STORY HOUSE REAL ESTATE 2024 A BUYER’S HANDBOOK

table of contents SHOPPING FOR HOMES HOME BUYING OVERVIEW UNDER CONTRACT PROCESS CHOOSING YOUR REAL ESTATE TEAM About Story House 4 Personal Commitment 7 The Roles of a REALTOR® 9 Core Values 10 Meet Sasha 11 Service Comparison 12 Our Agents 14 Understanding MLS Sheets 32 The “Works” Strategy 34 From Contract to Close 35 Your REALSCALE Updates 38 The Inspection Period 40 Home Warranty 41 Contingency Periods 42 What to Avoid During Closing 43 10 Common Title Problems 44 Mail-Away Closing Tips 45 Client For Life 46 Give Where We Live 48 Happy Clients Say it Best 50 The Home Buying Process 18 Home Buying Steps: The Financials 21 Investing in Real Estate 22 Understanding Your Monthly Payment 24 Reasons to Get Pre-Approved 26 The Mortgage & Loan Process 28 Out-of-Pocket Expenses 30

STORY HOUSE REAL ESTATE is a boutique residential Real Estate brokerage operating in the Central Virginia area, focused on offering exceptional service. Our success lies in our advocacy for our clients’ interests. Our team is dedicated to fulfilling our clients’ dreams of buying, selling, maintaining and improving their real estate assets. We have built our reputation on hard work and dedication; our goal is to be our clients’ real estate advisor for life.

ABOUT

STORY HOUSE

Story House Real Estate was founded on our belief that every home and every buyer and seller has a unique story to tell With every new contact we receive, a page is being turned Whether it is new home buyers just beginning one of the most exciting new chapters in their lives, or the retiree moving into the last chapter of homeownership and downsizing, we cherish the ability to be a part of your journey

Story House Real Estate recognizes that no transaction is quite the same as the one before it. That is why we have procured a team of the best professionals in real estate that are dedicated to helping you navigate the next chapter of your story

One thing that hasn’t been rewritten is our mission statement “to delight and surprise our clients with the highest level of customized service.” Our standard is to deliver more than you would expect from a real estate company, putting together the small details to make sure that your transition to the next chapter in life is smooth, stressfree, and dare we say, exceptional

We look forward to helping you write the next chapter in your story!

OUR LOCAL INSIGHT

While there are many things that we feel set us apart at Story House Real Estate, one of the biggest advantages to working with our team is our knowledge (and love!) of all things local!

Story House has a strong affinity for this area, and it shows in each interaction you have with us. Our roots in the greater Charlottesville area run deep and we love to share that with our clients

With our individual ties to the region, you will find us sporting UVA Alumni gear, visiting Downtown where our families once owned storefronts and restaurants, cheering on our kids at local youth sports events, volunteering with many local charities, dining at locally owned restaurants the list goes on!

When we say that we LOVE our area, we mean it and we can’t wait to share our passion for Central Virginia with you!

OUR REAL ESTATE BUSINESS HAS BEEN BUILT AROUND ONE GUIDING PRINCIPLE:

IT’S ALL ABOUT you!

Your needs. Your dreams. Your concerns. Your finances. Your questions. Your time. Your life.

Our focus is on your complete satisfaction In fact, our team works to get the job done so well, you will want to tell your friends and associates about it. As a result, more than 85 percent of our business comes from repeat customers and referrals

Good service speaks for itself. We are looking forward to the opportunity to earn your referrals too!

YOUR HOME our committment!

To us, what is most important is making sure that our clients find the perfect home We bring objectivity to the buying transaction and point out advantages and disadvantages of a particular property

Buying a primary residence is a major financial and emotional decision For most home buyers, the purchase

of a

primary residence is one of the largest financial transactions they will ever make

Tightened inventory is impacting the home search process. Due to suppressed inventory levels in many areas, buyers are typically purchasing more expensive homes as prices increase. More than half of all buyers find the most difficult task in the current market is actually finding a home to buy

The most important value our agents bring to the table is not helping buyers find a home, but helping buyers find the RIGHT home with the BEST terms By using strong negotiation skills, our agents find the BEST price and contract terms for our clients

We can also seek out off-market homes and attempt to be the first in the area to be informed about new homes coming to the market

Clearly understand your goals and objectives.

Outline the homebuying process and educate you on the market

Develop a plan and timeline to meet your needs.

Advise you for your long-term best interest.

Communicate often and respond quickly.

4 5 3 2 1 8 6 7 9 10 11

Support you in making informed decisions

Review all Real Estate forms in advance. Negotiate aggressively on your behalf.

Close deals on time, without unforeseen surprises.

Work discreetly, remain loyal, and protect your privacy.

Make the process as convenient and stressfree as possible.

7

MAKES THE

–JOHN C MAXWELL

Our business model is shaped around a team structure That means everyone you come in contact with is working together, each with a defined role, to help you There are no independent agents; everyone works for Story House Real Estate We’ve developed a team structure because we believe this is the best way to provide consistent “Wow” service every time. Our clients feel genuinely cared for since there is an expert for every facet of their transaction. Together, we create more success and better results; a win-win situation for your dreams

“Every member of your team was committed to supporting us and everyone answered any question we asked with expertise and in a most respectful manner We always felt heard with sensitivity to the stresses of the process We appreciate Sasha and team for always being client- centered All decisions were made cooperatively and were based on our needs, wants, and comfort levels Sasha and team shared their expertise, which is outstanding, and then let us make the final decisions ”

-THE MCFARLANDS

THE ROLES OF A REALTOR®

AND HOW WE CARRY THEM OUT

BUYER’S AGENT

During the home buying process, we represent you, the buyer As a buyer’s agent, we work solely for you and have no legal or other responsibilities to the seller We represent your best interests by showing you properties that suit your needs, negotiating all offers, monitoring the transaction from start to finish and taking you to the closing

SELLER’S AGENT

On the Story House team, Sasha and Madison represent all sellers, so if you are buying a home, you will always have your own representation. Real estate ethics prevent us from giving you opinions on price, condition, or other factors on a home represented by us that might influence your decision making process. In this case, our client is the seller, so we provide full disclosure to them

WE CAN SHOW YOU HOMES, NO MATTER WHERE YOU FIND THEM.

If you are looking to buy a newly constructed home, we have all the resources and abilities to help you make the purchase that’s right for you. We have established relationships with local builders, and we keep up-to-date on all new construction projects in the area We are involved in every stage of the building process and know how to help guide you through the many decisions that accompany buying a new home, including, and most importantly, the negotiation of the contract.

RESALE HOMES

Our experience with resale homes comes from having sold hundreds of homes throughout our careers. We know the local market and the many neighborhoods in the area, giving us the confidence in our ability to find just the right home for you and your family.

OTHER AGENTS’ LISTINGS

We can show you any home regardless of the name on the sign. The agent on the sign is the agent of the seller and does not represent you. Call us when you find a home that you’d like to see, not the agent on the sign.

NEW CONSTRUCTION FOR SALE BY OWNER

We can even help you buy a home sold by its current own- er Call us if you see a “For Sale by Owner” sign, and we will make it happen! We will contact the owner on your behalf and arrange the showing as quickly as possible.

meet sasha

SASHA TRIPP PRINCIPAL BROKER, OWNER

sasha@storyhousere.com

(434) 260-1435

Sasha Tripp is the owner and founder of Story House Real Estate and has been recognized in numerous local and national polls and accolades She has been named by Inman Magazine as one of the 100 Most Influential Leaders in real estate, was selected by REALTOR® magazine as one of the Top 30 REALTORS Under 30 in the nation, was the Charlottesville Area Association of REALTORS®, REALTOR® of the Year in 2018, Sales Associate of the Year in 2012, and Rookie of the Year in 2008.

Her 15+ years of expertise and oversight of 200+ transactions a year provides her with relevant market knowledge and insight to overcome problems and surprises during the transaction, and helps our agents successfully with their success from contract to closing.

Sasha is also an international real estate speaker and trainer – her experience and knowledge that she gathers from the other best real estate agents in the industry provide the team with invaluable marketing expertise and fresh ideas Her leadership places Story House on the leading edge of technology and strategy for our clients and partners

We want you to be an informed consumer. We believe that when you compare our services to those of our competitors, we stand out from the crowd Please use the following checklist to decide which broker can best handle your real estate transaction.

522 275

service comparison 275CLOSEDTRANSACTIONSIN2022 175+YEARSOFCOMBINEDEXPERIENCE 522OFFERSNEGOTIATEDIN2022

CHOOSING THE RIGHT AGENT FOR YOU

Are they a full-time licensed REALTOR®?

Are they in the top 1% percent of REALTORS® in Charlottesville?

Do they have experience selling homes of my style and price point?

Do they have a team and systems in place for consistent closings?

Do they have full-time licensed assistants as backup?

Do they have a full-time licensed transaction coordinator?

Are they available for private showings during the evening?

Are they available for private showings on the weekend?

Do they conduct a buyer meeting to educate their clients on the homebuying process and current market conditions?

Do they develop a custom and unique offer strategy to differentiate their buyers’ offer?

Do they help teach their clients how to build wealth through Real Estate?

Have they taken updated Real Estate courses in the last 90 days?

Do they provide daily and weekly updates on the status of a transaction?

Do they provide annual real estate reviews for their client?

Do they provide visual pricing tools to their buyers to ensure they do not overpay for a home?

Do they have any references I can contact or testimonials from clients?

STORY HOUSE AGENT OTHER AGENT

meet our agents

ERRIN SEARCY ASSOCIATE BROKER, VICE PRESIDENT OF SALES CRS, ABR, REALTOR®

errin@storyhousere.com

(434) 216-6358

Errin graduated from Virginia Commonwealth University with a B S in Psychology and Education She has been a REALTOR® in the area since 2005 and has deep roots in Charlottesville. Errin prides herself on great communication and the ability to navigate the complex and often emotional sales process with her clients She is married to her husband Bryan, who is an educator and coach, and they have two children, Charlie and Abby In her spare time, she loves to run, knit, cook, and spend time at all the wonderful local festivals, wineries, and restaurants that Charlottesville has to offer. The most tenured of our Sales Agents, Errin is aware of all available properties for sale (as well as several that are available off-market), her knowledge of Charlottesville real estate is unparalleled

JOSH WHITE ASSOCIATE BROKER, SALES PARTNER CRS, REALTOR®

josh@storyhousere.com (434) 216-6311

Josh graduated with a Bachelor’s degree in history from James Madison University and went on to get his Master’s in middle school social studies education at North Carolina State University He was a teacher, coach, athletic director, and educational hiring consultant prior to making the switch to real estate He began as the Transaction Coordinator on the team, consistently providing excellent service to our clients in every step of the process. He is married to Mallory, who is an architect at VMDO, and they have three children, Maggie, Libby, and Parks He loves woodworking, working on motorcycles, home improvement, and reading a good book in his down time He is very involved with The Point Church and has been a foster parent Josh is aware of all available properties for sale (as well as several that are available off-market), his knowledge of the Charlottesville real estate and investment properties is extensive

BRENTNEY KOZUCH ASSOCIATE BROKER, SALES PARTNER ABR, REALTOR®

brentney@storyhousere.com

(434) 216-6393

Brentney graduated from James Madison University with a B.S in Kinesiology concentrating in Sports Management and a minor in Business After college, Brentney interned with the University of Virginia’s Athletic Department specializing in marketing and promotions Brentney then decided to pursue a career in real estate! Her extensive knowledge of Charlottesville and the surrounding counties provides a strong foundation for evaluating market conditions to determine the right course of action for her buyers and investors Brentney works with roughly 10-20 buyers at any given time and her knowledge of Charlottesville real estate is exceptional Brentney is married to her husband, Brian who works at the University of Virginia and they have two mini Aussiedoodles, Kate and Beth! You can find them both at all of the UVA Basketball and Football games cheering on the Hoos!!

JESSICA TRIVETTE SALES PARTNER, REALTOR®

jessica@storyhousere.com

(434) 216-6399

Jessica graduated with a Bachelor’s of Arts in Psychology from the University of Tennessee After graduation, she and her husband David moved to Blacksburg, Virginia to open and operate the first of six Jimmy John’s locations in the Commonwealth With a desire to call Charlottesville home, she and her husband moved their four children to the area as they continued to expand their franchise Settling into the area in 2013 gave Jessica the knowledge and the foresight on what it takes to raise a happy, healthy family in the heart of the University of Virginia culture. In her spare time, she enjoys making home improvements, exercising, studying health and nutrition, reading, and focusing on anything that stimulates her creativity Having been a part of a local family business for many years, Jessica knows the importance of open communication and providing the best customer service possible

ZOYA CLAUS SALES PARTNER, REALTOR®

zoya@storyhousere.com

(434) 216-6303

Zoya began her career as a real estate paralegal after completing her Associates Degree and receiving her paralegal certificate from Blue Ridge Community College After realizing her love for working closely with people during closings, she pursued her real estate license Zoya was born and raised in Harrisonburg, Virginia, but soon after relocating for her husband’s job, she fell in love with the Greater Charlottesville Area. When not working, she loves spending time with her husband and traveling to new places, trying new restaurants and shopping for cool antiques When asked about her favorite travel destination, Zoya would say Aruba because of the beautiful beaches Zoya is also a huge reader

VIRGIL VELASCO SALES PARTNER, REALTOR®

virgil@storyhousere.com

(434) 216-6553

Prior to joining Story House Real Estate, Virgil was in the property management industry He received his B S in Interdisciplinary Studies from Florida International University and, following his new-found love for real estate, he earned his sales license in Florida When his fiancé was approved for a PhD program at UVA, he came to Charlottesville to earn his license in Virginia as well, and is well versed in the real estate needs of the UVA health community Outside of work, you will always find him with his friends, family, and dog Riley, or sipping a good whiskey while reading a great book Virgil was born in Cuba and is completely fluent in Spanish and is able to meet all our bilingual needs. Growing up around music, he loves to dance to a good Cuban salsa and eat great Cuban food

AARON HOWELL SALES PARTNER, REALTOR®

aaron@storyhousere com

(434) 216-0433

Aaron graduated from West Virginia University with a Degree in Pharmacy in 2000 and moved to Charlottesville immediately after graduating He worked with Kroger in various positions until 2008 and then transitioned to Walmart in Charlottesville until 2018 when he went part time as a pharmacist at the University of Virginia While maintaining his part-time status as a pharmacist, he attained his real estate license in 2019 Starting in 2010, Aaron began building his own real estate portfolio and currently has 23 units in three states Aaron met his wife, Megan, who is an RN and employed at Augusta Medical Center in Fishersville, in 2013 and got married in 2015. They have a dog, Lincoln, and two cats, “M” and “Newman ” Aaron enjoys lawn care, gardening, and has hiked extensively in the United States, Mexico, Ecuador, and Bolivia He also has a pilot’s license Aaron continues to be the Pharmacist in Charge at the Charlottesville Free Clinic and volunteers there several times a month Aaron has gained extensive knowledge about the central Virginia market with a special interest working with investors and vacation rentals

ABBY SEARCY SALES PARTNER, REALTOR®

abby@storyhousere com

(434) 987-7873

A native of the Charlottesville area, Abby has a great love for all things local Having grown up in a real estate family and learned from her mother, Errin, Abby is excited to embark on her own path with the Story House team. She is currently attending Liberty University in pursuit of a Strategic Communications Bachelors Degree In her spare time, she enjoys writing, cooking, spending time outdoors, her involvement with The Point Church, and spending time with her cats Billy and Jill

TROY HARDING SALES PARTNER, REALTOR®

troy@storyhousere.com

(434) 216-0543

Troy Harding was born and raised in Charlottesville and Fluvanna county, and has lived here for nearly his entire life Troy graduated with a Bachelor’s degree in Business Administration from Radford University. He has over 17 years of real estate experience and is committed to providing the best service to his customers with the utmost friendly nature and exceptional service His vast sales expertise and familiarity with the region make Troy very knowledgeable of all real estate throughout the area Troy is married to Brie, who is an Associate Director of Event Operations in Marketing at S & P Global, and has a beautiful daughter, Alivia. In his spare time, he loves landscaping, exercising, home improvements, going to wineries, and, most importantly, spending time with his family

ALEX TISCORNIA SALES PARTNER, REALTOR®

alex@storyhousere.com

(434) 216-5621

Alex Tiscornia is your expert local Realtor for Albemarle County, Charlottesville, Central Virginia & the Shenandoah Valley He will help you Scout & Sell your next house for purchase and comprehensively price your home for sale Alex has accrued valuable knowledge about the real estate market and the particularities of each neighborhood through experience and by being a lifelong resident

Whether you are looking to buy or sell real estate in the Charlottesville area or beyond, Alex Tiscornia will exceed your expectations by carefully listening to your needs and demonstrating what a dedicated, service oriented Real Estate professional brings to the table Alex is hands on, a great negotiator, and highly involved in the home buying / selling process from start to finish Additional realtor education has distinguished him with an Accredited Buyers Representative and Graduate Realtor designation With a passion for the great outdoors, he will often be found enjoying the trails, vineyards, golf courses, and Blue Ridge Mountains with his wife and their dog Scout

WILL NAFEI SALES PARTNER, REALTOR®

will@storyhousere.com

(434) 216-5542

Will is a longtime Charlottesville local since 2005. After college, Will interned with Rifkin Associates, a local Commercial Real Estate Firm which is where he found his love for properties and Real Estate Since getting licensed in 2016 Will has sold over 30 Million dollars in Real Estate His extensive local knowledge of Central Virginia will help you find the perfect property for your needs

STEPHEN FITZGERALD SALES PARTNER, REALTOR®

stephen@storyhousere.com

(434) 216-6221

Stephen graduated from Radford University with a degree in Business Administration and a concentration in Sports Administration Before coming into real estate, Stephen spent several years working for ACAC Fitness and Wellness He has been a Charlottesville resident most of his life and has extensive knowledge of the area. Being born and raised in Greene County, he has watched and taken part in the tremendous growth of the region throughout his time living here Along with real estate, he is also the Varsity Boys Basketball Coach at The Covenant School He is married to Amy, who works for the Darden School of Business at UVA, and they have two beautiful girls Olivia and Piper. Stephen loves all things outdoors, playing golf, eating at local restaurants, and attending UVA sporting events with his family

Of all our real estate experience, Story House is by far the best, on all fronts. Our agent worked relentlessly despite a picky client and difficult seller’s agent Our agent communicated exceptionally well about all the issues with the land search, sellers, sellers’ agents and supporting roles of the closing attorney, surveyors and builder Story House’s involvement in all these, and solving a lot of emergent problems was amazing

- CHRISTIAN H.

1. SELECT A REAL ESTATE AGENT

6. WRITE AN OFFER TO PURCHASE

2. OBTAIN FINANCIAL PRE-APPROVAL

3. ANALYZE YOUR NEEDS IN A BUYER’S CONSULTATION

5. VIEW PROPERTIES

4. SELECT PROPERTIES

7. NEGOTIATE TERMS

8. RATIFY THE CONTRACT

9. REMOVE CONTINGENCIES

CONDUCT INSPECTIONS

RESOLVE ANY ISSUES

OBTAIN MORTGAGE FINANCING

1. CREDIT CHECK

2. UNDERWRITING

3. APPRAISAL

4. SURVEY

5. INSURANCE

CONDUCT TITLE SEARCH

REMOVE ANY ENCUMBRANCES

OBTAIN TITLE INSURANCE

10. OBTAIN FUNDS FOR CLOSING

11. CLOSE ON THE PROPERTY

TAKE

OF HOME! ownership

KEY PROFESSIONALS

Throughout the home buying and selling process, you may also encounter the following industry specialists who are able to answer questions in their area of expertise.

REAL ESTATE AGENT

Licensed by the state to represent parties in the transfer of property.

HOME INSPECTOR

Objectively and independently provides a comprehensive analysis of a home’s major systems and components

LOAN OFFICER/LENDER

A representative of a bank or other financial institution They help customers identify their borrowing options, help them understand the terms of their loan, and are responsible for providing the Closing Disclosure to the borrower

APPRAISER

Works on behalf of a lender and provides a market analysis of the subject property. An appraiser’s finding is subjective and combined with market findings of sold properties within the surrounding neighborhood

CLOSING/SETTLEMENT/TITLE

Performs searches to ensure a clear title so a title insurance policy can be issued In some states, they facilitate the transfer of real estate

REAL ESTATE ATTORNEY

Can give advice on all legal aspects of the real estate transaction. Additionally, they are able to draft and review contracts, help decide how to take title and assist with the consummation or closing process In some states, real estate closings can only be conducted by attorneys

MOVERS

Professional movers are specially trained to move heavy loads with efficiency. They know where everything goes, how to most effectively get it from the truck to your home, and how to minimize the total time the truck is loaded

ASK YOUR AGENT FOR OUR CURRENT RECOMMENDED VENDOR LIST FOR SOME OF OUR FAVORITE RESOURCES.

“The most stressful part of the real estate process is probably thinking about how much money everything can cost – from the cost of moving, to purchasing a bigger home, to new furniture where needed Also, it was a bit nerve wracking waiting to ensure that everything went through perfectly –you don’t want to get your hopes up too high until things are signed and completely 100% finalized. But, overall the experience felt like an exciting adventure to us – It was fun looking at new houses and staying up late doing research I also felt like I learned a lot through the process from our agent They explained things step by step and had templates for most things So with each step of the process, we knew what expectations were, how long things would take, and that made me feel at ease Things are structured and organized and there’s not much guessing, which helps take some of the stress and anxiety out of the process.”

-THE CHULIS FAMILY

HOME BUYING STEPS:

the financials

The first step towards homeownership is understanding your purchasing power There is nothing more frustrating than finding your dream home only to find it doesn’t fit within your budget By preparing a budget, understanding your out-of-pocket costs and getting pre-approved, you will be on your way to purchasing a home that suits your financial needs.

PREPARING A BUDGET

01

02

Determine how much money you have for a down payment.

The most common amounts are 0%, 3.5%, 5%, 10%, and 20% or more.

If you own a home, our team will help you determine the amount of equity you will gain when you sell or refinance.

Determine how much money you have for closing costs This is in addition to your down payment Closing costs are approximately 3% of the sales price It is possible to have your closing costs financed in some cases; we will advise you on this along with your mortgage broker

03

Calculate a comfortable monthly mortgage payment you want or can afford

04 05

Download a mortgage calculator app on your phone or computer and begin to familiarize yourself with how they work.

Schedule an appointment with a mortgage lender. We have a list of several trusted and local professionals who we recommend for a smooth, timely closing.

There are three main ways to build wealth:

01

02

03

Inherit wealth

Start a business and/or work

Own Stuff: Real Estate, Stocks, Collectibles etc

Are you interested in how real estate can be a part of your long-term financial plan? We can help We can counsel you on developing your real estate portfolio, using real estate as a mechanism to meet your future aspirations and more specifically, to build wealth This is first accomplished through gaining a true understanding of your needs, desires and goals followed by extensive education

In order to build wealth in Real Estate you need a Team of

Experts:

• REALTOR®• Wealth Manager

• Mortgage Broker• Accountant

• Insurance Broker• Attorney

HOW DO YOU FIND YOUR TEAM?

Get referrals from us or others you trust Then, choose the professionals you not only connect with, but who are looking out for your long-term best interests

RENT VS. OWN VS. INVESTMENTS

The following are some questions we will help you answer as your Real Estate advisor.

What are your long-term real estate goals (min of 5-10 years)?

When is the right time for you to buy a home or investment?

If renting, how much longer do you want to rent? What are the pros and cons of renting?

How can owning a home help you build wealth?

What does it mean to be leveraged?

What is involved in owning investment property? Do you want to be a landlord?

Included in your monthly mortgage payment is PITI (principal, interest, taxes and insurance) If you pay cash, you will only pay taxes and insurance Other items include homeowners’ association (HOA) dues and mortgage insurance Utility bills may be a additional expense for some clients

Calculating your Monthly Payment

It is very important to understand how each of these items affect your monthly budget Many first-time homeowners will pay more for a mortgage payment than they were paying for rent

What price are you comfortable paying for your home? $

If obtaining a loan, what is the current interest rate? %

What do you want your Monthly Payment to be? $

What are the average property taxes for this price of home? $

What is the average cost for homeowners insurance? $

Do you need to pay mortgage insurance? $

Are there any annual or monthly HOA fees? $

Now you have all the information you need to start using a Mortgage Calculator effectively

www.usmortgagecalculator.org

PITI CALCULATOR (PRINCIPLE, INTEREST, TAXES AND INSURANCE) UNDERSTANDING YOUR MONTHLY PAYMENT

This mortgage calculator offers an interactive approach to determining your monthly payment.

We can refer you to a reputable mortgage professional whom you can call.

step 2

Gather all your financial paperwork

step 3 step 1

Meet with a mortgage broker to discuss the best loan products available for your financial picture and obtain a preapproval letter

YOUR NEXT STEPS

REASONS TO GET PRE-APPROVED:

01

With pre-approval, you can determine which loan program best fits your needs and which loan programs work for your budget/financial situation

02

You will know exactly how much you are qualified to buy. It’s no fun to find your ideal home and then realize that you can’t afford it

03

Your monthly payment will be set This will allow you to budget your money before making this large investment

04

You know what the down payment and closing costs will be and how much money you will need to bring to closing.

05

It shows the seller that you have been to the bank and that you are a serious and capable buyer

Your mortgage broker will review your credit report to determine any financial liabilities This includes: creditors names and outstanding balances for all debts including notes payable, life insurance loans, stock pledges, spousal and child support, credit cards and auto loans, and other liabilities Your mortgage broker will review your application, match you with the best loan products, and preapprove you for a monthly payment

Many of our clients find the loan process to be the most frustrating part of buying a home Your personal information will be scrutinized by an underwriter you will never meet They will ask for all kinds of documentation through the course of

your transaction Usually these documents will be needed with very little notice You may be asked to write an explanation on something found on your credit report or for a lapse in employment Just know you are not alone

If you want a loan, you must jump through all the hoops; there is no way around it All of the underwriters, no matter which company or how much you like your mortgage broker or bank, will review your financial package with a fine-toothed comb Although as Realtors® we have no control over the underwriters, we are here to support you Please never hesitate to include us in your concerns regarding the financial process

getting pre-approved pre-approval checklist

The following are some of the items your mortgage professional will need to pre-approve you for a loan

Home address(es) for last two years.

Your Social Security number(s)

Employment information for the past two years.

Tax returns from the last two years

Income information including two months of pay stubs, overtime, bonuses, commissions, dividends, interest, retirement and any other source of ongoing income

Two of the most recent month’s statements of all liquid assets including: checking, savings, investment accounts or other possible sources for down payment

Other assets including the value of bonds, stocks, life insurance, retirement funds, jewelry, automobiles, etc.

List of Real Estate owned including: property address, market value, outstanding liens, rental income, mortgage payments, taxes, insurance, and maintenance dues.

THE MORTGAGE & LOAN PROCESS

FUNDING YOUR HOME PURCHASE

1. Financial pre-qualification or preapproval

• Application and interview

• Buyer provides pertinent documentation, including verification of employment

• Credit report is requested

• Appraisal scheduled for current home owned, if any

2. Underwriting

• Loan package is submitted to underwriter for approval

3. Loan approval

• Parties are notified

• Loan documents are completed and sent to title

4. Title company

• Title exam, insurance and title survey conducted

• Borrowers come in for final signatures

5. Funding

• Lender reviews the loan package

• Funds are transferred by wire

WHY PRE-QUALIFY?

We recommend our buyers get pre-qualified before beginning their home search. Knowing exactly how much you can comfortably spend on a home reduces the potential frustration of looking at a home beyond your means.

5 MORTGAGE CLOSING TERMS YOU SHOULD KNOW

There are many factors to consider when buying a home. When it comes to the closing process, it is a good idea to know the terminology that will be discussed. This can help make the situation much more comfortable and professional for all parties involved. Below are some of the terms that may be discussed during the closing process.

ANNUAL PERCENTAGE RATE (APR)

The Annual Percentage Rate (APR) reflects the cost of all credit and finances as determined by the length of a year, including the interest rate, points, broker fees, and other credit charges obligated to the buyer

Down Payment

Like many transactions involving large sums of money, the mortgage process involves a down payment-the amount a home buyer pays in order to make up the different between the purchase price and the mortgage amount Some experts advise no less than 10% to 15% However, any amount over 20% of the purchase price is often recommended, and may be required to avoid having to pay for private mortgage insurance

LOAN ESTIMATE

The Consumer Financial Protection Bureau (CFPB) requires your lender to issue a Loan Estimate within three business days of receiving your mortgage application The Loan Estimate details the terms or your loans along with estimated closing costs

PRIVATE MORTGAGE INSURANCE (PMI) closing costs

PMI is typically required if a borrower puts a down payment that’s less than 20% of the home’s value The charge is usually included in the monthly mortgage payment in an attempt to protect the lender from possible default.

Closing costs may also be referred to as transaction costs or settlement costs and may include various fees and charges associated with finalization These may include or be related to application fees, title examination, title insurance, property fees, as well as settlement documents and attorney charges

estimating your out-of-pocket expenses

There are three “BUCKETS” that you can think about to help you plan for your expenditures for your real estate transaction. Have your buyer’s agent walk you through this prior to shopping so you know how much to save!

INSPECTIONS

We typically say to budget around $1,000-$2,000 depending on the type of property that you are purchasing (i e a rural property with a well and septic system will cost more if you elect to do a full well and septic inspection). We can discuss what inspections are important to you before you put in an offer and absolutely will during the inspection period. Please ask for a copy of the Story House Inspections Disclosure

DOWN PAYMENT/EMD

Your down payment should be discussed with your lender

Depending on the type of loan you have, your earnest money deposit (which is typically 1% of the sales price), will be applied to your down payment or could also be used toward your closing costs

CLOSING COSTS

Typically, these run between 2-3% of the purchase price, however, you can always request a Loan Estimate Form from your lender to ensure that you know how much in prepaids (interest, homeowner’s premiums, escrow set-up) and closing costs (attorney/title company fees, recording fees, lender’s origination fee, survey, appraisal, etc ) you will need to pay

The buying process can be intimidating, but that is why we have a team of professionals to help you along the way.

LET’S BREAK DOWN THE EXPENSES

There are a few out-of-pocket costs once you have an accepted offer. Some you will pay even if you do not close on the home. Think of these costs as an insurance policy; this money will help you answer the question: Is this the right home for me? It is better to find out early than to purchase the wrong home.

INSPECTIONS

BUDGET FOR $1,000–2,000

The following are a list of the most common inspections.

General Inspection - $500-1,000

• Sewer Scope - $125

• Sewer Inspections - $400-1,000

• Oil Tank Locate - $75

• Soil Test - $200

• Radon Testing - $150 Well Inspection - $500

LESS COMMON INSPECTIONS

BUDGET FOR $500-700

Although more rare, on occasion there are additional inspections, such as hiring a structural engineer, that may be necessary

APPRAISAL

BUDGET FOR $600-750

Appraisals need to be ordered immediately in the current market They cost approximately $600 Most Lenders will request credit card payment upon ordering

EARNEST MONEY

BUDGET FOR 1% OF THE PRICE Usually due within 5 business days after mutual acceptance (the time the Seller and Buyer come to an agreement and are in contract) The amount and due date of Earnest Money is negotiable Many clients offer roughly 1% or more of the sales price for the Earnest Money Deposit; however, there is no standard It is very important to note the Earnest Money goes towards your closing costs.

There are four ways you can potentially lose your Earnest Money

• If you lie

• If you write a bad check If you break the contract outside of your contingencies.

• If you do not get your Earnest Money Deposit in on time

We are here to keep you informed if you’re in jeopardy of one of these situations.

HOME WARRANTY

BUDGET FOR $500-800 Home warranties cost between $375-650 depending on the coverage The home warranty can be paid through closing

MOVING COSTS

Costs for moving, storage, and rent for overlap days needs to be considered as well

MOVING INFORMATION

MOVING OUT

A home is only yours once it closes by both parties Some sellers rent back from the buyer for upwards of several months, therefore allowing possession of the property to occur after the closing date

We strongly encourage our clients NOT to schedule their movers for the day of closing or possession. There is no way to guarantee a closing date It is also very stressful to reschedule movers since they are usually booked weeks in advanced.

GIVING

NOTICE & PAYING RENT

If you need to give notice, we strongly suggest giving notice when you are sure you are moving This may require you to pay another months rent or a mortgage payment This is another cost of purchasing a home that needs to be considered It is far less stressful to have overlap between the two places, giving you time to move and clean at your leisure

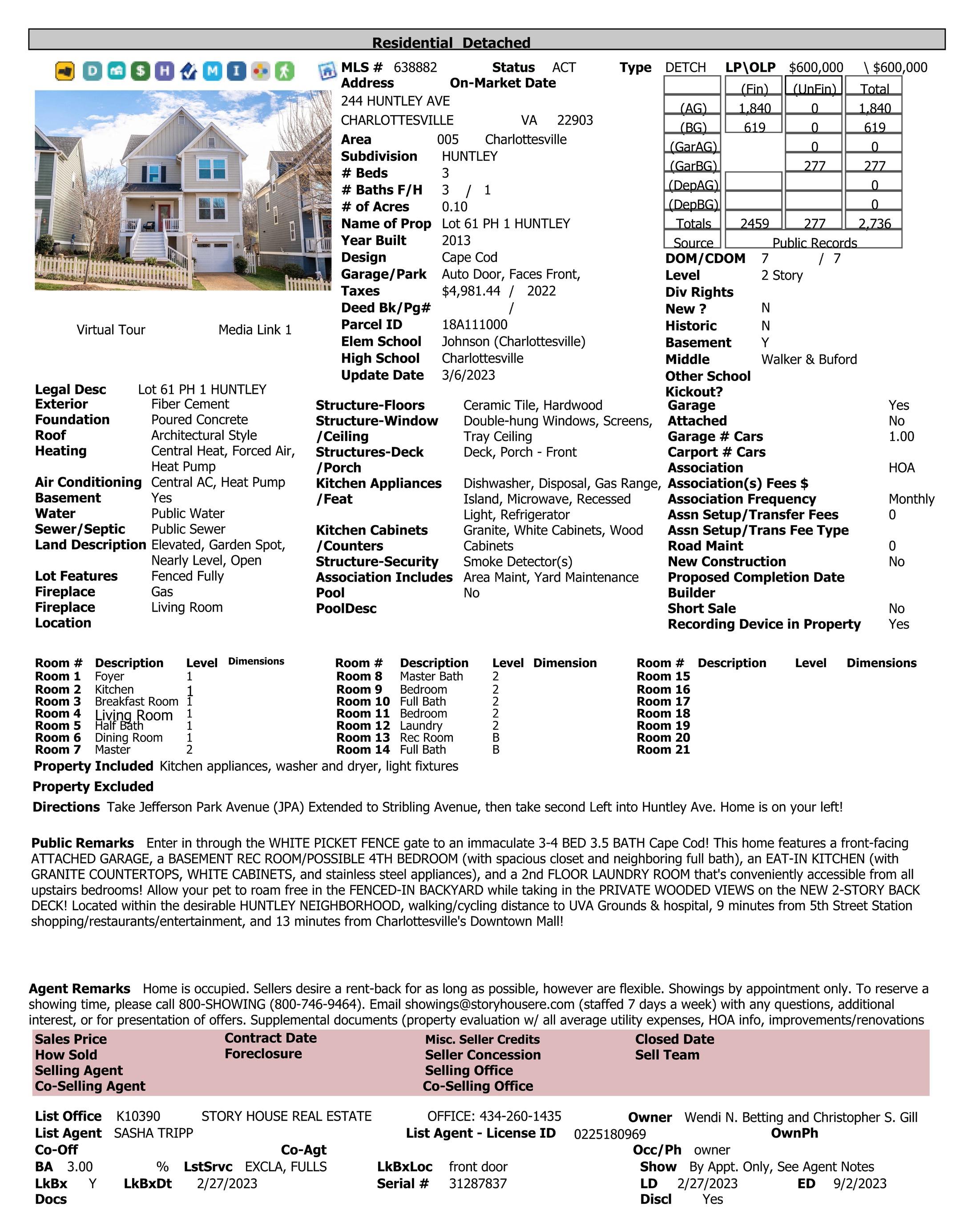

We will sign you up to receive listings directly from the Multiple Listing Service (MLS), based on criteria we discuss together The reports are not as visually appealing as some of the online search sites, but the information in the MLS is the most accurate and up to date It is very important to be checking the MLS reports on a daily basis, to ensure you do not miss anything To the right is an example of what an MLS report will look like

Our agent was approachable and communicated so well with us. Our agent spent so much time talking through what we were looking for and really helped us consider whether a house would be a good fit for us We are so pleased with the house we found and are really thankful for the help and guidance of Story House!

-THE TAYLOR’S

your search begins

Set up an account, search for homes, save your favorite homes, and be notified via email if there are any changes to your favorite homes. HOME SEARCH www.storyhousere.com

THE “WORKS” STRATEGY

Our Methods for Winning the Contract for You

Negotiating is the most important service we provide our clients The current real estate market will find many of our clients in multiple offer situations, when more than one buyer is competing to purchase a home To ensure our clients’

success, our team has developed the “Works” Strategy; a system that outlines all our clients’ options when writing an offer

The first aspect of the “Works” Strategy is finding the right price to offer We use visual pricing tools, statistics, and market data to develop a sound pricing strategy. No one wants to over pay for a home, especially in an upward moving market Once we identify the value, the next step is to look at how to make all the contract terms appealing to the Seller

One or several of these components may be used when writing your offer As a result, our clients write strategic and aggressive offers, win negotiations, and therefore purchase homes fast Buying a home is a time consuming process; our clients appreciate increasing their chances of winning an offer to secure their next move. We do this by finding the right home where our client has a financial advantage, looking for homes within our clients’ purchasing power (not beyond), and applying the “Works” Strategy

POSSIBLE SCENARIOS OUR TEAM WILL PRESENT

FROM THE “WORKS” STRATEGY:

Providing the Seller with a 1-day to 2-month rent back You may offer the Seller a rent back at the same cost of your PITI (principal, interest, taxes and insurance) or for no rent at all

Buying the home as-is with the Seller to do no repairs or with a home inspection for information only.

Ordering your appraisal immediately upon mutual acceptance.

Offering a short inspection period of 37 business days or waiving your inspection period all together

Offering as high an Earnest Money Deposit as possible, and/ or making your Earnest Money non-refundable

Committing to pay a cash sum on top of your loan amount within a pre-determined range.

FROM CONTRACT TO CLOSE

WE ARE BY YOUR SIDE EVERY STEP OF THE WAY

Once we have negotiated and signed your contract, our next goal is to stay on top of each and every step of the process to ensure your property closes successfully There are countless details and loose ends to handle, and you can be confident that our team will be as detail oriented as possible We will continue to keep you up to date on the closing process and will work diligently to ensure that the closing is as smooth and problem-free as can be

Our Story House agents were both very communicative and enthusiastic guides throughout the process, which was really appreciated when we went through a tough situation with an offer falling through that we all thought was a sure thing. They both sympathized with us and helped us bounce back together and eventually find our current house, which we love. Their patient explanations on many steps of the process, and quick turnarounds on several last minute scheduled showings, were both very appreciated They were fun to work with and see houses with! They also provided the follow- through to get all of our questions answered during the closing process Among the traits we listed in our initial introduction survey to Story House were honesty, responsiveness, and attentiveness to our desires. We felt that our agents fulfilled each of these every time we were in contact with them, given their timely communication and being on the lookout with us for issues or pitfalls with a potential property that we were not aware of The team’s transaction coordinator was also on the ball with communicating with others involved in the process, and helped us get our many questions answered

- DIANA & RYAN

STEP 1 | INITIATION

CONTRACT TO CLOSE COLE RAKES

There are five major steps that happen from contract to close. Our transaction coordinator will be by your side every step of the way.

Use this detailed checklist of the steps to follow along through the contract

After ratification, our Transaction Coordinator will forward the accepted Purchase and Sale Agreement to your selected Settlement Company or Real Estate Attorney along with contact information for all parties involved. For example, your lender, seller’s agent, seller’s closer, etc.

You will deliver your Earnest Money Deposit to your Agent via check or digital deposit

3 You will begin your Loan Application Process with your chosen Lender

STEP 2 | CONFIRMATION

Your chosen closer will review the contract and open a transaction file for your purchase

The title report will be ordered by the closer

If financing is being obtained, your closer will request information about your loan from your lender

STEP 3 | VERIFICATION

Your closer will receive the title report and conduct a review for any problems

If any title issues are found, the closer will work to clear the title of any encumbrances, such as Deeds of Trust, Liens, and Judgements

3 Our Transaction Coordinator will continue to send any documentation to the closer such as homeowners association dues, utilities, contingency removal addenda, invoices, etc.

4. Your lender will continue to gather needed information and documentation from you during this process for underwriting to review.

5 You will begin shopping for your homeowners insurance

TRANSACTION

COORDINATOR

to close process 1 1 1 2 2 2 3

STEP 4 | PREPARATION STEP 5 |

1 We will obtain a receipt of the lender loan documents

2

Your closer will prepare any documents necessary to close the file

3 Your closer will send estimated settlement statement to lender and Agent(s) to review

4 We will schedule a date and time for your closing appointment 1

5 We will ensure all utilities and homeowners insurance are set up to begin in your name as of the day of closing

You will sign all of your lender, purchasing documents, and deliver your cash to close at your scheduled appointment

Your lender will give approval to release the transaction for recording.

Your closer will have deed recorded at local government office and disburse all funds to appropriate parties and provide a final settlement statement to all parties

4 Your agent will notify you of recordation

5 Once recorded, the house is yours!

CLOSING

2 3

WHO HANDLES THE CLOSING? Attorney or Settlement Company? How do I choose? S e t t l e m e n t / T i t l e C o m p a n y R e a l E s t a t e A t t o r n e y X X X X X X Initiates Title search and examination Works to remove any existing encumbrances, such as liens, to ensure a clear title is delivered at closing Offers Title insurance for the purchaser Facilitate the transfer of real estate from seller to buyer Records Deed with City or County of property Works with Buyer’s Lender (if a loan is being obtained) and Seller’s settlement company/attorney to ensure all funds balance at closing Can offer legal advice pertaining to all aspects of a real estate purchase Can draft amendments, contracts, and review contracts X X X X X X X X

THE INSPECTION PERIOD

Most of our Buyers have an inspection period This is a time when the home is pending and no other buyers can attempt to purchase the home You, as the Buyer, have a specified period of time in which to inspect the home and ask any questions you need to know in order to decide if this is the right home for you We will set up your inspection appointments for you We strongly suggest you attend your general inspection. This is a minimum of one hour in your potential new home Based on the findings of the general inspection, more specific inspections may be recommended.

At any time during the inspection period you can back out of the home and get your Earnest Money back, based on the professional inspection reports Below is a description of what takes place during your general inspection

WHO IS A GENERAL HOME INSPECTOR?

A Home Inspector is someone who conducts a non-invasive examination of a home A home inspection gives the buyer more detailed information on the physical condition including the structure, construction, and mechanical systems The inspector will provide a written report, with photos, on the overall physical condition They will provide recommendations for

maintenance and repairs and attempt to estimate the useful life of major systems and finishes

WORKING WITH LICENSED HOME INSPECTORS

At Story House Real Estate, we always recommend working with a Licensed Home Inspector. We can offer referrals for Inspectors we have worked with previously, or you can choose to work with your own Inspector You can always tell if the Home Inspector is licensed, as they must provide their license number on all advertising and documents they present to clients Buyers are encouraged to check the DPOR website for updated licensing information status.

OBTAINING A WRITTEN AGREEMENT

A licensed Home Inspector must provide a copy of the preinspection agreement to their client prior to the inspection, unless prevented by extenuating circumstances A pre-inspection agreement is a written contract signed by the client that outlines the standards and work to be performed by the Home Inspector

THE WRITTEN REPORT

The Home Inspector is required to provide a written report of their findings The report is usually received no later than the next day

CAN THE INSPECTOR PERFORM WORK ORDERS IDENTIFIED IN THE INSPECTION?

Certified Home Inspectors may not offer to do, bid to do, or actually perform any repairs on a structure inspected by the business within 12 months of that inspection

APPRAISALS ARE DIFFERENT FROM HOME INSPECTIONS

An appraisal is different from a home inspection and does not replace a home inspection. Appraisals estimate the value of the property for lenders An appraisal is required if you are obtaining a loan and to ensure the property is marketable. Home inspections evaluate the condition of the home for buyers

RADON GAS TESTING AND OTHER SAFETY/ HEALTH ISSUES

The United States Environmental Protection Agency (EPA) and the Surgeon General of the United States have recommended that all houses be tested for radon. For more information on radon testing, call the toll-free National Radon Information Line at 1-800SOS-Radon or 1-800- 7677236 We recommend radon testing for all homes.

ADDITIONAL INSPECTIONS

We always recommend that our home buyers understand the entire picture of the condition of the home they are buying through additional inspections

WHAT ABOUT RADON?

During the inspection period, you have the option to conduct a radon test While the action levels established by the EPA are conservative as far as health concerns, radon is the second leading cause of lung cancer This test can give you a snapshot in time of the levels that exist in the home so that you can have the seller remedy the issue prior to your acceptance of the property

BUYER SEPTIC INSPECTIONS

When you purchase a resale home, basic inspection of the septic system may be required per the contract This is a very superficial inspection which does not reveal the integrity of the tank or the distribution box. Many buyers will request a more robust inspection as part of the purchase negotiation or conduct this inspection at their expense to avoid unwanted costs.

home warranty

BENEFITS

Buying a home is a huge decision If you are buying an older home, a warranty may be worth the expense With a warranty, you will be covered against the expense of many types of unexpected repairs for the first year No matter how closely you inspect a home, it’s hard to predict certain costs that may occur over time Such costs that are often covered by a warranty include internal plumbing repairs, electrical wiring, vital parts of the A/C and heating systems, and working components of major appliances

HOW TO MAKE A CLAIM

When a problem occurs, simply call the warranty company, and your claim will be processed right away Once the claim has been entered into their system, the warranty company will send a local contractor to your home to estimate and repair the issue

CONTINGENCY PERIODS

It is important to read the timeline and ask any questions you may have to ensure you understand all the due dates If you have any questions, please ask us immediately

*Not all of the following apply to every transaction

inspection report period

Typically 7-14 business days after mutual acceptance (this time is negotiable-check contract).

lead-based paint covenants + hoa

Typically 7-14 calendar days after mutual acceptance (only applies to homes built prior to 1978).

Typically 3 business days after they are received.

WHAT TO AVOID DURING CLOSING

AVOID CHANGING MARITAL STATUS

How you hold title is affected by your marital status Be sure to make both your lender and closing/settlement agents aware of any changes in your marital status so that documents can be prepared correctly

AVOID CHANGING JOBS

A job change may result in your loan being denied, particularly if you are taking a lower-paying position or moving into a different field Don’t think you’re safe because you received approval earlier in the process, as the lender may call your employer to re-verify your employment just prior to funding the loan

AVOID SWITCHING BANKS OR MOVING YOUR MONEY TO ANOTHER INSTITUTION

After the lender has verified your funds at one or more institutions, the money should remain there until needed for the home purchase.

AVOID PAYING OFF EXISTING ACCOUNTS UNLESS YOUR LENDER REQUESTS IT

If your loan officer advises you to pay off certain bills in order to qualify for the loan, follow that advice Otherwise, leave your accounts as they are until your escrow closes

AVOID MAKING ANY LARGE PURCHASES

A major purchase that requires a withdrawal from your verified funds or increases your debt can result in you not qualifying for the loan A lender may check your credit or re-verify funds at the last minute

IF YOU HAVE ANY QUESTIONS OR CONCERNS ABOUT YOUR FINANCES, SPEAK TO YOUR REALTOR, LENDER AND/OR YOUR CLOSING/SETTLEMENT AGENT.

10 common title problems

Have you ever wondered why you need title insurance? Your home may be new to you, but every property has a history. A thorough search can help uncover any title defects tied to your property. And, subject to the terms of the policy, your title insurance provides protection from title problems that may become known after you close your transaction. Some of these common issues are:

1. ERRORS IN PUBLIC RECORDS

To err is human, but when it affects your home ownership rights, those mistakes can be devastating. Clerical or filing errors could affect the deed or survey of your property and cause undue financial strain in order to resolve them

2. UNKNOWN LIENS

Prior owners of your property may not have been meticulous bookkeepers - or bill payers And, even though the former debt is not your own, banks and other financing companies place liens on your property for unpaid debts even after you have closed on the sale This is an especially worrisome issue with distressed properties

3. ILLEGAL DEEDS

While the chain of title on your property may appear perfectly sound, it’s possible that a prior deed was made by an undocumented immigrant, a minor, or person of unsound mind, or by one who is reported single but in actuality married. These instances may affect the enforceability of prior deeds, affecting prior (and possibly present) ownership

4. MISSING HEIRS

When a person dies, the ownership of their home may fall to their heirs, or those named within their will However, those heirs are sometimes missing or unknown at the time of death

Other times, family members may contest the will of their own property rights These scenarioswhich can happen long after you have purchased the propertymay affect your rights to the property

5. FORGERIES

Unfortunately, we don’t live in a completely honest world

Sometimes forged or fabricated documents that affect property ownership are filed within public records, obscuring the rightful ownership of the property Once these forgeries come to light, your rights to your home may be in jeopardy.

6. UNDISCOVERED ENCUMBRANCES

When it comes to owning a home, three can be a crowd At the time of purchase, you may not know that a third party holds a claim to all or part of your property-due to a former mortgage or lien, or nonfinancial claims, like restrictions or covenants limiting the use of your property

7. UNKNOWN EASEMENTS

You may own your new home and its surrounding land, but an unknown easement may prohibit you from using it as you’d like, or could allow government agencies, business, or other parties to access all or portions of your property While usually nonfinancial issues, easements can still affect your right to enjoy your property

8. BOUNDARY/SURVEY DISPUTES

You may have seen several surveys of your property prior to purchasing, however, other surveys may exist that show differing boundaries Therefore, a neighbor or other party may be able to claim ownership to a portion of your property

9. UNDISCOVERED WILL

When a property owner dies with no apparent will or heir, the state may sell his or her assets, including the home When you purchase such a home, you assume your rights as owner However, even years later, the deceased owner’s will may come to light and your rights to the property may be seriously jeopardized.

10.

FALSE IMPERSONATION OF PREVIOUS OWNER

Common and similar names can make it possible to falsely “impersonate” a property owner. If you purchase a home that was once sold by a falser owner, you can risk losing your legal claim to the property

The process of home buying is seamless with Story House Every team member is simply amazing! l loved the weekly updates, that clearly provided me a quick status about where we are in the home buying process. Our agent went above and beyond to provide me with home improvement ideas and several reliable local contractors Our agent paid attention to every minor little detail and patiently answered all my questions giving me reassurance and removing any stress.

- KRISHNAN S.

MAIL-AWAY CLOSING TIPS

As opportunity for real estate transactions expand across country and state lines, the frequency of mail-away closing is increasing. If you are involved in a closing that requires the mailing of documents, here are some tips that can help you avoid delays:

1. Inform your closing/settlement agent of the need to mail documents as soon as possible. This will allow them to better coordinate the document preparation and signing process.

2. Provide your closing/settlement agent with physical address and the best phone number. This should be done for each party involved in the transaction Most overnight delivery services will not deliver to a P.O. Box.

3. Be aware that many lenders have specific closing practices that may differ from local customs. Not all lenders allow documents to be

signed in advance of the closing date, and some require that the documents be signed in the presence of an attorney or at a local settlement agent’s office

4. Allow sufficient turnaround time for the documents to be signed. This may decrease the changes of funding delays due to errors in the signing process In order to disburse funds on a transaction, your closing/settlement agent may require the original documents to be returned and in their possession. The minimum time required to send and receive documents is three business days

CONGRATS! IT’S CLOSING DAY!

Congrats!

You’ve made it! With the help of Story House Real Estate, you were able to jump through all the hurdles of the home-buying process and begin your next chapter. Congratulations!

Though we’ve approached the end of this chapter, we still aim to be a part of your story. You are not entering homeownership alone! Any future real estate goals you may have including interest in investment properties, second homes, moving outside of the area and looking for referrals to other markets statewide, nationally, or globally, or anything at all, we are here as your advisors and advocates for life!

The home-buying process is such an exciting time, congratulations on this enormous accomplishment! Our main goal as a client and service-oriented company is to give as many people a great real estate experience as possible. If our time together proves worthy of recommending us to the people in your sphere, we would love the opportunity to connect with your family and friends!

be a client for life, STAY CONNECTED.

If you need help with anything home related now or in the future, you will have access to our full network of vendors and real estate professionals. There is no one you won’t be able to call or connect with, just by being a part of the Story House Family.

We are well-connected with several local businesses and services and we would be happy to connect you with our most trusted vendors!

Contractors, Repair Work, Remodel, Home Inspector, HVAC

Plumbing, Septic Inspection, Well Inspections

Landscaping, Land Survey, Environmental Consultant

Electrical Repairs and Updates, Lighting

Indoor/Outdoor Painting, Stucco

Roof Repair, Deck & Fence Building, Structural Engineer

Cleaning, Disposal, Power Washing, Carpet Cleaning

Movers, Local Appliance Delivery & Repair

Interior Design, Window Coverings Insurance, Refinance

WE GIVE WHERE WE LIVE

your closing,YOUR CHOICE!

At the end of a real estate sale with our team, Story House makes a donation on behalf of each closed client to a charity of their choice

Something that we are passionate about is making sure that Charlottesville continues to be a wonderful place to live, work and play. Story House Real Estate is proud to support a local charity with every closing. We are so thankful for our amazing clients and the incredible opportunity to improve and support the community we call home Additionally, every quarter, our team takes a day to give back to our community through charities that are close to our hearts We partner with our trusted service providers, our friends and family, and our clients to leave a life-changing impact on the community we call home.

Each of these charities benefited from Story House Real Estate in 2023 They were either recipients of our “Give Where You Live” campaign or recipients of our volunteer time.

250+ VOLUNTEER HOURS

OUR COMMUNITY IMPACT IN 2023 $45,000 DONATED LOCALLY 25+

EVENTS HOSTED & SPONSORED

happy clients say it best

“As out of town buyers, it was important that we have a highly competent, well- organized, communicative REALTOR® to help us in our search. Errin Searcy was all those things and more She helped us begin our search online and then showed us MANY properties on the few days we were in town She was so great at helping us find the exact right property And then, the closing process was so smooth--we were informed every step of the way I recommend Story House and Errin in the strongest possible way!”

GRETCHEN

& RAY BROWNE

“Everyone on the team was very communicative and prompt Brentney went above and beyond to help us close on our house and answered texts and emails that were probably way past her work hours. She was extremely proactive and friendly. We loved working with her!”

JULIANA SILLS

“Jess was always available when we had questions, any time we reached out It was so nice to know that she was there to help us through the process”

LINDSAY HEPLER

“Zoya was an amazing realtor. This was our first home purchase and we did it entirely out of state and over the phone. There was no way we could have done this without Zoya’s support. She did face time tours for us for all the houses we liked and went back and did neighborhood tours when we wanted to see more She was also always available and made sure all our questions were answered ”

DASANI MADIPALLI

“Professional, kind, and most importantly knowledgeable about everything we needed and pointed us in the right direction every time Story House was amazing at helping us through this new and complicated process, answering all our questions and being so readily available. It felt like we really mattered and that they were cheering for us to find the best place for our family, not just any house.”

MEGAN & JUSTIN BRYANT

“Abby Searcy was wonderful! Very knowledgeable and professional in regards to both real estate and communication I would highly recommend using Abby and Story House for your Real Estate needs ”

JIM STOLTZ

“Josh and Virgil were excellent from the beginning. They were always present but never pushy and gave us great insight during our initial house visits that helped us understand what we were looking for in a house and what we wanted to avoid They were available for listings on short notice during the weekends which were super helpful for us After we had found the right house, Virgil and Josh stayed in close contact and helped us make decisions that would ultimately lead us to making a competitive offer and closing Following closing, Cole did an excellent job at making sure everything was clearly explained and tracked, and the trio of Josh, Virgil, and Cole made sure that closing was an extremely smooth process Josh even managed to get some unexpected closing costs back to us following the inspection. One thing that we especially appreciated was the high quality recommendations for vendors given to us by Josh. In all instances, we went with someone that Josh recommended, and every one that we interacted with did an excellent job. Overall, we couldn’t have hoped for a better experience in buying our first house.”

KATE & ZACHARY BEARS

“The ability of the Realtors to be available after business hours was extremely helpful As a medical resident, my schedule was hectic at times and all of the staff was willing to work with me to find flexible times to talk and tour houses ”

JOHN BARRERA

“Story House makes exceptional use of enabling technology and engaged us with e-mail, constant but not excessive mobile contact, and easy-to-use mobile/web apps targeted to specific process steps. It’s clear that Story House Real Estate has built their business based on learning from each experience, and integrate many lessons learned from what is certainly a unique process They share information as needed, which we felt was great at helping us manage our expectations (and stress ) From our experience, everyone at Story House and every interaction was positive, uplifting and constantly mining gems out of every interaction We’re truly grateful for Story House’s effort!”

ALISON & STEVE VISOKAY

“The entire Story House team was fantastic to work with. Communication with both Errin and Cole was both concise and helpful. Errin provided us with excellent referrals for home inspection, radon testing and mitigation. Compared to other realtors we worked with, Errin was excellent in orienting us during a virtual showing of the property and sincere in her assessment of the property She promptly provided answers/feedback to our questions via either texts or emails She is a super star and would wholeheartedly recommend Story House to anyone looking for properties in Charlottesville ”

VALERY KOGLER

5/5 AVERAGE FROM OVER 500 REVIEWS ONLINE!

thank you! 2110 Ivy Road | Charlottesville, VA 22903 434-260-1435 | info@storyhousere.com www.storyhousere.com Thank you for the opportunity to be of service We are lucky to have clients like you and hope you will call us for any of your real estate needs