21 minute read

PROPERTY MANAGEMENT

TRAIN TO MANAGE

Industry knowledge and solid training in several skills is needed to become a successful property manager, writes ANÉL LEWIS

The way a property is managed has a direct and signifi cant impact on its long-term value, so it stands to reason that having certain sought-after skills and knowledge will enhance a career in this dynamic fi eld.

Neil Gopal, CEO of the South African Property Owners’ Association (SAPOA), recommends executive courses in property development and commercial property management. There are also short courses, covering topics such as real estate fi nance, that provide the skills needed. While most property management companies require a matric certifi cate when considering a candidate for a position, having a university qualifi cation would certainly “carry weight”, says Gopal.

SAPOA partners with several universities for real estate courses to ensure that the content is “relevant to industry and internationally recognised, allowing graduates to readily fi nd top positions with good companies”. Gopal adds: “The educational efforts of SAPOA are aimed at increasing knowledge and skills of the property industry among employees and ensuring that the content of programmes or workshops and other educational interventions are aligned to industry needs.”

SAPOA also offers numerous webinar sessions on relevant topics. Often, “experience is more important than education”, says Heinrich Ehlers, managing director of Devmark Property Management. Attributes such as tenacity and problemsolving will certainly count in a candidate’s favour when applying for a position as a property manager, he explains. “We like to look for someone who has experience in maintenance or construction on a senior management level as we have found that many property managers are lacking when it comes to the management of utilities and maintenance.” A candidate with excellent communication skills and who can obtain the best results from suppliers and contractors will also have an advantage, he adds.

ONLINE, SHORT, DIPLOMA AND DEGREE COURSES

Heinrich Ehlers

That being said, some institutions are offering excellent courses in property management, says Ehlers, who recommends online options such as UCT’s GetSmarter short course in property management. Wits University also offers short courses in commercial property management, via the Wits Commercial Enterprice unit, and it is the only university outside of America to offer the internationally recognised Institute of Real Estate Management (IREM) commercial property management (CPM) certifi cation.

The University of Pretoria offers BSc Real Estate, which includes a property management module, while the University of KwaZulu-Natal includes property management in its BSc in Property Development. Unisa also offers an undergraduate diploma in real estate that ensures students understand property management. IREM has a strong relationship with Wits, which also offers degrees and diplomas in real estate.

Tumelo Ramushu, president of IREM South Africa (Gauteng Chapter 123), says that 20 years ago there were very few formal qualifi cations available to pursue a career in property. The property industry was dominated by people with qualifi cations in accounting, engineering and even law. “Property was never recognised as a separate discipline.” IREM South Africa Gauteng Chapter, established in 2018, recognises property management as a distinct fi eld, aimed at enhancing the profi ciency of the real estate management sector with qualifi ed, regulated property professionals. Skills required for property management include fi nance, law, and an understanding of the built environment, as well as credit management, client services and communication. “It is a multidisciplinary career,” adds Ramushu.

While a degree will certainly “propel” an aspirant property manager up the career ladder, especially when it comes to middle and senior management, it is not enough to guarantee success, says Ramushu. A combination of qualifi cations and experience is recommended. IREM supports ongoing professional development by encouraging members to complete short courses in an array of subjects, from communication skills to professional etiquette. “When a person is continually enhanced, they learn more to manage better,” concludes Ramashu.

Neil Gopal

LEAVE IT TO THE EXPERTS

Investing in the services of a property management consultancy will save an owner much time and expense, writes ANÉL LEWIS

The return on a commercial property investment depends largely on how it has been managed and maintained. However, dealing with the day-to-day details of every aspect of managing a building, or a portfolio of properties, can be time-consuming and even costly.

Nkuli Bogopa, managing director of Investor Services at Broll, says one of the key advantages of using a consultancy is that its specialists have the level of skills required to knowledge and expertise,” she says, adding effectively manage built assets. “It is not only that this does not imply that the “trade secrets” about the bricks and mortar; you have to of the respective funds are also shared. “It understand the underlying asset in a building merely gives us the intel we need to better and how it operates effectively.” manage our properties.” Appointing an agency also means that a Building close relationships with tenants property owner no longer needs to appoint is key for property managers, adds Bogopa. additional employees to manage the differing It is those relationships that ensure tenant day-to-day building management functions. retention and keep occupancy rates high. “If a building owner needs to employ staff “It is also easier for a property consultant to manage everything from credit control to manage occupancy costs more closely, to managing rental income, the cost especially during challenging economic implications can be more than the budget times.” Risk management is another important allows,” says Bogopa. function performed by property management

She emphasises companies, she says. the importance of Iggy Sathekga, brand, experience, be that marketing and PR manager at a staff maintenance Mowana Properties, a Broll client, management systems, such as Archibus, controller, or an agency concurs, adding that the use removes the guesswork and human error in such as Broll. Broll has of a consultancy also ensures property management.” managed innumerable that property management is no Bogopa adds: “The wealth of knowledge funds and can tap longer left to chance. “Instead, it and collective expertise that a property into a vast network is a discipline that is thorough and management company has in one basket is of services to identify Nkuli which will, ultimately, improve and incomparable to trying to do it all in-house, trends. “We are very Bogopa enhance a property’s value. The especially if you want to maintain or grow a open to sharing our introduction of professional building building’s value.”

– NKULI BOGOPA, MANAGING DIRECTOR: INVESTOR SERVICES, BROLL AN AFRICAN FOOTPRINT

Broll Property Group has fully edged operations in Cameroon, Ghana, Indian Ocean Islands, Ivory Coast, Kenya, Mozambique, Namibia, Nigeria, Swaziland, Uganda and Zambia and provides services in a number of other countries. The lack of a formalised approach to property management and maintenance in these countries opened the door for Broll to replicate its South African offering elsewhere on the continent, bringing a wide scope of its specialised services and unique capabilities to those markets.

SHOPPING CENTRE PORTFOLIO

Mowana Properties manages two large portfolios worth a total of R40-billion. The rst portfolio under management is owned by Pareto Limited, a shopping centre owner with assets such as Cresta Shopping Centre, Menlyn Park Shopping Centre, Mimosa Mall, The Pavilion Shopping Centre, Southgate Mall, Southgate Value Market, Tygervalley Shopping Centre and Westgate Shopping Centre, with a total GLA in excess of 848 000m².

The second portfolio under management is owned by the Government Employees Pension Fund (represented by the Public Investment Corporation SOC Limited). This is a mixed-use portfolio boasting 152 properties inclusive of of ces, industrial, residential and retail.

Mimosa Mall, Bloemfontein

The past year can easily be described as momentous. It saw the start of a global pandemic and had a seismic impact on the South African commercial property market. In addition to the echoing chambers and hallways of organisations, retail outlets were empty of people for a large part of the year and rental properties faced complexities that could never have been prepared for.

The sector is now looking ahead to a year that presents a mixed bag of challenge and opportunity. Reduced tenancy rates, a slowgrowing economy and limited visibility into a vaccine strategy means that there is still uncertainty around investment into property development, low-cost student housing and Eskom. While the outlook is not as bad as perhaps 2008, it still puts pressure on the commercial property market to ensure a sustainable nancial future.

DELIGHTING THE TENANT WITH GOOD BUSINESS PRACTICE

The commercial property market is under pressure and property owners need to fi nd smart ways to keep their tenants happy, writes MARISKA BURGER

STREAMLINE THE ADMIN

RENTERS’ MARKET

According to the PayProp Rental Index for Q3 2020, rental growth saw a stark drop for two quarters, recording new lows in September 2020. The market will take time to recover and things are still not yet 100 per cent. The index found that quarterly growth year-on-year was halved from Q1 to Q2, measuring just 1.5 per cent, “the lowest it has been since the index was launched in 2012”.

It is a renters’ market that puts the tenant in control, so property owners need to nd alternative routes to engaging in tenant delight so that they keep the right people and pro ts. “The tenant has the power of veto and choice,” says Michael Franze, managing director at Citiq Prepaid. “They want more from their landlords and property managers. They want to feel engaged and heard. They want their needs re ected in the decision-making and they want to know that their investment in the property is valued. If the costs are too high, the rules too rigid or the systems too complex, tenants will vote with their wallet and go somewhere else.”

Tenant delight is the key to thriving in a complex market. It’s the hook that holds the tenant in a market that’s clamouring for their attention.

And it’s a complex trick to master when so many commercial properties have stunning resources and features on offer. “One of the most solid and appreciated foundations upon which to build tenant delight is minimal admin,” says Franze. “Tenants appreciate having to deal with less admin in their lives, so if your property can provide that service, then you’re already ahead of the game.”

One of the areas where admin can be easily minimised and streamlined is in utilities. Water and electricity can be costly for both the estate and the tenant. If the utilities are shared, if there’s a water leak, or if a tenant misuses a utility at the expense of the others, then this can result in a disputed bill and expensive time spent on resolving the situation. It also can cause a breakdown in the relationship with the tenant and between tenants, which is not ideal.

“Prepaid utility meters are a reliable way of mitigating the utility billing challenge,” concludes Franze. “They improve utility administration, cost management, payments and usage, plus they provide much-needed visibility into energy and water consumption. With prepaid sub-metering solutions, the body corporate can hand the control back to the tenant while engendering transparency and improving accessibility to essential services.”

This reduces the admin involved for the business as the property manager no longer has to collect payments from the tenants or deal with disputes around payments or amounts. With Citiq Prepaid, funds collected from the tenants are kept in a trust account and then transferred to the landowner by the second business day. The landowner then pays the municipality or Eskom directly. For a minimal service fee, there is no billing con ict, funds are stored in a secured account, the tenant gets control over their spend, and everybody’s admin is reduced.

It is a seamless way of avoiding the complexities of property rental and introducing a reliable and appreciated layer of tenant delight.

A Citiq Prepaid meter.

Michael Franze

MICHAEL FRANZE, MANAGING DIRECTOR, CITIQ PREPAID

THE POWER OF PERFECT TECH

By effectively harnessing technology, commercial property managers can ensure a healthy, profi table portfolio, generating immense value for themselves and their clients, writes DALE HES

Johann van der Merwe, managing “I like to describe property managers not director of intelligent property software just as property managers, but rather as management company WeconnectU, asset managers. We need to remember that says that an integrated technology landlords are investors in an asset class called ecosystem can take care of the most property. They expect property managers crucial challenges of commercial property to manage their assets and report on areas management. He identifi es these as beyond just rental income. Property managers compliance, portfolio manageability, scalability should be communicating on yield, capital and profi tability. growth and return on investment, just like their

“The manageability of a portfolio is always a counterparts in fi nancial markets.” challenge for commercial property managers,” WeconnectU has developed three fully says Van der Merwe. “To build a healthy integrated property management solutions, portfolio you have to focus on a few key focused on community property management, performance indicators (KPIs) rental asset management, and such as fi nancial management, inspection and maintenance arrears management, lease management. “Our rental management and compliance asset management solution to name few. In an ideal is the only one in South Africa world, commercial property that helps property managers managers would have one to reposition themselves as single dashboard that can commercial asset managers. track all of these KPIs.” It addresses all of the He explains that developments in software have Andrew Schaefer pillars needed to create a healthy portfolio.” allowed commercial property managers to scale up their portfolios while saving on costs such as expanding staff complements.

“In most cases, more properties in a portfolio equals more people who have to manage these properties. However, we have now developed amazing technology that can help to not only deliver better service, but also allow commercial property managers to manage more properties with the same core team.”

Van der Merwe stresses that technology can also address what he describes as a major “missing link” in the commercial property space – the nature of the relationship between commercial property managers and clients.

FIND AN END-TO-END SOLUTION

Van der Merwe suggests that when commercial property managers are looking to adopt new software systems they should be focused on fi nding an end-to-end solution that provides automation, intelligent reporting and integration. “For example, does the solution address the four core pillars of rental portfolio management – tenant vetting, account management, lease management, and inspection and maintenance management? Does the solution provide intelligent dashboards that summarise the KPIs of my portfolio in one place for better management? Does the technology help to unlock every possible income stream and automate that unlocking as much as possible? Can the solution help me to communicate my value as a property manager better to my clients?”

“COMMERCIAL PROPERTY MANAGERS NEED TO BUILD THE PERFECT ECOSYSTEMS FOR ULTIMATE EFFICIENCY AND BE ABLE TO DO MORE WITH LESS. ” – JOHANN VAN DER MERWE,

MANAGING DIRECTOR, WECONNECTU BEING TECH-ENABLED IS A MUST

During these current turbulent times becoming tech-enabled is a non-negotiable for commercial property managers, comments Van der Merwe. “To survive, commercial property managers need to build the perfect ecosystems for ultimate effi ciency and be able to do more with less. Client demands are only going to become greater in the future, and online portals and automation will be key elements in the commercial space,” he concludes.

Andrew Schaefer, managing director of Trafalgar Property Management, agrees that technology is essential for effective property management. He highlights that technology now has the ability to gather and analyse information about aspects such as vacancies and letting activities, rental arrears, maintenance tasks, budgets and administrative activities.

“Integrated property management information systems typically cover all of these functionalities. Automation enabled by technology innovation improves client service technology innovation improves client service effectiveness, productivity and effectiveness, productivity and turnaround times, and allows turnaround times, and allows property managers to manage property managers to manage larger portfolios to enhance larger portfolios to enhance their margins. their margins.

“It is essential for commercial “It is essential for commercial property managers to be aware property managers to be aware of the latest innovations and of the latest innovations and technologies available, particularly technologies available, particularly automation, to harness the automation, to harness the opportunities concerned,” opportunities concerned,” explains Schaefer. explains Schaefer.

Johann van der Merwe

THE VALUE OF COLLABORATIVE ENGAGEMENT

Investing wisely in solutions and partnerships will ensure the property sector’s future profitability

Installing prepaid meters minimise the risk of unpaid bills for building owners.

Prepaid sub-meters provide a great utility management solution.

The past 12 months could hardly be described as “business as usual”, yet businesses have continued despite the restrictions imposed due to the pandemic. The varied shifts in lockdown regulation and ongoing compliance limitations have put pressure on the property sector to maintain value, ensure liquidity and keep tenants safe while remaining compliant. It was a complex maze to navigate, one which continues to impact on the sector in a fragile 2021. However, it is not the same space that the property market entered into at the start of 2020 – lessons have been learned, steps have been taken and plans have been made. As Deloitte points out in its analysis of the impact of COVID-19 on the real estate sector, there is one word that defines how companies should approach the new year and the market in 2021 – resilience.

“Resilience is not just the ability to shift approaches and strategies to meet changing needs and markets, it is also about investing in solutions and approaches that are capable of allowing for greater flexibility and business agility,” explains Michael Franze, managing director at Citiq Prepaid. “The real estate sector must focus on building resilient foundations that can handle whatever challenges lie ahead.”

This doesn’t mean that organisations should be approaching the future with fear and trepidation. Quite the opposite. The past 12 months were a series of curveballs that taught organisations new tricks and new ways of embedding resiliency into their strategies and planning. They have also emphasised the value of partnerships.

“Collaboration is a key component of most business success stories,” says Franze, “working with partners that can provide solutions and support and can help future-proof investments and property. This is where Citiq Prepaid comes in. We offer the real estate sector a trusted and ethical partnership that ensures that properties remain on top of one area that can present significant problems down the line, especially in uncertain times – utilities.”

Utilities are often a hidden issue that only emerges after a tenant has left or when a company wants to sell. Unpaid bills – which can run into thousands of Rands – are suddenly sitting on the table. The municipality won’t issue a clearance certificate for a property unless all charges are paid. So, the

property owner has to either hunt down the person who incurred the charges or take the financial hit. For many, tracking down the tenant who left the bills unpaid is an almost impossible task as they’ve moved on, changed their name or possibly even left the country. And, if found, it’s unlikely they will consider paying a bill that could seriously affect their financial status.

“Unfortunately, unpaid municipal bills are a far more common problem than many companies realise,” says Franze. “Then, when it comes time to sell a property, they’re stung by a massive charge that will impact their profits. Fortunately, this can be avoided. One of the most reliable ways of minimising the risk of unpaid municipality bills or fraudulent activity is to install prepaid sub-meters. If these are of the right quality and installed to the right standards, they will ensure that tenants receive consistent utility supply without unexpected charges and that property owners don’t end up with unexpected bills.”

Citiq Prepaid is one of South Africa’s leading providers of prepaid sub-metering solutions. It has access to a vast network of accredited electrical contractors that understand exactly how to install and activate the meters for tenants and owners. The company is known for its high-quality solutions, low-cost and visible charges, and exceptional call centre support as well as its vast network of recharge points and online recharge options that allow for tenants to manage their payments without personal risk. Partnering with Citiq Prepaid ensures that utilities are always tightly managed, bills always paid, and a property is prepared for whatever may lie ahead.

For more information:

+27 (0) 87 55 111 11 sales@citiqprepaid.co.za www.citiqprepaid.co.za

WHERE DO INVESTORS FIND VALUE IN TIMES LIKE THESE?

South Africa along with the rest of the world is trying to come to grips with the effects of COVID-19. In a crisis like this, investment arenas suffer, portfolio values fall, investors are fearful and panic sets in, resulting in huge distruption of the investment sector

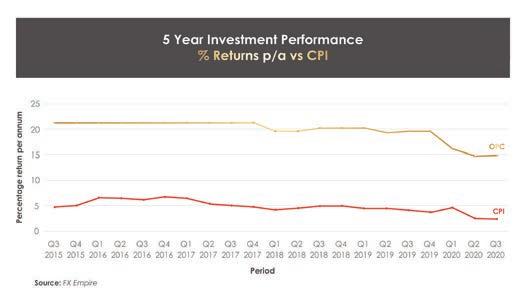

Investments Performance 2015 - 2020.

New Cape Town development to be funded by private investors.

During these trying times, investors must rethink the way they invest. They need to look for vehicles that protect and preserve their capital with structures that are geared to weather the short- to medium-term implosion and fluctuations we are currently experiencing. For investors looking for value, it’s time to change the way they invest. Opportunity Private Capital offers an investment product with a proven formula that encapsulates high fixed annual returns, fixed asset-backed security and secure structures to protect investors.

“I’ve been taking up investment opportunities with Opportunity for well over 12 years now and I will most certainly continue to do so for many more years to come. My investments have grown and created muchneeded financial stability. It always gives great comfort to know that there are multiple layers of security created in an effort to protect and preserve investors’ funds,” says Charles, a long-standing investor.

Opportunity Private Capital is a Cape Town-based boutique investment company that enables private investors to participate in the financing of residential property developments. It offers the opportunity to invest in the real estate sector and earn high fixed returns without the hassles associated with owning physical assets. Investors get to be part of the value that is extracted from developing and, because the projects are funded solely by their private clients, the clients hold all the development assets as security until they are repaid.

Opportunity Private Capital does not ever handle investor funds. All investor capital is paid into the attorneys trust account and the investment proceeds on exit are also paid by the attorneys, making for a seamless, diligently managed process.

“I’ve been investing with Opportunity Private Capital since August 2017. They have, without a doubt, provided me with absolutely incredible service and I have found that the investment processes are structured and very professional,” comments Ross, another investor.

GOOD RETURNS FOR INVESTORS

The company has established a secure assetbacked investment structure to ensure that investors get great value while having all the necessary protection against any downside. With a good track record, its clients continued to earn fixed returns of 18 per cent per annum

in 2020 despite the severe ramifications caused by the pandemic.

“Opportunity Private Capital is the ‘peace of mind’ option for any investor. Coming from a high-risk high-reward investment arena, I felt reassured to know that this ‘safe bet’ option in my portfolio has well above average returns too!” says serial investor, Genevieve.

Opportunity Private Capital has now opened its latest investment window with projected fixed returns to clients from 15 per cent per year. This is for the funding of a project in another high-demand middle-income suburb of Cape Town – an area that is seeing strong sales and rental demand due its safety and proximity to amenities. The projected length of this particular investment is 12 months with options to rollover (reinvest) into subsequent investment cycles thereafter. The retention rate of clients is well over 80 per cent currently, which is a firm indication that Opportunity Private Capital is finding value for its investors, even in times like these.

For more information:

+27 (0) 21 919 9944 invest@opportunity.co.za www.opportunity.co.za