At Norton Rose Fulbright, we have extensive experience in the energy sector and a dedicated team that can advise and assist on all legal aspects of this fast-developing industry shares

Norton Rose Fulbright South Africa

Norton Rose Fulbright South Africa has a dedicated and skilled projects and project development team. In addition, we can call on extra expertise and experience from our global practice. We have been a driving force behind an unprecedented number of successful transactions in the South African energy transition, delivering regulatory expertise, corporate and fi nancing transactional advice, intuitive South African business law acumen

and a competitive edge to sponsor and lender clients in the energy sector.

Our experience in the energy sector has been gained by advising on all aspects of the development of the industry, its diversity refl ecting the changes in the sector through privatisation, new models of regulation and fi nancing, and increasing internationalisation.

We are market leaders in the South African government’s various energy procurement programmes. Over the various

Norton Rose Fulbright South Africa

is one of the top legal practices in Southern Africa with close to 200 lawyers and offices in Johannesburg, Durban and Cape Town.

We are a proud level 1 BEE-certified company with a strong and experienced team of lawyers behind our name. We handle a rising tide of cross-border transactions on behalf of banks, development financial institutions, government bodies, major domestic and international corporates, large mining concerns seeking energy security, and multinationals.

bid submission phases of the South African Renewable Energy Independent Power Producer Procurement Programme (REIPPP Programme), of all the bidders selected as preferred bidders to date, we have advised on more than half of these projects on a mix of sponsor, lender and contractor mandates.

We offer a leading commercial legal practice throughout Africa, one of the fastest-growing economic regions in the world. We have an award-winning presence on the continent, having been voted African Alliance/Network of the Year by the African Legal Awards in 2021. We are active across key industry sectors, including power, oil and gas, renewable energy, infrastructure, mining, transportation, food and agribusiness, technology and healthcare. Our lawyers have experience working in more than 45 common law- and civil law-based African jurisdictions. They advise on groundbreaking projects and transactions and assist our clients with their ongoing commercial operations across Africa and internationally.

Complementing our energy practice are robust project fi nance, project development, infrastructure, and mining teams who, together, deliver an unsurpassed, full-service legal solution.

For more information: jackie.midlane@nortonrosefulbright.com matt.ash@nortonrosefulbright.com gregory.nott@nortonrosefulbright.com www.nortonrosefulbright.com

We have been a driving force behind an unprecedented number of successful transactions in the South African energy transition.Norton Rose Fulbright offers a full-service banking, finance, and projects team boasting a diverse group of competent lawyers with offices in Johannesburg, Durban and Cape Town. Scan this QR code to go directly to the Norton Rose Fulbright website.

ometimes, it seems like all anyone in South Africa can ever talk about is the energy crisis. And that’s fair enough, really. Tell a friend from another country that you’re without power for two to eight hours every day, and their eyebrows will practically leap off their face. On 9 May, Eskom recorded an unsavoury achievement when it matched the 2022 accumulated days of blackout time experienced by the average South African – in fewer than fi ve months!

With experts warning that the situation is going to get worse before it gets better, many are pushing for liquefi ed natural gas to be used as a power source in South Africa. We look at just how feasible this is on page 8. Speaking of liquids, our hydropower resources have been exploited extensively, but there’s still room to grow, as we see on page 12.

Meanwhile, if we want to exploit our renewable resources more efficiently, we need to solve the storage problem. This is why Eskom

recently broke ground on its first Battery Energy Storage System (page 16), and the Council for Scientific and Industrial Research is utilising a state-of-the-art testing facility to provide unique insights into battery performance (page 17). Feeding small-scale renewables into the grid is also a challenge, but market liberalisation and digital solutions can help (page 21).

Of course, nothing happens without the law saying it’s okay, so on page 35 we unpack the implications of section 6 of the National Energy Act coming into effect. Then on page 29, we look at the duty of energy companies to look after their employees’ mental health.

We also look at the challenges and opportunities for women in the energy sector (page 34).

Turns out there’s actually quite a lot to talk about, isn’t there? Let’s hope South Africa can walk the walk as well as we talk the talk when it comes to solving the energy crisis.

Anthony Sharpe Editor34 THOUGHT LEADERSHIP: WOMEN IN THE ENERGY SECTOR

Progress has been made in increasing women’s participation in the energy sector, but there is still a long way to go.

35 THOUGHT LEADERSHIP: LAW

Examining the implications of section 6 of the National Energy Act.

PUBLISHED BY

Picasso Headline, A proud division of Arena Holdings (Pty) Ltd Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

Editor: Anthony Sharpe

Content Manager: Raina Julies rainaj@picasso.co.za

Contributors: Matt Ash, Trevor Crighton, Gary Feldman, James Francis, Amina Onifade, Simeon Tassev, Renesh Thakoordeen, Philip van Niekerk, Rodney Weidemann

Copy Editor: Brenda Bryden

Content Co-ordinator: Natasha Maneveldt

Digital Editor: Stacey Visser vissers@businessmediamags.co.za

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Advert Designer: Bulelwa Sotashe

Cover Image: happyphoton/istockphoto.com

SALES

Project Manager: Gavin Payne GavinP@picasso.co.za | +27 21 469 2477 +27 74 031 9774

Sales: Brian McKelvie, Ilonka Moolman, Tarin Lee Watts

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

Copyright: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Energy is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/advertorials have been paid for and therefore do not carry any endorsement by the publisher.

Using natural gas for electric energy remains a contentious topic in South Africa, writes JAMES

FRANCIS

FRANCIS

With South Africa having reached the once-unthinkable – chronic load shedding – many are lobbying for new solutions, ranging from fatalistically accepting coal to enthusiastically developing renewable energies. In the middle is natural gas, an energy solution that, at its extremes, could be an economic hero or a debt-laden white elephant.

The gas-to-power debate is murky because of the fast-changing overall energy market, South Africa’s underdeveloped gas market and load-shedding pressure encouraging desperate solutions with long-term consequences.

Local gas has two problems: what comes first, the chicken or the egg? But then there’s also a shortage of hens. The first refers to creating a local gas market with significant demand and developing infrastructure to serve that demand – at present, neither exists, so which comes first? As for the hen, South Africa imports most of its natural gas and will continue to do so, at least for the near future.

Some see the energy crisis as an opportunity to address these problems, while others warn that those views are highly optimistic. What is the case for and against using gas for power generation in South Africa?

The government and the gas industry are bullish on developing local gas markets, believing that gas-to-power can be an anchor tenant for the local industry and justify extensive investment in gas facilities and pipelines. The 2019 Integrated Resource Plan anticipated 1 000MW of gas-to-power output in 2023 and 2 000 MW in 2027, noting that the figure could be higher if infrastructure expands.

“I strongly believe that gas has an important place in the energy mix,” says James Chester, senior director at Energy Capital & Power. “South Africa does have some gas infrastructure and, in general, well-developed energy infrastructure. There’s a lot of discussion around it. But to me, it’s very clear that gas would be good for South Africa. If we have it locally, we should develop it.”

Some are advocating much bigger leaps. Last year, Mineral Resources and Energy Minister Gwede Mantashe proposed an Eskom 2.0 strategy to take several old Eskom power stations and refurbish them to use gas,

specifically the Hendrina, Grootvlei and Camden plants, for a combined 4 800MW capacity.

Several countries have converted coal power stations to gas. Older power stations are particularly good candidates and conversion could, in theory, happen in three years. In reality, it’s likely six or more years due to complexities such as adding emission-reduction equipment. It would also require substantially more gas processing sites and long-distance pipelines than South Africa possesses.

Still, gas represents an opportunity to get more from South Africa’s established coal power sites. The case for gas also argues that it is a cheaper fuel, not impacted by weather changes and is easy to turn on and off with relatively little fuss. Moreover, waiting too long could also cost us, says Renergen CEO Stefano Marani. “Without developing domestic resources, we will always import our noncoal-based energy. Look at the sorry state of our oil refineries and their lack of production. Solar and wind cannot produce baseload without storage, and that is extremely expensive. Right now, we need to pick our poison. Are we going to continue to use diesel in our backup generators at a massively exaggerated price or diversify some of that generation capacity to the cheaper and cleaner alternative and only use diesel generation when critical?”

Such prospects attract investors and could be good for the economy. Investment firm Intergest South Africa published figures that claim a more developed local gas industry “could add R110-billion to gross domestic product and create 230 000 jobs,” though with the caveat of gas pricing. And that is a substantial caveat.

Gas is a complicated topic, and it is easy to go down rabbit holes regarding emissions, investment, and many other pros and cons. But while we can debate the chickens and eggs, the real issue is with the hen, namely supply.

“One of the ways of looking at it is that bringing a new fossil fuel into the power sector in South Africa from 2023 onwards is very different from a country that has been using it for a long time to produce electricity,” says Richard Halsey, policy advisor at the International Institute for Sustainable Development. “When you introduce something new into the market, there can be a lot of perverse incentives to use it more than it is required.”

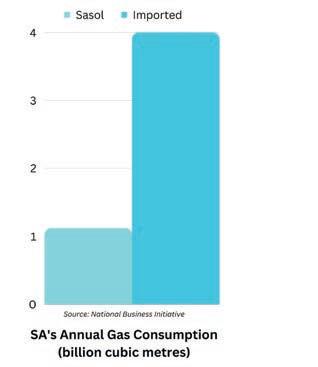

According to the National Business Initiative, South Africa consumed about 5 billion cubic metres (bcm) of natural gas during 2020,

THE CASE FOR GAS ALSO ARGUES THAT IT IS A CHEAPER FUEL, NOT IMPACTED BY WEATHER CHANGES AND IS EASY TO TURN ON AND OFF WITH RELATIVELY LITTLE FUSS.Gas for power generation could anchor a larger South African gas industry, though some experts note that renewable energy could devalue gas investments.

4.55bcm of which had to be imported. Though there is some domestic production in the country, PetroSA uses most of it. The jump needed for a major local industry is titanic: Intergest proposes that by 2035, South Africa could consume around 25bcm or a six-time increase in local gas demand.

Assuming gas demand does rise that much, where will it come from? Currently, the majority is imported from Mozambique. South Africa has identified two potentially massive offshore gas fields, though it’s not a foregone conclusion that these sites could be made operational. If they were, it would change the country’s gas prospects dramatically, says Marani: “The country has significant gas resources onshore and offshore. There is definitely investor appetite to bring these resources into operation, but the legislative framework allowing it is cumbersome, which is killing smaller players while scaring off the majors from development. We are making some gains, but Namibia will overtake us very soon and is likely to become a powerhouse economy in the region as their government is learning from our mistakes.”

Yet even if gas did become available, some question if there will ever be sufficient demand. They predict the falling costs and accelerating innovation of green technologies will make much of gas-to-power irrelevant, thus saddling future generations with colossal infrastructure debt. Even pro-gas reports, such as that by the National Business Initiative, note that gas demand for power won’t be enormous, adding that affordable gas is crucial. Meridian Economics, the Council for Scientific and Industrial Research, and the International Institute for Sustainable Development have all concluded to differing degrees that the rapidly changing energy market has outdated South Africa’s gas ambitions.

Yet most don’t outright oppose all gas-to-power options. Instead, researchers such as Halsey suggest proceeding with caution and being led by rational, flexible planning that acknowledges the changing nature of energy supply options. “Chronic load shedding has changed the dynamic and we’re using our existing diesel turbines way more than they are intended to be used. But you need to get out of that mindset.

According to the National Business Initiative, South Africa consumes about 180 petajoules (PJ)/5.12 billion cubic metres (bcm) of gas annually, of which 140PJ/4bcm is imported. The two largest current consumers are synfuels (110 PJ/3.13bcm) and the industrial sector (70 PJ/1.99). The biggest consumers of gas per province are Mpumalanga (110 PJ/3.13bcm), Gauteng (50 PJ/1.42bcm), and KwaZulu-Natal (20 PJ/0.5 bcm).

Once we’re out of this crisis, you don’t want to have over-committed to a crisis solution. It’s complicated. The debate now is a bit different to how it was a year and a half ago.”

Halsey also notes that if government does decide to pursue gas-to-power, then it should avoid expensive mega projects that could end up like the notoriously overpriced and underperforming Medupi and Kusile coal power stations. Rather investigate the merits of incrementally adding smaller generators or alternatives such as energy storage at strategic locations, he advises.

Should South Africa use gas-to-power?

Potentially. But knee-jerk investments or politically infused agendas without a secure domestic supply could worsen debt and energy problems. We must tread carefully.

“THE COUNTRY HAS SIGNIFICANT GAS RESOURCES ONSHORE AND OFFSHORE. THERE IS DEFINITELY INVESTOR APPETITE TO BRING THESE RESOURCES INTO OPERATION, BUT THE LEGISLATIVE FRAMEWORK ALLOWING IT IS CUMBERSOME.” – STEFANO MARANIIt is feasible to convert old coal power stations into sites that generate power from gas. South Africa is a net importer of natural gas and only has a small gas infrastructure footprint. Offshore gas fields may create abundant local supply, but this is not yet certain.

Virtually all renewables talk in South Africa is of solar and wind power, but the country has more capacity to leverage hydropower than most might realise, writes

RODNEY WEIDEMANNWith South Africa in the grips of an energy crisis and an increasing clamour to switch to renewable energy solutions, hydropower is a sustainable solution that should be part of the country’s future energy mix. This is why the government has announced a Hydropower Independent Producer Programme (HIPP). However, hydropower comes with its own challenges. South Africa is a water-scarce country, which is why hydropower currently only forms a small part of the energy mix. More pointedly, indications are that most of its capacity has already been developed, begging the question: where does this fit into the overall energy strategy?

Jay Bhagwan, executive manager for water use, wastewater resources and sanitation futures at the Water Research Council, explains that a key benefit of hydropower is that, as long as the water is flowing, there is little variation in power delivery. “This is different from solar, which only works when the sun is shining. Despite much of the country’s capacity in this space having been developed, when you start unpacking the remaining, less conventional opportunities of hydropower, you see enormous potential.

“Canals, irrigation channels and transfer pipelines from the mountains to the cities all have excess energy that can be harvested.

South Africa has a mix of small hydroelectricity stations and pumped water storage schemes. In a pumped water storage scheme, water is pumped up to a dam. Pumping the water uses some electricity but this is done in off-peak periods. During peak hours, when extra electricity is needed, the water is released through a turbine that drives an electric generator. Peak hours are usually between six and eight in the morning and evening.

Source: Department of Mineral Resources and Energy

Even stormwater flows in urban areas present possibilities.”

South Africa already has the infrastructure to move large quantities of water daily, under gravity and pressure conditions, from one catchment area to another, says Bhagwan. This is done over long distances and large elevations. “Obviously, when you move water under

pressure and gravity, there is a lot of excess energy that you can harness.”

Martin Meyer, head of power and infrastructure finance at Investec, agrees that hydropower has an important role to play – specifically because it can supply continuous green energy. “It is possible to put kinetic turbines into some irrigation canals or use water pressure from municipal reservoirs to drive turbines to provide power to these urban areas. While these are just ideas at present, I suspect implementation has mostly been stymied by the need for a generation licence. With this regulation altered, there is now far greater potential.

“I further understand that several dams in South Africa have existing – though currently nonoperational – hydropower stations built in, while others without such infrastructure could probably be retrofitted with turbines if required.”

Based on current trends, Bhagwan indicates that there will likely be a mix of international and local partners in the scheme. “We have seen the international players in the solar space targeting the larger projects, while the local businesses focus on the smaller ones. I would expect a similar trend with the HIPP.

“An example of the latter might be like implementing floating solar panels on a farm reservoir to supply power to the farm while also reducing evaporation, essentially killing two birds with one stone for the customer.”

Such projects would typically be financed the same way as other renewable deals, says Meyer. “From an Investec perspective, this would mean up to 25 per cent as equity and 75 per cent as debt. As an organisation, we certainly have a lot of appetite for hydro as an asset class, so would be interested in funding such projects, as long as the due diligence stacks up.”

Meyer believes there is probably the potential for at least another 100–200MW from hydropower. “That’s excluding pump storage schemes. The total potential investment in this space may be in the region of R5.7-billion–R11.4-billion.”

Bhagwan is more optimistic, suggesting South Africa can potentially get up to the gigawatt range if it operates smartly. “It is clear that interest is growing in hydropower, and the opportunities created by the HIPP will enable municipalities and the private sector to harness these much more effectively. This will generate new jobs, types of industries and skills while increasing the nation’s energy generation diversity.”

“CANALS, IRRIGATION CHANNELS AND TRANSFER PIPELINES FROM THE MOUNTAINS TO THE CITIES ALL HAVE EXCESS ENERGY THAT CAN BE HARVESTED.” – JAY BHAGWAN

overwhelming it with a flood of illegitimate requests or traffic. The goal of a DoS attack is to exhaust the target’s resources, such as bandwidth, processing power, memory or network connections, rendering it unable to respond to legitimate user requests.

There are also other ways utility systems can be exploited. Through hijacking devices, threat actors can initiate a data breach or exploit a gap in the network to gain additional access to another system and then stake an attack on other facilities within the network.

Access is defined by the type of device in use. Nowadays, we talk about smart cities and the internet of things and devices that form part of a larger mesh network of information. In the utility world, smart meters can now be used. However, some of these devices are actually extremely “dumb” and can be exploited easily.

There are many reasons to attack a utility plant. These providers are popular targets because, historically, they are not the most secure companies due to the level of technology used there. The programmable logic controllers and other equipment, for example, are not sophisticated as they were programmed to perform a specific function within predefined parameters. During the initial design of these systems, security was never a major consideration. Years down the line, it has become very difficult to secure these types of environments. The reality is that when there’s an easy target, there is always someone ready to exploit it.

Utility companies have a complex setup –geographically, they cover huge areas around the world. Because of this and how they integrate with third-party providers, those utility connections are potentially risks that could be exploited.

To further understand the threats posed to these, we need to look at the different types of malicious roles that can target utility providers.

Various roles are active in the cyberworld: hacktivists that support green initiatives through hacking, actors that try to cause damage for “glory” (without financial gain) and threat actors that aim to gain financially – for example, hijacking a utility to request a ransom.

There is no information available relating to South Africa. However, we did have a cyberattack on City Power in Johannesburg, which impacted consumers, but nothing on a national Eskom level that has been disclosed publicly. Worldwide, several utility attacks have occurred.

These attacks could be in the form of device or system hijacking, whereby a threat actor will hijack the utility meters and hold them to ransom, with the threat of consumers not having access to power until the ransom has been paid.

Another form is a denial-of-service attack (DoS), where the malicious actor denies users access. In essence, a DoS attack attempts to disrupt the availability or functioning of a computer network, system or website by

It’s critical to assess these types of devices and the associated risks and to define a programme that continuously monitors for vulnerabilities and risks. Many companies in the United States are starting to consolidate, unifying IT systems and operational technology, which shows that people understand that there is a connection between device vulnerability and security measures. The same security principles should always be applied: it’s all about managing risk and mitigating or preventing it as much as possible.

Because South Africa is behind the rest of the world in terms of the sophistication of our utility systems, we can learn a lot from other countries’ experiences and what they have done to protect themselves.

There are several tools available on the market that can help manage vulnerabilities. For example, vulnerability management company Tenable has a specific product called Tenable OT, which is focused on industrial networks, including electric grid systems, water, gas and oil – all critical industrial infrastructure.

In the world of cybersecurity, all infrastructure is at risk – threat actors just target different forms of infrastructure in different ways. While threats may vary in nature, companies need to understand the risks associated with their infrastructure and how they can work to prevent them as much as possible or mitigate the risk to an acceptable level.

THROUGH HIJACKING DEVICES, THREAT ACTORS CAN INITIATE A DATA BREACH OR EXPLOIT A GAP IN THE NETWORK TO GAIN ADDITIONAL ACCESS TO ANOTHER SYSTEM AND THEN STAKE AN ATTACK ON OTHER FACILITIES WITHIN THE NETWORK.Simeon Tassev Utility providers are an attractive target for cybercriminals, writes SIMEON TASSEV, MD and qualified security assessor at Galix

From state-owned Eskom enlisting experts from the private sector to fast-tracking the removal of red tape that allows private embedded generation projects to sell excess electricity, the president has set the stage for a win-win solution for government and business.

South Africa has many individuals that possess the skills and experience required to remedy the country’s multiple infrastructure challenges. Our country’s professionals are equipped to be part of sustainable, longterm solutions that alleviate service-delivery shortfalls, create jobs, and build the economy. We’ve seen first-hand in our company how this can be achieved through successful publicprivate partnerships (PPPs). Over the years, Tsebo has provided facilities management for numerous government projects.

Perhaps the most important “P” when it comes to PPP is “partnership”. Only through carefully vetted, transparent, compliant and accountable partnering can the private sector and government join forces for mutual success. In the case of Tsebo, this could mean creating, repairing and maintaining infrastructure, managing energy and providing engineering and other solutions that allow healthcare professionals, educators, politicians and policymakers to focus on their work.

But for private partners to be able to assist with municipal needs as and when they appear, change will need to first occur at a systemic level. We need to unburden ourselves from unnecessary bureaucracy and red tape. We need creative partnerships that are responsive to any given need, that share the burden of risk and that hold both the public and private sector mutually accountable for the success of the contract.

to “leave a legacy” in the communities where we work. We’ve made the development and care of people a strategic imperative – be they employees, partners, or community members.

The country’s energy shortage is just one of many problems that call for South Africans to come together and help a public sector that is under increasing strain. Choosing the right consortium of partners and instilling policies that promote flexibility to deploy private solutions as and when needed will form the backbone of a united front to face service delivery shortfalls.

South Africans are resilient and hardworking people. It’s time we all rolled up our sleeves and found ways to get past the challenges. I believe I speak for many in the private sector when I say that collaboration with government is the solution to making our country the world-class powerhouse it has the potential to become.

Melusi T. Maposa Chief Sales & Marketing OfficerFurthermore, the responsibility of private entities to use their skill and expertise to improve the country should include taking ownership of uplifting the communities where they operate. PPPs should also inherently provide positive long-term outcomes for underserved communities that go beyond “hiring local” or ticking off tender requirements. At Tsebo, we’ve made it our professional mandate

For more information:

+27 (0)76 733 2615

boitumelo@ ume.co.za

As South Africans continue to face load shedding, the government is changing its approach to provide a framework for local businesses to become a part of the solution to transform the energy sector, writes

MELUSI MAPOSA , chief sales and marketing officer at Tsebo Solutions Group

OUR COUNTRY’S PROFESSIONALS ARE EQUIPPED TO BE PART OF SUSTAINABLE, LONG-TERM SOLUTIONS THAT ALLEVIATE SERVICE-DELIVERY SHORTFALLS, CREATE JOBS, AND BUILD THE ECONOMY.

Having admitted that its power supply to South Africa is “unreliable”, Eskom is finally implementing alternative power solutions. By TREVOR

CRIGHTONIn December 2022, Eskom and Hyosung Heavy Industries broke ground on the first Eskom Battery Energy Storage System (BESS) project site at Elandskop, located within the Msunduzi and Impendle local municipalities in KwaZulu-Natal.

Construction is estimated to take 7–12 months, with the batteries at the site charged from the main grid via Eskom’s Elandskop substation. The facility will have a capacity of 8MW, equivalent to 32MWh of distributed electricity – enough to power a town the size of Howick for four hours. Crucially, it will be able to reduce strain on the network during peak hours.

Elandskop is part of the first phase of the BESS project, which includes the installation of approximately 199MW of additional capacity, with 833MWh storage of distributed battery storage plants at eight Eskom distribution substation sites throughout the country. This phase also includes about 2MW of solar photovoltaic (PV) capacity.

Phase 2 of the project includes the installation of a further 144MW of storage capacity, equivalent to 616MWh, at four Eskom distribution sites and one transmission site, with a PV capacity of 58MW. The BESS project will utilise large-scale utility batteries with a capacity of 1 440MWh per day and a 60MW PV capacity. All phase 1 sites are due to be commissioned by 30 June 2023 and phase 2 by December 2024.

The project will support the large-scale deployment of renewable energy, which has intermittency challenges in that power can’t be generated when the sun does not shine

Eskom operates the largest testing facility for large-scale energy storage in the southern hemisphere at a facility located in Rosherville, Ekhuruleni. The research facility aims to explore bulk energy storage solutions for grid strengthening and small-scale, behind-the-meter storage solutions for customers to store their own generated power. The test facility contains five 200kWh batteries synchronised and supplied to the grid as a 1MWh battery unit.

Source: Eskom

or when the wind does not blow. The battery storage will help overcome this challenge by managing demand during peak times – four hours a day for 250 days a year – and will also support grid stability.

Eskom’s integrated report 2020 prioritises strategic initiatives: the famed “seven pillars” that will enable the utility to achieve sustainability in the current business environment and to set itself up for the future. The fifth pillar is “innovation and transformation to create new revenue sources”, which compels Eskom to partner with players in battery storage technology to improve the dispatchability of variable energy from the Renewable Energy Independent Power Producer Procurement Programme plants and provide alternative solutions of support to its constrained network.

The project cost is approximately R11-billion, with the two phases financed in tranches of R5-billion and R6-billion through concessional loans from the World Bank, African Development Bank and the New Development Bank.

The African Development Bank’s BESS Project Appraisal Report states that battery electricity storage technologies are providing a range of services and options in the electricity value chain, while future costs are projected to decline as performance improves.

It lists other competitive projects that are becoming increasingly common on a utility scale, including notable MW capacity installations in the United Kingdom (225MW), Australia (100MW), United States (680MW), South Korea (432MW), Japan (255MW) and Germany (132MW). Large-scale grid-connected BESS projects are currently under construction in Senegal at the 60MW Taiba N’Diaye wind farm and 100MW in Morocco’s Masen solar park, but these have not been connected.

The report says that Eskom’s BESS project is an innovative technology expected to contribute positively to the reserve margin in view of constant load shedding, thus reducing the need to run expensive open-cycle gas turbines to meet generation shortfalls and peak shaving. Recent studies done in Australia by the Clean Energy Council show that a two- or four-hour BESS would be more cost competitive than a gas peaking plant in both levellised cost of energy and levellised cost of capacity due to faster reaction time and higher accuracy and flexibility. BESS was found to offer superior performance and greater commercial value than a gas peaker while providing cleaner energy.

The authors believe that the project will be critical in facilitating frequency regulation, flexible ramping and black-start services, which, in turn, stabilise the grid and potentially reduce rotational load shedding and load curtailment.

South Africa’s Council for Scientific and Industrial Research (CSIR) is at the forefront of developing and testing innovative energy storage technologies that will address the energy challenges facing South Africa. The organisation is now home to the world-class Indoor Energy Storage Testbed facility, which is providing unique insights into battery performance and endurance for specific operating conditions.

While lithium-ion batteries are quickly replacing lead-acid batteries, the testing team’s eyes are already on the future, preparing for the next generation of battery technology: solid-state batteries. How we store energy is at the heart of the successful use of renewable resources such as solar and wind. The facility thus brings hope for sustainable energy and a secure energy future.

The Indoor Energy Storage Testbed is a unique initiative that brings together industry, academia and government to test and evaluate a range of energy storage technologies, from batteries to capacitors, supercapacitors and ultracapacitors.

The laboratory’s initial focus is on testing lithium-ion batteries while developing a state-of-the-art battery management system. At present, the lithium battery market in South Africa lacks the necessary globally acceptable standards, posing a safety risk in applications that use batteries for application and product recalls. The indoor testbed fills this gap and mitigates the risk by assisting in creating and adopting internationally required standards locally.

This capability allows end users to get the most out of energy storage cells. A study commissioned by the World Bank identified South Africa’s lack of testing capacity as an issue, making the indoor testbed facility crucial in establishing new industries within the country.

The facility also addresses the challenge of the high cost of lithium batteries. The cost of renewable energy sources has decreased significantly over the past decade, while the cost of lithium batteries has remained relatively high. To address this challenge, the CSIR team is exploring new materials and processes that could see a reduction in the cost of battery cells. The repurposing of batteries, especially

electric vehicle (EV) batteries that have been put out to pasture, is also being expedited. So-called second-life batteries are those that have reached their end of life. In the case of EV batteries, these could be useful in other applications after being deemed unfit for mobile use.

Investment in research and innovation is critical in mitigating all risks linked to the high percentage of batteries entering South African markets, which could spark an environmental disaster. The CSIR Indoor Energy Storage Testbed facility exists in collaboration with VITO, an independent Flemish research organisation, under the framework of the World Bank’s Energy Storage Partnership. The project not only focuses on developing and testing new technologies, but also embraces and works with stakeholders committed to the transition to a sustainable energy future.

Energy storage is a critical component of the just energy transition to a sustainable energy future. The CSIR is committed to working with its partners to accelerate the deployment of these technologies and to build a community of stakeholders committed to a sustainable energy future.

THE INDOOR ENERGY STORAGE TESTBED IS A UNIQUE INITIATIVE THAT BRINGS TOGETHER INDUSTRY, ACADEMIA AND GOVERNMENT TO TEST AND EVALUATE A RANGE OF ENERGY STORAGE TECHNOLOGIES.

THE CSIR TEAM IS EXPLORING NEW MATERIALS AND PROCESSES THAT COULD SEE A REDUCTION IN THE COST OF BATTERY CELLS.An energy storage container used in the Indoor Energy Storage Testbed Facility that tests battery performance.

A state-of-the-art testing facility is providing unique insights into battery performance, endurance and durability for specific operating conditions. By RENESH THAKOORDEEN, Council for Scientific and Industrial Research energy storage testbed project leader

RAY FERNANDEZ of Probenergy answers questions on all things energy-related.

Energy, air and power solutions company Probenergy has been keeping pace with the shift to renewable energy technologies, expanding its automotive, mining and industrial segment focus to include alternative energy solutions, material handling and recycling. Probenergy has a specialist team that remains on the cusp of leading battery storage technologies.

While grid-tied solar systems can provide substantial energy cost savings while the sun shines, they don’t protect businesses and homes from the disruptive pain of load shedding. The real game-changer is incorporating new affordable, efficient energy storage systems that enable hybrid solar solutions. Probenergy has the vision to deliver energy solutions with uncompromising service, quality and end-of-life value to maximise the return on investment for different market segments.

Q: What industries and applications does Probenergy cater for?

We offer quality, cost-effective power solutions for a wide range of applications, including solar, backup solutions, UPS, industrial, marine and

telecommunications. From domestic use to retail, mining, education, telecoms, technology and agriculture, through to the utility market and independent power producers, our solutions are specialised and scalable.

Q: What services does Probenergy offer? We conduct energy audits to identify energy needs, monitoring usage over a week. We can then design and simulate systems, taking it through to installation, implementation and commissioning. Monitoring and maintenance is vital, and we pride ourselves on expert after-sales service.

Q: What new evolving technologies and products have you recently added to the Probenergy stable?

Probenergy solutions include lithium batteries, hybrid inverter systems, supercapacitors, inverters, solar kits and Tier 1 solar panels from leading brands. The range further includes next-generation battery chargers and boosters. We have solutions for electric and material-handling vehicles. Our range of supercapacitors and graphene supercapacitors

SIGNIFICANT TAX INCENTIVES FOR BOTH DOMESTIC AND COMMERCIAL USERS OF SOLAR ENERGY IN SOUTH AFRICA MAKE 2023 THE IDEAL YEAR TO MAKE THE TRANSITION TO SOLAR POWER.

expand our offer for containerised solutions. From gate motors to golf carts, smart cities to data centres, we’ve got you covered with the right product.

Q: When it comes to cost-effective backup power for home and small business use, what is your standout battery solution? The Generation 2 MaxLi lithium-ion phosphate battery (LiFeP04) range is compact and stackable. They are ideal for small home usage through to offices and small businesses.

Q: Supercapacitors are big news for business. What are the new developments? Supercapacitors combine the energy storage properties of batteries with the power discharge characteristics of capacitors. While supercapacitors can deliver and absorb a high current, they remain extremely temperature tolerant and maintain a long life cycle. Graphene supercapacitors are the most efficient, fastest charging, longest lasting, easily scalable battery investment for commercial solar on the market.

Q: Solar solutions can require a large capital outlay. What financing solutions does Probe have available?

Probe has partnered with funders to offer rent-to-own/lease solutions. The right fi nancial solution turns capital expenditure into manageable operating expenses over time, making the most appropriate technologies for different businesses accessible. Signifi cant tax incentives for both domestic and commercial users of solar energy in South Africa make 2023 the ideal year to make the transition to solar power.

Q: What advice do you have for domestic or business users wanting to install solar? Turn to a reputable provider as a first step. You need a provider that can solve the challenges of commercial solar by offering not just the best battery technologies and well-priced products with a scalable, modular approach, but also detailed energy assessments, excellent ongoing maintenance and service, and rent-to-own financing options. At Probe, we are battery experts, and we’re committed to taking the best power solutions across Africa.

Market liberalisation and digital solutions have the potential to ensure the long-term sustainability of our energy supply, writes PHILIP VAN

The ongoing power crisis faced by South Africans has advanced the implementation of several extensive reforms of the legislative, policy and regulatory framework of the South African electricity supply industry. These reforms are aimed at liberalising the industry, facilitating further private investment in generation capacity, and creating a level playing field between public and private generators of electricity.

As South Africa progresses toward a competitive electricity supply market and as the landscape evolves, the market will likely begin to reflect that of other liberalised electricity supply industries, where private generation exists alongside public generation and fair competition is facilitated through an independent market and system operator. Unlike the stronghold of Eskom’s previous vertically integrated monopoly, the anticipated mature market will allow for greater efficiency, with the objective of long-term security of electricity supply.

Historically, Eskom has been responsible for power generation, transmission and more than half of the distribution of electricity to consumers, with municipalities being accountable for approximately 40 per cent of the

manager at Enpower

country’s power distribution. But as the process of unbundling begins, liberalisation is beginning to mobilise. Regulatory change allowing private generators to sell electricity directly to end users enables utility-scale generation while leveraging the national or local grids.

Legally, the authority responsible for the network (Eskom or municipality, depending on the licence area) is obligated to give nondiscriminatory access to these networks, and while they facilitate the passage of energy, there is no physical transportation of the exact electrons from the generator to the end user. The grid authority merely assists with reconciling a financial transaction between the two, measuring what power goes in on one end of the grid and ensuring delivery at another point on the grid.

A commercial power purchase agreement between the generator and the end user/s, either directly or through an electricity trader, is agreed upon and outlines the terms under which the electricity is sold. This financial transaction warrants the connection and the wheeling and/or trading of the electricity on the grid.

Once the generator connects the generation facility to either the transmission or distribution network, the flow of electricity can take place. This connection process is technical, but in a nutshell, it controls how much electricity can

be delivered to the grid. Once delivered, the grid authority manages the financial transaction required to transfer the energy to the end user.

Digital solutions can not only streamline the process described, but are also essential for an efficient liberalised market. The immediate area where digital solutions will play a role is in the metering, reconciliation and billing segment. In a liberalised market, the metering infrastructure is the backbone of the market, upon which all private trading happens. With digital solutions, one can ensure auditable and accurate metering.

Renewable energy generators introduce unique challenges due to their intermittent nature, but this can be alleviated, to a great extent, by the deployment of digital solutions and digitalising the grids. Digitalisation will also expose previously unknown inefficiencies and can reduce energy prices even further. While the private sector and consumers are ready for the renewable future, market reform is the responsibility of national government. Legislation and regulation have been supportive of liberalisation for many years, but the implementation has been slow.

Together with adequate market signals, not only does the private sector require the correct environment, but also stability and enforcement of the correct policies to liberalise. The process of liberalisation has proven around the world to provide not only short-term benefits to big and small consumers alike in terms of lower prices, but also to deliver long-term sustainability.

WHERE DIGITAL SOLUTIONS WILL PLAY A ROLE IS IN THE METERING, RECONCILIATION AND BILLING SEGMENT.Philip van Niekerk

NIEKERK , quantitative

Trading

The number of projects and innovative solutions focused on energy bode well for the transformation of the country, its people and the economy, writes THEUNS EHLERS, head: resource and project finance, Absa CIB

Absa recently released its annual financial results and two important numbers must be highlighted. The first is that Absa is working on power projects representing over 2000MWs, and the second is that the bank has R45-billion in new power projects in the pipeline. This is on top of the approximate 4GWs worth of projects closed to date.

In the context of our economy, these are considerably significant.

As a South African, it is easy to become disheartened by the ongoing economic challenges brought about by load shedding. Whether it be factories standing idle when the power goes off or coming home to no electricity, the challenges affect all citizens and businesses.

Therefore, when we look at the sheer scale of projects in the pipeline, we believe that the next few years will be transformative for our country, our people and the economy.

While Eskom is a major cog in the South African electricity infrastructure, it is important to realise that the broader ecosystem is changing quite rapidly, and we should be aware of this shift.

The lifting of the cap on generation projects has opened the door for several new developments. We are now entering an era where an independent energy exchange has been licensed and established to resell excess

power, and buyers and sellers can negotiate market-related rates. While there are still questions around distribution and transmission, this massive leap forward could potentially serve as a blueprint for the energy transition across the African continent.

Captive power projects are growing rapidly across the country, and as one of the successful major funders of these projects, we have learnt important lessons over the last 12 to 18 months that make us a funder-of-choice for many of these transactions.

Unlike the government-backed renewable energy projects in South Africa where we have sovereign guarantees backstopping Eskom’s commitments under the PPAs (power purchase agreements) for the captive market, banks and investors have to take a very long-term view on the off-taker, where the credit quality may not match that of the sovereign. In the normal corporate lending world, corporates typically raise debt financing for much shorter tenors compared to what is required under a captive Independent Power Producer (IPP) project with a 20-year PPA.

Banks and investors are now starting to take a broader view on the energy market, looking beyond the initial power off-taker to a market where it will be possible to find alternative off-takers for projects supplying power into the national grid and eventually to power traders where a spot market is expected to develop over time. In this context, it becomes important to understand where a specific project sits on the energy cost curve to provide some comfort that it will be able to produce power at a competitive rate should it need to sell power into a liberated market over time.

For most of our clients the investment in renewable energy serves three main purposes. Firstly, it provides a level of energy security, particularly for captive, behind-the-meter systems where the combination of a solar installation with battery storage can supply a minimum level of baseload power. Secondly, based on the tariffs we are witnessing in the market, entering into long-term PPAs with grid-connected IPPs, can result in a significant saving on their electricity bill, compared to what they pay the utility. These projects, therefore, assist clients to lower their operating cost base and improve their position on the global cost curve. Lastly, the introduction of renewable energy into a client’s energy mix assists in their targets to reduce reliance on fossil fuels, thereby reducing their carbon footprint, where most corporates now have clear ESG goals to achieve net zero emissions by a certain date.

We are in an exciting phase for the energy market across the continent. There are short-term pains and frustrations when it comes to grid capacity, but we must not lose sight of the innovations taking place and how we can utilise these to be a blueprint for the rest of Africa.

For more information:

Theuns.Ehlers@absa.africa cib.absa.africa

• The South African small, medium and micro enterprise (SMME) sector contributes more than 40 per cent of the total gross domestic product and accounts for over 87 per cent of employment in the country, according to FinMark Trust.

Financers, lenders and grant originators are stepping in to save South Africa’s small to medium enterprise (SME) sector from the worst effects of load shedding. With more load-shed days in 2023 so far than in the entirety of 2022, the impact on industry and everyday life is mounting – and business closures resulting from this could lead to an even larger unemployment crisis in a country where over 42 per cent of the working-age population already can’t find employment.

Absa has expanded its financing offering to businesses and homeowners to offer R50-million in grants to SMEs for installing sustainable energy solutions to help keep their businesses running.

Launched in April 2023, the Green Asset Finance programme offers sustainable energy subsidies for qualifying SMEs. It’s the only grant of its kind providing much-needed support to small business customers to finance solar installations and keep the lights on.

Eligible SMEs whose commercial properties are financed by Absa are being contacted by the bank, offering subsidy amounts up to R50 000 or 10 per cent of the overall installation value, based on clearly established factors.

“At this stage, the grant offering is limited to SME customers that bank with us and have properties financed with us,” says Ronnie Mbatsane, Absa relationship banking SME business managing executive. “That being said, we are not turning away any customers that enquire in this regard. We will still consider their renewable energy financing requests and follow our normal application process, but they must be South Africa-based.

“As part of the Green Asset Financing initiative, we are not limiting SME customers to a specific supplier database. However, in the best interests of customers and the bank alike, we will vet the suppliers and the products they install to ensure that these meet specific standards as part of the application process.”

Mbatsane says that Absa values SMEs’ contribution to society and strives to cater to their unique needs through financial and nonfinancial support.

“As Absa, we strive to be an active force for good in everything we do, which includes how we show up to support small businesses, particularly during this tough operating environment. As a vital segment of our economy, small businesses contribute to job creation and support neighbourhoods and communities. Together, we are reimagining a better tomorrow for small businesses.”

Entrepreneur finance agency Business

Partners operates a R400-million energy fund for SMEs to allow them to access finance to keep operating during load shedding. Loan amounts run from R250 000 to a maximum of R2 000 000, with various qualifying criteria and terms. “The long-term benefits of running a

• In 2022 alone, South Africa recorded over 1 900 liquidations, according to Statistics South Africa. Most of these businesses retrenched a large number of employees to survive the impact of the COVID-19 pandemic. Just as many businesses began to recover, load shedding dealt another blow to SMMEs operating in the country.

• According to ESI Africa, 64 per cent of township small businesses halt operations during load shedding and almost 66 per cent of business owners have shed jobs because of load shedding.

more energy-secure business will far outweigh the cost of the investment,” said executive director and CIO Jeremy Lang in a press release from the organisation. “With alternative energy sources, businesses can future-proof their operations and position themselves as potential contributors to the impending embedded generation programme, while also reducing the cost of energy.”

SME funding provider Lulalend has partnered with several renewable energy partners countrywide to offer easily accessible funds for SMEs. “While the initial investment in solar panels may seem daunting, the long-term savings can be significant,” writes

Tom

Stuart, chiefmarketing officer at Lulalend. “Not only will you be able to reduce your reliance on the grid (and therefore your monthly electricity bill), but you will also be able to take advantage of the tax incentives mentioned in the recent budget speech.”

“The long-term benefits of running a more energy-secure business will far outweigh the cost of the investment.” – Jeremy LangRonnie Mbatsane

Keeping the business lights on during load shedding requires innovative solutions, which, in turn, require cash injections.

By TREVOR CRIGHTON

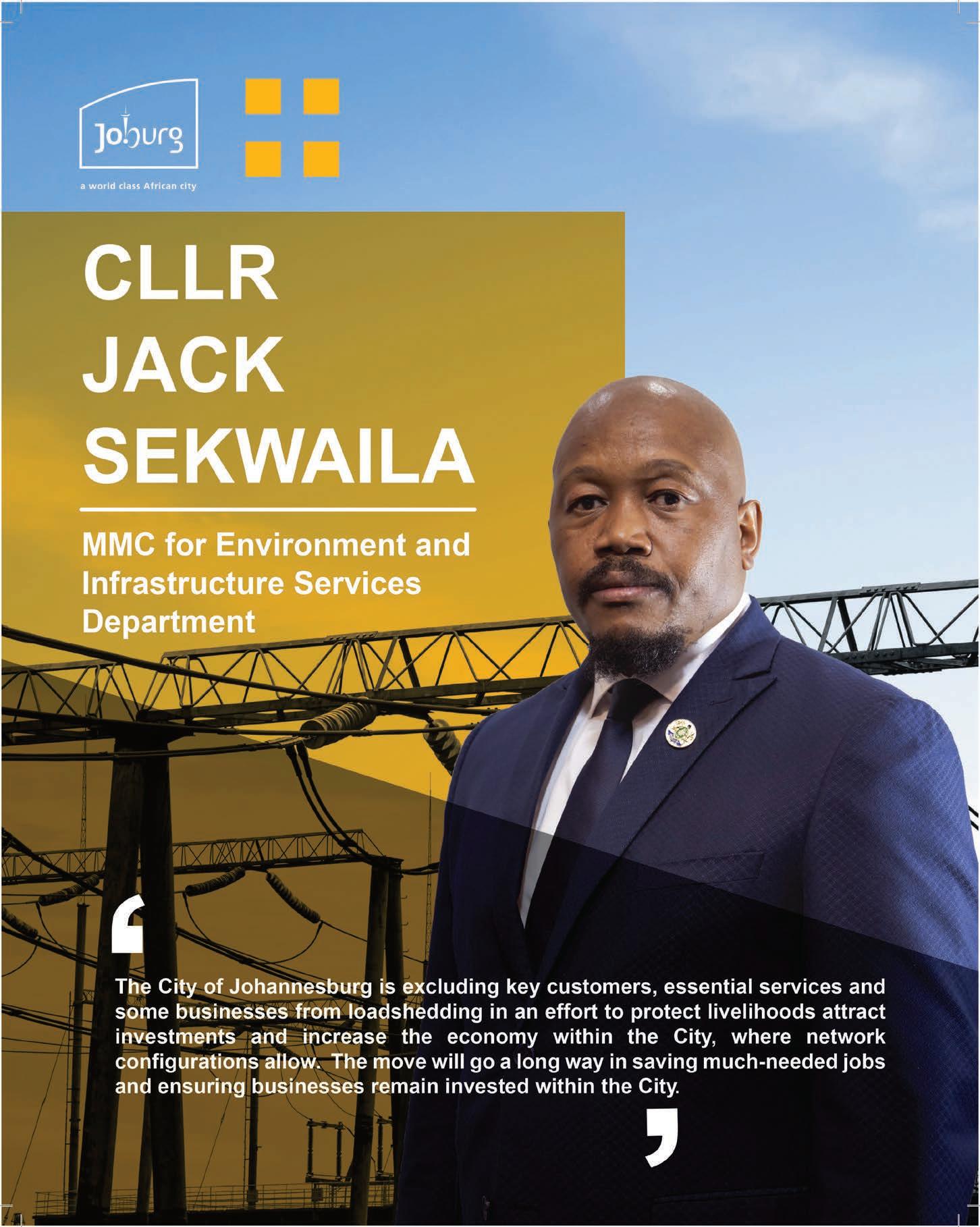

City Power, which has been tasked with implementing the Gauteng provincial energy plan, has started rolling out projects, including the installation of solar high mast lights, in

During the premier’s State of Province Address, City Power was announced as the implementing agency for the Provincial Energy Plan led by the premier. City Power has started implementing some of the projects planned following the city’s Energy Indaba.

The roll out of these energy programmes and projects includes the installation of solar high mast lights, which started in Soweto Meadowlands. This will be followed by the installation of solar geysers, mostly in nonaffluent areas, as well as solar rooftops on all City of Johannesburg buildings.

The solar high mast project will assist with providing lighting during load shedding or prolonged power cuts, mainly in areas, such as Soweto, that are not supplied by City Power. This will help to improve safety and further reduce technical and nontechnical losses. The project forms part of the city’s priority initiatives to create a safer city and improve visibility in identified hotspots.

The project commenced in April 2023 and will see 50 solar high mast lights installed by the end of the current financial year.

Currently, 19 solar high mast lights have been installed in areas such as Meadowlands, Orange Farm, Ivory Park, Alexandra and Finetown, among others. With the offi cial switch on launch which took place on the 9th of June 2023 in Finetown.

City Power is working on implementing its NERSA-approved Feed-in-Tariff, where customers with PV solar systems can feed their excess power to the grid. This energy is credited to the customer at a lower rate than the current Eskom energy prices paid by City Power. The customer’s energy bill will therefore decrease because of the rebate/credit on the Feed-in-Tariff. City Power will be able to “on-sell” the surplus from PV customers with a markup of around 40 cents per kWh.

the way for the City of Johannesburg to become a world-class African city.

The intention is to increase profitability, reduce dependence on Eskom, retain customers and realise sustainability for the city over a 15-year period. City Power is committed to creating value for its customers by procuring 40 per cent of energy from other sources by 2030.

These include the onboarding of Independent Power Producers (IPPs) – both short- and long-term, the installation of rooftop solar systems, ripple-relay and load-limiting systems, investment in energy efficiency and energy management systems, solar high mast lights, geysers and the recommissioning of open cycle gas turbines.

City Power has deployed 194 000 ripple-relay receivers at different households for geyser load control, which will remotely switch off the customer’s geyser to shed 80 megawatts from the network.

Furthermore, City Power has requested additional funding from the City of Johannesburg to expand the current base to enable curtailing more load from the grid through geyser load management, thereby averting higher stages of load shedding.

City Power is rolling out smart meters which will be token identifier (TID) complaint to households across the city for remote operation. These smart meters enable City Power to remotely curtail load on different households without completely switching off the power supply.

In this case, customers will be able to switch off energy-guzzling appliances, such as stoves, heaters, pool pumps and underfloor heaters.

The smart meter load limiting will complement the ripple heaters, where customers whose geysers were switched remotely through ripple relays will not be impacted twice through smart meter load curtailment.

The city is also embarking on rolling out rooftop solar geysers for water heating, contributing 30 per cent of consumption in the average household.

This initiative will assist in alleviating pressure on the grid, resulting in peak demand charges being less. In addition, customers will receive reduced bills.

City Power is exploring sources of alternative energy mix (AEM) to catapult the entity into a new era of inventiveness and sustainability. This paves For more information: www.joburg.org.za

THE SOLAR HIGH MAST PROJECT WILL ASSIST WITH PROVIDING LIGHTING DURING LOAD SHEDDING OR PROLONGED POWER CUTS, MAINLY IN AREAS, SUCH AS SOWETO, THAT ARE NOT SUPPLIED BY CITY POWER.

South Africa’s energy, mining and resources sectors have long been viewed as relatively hazardous industries, given the often-demanding nature of the work. However, their biggest challenge right now is a burgeoning mental health crisis, writes GARY FELDMAN, executive head of healthcare consulting at NMG Benefits

Many companies in the energy sector already have existing clinics, medical facilities and wellness programmes. By getting those facilities accredited with medical aid schemes, companies can effectively lower the cost burden of these facilities and free up funds for other employee programmes.

There is also a growing realisation that employers have a real opportunity to improve the financial wellbeing of their employees – and increase their ability to retain their people – through smart restructuring of their benefits packages.

In some sectors, for example, there is a massive demand for funeral plans. By providing compulsory funeral cover for employees, employers would be able to provide the benefit at a fraction of what they would pay if they took out commercially available funeral cover in their personal capacities.

Given the physical demands of the industry, workers may be at higher risk of injury or disability. Offering disability insurance that provides income replacement in the event of an injury or illness can help employees manage financial stress during difficult times.

Many companies are also looking more closely at the benefits associated with retirement funds. While the major function of a retirement fund is to build a pension, adding elements such as life and disability cover at a group level can be done for relatively small contributions.

The annual Mental State of the World Report puts South Africa as one of the lowest-ranked countries in the world when it comes to mental health. While Venezuela topped the list with a score of 91, the United Kingdom and South Africa had the lowest scores at 46. The South African Depression and Anxiety Group (SADAG) estimates that one in three South Africans will experience a mental health problem or illness in their lifetimes, but even before the pandemic, only one in ten would seek help.

In South Africa, and specifically the energy and resources sectors, there’s a huge cultural stigma around mental health issues. The problem is that these issues can have a major impact on productivity and safety in the workplace. So, it’s critical that employers actively invest in and support their employees’ mental health and wellbeing.

Employers in the energy and resources sectors that take a proactive and flexible

approach to supporting their workforces are seeing real improvements in productivity. There is a clear correlation between having an effective employee assistance programme and absenteeism management programme in place and improved productivity.

A HEALTHY RETURN Research suggests workplace initiatives designed to promote good mental health among employees can provide companies with a measurable return on their investment. According to the World Health Organization, companies can see a $4 return on every $1 they put towards treating common mental health concerns.

Employers that invest in their employees are seeing healthcare and disability costs go down, as many physical ailments are linked to mental health. It’s more important than ever to sense-check your people policies and talk to your employees about how you can support them.

Like many industries, the energy and resources sector employs a significant number of workers who are nearing retirement age. Offering robust retirement plans that meet the needs of these workers is a valuable benefit to attract and retain top talent.

One of the big challenges for the energy and resources sector has always been that it employs a range of people with widely differing income levels. A one-size-fits-all approach simply doesn’t work.

EMPLOYERS IN THE ENERGY AND RESOURCES SECTORS THAT TAKE A PROACTIVE AND FLEXIBLE APPROACH TO SUPPORTING THEIR WORKFORCES ARE SEEING REAL IMPROVEMENTS IN PRODUCTIVITY.SADAG 2021 MENTAL HEALTH REPORT MENTAL STATE OF THE WORLD REPORT

Progress has been made in increasing women’s participation in the energy sector, but there is still a long way to go, writes

Globally, there is a 20 per cent wage gap between men and women, and this is more evident within the energy sector, according to a United Nations’ Global Perspective article. Men continue to dominate the sector as engineers, project managers, financial advisers and directors and executives of energy companies and the financiers that support them. Globally, women represent 5 per cent of board executives and 16 per cent of board members in power and utility companies.

Discussion of STEM-related programmes has become a global priority. Women only used to make up 28 per cent of the workforce in this area, and men vastly outnumber women majoring in most STEM fields in college. The gender gaps are particularly high in some of the fastest-growing and highest-paid jobs of the future, such as computer science and engineering.

There is progress, however. Recent research from the United Kingdom’s House of Commons Library found women in the United Kingdom, for example, are 35 per cent more likely to go to university than men. Women make up 47 per cent of employees in traditionally male-dominated STEM degree subjects, and now represent a quarter of the jobs in mathematical sciences and 13 per cent of engineering positions. There

THERE

has also been an increase in female students following less traditional career paths, such as computer programmer, aircraft pilot and even firefighter, to name a few, according to an article on Study Portals Master Awareness and mentorship have played a large part in increasing women’s participation in subjects such as computer science and engineering. As it stands, there are 66 840 more women now on degree courses than men, compared with 34 035 in 2007, as reported in a working paper from the Wisconsin Center for Education Research. Although women continue to be under-represented in sectors such as computer science and engineering, the progress is encouraging.

The current move towards climate-friendly energy sources requires fewer technical skills and more intellectual and cross-functional skills, thereby creating greater opportunities for women. Skills such as risk management and project management offer women more opportunities to grow within the energy sector. Nevertheless, acquiring and obtaining the required training and certification, particularly in the STEM fields, is crucial, given that most

renewable energy jobs are highly skilled in nature and require these sorts of expertise. Passion for taking on challenging roles in the sector is also vital, as the sector, being a very technical one, requires a high level of concentration and dedication, which can only be developed out of love and interest.

Encouragingly, new and emerging legal frameworks seek to mandate certain levels of gender involvement in the workplace (extended paid maternity leave, childcare plans, and so forth) to create a more conducive working environment for women.

AminaWomen who have overcome the sectorial imbalance must continue to speak out, thereby motivating the next generation of women to step up their interest in the sector.

HAS ALSO BEEN AN INCREASE IN FEMALE STUDENTS FOLLOWING LESS TRADITIONAL CAREER PATHS, SUCH AS COMPUTER PROGRAMMER, AIRCRAFT PILOT AND EVEN FIREFIGHTER.Onifade AMINA ONIFADE , COO of Genesis Energy Group HOUSE OF COMMONS’ EQUALITY OF ACCESS AND OUTCOMES IN HIGHER EDUCATION IN ENGLAND WISCONSIN CENTER FOR EDUCATION RESEARCH ON GENDER AND BELONGING IN UNDERGRADUATE COMPUTER SCIENCE UNITED NATIONAL GLOBAL PERSPECTIVE STUDY PORTALS MASTER ARTICLE

MATT ASH, head of energy at Norton Rose Fulbright, unpacks the implications of the updated legislation for the energy sector

The promulgation in April of section 6 of the National Energy Act coming into effect was met with cheers, but the jubilation appears to have dissipated somewhat as the true implications of such promulgation begin to be appreciated.

The National Energy Act was passed in 2008, with various parts being brought into effect in 2009, 2011 and 2012. In essence, the legislation is designed to ensure that diverse sustainable and affordable energy resources are available to support economic development and growth in South Africa, mindful of environmental management requirements and the imperatives of various economic sectors.

To achieve this, the act provides for integrated energy planning that promotes efficient energy production and consumption, addresses the need for an increase in renewable power generation and the holding of strategic energy feedstocks and carriers, and the promotion of adequate investment in energy production and the infrastructure required for such production, transport and utilisation.

From this, it will be appreciated that the legislation is designed to address all of the energy resources with which the nation has been blessed – from hydrocarbons (oil, natural gas) through hard carbon (coal) to renewable energy resources (solar, wind, biomass, hydro “head”).

Chapter 2 was brought into effect in March 2012, and has informed the development and

revision of the Integrated Resource Plan (IRP), a planning and development tool provided for under the Electricity Regulation Act to guide the development of production and utilisation of electrical energy.

Chapter 3 of the act (section 6 being the only provision in this chapter) provides for integrated energy planning to foster and support the satisfaction of the obligations set out under Chapter 2. In terms of section 6, the minister must develop, review and publish annually an Integrated Energy Plan (IEP) that deals with energy supply, transformation, transport, storage and demand in a manner that accounts for, inter alia, energy security of supply, economic viability and affordability, social equity and employment, the environment, and international commitments. Section 6 stipulates that such IEP must take account of issues, such as optimal use of indigenous and regional energy resources, sustainable development, economic viability, environmental, health, safety, and socioeconomic impacts, and the developmental requirements for the southern African region, taking into account all viable energy supply options, and guiding the selection of appropriate technology to meet energy demand and the investment in energy infrastructure. Importantly, before finalising any IEP, the minister must invite public comment and duly consider comments received.

From this, it is obvious that the IEP process is far wider and more comprehensive than that of an IRP under the Electricity Regulation Act, requiring careful consideration and evaluation of the optimal use of all energy resources for the production and use of energy in all its forms, not just electrical energy. In so doing, the IEP will have to consider present policy pertaining to exploitation of all of our natural resources capable of being converted into energy, including water (for hydrogen), coal, oil, gas, and any associated byproducts of such resources such as petroleum and liquefied petroleum gas.

Consequently, the process will not be undertaken nor completed in short order. Some disappointment has been expressed with section 6 coming into effect only in April 2024. Although government has indicated that a draft IEP would be available for consideration before the end of 2023, the track record in the energy sector, in particular the time taken to revise the IRP, indicates that this is not likely to happen. Respectfully speaking, the date of coming into effect of the provision is somewhat of a red herring. There is nothing in the legislation stipulating that the IEP must be produced within a certain time frame; rather, section 6 stipulates that an IEP must be produced, then revised and published annually. Strictly speaking, then, government is only obliged to start the IEP process from April 2024.

Without being obliged to do so (section 6 not having been promulgated), back in 2012, the Department of Energy did formulate an IEP, and undertook extensive stakeholder engagement on the proposed plan during 2016 and 2017.

It remains to be seen whether or not that draft will be dusted off and updated for the required 20-year horizon as from 2024. What is clear is that the whole stakeholder engagement will have to start afresh, which, as previous experience in 2016 and 2017 indicates, is not a speedy process.

In the meanwhile, policy and energy sector initiatives in the broader energy sector will continue to be informed and guided by the principles contained in the 1998 White Paper on Energy.

THE IEP WILL HAVE TO CONSIDER PRESENT POLICY PERTAINING TO EXPLOITATION OF ALL OF OUR NATURAL RESOURCES CAPABLE OF BEING CONVERTED INTO ENERGY.