17 minute read

MANUFACTURING SECTOR HIT HARD BY PANDEMIC

MANUFACTURING

SECTOR HIT HARD BY PANDEMIC

By Nelendhre Moodley

The manufacturing sector accounts for just under 14% of South Africa’s GDP. In a bid to better understand the impact of the pandemic on the sector, Industry Snapshot chatted to Liz Hart – MD of Siyenza Events, organisers of the Manufacturing Indaba.

How important is the manufacturing sector to the South African economy?

Manufacturing activities promote development as they boost the value generated in an economy by creating activity further along value chains, from raw materials to finished products.

South Africa’s manufacturing sector remains one of the key contributors to directly impact employment. It remains imperative for key industry players to acknowledge the direct and indirect impact that manufacturing growth has on boosting economy-wide employment.

The introduction of innovative technologies and methodologies in the manufacturing realm further increase productivity levels. In addition, manufacturing creates employment opportunities, boosts the skills of the workforce, reinforces the economy, extends developments into the wider economy, and tends to support social stability.

Furthermore, manufacturing can contribute to provide a level of equilibrium between creating local competition for imports along with producing goods for export. A recent GDP report published by Statistics South Africa indicated that manufacturing currently accounts for just under 14% of the nation’s GDP.

This equates to R386-billion of the total economic value. Manufacturing is the fourth largest industry in South Africa, and within the sector, the food and beverages category is the biggest player, contributing 26% to the total manufacturing value added. Petroleum and chemical products are second, at 24%, followed by basic iron and steel at 19%.

How did the sector fare in 2020?

Negative growth rates in the volume of manufacturing production data were released by Stats SA owing to South Africa’s national lockdown occasioned by COVID-19 which had dire consequences on manufacturing output.

Data reflects a deceleration by -16.3% in June 2020 compared with June 2019 which is concerning for local companies in both the metals and engineering cluster of industries as well as the broader manufacturing sector, especially given the need for key labour-intensive sub-industries to remain resilient for job creation and sustainability.

The ban on alcohol sales had a destructive impact on the food and beverage division of manufacturing, while work interruptions and a decline in demand for steel were detrimental to facilities specialising in metals and machinery. However, despite a relative slowdown on a monthon-month basis, seasonally adjusted manufacturing production increased by 16.8% in June 2020 compared with 30.4% in May 2020.

Stats SA stated that all 10 manufacturing divisions reported negative growth rates, although the metals and engineering sector, comprising the basic iron and steel, non-ferrous metal products and metal products and machinery, saw the largest negative contributions, of 36.6%.

The manufacturing outlook for 2020 is dire, especially given the need for companies to remain resilient against the backdrop of a weak economy that is additionally under constraint owing to the COVID-19 pandemic.

The decline in manufacturing output remains a concern and such underperformance exacerbates the various obstacles confronted by local businesses in the diverse M&E subsectors, including a disruption of supply-chain activity since the advent of COVID-19. It remains critical for policymakers to focus on demand-side measures aimed at increasing demand, and accordingly, production for local businesses.

© ISTOCK – PJ66431470

What are some of the key challenges that the sector has faced, especially those companies related to the mining sector?

The key contributing factors directly impacting South Africa’s manufacturing sector, especially companies related to mining, include the following:

Political instability and insecurity.

State capture, corruption and mismanagement.

Infrastructure constraints.

Low productivity (cost of manufacturing).

Lack of skills development.

Negative perceptions of potential investors.

COVID-19 pandemic.

Volatile exchange rates.

Moody’s downgrade.

Unreliable electricity supply.

Weak demand.

Record levels of unemployment, rising poverty levels and increasing political uncertainty have justifiably rendered investors cautious as they opt to seek investment opportunities abroad. In order to stimulate economic growth and job creation, government needs to offer greater commitment to support local manufacturers.

Have there been any opportunities that companies in the manufacturing and mining sectors were able to take advantage of?

Given the prevailing remote nature of Africa’s mine camps, the mining industry was able to implement on-site lockdowns and strict access controls in response to national lockdown laws. Furthermore, sites already enjoy a robust culture of health and safety, enabling operators to establish vigorous testing and isolation infrastructure, very often outweighing those of their respective governments.

Supported by a weaker rand, mining entities (and indirectly their manufacturing counterparts) have continued to enjoy the gains in commodity prices, with the rise of platinum basket prices increases and as investors turned to gold as an investment safety net amid concerns about the pandemic and global trade tensions.

These gains were achieved despite increased operating costs and lower production primarily in the second quarter owing to the national lockdown.

Moreover, the mining sector again outperformed the JSE All Share Index and even outperformed the global mining index.

In addition, mining stakeholders benefited from the greater returns with mining companies reinforcing their social licence to operate in supporting their employees and direct communities, thereby laying a stable foundation for future growth.

The scale and resilience of the mining industry will be given a focal place in the recovery plans of many commodity producers.

South Africa’s economic recovery plan has prioritised revitalising the mining industry.

The government wants to increase South Africa’s share of global exploration expenditure to 3% from 1% currently.

To promote investor confidence, it is making similarly aspiring strides to simplify mining regulations and expedite approvals so that mining and environmental permits can be awarded in half the time.

The mining sector proved its resilience and capitalised on opportunities during the past year. It was critical in providing support during the pandemic and will be a vital element of the strategy to rebuild South Africa, thereby being made a top priority in the eyes of the government and opening up a plethora of opportunities for the industry and the respective players thereof.

What is the outlook for 2021?

While it may take a great deal of time before the sector experiences meaningful growth, manufacturing output levels will progressively increase. As restrictions continue to ease and the economy commences its path to recovery postCOVID-19, demand-related challenges will subsequently dwindle and the increased demand for intermediate and final manufactured products will follow suit, invariably pressing entities to increase capacity utilisation and manufacturing processes, thereby increasing sales as well as profits and margins.

What are some of the future trends within the manufacturing sector owing to the pandemic? Employee safety

Fundamental safety precautions such as workspace sanitisation and social distancing on the production floor will remain essential, along with scrupulous monitoring of who enters and exits their facilities and which individuals and equipment they interact with. This has led many manufacturers to insource facilities maintenance and management and to prioritise traceability, which necessitates that manufacturers retrieve internal equipment data from original equipment manufacturers.

Another safety priority extends to field service. Technicians will have to be better prepared for the job so as to complete work both quickly and efficiently with limited contact. This in turn is expected to directly impact supply chain visibility as manufacturers require improved transparency from suppliers when monitoring issues and claims throughout the manufacturing process.

IoT

COVID-19 has rendered IoT technology increasingly relevant owing to its remote monitoring and predictive maintenance capabilities. IoT solutions enable manufacturers to safely and remotely monitor equipment performance and identify issues before a malfunction even

occurs as devices empower technicians to formulate solutions before arriving on-site so the job is completed at a much more efficient rate.

Pandemic exit strategy

Manufacturers will need to plan a COVID-19 exit strategy and ultimately reset their businesses. To adapt to the “new normal” manufacturers must realign forecasts, evaluate the impact on the business, and identify where to restructure, rescale or retire. Given the extensive range prevalent within the manufacturing sector, each entity’s post-pandemic planning framework will differ from the next.

Big data

With IoT and predictive maintenance becoming increasingly relevant, big data is set to become a prevalent theme among manufacturers. The ability to collect data from a variety of sources, coupled with progressively more effective cloud computing capabilities, enables manufacturers to dissect data to provide them with extensive real-time insights to their business which will stand them in good stead in reassessing their forecasting and planning frameworks and developing an efficient pandemic exit strategy.

VR and AR support

COVID-19 has been a major hindrance to the field service element of manufacturing companies, preventing technicians from going on-site to install or repair equipment. However, assistive technology such as augmented reality (AR) and virtual reality (VR) has made it possible for technicians to provide remote assistance by sending customers’ AR- and VR-enabled devices and guiding them through basic troubleshooting and repairs.

For many manufacturers, this presents an exciting opportunity. More customers

Manufacturing is the fourth largest industry in SA.

© ISTOCK – Kuzihar

R386-billion Manufacturing sector’s contribution to GDP

are open to this concept, enabling manufacturers to evaluate new processes and procedures with the long-term objective of making them permanent fixtures.

Reshoring and near-sourcing

COVID-19 has prompted a renewed reshoring effort, transferring business operations that were moved overseas back to South Africa – from where they were originally relocated. Reshoring enables us as a nation to rebalance our economy, create new jobs and cut our trade deficit. Similarly, the pandemic has incited manufacturers to reassess sourcing.

COVID-19 has severely disrupted the global supply chain and has consequently made it increasingly complicated for manufacturers who source from other countries to acquire materials.

This has motivated many manufacturers to diversify sourcing by adopting near-sourcing. Near-sourcing, also known as local sourcing, is the process by which a business brings operations closer to where its finished product is sold. In manufacturing, this generally relates to the sourcing of raw materials from domestic suppliers.

Heading into 2021, both reshoring and near-sourcing are expected to be prominent trends as manufacturers endeavour to reduce or eliminate reliance on foreign materials, thereby providing opportunities for those involved on the local front. n

HIKVISION SOLUTION FOR THE MINING INDUSTRY

Dedicated to a Safer and Smarter Mining Environment

Hikvision ensures safer working environments in mining operations and effectively combats theft for the industry. Our one-stop solution covers all common mining scenarios, from perimeter protections and egress to underground operations and more. Hikvision is also applying deep learning technology to provide more advanced applications such as facial recognition, hard hat and safety vest detection, perimeter intrusion detection, behavior analysis, and more.

Touch-free Temperature Screening Ingress and Egress Control

Centralized Management

Fleet Management

Extensive Product Line Coverage

Highly Efficient Access & Attendance

Life and Asset Protection Temperature Detection

Staff Monitoring

Reuben Ramahlare, BME senior human resources business partner.

Unemployed youth are being trained in technical skills to improve their employability and open doors to starting small businesses, thanks to BME’s partnerships with training providers.

Reuben Ramahlare, senior human resources business partner at Omnia Group company BME, says this follows the signing of service agreements with local training colleges.

“An important strategic focus for us is to develop and empower communities through training, as part of our positive impact in the areas where we operate,” said Ramahlare. “This includes communities near our operations in North West province, Northern Cape, Mpumalanga and Gauteng – and targets 70% women’s participation in the programmes.”

Through this initiative, BME has been sponsoring the training of a range of vocational skills such as welding, plumbing and general property maintenance. The training bodies provide learners with certificates of competence, facilitating their path to employment or self-employment.

He noted that groups of learners are put forward by local municipalities and spend up to a month in training. In the case of the welding course, the successful learners are provided with welding and personal protective equipment by BME, to apply their skills in the marketplace. They are also trained in basic business skills for starting their own small enterprises, including financial management and applying for tenders. Thirty-five candidates have been trained this year in Brits, Kathu, Middelburg and eMalahleni.

The training organisations that BME has partnered with include the Mineral Mining Training Institute in Brits, Kathu and Middelburg, the Colliery Training Centre in eMalahleni and the Ekurhuleni Artisans and Skills Training Centre in Kempton Park.

BME BUILDS SKILLS IN MINING COMMUNITIES

BME strives to develop and empower communities.

TRONOX SPONSORS COMPUTER CENTRE FOR SCHOOL

Tronox KZN Sands recently handed over a computer laboratory to Mbuyiseni High School at Mangezi, KwaDlangezwa. Mbuyiseni is one of the best performing deep rural schools under the King Cetshwayo District, with 363 learners, Tronox said.

“We believe such projects allow for the empowerment of not only the learners and the school, but the community as a whole. This is an investment that will offer the learners the opportunity to be exposed to new and up-to-date information that can help open their world to new possibilities,” said Nozuko Basson, regional manager for Communities and Corporate Affairs, Tronox South Africa.

The state-of-the-art laboratory has been equipped with 33 new computers and desks with Microsoft licensing and router for internet connection, a printer and a projector. Air-conditioning and fans have been installed to protect the equipment from heat, dust and moisture and is fully burglar-barred for safety.

The disadvantages of not having internet-connected computers at the school means that the learners have been excluded from the ever-changing digital learning platforms available. The school will now be in a position to enhance teacher and learner relationships to become more effective because they will have access to better quality education, said Basson.

Tronox is committed to making a positive impact at the schools in the areas in which they operate by providing learners and educators with equal opportunities to move away from the chalk board where teachers are the only source of knowledge, to computers, which play an important role in the transformation of education.

CRANE AGENT WINS CONDRA ORDERS

Richards Bay-based lifting equipment company North Coast Cranes & Lifting has won orders for Condra cranes to be installed in a chemical element refinery furnace and on a mining dredge. An order for two further machines is expected.

North Coast Cranes is Condra’s Northern KwaZulu-Natal agent, with a mandate to install and commission machines as they arrive from the Johannesburg factory, and provide scheduled maintenance and on-call service support.

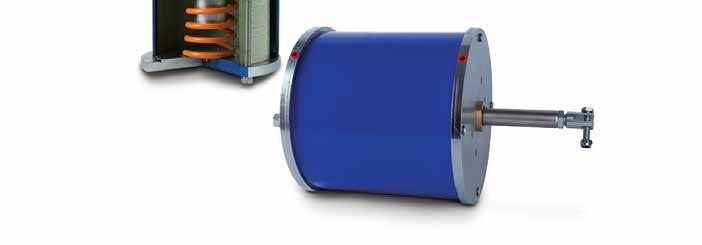

The first of the two orders is for a 10-tonne, 6.5m-span Condra furnace crane. This will be a double-girder electric overhead underslung machine supporting an underslung crab and foot-mounted hoist moving between two girders arranged as an extendable boom to allow the retrieval of casting pots from an adjacent bay, the company said.

The second order is for a maintenance and repair machine to be installed on a mining dredge. It will be a 10-tonne, 13.5m-span Condra portal crane of straightforward design with cantilevers to allow equipment to be lifted and lowered from adjacent vessels. The new orders will add to Condra’s substantial installed base of cranes in and around Richards Bay.

Condra crane with extendable boom.

VOESTALPINE BÖHLER WELDING AND AFROX FORM JV

Welding specialist voestalpine Böhler Welding and Afrox have strengthened their presence in the South African and Sub-Saharan African region through a joint venture to manufacture welding consumables.

Afrox has contributed its current welding consumables factory located in Brits, in the North West province, into a new company and sold 51% thereof to voestalpine Böhler Welding.

The new joint venture company will be named voestalpine Böhler Welding Africa and managed by voestalpine Böhler Welding. It will manufacture Afrox and voestalpine Böhler Welding products for South African, sub-Saharan African as well as other export.

BELL TAKES ITS TECHNOLOGY UNDERGROUND

The latest generation Bell B30L and

B35L low-profile articulated dump trucks (ADTs) deliver the lowest costper-tonne solution, more practical styling and an “autonomous ready” platform that is easily configurable for remote operation either by a handheld remote control or a more sophisticated autonomous control centre, the equipment manufacturer said.

Bell Equipment product designer Shaun Tucker explained that making the truck future-proof was a key design input as “the machines generally have a long life underground and in five years’ time there may be more of a need for autonomous control than there is today”.

“Underground haul roads don’t change and could easily allow worksites to be automated in the future, so we chose components that would open that gap for us. Additionally, the remote capability allows the machine to be operated via remote control in dangerous conditions where it might not be safe for an operator.”

The Bell B30L was recently demonstrated at two open days at the Bell Factory in Richards Bay. The truck will now be tested at a local underground mine where it will join the mine’s existing fleet in a production cycle.

OWN THE ROAD WITH A PLAN TAILOR-MADE FOR YOU.

INTRODUCING A NEW, FLEXIBLE SERVICE AND MAINTENANCE PLAN FROM HINO.

We know everyone’s needs are diff erent, that’s why Hino is proud to introduce a service and maintenance plan that is individually tailored to you, your business and your fl eet. And if your needs change down the road, you have the peace of mind that your plan can change too.

Contact your nearest Hino dealer today to fi nd out how to make your trucking go even further or visit Hino.co.za

If its not INVAL, it’s not Invincible