Directors' report

Your directors submit their report on Sydney Dance Company (the "Company") for the year ending 31 December 2022.

DIRECTORS

The names of the Company’s directors in office during the financial year and their qualifications and expertise are set out below. Directors were in office for this entire period, unless otherwise stated.

Brett Clegg, GAICD, BBus MCom (Advanced Finance) Chair, appointed 23 March 2015

Mr Clegg was appointed Chair on 12 August 2019. Mr Clegg is an adviser to chief executives and boards, specialising in strategic communications, issues management, innovation and capital markets transactions. His career has spanned professional services, investment banking, publishing and the technology sectors. Mr Clegg is a Trustee of the Australian Museum, an ambassador for the Australian Indigenous Education Foundation, a former Director of HiPages Group and a former Council Member of the University of Technology Sydney. His expertise relates to corporate strategy, media and technology, finance, fundraising and corporate contacts.

David Baxby, MAICD, BCom, BLaw (Hons), appointed 12 August 2019

Mr Baxby is an active investor across a range of companies in Australia and New Zealand. He is the co-founder of Coogee Capital and a non-executive director for WHSP and the Kin Group as well as Chairman of Workpac Group and Dynasty Gaming and Media. Prior to 2020 he was the Managing Director of the Industrials division of Wesfarmers Limited and held a number of commercial and leadership roles within the Virgin Group, Richard Branson’s family office, the last being Global Co- CEO. David also served as President and CEO of Global Blue, the international shopping transaction processing business. His past Directorships include Virgin Australia, Frontier Digital Holdings, Virgin Atlantic Ltd, Virgin Holidays Ltd, Virgin America Inc and Air Asia X. Mr Baxby was a Partner and Executive Director of Goldman Sachs in both London and Sydney. Mr Baxby’s expertise is in the areas of operational management, finance, strategic management, and corporate contacts. Mr Baxby currently sits on the Council of Bond University.

Jillian Broadbent AC, BA (Maths & Economics), appointed 15 March 2018

Ms Broadbent serves on the board of Macquarie Group Limited and the Sydney Dance Company and has recently completed an 11-year term as Chancellor of the University of Wollongong and 10 years on the Board of Woolworths Limited. She was 15 years on the board of the Reserve Bank of Australia, the inaugural Chair of the Clean Energy Finance Corporation and has served as Chair of the board of Swiss Re Life and Health Australia Limited. Ms Broadbent has expertise in the areas of finance, strategic management and corporate governance. Ms Broadbent has served on the boards of the Sydney Theatre, Company, the Australian Brandenburg Orchestra and the Art Gallery of New South Wales and has expertise in the areas of finance, strategic management and corporate governance.

David Friedlander, BCom/LLB, Master of Laws, appointed 14 October 2019

Mr Friedlander is the Australian Chairman of King Wood & Mallesons. Mr Friedlander is aPanel Member of Adara Partners and Chairman of the Public Education Foundation. He is also a member of the New York State Bar Association – International and Business Law Section, the Law Council – Corporations Committee, the International Bar Association and a Lecturer in Takeovers and Hybrid Securities at the University of Sydney. He was previously a member of the Australian Takeovers Panel. Mr Friedlander has expertise in law, capital markets transactions, board governance, and corporate networks.

Mark Hassell, appointed 31 January 2017

Mr Hassell is a Partner at KPMG Australia in the Customer Advisory Management ConsultingPractice where he isthe National LeadPartner for Customer in Government and the National Management Consulting Partner for Public Transport. Prior to this Mr Hassell was Chief Customer Officer at Virgin Australia Airlines leading the Customer and Brand transformation from the low-cost Virgin-Blue airlines. Mr Hassell has previously held several senior management positions in his field at British Airways and Qntas including Global Head of Customer Experience at British Airways based in London. As well as the experience he brings to the Board, Mr Hassell also chairs the Marketing and Commercial Activities Sub-Committee. Mr Hassell is a Trustee of the NSW Museum of Applied Arts & Science (Powerhouse).

Sandra McCullagh, GAICD, MBA, BA (Computer Science), BSc (Computer Science and Maths), appointed 12 August 2019

Ms McCullagh is an experienced non-executive director. She is a director of Workcover Queensland and Australian Ethical Investments and chairs their Investment Committee. Ms McCullagh is also a director of the Investor Group on Climate Change, a member of the Chief Executive Women’s Membership Committee, and a member of the New Zealand Stock Exchange Corporate Governance Institute. Ms McCullagh was previously both a Director - Equities Research, and Head of Environmental, Social & Governance Equities Research at Credit Suisse, and has held senior positions at several energy companies. Ms McCullagh’s expertise is in the areas of finance, strategy and corporate governance.

Catriona Mordant AM, appointed 22 November 2016

Ms Mordant is a foundation Board Member of the Museum of Contemporary Art Australia, a Member of the International Council of the Tate in London and a Member of the advisory board of Venetian Heritage in Venice. Ms Mordant has expertise in fundraising, strategic management and corporate contacts.

Paris Neilson, BA, MMS, appointed 12 August 2019

Ms Neilson is a Trustee of the Neilson Foundation which supports a range of organisations that assistdisadvantaged individuals and communities as well as arts organisations across the sector, she is a trustee of the AGNSW and co-chair of the capital campaign for Griffin Theatre. She has experience in the arts sector through her time setting up and managing Sydney’s White Rabbit Gallery, and various board and committee positions she has held with such companies as the Biennale of Sydney.

Emma-Jane Newton, MAICD, BCom (Hons), appointed 30 April 2018

Ms Newton is a Managing Director in the Investment Banking Division of Morgan Stanley and was previously an Executive Director at Telstra in senior finance roles. Prior to joining Telstra she was a Managing Director at Credit Suisse. Ms Newton has expertise in finance, strategy, and corporate development. Ms Newton is a member of Australian Takeovers Panel. Ms Newton has chaired the Audit and Risk Committee since June 2019 and Deputy Chair since December 2021.

Emma Gray, MBA, GAICD, appointed July 2021

Ms Gray is a Non-Executive Director, and seasoned executive with over 20 years business experience working with ANZ, Woolworths, and Bain and Company. She has deep expertise in banking, retail, and the use of data to create great customer experiences.

Alexa Haslingden, Bachelor of International Relations, Stanford University, appointed, September 2021

Ms Haslingden is the Chair of Lou’s Place, a daytime, drop-in centre serving women in crisis, suffering from domestic violence, addiction, homelessness, and mental health issues acrossgreater Sydney. She also sits on the board of The RACAT Group. RACAT is a diversified media company with operations in film, television, print and digital publishing and mobile games across four companies: Australian Geographic, Northern Pictures, Junkee Media and Runaway Play. Alexa has over 25 years’ experience in the advertising industry, having worked in New York, Hong Kong, and Australia.

Larissa Behrendt AO, LLB, B.Juris, LLM, SJD, appointed 5 December 2022

Distinguished Professor Larissa Behrendt AO is a Eualayai/Gamillaroi woman and Laureate Fellow at the Jumbunna Institute of Indigenous Education and Research at the University of Technology, Sydney. She is a graduate of the UNSW Law School and has a Masters and SJD from Harvard Law School. She is a Fellow of the Academy of Social Sciences in Australia and a Founding Fellow of the Australian Academy of Law. She has published numerous textbooks on Indigenous legal issues. Larissa won the 2002 David Uniapon Award and a 2005 Commonwealth Writer’s Prize for her novel Home. Her second novel, Legacy, won a Victorian Premiers Literary Award. Her most recent novel, AfterStory (2021, UQP) won the 2022 Voss Literary prize. Larissa is an award-winning filmmaker. She won the 2018 Australian Directors Guild Award for best Direction of a Documentary Film for After the Apology and the 2020 AACTA for Best Direction in Factual Television for her documentary, Maralinga Tjarutja. She is a trustee of the Australian Museum, Chair of the Cathy Freeman Foundation, now Community Spirit Foundation, Chair of the Australia Council’s First Nations Arts and Culture Strategy Panel, a board member of Sydney Dance Company and a member of the NSW Literature Board. She is a former Chair and Board Member of the Bangarra Dance Theatre and has previously held board positions on the Museum of Contemporary Art, Sydney Festival, Sydney Writers Festival and the Sydney Community Fund. With Lindon Coombes, Larissa co-authored the Do Better report for the Collingwood Football Club. She chaired the 2011 review of Indigenous Higher Education. Larissa was awarded the 2009 NAIDOC Person of the Year award and 2011 NSW Australian of the Year. She was awarded an Order of Australia in 2020 for her work in Indigenous education, the law and the arts. Larissa received the Human Rights Medal 2021 from the Australian Human Rights Commission. She is the host of Speaking Out on ABC Radio.

Company Secretary

Sean Radcliffe, CGMA, BCom (Hons), appointed November 2006

Sean is the Chief Financial Officer of Sydney Dance Company

Board Meetings

The number of meetings of directors held during the year and the number of meetings attended by each Director were as follows;

PRINCIPAL ACTIVITIES

The principal activities during the year were as follows:

▪ Production and presentation of dance performances in Australia

▪ Promotion and the study of dance

▪ Commercial activities to provide financial support forthe above, including daily dance classes, school holiday workshops and dance studio hire

▪ Fundraising tosupport production, promotion and presentation of dance performances in Australia

SIGNIFICANT EVENTS AFTER YEAR END

There have been no significant events occurring after the reporting period which may affect either the Company’s operations or results of those operations or the Company’s state of affairs.

OBJECTIVES and RESULTS

2022 began with Sydney Dance Company performing at the Sydney Opera House as part of Sydney Festival 2022. Operations continued to be impacted by the pandemic, particularly the Omicron outbreak across summer, and ongoing changes in societal behaviour. However, with careful planning and risk mitigation, the Company was able to undertake its first international tour since the pandemic, returning to the world stage across four weeks in France. Two seasons were then held in Sydney at the Roslyn Packer Theatre – ab[intra] and Resound, with the year rounding out with the 9th edition of New Breed at Carriageworks. The National Tour featured Impermanence, taking in 18 performances across 14 locations, including our first ever shows in Kalgoorlie and Karratha, with COVID-delayed performances at Night at the Barracks also engaging a new community. The year featured three visits to Melbourne, including performances in the MPavillion, performances of Impermanence with the Australian String Quartet, and participation in Dance X: Festival of Dance, plus showcasing of creative industry partnerships with event performances in collaboration with Cartier and Australian Fashion week, as well as participation in the ABC 90th birthday milestone celebrations.

Sydney Dance Company formally became a Registered Training Organisation (#45863), enabling the Company to directly provide accredited training for the first time. The Preprofessional Year (PPY) course continued to deliver training to two cohorts of dancers, who, alongside the annual PPY revealed program, also performed in the New Annual Festival in Newcastle. Our advanced training also delivered programs for the Sydney Conservatorium Bachelor of Music (Performance) students and McDonald College Strathfield, with our Youth Ensemble program culminating inperformance outcomes in the Neilson studio for the first time. The school workshop program delivered 119 workshops, viewed by 2,893 online and in-person student attendees. Our open class program, although disrupted at the beginning of the year due to COVID, had over 81,000 attendances with 132 dance teachers employed. The conditioning studio had its first full year of operation, supporting the company dancers and PPY dancers as well as offering services to the general public.

At the Wharf, the Company continued its support and amplification of the contemporary dance sector, producing INDance which showcased the work of four independent dance makers across a two-week season. The Wharf also hosted events for a range of other organisations, including Australian Tap Dance Festival, Crossroads Live, NSW Department of Education, Ausdance, Phunktional Arts, Sydney Eisteddfod and Sydney Fringe, plus Happenings, a series of free Friday night activations supported by the City of Sydney.

WethanktheAustralian andNSWGovernmentforthe supporttheyhave providedto Sydney Dance Company as the organisation returns to post-pandemic operations, including additional support provided through the Create Rescue & Restart funding and federal support through RISE. The organistaion continued also to be highly reliant on income through philanthropic donors and partners, with the launch of the Carla Zampatti Commissioning fund to continue this vital support of new works and creative endeavors. Across 2022 Sydney Dance Company employed 127 staff and contractors. Lou Oppenheim replaced Anne Dunn as Executive Director in February 2022.

The lease at Walsh Bay has a significant effect on the Company’s Balance sheet and P&L at reporting date and will continue in future years due to the accounting required under “AASB 16 Leases”. After this accounting requirement, the deficit for the year ended December 31 2022, was ($523,929) (2021: surplus $2,017,277). Management calculates that an operational deficit of ($410,285) (2021: surplus $1,166,257) was achieved in 2022.

MEMBERS GUARANTEE

The Company is a public company limited by guarantee that is incorporated and domiciled in Australia. If the Company is wound up, its Constitution states that each member is required to contribute a maximum of $100 each towards meeting any outstanding obligations of the Company, a total of $1,400 at 31 December 2022.

As at 31 December 2022,the number of members was 14(2021: 12 members).

INDEMNIFICATION AND INSURANCE OF DIRECTORS AND OFFICERS

Since the end of the previous financial year, the Company has not indemnified or made a relevant agreement for indemnifying against a liability of any person who is or has been an officer or auditor of the Company.

Since the end of the previous financial year, the Company has paid premiums in respect of directors’ and officers’ liability and legal expenses insurance contracts. These insurance contracts insure against liability (subject to specific exclusions) for persons who are or have been directors or officers of the Company.

The Directors have not included details of the nature of the liabilities covered nor the amount of the premium paid in respect of the directors’ and officers’ liability and legal expenses’ insurance contracts, as such disclosure is prohibited under the terms of the contract.

INDEMNIFICATION OF AUDITOR

Totheextentpermittedbylaw,theCompanyhasagreedtoindemnifyitsauditor,Ernst&Young (Australia), as part of the terms of its audit engagement agreement against claims by third parties arising from the audit (for an unspecified amount). No payment has been made to indemnify Ernst & Young (Australia) during or since the financial year.

AUDITOR’S INDEPENDENCE

The directors received an independence declaration from the auditor of Sydney Dance Company. A copy has been included in this report.

Signed in accordance with a resolution of the directors.

Brett Clegg Chair

Brett Clegg Chair

Sydney, 28 April 2023

Auditor’s independence declaration to the Directors of Sydney dance Company

In relation to our audit of the financial report of Sydney Dance Company for the financial year ended 31 December 2022, and in accordance with the requirements of Subdivision 60-C of the Australian Charities and Not-for profits Commission Act 2012, to the best of my knowledge and belief, there have been:

a. No contraventions of the auditor independence requirements of any applicable code of professional conduct; and

b. No non-audit services provided that contravene any applicable code of professional conduct.

Yvonne Barnikel PartnerStatement of profit or loss and other comprehensive income

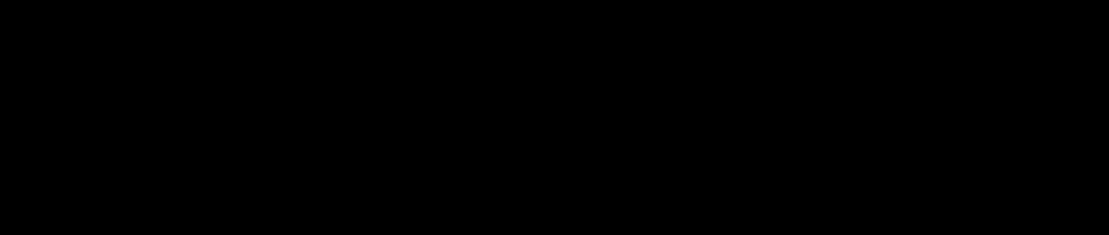

For the year ended 31 December 2022

The above statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes

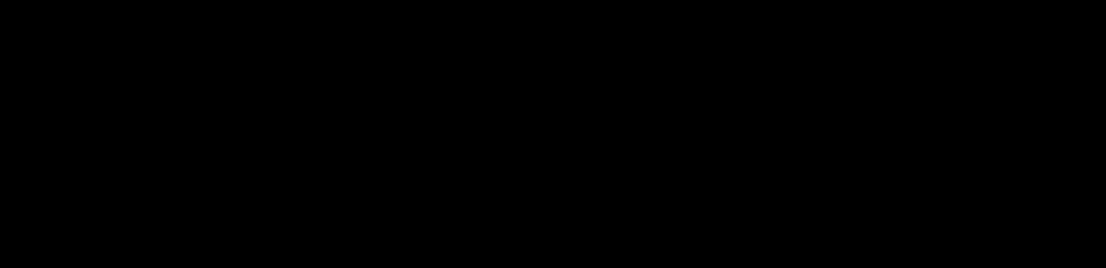

Statement of financial position

The above statement of financial position should be read in conjunction with the accompanying notes.

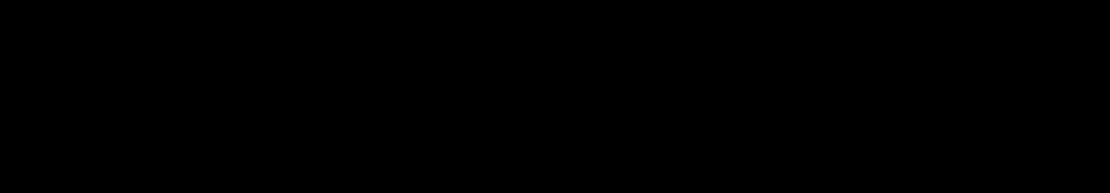

Statement of changes in equity

For the year ended 31 December 2022

Statement of cash flows

The above statement of cash flows should be read in conjunction with the accompanying notes. The statement of cash flows shows cash flows exclusive of reserves held under the reserve incentive scheme that is disclosed in Note 10.

Notes to the financial statements

For the year ended 31 December 2022

1 OVERVIEW

The general-purpose financial statements of Sydney Dance Company (“the Company” for the year ended 31 December 2022 were authorised for issue in accordance with a resolution of the directors on 28 April 2023.

Sydney Dance Company is a not-for-profit company, limited by guarantee. The registered office and principal place of business of the Company is: Wharf 4/5, Walsh Bay Arts Precinct, 15 Hickson Road, Dawes Point, NSW 2000.

The nature of the operations and principal activities of the Company are described in the Directors’ Report.

The Company is exempted from income tax by virtue of section 50-5 of the Income Tax Assessment Act, 1997.

The financial report is a general purpose financial report, which has been prepared in accordance with the requirements of the Australian Charities and Not-for-profits Commission Act 2012 and Australian Accounting Standards – Simplified Disclosures. The Company is not publicly accountable. In 2022, the Company has adopted AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-forProfit Tier 2 Entities. Other than the change in disclosure requirements, the adoption of AASB 1060 has no significant impact on the financial report because the Company’s previous financial report complied with Australian Accounting Standards – Reduced Disclosure Requirements.

The financial statements:

• have been prepared on a historical cost basis

• are presented in Australian dollars ($)

• present reclassified comparative figures where required to conform with changes in presentation in the current year.

Going concern

The financial statements have been prepared on a going concern basis which assumesthe Company will be able to pay its debts, as and when they become payable, for a period of at least 12 months from the date of the financial report.

The Company posted a deficit result for the year of ($523,929) (2021: surplus $2,017,277), and at year end had a surplus of net assets of $7,560,591 (2021: $8,084,519) and net current assets of $5,528,536 (2021: $5,727,351). The Company generated net cash outflows from operating activities of ($602,604) (2021: inflow $3,605,417). The Company does not have any bank or other external debt. The Company has Tenant Works Contribution commitments to the NSW Government which will fall due over the next 7 years in relation to the renewal of its Walsh Bay home. These commitments have been included in cash flow projections.

The ability of the Company to maintain its operations is dependent inter alia on the continuing support of various Governments by way of grants. The Tripartite Agreement is current for the period 2021-2024 with the Australia Council for the Arts and Create NSW, subject to the Company continuing to meet the requirements of the Tripartite Agreement. The Tripartite Agreement requirements include the achievement of agreed on key performance indicators.

The Company’s Directors have undertaken a thorough assessment of going concern; this review considered the operating budgets and detailed cash flow for the Company for the period 12 months from the date of these financial statements.

2 SIGNIFICANT ACCOUNTING JUDGEMENTS, ESTIMATES AND ASSSUMPTIONS

The preparation of the Company’s financial statementsrequires management to make judgements, estimates and assumptions that affectthe reported amounts of revenues, expenses, assets and liabilities, and the accompanying disclosures, and the disclosure of contingent liabilities. Judgements and estimates which are material to the financial statements are found in the notes to the financial statements.

The Company based its assumptions and estimates on information which was available at the time the financial statements were prepared. These assumptions and estimates about future developments may change due to market changes or circumstances arising beyond the control of the Company

3 REVENUE AND EXPENSES

The specific performance obligation for recognition of each revenue stream is noted below

On receipt where unconditional/nonreciprocal, or on delivery of event or project where sufficiently specific performance obligations are included in the contract.

Point in time or over a period depending on the nature of the in-kind. A corresponding expense is recorded at the time that revenue is recognised.

1. Individual Class Fees - point in timeProvision of dance class. 2. Gift Vouchers – point in time – redemption date. 3. Multipacks – point in time for each individual class. 4. Membership –period of time – membership period. 5. Merchandise – point in time – sale School Holiday

Commercial Dance Class including individual class fees, multipacks, and sale of gift vouchers. For both in-studio and virtual classes

Over a period - delivery of workshop

The Company’s refund policies are as follows:

Box Office - a refund is provided to customers where the performance is cancelled, rescheduled or relocated prior to the event. To the extent that a performance is cancelled during its course, a ticketholder may be eligible for a full or partial refund depending upon the circumstances which caused the cancellation. In some circumstances the Company will apply its discretion and grant a refund where either the customer’s amenity or enjoyment has been diminished in some significant way. The amount of any refund is limited to the cost of the ticket purchased plus any direct transaction costs such as booking fees and credit card surcharges.

Dance Classes – Dance class purchases are non-refundable and non-transferrable. Credit notes are provided upon provision of a medical certificate.

(b) Government grant income included in the statement of profit or loss and other comprehensive income

Adoption of AASB 16 Leases in 2020 changed the way that the Company accounts for rental expenses. Sydney Dance Company continues to receive in-kind rental support, no income or expense relating to in-kind rent assistance has been recognised in the current period as the Company has elected to record the right of use asset and lease liabilities at cost. The NSW Government estimates the value of the in-kind rental support to be $970,557.02 for both Hickson Road and Lilyfield locations.

Revenue from government grants is recognised as each performance obligation attached to each individual grant is met. The specific performance obligations vary depending upon the terms of each grant.

When the grant is provided to meet a specific expense and the performance obligations are sufficiently specific to meet AASB 15’s requirements, revenue from the grant is recognised over the period in which the relevant cost for which it is intended to compensate, is expensed.

Where a grant is provided to meet the overarching objectives of the Company and is not tied to specific, identifiable performance obligations, it is recognised immediately as revenue.

Key Judgement

Government grants are recognised when there is reasonable assurance that the grant will be received, and all attaching conditions will be complied with. Judgement is involved in determining the timing of this recognition.

(d) Salaries and employee benefit expenses included in the statement of profitor loss and other comprehensive income.

(e) Depreciation expense included in the statement of profitor loss and other comprehensive income

4 FUNDRAISING

Sydney Dance Company undertakes fundraising appeals throughout the year and holds an authority to fundraise under the Charitable Fundraising Act, 1991 (NSW). Additional information and declarations to be furnished under this Act follow:

Details of aggregate gross income andtotal expenses offundraising

Application of funds

Funds raised through individual giving and fundraising events support Sydney Dance Company’s activities.

Forms of fundraising*

Appeals held during the year ended 31 December 2022: - General and Personal Appeals for the Commissioning Fund, Education activities, Annual giving program, and Capital Campaign, and - Fundraising events include the annual fundraiser, Dance Noir, and commissioning dinner.

Agents

Sydney Dance Company employs professional staff to manage and co-ordinate its fundraising activities and does not engage commercial fundraising agents to secure donations.

Comparison of monetary figures and percentages for the year ended 31 December 2022:

*No disclosure is provided as all income received and expenditure incurred is in connection with the presentation of Sydney Dance Company’s activities.

5 CASH AND SHORT-TERM DEPOSITS

Cash and short-term deposits comprise cash at bank and on hand and short-term deposits with a maturity of three months or less. Cash at bank earns interest at floating rates based on daily bank deposit rates and short-term deposits earn interest at the respective short-term deposit rates.

Cash at bank and on hand includes the balance of an endowed amount totaling. $179,976 (2021: $205,584) originally received in 2018. In accepting this endowment, the Company has agreed to utilise the proceeds of this endowment to develop and maintain the Hephzibah Tintner Artist Development Program. These funds are to be used over a 10-year period for the professional development of young artists under the program. Funds are held in a separate bank account.

6 TRADE AND OTHER RECEIVABLES

A receivable is recognised if an amount of consideration that is unconditional is due from the customer (i.e., only the passage of time is required before payment of the consideration is due). Trade receivables, which generally have 14-30 days terms and are non-interest bearing, are recognised and carried at original invoice amount less an allowance for expected credit losses. Expected credit losses are determined by a review of the specific trade receivables outstanding at any reporting date having regard to the nature of these receivables and their expected recovery.

Revenues, expenses and assets are recognised net of the amount of GST. The net amount of GST recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the statement of financial position.

Cashflows are included in the Statement of cash flow on a gross basis. The GST component of cashflows arising from investing and financing activities, which is recoverable from, or payable to, the ATO is classified as part of operating cashflows.

7 INVENTORY

The Company holds merchandise which is offered for sale through the dance studios Other inventory held comprises of snacks and beverages which is offered for sale through the SDC bar and goods which have been provided in-kind for use in promotional events and activities. Merchandise, snacks and beverages are valued at the lower of cost (after rebates and discounts) and net realisable value, being the estimated selling price in the ordinary course of business less the estimated costs necessary to make the sale. In-kind goods are valued at their replacement cost.

The contract modification refers to the signing of the lease for premises at 15 Hickson Road. The lease was signed on 17 December 2022.

At the inception of a contract, Right-of-use assets are measured at cost, comprising the following:

• the amount of the initial measurement of the lease liability;

• plus lease payments made at or before the commencement date, less any lease incentives received;

• plus initial direct costs incurred; and

• less an estimate of costs to be incurred in restoring the underlying asset to the condition required by the terms and conditions of the lease.

Subsequently, right-of-use assets are depreciated on a straight line basis over the term of the lease arrangement. They are also adjusted for any accumulated impairment losses or remeasurement of the lease liability, please refer to Note 15.

SDC accounts fora lease modification (i.e., a change in the scope of a lease, or the consideration for a lease, that was not part of the original terms and conditions of the lease) as a separate lease (i.e., separate from the original lease) when both of the following conditions are met:

• The modification increases the scope of the lease by adding the right to use one or more underlying assets.

• The consideration for the lease increases commensurate with the stand–alone price for the increase in scope and any adjustments to that stand–alone price reflect the circumstances of the particular contract.

If both of these conditions are met, the lease modification results in two separate leases, the unmodified original lease and a separate new lease. SDC account for the separate contract that contains a lease in the same manner as other new leases.

For those lease modificationsthat do notresult in a separate lease, SDC allocate the consideration in the contract and remeasure the lease liability (using the lease term of the modified lease and the discount rate (i.e., the interest rate implicit in the lease for the remainder of the lease term if that rate can be readily determined or if not the lessee’s incremental borrowing rate) as determined at the effective date of the modification.

9 PROPERTY, PLANT AND EQUIPMENT

Plant and equipment is stated at cost, net of accumulated depreciation. All other repair and maintenance costs are recognised in the statement of profit or loss as incurred.

Depreciation is calculated on a straight-line basis over the estimated useful lives of the assets. The range of useful lives used in the current and comparative period are as follows:

Plant and equipment - 2 to 10 years

Office equipment - 5 years

Furniture and fittings - 5 -10 years

Computer software - 3 years

The useful lives of property, plant and equipment are reviewed at each financial year end and adjusted prospectively, if appropriate.

At each reporting datethe Company assesses whetherthere is an indication that an asset may be impaired. There were no indications of impairment noted at 31 December 2022.

An item of property, plant and equipment ceases to be recognised when it is disposed of

or when no future economic benefits are expected to arise from its use or disposal. Any gain or loss arising on derecognition (calculated as the difference between the net disposal proceeds and the carrying amount of the asset) is included in the statement of profit or loss and other comprehensive income at the time of derecognition.

10 RESERVE INCENTIVE SCHEME

The funds received under the Reserve Incentive Scheme Agreement together with the Company’s contribution are held in escrow for a period of 15 years ending on 2 April 2028 and are subject to the terms and conditions of the Reserve Incentive Scheme Agreement between the Australia Council for the Arts, Create NSW and the Company. The funds have not been used to secure any liabilities of the Company. The funds consist of shortterm deposits of $568,581 (2021: $567,648). No funds were required to be paid into this account by the Company in 2022 (2021: nil). The increase in the fund balance relates to interest received from short-term deposits.

11 TRADE AND OTHER PAYABLES

Trade and Other payables are non-interest bearing and are recognised at the amount expected to be paid by the Company in settling the liability. They represent liabilities for goods and services provided to the Company prior to the end of the financial year for which the Company is obliged to make future payments. The amounts are unsecured and are usually paid within 30 days of recognition. Due to their short-term nature, they are not discounted. They are financial liabilities measures at amortised cost.

Included in Other Payables are liabilities for wages and salaries recognised in respect of employees’ services up to the end of the reporting period which are measured at the amounts expected to be paid when the liabilities are settled

12 CONTRACT LIABILITIES

Contract liability is recognised if a payment is received or a payment is due (whichever is earlier) from a customer before the Company transfers the related goods or services. The key categories of contract liabilities relate to:

• Dance class tickets which include 3, 5 and 10 pack dance class tickets which have an expiry date of 6months (2021: 6months).Dance classtickets include both studio and online class tickets.

• Education activity relating to 2023 Pre-Professional Year payments and school matinee bookings.

• Sponsorship income relates to contracted income received in advance of the performance obligation being satisfied.

• Performance vouchers which are limited to performances within a specific year

• Gift vouchers for use inpurchasing danceclasses whichhavea 3-year expiry date

Key Estimate

The amount which relates to unused dance class tickets outstanding at year end is recognised as a contract liability. The contract liability is reduced by the value of tickets that are expected to remain unused at their expiry date. Estimates of the future use of these tickets, based on historical use of tickets, are applied in the calculation of this value.

13 EMPLOYEE BENEFIT LIABILITIES

An annual leave liability is recognised in respect of employees’ service up to the end of the reporting period. These liabilities are measured at the amounts expected to be paid in future periods when the liabilities are settled.

The Company recognises a liability for long service leave measured as the present value of expected future payments to be made in respect of services provided by employees up to the reporting date. Expected future payments are discounted using market yields at the reporting date on high-quality corporate bonds with terms to maturity and currencies that match, as closely as possible, the estimated future cash outflows.

Where the Company has an unconditional right to defer the settlement of the long service leave for at least 12 months after the reporting date it is presented as a noncurrent liability.

Key Judgement and Estimates

In determining the liability for long service leave consideration is given to expected future wage and salary levels, the amount of future oncosts, and anticipated periods of service.

14 GOVERNMENT GRANT ADVANCES

Government grant advances are recognised if a payment is received or a payment is due (whichever is earlier) from a government related body when the performance obligations included in the government grants have not been fulfilled.

Both current and non-current lease liabilities shown above refer in the majority to payments to Create NSW for tenancy rent over the remaining 23 years of the lease and the tenant contributions required under the lease.

At the inception of all contractual arrangements the Company assesses whether the contract is, or contains, a lease. This determination is based on whether the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

The lease term is determined as being the non-cancellable period of a lease, together with periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option; and periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option.

Where a contract contains a lease the Company recognises a lease liability. The liability is measured at the present value of the lease payments outstanding at commencement for the non-cancellable lease period and any option periods which are reasonably expected to be exercised. Lease payments are discounted using the Company’s incremental borrowing rate which is determined having regard to the tenor of the lease and the nature of the asset.

Subsequently, the lease liability is measured by:

• increasing the carrying amount to reflect interest on the lease liability;

• reducing the carrying amount to reflect the lease payments made; and

• remeasuring the carrying amount to reflect any reassessment or lease modifications or to reflect revised in-substance fixed lease payments.

The rent paid by Sydney Dance Company on all of its premises is subsidised by the NSW Government and, as a consequence, is lower than market. Due to the significant difficulty which would be encountered in estimatingthe market rental,the Company has relied onthe temporary relief available under AASB 2018-8 Amendments to Australian Standards – Rightof-Use Assets for Not-for-Profit Entities. This amendment allows not-for-profit entities to elect to initially measure a class or classes of asset at cost where lease terms and conditions are significant below-market principally to enable the entity to further its objectives.

Where the Company has the unconditional right to defer the settlement of its lease obligations for at least 12 months after the reporting date they are presented as a noncurrent liability.

Presented below is a maturity analysis of undiscounted future lease payments:

Key Judgement and Estimates

In determining the amount of the lease liabilities, judgement has been applied in determining the option periods which are reasonably likely to be exercised and the incremental borrowing rate which would be applicable to the Company.

16

CONTRIBUTED EQUITY

The membership fees were contributed by the initial members upon establishment of the Company. In accordance with the Constitution, members are not entitled to any reimbursement or return of initial membership fees upon ceasing to be a member.

17 RESERVES

Capital reserve This company maintains a Capital reserve for the purpose of accumulating funds to pay for Sydney Dance Company’s costs and contribution to the Wharf Redevelopment Project including fit out..

Reserves Incentive Scheme please refer Note 10

Hezipah Titner Artist Development Program Fund The company maintains the Hezibah Tintner Artist Development Program Fund for the purpose of reserving the endowment funds received to support the development of young artists over a period of ten years. Please refer Note 5.

18 COMMITMENTS AND CONTINGENCIES

(a) Commitments

The Company had no commitments relating tothe short-term lease of performance space at 31 December 2022. (2021: none).

(b) Contingencies

The directors are not aware of any contingent liabilities as at 31 December 2022 (2021: none).

19 RELATED PARTY DISCLOSURES

Total donations from directorswere $404,107 for 2022 (2021: $717,139).

20 KEY MANAGEMENT PERSONNEL

(a) Details of Key Management Personnel

CurrentDirectors

Brett Clegg Chair

Pamela Bartlett Director (resigned 26 April 2022)

Jillian Broadbent AC Director

Emma Gray Director

Alexa Haslingden Director

Mark Hassell Director

Catriona Mordant AM Director

Emma-Jane Newton Director

David Baxby Director

Sandra McCullagh Director

Paris Neilson Director

David Friedlander Director Executives

Anne Dunn Executive Director (resigned 14 January 2022)

Lou Oppenheim Executive Director (appointed 21February 2022)

Rafael Bonachela Artistic Director

Sean Radcliffe Chief FinancialOfficer

CarolineSpence Deputy Executive Director (resigned 21 July 2022)

Non-executive Directors of Sydney Dance Company do not receive remuneration for serving on the Board of Directors.

(b) Key Management Personnel

(c)

Other transactions and balances with Key Management Personnel

There are no other transactions or balances withkey management personnel otherthan the Directors’ donations disclosed in Note 19.

21 EVENTS AFTER THE REPORTING PERIOD

There have been no significant events occurring after the reporting period which may affect either the Company’s operations or results of those operations or the Company’s state of affairs.

22 AUDITOR’S REMUNERATION

The auditor of the Company is Ernst & Young and the fee for auditing the statutory financial report is $27,000 (2021: $20,000)

Directors' declaration

In accordance with a resolution of the directors of Sydney Dance Company, I state that: In the opinion of the directors:

(a) the financial statements and notes of Sydney Dance Company are in accordance with the Australian Charities and Not-for-profits Commission Act 2012, including:

(i) giving a true and fair view of its financial position as at 31 December 2022 and performance for the year ended on that date;

(ii) complying with Australian Accounting Standards- Simplified Disclosures and the Australian Charities and Not-for-profits Commission Regulation 2013; and

(b) there are reasonable grounds to believe that the Company will be able to pay its debts as and when they become due and payable.

(c) the provision of the Charitable Fundraising Act (1991) and its regulations and the conditions attached to the Authority to conduct fundraising have been complied with; and

(d) the internal controls exercised by the Company are appropriate and effective in accounting for all income received and applied to its fundraising appeals

(e) the government funding received has been spent in accordance with funding agreements.

On behalf of the Board

Brett Clegg ChairSydney, 28 April 2023

Declaration by Chairperson as required by the Charitable Fundraising Act 1991 (NSW)

I,

Brett Clegg, Chairof Sydney Dance Company, declare that in my opinion:

(a) the accounts for the year ended 31 December 2022, give a true and fair view of all income and expenditure of Sydney Dance Company with respect to fundraising appeals; and

(b) the statement of financial position as at 31 December 2022, give a true and fair view of the state of affairs of Sydney Dance Company with respect to fundraising appeals; and

(c) the provisions of the Charitable Fundraising Act 1991 (NSW) and the regulations under the Act and the conditions attached to the authority have been complied with: and the internal controls exercised by Sydney Dance Company are appropriate and effective for all income received and applied from any fundraising appeals

Brett Clegg ChairSydney, 28 April 2023

Independent Auditor's Report to the Members of Sydney Dance Company Opinion

We have audited the financial report of Sydney Dance Company (the Company), which comprises the statement of financial position as at 31 December 2022, the statement of profit or loss and comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, notes to the financial statements, including a summary of significant accounting policies, and the directors' declaration.

In our opinion, the accompanying financial report of the Company is in accordance with the Australian Charities and Not-for-Profits Commission Act 2012, including:

a) giving a true and fair view of the Company’s financial position as at 31 December 2022 and of its financial performance for the year ended on that date; and

b) complying with Australian Accounting Standards – Simplified Disclosures and the Australian Charities and Not-for-Profits Commission Regulation 2013

Basis for Opinion

We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Report section of our report. We are independent of the Company in accordance with the ethical requirements of the Accounting Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (including Independence Standards) (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Information Other than the Financial Report and Auditor’s Report Thereon

The directors are responsible for the other information. The other information obtained at the date of this auditor’s report is the directors’ report accompanying the financial report, but does not include the financial report and our auditor’s report thereon.

Our opinion on the financial report does not cover the other information and accordingly we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial report, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial report or our knowledge obtained in the audit or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of the Directors for the Financial Report

The directors of the Company are responsible for the preparation of the financial report that gives a true and fair view in accordance with Australian Accounting Standards – Simplified Disclosures and the Australian Charities and Not-for-Profits Commission Act 2012 and for such internal control as the directors determine is necessary to enable the preparation of the financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error.

In preparing the financial report, the directors are responsible for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters relating to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Company or to cease operations, or have no realistic alternative but to do so.

Auditor's Responsibilities for the Audit of the Financial Report

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with the Australian Auditing Standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report.

As part of an audit in accordance with the Australian Auditing Standards, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial report, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by the directors.

• Conclude on the appropriateness of the directors’ use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial report or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the financial report, including the disclosures, and whether the financial report represents the underlying transactions and events in a manner that achieves fair presentation.

We communicate with the directors regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Report on the requirements of the NSW Charitable Fundraising Act 1991 and the NSW Charitable Fundraising Regulation 2021

We have audited the financial report as required by Section 24(2) of the NSW Charitable Fundraising Act 1991. Our procedures included obtaining an understanding of the internal control structure for fundraising appeal activities and examination, on a test basis, of evidence supporting compliance with the accounting and associated record keeping requirements for fundraising appeal activities pursuant to the NSW Charitable Fundraising Act 1991 and the NSW Charitable Fundraising Regulation 2021.

Because of the inherent limitations of any assurance engagement, it is possible that fraud, error or non-compliance may occur and not be detected. An audit is not designed to detect all instances of non-compliance with the requirements described in the above-mentioned Act and Regulation as an audit is not performed continuously throughout the period and the audit procedures performed in respect of compliance with these requirements are undertaken on a test basis. The audit opinion expressed in this report has been formed on the above basis.

Opinion

In our opinion:

a. The financial report of the Company has been properly drawn up and associated records have been properly kept during the financial year ended 31 December 2022, in all material respects, in accordance with:

i Sections 20(1), 22(1-2), 24(1-3) of the NSW Charitable Fundraising Act 1991;

ii Sections 14(2) and 17 of the NSW Charitable Fundraising Regulation 2021;

b. The money received as a result of fundraising appeals conducted by the Company during the financial year ended 31 December 2022 has been properly accounted for and applied, in all material respects, in accordance with the above mentioned Act and Regulation.

Ernst & Young

Yvonne Barnikel Partner Sydney

Ernst & Young

Yvonne Barnikel Partner Sydney

28 April 2023