MAY / JUNE 2023 R39.90 (incl VAT) International R44.50 (excl tax) INTELLIGENT MINING A 4IR future The future is platinum Ongoing development in the DRC Freight rail lifeline Peter Phahlane, Product Management Director at Komatsu R100-billion: Private sector investment needed R8-trillion: Added to the economy by 2050 KOMATSU Boosts productivity and efficiency MIN NG READ WHAT REALLY GOES DOWN IN SADC SA www.samining.co.za

info@tegaindustries.co.za | www.tegaindustries.co.za an ideal liner for high aspect SAG mills from 34 to 40ft in diameter maximizes mill availability Resilient design cushions high energy impacts and liner cracks avoids

IN BRIEF

6 BME increases global footprint with Indonesian JV.

FEATURES

20 The future is platinum

SA has the largest global share of platinum group metals. In a renewable future, this sector can significantly add to jobs and GDP in coming years.

24 DRC’s Kamoa Copper Complex continues its growth

The ongoing development taking place at the Kamoa Copper Mining Complex in the DRC has led to plans to significantly increase production capacity.

26 Private sector must go all out on freight rail improvements

The announcement of the National Rail Policy opens the door for private sector investment in SA’s ailing freight rail industry.

29 Intelligent mining and a 4IR future

The Fourth Industrial Revolution o ers the benefits of productivity, safety, security and profitability to mines that digitally transform. NEWS IN NUMBERS

R8-trillion: Added to the economy by 2050

R100-billion: Private sector investment needed

4 Out of Africa www.linkedin.com/company/samining/

or www.businessmediamags.co.za

CONTENTS MAY / JUNE 2023 24 29 20 The future is platinum. Intelligent mining and a 4IR future. DRC’s Kamoa Copper Complex continues its growth. By implementing the latest technology solutions in its capital equipment, Komatsu improves coal mines’ productivity and e iciencies, while reducing their costs. MAY JUNE 2023 R39.90 (incl VAT) International R44.50 (excl tax) INTELLIGENT MINING A 4IR future The future is platinum Ongoing development in the DRC Freight rail lifeline Peter Phahlane, Product Management Director at Komatsu R100-billion: Private sector investment needed R8-trillion: Added to the economy by 2050 KOMATSU Boosts productivity and efficiency MIN NG SA www.samining.co.za COVER STORY: PAGE 10

26

20

REGULARS

businessmediamags.co.za/mining/sa-mining/subscribe/

www.facebook.com/businessmediaMAGS/company/samining/ twitter.com/BMMagazines www.instagram.com/business_media_mags/ To visit our website. SCAN HERE SUPPLIERS GUIDE 2023 PAGE 38

www.samining.co.za

THE POSITIVE IMPACT OF TECHNOLOGY, SUSTAINABILITY AND GOOD POLICY

Rodney Weidemann

The Fourth Industrial Revolution has led to significant change occurring throughout entire industries, and mining is no exception. In fact, mining is an industry that is rapidly digitally transforming, which – thanks to the implementation of “intelligent mining” – opens up a host of new ways that mines can increase profits while reducing the overall impact on the environment.

One of the key benefits of an intelligent mine is the manner in which technology can help to improve security – both of the physical and of the cyber kind. In this issue, we look at not only how it can help to protect your network from attack, but also how mines can use technology alongside standard physical security solutions to improve e orts to physically secure a particular site.

On the materials handling side, South Africa has long struggled with rail access, due to ongoing challenges at Transnet, particularly in regard to rolling stock issues and rail infrastructure the . Currently – due to significant underspend on track maintenance in past years – the country now faces a bill of around R100-billion in spend, in order to restore track integrity.

Therefore, the announcement of a National Rail Policy opens the door for private sector investment in SA’s ailing freight rail industry. The African Rail Industry Association (ARIA) suggests that SA is approaching a critical inflection point regarding its railways, and that it is pleased Transnet has taken the bold step to commit to private sector funding and third party rail access.

At the recent Platinum Group Metals (PGMs) Day, the Minerals Council South Africa outlined the bright future for the country’s PGMs sector, noting that SA is the key source of PGMs worldwide, holding some 87% of global resources.

With the world focused on renewable technologies and fuel cell electric vehicles, the MCSA indicates that by properly developing this sector, the PGMs industry could add up to R8-trillion to South Africa’s economy by 2050, and create around one million direct and indirect jobs.

Venturing further into Africa, we take a look at the ongoing development of the Kamoa Copper Mining Complex in the Democratic Republic of the Congo, and its plans to increase production capacity, and touch on how other operators in the region ensure both sustainability and local talent creation.

We also take a closer look at the where and how of the implementation by Murray & Roberts of a sha -sinking methodology that is new to the country, but is considered to be significantly safer. The company has been involved in sha sinking at key projects, including the Venetia Underground Project, and the Palabora Copper Mine, both situated in Limpopo.

Finally, in our cover story, we take a look at how, in an industry struggling with multiple challenges, Komatsu is improving coal mines’ productivity and e iciencies and reducing their costs, through the implementation of the latest technology solutions in its capital equipment.

EDITOR

Rodney Weidemann

Tel: 062 447 7803

Email: rodneyw@samining.co.za

ONLINE EDITOR

Stacey Visser

Email: vissers@businessmediamags.co.za

ART DIRECTOR

Shailendra Bhagwandin

Tel: 011 280 5946

Email: bhagwandinsh@arena.africa

ADVERTISING CONSULTANTS

Ilonka Moolman

Tel: 011 280 3120

Email: moolmani@samining.co.za

Tshepo Monyamane

Tel: 011 280 3110

Email: tshepom@samining.co.za

PRODUCTION CO-ORDINATOR

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

SUB-EDITOR

Andrea Bryce

BUSINESS MANAGER

Claire Morgan

Tel: 011 280 5783

Email: morganc@sahomeowner.co.za

GENERAL MANAGER MAGAZINES

Jocelyne Bayer

SWITCHBOARD

Tel: 011 280 3000

SUBSCRIPTIONS

Neesha Klaaste

Tel: 011 280 5063

Email: neeshak@sahomeowner.co.za

PRINTING

CTP Printers, Cape Town

PUBLISHER

Arena Holdings (Pty) Ltd, PO Box 1746, Saxonwold, 2132

Copyright Arena Holdings (Pty) Ltd. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic or mechanical, without prior written permission. Arena Holdings (Pty) Ltd is not responsible for the views of its contributors.

www.samining.co.za 2 SA MINING MAY / JUNE 2023 FROM THE EDITOR

© ISTOCK –Denis Shevchuk MIN NG READ WHAT REALLY GOES DOWN IN SADC SA www.samining.co.za

Off-Highway

diesel

can

www.boschoffhighway.co.za/ Bosch

Spare parts for heavy-duty

you

trust.

MOPANI COPPER MINES

DEMONSTRATES ETHICS IN ITS PROCUREMENT AND SUPPLY CHAINS

Mopani Copper Mines PLC is setting the standard for Africa’s mining sector a er achieving the prestigious Chartered Institute of Procurement & Supply (CIPS) Corporate Ethics

Kite Mark for its commitment to investing in ethical practices in its procurement and supply chain professionals and activities.

The company is playing a crucial role in Zambia’s e orts to increase copper mining output to three million tonnes a year by 2032, a target high on President Hakainde Hichilema’s agenda since coming to power in August 2021.

Mopani Copper Mines is going to great lengths to become a world-class operation, and to this end, has aligned its 71 supply chain employees with CIPS, a United Kingdom-based global professional body representing the procurement and supply chain profession, to ensure they are benchmarked against the highest international standards. Mopani has also become a CIPS member. The CIPS Corporate Ethics Kite Mark recognises these outstanding e orts.

The accolade publicly reinforces an organisation’s assurance to ethical sourcing and supplier management, and signals to suppliers, customers, potential employees and other stakeholders that they are dealing with an entity that is committed to ensuring its sta are trained in ethical sourcing and supplier management. It also shows they have adopted ethical values in the way in which they source and manage suppliers.

Craig O’Flaherty, head of CIPS for Business, CIPS Africa, says: “The CIPS Corporate Ethics Kite Mark reinforces Mopani Copper Mines’ commitment to ethical sourcing and supply chain management and is a shining example to other organisations in Zambia to do the same.”

WEC PROJECTS SECURES NEW ORDERS FROM LUCARA DIAMOND

Following its successful expansion of the sewage treatment plant at the Lucara Diamond’s Karowe Mine in Botswana, WEC Projects has secured further orders from the client.

The company will design and construct a sedimentation trap, tanker filling station and associated infrastructure – including stormwater drains and fencing. Karowe Mine is located in the arid eastern Kalahari Basin, where temperatures average 35°C.

As a result, water is scarce, so much so that the government has imposed severe water restrictions on companies operating in the region. WEC Projects originally designed and built artificial wetlands that the mine uses to treat its e luent, removing contaminants such as ammonia, suspended solids and heavy metals, to a standard for reuse as process water.

The new sedimentation trap will be used in the water recycling process of the mine’s drilling operations. The e luent is pumped from the underground drilling areas to a concrete trap and clarification unit, where it is dosed with alum and a polymer to enhance the settling of the solids.

The e luent overflows from the trap to the plant’s oil skimmer to remove floating oil. The system treats an average of 34m3 of e luent a day, but can be expanded up to 150m3 a day if required.

The polished water is drawn from the tanker station and disinfected by dosing with chlorine. Although the water is not suitable for human consumption, it is reused in applications such as dust suppression.

www.samining.co.za 4 SA MINING MAY / JUNE 2023 OUT OF AFRICA

© ISTOCK –Ari Widodo

Engineering solutions for the Global Mining Industry

Mining Geotechnical Ventilation Mechanical Electrical Metallurgical

SOUTH AFRICA OFFICE: +27 11 476-7091

Etienne de Villiers: +27 83 327 6517 / etiennedv@baraconsulting.co.za

Jim Pooley: +27 82 373 0796 / jim@baraconsulting.co.za

Clive Brown: +27 82 557 5373 / clive@baraconsulting.co.za

www.baraconsulting.co.za

UNITED KINGDOM OFFICE

Andrew Bamber: +44 744 486 4046 / bamber@baraconsulting.co.uk

www.baraconsulting.co.uk

BME INCREASES GLOBAL FOOTPRINT

WITH INDONESIAN JV

Local blasting and explosives solutions specialist BME continues to expand its operations globally, thanks to the recent signing of a joint venture (JV) with a leading Indonesian player

According to group CEO Seelan Gobalsamy, the JV will combine BME’s innovative technology, products, and solutions with the local networks, experience, and resources of PT. Multi Nitrotama Kimia (MNK).

“The JV creates an integrated o ering with an expanded suite of products and services for both surface and underground mines. For us, it is all about partnering with an organisation that understands the Indonesian market, that can bring local knowledge to bear, and which has the relevant mining licences we can leverage, in order to help them improve their operations,” he says.

“In addition, it allows both organisations to move all their customers under a single roof, ensuring that the customer experience is significantly improved. At the same time, there are many new customers in this market that can be unlocked, and we believe that o ering access to BME’s state-of-the-art technologies – like electronic blast systems, digital blasting tools and unique emulsion formulations – will play a huge role in helping us to achieve this.”

Gobalsamy suggests that building BME’s business out in this region is key going forward, noting that Indonesia is an

important part of this strategy. He says the companies’ value systems are well aligned, and that BME not only hopes to grow its presence in this market, but may also consider exploring other territories with the JV.

oil in our emulsions makes them more environmentally friendly by reducing carbon emissions.”

The JV will also a ord MNK entry into the explosives market and access to the global best practice explosives technologies we deploy. As far as skills go, explosives is a highly regulated industry, so BME is careful and systematic regarding the intense knowledge transfer it is undertaking with MNK.

“We have engineers across the world who develop, research and innovate all the time, and this is the knowledge and skills we are bringing to the local Indonesian market. We employ a combination of global engineers who provide knowledge at a high level and a full team on the ground to transfer skills to the local engineers.

“We are aware that mines here want to undertake larger blasts, more accurately, and with better fragmentation, something that our technologies enable. There is also an immense focus on reducing carbon emissions and working more sustainably. Here, the fact that we leverage used

“At BME, we set out on a path several years ago with the goal of expanding the business globally, and this JV demonstrates a significant step forward on this path towards international expansion. Together with our existing expansion in Canada, this JV puts us on the front foot as far as our global strategy goes, and allows us to take our unique explosives solutions to the rest of the world,” he says.

www.samining.co.za 6 SA MINING MAY / JUNE 2023

IN BRIEF

©

ISTOCK –CHAO-FENG LIN

We have engineers across the world who develop, research and innovate all the time, and this is the knowledge and skills we are bringing to the local Indonesian market.

– Gobalsamy

“ “

Over 50 years of expert experience, spectacular services, premium products and a sound reputation, Bearing Corporation has secured their position as one of the leading bearing companies in Southern Africa.

Bearing Corporation is an approved and authorized distributor of all premium Schaeffler products and carry a wide range of bearings that are available for distribution nationwide.

Their services are not only limited to wholesale. Bearing Corporation is available to assist you or your company with all types of bearing repairs and replacements with their 24 hour bearing breakdown service.

Bearing Corporation carries a wide selection of Schaeffler products; asymmetric spherical bearings, cylindrical roller bearings, taper roller bearings, plummer blocks, deep groove ball bearings and more.

WE CARRY A WIDE RANGE OF:

our website at

011 451 8500 www.bearingcorporation.co.za | info@bearingcorporation.co.za |

Visit

www.bearingcorporation.co.za

FAG Spherical Roller Bearing 240/600 Tapered Roller Bearing

BEARING CORPORATION

THE WORLD

FAG Asymmetric Spherical Roller Bearing Plummer Blocks

TURNING

Full Complement Cylindrical Roller Bearing

Deep Groove Ball Bearing

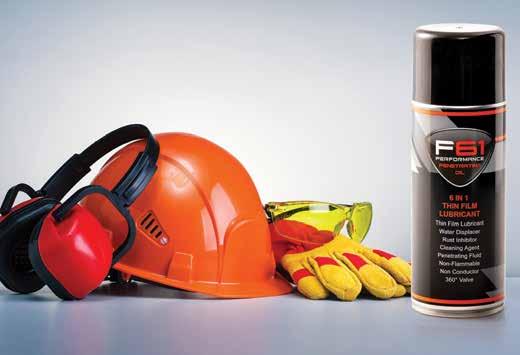

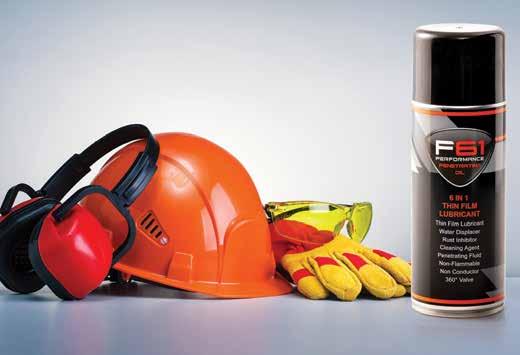

SAMI – DRIVING THE PERFORMANCE CULTURE TM WITHIN AFRICAN INDUSTRY

Propelling companies towards the heights of success through performance transformation – SAMI gets you in gear for real, measurable bottom-line results

Operators in Africa know that clearing a path to productivity –and staying on it – comes with a unique set of challenges. However, it is crucial to understand that true industry leaders do more than keep a steady wheel on a bumpy ride – they gain momentum and proceed full throttle on a highway to maximum returns. Imagine the vehicle for ultimate performance in your organisation: it runs on efficiency, effectiveness, integrity, and predictability. Turn the ignition on and see what happens when an enterprise is led with a clear purpose: the people are enabled, the operation is safe and predictable, and the business outcomes perpetually meet targets. This is the definition of the Performance CultureTM that Strategic Asset Management Inc. (SAMI) implements in your

enterprise. SAMI has entered African industry in a revolutionary drive to guide industrial operators through organisational culture transformation that prioritises profitability, sustainability, and continuous improvement. Our Performance CultureTM process is a unique, behaviour-based asset management approach that has created economic value in industries across the globe. With SAMI now established in Africa, the company is positioned to put the keys to achieving and sustaining the highest levels economic performance in your hands, so that you can reap the benefits in your business. In the spirit of its community-focused outlook on innovation, SAMI president and CEO Mark Broussard will be speaking at the upcoming 2023 SAAMA conference, as International Speaker.

We transform business –For good!

MANAGEMENT CONSULTING CORPORATE PROFILE samicorp.com

Strategic Asset Management Inc. © ISTOCK –bashta

6186

© ISTOCK –Thossaphol Contact: Anton Bouwer Africa Region Manager 082 559

Your uptime partner

Keeping your machines at peak performance is critical to your peak profitability. To help you meet your targets, our room and pillar mining equipment is designed for reliability – including remote machine health monitoring. Komatsu life cycle management, component exchange, parts, and in-market service programs give you peace-of-mind.

See how our machines and services can help you be successful at https://mining.komatsu/en-za/room-and-pillar

12 Commercial Road, Wadeville, Germiston | Tel. +27 11 872 4000 Scan to learn more © 2022 Komatsu Ltd. or one of its subsidiaries. All rights reserved.

LEVERAGING TECHNOLOGY

TO IMPROVE CAPITAL EQUIPMENT PROFITABILITY

In an industry struggling with multiple challenges, Komatsu improves coal mines’ productivity and effi ciencies by implementing the latest technology solutions in its equipment

Technology has always been key to mines’ ability to achieve greater loads and, ultimately, returns. This is as true of capital equipment technologies as it is for any other aspect of the mining game.

Not only does technology help to make a dangerous industry safer, suggests Peter Phahlane, product management director at Komatsu, but applied correctly, it improves both productivity and profitability.

“At Komatsu, we have always believed in the benefits of having connected equipment. For example, our JoyConnect o ering has enabled us to improve our ongoing digitalisation drive to cover all our underground equipment,” he says.

“The JoyConnect solution is well supported by processes and systems that help to ensure that information is converted e ectively into actions that assist customers with key issues, such as high equipment availability and production. We have also developed automation features such as continuous miner automation (CMA) and

cutter distance control.”

Phahlane says CMA ensures that the cutting cycle is optimised, as it eliminates human factor deficiency, while also ensuring consistency in the cutting cycle. This results in consistent production and better roof and floor control in coal mining sections.

“We also plan to launch a new product range for continuous miners, along with a new product range, known as Bunker Bolter. These new products will hit the ground this year and we expect these new additions to our range to assist our customers to attain higher levels of productivity in what can only be described as challenging mining conditions.”

BUSINESS IMPROVEMENTS

Asked how the specific new equipment technologies Komatsu supplies help customers improve their business, he points out that the company works closely with its customers, and the broader coal mining industry, to commercialise technologies like its air mover.

“The air mover solution plays a key role in e orts to reduce the dust exposure experienced by underground employees. We have also developed a screenless scrubber, designed to minimise the maintenance of the scrubber system, once again helping to drive down the underground dust count.

“We understand that investing in capital equipment is a costly exercise, which is why we continuously work on improving the cost of our products. To this end, we have various technology o erings on di erent equipment, to help ensure that we are able to assist customers with these costs.”

He says Komatsu has also worked on reducing the cost of its rebuilt equipment, in order to ensure that the company is able to o er customers a deal that is aligned to their business strategy, and meets their desire to lower both capital and operating costs.

“One of the key benefits customers gain from using Komatsu equipment is that we have a strong presence in South Africa. Komatsu manufactures most of its products locally, with the local content of its shuttle car and continuous

www.samining.co.za 10 SA MINING MAY / JUNE 2023 MINING EQUIPMENT COVER STORY

miners (CMs) sitting at over 70%,” he says.

“Another aspect of our service that appeals is the fact that our team of engineers will work directly with a customer, in order to develop a solution that addresses their organisation’s unique challenges.”

He says it’s a similar scenario with Komatsu’s well-developed and trained service team, which works directly with customers on a daily basis, to ensure they are able to obtain the greatest value from both the company’s products and its services.

“In fact, the direct model we use in our underground mining business ensures that we are as close as possible to our customer, and thus able to o er a premium level of service – this is definitely one of our strongest points,” says Phahlane.

THE PEOPLE ELEMENT

Understanding how best to use the equipment, and to get the best out of it, is also key for the customer, he suggests, which is why Komatsu places great emphasis on training and education.

“We have therefore invested significantly in training programmes, with a view to making sure that they are impactful and assist in upli ing the skills of operators and artisans. We have even developed a mixed reality application for mobile devices, designed to be used by artisans underground, to assist with fault finding and proper maintenance e orts.”

In addition, he indicates that Komatsu has designed a mobile vehicle – installed with hi-tech equipment – that can actually take training directly to the mine’s site.

“This vehicle has a satellite that is linked to our smart service centre, along with hi-tech simulators that are used for the purposes of training. The ability to provide onsite training at the mine further improves productivity, and we have witnessed the impact this training programme has had in respect of improving machine availability and increasing production.”

Asked what the future holds for Komatsu and its customers in this sector, Phahlane says the company will continue to support

R&D IS THE ANSWER

Komatsu is recognised globally for its research and development (R&D) e orts, aimed at delivering the best products and solutions to Africa and the rest of the world, with the company investing close to $1-billion a year into global R&D.

With its long history in the industry, Komatsu has established a solid reputation for developing machines and equipment that combine innovation and technology with industry-leading levels of reliability, durability and productivity. The company’s technological advancements focus on a range of aspects – from site, machine and operator safety, reduced environmental impacts and skilled operator shortages, to solutions that help overcome project time and cost constraints, and the demands for increasingly sophisticated project management.

the coal industry with new technologies and solutions, designed to improve mining capabilities – until the last coal is mined.

“We have plans in the near future to introduce new o erings that will assist the industry with other challenges it faces, and will also soon be introducing a new range of CMs. Moving forward, we will continue to not only launch new technologies and solutions, but will remain focused on assisting our customers to drive costs down, and to ensure that the clients’ total cost of ownership for our equipment delivers genuine business value.”

www.samining.co.za SA MINING MAY / JUNE 2023 11

Komatsu has always believed in the benefits of having connected equipment, as this boosts productivity and e iciency.

“

– Phahlane

“

Joy shuttle car.

Joy continuous miner.

THREE TRENDS IN MINING DRIVEN BY ROLLING BLACKOUTS

South Africa is a vibrant and diverse country rich in natural resources, holding the world’s largest reported reserves of gold, platinum group metals, chrome and manganese ore – and the second largest reserves of zirconium, vanadium and titanium.

It’s no surprise then that these resources have long played a key role in contributing to South Africa’s growth and development, with mining something deeply ingrained in the country’s history.

Today, the local mining industry is the world’s fi h largest mining sector in terms of gross domestic product (GDP), contributing around R494-billion, or 7.5%, to the country’s GDP.

However, the country’s current load-shedding crisis, which has been part of South Africa’s grid since 2007, has placed significant pressure on the local mining industry, threatening its ability to continue to contribute to the fiscus, the labour market, and the broader economy.

Yushanta Rungasammy

CMS South Africa

We know that energy is a key driver of industry, but this is particularly true for industries like mining which is both energy- and labour-intensive. As South Africa’s power supply capabilities continue to worsen and become even more unpredictable, and if the industry is unable to adapt to this worsening energy climate, the damage to the country’s mining sector will compound until it can no longer sustain itself.

South Africa has continuously experienced a greater intensity and rate of load shedding with every year that passes. In 2021, the country experienced 48 days’ worth of power rationing, and this rose exponentially to more than 200 days in 2022. This resulted in the yearon-year decrease of mining output by some 9%, according to Statistics South Africa’s latest mining production and sales report in November 2022, which marked the 10th consecutive month of decline in mining production.

The country has already recorded 81 days’ worth of scheduled power outages this year, and we’re only in the first quarter. Meanwhile, the South African Reserve Bank has predicted that there will be around 250 days of rolling blackouts in 2023 – and with an estimated $51-million lost every day due to load shedding, this translates to a historic economic loss of $12.7-billion.

While this might paint a relatively bleak picture for the country’s mining industry going forward, the sector is determined to become resilient and sustainable, and mining companies are adjusting to the challenge of load shedding by adopting the following three trends.

REDUCING ENERGY DEMAND

Mining companies in SA have acknowledged that becoming more energy e icient will be key to the mining industry overcoming the

energy challenges in the country. Not only will energy e iciency reduce power costs and ensure less expenditure in mining operations, but energy management strategies are helping mining companies to improve their return on investment and optimise energy-consuming components of mining operations.

SHIFTING TO RENEWABLE ENERGY

Insu icient and unreliable energy supply has spurred the industry’s move towards building its own self-generation capacity. This is helping mining companies to ensure seamless power uptime that helps to maintain and grow productivity output and increase energy reliability at plants.

According to the Minerals Council South Africa, the mining industry currently has a pipeline of 73 self-generation projects from 24 mining companies, that should generate 5.1 gigawatts (GW) of electricity, valued at more than R65-billion. Most of these projects involve the generation of power through renewable sources like solar power. This includes the firstof-its-kind private power purchasing agreement that will see two solar PV projects constructed to supply electricity – through wheeling arrangements with Eskom – to five mining facilities across the Western Cape and KwaZulu-Natal.

USING TECHNOLOGY TO REMOVE UNPREDICTABILITY

The industry has recognised the need to evolve the way in which it operates, not only in direct response to the current load-shedding crisis, but in order to withstand widespread disruption in the form of the Fourth Industrial Revolution, as well as environmental challenges (such as the COVID-19 pandemic) and various geopolitical risks.

The best way to do so is through digital transformation that enables new ways of generating revenue. Through the use of emerging and advanced technologies, South Africa’s mining sector is opening up new possibilities and creating new solutions that ensure the industry’s continued resilience, adaptability, and the responsible mining of resources – while contributing value to local talent and growing the economy in a more sustainability-driven world.

Technologies like cloud computing, artificial intelligence and more are helping mines to harness their data to drive actionable insights that improve performance and create better maintenance and repair strategies to reduce downtime and increase e iciencies. All of these technologies can be leveraged to help eliminate unpredictable performance issues of the kind that could lead to significant financial losses and wastage.

www.samining.co.za 12 SA MINING MAY / JUNE 2023 The

© ISTOCK –VanderWolf-Images

views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

With no light at the end of the load-shedding tunnel, mines in SA are adopting three key trends to help them to remain resilient and sustainable

COLUMN ENERGY

MAKING MINING REGULATIONS WORK

Despite worsening constraints on critical infrastructure, the mining industry remains one of South Africa’s key job creation and economic sectors, contributing around R494-billion to the country’s GDP, and employing around 475 560 people, in 2022. As far as the government’s approach to international investment is concerned, South Africa is “open for business”, with global investment in the mining sector welcomed and encouraged.

From a legal perspective, the SA mining sector has a world-class legal regime. However mines, particularly emerging and junior miners, still face several challenges within the system, which in turn impacts on international investment across the mining sector. In terms of our mining regulatory system, much can be done to improve certain of the legal and administrative challenges junior miners and international investors face when considering investing in the South African mining sector.

HOW CAN WE IMPROVE OUR MINING REGULATIONS?

Mining in SA is presently heavily regulated. Broadly speaking, to be granted a mining right for a certain mineral, a mining company must apply to the Department of Mineral Resources and Energy (DMRE) in terms of the Mineral and Petroleum Resources Development Act, No. 28 of 2002 (MPRDA), for the mining right, which is a costly, time-consuming and heavily administrative exercise.

The application process is based on a “first come, first served” basis and the minister of Mineral Resources and Energy is obliged to grant the mining right as soon as certain specified requirements are met. Once the mining right has been granted, and before a mine can commence operations, the mining company must further apply for various compulsory licences. These include but are not limited to a

water-use licence, a waste management licence, as well as an environmental authorisation. Without these, the mine risks receiving substantial fines or being issued with directives, and the potential of being ordered to stop operations.

The overall application process is timeconsuming and financially burdensome. Once the mining right applicant has submitted their application online, it is printed out and separated into various divisions of the DMRE, which are all responsible for making recommendations as to the final decision-maker. There is currently no way of formally tracking where in the process the application is, something which an automated application system could quite easily rectify.

In respect of time frames, it could take up to 300 working days to process and decide on a wateruse licence, for example, although the regulations are being revised and updated accordingly. A potential solution to this could be the adherence by the applicable departments to strict regulatory time frames and the potential incorporation of a “deemed authorisation” period, where a er a certain number of days have passed, an application is automatically deemed to be approved. This will aid greatly in reducing the slow pace of processing applications.

One of the major issues, however, is that there is a lack of separation between the laws regulating the well-established major mines, and emerging or junior mines. Current mining legislation appears to have a one-size-fits-all approach and places a heavy burden on junior and exploration miners, who are vital to the overall health and endurance of the SA mining industry.

For example, like the majors, junior and exploration miners are required to engage in meaningful consultations with relevant stakeholders and to follow the same process and time periods as the majors, to obtain rights and authorisations. However, they do not have access to the same financial resources as the majors.

COLUMN FINANCE & LEGAL

© ISTOCK –Nneirda

The views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

Mining is a heavily regulated industry, but not all regulations are suitable for all types of miners. The regulatory environment would clearly be advanced by having more nuance around how junior miners are dealt with by the laws

www.samining.co.za 14 SA MINING MAY / JUNE 2023

Vanessa Stander Candidate Attorney at NSDV

One of the major issues is that there is a lack of separation between the laws regulating the well-established major mines, and emerging or junior mines.

“ “

Lastly, the implementation of a mineral cadastral system that specifies available mining and prospecting rights, land occupied under a mineral right, and ownership and expiry of current mineral right – which we believe is in the process of being implemented in the near future – will go a long way to clarifying which minerals in which areas mines can apply for.

What laws are needed and which should be removed?

As previously mentioned, the SA mining industry has a worldclass legal regime. The dilemma is not necessarily that we need more laws, but rather that there should be a relaxation of certain laws and regulations to accommodate junior miners. Regulations aimed at providing a grace period for emerging junior miners to generate income and establish their operations before being expected to provide the same social performance as the major mines will be readily welcomed.

One of the compulsory requirements when applying for a mining right is the submission of a social and labour plan (SLP). Informing the contents of the SLP is the requirement that the mining right applicant must meaningfully consult with all relevant stakeholders, including the mining community, and interested and a ected persons. The requirement applies to the majors, junior and emerging miners who are applying for a new mineral right.

The definition of “meaningful consultation”, however, remains vague and provides little clarity as to what precisely the consultation process constitutes. Well-established mines may have a clearer idea of what the DMRE considers to be meaningful consultation. But for junior and emerging miners, the concept – without proper guidance – may leave them wondering to what extent they need to consult with the community and other relevant stakeholders to constitute “meaningful consultation”. A reworking of the definition to provide clarity for all mining right applicants will be welcomed.

Another prerequisite for mining right applicants is that they must obtain an environmental authorisation (EA) to be granted a mining right. The applicant must apply for the EA to the DMRE in terms of the Environmental Impact Assessment Regulations published under Government Notice R982 in Government Gazette 38282 on 8 December 2014 (as amended) in terms of the National Environmental

Management Act, No. 107 of 1998 (NEMA). The process is conducted in terms of the One Environmental System (OES), which came into operation on 8 December 2014.

However, there appears to be an inter-governmental conflict of interest in respect of the OES, when one considers that the primary purpose for the obligation to obtain an EA is environmental protection. The DMRE is required to promote economic development through mineral exploitation, while taking into consideration the e ects on the environment. Mining activities by their nature have an adverse e ect on the environment.

Given the ever-growing emphasis on environmental protection and sustainability governance, one wonders whether the DMRE is the correct decision-maker in terms of the issuing of environmental authorisations, or if this function would be better placed in the hands of the Department of Forestry, Fisheries and the Environment.

What else can help drive increased investment in SA mining?

Applying for a mining right is a heavily administrative exercise and relies on government o icials to assess, process, and ultimately grant the application. Unfortunately, state-owned enterprises and government departments have gained a reputation for being notoriously di icult to get hold of, and ultimately, deal with.

More e iciency in the mining system in terms of the processing of applications is needed to ensure the timely and e icient processing and granting of applications and authorisations. If the government wishes to increase investment opportunities in the mining sector for junior and exploration miners, it would do well to review the regulations and relax them slightly. Perhaps by o ering a grace period for junior miners to establish themselves first before being required to operate on the same scale as the majors.

Tax incentives for junior miners are another possible avenue to be considered to help drive investment in the mining sector. Lastly, the creation and implementation of an e ective and transparent mineral cadastral system will go a far way in not only cataloguing SA’s available minerals, but will aid greatly in providing regulatory certainty and building confidence in the DMRE and the mining sector in general, something which is all too important to the potential investor.

© ISTOCK –Alfio Manciagli © ISTOCK –poco_bw

www.samining.co.za SA MINING MAY / JUNE 2023 15

“ “

The SA mining sector has a world-class legal regime. However mines, particularly emerging and junior miners, still face several challenges within the system.

PROTECT YOUR PEOPLE, PROTECT YOUR PROFIT

Due to a buoyancy in commodity prices – an unfortunate and direct result of the Russia-Ukraine war – Finance Minister Enoch Godongwana had the necessary wiggle room to pass on some desperately needed relief to taxpayers. But as he himself warned, the country couldn’t rely on this revenue for the long term, given that commodity prices are determined by many macro-economic variables.

And already we’ve seen a shi over the past few months. While gold continues to shine, the price of iron ore has dropped, thanks to sluggish Chinese demand. Rhodium has plummeted by around 35% since the beginning of the year –triggering Northam Platinum to withdraw its o er to take control of Royal Bafokeng Platinum – and major mines have reported a slump in their profits.

Earlier this year, Anglo American admitted that its 2022 profits had dropped by almost 50% on the previous year, thanks to a soar in energy, while Rio Tinto announced a 41% decline in 2022 net earnings, which it attributed to downward pressure on commodity prices.

What do these movements tell us? That mining remains cyclical, and at the mercy of macro-economics. As the World Bank states: “Global macro-economic shocks have become the main source of fluctuations in commodity prices, accounting for more than two thirds of the variance of global commodity price growth.

“The swings in commodity prices witnessed in 2020-21 have brought to the fore the vulnerabilities of the many emerging market and developing economies (EMDE), especially low-income countries (LICs), highly dependent on commodity exports.”

In other words, countries such as South Africa. It goes on to say that global demand shocks account for 50% of the variance of global commodity price growth, while global supply shocks account for 20%.

In the past few years, the boom in commodity prices meant that mining organisations benefitted. But as these recent market movements demonstrate, there is a very real danger in allowing our profits to be determined by a cycle which is just that – cyclical.

There’s not a thing that we, as an industry, can do about the price of gold, or platinum, or iron ore – or anything else. So where do we need to focus to keep our bottom line looking healthy?

THE PEOPLE PERSPECTIVE

The key lies in building supervisor capability within the mining sector and focusing on helping mines to control their cost curve. There’s an example that forms part of the OIM modules, which goes something like this:

“There are two mines that are largely the same. Same depth, mining the same reef, with the same labour force. Because these mines are the same, it will cost the same to take out one tonne of rock (i.e. the same amount of labour, machinery cost etc.). The only di erence is the grade or grams of gold per tonne. Mine A mine yields 40g of gold per tonne of rock, while Mine B yields 2g of gold.

“Thus, Mine A must get out 25 tonnes of rock to yield 1kg of gold, while Mine B must get out 500 tonnes to produce the same amount. Therefore, it stands to reason that Mine A’s total production cost will be much lower to produce the same amount of gold.”

The point of this story is to illustrate that we cannot control the amount of gold (or any other commodity) we yield per tonne we extract, which will a ect our costs and thus profitability. So we need to keep our eyes fixed firmly on what makes up our cost per tonne, as this is something that is within our grasp. And this is where your people can make or break your bottom line.

What typically costs mines? While there’s always some variance between mines, these would typically be salaries and wages, leave/ absenteeism, machinery and tools/equipment, injury and first aid supply costs, as well as the and accidents.

This is where the mining supervisor plays a critical role. Through coaching them on how to plan properly and execute competently, we can have more e ective blasts. We can promote a more e icient system. We can ensure our machines are well maintained and working at optimal capacity.

We can create contingency plans for absenteeism. It’s not necessarily about increasing yield: while the amount of tonnes we extract might be fixed, we can ensure that those tonnes are as profitable as possible by focusing on reducing our cost per tonne.

Mines also deteriorate a er a few years, which means that we need to be even more e ective in our operations. This is where it becomes critical to keep our costs at the same level, not allowing wastage to happen. We need to look at where we spend time, making sure that it is on activities that extract the most value.

Ultimately, by focusing on your people, you will safeguard and futureproof your bottom line when the commodity cycle again spins around.

COLUMN MANAGEMENT CONSULTING

© ISTOCK –Isachenko

The views expressed are the author’s own and do not necessarily reflect SA Mining’s editorial policy.

In a country that is, by now, quite jaded because of the sheer volume and frequency of bad news we seem to bear witness to, this year’s Budget Speech delivered a largely unexpected but well-received windfall, to the tune of around R300-billion

www.samining.co.za 16 SA MINING MAY / JUNE 2023

Arjen de Bruin MD at OIM Consulting

Unlock the full poten�al Healthcare | Re�rement | Investment Consul�ng | Financial Planning | Actuarial Services | Short-Term Risk Insurance T&Cs apply. The NMG SA Group of Companies are authorized financial service providers t/a NMG Benefits Connect with us today of your mining team with our comprehensive employee benefits package. From health coverage to re�rement planning, we've got you covered. info@nmg.co.za | 011 509 3000 | www.nmg.co.za Finding a be�er way

HELPING MINERS

PROTECT THEIR LONG-TERM FUTURE

Regardless of the industry, employee benefits typically refer to retirement funding and group insurance, as well as medical aid and healthcare-type benefits. At NMG, it’s important that these benefits are set up in an integrated way that considers overall financial wellbeing.

According to Craigh Chidrawi, Executive Head of Retirement and COO at NMG Benefits, this means that NMG Benefits takes into account the benefits from an individual’s perspective, asking questions like: have they got a budget in place, a will, and do they have su icient protection when there is an illness or injury?

“Statistics consistently show that very few retirees have enough money saved to provide them with the income they need in retirement. National Treasury has previously reported that only 6% of South Africans will have enough money to retire comfortably.

“It’s unlikely that you will be able to live o the state pension in your retirement, so you do need to rely on your own savings, and especially the savings you make through your employer’s retirement fund, to support you in retirement,” he says.

“Many individuals are forced to retire earlier than they had planned, while they also live longer – meaning they need support for longer, so inflation takes its toll on their

savings. If you want to maintain the same standard of living in retirement that you had when you were working, you need a sizeable amount of money.

“The current advances in technology and medicine means we are living longer and need to fund for an income to sustain us longer in our retirement.”

EMPLOYEE WELLNESS

NMG Benefits understands that mining is a dangerous and demanding job, so the promotion of health and wellness programmes is of utmost importance, specifically for mining companies.

This is due to additional physical risks that these employees are exposed to, as well as the loss in productivity due to employee illness. An e ective programme will promote healthy lifestyle choices, increase awareness, reduce risks, potentially increase production as well as employee morale.

“Over the years, NMG Benefits has found many companies shi ing towards a fully integrated healthcare employee wellness solution, which includes an employee assistance programme, an onsite occupational health clinic, medical scheme, gap cover and primary healthcare cover,” says Gary Feldman, Executive Head of Healthcare Consulting.

Chidrawi notes that many South Africans are feeling immense pressure on their overstretched budgets. They are faced with debt and rising expenses in a di icult job market. It may seem di icult to do, but we need to look a er our future needs and actively plan to reach a better retirement.

NMG Benefits, continues Feldman, supports the employer by ensuring these programmes work together to achieve the overall objectives of the organisation.

“The establishment of a health and wellness committee along with all relevant representation, including the unions, will ensure employee support and participation. One of the key initiatives that comes from this committee will be to increase regular

www.samining.co.za 18 SA MINING MAY / JUNE 2023 MANAGEMENT CONSULTING CORPORATE PROFILE

It is more vital than ever for mines to offer holistic employee benefi ts, including retirement plans, health and wellness programmes, mental health support and disability insurance

National Treasury has previously reported that only 6% of South Africans will have enough money to retire comfortably.

– Chidrawi

“ “ © ISTOCK –1971yes

health screenings of all employees, such as diabetes, hypertension, and HIV,” he says.

“Employer wellness days play an essential role in promoting employee health and preventing the onset of chronic diseases. NMG Benefits assists with the planning of the wellness day and ensures that a communitybased service model is used.”

“Where possible, local providers are contracted to o er services such as screening, eye examinations and dental check-ups, to mention a few.”

MENTAL HEALTH

The mining industry is a challenging and highpressure environment, she continues, noting that there are a number of critical dangers. These include impaired performance and productivity, increased absenteeism, increased risk of accidents and injuries, high sta turnover rates, negative impact on the workplace culture, and an increase in healthcare costs.

“Mining companies should promote mental health and wellness through initiatives such as fitness programmes and healthy eating options, and should also create opportunities for relaxation and social connection.

“These initiatives can help employees maintain a healthy work-life balance and reduce stress levels. It is important to create a culture of wellness and a safe and healthy workplace.”

Feldman indicates that employee assistance programmes can provide employees with access to mental health services and support – including counselling and therapy – to address issues such as stress, anxiety, financial guidance, and depression.

“Remember that looking a er employees’ mental health can help to reduce absenteeism. For a mining company, this can certainly have a positive impact on productivity, as well as on health and safety. NMG’s role is to analyse various o erings and recommend the most suitable solution.

“One of the leading causes of mental health is related to financial stress and insecurity – something that can lead to substance abuse, physical abuse, and self-harm. To this end, NMG Benefits o ers a unique solution called SmartAlec which focuses on financial literacy.”

Poor financial decisions o en lead to distress and lack of peace of mind, says Chidrawi, suggesting that such decisions o en don’t come from negligence, but rather from simply not being educated about matters of finance. NMG SmartAlec – conveniently available via WhatsApp –teaches basic finance, which will bring the user confidence and protect their mental health.

WHAT DOES NMG BENEFITS DO?

NMG Benefits has over 30 years’ experience in the healthcare industry, specialising in reviewing, supporting, and guiding the employer, as well as the organised labour, around which are the most appropriate products for their employees. It also supports the implementation process and ensure ongoing education and participation is achieved.

An entity that is independent from insurers and asset managers, NMG’s approach is collaborative, in that it works with multiple service providers. This allows it to provide unbiased advice in members’ best interests.

NMG Benefits helps plan the strategic direction of the employee benefit arrangements, to ensure the benefits o ered encourage productivity, loyalty and engaged employees, while protecting future financial security. The company also uses data analysis and industry insights wherever possible, to ensure that the decisions made are appropriate for the membership.

DISABILITY INSURANCE

“Disability insurance is important in all industries, especially in the mining sector. As individuals, it is important that our ability to earn an income is protected, if we fall ill or are injured.”

“NMG’s approach is to understand each group’s member profile and their unique needs. This might involve engaging with the trustee board and surveying members’ needs to understand how current benefits are valued, and which potential benefits the members would derive most from. Employers of choice consider input from their employees in their benefits o ering.”

Quite o en, Chidrawi points out, funds o er disability benefits that haven’t changed in many years. This is wrong, as the benefits o ering needs to be reviewed regularly, with alternative arrangements also considered.

“The final step is to go to the insurance market for quotations, to identify insurers that o er the kind of reputable cover that will be there for disabled members for many years to come,” he says.

www.samining.co.za SA MINING MAY / JUNE 2023 19

Remember that looking a er employees’ mental health can help reduce absenteeism and have a positive impact on productivity, health, and safety. – Feldman

“ “

© ISTOCK –Magnifical Productions

© ISTOCK –Juan Jose Napuri

THE FUTURE IS

PLATINUM

By Rodney Weidemann

Something that many citizens are unaware of, but which was recently confirmed once again by a report from the World Energy Council, is that the green economy is much more minerals-intensive than the average person thinks. In particular, the platinum group metals (PGMs) – chrome, nickel, manganese, zinc and copper – mean that mining itself will do well.

With South Africa particularly rich in PGMs, the country will have an outsize role to play in the green economy. At the same time, however, concerns have been raised about the impact the transition to renewables will have on SA’s large coal mining sector.

Moreover, in Mpumalanga – where there are concerns about the impact of the energy transition on coal miners and mining communities – there are three manganese mines, 18 chrome mines and six PGM mines. With such options available in this region, and the fact that coal miners have a similar skill set, it means they can quite easily match the mining needs in the PGM sector.

At the recent PGMs Day event, local mining personality Bernard Swanepoel, chairing the day, suggested that the local PGMs industry was at a historic point, where

the challenges are huge and scary, but similarly, the opportunities are huge and exciting.

“One can almost summarise the future demand dynamics by pointing to the idea normally used to describe technology adoption – of a peak of inflated expectations, followed by a trough of disillusionment, then the slope of enlightenment before reaching the middle ground, the plateau of productivity,” he says.

“For example, hydrogen remains on the hype peak, as – although we can make green hydrogen – we cannot yet do so at a reasonable cost, and enable it to substitute for anything. However, in the next decade, we will have passed through the disillusionment phase, up the slope of enlightenment, and we can expect hydrogen to play a much more significant role.”

POSITIONING PGMS FOR THE FUTURE

Reflecting on the progress of the PGMs industry and how best to position PGMs for the future, Roger Baxter, CEO of the Minerals Council South Africa (MCSA), notes that SA is the key source of PGMs worldwide, holding some 87% of the global resources.

“Of course, it’s important to remember

that minerals in the ground don’t represent any wealth, unless three criteria are met: there must be a market for them; they must be able to be mined safely and profitably; and this must be done in an environmentally sensitive manner that is ESG-compliant.

“Moreover, this is an industry that currently employs around 172 000 people directly, and it is estimated that some 500 000 people in total have jobs due to the PGMs sector.”

Baxter indicates that the MCSA has developed a dra national platinum strategy, designed to realise the world’s largest PGMs resource, by helping to develop those markets that enable growth in the PGMs sector.

“Ultimately, this could add up to R8-trillion to the SA economy by 2050, and create about one million direct and indirect jobs. So it is clearly a sector with incredible potential, but long-term success relies on the government, private sector, communities and the unions to come together to solve the short-term challenges.

“These short-term issues – in the form of load shedding, security and SA’s rail problems – require collaboration between all parties, as it is essential we solve these

www.samining.co.za 20 SA MINING MAY / JUNE 2023 PRECIOUS METALS

South Africa, with the largest global share of platinum group metals, has the potential to leverage this sector to grow both jobs and the economy in the next decade

© ISTOCK –Sunshine Seeds

challenges if we hope to realise the PGM promise of the future.”

He says when looking to this future, it should be obvious that PGMs’ green credentials are longstanding, and they will play a key role in the growing global energy transition.

Baxter says he expects there to be four main segments of demand, notably automotive (estimated to be between 31-43%); industrial (22-27%); jewellery (2432%); and investment (0-20%).

GROWING DEMAND

“Obviously, the switch from internal combustion engine (ICE) vehicles to fuel cell electric vehicles (FCEVs) will play a big part. As demand for ICE vehicles eases over the next 10 or 15 years and these are phased out, so FCEVs will become a critical driver of platinum growth demand. In fact, broadbased adoption of FCEVs in the next decade could see additional annual demand for more than three million ounces of platinum,” he says.

In addition, Baxter continues, demand for platinum in heavy-duty FCEVs is promising, as it also enables the decarbonising of large freight transport. These trucks are

expected to be one of the first segments of the hydrogen economy to achieve real economies of scale.

“Interestingly, these hydrogen-powered vehicles make up only around 1% of the global trucking market today, but by 2035, they are expected to account for at least 50%. This could result in net carbon dioxide savings of up to 11% of the Paris Agreement’s 2030 targets.

“The scarcity value of PGMs, particularly platinum, can be illustrated by noting that all the gold mined by South Africa in its history would fill approximately three-and-a-half to four Olympic-sized swimming pools. In comparison, all the platinum mined in the history of humankind would only fill a single such pool ankle-deep.”

Recognising the value of PGMs to the green economy, he points out that the MCSA has launched a Hydrogen Leadership Forum, designed to chart a strategy around how to use hydrogen to:

■ Create sustainable and cost-e ective green energy.

■ Decarbonise mining operations.

■ Address risks of global carbon border taxes for their products.

■ Create pollution-free environments for

KEY ROLES FOR PGMS IN THE GREEN ECONOMY

PGMs are green metals, so have a critical role to play in cleaning up the vehicle industry and eliminating greenhouse gases.

Green hydrogen is having an impact in terms of decarbonising heavy industries.

PGM-based proton exchange membrane (PEM) technologies are well suited to using intermittent renewable energy feeds – like solar.

Hydrogen fuel cells o er an e icient and green alternative for delivering power.

Platinum is an e ective catalyser for PEM electrolysers and fuel cells.

Iridium is key to the hydrogen economy, as it is used, alongside platinum, in PEM electrolysers, to produce hydrogen.

Ruthenium is also e ective in PEM fuel cells alongside platinum, and is scalable from small devices to heavyduty transport.

employees, by using hydrogen fuel cell vehicles and machines in mining – both underground and on the surface.

“It must be remembered, however, that PGMs are worth nothing without people. It thus falls to the people of SA to make PGMs a critical industry for the future, by forging partnerships that can help change the world.

“If we have a vision and a plan – and we do – we can take our local PGM industry to a whole new level, making it a critical contributor to the economy.

“Or, to quote President Nelson Mandela: A vision without action is merely daydreaming. Action without vision is simply passing the time. But a vision with action can change the world,” he says.

www.samining.co.za SA MINING MAY / JUNE 2023 21

© ISTOCK –Oat_Phawat © ISTOCK –allanswart

The PGM sector could add up to R8-trillion to the SA economy by 2050, and create about one million direct and indirect jobs. – Baxter

“ “

COMMODITIES GROWTH SUPPORTING AFRICA’S

African trading and investment firm

E&T Minerals recently announced its bold plans to expand into the Southern African Development Community (SADC). Amid a challenging global economy, the company is showing its resilience and ambition by exploring the development of mines, rail, and port linkages across countries such as Zimbabwe, Zambia, Botswana, Mozambique, and potentially Namibia in the future.

CEO Emmanuel Ngulube expresses the firm’s optimism: “We perceive this as the perfect moment to delve into the SADC markets. Our goal is to stimulate this region’s economies, increase mineral exports, and most importantly, strengthen the bonds among these countries.”

Ngulube outlines the company’s plan to support mining sectors in regions rich in resources, such as the Zambian Copperbelt, Botswana’s coal deposits, and Zimbabwe’s lithium reserves. “We intend to give these mines an alternative and more e icient means of transport. We aim to also streamline the entire supply chain from the mines to the global market.”

He says thanks to the company’s

experience in this industry, gained over time, it is able to both understand and overcome the traditional challenges here, playing a vital role in connecting the SADC markets to the ports and directly benefitting the people in the region.

E&T Minerals also places high priority on investing in the SADC region’s rapidly growing youth population. Eyre says, “We have an unwavering belief in the potential of this continent and its next generation of leaders. We are dedicated to supporting and upli ing the communities where we operate, focusing on areas such as social inclusion, education, life skills, infrastructure development, and employment.”

COO Daniel Eyre discusses the company’s journey from initially focusing on its domestic market in South Africa, explaining: “Our initial aim was to support and grow the local market. The lack of rolling stock previously restrained our expansion into SADC, but we’re now actively collaborating with various mines and logistical partners in these regions.”

To put these words into action, E&T Minerals is launching a large-scale educational initiative across the SADC region, which includes creating learning centres, refurbishing schools, and exposing the youth to novel opportunities. The company has done this before in the establishment of the Ithemba Lethu 4IR Lab in Hendrina, Mpumalanga, so there is no question as to the expansion of this initiative.

Sharing his enthusiasm for the project, Ngulube says, “We’re thrilled not just about the trajectory of our company, but more importantly, about the potential prosperity of Africa as a whole. Together, we can overlook past mistakes, focus on the present, and plan for a prosperous future that our children’s children will enjoy and be proud of.”

www.samining.co.za 22 SA MINING MAY / JUNE 2023 JUNIOR MINING CORPORATE PROFILE

With a strong focus on the development of mines, rail, and port linkages in Africa, E&T Minerals is now preparing to expand across the SADC region

©

ISTOCK –Grant Duncan-Smith

Our goal is to stimulate this region’s economies, increase mineral exports, and most importantly, strengthen the bonds among these countries

“ “

DRC’S KAMOA COPPER COMPLEX

CONTINUES ITS GROWTH

By Benjamin van der Veen

In May 2023, Ivanhoe Mines published an updated, independent Integrated Development Plan (2023 IDP) that charts the future development plan for the Kamoa Copper Mining Complex in the DRC.

The 2023 IDP encompasses two specific studies. The first is a pre-feasibility study (PFS) for the Phase 3 and 4 expansions of the Kamoa Copper Mining Complex, resulting in a staged increase in nameplate production, a total of 19.2 million tonnes per annum over a 33-year life.

The second study is a preliminary economic assessment (PEA) that evaluates a further nine-year extension to the mine life of the Kamoa Copper Mining Complex to 43 years overall – maintaining production from the Phase 1 to 4 concentrators beyond 2060.

Robert Friedland, executive co-chairman of Ivanhoe Mines, says: “This Integrated Development Plan demonstrates the bright future and vast potential for the DRC and its people, which is ready to become a world leader in the responsible supply of

vital electric metals. These are required by governments around the world to enact policies to combat climate change.”

One year a er its unveiling, Kamco’s mining project near Kolwezi is exceeding expectations. Furthermore, if its development continues well, it will become the world’s third largest copper production complex by 2024.

233 million tonnes

Total crude ore

The Kamoa-Kakula concession, which includes the three Kamoa Copper (Kamco) mining licences, covers 400km2, 25km west of Kolwezi, in Lualaba. It is estimated that the reserves of this mega-complex include 233 million tonnes of crude ore grading 4.46% copper, or 10.4 million tonnes of contained copper.

The complex’s development is implemented in stages. The first stage involved constructing the Kakula and Kansoko mines, and the first concentrator with a processing capacity to handle the 3.8 million tonnes of ore excavated yearly and fed from the Kakula mine.

The first copper concentrate was produced on 25 May 2021 and processed 105 884 tonnes of contained copper a er just seven months of operation.

OPTIMISING KAMOA’S CONCENTRATOR CAPACITY

The second phase of the Kamoa-Kakula concession was launched in 2022, when a second, 3.8 million-tonne, capacity concentrator was commissioned in March of that year. Production is forecast to reach 450 000 tonnes by the second quarter of 2023, thanks to an investment that aims to optimise concentrator capacity.

The third phase, which has also begun, will result in the development of the Kamoa 1 and 2 mines, and additional access to the Kakula West copper deposit.

www.samining.co.za 24 SA MINING MAY / JUNE 2023 PROJECTS IN AFRICA

© ISTOCK –Funtay

The Democratic Republic of the Congo (DRC) government’s decision to allow the privatisation of the country’s mines has led to areas such as southern Katanga being extensively explored, resulting in exciting mining prospects and discoveries

This phase involves constructing a new concentrator, which will have a capacity of five million tonnes of ore per year. This concentrator is proposed to be operational by the end of 2024. The complex’s production is expected to reach 600 000 tonnes of contained copper per annum, making Kamoa-Kakula the world’s third largest copper project.

A new direct-to-blister flash smelter, the largest in Africa, is set to be built to produce blister copper with a copper content of 99.9%. Its production capacity will be 500 000 tonnes of blister copper per year.

According to Ivanhoe Mines, there are several reasons that justify the need to create a new direct-to-blister flash smelter:

A portion of Kamco’s copper concentrate is currently processed into blister copper at Kolwezi, in the Lualaba Copper Smelter (LCS), owned by China Nonferrous Mining Corp (CNMC) Ltd and Yunnan Copper of Kunming.

An agreement signed by CNMC and Ivanhoe Mines only covers 150 000 tonnes of copper concentrate (which is the current limit for LCS).

Kamoa-Kakula’s concentrate production is around one million tonnes per year, the rest (850 000 tonnes) is exported, and Kamoa obtained a waiver from the DRC’s government to export the concentrate.

This is no small operation either.

Construction on the new smelter began in May 2022 and is set to cost some $800 million. The company notes that the smelter should be operational by the end of 2024, and will be able to process most of the Kamoa Complex’s contained copper. Ivanhoe adds, however, that if needed, the Lualaba Copper Smelter will be used to process the remaining 100 000 tonnes and export the contained copper.

KIBALI’S TIER ONE PRODUCTION PROFILE EXTENDS TO 2033

The Barrick Gold Corporation, an industry leader within the DRC in sustainability – with a strategy that holistically links the management of challenges related to climate change, poverty and biodiversity loss – recently extended its Kibali plant’s Tier One production profile for the fourth successive year, exploration replacing the gold that Kibali mined in 2022.

Kibali’s Tier One production profile extends to 2033 and grows reserves to a level equivalent to that in the original 2010 feasibility study, despite producing more than 6.4 million ounces of gold since commissioning. It continues to explore additional reserves to replace depletion at Kibali and for new growth opportunities elsewhere in the DRC.

Barrick’s president and chief executive, Mark Bristow, believes the mutually beneficial partnership between the company and its local stakeholders, notably the government, demonstrates that it’s possible to build and operate a successful, world-class mine run by host country nationals in one of Africa’s remotest corners.

“Kibali has multiple partnerships with local businesses, many of which we have actively mentored, such as the all-Congolese team that built the mine’s Azambi hydropower station,” Bristow says.

“It is also worth noting that Kibali’s three continuously upgraded hydropower stations and battery backup systems have led the Barrick group’s green energy drive. Approximately 80% of the mine’s power requirement is provided by renewable energy sources. This will rise when the planned new solar plant is commissioned in 2025, further reducing Kibali’s carbon footprint and costs.”

The mine also continues to invest in recruiting and training Congolese nationals, who already account for 95% of its workforce and 76% of its leadership, emphasising the skills development of potential managers and technicians.

www.samining.co.za SA MINING MAY / JUNE 2023 25

Size of the KamoaKakula concession © ISTOCK –Nordroden

400km2

This Integrated Development Plan demonstrates the bright future and vast potential for the DRC to become a world leader in the responsible supply of vital electric metals. – Friedland

“ “

PRIVATE SECTOR

MUST GO ALL OUT ON FREIGHT RAIL IMPROVEMENTS

In South Africa, rail has always played a crucial role in supporting productivity and increasing the sustainability of the country’s economy. However, for far too long, transportation challenges, structural delays and ongoing the of infrastructure have had a detrimental impact on freight services.

For several years, the country’s freight rail service, overseen by Transnet, has been in a state of decline, with the amount of freight carried by train having reduced dramatically over the past five years. Since freight rail handles block train consignments of primary minerals, commodities, imports and exports, and it’s the primary source for moving goods, this decline has hit the mining sector especially hard.

To address this, President Cyril Ramaphosa recently came out strongly, telling Transnet to attend to its crisis and saying the adoption of the National Rail Policy should serve as a guide to the modernisation and reform of the rail sector.

In fact, a statement from Transport Minister Sindisiwe Chikunga at the African Rail Industry Association’s (ARIA) annual general meeting confirmed government’s e orts.

“For the first time in a century, South Africa has a comprehensive National Rail Policy to guide the realisation of Vision 2050 for railways, as articulated in the National Transport Master Plan. The key thrust of the National Rail Policy is enabling investment in our railways, through the opening up of a space for the private sector to invest in equitable access to both the primary and secondary rail network,” says Chikunga.

“The policy introduces secondary interventions that will give e ect to institutional repositioning and allow for on-rail competition. This will then open up the rail market to other operators to compete and improve operational e iciency that is needed to improve service quality and competitive pricing in the freight sector.”

PRIVATE SECTOR ALIGNMENT

During his keynote address at the AGM, ARIA chairperson James Holley pointed out that if one looks at the metrics, SA is in a bad place. ARIA estimates that in the past year, Transnet has moved between 125 million and 160 million tonnes, which is a 29% decline in freight volumes in just five years.

“We are approaching a critical inflection point with regard to our railways, in that we need an urgent direction change, or the upstream economy will su er terrible consequences. We are talking about the heart of the SA economy, and the lack of freight rail is essentially blocking the blood this heart needs. Much like an unhealthy human, if we do not undertake a significant change, we are going to die,” he says.

“Regarding our alignment to the National Rail Policy, we believe it is imperative to all coalesce behind the current government policy. From my perspective, the time to debate this policy is past – it has taken 14 years to develop a progressive policy that

www.samining.co.za 26 SA MINING MAY / JUNE 2023 MATERIALS HANDLING

The announcement of the National Rail Policy opens the door for private sector investment in SA’s ailing freight rail industry

©

–

ISTOCK

TomasSereda

can ignite our economy, and now is the time to implement it.”

He says perhaps the toughest problem to solve is that of track infrastructure investment, mostly due to the significant underspend on track maintenance in past years, leaving the country with a bill of around R100-billion in spend to restore track integrity.

“There are three realistic sources for this potential finance – Transnet, government and the private sector. The basic reality of SA’s current fiscal position demonstrates that it is unlikely that government will be able to fund this. However, the appetite certainly exists within the private sector, because of its desperate need for freight rail capabilities.

“As ARIA, we want to commend Transnet for the bold step to commit to private sector funding, although we understand the concerns that this may simply result in a private sector monopoly replacing a

www.samining.co.za SA MINING MAY / JUNE 2023 27

We are talking about the heart of the SA economy, and the lack of freight rail is essentially blocking the blood this heart needs.

– Holley © ISTOCK –tongboonto

“ “

THE LUXEMBOURG RAIL PROTOCOL

According to Howard Rosen, chairperson of the Rail Working Group (RWG), it is a fact that the government is desperately short of money, and that a lot of funding is needed to undertake rail rehabilitation. RWG is an interest group representing the railway industry and whose main focus is to ensure that the Luxembourg Rail Protocol is brought into force in as many countries as possible.

“The first order of business is that the public sector does not need to own the rolling stock used. All that is required is a legal framework to give the private sector the confidence to invest in this instead,” he says.

He explains that the protocol creates an international registry to enable anyone to see who has a claim on a particular asset. In addition, this registry provides security if a debtor becomes insolvent.

“We see this as an important tool for the development of trade across Africa. A er all, there is no point in having a continental free trade area if we can’t e ectively deliver the goods.”

He notes that the Luxembourg Rail Protocol delivers cheaper and easier private finance for rolling stock. It o ers a common system, operating across all contracted states, with simple documentation and structures, and that frees governments from rolling stock finance, which is instead le to the private sector.

“I expect that once SA ratifies this – probably towards the end of the year – we will see other Southern African Development Community states begin to adopt it as well. This should ultimately lead to the creation of a seamless network, where operators can rest easy with moving their stock around, without fear of losses or high premiums on insurance.”

public sector one. Nonetheless, it remains something to celebrate.”

Holley does note, however, that there is nothing in the regulations or law preventing the immediate implementation of third party rail access. He says the need for this has never been greater, in respect of how it can boost both business and the economy.

“ARIA supports the new legislation in regard to third party access, but we do not support the notion that third party access has to wait until the actual implementation of the law,” he says.

IMPROVING THE CORE