Beyond solar and wind, it offers enormous potential for the African continent

Beyond solar and wind, it offers enormous potential for the African continent

As a trusted adviser, we’ve partnered with Seriti to continue its just energy transition through the purchase of the Windlab Africa Platform. The deal allows Seriti to harness wind and solar assets to reduce its carbon footprint and ensure sustainability as a diversified renewable power producer.

Traditional values. Innovative ideas.

ENGIE was the first Independent Power Producer in South Africa. At present, we have an installed capacity of 1.3 GW, with another 425MW in advanced development and a pipeline of over 2GW. We have implemented a Green Hydrogen solution* in mobility – a global first, piloted in South Africa.

Our purpose is to accelerate the transition towards a carbon neutral economy through reduced energy consumption and more environmentally friendly solutions. This purpose brings together the company its employees its clients and its shareholders and reconciles economic performance with a positive impact on people and the planet.

We leverage off our international expertise and partner with local entities to ensure we implement the best energy solutions for South Africa.

AfricaCommunications@Engie.com Scan

8 ENABLING THE PRIVATE SECTOR TO SOLVE THE ENERGY CRISIS

International law firm Allen & Overy shares their perspective on the country’s energy situation, and what they think needs to happen from a legal and commercial standpoint.

11 HOW A DIRTY INDUSTRY IS GOING GREEN

Mining is rapidly cleaning up its image and making a positive contribution to carbon reduction.

13 MOVING BEYOND LEGACY THINKING

To deliver effective energy access in Africa, we need to consider new ways of doing things, like utilising mini-or micro-grids.

16 ELECTRIC VEHICLES DELIVER!

Electric vehicles are proving enormously successful for short-distance deliveries, such as those performed by retailers for their online goods.

21 WHY EVERYONE SHOULD WANT AN EV

A man-in-the-street view of what it’s like to drive an EV, and the benefits it offers over internal combustion engines.

24 TRANSITIONING TO MANUFACTURE EV S

South Africa is at risk of losing export markets for our automotive industry, unless we begin to transition to EV production.

28 BUILDING A STRONG EXPORT SECTOR

The African continent is well positioned to be an exporter of green hydrogen – experts discuss how SA can capitalise on this.

29 SA’S GREEN HYDROGEN NATIONAL PROGRAMME

Looking at the challenges facing SA’s Green Hydrogen National Programme, and the benefits that might spin out of this.

33 SA’S GREEN HYDROGEN CORRIDOR

What the MoU between the Western Cape and Northern Cape means for the establishment of a green hydrogen corridor.

34 IMPACT RENEWABLES CAN HAVE IN AFRICA

Unpacking the role that renewables have to play in improving lives and boosting economies in Africa.

39 ESTABLISHING A CARBON-NEUTRAL GRID

With massive carbon emissions globally, electric utilities play a crucial role in achieving a low-carbon future, so it is crucial they decarbonise their grids.

42 FINANCING OUR ENERGY FUTURE

How financing sources and structures could drive South Africa’s future energy mix.

44 THE NEW CLIMATE FINANCE PARADIGM

How the Just Energy Transition Investment Plan will work, and what it will cover.

45 OBTAINING INVESTMENT IN A RENEWABLE PROJECT

Taking a look at what investors seek when investing in renewable energy projects.

48 A NET-ZERO FUTURE IS A COLLECTIVE RESPONSIBILITY

To help mitigate the growing climate crisis, we urgently needs smart solutions, and every organisation, government and individual has a role to play.

48 WASTE-TO-ENERGY IS AN IMPORTANT PART OF THE JUST ENERGY TRANSITION

Much of the waste going to landfills, if managed effectively, could be reused as alternative resources in the form of waste-to-energy solutions.

49 THE IMPORTANCE OF RECYCLING LEAD-ACID BATTERIES

As we move away from using lead-acid batteries, it becomes crucial for users to ensure the correct disposal of these items.

49 PROTECT YOUR HOME FROM ENERGY VAMPIRES

Smart technologies offer homeowners the opportunity to nimbly automate household devices in ways that enable them to save on electricity costs.

50 THE IMPORTANCE OF ESG CREDENTIALS FOR IPP S

Renewable energy IPPs can be the enablers of ESG for the rest of the market – if they share the right credentials.

51 UNMANAGED ENERGY CONSUMPTION IS A REAL THREAT

If businesses don’t know what is contributing to their electricity bills, it becomes very difficult to reduce costs.

52 WHAT WILL OUR FUTURE ENERGY MIX LOOK LIKE?

Material planning is going into what SA’s future energy mix could look like, and this planning is also considering costs and funding sources. EY’s expert unpacks the details.

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Rodney Weidemann

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Alexandra Clüver, Trevor Crighton, Andrew Dickson, Sandra du Toit, Alexandra Felekis, Caryn Gootkin, Dale Hes, Roger Hislop, Lubumba Kamukwamba, Mzukisi Kota, Murray Long, Mlungisi Mahlangu, Nicolas Marsay, Benjamin Mbana, Zuko Mdwaba, Vladimir Milovanovic, Alessandra Pardini, Anthony Sharpe, Kate Stubbs, Benjamin van der Veen

Copy Editor: Anthony Sharpe

Content Co-ordinator: Vanessa Payne

Digital Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Advert Designer: Bulelwa Sotashe

Cover Image: istock.com/ Scharfsinn86

SALES

Project Manager: Gavin Payne

GavinP@picasso.co.za | +27 21 469 2477

+27 74 031 9774

Sales: Brian McKelvie, Brownyn Rachman, Mark Geyer

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

The majority of South Africans have not felt so powerless since the advent of democracy, as rolling blackouts impact businesses, individual homeowners and the nation as a whole.

Clearly, energy is of the highest concern right now, and following President Cyril Ramaphosa’s State of the Nation Address, we asked international law firm Allen & Overy to share their perspective on the country’s energy situation, and what they think needs to happen from a legal and commercial standpoint.

But despite the many areas of challenge this sector faces, it is not all doom and gloom, as we look at how mining, a traditionally “dirty” industry, is transitioning to renewables and making a positive contribution to carbon reduction. In addition, we look at new ways of thinking, such as implementing micro-grids to supply energy to the under-serviced.

Despite the country’s electricity generation woes, electric vehicles (EVs) are gaining in popularity, especially as short-range delivery vehicles for retailers. We get a behind-the-wheel view of what it is like to drive one of these cars, and a stark warning that our automotive industry urgently needs to transition to manufacturing EVs – or risk losing our export market.

Beyond solar and wind, green hydrogen offers enormous potential benefi ts for South Africa and the continent as a whole. In fact, the Western Cape and Northern Cape have signed a memorandum of understanding to create a green hydrogen corridor. Similarly, we consider the potential benefi ts and challenges of South Africa’s Green Hydrogen National Programme. We also look into the

possibility of African nations working together to build a strong export sector for this product.

Renewable solutions such as solar and wind form a big part of the Just Energy Transition Investment Plan (JET IP), so we consider how the plan will work and exactly what it will cover. We also gain insight into the role that renewables have to play in improving the lives of citizens and in boosting economies in Africa, along with taking a deep dive into exactly what investors seek when choosing to invest in renewable energy projects on the continent.

A number of experts in the fi eld also write for us, discussing legal aspects like power market reform and the JET IP, and the importance of renewable energy independent power producers demonstrating solid environmental, social and governance credentials. We also look deeper into environmental concerns like utilities establishing a carbon-neutral grid, recycling lead-acid batteries and the vital role of waste-to-energy conversion in the overall JET plan.

An expert cautions that a net-zero future is a collective responsibility, with every organisation, government and individual having a role to play, while another notes how vital it is for companies to be able to understand exactly what is contributing to their electricity bills, in order to reduce costs effectively.

We also look at what South Africa’s future energy mix could look like, while providing advice to homeowners on how certain smart technologies can help them reduce their household electricity expenses.

It appears that while our immediate future will be impacted by ongoing rolling blackouts, much is at least being done to implement the JET IP, bring more renewables into the mix and plan for a long-term green energy future.

Hopefully, we are not too far from our country’s greatest dream: returning power to the people!

COPYRIGHT: No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Energy is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

Rodney Weidemann Editori doubt any reader will be surprised to learn that in the midst of the current crisis, Eskom itself refused to respond to our request for comment.

South Africa has been facing significant challenges with electricity supply for many years, which has resulted in frequent power outages and load shedding. Ageing infrastructure and the growing demand for electricity have exacerbated the problems. The need to implement load shedding to manage the electricity supply and demand imbalance is significantly impacting our households, businesses, and the economy.

The complete electricity value chain, from generation to transmission to distribution and to the customer, is dependent on accurate measurements to operate and function optimally. If the measurements are inaccurate, the evaluation and control of the electrical energy system cannot be precise. Likewise, energy-efficiency initiatives are also informed and facilitated by accurate measurements. The study of measurement, measurement science, is called “metrology”.

The National Metrology Institute of South Africa (NMISA) has technical expertise in electrical measurements to verify, validate, and ensure that electrical measuring equipment and related devices are accurate to the highest level, thereby supporting reliable operation and maintenance

of electrical systems and fair energy trade/billing. Accurate measurements are an indispensable link in the value chain, as monitoring and control of electrical systems are always informed and enabled through measurements.

In recent years, the field of electrical precision measurements has received more attention, mainly due to the advancement of science and technology as well as the evolving needs in the electrical industry. The importance of accurate measurements will be amplified in the electricity supply space in the very near future, considering that there will be bidirectional trade of energy where customers who are usually the consumers of energy will also sell back into the grid. As such, both seller and buyer of electrical energy will need to have confidence in the measurements of the energy meters. NMISA

ensures that confidence in energy meters through its internationally comparable electrical measurement standards.

THE DANGERS OF INACCURATE MEASUREMENTS

NMISA is mandated under the Measurement Units and Measurement Standards Act, No 18 of 2006, to keep and maintain internationally recognised national measurement standards (NMS). NMS have proven traceability of calibration and measurement capabilities to the International System of Units (SI units) in their accredited laboratories. The SI base units include meter, second, mole, ampere, kelvin, candela, and kilogram. Many SI-derived units, for example, volt, watt, and joule, are obtained from the base units.

The NMS are disseminated to industry, for example, the electrical power industry, through

Accurate measurements are indispensable for reliable monitoring and sustainable control and maintenance of the national power grid, writes NIMSA

ACCURATE MEASUREMENTS ARE AN INDISPENSABLE LINK IN THE VALUE CHAIN, AS MONITORING AND CONTROL OF ELECTRICAL SYSTEMS ARE ALWAYS INFORMED AND ENABLED THROUGH MEASUREMENTS.

calibration of related electrical measuring instruments and devices used in the electricity value chain. Calibration involves comparing (and transferring) the accuracy of a known NMS, which is the reference, to another device. The accuracy and correctness of the electrical measurements obtained through the NMS are essential to all stakeholders, such as energy producers, transporters, distributors and consumers, as well as for the reliable operations of the electrical power systems.

There are several consequences of inaccuracy, for example:

• If measurements are inaccurate (for example, in metering systems), then fair trade is inhibited since the billing is not trustworthy.

• If power quality measurements are inaccurate, dirty power can enter the grid and cause instabilities.

• If a sensing element in the electricity network is not operating accurately, important warning information on the state of a network structure may be missed.

• If boiler temperature is not accurately measured, then the control of the boiler flow temperature cannot be correct and energy efficiency can be compromised. Ultimately, if measurements are not accurate, then monitoring and reliable control cannot happen, and proper maintenance or operation of systems can be compromised. If measurements are inaccurate, operation of instruments and systems within the allowable limits according to standards and regulations cannot be verified. Thus, accurate measurements are the cornerstone of proper operations in the electrical power industry and, by extension, in every facet of our daily lives, such as health and safety, manufacturing, environmental protection, and energy security, among others.

To this end, within the electrical industry, NMISA promotes and supports the accuracy of electrical measurements that satisfy the relevant technical specifications of the respective electrical measuring instruments and devices by performing internationally comparable calibrations. NMISA offers calibration and measurement services in a wide scope of electrical quantities for the electrical industry as depicted in Figure 1.

devices operate within the relevant technical specifications, national and international regulations, and related codes of practice in the electricity industry. Furthermore, NMISA has technical experts who provide relevant measurement expertise and consultation relating to electrical measurements, calibrations, and test equipment.

These services are provided through calibration with high-end NMS, equipment and systems that are regularly compared against international measurement standards.

Some of the industries served by the NMISA electrical laboratories include energy meter manufacturers, power utilities, electrical component manufacturers, municipalities, and accredited laboratories.

The NMISA electrical laboratories perform calibrations and measurements that verify if electrical measuring instruments and

Scan this QR code to go directly to the NMISA website.

For more information: info@nmisa.org www.nmisa.org

During the State of the Nation Address, President Cyril Ramaphosa declared a national state of disaster in the energy crisis.

ALESSANDR A PARDINI and ALEX ANDR A CLÜVER (partners in A&O’s Projects practice); BENJAMIN MBANA (head of Tax); and ALEX ANDR A FELEKIS (counsel in the firm’s Projects practice) of Allen & Overy unpack what this means

These issues have been known to the government for years. They know what to do. Now they just need to do what they have been planning to do, which is to implement the separation of Eskom and supplement the failing aspects with private-sector solutions. Enable, enable, enable – that’s what they must do. Look what happened when they raised the generation licence cap from 1 to 100 megawatts.

It is clear that the private sector in South Africa is good at “self-solving”, and well positioned to assist in solving the grid capacity issue. At the moment, with grid capacity being limited, it is hampering the private sector from adding more power to the mix.

The declaration by President Cyril Ramaphosa of a national state of disaster related to the electricity crisis during the State of the Nation Address has raised both cheers and concerns. In it, he announced the return to a dedicated energy ministry, promised the fast-tracking of renewable energy into the national grid, and outlined tax incentives for households and businesses that switch to renewable energy –all in an effort to solve South Africa’s intractable energy crisis.

But are these measures achievable and are they enough to get the country out of this crippling crisis? International law firm Allen & Overy is the most prominent source of advice on energyrelated matters to both the public and private sectors in South Africa, including the renewable energy and mining sectors. These are our perspectives on the country’s energy situation, and what we think needs to happen from a legal and commercial standpoint.

First of all, Eskom is made up of three divisions that ideally – as the government has acknowledged – need to be separated: transmission; distribution and generation. The first two are functional, with high availability levels but current constraints in respect of capacity. This indicates that future planning and strengthening are at serious risk.

The critical issue at present is generation, which has traditionally been the profitable division of Eskom’s business, but which has been failing in the absence of proper maintenance and skilled operators. It appears the only viable solution for generation moving forward is the privatisation of key assets.

Allen & Overy’s lawyers have been instrumental in evolving the country’s legal system to allow for a sustainable energy future. We know Eskom can’t generate enough power, therefore we need to pump more privately generated power into the national grid. But the grid is actually not yet in a state to receive all the private power that could be generated. As a country, we first need to add capacity to the transmission system.

The state is now in a position where it will probably be forced to source more power from power ships, as some other energydeprived African countries do. These seem like an inevitable short-term solution, so chances are good that the government will procure power from foreign power barges because it can be done quite quickly. We hope such procurements will be done only on a short-term basis.

The state of disaster will truncate procurement pathways for alternative sources of power, which cynics will say is a recipe for corruption, but which pragmatic optimists like us will say is necessary to find shorter routes to a solution to the energy crisis. COVID-19 has taught us that if red tape is cut, we can find quicker solutions to our greatest collective challenges.

Mining and energy never belonged in the same portfolio. With the two combined, energy –especially of the renewable sort – will always play second fiddle. The reality is that South Africa’s gross domestic product is heavily reliant on mining, which is still heavily reliant on coal for power generation.

The state is now in a position where it will probably be forced to source more power from power ships, as some other energy-deprived African countries do.Alessandra Pardini Alexandra Clüver

That creates a conflict with South Africa’s carbon neutrality agenda. So, if we want to start taking renewables seriously, the energy portfolio must have its own minister and director general, to prioritise implementation over the coming years.

South Africa’s base load energy will come from coal in the foreseeable future because the country does not have natural gas, and importing liquefied natural gas (LNG) for base load power is too expensive in light of current geopolitics.

We are witnessing more and more individuals and companies turning to solar and their own power generation in order to alleviate the difficulties posed by the ongoing power crisis. The introduction of tax incentives to allow households and businesses to tap solar energy, using rooftop panels, will serve as a means of incentivising taxpayers to help alleviate pressure on the national power utility’s grid.

In 2016, National Treasury introduced tax legislation that provides for an acceleration of depreciation on machinery, plants or utensils, owned or acquired by companies and used in the purpose of trade, to generate electricity using solar energy. This legislation does not serve as a

A burgeoning battery market and value chain in the country could generate up to R36-billion in revenue a year by 2032, as well as tens of thousands of jobs.

tax break, but instead provides a time value of money benefit, in relation to tax deductions to which corporate taxpayers would be entitled. When this legislation was introduced, National Treasury and government had not foreseen the extent of the power crisis that has unfolded since 2016.

Accordingly, to give effect to the proposed tax breaks, a revision of the current legislation is necessary in order to provide a meaningful tax incentive as opposed to what is currently available, and an opportunity for households also to benefit from personal electricity generation.

One must, however, caution that the provision of tax breaks will likely only serve as a short-term solution to the power crisis. Furthermore, using tax incentives is not always an effective means of influencing taxpayer behaviour.

Due to the intermittent nature of renewable energy, additional sources of stable generation are required to meet South Africa’s energy needs. A short- to medium-term solution is the introduction of energy storage systems on the grid, or the integration of these solutions

with wind and/or solar projects. According to a new report by the World Bank, South Africa is expected to show rapid growth in energy storage demand over the next five years. A burgeoning battery market and value chain in the country could generate up to R36-billion in revenue a year by 2032, as well as tens of thousands of jobs.

In order to maximise the commercial viability of energy storage systems, the network operator should create a procurement model in terms of which it can enter into service and response contracts and/or capacity contracts with energy storage providers on an expedited basis.

The long-awaited gas-topower procurement, in terms of which imported LNG will be used as a fuel source, seems like the obvious answer, but affordability and environmental considerations make this a complicated solution.

Hybrid power solutions, including wind and solar power and battery storage, are the next step in terms of private power generation for South Africa’s mines and their ability to sell power back into the national grid. We need security of supply, price arbitrage, revenue stacking, reverse auctions and prioritised procurement – but we are not there yet.

Enpower Trading (Pty) Ltd is a licensed private electricity trading company with the mission to provide unique and innovative energy supply solutions for the future of energy in South Africa. The first energy trader to secure a license from the National Energy Regulator (NERSA) in over a decade, Enpower Trading will play a critical role in accelerating private investment in new generation capacity, putting power back in South Africa’s hands.

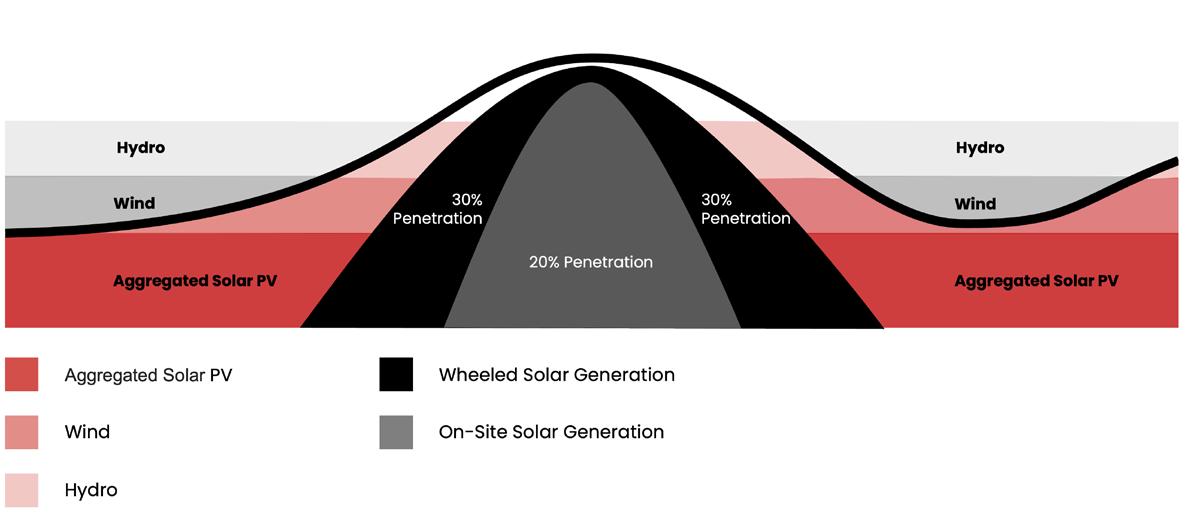

Leveraging electricity wheeling and trading will be instrumental in increasing the generation capacity on the Eskom and Municipal network grids which will stabilize the electricity supply industry over time. “Electricity wheeling” is the buying and selling of generated power, which includes the transportation of additional electricity produced by power producers to a buyer using utility-owned power grids.

Wheeling has since evolved from being merely a one-to-one transaction to allow for multi-lateral transactions which facilitates the transportation of electricity on behalf of Independent Power Producers (IPPs) to multiple off-takers.

The many-to-many or many-one offering is the ability to aggregate energy supply from multiple generators, consolidating and blending any form of renewable power available in the energy mix. This allows for the aggregation of a specific customer’s total energy demand across their multiple sites under one offtake agreement.

A blended energy mix offering increases the customer’s total renewable energy penetration % as more renewable energy sources are added to the Enpower Trading portfolio. Through aggregation, a blended offering can deliver a full renewable energy solution which can support our customers with their ambition to reach ‘net zero’ over time.

The trader model therefore provides risk diversification for both customer and generator - as they are not locked into a long-term deal with one specific supplier - whilst also providing fixed annual escalations and flexible contracting terms. As such, Enpower Trading is able to deliver utility- scale solutions to assist in alleviating the generation shortfall in South Africa and reducing the need for loadshedding over time.

Whilst there are several challenges hindering access to the market, the gradual unbundling of power generation, transmission and distribution in South Africa means that customers now have the choice to buy privately generated electricity from reliable sources, enabling competition and increasing generation capacity through multiple sources.

This is the first step toward unleashing the merchant market where demand is met through dynamic trade and Enpower Trading is uniquely skilled and well positioned to facilitate market enablement as South Africa transitions to a more open and competitive energy sector.

As South Africa and the world grapple with the transition to a low-carbon future, our mining sector can support this move in a number of ways. Mines are producing more critical minerals that underpin renewable energy production and battery manufacturing – key pillars in moving away from carbon-based technologies. They are also are coming up with innovative ways forward that embrace energy efficiency and renewable energy sources.

On the production side, Africa contributes mainly through mining copper, cobalt and tantalum in Central Africa, while platinum group metals are mined in Southern Africa. According to SRK Consulting director and principal consultant Andrew van Zyl, these commodities come from regions that have contributed relatively little to the carbon emissions hastening climate change. “Despite this, African countries are, through their mining industries, making a significant contribution to supplying the minerals for a global energy transition. There are also possible reserves of lithium in Zimbabwe, and perhaps in the Democratic Republic of Congo, Namibia and Ghana.”

Van Zyl notes that mining companies in Africa, as elsewhere, have focused increasingly on environmental, social and governance (ESG) compliance. This includes climate change and resilience, which drives efforts to reduce mines’ carbon footprint. At the level of mining operations, there is growing momentum in raising energy efficiency as a route to cutting carbon emissions. There are also efforts to substitute fossil fuels with renewable sources of energy.

Following the South African government’s landmark decision in late 2021 to increase the licensing threshold for embedded generation projects from 1 megawatt (MW) to 100MW, mining companies in South Africa are expected to spend as much as R65.2-billion on renewable energy projects in the near term.

The industry plans to introduce up to 3 900MW of solar, wind and battery energy projects. Several mining companies in Southern Africa have already implemented plans to develop solar photovoltaic (PV) plants, with a combined capacity of 585MW.

Sibanye-Stillwater has proposed a three-project plan to introduce 175MW of renewable energy across its platinum group metal (PGM) mining operations in South Africa, which will consist of an 80MW solar PV project at its Rustenburg Platinum Mines Complex, a 65MW solar PV project at its Karee Complex and a 30MW solar PV project at its Bushveld Complex. Accounting for approximately 39 per cent of the group’s energy demand, Sibanye-Stillwater’s South African PGM operations are equivalent to around 310MW.

Gold Fields has finalised plans to construct a 40MW solar PV plant at its South Deep gold mine near Westonaria, 50km southwest of Johannesburg. The project currently comprises 116 000 solar panels. The plant will supply the mine with a fifth of its power needs.

The first phase of Harmony’s renewable energy journey consists of a 30MW solar energy plant in the Free State. In phase two, the company will build an additional 137MW of renewable energy at its various longer-life mines, while phase three is in the planning stage and progressing as anticipated.

One of the world’s largest producers of platinum has selected a South African independent power producer to assist with its renewable energy needs. A consortium comprising Pele Green Energy and EDF Renewables South Africa will build a 100MW solar PV plant at Anglo American Platinum’s Mogalakwena mine in Limpopo. The plant is expected to become operational by the end of 2023.

“The ESG-linked financial transactions that we have concluded, alongside the construction of the solar energy plants, are a watershed moment for Harmony and our host communities,” says Jared Coetzer, head of Harmony Gold’s investor relations. “Not only will these transactions help us to deliver on our environmental and social obligations and undertakings, but they will also de-risk the business and deliver many socioeconomic benefits. ‘Mining with purpose’ is ensuring that our investors and other stakeholders continue to derive value and positive returns in a global climate of energy uncertainty.”

Government has secured approximately R100-billion of investment in its Risk Mitigation Independent Power Producer Procurement Programme and the fifth bid window of the Renewable Energy Independent Power Producer Procurement Programme.

Source: Department of Mineral Resources and Energy

The mining industry has long had a reputation for being a polluting and dirty sector. However, it has a key role to play in the world’s low-carbon future, writes

BENJAMIN VAN DER VEEN

Section 153 of South Africa’s constitution places the responsibility on municipalities to ensure the provision of services, including electricity reticulation, to communities in a sustainable manner. Under Eskom’s buckling coal-fired fleet, this obligation (which municipalities have struggled to meet at the best of times) is becoming an evermore unrealistic challenge.

Servicing the electricity needs of South Africa’s mushrooming informal settlements is a particularly daunting task, but government can look towards several pockets of policy-making and renewable energy innovation in the Western Cape, as the country moves towards its Just Energy Transition.

Since its establishment in 2012, the award-winning iShack Project, from the Sustainability Institute Innovation Lab (SIIL), has provided a basic solar electricity service to six communities and up to 3 000 households in Cape Town and Stellenbosch.

The project came about after a 2010 Stellenbosch University study of government’s informal settlement upgrading policies found that the waiting period for many communities to receive formal services was often a decade or longer.

“The current state of Eskom means that the pace of connecting the growing number of un-electrified households to the grid is going to slow down even further,” says SIIL director Damian Conway. “Policies, such as the 2003 Free Basic Electricity policy, need to be updated to clearly direct and enable municipalities to adopt renewable off-grid technologies for low-income households, in order to meet their primary mandate of basic service delivery.”

One such updated policy is that of Stellenbosch Local Municipality, which amended its indigent policy to better enable the provision of subsidised

South Africa needs to move beyond legacy thinking if it is to meet its constitutional obligations to provide electricity. DALE HES investigates how this can be achieved

solar electricity to off-grid households, in partnership with iShack. Through the policy, a R150/month subsidy gives households in two informal settlements free basic solar electricity that they can access voluntarily by paying a small installation fee.

“This makes the service affordable for all households and it gives the municipality the benefit of time to plan and budget for eventual grid-electrification,” says Conway. “Unfortunately, other municipalities have been slow to emulate or build on this innovative and financially sustainable approach.”

In Cape Town, Zonke Energy delivers solar energy to off-grid households in Khayelitsha and Philippi, using solar towers to provide centralised generation, metering and storage. Clients are billed at daily, affordable rates for a fixed maximum daily consumption.

Zonke Energy CEO and founder Hendrik Schloemann points to the need for updated policy and government funding support. “In order to scale, social enterprises in the energy access sector require suitable finance options, and would benefit from updated and supportive government policies to regulate this growing sector.”

Conway agrees, saying that iShack has tested a range of funding and pricing models with some “interesting results”. “We have concluded that the service is difficult to scale without some form of government support.”

While government has approved a R147-billion investment plan to accelerate the country’s transition away from coal and towards clean energy, Conway said that it is crucial that all sectors of society are included in the Just Energy Transition. “We often think of renewables either in terms of big infrastructure to help solve the Eskom capacity crisis, or as a means for wealthy households to ‘Eskomproof’ themselves. The Just Energy Transition, which is a laudable concept for the country’s move to renewables, carries the risk of ignoring energy justice for the millions of people who are most in need of basic energy support.”

With contingency measures in place to mitigate two levels of Eskom load shedding in the City of Cape Town, the Western Cape is undoubtedly leading South Africa’s renewable energy pack, and energy resilience is topping the provincial government’s agenda in 2023.

Speaking at a green energy session in the Overberg in December, energy analyst Clyde Mallinson said that the Western Cape alone could theoretically be able to resolve nationwide load shedding through renewable energy. A caveat, however, is that it would require the province to build 7.5 gigawatts (GW) of solar PV, 4.5GW of wind and 3.2GW of storage capacity, at a cost of R256-billion.

“The current state of Eskom means that the pace of connecting the growing number of un-electrified households to the grid is going to slow down even further.” – Damian ConwayThe iShack Project has provided an affordable, innovative energy solution to more than 3 000 households. Zonke Energy provides centralised generation through solar towers.

At Norton Rose Fulbright, we have extensive experience in the energy sector and a dedicated team that can advise and assist on all legal aspects of this fast-developing industry shares

Norton Rose Fulbright South Africa

Norton Rose Fulbright South Africa has a dedicated and skilled projects and project development team. In addition, we can call on extra expertise and experience from our global practice. We have been a driving force behind an unprecedented number of successful transactions in the South African energy transition, delivering regulatory expertise, corporate and fi nancing transactional advice, intuitive South African business law acumen

and a competitive edge to sponsor and lender clients in the energy sector.

Our experience in the energy sector has been gained by advising on all aspects of the development of the industry, its diversity refl ecting the changes in the sector through privatisation, new models of regulation and fi nancing, and increasing internationalisation.

We are market leaders in the South African government’s various energy procurement programmes. Over the various

Norton Rose Fulbright South Africa

is one of the top legal practices in Southern Africa with close to 200 lawyers and offices in Johannesburg, Durban and Cape Town.

We are a proud level 1 BEE-certified company with a strong and experienced team of lawyers behind our name. We handle a rising tide of cross-border transactions on behalf of banks, development financial institutions, government bodies, major domestic and international corporates, large mining concerns seeking energy security, and multinationals.

bid submission phases of the South African Renewable Energy Independent Power Producer Procurement Programme (REIPPP Programme), of all the bidders selected as preferred bidders to date, we have advised on more than half of these projects on a mix of sponsor, lender and contractor mandates.

We offer a leading commercial legal practice throughout Africa, one of the fastest-growing economic regions in the world. We have an award-winning presence on the continent, having been voted African Alliance/Network of the Year by the African Legal Awards in 2021. We are active across key industry sectors, including power, oil and gas, renewable energy, infrastructure, mining, transportation, food and agribusiness, technology and healthcare. Our lawyers have experience working in more than 45 common law- and civil law-based African jurisdictions. They advise on groundbreaking projects and transactions and assist our clients with their ongoing commercial operations across Africa and internationally.

Complementing our energy practice are robust project fi nance, project development, infrastructure, and mining teams who, together, deliver an unsurpassed, full-service legal solution.

For more information: jackie.midlane@nortonrosefulbright.com matt.ash@nortonrosefulbright.com gregory.nott@nortonrosefulbright.com www.nortonrosefulbright.com

We have been a driving force behind an unprecedented number of successful transactions in the South African energy transition.Norton Rose Fulbright offers a full-service banking, finance, and projects team boasting a diverse group of competent lawyers with offices in Johannesburg, Durban and Cape Town. Scan this QR code to go directly to the Norton Rose Fulbright website.

Despite

Electric vehicles (EVs) may be hugely expensive to import to South Africa and our local industry isn’t yet producing them at scale, but leading retailers like Woolworths and Checkers have realised that the switch away from combustion-engine delivery vehicles is the future. After all, EVs are more sustainable, responsible and efficient, and they’re already making inroads in the local delivery space.

In June 2022, Woolworths formed a partnership with logistics group DSV and mobility specialists Everlectric, to use electric panel vans (EPVs) to deliver online purchases in Gauteng, Cape Town and Durban.

The partnership has Pretoria-based Everlectric providing the EPV fleet to DSV and Woolworths in a solution termed “EVs-as-a-service”. DSV receives fully maintained and insured EVs, charging infrastructure and green electricity that covers a specified number of kilometres over a set rental period, using the Everlectric solution to operate a dedicated green logistics fleet for Woolworths, to support last-mile deliveries.

“For over 15 months, we trialled two electric online delivery vehicles to validate performance and suitability,” says Woolworths mobile and online director Liz Hillock. “One is still currently in operation, as we wait with much anticipation for the arrival of the first batch of our EV order, which is on track to land in the first quarter of this year. Thereafter, additional batches will land at four- to six-monthly intervals. We are aiming to replace around 70 per cent of our current online scheduled-delivery fleet, which comprises more than 75 vehicles, in the next 6–18 months.”

Woolworths has invested more than R1-billion in its digital capabilities over the last three years, to meet the evolving needs of its customers. “This has differentiated our services, resulting in an exponential growth in online sales,” says Hillock. “This latest investment in EPVs enables us to continue growing our online business and deliver the Woolworths difference, but with a lower carbon footprint.”

The move comes on the back of record fuel prices last year, and is proving inspired in the face of escalating stages of load shedding this year. “Load shedding has minimal-to-no impact, as the vans have substantial overnight downtime available for charging,” explains Hillock. “As far as possible, electricity from renewable sources

will be used to power them, maximising the opportunity to utilise solar on site and additional chargers co-located at strategic Woolworths store locations. Should there be any exception to renewables recharging, DSV and Everlectric will work with an audit firm to procure renewable energy certificates, to offset any indirect grid energy emissions.”

During testing, the fully imported EPV saw one charge lasting for a full day of deliveries, at about 240km, with a maximum range of 300km and a governed top speed of 120km/h. The vehicle has already been successfully homologated and licensed in South Africa.

“The vehicle can come in various configurations, including a panel van, a chassis cab and an isolated, fully electric refrigeration unit,” says Hillock. “We opted for EPVs over electric motorcycles, as the vehicles are scheduled to fulfil online home-delivery orders within a 5km radius of stores.” She notes that there are some routes where the route parameters are not ideally suited to the EVs and are thus unlikely to be converted. “There are, however, other service channels that might suit different types of electric vehicles, like electric motorcycles.”

Initial estimates were that the switch to EVs had the potential to save 700 000kg of tailpipe carbon emissions a year, but Hillock says the actual saving will ultimately depend on the

load shedding’s best efforts, South Africa’s retailers are proving that the delivery vehicle’s future is electric, writes TREVOR CRIGHTON

“This latest investment in EPVs enables us to continue growing our online business and deliver the Woolworths difference, but with a lower carbon footprint.” – Liz Hillock

Liz Hillock

Woolworths’ switch to EVs for home deliveries is estimated to have the potential to save 700 000kg of tailpipe carbon emissions a year, demonstrating the impact that might be achieved should all other retailers follow suit.

S ource: Woolworths

volume of orders the company can move into its EV fleet. “Each EV that we deploy delivers immediate savings on C02 emissions and reduces our overall environmental impact. In the longer term, these savings are certain.

“In 2021 we announced bold new sustainability goals and ambitions, which included the goal to have zero net carbon emissions by 2040. We are very much looking forward to being the first retailer in South Africa to embark on such an extensive roll-out of EPVs to support our growing online business.”

Woolworths’ key learnings so far are that the EVs were able to meet the majority of online delivery requirements, speed, reliability, range and cargo space sizing. Indications are that, at current fuel price levels, these are cheaper to operate than the equivalent internal combustion engine vehicle. “We believe that EVs are the future, in that they reduce carbon emissions substantially,” says Hillock. “Each one deployed to replace an internal combustion engine vehicle saves an average of one tonne of urban C02 emissions per vehicle per month.”

She believes that operating an EV fleet will inevitably have an impact on consumer adoption of EV vehicles. “When the consumer begins to appreciate the positive impacts of our adoption of EVs, there will be greater pressure for driving adoption by other channels and other operators.”

The Shoprite Group is piloting the operation of a heavy-duty Scania battery electric vehicle (BEV) for local deliveries. The refrigerated truck can

hold approximately 16 pallets and is powered by nine batteries, with solar panels fitted to its roof and a fully electric cooling system also powered by the vehicle’s battery packs. The vehicle is recharged using renewable energy generated by the group’s existing solar installations.

“The Shoprite Group places significant focus on reducing its environmental impact across operations,” says Andrew Havinga, chief supply chain officer for the group. “One of the ways we’re doing this is by increasing the energy efficiency of our truck fleet.”

Havinga says the acquisition of one of the world’s most advanced electric trucks is another major move in this direction. “Our continued investment in Euro V-compliant vehicles demonstrates the group’s intention to intentionally introduce more fuel-efficient and clean-burning engine platforms to its fleet, meeting both international and local environmental targets to reduce our carbon footprint. Lessons learned from this pilot will help guide the strategy going forward.”

The truck’s special glow-in-the-dark signage makes it more visible when travelling at night. When exposed to sunlight, the signage absorbs and stores particles that are emitted in the dark. More than 1 041 of the group’s existing vehicle trailers are also fitted with solar panels, enabling the refrigeration and tailgate lift to run on solar power even when the engine is not running.

Over the past 12 months, the Shoprite Group has increased its installed capacity of solar photovoltaic systems by 82 per cent to 26 606 kilowatts peak. The 143 674m2 of solar panels at 62 sites is equivalent in size to 20 soccer fields. The group also has EV charging stations at selected sites and plans to expand this further.

Local EV distributor and importer Enviro Automotive has announced local production plans for leading Chinese vehicle manufacturer DFSK Motor’s EVs. Local production will reduce acquisition costs and make commercial EVs more affordable and sustainable for South African transport operators.

“We have years of experience in the renewable energy market, which influenced our decision to start our local assembly programme with the production of battery packs for EVs,” says Gawie Brink, technical director of Enviro Automotive and founder of Solar Europe. “This will reduce the acquisition costs of our vehicles and strengthen our competitive position in the fast-growing local EV market.”

Enviro Automotive MD Gideon Wolvaardt points out that the company’s commercial electric vehicles (CEVs) are currently in testing with many last-mile delivery transport operators, like Takealot. “CEVs are purpose built for last-mile deliveries to create massive cost savings. That is what transport operators want to see – a direct saving on fuel or energy and a low total cost of ownership over the lifespan of their fleet vehicles.”

Wolvaardt explains that the biggest misconception around CEVs is that Eskom’s problems will hamper their operations. “This isn’t true. Many delivery warehouses already support solar power to escape load shedding. These facilities can be used to charge CEVs, either AC or DC charging, depending on the type and number of CEVs being used.

“The response in the last few months has confirmed our initial market research, suggesting that transport operators involved in last-mile deliveries want cheaper and more sustainable solutions for their businesses. Our decision to invest in a local assembly operation indicates our confidence in the growing CEV market,” concludes Wolvaardt.

“Commercial electric vehicles are purpose built for last-mile deliveries to create massive cost savings.” – Gideon WolvaardtA Woolworths electric panel van ready to make deliveries EV charging

Electric vehicles (EVs), we are told, are the future, and while the principles behind them seem great – no more fossil fuels, less maintenance and greater comfort – many remain sceptical of their true effectiveness. Until recently, I was one of those sceptics.

However, having been afforded the opportunity to test drive the Audi e-tron SUV, with its state-of-the-art electric drive, I can confirm all the good things the converts say about these vehicles, and more.

The first thing to note when driving an EV is the simplicity of starting the car with the push of a button. The second, more unusual thing to note is that upon ignition, you know the car has started because the electronic touchscreen and dashboard light up, not because you hear the engine roar.

Driving a virtually silent vehicle is an initially eerie experience for anyone used to the noise of a petrol car. With an EV, pulling off makes no sound at all, even with the phenomenal power beneath you.

A driver of 30 years’ experience, I was nonetheless unprepared for the incredible torque and the speed at which the e-tron was able to go from zero to 60km/h. It makes overtaking slower vehicles on the highway a pleasure, and ensures one feels ever so slightly like a Formula One driver every time you put your foot down.

I can also confirm that the EV couples its power with a smooth ride, stable handling and

A plug-in electric vehicle, the e-tron also recovers and stores energy during normal driving, allowing for greater range. The current range is approximately 300km on a full charge, which, while significantly less than the range of a conventional diesel-powered SUV, is far healthier for the environment.

regenerative braking, which slows the vehicle immediately when you take your foot off the accelerator, requiring you to apply the actual brakes only when you want to come to a complete stop.

The first thing one notices about the car is the virtual exterior mirrors, which are in fact cameras, with the image they project shown on a high-contrast display mounted on the inside of the door.

The e-tron comes equipped with a digital infotainment system that is run through dual touchscreens. The upper screen provides access to the standard Apple CarPlay and Android Auto apps, as well as the audio system, while the bottom screen is mainly used for controlling the climate settings.

A third display, the Audi virtual cockpit, allows you to choose an optional heads-up display, which made this particular user feel a little like he was at the controls of a fighter jet. Along with several power points, the system also features a subscription-based Wi-Fi hotspot and a wireless charging pad on the centre console.

The vehicle also has clever charging and range calculators, allowing you to plan your journeys, view the public charging station network, and manage your charging account as an e-tron owner.

The number of charging stations continues to increase, and utilising these is neither as difficult nor as complex as it might initially appear. Although my first attempt at charging the vehicle, at Fourways Mall, was a little confusing and required a bit of learning, it turned out to be quite simple in the end.

Moreover, with just a little bit of planning, it is easy to combine your charging period with a trip to the shops for an hour or two, killing two birds with one stone.

Charging options include:

• At home, you can use 230V and 400V sockets with the charging system compact, which allows them to charge with a maximum of 11kW.

• A wall-mounted 7kW home charger can also be installed, enabling you to charge the battery in around nine hours, a third of the time it takes using a standard three-pronged plug.

• Public chargers offer an even quicker option: 150kWh that can charge the battery from 20–80 per cent in as little as 30 minutes. In conclusion, I have been driving for decades, and have experienced motor cars, SUVs and even light trucks before, and I can say without a shadow of a doubt that my experience with an EV has proven to be the most exciting time I have had driving. The Audi e-tron is powerful, drives incredibly smoothly and has every kind of extra you could ever hope for.

After test driving a high-end electric vehicle, RODNEY WEIDEMANN reports that these cars outperform petrol cars by an order of magnitude

Driving a virtually silent vehicle is an initially eerie experience for anyone used to the noise of a petrol car.

South Africa’s automotive industry faces losing 50 per cent of its production volume if it doesn’t transition to producing electric vehicles – now.

By TREVOR CRIGHTONThe South African automotive industry contributes around 4.3 per cent to GDP, with the industry’s R207.5-billion in exports of vehicles and automotive components representing 12.5 per cent of the country’s total exports in 2021. The manufacturing side of the industry alone employs about 110 000 people, with 900 000 involved across the value chain.

The lack of impetus in switching its focus from internal combustion-engined (ICE) vehicles to electric vehicles (EVs) puts at least 50 per cent of the country’s production volume at risk from 2025. This is due to the banning of ICE drivetrains in almost all European countries, where over 60 per cent of our production is exported.

Ingolstadt automaker Audi has announced that it will only be launching all-electric vehicles from 2026, and will cease selling ICE vehicles from 2033. Although Audis are full imports to South Africa, the Volkswagen Group has a long-established manufacturing and sales base in the country.

“The consideration of and inclusion of EV production in South Africa requires a focus on myriad elements across the ecosystem, from sourcing components to second life and recycling,” says Sascha Sauer, head of Audi South Africa. “If South Africa wants to remain relevant in the global automotive market and have access to the latest vehicle technology, all parties in the private and public sectors need to work together to meet these challenges and requirements with resourcefulness and determination. South Africans have proven time and again that these are characteristics they possess.”

Between a rock and a charge place Ravin Sanjith, automotive sector lead at Deloitte Consulting Africa, identifies five major challenges to EV production in South Africa: a lack of infrastructure; high costs; limited battery

production; lack of or limited government support; and limited consumer awareness.

“South Africa’s limited charging infrastructure makes it difficult for consumers to own and operate EVs,” says Sanjith. “Moreover, according to the Deloitte E-Mobility Congress of South Africa presentation, the starting vehicle retail price was R700 000, with the highest being R4-million. This makes them less accessible to many South African consumers.”

Import taxes on EVs are higher than those on ICE vehicles. Sauer says that Audi participates in various committees dedicated to the ongoing engagement with the government on the topic.

“Bringing the import tariff of EVs down to be in line with those of ICE passenger vehicles is a necessary first step. Introducing incentives beyond this, as in many other countries – whether directed at manufacturers or directly to consumers – would help accelerate adoption. It is time for South Africa, as a signatory to the Paris Agreement, to act on its promise to help grow EV sales and move to a more sustainable form of mobility.”

The Department of Trade, Industry and Competition currently has an Automotive Masterplan that is meant to support local manufacturers, with specific targets in place such as increasing the use of local materials from 39 to 60 per cent, and raising employment, among other objectives – but it has yet to include any policy on EVs.

Sauer says that the future of mobility also goes beyond the electric drivetrain consideration, incorporating a connected lifestyle and facilitating a seamless transition between home, vehicle and workplace, through the integration of digital technology. “We see a whole ecosystem developing around owning and using an EV. Just consider how an EV could contribute to improving the current energy crisis once it offers bidirectional charging, which feeds electricity back into the grid. Electric cars will be able to charge intelligently during off-peak times when electricity is cheaper and capacity is less strained. Furthermore, the future of mobility considers autonomous driving possibilities and the exciting impact this has on vehicle design, especially the interior space for our customers.”

In Sanjith’s opinion, the production of EVs is quite a long way away for South Africa. “Adoption will be constrained by the cost and probably remain below 2 000 units for 2023, with fewer than 100 charging stations. Load shedding will constrain high-urban consumer and fleet use. That being said, South Africa remains ideally placed to become the assembly and distribution hub for Africa, where there is a need for light commercial vehicle solutions throughout the continent.”

“It is time for South Africa, as a signatory to the Paris Agreement, to act on its promise to help grow EV sales and move to a more sustainable form of mobility.” – Sascha Sauer

Effective infrastructure is a vital component in building economies and communities in Africa. We make strategic infrastructure investments designed to generate superior long-term returns for investors and support the development of our continent.

Our ability to find and realise opportunities on the African continent has established AIIM as one of the largest and most experienced infrastructure equity fund managers in Africa.

The shift to renewable energy systems relies on energy stores to ensure consistent electric supply. The two main stores of energy are battery storage and hydrogen in one of its forms – be that gas, liquid or ammonia.

According to Frank Blackmore, lead economist at KPMG, in striving for a zero-carbon energy solution using hydrogen, it is critical that the hydrogen be produced through use of renewable energy, rather than fossil fuels. “The green hydrogen production process would require a new industry to be established in South Africa. This would thereby assist in a just energy transition by absorbing labour, ensuring a clean environment, enabling energy independence and potentially boosting the export market.”

Blackmore says Africa as a whole is considered well positioned to be an exporter of green hydrogen. “As an emerging and developing continent, it does not use a lot of energy yet, even though this demand will grow as the continent develops. The current status, however, will allow for exports as investments in green hydrogen production are made. Moreover, Africa is endowed with a very suitable climate for the production of green hydrogen through abundant renewable means including solar, wind and water.”

Dr Roelof van Huyssteen, PwC’s energy strategy and law expert, points specifically to the north and south of the continent as being well placed to create green hydrogen abundantly. “From a localisation point of view, we have Sasol, which will be a key player in the green hydrogen value chain, as it is expected to be able

to produce valuable fuels for the aviation and maritime industries.

“We must remember that to develop a green hydrogen market, we need skills that are specific to this sector, namely around things like operating electrolysers and beneficiating platinum group metals. Therefore, it is vital that educational institutions expand their courses to include training related to green hydrogen.”

Becoming an exporter

Blackmore point out that certain major challenges still need to be overcome for South Africa to become a green hydrogen exporter. These include the establishment of a legal and regulatory framework outlining aspects like who may manufacture green hydrogen, how it should be transported safely and how it should be stored. “Markets for green hydrogen are already active abroad, but a successful industry would also need a local market to be established by, for example, investing in a fuelcell production industry, or by removing custom duties from electric vehicles (EVs) in order to establish more local EV demand, along with service and supply industries.”

Adding a proportion of green hydrogen into the existing gas infrastructure and through pipelines would also be a quick win, adds Blackmore, resulting in a higher energy release once combusted. “It is also worth noting that although costs for green hydrogen are still relatively high when compared to fossil fuel sources, these will quickly fall once the production market grows.”

Van Huyssteen says that key to a successful export market is increased stakeholder

Demand for hydrogen, which has grown more than threefold since 1975, continues to rise, although it is currently almost entirely produced from fossil fuels. This demonstrates the urgent need for a green hydrogen market.

Source: International Energy Agency

engagement between players like Sasol and Transnet around how best to develop the necessary infrastructure. “Also, given the size and complexity of the green hydrogen value chain, this would need new and innovative financing structures.”

He agrees with Blackmore about the need for an enabling regulatory framework, adding that the current one doesn’t really support the uptake of green hydrogen. “Perhaps we will need tax incentives, or to introduce regulations to support the increased uptake of green hydrogen. There is little doubt that these financing and regulatory issues need to be addressed properly before we can view ourselves as a potential exporter.”

In this context, says Van Huyssteen, it may be better for African nations to collaborate. “A lot of work has already been done in this regard in Namibia, while other countries like Egypt and Morocco also have relevant experience. It will be important for us to work with our African neighbours to develop a stronger communal market for green hydrogen exports.”

It’s imperative that South Africa follows through on this potential to become a green hydrogen exporter, concludes Blackmore. “The potential benefits of moving to a more pure hydrogen –as opposed to hydrocarbon – based energy economy are overwhelming. These range from a healthier local environment and planet to the development of new industries and technologies that will create jobs and allow exporters to earn an income, while in the longer term also becoming largely energy independent.”

Hydrogen is an important part of South Africa’s sustainable alternative energy plans, both in terms of the local and export markets, writes

RODNEY WEIDEMANN

“It will be important for us to work with our African neighbours to develop a stronger communal market for green hydrogen exports.” – Dr Roelof van Huyssteen

Depending on whose data you use, South Africa is either the 12th-or 13th-largest emitter of greenhouse gases, accounting for about 1 per cent of the global annual total. That’s more than double our contribution to global GDP, which stands around 0.4 per cent. Some would argue it makes more sense to look at per capita emissions instead. The Union of Concerned Scientists pegged our CO2 emissions per person at 8.1 tonnes in 2020 (latest data). That’s more than China or India, and far above the global average of 4.1 tonnes. Either way you look at it, South Africa needs to clean up its energy act.

Green hydrogen forms a big part of that clean-up plan, with government having identified a R300-billion investment pipeline under the country’s Green Hydrogen National Programme. The money will be used to accelerate the development of nine of the programme’s 19 projects, according to Masopha Moshoeshoe, green economy specialist and green hydrogen lead in the Investment and Infrastructure Office of the Presidency.

“Despite this already significant investment pipeline, South Africa as a full value chain green hydrogen investment destination still offers substantial additional investment opportunities,” says Moshoeshoe, “such as green shipping, green fertiliser production, electrolyser manufacturing (leveraging off of our platinum group metals mining), pipeline development, green field port developments like that at Boegoeberg Se Baai, and upgrades that may be required at other ports such as Saldhana Bay, the Port of Ngqura and Richards Bay.”

Moshoeshoe adds that a number of initiatives are underway to assist the current projects in developing from pre-feasibility to feasibility studies and ultimately to financial close. “These include securing concessional funding for feasibility studies, the negotiation of bilateral government-to-government agreements (which enable business-to-business linkages for offtakes, technology supply and transfer, fundraising and so forth), and supportive policy and strategy announcements such as the publication of the Hydrogen Society Roadmap, the Green Hydrogen Commercialisation Strategy, and the Just Energy Transition Investment Plan.”

As a nascent producer of green hydrogen, South Africa faces stiff competition from a number of potential green hydrogen hubs around the world, including Chile, Australia, the Middle East and North Africa.

“All of these production hubs have large-scale projects that are competing for a limited amount of early-stage, premium-demand and project-preparation funding,” explains Moshoeshoe.

“As such, the majority of projects in South Africa’s pipeline need assistance in securing offtakes and project preparation funding. This needs to be supported by a co-ordinated approach across multiple departments in

Aside from green hydrogen itself, which is emerging as an exciting new frontier for energy storage and transportation, South Africa’s Green Hydrogen National Programme projects encompass multiple derivative products with potential economic benefits, including green ammonia, e-methanol, sustainable aviation fuel, green steel, fuel cells, mobility and infrastructure.

Source: Infrastructure Office of the Presidency

government, the securing of concessional funding, creation of supportive green certification standards and further investment in skills development.”

Thankfully, the country also has numerous key structural competitive advantages, says Moshoeshoe, including the following:

• Some of the world’s best wind and solar irradiation

• Large tracts of land not suitable for food production or human settlements that can be used for renewable energy production

• Available water through the desalination of seawater

• A geographical position that enables us to supply both Europe and the Far East

• The largest industrial base on the African continent

• A deep and embedded knowledge of how to produce power fuels or e-fuels from hydrogen using the proprietary Fischer-Tropsch process

President Cyril Ramaphosa has said South Africa has the potential to produce 130 million tonnes of green hydrogen and derivative products by 2050. This will require 140–300 gigawatts (GW) of renewable energy, while the country has only procured 7GW of wind and solar since 2011 – a point of obvious concern.

Moshoeshoe says the development of the sector is not expected to be linear, with much of it to occur between 2040 and 2050 as green hydrogen reaches price parity with fossil fuels.

“What is required to capture the potential of the green hydrogen sector in the long term is for South Africa to establish itself as a commercially viable, reliable production hub by 2030. This requires the development of 3–5GW of electrolyser capacity supplied with 6–10GW to renewable energy by 2030, highlighting the importance of the current cohort of gazetted projects and the need to help the leading ones to reach financial close.”

In an effort to secure South Africa’s position as a leading producer of green hydrogen, government has secured a significant investment pipeline, writes

ANTHONY SHARPE

“Despite this already significant investment pipeline, South Africa as a full value chain green hydrogen investment destination still offers substantial additional investment opportunities.” – Masopha MoshoeshoeMasopha Moshoeshoe

andprojectmanagementservicesincludingcoordination,design,procurement,andconstruction managementandexecutionensuringcompliancewiththeclient’sbriefandrequirements.Aswellas a newly established 100% held subsidiary called Lesedi Renewables Africa.

Asaresponsibleemployer,wearededicatedtotheadvancementoftheskillsgrowthofouremployees throughdevelopingandmaintainingaskilledandproductiveworkforce.Weprideourselvesin successfulandsustainablelearnership,apprenticeship,andengineer-in-trainingprogrammeswhich we have been running since 2014.

BRAND PROMISE

Webuildrelationships,reputationsandcon denceby combiningacan-doattitudewithengineeringexpertisein pursuit of empoweringAfrica.

BY LEADING THE POWER GENERATION, MINING, AND OIL & GAS INDUSTRIES SINCE 1984

• EP&C of the Balance of Plant for Eskom’s four Gas Turbine Power Stations constructed in Atlantis and Mossel Bay in the Western Cape, South Africa.

• Mechanical erection of 14x150MW gas turbines for Siemens and associated turbine halls.

• Since 1990, Lesedi has successfully completed projects across Africa, illustrating our expertise.

• Lesedi has successfully concluded agency agreements for several state of the art products and services such as CONCO System Inc. and Arkema (DMDS).

• Lesedi performs Mechanical Heat Exchanger and Condenser Tube Cleaning as the African distributor for Conco Services LLC based in the USA. Conco has cleaned over 100 million condenser and heat exchanger tubes, making it the number one condenser and heat exchanger performance company in the world.

• Execution of turnkey engineering projects in the minerals processing and mining industries. Through its network of world-class technology partners, Lesedi o ers gas-cleaning and emissions control plants for its clients.

• Lesedi provides systems for the capture of dust, tars, acid mists, SO2 and various other acidic gases and contaminants in the mining sector.

• Lesedi achieved preferential bidding status for two biomass projects for the South African RIEPPP (16.5MW - sugar cane & 5MW - wood chip). More than 20 projects under development in Africa.

• Our global partner has built over 100 bio-energy power plants, totalling more than 2,650 MW.

• 30 years of upgrade and maintenance projects at Eskom’s Koeberg Nuclear Power Station in Cape Town, South Africa, including over 150 modi cations on the plant.

• International maintenance services contracts in England, Brazil, China, France and the USA, resulting in over 75 interventions since 2006.

• Balance of Plant for Eskom’s Medupi and Kusile Power Station, the biggest dry-cooled power stations in the world

Turnkey Engineering contracts for plant life extension and major refurbishments icluding:

- High frequency power supplies

- Electrostatic precipitator

- Ash handling systems

Lesedi is an Engineering Procurement and Construction (EPC), EPCm and Operations and Maintenance (O&M) contractor with a diversified service offering operating in the Power Generation, Mining as well as Oil and Gas sectors. Lesedi executes turnkey bespoke projects from concept and basic design to detailed engineering, procurement, project management, installation and commissioning, as well as project and contract management function.

Lesedi Renewable division capabilities also extend to include: Project Development for Biomass, Biogas, Waste to Energy, Hybrid (Wind, solar, battery) projects in the IPP markets.

We build relationships, reputation, and confidence by combining a can-do attitude with engineering expertise in pursuit of empowering Africa.

The Lesedi The Lesedi Skills Academy (LSA) is the brainchild of Lesedi Nuclear Services. Lesedi (a majority shareholder in the academy) is a leading African engineering, procurement and construction (EPC), and maintenance company with a long history in nuclear, industrial power, mining, oil and gas industries. The Lesedi Skills Academy, a private training provider and an EME (75% BO; 42,62% BFO), opened its doors in 2015.

The Academy provides skills development and training (Mechanical Fitting, Boilermaking & Basic Welding), allowing young people, and previously disadvantaged individuals to enter the formal job market. Through focussed quality training, employed and unemployed learners are provided with the knowledge and skills to progress in the Engineering and related fields.

Follow us:

LesediNS

Lesedi

Lesedi__NS

Contact Lesedi Nuclear Services:

Email: info@lesedins.co.za

Phone: +27 21 525 1300

ww w. lesedins.c o .z a

Contact Lesedi Skills Academy:

Email: info@lesedisa.com

Phone: +27 21 525 1530

ww w. lesedisa.c o .z a

Over the past 10 years, Zutari’s deep technical mastery and experience allowed us to optimise the delivery of renewable energy projects. From strategy, through planning, design, construction, and operations; our holistic approach to sustainability means that we are committed for the long run.

As we accelerate our country’s decarbonisation journey, we embrace the use of digital technology to further enhance efficiency by streamlining how we shape, design, and share your renewable energy project.

See how Zutari can help you do more: www.zutari.com/energy

The Western Cape and Northern Cape are working together to establish a competitive green hydrogen economy, writes ANTHONY

South Africa’s biggest and most sparsely populated province, the Northern Cape, relies on mining and agriculture to drive its economy. However, with all that open space and the country’s highest volumes of solar radiation, it’s also an area of huge potential for solar photovoltaic (PV) projects, making it a hub for green energy development.

For that reason, the Northern Cape plays a pivotal role in government’s Hydrogen Society Road Map (HSRM), which was released in February 2022. The HSRM’s targets include installing 10 gigawatts (GW) of electrolysis capacity and developing 500 000 tonnes of hydrogen per year in the province by 2030.

The Western Cape also receives plentiful sunshine and is on a drive to reduce its reliance on Eskom’s fleet of ageing coal power plants. “Our energy supply and economy are far too dependent on coal, which exacerbates climate change, and impacts our efforts to live more sustainably and productively,” says Western Cape premier Alan Winde. “The energy crisis is immense for South Africa and much of the world, and we must pounce on any opportunity to help end it.”

In recognition of the enormous potential offered by renewable energy to both provinces, along with their roles in meeting South Africa’s broader

SH ARPEgreen hydrogen goals, the Western Cape and Northern Cape last year signed a memorandum of understanding (MoU) to develop a green hydrogen corridor and hub.

“The Northern Cape and the Western Cape have globally recognised potential for the production of green hydrogen, and for the export of green hydrogen derivatives and valueadded products,” explains Winde. “As a key contribution to developing the green hydrogen economy in South Africa, the intention of the heads of agreement (HoA) contained in the MoU is to progress from cooperation to collaboration between the two provinces.”

Winde says the HoA includes a range of focus areas, such as infrastructure development to support mega-scale renewable energy production, value chain development and community involvement, and priority market pathways and exports. “Apart from these principles and areas of cooperation, the HoA will also assist in unlocking financial support from local and international funding and financing institutions.”

The primary aim of the green hydrogen corridor concept is to set out the components of the overall green hydrogen developments in the Southern African Development Community (SADC) states along the west coast. To this end, government has initiated efforts to cooperate with Namibia, which also has enormous renewable energy potential.

Local governments aren’t the only ones committing to work together on green hydrogen. Sasol and ArcelorMittal

South Africa last year signed a joint development initiative to explore the Saldanha region’s green hydrogen export potential, and to study the possibility of using renewable electricity and green hydrogen to convert carbon captured from steel production into sustainable fuels and chemicals.

Source: Sasol