SPOTLIGHT

THE STATE OF MODERN ALCOHOL (+NON-ALC)

BREAKING DOWN ALCOHOL DISTRIBUTION

SPRING

The Rise

Ready-to-Drink DTC

(Non-Wine) Alcohol

‘23

of

for

PLUS

WWW.STARTUPCPG.COM 2 THE SPOTLIGHT SPRING 2023 TABLE OF CONTENTS 03 Letter from the Editor 05 Meet the Startup CPGer Jessi Freitag, Host of Startup CPG's 06 Meet Parch Redefining the Non-Alcoholic Cocktail 12 Breaking Down Alcohol Distribution 16 Meet Veso The Modern Aperitif 20 DTC for (non-wine) Alcohol 24 Ready-To-Disrupt How startup RTD brands are ‘clawing’ through the competition 30 Navigating Data Crisp’s guide to creating a “data calendar” 32 Getting Liquid to Lips in Non-Alc 36 San Francisco Commuity Feature In Good Taste Wines

Every category in CPG is nuanced. Each comes with its own restrictions, challenges around messaging or packaging, disruptions in the supply chain or slew of ethical sourcing or sustainability concerns.

Every category in CPG is nuanced. But when it comes to alcohol and nonalcohol, the nuance is perhaps even more layered. Alcohol is a state-changer, a liquid that comes with associations far beyond the bottle. Non-alcoholic brands are a direct response to these state-changers, a challenge to the “norm.” The state of modern alcohol cannot be summarized neatly; rather, it’s a dialogue. In this edition, we spoke with brands across alcohol and non-alcoholic beverages to better understand the state of modern alcohol — and continue the conversation past the first sip.

For alcohol brands, the greatest challenge lies in distribution. Distribution has failed to catch up to the speed of innovation; while the category rapidly accelerates at the product level, distribution continues to be restricted by a system implemented in the 1930s. The three-tier system in alcohol distribution was first implemented in the United States after the repeal of Prohibition, with the goal of preventing vertical integration in the alcohol industry. In its modern form, this system ironically benefits large brands and presents countless barriers for startups attempting to reach consumers. This edition shares the ins and outs of this system — and ways that even the smallest brands can start working around it to kick the Claws to the curb.

For non-alcoholic brands, the greatest challenges lie in education and differentiation. This category is reaching its “awkward phase” — too nascent to be widely understood by consumers, yet growing too rapidly for individual brands to stand out amongst the competition. We interview standout brands like Parch and industry partners in the space to learn more about how to differentiate while remaining approachable to consumers.

Whether you operate an alcoholic or non-alcoholic brand, work in an adjacent category, or are simply interested in the space, I hope you find something in this edition that speaks to you.

As always, please share any feedback or ideas for future editions with me at jenna@startupcpg.com.

Cheers,

Jenna Managing Editor, The Spotlight

Jenna is the Managing Editor of The Spotlight magazine and works on Startup CPG’s marketing team. She is passionate about emerging CPG, also working as a freelance publicist and copywriter.

EDITOR'S LETTER DEAR STARTUP CPG COMMUNITY,

3

WWW.STARTUPCPG.COM

THE SPOTLIGHT

EDITORIAL TEAM

4

WWW.STARTUPCPG.COM

Jenna Movsowitz Managing Editor, The Spotlight

Grace Kennedy Staff Writer

Tamara Romčević Designer

MEET THE STARTUP CPGER:

HOST OF STARTUP CPG'S PODCAST JESSI FREITAG

1 TELL US ABOUT YOUR BACKGROUND IN 3 SENTENCES.

I've worked in marketing and operations for the last 10+ years in a variety of industries and have always been a nerd for staying organized and using software tools at work. I joined the CPG world when I was the first hire at a venture-backed CPG brand where I helped grow the team to about 30 employees, build out a manufacturing facility, and support national distribution and retail launches. I started podcasting in 2021 with a personal podcast, Iroh's Corner, and then started as the Season 3 host of Startup CPG that year along with pivoting to freelance operations and project management work.

2 WHAT ARE YOU PASSIONATE ABOUT (IN 5 WORDS OR FEWER)? Learning new things every day

3 WHAT’S BEEN THE MOST REWARDING PART OF BEING PART OF THE STARTUP CPG COMMUNITY?

Being able to meet other community members in the Slack and then growing real friendships. I love going to Expos and seeing so many people I know from the online world and getting to finally have an in-person conversation. Also it makes going to the grocery store so fun when I know the story and people behind my favorite brands.

4 FAVORITE SNEAK-INTO-THE-KITCHEN-IN-THE-MIDDLE-OF-THE-NIGHT SNACK? Amazi's Dried Pineapple!! (I literally ate a whole bag while writing this)

5 A CPG BRAND YOU EAT/DRINK EVERY DAY?

So many! But Funky Mello, Oat Haus, and Mid-Day Squares are daily snacks. I rarely go a day without a Spindrift.

6 FAVORITE (NON-STARTUP CPG) PODCAST?

I never miss an episode of Ask Iliza Anything or Shit You Should Care About.

7 MOST INTERESTING THING YOU'VE LEARNED ABOUT THE CPG INDUSTRY? "Success" can look so different for different people and I love seeing and hearing the different approaches of founders and members of the CPG ecosystem. Also, to never underestimate the value of asking the right question (both on the show and in day to day life).

5 WWW.STARTUPCPG.COM

Meet Parch

REDEFINING THE NON-ALCOHOLIC COCKTAIL

WWW.DRINKPARCH.COM

6

vibrant new brand setting the stage in non-alc

The

The founders of Parch, Ila Byrne and Rodolfo Aldana, spent the majority of their careers in booze. Byrne worked for industry titans like Treasury Wine Estates and Diageo while Aldana ran the agave portfolio for the largest spirit company in the world, helping the company grow Don Julio and acquire Casamigos. So why did two alcohol industry veterans then decide to start a non-alcoholic cocktail brand?

A few years ago, Aldana was diagnosed with an aggressive form of cancer. He left his job to focus on treatment, and he also chose to give up all forms of alcohol. Aldana thankfully went into remission, but when he started socializing again, he found himself disappointed by the options non-drinkers like himself had to choose from at parties or events. Nothing delivered on what he had enjoyed about the mezcal and tequila traditions he had spent his career in. He wanted something adult (no sugary Shirley temples), something indulgent (plain seltzer wasn’t cutting it), and something complex (non-alcoholic beer just tasted like beer). Everything he tried felt dumbed down, artificial and immature. What if he made his own?

Enter Ila Byrne. From her position at Diageo, Byrne watched as new and exciting NA brands like Seedlip hit the market at the same time as many consumers were beginning to re-examine their drinking habits. She knew there was an opportunity to be found in the NA sector, but she wasn’t sure what role she had to play in it.

A few years later, having left Diageo and working as a consultant, Byrne received a message from Aldana: What if we made a non-alcoholic beverage that offered the same quality as a cocktail you might order at a mixology bar?

As they began ideating, Byrne and Aldana agreed: the NA category was offering consumers a compromise. “You can drink something that kind of feels like alcohol, but it’s downgraded. The narrative was that non-alcoholic drinks are less than the real thing. We wanted to offer consumers more, providing a beverage people were actually excited to drink — not just appeased.” Furthermore, they wanted to create a beverage that allowed non-drinkers like Aldana to partake in socializing without feeling left out: to give them a drink they felt proud to hold in their hand and share at a party. And with these goals in mind, Parch was born.

WHAT IS PARCH?

Parch is an agave-based non-alcoholic cocktail inspired by the tequila and mezcal traditions Aldana was steeped in and the “lush biodiversity” of the Sonoran desert. As they developed their flavor profiles, they looked to the desert for unexpected combinations including prickly pear cactus and other desert botanicals, practicing the ethos, “if it grows together, it goes together.”

At first, Byrne and Aldana tinkered with their flavors at home, getting feedback from friends and trusted bartenders. But, Byrne explains, “It’s one thing to try the product in your home kitchen, but it’s an entirely different thing to commercialize it.” To move their product out of their homes and into the hands of consumers, they worked with a liquid developer with a background in functional beverages who helped them land on drink formulations they’d be able to scale.

After a year of development, Aldana and Byrne launched two flavors in 2022: Spiced Piñarita (a smoky, spicy sparkling pineapple drink with mole bitters and cocoa extract) and Prickly Paloma (a cocktail with grapefruit, orange bitters, prickly pear cactus, hibiscus and more.)

If it sounds like each drink packs in a lot of flavors, it’s because they do; each of their drinks has 12 to 15 different natural ingredients, including herbal powders, frozen puree, juices, and botanicals. Byrne and Aldana also worked with herbalists to include four adaptogens in their cocktails: ashwagandha, American ginseng, Gaba, and L-theanine.

“Since we’re taking out the alcohol component, we wanted to give something to people to help them feel relaxed. We don’t want to get you high, put you to sleep, or put you into a state of euphoria. We just want to give you that feeling a glass of wine provides — a nice deep breath.” Still, Byrne is clear

WWW.DRINKPARCH.COM

7

that the adaptogens in their drinks are not a quick fix: “It’s not like popping a pill. Adaptogens work with your body and build up in your system over time.”

Once the liquid inside of the can was established, Byrne and Aldana moved on to branding, another area where they sought differentiation. “This category can be very puritanical, mimicking the styles of clean beauty brands that are very minimal, using only whites or pastel colors. We wanted to push against that and lean into something that felt optimistic, intriguing, sunny, and lush.”

Their can design includes rich reds and greens, while their site portrays idyllic imagery of the Sonoran desert and people enjoying Parch in chic glasses rimmed with salt. Parch drinkers are a part of the party, not separate. Abstaining from alcohol, Byrne says, “should never feel embarrassing.” The Parch can, with its bright colors and celebratory graphics, fits in at any gathering without a second thought.

THE (BUMPY) ROAD TO LAUNCH

Parch officially launched in June 2022 — and the road to launch was not exactly smooth.

First, the complexity of Parch’s beverages made it challenging to find a co-manufacturer. “Not everyone wants to make Parch. Most co-manufacturing facilities want to make flavored water. It’s the easiest thing to make and it’s super profitable. Parch uses 12-15 natural ingredients and is much more complex to make.”

When they finally found a co-manufacturer, they pushed forward. They initially planned to launch in glass bottles, but couldn’t acquire glass anywhere — so they pivoted to aluminum cans. As it turns out, getting cans was challenging, too. “We ended up having to import [cans] from China at a huge bulk scale.” To make matters worse, the cans they imported were shipped in one of the container ships that got stuck in Southern California for months on end.

Eventually, the cans arrived and they released a product they felt proud of. But of course, another hurdle arose. After the first production run, their co-manufacturer backed out. “They said, ‘you’re too complicated. We want to go back to making flavored water & energy drinks, so you’ll have to find someone else.’”

Their co-manufacturer backed out at the same time that they received a huge opportunity with a national grocer who wanted to stock Parch. Byrne and Aldana then spent six months chasing after a new co-manufacturer. “I begged people. I didn't cry, but I was ready to.” After months of chasing or, in Byrne’s words, “stalking,” a new partner came through who they are now happily working with.

Even with a new co-manufacturer locked down, more issues presented themselves: their freight company left behind an entire truck of juices and another shipment of juice went missing in transit. “It seems like this is just the life of a start-up,” Byrne confesses. Because of this, Byrne tries to remind herself and her partner not to sweat the small stuff. “Sometimes there’s an issue with a label that is not perfectly printed and you have to suck it up because you’re working so fast. As long as it’s safe and still tastes great, that is the most important thing for consumers. But the perfectionist in me panics, thinking, ‘Oh my god, this line is slightly blurry.”

BRINGING PARCH TO CONSUMERS

As Parch grows, they have been working diligently to get their drink into as many people’s hands as possible. In some ways, this process is easier for an NA brand. They don’t have to go through the dreaded three-tier system, making it easier to distribute Parch across the country at a much quicker pace.

However, Byrne has found most liquor distributors are still quite resistant to taking on a NA brand, which makes it challenging to get Parch and other NA drinks into large liquor stores. “[Liquor distributors] make so much money on alcohol distribution that they haven’t seen the need [to stock NA].”

The problem with this, Byrne argues, is that liquor stores are likely where the

8 WWW.DRINKPARCH.COM

NA category will see the most growth. Data from Nielsen shows that 82% of people who buy non-alcoholic beverages also buy traditional alcoholic drinks. NA drinks like Parch are “an additional basket purchase for most people. Maybe they’re buying for someone else in the household, but most likely they’re buying for themselves to add into their repertoire on days they don’t want to drink or as the third drink of the night.”

Byrne hopes to see liquor stores start dedicating entire sections to NA beverages, and she references the dairy industry as an example of what she hopes will come: “The dairy fridge has changed dramatically over the last decade, with plant-based milk alternatives alongside cow’s-milk. We believe the same will happen for NA.”

Until the liquor distributors catch up, Parch is focusing on the locations they can launch in, which includes 46 states and 450 stores across a wide range of categories: non alcoholic liquor stores, wineries, breweries, small bottle shops, natural grocery stores, yoga studios, boutique hotels, and more. They also sell Parch on Amazon and have a DTC option on their site www.drinkparch.com.

Above all, their focus is on getting Parch into as many people’s hands as possible. “When we look at our business plan from 2020, the revenue we thought we would generate from DTC was much more than it actually is. We’ve seen way more conversion from reaching real people in real life at real events.”

In light of this and to cut costs, Parch cut their PR partnership and their Instagram, Facebook, and Google ads, which didn’t provide the results they had hoped. Now, all of their marketing money goes into sampling and in-person events. They use their seven-person team located across the country as brand ambassadors for sampling and have connected with sober communities through partnerships with events like Daybreaker where they’re able to reach as many as 1200 people at sober dance parties. As they build, they plan to take on more partnerships and events.

“Consumers want that tangible interaction with the product,” Byrne says. “Whether it’s Pop-up Grocer or Foxtrot or any number of stores, people are going there for the community.”

JUST BECAUSE ITS NON-ALCOHOLIC DOESN’T MEAN ITS CHEAPER

Setting a price that consumers can understand is another challenge NA brands like Parch have to contend with. “People think that non-alcoholic means you've taken something out so it should be less expensive. But it’s actually extremely hard and expensive to make a great-tasting NA product.”

Heineken has aided in consumer education by pricing Heineken Zero (their NA beer) at the same point as their regular beer. When such a large brand indicates to consumers that NA is not necessarily cheaper, consumers will hopefully begin to better understand NA price points.

Parch priced its product at $5 a can to reflect the quality of the product and the ingredients that have gone into it. Furthermore, pricing it any lower would set them on the same level as your run-of-the-mill soda, which they felt would devalue their offering.

“We want this to be affordable, but it’s an affordable luxury. Our four-pack is more expensive than most beer or soda, but you're also getting so much more in return.” Not only are consumers getting a healthier beverage, but NA drinks like Parch also allow non-drinkers to socialize. “You get to be a part of the social situation without harming your body. We're offering people the opportunity to be included and feel good about their choices. And people will pay for that.”

WWW.DRINKPARCH.COM 9

WHAT DOES THE FUTURE HOLD FOR PARCH?

As the NA space continues to grow, Parch hopes to be one of the pioneers of the next generation of NA offerings and has exciting plans to launch a new product this summer. “we call ourselves the third wave of nonalcoholic beverages,” and they are excited to see the offerings for non-drinkers continue to evolve as consumer attitudes toward alcohol shift.

“The awareness people are gaining about the overconsumption of alcohol is inspiring,” Byrne says. “We don’t have to remove it from our lives entirely, but we should be more respectful of how we drink it — taking the time to savor nice wine or a delicious mezcal cocktail, instead of guzzling cheap stuff. We want to respect ourselves, respect alcohol, and find ways to enjoy life that don’t have to include alcohol.” And one of those ways, Parch and Aldana hope, will be by opening a can of Parch, pouring it over ice, and sitting back to relax.

WWW.DRINKPARCH.COM 10

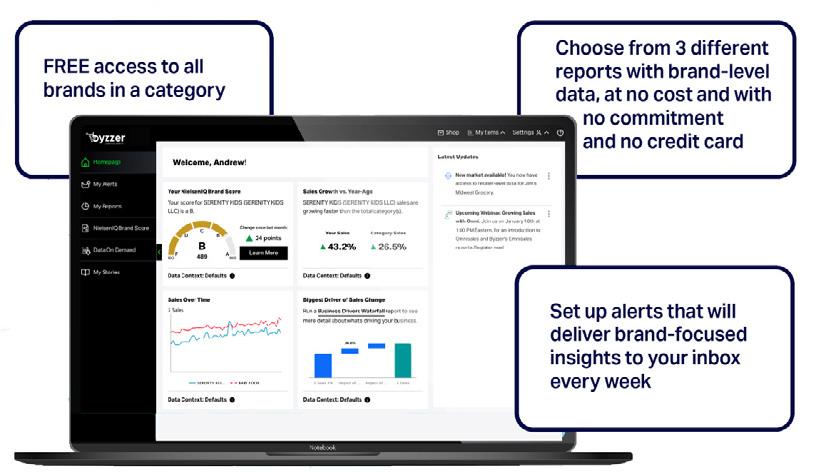

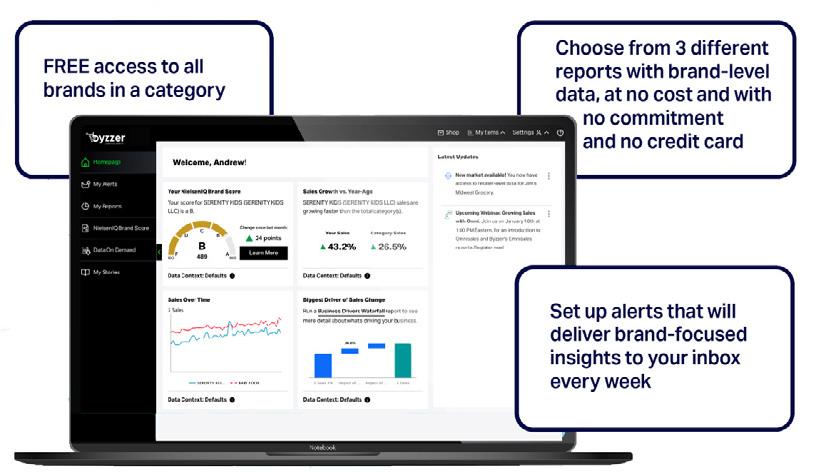

Get market clarity fast, with Byzzer. Powered

Byzzer gives emerging brands the most complete and clear understanding of consumer buying behavior, revealing your next pathway to growth at a price that fits your budget. Our cloud-based platform, ad hoc reports, and team of experts will help you access the Full View™ of retail and consumer data—without breaking the bank.

NIQ has provided retailers and brands with the Full View of consumer buying behavior since 1923. Byzzer powers emerging brands with the most comprehensive and up-to-date retail and consumer data on the market, because brands of all sizes deserve the Full View.

© 2023 Nielsen Consumer LLC. All rights reserved.

by NIQ. Get Free Access Today

By Grace Kennedy

BREAKING DOWN ALCOHOL DISTRIBUTION

We Can’t Go Over it, We Can’t Go Under it, We Have to Go Through it

You’ve spent the last year developing the perfect flavor balance in your drink, securing hard-to-find ingredients, designing eye-catching branding, and finding the right co-manufacturer. Now, you’re finally ready to launch your alcohol brand and share it with the soon-to-be adoring masses. There’s just one problem: you don’t have a distributor.

Of all the alcohol brands we spoke to for this issue, the most frequently cited headache was finding and working with a distributor. For good reason — alcohol distribution is a convoluted, confusing, and highly-regulated space. And yet, there is no way around distribution if you want to get your drink into the hands of consumers. So how are brands navigating their way through it?

WHAT IS THE THREE-TIER SYSTEM?

Much of the headache around distribution stems from the constraints of the three-tier system. As one brand I spoke to put it, the three-tier system is “a monster that no one should have to deal with.”

When the 21st Amendment passed, ending prohibition, states received the authority to regulate alcohol distribution as they saw fit, with one very significant caveat: the three-tier system. It was designed to control the distribution and consumption of alcohol and required all alcohol products to pass through three “tiers” before reaching consumers:

12

WWW.STARTUPCPG.COM

1. PRODUCERS

2. DISTRIBUTORS

3. RETAILERS

Producers make the product and sell it to distributors (typically at a 50% increase) who sell it to retailers who finally sell it to the public. Importantly, none of the tiers can be passed over or skipped. Chris Beyer, the founder of the modern aperitif brand Veso, explains, “You’ve never bought Budweiser from budweiser.com or gone to a Grey Goose bar, and that is because they’re illegal. They’re not allowed to operate bars, and they’re not allowed to sell directly to you.”

HOW DOES IT IMPACT DISTRIBUTION?

The three-tier system is partly to blame for the massive markups (sometimes up to 150%) we see in alcohol products as the price is raised as products pass through each tier. This puts the big guys at an advantage: they can move enough product to cut prices while smaller producers do not have the same flexibility.

To make matters worse, the exact constraints of the three-tier system vary from state to state, and beer, wine, and spirits are all handled differently. For example, wineries can ship directly to consumers (DTC) in 47 states, while breweries can only ship DTC in 10 states and distilleries only seven. Furthermore, with each state having different regulations, brands must obtain a new distributor for every state they want to sell in.

At the center of the three-tier system, distributors hold a great deal of power, but most consumers are unaware of the role they play in the alcohol industry. We go to the liquor store, buy the alcohol we want, and don’t consider the journey it has taken to get to us. In part, this is because distributors largely work in the background: a shadowy intermediary that some have jokingly compared to the mob, with strict operating territories, exclusivity rights, and fierce competition. But distributors, as unseen as they may be to the public, are essential to a brand’s success, and the only way to grow is through them.

SELF-DISTRIBUTION

With all of the complications of finding a distributor, is it possible for brands to just do it on their own? Yes and no.

Self-distribution offers emerging brands the chance to get their product out there without banging down the doors of a distributor and signing lengthy, binding contracts they might not be ready for. However, the legality of self-distribution depends on the state your brand operates in and the type of product you sell. In California, wineries and breweries are allowed to self-distribute if the product is made in-state but in Delaware self-distribution is illegal.

For Beyer, self-distribution allowed him to hit the ground running in the early days of his business. “People would text me to ask for more cases and I could drop them off that night. If I made a sale, I could run out to the trunk of my car, and drop off the cases immediately, and they could put Veso on the menu or on the shelves that night.”

Mizo, a hard-seltzer and hard lemonade company founded by Chris Tran and Holly Paul, also began by self-distributing their product from the trunk of their car. “Most brands start with independent markets because you can sell into them individually. You can just go down the street, talk to the manager, and say, ‘Hey we have this product. Do you want to take it?’”

Still, there is a ceiling many brands will hit when self-distributing. If you want to grow beyond your immediate radius and expand into larger retailers, brands will need to work with a distributor. Beyer says, “Self-distribution started becoming a bottleneck for our growth, and I realized that we could grow significantly more if we found a distributor.” Distributors can also accelerate growth by enabling brands to connect with larger retailers who might have otherwise been unwilling to open an email from them. “When talking to larger retailers,” Tran explains, “having a distributor is table stakes. If you don't have a distributor, they're not going to talk to you.”

FINDING A DISTRIBUTOR

Unfortunately, finding a distributor is much more difficult than one would hope. Dave Bailey, who spent close to a decade

buying and selling alcohol before starting his brand, explains, “It's not like if you Google distributors in your state, you’re going to find a source listing all of the quality distributors and their contact information. Most of the [distribution] sites are pretty old school and a lot of the distributors are family-run. It's not user-friendly for a new brand to navigate who they need to speak to and how to pitch their product.”

Currently, four distributors control about 60 percent of the market — Southern Glazer’s, Breakthru Beverage Group, Republic National Distributing Company (RNDC), and Young’s Market Co — but distributors operate on all levels from single cities to nationwide.

As brands begin seeking distributors, Bailey first recommends research: “Use any sort of industry connections you have to hear about other brand’s experiences, good or bad, to gain knowledge of the current landscape.”

It is also worth considering if your brand is ready before approaching distributors. Large distributors are wary of taking on new brands— if they are unable to sell the product, they will be left with it collecting dust in their warehouse. Because of this risk, distributors typically don’t take on brands until they’ve reached a reliable threshold of growth. This reality was part of the reason Veso self-distributed for as long as they did. Beyer explains, “Distributors pay upfront for the product, so it's a risk for them, and they don't want to take on a brand until it has acquired enough accounts that they can reliably profit from. We would not have been able to get into a distributor when we only had one account, so we had to wait until we grew.”

Once your brand is ready and you have identified the distributors you might want to work with, “you can either do a cold outreach and hope they respond,” Bailey says, “or find someone in the industry — a buyer at a grocery store you’re doing well at or an advisor to your brand — and ask them to facilitate an introduction.” This approach tends to be more effective, Bailey admits, as many distributors, particularly the larger ones, require a warm introduction before they are willing to engage.

Small distributors are often easier to reach than one of the “big four,” but, gener-

13 WWW.STARTUPCPG.COM

THE BIG 4 ALCOHOL DISTRIBUTORS

ally it can be hard for new brands to get in touch with a distributor without a connection. We found the same in researching this very article; we attempted to get in touch with a distributor, but after a few weeks of back and forth, they stopped responding. And on more than one distributor’s website, the “learn more” or “let’s get started” pages for prospective brands were broken links. The metaphor is not lost on us.

“As a small brand in alcohol, it's really difficult to get a hold of a distributor,” Tran explains. “The distributor wants to know that you have XYZ retail accounts on board. But many retailers won’t talk to you if you're not working with their set list of preferred distributors.”

Anna Zesbaugh, the founder of the hard kombucha brand Hooch Booch, likened it to getting a job after college, “Employers ask, ‘Do you have five years of experience?’ and you’re like, ‘No. I just graduated college.”

START SMALL AND GET CREATIVE

Bailey knew of this reality when he and Camillia Taffe started their hard tepache brand Crooked Owl, so they started working with a small distributor who would essentially allow them to self-distribute without the legal headache. They teamed up with TapRm, a B2B SaaS platform that operates both nationwide e-commerce sales and a more traditional distribution model in New York City.

“Their business model requires they take a higher profit margin, and they also take a monthly fee to operate your direct-to-consumer offering. In this way, they lower their risk and are more open to young brands.” For a small brand like Crooked Owl, working with TapRm has been immensely helpful in getting their footing in

New York City. They’ve worked with sales reps from TapRm’s team who have helped them connect with both off and on-premise locations. That being said, a service like TapRm, while great for emerging brands, does require a bit more leg work on the part of the founders. “The brands that are successful with companies like TapRm are the ones that are going to be boots on the ground. They have to be comfortable going to the bars themselves and selling the product.” For brands without any proven history, such a route can be a great way to prove viability in the market, and as they gain more accounts, they can start to meet with distributors who have a greater sales force behind them.

Another brand we spoke with (who chose to remain anonymous) decided to take a slightly more unorthodox approach. When they first got in touch with a large regional liquor store chain, the store asked for the name of their distributor. The problem was, the brand didn’t have one yet. Scrambling and eager to jump on the retail opportunity, they gave the retailer the name of a regional distributor in their area. When it came time to onboard, and the retailer asked to get in touch with their distributor, they told them, “We’re just in advanced conversations with that distributor. But who are your preferred distributors? We would love to be good partners with you by working with your preferred distributor.” When the retailer gave them their preferred list, the brand asked for an introduction. This intro got the ball rolling, and after close to a year of negotiations, they signed with RNDC.

DISTRIBUTION IS LIKE A MARRIAGE — GO INTO IT WISELY

Knowing how challenging it can be to find

a distributor, brands may be excited to hear that a distributor wants to work with them. However, brands shouldn’t always leap at the first opportunity they get without considering if the distributor is the right fit. Meeting with a distributor should be an interview for both sides; they want to know how viable your product is and you need to know what capabilities they have to sell your product. Consider, what does this distributor typically sell? Are they relevant in your market? And who do the retailers you want to work with prefer?

This is especially essential as you move up in scale to larger distributors. One emerging brand we spoke to initially signed a contract with RNDC. “We had big eyes. We saw ‘second largest distributor in the nation,’ and we had senior buy-in so we thought it would be huge for our small brand. But the problem was, we’re a small brand in a big house.” The brand found there was a disconnect between senior leadership’s interest and the sales team’s understanding of how to sell their product. Now, they’re rethinking their strategy and seeking out a smaller distributor who specializes in craft products. The problem is, getting out of a distribution contract can be extremely challenging. “It’s not dissimilar to a marriage. There are a lot of binding legal contracts and if you break them it can be expensive and contentious.”

If your brand does decide to work with a large distributor, Bailey explains, “You have to make sure they have buy-in to push your product — otherwise you can get lost.” In some cases, buy-in might require offering outsize incentives to the sales reps to encourage them to push your brand over others. If your distributor sells Tito's, a product sales reps are likely to make a large commission on, brands will need to overpay sales reps at first with incentives to make sure the team is fully bought in.

14

WWW.STARTUPCPG.COM

Furthermore, when it comes time to negotiate and sign a contract, brands should be careful not to agree to the distributor's terms just because they feel they have no other choice. Tran explains, “As a small brand, distributors think that they have all the negotiating leverage and they will try to squeeze you out of your margins and the contract terms. But as hard as it is, brands have to remember that no matter how small we are, we have leverage. We're giving them business and they wouldn't have anything to distribute if we did not give them a product.”

These negotiations will not be short — they stretched up to a year for many brands — but by taking the time, brands will avoid getting locked into a contract they will regret signing.

CHOOSING YOUR DISTRIBUTION STRATEGY

Once you have a distributor, you will probably feel ready to sit back, relax, and watch as your product flies off the shelves. Unfortunately, that is rarely the case. Every distribution house is different, and, depending on its size and capacity, will be more or less willing to help build your brand and sell your product.

In Tran and Paul’s experience, “with less established, smaller distributors, they inherently have more buy-in to your brand because they cannot rest on their laurels, knowing they’ll sell enough Tito’s and Tanqueray to meet their margins. They want to be your partner in building out your brand in the regions they handle.”

Larger distributors like RNDC and Southern, on the other hand, are often “glorified shipping trucks,” they say. “They’re delivering your product and you’re doing 99% of the work selling it.” Because of this, brands need to weigh the pros and cons of small and large distributors when it comes to their distribution strategies. RNDC might give you the ability to expand into large retailers like Walmart and Costco because they already have the connection, but they will not do much to help sell your product once it hits the shelves. A more regional distributor might not have immediate access to Walmart, but they are incentivized to get out there and move your product, selling on your behalf at independent stores and restaurants.

Smaller distributors also tend to have

very specific distribution zones that one might liken to a gerrymandered congressional map. Within those zones, your distributor will have exclusivity on your product, and if there is a store outside of their borders, they won’t touch it. This can present a problem if you want to work with large distributors who will want exclusivity over the entire state, not just regions.

“A lot of small brands will start working with a regional distributor who can handle an area like Los Angeles,” Trans says. “As they grow, they will decide to start talking to a distributor like RNDC. Unfortunately, the brand now has a lot less leverage in these conversations because they can’t give RNDC exclusivity on all of California.” Without exclusivity, RNDC’s job becomes more complicated. It is much easier to sell your product to Walmarts across the state without discretion than it is to have to avoid certain counties where another distributor has control, Because of this, large distributors may be less willing to work with your brand if another distributor already has exclusivity over part of the state.

As brands grow, they should consider the strategy they want to use to move their product. Do you want to get your product into large retail chains or focus on smaller independent stores? If you want to work with a large distributor, remember that much of the work of selling the product will be in your hands. In this case, some brands may hire brand ambassadors to build out their market presence and sell-product without relying on their distributor.

ON-PREMISE VS. OFF-PREMISE DISTRIBUTION

Another element of a brand’s distribution strategy will be its approach to on-premise and off-premise locations. Which should come first: restaurants or retail?

The answer to this question will vary for each brand depending on their offering. An RTD product, for example, might have better luck at retail stores, as consumers tend to drink RTDs at home or parties, while a new liqueur might find success partnering with craft cocktail bars. No matter what you sell, however, most brands will likely want to do a bit of both to get as many eyeballs on their product as possible.

On-premise can mean anything from your small local bar to a massive concert venue. For smaller restaurants and bars,

brands will need to build relationships with the lead bartender and or beverage director to get their product stocked. Large restaurant groups and venues, however, tend to have a bit more infrastructure and are typically easier to reach via email. Getting stocked in off-premise stores is similarly a bit more straightforward than in small bars and restaurants. Retail buyers tend to be available via email and brands can work with their distributors to schedule meetings and tastings.

WHAT ABOUT DIRECT-TOCONSUMER?

The final distribution element for alcohol brands to consider is their Direct-to-Consumer offerings. DTC presents yet another challenge for alcohol brands as they navigate high shipping costs and three-tier-compliance. Most brands admit that DTC is far from their priority when it comes to distribution, but they will set it up on their site (through a third-party) so consumers can convert their interest should they not live close to a local store.

Overall, however, most brands have found their products to be much more successful in IRL shopping experiences. Tran explains, “Consumers want that immediate satisfaction in buying alcohol that you can only really get shopping in the store.”

SLOW AND STEADY WINS THE RACE

Of all of the advice we heard from brands around distribution, the most frequently mentioned might also be the most annoying: have patience. The alcohol industry, with all of its rules and regulations, is extremely hard to break into, let alone become a major player. It can take years for brands to expand into more than one state and even longer to go nationwide. Building a brand takes time, and alcohol brands will need to prepare themselves for the many hoops they will be forced to jump through as they grow.

But if you’re willing to trust that slow and steady wins the race, building an alcohol brand is possible, and what’s more, “it doesn’t have to be perfect before going to market,” Zesbaugh argues, “just get it out there.” Our tip? Before you launch, get a lawyer on speed dial — we have a feeling you’ll be asking quite a few questions along the way.

15

WWW.STARTUPCPG.COM

By Jenna Movsowitz

Meet Veso

THE MODERN APERITIF

WWW.DRINKVESO.COM

16

While Chris Beyer’s recent-grad, tech industry peers were recovering from hangovers and sulking in their Sunday Scaries, he was picking grapes in a vineyard with a bunch of 60-year-old men. Going to the vineyard became a Sunday ritual for Beyer, the young scrappy helper for his dad’s group of hobbyist winemakers.

“I honestly didn't really like wine before that, but I really fell in love with it when I got to see the whole process up close,” recalls Beyer. His dad’s group of friends had been making wine for 6 years, starting with one barrel in a home wine cellar and growing to produce nearly 10,000 bottles a year at their peak. Still operating as hobbyists, they split the bottles over five families and the head winemaker — leaving each family with 1,000 bottles per year. Put simply, there was too much wine. So when Beyer got involved, he began thinking about commercializing it.

But Beyer was haunted by the trope: how do you make a million dollars in wine? You start with a billion. He knew that entering this competitive industry would require more than a passionate group of 60-something men. It would require a clear, distinct “edge.”

“I was always looking to see what younger generations were drinking. I saw that people were less focused on the nuance of a 2018 versus 2019 Cabernet. They wanted something with wider variation,” says Beyer. “I landed on a thesis: people were going to get into bolder, fruitier, spicier flavors.”

He found that variation abroad. While in Europe in 2019, Beyer discovered vermouth and aperitifs — wine infused with spices and botanicals and fortified up to around 18%.

When he returned to the U.S., Beyer began experimenting: “I started tinkering around — infusing and fortifying and fermenting everything in my kitchen. I finally settled on an infusion process for a white wine base, using fresh strawberries, citrus, botanicals and spices.” But at the same time as Beyer was beginning his aperitif journey in the U.S., the brand Haus started to blow up. “Haus did a really good job marketing and elevating aperitifs into the mainstream,” he recalls. “I looked at them and I was like, I cannot do this better than them.”

It took six months for Beyer to realize that what he was building was something different — and that there was space for more than one person in this industry. So he perfected his two formulations and put all of his bets on family feedback. “The idea was that if I had my family try them around Christmas, and they thought they weren't totally terrible, I would jump into it.” Needless to say, his family was (delightfully) “shocked” by the liquid.

In 2021, Beyer incorporated and applied for a liquor license, rented space from a winery in San Francisco, and got to work on building Veso. He worked on translating what he had done in his kitchen — a gallon and a bunch of strawberries from the farmers’ market — to 300 bottles, then 2000 bottles, learning how to handle fresh fruit at scale and manufacture by hand. “I had to teach myself everything from food science to manu-

facturing and winemaking,” he recalls, all while testing with consumers, bartenders and retailers. In October 2021, Veso officially launched into the world.

EXPANDING INTO ON-PREM

Getting Veso onto menus was the first key step in Beyer’s strategy. “I didn’t want to get into retail too fast.” He was concerned that people still required education about aperitifs, and if they drank them the wrong way, their impression would be spoiled. “The best place to be introduced is in a bar or restaurant setting.”

At the same time, Beyer wanted to be strategic around which restaurants and bars introduced the liquid to consumers. “I was careful not to sell into sub-premium places. If we had said, ‘we're in that dive bar or fast casual spot,’ the big restaurants and nice restaurants wouldn't pick us up. Going premium and then working your way down is important.”

For Beyer, this looked like starting with one of the best (and one of Beyer’s favorite) restaurants in San Francisco: Rich Table. “It was a bold move to try to get in there first, but I was naive and had no idea what I was doing,” he remembers. He often frequented the restaurant and had even met the Beverage Director through a friend, but hadn’t yet mentioned his brand. One day, though, he decided to bring a few bottles to just go sit at the bar with a friend and “see what would happen.” They each ordered a few drinks before hinting to the bartender that he made aperitifs, then casually mentioning that he had a bottle with him. The bartender was intrigued and tried it on the spot — offering to share it with the Beverage Director later that day. Two weeks later, the Beverage Director emailed Beyer asking to put Veso on the menu. “Getting this kind of account helped us immensely in the future. Our second, third, and fourth accounts all trusted our brand simply because we could say we were already in Rich Table. It was a major validation point.”

Beyer’s Advice for On-Prem

“On-prem is very relationship-based,” Beyer explains. The decision-makers in restaurants are typically the Beverage Director or the Lead Bartender. If it's wine, there is a Wine Buyer, and if it's a restaurant group, there's typically a Beverage Director for the whole group, which is more corporate, and feels more like going into mass retail.”

The catch is that the restaurant industry isn’t checking emails — so you have to meet them in person. “The tough thing is, there’s no good time to do it. If they’re open, they’re too busy. If you come in before they open, they’re frantically getting ready. It's a really hard game to play. You have to leverage connections or go to bars and drink in front of the bartender.”

If you are able to catch the right person at the right time, Beyer offers the following script: “’Hey, I’m a local aperitif maker and wanted to see if I could set up some time to pour samples

WWW.DRINKVESO.COM

17

for you now or next week.’ They don’t need a full sell sheet, or to know that you’re 40% less sugar than Campari. They want the least friction possible.” He does, however, recommend that you come prepared with a bottle. Having a physical product helps establish legitimacy before the tasting — “this isn’t just some kid making beer in his closet.”

Because showing face isn’t sustainable at scale, Beyer notes that big spirits companies will use distributors along with brand ambassadors, who are either part-time or full-time former bartenders or Beverage Directors. These folks know everyone in the industry, and will go out and sell your product “either directly door-to-door or they'll create cocktails and host events and happy hours for bartenders and industry people.” With on-prem being so relationship-based, these ambassadors can significantly help accelerate your reach.

RETAIL STRATEGY

While on-prem is more nuanced, expanding into retail is much more similar to the “typical” CPG process: getting in touch with buyers (who do check their emails) and scheduling tastings and meetings.

To get onto retail shelves, Beyer began by self-distributing (legal for wine in the state of California). This limited him to the local area, but also meant that Beyer retained full control over the brand. “If I made a sale, I could drop it off at that moment. Sometimes restaurants would even put it on the menu that very night.”

Self-distribution was also necessary before distributors would even consider bringing on the nascent brand. “Distributors pay upfront for the product, so it’s a risk to them. They don’t want to take you on until you’ve had enough growth that they would get profit from your existing accounts.” The first year and a half of this was tough — building momentum seemed to require momentum. But once Beyer hit around 35 spots and felt Veso was reaching a bottleneck, he finally approached a distributor, Revel Wine, who Veso is now working with on a broker basis.

Revel has been a huge asset to the brand and significantly reduced buying friction, but Beyer is quick to note that distributors don’t do all of the work. “You don’t just pass everything off once you have a distributor. There’s a whole set of distribution

management expertise that you need to leverage. I still have to go on the ground and do sales work,” he says.

Now, Beyer’s greatest challenge has shifted: “Once you get into retail, you want to maintain velocity. But at the same time, you need to keep product in stock.” When retailers deplete inventory, they often forget to reorder and the brand has to essentially “resell” it to them. In restaurants, too, you need enough stock to stay on the menu or they’ll pull you — they don’t want to see “flip-flopping.”

Beyer’s Advice for Off-Prem

Though Beyer wasn’t emphasizing off-prem initially, he quickly found that the interplay between on- and off-prem can be incredibly valuable for startup brands: “A restaurant in San Francisco requested samples because they had found us in a small boutique liquor store. The retail side can inform on-prem — if bartenders start seeing you everywhere, it gives your brand credibility before you approach them.”

At the same time, being on-prem helped boost velocity in retail. “People often see Veso on a menu, see how it’s being used, and then want to purchase it themselves at home. You have to do both on- and off-prem in tandem.”

ECOMMERCE AS A MARKETING TOOL

When Veso launched, they were exclusively DTC. Since Veso is technically wine, they are legally allowed to ship to most states, and each state requires its own license. But they quickly found that the costs associated with DTC were unsustainable for the brand. Firstly, shipping liquid (and particularly alcohol) is incredibly expensive — both because of the sheer weight of a glass bottle and the additional $4 just to get the recipient to sign. Second, Beyer found that paid ads were a “money pit” due to rising CAC.

“Though we offer free shipping, we found that people would still rather go to the store to buy it. There’s some psychological friction around getting alcohol shipped — people want to see the brand in person.” Thus, Beyer moved towards using ecommerce mostly as a marketing channel.

“I keep it open so people can order, and we do get orders

18 WWW.DRINKVESO.COM

weekly, but I'm not really investing in it yet,” says Beyer. Veso’s site is currently acting as a hub for storytelling, as well as a landing page for new releases pushed to their email list and Instagram followers. In the future, they’re hoping to also launch a subscription club. “Subscription clubs are the best way for wine to use ecom, because the AOV and LTV are both significantly higher.”

LOOKING AHEAD

As Veso continues to expand in California, they’re looking for new ways to garner brand awareness across the country. Their most exciting upcoming activation? A fully custom, co-branded vermouth product for TikTok influencer Drinks By Evie to be launched in August or September. Because they self-produce, a collaboration like this is simple to execute. Plus, “an influencer doesn't want to go to some factory winery and pick out flavor extracts. That's not fun. They want to actually see the craft process.” Ultimately, Veso and Evie will be splitting profits and driving new eyeballs to the brand.

While self-production has been opening up many opportunities for the brand, Beyer has also begun thinking about how to expand more efficiently. “Right now, we are 20 people hulling strawberries by hand. We’re trying to figure out how to do this in a more automated way before we can consider scaling.” His plan right now is to scale as much as possible in the current facility, then start moving the process over to bigger wineries with greater capacity. “Most brands start out with a fully automated process. But I started with an extremely labor-intensive process — so anything I do will make it easier. It won’t be that difficult to scale.”

In the meantime, Beyer and his small team are knee-deep in 1,300 pounds of strawberries and 2,000 pounds of citrus for their next production run. Though he’s moved beyond the days of wine-caddying for his dad’s friends, Beyer still remembers his roots. “I wanted Veso to be made with a process I could be proud of, with ingredients straight from farms. Along the way, I realized that it wasn’t just about creating something better in the bottle — it was about enhancing the entire experience, inspiring a more intentional drinking culture. One that is built around people, places, and memories.”

WWW.DRINKVESO.COM 19

By Jenna Movsowitz

DTC FOR ALCOHOL(NON-WINE)

Alcohol brands face a unique challenge: they often do not know their customers. Where other CPG brands can utilize their direct-to-consumer ecommerce sites to gather first-party data, alcohol brands are subject to the three-tier system, preventing any direct relationship with consumers.

In a world with increasing optionality, offering consumers a personalized experience could be what sets a brand apart. So how do brands obtain first-party data when stuck in a three-tier system?

We spoke with Jordan Tepper, co-founder of Apologue, to learn more about how he navigates the DTC landscape — and the workarounds that have enabled the company to dominate the bottled cocktail space.

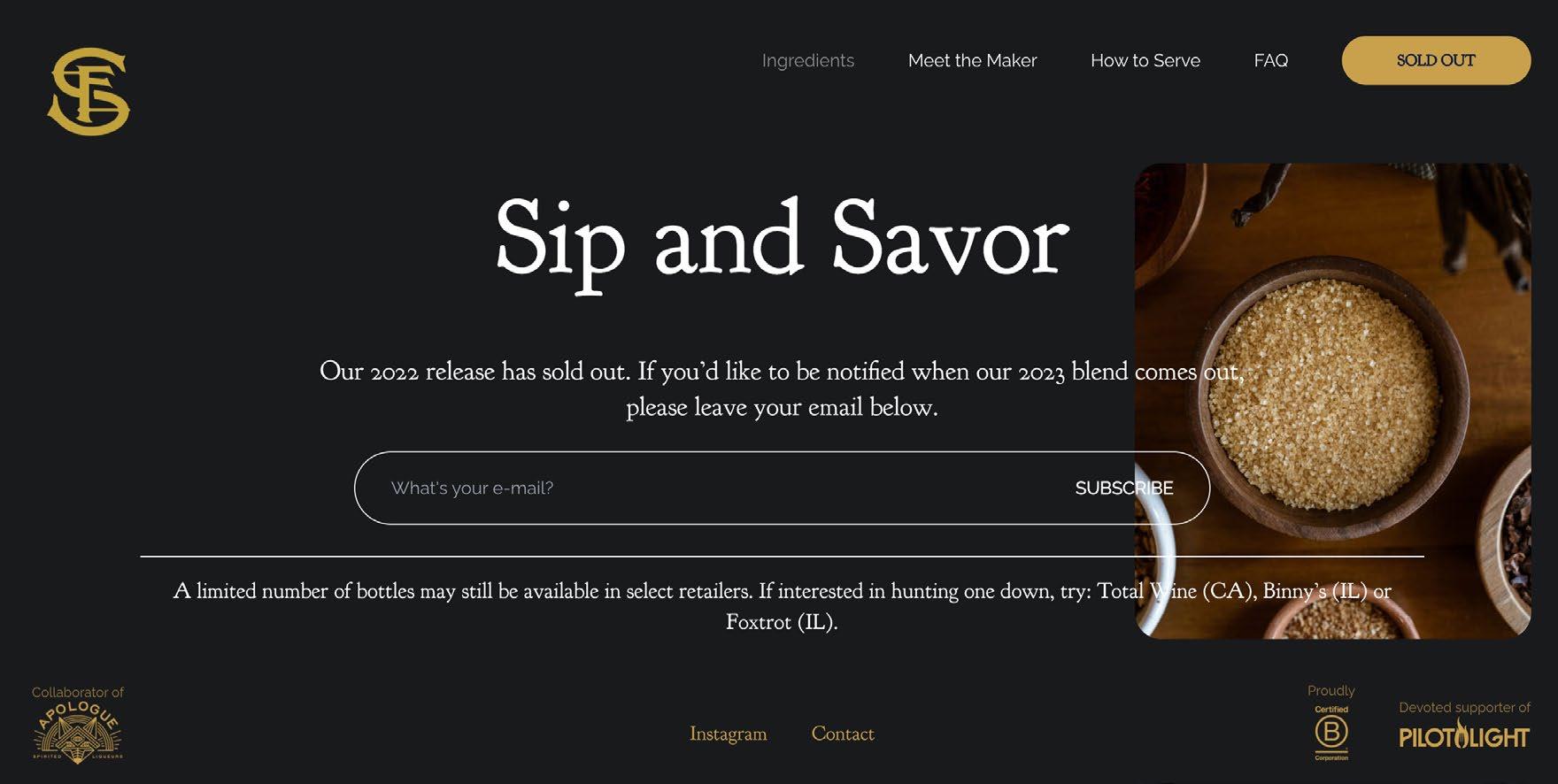

Apologue is somewhat of a microcosm of the industry. With three separate lines of business, each experiment with a differentiated distribution strategy. They started with canned tequila-based RTDs (a collaboration with Chicago’s beloved Big Star restaurant), but quickly found that the unit economics for shipping a $20 four-pack of margaritas was hard to justify. This got Tepper interested: how could they stay in the ready-to-drink cocktail category without competing on cost? They ultimately found the answer in Sunday’s Finest Gold Fashioned, the most premium possible ready-to-drink cocktail made with the “best ingredients on the planet” and packaged in a stunning glass bottle. Gold Fashioned joined their lines of Apologue Liqueurs and canned cocktails

as their golden child, the premium option distributed 50/50 on ecommerce and on-premise retail. This option would drive traffic to their website and kick off their omnichannel approach. Meanwhile, they focus their liqueurs mainly on on-premise (bars, restaurants) and canned cocktails on off-premise (retail stores).

THE WORKAROUND FOR DTC ALCOHOL

To remain three-tier compliant, non-wine alcohol brands cannot sell directly from their website and must use a third party. There are ways to get scrappy with this; Mizo, for example, took a more analog approach and partnered with a local liquor store to build out a DTC option that is funneled through the store. They sell their product wholesale to the liquor store and the owner runs their DTC website and fulfills orders.

Some other options include utilizing alcohol delivery sites including Drizly, Reserve Bar, Sipsy (LA-focused) and TapRm (NYC-focused). These sites either function as retailers or work with retailers to deliver alcohol directly to consumers. But for brands looking to engage directly with their customers, these sites are not enough. The Drizlys of the world, like in-person retailers, do not share consumer data back you. While you can offer more accessibility to customers, you still cannot offer a personalized experience without understanding who our customer is.

The only real “workaround” is to solve

the solution from the inside out using third-party ecommerce platforms. Platforms like Barcart, Speakeasy, and Accelpay all seamlessly integrate into existing DTC sites. These platforms then work with local retailers to fulfill orders, but the customer never knows the difference — almost like white labeling the purchasing process. When a consumer goes to checkout on your website, they will feel like they are purchasing directly from you, no pop-ups or site diversions required. Consumers get a seamless front-end experience, while brands can reap the benefits of first-party data.

Apologue launched their Sunday’s Finest Gold Fashioned brand on ecommerce in October 2021. Using Accelpay, their $150 bottled cocktail has sold out twice since launching.

20 WWW.STARTUPCPG.COM

HOW TO FIND YOUR DTC PARTNER

There are a few major players in this space, including Barcart, Speakeasy and Accelpay. When deciding on a platform, Tepper recommends considering:

1. Tech team. Know who’s behind the platform and make sure that your web developers feel comfortable working with them and seamlessly integrating.

2. Cost. Each platform has its own upfront costs, as well as cuts they take from both the brand and the retailers.

3. Retailer compatibility. Make sure that retailers feel comfortable getting on board with

them and are satisfied with the cut they’re taking.

Ultimately, each will have its pros and cons. Once you find the right platform for your brand, though, they all will generate the same experience for the customer on the other side.

UNIQUE CHALLENGES WITH DTC Competition

When you have your own DTC site, suddenly other ecommerce retailers can compete with you — for your own customer. Essentially, ecommerce partners like Spirit Hub or Reserve Bar have the budget to run paid ads. When prospective customers googles Gold Fashioned, for ex-

ample, they will likely come across Spirit Hub, where it’s discounted by $15. “Other ecommerce retailers will overpay on SEO as an acquisition tool, and then discount your product. The challenge is then figuring out a way to offer the consumer greater value ordering from our DTC site without competing on price.”

To drive traffic to the Sunday’s Finest site, Apologue offers value through free shipping and pre-release to their customers. Since they have sold out of Gold Fashioned twice, offering first-to-know access to customers is of great value. They also rely on press placements and in-person event activations to drive traffic to their site. But ultimately, customer poaching is inevitable, and DTC brands should be prepared to accept this fate.

21 WWW.STARTUPCPG.COM

Variability of service

The biggest problem with this model, Tepper believes, is the retailers on the backend fulfilling each order. “Their brands are not at stake,” he says. If a customer is shopping in-person at a Fine Wine & Good Spirits, for example, they associate their purchasing experience with that store, not the brand they happen to pick up on its shelf. If they have a negative experience shopping in the store or receiving an order online, they blame the retailer. But because the retailer operates behind the curtain in the case of Accelpay, the brand of the retailer is not associated with the fulfillment experience — which puts the alcohol brands at stake.

“The retailers behind these platforms don’t care about the individual consumer nearly as much as you do. We often have retailers accept orders without any inventory in stock, which can significantly delay shipments,” Tepper notes. The quality of the service is also less important to these retailers, meaning that product can arrive damaged.

“We have customers complain that their bottles are showing up broken or super delayed. Luckily, the brand is able to do customer service, because you do have that first-party data. You can see when the retailer shipped it, what the tracking ID is, and email the customer directly.” Though the fulfillment process may not go to plan,

obtaining first-party data through these platforms allows brands to have complete control over customer service.

“Many customers are ordering our product for birthdays or special occasions. Making sure these customers get their product on-time and intact can be sensitive, so being able to talk to them on the phone or email back and forth with them has been really helpful,” Tepper says. “We’ve gotten really positive responses about our customer service, and I think that helps build goodwill.”

TIPS FOR BRANDS CONSIDERING DTC

If you decide to start working with a DTC platform, “you have to own the consumer journey from the beginning to the end,” says Tepper. “You cannot rely on the third-party payment processor or the retailer to provide a seamless experience. You have to hold their hands — which sometimes can even mean sending them custom shipping packaging — to make sure that your product arrives exactly how you want it to arrive.”

Tepper also encourages brands to think critically about their retail partners throughout this process. “There's a magic sauce in how many retail partners you work with,” he says. “If you only work with one retail partner, you have you put a lot of your eggs in a basket that's operating a grey legal area. If that person doesn't come through for you, that’s a lot of risk.” At the

same time, if you work with 20 retailers, you're not going to be a meaningful enough supplier for them to care about your product.

THE “NECESSARY EVIL”

Though platforms like Accelpay present their own challenges, Tepper views them as a “necessary evil.” Beyond the immediate benefits of direct communication with your customers, Tepper believes that setting up this infrastructure will be critically important for the future of alcohol. “Say Illinois suddenly passes DTC spirits shipping. If 30% of our consumers are in Illinois, and we have all their emails from Accelpay, we can direct them to our website to buy bottles at the same price point,” Tepper says. “That means they’re not paying more, but we're capturing an additional $60 margin per bottle that would typically go to a retailer. That’s very meaningful — and that’s starting to happen.”

Aside from the future of DTC, “in terms of building a brand, developing relationships with consumers and building a community, these platforms are crucial. If you don’t know who your customers are, you cannot engage with them.” Tepper also believes that DTC sites can create a sense of brand affinity for consumers. “You think about wineries in Napa Valley — when a consumer goes there and tastes wine, they have a strong affinity with the brand.”

22

WWW.STARTUPCPG.COM

“ANYTHING YOU CAN DO TO CREATE A GREATER DEGREE OF CONNECTIVITY WITH YOUR CONSUMER IS GOING TO MATTER AT THE END OF THE DAY.”

By Grace Kennedy

By Grace Kennedy

Ready-To-Disrupt

HOW STARTUP RTD BRANDS ARE ‘CLAWING’ THROUGH THE COMPETITION

WWW.STARTUPCPG.COM

24

Hard seltzer swept the nation in 2018, popping up on college campuses, bachelorette parties, beach picnics, and all other manners of social gatherings. Hard seltzer, and specifically White Claw, offered a new way of drinking: people no longer had to choose between a 30-rack of Bud Light or a fancy bottle of wine. Instead, they could partake in #ClawLife, with a canned beverage that was affordable, low in calories, easy to transport, and endlessly sharable.

In the coming years, as White Claw’s ubiquity grew, consumer demand for ready-to-drink (RTD) beverages increased right alongside it. Other brands quickly followed suit and the space saw competition from newer brands like High Noon (a vodka-based seltzer) and titans of the industry like Bud Light and Corona.

When the pandemic began in 2020, the growth of RTDs only accelerated. People were stuck at home, missing the cocktails and other beverages they had typically enjoyed at bars, restaurants, and gatherings. RTD beverages offered consumers the chance to experience the drinks they missed without having to leave the house or buy a slew of expensive ingredients.

A few years later, and with pandemic restrictions largely lifted, it is clear that RTD beverages were not just a pandemic fad like making sourdough or watching Tiger King. In 2021, RTDs growth was greater than any other leading alcoholic beverage sector including tequila, whiskey, and scotch.

One-third of all US households bought an RTD product in 2022, and according to Drizly's Retail Report, 60 percent of retailers surveyed plan to stock more RTD beverages in the coming year.

RTDs are the future of modern alcohol — so what are they and who is buying them?

WHAT IS A MODERN RTD?

Today’s RTD beverages have come a long way from their wine cooler predecessors. And though White Claw may still reign supreme, RTD includes much more than hard seltzer. RTD primarily includes three categories:

1. Malt-based (hard seltzer, hard kombucha, hard tea, etc.)

2. Spirit-based (i.e vodka soda and other RTD cocktails)

3. Wine-based (wine in cans)

Of these categories, hard seltzers account for 43% of RTD sales, flavored malt beverages make up 37%, spirits-based takes 10.5%, and wine-based is the lowest at 8.9%. While hard seltzer and maltbased RTDs are still the most popular, spirit-based cocktails are growing rapidly. The total volume sales of spirits-based RTD cocktails increased 226 percent from 2016 to 2021, making the category one of the fastest-growing segments across beverage alcohol. Furthermore, in a survey from Public Opinion’s Strategies, fifty-five percent of respondents said they preferred spirits-based beverages to other RTD choices

RTD’s main consumers tend to skew young: of the people buying RTDs in 2022, two-thirds were millennials and Gen X. The online platform Drizly found similar numbers: 62% of RTD purchases on their website were from millennials. RTDs reach an audience that is moving away from the drinking styles of their parents, who stuck to one of three things: wine, beer, or spirits. No longer confined to being wine, beer, or whiskey drinkers, Millennials and Gen X want more: new flavors, enticing branding, sharable packs, and healthier options.

Such demand for RTDs offers an exciting opportunity for young brands

and others considering entering the market. But the RTD space is also getting crowded, and any brand considering throwing its hat in the ring will need to be extremely clear on its point of differentiation before doing so.

We spoke to four brands making their mark on the RTD space with new and exciting offerings to gain insight into how brands can differentiate in this quickly growing market.

PEOPLE DON’T WANT ANOTHER HARD SELTZER

When Chris Tran and Holly Paul first started Mizo, they debuted a hard seltzer line with flavors inspired by their Asian heritage. However, they quickly realized that buyers simply weren’t interested in yet another hard seltzer. The buyers they spoke with had too many hard seltzer brands on shelf, and they were only trying to consolidate. Why would a buyer take a risk on a new small hard seltzer brand when they are already full to the brim with White Claw, Truly, and 50 other hard seltzer brands with brand recognition and a proven track record?

Buyers are increasingly asking this question about not only hard seltzer, but all RTD beverages. With such a saturated market, brands will need to be able to prove “why me” and “why now” to break through the noise. To do so, brands can focus on four elements: storytelling, flavor, better-for-you options, and premium positioning.

STORYTELLING

Once Mizo recognized the over-saturation of hard seltzer lines, they decided to pivot, launching a hard lemonade product. To further differentiate, they leaned into their form factor, invoking the nostalgia that lemonade so often brings

WWW.STARTUPCPG.COM

25

with juice pouch packaging.

“People want to have comforting experiences that remind them of happy times, so we wanted to create a product that celebrated nostalgic memories. Everyone finds so much comfort in nostalgic memories and the juice box is kind of a universal memory.”

The lemonade pouch is now one of the first things people notice or comment on when encountering Mizo for the first time, and has helped them immensely in pitching their product to buyers.

Brands can also differentiate by offering something entirely new to consumers. After falling in love with tepache, a Mexican fermented pineapple drink, while traveling, Crooked Owl founders Camillia Taffe and Dave Bailey — both of whom have backgrounds in alcohol — decided to launch hard tepache in the States. Tepache is largely not commercialized, with only a few brands selling the non-alcoholic version in the states.

To introduce their hard tepache to an American audience, Taffe and Bailey are purposefully leaning into the historical background of the beverage and the sense of discovery it can provide consumers. In drinking Crooked Owl, consumers are given the chance to partake in and discover a long-storied tradition. In your branding, ask yourself, “What story are we telling?” and “What memories or feelings can we evoke with our beverage?” Drinking is largely a social act with stories, memories, and feelings associated with each sip. To stand out, RTDs can play into this, using branding to tell a compelling story that will get consumers to turn to the next page.

NEW FLAVOR EXPERIENCES

RTD brands can also differentiate themselves by offering new flavor experiences that move beyond the classic lemon,

lime, or berry. For Tuan Lee, founder of craft cocktail RTD Vervet, that meant taking classic craft cocktails and re-imagining them with a California twist. Their Tiki Tea combines a margarita with a Moscow mule while their Pale Mary uses Santa Barbara lemons and spicy celery-habanero bitters.

Hooch Booch, a hard kombucha line, leans into classic cocktail flavors to attract consumers to their less traditional beverage. Offering classic cocktail flavors like Paloma, old-fashioned, or even espresso martini, lowers the barrier to entry for hard kombucha. “People think kombucha tastes like sticky, vinegary feet. Our flavors make the drink more approachable because people already know what an old fashioned is.”

Flavor is one of the top reasons consumers choose an RTD. In a 2022 survey from the Distilled Spirits Council, 94 percent of respondents said they choose RTDs because they offer their preferred

26 WWW.STARTUPCPG.COM

flavor choice, and 88 percent selected RTDs because the taste aligns with their favorite alcoholic beverage. Offer consumers something entirely new or give their favorite cocktail an unexpected twist; above all, people want to drink something delicious.

BETTER-FOR-YOU

In a space that was once known for its overly sweet wine coolers of the 80s, many RTD brands are finding success in offering healthier alcohol options to consumers. In many ways, some of the popularity of brands like White Claw and High Noon lies in their “better for you” attributes, appealing to drinkers looking to consume something low in calories, low in sugar, and gluten-free.

Vervet has found success with their Sake tonic at Erewhon, offering shoppers an RTD that is gluten-free, has no artificial flavors, and utilizes plant-based

preservatives. Mizo, on the other hand, positions itself as a healthier alternative to Mike’s Hard Lemonade, offering close to 90% less sugar. Their hard lemonade is also not carbonated while most RTDs on the market are. Mizo has found many consumers who appreciate the option to switch to a non-carbonated beverage to avoid bloating or any other gastrointestinal problems.

Taffe of Crooked Owl has Celiac, so she has to avoid anything with gluten in it. In creating Crooked Owl’s hard tepache, they made sure to create a beverage that Taffe and anyone else, no matter their dietary restrictions or preferences, could enjoy. Crooked Owl is gluten-free, diabetic friendly, 100 calories, and 5% ABV. Like Hooch Booch and other hard kombuchas, it also offers probiotic benefits.

As consumers adopt healthier habits, better-for-you alcohol options are gaining more and more traction among

health-conscious consumers. Offering better-for-you beverage options only enhances the accessibility of RTDs as drinks that anyone can enjoy — and the more people who can drink your beverage, the more potential customers you will have.

PREMIUM

Brands can also target premium consumers, aka those who are interested in RTDs, but want something more elevated than your typical hard seltzer or vodka soda. Consumers may have flocked to White Claw at first, but as the RTD market has grown, many consumers want a product that is more crafted and distinct, providing a unique opportunity for brands to differentiate.

Vervet relies on its roots in craft cocktails to bring its brand to premium status. All of their recipes were crafted by Hope Ewing, a 15-year craft cocktail bartender and writer with bylines in PUNCH and

WWW.STARTUPCPG.COM 27

Serious Eats, among others. Vervet aims to practice the same ethos of the chefs they love. Lee explains, “A recipe is only as good as its ingredients. The same applies to our cocktails.” Their negroni spritz uses a house-made Amaro with Santa Barbara citrus and their Strawberry Spritz uses berries sourced from Oxnard, a California city known for its prolific production of the fruit. Vervet attracts the same people who might seek out the hottest new chef’s restaurant serving farm-to-table produce or attend the farmer’s market with religious fervor.

Crooked Owl is also going after the premium drinker: “We don't think we're going to convert the everyday White Claw drinker.” Instead, they are targeting the “on-the-nose millennial who wants to signal that they know what’s cool.” In this way, the premium associated with Crooked Owl is less about the freshness of the ingredients and more about the clout of identifying the next big trend. “The person that would come to the party with a cool IPA a decade ago is the same type of person that might come to the party with our hard tepache.”

No matter if you’re targeting the Brooklyn millennial or California foodie, brands should consider seeking premium consumers if they want to find an untapped and eager consumer base.

WHAT SHOULD AN RTD COST?

When it comes to pricing, RTD brands need to be strategic as they come up

against their inexpensive and mass-produced competitors. “Consumers can get a 12 pack of White Claw for $15 or $16.99, but it would be really hard for any up-andcoming brand to break even the $19.99 price point.” The wide availability of inexpensive RTDs has created a mental barrier for consumers when considering a new brand. “If it’s the choice between $16.99 White Claw and $20.99 craft hard seltzer, they’re going to pick the White Claw probably eight or nine times out of 10.”

To combat this mental barrier, brands can “play with pack configurations,” Tran explains. Consumers tend to be less aware of the price-per-unit when they’re buying alcohol, so brands can sell their products in four or eight-packs to offer consumers lower costs at the check-out line without jeopardizing their profitability. Non-spirits-based RTDs also have a leg-up when it comes to pricing; they can trade at a discount, compared to spirits-based RTDs that are hit with a hefty federal excise tax (The federal excise tax on a spirits-based RTD is more than double that of a malt-based RTD).

Brands should also consider who their competitors really are. Is it the mass-appeal brands like White Claw or the niche, locally-brewed beer? Crooked Owl is less concerned with competing with the heavy hitters than they are with the brands they sit next to on the shelf. “We don't think we're going to convert the everyday White Claw drinker,” Bailey says. Luckily, “we find we’re able to play in the upper premium channel really well because we stand up against hard

kombucha and other craft RTDs, which are similarly priced.”

THE WILD WEST OF RTD

If you’re thinking about entering the crowded RTD space, Lee urges brands to practice “radical simplicity” at first. “Start with one flavor, build your brand, gain consumer trust, and grow a loyal audience. Focus on creating a massive hit with one flavor and then grow and expand from the momentum your first flavor creates.” Consumers are overloaded by choices — give them one flavor they love and grow from there as people come back again and again. Radical simplicity will also lower start-up costs, giving brands a head start in the capital-intensive alcohol industry.

Most important, however, is that any brand thinking of getting involved in RTDs understands the competition they are up against. Bailey explains, “The barriers to entry are getting lower and there is only going to be more and more competition. Before you put your dollars behind a brand, make sure you’re offering something that is truly differentiated and that you want to stand behind.”

“The RTD space is like a liquid gold rush,” explains Lee. Some brands will head out west and strike gold while others may get lost along the way. So before you jump on the RTD bandwagon, make sure you know exactly where you’re planning to strike and that no one else has already beaten you to the punch — gold is a finite resource.

WWW.STARTUPCPG.COM 28

WWW.STARTUPCPG.COM 29

Navigating Data

CRISP’S GUIDE TO CREATING A “DATA CALENDAR”

By the end of 2022, PANOS Brands had saved $50,000 in carrying costs through improved inventory management – all while saving over 100 hours of manual data-pulling.

How’d they do it? By conveniently leveraging timely, actionable data at all the right moments.

As a growing CPG brand, you may already know how powerful data can be. But you also may be wondering where to start, or how to integrate actionable insights into your day-to-day schedule. At Crisp, we put the latest retail data at your fingertips, so you can focus on taking your business to the next level. Here’s our recommended “data calendar” to help you prioritize what to track on a daily, weekly, and monthly basis.

Daily

With Crisp, brands can quickly and conveniently access their latest retail data each day to manage operations and problem-solve. We recommend filtering your reports based on particular retailers or products, then bookmarking them for convenient daily use.

Inventory – With products moving through multiple distribution centers and store locations, it can be difficult to keep tabs on where your stock ends up and how it’s being depleted. With Crisp’s inventory and distribution dashboards, CPG teams can easily track which products are in

stock and where. Check your inventory daily to determine which DCs are over- or under-stocked, then work with your brokers and buyers to proactively replenish supply as needed.

Case study: NotCo uses daily inventory reports to avoid critical out-of-stock issues

Problem Solving – Have a specific question or concern? There’s a report for that. With interactive, clickable dashboards, Crisp helps you dig in as-needed to solve any issues that come up in the week. With just a click, you can drill down by region, retailer, product or time period to get to the bottom of any trends you’re seeing.

Weekly

Weekly reporting doesn’t have to be a major hassle. Save short blocks in your week to prepare sales reports, assess merchandising efforts, and further review inventory.

Monday Recap – Grab a cup of coffee and take some time to recap the prior week’s performance. Review sales reports, measure the effectiveness of merchandising efforts, and ensure all is well in your supply chain by tracking shipments to and from distribution centers.

Share – Start the week by sharing snippets of success or performance trends to prepare your team for the week ahead.

30 WWW.STARTUPCPG.COM

When you know which reports to check on a daily, weekly or monthly basis, you’ll have the insights you need to keep shelves stocked and sales growing – without spending all day downloading spreadsheets

With Crisp, you can easily share custom, granular sales reports with your team and partners.