BUSINESS PLAN

St. Louis County, Missouri

County Executive Sam Page

PREPAREDBY:

Division of Performance Management & Budget

Division of Performance Management & Budget

ST. LOUIS COUNTY, MISSOURI 2024 RECOMMENDED BUSINESS PLAN

September 29, 2023

The County’s financial position remains unchanged from the past several years. We have a mismatch between annual revenue and spending, and we continue to rely on fund balance and one-time revenue sources to close the gap. As you know, this cannot continue indefinitely. However, better than anticipated financial results from fiscal year 2022 along with additional one-time revenue from legal judgments and property sales provides us with additional time as we consider transformational decisions.

The collaborative budget workgroup meetings, town halls, and the participatory web-based budget simulation implemented earlier this year ushered in an unprecedented era of cooperation and transparency on budget matters. It became apparent through our discussions that no easy decisions lie ahead. Each of us places a different value on each service that the County provides. Our willingness to pay for the services provided by the County is inconsistent with our service expectations.

As we continue to work through these issues, I am proposing a budget for 2024 that maintains most programs and service levels while also considering new sources of revenue for the County. In 2024, I recommend restoring the property tax rate to the 2022 level. For homeowners, this represents an additional 3.9 cents (per $100 of assessed value) over the 2023 tax rate or $22 for the average home. We have the same inflationary pressures as other places, and we should respond in a like manner like other regional governments. I also recommend reallocating 1.4 cents of property tax levy from the Debt Service Fund to the General Revenue Fund. These actions will provide an additional $11.2 million of annual revenue for general funds operations. In addition, I suggest we continue collecting interest on the NFL settlement funds as we look at transformative ways to use these one-time funds for St. Louis County.

This proposed budget allows us to continue operating while we make long-term changes to find the appropriate balance between revenues and spending. With this context, I herein offer my proposed annual budget for the fiscal year beginning on January 1, 2024, for your approval. In accordance with Article VIII, Section 8.020 of the St. Louis County Charter, and applicable state statutes, I request appropriations totaling $1,025,568,521.

I. Budget Comparison

The County provides services through 24 separate funds as summarized in the table below. The General Revenue Fund is available for any service, whereas the other 25 funds receive revenues that are designated for specific functions. The recommended budget reflects a decrease of $21.6 million or 2.1% from the 2023 level as amended.

The best year-over-year comparison of the County’s budget is the operating budget. The 23 funds that make up the operating budget are the primary means by which most of the financing, acquisition, spending, and service delivery activities of the County are controlled. The recommended 2024 operating budget is $763.7 million – a decrease of $13.9 million or 1.8% from the 2023 adjusted level.

Table 1: Summary of Recommended Appropriations and Tax Rates

Highlights of the recommended 2024 budget include:

• $4.4 million for a pay program benefitting employees not included in a collective bargaining agreement. This provides up to a 4% pay increase beginning mid-year in 2024.

• $8.4 million for Police to fund pay increases required under collective bargaining agreements and vehicle purchases.

• $3.2 million for the Board of Elections to fund the County’s required contributions toward the cost of election dates in 2024.

• $1.7 million to outsource maintenance services within the Justice Center due to lack of available County staff.

• $1.1 million to fund 16 additional corrections officer positions in the Department of Justice Services to provide shift relief and offset overtime expenditures as the Department continues to implement recommendations of a recent operations review.

• $898,800 for the Department of Administration to improve the use of the County’s Enterprise Resource Planning system, the electronic backbone of the County’s financial, budget, procurement, and human resources functions.

• The exclusion of one-time appropriations for projects currently in progress:

o Jamestown Mall demolition ($6.0 million)

o Police facility construction ($23.8 million)

o On-call architecture and engineering project management services ($5.5 million)

o Poll Pad hardware/software ($2.6 million)

o Comprehensive Plan update ($1.0 million)

• A reduction of $718,000 for the ShotSpotter system.

• A reduction of 26 positions (4%) in the Department of Public Health.

• A decrease of $18.8 million or 22.3% for the Children’s Service Fund because the 2023 appropriation level was higher than normal to accommodate an overlap in grant funding cycles.

• A decrease of $973,785 or 14.7% for the Convention & Recreation Trust Fund due a reduction of $500,000 for the final preservation payment on the original Domed Stadium bonds and elimination of $500,000 in one-time funding for a track & field complex feasibility study. These decreases are offset by minor increases in debt service payments required for existing bond issues.

The recommended budget also includes more funding for transportation projects:

• $200.1 million for mass transit funds which reflect the estimated maximum amount of sales tax revenue that may be distributed to Bi-State Development for public transportation services. Actual distribution of these funds will be based upon the budget you adopt for Bi-State next summer. Appropriations are set at the maximum amount to comply with bond requirements.

• $62.8 million for transportation capital funds to support the five-year capital construction program of the Department of Transportation and Public Works. The 2024 recommended workplan will support $70.0 million of project activity, including $8.2 million of construction work in 2023 and prior year awarded construction projects.

The recommended budget does not include the following which require additional development and discussion:

• Appropriations from the NFL Settlement Fund or the Opioid Remediation Fund. These funds will continue to generate interest until comprehensive spending plans are developed.

• Funds to address the findings of the pay study to help us attract and retain talent.

• Funds for additional cybersecurity efforts.

• Funds related to Project Cornerstone.

II. Revenues

Revenues in all budgeted funds are projected to be $916.2 million in 2024, an increase of $25.0 million or 2.8% over the revised 2023 estimate. In the operating budget, revenues are projected to increase by $38.0 million or 6.0%.

Highlights of the revenue projection include:

• $14.7 million or 2.3% growth in tax revenues, which account for 72.2% percent of all revenue collected, including:

o An increase of $7.2 million or 5.3% in property tax revenues due to the restoration of tax rates back to the 2022 level. This will provide additional revenue to support County operations and help offset the deficit in 2024.

o A shift of $4.0 million of property tax revenue between the Debt Service Fund and the General Revenue Fund.

o Slight growth in sales tax revenue (2.6%), including 2.0% growth in base revenue growth along with the annualization of the 3.0% tax on the sale of recreational marijuana that will begin to be collected in October 2023.

o A reduction of $5.1 million or 15.8% in utility gross receipts tax revenue due to one-time funds for a legal judgment received in 2023.

o A $10.3 million or 4.2% increase in all other revenue sources combined, which account for 28 percent of all revenue collected. This increase is due to the anticipated availability of federal funds to support transportation capital projects and the housing of federal prisoners in the Justice Center.

The revenue forecast does not include recommendations of the ongoing fee study which will not be complete until the end of 2023.

III. Financial Plan Challenges

Each fund in the recommended budget has a separately managed financial plan. Two of these funds continue to provide the most significant challenges – the General Revenue Fund and the Health Fund. In 2024, the General Revenue Fund is projected to have a structural deficit of $27.3 million (7.3%) and the Health Fund is projected to have a structural deficit of $12.0 million (17.5%). To preserve existing program and services levels, I propose to cover these deficits by restoring the property tax levy to the 2022 level, reallocating the existing property tax levy, making targeted reductions, and lowering our fund balances. The projected 2024 ending balances for these funds are $63.2 million (18.3%) in the General Revenue Fund and $29.8 million (52.5%) in the Health Fund – both above our fund balance policy of an ending balance equal to or greater than 10.0% of revenue.

As you can see from the deficits detailed above, the imbalance between the costs of providing government services to our residents and the amount of revenue provided continues to be a cause for concern. Soon, we will be forced to reduce service levels or seek additional revenue.

Sources of new revenue could include increasing the property tax rate further in even-numbered years, a ballot initiative to increase the property tax rate in any year, or revisiting the issue of a use tax to provide revenue for county operations and level the playing field for brick-and-mortar retailers in the County. Our reserves are a finite resource that cannot be used indefinitely to balance the budget.

I remain committed to working with you to address the challenges that lie ahead.

Respectfully submitted,

Sam Page

Attachment

cc: Kelli Dunaway, Lisa Clancy, Rita Days, Ernie Trakas, Mark Harder, Dennis Hancock

ST. LOUIS COUNTY EXECUTIVE SAM PAGE

CHIEF OF STAFF

CHIEF OPERATING OFFICER

CHIEF COMMUNICATIONS OFFICER

PROSECUTING ATTORNEY

ASSESSOR

St. Louis County Council

Rita Heard Days

Kelli Dunaway

Dennis Hancock

Shalonda D. Webb, Chair 4th District

Directors

Karen J. Aroesty Administration

Eric Fey Board of Elections (D)

Rick Stream Board of Elections (R)

Emily Koenig Children’s Service Fund

Diann L. Valenti County Council

Dana Redwing County Counselor

Rodney Crim Economic Development Partnership

Howard Hayes Human Services

Will Reise (acting) Information Technology

Hope Whitehead Judicial Administration

Circuit Court Judges

Thomas C. Albus

John N. Borbonus

Heather R. Cunningham

Jason D. Dodson

Margaret T. Donnelly

Bruce F. Hilton

Kristine A. Kerr

Associate Circuit Court Judges

Lorne J. Baker

Jason A. Denney

Ellen W. Dunne

Mondonna L. Ghasedi

Joseph L. Green

John R. Lasater

Virginia W. Lay

Ellen Sue Levy

Brian H. May

Doug Moore

Douglas Burris Justice Services

Courtney Whiteside Municipal Court

Brian Schaffer

Parks and Recreation

Jacob W. Trimble Planning

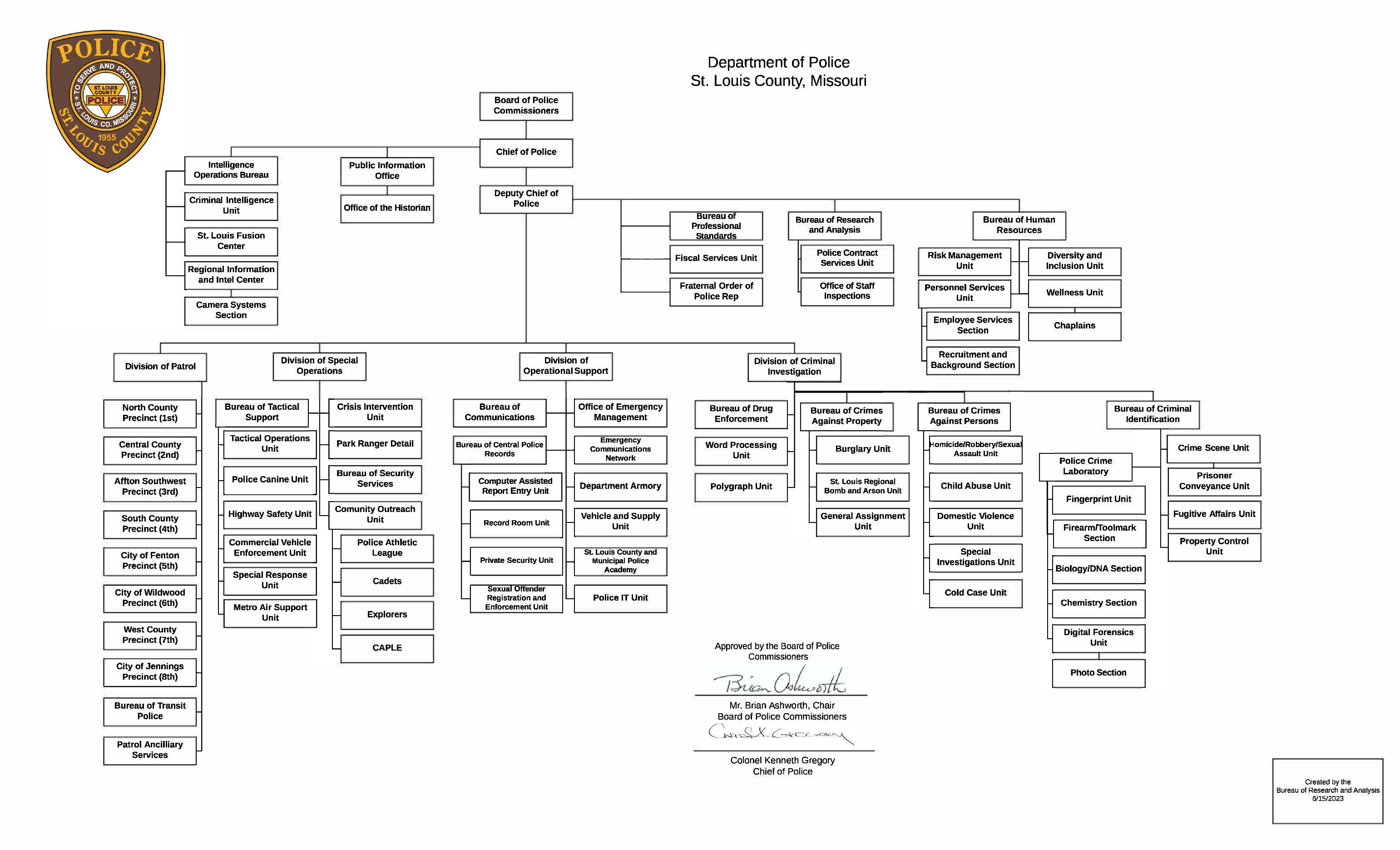

Col. Kenneth Gregory Police

Timothy M. Weaks Public Administrator

Dr. Kanika Cunningham Public Health

Ericka Savage (acting) Revenue

John D. Bales Spirit of St. Louis Airport

Stephanie Leon-Streeter, PE Transportation & Public Works

Ellen H. Ribaudo

Richard M. Stewart

David Lee Vincent, III

Dean P. Waldemer

Nancy Watkins McLaughlin

Jeffrey P. Medler

Mary Elizabeth Ott

Matthew H. Hearne

Robert M. Heggie

Megan Julian

Julia Pusateri Lasater

Amanda B. McNelley

Division of Performance Management & Budget

Paul Kreidler, PMB Director

Mary Hografe, Budget Manager

Dylan Lenzen, Performance Manager

James Washburn, County Data Officer

Stanley J. Wallach

Joseph L. Walsh, III

Nicole S. Zellweger

John F. Newsham

Krista S. Peyton

Natalie Warner

Lydia Boote, Performance Analyst

Rhett Nicks, Performance Analyst

Sunita Sankpal, Data Analyst

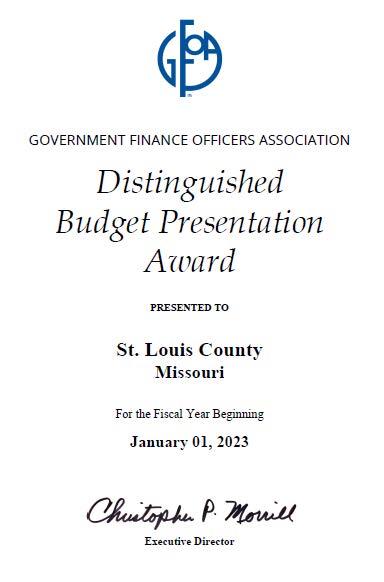

The Government Finance Officers Association of the United States and Canada (GFOA) presented a Distinguished Budget Presentation Award to St. Louis County, Missouri, for its annual budget for the fiscal year beginning January 1, 2023. To receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as an operations guide, as a financial plan, and as a communications device.

This award is valid for a period of one year only. The county believes that this budget and business plan continues to conform to program requirements and it will be submitted to GFOA to determine its eligibility for another award.

READER’S GUIDE

The St. Louis County Business Plan contains a narrative discussion of the county’s financial plan, revenue estimates and department budgets. Each department in the budget is described with narrative, as well as charts and graphs, and the budget is detailed by department, division, and fund.

Business Plan Organization

This business plan begins with an introduction to St. Louis County as well as information on financial policies and how the business plan is developed. This section also contains combined statements of revenues, expenditures and changes, and a long-term forecast for the General Revenue Fund.

An executive summary provides the reader with a synopsis of the business plan.

The revenue forecast provides information on 2023 and 2024 estimated revenues by fund. Property and sales taxes are highlighted in this section and a description of non-general funds is provided.

The narrative sections incorporate all funds appropriated to a department. Departments are organized into five program areas:

• Economic Development and Infrastructure

• Health and Well-Being

• Public Safety

• Recreation and Culture

• General Government

The remaining chapters are devoted to debt management, the Capital Improvement Program, grants, and supplemental information.

The Debt Management chapter summarizes the county’s credit rating, property tax levy, and bonded debt.

The Capital Improvement Program highlights capital projects that are funded in the 2024 budget, as well as those under consideration for funding through 2028.

The Grants chapter details the estimated grant funding received by county departments in 2023 and funding projected for 2024.

The final chapter, Supplemental Information, provides historical tax rate information, a fund dictionary, glossary, and description of acronyms.

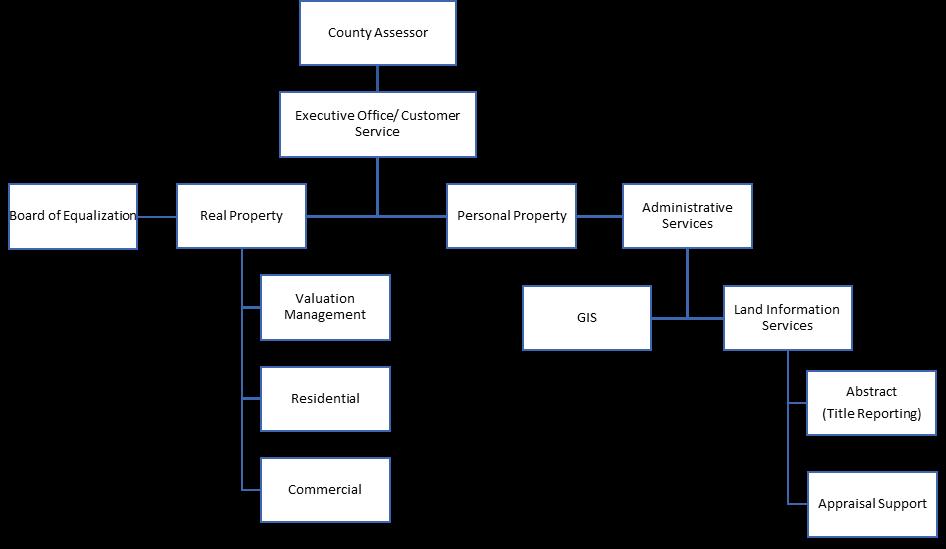

Department/Office Narrative Organization

Each narrative within the business plan is structured in the same way. The narrative is a descriptive and visual representation of the department or office’s objectives. The following pages provide a description of each section in the narrative.

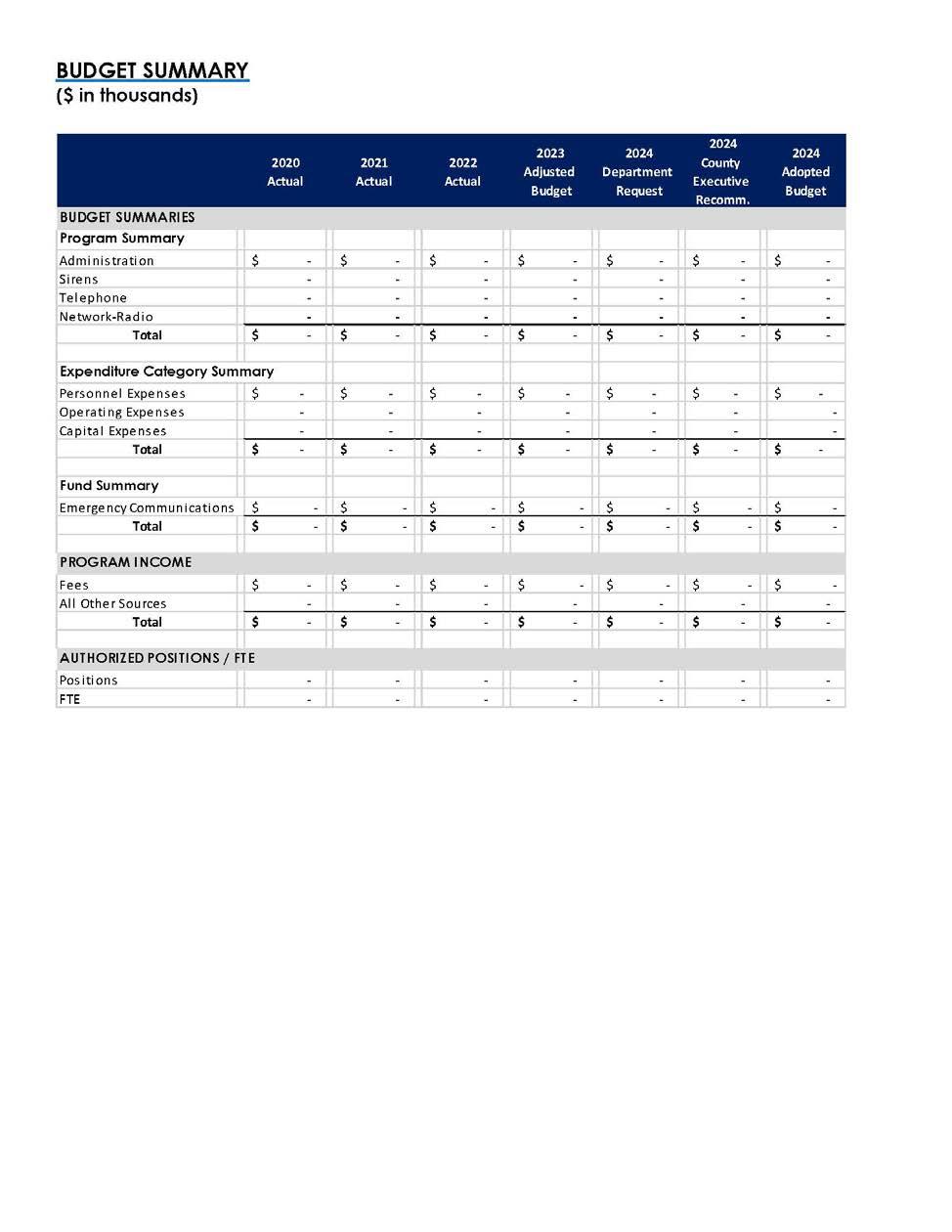

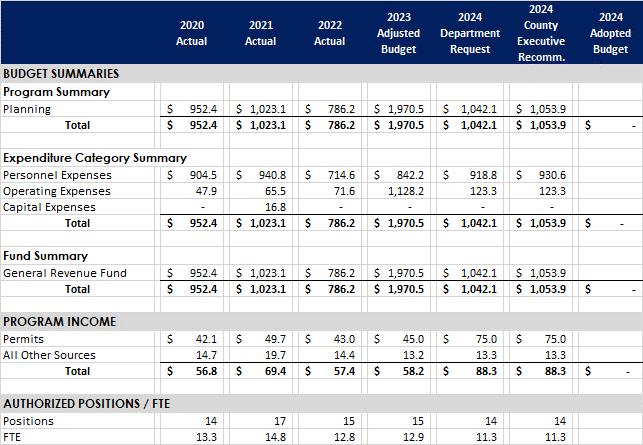

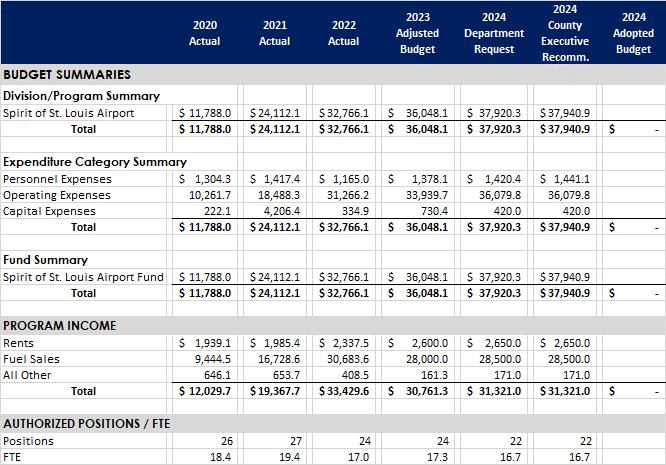

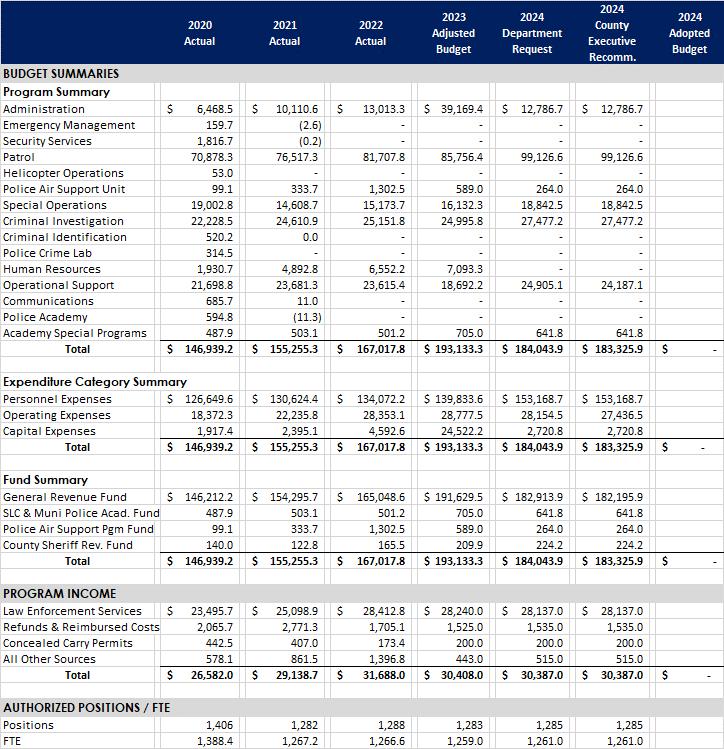

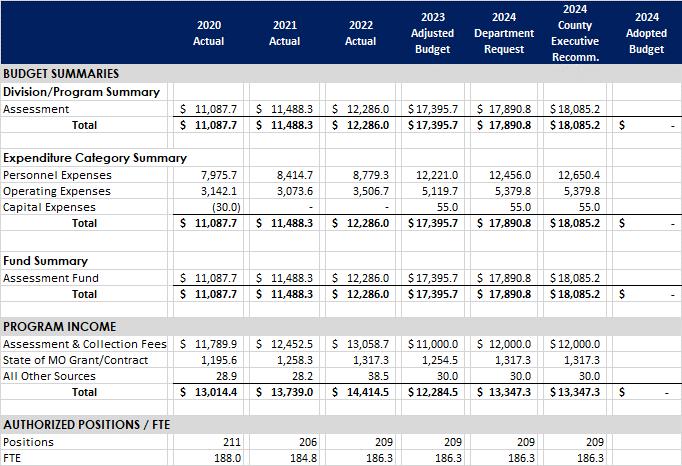

The final page of each narrative is a budget summary that is divided into three sections:

• Budget Summaries:

o Program Summary: expenditures and appropriations for the department divided into appropriated divisions and/or programs.

o Expenditure Category Summary: expenditures and appropriations for the entire department divided into personnel, operating, and capital categories.

o Fund Summary: expenditures and appropriations for the entire department divided by fund. Some departments receive appropriations from more than one fund.

• Program Income: revenue generated through department activities.

• Authorized Positions / FTE: summary of positions and full-time equivalents (FTEs) authorized for the department (all funds).

Data provided in this budget summary is organized by year:

• 2020 Actual: total expenditures and encumbrances incurred, revenue received, and total number of positions in the department/division/program during fiscal year 2020

• 2021 Actual: total expenditures and encumbrances incurred, revenue received, and total number of positions in the department/division/program during fiscal year 2021

• 2022 Actual: total expenditures and encumbrances incurred, revenue received, and total number of positions in the department/division/program during fiscal year 2022.

• 2023 Adjusted Budget: appropriations, revenue estimates, and positions as of August 2023 This considers transfers into and out of accounts, as well as any supplemental appropriations passed by the County Council.

• 2024 Department Request: 2024 appropriation and positions requested by the department and projected program revenue for consideration by the County Executive.

• 2024 County Executive Recommended: 2024 appropriation and positions recommended by the County Executive to the County Council along with projected program revenue.

• 2024 Council Adopted: 2024 appropriations and positions adopted by the County Council along with projected program revenue.

From Budget Book to Business Plan

In previous years, the Budget Office prepared a line-item budget, while analysts separately worked with departments to solidify goals and key performance indicators to measure impact. The creation of the Division of Performance Management and Budget in 2019 married the performance management aspect of county government administration with its financial management. The layout of the current Business Plan attempts to draw a clearer connection between the work that departments do, how those activities are funded, and how effective they are at serving the residents of St. Louis County. Additionally, staff worked with departments and offices across the county to reconsider their performance measures. As a result, many measures were dropped from the Business Plan as they were not being actively used by departments to measure efficiency or effectiveness. Many new measures were identified that stem directly from department priorities and are now included in the Business Plan. As such, you will notice that some of these new measures lack historical data if they were not previously tracked by departments.

2024 Priorities

In 2022 and 2023, many departments revised or replaced their priorities and performance measures Where possible, each department’s priorities and performance measures are captured under the division or program area responsible them. Additionally, there is a code next to each priority that ties them back to the County Executive’s Strategic Plan.

As shown in the table below, the County Executive’s strategic priorities fall into three broad categories under the umbrella of “A St. Louis County for Everyone:” health and safety for everyone, opportunity for everyone, and good government for everyone. The first, health and safety for everyone, will be achieved by addressing the opioid epidemic, reducing health disparities within our community, and reforming policing and the criminal justice system.

The second priority, opportunity for everyone, includes providing access to family-sustaining jobs, promoting inclusive community development, improving quality of life, and rebuilding pride and optimism in the county.

Finally, good government for everyone, focuses internally on county operations to transform the constituent experience, improve the effectiveness of county services, and ensure that those services are as efficient and responsible as possible.

County

Executive Strategic Priorities “A St. Louis County for Everyone”

Health and Safety for Everyone

Curb

Good

Ensure

ST. LOUIS COUNTY |2024 Recommended Budget Summary

*To improve comparison on a year-to -year basis, does not include funding committed in prior budgets

ST. LOUIS COUNTY |2024 Recommended Tax Rate Summary

INTRODUCTION

ST. LOUIS COUNTY PROFILE

St. Louis County was formed on October 1, 1812 (nine years before Missouri became a state) as one of the counties organized by Governor William Clark out of the five administrative districts of the Upper Louisiana Territory. As originally formed, St. Louis County included the area that is now St. Louis City, St. Louis County, Jefferson County, and Franklin County. In 1818, Franklin and Jefferson Counties were formed out of the original St. Louis County. In 1876, St. Louis City separated from St. Louis County, leaving the county at its present size of 524 square miles. In 1877, the City of Clayton was selected as the county seat.

With a population of 1,001,982, St. Louis County is the largest county in Missouri containing 16 percent of the state’s population. St. Louis County is the 46th largest county in the United States. St. Louis County is also an important employment center with nearly half of the metropolitan area’s jobs and one quarter of all jobs in Missouri.

Demographics

The county’s 1 million residents live in 88 municipalities and unincorporated areas. The county is comprised of seven Council Districts and has 641,399 registered voters.

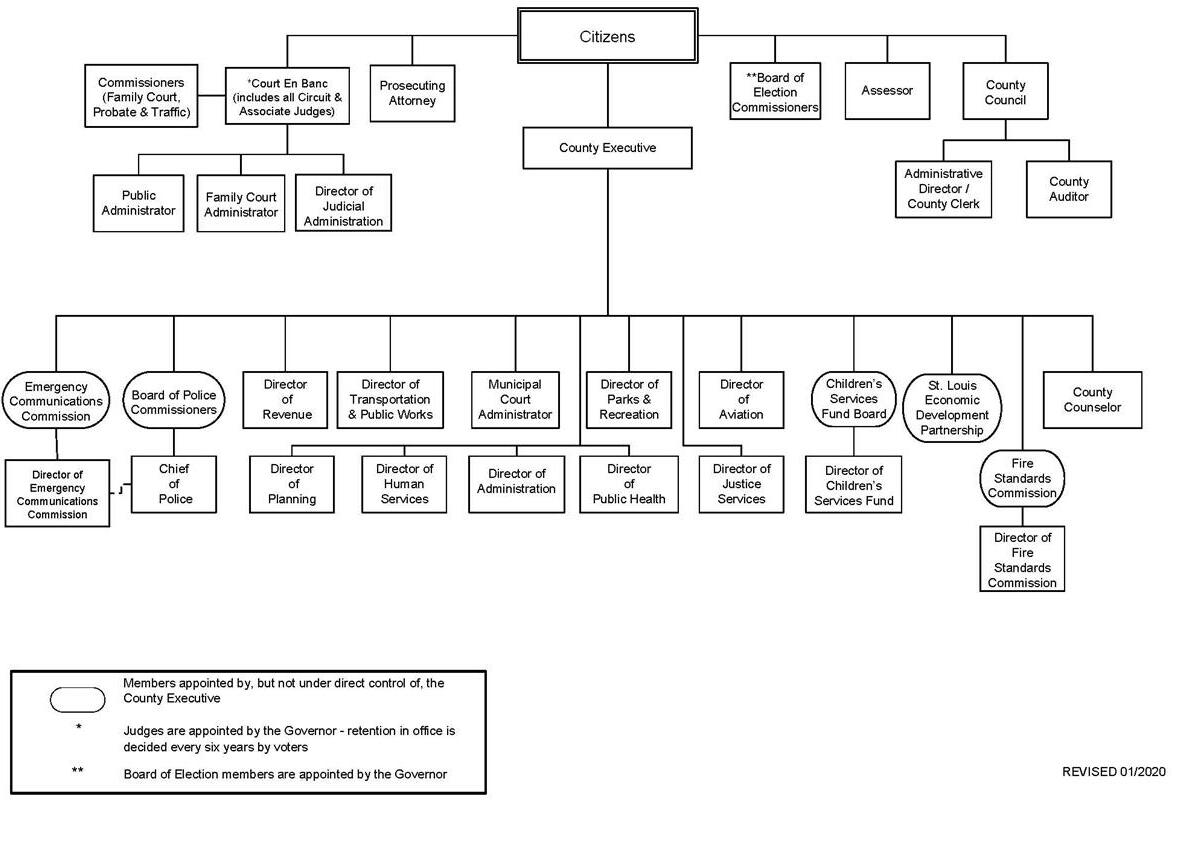

Government

Voters select the County Executive and a seven-person County Council to govern the county and work to provide high quality services to businesses and visitors. The Prosecuting Attorney and Assessor are also elected. Elected officials serve four-year terms.

Infrastructure

The county maintains the Spirit of St. Louis Airport, approximately 3,169 lane miles of roadway, 680 traffic signals, and 220 vehicle and pedestrian bridges. Visitors and residents alike enjoy 68 county parks, 166 miles of trails, 44 playgrounds, 65 athletic fields, and 7 recreation complexes

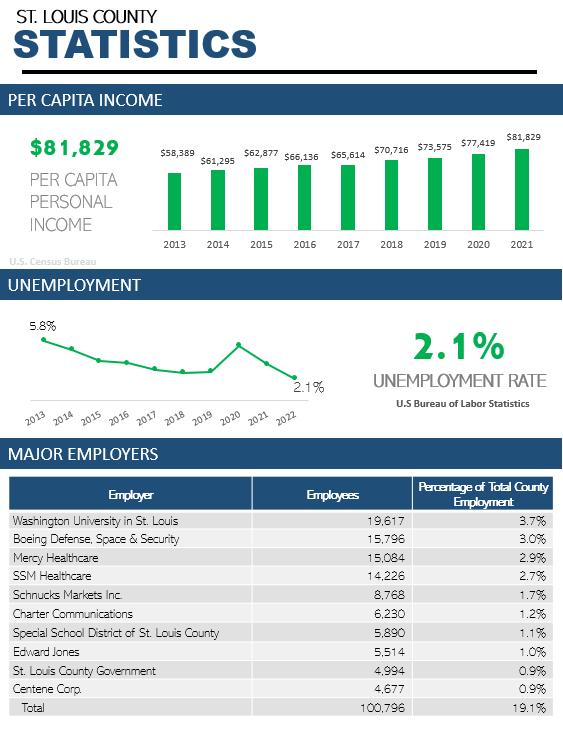

Economy

With a thriving business community and exceptional schools, St. Louis County provides a rich quality of life for its residents. In addition to its acclaimed cultural amenities, the county boasts the highest per capita personal income and educational attainment in Missouri and employs more people than any other county in the state.

St. Louis County’s 88 municipalities have primary responsibility within their jurisdictions for services such as public safety, planning and zoning, local street maintenance and building code enforcement. The unincorporated area, which contains nearly one-third of the county’s population and one-third of its area, comes under the direct jurisdiction of county government.

The county’s 24 school districts are independent governmental entities, as are the 25 fire protection districts, which share fire protection responsibilities with 19 municipal fire departments. Special service districts provide sewer, library, junior college, and cultural facilities within the county. Privately owned utilities provide electrical, natural gas, water, and telephone service.

The county operates as a first-class county of the State of Missouri governed by a charter, originally adopted in 1950. The elected County Executive serves as the chief administrative officer of the county. The legislative body is composed of a seven-member County Council. The county’s fiscal year begins on January 1st.

The county provides a wide range of services falling within three categories: 1) county-wide services, which are available on an equal basis to all residents of St. Louis County; 2) services to unincorporated areas; and 3) services to incorporated areas by contractual agreement. The county also owns and operates Spirit of St. Louis Airport as a self-supporting enterprise. Major services provided by the county include:

• Police protection

• Health care

• Environmental health

• Human services programs

• Public works

• Tax assessment

• Low-income assistance programs

• Judicial and justice services

• Parks and recreation

• Election administration

• Planning and zoning

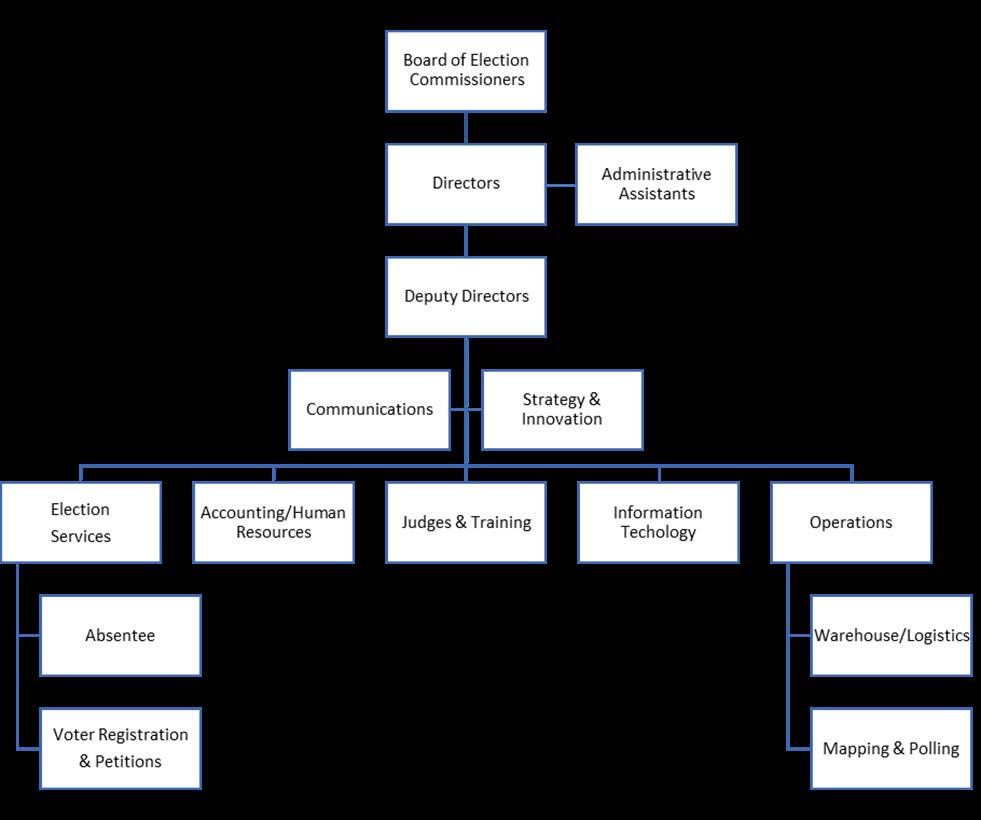

ST. LOUIS COUNTY GOVERNMENT: ORGANIZATIONAL CHART

ST. LOUIS COUNTY COUNCIL

District 4 Shalonda D. Webb (D) Chair

District 1 Rita Heard Days (D)

District 2 Kelli Dunaway (D)

District 5 Lisa Clancy (D)

District 6 Ernie Trakas (R)

District 4 Shalonda D. Webb (D) Chair

District 1 Rita Heard Days (D)

District 2 Kelli Dunaway (D)

District 5 Lisa Clancy (D)

District 6 Ernie Trakas (R)

Budgetary and Financial Policies and Guidelines

The fiscal year of St. Louis County is the twelve (12) months beginning on the first day of January in each calendar year. Such fiscal year shall constitute the budget and accounting year (301.020 SLCRO 1974 as amended)

Charter Requirements

Pursuant to the St. Louis County Charter, Article VIII, the County Executive must submit a balanced current expense budget to the County Council no later than 90 days prior to the beginning of each fiscal year. The budget must include a complete financial plan for all county funds and activities, including proposed tax rates, an estimate of all income and revenue and all proposed expenditures for current operations, debt service and a capital program.

The annual budget document does not include all funds reported in the audited financial statement. Grant funds, capital projects funds (except the Transportation Highway Fund), trust and agency funds or special revenue funds that have been authorized by ordinance by the County Council as available and appropriated as received are not included in the budget document. The fiscal year for these funds is not necessarily the calendar year, nor do the appropriations lapse at the end of each year

The budget document must include, by fund: (a) the estimated income and revenue of the fund for the budget year and (b) the estimated income and revenue of the fund during the fiscal year immediately preceding the budget year. The total expenditure proposed in the budget for each fund shall be no greater than the lesser of (a) and (b), plus any unencumbered cash balance in the fund at the end of the fiscal year immediately preceding the budget year. The County Executive may propose additional expenditures if he also proposes additional income and revenue, but such additional expenditures may not exceed

ninety percent of the estimated additional income and revenue to be received from taxes plus the total estimated additional income and revenue to be received from any other source.

Prior to adoption of the budget, the County Council holds at least one public hearing where interested citizens can comment on and ask questions regarding the proposed budget. The proposed budget is available for public inspection on the county’s web site (stlouiscountymo.gov) and at the Division of Performance Management and Budget (PMB) offices once it has been presented to the County Council. The final budget is typically adopted by county ordinance before December 31st. If the council fails to adopt the budget by that date, the amounts appropriated for the current fiscal year shall be appropriated for the new fiscal year on a month-to-month basis, until the council adopts a budget.

The County Executive and/or the County Council may propose supplemental or emergency appropriations during the year which are approved via ordinance. The County Executive may request County Council approval to transfer appropriations within the same fund and department during the fiscal year.

Every appropriation, except an appropriation from general obligation bonds of the county, shall lapse at the close of the fiscal year to the extent that it has not been expended or encumbered. Any cash surplus in any fund at the end of any fiscal year shall be carried forward and merged with the income of the fund for the succeeding year.

Budget Transfers and Amendments

The budget is a living document which is frequently adjusted to meet the changing demand for services during the fiscal year. Accordingly, budget transfers and amendments are part of a larger on-going budget monitoring process. Funding issues are addressed as they arise via budget transfers and amendments

pursuant to Section 8.050 of the County Charter which states:

Section 8.050. The council may by ordinance during any fiscal year make supplemental or emergency appropriations from available income and reduce or transfer appropriations. The county executive may request transfer of appropriations within any department during any fiscal year. These transfers must be approved by the council. The council shall, by ordinance, establish procedures to efficiently manage budget transfers and council approvals.

Budget transfers allow for an increase or decrease in any appropriation within the same fund and department, provided that total appropriations remain unchanged. Budget transfers are initiated by county departments and are reviewed and approved by the director of the requesting department and the Budget Director (as the County Executive’s designee). The transfer request is then submitted to the County Council for final approval.

Budget amendments allow for any change to appropriations that cannot be accomplished through a budget transfer. These situations include increasing or decreasing the total amount of appropriations and transferring appropriations between departments.

Typically, budget amendments appropriate revenues from a source not anticipated in the budget and received for a specific purpose. The process for obtaining a budget amendment begins with a department director requesting, through a formal letter, that the County Executive pursue legislation to implement the proposal. If the County Executive supports the request, he formally requests legislation from the County Council who considers the specific request through the legislative process. A budget amendment may also be initiated by the County Council itself. If the council approves the amendment in the form of an ordinance, and that ordinance is signed by the County

Executive, the appropriation changes are made to the proper budgets.

Emergency Fund

As required by Missouri law, St. Louis County’s annual budget shall include an appropriation in an amount not less than three percent of the total estimated general fund revenues in an emergency fund (RSMo 50.540). The County Council may, by resolution at any time upon recommendation of the County Executive, make transfers from the emergency fund appropriation account to any other appropriation account within the General Revenue Fund (302.070 SLCRO 1974 as amended). Transfers from the Emergency Fund may only be made for unforeseen expenses upon approval of the County Council.

Budget Guidelines

The St. Louis County annual budget process is a collaborative effort involving all county departments, PMB, and the County Executive. PMB serves as the link between departments and the County Executive.

Departmental involvement starts early in the process with the development of revenue estimates. Departmental estimates are then combined with PMB’s general revenue estimates. These estimates are added to fund balance estimates to determine the amount of funding available for appropriation. These numbers are monitored and updated throughout the budget process.

Budget guidelines are developed taking County Executive goals and objectives and available funding into consideration. Guidelines that include information for departments on the expected format of their budget requests and standardized costs are then prepared.

All budget requests are returned to PMB where they are reviewed for completeness and adherence to guidelines are then summarized by fund and compared to available funding.

FY24 BUSINESS PLAN DEVELOPMENT CALENDAR

Funds Included

(all dates 2023)

MARCH

1 Munis open for 2024 budget development (Projection #22401)

APRIL 26 Fiscal Manager Meeting

28 All position updates/corrections complete

MAY 12 2023-2028 revenue estimates due

15 Salary and Benefit Projection created (Run #124)

31 Department review/update to business plan narrative (mission, core business functions, program descriptions, org charts) complete

JUNE

1 Budget Kickoff Video released (via LinkedIn Learning)

23 Small department budgets (see table below) due in Munis and supporting documents (including Capital Improvement Program (CIP) and grants list) submitted to PMB.

30 Budget Level 1 (department request) closed

JULY

7 Budget Level 2 (department director) closed

Large department budgets (see table below) due in Munis and supporting documents (including CIP and grants list) submitted to PMB

10-21 Small department budget meetings

AUGUST

7-18 Large department budget meetings

SEPTEMBER

8 Deadline for final budget decisions

29 County Executive’s Recommended Business Plan submitted to County Council

OCTOBER-NOVEMBER

TBD Council Budget Oversight Committee Hearings

TBD Council Budget Public Hearing

DECEMBER

TBD Council adopts budget

The budget process has been developed to give PMB information regarding a department’s needs, desires, and priorities so that a recommended county budget can be developed that falls within the available funding parameters and the goals and objectives determined by the County Executive. Often this is accomplished by requesting multiple budget scenarios and proper documentation from departments.

Once approved by the County Executive, a recommended budget is submitted to the County Council for their approval. Prior to voting on the recommended budget, the County Council holds a hearing to receive any comments regarding the budget from the public. The council also meets as a Committee of the Whole to hold hearings with all county departments.

The legal level of control at which actual expenditures may not exceed the budget is at the department level within the general funds and at the fund level for all other budgeted fund types.

Financial Policies

The accounting policies of the county conform to Generally Accepted Accounting Principles in the United States of America (GAAP) applicable to governmental entities. The following is a summary of significant accounting policies:

Financial Structure

The county’s financial structure is organized based on funds, each of which is considered a separate accounting entity with self-balancing accounts that comprise its assets, liabilities, fund balances/net assets, revenues and expenditures, or expenses. Governmental resources are allocated to and accounted for in individual funds based upon the purposes for which they are to be spent and how spending activities are controlled.

The following fund types are used by the county:

Governmental Fund Types

Governmental funds are those through which most governmental functions are financed. The acquisition uses and balances of the county's expendable financial resources and the related liabilities (except those accounted for in proprietary funds) are accounted for through governmental funds. The measurement focus is on determination of and changes in financial position rather than upon net income. The following are the county's budgeted governmental funds:

o General Funds - The general funds are the general operating funds of the county. They are used to account for all financial resources except those required to be accounted for in another fund. The general funds include five unique funds: General Revenue Fund, Special Road & Bridge Fund, Health Fund, Park Maintenance Fund, and the NFL Settlement Fund.

o Special Revenue Funds – Special revenue funds are used to account for specific revenues that are legally restricted to expenditures for specific purposes.

o Debt Service Fund - The Debt Service Fund is used to account for the accumulation of resources for, and the payment of, long-term debt principal, interest, and related costs.

o Capital Improvement Program Funds –Used to account for revenues and expenses of capital construction programs.

o Proprietary Fund Types

Proprietary funds are used to account for activities that are like those found in the private sector. The measurement focus is on the determination of net income, changes in net assets (or cost

recovery), financial position, and cash flows.

The county applies all applicable Governmental Accounting Standards Board (GASB) pronouncements as well as the following private-sector pronouncements issued on or before November 30, 1989, unless these pronouncements conflict with or contradict GASB pronouncements: Financial Accounting Standards Board (FASB) Statements and Interpretations, Accounting Principles Board (APB) Opinions, and Accounting Research Bulletins (ARBs) of the Committee on Accounting Procedure.

Measurement Focus and Basis of Accounting and Budgeting Measurement focus refers to when revenues and expenditures or expenses are recognized in the accounts and reported in the basic financial statements. Basis of accounting relates to the timing of the measurements made, regardless of the measurement focus applied.

Governmental fund financial statements are reported using the current financial resources measurement focus and the modified accrual basis of accounting.

Under the modified accrual basis of accounting, revenues are recorded when both measurable and available. The term "available" is defined as collectible within the current period or soon enough thereafter to be used to pay the liabilities of the current period. For the county, “available” is defined as expected to be received within sixty days of fiscal year-end. Expenditures generally are recorded when a liability is incurred, as under accrual accounting. However, debt service expenditures, as well as expenditures related to compensated absences and claims and judgments, are recorded only when payment is due (i.e., matured).

The county recognizes assets from derived tax revenue transactions (such as sales and utilities

gross receipt taxes) in the period when the underlying exchange transaction on which the tax is imposed occurs or when the assets are received, whichever occurs first. Revenues are recognized, net of estimated refunds and estimated uncollectible amounts, in the same period that the assets are recognized, provided that the underlying exchange transaction has occurred. Resources received in advance are reported as deferred revenues until the period of the exchange.

The county recognizes assets from imposed nonexchange revenue transactions (such as real estate and personal property taxes) in the period when an enforceable legal claim to the assets arises or when the resources are received, whichever occurs first. Revenues are recognized in the period when the resources are required to be used or the first period that use is permitted. The county recognizes revenues from property taxes, net of estimated refunds and estimated uncollectible amounts, in the period for which the taxes are levied. Imposed nonexchange revenues also include permits and court fines and forfeitures.

Intergovernmental revenues, representing grants and assistance received from other governmental units, are generally recognized as revenues in the period when all eligibility requirements, as defined by GASB 33, have been met. Any resources received before eligibility requirements are met are reported as deferred revenues.

Charges for services in the governmental funds are exchange transactions and are therefore not subject to the provisions of GASB 33. They are recognized as revenues when received in cash because they are generally not measurable until received.

Proprietary funds distinguish operating revenues and expenses from non-operating items. Operating revenues and expenses generally result from providing services and producing and delivering goods in connection

with a proprietary fund's principal ongoing operations. Transactions which are capital, financing, or investing related are reported as non-operating revenues. Interest expense, financing costs, and miscellaneous expenses are reported as non-operating expenses.

The budget is prepared in conjunction with the modified accrual accounting policies practiced by St. Louis County.

Encumbrances

Within the governmental funds, fund balance is reserved for outstanding encumbrances, which serves as authorization for expenditures in the subsequent year. Encumbrances will remain in force and will be liquidated under the current year’s budget.

Cash and Investments

The County Treasurer maintains a cash and investment pool that is available for use by all funds, except certain restricted Special Revenue and Agency Funds. Investment income earned on pooled cash and investments is distributed to the appropriate funds based on the average daily balance of the cash and investments of each fund. In addition, cash and investments are separately maintained by other county

officials, several of the county's departments, and third-party trustees and fiscal agents.

Property Taxes

Property taxes are levied annually in October based on the assessed valuation of all real and personal property located in the county as of the previous January 1. The current county tax rate is $0.418 per $100 of assessed valuation for residential real estate. Taxes are billed in November and are due and collectible on December 31. All unpaid taxes become delinquent on January 1 of the following year and attach as an enforceable lien on the property at that date.

Capital Assets

Capital assets include buildings, improvements, equipment, and infrastructure assets (e.g., roads, bridges, and similar items). Capital assets are defined by the county as assets with an estimated useful life greater than one year with an initial, individual cost of $5,000 or more; land improvements with a cost of $5,000 or more; infrastructure (other than roads or bridges) with a cost of $50,000 or more; roads, bridges, and improvements to roads and bridges with a cost of $500,000 or more; and all land.

St. Louis County, Missouri

Financial Organization Chart: 2024 Recommended Budget

ST. LOUIS COUNTY 2024 BUDGET - FUND ANALYSIS

Notes To 2024 Budget – Fund Analysis

• The 2022 Ending Fund Balance: Budget Basis is generally lower than the fund balance reported in the 2022 Annual Comprehensive Financial Report (ACFR) because it is reduced by existing encumbrance balances and amounts reserved for potential payout of sick and vacation time for future retirees.

• The calculations of the 2023 Estimated Fund Balance Ending can be found in Table I (Summary Tables Chapter)

• The 2024 Estimated Revenue & Transfers may be different than the amount of estimated income used to calculate the dollars available for appropriation (see the Table I calculation for each fund). Per the County Charter, the amount of income available for appropriation is the lesser of the current year's estimate (2023) or the budgeted year's estimate (2024). This generally has the effect of reducing the amount available to appropriate and therefore the final approved budget.

• The Estimated Fund Balance Ending 2024 does not reflect an estimate of appropriations that remain unspent at the end of the fiscal year. While this varies by fund, the average lapse or “return” for all general funds averaged 9.9% over the past five years.

ST. LOUIS COUNTY, MISSOURI COMBINED STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE 2022 ACTUAL ($ in thousands)

^Beginning/Ending Balance reflects the budget basis, which is generally lower than the fund balance reported in the Annual Co mprehensive Financial Report (ACFR) because it is reduced by existing encumbrance balances and other adjustments.

*Adjustments reflect changes in encumbrances, compensated absence balances, restricted funds, and other misc. adjustments.

ST. LOUIS COUNTY, MISSOURI COMBINED STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE 2023 ESTIMATED ($ in thousands)

*Transfers In for General Funds include ARPA revenue loss allocations and reimbursements from bond proceeds. Transfers in for Special Revenue Funds include allocations from the Insurance Administration Fund and reimbursements from bond proceeds.

Capital Funds are adjusted for projects budgeted prior to 2022.

*Reserve for

ST. LOUIS COUNTY, MISSOURI

COMBINED STATEMENT OF REVENUES, EXPENDITURES, AND CHANGES IN FUND BALANCE 2024 RECOMMENDED BUDGET ($ in thousands)

2023-2028 LONG-TERM FORECAST – GENERAL REVENUE FUND (1010)

Purpose

The purpose of the long-term forecast is to provide a forward-looking view of the General Revenue Fund, allowing for evaluation of the long-term sustainability of the annual budget. The forecast also provides a starting point for future budgetary decision-making by identifying the balance between potential spending needs and projected revenues.

This long-range forecast is an important financial planning tool that is updated throughout the year as new information about revenues and spending becomes available. This information is used to:

• Incorporate necessary budget adjustments into long-range financial projections

• Ensure that both additions and reductions to the budget are sustainable

• Maintain options to deal with unexpected contingencies

• Continue advance planning to anticipate factors affecting revenues and service needs

There are many factors that can impact this forecast, including changes in the real estate market, changes in economic conditions, changes in the costs of goods and services, and unforeseen events such as natural disasters to name a few. Therefore, it is important that this projection be viewed only as an estimate of what the future could look like given what is known today

Assumptions

Revenue is estimated to increase by 4.8% in 2023 driven by increases in investment earnings, property tax, sales tax (including the new sales tax on recreation marijuana), and one-time revenues from legal judgments and the sale of real estate. In 2024 revenues are projected to grow by 2.3% due to restoration of the property tax rate to the 2022 level, the transfer of property tax levy from the Debt Service Fund, and annualization of the new marijuana sales tax.

General Revenue Fund (1010)

Note: the increase in the Ending Balance in 2021 and 2022 is due to the transfer-in of federal CARES-CRF and ARPA-SLFRF COVID relief funds

Revenues are projected to increase by an average of 1.0% from 2025 through 2028. This forecast is based on the following assumptions:

• Property values will grow, but the county’s revenue will be limited in reassessment years to the prior year’s revenue plus an inflationary adjustment. Any tax rate reductions in reassessment (odd-numbered) years will not be restored in the subsequent (even-numbered) year

• Sales tax revenues will grow by 2% per year

• All other sources fluctuate minimally each year.

• No allocations of the NFL Settlement Fund are included.

Expenditures are projected to increase 16.4% in 2023 and decrease by 5.0% in 2024. A portion of this fluctuation is due to $29.8 million in one-time spending in 2023 on police capital facilities and the demolition of Jamestown Mall Between 2025 and 2028, spending is estimated to increase an average of 3.5% per year based on the following assumptions:

• Public safety salaries will increase pursuant to collective bargaining agreements, and the budget will include a merit pay program for

other employees each year. The number of funded positions remains unchanged from 2025-2028. This forecast does not include the potential cost of addressing or correcting pay issues such as comparison to the market rate, compression, etc.

• Fringe benefit costs increase 4.0% per year to allow for growth in employee retirement and health care costs. This forecast does not include additional retiree cost of living adjustments

• Costs for purchased services, commodities and supplies, and capital outlays are projected to increase slightly each year (1%)

• Projections for the transfer payments category fluctuate to accommodate the number of elections budgeted in each year.

Fund Balance / Reserve

The budget is projected to be in a structural deficit position each year moving forward. This will draw fund balance down below the 10% reserve policy in 2025 and the budget will no longer be sustainable without significant changes in 2026.

EXECUTIVE SUMMARY

REVENUES: WHERE THE MONEY COMES FROM

See the Revenue Forecast chapter of this document for detailed information on revenues

Total revenue in all budgeted funds is projected to be $916.2 million in 2024, an increase of $25.0 million or 2.8% from the 2023 revised estimate of $891.2 million. Revenue from taxes (property, sales, utility gross receipts, casino, emergency telephone, and hotel/motel) account for 72.2% of the total. The remaining 27.8% is composed of revenue generated through program activities, intergovernmental (state/federal) revenue, and other sources. Over half (55.7%) of all revenues collected are received in the general funds, and nearly one-fifth (20.3%) are dedicated for public transportation purposes. The remaining revenues are received in special revenue, enterprise, debt service, and transportation capital construction funds.

2024 PROJECTED REVENUES BY CATEGORY

Highlights of the 2024 revenue projection include:

• An increase of $7.2 million or 5.3% in property tax revenues due to the restoration of tax rates to the 2022 level. This will provide additional revenue to support County operations and help offset the projected General Revenue Fund deficit in 2024.

• Transfer of 1.4 cents of property tax levy from the Debt Service Fund to the General Revenue Fund ($4.0 million annual revenue impact).

• Sales tax revenues increase by $11.9 million or 2.6% due to projected 2% base growth and annualization of the 3.0% sales tax on the sale of recreational marijuana that will be collected starting in the 4th quarter of 2023.

• Elimination of $8.0 million of one-time revenues received in 2023 related to a utility gross receipts tax legal judgment ($4.5 million) and the sale of real estate ($3.5 million).

Total Revenue by Category ($ in millions)

The county’s largest sources of revenue are sales tax and property tax. The county’s ten sales taxes produce 51.0% of all projected revenue in the budget while property tax produces another 15.6%.

Sales tax revenues are estimated to increase by $9.6 million or 2.2% in 2023 and another $11.9 million or 2.6% in 2024. Estimates include 2% base revenue growth along with the implementation of the “Prop M” 3% tax on the sale of recreational marijuana ($0.8 million in 2023 and $3.0 million in 2024). These revenues are closely monitored, and estimates are adjusted throughout the year as new data becomes available.

2024 Projected Sales Tax Revenue ($ in millions)

The 2024 proposed property tax rate restores rates back to the 2022 level at 41.8 cents per $100 of assessed valuation for residential real estate. In addition, 1.4 cents of the tax rate are recommended to be transferred from the Debt Service Fund to the General Revenue Fund

Property tax revenue is projected to increase by $7.2 million or 5.3% in 2024.

Although taxpayers submit their entire property tax bill to the St. Louis County Collector of Revenue, the county distributes most of this money to other taxing districts, including school districts, municipalities, fire districts, etc. In 2022, property taxes supporting county operations and debt service were responsible for 4.6% of the average taxpayer’s bill.

APPROPRIATIONS: WHERE THE MONEY GOES

The 2024 recommended budget for all funds is $1,025,568,521, a decrease of $21,593,583 or 2.1% 1 . This budget supports all operating departments of the county, highway capital projects, the Spirit of St. Louis Airport, debt service obligations, and distributions to Bi-State/Metro for public transportation but does not include grant funds or trust and agency funds which are appropriated by the County Council when received.

The budget is organized within funds, each of which functions as a separate “checkbook” with various legal and operational requirements. The 2024 recommended budget includes appropriations from 24 funds, with 57.9% coming from the general funds which are the main operating funds of county government.

The “operating budget” (see table above) is the primary means by which most of the financing, acquisition, spending, and service delivery activities of the county are controlled. The recommended operating budget is $763,740,340, a decrease of $13,883,146 or 1.8% The largest area of spending is Public Safety (38.1%) while the largest type of expenditure is salary and fringe benefits (55.9%) (see charts, below).

The budget for each department/office is discussed below. The budget maintains existing programs and service levels, however there are several changes that impact most departments and offices:

• An increase of $4.4 million will provide for employee pay increases in 2024 except for elected officials and employees covered by collective bargaining agreements (who receive increases per the terms of their agreement).

• A decrease of $758,052 due to updated costs for retirement, medical insurance, worker’s compensation, and unemployment compensation.

• Elimination of $24.3 million of “turnover and hiring lag” appropriation reductions made by the County Council during the 2023 budget process. The recommended budget fully funds each position for 12 months.

OPERATING

OPERATING

POSITIONS

The budget funds 4,926 positions or 4,586.7 full-time equivalents (FTE), a decrease of 4 positions and an increase of 5.5 FTEs compared to the 2023 adjusted level. Economic

Health

BUDGET SUMMARIES

The following summaries provide an overview of the budget organized by functional area. These functional areas include Economic Development and Infrastructure, Health and Well-Being, Public Safety, Recreation and Culture, and General Government. More detailed information on each department’s budget, priorities, and performance measurements can be found within each department or office’s narrative later in this document.

Economic Development & Infrastructure

St. Louis Economic Development Partnership

The St. Louis Economic Development Partnership is the regional economic development organization which attracts, retains, and facilitates growth of businesses in St. Louis County and City. The Partnership works with economic development partners to help companies of all sizes thrive in the St. Louis region. The Partnership serves as the convener of strategic regional economic development initiatives.

The St. Louis Economic Development Partnership is responsible for the management of:

• Attracting, retaining, and growing businesses and jobs and increasing capital investment

• Advancing community investment, The St. Louis Promise Zone, and redevelopment of strategic real estate assets

• Supporting startups and the entrepreneurial communities and facilitating access to resources

• Accelerating growth of the region’s foreign-born populations through the Mosaic Project

• Increasing foreign trade and investment

• Facilitating major economic development projects

The 2024 recommended county investment in the partnership is $4,486,000 – no change from the 2023 level.

Department of Planning

The mission of the Department of Planning is to foster healthy communities by guiding development and reinvestment, developing long-range plans, promoting citizen engagement, and using data and information technology to guide public policy. Core business functions of the department include the management of:

• Administering the Zoning and Subdivision Ordinances

• Preparing community plans, small area studies, and other small geography planning documents

• Preparing the County’s Comprehensive Plan and guiding its implementation

• Monitoring annexations and municipal boundary changes throughout the County

• Processing petitions for changes in zoning and other special procedures as outlined in the Zoning Ordinance

• Site development plan and subdivision plat review

• Staffing of the Planning Commission and Board of Zoning Adjustment

• Subdivision and land disturbance escrow management

• Home day care licensing

• Outreach and planning in targeted communities

• Serves as the County’s liaison to the Boundary Commission

• Responding to citizen inquiries

The 2024 recommended budget for the Department of Planning is $1,053,879, a decrease of $916,582 or 46.5%. The budget decreases due to the elimination of a one-time appropriation of $1 million in the 2023 budget to update the county’s Comprehensive Plan.

Spirit of St. Louis Airport

The Spirit of St. Louis Airport provides a safe, efficient, dependable, and attractive firstclass public facility that professionally serves the users and tenants. The airport strives to maintain its role as a major air transportation facility for the St. Louis region while continuing to be a responsive and responsible neighbor to the surrounding community.

Spirit of St. Louis Airport is a Federal Aviation Administration (FAA) Air Carrier Certified Airport and is responsible for the management of:

• A self-supporting enterprise fund through the sale of jet fuel

• A 7,485-foot all-weather runway

• A 5,000-foot parallel runway

• Precision Instrument Landing System (ILS) approaches

• FAA Control Tower

• 24-hour United States Customs Service

• 24-hour Airport Police Service

• 24-hour Aircraft Rescue Firefighting response service

The 2024 recommended budget for the Spirit of St. Louis Airport is $37,940,914, an increase of $1,892,794 or 5.3%. The budget includes $4.0 million to replace the West Terminal and $400,000 for safety management systems updates and design services for the north runway.

Department of Transportation & Public Works

The mission of the Department of Transportation and Public Works is to promote the health, safety and well-being of St. Louis County residents by providing a transportation system that supports multi-modes and encourages regional growth and opportunity; enforce internationally accepted building and property maintenance codes reasonably and judiciously for public health, safety and protection; provide customer friendly building spaces in which to conduct county business; and, support innovative problem solving that enhances public service.

The Department of Transportation & Public Works is responsible for the management of:

• Planning, design, construction, inspection, operation, and maintenance of 3,169 lanemiles of road

• 220 vehicle and pedestrian bridges

• 1000+ crossroad culverts

• 1,300 miles of sidewalks

• 47 miles of dedicated on-street bicycle lanes

• 13 miles of signed bicycle routes

• 680 signals and beacons

• 250,000 signs

• 35 owned buildings (2.9M gross ft2)

• 16 building leases (0.3M gross ft2)

• Review of 14,400 plan sets

• Issuance of 57,300 permits

• 139,400 construction inspections

• 18,400 re-occupancy inspections

• 8,400 property maintenance inspections

• Monitoring of over 1,200 vacant nuisance properties

• Mowing of 2,600 vacant lots

The 2024 recommended budget for the department is $113,978,424, a decrease of $1,674,418 or 1.4% (not including the Highway Capital Construction Program which is summarized at the end of this chapter). The budget includes a decrease of $5,540,000 for the one-time cost of a consultant contract for Project Cornerstone and an increase of $1,690,000 to outsource maintenance of the Justice Center. The budget also eliminates $1,821,490 of turnover and hiring lag appropriation reductions that were included in the 2023 budget.

• Capital and operating budget development and oversight

• Supply acquisition and safety training

• Maintenance of 3,557 vehicles, trucks, and engine-powered equipment

• Maintenance of 2 county-owned parking garages

• Fuel supply for county vehicles/equipment and municipal fleets by contract

• Contract management of water service line repairs on qualifying residential lines within St. Louis County

• Contract management of sewer lateral line repairs in unincorporated St. Louis County and within municipalities by contract.

• Construction management for department administered road and bridge projects

• Inspection for all Special Use Permits issued for work in the public right of way

Health & Well-Being

Children’s Service Fund

The Children’s Service Fund (CSF) works to improve the lives of children, youth, and families in St. Louis County by strategically investing in the creation and maintenance of an integrated system of care that delivers effective and quality mental health and substance use treatment services.

The Fund is responsible for:

• Strategic investments of sales tax revenue

• Ensuring accountability of sales tax revenue through programmatic and financial review of funded agencies

• Evaluating service gaps through community needs assessments, data analysis, and stakeholder engagement

• Developing strategic partnerships with other agencies

• Supporting non-profit agencies through capacity building and technical assistance

The 2024 recommended budget for the Children’s Service Fund is $65,226,406, a decrease of $18,772,434 or 22.3%. This decrease is due to a $20,000,000 reduction for core funding and special programs as approved by the CSF Board.

Department of Human Services

The Department of Human Services is committed to providing the support, services, and resources that help individuals of all ages live safely, productively, and independently.

The Department is responsible for the management of:

• Providing services for homeless and potentially homeless individuals and families

• Assisting county older residents with maintaining independent living and quality of life

• Providing information, referrals and case management services for veterans and their families

• Providing community-based intervention, case management, mental health and youth development services for at-risk children and youth

• Operating a 39-bed residential domestic violence shelter for abused women and their children

• A full spectrum of employment services for job seekers and employers funded by the Department of Labor (not included in this budget)

• Increasing Sustainable Economic and Housing Options for Marginalized Populations through federally funded programs (not included in this budget)

The 2024 recommended budget for the department is $4,702,831, an increase of $1,006,706 or 27.2%. The budget includes an increase of $101,877 for warming and cooling shelters, a reduction of $76,756 from grant reimbursements, and the elimination of $681,065 of turnover and hiring lag appropriation reductions that were included in the 2023 budget.

Public Administrator

The Office of the Public Administrator is established by state law to serve as guardian, conservator, personal representative, executor, and other necessary roles upon appointment by the Probate Court. The Public Administrator shall take into their charge and custody the estates of incapacitated and disabled individuals, the estates of deceased individuals, and the estates of minors, promoting the selfworth of each individual as well as preserving, protecting, and managing their assets. The office strives to install values of advocacy, dignity, empathy, and integrity into their everyday work while serving the most vulnerable citizens of the county.

The Office of Public Administrator is responsible for the management of:

• Guardianship of incapacitated and disabled individuals

• Conservatorship of the estate and assets of incapacitated and disabled individuals

• Conservatorship of the estate and assets of minors

• Administering the estates of deceased persons

• Collaborating with state and community-based resources to improve services

• Educating the community through personal interaction and community involvement

• Advocating and influencing public policy for the welfare of words and protectees

The 2024 recommended budget for the Office of the Public Administrator is $1,049,928, an increase of $49,025 or 4.9%. The budget includes an additional Deputy Public Administrator position to fulfill the office’s additional needs due to increased caseloads.

Department of Public Health

The Department of Public Health works to promote, protect, and improve the health and environment of the community. The department’s vision is that St. Louis County has healthy people, a healthy environment, and equitable communities. The department believes in:

• Being a public health leader in the community

• Providing equitable access to services and resources

• Being responsive to the changing needs of the community

• Operating in an ethical, transparent, and fiscally responsible manner

• Serving the community with dignity and respect.

The Department of Public Health is responsible for the management of:

• Assessing and monitoring the health status of the population and making information available to the public on communicable and chronic diseases, emerging epidemics, and the social and structural determinants of health

• Assessing health hazards and their root causes, and the environmental status of the community while making information available to the public on conditions that may contribute to health outcomes

• Preparing for emergencies that may affect the health of the public and participating in deploying a trained public health workforce in the event of any emergency, disaster, or epidemic

• Ensuring the effective enforcement of all codes, ordinances, and best practices related to protecting the health of the public

• Ensuring equitable availability of services, programs, and access to care necessary to the population based on their health needs either through the direct provision of services or through effective community linkages and partnerships

• Controlling or contracting the operation of all direct clinical services provided by the county including medical care, dental care, preventative care, mental and behavioral health, and treatment of infectious diseases

• Informing and educating the population and acting as a community resource on health-related topics

• Recommending to the governing entities from time to time such policies as will tend to preserve or promote the public health of the county

• Strengthening, supporting, and mobilizing community partnerships and cooperative relationships with neighboring jurisdictions, state and federal agencies, and local and national organizations for the promotion and protections of the public health of the population

The 2024 recommended budget for the Department of Public Health is $84,980,604, an increase of $4,178,956 or 5.2%. The budget eliminates 26 positions and $5,421,195 of turnover and hiring lag appropriation reductions that were included in the 2023 budget.

Public Safety

Emergency Communications Commission

The St. Louis County Emergency Communications Commission (ECC) provides a coordinated council of department leaders from public safety agencies and local government entities, with an emphasis on providing interoperable communications that allow firefighters, emergency management services, police, and other groups to better manage incidents by sharing vital information in a rapid fashion.

The Commission is responsible for the management of:

• Countywide interoperable radio communications

• Upgrading 911 communications in the county

• The Emergency Outdoor Warning Siren network

• Management and support of ESInet (emergency services internet protocol network) and MPLS (multiprotocol label switching) networks

The 2024 recommended budget for the commission is $19,167,556, a decrease of $466,440 or 2.4%. This decrease is driven by a reduction in the cost of maintaining telephone equipment.

Department of Judicial Administration

The Department of Judicial Administration serves the citizens of St. Louis County by providing access to a fair, impartial, prompt, and cost-effective system of justice that ensures that all are treated with courtesy and dignity, and that fosters the respect and confidence of the public in an independent judicial system. Funding, other than salaries and benefits for judges and Circuit Clerk personnel and costs of the Law Library, is provided by the County as mandated by state law.

The Department of Judicial Administration is responsible for the management of:

• Providing access to justice using jury and bench trials

• Alternative treatment courts to serve veterans, individuals with substance use disorders (including opioid addiction), mental health issues, alcohol-related driving offenses and domestic violence issues

• Substance Abusing Families Engaged in Treatment and Intervention (SAFETI) Court to provide close monitoring of parents with substance abuse problems who have children involved in the child welfare system

• Execution of court orders for attachment, replevin, levy under general execution, eviction, and garnishment of execution

• Execution of court orders to apprehend and transport alleged mentally ill, dangerous, and/or incompetent persons to and from mental health facilities and court for hearings

• Programs and services to protect children from abuse and neglect

• Programs and services for delinquent youth

• Prosecution of juvenile delinquency matters

• Safe and secure custody of juveniles within the Court’s Juvenile Detention Center

• Multi-lingual automated assistance and referrals for victims of domestic violence

• Free marriage ceremonies for all couples who come to the courthouse with a St. Louis County marriage license

• Expanded community partnerships to provide support, counseling, and alternatives to detention for court-involved youth

• The Exchange Center, which provides a safe, secure environment for the transfer and supervision of children in families with court-ordered visitation

• The Parent Education Program to help adults understand and cope with the impact of separation and divorce on their children

The 2024 recommended budget for the Department of Judicial Administration is $34,046,235, an increase of $612,450 or 1.8%. The recommended budget includes four new detention deputy juvenile officer positions due to increases in the detention population.

Department of Justice Services

The mission of the Department of Justice Services is to serve and protect the community by means of a trained and dedicated workforce, and utilizing best practices to provide supervision, rehabilitation, and opportunities in a safe, secure, and humane environment.

The department is responsible for:

• Serving and protecting the community

• Providing custody, supervision, and guidance to those persons who are mandated to county jurisdiction

• Maintaining the highest level of security ensuring the safety of the community, residents, and staff

• Providing a safe, healthy, and humane environment for detainees and staff

• Encouraging detainees to grow academically, physically, socially, and vocationally

• Providing educational, recreational, religious, and vocational programs

• Advancing staff supervision and leadership

• Supporting the return of detainees back into the community

• Performing human resources, fiscal management, accreditation standards, internal affairs, and programs for detainees and those released

• Processing of all arrested persons conveyed to the Intake Center including warrant data, records checks, fingerprinting, mug shots, classifications, and release authorizations

• Supervision of all resident transfers to courts, clinics, hospitals, and state prisons

The 2024 recommended budget for the Department of Justice Services is $37,422,661, an increase of $7,772,885 or 26.2%. The budget includes $1,898,312 to annualize 12 Corrections Officer positions added during 2023 and provide funding for 16 new Correction Officer positions in 2024. The budget also includes an additional $884,000 for the food service contract due to a jail higher population and new contract pricing, and the elimination of $3,259,991 of turnover and hiring lag appropriation reductions that were included in the 2023 budget.

Municipal Court

The Municipal Court seeks to resolve all municipal cases in an expedient, fair, and unbiased manner while upholding the integrity of the court as a court of law, the ordinances of the county, the laws of the state, and the Missouri and United States Constitutions. Part of the court’s mission is to provide impeccable customer service and maximize access to the court for all citizens of St. Louis County and all that have a need to conduct business with the court.

The Municipal Court is responsible for the management of:

• Providing a safe place for the peaceable resolution to a dispute

• Ensuring fair and unbiased justice is carried out in all cases

• Adjudicating cases between parties where the defendant is accused of violating a local county ordinance or that of a municipality contracted with the court for court services

• Maintaining a complete and accurate record of events in all cases

• Collection of lawfully assessed court fines and costs

The 2024 recommended budget for the Municipal Court is $1,946,841, an increase of $452,810 or 30.3%. The budget includes an increase of $21,900 for computer equipment, an increase of $61,982 for the county’s self-insurance program, and funds to annualize salary and position changes approved during 2023.

County Police Department

The mission of the St. Louis County Police Department is to work cooperatively with the public, and within the framework of the Constitution, to enforce the laws, preserve the peace, reduce fear, and provide a safe environment in our neighborhoods.

The department is responsible for the management of:

• Police protection through the patrol of communities and Metro Link Transit services

• Neighborhood police officers and school resource officers supporting the community

• Crisis Intervention Team (CIT) trained officers throughout the department to deescalate mental health crises

• Crisis negotiation team to respond to mental health barricaded subjects to deescalate without SWAT

• Community engagement through youth and diversity and inclusion programs

• Investigation of crimes within St. Louis County

• Crime Laboratory scientific support of criminal investigations

• Collect and disseminate criminal intelligence throughout the region via the St. Louis Fusion Center

• Air patrol though a cooperative agreement with the St. Louis Metropolitan Police and St. Charles County Sheriff Departments

• Emergency 911 calls received and dispatched by the Bureau of Communications

• Police recruit training and continuing education for current staff at the County and Municipal Police Academy

• Security services provided to all St. Louis County government buildings

• Response plans for countywide emergency situations with the Office of Emergency Management

The 2024 recommended budget for the department is $183,325,931, a decrease of $9,807,389 or 5.1%. The budget includes an increase of $6,366,255 to fund pay increases as required by existing collective bargaining agreements and $1,998,581 to replace high mileage vehicles. The budget eliminates $7,690,568 of turnover and hiring lag appropriation reductions that were included in the 2023 budget, $23,800,000 for one-time matching funds for capital facilities, and $718,000 for ShotSpotter.

Prosecuting Attorney

The Prosecuting Attorney represents the citizens of St. Louis County by fairly and effectively prosecuting violations of state criminal statutes, promoting public safety, empowering victims of crime, and building a safe community for everyone. The Prosecuting Attorney’s Office promotes public safety by protecting the community from those who commit violence, providing pathways to treatment for people with substance use and mental health challenges, and establishing trust with the communities it serves.

The Prosecuting Attorney is responsible for the management of:

• Warrant application process (to include review and charges)

• Criminal Case Management from inception to closure

• Traffic Case Management from inception to closure

• Alternative Court Management (Drug Court, DWI Court, Mental Health Court, Veteran’s Court)

• Diversion Program Management

• Victim Services Management

• Child Support Services

• Taxes and Bad Check Collection

• Community Engagement

• Grand Jury hearings and administration

• Conviction Incident Review Unit

• Operation of two satellite offices within local police departments

Wesley Bell St. Louis County Prosecuting Attorney

The 2024 recommended budget for the Prosecuting Attorney is $15,435,428, an increase of $602,377 or 4.1%. The budget includes a decrease of $695,163 for insurance costs, the elimination of $1,075,431 of turnover and hiring lag appropriation reductions that were included in the 2023 budget, and the addition of $90,000 to replace two high-mileage vehicles.

Recreation & Culture

(in thousands)

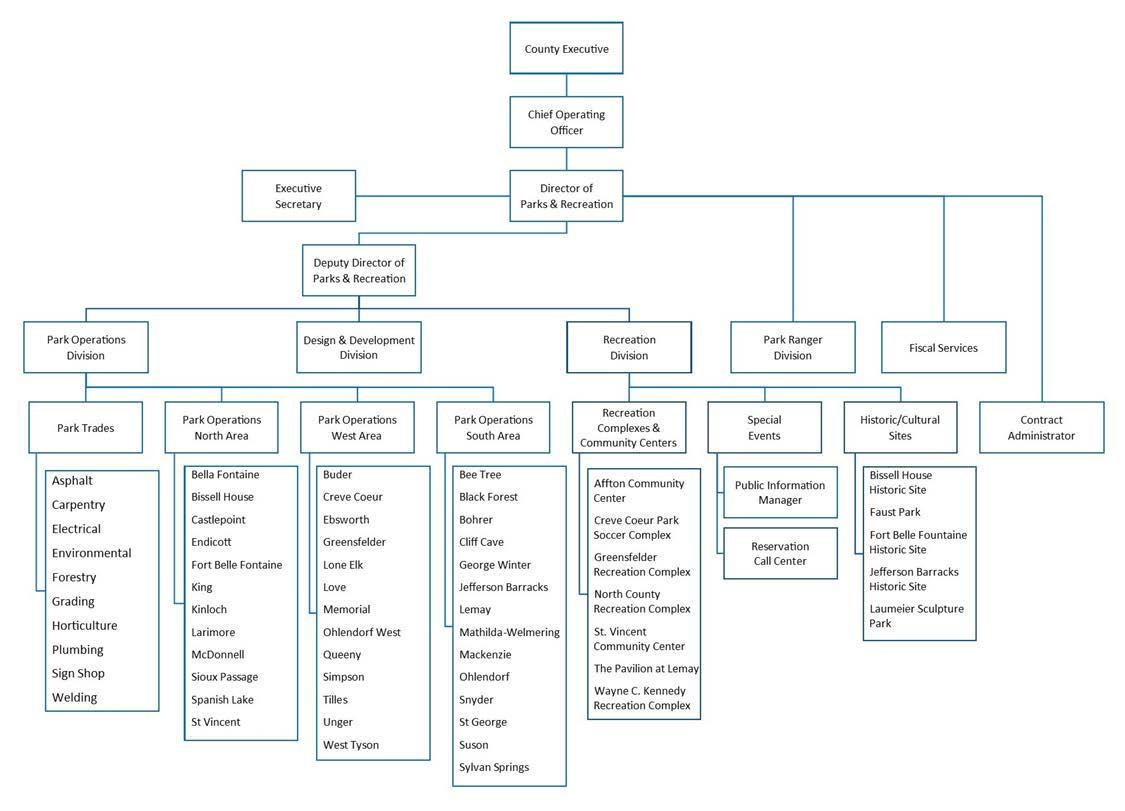

Department of Parks & Recreation

The Department of Parks and Recreation works to provide high quality parks, facilities, and recreation services that enhance residents’ lives through responsible and effective management of resources.

The department is responsible for the management of:

• 68 parks with 11,400 acres

• 7 recreation complexes

• 6 historical/cultural sites

• 166 miles of trails

• 65 athletic fields

• 44 playgrounds

• 78 picnic shelters

• 590 acres of lakes