22 minute read

Materials Handling & Logistics

FIXING SA’S RAIL TRANSPORT

While rail remains one of the most effi cient means of bulk transport, currently less than 20% of South Africa’s mineral resources travel that way. Can we rescue our railways?

By James Francis

Railways are the backbone of the modern world. Historically, they drove the expansion of industrialisation. Today, they are the most e icient way to move large volumes of cargo across land, connecting producers with export hubs.

Even though road vehicles carry significant amounts of goods, “steel on steel” railways are much more e icient. For example,

Khanye Colliery near Johannesburg uses 80 trucks carrying 34 tonnes each to replace one average Transnet train. Why would a mine need delivery trucks?

South Africa’s railways are in a sorry state, covering less than 20% of general freight and 10% of passengers, according to the

National Rail Policy Dra White Paper.

Mines consequently rely heavily on road freight to move their resources – at high costs. “The Minerals Council South Africa estimates that the bulk minerals producers will incur an opportunity cost this year of

R50-billion compared to R35bn in 2021, because of Transnet Freight Rail’s di iculties in meeting contracted tonnages,” says Allan

Seccombe, the Mineral Council’s head of communications. “As a result, companies are increasingly turning to road transport to meet their contractual obligations to their customers.”

DAMAGE BEHIND RECORD PROFITS

Mines still make a profit. Thungela Resources reported high profits for the 2021 financial year, thanks to realised coal prices reaching US$240/t from US$75/t the previous year due to high demand for coal and other resources. But road freight costs more than twice that of rail freight. Mines are already reducing their forecasts due to transport constraints. pressure: Exxaro’s sales in the first half of 2021 decreased by 1 821 kilotonnes (-31%), Thungela Resources lost R30bn in foreign sales, and Kumba Iron Ore dropped its fullyear sales guidance by one million tonnes, because of rail constraints.

These issues don’t only a ect mines. Experts at the Joburg Mining Indaba estimate South Africa has lost R12bn in forfeited taxes. Worse still, our roads are crumbling under the additional tra ic. And exporters are severely trimming margins to remain competitive against markets reaping the benefits of rail freight saving.

R30-billion

Foreign sales lost by Thungela Resources

“Our view is that big mining companies’ profits were hugely a ected because of Transnet’s inability to maintain the ailing infrastructure system, equipment breakdowns, outdated trains, and delays in the transportation of products,” says Mesela Nhlapo, chief executive o icer at the African Rail Industry Association (ARIA). “This has no doubt contributed negatively to the profits of mining companies. In total coal volumes dropped from 76 mtpa [metric tonnes per annum] in 2017 to 58 mtpa in 2021. The costs of this 18 mtpa drop in the context of the current coal price are extraordinary.”

ARIA cites several examples of this

TRANSNET’S CHALLENGES

Other deterioration factors include a strategic decision to sweat existing railways over building new ones (going back to 1986). Yet Transnet carries much of the blame. Governance problems, contracting issues for parts and maintenance, and incredible levels of the are crippling the state-owned enterprise. During FY2022, thieves pilfered some 1 500km of cables across the nation – a 1 096% increase over five years, and one so stark that Transnet security personnel are now peace o icers with powers to make arrests and aid in prosecutions.

Corruption and mismanagement are also big problems, characterised by public scandals and the recent court appearances

of former Transnet employees on charges including money laundering. Dodgy procurement contracts, irresponsible equipment investments and a lack of consistent maintenance have done the most damage. Transnet admits it has challenges with procurement.

“Over 300 locomotives are parked because of the inability to source spare parts from a key Chinese manufacturer, relating to the disputed 1064 locomotive programme,” says Transnet spokesperson Ayanda Shezi.

Nothing summarises the situation as well as comparisons with Eskom, SA’s collapsing power utility. Some are already calling Transnet the second Eskom – alarming because power generation and railways are two non-negotiable pieces of a functioning industrial society. South Africa’s future hangs in the balance.

HOPE ON THE HORIZON

Fortunately, all is not lost. Transnet forms part of a powerful and wide-ranging community that is busy putting shoulder to the wheel to reverse these issues. Foremost, since 2020 the state-owned enterprise has been under the leadership of CEO Portia Derby, who has not minced words about what needs to be done. Her leadership bravely stared down union strikes that did incredible damage to the economy, and is now negotiating to improve parts procurement.

Transnet is also working with the World Bank “to implement 10 priority initiatives that will deliver value in the container sector in the medium to long term. Many of these initiatives have been implemented and are yielding results, but require consistent focus to improve performance on a sustainable basis”, says Shezi.

There is a spirit of collaboration, with stakeholders working together to deliver improvements. The National Rail Policy lays the groundwork for extensive public-private cooperation, including third parties operating parts of the network. Groups such as ARIA have been lobbying for these changes.

“The National Rail Policy stipulates that third-party access should happen in a way that promotes investments and creates a level playing field for all players in the industry,” says Nhlapo. “Rail is an enabler of economic growth. This private sector participation is crucial in assisting the South African economy to expand and address transformation issues – such as the inclusion of women and youth – in the freight rail industry.”

There are still hurdles, such as changing Transnet’s internal rules and processes for greater third-party access. But across the board, everyone recognises that collaboration will save our railways.

“[We] strongly advocate public-private partnerships on key infrastructure like rail, ports and energy,” says Seccombe. “The private sector has access to capital and project management expertise that can help unlock the potential inherent in our export channels. Key to this is the involvement of the private sector in the railing of bulk commodities and the export of these commodities through the ports. There has to be an ‘open (policy) mind’ about this, and cooperation with the private sector in codesigning the most optimum model.”

In our complex world, mining needs every edge to remain competitive. Fortunately, all stakeholders are working to turn this around. Transnet’s recovery may serve as a blueprint to rescue other ailing infrastructure entities. Success is not a luxury we can a ord to delay, says Nhlapo.

“Rail reform represents an opportunity for investment, competitiveness, growth, and significant jobs. Early projections by ARIA suggest that additional parties using the rail network rail will create tens of thousands of upstream jobs, by enabling industry (like smelters, steel mills, manufacturing, and agri-processing) and mining (new coal, manganese, and iron ore mines, among others) to become internationally competitive.” ■

Transnet’s lines could soon be open to third-party operators as part of a collaborative e ort to save our railways.

In our complex world, mining needs every “ edge to remain competitive. Fortunately, all stakeholders are working to turn this around. “ – Nhlapo

South Africa’s railways carry only 20% of general freight and 10% of passengers. Mesela Nhlapo, chief executive o icer at the African Rail Industry Association.

TO PREVENT FLOODING, FLOODING, BE PREPARED

When the rainy season arrives, mines face challenges around fl ooding. The answer is to regularly check your pump installations for performance and reliability

Much of the local mining industry is located in Southern Africa’s summer rainfall regions, and mines in particular face the risk of disruption if pits or sha s are not dewatered quickly enough. With the rainy season having now arrived, it is imperative that those mines facing a wet summer check that their equipment is still up to the task. Justin Bawden, internal sales at

Integrated Pump Technology, points out that now is the ideal time to conduct a full check on all pump installations. He notes that it is critical for such entities to ensure their submersible dewatering pumps are 100% operational if they want to prevent flooding and disruption. “Weather patterns have become less predictable, with some regions experiencing drought conditions for extended periods.

On the other hand, parts of the country may experience heavy rainfall consistently. The latter creates a great demand for pumps, while in the regions witnessing more arid conditions, pumps may go unused for some time,” says Bawden. “It is thus very important to ensure that your pumps are regularly checked for performance and reliability, particularly as they must o en be put into service at short notice.”

He says a key concern is that some pumps are le unused in applications where solid particles can clog up components through sedimentation. “In a muddy application, for instance, particles should not be allowed to thicken around a pump over a period of months. If a pump is restarted under these conditions, it could lead to the impeller sha snapping,” says Bawden.

For these reasons and more, he urges mines to take stock of which pumps they have available at the various dewatering “hotspots” around their sites. By re-assessing the demands that the rainy season will soon place on each of these points, he suggests, it will enable them to ensure that their pump capacities are well aligned.

“It is vital to understand the key aspects of each pumping application – from the required flow rate and vertical head to the pipeline and the nature of the material being pumped. This makes for cost-e ective choices that provide the necessary duty when heavy rains arrive,” he says. ■

WHAT ABOUT DRAINAGE?

When tailings dams fail (see page 22), the consequences can be lethal, which is why it’s important that drainage systems remain operational and function e iciently.

Aside from ensuring that the dam walls are sound, it is also important to monitor drainage. If the drainage system gets blocked, it can pose major safety risks.

High-pressure jetting equipment can be used to ensure this is the case, says Sebastian Werner, MD of Werner Pumps.

“The way most tailings dams work is that a slurry of mining waste is piped into the dam, and the solids then settle to the bottom. The water is recycled to be used in the separation process again.”

If the drainage system gets blocked, he notes, it causes flow restriction and can a ect safety factors such as the degree of saturation in the dam, and phreatic surface levels. Blockages can be caused by anything from algae buildup to mineral deposits.

“To avoid or deal with blockages, regular jet-rodding is recommended. This entails using high-pressure water jetting equipment to scour the walls of the drainage system to allow water to flow freely by unclogging the pipes. It can also assist in identifying damaged pipes,” says Werner.

LTE MEDICAL SOLUTIONS

PROVIDES INNOVATIVE HEALTHCARE

With a growing need to provide access to quality healthcare, all stakeholders need to ensure that this becomes a reality, particularly in places of occupation, and more so in the mining and industrial space that employs thousands of people,” says LTE Medical Solutions COO Andries Vorster.

“With mining and industrial companies required to provide occupational health as well as corporate wellness to both their employees and communities exposed to various risks and hazards within the workplace, LTE provides assistance to organisations in the mining and industrial space in rendering occupational healthcare e ectively. This is particularly true for companies who don’t have a budget to set up an onsite healthcare facility.”

Established in 2012, LTE is a division of Vertice Healthcare, one of South Africa’s largest private healthcare organisations, and its core focus is on delivering innovative healthcare solutions for high burden diseases, including (among others) tuberculosis (TB) and HIV.

With a track record in more than 20 African countries, LTE o ers mobile healthcare clinics, comprehensive occupational health so ware systems, cutting-edge computeraided diagnosis (CAD) so ware, capital medical and radiology equipment, and outsourced health screening services.

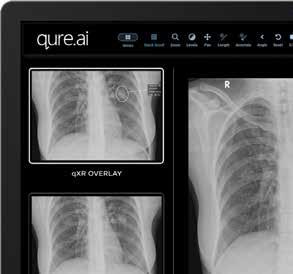

“As a specialist in mobile healthcare solutions, LTE strives to provide healthcare services that support organisations in the mining and industrial sectors. The mobile healthcare clinics’ o ering includes mobile occupational clinics for occupational lung disease screenings; TB prevalence studies; periodic and exit X-ray examinations; and benefit medical examinations. These units can be deployed to even the most remote areas, operating using solar power and o line capable so ware solutions, which include a comprehensive monitoring and evaluation patient management platform (Lynx-HCF), cloudbased picture archiving and communication system (PACS) – for radiology image storage, and CAD artificial intelligence (AI). This allows for electronic data collection during screening and consultations, eliminating human error, automating acquisition of digital X-rays, CAD AI-assisted CXR pathology classification, and clinical workflow management. Vorster says this enables X-rays taken, for example, on a site in Tanzania to be sent to South Africa for interpretation by a specialist.

LTE is currently involved“ in some of the largest CAD “ AI-focused TB screening programmes in Africa.

“We can supply our clients with either specific medical equipment hardware or provide mobile clinics as turnkey solutions, which are fully self-sustainable and can be placed at specific sites to o er healthcare services for both contractors and employees. We also o er a fully outsourced model where we operate the clinics by providing the healthcare workers as well,” he says.

To ensure high-quality service delivery, LTE’s mobile clinics can be provided with qualified medical personnel, including radiographers and remotely supported radiologists. Supported through its e-health solution Lynx-HCF, this approach leverages the integration between hardware and so ware technologies, optimising workflow, making medical evaluations quicker, sharing expensive resources like specialist doctors to obtain optimal outcomes in the shortest time, and positively impacting both costs and e iciencies.

Vorster says the company uses the latest in AI (Qure.ai) so ware, integrated within the patient management so ware Lynx-HCF, which can identify nearly 30 di erent lung pathologies including TB, lung nodules and congenital defects in under a minute. The use of CAD AI is endorsed by the World Health Organization and is used in various TB studies globally, and in South Africa.

“In essence, TB as well as other lung pathologies can be detected in less than a minute, which assists with targeted diagnosis and referral management of employees. For mines, this means that a decision on whether to send an employee back to work can be made more quickly, depending on what the CAD AI picks up.”

Currently miners are only allowed to go down a sha once they have a certificate of fitness. That can take anything up to 48 hours to obtain, leaving mine workers forced to remain idle until they receive the certificate, resulting in a loss in productivity. The CAD AI tools are especially useful when used during large-scale screenings.

“LTE is currently involved in some of the largest TB screening programmes of this nature in Africa. In fact, just here in SA, we were appointed by South Africa’s National Department of Health to supply our integrated solutions, as part of a Global Fund project for active TB case finding, to screen some 620 000 participants. We have also been appointed to supply similar solutions to other customers in both the public and private healthcare sectors.”

According to Vorster, conventional TB testing methods are expensive, and using CAD AI to screen clients reduces costs, because only those clients who display abnormalities will require further testing. Discussing how its innovative smart solutions operate, Vorster explains that LTE’s mobile units are equipped with the latest cuttingedge radiology, medical technology, and renewable power systems. These allow for travelling to various sites – urban, semi-urban and rural – where clinical examination and testing is required. Completed screenings are uploaded in real time onto a cloud server (with o line functionality in areas with no internet access) and access to data is provided to the clients within a matter of minutes.

“This enables us to reach people in remote areas and o er them the same reports and quality of service that a person standing in front of a doctor would get,” says Vorster.

LTE’s mobile clinic service is especially useful to small mining operations, which are unable to provide the services that big mines have. They are also supportive of healthcarerelated services such as HIV screening, wellness screening and community health screening services, as part of mines’ e orts to improve healthcare outcomes in surrounding communities, through their corporate social responsibility initiatives. >

Mobile health solutions.

Being an innovator in delivering new solutions for occupational health, corporate wellness and community-based screening, LTE’s research and development division pushes the boundaries of how mobile-based radiology can be rendered.

The company recently launched its XPOD, a revolutionary self-contained X-ray equipped facility that o ers a controlled environment for high-volume chest X-ray examinations in a small footprint. CAD AI-enabled, it is ideal for screening services close to operational areas, and can be used to screen for tuberculosis, silicosis, and other lung pathologies.

By combining locally developed so ware care plans that include, among others, mental wellness, HIV, skin cancer, vaccinations, and tele-medicine consultation services, the Lynx-HCF platform allows for a comprehensive employee management platform, ensuring better health risk assessment and greater access to clinical resources.

“We strive to provide locally built solutions that are made in Africa, for Africa, and allow for greater access to healthcare at lower cost,” says Vorster.

LTE provides its mobile clinics, radiology solutions and health so ware systems across Africa and as a Vertice Healthcare company conforms with ISO13485, ISO9001, ISO27001 quality standards on the products it produces and supports.

Innovative XPOD.

OUR IMPACT

“LTE as a company remains rooted in its principle of delivering quality healthcare to those who need it most,” says Vorster. “At the core of its values are the people, the clients and communities LTE serves and operates in.”

Its focus is around early detection, which results in timeous and relevant care to the end clients. This ensures good clinical outcomes and helps organisations maintain healthy workforces. Supporting and reaching those who cannot easily access services avoids late presentation for healthcare, o en with complications and comorbidities, thereby reducing the burden on the health system.

“Being able to assist miners, employees and employers to live a healthier life, by supporting screening and early detection of life-threatening diseases, is something we are proud of,” says Vorster. ■

THE HOTTEST AFRICAN MINING PROJECTS

ANNOUNCED AT MINING INDABA

Mining continues to be a major growth sector for much of Africa, as evidenced by the announcement at the recent Mining Indaba of some of the most prestigious projects under way on the continent

By Benjamin van der Veen

There is no doubt that Africa is home to some of the world’s most interesting and exciting mining projects. The African Mining Indaba recently discussed some of the mining developments most likely to be the kind that will play a major role in altering the future of mining in Africa. The projects are as follows.

TENDAO GOLD PROJECT – DEMOCRATIC REPUBLIC OF THE CONGO

The north-east DRC is a gold-rich region filled with multimillion-ounce operations. One of these operations is the impressive Kibali gold project. However, it is the underdeveloped Tendao project that is the latest DRC initiative to gain mainstream attention.

Okapi, a local small-cap gold miner, has acquired a 50% equity share in the mine from Amani Gold Limited. This Australian-listed mining company operates the Giro project surrounding Tendao.

The Tendao gold project is located within the bountiful Kilo-Moto greenstone belt and holds enormous potential. According to Okapi chairman Klaus Eckhof: “Randgold previously called this area ‘the world’s hottest gold exploration ground’.

“We will undertake an aggressive exploration programme over the short term, to fully test and hopefully define significant resources at the project, and move from explorer to producer,” he says.

According to Okapi, some 90% of all gold produced in the DRC comes from the KiloMoto belt. Okapi Resources is in discussions with the vendor to assess recouping any funds forwarded to them as part of the consideration for the acquisition.

GAKARA MINE – BURUNDI

With battery and electric vehicle technology quickly becoming the global standard for transportation, Africa’s rare earth metals are in hot demand. Projects like the Gakara mine are becoming star attractions, putting mineral-producing countries on the map.

The Gakara rare earth project, located in the Bujumbura province of Burundi, is one of the world’s highest-grade rare earth deposits, and the only producing rare earth mine in Africa. The mine is, in fact, considered one of the world’s richest rare earth deposits.

According to research from operator Rainbow Rare Earths, alongside MSA Group, the map’s exploration potential is up to 80 000 tonnes of mineralised material, with gradings between 47% and 67%. That’s many times higher than industry norms.

What’s more, Gakara – which has been producing for just over two years – has been relatively cheap for a high return on investment. The total capex at the site is estimated at around US$10-million. Given the demand for rare earth metals for magnets, electric vehicle components, smartphones and more, it is a highly lucrative development, and one that highlights why investors find Africa profitable.

As of 2019, an expansion regime is coming to Gakara. Rainbow plans on boosting production by spreading operations over multiple deposits at the Gakara site. Additionally, it is looking at improving downstream separation capability to capture more mineral content. To do so, Rainbow has launched a joint venture with TechMet to develop this capability further.

SOUTH EAST ORE BODY – ZAMBIA

Zambia, Africa’s second-largest metal producer, saw output rise 10.6% in the first half of the year, on the back of a stable power supply and relatively higher metal prices in recent months.

Regarding RHA Tungsten, “ shareholder discussions are ongoing, and the “ mine is expected to start operations next year. – Chitando

One of the most recent greenfield mines to begin operations in Africa is one that reflects the growing influence of China on continental mineral extractions. In August 2018, NFC Africa, majority-owned by China Nonferrous Metal Mining (Group) Co, launched production at its South East Ore Body copper mine, Chambishi, in Zambia.

The operation was expected to produce 60 000 tonnes of copper within a couple of years, once full capacity was reached. Total copper ore reserves are estimated at 76 million tonnes, although with an average grade of 2.18%.

Overall, Chambishi South-East Mine is expected to hold a minimum lifespan of 20 years. This is good news for Zambia, Africa’s second largest copper producer. NFC Africa currently also mines at the Chambishi Main Mine and Chambishi West Mine.

RHA TUNGSTEN – ZIMBABWE

Zimbabwe, secured a US$6m investment from the Zimbabwean government to continue production in May 2019.

This was considered a crucial investment, as the mining industry is a critical economic enabler, one that in fact contributes about 20% to the country’s gross domestic product and is essential to the growth of other sectors, such as agriculture and manufacturing.

The RHA open pit was initially reopened in 2015, but following a number of problems with low-grade ore, production became fairly sporadic throughout 2016 and 2017. However, by reaching an agreement with Zimbabwe’s government and 51% partner, the National Indigenisation and Economic Development Fund, RHA was able to continue its operations.

Although tungsten is not among the significant contributors towards the US$12-billion mining milestone sought by 2023, the Zimbabwean government is committed to ensuring that over 60 mineral deposits, including newly discovered coal and gas, contribute to economic development and drive the country to an upper middle-income economy by 2030.

In an interview on the sidelines of the recent Chamber of Mines annual conference at Victoria Falls, Mines and Mining Development Minister Winston Chitando said shareholder discussions were ongoing, and the mine was expected to start operations next year.

“There has been lack of activity but it’s coming back. Discussions are taking place with shareholders and we expect that by next year it will be up and running, as the investor is already there,” said Chitando. ■

GAKARA MINE NUMBERS

■ 80 000 tonnes of mineralised material. ■ Gradings between 47% and 67%. ■ Total capex estimated at

US$10-million.