21 minute read

Positive employment news

By stessa.com Email Newsletter

Positive employment news

Advertisement

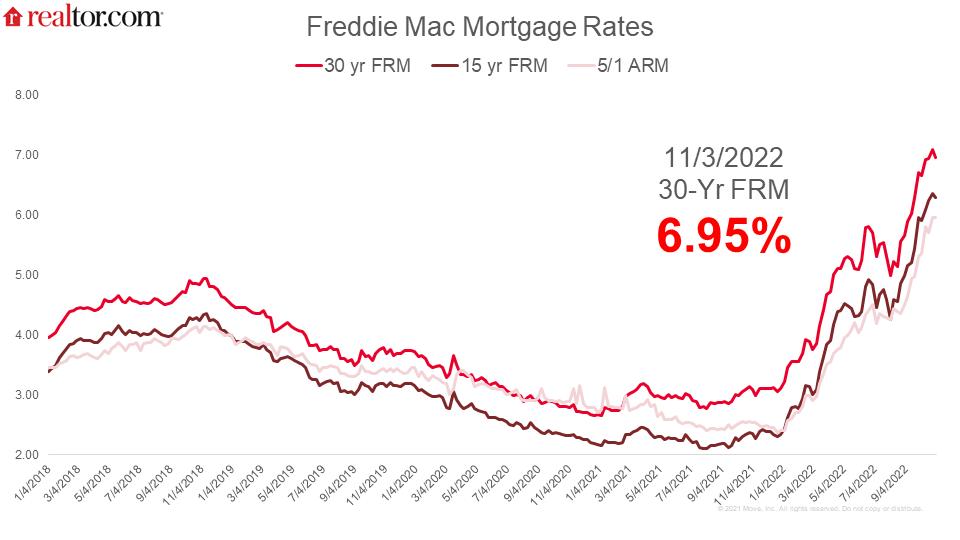

Interest rate rises

As expected, the Federal Reserve last week raised its benchmark rate by another 0.75%, to a range of 3.75% to 4%, the highest level in 15 years. According to Realtor.com, the 30-year benchmark rate dipped slightly but is still hovering around the 7% mark and is likely to push higher in the near term.

Source: Realtor.com (November 2021)

“After the meeting, Jerome Powell indicated that the Fed plans to evaluate the impact of this year’s aggressive monetary tightening on economic indicators and inflation, with the possibility of scaling back the rate increases. However, he made it clear that any slowdown in monetary policy is premature, and that rates are likely to end up much higher than initially expected.”

Following the rate hike announcement, PBS released an article outlining that despite the rapid rise in rates, the Fed has signaled that a rate increase deceleration may be in the works. The Fed noted that they need to consider the cumulative effect of rate hikes on the economy, and that these take time to fully affect the impact of inflation. This suggests that they may not be looking to raise rates as quickly over the next few meetings.

Howard Schneider and Ann Saphir of Reuters agree, noting t hat “[e]ven if policymakers do scale back future increases, he [Federal Reserve Chair Powell] said, they were still undecided about just how high rates would need to rise to curb inflation.”

Jessica Dickler of CNBC reports that these rate increases have dramatically impacted the affordability of homeowners. At the beginning of 2022, if

someone qualified for a $300,000 mortgage, with the current rate hikes, that same qualification now sits at only $200,000.

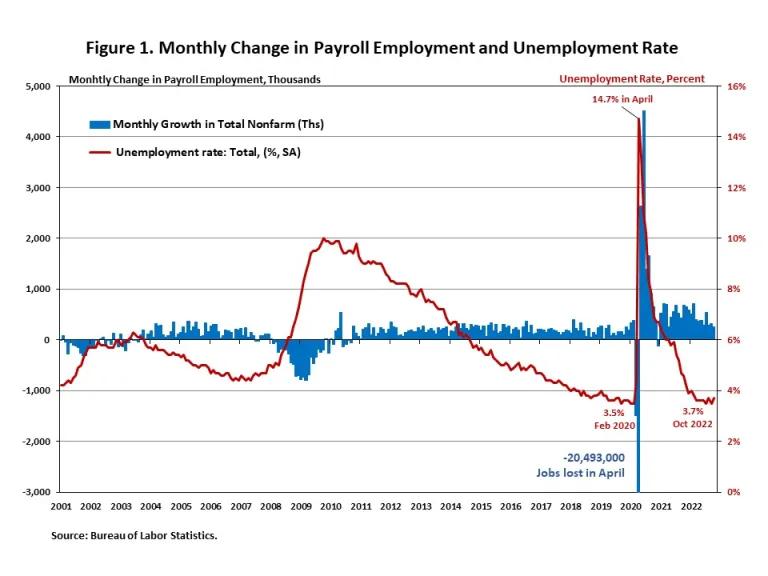

Employment

The U.S. Bureau of Labor Statistics released its October employment conditions report last week, and the results were fairly positive. According to the Mortgage Bankers Association (MBA) Deputy Chief Economist Joel Kan:

“Job growth for October was slightly stronger than expected, with a gain of 261,000 jobs. The number of jobs added to the economy did slow from September’s total, but this was still a strong positive gain that kept the monthly average for 2022 at over 400,000 jobs added per month. Most of the October growth was in the service sector, while the goods producing industries saw the lowest gain since January 2022. Construction employment was essentially flat over the month, consistent with the slowdown in the home building sector.”

More specifically to real estate, cracks are showing in the job numbers, according to Orion Jones of The Real Deal, highlighting that the housing market is slowing down. This includes losses in warehousing and real estate leasing jobs. That said, leisure and hospitality were bright spots, adding 20,000 jobs in October.

According to Jing Fu of the National Association of Homebuilders (NAHB), “Over the last 12 months, home builders and remodelers added 105,300 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,195,000 positions.” And, although unemployment increased by 0.2%, we are still seeing strong employment numbers:

Source: NAHB (November 2022)

Finally, George Ratiu, senior economist at Realtor.com, had this to say about the October employment numbers as it relates to real estate:

“For the Federal Reserve, a tight labor market amplifies the concern that workers will retain an advantage during wage negotiations, leading to higher incomes and continued pressure on prices. At the same time, coming out of a global pandemic, which displaced millions of workers and led to a two-and-a-half year recovery, the solid job market is keeping Americans on a stronger financial footing, especially amid soaring prices for goods, services and housing. For real estate markets, rising employment and pay are welcome news, as they may help to partially offset the significant headwinds brought about by surging mortgage rates.”

By Peoples Bank Press Release

PBCO Financial Corporation (OTC PINK: PBCO), the holding company (Company) of People’s Bank of Commerce (Bank), announced today its financial results for the 3rd quarter 2022.

Highlights

• Third quarter net income of $3.0 million, or $0.59 per diluted share

• Steelhead gross factoring revenue of $1.9 million, a 6.2% increase from Q3 2021

• Core earnings (excluding PPP fee income) up 73.9% from Q3 2021

• Investment securities increased $42.6 million, or 20.9%, over Q3 2021

The Company reported quarterly net income of $3.0 million, or $0.59 per diluted share, for the 3rd quarter of 2022 compared to net income of $2.7 million, or $0.53 per diluted share, in the same quarter of 2021. Earnings per share for the trailing 12 months were $2.14 per share, down from $2.28 per share for the prior twelve-month period.

Deposits decreased $12.2 million, a 1.6% decline from the prior quarter ending June 30, 2022. Over the last 12 months, deposits contracted by $12.1 million, also a decline of 1.6%. “During 3rd quarter, the Bank experienced a decrease in deposits as customers sought alternative investments at higher yields on their non-operating cash balances,” commented Joan Reukauf, Chief Operating Officer. “The Bank is in a position where it does not have to aggressively compete for high-cost deposits and some deposit runoff was expected. Although deposits declined during the quarter and year to date, the Bank continues to have excess liquidity available to fund loans and add to the investment portfolio,” added Reukauf.

“Portfolio loans were flat during the 3rd quarter of 2022, compared to 2nd quarter of 2022,” commented Julia Beattie, President. Excluding PPP loans in the portfolio as of 9/30/21, portfolio loans were up $11.4 million from the same quarter, prior year, a 2.6% increase. “Loans have been relatively flat during the year as the Bank made a conscious decision this year not to compete for loans based on historically low rates until the markets stabilize, instead focusing on high quality loan growth,” added Beattie. “These kinds of economic cycles do not favor a high growth strategy - quality and safety tend to win out as consumers and businesses adjust to the new reality.” Future reports will exclude commentary on the PPP program as it is no longer relevant to the financial statement discussion.

The investment portfolio increased $42.6 million or 20.9% from the 3rd quarter of 2021. During the most recent quarter, investments increased $1.7 million from June 30, 2022, or 0.7%, and the average life of the portfolio decreased from 5.0 to 4.6 years. With the steep rise in market rates during 2022, the Bank has limited investment purchases to short-term maturities of less than 2 years. As of September 30, 2022, the gross unrealized loss on the investment portfolio grew to $32.4 million or 11.6% of book value. Securities income was $979 thousand during the quarter, or a yield of 1.5%, versus $903 thousand or a yield of 1.4% for the 2nd quarter of 2022.

Classified assets were up modestly from the prior quarter as total loans past due or on non-accrual increased slightly, as a percentage of total loans, from the prior quarter to 0.38% versus 0.22% as of Q2 2022. During the 3rd quarter, the Allowance for Loan and Lease Losses (ALLL) was updated based on changes in loans and updated economic expectations, which were factored into the Bank’s analysis. As of September 30, 2022, the ALLL was 1.08% of portfolio loans and the unallocated reserve stood at $790 thousand or 16.3% of the ALLL.

Third quarter 2022 non-interest income totaled $3.0 million, an increase of $245 thousand from the 3rd quarter of 2021. During Q3 2022, Steelhead Finance factoring revenue increased $111 thousand, a 6.2% increase over the same quarter of 2021. Conversely, mortgage income decreased $333 thousand, or 54.1%, from the 3rd quarter of 2021, a trend that began with the rising interest rates in Q1 2022. “Today’s mortgage rates, although up significantly from a year ago, are still reasonable when compared to long-term averages,” commented Echo Hutto, SVP and Manager of the Mortgage Division for People’s Bank. “As home purchasers, home sellers and real estate professionals become more comfortable with the new rate cycle, home prices should reflect borrower’s ability to pay and activity should pick up,” added Hutto. Non-interest expense totaled $5.5 million in the 3rd quarter, down $332 thousand from the same period in 2021. Notably, advertising expenses were the largest driver for the decrease, down $278 thousand in the 3rd quarter of 2022 versus the same period in 2021 when the Bank expensed $250 thousand in donations toward housing relief support for survivors of the 2020 Alameda Fire. Also notable was the decrease in personnel expense of $597 from the prior quarter of 2022. The Bank did not accrue for a quarterly bonus during 3rd quarter as loans and deposits have not tracked with goals established for 2022, the result of the Bank adjusting its strategy to deal with higher interest rates. Salaries and commissions were down $70 thousand and $64 thousand during 3rd quarter, respectively, due to several vacant positions and the slowdown in mortgage production noted above.

As of September 30, 2022, the Tier 1 Capital Ratio for PBCO Financial Corporation was 10.1% with total shareholder equity of $65.0 million. During the quarter, the Company was able to augment capital through earnings while assets also decreased with the decrease in deposits. The Bank’s Tier 1 Capital Ratio was 12.8% at quarter-end, up from 12.7% as of June 30, 2022. The Company also had unrealized losses on its investment portfolio, net of taxes, of $23.6 million, which is attributed to changes in market value in the current rising rate environment. The net unrealized losses in the investment portfolio resulted in the decline in Book Value Per Share and Tangible Book Value per share from prior periods. “Although the unrealized loss in the investment portfolio increased from the prior quarter with the increase in market rates during the same period, the Bank continues to maintain strong liquidity and access to multiple alternative sources of liquidity. The Bank has a very strong capital position that continues to be well above the threshold to be considered wellcapitalized,” commented Lindsey Trautman, Chief Financial Officer.

“While the Company’s total assets shrank from the prior quarter, the Company continued to provide solid core earnings, which has allowed the Company to maintain a strong position given the current economic uncertainty,” commented Julia Beattie.

PBCO Financial Corporation’s stock trades on the overthe-counter market under the symbol PBCO. Additional information about the Company is available in the investor section of the Company’s website.

Founded in 1998, People’s Bank of Commerce is the only locally owned and managed community bank in Southern Oregon. People’s Bank of Commerce is a full-service, commercial bank headquartered in Medford, Oregon with branches in Albany, Medford, Ashland, Central Point, Grants Pass, Jacksonville, Klamath Falls, Lebanon, and Salem.

By Press Release https://www.oregon.gov/

Continuing a forty-year presence in Japan, Business Oregon announces its new representative to lead Oregon’s Japanese Representative Office and represent the state of Oregon’s business and trade interests in Japan. Masao Kumori will lead Oregon’s team in Japan. Masao has worked with more than 70 major Japanese companies on global investment opportunities and represented North East England in Japan for 23 years to attract investment, collaborate on research and development, and make business-tobusiness connections. The Japan Representative Office works with Business Oregon staff and stakeholders to increase global business opportunities between Japan and the state of Oregon.

“The rich cultural, education, and business ties between Oregon and Japan have been built through years of dedicated effort from representatives from our state working with our Japanese counterparts,” said Sophorn Cheang, Director of Business Oregon. “Our new group operating Oregon’s Japanese Representative Office will continue this tradition and strengthen our foreign partnerships, while looking for new emerging opportunities.”

The Japan Representative Office helps Oregon exporters and small businesses grow global sales in the Japanese market, coordinates Oregon trade activities, and develops international business recruitment strategies to increase Japanese investment into Oregon. Masao and his team will operate the office in Japan, and also leverage the global resources of Wavteq, a globally recognized investment, trade, and economic development consultancy that Oregon is contracting with to support the state’s global development work.

“Global business, regardless of which industry you are in, is moving at an incredibly rapid pace,” said Masao Kumori. “New policies, companies, and economic realities are shifting the nature of cross-border trade and investment demand, making it essential to improve connections, partnerships, and tools to drive international commerce. Oregon’s competitive advantages provide a unique position to capitalize on these opportunities. The Wavteq team and I are eager to begin our work to advance the state’s long and prosperous business relationships in Japan.”

“We are incredibly excited to represent and help facilitate Japanese cross-border investment and trade opportunities for Business Oregon,” said Dr. Henry Loewendal, CEO of Wavteq. “A talent-rich labor force, competitive industry clusters, highly desirable creative culture, quality of life, and strong track record of export success are among the many reasons we are encouraged for future business growth.”

Oregon and Japan have a strong relationship that spans many decades of trade. Japan is Oregon’s 6th-largest export market with Oregon exports to Japan totaling $1.6 billion in 2021. Semiconductors and other electronic components are Oregon’s top exports into Japan, valued at $365 million last year.

Japan is Oregon’s largest export market for food and agriculture products such as oilseeds, grains, fruits, vegetables, wood products, and other specialty agricultural products. In addition, the aerospace industry is another opportunity for Oregon exporters to Japan, with $108 million in value exported last year.

Japan is one of Oregon’s largest sources of Foreign Direct Investment. Currently, more than 150 Japanese companies have operations in Oregon. Governor Kate Brown has continuously supported and cultivated Oregon’s close relationship with Japan. During Governor Brown’s tenure, the number of Japanese companies in Oregon has increased by 26%, and Oregon’s exports to Japan have increased by 50%.

Oregon is conducting a business development mission to Japan and Korea next month led by Governor Brown, from October 14 through October 26. This important global mission to Asia consists of activities to promote Oregon products, build relationships, and attract Japanese and Korean business investment into the state. While COVID put a hold on inperson trade activities, this trip will be the first Governor-led mission coming out of the pandemic.

Business Oregon can help Oregon small businesses enter new markets and has some matching grant opportunities as well. More information is available online at biz.oregon.gov. Also sign up for future global trade news here.

Business Oregon Announces Team Leading Oregon’s Japanese Representative Office

By Press Release https://news.sou.edu/

SOU to expand solar power, move toward energy independence

Southern Oregon University has been awarded a $1 million grant from the Oregon Department of Energy to expand solar power production on campus, in the next step toward its ambitious goal of becoming the first college or university in the U.S. to generate 100 percent of the electricity used on campus.

The award from ODE’s Community Renewable Energy Grant Program will add solar arrays to The Hawk Dining Commons and the Lithia Motors Pavilion/ Student Recreation Center complex, and will pay for the installation of battery storage at the Hawk to support students, first responders and the broader community, if needed.

“This is a tremendous opportunity for SOU, and for our students and the Ashland community,” SOU President Rick Bailey said. “This grant supports our campus-wide efforts to expand sustainability as an integral part of our everyday operations. It also is a significant milestone in our entrepreneurial mission to reduce costs and broaden revenue, easing the financial burden on students and their families.”

Solar energy production is a key element of SOU’s innovative plan to develop new revenue streams and reduce dependence on the two traditional funding sources for

public higher education nationwide – tuition and state funding. The proportions of funding from those two sources has flipped over the past 25 years in Oregon, from two-thirds state money and one-third tuition, to exactly the opposite.

Energy self-sufficiency will save SOU at least $700,000 per year in utility costs and President Bailey plans to expand the program from there, with additional solar installations that will enable the university to generate income by selling electricity to local utilities. He achieved that on a smaller scale at Northern New Mexico College, where he served as president before being hired at SOU in January.

SOU is also awaiting confirmation of a $2 million federal grant for its campus-wide solar build-out. Oregon’s U.S. senators, Jeff Merkley and Ron Wyden, have placed SOU’s request in the senate’s draft appropriations bill for the 2023 fiscal year, which is currently in a process known as “Congressionally Directed Spending.” The federal grant, if awarded, will pay for additional solar arrays on SOU’s parking lots and rooftops.

For the state grant that was awarded this week, SOU submitted its application in July for $1 million toward a project that will cost a total of $1.34 million. It is considered both a community renewable energy project and a community energy resilience project, under the definitions of ODE’s Community Renewable Energy Grant Program.

The program was created by the 2021 Legislature, which set aside $50 million for projects throughout the state over the next three years – with $12 million available in the 2022 funding cycle. The program – open to Oregon tribes, public bodies and consumer-owned utilities – drew a total of 56 applicants who submitted 68 applications, with 20 projects awarded grants in the program’s first round.

“These new solar projects at SOU will take our efforts to the next level,” SOU Sustainability Director Becs Walker said. “We are pursuing all viable opportunities to generate renewable energy on campus. This will help us financially as well as set us on the pathway to achieve carbon neutrality. Our university is helping to lead the way for our community, region and the state of Oregon.”

SOU chose the Hawk Dining Commons and Lithia Motors Pavilion/Student Recreation Center projects for this year’s state funding based on site readiness, community resiliency and public welfare factors. SOU will continue to implement energy conservation and energy efficiency measures as it increases its solar.

The university currently has nine solar arrays on its Ashland campus with a total output of 455 kilowatts, plus an array at the Higher Education Center in Medford and a pole-mounted array installed last year by a nonprofit on land leased from SOU. The two new arrays supported by the state grant will increase SOU’s solar capacity by a total of 359 kilowatts.

SOU’s first solar array – a 6 kilowatt project with 24 solar panels – was installed on the Hannon Library in 2000. A total of five new arrays have been added in just the past three years, in projects funded through a combination of private investors, grants, the student body and the university. SOU’s Hawk Dining Hall & McLoughlin Residence Hall each have solar hot water systems installed to augment the natural gas domestic water heating, and the campus also has three net-zero buildings – they create as much or more energy than they use.

Solar energy production is one of four opportunities that SOU is currently pursuing in its effort to be more entrepreneurial in its approach to revenue generation. The university has also initiated a project to raze its vacant Cascade housing complex, which was completed in the early 1960s, and replace it with an innovative senior living facility that produces synergy between its residents and the university. Funding for the demolition has been approved by the state and is expected to begin in the next few months.

Other projects that will produce revenue or reduce expenses for SOU include the establishment of a University Business District in southeast Ashland – discussions are underway with the local business community – and replacement of its operational software with the cutting-edge Workday platform, which eventually will save the university about $750,000 per year in recurring costs.

The projects are part of an effort to “reengineer” SOU’s financial structure, reducing expenses to better reflect current enrollment and academic interests, expanding revenue sources and positioning the university for strategic growth into the future.

By Marshall Doak, SOU SBDC Director

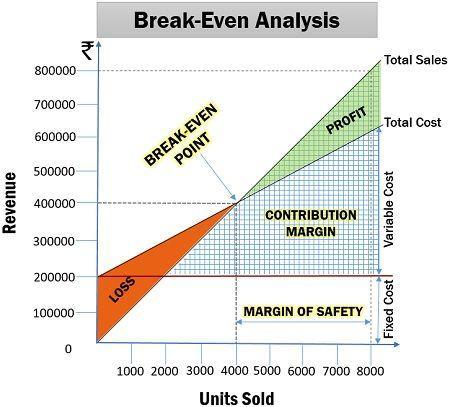

Knowing Your Breakeven Point

In line with recent articles regarding various aspects of surviving inflationary and recessionary times, I’d like to discuss how a business can figure out how to react in these situations. Gaining intelligence and insights through reading articles or watching videos and acting on the advice, or initiating changes to your business operations based on ‘gut instincts’ can be a good thing to do, but can also lead to disaster if the strategies are not appropriate for the situation. If you are looking at uncertain upside returns and high probabilities for downside disaster, what are you to do? How are you going to make good decisions? Perhaps you have chosen option #3, which is to do nothing, hoping for a better outcome through this method. Unfortunately, this third option is rarely a good idea, as maintaining a ‘nodecision’ trajectory during deteriorating business conditions has been proven to cause failure.

The first solution to this dilemma is to look for tools to measure and evaluate your business’s performance with. One such tool is to understand what breakeven points are and how to use them. As a primer, a person could say that April 18, 2023 (Tax Freedom Day 2023) is a breakeven point, as this is the day next year that the annual tax burden is fulfilled and that the tax cost for businesses has been satisfied through revenues produced, on average.

Coming closer to home, within a business breakeven points can be determined through simple means, depending on what is needing determination. For instance, many businesses want to know how much production, business

Photo by Campaign Creators on Unsplash

operations, or units produced or sold need to happen in order to satisfy the firm’s fixed costs? The point at which the levels of operations produce sufficient revenues to satisfy the fixed cost burden is a breakeven point. In the figure on the right, this point is at the intersection of the lower angled (total sales) line at the bottom of the red triangle and the horizontal fixed-cost line, shown as a small yellow dot.

More importantly, to most businesses, the point marked ‘breakeven point’ on the diagram is the one most business owners want to know. At this point, all of the fixed costs and all of the variable costs involved in the manufacture and delivery of the good are satisfied through sales and the net is zero to the owner. From here on, the business starts earning profits while still covering all of the costs involved with the manufacture of the goods. Determining this break-even point is a powerful tool to use when you want to understand how your business is performing. Several considerations to think about when using this are:

• All of the relevant costs a business experiences are accounted for in the ‘Total

Cost’ figures;

• Make sure the figures used accurate and are based solely on the business’s performance as reflected in the Income Statement;

• The more accurate the numbers are, the better use they are in determining product or service pricing, based on the company’s experience. This can be especially useful when price increases are being experienced for the production inputs that build finished products revenues;

• This model applies equally to service businesses, retailers and manufacturers;

• Once the breakeven point is reached, additional production and sales contribute directly to the bottom line profitability, making it possible to increase profits through discounting as a purposeful act and not as a reactionary response to market pressures;

• This model gives insights into aspects of cost accounting within a business to assist the decision-making process, moving that process away from exclusively using ‘gutfeelings’.

Most small business owners think it is important to keep good accounting records so that they can avoid tax problems, or to make sure they are good stewards of their employees needs. These are all important considerations. It is when the realization hits that the accounting information can be used to make accurate and timely decisions to manage the business to be productive and profitable, even in recessionary and inflationary times, that the real understanding of how powerful this information can be is achieved.

—Marshall Doak is the Director of the Southern Oregon University Small Business Development Center and a huge supporter of innovation and the community that forms around innovation in the economy. In private practice, he works with businesses that plan to transition to new ownership within the next five years, assisting them to build value that can be converted to retirement income when the business sells. He can be reached through: mdoak06@gmail.com or 541-646-4126.