THE

IS

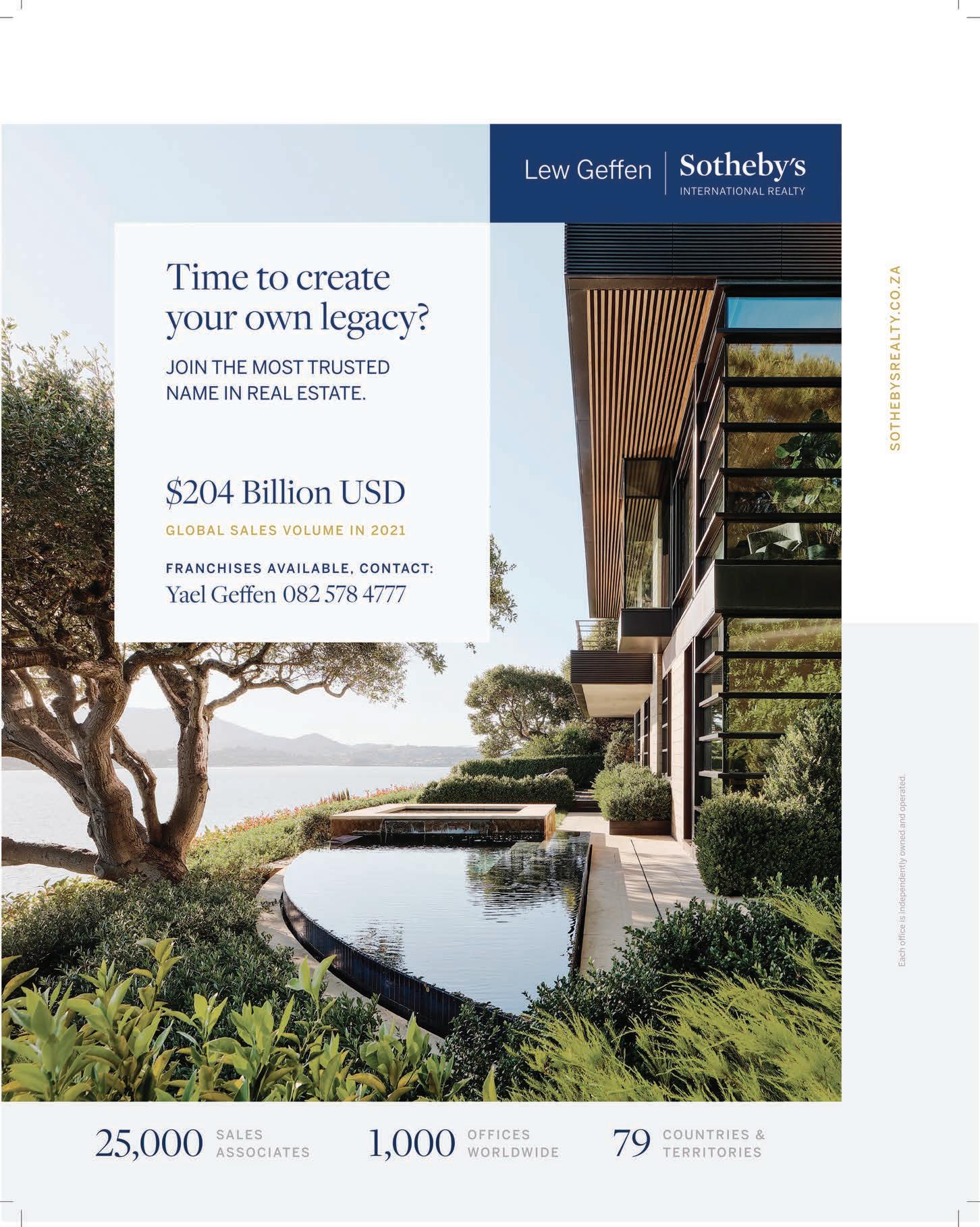

Picasso Headline, a proud division of Arena Holdings Pty (Ltd), Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

Editor: Anthony Sharpe

Content Manager: Raina Julies , rainaj@picasso.co.za

Contributors: Trevor Crighton, Yael Geffen, Caryn Gootkin, Nadeema Jones, Anél Lewis, Lizo Mnguni, Donovan Theart, Lisa Witepski

Copy Editor: Lucinda Jordaan Content Co-ordinator: Vanessa Payne

Head of Design: Jayne Macé-Ferguson

Senior Design: Mfundo Archie Ndzo

Advert Designer: Bulelwa Sotashe Cover Image: www.istockphoto.com/monkeybusinessimages

Project Manager: Tarin-Lee Watts, WattsT@picasso.co.za | +27 87 379 7119

Production Editor: Shamiela Brenner Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat, fatimad@picasso.co.za Printer: CTP Printers, Cape Town

Management Accountant: Deidre Musha Business Manager: Lodewyk van der Walt General Manager, Magazines: Jocelyne Bayer

COPYRIGHT: Picasso Headline. No portion of this magazine may be reproduced in any form without written consent of the publisher. The publisher is not responsible for unsolicited material. Franchising is published by Picasso Headline. The opinions expressed are not necessarily those of Picasso Headline. All advertisements/ advertorials have been paid for and therefore do not carry any endorsement by the publisher.

According to the Organisation for Economic Co-operation and Development, there are around 2.6 million small, medium and micro enterprises (SMMEs) in South Africa, of which 37 per cent are formal. A third of these provide one to 10 jobs and, overall, their contribution to gross value added has increased from 18 per cent in 2010 to 40 per cent in 2020.

Those are big numbers for small business, which is often described as the engine driving South Africa’s economy.

The undeniable truth is that our country needs as many SMMEs as possible to drag our stagnating economy forward and to absorb our millions upon millions of unemployed citizens. And we need those enterprises to succeed. Franchises provide a structured, tried-and-tested means for entrepreneurs to run their own enterprises, which is why South Africa’s franchising sector is so crucial to our future.

In this issue of Franchising, we look at whether or not this holds true in a post-COVID-19 world, and how franchisees are adapting and taking advantage of renewed consumer spending.

Many of the entrepreneurs supported by the sector are women – who, globally, have been disproportionately affected by the fallout from the pandemic – we take stock of the present situation for them, as well as what the future holds.

Funding remains a challenge especially with banks more risk averse than ever, so we size up the options available to budding small business owners. We also dot our I’s and cross our T’s on the intricacies of intellectual property.

Anthony Sharpe, Editor

Anthony Sharpe, Editor

Is franchising still an economic powerhouse in a post- COVID world?

What is it about this business model that attracts women entrepreneurs?

Now more than ever, businesses need to protect themselves from risk

What are the rules governing intellectual property in a franchise agreement?.

A deep dive into the various funding options available

How does modern communication tech facilitate a franchise’s operations?

Franchising has long been seen as a pillar of economic growth – but does this hold true in a post- COVID world? By LISA WITEPSKI

According to franchisors – at least those active in the quick service restaurant (QSR) sector – the answer is yes. In fact, the idea of buying into a proven model is even more attractive than usual for people who lost their jobs during the pandemic. This may be why enquiries from potential franchisees are on the rise.

Aneez Amod, director of Jimmy’s Killer Brands, reports that the company receives enquiries “every single day” – and is planning to open at least four new stores, possibly six, by the end of the year.

Growth in existing stores is on the up, too, with the brand having enjoyed 34 per cent year-on-year growth since 2020.

King Pie is experiencing a similarly positive trajectory, with trade having almost returned to pre-pandemic levels and the franchise’s footprint increasing by 10 per cent during the past year.

It’s not only the food sector that’s experiencing a recovery. Felicia Ntisa, a franchisee for Sorbet who owns Sorbet Nails and Sorbet Man in Hyde Park, as well as Sorbet Nails in Bryanston, confirms that, after taking a hit during the first three months of closure, her Hyde Park stores are starting to perform well once more, although the Bryanston franchise is taking a little longer to find its footing again.

Morne Cronje, head of franchising at FNB Commercial, points out that some of the jubilation many franchisees are feeling comes from the lifting of lockdown regulations. However, he maintains a more cautious outlook about what lies ahead for franchisors, as a number of obstacles remain.

Take load shedding for example: Clara Namnick, head of marketing for Del Forno, says that while the franchise, which specialises in wood-fired pizzas, actually benefits from scheduled power cuts, the reality is vastly different for most brands.

Amod says that his franchisees have been instructed to close their stores during power outages, as this is more cost effective than running and maintaining generators. Nevertheless, some stores lose up to R5 000 per day during load shedding.

Ntisa says that although the malls where her stores are located are fitted with generators, load shedding unavoidably affects traffic to those malls.

“Despite having shown its ability to overcome the pandemic, the

sector still needs to ride out such headwinds,” says Cronje. “Single-restaurant owners lack the luxury of being able to spread the risk between multiple stores, and so will be hardest hit.”

Cronje adds that new entries to the market remain slow, as access to capital is still a big hurdle: “The current economic landscape makes it difficult to enter any new business venture.”

That said, there is a noticeable uptick in the number of franchisees and business owners buying second and even third stores – which points to a trend of consolidation. “Bigger operators are getting bigger and buying smaller, struggling stores,” notes Cronje.

The best bets for would-be franchisees? Retail, fuel, hardware, construction, automotive and QSR are all performing well, Cronje says, and in most cases have returned to pre- COVID levels. The beauty and sit-down restaurant industries are also showing a solid recovery.

FNB expects GDP growth to come in at 1.8 per cent this year, says Cronje. “We are concerned about the elevated risk of a near-term technical recession, although this is not our base case. Our forecast reflects our estimate of an economic contraction in the second quarter of the year, as the economy suffered materially from flooding in KwaZulu-Natal, intense load shedding and labour unrest.”

The undeniable economic tumult notwithstanding, consumers aren’t hesitating to spend, making franchising an attractive option in the present circumstances. “I believe that the consumer mindset has changed,” acknowledges Cronje. “People have become more conscious about how they spend their money post-lockdown; they feel more confident spending on a proven product, which is why franchises in general have been quite resilient.”

“Bigger operators are getting bigger and buying smaller, struggling Stores.” MORNE CRONJEMorne Cronje

No other industry, which spans around 14 different business sectors, has contributed so extensively and continuously over the past 50 years to the country’s gross domestic product and brought together the winning elements of entrepreneurship, small business development and job creation. The Franchise Association of South Africa (FASA) asked some of its members from the various sectors they operate in to share how they are coping with the current load-shedding situation and economic uncertainty.

“Continual load shedding is not sustainable; it increases costs and reduces profits, resulting in job losses and reduced opportunities. If living through a pandemic for over two years has taught us anything, it is that it’s imperative to have a recession-proof business – one that will make it through the good and bad economic cycles. We have continued to thrive through these challenges, becoming more streamlined and efficient – and demonstrated the resilience of our model.”

Richard Mukheibir, MD, Cash Converters

Richard Mukheibir, MD, Cash Converters

“Despite being adversely affected by the pandemic and moreso with the rioting and looting of the past two years, OBC’sstore sales have increased significantly since then, achievingsales in most stores that are well above average growth andinflation. With the cost of food staples continually increasing,especially for those with many mouths to feed, we strive to fillconsumer tables with excellent value for money and continueto contribute and be part of the social fabric of our society.”

Tony da Fonseca, CEO, OBC Better Butchery

“The pandemic and load shedding cost us in terms oflost sales. We are facing challenging years ahead wherethe brand may find it tough to reach its targets, but ourfocus on customer service, price and product quality hasallowed us to maintain our position as market leaders.Despite the tight economy, rising costs in rentals andelectricity, and business confidence at an all-time low,our franchise group is committed to working with eachbusiness partner to ensure every store achieves itsprofit targets.”

Chris Wheeler, CEO, PostNet

Chris Wheeler, CEO, PostNet

“The impact of the pandemic coupled with other economic hardships has taken its toll on industry as a whole, with our supply chain marginally impacted. Since then On Tap has seen some great growth figures, with some stores even breaking previous sales records. This was due to smart planning and financial decisions made before 2020, which resulted in us offering our franchisees provisions or reductions in their franchise fees – giving them some extra breathing space to save on operating costs.”

Johan Van Wyk, Managing Director, On Tap

“Due to our great business model and world-class partners, InXpress franchisees have been able to not only survive, but also thrive through international recessions, pandemics, natural disasters and supply chain difficulties. It has been amazing to experience the resilience of the South African franchisees and their ability to adapt to current circumstances. The pandemic has reminded us to focus on what works and make it work brilliantly!”

Tersia Visagie, Country Manager, InXpress South Africa

Tersia Visagie, Country Manager, InXpress South Africa

“The auto repair aftermarket was given a much-needed boost with the right-to-repair legislation introduced in July 2021 where consumers are no longer forced into expensive service-plan offerings by dealerships. Finding an ethical and dependable car service centre becomes crucial, and franchising provides established brands and franchise opportunities to join the market. The CARtime franchise system provides motorists with a nationwide network of affordable quality service centres with a strong ethos behind the brand.”

“Starting a business is always a risk and a great sacrificialdecision. With the world seeing unprecedented times inthe past two years, without doubt, the hair, beauty andcosmetic industry has taken tremendous strain. LegendsBarbershop came out of the lockdown with only 13 stores,but through resilience and dedication, we were able topick up and support our franchisees and employeesduring this time, and since then have persevered toopen over 50 stores.”

Sheldon Tatchell, Founder, Legends Barbershop

“The Fast Food sector proved to be more resilientthan other sectors in the face of multiple challenges,including load shedding, rising interest rates, fuel pricehikes, increasing food inflation, and operating costs thatnegatively impacted consumers’ disposable incomes.Roman’s core focus – to remain a customer-centric organisation offering the best value proposition inour sector – helped protect our franchise profitability.Remaining front of mind and prioritising our customers’needs, as well as safeguarding our franchisees’ bottomline remains Roman’s Pizza’s imperative.”

John Nicolakakis, CEO, Roman’s Pizza

“The emotional and social impact on babies and toddlers of the COVID-19 pandemic was something that was only perceived and noticed as the impact of the pandemic unfolded. Being in touch with so many schools, teachers, parents, children, and babies, Monkeynastix as a group had a unique birds-eye view of the emotional impact on children aged three months to twelve years. All of a sudden, the landscape of the approach to movement education had to be re-adjusted to constantly redevelop new ideas to combat childhood anxiety.”

Dirk Cilliers, CEO, Monkeynastix

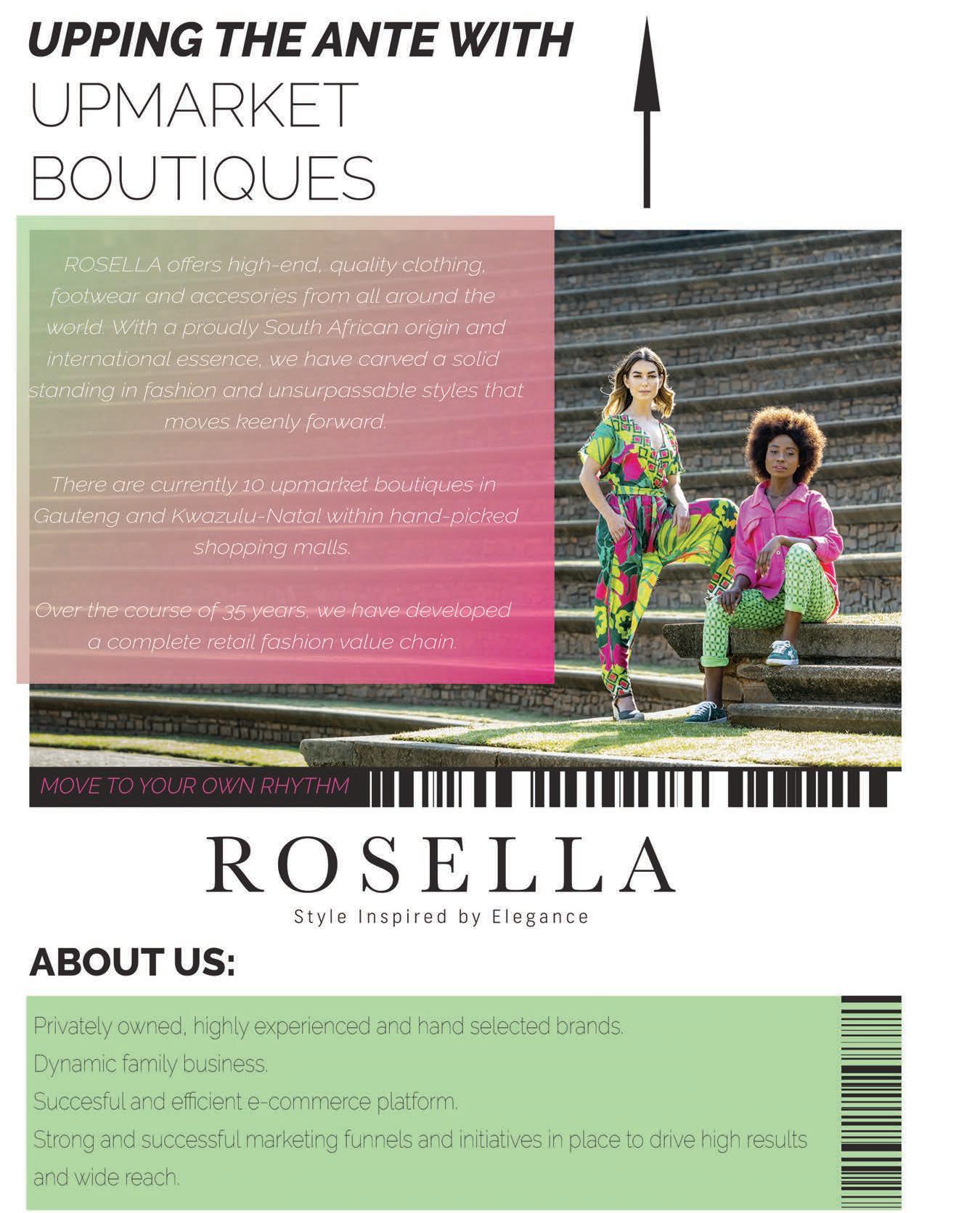

“The fashion industry has shown tremendous resilience through the years, and even in the wake of economic change, has been able to adapt and grow through exploring new ways to reach audiences. With government incentives to make the domestic textile and clothing industry more competitive, signs of recovery are encouraging, and Rosella has developed a complete fashion retail value chain that, through franchising, provides the tools needed to operate a prosperous business.”

Intrepid women entrepreneurs are playing an increasingly dominant role in the franchise sector – and multiplying the effect by inspiring others, writes DENISE MHLANGA

Since embracing the franchising model in the 1960s, South Africa has established a business sector that contributes significantly to economic growth and job creation – about 14 per cent of country’s GDP – through its 800 business brands operating in more than 48 000 outlets. It employs about half a million people – and women are franchisees in almost all sectors of the industry.

“Franchising is attractive to women entrepreneurs as it provides the necessary safety net that a normal or independent start-up business does not –and women are particularly good at working within a system,” notes Pertunia Sibanyoni, chairperson of the Franchise Association of South Africa (FASA).

Sibanyoni says many women run multiple franchises and are reaping the rewards.

Many bought into franchising as individuals or with their partners, she reveals, adding that couples make up a high proportion of franchisees – and they tend to be successful because the business then becomes a family affair.

Women are good at managing people, work well in a team and have good negotiation skills, all of which works in their favour, adds Sibanyoni. “In addition, women are creative and good at networking, which makes franchising especially attractive. It also offers a certain peace of mind, as in franchising, one is in business for oneself but not by oneself.”

The 2019 FASA franchising survey showed that more than 30 per cent of successful franchises are headed by women. While this figure lags first-world countries, women in South Africa will play an increasingly dominant role in the franchising sector.

In South Africa, franchising spans more than 14 different business categories, with many women opting for franchises in the services

sector, such as beauty and slimming salons, nail bars, education, real estate and businessto-business areas, says Lindy Barbour, director of The Franchise Firm.

Barbour points to a number of successful franchises started by women entrepreneurs who successfully implemented their unique ideas and concepts, expanded the businesses, and have empowered other women in the process.

Michelle Royston, founder and franchisor of WAXIT, a franchise network of discreet waxing salons for men and women, is one such success story. Since opening shop in July 2015, she has expanded to 11 wax bars countrywide, with further expansion plans on the cards.

Barbour and her partner Nicola Maré became WAXIT Southdowns franchisees in 2020, following two decades of working in franchise training development consulting. She says becoming a franchisee during the COVID-19 pandemic was not easy, but the franchisor was hands-on. “Our success is due to the hard work we put into the business, coupled with the support of the franchisor.”

Mmenyana Ranku, operations director at KFC Africa, says a tough economy is affecting the franchise sector as operational costs are squeezing franchise margins, but despite this, there are untapped opportunities in the franchise sector.

She advises anyone interested in the sector to conduct thorough due diligence and research available funding options. “Many hopefuls fail to enter the sector because of the start-up cost of buying a franchise, particularly that of an established brand.”

Ranku advises that a focus on sustainability and social consciousness has become an important factor for consumers, who are more inclined to support businesses that are mindful of the impact they have on the environment and are committed to giving back to the communities they serve.

She also adds that in a fiercely competitive environment, remaining agile is crucial. “Knowing what differentiates your business from your peers is non-negotiable, as is keeping consumers interested in your franchise offering.”

INSPIRING ENTREPRENEURSHIP Zamaswazi Gamede, owner of Global Direct, joined insurance franchise The Unlimited in September 2017 before starting her own business.

As a franchisee with The Unlimited, Gamede received valuable coaching and personal skills development courses that helped her build business acumen and become an entrepreneurial change-maker. Today Gamede employs 30 people.

“As entrepreneurs, we play a significant role in the economy, through job creation and coming up with innovative solutions to problems faced by our communities,” explains Gamede, but adds that access to capital is crippling. “Government should be more enabling by investing in programmes that teach young people entrepreneurial skills.”

Most franchises operate from Gauteng, followed by KwaZulu-Natal and the Western Cape.

Source: Franchise Association of South Africa

About 25 per cent of women-led businesses suffered the negative effects of the COVID-19 pandemic, with many forced to close down, according to the Global State of Small Business Report.

Gender inequalities around access to markets represented a significant setback, says Nirmala Reddy, strategy specialist for enterprise development at Nedbank. “However, Nedbank has various programmes aimed at assisting women entrepreneurs, and we see the fruits of these interventions via an increase in the number of new projects and new businesses being launched.”

Reddy adds that economic turnaround, specifically through women-owned businesses, requires commitment and collaboration across all stakeholder groups.

“The financial crisis and the burden of working from home has definitely placed strain on the woman business owner, with her role as a caregiver often resulting in emotional, mental and physical fatigue.”

In today’s volatile economic and civil environment, protecting yourself against risk is essential, writes LIZO MNGUNI, pricing manager and spokesperson at Old Mutual Insure

According to analysts at McKinsey & Company, operational pressures may lead to 60 per cent of closures for South African small, medium and micro enterprises (SMMEs). SMMEs contribute to more than 20 per cent of GDP, and employ about 47 per cent of the workforce in South Africa – underscoring the need for financial security in the industry, according to the Bureau of Economic Research.

For SMMEs to grow sustainably and deliver on their role as the country’s economic engine, business owners need to take risk management very seriously. The unexpected can cripple a business in volatile markets, as we are currently experiencing.

All businesses face perils on their growth journey, such as floods that can damage stock, a fire that can destroy the premises or vehicle accidents can impact logistics and distribution, bringing a thriving business to a grinding halt.

We are already seeing an increase in weather-related perils as a result of climate change: earlier this year we saw the extensive damage to businesses and households alike as a result of devastating floods in KwaZulu-Natal.

Against these risks, insuring business assets is a must – especially if you rely on motor vehicles, own a building, keep inventory or

valuable contents on your premises, or are reliant on electronic equipment.

For a manufacturer, protecting valuable stock during storage or transportation is essential. The priority for a motor fl eet owner, on the other hand, is comprehensive cover protecting specialist vehicles against accidents, theft or liability.

A business also needs to be covered for third-party liability, which protects an enterprise from the risks imposed by lawsuits and similar claims.

It is essential to understand whether a particular business needs property damage cover, fire insurance, business interruption cover, comprehensive motor insurance, legal liability or third-party cover, financial risk support, or theft, fraud or employee dishonesty protection – or any combinations of these.

Regardless of their circumstances or type of venture, small business owners work under high pressure and have fewer margins for error, especially as technology, distribution and consumption patterns and priorities alter. Today, the cost of repair or replacement could be a major setback. Loss of profits can make it even more difficult to pay off loan instalments, retain cash for investment or meet other business commitments.

From an insurer’s perspective, franchisees are generally considered less risky than their smaller, stand-alone business counterparts.

Lizo MnguniIn 2021 we also saw how damage caused by civil unrest in parts of Gauteng and KwaZuluNatal resulted in major setbacks to businesses. For this, South Africa has a state-owned special risks insurer, Sasria, that operates independently to cover businesses against losses caused by civil commotion, public disorder, strikes, riots and terrorism.

Recent events have proved how important it is that consumers and businesses insist on Sasria cover. While no one may have foreseen an event of such magnitude, the point of insurance is to protect one against risk. Sasria cover is “sold” as an optional add-on to an existing commercial or personal insurance policy. The cover is cheap relative to the premium on the main contract, so many businesses sign on. Those that do not have insurance, and most of those who have an insurance policy without the special risks add-on, will have to foot their losses themselves, or turn to government for help.

Small businesses or entrepreneurs who are looking to take their business to the next level may be considering franchising, which can be an effective way to expand a company. It may be helpful to know that from an insurer’s perspective, franchisees are generally considered less risky than their smaller, stand-alone business counterparts.

As risks become more complex and costs grow, we urge SMMEs to consult professional brokers to determine where to place their hard-earned money to safeguard themselves against possible harm. As the choices are overwhelming, comprehensive and effective small business cover can only be achieved with brokers who are qualifi ed and experienced in specific industries, fi elds, services or types of businesses.

By managing risk through proper insurance cover, SMMEs can ensure that they remain profitable and sustainable through potentially devastating setbacks.

Thanks to its ability to adapt to change, and its forward thinking and planning, the franchising sector is proving resilient in tough times, writes THE FRANCHISE ASSOCIATION OF SOUTH AFRICA

As South Africa continues to grapple with ongoing load shedding, the key to recovery for the over 800 franchisors and their 38 000 franchisees is to capture the spirit of perspective and position change by focusing on the horizon and the vision for the future.

The consensus from The Franchise Association of South Africa’s (FASA) member base in the 14 business sectors the association represents is that the silver lining is to commit to action, have a target and the motivation to pull through the storms and set one’s sights for future growth.

Creating an early warning system is the biggest lesson that has come out of the pandemic. The second is recognising that as a collective, franchising is a lot stronger. Traditionally, the franchise industry has successfully weathered difficult economic times with adaptability as a primary aspect of its DNA. When a crisis occurs, the franchisor is already looking at how he can adapt so his franchisees can keep moving forward. According to Pertunia

Sibanyoni, chairperson of FASA, “that is the beauty of the ‘collective’ made up of franchisors and franchisees who, in times of crisis, come together to tackle the challenges, find solutions and forge a new path.”

The franchise sector worldwide has proved, through the pandemic and other hardships, that underpinning its success is a business system that works within the framework of ethical business practices. Franchising has all the checks and balances in place to take some of the risk out of people starting and running businesses and, more importantly, surviving many challenges, such as the pandemic and other economic challenges.

Following FASA’s conference, which brought together franchisors and stakeholders from a range of business sectors that franchise, the consensus was that the pandemic and other curveballs of the past two years have taught franchisors that they can’t solve the world’s problems, but they can tackle the future in bite-size chunks. They can commit to making positive changes, do scenario planning, set long-term goals for their businesses, and be prepared for any eventuality. Many brands

were surprised with how quickly they and their franchisees have adapted to the new normal, were able to pivot quickly, and provide the necessary cushioning and support to overcome the obstacles.

Freddy Makgato, CEO of FASA says “Franchising is successful because it works as a collective and FASA has a crucial role to play in facilitating the creation of more franchises to add to the already successful ones that contribute almost 14 per cent to the country’s gross domestic product. Businesses, especially franchises, with sound business ethics can create jobs and should be prioritised.

Government must free up all legislative obstacles for those businesses to create opportunities that will contribute to skills transfer and job creation. We therefore need to strengthen our collaborative and co-operative efforts with other stakeholders and get government to partner with us in fi nding new avenues for growth.

With franchising covering fourteen different business sectors, and with more that have the potential to be franchised, FASA and the franchise community have an important role to play in the country’s future.”

Scan this QR code to go directly to the FASA website.

For more information: +27 11 615 0359 enquiries@fasa.co.za www.fasa.co.za

“Franchising is successful because it works as a collective and FASA has a crucial role to play in facilitating the creation of more franchises to add to the already successful ones that contribute almost 14 per cent to the country’s gross domestic product.”

– Freddy Makgato

There’s no denying that a brand’s logo is its signature statement. Entrenched everywhere – from stationery to décor – it becomes a measure of success if instantly recognised. And, as with all elements of a company’s intellectual property, it may be licensed to a franchisee –but belongs to the franchisor. ANÉL LEWIS looks at why the protection of intellectual property is a key aspect of any franchise agreement

One of the franchisor’s most significant asset is its intellectual copyright, know-how and get-up (unique decor), says Charl Groenewald, a director at MacRobert Attorneys and head of the Franchise Law and Intellectual Property division.

Given the considerable value of these “creations, inventions and other products of the human mind”, any franchise agreement stipulates strict rules and measures as to how the franchisee is allowed to exploit and use this intellectual property. “As intellectual property is only licenced to the franchisee, the franchisee does not retain ownership of any aspect thereof, and once the franchise agreement is terminated, this licence is terminated,” explains Groenewald.

These are defined as any name, slogan, device, logo, or symbol used in relation to the franchise business, says Groenewald. The franchisor can obtain exclusive rights to the trademark by registering it in terms of the Trade Marks Act, or by acquiring rights through extensive use of the trademark.

Groenewald emphasises that a franchisor has exclusive rights to his trademark even if it is not registered. Eugene Honey, a partner at Adams & Adams and legal advisor to the Franchise Association of South Africa, advises that, to qualify for registration, a

trademark must distinguish a product or service from those of its competitors.

Copyright is the right given to the creator or author not to have that work copied or reproduced without authorisation, explains Honey. It exists in various types of works or materials, including literary works (novels, manuals, and publications), artistic works and even computer programs. Honey says that generally, the author of the copyright work is the owner. Exceptions include work originated on commission, or under employment; in this case, the employee would be the author and the employer the owner.

Many of the features that contribute to a franchise’s success can be found in the know-how, says Honey. While there is no statutory protection for know-how – which includes technical knowledge, commercial information and practical experience developed within a franchise – it should be protected by confidentiality provisions in the franchise agreement.

Once a franchise contract ends, the franchisee may not use any of the franchisor’s intellectual property in a new venture or business relationship. All intellectual property must be returned, and the franchisee must refrain from using any of the franchisor’s know-how and confidential information for their next venture, says Groenewald. This includes business methods, financial data, strategies, price lists and supplier and creditor lists.

There is no facility for the formal registration of copyright in South Africa – other than for cinematographic films. However, the Copyright Act automatically protects original works from being copied or adapted without authorisation. Furthermore, the same protection applies to works created in or by residents of the more than 280 countries that have adopted the Berne Convention.

Source: Eugene Honey, a partner at Adams & Adams and legal advisor to the Franchise Association of South Africa

As the franchise agreement licences the use of intellectual property to the franchisee, any unauthorised or non-compliant use thereof could be considered a breach of this agreement, says Honey.

Restraint of trade clauses feature in most franchise agreements to protect the franchise system. Some types of intellectual property enjoy statutory protection, in terms of the Copyright Act or Trade Marks Act.

In addition, common law remedies such as passing off or unlawful competition may also be applicable once the franchise contract has ended. These remedies could justify a court order to terminate the unauthorised use with immediate effect, as well as payment of damages for losses suffered, explains Honey.

“Our courts generally frown on any infringement of a franchisor’s intellectual property by an ex-franchisee, and will not hesitate to provide the necessary remedial orders to not only prevent the infringement in question, but in certain instances to also compensate the franchisor by awarding a reasonable royalty in lieu of damages,” concludes Groenewald.

Old Mutual’s Masisizane Fund, a non-profit funding entity that offers development finance and business support, has a specific focus on black women, youth and people with disabilities.

Source: Old Mutual

The vast majority of entrepreneurs interested in becoming franchisees are not able to self-fund the full franchise fee and would need a funding partner. Commercial banks are usually the first port of call.

“However, in the current economy banks have become more risk averse and cautious about approving loans,” says Sasha-Lee de Bod, consultant at Franchising Plus.

Anita du Toit, franchise consultant at Franchise Fundi, says all the major commercial banks have franchise divisions that have relationships with franchisors, so they understand funding for the purchase of these types of businesses. “The banks all generally follow the rule of thumb of potential franchisees having to contribute at least 50 per cent of the price of the franchise, which can be a big barrier to entry to many entrepreneurs. But some do have empowerment finance options for those who don’t have the required contribution. They also

all tend to have some specific value propositions in terms of which they will consider lesser own contribution (say 30 or 40 per cent), usually based on the strength of the franchisor, as well as other factors.”

Like the other major banks, Absa uses the set industry norm of a 1:1 funding-to-owncontribution ratio as a funding guideline.

“Depending on the franchise brand and the own contribution set by the franchisor, we do sometimes call for a higher or lower own contribution,” says Abigail Makhubele, business development manager for retail at Absa. “We have, in certain cases, funded up to 60 per cent or even 70 per cent based on leverage, which is a key driver in our understanding of how comfortable the franchisee will be in servicing the loan. But as a rule of thumb, the client needs to put up their own contribution – usually 50 per cent of the purchase price of the franchise – as well as provide security for the loan we advance, usually the other 50 per cent.”

In deciding whether to lend to a particular franchisee, banks take a

Abigail Makhubele

Abigail Makhubele

wide range of factors into account. “In assessing a loan application, we consider the individual entrepreneurial skill set of the franchisee, what industry experience they have, how connected they are in the particular industry, their financial and business knowledge, and how prepared they are to get their hands dirty in the day-to-day operations of the business,” advises Makhubele. “We need to assess the applicant’s business acumen, and ability to adapt to the franchisor’s set standards and procedures. The franchisee is effectively an ambassador of the brand, and should be able to implement and adhere to operational efficiencies as set out by the franchisor. If they don’t have all these qualities, we look at whether or not they have a strong manager in place who knows the ins and outs of the business, and understands the profit margins and how many units need to be sold to reach the desired profit benchmark.”

Looking to buy a franchise? CARYN GOOTKIN explores some of the funding options available to potential franchiseesSasha-Lee de Bod ABOUT THE MASISIZANE FUND

Before you apply for funding, you need a clear business plan. “Many entrepreneurs deride banks for being unwilling lenders, yet banks in turn say they are more than willing to finance any sound business idea backed by a solid business plan,” says Sasha-Lee de Bod of Franchising Plus.

There are several institutional alternatives to bank funding, though: some stand-alone funders and other development funders.

“The National Empowerment Fund (NEF) is quite active in the franchising industry,” says du Toit. “They work closely with franchise owners and franchisors, most notably in fuel retail, so they might consider a lesser own contribution and lighter security conditions.”

The NEF iMbewu Fund’s franchise finance division lends up to R10-million over a maximum term of seven years to aspirant black franchisors.

Another option open to people looking to invest in a franchise is the Small Enterprise Finance Agency (SEFA), an implementing agency of the Department of Small Business Development.

“SEFA is a development finance institution (DFI) that provides funding to a maximum of R15-million through its direct lending channel,” explains Don Mashele, head of SEFA’s business development unit. “The agency also provides credit guarantees to participating commercial banks, to the benefit of SMMEs and new entrants in the franchise arena. This helps SMME borrowers who can’t access commercial bank loans because they do not have the collateral required by the lenders,” adds Mashele.

Makhubele says that DFIs like SEFA play a crucial role in helping banks advance their transformation agendas. “At Absa we are steering an inclusive franchise market; we want to see substantial growth in the number of franchises owned by black people and previously disadvantaged individuals (PDIs), as defined in the sector,” she notes. “Our collaboration with SEFA is key for us in bridging the financing gap that a lot of prospective franchisees have. For historic reasons, many PDIs

do not own sufficient assets that can be used as collateral for their loans, but through collaborations like the one we have with SEFA and other DFIs, we can assist entrepreneurs who are ready to enter the franchise market and have at least some form of own contribution.”

Own contribution, or “skin in the game”, is a non-negotiable, adds Makhubele. “When clients have invested their own hard-earned cash, they are impelled to drive the business forward and ensure it succeeds. So unencumbered own contribution (the entrepreneur brings some equity to the deal) is vital. We connect qualifying clients with SEFA and Absa Enterprise Development, who can issue guarantees as securitisation instruments for the loan we advance to the client.”

It is, according to de Bod, often the franchisor who sets the own contribution requirements, which the financial institutions follow. “This is important for another reason: generally these businesses cannot afford to repay a 100 per cent loan because it would be over-indebted, which would result in it failing.”

Aspiring women franchisors should take note of the Industrial Development Corporation’s Isivande Women’s Fund, which aims to accelerate women’s economic empowerment by providing more affordable, usable and responsive finance than is otherwise available to women entrepreneurs. This Fund provides loans of between R30 000 and R2-million.

Apart from personal savings, retrenchment packages, commercial banks, and governmental or other institutional funding, there are several other routes to finance a new business.

“A potential franchisee may need to get creative to finance their franchise,” says de Bod. “This could take the form of a soft loan through family and friends, which has many advantages – including not having to put up security, pay high rates of interest or pay it back according to a strict timeline. But we suggest you do draw up a loan agreement to protect the relationship if the business fails.” Bringing in a financial or “silent” partner is another way to fund the acquisition.

Some franchisors also offer tailored financing solutions. “This may take the form of a joint venture partnership, or assistance with accessing finance through enterprise development or B-BEEE,” says de Bod. “If all else fails, they could turn to a stokvel or crowdfunding,” she concludes.

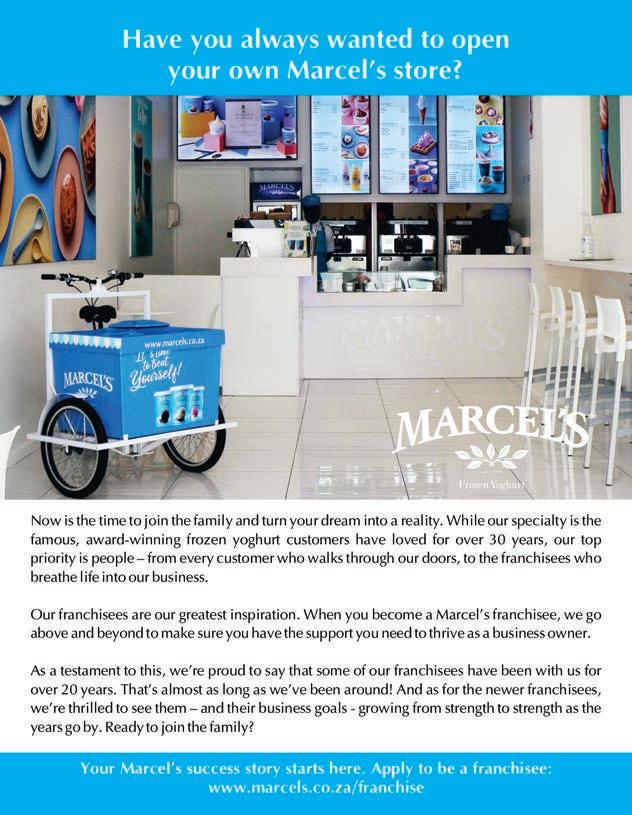

DONOVAN THEART, business development manager at Marcel’s Frozen Yoghurt, outlines the advantages of employing tech tools in almost every facet of day-to-day operations

Established in 1989, Marcel’s Frozen Yoghurt is based in Stellenbosch’s Devon Valley, where we manufacture and directly supply our 18 corporate and 12 franchise outlets, along with various retailers in the FMCG industry. We strive to provide the best possible service to our franchise partners and corporate stores – and, most importantly, to our customers. To do so, employing various forms of technology correctly is essential.

Communication with our customers, aligned with our store activity, is key to the business model we operate. We employ a variety of apps, and media platforms – such as social media, email, WhatsApp, Microsoft Teams and Zoom – to support our franchisees in managing their investments and ensuring they receive the best possible service and support from us as the franchisor. This was especially important in the context of the COVID -19 pandemic, where face-to-face communication and site visits were difficult.

The impact technology has on our day-to-day operations is most evident when it fails, as we then face multiple challenges to ensure a successful day-to-day operation.

Technology provides us with both speed and accuracy of communication: it forms an interlink across our entire value chain – from procurement, recipe and manufacture, to stock counting and stock holding at the appropriate temperature control; this includes order, supply, temperature-controlled

Technology provides us with both speed and accuracy of communication: it forms an interlink across our entire value chain.

delivery and distribution, and receipt of delivery. Technology facilitates the supply and sale to our customers, payment and, ultimately, the enjoyment, experience and the memory they have when consuming our frozen yoghurt.

We have camera monitoring in all our stores, which we can view from head office to record activity and ensure traceability around anything that takes place in production, dispatch and service to the customers from front or back of house.

To ensure all stock transfers, stock holding, sales activity, product description through article numbers and barcodes, financial statements throughout our business for each management accounts, and customer accounts and activity are loaded, we make use of the accounting system Navision at our head office. This is integrated with LS Retail, among other point-of-sale (POS) systems in our stores, to monitor all POS transactions, gross profit margin consistency, stock movement accuracy in line with stock received and sales volumes – helping us to accurately project supply in line with sales demand.

As a frozen yoghurt business, temperature control is obviously crucial. This is monitored from our warehouse, which can store 800–1 000 pallets of products. We make use of a temperature control system linked to our cellphones and our alarm system at head office.

The ever-evolving technology of today allows us to manage and provide the best service to all Marcel’s Frozen Yoghurt outlets, franchise business partners and all stakeholders, resulting in the best possible product and service received by our loyal end consumers.