6 minute read

2. leTTers To The ediTor / review

SP’s Civil Aviation

Yearbook 2020-2021

T h i r d i s s u e

editorial

An Industry at an Inflection Point

Welcome to the 2020-2021 edition of SP’s Civil Aviation Yearbook! every catastrophic event is an agent of change. each one produces advances in technology, new trends emerge, and people reassess their work and life priorities. The 2008 global financial crisis accelerated the rise of digital banking. now, climate awareness is driving the push for electric-powered automobiles and airplanes. Since the outbreak of the pandemic in 2020, how we work, buy products and services, and travel is changing. it makes forecasting everything more difficult, particularly when history is no longer an accurate basis for predicting the future. today, commercial aviation is at an inflection point. after a prolonged shutdown in which over 90 per cent of flights were cancelled during the 2020 peak of the pandemic, airlines are rebuilding their yield management systems to estimate demand and revenue from fewer high-fare business passengers and more low-fare leisure travelers. international flight schedules are yet to be restored since many countries are slow to fully re-open their borders. big aircraft were pulled from service. Many will never fly again.

It’s a whole new ball game

The statistics section of our Civil aviation Yearbook tracks the annual changes in passenger and cargo demand, fuel price, and ranks airport throughput by country, among other measures. For the past 18 months, however, the massive disruption to global aviation renders 2020 and 2021 comparisons meaningless. australia is still essentially closed, Singapore has introduced Vaccinated traveler lanes (Vtls) with several countries to control passenger flows, Japan, hong Kong, and taiwan are restricting entry, and yet domestic air travel in China and india is booming. data from 2019, therefore, are the only benchmarks for future comparisons.

the new normal

What can we expect in the coming years? industry analysts and airline executives believe 2019 traffic levels will return by 2024. that estimate is speculative at best given the possibility of new coronavirus variants emerging that could set back any robust global recovery. as covid shifts from pandemic to endemic over time, many industry changes we’re seeing now will become permanent. our guest contributors highlight some of these – universal health passports, contactless check-in, growth in cargo tonnage and digital commerce, and a preference for nonstop flights.

From my perspective, there are five emerging trends that are defining the speed of recovery and the future of the industry.

ediTorial

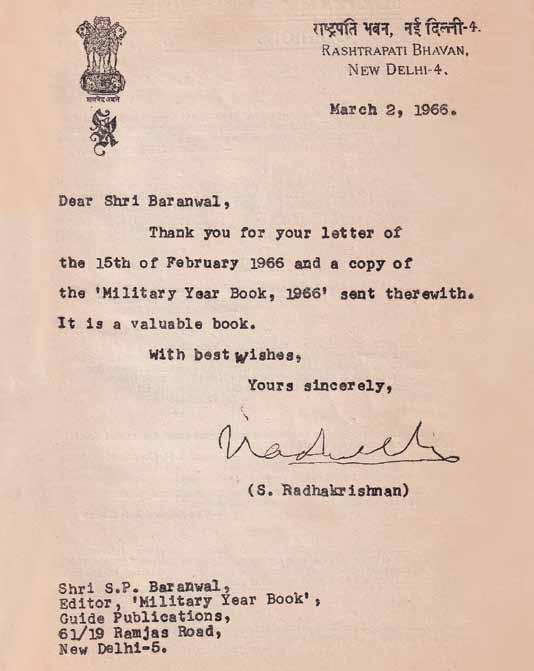

Set of kind words from Dr S. Radhakrishnan, Second President of India, addressed to our Founder Editor-in- Chief, in March 1966 in the context of our first Yearbook - the ‘Military Yearbook’ launched in 1965, and now known as SP’s Military Yearbook. This very long-established background of the Yearbook has been the foundation of SP’s Civil Aviation Yearbook. Following the path of the first Yearbook, SP Guide Publications had introduced SP’s Civil Aviation Yearbook in the year 2018 to fill the vacuum of such a detailed reference document on civil aviation industry covering not just India but the countries across Asia. The Yearbook strives to remain the leader in Asia after having become the first mover in the space of civil aviation reference document.

ediTorial

The New Normal: While uncertainty looms large over global travel’s restoration, the airline industry has to overcome the financial grievances as well as innovate for transforming consumer behavior Cargo & Supply Chains: Air cargo industry is at the threshold of a giant transformation as passenger airlines discover its vital cash-generating contribution to their survival during the pandemic

1. Inequity of Vaccination Rates

Wealthy countries with access to vaccine supplies reopened faster than those without. it will take longer for the populations of poorer countries to be inoculated and, consequently, air travel to resume.

2. Domestic Leads International

only a handful of asian countries have significant domestic markets that are helping their airlines stay afloat. China’s 2021 Q3 local rPKs have rebounded above 2019 levels. The same is true for india. domestic demand and confidence have recovered so quickly that a start-up carrier, akasa air, has ordered 72 new boeing 737 Max jets to serve national routes.

Countries that are dependent almost exclusively on international travel, namely Singapore, taiwan, and Thailand, rely on government directives that dictate flight frequency and destinations. The political, economic, and cultural diversity of the region will result in a slow, gradual restoration of air services, particularly in the absence of a universal digital health passport or protocols.

3. Business/Leisure Mix

We all love to hate virtual meetings but they have proven extremely effective, especially for international businesses. Corporate travel departments likely welcome their reduced budgets. road warriors learned how to work from home which decimated demand for premium cabin aircraft seats, hotel rooms, and hire cars.

Those high-fare travelers won’t completely retreat to their remote offices, but they will be fewer in number, especially in the short term. i suspect corporations will be reluctant to send large contingents of executives to high-risk countries until there is some semblance of stability and safety.

Will business Class cabins get smaller as a result? low cost carriers were enjoying robust growth prior to the pandemic and are eager to capture a share of the pent-up demand from leisure travelers. With an expected decline in the volume of high-fare business passengers, airlines can expect revenue to be generated by more low-fare customers. the change in the business/leisure mix will most certainly impact the magnitude of flight profit, and margin.

4. Going Green

older, inefficient aircraft were parked and later purged from airline fleets as the industry contracted in 2020. The drive to greater sustainability has accelerated development of sustainable aviation fuel (SaF) and alternate propulsion architecture for new aircraft. allelectric engines are coming with oeMs determined to meet the 2050 industry zero-carbon emissions target.

For all the hype of the benefits of greener machines, the reality of infrastructure, fuel delivery networks (particularly for hydrogen), breakthroughs in battery technology, and cost, tempers the excitement. i’m hoping the momentum we’re seeing today continues and we see viable concepts sooner rather than later.

5. Cargo & Supply Chains

When airlines grounded most of their fleets, we realised how much we depend on the belly space of scheduled flights to carry high-priority cargo. removing that capacity almost instantly exposed the vulnerability of global supply chains to disruptions in commercial aviation.

The negative effects were further amplified by a huge spike in digital commerce as more shoppers purchased good and services from screens rather than brick-and-mortar stores.

India is still trying to maintain the track of growth despite of COVID-19 challenges. Air India returning to Tata group is sort of a positive sign in terms of an upcoming healthier version of the airline. Jet Airways after a long halt, is set to return to skies in 2022. Akasa Air, a brand new airline that has already placed orders for around 70 Boeing 737 MAx, is another factor that adds to India’s growth story.