2 minute read

ANNEXURE IV: COMMUNITY BUSINESS MODELS

Report - Addressing Land Issues for Utility Scale Renewable Energy Deployment in India

ANNEXURE IV: COMMUNITY BUSINESS MODELS

Advertisement

As the economy is expanding the electricity demand is going to grow further. Due to the renewable energy impetus, an increase in the development of wind and solar farms is expected in India. RE projects require land, which is a scarce resource. Since RE sector is growing fast, the land acquisition issues may rake up socio-economic conflicts.

To minimise the socio-economic impacts of RE projects due to land procurement, few community business models have been developed which are discussed below.

LLP Model

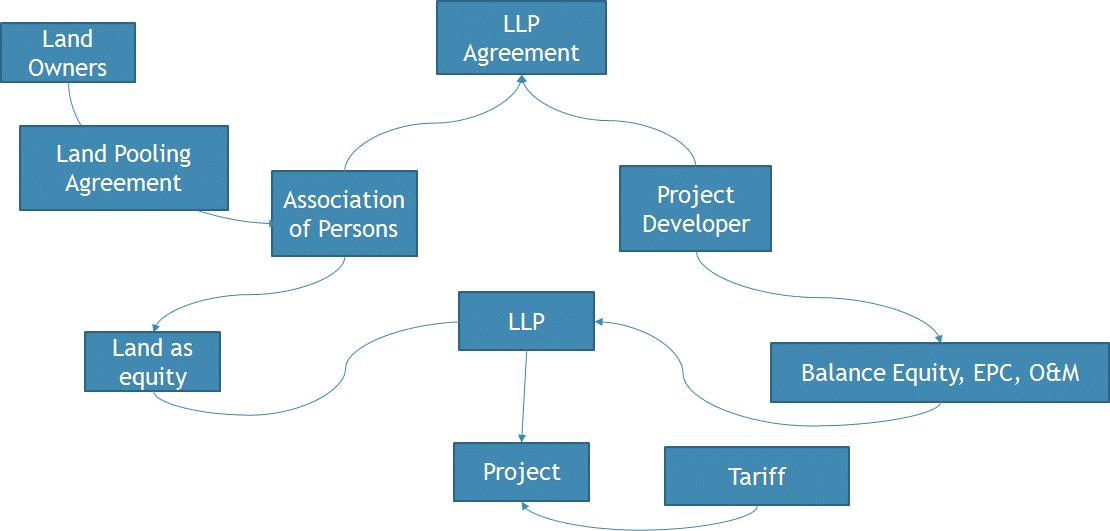

A Limited Liability Partnership (LLP) may be formed, where the land-owners become stakeholders in the LLP to the extent of their land value contribution. Refer Figure 12.

Figure 12: Schematic of LLP Business Model

The key aspects of the LLP model are as follows: 1) Landowners will be engaged in the business as equity shareholders. Value of equity shareholding will be corresponding to the value of land. Return on Equity therefore will be accordingly computed. 2) Capital value of land will be open to negotiation between the landowners and

Report - Addressing Land Issues for Utility Scale Renewable Energy Deployment in India the Project Developer. Landowners will get proportionate ownership and interest in the project. As per the prevailing regulatory norms the land value allowed is on an average 5-6% of the total project cost. A project is generally financed in 30:70 (Equity: Debt) ratio. The normative 5-6% allowed under the regulations, will form part of 30% of equity contribution and therefore will translate into 20% of equity in absolute terms. Project developer needs to deploy the balance equity.

3) EPC and O&M activities will be undertaken by the Project developer and would be duly compensated for the same. An Agreement will be executed between the landowners, represented as Association of Persons, and the Project Developer.

Sufficient safe-guards will be incorporated in the Agreement to ensure time bound completion of the Project. The LLP Agreement would include indemnity clause to ensure that the land or its value is secured. In case of default, where the LLP is unable to service its debt and the LLP is taken over by a financial institution, the landowners will continue to have same returns and security as promised originally under the Agreement.

4) This model can be explored in Captive Generation Plants, by high demand consumers like industries and commercial establishments. In case there is no expertise, sub-contractors may be engaged for EPC and O&M activities.