4 minute read

How gas inflates energy prices

By Adnan Chokhandiwala

Gas plays a key role in setting energy prices. Before energy reaches an end-user, which may be a consumer or a business, it is bought by suppliers in the wholesale market Since the war in Ukraine caused energy prices to rise sharply, wholesale prices have risen to make up 50-60% of what consumers pay for their electricity with the April 2022 price cap (National Grid ESO), thus highlighting its importance.

Advertisement

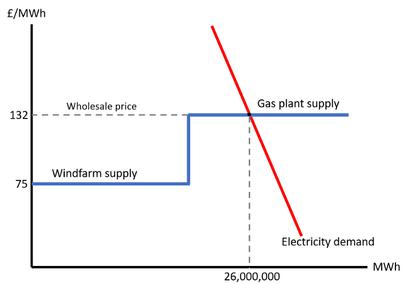

In the UK, national pricing is used. There is one wholesale price across the country, at a given time. This is set using marginal pricing. The power exchange accepts bids from electricity generators, who provide the price they are willing and able to produce electricity at. The bids of each supplier are aggregated, sorted from lowest to highest by price and the final supplier needed to meet electricity demand is used to set prices. The cost they bid is set as the price for all suppliers, including those that bid below them.

In January 2023, the price of electricity in the Day Ahead Baseload market, one of the UK’s many wholesale markets, was on average £132 per MWh (Ofgem, 2023). The market can be simplified to two suppliers: a wind farm which is willing to provide electricity at £75/MWh and a gas-fired plant which is willing to provide electricity at £132/MWh In the market, wind is not able to meet demand alone The power exchange accepts the bid from the gas producer as the final bid In this month, the UK consumed 26m MWh (National Grid ESO, 2023a). Due to the way the market is structured, both the wind producers and the gas producer would be paid £132/MWh. Despite wind producing energy at a significantly lower price, the fact that gas is needed to meet demand means that prices are higher than they otherwise would have been.

Advocates of such a system claim it keeps wholesale prices as low as possible: electricity suppliers have the incentive to bid only their operating costs (marginal costs) to ensure they remain competitive and receive an offer Producers also have the incentive to reduce their costs to the lowest possible level, their profit is the market price minus any costs they may incur Any costs saved are extra profit for the business. On an aggregate level, if every firm took such an approach this could lower market prices.

Another advantage is that it takes advantage of the fact that the most popular low-carbon sources such as wind and solar have extremely low operating costs. After high startup costs to build the necessary infrastructure, the cost of an additional unit of electricity is extremely low, approaching zero in many cases. A solar farm requires no extra inputs to produce electricity, besides regular maintenance. This means that they are the first picked to produce electricity. Carbon emitting generation, which has a higher marginal cost, is given a lower priority and is used only if needed, this minimises carbon emissions.

In theory, this market structure sounds ideal: it is efficient and environmentally friendly. However, the real world is not as kind. After the war in Ukraine, wholesale energy prices spiked as the price of gas rose to unprecedented levels (though it is worth noting that they are significantly lower than the peak reached in 2022) In the UK, Italy and Spain gas set the price of power more than 80% of the time (Zakeri et al , 2022) On average across 2022, gas provided less than 40% of energy production in the UK (National Grid ESO, 2023b). It plays a disproportionate role in the market, as the most common energy source to be chosen last, it dictates wholesale energy prices. It is through this that it influences household and business energy prices.

One potential solution to this problem is to split electricity prices across the UK. A single price across the country fails to reflect the diversity of electricity generation and consumption across regions. Certain regions, such as the Scottish Highlands, produce significantly more energy than they consume, whilst others run at energy deficits. Physical constraints in energy transmission and storage meant that enough wind energy to supply 800,000 UK households went to waste in 2020 and 2021 (Drax, 2022). To meet energy demands elsewhere in the country, gas generation is used to overcome constraints.

In 2022, the National Grid spent £717m on gas turbines to plug such gaps (Sky News, 2023). Renewable energy generation is wasted in favour of fossil fuels. The UK government is looking into whether regional pricing can help solve the imbalance of energy production. Regional pricing could mean higher prices in regions like the South-East of England, encouraging investment in renewable energy where it is needed the most It could also have the additional benefit of promoting energy storage solutions in regions where there is excess power produced.

The short-term cost of introducing more regionalised pricing is outweighed by the efficiency gains. Regionalisation would allow for optimal dispatch of energy when and where it is needed. Consumer’s preferences would more closely be reflected in investment and would reduce the risk of overbuilding unnecessary infrastructure in the future. A gain in efficiency of electricity provision and investment would be passed on to consumers through lower prices.

Localisation of the energy market to reduce inefficiency could not come soon enough. Decarbonisation of the energy grid means that congestion costs have increased 8-fold since 2010 and are forecasted to reach £2.3bn annually by 2026 (National Grid ESO, 2022) The government considering regionalisation of the system is an exciting prospect which will hopefully encourage local investment in renewable energy and reduce energy bills.

References:

National Grid ESO (no year)- https://www nationalgrideso com/electricity-explained/how-electricity-priced Ofgem (2023) - https://www.ofgem.gov.uk/energy-data-and-research/data-portal/wholesale-market-indicators

National Grid ESO (2023a) - https://www nationalgrideso com/document/275836/download Zakeri et al. (2022) - https://ssrn.com/abstract=4170906

National Grid ESO (2023b) - https://www nationalgrideso com/news/britains-electricity-explained-2022-review Drax (2022) - https://www.drax.com/press release/cost-of-turning-off-uk-wind-farms-reached-record-high-in-2021/ Sky News (2023) - https://news sky com/story/britons-paying-hundreds-of-millions-to-turn-off-wind-turbines-as-network-cant-handle-the-power-they-make-onthe-windiest-days-12822156

National Grid ESO (2022) - https://www nationalgrideso com/document/258871/download