New proposed tax deal revives expanded Child Tax Credit

By Bria Overs Word In Black

An expansion of the Child Tax Credit (CTC) is back on the table in Congress. Lawmakers announced an overall $78 billion tax plan, including $33 billion over three years for the CTC.

The 2021 American Rescue Plan expanded the CTC for six months and was deemed a major success because of its impact. In that time, the national supplemental child poverty rate hit a historic low of 5.2% and lifted 3 million children out of poverty. At the same time, the child poverty rate for Black children

under 17 dipped to 8.1%, with an estimated 716,000 Black children no longer in poverty.

However, Congress failed to make a deal to save it before the end of 2021, and by the following year, the supplemental child poverty rate more than doubled to 17.8% for Black children. In 2022, without the expansion, 38% of Black children were not eligible for the full credit

this opportunity to pass pro-family policy that helps so many kids get ahead,” Senate Finance Committee Chairman Ron Wyden (D-Ore.) said in a statement

“Sixteen million kids from low-income families will be better off as a result of this plan, and given today’s miserable political climate, it’s a big deal to have

The Center on Budget and Policy Priorities (CBPP) estimates around 16 million children whose families are low-income would benefit from the proposed expansion. And more than one in three Black and Latino children under 17 would benefit

The Tax Relief for American Families and Workers Act of 2024 is a bipartisan tax framework approved by Sen. Wyden and Republican U.S. Rep. Jason Smith of

Missouri, Ways and Means Chair. Here’s what it currently features:

Changes to the calculation for the refundable credit

To qualify for the CTC, a taxpayer’s earned income must be $2,500 or more. Under this proposal, a taxpayer’s earned income would be multiplied by 15% and multiplied by the number of qualifying children.

Increase to the maximum refundable amount per child

Child Credit

Continued from D2

The current maximum per child is limited to $1,600. The new proposal would increase the amount per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025.

“There are large gains for larger families under this proposal,” says Sophie Collyer, research director at the Center on Poverty and Social Policy at Columbia University. “They were also the most disadvantaged under the current structure.”

Adjustment of credit for inflation

In the 2024 and 2025 tax years, the value of the CTC would be rounded down to the nearest $100. Collyer says

the actual value of the CTC has fallen drastically in recent years because it was not adjusted for inflation, even in years when inflation was at its highest.

Determining earned income

For the 2024 and 2025 tax years, taxpayers can use their income from the prior year to calculate the maximum CTC if the earned income in the current year was less than the previous.

What’s next

Not everyone in the country’s legislature is excited about this plan. Senate Republicans and House Democrats argue that the proposed expansion of the CTC does not go far enough, The New York Times reported. It does not have the full support of all, including President Joe Biden, who would prefer a broader expansion.

Parents and caregivers with the Economic Security Project gather outside the White House to advocate for the Child Tax Credit in advance of the White House Conference on Hunger, Nutrition, and Health on September 20, 2022 in Washington.

Photo by Larry French / Word In Black

Combating the racial wealth gap

By Sarah Foster Bankrate

White Americans hold eight times the wealth of the typical Black family and five times the wealth of the typical Hispanic household, the Federal Reserve estimated in its 2019 Survey of Consumer Finances. White families also had the highest median level of wealth at $188,200, the survey found, compared with $24,100 for Black families and $36,100 for Hispanic families.

Here are some tips to help reduce the historic gap

1. Increase your financial literacy

Seven money moves for individuals of color

through education

An estimated 13.8% of Black households were unbanked in 2019, along with 12.2 percent of Hispanic households, according to a 2019 Federal Deposit Insurance Corp. survey

That’s where education and financial literacy comes in, an important part of combating wealth disparities. Start by exploring what online resources are out there to help you increase your personal finance knowledge. That could be through nonprofits, such as the National Endowment for Financial Education, training on social media sites such as LinkedIn or explanatory websites such as Napkin Finance and Bankrate.com

2. Automate your savings

Education also goes beyond just personal finance but looking into the causes of the racial wealth gap, so you can arm yourself with the knowledge and tools you need to combat it as much in your financial life as possible.

Financial experts say it’s important to also share your experiences with others — whether it’s to help individuals of color navigate the issues you’ve dealt with or to engage your White counterparts in a discussion about the privileges they’ve had.

3. Negotiate for higher pay and advocate for yourself

Negotiating for a raise might be an uncomfortable money conversation, but experts say it’s an important part of combatting the racial wealth gap to make sure you’re not leaving money on the table and getting paid less than you’re worth.

“Don’t be humble when filling out your appraisals,” says Alanna Anthony, founder of Financialdemic. “Brag on yourself because even though you think your manager knows what you did all year, it’s not at the forefront of their mind. You have to advocate for yourself.”

4. Automate your savings and build

Wealth Gap

Continued from D4

a financial plan

Wealth gaps can make saving, paying down debt and investing money seem impossible, especially when individuals of color are contending with being paid less than their White counterparts.

Yet, experts say they’re all important goals that can help build more financial confidence and security, meaning formulating a financial plan is a crucial step to ensure that you’re maximizing your money.

For example, the more cash you have stashed away in a rainy day fund, the more likely you’ll avoid accumulating debt when emergencies hit. The less money you spend on nonessential purchases, the more you might be able to contribute to your retirement accounts or investments. Paying down debt will also

help you continue to build wealth in other areas, like homeownership.

5. Don’t shy away from investing

Just 34% of Black households and 24% of Hispanic households reported owning stocks, compared with 61 percent of Whites, according to the Fed. That might be turning a corner, with

Increasing financial literacy should be a family project in Black households. Teaching children the basics about savings accounts and investments can put them on a path to financial security.

6. Consider starting a business or side hustle

Individuals of color are taking an interest in finding their own path toward financial freedom, particularly by starting their own business. On average, 380 out of every 100,000 Black adults became entrepreneurs in 2020, up from 240 in the prior two years, according to an annual study from the Kauffman Foundation

7. Plan for retirement

29% of Black investors under 40 in a Charles Schwab survey reporting that they jumped into the market for the first time in 2020. But a Bankrate survey from March 2021 suggests that more work needs to be done, with 56 percent of investors and 41 percent of noninvestors seeing the stock market as rigged.

But even beyond salaries, sometimes high-skill positions can offer you valuable workplace benefits that aren’t always gleaned from looking at your salary information, such as the opportunity to invest in workplace retirement plans

Black and Hispanic families are far less likely to have retirement accounts, Fed data shows. Even among middle-aged families, 65% of White families have at least one retirement account, compared with 44 percent of Black families and just 28% of Hispanic families.

Photo courtesy of Bankrate

How to protect yourself from cyber security threats

Practice

good ‘cyber hygiene’

By Renata Sago

In 2000, Tami Hudson was working as a consultant implementing security standards for a company. Her team was conducting a review and noticed that the code in one of the databases had changed – all within a two-week period.

“The code was totally different,” Hudson remembers.

“It wasn’t a matter of ‘I think we’ve been attacked or ‘Let’s look at our cybersecurity program.’ It was really a matter of How did this change? How did someone get access to it? Who has the password?”

This happened during the Y2K scare when organizations around the world were grappling with how to transition computer systems into a new format. The language for cybersecurity had not yet developed. Neither had some techniques for how to deal with cyber threats. These days, Hudson spends her time helping people protect themselves from cybercriminals in personal and business activities.

According to the Internet Crime Report, there were 800,944 reports of cyber-attacks and incidents to the FBI’s Internet Crime Complaint Center in 2022. The estimated potential loss was $10.2 billion.

“Fifteen years ago when a lot of people thought of threat actors, they would think of a kid in his parents’ basement with a hoodie in a dark room doing all these things,” Hudson says. “That has changed. You don’t have to be extremely technical.”

Typical cyber threats include phishing, malware, fraudulent advertising, and fraudulent applications. Throughout the year, threat actors play upon human behaviors, such as being in a haste, wanting to be charitable, not looking through

emails in detail or eagerly clicking links that are not secure. They often use bots to gather information from the internet, too.

“Bots are applications that are programmed to perform certain tasks. So essentially, they are digital tools – and there are good bots and bad,” says Hudson. “They are moving faster than you or I.”

In the midst of potential threats, it’s important to develop a plan for protecting yourself. Hudson encourages practicing good “cyber hygiene” through the following practices:

• Keeping a unique password – and keeping it private.

• Changing your password regularly.

• Being careful about the information you provide to websites, especially when answering security questions.

• Using two-factor authentication

• Updating software

• Setting up account alerts

• Opting out saving credit card information after a purchase

• Steering clear of too-good-to-betrue emails and links.

“Look up the name of the company,” implores Hudson. “This is something threat actors don’t want you to do. They don’t want you to research them. Look up the name of the company and type

in the word scam and see what comes up there. That is just another really easy way to see if the person or the business that you’re doing business with is actually legitimate.”

• Knowing how to identify a secure link and domain.

The spelling, domain name, and URL are helpful hints. Websites that have https are technically secure compared to websites that have http.

This article was provided by Wells Fargo and is part of it’s the Financial Journey Series

Photo courtesy Getty Images

Six best money management tips for personal finances

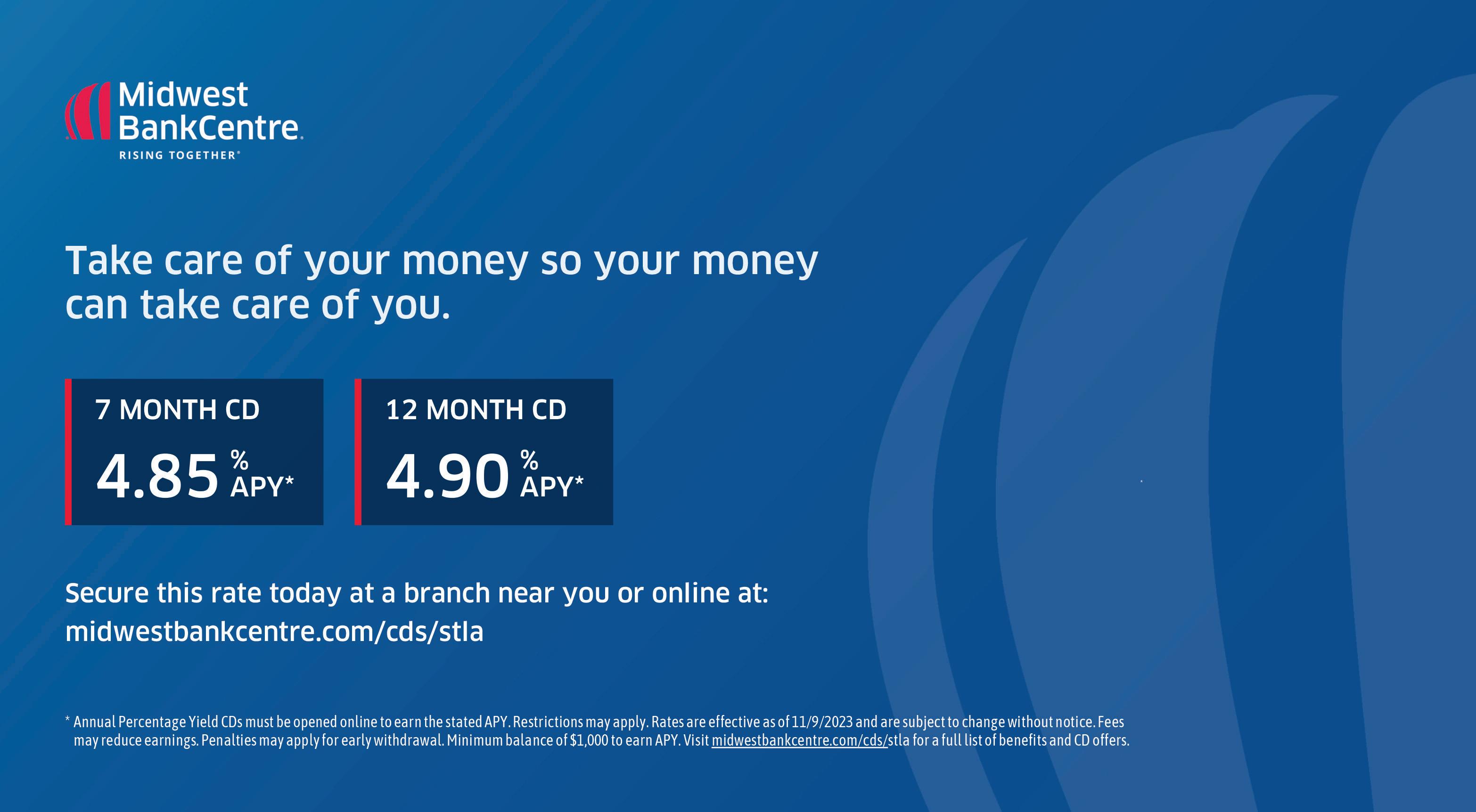

By Ashley O’Neil Midwest Bank Centre

Effective money management is crucial for achieving financial stability and security. By adopting smart money management practices, individuals can reduce financial stress, make the most of their income, and work towards their financial goals. This article presents six essential money management tips that can help you take control of your personal finances and pave the way for a brighter financial future.

Tip 1: Create and prioritize financial goals

One of the first steps in effective money management is to establish clear and realistic financial goals. Whether it’s saving for a down payment on a home, paying off student loans, or building a retirement nest egg, defining your objectives will give you direction and purpose. Break down your goals into short-term and long-term targets, and assign priorities based on your financial situation and aspirations. This will guide your financial decisions and help you stay focused on what truly matters.

Tip 2: Master the art of budgeting, expense tracking

A well-crafted budget is a powerful tool for managing personal finances. Start by tracking your income and expenses using budgeting apps or spreadsheets. Categorize your expenses and identify areas where you can cut back. Set realistic spending limits for different categories and be diligent in tracking your progress. By actively monitoring your spending habits, you can make informed decisions, avoid unnecessary expenses, and stay within your financial means.

Tip 3: Build and maintain an emergency fund

Life is full of unexpected surprises, and having an emergency fund is vital for financial stability.

Effective money management is crucial for achieving financial stability and security. By adopting smart money management practices, individuals can reduce financial stress, make the most of their income, and work towards their financial goals.

Tip 6: Plan for

retirement, secure financial stability

Retirement planning is crucial for long-term financial security. Contribute regularly to retirement accounts such as 401(k)s or IRAs and take advantage of employer matching programs whenever possible. Evaluate your retirement goals and seek expert advice to develop a sound retirement strategy. The earlier you start saving for retirement, the more time your money has to grow through the power of compounding.

Take control of financial future

Tip 4: Optimize savings and investing strategies

Saving money is not just about putting it aside; it is also about making your money work for you.

Aim to save three to six months’ worth of living expenses in an easily accessible account. Set up automatic transfers from your paycheck or designate a portion of your income specifically for this purpose. Building an emergency fund provides a safety net during unforeseen circumstances and prevents you from relying on credit cards or loans for sudden expenses.

Look for savings accounts with competitive interest rates and explore investment options that align with your risk tolerance and financial goals. Consider diversifying your investments through mutual funds or retirement accounts, allowing you to benefit from compound interest and potential market growth.

Seeking professional financial advice can help you make informed decisions and maximize your savings potential.

Tip 5: Manage credit cards, improve credit

score

Credit cards can be valuable financial tools if managed responsibly. Pay your credit card bills in full and on time to avoid interest charges and late fees. Keeping your credit utilization ratio low and maintaining a healthy credit history can positively impact your credit score. Regularly review your credit report for accuracy and address any discrepancies promptly. A good credit score opens doors to better interest rates on home or commercial real estate loans and can save you money in the long run.

By implementing these six best money management tips, you can take control of your personal finances and work towards achieving your financial goals. Remember that financial success is a journey that requires discipline, perseverance, and continuous learning. Develop good money management skills, seek financial education, and adapt your strategies as your financial situation evolves. The team at Midwest BankCentre with effective money management, you can create a brighter and more secure future for yourself and your loved ones with the help of a St. Louis mortgage company.

At Midwest BankCentre, we know how important effective money management is to you and your family, now and for future generations. Call us at 314-631-5500 or visit a branch today for a no-obligation conversation with a banking specialist. Bring all your questions and doubts, and we will listen, learn and decide how best to help you achieve your dream of a bright financial future.

Ashley O’Neal is SVP Retail Market Manager of Midwest BankCentre www.midwestbankcentre.com

Photo courtesy of Midwest BankCentre