By Robin Boyce For The St. Louis American

The St. Louis Regional Unbanked Task Force (STRUT) announced at its August general meeting strong increases in individuals signing up for checking and savings accounts in its first four months of the GetBankedNow.com campaign.

STRUT’s mission with the national Bank-On Save Up initiative is to encourage at least 20,000 people to open accounts with banking institutions locally by 2015. Several banks and nonprofit agencies came together three years ago to find solutions to getting more St. Louisans banked after a scathing report by the FDIC that said when it came to unbanked minority communities St. Louis ranked third in the country.

“One of the most important aspects of the Bank-On

“What our bank partners are seeing currently is retention of 99 percent opened accounts.”

- Alex Fennoy

Save Up initiative is the partnerships with banks and non-profit to inform and educate the public,” says Jackie Hutchinson, co-chair for STRUT and Vice President of Operations for the People’s Community Action Corporation.

“The potential savings impact for families yearly has almost reached $1 million and will continue to grow.”

STRUT embarked on a strong effort to penetrate unbanked consumers with radio station remotes at banks, developing a unique website, working with nonprofit agencies on getting their constituents financial education and a media campaign that includes billboards along with PSAs. Participating at community events to educate the public is one of the key components STRUT say will make the difference when putting a friendly face to a financial institution.

“I am encouraged because we know other bank on initiatives around the country have had a ramp up period

of 9 months to a year,” says Alex Fennoy co-chair for STRUT. “If we continue on this trajectory we will surpass our 20,000 account goal.”

Fennoy, who is also senior vice president of community development for Midwest Bankcentre, added the goal was to retain 80 percent of opened accounts.

“What our bank partners are seeing currently is retention of 99 percent opened accounts,” says Fennoy. “The Bank-On Save Up initiative has seen nearly 1000 new accounts open in this relatively short time. These numbers are encouraging for our banking community in meeting our goal.”

In the first four months of the campaign and with a late start in banks reporting, STRUT has seen since first quarter a 190 percent increase in new checking accounts and a 182 percent increase in individuals signing up for savings accounts. All the banks participating have not reported their finding to the Federal Reserve Bank as of yet but with the efforts of STRUT, the Bank On Save Up initiative is well on its way to helping St. Louis grow into a financial healthy community.

STRUT partners are also considering creating mobile apps, going to parent-teachers’ meetings and hitting the local night club scene where the unbanked demographic can be reached.

STRUT is also a member of the national joinbankon. org network of similar programs across the country. “We hope to share our Bank-On Save Up model nationally,” says Hutchinson. “We want our successes replicated in other communities facing similar problems.”

St. Louis Community Credit Union was recently named 2013 Community Credit Union of the Year by the Credit Union National Association (CUNA). St. Louis Community was selected as a first-place winner in its class of institutions that are $250 million or less in asset size.

“This honor is a testament to the dedication of our staff as they work diligently to meet our members’ needs through compassion, respect and valuefocused service,” said Patrick Adams, President/CEO, St. Louis Community Credit Union. “We are in the business of empowering the low-to-moderate income community. That’s what we do best.”

According to CUNA, the 2013 Community Credit Union of the Year Award gives recognition and distinction to credit unions that best demonstrate the fundamentals of the credit union

movement while also establishing a positive influence in the field of service. Through its account services, locations and community outreach efforts, St. Louis Community Credit Union operates as more than a credit union. It serves as a beacon of financial empowerment and capability for its members and the communities it serves.

As a full-service Community Development Financial Institution (CDFI), St. Louis Community Credit Union primarily serves low-to-moderate

accounts and a payday loan alternative. St. Louis Community Credit Union has 11 area locations. As a way to promote financial capability, the organization invests time and resources into developing offices that cater to underserved populations. In 2011, the Credit Union began a partnership with social service agencies by placing minibranches within those facilities. This offers an added layer of convenience and access for communities that are in dire need of mainstream banking services.

n “We are in the business of empowering the low-to-moderate income community.”

– Patrick Adams, president/CEO, St. Louis Community Credit Union.

St. Louis Community Credit Union recently opened a branch at the Metropolitan Education and Training Center, located at 6347 Plymouth Ave. in Wellston. The branch opening was supported and attended by many of the region’s most senior African-American elected officials, including County Executive Charlie A. Dooley, state Senator Maria ChappelleNadal and Lewis Reed, president of the Board of Aldermen for the City of St. Louis. Patrick Adams , president of St. Louis Community Credit Union (the tall man in the back row) also attended.

income individuals living in and around the region’s urban areas. It offers assetbuilding products that help consumers increase their standard of living and better their lifestyle. By serving the underserved, St. Louis Community Credit Union meets consumers where they are financially through credit building products, second-chance checking

The mini-branch locations operate like any other Credit Union branch and range between 300 and 800-square-feet. St. Louis Community Credit Union opened its first mini-branch in the MET Center in summer 2011 (Wellston) and expanded into two additional offices thereafter: Grace Hill Water Tower (fall 2011) and Kingdom House (winter 2012).

In 2012, the Credit Union’s Foundation, the St. Louis Community CU Foundation, opened the CU Excel Center in Northwoods, MO with support from Carrollton Bank. The Center offers free financial literacy, life skills education and one-on-one financial coaching to the community at large. All classes are taught by subject matter experts, including: a full-time financial educator and community outreach specialist, bank partners and social service agency representatives. Collectively, these groups join forces to help low-to-moderate income residents improve their financial situation through the power of education. Attendees receive free information on a variety of subjects from effective budgeting to managing stress during tough economic times. Through preand post-testing measures, there is a 50 percent increase in class attendees’ basic financial literacy knowledge from the time they enter to when they leave the CU Excel Center.

Since opening, the CU Excel Center has served more than 2,400 people. The Credit Union and the Foundation have reached more than 20,000 since 2008 through their financial education efforts alone.

For more information on St. Louis Community Credit Union, visit www. stlouiscommunity.com.

By Charlene Crowell Center for Responsible Lending

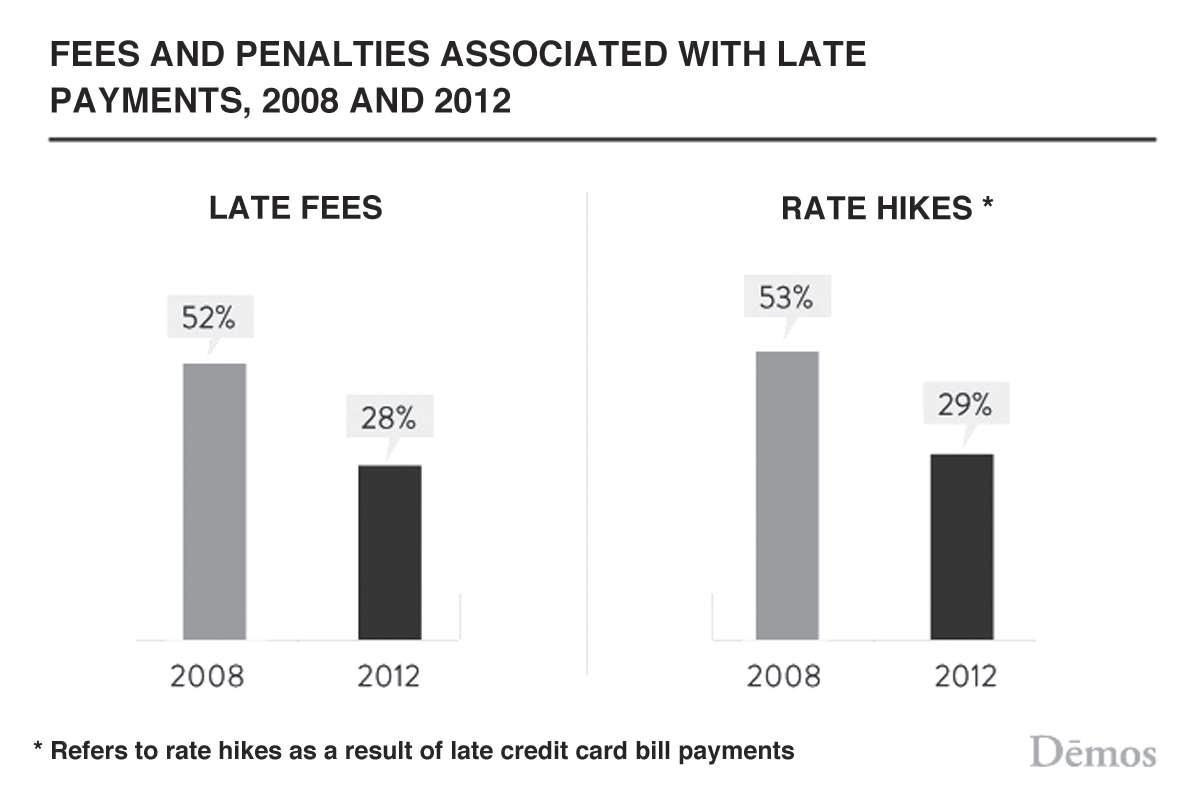

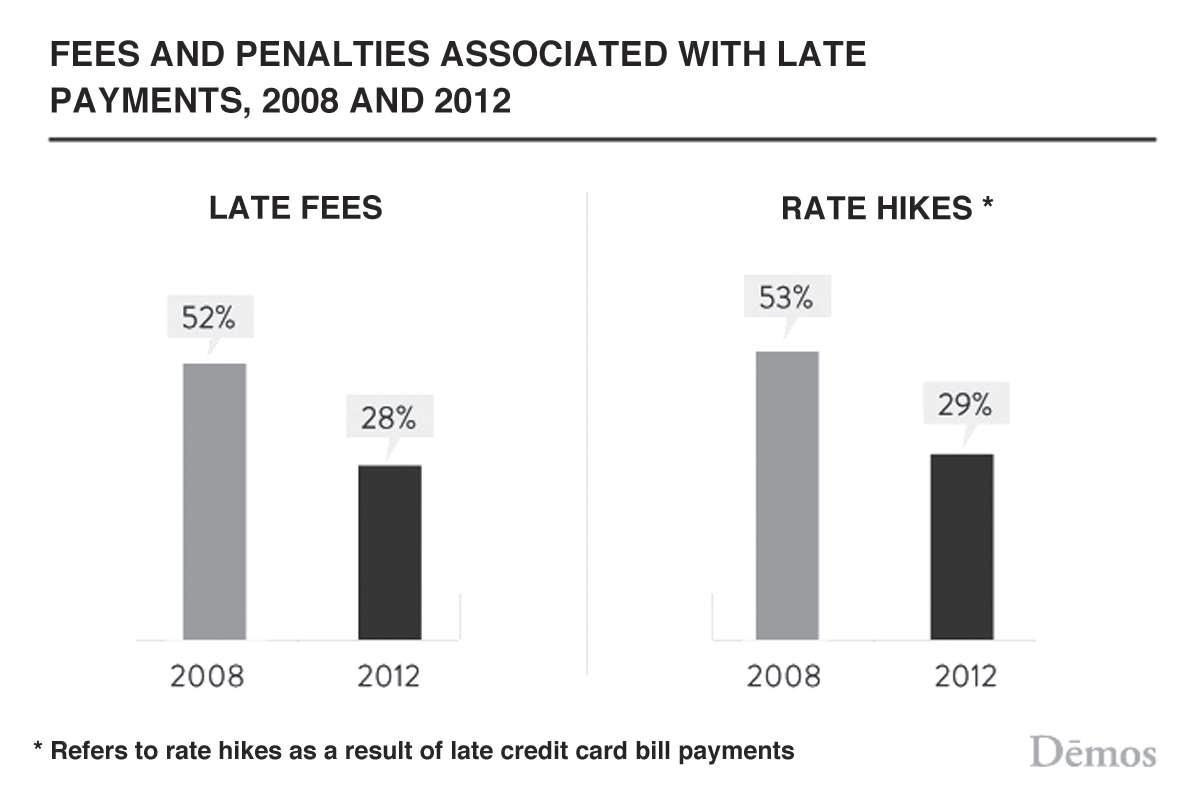

With 71 percent of consumers having at least one credit card, new research findings from two different sources show that the Credit CARD Act, enacted in 2009, is working. The only difference between the reports is just how much consumers are benefitting.

According to the Consumer Financial Protection Bureau (CFPB), the total cost of credit declined by two percentage points between 2008 and 2012, with borrowers saving $4B in fees that would have been charged if not for the new law.

“The CARD Act was passed with the specific goal of making the credit card market fairer and more transparent for

consumers,” said Richard Cordray, CFPB director. “Consumers need access to credit; we simply want to ensure that they have responsible access to credit.”

CFPB found that in two specific areas,

America’s consumers have already saved $2.5B in over-limit fees which have mostly disappeared. Before the law took effect, these fees were assessed each time a transaction exceeded approved credit limits. The law now limits fees to be charged only once in a single billing cycle but also requires customers to opt-in to the fees. Additionally, late fees have also dropped by $1.5B and on average dropped in cost by $6 since the law took effect.

A related working paper released days earlier by the National Bureau of Economic Research estimates that the law has performed even better, saving consumers an estimated $20.8B per year. This estimate, based on an analysis of over 150 million credit card accounts, showed a drop in costs of more than 10 percent for consumers with the lowest FICO scores and an annualized reduction in borrowing costs of 2.8 percent on average daily balances. This report was developed jointly by the Office of the Comptroller of the Currency and academicians from the University of Chicago Booth School of Business, New York University, and the National University of Singapore. Either way, the effects of this key regulatory reform are welcome financial relief news for consumers.

fair and transparent practices in the credit card market. It included specific protections for young consumers, under the age of 21. They now must demonstrate an independent ability to repay the debt or secure an adult co-signer. Since enactment of the CARD Act, credit card holders under 21 have dropped by half.

Other CARD Act requirements include:

· Customer statements must clearly show how long it will take to pay off the bill if the consumer opts to pay only the minimum amount due, including interest charges;

· Card issuers cannot change terms or interest rates on customers who are current on their accounts; and

· Customers must be delinquent for 60 days before a rate increase can be imposed.

Even so, the CFPB finds problem areas remain despite these provisions and customer savings. Further and greater regulatory examination may be warranted.

For example, the mailings that offer low and no interest to finance purchases for a specific period of time are known in the industry as deferred interest products. While the offers may appear tempting, it is not widely understood by consumers that if the balance is not paid in full by the designated date, interest will be charged and assessed retroactively to the transaction date.

n Signed into law in May 2009, the Credit CARD Act sought to establish fair and transparent practices in the credit card market.

Similarly, CFPB will closely monitor fees assessed before an account is opened. Some cards include what is known as harvester fees have high upfront costs, e.g. application fees, and low limits. As a result, the initial fees absorb much of the card’s credit limit. Currently not covered by the CARD Act, CFPB’s review of these charges will determine whether it should take action under its authority.

Other areas of concern for the Bureau include credit card rewards programs, add-on products, online disclosures, and grace periods – the time between the end of a billing cycle and when a balance is due.

When consumers understand the terms and responsibilities incurred through credit, they are better able to comparison shop for the best product. More importantly, no consumer wants to feel snookered by a deal gone bad.

Signed into law in May 2009, the Credit CARD Act sought to establish

For more information on CFPB’s new report, visit www.consumerfinance.gov

You probably already know that it is difficult to obtain a loan or credit card when you don’t have a high credit score, but did you know that your credit report and score also influences other financial products? The ability to rent an apartment or home, the price you pay on car insurance, and the ability to obtain utilities, a bank account, and a cell phone are all influenced by your credit report and score. Someone with a low credit score could have to pay $600 for a deposit on a cell phone! While all this news might seem discouraging, it can be very easy to increase your credit score. Follow these five simple steps and you are on your way to a better credit score:

1. Have good lines of credit: a small loan or a small credit card! A $300 dollar secured credit card will do the same thing as a $25,000 unsecured credit card. You only need 2-3 good lines of credit that report to your credit report to increase your score.

2. PAY ON TIME! A 30 day late payment can drop your score 50-100+ points. So don’t open lines of credit that you can’t afford and make sure that you have a reminder system in place to make sure your bills are paid on time. If you aren’t paying on time now, get caught up and stay caught up!

3. Keep your balance low on credit cards. Don’t use your credit cards for consumption but using them for credit building can have a high impact on your score which = lower interest rates and more money saved! ** Keep balances on credit cards under 30% of your credit limit at all times! Even less is better

4. Have a mix of types of credit –at least one loan and one credit card. Having one of each will show creditors that you can manage different types of credit.

5. Have relationships with creditors. Opening loans and paying them off before 6-12 months doesn’t help to increase the credit score (although could save you money in interest). But you want to show that you can be with a particular creditor for more than 12 months. The longer you are with one creditor the higher your score will go. Many banks and credit unions in the St Louis area are offering credit building or credit –rebuilding products that are focused on helping individuals to increase their score. Don’t be afraid to walk into your local bank or credit union and ask what products they have that can help you with your credit situation. Lastly, be wary of credit repair companies. Someone who charges hundreds of dollars and promises a quick fix is too good to be true. The only true way to deal with negative debt (like collections and charge off’s) is to pay them off or for time to pass. If something is truly inaccurate on your credit report, as a consumer you have the right to dispute that information yourself. Start by getting your free annual credit report at www.annualcreditreport.com. For more information about Justine PETERSEN’s credit building products and services, please contact us at 314-533-2411 or www.justinepetersen.org.

By Linda O’Leary

For The St. Louis American

Buying a home vs. renting is a big decision that takes careful consideration. But the rewards of home ownership are great. It is an achievement that offers a sense of pride, financial stability and potential tax advantages.

Yes, there are certain responsibilities associated with owning a home. Landlords will often argue the benefits of renting. If you are renting, you’re helping them make their mortgage payment.

However, if you were to purchase your own home, you would be on your

Linda O’Leary

way toward building equity. Not only would your own home give you added space, your own back yard and overall privacy – home ownership would also give you some tax advantages. Depending on your tax bracket, owning a home is often less expensive than renting after taxes. If there is any time to buy it is NOW! Home prices are low today. Don’t miss this opportunity to take advantage of the current market before home values rise.

Linda O’Leary is a loan officer affiliated with Commercial Bank of Westport.

U.S. Bank will build its first new, stand-alone branch in the St. Louis area in almost 20 years. A groundbreaking ceremony was held on Tuesday, October at the new location, 11532 Page Service Dr. in Maryland Heights.

“Maryland Heights is a thriving community with strong neighborhoods and growing small businesses,” said Joe Imbs, U.S. Bank’s St. Louis market president. “U.S. Bank is thrilled to become a bigger part of this community with the opening of a full-service branch, and we look forward to serving the banking needs of consumers and businesses here for years to come.”

The environmentally-friendly, LEEDcertified branch is expected to open in March 2014 and represents the bank’s first de novo branch in the St. Louis

area in 20 years. Some of the building’s green features include green energy mechanical and electrical systems, use of “high-recycled content” materials for building, the use of natural light in the building’s design as well as energyefficient LED lighting on the interior and exterior.

The new branch will be open Monday through Friday from 9 a.m. until 5 p.m., with drive-through hours from 8 a.m. to 6 p.m.

U.S. Bank is celebrating its 150th anniversary this July. With 119 branches and more than 4,000 employees in St. Louis, U.S. Bank is the No. 1 retail bank in the market. Last year, its employees gave back by spending more than 8,400 hours volunteering with local organizations. Statewide, U.S. Bank provided more than $4.4 million in contributions to the community.

In addition, St. Louis is home to U.S. Bank’s community development subsidiary, U.S. Bancorp Community Development Corporation.

1. Credit unions are notfor-proit inancial cooperatives.

2. Credit unions are owned and managed by their members & every customer is a member and an owner

3. At a Credit union, each member has equal ownership –regardless of how much money a member has on deposit.

4. Credit unions do not issue stock or pay dividends to outside shareholders.

5. Credit union earnings are returned to members in the form of lower fees, lower loan rates and higher deposit rates.

Pier Y. Alsup

SVP Marketing & Communications Anheuser-Busch Employees’ Credit Union American Eagle Credit Union

6. Credit union membership is available through an employer, organizational afiliations (such as a church) or a community-charter based on where you

live and/or work.

7. Credit unions offer a wide range of inancial products and services such as checking accounts, new and used auto loans, mobile and online services, youth/ young adult and senior programs, to name a few.

8. Credit unions are insured by the National Credit Union Association (NCUA).

9. Credit unions focus on inancial literacy and assist members of all ages to become better-educated consumers.

10. The social mission of the credit union movement is “people helping people” and focuses on the local community, national and international efforts.

By Robin Boyce For The St. Louis American

The St. Louis Regional Unbanked Task Force (STRUT) announced at its August general meeting strong increases in individuals signing up for checking and savings accounts in its first four months of the GetBankedNow.com campaign.

STRUT’s mission with the national Bank-On Save Up initiative is to encourage at least 20,000 people to open accounts with banking institutions locally by 2015. Several banks and nonprofit agencies came together three years ago to find solutions to getting more St. Louisans banked after a scathing report by the FDIC that said when it came to unbanked minority communities St. Louis ranked third in the country.

“One of the most important aspects of the Bank-On

“What our bank partners are seeing currently is retention of 99 percent opened accounts.”

- Alex Fennoy

Save Up initiative is the partnerships with banks and non-profit to inform and educate the public,” says Jackie Hutchinson, co-chair for STRUT and Vice President of Operations for the People’s Community Action Corporation.

“The potential savings impact for families yearly has almost reached $1 million and will continue to grow.”

STRUT embarked on a strong effort to penetrate unbanked consumers with radio station remotes at banks, developing a unique website, working with nonprofit agencies on getting their constituents financial education and a media campaign that includes billboards along with PSAs. Participating at community events to educate the public is one of the key components STRUT say will make the difference when putting a friendly face to a financial institution.

“I am encouraged because we know other bank on initiatives around the country have had a ramp up period

of 9 months to a year,” says Alex Fennoy co-chair for STRUT. “If we continue on this trajectory we will surpass our 20,000 account goal.”

Fennoy, who is also senior vice president of community development for Midwest Bankcentre, added the goal was to retain 80 percent of opened accounts.

“What our bank partners are seeing currently is retention of 99 percent opened accounts,” says Fennoy. “The Bank-On Save Up initiative has seen nearly 1000 new accounts open in this relatively short time. These numbers are encouraging for our banking community in meeting our goal.”

In the first four months of the campaign and with a late start in banks reporting, STRUT has seen since first quarter a 190 percent increase in new checking accounts and a 182 percent increase in individuals signing up for savings accounts. All the banks participating have not reported their finding to the Federal Reserve Bank as of yet but with the efforts of STRUT, the Bank On Save Up initiative is well on its way to helping St. Louis grow into a financial healthy community.

STRUT partners are also considering creating mobile apps, going to parent-teachers’ meetings and hitting the local night club scene where the unbanked demographic can be reached.

STRUT is also a member of the national joinbankon. org network of similar programs across the country. “We hope to share our Bank-On Save Up model nationally,” says Hutchinson. “We want our successes replicated in other communities facing similar problems.”

St. Louis Community Credit Union was recently named 2013 Community Credit Union of the Year by the Credit Union National Association (CUNA). St. Louis Community was selected as a first-place winner in its class of institutions that are $250 million or less in asset size.

“This honor is a testament to the dedication of our staff as they work diligently to meet our members’ needs through compassion, respect and valuefocused service,” said Patrick Adams, President/CEO, St. Louis Community Credit Union. “We are in the business of empowering the low-to-moderate income community. That’s what we do best.”

According to CUNA, the 2013 Community Credit Union of the Year Award gives recognition and distinction to credit unions that best demonstrate the fundamentals of the credit union

movement while also establishing a positive influence in the field of service. Through its account services, locations and community outreach efforts, St. Louis Community Credit Union operates as more than a credit union. It serves as a beacon of financial empowerment and capability for its members and the communities it serves.

As a full-service Community Development Financial Institution (CDFI), St. Louis Community Credit Union primarily serves low-to-moderate

accounts and a payday loan alternative. St. Louis Community Credit Union has 11 area locations. As a way to promote financial capability, the organization invests time and resources into developing offices that cater to underserved populations. In 2011, the Credit Union began a partnership with social service agencies by placing minibranches within those facilities. This offers an added layer of convenience and access for communities that are in dire need of mainstream banking services.

n “We are in the business of empowering the low-to-moderate income community.”

– Patrick Adams, president/CEO, St. Louis Community Credit Union.

St. Louis Community Credit Union recently opened a branch at the Metropolitan Education and Training Center, located at 6347 Plymouth Ave. in Wellston. The branch opening was supported and attended by many of the region’s most senior African-American elected officials, including County Executive Charlie A. Dooley, state Senator Maria ChappelleNadal and Lewis Reed, president of the Board of Aldermen for the City of St. Louis. Patrick Adams , president of St. Louis Community Credit Union (the tall man in the back row) also attended.

income individuals living in and around the region’s urban areas. It offers assetbuilding products that help consumers increase their standard of living and better their lifestyle. By serving the underserved, St. Louis Community Credit Union meets consumers where they are financially through credit building products, second-chance checking

The mini-branch locations operate like any other Credit Union branch and range between 300 and 800-square-feet. St. Louis Community Credit Union opened its first mini-branch in the MET Center in summer 2011 (Wellston) and expanded into two additional offices thereafter: Grace Hill Water Tower (fall 2011) and Kingdom House (winter 2012).

In 2012, the Credit Union’s Foundation, the St. Louis Community CU Foundation, opened the CU Excel Center in Northwoods, MO with support from Carrollton Bank. The Center offers free financial literacy, life skills education and one-on-one financial coaching to the community at large. All classes are taught by subject matter experts, including: a full-time financial educator and community outreach specialist, bank partners and social service agency representatives. Collectively, these groups join forces to help low-to-moderate income residents improve their financial situation through the power of education. Attendees receive free information on a variety of subjects from effective budgeting to managing stress during tough economic times. Through preand post-testing measures, there is a 50 percent increase in class attendees’ basic financial literacy knowledge from the time they enter to when they leave the CU Excel Center.

Since opening, the CU Excel Center has served more than 2,400 people. The Credit Union and the Foundation have reached more than 20,000 since 2008 through their financial education efforts alone.

For more information on St. Louis Community Credit Union, visit www. stlouiscommunity.com.

By Charlene Crowell Center for Responsible Lending

With 71 percent of consumers having at least one credit card, new research findings from two different sources show that the Credit CARD Act, enacted in 2009, is working. The only difference between the reports is just how much consumers are benefitting.

According to the Consumer Financial Protection Bureau (CFPB), the total cost of credit declined by two percentage points between 2008 and 2012, with borrowers saving $4B in fees that would have been charged if not for the new law.

“The CARD Act was passed with the specific goal of making the credit card market fairer and more transparent for

consumers,” said Richard Cordray, CFPB director. “Consumers need access to credit; we simply want to ensure that they have responsible access to credit.”

CFPB found that in two specific areas,

America’s consumers have already saved $2.5B in over-limit fees which have mostly disappeared. Before the law took effect, these fees were assessed each time a transaction exceeded approved credit limits. The law now limits fees to be charged only once in a single billing cycle but also requires customers to opt-in to the fees. Additionally, late fees have also dropped by $1.5B and on average dropped in cost by $6 since the law took effect.

A related working paper released days earlier by the National Bureau of Economic Research estimates that the law has performed even better, saving consumers an estimated $20.8B per year. This estimate, based on an analysis of over 150 million credit card accounts, showed a drop in costs of more than 10 percent for consumers with the lowest FICO scores and an annualized reduction in borrowing costs of 2.8 percent on average daily balances. This report was developed jointly by the Office of the Comptroller of the Currency and academicians from the University of Chicago Booth School of Business, New York University, and the National University of Singapore. Either way, the effects of this key regulatory reform are welcome financial relief news for consumers.

fair and transparent practices in the credit card market. It included specific protections for young consumers, under the age of 21. They now must demonstrate an independent ability to repay the debt or secure an adult co-signer. Since enactment of the CARD Act, credit card holders under 21 have dropped by half.

Other CARD Act requirements include:

· Customer statements must clearly show how long it will take to pay off the bill if the consumer opts to pay only the minimum amount due, including interest charges;

· Card issuers cannot change terms or interest rates on customers who are current on their accounts; and

· Customers must be delinquent for 60 days before a rate increase can be imposed.

Even so, the CFPB finds problem areas remain despite these provisions and customer savings. Further and greater regulatory examination may be warranted.

For example, the mailings that offer low and no interest to finance purchases for a specific period of time are known in the industry as deferred interest products. While the offers may appear tempting, it is not widely understood by consumers that if the balance is not paid in full by the designated date, interest will be charged and assessed retroactively to the transaction date.

n Signed into law in May 2009, the Credit CARD Act sought to establish fair and transparent practices in the credit card market.

Similarly, CFPB will closely monitor fees assessed before an account is opened. Some cards include what is known as harvester fees have high upfront costs, e.g. application fees, and low limits. As a result, the initial fees absorb much of the card’s credit limit. Currently not covered by the CARD Act, CFPB’s review of these charges will determine whether it should take action under its authority.

Other areas of concern for the Bureau include credit card rewards programs, add-on products, online disclosures, and grace periods – the time between the end of a billing cycle and when a balance is due.

When consumers understand the terms and responsibilities incurred through credit, they are better able to comparison shop for the best product. More importantly, no consumer wants to feel snookered by a deal gone bad.

Signed into law in May 2009, the Credit CARD Act sought to establish

For more information on CFPB’s new report, visit www.consumerfinance.gov

You probably already know that it is difficult to obtain a loan or credit card when you don’t have a high credit score, but did you know that your credit report and score also influences other financial products? The ability to rent an apartment or home, the price you pay on car insurance, and the ability to obtain utilities, a bank account, and a cell phone are all influenced by your credit report and score. Someone with a low credit score could have to pay $600 for a deposit on a cell phone! While all this news might seem discouraging, it can be very easy to increase your credit score. Follow these five simple steps and you are on your way to a better credit score:

1. Have good lines of credit: a small loan or a small credit card! A $300 dollar secured credit card will do the same thing as a $25,000 unsecured credit card. You only need 2-3 good lines of credit that report to your credit report to increase your score.

2. PAY ON TIME! A 30 day late payment can drop your score 50-100+ points. So don’t open lines of credit that you can’t afford and make sure that you have a reminder system in place to make sure your bills are paid on time. If you aren’t paying on time now, get caught up and stay caught up!

3. Keep your balance low on credit cards. Don’t use your credit cards for consumption but using them for credit building can have a high impact on your score which = lower interest rates and more money saved! ** Keep balances on credit cards under 30% of your credit limit at all times! Even less is better

4. Have a mix of types of credit –at least one loan and one credit card. Having one of each will show creditors that you can manage different types of credit.

5. Have relationships with creditors. Opening loans and paying them off before 6-12 months doesn’t help to increase the credit score (although could save you money in interest). But you want to show that you can be with a particular creditor for more than 12 months. The longer you are with one creditor the higher your score will go. Many banks and credit unions in the St Louis area are offering credit building or credit –rebuilding products that are focused on helping individuals to increase their score. Don’t be afraid to walk into your local bank or credit union and ask what products they have that can help you with your credit situation. Lastly, be wary of credit repair companies. Someone who charges hundreds of dollars and promises a quick fix is too good to be true. The only true way to deal with negative debt (like collections and charge off’s) is to pay them off or for time to pass. If something is truly inaccurate on your credit report, as a consumer you have the right to dispute that information yourself. Start by getting your free annual credit report at www.annualcreditreport.com. For more information about Justine PETERSEN’s credit building products and services, please contact us at 314-533-2411 or www.justinepetersen.org.

By Linda O’Leary

For The St. Louis American

Buying a home vs. renting is a big decision that takes careful consideration. But the rewards of home ownership are great. It is an achievement that offers a sense of pride, financial stability and potential tax advantages.

Yes, there are certain responsibilities associated with owning a home. Landlords will often argue the benefits of renting. If you are renting, you’re helping them make their mortgage payment.

However, if you were to purchase your own home, you would be on your

Linda O’Leary

way toward building equity. Not only would your own home give you added space, your own back yard and overall privacy – home ownership would also give you some tax advantages. Depending on your tax bracket, owning a home is often less expensive than renting after taxes. If there is any time to buy it is NOW! Home prices are low today. Don’t miss this opportunity to take advantage of the current market before home values rise.

Linda O’Leary is a loan officer affiliated with Commercial Bank of Westport.

U.S. Bank will build its first new, stand-alone branch in the St. Louis area in almost 20 years. A groundbreaking ceremony was held on Tuesday, October at the new location, 11532 Page Service Dr. in Maryland Heights.

“Maryland Heights is a thriving community with strong neighborhoods and growing small businesses,” said Joe Imbs, U.S. Bank’s St. Louis market president. “U.S. Bank is thrilled to become a bigger part of this community with the opening of a full-service branch, and we look forward to serving the banking needs of consumers and businesses here for years to come.”

The environmentally-friendly, LEEDcertified branch is expected to open in March 2014 and represents the bank’s first de novo branch in the St. Louis

area in 20 years. Some of the building’s green features include green energy mechanical and electrical systems, use of “high-recycled content” materials for building, the use of natural light in the building’s design as well as energyefficient LED lighting on the interior and exterior.

The new branch will be open Monday through Friday from 9 a.m. until 5 p.m., with drive-through hours from 8 a.m. to 6 p.m.

U.S. Bank is celebrating its 150th anniversary this July. With 119 branches and more than 4,000 employees in St. Louis, U.S. Bank is the No. 1 retail bank in the market. Last year, its employees gave back by spending more than 8,400 hours volunteering with local organizations. Statewide, U.S. Bank provided more than $4.4 million in contributions to the community.

In addition, St. Louis is home to U.S. Bank’s community development subsidiary, U.S. Bancorp Community Development Corporation.

1. Credit unions are notfor-proit inancial cooperatives.

2. Credit unions are owned and managed by their members & every customer is a member and an owner

3. At a Credit union, each member has equal ownership –regardless of how much money a member has on deposit.

4. Credit unions do not issue stock or pay dividends to outside shareholders.

5. Credit union earnings are returned to members in the form of lower fees, lower loan rates and higher deposit rates.

Pier Y. Alsup

SVP Marketing & Communications Anheuser-Busch Employees’ Credit Union American Eagle Credit Union

6. Credit union membership is available through an employer, organizational afiliations (such as a church) or a community-charter based on where you

live and/or work.

7. Credit unions offer a wide range of inancial products and services such as checking accounts, new and used auto loans, mobile and online services, youth/ young adult and senior programs, to name a few.

8. Credit unions are insured by the National Credit Union Association (NCUA).

9. Credit unions focus on inancial literacy and assist members of all ages to become better-educated consumers.

10. The social mission of the credit union movement is “people helping people” and focuses on the local community, national and international efforts.