4 minute read

IN CONSTANT REFORMATION

The Hellenic Logistics Association (EEL), in collaboration with the Design, Operations, & Production Systems Lab (DeOPSys) of the Department of Financial & Management Engineering of the Engineering Faculty of the Aegean University, concluded a while ago the 5th panhellenic survey in the supply chain sector.

In the following interview, the president of the Hellenic Logistics Association (EEL) Mr Vasilis Zeimpekis, analyses the main findings of the survey, which highlight the issues that businesses in the market face, as well as future trends.

Advertisement

SC&L: What was the aim of the research and what was the profile of the participating businesses?

V.Z. The aim of the 5th Panhellenic research that was conducted by the Hellenic Logistics Association (EEL) in collaboration with the Design, Operations, & Production Systems Lab (DeOPSys) of the Department of Financial & Management Engineering of the Engineering Faculty of the Aegean University was double: a) To assess Greek logistics and their contribution to the country and b) to record the trends, prospects, and challenges of Greek logistics through the voice of Greek businesses. At this point I would like to thank the 207 businesses that participated in the survey, on behalf of EEL and the Aegean University. Specifically, 60% of the sample concerned businesses with activity in the marketing sector, 29% in the logistics and transport services sector and 11% in the manufacturing sector.

SC&L: What is the current state of the logistics industry? What are the main findings of the research?

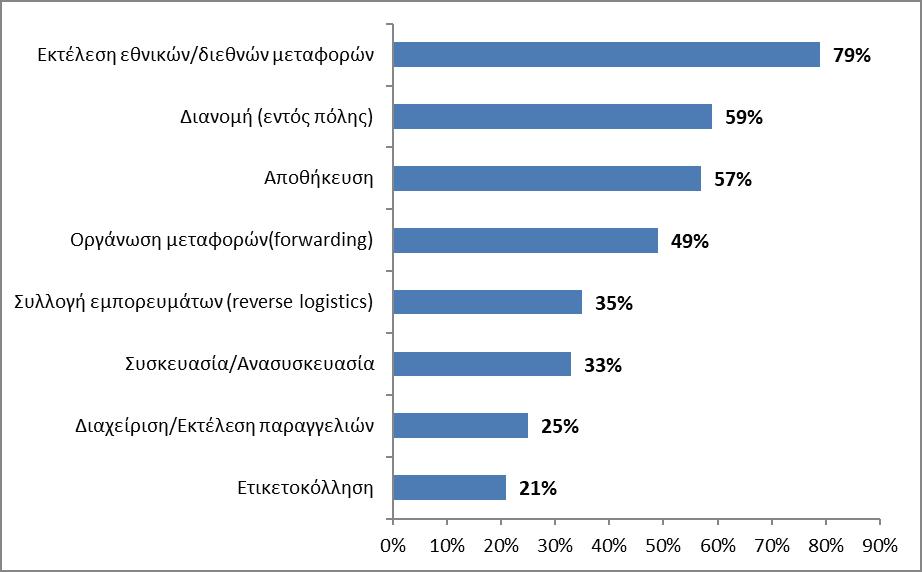

V.Z. An initial finding is that the outsourcing rate continues to be low (19% of the businesses surveyed have opted for full outsource of logistics procedures) compared to the European average, while transport / distribution and warehouse activities are the two main activities that businesses outsource to logistics service providers (Figure 1). Additionally, the cost of logistics in relation to the total operating costs ranges from 1% - 10% in the majority of the sample businesses. The businesses that have chosen the in-house business model, have managed to have estimated costs very similar to those of 3PL.

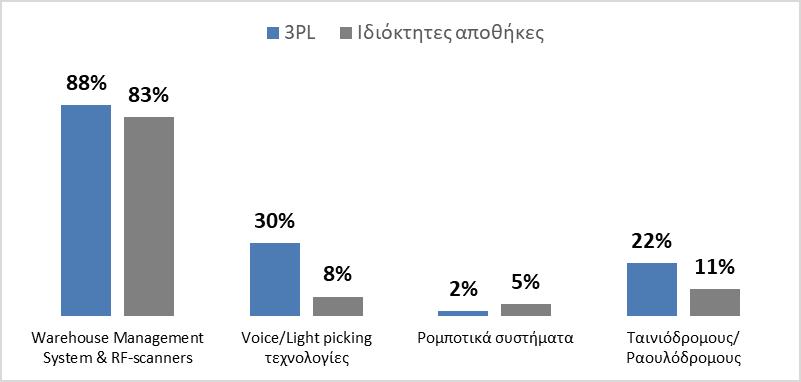

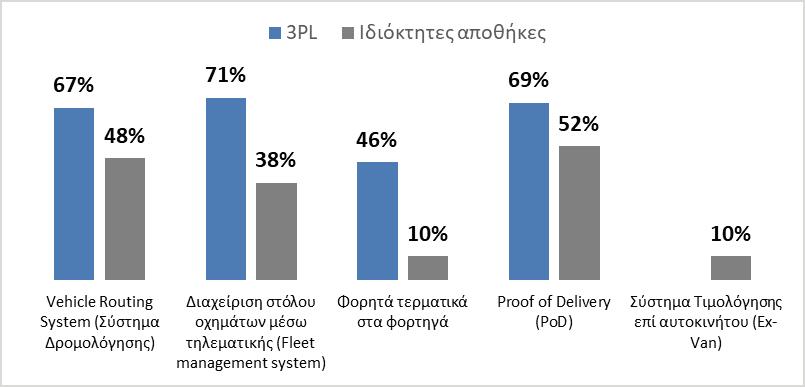

In addition, due to the development of e-commerce, it is important to mention that both commercial / manufacturing businesses and logistics businesses have turned their attention to the use of small and medium vehicles, in order to increase the speed and flexibility of distribution in urban centers (city logistics). Finally, the use of information systems is at a satisfactory level, while the reports for the implementation of automation and 4.0 logistics technologies are encouraging (Figure 2).

SC&L: What are the prospects and the strategy that the businesses will follow in the upcoming period?

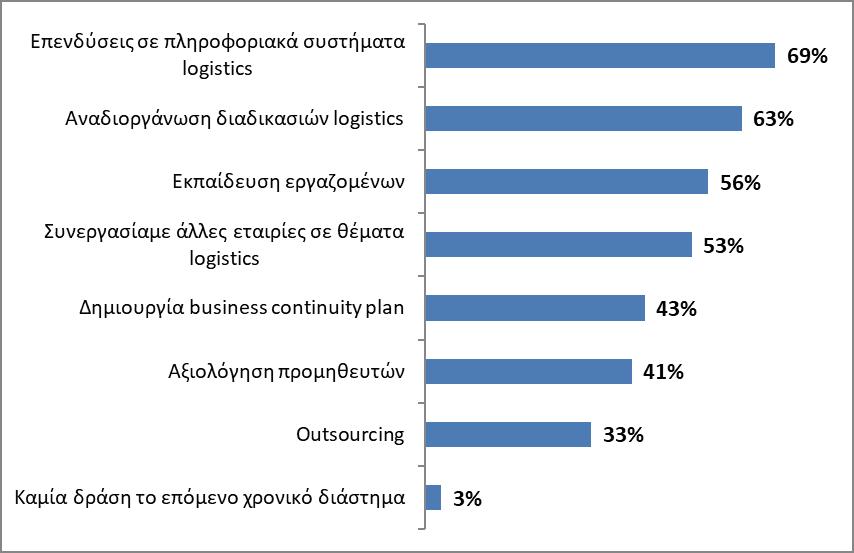

V.Z. Most of them plan to implement strategic investments in information systems (mainly warehousing and distribution) and to reorganise logistics processes, so that they can smoothly introduce new technologies and proceed with their digital transformation (Figure 3). At the same time, the majority of the businesses that participated in the survey, aim at strengthening and developing the skills of their employees and at their continuous training.

SC&L: What are the future trends and opportunities that businesses foresee for the

How do you manage the supply chain’s activities?

52% 29% 19%

Partial outsourcing

What are the main supply chain activities that businesses assign to third parties?

Pursuance of national/ international transports

Delivery (within town)

Storage

Transport management (forwarding)

Commodity collection (reverse logistics)

Packaging/ Repackaging

Order Management/ Fulfillment

Labelling

Businesses rendering logistics services

Commercial/ Manufacturing businesses a satisfactory level, while the reports for the implementation of automation and 4.0 logistics technologies are encouraging.

upcoming period?

V.Z. The majority of businesses that participated in the survey foresee significant opportunities for the development of the domestic logistics market, however, they consider the lack of available storage space and appropriate financial tools as key obstacles to the development of the sector (Figure 4). In particular, the participating businesses report that Greece’s strategy should

Businesses rendering logistics services

Commercial/ Manufacturing businesses be focused on facilitating the licensing of Business Activity Codes, on the further strengthening of ports, on the development of National Freight Parks and on the reorganization of rail transport. Moreover, when asked about the key issues they face within their business, they focused on the following: a) inability to have medium-term strategic planning, b) inability to find staff and c) lack of funds for investments.

SURVEY

Investments Pursuance of national/ international transports Delivery (within town) Storage Transport management (forwarding) Commodity collection (reverse logistics) Packaging/ Repackaging Order Management/ Fulfillment Labelling Warehouse (WMS, pick-to-light, pick-to-voice, vision picking, sorters, etc.) How do you foresee the development of the domestic logistics market? There are plenty opportunities for development

45% 37% 11% 7% The market seems to stir again We maintain a waiting attitude

There are still major issues Which do you consider the main obstacles for the development of the logistics sector (in operational and ordinal level)? 01 27% 02 25% 03 20% 04 11% 05 7%

Lack of available and quality storage spaces and infrastructure Lack of appropriate financial tools Establishment and development of business parks framework Licensing Lack of loaning potential from financial institutions 20

Figure 3. Most businesses plan the implementation of strategic investments in information systems, in reorganization of Logistics procedures and in training/ specialising of their staff.

SC&L: Sustainability is becoming increasingly important for the activity and prosperity of businesses and society.

What was the response of businesses on this matter?

SC&L: In conclusion we would like you to briefly outline the main findings of the survey. What should we retain from all the findings?

I will try to summarise the findings of the 5th Panhellenic Survey shortly, by categorising them into 3 pillars.

Pillar 1 - Current status

• A decline is observed in Greece’s position in the global logistics market (42nd position LPI), according to 2018 data from the World Bank, however the latest period shows an improvement which seems

Pillar 2 – Challenges

• Road transport is the dominant means (69.5% share) in Greece. Nevertheless, the fleet is old and of limited capacity. Synergies in road transport are necessary

• The port of Piraeus dominates the Mediterranean. The port of Thessaloniki has significant prospects to become a Balkan hub

• 3PL storage spaces increase significantly. However, outsourcing shows significant growth potential.

• 3PL businesses offer a wide range of services but need to invest in systems and training to become more competitive

Pillar 3 – Future trends

• The COVID-19 pandemic accelerated the launch of supply chain reorganisation and modernisation activities icant ground is being gained in the implementation of cutting-edge technologies

The legislation regarding the licensing of Business Activity Codes continues to be an obstacle to the development of the logistics sector

Sustainable development is a priority of businesses, since they have begun to realise the importance of sustainability (with an emphasis on the environment)

30 Years of EXPERIENCE

100% Greek Company

FULL LOADS ¯ PART LOADS GROUPAGE SHIPMENTS ALL OVER EUROPE

24.000 m2 OWNED FACILITIES

30.000 SHIPMENTS/YEAR