December 2022

Serving Benton, Coos, Curry, Deschutes, Douglas, Jackson, Josephine, Klamath, Lane, Lincoln & Linn Counties Since 2015 The Journal for Business in Southern Oregon Sponsored by HELP MORGAN RECOVER HIS LIFE SAVINGS! PAGE 12 BIG ORGANIZATIONS AND SMALL MOM AND POP SHOPS CAN BE VICTIMS OF CYBER FRAUD PAGE 16 PHISHING SCAM TIPS PAGE 18 SouthernOregonBusiness.com Our communities are under attack. Cyber Fraud is rampant and out of control.

Proudly

The Southern Oregon Business Journal extends sincere thanks to the following companies for sponsoring the journal. Without their support we could not produce a FREE resource for Southern Oregon businesses. Founder Greg Henderson ghenderson703@gmail.com

It’s Christmas time! We are supposed to be spreading cheer at this time of year.

The photo on the covers are from Chad Sobotka. I love his photos and I’m thankful that he gives me permission to share them with all of you.

This issue focuses on Cyber Fraud. Not very Christmasy of a theme, but it’s important to not wait to talk about it.

On the cover I state, “Our communities are under attack. Cyber Fraud is rampant and out of control.” And I feel it’s true.

We can’t wait for bad actors to turn nice and stop what they are doing and we can’t wait for the law to fix this issue, they can only track it at this point. We need to understand all the threats that are coming at us and become hyper diligent about our own cyber security.

It’s too easy for bad actors to spoof emails, or texts that look official and align with life events and convince you to provide info or worse provide funds.

Read the story about our friend Morgan, who runs Northwest Pizza, and find out how he was swindled by emails that looked legit, during a house purchase event in his life, proving instructions to him on where to wire the money for the down payment at closing.

Unfortunately, once the deed is done, it’s done. He has an active FBI investigation going but most likely the money is gone.

This same thing is happening to millions of us and thousands of businesses because it’s easy to do.

So how do you stop this from happening to you and your business?

It starts with education. Read A Message from People's BankStop the Fraud on page 15, Big Organizations and Small Mom and Pop Shops can be victims of cyber fraud on page 16 and Phishing Scam Tips on page 18.

Then make process changes and behavior changes to you and your company on how it handles emails and requests for information and transactions.

My wife and I are committed to learn and do what we can to help stop the bad actors from stealing from us and I’m committed to sharing what I learn with you so you can stop it from happening to you as well.

The only good part of what happened to Morgan and his family is that the community is rallying to help him build back the funds he lost.

And that makes me feel all Christmassy inside.

After you read Help Morgan Recover His Life Savings on page 12, I hope you join my wife and I in helping Morgan continue to feel the love and support by donating a even a small amount to the GoFundMe campaign that was created for their benefit.

I know he appreciates it and is humbled by the outpouring of love and support.

https://www.gofundme.com/f/help-morgan-recover-his-life-savings

Thanks for reading. Happy Holidays to you and your family.

Jim Jim@SouthernOregonBusiness.com

PROJECT A - PAGE 38

| Southern Oregon Business Journal December 2022 2 A Few Words from Jim December 2022

Business Journal in 2015 and retired

PLEASE SUPPORT OUR ADVERTISERS

Greg started the Southern Oregon

in 2020.

AMERITITLE - PAGE 4 FIRST INTERSTATE BANK - PAGE 8 ENERGY TRUST - PAGE 14 PEOPLE’S BANK - PAGE 20 NWTA - PAGE 22 MANAGED HOME NET - PAGE 23 SOU - LEADERSHIP BEGINS HERE SOUTHERN OREGON UNIVERSITYPAGE 26

December 2022 Proudly Serving Benton, Coos, Curry, Deschutes, Douglas, Jackson, Josephine, Klamath, Lane, Lincoln & Linn Counties Since 2015 The Journal for Business in Southern Oregon Sponsored by HELP MORGAN RECOVER HIS LIFE PAGE 12 BIG ORGANIZATIONS AND SMALL MOM AND POP PAGE 16 PHISHING SCAM TIPS PAGE 18 SouthernOregonBusiness.com Our communities are under attack. Cyber Fraud is rampant and out of control.

Ashland, Oregon Ashland Springs Hotel in Winter by Chad Sobotkahttps://www.flickr.com/photos/ chadsobotka/

5350 HWY 66, Ashland, Oregon 97520 www.SouthernOregonBusiness.com DECEMBER 2022 -

A JOURNAL FOR THE ECONOMICALLY CURIOUS, PROFESSIONALLY INSPIRED AND ACUTELY MOTIVATED

Cyber Fraud

Help Morgan Recover His Life Savings! - 12

A Message from People's Bank - Stop the Fraud - 15 Big Organizations and Small Mom and Pop Shops can be victims of cyber fraud - 16

Phishing Scam Tips - 18

Southern Oregon Business News

Industry Veteran Christine Barone Named President at Dutch Bros Inc. 5

Southern Oregon's Premier Winery - Valley View Winery celebrates 50 years 6

Rogue Creamery’s Rogue River Blue served in White House State Dinner 7

Oregon’s Unemployment Rate Rises to 4.1% in October - 8

Regulation Crowdfunding Can Help independent Businesses Access Capital When They Need it Most 10

People's Bank Hires Local Team For Eugene Market 21

SOU “pathway” programs for Latino/a/x youth get boost from state grant 24

Patridge hired as SOU general counsel 27

Workforce Assistance 28

Our Gift 30

Lithia & Driveway (LAD) Increases Revenue 18% 32

Overcoming Second-Chance Hiring Anxiety 34

TABLE OF CONTENTS

By Press Release

By Press Release

Dutch Bros Inc. (NYSE: BROS; “Dutch Bros” or the “Company”) one of the fastest-growing brands in the food service and restaurant industry in the United States by location count, today announced that it will name Christine Barone as President. Ms. Barone will begin in Q1 2023 and report to Joth Ricci, who will remain in his leadership role as CEO.

Ms. Barone has worked in the food service and beverage industries for more than a decade and most recently served as Chief Executive Officer at True Food Kitchen, a high growth restaurant and lifestyle brand, since August 2016. Prior to that, she served in various leadership roles at Starbucks. Earlier in her career, she held positions with Bain & Company and Raymond James. She holds a BA in Applied

Industry Veteran

Christine Barone Named President at Dutch Bros Inc.

Mathematics and an MBA from Harvard University.

As President of Dutch Bros, Ms. Barone will spearhead company operations as the brand continues to scale towards its goal of 4,000 shops in the next 10 to 15 years. Her hands-on leadership, deep knowledge of the coffee and service industries, and digital marketing expertise will be crucial in Dutch Bros’ next phase of growth.

“We’re pleased to welcome Christine to our team. She’s a wellrespected industry leader known for her incredible strategic and operational skills,” Ricci said. “As we look to the next phase of our brand story, we’re committed to bringing in best-in-class leadership to help us scale and grow.”

Ms. Barone said, “I’m inspired by the vision of the co-founder and the executive leadership and excited by Dutch Bros’ future. I’m looking forward to helping the brand navigate its next phase of growth and continue making a meaningful difference in the lives of customers and employees. As a team, we will continue to build on Dutch Bros’ unique culture and celebrate the people and actions that make this company great.”

About Dutch Bros Inc.

Dutch Bros Inc. (NYSE: BROS) is a high growth operator and franchisor of drive-thru shops that focus on serving high QUALITY, hand-crafted beverages with unparalleled SPEED and superior SERVICE. Founded in 1992 by brothers Dane and Travis Boersma, Dutch Bros began with a double-head espresso machine and a pushcart in Grants Pass, Oregon. While espresso-based beverages are still at the core of what we do, Dutch Bros now offers a wide variety of unique, customizable cold and hot beverages that delight a broad array of customers. We believe Dutch Bros is more than just the products we serve—we are dedicated to making a massive difference in the lives of our employees, customers and communities. This combination of hand-crafted and high-quality beverages, our unique drive-thru experience and our communitydriven, people-first culture has allowed us to successfully open new shops and continue to share the “Dutch Luv” at 641 locations across 14 states as of September 30, 2022.

To learn more about Dutch Bros, visit www.dutchbros.com, follow Dutch Bros Coffee on Instagram, Facebook, Twitter, and TikTok, and download the Dutch Bros app to earn points and score rewards!

Southern Oregon Business Journal December 2022 | 5

PUBLIC

LOCAL

COMPANIES

By Social Post on Facebook facebook.com/valleyviewwinery

Fifty years ago, when our parents founded Valley View Winery, people said they were crazy and it would never last. Forty years ago, when our

Southern Oregon's Premier

Winery

Established first in the 1850's, Valley View Winery celebrates 50 years

father died, they said Valley View would certainly fail now. We have heard for years that the Southern Oregon wine industry was just a novelty, a gimmick, and would fade away. As always, sour grapes make bad wine and are not welcome here!

Today, as we celebrate our 50th anniversary, Valley View Winery is as strong as ever. The wines are as fine as ever. The future is as bright as ever.

Valley View Winery is not, and has never been, for sale.

The Wisnovsky Family is proud to see the Third Generation learn this history and prepare to lead our Pioneer winery from

our half-century vineyard in the beautiful Applegate Valley for decades to come.

Valley View and all Southern Oregon wineries continue to grow and make delicious wines because of you. Every time you buy a bottle you help hundreds of families, beautiful vineyards and tasting rooms, musicians, farm and hospitality workers, and many others. We are forever thankful for your support. Please share this widely, let's make social media a positive place for our community! #ValleyViewWinery

| Southern Oregon Business Journal December 2022 6 AGRICULTURE

By Social Post on Facebook December 1, 2023 facebook.com/RogueCreamery

BREAKING MOOS: We are over the moon that Rogue River Blue has been selected for tonight's White House State Dinner honoring visiting French President Emmanuel Macron!!! It will be the key element on a cheese course served to President Biden, the First Lady, visiting French

Rogue Creamery’s Rogue River Blue served in White House State Dinner

First Lady Jill Biden made the announcement yesterday. “And I’m especially excited that we are featuring American cheeses for our cheese course, including Rogue

River Blue, the champion of the 2019 World Cheese Awards,” she said. Availability of Rogue River Blue was already very limited before this announcement was made.

https://roguecreamery.com/

Southern Oregon Business Journal December 2022 | 7 AGRICULTURE

President Emmanuel Macron, his wife Brigitte Macron, and 300-400 guests.

By Oregon Employment Department https://www.qualityinfo.org/press-release

Oregon’s unemployment rate rose to 4.1% in October from 3.8% in September and was above the recent low of 3.5% reached in May, June and July. October was the first month Oregon’s unemployment rate was above 4% since January, when the rate was 4.2%. Meanwhile, the U.S. unemployment rate rose from 3.5% in September to 3.7% in October. In Oregon, nonfarm payroll employment rose by 5,200 jobs in October, following a loss of 500 jobs in September.

Oregon’s Unemployment Rate Rises to 4.1% in October

The gains in October were largest in financial activities (+2,500 jobs), manufacturing (+1,100), health care and social assistance (+1,100), leisure and hospitality (+800), and construction (+700). These gains were partially offset by losses in retail trade (-700 jobs) and government (-600). Oregon’s private sector added 5,800 jobs in October, reaching another alltime high of 1,682,300. This was 10,600 jobs, or 0.6%, above this sector’s pre-recession peak in February 2020. Financial

activities added 2,500 jobs in October, bouncing back from job declines totaling 1,600 between June and September. Job gains in October were strongest in real estate and rental and leasing, which added 1,900, as firms in the following industries added workers: rental centers and lessors of buildings and dwellings. Construction continued its rapid expansion of the past 12 months, when it added 8,800 jobs, or 7.9% growth. It employed 120,900 in October, another record high,

| Southern Oregon Business Journal December 2022 8 EMPLOYMENT

Member FDIC. Equal Housing Lender. ⌂ *Minimum initial deposit of $25,000 required for consumer accounts; $50,000 required for business accounts. Must have a First Interstate checking account. 2.02% Annual Percentage Yield (APY). APY accurate as of 11/07/2022. Rate may change after account is opened. Fees may reduce the earnings on the account. No institutional or brokered deposits accepted. Terms and conditions subject to change. Earn 2.02% APY* with our Indexed Money Market account. Turn rising rates into financial feel-goods. Earn 2.02% APY today and continue with half the federal funds rate for the lifetime of the account. Learn more at firstinterstate.com/fall22special

which was well above construction’s prerecession total of 112,300 in February 2020. In contrast to the rapid growth of many of Oregon’s industries, retail trade trended downward this year. It employed 208,500 in

October, which was a loss of 2,900 jobs during the first 10 months of the year. Since October 2021, general merchandise stores cut 2,300 jobs, which was the most of the retail component industries. Two

other retail industries shedding jobs over the year included motor vehicle and parts dealers (-900 jobs) and building material and garden supply stores (-800).

https://www.qualityinfo.org/documents/20126/110739/ Employment+in+Oregon/443acc10-b64ae9d5-2f48-988e1e0d45df?version=1.116

Southern Oregon Business Journal December 2022 | 9

By CJ Connell High Desert Herb & Spice Co Redmond, OR Sustainable Independent Lifestyle (Multi Media Newsletter)

As small businesses and farmers are increasingly priced out of the traditional loan market, crowdfunding can offer an alternative to acquiring the funds they need to expand.

Regulation Crowdfunding Can Help independent Businesses Access

Capital When They Need it Most

The Federal Reserve's aggressive interest rate increases are making traditional loans too expensive for many independent businesses, impacting Main Streets and weighing on economic growth.

In this credit environment, venture entrepreneurs should

consider an innovative and relatively new alternative to accessing growth capital: regulation crowdfunding. This approach allows a company to issue securities, stocks, and bonds directly to the market. It generally offers lower costs and better terms than traditional broker-dealers,

angel investors, or venture capital funds.

Created in Title III of the JOBS Act of 2012, regulation crowdfunding puts businesses in charge of the funding process, not bankers. It empowers entrepreneurs to offer securities, stocks or bonds to the public directly

| Southern Oregon Business Journal December 2022 10 FINANCING

Photo by Randy Fath on Unsplash

over the internet through specialized websites called portals. It provides access to capital for independent businesses and opens earlystage investment opportunities for ordinary investors. It's perhaps the most significant change in business financing regulations since 1933 and 1934 when the SEC and the "private equity" structure were created. Unfortunately, this innovative financing option has been hampered by regulatory challenges, including strict limits on its use. But in the spring of 2021, the SEC released new rules boosting the maximum amount small businesses can raise to $5 million in a 12month period, from $1.07 million, vastly expanding the potential for growth businesses.

Since the SEC's update, regulation crowdfunding investments have more than doubled. Meanwhile, traditional venture funding struggles.

The SEC's 2021 changes also ended limits on accredited investors and reduced limitations on non-accredited investors. Now Americans who earn less than $107,000 per year can participate in these ventures by making annual crowdfunding investments of

either $2,200 or 5% of their net worth, whichever is greater. This change increases investment opportunities for ordinary Americans looking for venture capital potential returns. (Disclaimer: Regulation crowdfunding investments are risky and should be limited to investment funds you are willing to lose.)

With well over a billion dollars raised by small businesses since its inception, regulation crowdfunding has had many success stories. One notable example is the Bay Area Ranchers' Co-op, created by a group of San Francisco Bay Area ranchers. At the end of 2019, Bay Area ranchers faced a major problem: The only local USDA meat processing facility available decided to curtail its services, leaving many small ranchers facing an end to their meat production operations. In response, a group of 16 ranchers banded together to create the BAR-C in hopes of building their own USDA meat processing facility.

Under the guidance of their law firm, Cutting Edge Capital of Oakland, California, they used regulation crowdfunding to raise $302,000 of the $1.2 million needed to start their own meat processing plant in Sonoma County that opened earlier this year. Since then, the co-op has increased to 41

ranchers, benefitting the entire Bay Area with locally sourced, fresh, and safe meat.

The small business advocacy group, Job Creators Network, recently released a policy playbook to help jumpstart the economy. One of the provisions calls for boosting access to capital options for small businesses. Such grassroots efforts to bolster access to capital for independent businesses can help make regulation crowdfunding mainstream and empower many more small businesses to replicate BARC's success.

Regulation crowdfunding is at the top of the list of innovative new ways to deliver alternative funding options to entrepreneurs at this time when they need it most.

CJ Connell is a retired stockbroker at Morgan Stanley, now a farmer and the owner of High Desert Herb & Spice Co in Oregon, the author of a forthcoming book on the investment crowdfunding revolution, and a partner of Job Creators Network Foundation.

Southern Oregon Business Journal December 2022 | 11

By Jim Teece

Help Morgan Recover His Life Savings!

LOCAL HEROES

Using information gathered from public Social Posts on Facebook and the GoFundMe setup by Dee Fretwell

recovery and is now sitting in a major shortfall due to no parties involved being capable of financial assistance. In short, Morgan lost his life savings. Even with FBI involvement, they haven’t been able to recover the stolen funds.

Time for us to rally around one of our own and help as best we can. Please consider donating whatever you can. Anything ($1, $20, $100, $1000, etc) truly helps! We all know and love Morgan, and it’s impossible to find someone who hasn’t been positively affected by his constant generosity over the many years he’s been in business.

Thank you so much for your consideration!

“

https://www.gofundme.com/f/ help-morgan-recover-his-lifesavings

Here is what I shared about Morgan on FB back in 2016 when he was written about in Forbes.

“I am proud of my dear friend and past student Morgan George for being "discovered" and recognized by a contributing writer in Forbes for his "pay it forward" attitude. What she didn't realize is that we "love" Morgan because he loves us.

He loves our schools, he loves our students, he loves our athletes and he loves our crazy community.

Running a restaurant is insanely hard. Running one in a small town with 75 of them is nearly impossible. He works 7 days a week. I'm talking about real, back breaking in a hot kitchen work. And yet he's always smiling.

And you can't help but love him most when he comes out of the kitchen covered in white dough dust and pizza parts and sweat and he sees you, smiles and comes over to give you a hug.

I am now his student.

I watch everything he does with pride.

I have seen him see kids across the room, standing at a video game, pretending to play because they can't afford to. (I used to be that kid) He walks up to them and chats with them and drops a quarter or two in so they can play for real and he goes back to work. Their moms are delighted.

I have seen him write checks to schools when I can see in his eyes that he hopes he can pay himself that month.

I have seen him make everyone feel like family.

When I have family in town or important clients from all over the world or need to treat my hard working employees to a break, I take them to Northwest, for good food, good times and

to meet a good human and friend that I love and adore.”

The outpouring of support has been overwhelming although the amount raised is only 1/3 of the amount lost, Morgan shares his gratitude openly online.”All of you have written such kind and loving messages, I’m really just overwhelmed by the love you’ve shown me.”

The community has come out in complete support.

Anjie Seewer Reynolds

Posted “OMG. This guy is the first to contribute to anything. He's been lifting up kids and people in need for years and years. I'm so sad that his entire house downpayment was stolen. Hope we can help him recover. We love you, Morgan George You're a local treasure.”

Alyssa Sagorsky

Wrote “My time at working at Northwest during college is one of my fondest memories. Morgan was so much more than a boss, he treated all of us like family and helped us all where he could. He was the first to help families in need, support organizations in the community and never asked for anything in return. I’m so sad and angry this happened to such a good hearted person. Please consider a donation if you can ”

Southern Oregon Business Journal December 2022 | 13

Jessie Sharpe wrote “ There are few people who have continually made as much of a point of supporting their community as Morgan George . Every week he provided stacks of pizzas for community feeds. He went above and beyond in providing food to survivors of the Almeda fires. For years he provided a venue for kids and new bands trying to get their music out into the world. He made a point of providing jobs to people who other restaurants wouldn't hire for BS discriminatory reasons. Now he needs support from the same community he's always been there for. His life savings were stolen from him. If you

have the means to support him, please consider doing so.

“

Vanessa Martynse Houk Shared “

I have so many Morgan George stories.

When my mom passed away from cancer, and we were here trying to make sure that people had a meal on New Years Day, Morgan and his team showed up in Pioneer Hall with a feast. His kindness in stepping in, so that I could step back just goes beyond words. Then during the pandemic, there he was again. Northwest pizza provided meals every single Friday for longer than I can even remember. The

Almeda fire happened and guess who was right there, stepping up again? Morgan's kindness is the stuff that legends are made of.

He needs some of that to come back to him (in droves) right now.

Someone stole his life savings, but that doesn't get to be the end of the story. Please donate and share far and wide. Thank you. ” https://www.gofundme.com/f/ help-morgan-recover-his-lifesavings

Whatever

tastes, savings are always delicious. Find out more at EnergyTrust.org/for - business.

| Southern Oregon Business Journal December 2022 14

Serving customers of Portland General Electric, Pacific Power, NW Natural, Cascade Natural Gas and Avista. Running a kitchen takes creativity and innovation, which means using

you

ways

not be obvious.

the

reducing our energy costs.

WE STILL MAKE OUR CLASSIC DISHES. BUT OUR NEW FAVORITE RECIPE MIGHT BE ONE FOR SAVING ENERGY.

what

have in

that might

And that’s

approach that Energy Trust of Oregon brought to

your

A Message from People's Bank - Stop the Fraud

It’s the holiday season and, unfortunately, fraudsters don’t take a vacation. As a matter of fact, this is the time of year when fraud attempts are at an all-time high and scammers will stop at nothing to gain access to your account. We want to help customers think twice before clicking a link or giving up personal information by email, text or over the phone.

If you receive a suspicious email or text:

• Do not download any attachments in the message. Attachments may contain malware such as viruses, worms or spyware.

• Do not click links that appear in the message. Links in phishing messages direct you to fraudulent websites.

• Do not reply to the sender. Ignore any requests from the sender and do not call any phone numbers provided in the message.

• Report it. Help fight scammers by reporting them. Forward suspected phishing emails to the Anti-Phishing Working Group at reportphishing@apwg.org. If you got a phishing text message, forward it to SPAM (7726). Then, report the phishing attack to the FTC at ftc.gov/complaint. In addition, call your local branch of account to report the fraud. Be sure to include any relevant details, such as whether the suspicious caller attempted to impersonate the bank and whether any personal or financial information was provided to the suspicious caller.

If you receive a suspicious phone call:

• If you receive a phone call that seems to be a phishing attempt hang up or end the call. Be aware that area codes can be misleading. If your Caller ID displays a local area code, this does not guarantee that the caller is local.

• Do not respond to the caller’s requests. Financial institutions and legitimate companies will never call you to request your personal information. Never give personal information to the incoming caller, including passwords or security questions.

Educating our customers is one of the most effective ways to prevent falling victim to scams. It’s time to put scammers in their place.

People's Bank

Southern Oregon Business Journal December 2022 | 15

By Jim Teece Using various sources for content

Big Organizations and Small Mom and Pop Shops can be victims of cyber fraud

| Southern Oregon Business Journal December 2022 16

CYBER FRAUD

Photo by Towfiqu barbhuiya on Unsplash

If you run a business of any size then you are a target for cyber fraud. The article above about Morgan losing his life savings is not a “He should have known better” kind of story. Everyday we are falling victim to cyber fraud.

It comes in many forms and from many organizations.

In 2017 Southern Oregon University was a victim of an email scam during a capital construction project that cost the university $1.9 million.

How did that happen?

The scammer, posing as an established vendor, sends an e-mail to the university’s accounting office with bank account changes to be used for future payments.

Because there was a lack of process in place (there is now), the address change was made and when the next payment was sent, it was sent to a bad actor bank account.

My wife and I own several small businesses and she gets legitimate looking emails frequently from me that ask for checks to be cut or payments to be made.

Because we have a process in place she checks with me in person before paying off any email or text I send.

I receive SMS messages all the time that seem to be from

Amazon or UP asking me to click on a link to confirm my delivery info.

Morgan runs Northwest Pizza.

He was trying to buy a house. The email came seemingly from the title company with wire instructions. The timing of the email made sense. The contact info on the email was the same name he was expecting it from. He followed the instructions and transferred the money as requested.

And then it was gone.

He has worked with the FBI, the banks and the organizations involved to no avail.

The electronic transfer was easy and simple and untraceable.

The bad actors set up a fake account. Some how they found out about his home purchase and intercepted emails and knew how to write a normal looking transaction based email.

Technology and our desire for convenience makes it too easy.

Banks know this is a major problem. We read all the time about the grandma that was tricked or a large sum fraud, but there are millions of small frauds happening everyday.

My niece is a Millennial and they are supposed to know

technology better than all of us right? Not true. She lives at home and her parents pay for all her expenses so her paychecks go straight into the bank. She felt good knowing that she was saving a lot of money. And then one day it was all gone. She, the bank and the FBI don’t know how but small withdrawals that look normal kept hitting her account via a payment service like Venmo or Cash. The bad actors tried small amounts first and didn’t notice any password changes or alerts. So they made the amounts more and more frequent. Because she didn’t pay attention or pay for a service that alerts you for every transaction on your bank account, the money was slowly phoned out. How much money? Over $50,000 dollars. Gone. Sure, she learned a lot of lessons, we hope, and changed passwords etc, but the convenience of using your atm to pay people with apps like Venmo make it really easy for bad actors to get access to your account.

So I’m going to spend more time in 2023 writing about cyber fraud and sharing tips on what we must do to protect our bank accounts.

It’s a pain in the but to add layers of security to our lives but if you have any money in the bank you owe it to yourself to protect it, because in the end, it’s your responsibility.

Southern Oregon Business Journal December 2022 | 17

CYBER FRAUD

Taken from https://www.banksneveraskthat.com/ American Bankers Association https://www.banksneveraskthat.com/wp-content/uploads/2022/09/ BNAT22_Web_RedFlagsInfoSheet.pdf

Phishing Scam Tips

Americans lost $5.8 billion to phishing and other fraud in 2021, a 70% increase from 2020.

Source: Federal Trade Commission 2021

Get scam smart.

Every day regular people like you lose their hard-earned money to online phishing scams. Don’t fall for fake — learn how to spot shady texts, emails, and phone calls by knowing the things your bank would never ask.

RULE 1: BE ALERT

Email scams account for 96 percent of all phishing attacks, making email the most popular tool for the bad guys. Often, the scammer will disguise the email to look and sound like it’s from your bank.

Avoid clicking suspicious links

If an email pressures you to click a link — whether it’s to verify your login credentials or make a payment, you can be sure it’s a scam. Banks never ask you to do that. It’s best to avoid clicking links in an email. Before you click, hover

over the link to reveal where it really leads. When in doubt, call your bank directly, or visit their website by typing the URL directly into your browser.

Raise the red flag on scare tactics

Banks will never use scare tactics, threats, or high-pressure language to get you to act quickly, but scammers will. Demands for urgent action should put you on high alert. No matter how authentic an email may appear, never reply with personal information like your password, PIN, or social security number.

Be skeptical of every email

In the same way defensive driving prevents car accidents, always treating incoming email as a potential risk will protect you from scams. Fraudulent emails can appear very convincing, using official language and logos, and even similar URLs. Always be alert.

Watch for attachments and typos

Your bank will never send attachments like a PDF in an unexpected email. Misspellings and poor grammar are also warning signs of a phishing scam.

Phone Call Scams

Scammers sometimes try to cheat you out of your money by impersonating your bank over the phone. In some scams, they act friendly and helpful. In others, they’ll threaten or scare you.

Scammers will often ask for your personal information, or get you to send them money. Banks never will.

Watch out for a false sense of urgency

Scammers count on getting you to act before you think, usually by including a threat. Banks never will. A scammer might say “act now or your account will be closed,” or even “we’ve detected suspicious activity on your account” — don’t give into the pressure.

Never give sensitive information

Never share sensitive information like your bank password, PIN, or a one-time login code with someone who calls you unexpectedly — even if they say they’re from your bank. Banks may need to verify personal information if you call them, but never the other way around.

Don’t rely on caller ID

Scammers can make any number or name appear on your caller ID. Even if your phone shows it’s your bank calling, it could be anyone. Always be wary of incoming calls.

| Southern Oregon Business Journal December 2022 18

Hang up—even if it sounds legit

Whether it’s a scammer impersonating your bank or a real call, stay safe by ending unexpected calls and dialing the number on the back of your bank card instead.

Text Message Scams

Phishing text messages attempt to trick you into sharing personal information like your password, PIN, or social security number to gain access to your bank account. As long as you don’t respond to these messages and delete them instead, your information is safe. All you need to do is spot the signs of a scam before you click or reply. Slow down—think before you act

Acting too quickly when you receive phishing text messages can result in unintentionally giving scammers access to your bank account — and your money. Scammers want you to feel confused and rushed, which is always a red flag. Banks will never threaten you into responding, or use high-pressure tactics.

Don’t click links

Never click on a link sent via text message — especially if it asks you to sign into your bank account. Scammers often use this technique to steal your username and password. When in doubt, visit your bank’s website by typing the URL directly into your browser or login to your bank’s mobile app.

Never send personal information

Your bank will never ask for your PIN, password, or one-time login code in a text message. If you receive a text message asking for personal information, it’s a scam.

Delete the message

Don’t risk accidentally replying to or saving a fraudulent text message on your phone. If you are reporting the message, take a screenshot to share, then delete it.

Mobile Payment App Scams

Scams using payment apps such as Cash App, PayPal, Venmo, or Zelle, are growing more and more prevalent as those platforms become increasingly popular. Once you’re hooked, it only takes seconds for a scammer to access your hardearned cash.

Be wary of texts or calls about payment apps

Payment app scams often start with a phone call or text. If you get an unexpected call, just hang up. If you get an unexpected text, delete it. Even when they seem legitimate, you should always verify by calling your bank or payment app’s customer service number.

Use payment apps to pay friends and family only

Don’t send money to someone you don’t know or have never met in person. These payment apps are just like handing cash to someone.

Raise the alarm on urgent payment requests

Scammers rely on creating a sense of urgency to get you to act without thinking. They might claim your account is in danger of being closed, or threaten you with legal action. These highpressure tactics are red flags of a scam — a real bank would never use them.

Avoid unusual payment methods

Banks will never ask you to pay bills using a payment app, or ask you to send money to yourself. Scammers can “spoof” email addresses and phone numbers on caller ID to look like they’re from your bank, even when they’re not. When in doubt, reach out to your bank directly by calling the number on the back of your card.

RULE 2: BEEF UP YOUR DEFENSES

Lock down your accounts

Set up multi-factor authentication on your bank and email login.

Use random or complex passwords.

If you receive a text or call from your bank, hang up and call the number on the back of your card.

Keep your browsers up-to-date with the latest defenses, like virus protection and malware alerts.

RULE 3: TAKE ACTION

• Stay safe from scams with these tips

• Contact your bank.

• Change your passwords and visit IdentityTheft.gov

• Report the scam to the FTC.

Southern Oregon Business Journal December 2022 | 19

1528 Biddle Road Medford, OR 97504 541-776-5350

1311 East Barnett Road Medford, OR 97504 541-622-6222

Albany Branch

333 Lyon Street SE Albany, OR 97321 541-926-9000

Central Point Branch

1017 East Pine Street Central Point, OR 97502 541-665-5262

Jacksonville Branch

185 E. California Street Jacksonville, OR 97530 541-702-5070

Lebanon Branch

1495 South Main Lebanon, OR 97355 541-223-7180

Ashland Branch

1500 Siskiyou Boulevard Ashland, OR 97520 541-482-3886

Grants Pass Branch

509 SE 7th Street Grants Pass, OR 97526 541-955-8005

Klamath Falls Branch

210 Timbermill Drive Klamath Falls, OR 97601 541-273-2717

Salem Branch

315 Commercial Street SE, Suite 110 Salem, OR 97301 503-468-5558

| Southern Oregon Business Journal December 2022 20

BRANCHES

Medford Branches

NMLS#421715 Conventional Government Construction Jumbo We offer Mortgage Loans in ALL our locations. With our ten Oregon branches and beyond banking hours eBanking services, you can bank with us anytime, anywhere.

By Peoples Bank Press Release

People’s Bank of Commerce is pleased to announce the hiring of a Eugene team of bankers and will be opening a location in the Eugene area soon. The team includes Mark Rodewald – Market President, Torsten ThomasCommercial Loan Officer Team Lead, Jenny Freeman –Business Development Officer and Ryan Rodewald – Commercial Loan Officer.

“We are very fortunate to have Mark and his team join us to help open our new office and embark on our expansion into the Eugene market,” says Julia Beattie, President. “This team has many years of banking experience and a strong presence in the Eugene market. With their connections in the community, we are looking forward to helping businesses and consumers thrive in the area.”

Market President Mark Rodewald has been in the financial services industry for over 25 years. Prior work experience includes various positions in commercial banking,

People's Bank Hires Local Team For Eugene Market

most recently for Bank of the Pacific and Wells Fargo Bank. Rodewald is a graduate of University of Oregon and Pacific Coast Banking School. He is a past president of the leadership board of the Relief Nursery and is still serving on the leadership board.

Torsten Thomas joined the bank with 25 years banking experience. His prior job positions consisted of Commercial Bank Team Lead for Bank of the Pacific and Senior Business Relationship Manager at Wells Fargo Bank. Thomas is active in the community with the Eugene Area Chamber of Commerce as a member of the Business Leaders Task ForceHomelessness Initiative. He has a Bachelor of Business Administration degree from Georgia State University.

Jenny Freeman has been in the financial industry for more than 25 years. Her prior experience has been in the commercial banking arena most recently with Bank of

the Pacific and Wells Fargo Bank. Freeman is a graduate of the Pacific Coast Banking School and has received an American Institute of Banking Certificate. She volunteers in the community and is a board member of Commercial Investment Development (CID) where she serves as Secretary.

Ryan Rodewald joins People’s Bank as a Commercial Loan Officer with over 7 years banking experience in the analyst/ underwriting function. Rodewald is a graduate of University of Oregon with a BA in Economics. He is engaged with his community and serves on the board of directors for the Active 20-30 Club of Eugene.

People's Bank of Commerce is a community bank headquartered in Medford, Oregon, with branches in Medford, Ashland, Central Point, Jacksonville, Grants Pass, Klamath Falls, Albany, Lebanon, and Salem, with Eugene coming soon.

Southern Oregon Business Journal December 2022 | 21 BANKING

Mark Rodewald, Market President

Torsten Thomas, Commercial Loan Officer Team Lead Jenny Freeman, Business Development Officer Ryan Rodewald, Commercial Loan Officer

By Press Release https://news.sou.edu/

By Press Release https://news.sou.edu/

Southern Oregon University’s pathway programs that introduce local Latino/a/x students to the promise of higher education have received funding that will allow them to rebuild toward pre-pandemic numbers and achievement rates.

The highly successful Pirates to Raiders program in the Phoenix-Talent School District and the Bulldogs and Hornets to Raiders programs in the Medford School District will be boosted by a $250,000 grant for the current academic year.

SOU “pathway” programs for Latino/a/x youth get boost from state grant

The grant is from the Oregon Department of Education’s Latino/a/x & Indigenous Student Success program, funded by the 2019 Oregon Legislature. Pending legislative approval and measurable progress toward its goals, funding for the SOU programs will be renewable at up to $200,000 per year.

“These programs and others across the state will receive significant needed support, thanks to the Legislature’s recognition that systemic inequities that Latino/a/x and

Indigenous students have historically experienced must be addressed,” said Rachel Jones, SOU’s director of outreach and engagement.

“Our communities will benefit from the success of their students, and their future involvement throughout the region.”

The SOU grant focuses primarily on the Pirates, Bulldogs and Hornets to Raiders programs – located at Talent Middle School and Phoenix High School, and at Medford’s McLoughlin and

| Southern Oregon Business Journal December 2022 24

HIGHER EDUCATION

Hedrick middle schools and North and South Medford high schools – but will also support other ongoing SOU programs and events, including Academia Latina, Latino Family Day and the Cesar Chavez Leadership Conference.

The Pirates to Raiders program began in 2011, Bulldogs to Raiders in 2015 and Hornets to Raiders in 2017. All are intended to open doors to Hispanic students by forming partnerships between students, their families, their school districts and SOU to ensure that the students remain on track for high school graduation and college. Family members make sure their students attend school, manage their studies and participate in events related to the program. The university and school district offer mentoring, financial aid information, transportation to program events and opportunities to learn about SOU. The students take appropriate college preparatory courses, attend two program-related events each year and sign contracts, promising to stay on track to graduate on time.

The programs had grown to a total of about 375 students prior to the COVID-19 pandemic, achieving a high school graduation rate that was

43 percent higher than Oregon’s Latino/a/x student benchmark, double the statewide rate of higher education enrollment for Latino/a/x students and 3.8 times the rate of four-year college enrollment. The programs suffered through the pandemic, hurt by online-only instruction and staffing challenges in their host school districts.

The grant will enable SOU to hire Latino/a/x community members to serve as project coordinators supporting Latino/a/x students at the host schools. The programs have previously relied on staffing from site coordinators hired by the host schools, but those positions have been overtaxed with other duties and have seen high turnover. The new project coordinators from SOU will work with the schools’ site coordinators to provide more consistent services to students, increased engagement with parents and additional attention to culturally responsive curricula and teaching.

Students in the pathway programs will have increased access to mentoring, tutoring and workshops, and the programs will be better able to offer incentives – such as field trips and awards – for students who are on track academically

or achieve key academic milestones.

Parents will receive regular updates on their students’ progress, have another trusted contact at their children’s school and receive support completing applications for extracurricular programs, financial aid and college admission. A new Parent Leadership Team made up of the parents of Latino/a/x students in four local school districts – Phoenix-Talent, Medford, Central Point and Eagle Point – will be formed to better incorporate community input into the pathway programs.

SOU will also partner with the Southern Oregon Education Service District’s Migrant Education Program to establish Latino Student Unions at schools that host the pathway programs; the SOU English Department will design a Cultural Empowerment Institute to help secondary school teachers focus on antiracist and culturally responsive teaching; and the university will provide various offsets for opportunities such as dualcredit courses, college credit for foreign language skills, college application fees for those with demonstrated financial need and college move-in expenses for a limited number of students.

Southern Oregon Business Journal December 2022 | 25

| Southern Oregon Business Journal March 2020 26 sou.edu • 855-470-3377 “Between the biology program and our Army ROTC program, SOU helped prepare me for my doctorate program at Texas A&M and leading my infantry platoon in the Texas Army National Guard.” HALEIGH WAGMAN ‘20 FIRST FEMALE INFANTRY OFFICER PRODUCED BY AN ROTC PROGRAM IN OREGON

By Press Release https://news.sou.edu/

Rob Patridge, who has held several high-pro public service positions throughout Oregon, has been hired following a nationwide search to become Southern Oregon University’s in-house attorney. He will begin work as SOU’s general counsel on Dec. 5.

“Rob’s varied legal career has been punctuated by innovation and leadership, guiding his clients through situations both routine and groundbreaking,” SOU President Rick Bailey said this week in a message to campus. “His

Patridge hired as SOU general counsel

He has directed several “change management” efforts for clients, and led government and business leaders through emerging issues in commercial alcohol, tobacco, hemp and cannabis regulation, in his current position as regulated products leader at the international Deloitte Consulting firm. His clients at Deloitte have also included health care and financial institutions.

Patridge’s other work experience includes 13 years as managing member of the Covey Consulting firm, three years as president of Powder River’s Meridian Investments branch, six years as general counsel for Pacific Retirement Services, Inc., almost four years as a deputy district attorney for Jackson County and five years with Applied Laser Systems, Inc., of Medford.

He earned a bachelor’s degree in political science and a law degree from Willamette University, and has southern Oregon roots, graduating high school in Eagle Point.

t SOU as we re-

developing entrepreneurial revenue

Patridge has served four years as the Klamath County District Attorney, almost five years as chair of the Oregon Liquor Control Commission, two years as general counsel and district director for former U.S. Representative Greg Walden, three terms as State Representative for Oregon House District 50 and two years as a Medford City Council member.

Patridge succeeds Jason Catz as SOU’s general counsel, following Catz’s resignation earlier this year to take a position at Oregon State University.

“I want to personally thank our search committee – led by Vice President Toya Cooper – for the successful search that led to Rob’s hiring,” President Bailey said. “I encourage each of you to welcome Rob to our campus and to get acquainted with him as time allows.”

Southern Oregon Business Journal December 2022 | 27

HIGHER EDUCATION

Businesses are facing increasing pressures to maintain operational margins. Previous articles have looked into various ways to maintain margins through recording and measuring financial performance. These have all been related to cash flow, market acquisition, accounting and analyzing financial statements to determine specific areas where entrepreneurs can improve operations in order to regain healthy margins. These internal

operational adjustments are important steps to take, but may not be enough to fully make the needed profitability goals. It is heartening that external sources of assistance are available as well. It is important to take advantage of all the available resources in order to survive the economic weaknesses currently being experienced.

Assistance programs from the public sector are available and currently funded to aide employers to hire and retain

employees. This article explores some of these programs made available to companies that wish to take advantage of the opportunities to reduce the costs involved with hiring, training and retaining employees, regardless of company size.

To start with, I would like to highlight the services the SOU Small Business Development Center (SBDC) brings to the hiring process as well as compliance with the rules and

| Southern Oregon Business Journal December 2022 28 SMALL BUSINESS DEVELOPMENT CENTER

Photo by Jason Goodman on Unsplash

regulations for hiring and retaining employees in Oregon. The SOU SBDC has an HR specialist on staff who can work with you 1:1 to help you with your employment questions. They can be reached at: sbdc.sou.edu.

Contact WorkSource Oregon Rogue Valley for job postings, wage analyses, labor market information, and for assisting in the recruitment, incumbent work training and programs, and with the interview process. The business team can also assist with various programs for training, layoff aversion, tax credits, hiring and retention. Many opportunities are becoming available for diversity and inclusion and working with distressed and/or underserved populations, such as minorities, women-owned businesses and veteran employment services. The business team is your contact to other industry and community partners, they assist in making connections vital to your business.

For employees, they can assist in training, assessing skills, and provide work experience opportunities and partial wage reimbursement for OJT employees. WorkSource Oregon Rogue Valley can be contacted through their website:

https://worksourcerogue.org/ employers/customizedbusiness-services/.

Contact them to see what kinds of internships and training options they currently have funding to support. Look HERE to see the programs they list on their site.

Through Equus Workforce Solutions, the JOBS Plus program assists employers and entry-level employees to be able to afford and support workforce development needs. Participating employers are reimbursed at the Oregon minimum wage, plus payroll taxes and workers compensation costs, for the first month of the six month JOBS Plus period, and minimum wage minus one dollar for the remaining five months. If you are considering hiring and would like some assistance with bringing-on affordable employees, the JOBS Plus program might be a good solution for your needs.

The dollar per hour is placed into a separate education fund that the JOBS Plus participant can access after the program for continued education expenses. For additional information and to connect with the JOBS Plus program, please contact Daniel Scotton at: https://www.facebook.com/ EquusRV/ or directly at: Daniel.Scotton@equusworks.c om.

Regardless of how you plan to staff your business, the resources mentioned in this article are available to you, in many cases without cost, to assist you in hiring and retaining qualified employees. Typically, these programs are accessed by larger companies, but they are available to all businesses, and may actually be of higher value to smaller employers than larger ones. They are worth looking into and considering as part of any well-rounded HR plan.

Bringing a strategic approach to business development through the leveraging of public funds for employee recruitment, training, and retention can be a sound strategy for maintaining viability and profitability through the upcoming year, if you take a moment and connect with these programs for assistance. Good Luck!

Marshall Doak is the Director of the Southern Oregon University Small Business Development Center and a huge supporter of innovation and the community that forms around innovation in the economy. In private practice, he works with businesses that plan to transition to new ownership within the next five years, assisting them to build value that can be converted to retirement income when the business sells. He can be reached through: mdoak06@gmail.com or 541-646-4126.

Southern Oregon Business Journal December 2022 | 29

Our

Gift

by

2022 is worn out. Everything wears out. Its predictable and guaranteed.

Bridges, highways, stoves, lawnmowers, computers, shovels, floors, and cars all eventually need to be repaired or replaced. They just wear out – usually after the warranty has expired.

You and I didn’t expect an entire year to wear out. 2022 is near its end, and the aging shows. Time for a reset.

It’s a good time to have our collection of holidays and celebrations. By now your Thanksgiving gatherings have dispersed and you’re thinking about diets in the New Year resolutions, knowing that there’s still Christmas and the New Year gatherings with ample food and enjoyment in the plans. Five weeks at the end of every year to share happiness, good wishes, and special food in abundance is a proper way to prepare for 2023. Our welcoming of the new year is certain, but many will be less enthusiastically optimistic than last year. Time and experience are teachers with a voice. Optimism requires more time and a more hopeful voice to overshadow the disappointments of years like 2022. Discovering there were some very

good things about the year we leave behind will one day be clear in our memories.

The passing of Queen Elizabeth was sad, a monarch who served for four generations with unwavering dignity and royal values admired around the world. On the other hand, the presence and public adoration of Prince William and Princes Kate is refreshing, and more than hopeful. Our world is hungry for the type of examples they are proving to be.

To be sure, I’m rather excited about the coming year. Covid has been an emotional burden as well as a health concern of the pandemic kind. The Russian/Ukrainian War an international concern and a terrible experience shows us how such an atrocity can impact the world in important ways, especially those directly impacted in the war zone itself.

The embarrassment of divisiveness in a country such as ours that should know how to settle differences proves how similar America is to many other countries around the world. Getting a mature handle on our differences is more difficult that most of us realize –it is possible, I firmly believe - but much more difficult than protests and violence want them to be.

Let’s be kind to our neighbors for a few short weeks, resolving to remain that way for the year ahead.

Consider ways to be an asset to everyone. Help is needed in many ways; housing, food and healthcare, education, employment, agriculture, water, energy sourcing and distribution, manufacturing, childcare, transportation, communications, and many, many others.

We are not short of people to do the work. We are not short of knowledge and experience of how to do the work. We are not short of people capable of leading every challenging effort. We are too reluctant to start doing. Ideas and concepts are in abundance. It’s the action of doing that requires leadership. All of us, each of us, possess enough to be a part of all our work to make 2023 a better experience. Your gift of time may be the most important gift of all.

Enjoy your holidays and Happy New Year.

“To give less than your best is to sacrifice the gift.” Steve Prefontaine

Southern Oregon Business Journal December 2022 | 31 Photo by freestocks on Unsplash

Greg Henderson is the retired founder of the Southern Oregon Business Journal. A University of Oregon graduate and a six year U.S. Air Force veteran. Contact him at ghenderson703@gmail.com

Greg Henderson

By Press Release Oct. 19, 2022 /PRNewswire/

Lithia & Driveway (LAD) Increases Revenue 18%

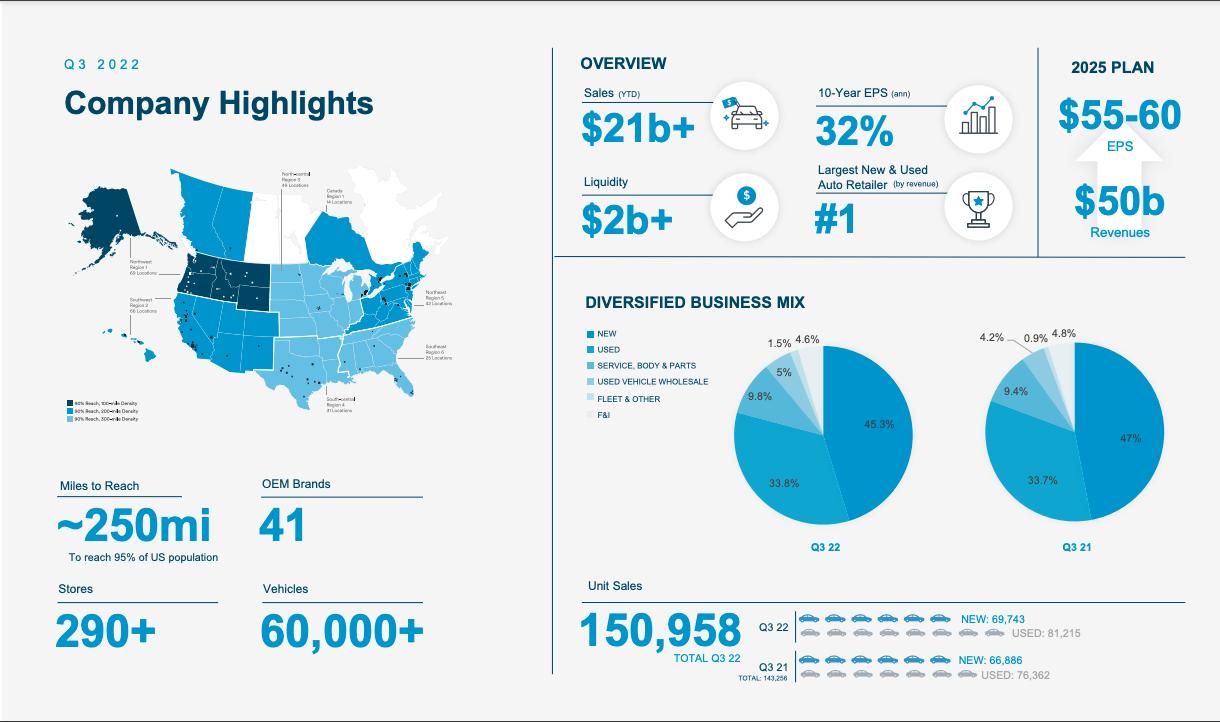

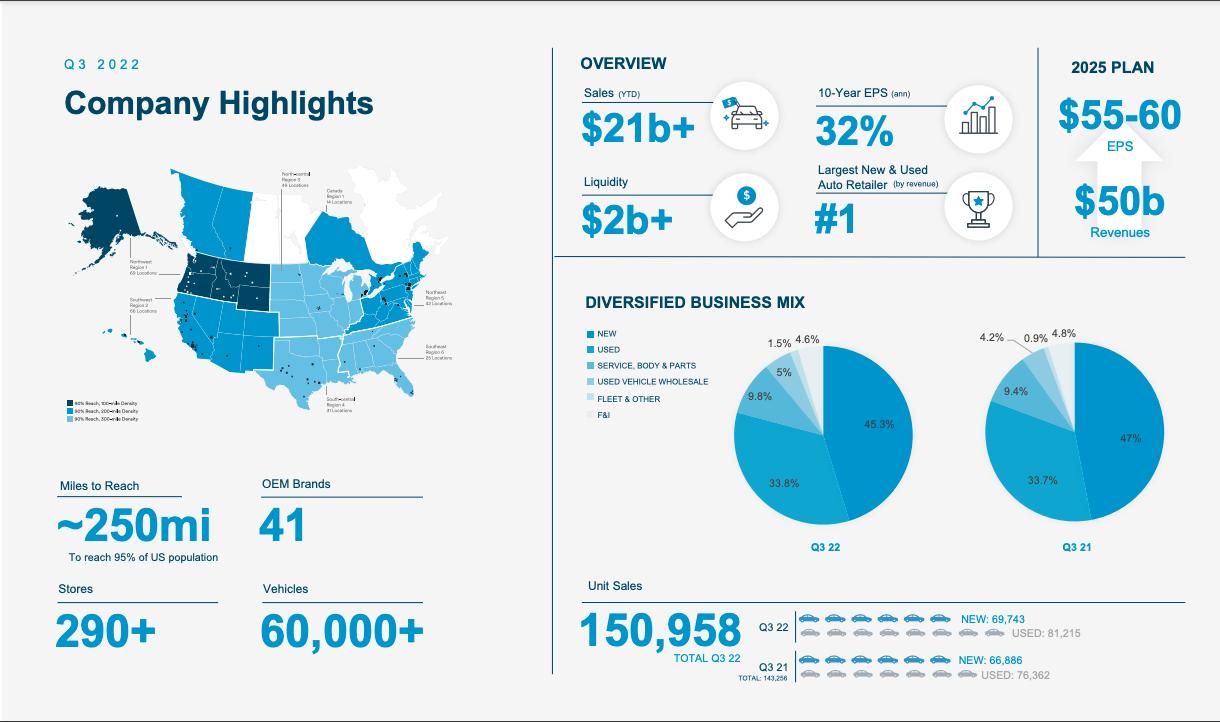

Lithia & Driveway (NYSE: LAD) reported the highest third quarter revenue and earnings per share in company history.

Third quarter 2022 revenue increased 18% to $7.3 billion from $6.2 billion in the third quarter of 2021.

Third quarter 2022 net income attributable to LAD per diluted share was $11.92, an 18% increase from $10.11 per diluted share reported in the third quarter of 2021. Adjusted third quarter 2022 net income attributable to LAD per diluted share was $11.08, a 1% decrease compared to $11.21 per diluted share in the same period of 2021. Foreign currency exchange negatively impacted earnings per share by $0.54.

Third quarter 2022 net income was $330 million, a 7% increase compared to net income of $309 million in the same period of 2021. Adjusted third quarter 2022 net income was $307 million, a 10% decrease compared to adjusted net income of $342 million for the same period of 2021.

As shown in the attached non-GAAP reconciliation tables, the 2022 third quarter adjusted results exclude an $0.84 per diluted share net non-core benefit related to a net gain on the sale of stores and a non-cash unrealized investment gain, partially offset by acquisition expenses. The 2021 third quarter adjusted results include a $1.10 per diluted share net non-core charge related to a non-cash unrealized investment loss, loss on redemption of senior

notes, acquisition expenses, insurance reserves, and asset impairment.

Third Quarter-Over-Quarter Comparisons and 2022 Performance Highlights:

• Revenues increased 18.2%

• Gross profit increased 10.5%

• Vehicle gross profit per unit of $6,139, down $36

• Driveway averaged over 2 million monthly unique visitors in Q3

• Driveway transactions increase by 327%

• Driveway Finance penetration rate rose to over 11% in Q3

| Southern Oregon Business Journal December 2022 32

PUBLIC COMPANIES

LOCAL

• Adjusted SG&A as a percentage of gross profit was 59.6%

"We posted strong results across our business lines this quarter, while navigating the current environment, integrating a steady stream of acquisitions and continuing to grow Driveway and Driveway Finance. Our teams are focused on improving operating leverage as fundamentals normalize across our industry," said Bryan DeBoer, Lithia & Driveway, President and CEO. "With our size and scale, we are well positioned with financial flexibility and liquidity to continue delivering growth with strong returns as we progress toward achieving our 2025 plan."

For the first nine months of 2022 revenues increased 29% to $21.2 billion, compared to $16.5 billion in 2021.

Net income attributable to LAD for the first nine months of 2022 was $35.10 per diluted share, compared to $26.91 per diluted share in 2021, an increase of 30%. Adjusted net income attributable to LAD per diluted share for the first nine months of 2022 increased 24% to $35.30 from $28.52 in the same period of

2021. Foreign currency exchange negatively impacted earnings per share by $0.65.

Corporate Development

During the third quarter, LAD acquired six locations, including five Wilde Automotive Group locations in Wisconsin, expanding presence in the North Central region, and Elk Grove Ford in Elk Grove, California. In October, LAD acquired six locations in the Pacific Northwest with Airstream Adventures. LAD has acquired over $3.0 billion in annualized revenues to date in 2022 and $13.3 billion in annualized revenues since the announcement of the 2025 Plan in July 2020.

Balance Sheet Update

LAD ended the third quarter with approximately $1.6 billion in cash and availability on our revolving lines of credit. In addition, unfinanced real estate could provide additional liquidity of approximately $0.4 billion.

Dividend Payment and Share Repurchases

The Board of Directors approved a dividend of $0.42 per share related to third quarter 2022

financial results. The dividend is expected to be paid on November 18, 2022 to shareholders of record on November 11, 2022.

In 2022, LAD repurchased approximately 2.3 million shares at a weighted average price of approximately $281. Under the current share repurchase authorization, approximately $77 remains available.

About Lithia & Driveway (LAD)

LAD is a growth company focused on profitably consolidating the largest retail sector in North America through providing personal transportation solutions wherever, whenever, and however consumers desire.

Sites www.lithia.com investors.lithiadriveway.com www.lithiacareers.com www.driveway.com www.greencars.com www.drivewayfinancecorp.com

Southern Oregon Business Journal December 2022 | 33

By Marta Tarantsey, Roslyn Donald and Daniel Scotton

Business owners throughout Southern Oregon are having trouble hiring staff. Turnover

Overcoming Second-Chance Hiring Anxiety

rates are high. In times like these, employers need to give “second chance” job

applicants another look. Who is a second-chance, or justiceinvolved, applicant? The term

| Southern Oregon Business Journal December 2022 34 FINDING THE BEST

refers to applicants who have been involved with the justice system, whether at the federal, state or local level.

During Summer 2022 both Jackson and Josephine counties had functionally 0% unemployment. Many companies have openings that have been vacant for more than two quarters. Unemployment increased in Jackson County from its low of 3.7%1 in July to 4.3% in November 2022, largely due to seasonal agriculture positions. However, the problem still remains: far too many open positions and far too few qualified persons to fill them. Our first Finding the Best article emphasized veterans as an underutilized employee group. Now we focus on second-chance employees as another solution to employers’ ongoing workforce woes.

According to an ACLU report, nearly 1 in 3 adult Americans have a criminal record.2 In 2019 alone, 189,000 people were released from prison or jail in Oregon.3 That’s roughly equivalent to 5% of the 2022 Oregon population over 18, and that’s the release data for only one year. Multiply that number by 5 years, and that ACLU statistic is not so

farfetched. When you as an employer are looking to hire, you may be nervous about hiring a candidate with a criminal record. However, ruling out all second-chance candidates limits your hiring pool. In tight labor markets, most employers cannot afford to ignore this large group.

Can you, as an employer, trust a second-chance employee? In a paper from 2018, the Institute of Labor Economics states, “So far, the evidence on tenure has shown that having a criminal background makes an employee less likely to leave voluntarily and likely to have a longer tenure. Employees with a criminal record are no more likely to be terminated involuntarily in customer service positions, but more likely in a sales position. 4 In fact, studies of second-chance candidates in the workforce show that these employees will have less turnover precisely because they had to work harder to get hired.

In Scotton’s experience running a franchise quick service restaurant, the backof-house staff was almost entirely composed of formerly incarcerated people. While their offenses varied, their work ethic was consistent:

always showing up on time, always fulfilling if not exceeding expectations. They went the extra mile to both show and receive respect. No employee is perfect, but in Scotton’s experience these employees were excellent team members. He was able to maintain a full staff for seven months without a single position turning over.

In fact, with higher retention rates and greater loyalty, job seekers with criminal histories are “a better pool for employers,” according to researchers. Companies are recognizing this advantage. At Total Wine & More, human resources managers found that annual turnover on average was 12.2% lower for employees with criminal records.5

What about lack of experience? Since some individuals spend a long time behind bars, they lack skills when reentering society. In Jackson County, the Pioneer Project is working to help second-chance individuals gain the social and technical skills needed to reenter the working world. The project prospectus released this year states:

Southern Oregon Business Journal December 2022 | 35

The Pioneer Project is seeking to combine education, social service, and community to bolster our community in exciting new ways. [The Pioneer Project] addresses social concerns including reduced recidivism, increased community housing, and a pathway to happier, safer communities now and in the future by increasing connection and breaking the cycles of poverty, addiction, and trauma-related problems.

The plan seeks to enroll formerly incarcerated persons in a wrap-around service that provides a chance at BOLI certified pre-apprenticeship trade experience combined with housing and mental health services.

Certainly second-chance candidates will merit greater scrutiny during the hiring process. Oregon’s Fair Chance hiring laws (also known as “ban the box” law) stipulate that employers may

not ask about a job candidate’s criminal record until an interview has been provided. Once the candidate has been interviewed, the employer may wish to run a background check.

However, not all background checks are reliable. Be aware that errors often occur.

According to the Back to Business report, “Contracting with a qualified agency is critical because a lot of background check data is

| Southern Oregon Business Journal December 2022 36

wrong or incomplete. In fact, one study of New York State found that 87 percent of criminal records reported included at least one error.”If possible, it’s best to use a background check agency that follows guidelines set forth by the National Association of Background Screeners.

In the past, the Governor’s Reentry Council Business Implementation Team convened the “Second Chance Employers Tour,” a series of discussions throughout the state, most recently in Southern Oregon in 2018. With enough momentum and involvement from employers interested in this issue, Southern Oregon can revitalize this important conversation.

One objection many employers have to hiring second-chance or justiceinvolved people is the chance that the new hire may commit another crime while on the job. To mitigate any possible liability, there are two federal programs that incentivize employers to hire from marginalized groups. One resource is the Federal Bonding Program (FBP). which offers a $5,000 bond at no cost to either the employer or

employee that insures the employer against any liability incurred by a new employee for the first six months on the job. Specific crimes covered are theft, larceny, and embezzlement. It applies to candidates who have been involved in the justice system or who experience other barriers to employment. For more information, contact Jarred Parker, Federal Bonding Program Coordinator, at jarred.m.parker@employ.oreg on.gov.

Another resource is the Work Opportunity Tax Credit (WOTC) program. This program covers job candidates from marginalized groups like veterans, recipients of state assistance, or people with difficult work histories. Employers can receive tax credits from $1,500 to $9,600 per year based on the employee’s wages and hours worked. To learn about WOTC resources in your area, connect with the Workforce Investment Board that serves your county.

Second-chance candidates can pose concerns for employers, but the payoff is valuable. If you are looking for employees who will be loyal, punctual and hard-working, it

is worth your while to consider “second-chance” candidates. Find library resources on second-chance hiring.

1 https://www.qualityinfo.org/rogue-valley Accessed Nov 20, 2022

2 Back to Business: How Hiring Formerly Incarcerated Job Seekers Benefits Your Company. Trone Private Sector and Education Advisory Council, 2017. Accessed Nov 20, 2022 Back to Business: How Hiring Formerly Incarcerated Job Seekers Benefits Your Company | American Civil Liberties Union (aclu.org)

3 Prison Policy Initiative, Mass Incarceration by State, (Accessed Nov 20, 2022) https://www.prisonpolicy.org/ blog/2022/08/25/releasesbystate/

4 Criminal Background and job performance, IZA Journal of Labor Policy, (Accessed Nov 18th, 2022)

5 Back to Business report, p.8

6 Back to Business report, p. 15

https://izajolp.springeropen.com/articles/10.1186/ s40173-018-0101-0

About the Authors

Roslyn Donald is the business librarian for Jackson County Library District. Her mission is to support residents in reaching their economic potential. The business librarian is trained to help small businesses, nonprofits and job seekers find the information they need to make decisions. When you Book a Librarian, you will be connected with resources and services that match your needs.

Marta Tarantsey supports Southern Oregon communities and businesses as the Regional Development Officer with Business Oregon. While her team’s work shifted heavily towards pandemic economic response and business and community fire recovery in 2020, she continues to support start-up and existing business support ecosystem efforts.

Daniel Scotton graduated with a B.A. in Philosophy and a B.B.A with an International Concentration from Hamline University in 2019. He returned to the Rogue Valley in 2021 where he began his role of Business Services Consultant at Equus Workforce with a background that includes almost a decade in the hospitality industry, as well as a decade of volunteer work in areas such as public speaking and job readiness training, having worked primarily with youth organizations such as DECA, Future Business Leaders of America, Business Professionals of America, and Wayzata’s Compass Program.

Southern Oregon Business Journal December 2022 | 37

541-488-1702

Sponsors

Southern Oregon Business Journal December 2022 | 39 REACH YOUR TARGET ADS THROUGH Send your ad copy to: Jim@SouthernOregonBusiness.com Jim Teece - Publisher Thousands of Business People get a chance to see your ad in the monthly Business Journal.

The Southern Oregon Business Journal extends sincere thanks to the following companies for their continued presence as important cogs in the wheels of industry in southern Oregon. Please check out our advertisers. We appreciate them for supporting the Southern Oregon Business Journal. People’s Bank - Page 20 SOU - Page 26 Amerititle - Page 4 Energy Trust of Oregon Page 14 Project A - Page 38 Managed Home Net Page 23 NWTA Page 22 First Interstate Bank Page 8 Earn 2.02% APY* with our Indexed Money Market account. Turn rising rates into financial feel-goods. Earn 2.02% APY today and continue with half the Learn more at firstinterstate.com/fall22special Serving customers Portland General Electric, Pacific Power, NW Natural, Cascade Natural Gas and Avista. Running kitchen takes creativity and innovation, which means using that Energy Trust of Oregon brought to reducing our energy costs. EnergyTrust.org/for-business. WE STILL MAKE OUR CLASSIC DISHES. BUT OUR NEW FAVORITE RECIPE MIGHT BE ONE FOR SAVING ENERGY.

Southern Oregon Business Journal 5350 HWY 66, Ashland, OR. 97520 www.southernoregonbusiness.com

Lithia Park, Ashland Lower duck pond while snowing by Chad Sobotka - https://www.flickr.com/photos/chadsobotka/

Lithia Park, Ashland Lower duck pond while snowing by Chad Sobotka - https://www.flickr.com/photos/chadsobotka/

By Press Release

By Press Release

By Press Release https://news.sou.edu/

By Press Release https://news.sou.edu/