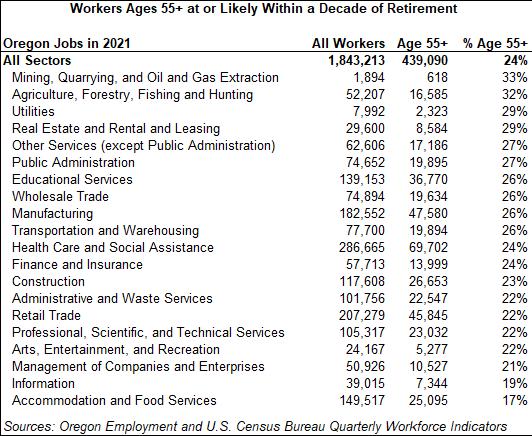

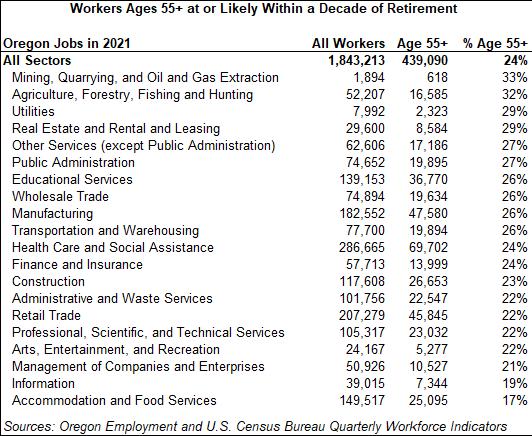

Oregon’s Aging Workforce by Industry and County in 2021 - 22

Owners of Ashland based 1000Museums.com acquire New Jersey based Museum Store Products - 26

SOU Board of Trustees approves realignment plan - 28

PBCO Financial Corporation Reports Q1 2023 Earnings - 31

A new enterprise system for your business: Dos and Don’ts - Part 1 - 32

SBDC - Where is the Hidden Value? - 36

Is This Heaven? No, It’s Rural Oregon. - 39

Faction and Arcimoto Announce Commercial Teaming and Joint Investment Agreement for CoDevelopment of Driverless Vehicle Platforms - 42

Arcimoto Appoints Chris Dawson as Chief Executive Officer - 44

5350 HWY 66, Ashland, Oregon 97520 www.SouthernOregonBusiness.com MAY 2023 - TABLE OF CONTENTS

A JOURNAL FOR THE ECONOMICALLY CURIOUS, PROFESSIONALLY INSPIRED AND ACUTELY MOTIVATED

By Jim Teece

By Jim Teece

I noticed this book on the bookshelf while interviewing Nathan Miller (page 16) so I decided to buy a copy and read it.

"Lost and Founder" is a candid and insightful book written by Rand Fishkin, the founder of Moz, a popular SEO software company. The book is a memoir of his journey as an entrepreneur, and it provides a detailed account of the ups and downs of building a startup.

One of the most striking features of the book is the author's honesty about his failures and mistakes.

Fishkin does not shy away from discussing his shortcomings and his struggles to manage his company. This openness makes the book relatable and valuable for anyone who has ever tried to build a business.

The book also offers practical advice on how to start and grow a company. Fishkin discusses topics such as

Lost and Founder (A Painfully Honest Field Guide to the Startup World) by Rand Fishkin

fundraising, hiring, and marketing, providing insights based on his own

Another aspect of the book that I found interesting was the author's discussion of the culture of Silicon Valley and the startup world.

Fishkin questions the traditional model of startup culture, which often promotes rapid growth at all costs. He advocates for a more sustainable approach to entrepreneurship that prioritizes longterm success over short-term gains.

Overall, "Lost and Founder" is a must-read for anyone interested in entrepreneurship, especially in the tech industry.

experiences. He provides actionable tips and examples that entrepreneurs can apply to their own businesses.

The book is engaging, informative, and thought-provoking. It offers a realistic perspective on the challenges of starting and growing a company, and it provides practical advice for overcoming those challenges.

Southern Oregon Business Journal May 2023 | 5 READING LIST

By Press Release https://www.osfashland.org/en/news-multimedia/newsannouncements/nataki-announcement.aspx

Oregon Shakespeare Festival Artistic Director, Nataki Garrett, Announces Resignation

ASHLAND, Ore. (May 5, 2023) –After four years serving as Artistic Director and stepping in as Interim Executive Artistic Director in January, Nataki Garrett is announcing her resignation from the Oregon Shakespeare Festival (OSF). Her last day will be May 31, 2023. Board member Octavio Solis will be stepping in to help oversee and support the artistic leadership team during this transitional phase.

Garrett, only the sixth artistic director for OSF, joined the company in August 2019. She played a critical role in guiding the organization through numerous transitions and crises, including the COVID-19 pandemic, which forced the company to shut down shortly after the opening of the 2020 season, what would have been Garrett’s first full season. During the shutdown, she raised $19M after fundraising and successfully

galvanizing a cohort of Oregon arts leaders to secure funding for the state’s performing arts organizations from the federal relief fund package. She started a nationwide advocacy coalition for non-profit theaters, the Professional Non-Profit Theater Coalition (PNTC), in 2020 that provided access to $15B in SVOG (Shuttered Venues Operator Grants) relief funding. A champion for the arts, artists, and the industry, Garrett has testified twice before Congress on the need to support the creative economy.

Artistically, Garrett conceived and launched an interactive and immersive digital platform, O!, which became all the more vital in live theatre’s absence as a source of groundbreaking performance, art, and discussion. Among her OSF directing credits include: How to CatchCreation (2019) ; Confedera tes (2022); The Cymbeline Project,

Episode 4 (2022); and Romeo & Juliet (2023). In addition, The Cymbeline Project, a multiepisode, digital production of Shakespeare's play, was conceived by Garrett. She also served as executive producer for the Sundance award-winning short film, You Go Girl!, and made OSF the epicenter of the intersection between XR and theater through her conception of Quills Fest, a public platform that sits at the intersection of immersive technology and live performance.

“OSF has greatly benefitted from the incredible talent and passion that Nataki brought to her roles as Artistic Director and later, as Interim Executive Artistic Director,” says Board Chair Diane Yu. “She joined OSF in 2019, just seven months before the pandemic closures and the Almeda fire. Under her leadership, OSF survived the

| Southern Oregon Business Journal May 2023 6 TOURISM

pandemic as she successfully brought people in the industry together to obtain public funding to carry us through. The board appreciates Nataki for her willingness and ability to apply her unique skills during these past 4 years, and for bringing her vision for American theatre.”

As the first Black female artistic director in OSF’s 88-year history, Garrett’s appointment was historic. Her work encompassed current and emerging technologies and media, reaching not only the stage, but digital and film.

Solis will be spearheading efforts to secure an interim Artistic Director.

“The Oregon Shakespeare Festival has been profoundly affected by Nataki Garrett during her tenure as its 6th world-renowned Artistic Director to helm the organization,” says Solis. “Without her selfless commitment, we would not have weathered the brutal hits caused by the pandemic shutdown and the devastating fires of the last four years. During this time, she brought new faces, new blood and new perspectives, which served our company well and kept faith with its mission and core values. We are actively conducting a search for an interim Artistic Director to ferry the company through the season, to which we are unwaveringly committed. In the meantime, we, the board, along with the staff, artists, and audiences, offer our steadfast guidance and support to the

company as the 2023 season opens.”

In addition to Solis, other members of the Board of Directors’ Executive Committee will provide support during the leadership transition, serving as special liaisons and advisors for various teams, including Development, Marketing and Community Relations, and Finance and Audit. Board member Tony Drummond, along with Yu, will serve as management transition co-leaders, meeting with senior team leaders on a regular basis and helping to oversee general transition matters. This is a temporary management structure that the board anticipates will last 3 to 4 months.

The board will also play an active role in helping the company throughout The Show Must Go On: Save Our Season, Save OSF fundraising campaign, with a $2.5M goal to launch the season. OSF will continue to fundraise to complete the season. Garrett was instrumental in helping to launch the campaign, inviting Kamilah Long, Director of Development, to OSF to launch the current grassroots campaign, which has raised $1M in one week. By honoring and building from Garrett’s work and carrying the legacy of Angus Bowmer and other past leaders of OSF, the Board will support staff in ensuring the Festival celebrates its 90-year anniversary and beyond.

“I am leaving with gratitude and great respect for the many talented people I have come to know and work with here at OSF, who work tirelessly to make sure the show must go on” says Garrett.

“I have always centered the work on our stages both live and digital, as cultural justice and I remain committed to ensuring the work of the theater expands our capacity for empathy and our world view. This season is a reflection of what I set out to do when I came to OSF: center the artists as thought leaders who transform culture. This version of OSF centers Inclusion, Diversity, Equity and Access (IDEA) work. We are a company of artists who know we are valued, are engaged with the work with ownership, and who value the company because they know the company values them. They deserve, and OSF deserves, the community’s ongoing support.

“I remain hopeful that, despite the challenges still ahead for OSF and our industry as a whole, that the Festival will become a container for the future so that generations who come can continue OSF's legacy of groundbreaking art making.”

Southern Oregon Business Journal May 2023 | 7

By Press Release - 05/09/2023

https://investors.dutchbros.com/news/news-details/2023/Dutch-BrosInc.-Reports-First-Quarter-2023-Financial-Results/default.aspx

Dutch Bros Inc.

First Quarter 2023 Financial Results

Record 45 New Systemwide Shop Openings in Q1 2023

Quarterly Revenue Increased Nearly 30% to $197.3 million

Reaffirms 2023 Guidance

GRANTS PASS, Ore.--(BUSINESS WIRE)-- Dutch Bros Inc. (NYSE: BROS; “Dutch Bros” or the “Company”) one of the fastestgrowing brands in the food service and restaurant industry in the United States by location count, today reported financial results for the first quarter ended March 31, 2023.

Joth Ricci, Chief Executive Officer of Dutch Bros, stated, “In Q1, we opened a record 45 shops systemwide and grew revenue almost 30%. We also saw meaningful margin expansion, driven by significant improvements in labor efficiency and G&A leverage. We doubled down in our pursuit of more profitable growth and delivered strong companyoperated shop margins. I’m proud of how our teams responded quickly and decisively to the economic climate, demonstrated by their focused effort on accelerating profitability as we grow our shop footprint.”

He continued, “During the quarter, we were encouraged by our customers’ responses to our traffic-

driving initiatives, including our “Fill-a-Tray” promotion, which resulted in the largest single sales day in Dutch Bros recorded history. We will continue to utilize innovative strategies to generate traffic demand and build momentum.”

He concluded, “Our new shops are highly efficient, mature quickly, and continue to demonstrate predictable and attractive margin profiles. The class of shops opened in 2019, 2020, and 2021 have already achieved our 30% contribution margin target, and the class of 2022 is maturing in line with our margin expectations. We are hitting these targets as we continue entering new trade zones across the country. This performance gives us confidence in Dutch Bros growth strategyboth in the near-term and beyond.”

First Quarter 2023 Highlights

Opened 45 new shops, 42 of which were company-operated, across 9 states. All of these new shops continue to be led by

existing or newly-promoted regional operators.

Total revenues grew 29.6% to $197.3 million as compared to $152.2 million in the same period of 2022.

System same shop sales2 declined (2.0)%, inclusive of the impact of our fortressing strategy, which results in sales being transferred from existing shops to new ones, as compared to the same period in 2022. Company-operated same shop sales declined (3.5)%, inclusive of the impact of our fortressing strategy, as compared to the same period of 2022.

Company-operated shop revenues increased 33.0% to $173.2 million, as compared to $130.2 million in the same period of 2022.

Company-operated shop gross profit was $28.9 million as compared to $16.6 million in the same period of 2022. In the first quarter of 2023, companyoperated shop gross margin, which includes 190bps of preopening expenses improved to

| Southern Oregon Business Journal May 2023 8

Reports

OREGON PUBLIC COMPANIES

16.7%, a year-over-year increase of 390bps.

Company-operated shop contribution1, a non-GAAP financial measure, grew 76.1% to $41.9 million as compared to $23.8 million in the same period of 2022. In the first quarter of 2023, company-operated shop contribution margin, which includes 190bps of pre-opening expense, improved to 24.2%, a year-over-year increase of 590 bps.

Selling, general, and administrative expenses were $46.0 million (23.3% of revenue) as compared to $45.2 million (29.7% of revenue) in the same period of 2022.

Adjusted selling, general, and administrative expenses1, a nonGAAP financial measure, were $36.7 million (18.6% of revenue) as compared to $31.7 million (20.8% of revenue) in the same period of 2022.

Net loss was $9.4 million as compared to $16.3 million in the same period of 2022.

Adjusted EBITDA1, a non-GAAP financial measure, grew 147.2% to $23.9 million as compared to $9.7 million in the same period of 2022.

Adjusted net loss1, a non-GAAP financial measure, was $0.5 million as compared to $2.5 million in the same period of 2022.

Net loss per share of Class A and Class D common stockdiluted was $0.07 as compared to net loss per share of $0.10 in the same period of 2022.

Adjusted net loss per fully exchanged share of diluted common stock1, a non-GAAP financial measure, was $0.00 as compared to $0.02 in the same period of 2022.

Outlook

Dutch Bros is reaffirming the following full-year 2023 outlook:

Total system shop openings in 2023 are expected to be at least 150, of which at least 130 shops will be company-operated.

Total revenues are projected to be between $950 million and $1 billion.

Same shop sales2growth is estimated to be in the low single digits. At this point we have no plans to take additional pricing

action in 2023. We expect lowsingle digits growth from pricing to roll-over into 2023 from pricing action taken in 2022.

Adjusted EBITDA3 is estimated to be approximately $125 million. This includes approximately $8 million we elected to make in labor investments related to wage increases in federal minimum wage markets and approximately $11 million in mandated wage increases in markets that do not adhere to the federal minimum wage standard.

Capital expenditures are estimated to be in the range of $225 million to $250 million, which includes approximately $15 million to $20 million in spending in 2023 for our new roasting facility projected to open in 2024.

Southern Oregon Business Journal May 2023 | 9

By Henry Fields Workforce Analyst Douglas and Lane counties Oregon Employment Department

https://www.qualityinfo.org/-/oregon-s-part-time-workers-one-fifth-of-employment-in-2022

Although most people work in full-time jobs, around 19% of employed Oregonians usually worked parttime schedules in 2022. People work part time for a variety of reasons. Part-time jobs offer flexibility for some who seek a job that fits their circumstances, such as students, those looking for additional income from seasonal work, or a spouse in a household

Oregon’s

Part-Time Workers: One-Fifth of Employment in 2022

with young children. Workers in those circumstances are generally considered the “voluntary part-time employed.”

Another group of part-time workers is the “involuntary parttime employed.” These are people working part-time schedules because they can’t find full-time employment or have had their hours cut at work from a

usual full-time schedule down to a part-time schedule because of economic conditions, such as slack work, unfavorable business conditions, or a slow economy.

The Current Population Survey (CPS) collects data for the U.S. and Oregon about full- and parttime workers. Those figures include the demographics of people working part time,

| Southern Oregon Business Journal May 2023 10 EMPLOYMENT

reasons for working part time, and how these numbers change over time. Among several things, these data can be used to determine how many people are “voluntarily” or “involuntarily” working part time.

What Is a Part-Time Worker?

Although full- and part-time job classification can be generally thought of as working above or below a fixed number of hours per week, the reality is more complex since people generally have a “usual” number of hours that they work per week, an “actual” number of hours they did work each week, and a “preferred” number of hours they would like to work each week.

The Bureau of Labor Statistics (BLS) distinguishes between usual full- and part-time workers based on 35 hours per week:

Full-time worker: a person who usually works 35 or more hours during the survey reference week (at all jobs combined).

Part-time worker: a person who usually works fewer than 35 hours per week (at all jobs combined).

Usual work schedules, actual work schedules, and preferred work schedules may differ. The actual hours a person is at work during a week may differ from the usual number of hours they work for “noneconomic” or “economic” reasons. Noneconomic reasons could be family or personal obligations, school or training,

vacation, illness, or bad weather. Economic reasons include slack work, material shortages, and repairs to plant or equipment. For example, if a person who usually works 40 hours per week goes on vacation for a couple of days, their usual work status would classify them as a “usual full-time worker” but the actual number of hours worked would be less than 35. Thus, this person would be a usual full-time worker who was at work between 1 and 34 hours for noneconomic reasons.

The close relationship between employment and overall economic conditions was clear during the last two recessions, when unemployment rates

Southern Oregon Business Journal May 2023 | 11

increased and the percentage of those working part time for economic reasons increased. As hours were cut back and employees laid off, more people turned to part-time employment.

Characteristics of Part-Time Workers

Of the 158.3 million people employed in the U.S. in 2022, 132.2 million (83.5%) were employed full time and 26 million (16.5%) were employed part time. Percentages in Oregon were different, with 81.2% of Oregon’s total employment usually working full time and 18.8% usually working part time in 2022. Taking a longer-term perspective, Oregon tends to have a higher percentage of parttime workers than the U.S.

U.S. data show that both younger and older workers are more likely to work part time. In 2022, 41.5% of workers aged 16 to 24 years and 20.0% of workers aged 55 years and over worked part time. In contrast, only 10.4% of workers aged 25 to 54 years, a group traditionally considered to be of “prime working age,” worked part time. Younger workers are likely working part-time schedules for reasons related to school attendance, and older workers are likely working part time for reasons surrounding the transition to retirement from a “full-time career job.”

Oregon data by specific age group from the CPS are limited to age 16 to 19 years. However, Oregon data for 2022 tell a

similar story with workers aged 16 to 19 years more likely to be working part time. Approximately 68% of employment for those aged 16 to 19 years was part time.

Although both men and women are more likely to be employed full time rather than part time, a majority of those working part time are women. In 2022, nearly two-thirds (62.7%) of U.S. parttime workers were women, and slightly less than one-third (37.3%) were men. Less than half of part-time workers are married with a spouse present (43.3%). About 43% of part-time workers have never been married, and around 14% are widowed, divorced, or separated. Oregon data by gender for 2020 show around 63% of part-time workers are women.

Trends in Part-Time Employment

In 2022, the highest concentration of part-time employment in the U.S. was in service occupations, with 37% of total employment in these occupations being part time. Included in this group are occupations such as fast food and counter workers, and waiters and waitresses. Other occupations with high concentrations of parttime workers are sales and office occupations (26% of employment in this occupation) which include jobs such as retail sales workers. About 16% of natural resources, construction occupations are part-time, the lowest rate of the major occupation groups.

The industries with the highest percentage of part time workers are leisure and hospitality (42%), wholesale and retail trade (28%) and education and health services (24%). The industries with the lowest share of workers in part time roles were manufacturing (11%), construction (14%) and financial activities (14%).

Part-time employment offers a wide range of opportunities; the reasons vary by individual circumstances as well as economic conditions.

Approximately 17% of workers in the nation worked part time in 2022, compared with 19% of Oregonians. Nationally and statewide, younger and older workers are more likely to work part time, as are women. The percentage of those working part-time for economic reasons rose and fell in tandem with the changes in the unemployment rate over the last 20 years. Whether part-time employment is voluntary or involuntary, the range of occupations provides opportunities for many Oregonians.

| Southern Oregon Business Journal May 2023 12

By Press Release

https://development.oregon4biz.com/acton/rif/14786/ s-0656-2304/-/l-0007:4d5c/q-000c/ showPreparedMessage?sid=TV2:FREfoSGmd

Business Oregon Supports Roseburg Forest Products' Oregon Expansion

“Business Oregon is thrilled to support Roseburg Forest Products, and we are proud to be their partner on the company’s expansion in Oregon,” said Sophorn Cheang, Director of Business Oregon. “This expansion will cultivate rural economic stability by connecting rural Oregon communities to larger urban markets and will create new family-wage jobs in Dillard.”

Business Oregon awarded Roseburg Forest Products a grant of $3 million from the Emerging Opportunity Fund to expand the company’s manufacturing presence in Oregon. Roseburg Forest Products (Roseburg) is planning a series of significant investments in Oregon totaling $700 million over the next four years. The $3 million award from Business Oregon helps support Roseburg’s Oregon expansion through the purchase of machinery for its approximately $45 million Dillard Components plant at the company’s Dillard complex. This new plant will be dedicated to production of Armorite exterior trim, a new product offering from Roseburg.

Roseburg is one of Oregon’s anchor employers. The company employs 3,500 people in North America, 2,350 of them in Oregon. Most Roseburg employees earn more per hour than the median Oregon worker and live in rural areas of the state, making the company a linchpin of Oregon’s rural economy.

Roseburg’s new Dillard Components plant will be uniquely high-tech and heavily automated. The new production jobs in this plant will be among the highest-paying production positions in the company due to the need for employees skilled in computer technology, robotics, and other forms of cutting-edge automation.

Supporting Roseburg’s investment and new product line expansion in Oregon with an Emerging Opportunity Fund award means an increase in value-added products manufactured in Medford and Dillard, most of which will be sold to California and other out-ofstate markets. This project will have significant, long-term economic impact in the region including creation of additional high-tech jobs in rural Oregon, expanding production output for Oregon-made wood products, and the introduction of a new and innovative product line in a strategic and key Oregon industry sector.

Learn more about Business Oregon and its programs to support businesses both big and small, at oregon.gov/biz.

Southern Oregon Business Journal May 2023 | 13 BUSINESS OREGON

By Press Release https://development.oregon4biz.com/acton/rif/14786/s-0662-2305/-/ l-0007:4d5c/l-0007/showPreparedMessage?sid=TV2:gKhQZ0ad1

Business Oregon Announces Economic Equity Investment Program Grant Awards

Business Oregon is pleased to announce grant awards to 37 organizations across the state through its newly created Economic Equity Investment Program (EEIP). The EEIP was created in 2022 by Senate Bill 1579 and made nearly $15 million in grant funding available to culturally responsive organizations to provide outreach, support, and resources to eligible beneficiaries to address longstanding economic inequities. Business Oregon received nearly 90 program applications, requesting over $51 million in funds. After a thorough evaluation process involving agency staff and a diverse panel of external reviewers, 37 grants were awarded.

“The Economic Equity Investment Program is a key step toward closing the racial wealth gap

and advancing opportunities for Oregon’s disproportionately underrepresen ted communities,” said Sophorn Cheang, Director of Business Oregon. “We are so grateful to former Senator Akasha Lawrence Spence for championing this bill, to the program advisory group for their leadership and expertise, and to the reviewers for their dedicated involvement in the evaluation process. Business Oregon is proud to partner with the grant award recipients to deliver culturally responsive and culturally specific services to Oregon communities, and we are confident that this program will lay the foundation for greater economic equity.”

Following this announcement, Business Oregon will work with grant recipients on the development and negotiation of

contracts and anticipates the first payment of funds being disbursed in the Summer of 2023. Recipient organizations will have approximately 18 months to distribute programming and resources to eligible beneficiaries. The EEIP funding currently represents a one-time investment by the Oregon State Legislature.

“The Economic Equity Investment Program is the result of communities, advocates, and policy-makers coming together to address longstanding wealth disparities and the factors that perpetuate them,” said former Senator Akasha Lawrence Spence. “The awards made through the EEIP are critical to ensuring that all Oregonians have access to the opportunities and resources that contribute to economic well-being and intergenerational wealth creation. I am

| Southern Oregon Business Journal May 2023 14 BUSINESS OREGON

thrilled to see this program operational and look forward to seeing the impact it has on the individuals, businesses, and communities who inspired our work.”

Successful applicants demonstrated a meaningful track record of delivering programs or resources to target populations within at least one of the following key areas: land ownership and real property acquisition, entrepreneurship and business development, workforce, and intergenerational wealth building.

The funded projects are listed below under each of those four categories.

Ownership of Land, Principal Residences, and Other Real Property:

11 Projects; $5,985,020

Awarded

Bienestar ($354,500)

CASA of Oregon ($752,500)

Catholic Charities of Oregon ($250,000)

Farmworkers Housing Development Corporation ($480,000)

Habitat for Humanity Oregon ($850,000)

Hacienda CDC ($692,775)

Immigrant and Refugee Community Organization ($400,000)

Kor Community Land Trust ($400,000)

Native American Youth and Family Center ($900,000)

Umatilla-Morrow Head Start ($205,245)

Community Home Builders ($700,000)

Entrepreneurship and Business Development: 16 Projects; $5,181,484

Awarded

Black United Fund of Oregon ($60,000)

Be-Blac ($200,000)

Bohemia Food Hub ($50,000)

Capaces Leadership Institute ($300,000)

Consejo Hispano ($250,000)

High Desert Partnership ($400,000)

Livelihood NW ($220,250)

Micro Enterprise Services of Oregon ($200,000)

National Association of Minority Contractors ($273,000)

Nixyaawii Community Financial Services ($400,000)

Oregon Native American Chamber ($456,464)

Philippine American Chamber of Commerce of Oregon and the Black American Chamber of Commerce ($700,000)

Strategic Economic Development Corporation/Latino Business Alliance ($400,000)

The Next Door ($271,770)

Urban League of Portland ($800,000)

Warm Springs Community Action Team ($200,000)

Workforce Development: 5 Projects; $1,049,360

Awarded

Asociación Hispana de la Industria del Vino en Oregon y Comunidad ($195,360)

Constructing Hope ($150,000)

Portland Opportunities

Industrialization Center & Rosemary Anderson High School ($124,000)

Unidos Bridging Community ($400,000)

Venture Partners Education and Career Development - Venture Lab ($180,000)

Intergenerational Wealth Building: 5 Projects; $1,535,066

Awarded

Centro Cultural del Condado de Washington ($500,000)

Ecumenical Ministries of Oregon ($207,066)

Project Youth+ ($140,000)

Rural Development Initiative ($250,000)

Umpqua Community Development Corp/ NeighborWorks Umpqua ($438,000)

More information about this program and detailed descriptions of the awarded organizations and their programs can be found on Business Oregon’s website.

Southern Oregon Business Journal May 2023 | 15

By Jim Teece

Anyone can be successful, Just ask Nathan Miller

Ifirst met Nathan Miller, Founder, President of Rentec Direct (rentecdirect.com), a Grants Pass based Software as a Service(SAAS) company in the landlord/property manager space, when he was the CTO (Chief Technology Officer) for a company in Grants Pass that was a SAAS for Internet Service providers, VISP.

I was a new customer of VISP and toured the facility one day and met Nathan, who was

responsible for keeping all the servers up and secure. He proudly showed off his server room and how many racks it took to support ISPs all over the world. Todd, the owner of VISP, was talking about moving the company to the Philippines for many reasons and I asked Nathan if we were going to go with him.

I recall him telling me that he was going to stay in Southern Oregon and continue working

on this side hustle of software for landlords and property managers. He was excited to move the servers into this new thing called the cloud.

I kept tabs on Nathan over the next 15 years, running into him at different times and each time he said in his quiet unassuming way that it was going ok.

In 2019 Rentec Direct was selected by SOREDI (Southern

| Southern Oregon Business Journal May 2023 16 INSPIRING BUSINESS PEOPLE

NATHAN PLAYING PING PONG AT THE PING PONG SHOW DOWN

Oregon Regional Economic Development Inc) to host the Rogue Tech Tour event at their office and I was invited to be a part of it. I remember walking into a magnificent mansion converted into offices in downtown Grants Pass and being blown away at how cool it was. After everyone left, I found Nathan playing ping pong with one of his employees. They were not messing around. I could tell that they both took ping pong very seriously and I found myself smiling as I watched them battle. I think his opponent beat him after several long volleys and she was even pregnant at the time.

Recently I had the opportunity to sit with Nathan (via Zoom) and discuss what his journey

has been like and where Rentec Direct is now. He made it clear that he wasn’t looking for a story about him or the business but he was interested in inspiring future entrepreneurs by using his success with Rentec Direct as an example. He honestly believes that anyone can teach themselves all the skills required to run a successful business. He wants everyone to know that you don’t need investors and you don’t need bank loans to be as successful as he is.

How successful is he? Rentec Direct has grown to 16 employees, boasting 25,000 clients with 10,000 of those being active monthly recurring revenue ones managing 300,000 properties, and last year they hit the $10,000,000

in annual revenue milestone. Because of their 30% Year over Year (YOY) growth they have been on the Inc 5000 Fastest Growing Private Companies, six years in a row.

My hour with him left me inspired and excited to implement some of his philosophy into each of my small businesses. My head is swimming with ideas for new business ventures, even as I put the finishing touches on this story together. He has a quiet and strong demeanor that inspires and instills confidence that you can do anything, as he shares his own story.

I felt like I could do what he did, because he truly believes that if he can do it, then anyone can.

Southern Oregon Business Journal May 2023 | 17

NATHAN PLAYING PING PONG WITH KAYCEE

Anyone can be successful.

Find a niche.

While he was a network engineer for another Grants Pass company he started buying rental properties on the side and needed a software tool to help him manage them. He couldn’t find one that met his needs so he decided to write his own. He didn’t do it because he

thought he would start a company. He did it to help himself, and other landlords like him, be a better landlord. To save time.

Teach yourself.

He needed to teach himself programming in PHP to accomplish this goal. He didn’t

set out to start a company. He set out to write a program to help him be a better property manager and landlord. He didn’t know how to program so he had to learn and taught himself programming. When he realized he needed to start a company he taught himself how to do that. When he realized he needed skills to

| Southern Oregon Business Journal May 2023 18

THE RENTEC DIRECT TEAM IN FRONT OF THEIR HEADQUARTERS IN DOWNTOWN GRANTS PASS, OREGON

The top takeaways from my conversation with Nathan.

successfully run a company he taught himself how to do that.

Bootstrap the company.

server to launch the company with.

Wake up early

Already a morning person, but with a full-time job, he woke up at 3 and 4 am every day, drank coffee, and spent up to 4 hours a day learning how to code and discovering the joy of seeing his software come alive in a web browser. He woke up excited to see what he could learn and accomplish that day.

After building the software for himself, he shared it online for free and it grew to a couple hundred users in a short amount of time. They came after him for feature requests and tech support so he knew he needed to start a company and have some revenue in order to hire someone. He started charging ten cents a unit per month and that helped pay for the employee. The entire startup capital to begin Rentec Direct was the $140 he took from his wallet to purchase an old, used, slow

Save your customers time

Nathan takes a lot of pride in how he loves to spend 8 hours on a problem that will save his 10,000 customers 15 minutes each and how that equates to 150,000 minutes of savings. That’s a huge impact on humanity and the lives of his customers. 15 minutes may not seem like much, but at that scale, it adds up to a significant amount of time saved.

Southern Oregon Business Journal May 2023 | 19

THE VERY SERIOUS RENTEC DIRECT TEAM IN FRONT OF THEIR HEADQUARTERS IN DOWNTOWN GRANTS PASS, OREGON

Automate everything

Rentec automates many if not most of the work required to be a successful landlord.

Nathan brings that same mindset to his own company. By automating all the minutia in your business it frees you up to focus on innovation and growing your business.

Nathan loves to compare his operation at Rentec Direct with their nearest competitors because Rentec Direct is as or more successful than

competitors who have hundreds of employees, primarily because of the efficiencies and automation they have built.

Find the niche within the niche.

His competition focuses on large property managers that handle thousands of properties and Nathan’s team focuses on the small landlord and owner of a small number

of properties. The big companies can't compete in this small space and Nathan’s small agile team thrives in it.

Work 40-hour weeks.

He is proud of the fact that he and his team are only asked to work 40 hours a week. He maintains a healthy balance of work, family, and personal time and he expects his employees to do the same.

| Southern Oregon Business Journal May 2023 20

NATHAN AND HIS WIFE KAYCEE NOT PLAYING PING PONG

Educate and Lead your industry

They used to have to buy customers with AdWords but since focusing on an industry blog they launched in 2014 that educates customers and potential customers he is getting nearly 50% of his new customers from the blog. He still spends $25,000 a month on ads but he knows he would have to spend a lot more if it weren’t for his blog. He believes that part of his job is to make the industry stronger. When the industry is doing better, his company does better.

Enjoy what you do every day

.

Ok, Most days. Focus on solving the problem and then move on. Get back to doing what you enjoy doing. Learning. Solving problems. Finding ways to save customers time.

them to do more. They depend on it and trust it to help them be better business people.

Don’t sell

Build a platform that others build on top of. Landlords are business people. When you build a platform that business people use every day to run an efficient business it empowers

Reinvest in your company constantly.

Nathan is proud of the fact that he has never taken out a loan for the company. He has taken out loans for real estate transactions he has done personally, but he hasn't had to take out a loan or ask for investment from any 3rd party.

When his business hit $3M in recurring annual revenue the businesses looking to buy businesses started reaching out. When Rentec Direct hit the $10M recurring annual revenue, the potential buyers flooded him daily, somehow some wannabe buyers even have his personal cell number, with requests to buy his company. He has been told that his company is now worth $100,000,000 but he asks himself, “What would I do with $100,000,000 that is different from what I do today? Not much, so why sell?" Nathan is also proud of the fact that every dollar that isn’t reinvested back into the company is invested in Oregon. He strongly believes that people sell their businesses when they have outside investors because the investor wants to cash out. It’s not always best for the business or the customers, but it’s best for investors and that is why they sell.

Owning 100% of the business allows you to run the business you love and not be forced to sell it to the highest bidder.

Southern Oregon Business Journal May 2023 | 21

NATHAN AND HIS FAMILY - PHOTO CREDIT: KELCIE JEAN PHOTOGRAPHY

By Gail Krumenauer State Employment Economist Oregon Employment Department

https://www.qualityinfo.org/-/oregon-s-aging-workforce-by-industry-and-county-in-2021

Oregon’s Aging Workforce by Industry and County in 2021

Oregon’s workforce is aging. The number of Oregon jobs held by workers age 55 and over more than tripled from 1992 to 2021, while their total number of jobs grew by slightly more than half (51%). Workers 55 years and over held 10% of all jobs in 1992. By 2021, that share increased to 24%. Driving

this trend is the fact that everyone in the Baby Boomer Generation is now 55 and older, and they are more likely to be in the labor force than previous generations were at ages 55 and beyond. Many of these workers may plan to retire in the next 10 years, taking their skills and experience with them.

The aging workforce is a general demographic trend that’s expected to continue in the coming years. It impacts employers, industries, and regions to varying degrees. Employers should know the age profile of their own workforce so

| Southern Oregon Business Journal May 2023 22 EMPLOYMENT

they can plan accordingly for increased turnover and recruitment efforts due to retirements. At a broader level, workforce planners need to know the demographic profiles of entire industries and regions to help gauge the need for future replacement workers.

Health Care Has the Most Workers Age 55 and Over

The pace of retirements will likely be faster in industries that have an older workforce profile.

Industry age profiles vary. The relatively young accommodation and food services sector has 17% of jobs held by workers ages 55 and over. By contrast, one out of three jobs (33%) in the mining and quarrying sector are held by workers 55 and older. Although natural resources, utilities, and real estate have higher concentrations of older workers, they employ fewer workers than many industries and are expected to require relatively fewer replacement workers.

Some employers in industries with a large number of workers 55 years and older may struggle to a greater degree to find enough workers if they don’t plan ahead.

Health care (both private and public) stands out for the size of its aging workforce, with nearly 70,000 workers ages 55 and over. Other industries with a large number of workers nearing retirement age include manufacturing (48,000 workers),

Southern Oregon Business Journal May 2023 | 23

sou.edu • 855-470-3377

“SOU gave me the opportunity to grow and to change my life and to help change the lives of other people.”

ANGELICA RUPPE MS ’86

retail trade (46,000), and private and public educational services (36,000). Employers in these and in all other industries need to plan for how they are going to attract replacement workers, especially for jobs that require significant training.

Rural Counties Have Older Workforces

Rural counties tend to have a higher shares of older workers, and could feel the impact of the aging workforce more than metro counties. More than one out of four jobs (27%) were held

by workers 55 years or older in rural areas. That represents approximately 64,000 workers in rural Oregon who may be looking to retire within the next decade.

held by workers ages 45 to 54 (102,000). Meanwhile, rural Oregon has fewer jobs held by workers ages 45 to 54 (47,000).

Employers in metro counties will generally tend to have a larger pool of younger workers to recruit from when replacing retiring workers. Rural counties will need to either recruit workers from other areas, or engage area workers who aren’t actively in the labor force, just to maintain the size of their current workforces.

Employment by Age Data

Although older workers are a smaller share of the workforce (23%) in metro counties, there are a lot more of them.

Multnomah County alone has more workers ages 55 and older (106,000 workers) than all of rural Oregon combined (64,000). However, Multnomah County has nearly as many jobs

Information about employment by age group for industries and counties is from the U.S. Census Bureau’s Center for Economic Studies Longitudinal EmployerHousehold Dynamics (LEHD) program and the Local Employment Dynamics (LED) partnership with the states. Employment data is the average of quarterly employment for 2021.

To explore and use the data available from LED, visit lehd.ces.census.gov.

Southern Oregon Business Journal May 2023 | 25

By Jim Teece

Owners of Ashland based 1000Museums.com acquire New Jersey based Museum Store Products

Meet my friend Wood Huntley. He started his business, Museum Store Products, 38 years ago. He fondly remembers sitting on the floor of his living room with his wife Beirne, laminating photos and making magnets to sell to his first customer, The Philadelphia Museum of Art.

Today he has grown the business to over 25 employees making everything from

magnets to notebooks, puzzles to keychains in a 10,000 SQFT factory in rural New Jersey.

Alan and I met Wood in person, but we had heard of the legend prior, almost a year ago, at the industry trade show, MSA Forward, in Boston and we hit it off right away. One thing I saw first hand at the show is that everyone loves Wood. He has a genuine love for everyone he works with and

a desire to make the industry stronger and better.

He and Alan started collaborating on different projects right away and I have quietly visited his operation 3 times to learn about his business since.

He has done an amazing job growing a wonderfully skilled team and running a business that is a leader in the industry

| Southern Oregon Business Journal May 2023 26 ACQUISITION

and I have learned a lot from him on my visits.

His product line is more diverse than ours at 1000Museums and there is very little overlap. Not only is he an entrepreneur but he also serves as president of the board at the Shakespeare Theatre of New Jersey. https:// www.shakespearenj.org/

We worked together so well that we started dreaming of ways to grow both of our businesses together.

So I’m pleased to share with you that the 4 partners (Alan Oppenheimer, Stanley Smith, Mac and myself) have purchased 100% of Museum

Store Products and Wood is now our VP of sales at the company he started.

It’s important to note that he isn’t retiring.

Far from it. He’s excited to be able to focus on doing what he loves doing most and that is selling the amazing products they make, to his friends that run the museum stores.

We are truly excited and honored to have the trust and faith of Wood and Beirne in us to carry on the tradition of “Made in the USA” quality, industry leadership and customer friendship they have fine-tuned over the last 38 years.

We strongly believe that Art Authority + 1000Museums + Museum Store Products is truly something that is Better Together.

We will be showcasing this at this years MSA conference in Denver with adjoining booths. The companies are separate, stand alone companies and there are no drastic changes planned for either of them.

We will continue to operate in Ashland, Oregon and Hackettstown, New Jersey.

I’m happy and excited and encourage you to follow along as we continue to grow.

Please check out https:// www.1000museums.com/msp/ for more details.

“It’s been a fun ride and I have made the best friends,” reflects Wood on his life’s work, “I am proud of what we built together but it’s time for me to sell the business and focus on what I love doing most… Selling the amazing products we make at Museum Store Products to all of my friends in the Museum world.”

“We are honored to have been chosen by Wood and Beirne to take over the reigns of the highly respected company that they have built over the last 38 years,” said Jim Teece, one of the owners, “I have over 33 years experience in running companies and I look forward to working with Wood in his new role as VP of Sales and the rest of the amazing team he has in place in the New Jersey factory in my role as President of Museum Store Products.”

“I am really looking forward to seeing how 1000Museums and Museum Store Products can work together to further our mutual mission of helping museums thrive,” said Alan Oppenheimer, one of the new owners and managing partner at Art Authority and 1000Museums.

Key Points

1. 1000Museums and Museum Store Products are now under joint ownership but will each operate independently and cooperatively.

2. Each company will remain under the same industry-focused leadership with over 50 years of experience combined.

3. The companies have complementary product lines: from magnets and mugs through custom-framed archival prints, and everything in between.

4. Both companies will continue to proudly make the highest quality museum store products in the U.S.A. (New Jersey and Oregon)

Southern Oregon Business Journal May 2023 | 27

By Press Release Southern Oregon University

https://news.sou.edu/2023/04/sou-board-of-trustees-approves-realignment-plan/

SOU Board of Trustees approves realignment plan

The Southern Oregon University Board of Trustees voted unanimously today to adopt the SOU Forward fiscal realignment plan – a four-plank strategy that balances expenses with revenue and then prepares the university for strategic growth by diversifying its sources of revenue.

The board focused primarily on the plan’s first plank –immediate cost management –while the three planks or elements that are centered on

revenue generation will unfold over the next several years.

“University leaders clearly understand SOU’s difficult position and have identified the steps necessary to address the institution’s immediate financial threats,” said Daniel Santos, chair of the SOU Board of Trustees. “What my fellow board members and I find most hopeful is that this plan also lays out a course of action that will enable the university to diversify its revenue and

avoid similar threats in the future.”

The cost management measures that trustees adopted will reduce expenses by $3.6 million this year while identifying another $9 million in recurring cost reductions. They address structural flaws in the university’s financial model that otherwise would result in a projected $14.6 million deficit by the 2026-27 fiscal year.

The measures will reduce the SOU workforce by the

| Southern Oregon Business Journal May 2023 28 HIGHER EDUCATION

equivalent of almost 82 fulltime positions – about 24 of them resulting in current employees losing their jobs. The remainder will be achieved through a combination of current job vacancies, retirements, voluntary departures and nonrenewable contracts. The university is working closely with the 24 current employees whose positions will be lost to identify other opportunities. Those whose positions are impacted are being given advance notice ranging from 120 days to 15 months, depending on job category.

“Make no mistake, this continues to be a challenging process for all of us at SOU,” President Rick Bailey said. “But we will remain committed to kindness, compassion and unity. We are in this together, and will always be mindful of the ways in which this plan affects all of our students, faculty and staff.

“Ultimately, as challenging as this work is, we are doing it because we are united in our love for students. We owe it to current and future students to take the steps necessary to keep SOU affordable and accessible for generations to come.”

The staffing reductions will touch SOU’s three employee

groups almost equally, with 27 faculty positions, 30 classified positions and 25 unclassified positions affected. The timing of reductions will vary over the next year and a half, with most being achieved by June 2024 or soon thereafter.

The realignment process, which began in earnest last October, has aimed for transparency and collaboration, with input from SOU’s shared governance partners – the Associated Students of SOU, Faculty Senate and Staff Assembly –and the unions representing both faculty and classified employees. With each decision, efforts have been made to maintain academic excellence and student experiences.

The structural flaws in SOU’s fiscal model are the result of a longstanding reliance on the combination of state appropriations and tuition revenue to pay for most operations. The proportion of

those two funding sources has flipped in recent decades for all of Oregon’s seven public universities – what used to be about a two-thirds share from the state and one-third from tuition is now the exact opposite.

President Bailey has said that SOU can “no longer pull the tuition lever” each time its budget must be balanced. The SOU Forward plan identifies strategies that will build the university’s fiscal resilience and reduce its reliance on state funding and tuition.

Those revenue-generating planks call for the university to reimagine how it supports faculty and programs seeking funding from external granting agencies and organizations, leverage an ongoing surge in philanthropic support for SOU and diversify revenue by pursuing entrepreneurial opportunities that include solar power generation and creation of a senior living facility.

Southern Oregon Business Journal May 2023 | 29

We put people frst.

We proudly serve our local communities anytime, anywhere with our many Oregon branches and eBanking services.

Ashland Branch

BRANCHES

Medford Branches

1528 Biddle Road

Medford, OR 97504

541-776-5350

1311 East Barnett Road

Medford, OR 97504 541-622-6222

Albany Branch

333 Lyon Street SE Albany, OR 97321 541-926-9000

1500 Siskiyou Boulevard

Ashland, OR 97520 541-482-3886

Central Point Branch

1017 East Pine Street

Central Point, OR 97502 541-665-5262

Eugene Branch

360 E 10th Ave, Suite 101 Eugene, OR 97401 541-393-1070

Grants Pass Branch

509 SE 7th Street

Grants Pass, OR 97526 541-955-8005

We offer Mortgage Loans in ALL our locations.

Jacksonville Branch

185 E. California Street Jacksonville, OR 97530 541-702-5070

Klamath Falls Branch

210 Timbermill Drive

Klamath Falls, OR 97601 541-273-2717

Lebanon Branch

1495 South Main Lebanon, OR 97355 541-223-7180

Salem Branch

315 Commercial Street SE, Suite 110 Salem, OR 97301 503-468-5558

NMLS#421715

Conventional Government Construction Jumbo

COMMUNITY BANKING

By Press Release

https://peoplesbank.q4ir.com/news-market-information/press-releases/news-details/2023/PBCOFinancial-Corporation-Reports-Q1-2023-Earnings/default.aspx

PBCO Financial Corporation (OTC PINK: PBCO), the holding company (Company) of People’s Bank of Commerce (Bank), announced today its financial results for the first quarter of 2023.

Highlights

Net income of $1.7 million in the quarter, or $0.31 per diluted share

Loan growth of $13.0 million in the quarter, an increase of 2.74% compared to Q4 2022

Net interest margin of 3.49%, a decrease of 0.25% compared to Q4 2022

Cost of deposits was 44 basis points, an increase of 28 basis points when compared to Q4 2022

Opened a full-service branch in Eugene, Oregon

The Company reported net income of $1.7 million, or $0.31 per diluted share, for the first quarter of 2023 compared to net income of $2.4 million, or $0.45 per diluted share, in the same quarter of 2022. The reduction in earnings for the first quarter is primarily due to the rising cost of deposits as depositors sought higher yields and reduced mortgage lending and Steelhead revenue due to inflationary pressures.

“Despite higher funding costs and increased competition for deposits as liquidity left the banking system, the bank is well positioned with a strong core deposit base and capital to support future growth and economic challenges,” commented Ken Trautman, Chief Executive Officer. “The bank recently opened a new branch in Eugene as part of its strategic growth initiative,” added Trautman. “The banking industry is resilient, and in spite of recent challenges, remains strong overall versus the last economic downturn.”

Deposits decreased $19.1 million during the quarter, a 2.8% decline from the fourth quarter of 2022. Over the last twelve months, deposits decreased $124.4 million, a decline of 15.6%. “The deposit outflow over the last year was expected considering the large deposit inflow as a result of government stimulus during the COVID-19 Pandemic,” commented Joan Reukauf, Chief Operating Officer. “Competition for deposits increased as the government began its quantitative tightening initiative in 2022, in combination with steep Fed Funds rate increases to combat persistent inflation, which incented depositors to seek higher yields on their liquid balances.”

PBCO Financial Corporation Reports Q1 2023 Earnings

Loans increased $13.0 million in the quarter, or 2.7% growth compared to the fourth quarter of 2022. “The bank continued to grow its loan portfolio during first quarter, with demand for loans staying strong in spite of significantly higher borrowing costs than the same period last year,” commented Julia Beattie, President.

The investment portfolio decreased to $234.6 million in Q1 2023 from $236.3 million at the end of Q4 2022, a 0.7% decrease. The average life of the portfolio decreased to 4.5 years from 4.6 years during the quarter as short-term investments matured and were not replaced. Securities income was $1.04 million during the quarter, a yield of 1.76%, versus $1.06 million or a yield of 1.79% for the fourth quarter of 2022. “The bank’s investment portfolio is classified as available-for-sale, meaning there are no undisclosed, unrealized losses that could negatively impact the bank,” noted Lindsey Trautman, Chief Financial Officer. “While rising interest rates have negatively impacted the market value of our investment portfolio, the bank continues to be well-capitalized when considering the impact on capital of the unrealized loss,” added Trautman. As of March 31, 2023, the net after tax unrealized loss on the investment portfolio was $18.9 million versus $22.7 million as of December 31, 2022. Highly rated government agency and government sponsored agency investments comprise 94.8% of the investment portfolio with the balance of approximately 4.5% held in municipal investments and 0.7% held in corporate sub-debt issued by community banks. As of Q1 2023, liquid assets to total assets were 24.0%, including the market value of the investment portfolio, less pledged investments of $53.7 million.

Non-performing assets improved in Q1 as total loans past due or on non-accrual decreased to 0.26%, as a percentage of total loans, versus 0.56% as of Q4 2022. “Credit quality has remained strong during the first quarter, with past due loans improving from the prior quarter,” noted Bill Whalen, Chief Credit Officer. During the first quarter, the Allowance for Loan and Lease Losses (ALLL) increased by $318 thousand. Of the increase, $261 thousand was attributed to implementation of the new Current Expected Credit Losses (CECL) accounting standard, which went into effect on January 1st and provides for an accounting adjustment as an offset to retained earnings, net of deferred taxes. The difference of $57 thousand was the loan loss provision for the quarter under the new standard. As of March 31, 2023, the ALLL was 1.13% of portfolio loans.

First quarter 2023 non-interest income totaled $2.2 million, a decrease of $222 thousand from the fourth

quarter of 2022. During Q1 2023, Steelhead Finance factoring revenue decreased $90 thousand, a 5.8% decrease from the prior quarter. “Although factoring revenue decreased during the 2nd half of 2022 and Q1 of 2023, overall activity is strong and will continue to provide a diversified income source outside of the bank’s traditional banking products” commented Bill Stewart, President of Steelhead Finance. Increased mortgage rates have continued to negatively impact mortgage production, and consequently, mortgage income decreased $87 thousand, or 59.6%, from the fourth quarter of 2022. “Although mortgage production continued to trend negatively during the first quarter, mortgage rates have improved recently,” commented Echo Hutto, the mortgage division manager. “The bank recently hired a new team of seasoned mortgage lenders to increase production in our northern market going into the spring and summer months,” added Hutto.

Non-interest expenses totaled $6.2 million in the first quarter, up $54 thousand from the previous quarter. The primary reason for the increase in expenses was attributed to salary adjustments implemented at the start of the year. “The bank has focused on improving efficiency in 2023 as a strategic objective for the year,” noted Beattie. “The board and management have set a goal to be more efficient as the bank matures into its existing infrastructure. The Eugene expansion and the recent increase in the mortgage lending team will have a short-term impact on efficiency that should correct as we penetrate new markets,” added Beattie.

As of March 31, 2023, the Tier 1 Capital Ratio for PBCO Financial Corporation was 10.98% with total shareholder equity of $73.6 million. During the quarter, the Company was able to augment capital through earnings, while the unrealized loss on the investment portfolio also improved, as noted above. The Tier 1 Capital Ratio for the Bank was 12.60% at quarter-end, up from 12.55% as of December 31, 2022. Tangible Capital was $69.8 million, or 8.60% as of March 31, 2023, versus Q4 2022 at $64.6 million or 8.04%.

About PBCO Financial Corporation

PBCO Financial Corporation’s stock trades on the over-the-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website at: www.peoplesbank.bank.

Southern Oregon Business Journal May 2023 | 31

Founded in 1998, People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Ashland, Central Point, Eugene, Grants Pass, Jacksonville, Klamath Falls, Lebanon, Medford, and Salem.

By Jim Myers Praxis Analytics

The world is changing, at times much faster than we want to admit.

In the past, it was possible to close off your business systems from the rest of the world.

The internet has put an end to that reality; the days of a business working within a closed system are long gone.

A new enterprise system for your business:

We now have a plethora of innovative systems, development methods and system vendors to choose from for your enterprise system needs.

The question for business leaders is this: When the time comes for you to transition your business systems will you be comfortable with your decisions? (1) One of most common oversights is that even though a business may

Dos and Don’ts - Part 1

recognize the need to upgrade their systems, their approach is stuck in the past.

Many times leaders, while understanding that the environment has changed, cling to outmoded approaches based upon a poor set of assumptions.

The evolution of enterprise systems (2) has been driven by the recognition for improved data-

| Southern Oregon Business Journal May 2023 32

SYSTEMS

driven decision making based on the capture of data to support information access and knowledge development.

Information, like other company assets, has immense value when used properly and it needs to be safeguarded and maintained.

There are three critical common components needed by businesses as they move to upgrade their current systems that allow them to take advantage of increased functionality and access to information.

These are: 1) Planning for business needs in the future, e.g. tying business strategy with systems strategy; 2) Designing the new system to support the new systems strategy; and 3) Working with your team to take advantage of your new system strategy.

In this three part series we discuss those components, review a cautionary example of how not to do them, and look at solutions so you can avoid the potential of wasting time and money in a system transition.

Requirements “Always do what you have always done, and you will always get what you have always got.”

Caution: Avoid defining system needs based upon the past and overlooking the future.

Your new system(s) will support your future strategy, so if the business capabilities required to support your strategy are not

clear, the chances are your future systems will be inadequate.

This is a case where form should follow function, what your system delivers follows what the business needs for future success.

That means focusing on what will happen in the future as opposed to what happens now.

When working with team members to gather their valuable insights, the focus needs to be on what will happen in the future as outlined in your business strategy.

Getting to a place where you are prepared for the future comes from quality requirements* that guide system selection/ development and later, configuration and implementation.

Of course, that future business strategy needs to come from leadership’s intentions about, and vision for, the business.

*Requirements in a systems sense is the explicit statement of those things or states of being (specifications) essential to the successful existence of a useful enterprise system, they are quality standards.

If the end state is not defined, or is out of date, the requirements will not deliver a system acceptable for its intended use.

Example: I once accepted an invitation by a system development team to review their new customer service system slated to be implemented soon.

The development of the system had unfortunately been postponed multiple times and was now many years beyond its planned deployment.

The results of their efforts would have been a great system – if it had been available a decade earlier.

The reality was that the recognition of needing a new system had happened too late and half the target user group interviewed many years prior to develop system requirements were retired by the time the new system was implemented.

The new generation of users would unfortunately soon find out that what had been built was now both foreign in appearance, and hopelessly lacking in functionality.

While the original requirements were assuredly based upon the best of intentions, at no time in the delayed development process were the requirements reexamined for validity, nor were the risks associated with the original approach and its delayed delivery discussed.

Without a thoughtful review of the business strategy, business capabilities, systems strategy and solution requirements in light of changing conditions, the team could not deliver what the current circumstances required.

Solution: Well defined system requirements address your future business capabilities prioritized by their value.

Southern Oregon Business Journal May 2023 | 33

A capability is an outcome required to sustain the business.

Capabilities are the ‘what’ of the business and represent outcomes needed to attain your goals.

Core capabilities are those activities, approaches, and methods that differentiate your business in the market.

Unfortunately, the identification of core capabilities is too often overlooked in relation to new systems.

By focusing on those core capabilities required for the future and ensuring they are represented in system selection/ development requirements you set your team up for success.

Those well-developed requirements help team members think in terms of what the business needs in the future.

At each step the team can review their progress against what they understand is needed.

If there are delays they have an explicit foundation on which to review their choices and make changes as needed.

That way your new system will be something better suited for 2030 instead of 2010! Countermeasure - Create and Maintain Good Requirements.

Countermeasure - Create and Maintain Good Requirements.

Take the time to create a business strategy, translate it into an enterprise systems strategy and develop your system requirements.

Go ahead and gather information from customers, suppliers and team members in light of your business strategy so you can outline a set of core capabilities that your new system will support.

Using those identified and prioritized core capabilities, develop system requirements on which to base your selection/ development criteria.

An explicit system strategy pays many dividends in the long run as you avoid unnecessary wasted time and money addressing obstacles that should not have existed to begin with.

Explicit requirements allow you to avoid ending up with an outmoded system that fails to support your future business needs.

(1) See “Does Your Business Need an Enterprise Systems Strategy?”, in the January 2020 issue of the Southern Oregon Business Journal, https:// southernoregonbusiness.com/ does-your-business-need-anenterprise-systems-strategy/

(2) Enterprise System: Application of complex software that encompasses and integrates business functions.

Typically an Enterprise Resource Planning (ERP) System includes modules designed to address unique business functionality (i.e., reporting, sales management, accounting, inventory, production, human resources, materials planning, purchasing, customer service, etc.).

Most systems comprise standard modules (“core functionality”) and optional modules to allow flexibility in addressing enterprise specific requirements.

Modern systems allow for system configuration (not software coding) at the record, module and system level through the use of user defined data fields and field behavior, data tables and table relationships, user and group level security and access rules, interface management, and audit tracking capabilities.

© 2023 Praxis Analytics, All Rights Reserved

Jim Myers is the principal of Praxis Analytics, Incorporated and a trusted advisor to business leaders in their quest to transform intentions into results.

With experience spanning over two decades, Jim worked in manufacturing, supply chain, customer service and maintenance management roles within markets ranging from capital equipment to aerospace and defense.

As Associate Dean of the Atkinson Graduate School of Management at Willamette University Jim led projects that doubled capacity, automated planning/ scheduling systems and integrated best practices into school operations.

He has taught graduate courses in Operations and Information Technology, Strategy Alignment, and Project Management.

A former Marine, Jim credits the USMC with teaching him the value of leadership, quality people, good systems, and mission accomplishment.

Jim can be reached at praxis@wvi.com .

| Southern Oregon Business Journal May 2023 34

By Marshall Doak, SOU SBDC Director

By Marshall Doak, SOU SBDC Director

Where is the Hidden Value?

When companies sell, the results are all over the board regarding what the selling price is for like-sized companies. Some of the factors in a business’s value can be attributed to the physical assets that transfer from seller to buyer. These can be counted, costed, discounted or other wise modified in order to arrive at a consensus of value. At times, the valuation process ends right there, an agreement on what the physical assets are worth. But what happens if the

process doesn’t end there, what happens when the nonphysical assets, the intangible assets, have high value? How do you arrive at a fair price for these assets and the business?

Expert market professionals and business valuation professionals develop tools to estimate what the financial contributions are to the company from the intangible assets. Some assumptions are

made when developing numbers and benchmarking them against industry peers to arrive at conclusions. Areas that are examined include the contributions made from intellectual property assets such as reputation, branding, location, capabilities of management and staff and the depth of the customer list to name a few. Reasonable estimates are made using comparison data for performance to arrive at what the dollar value these assets contribute to the bottom line.

| Southern Oregon Business Journal May 2023 36

ASK

SMALL BUSINESS DEVELOPMENT CENTER

Obviously, stronger intangible assets are valued higher in the marketplace, resulting in a higher value at sale or valuation time, should it be necessary to price the value of adding a partner into the company while recognizing the founding partners’ equity at the time of new partner entry.

Like many physical assets, intangible assets require time to increase in value. The recognition of having a stellar reputation takes a while to achieve and market out to a wider audience in order to create lasting sales and value for the company. The importance of having a distinct, recognizable, defensible brand can’t be overstated. In some companies, the majority of the company’s value is due to the branding (Apple, Coca-Cola, etc).

totality of the value of the business.

START OUT RIGHT

I am spending a lot of time in this article discussing the time of sale as being significant for good reason. Many entrepreneurs struggle for years to build a successful business that will support themselves as well as employees and sale time is almost the only way to recover the investments made over the years. The best manner to have a high value and recoup the numerous investment tranches from years past is to elevate your business practices from the start. If you don’t know what that means or how to start, call for an appointment, we are in the business of helping you figure that out.